Summary of housing policy actions

2023 has been a momentous year in housing policy at the provincial level. More has changed this year on the housing front than did in the past 40, and it’s getting quite confusing to keep all the different reforms straight. Given that the premier recently mentioned that he’s “nowhere near satisfied” on housing, it’s likely also not the end to housing reforms for a while. To that end I thought it was worth putting together a quick overview of all the changes that the province has made this year. I’ll keep this updated as we get more information in the coming year, as there remain many unanswered questions about what these changes will look like when they are implemented by municipalities.

In addition most of these are reforms that primarily have medium and long term impacts. Given that there is a provincial election next year with housing one of the primary issues, it remains to be seen whether these reforms will take hold or be reversed by the next government.

Note this summary is assembled from available information on a best effort basis. Please verify the information in the associated acts and regulations.

Building code reforms

This is not a land use reform per se, but nevertheless highly impactful for housing. In the short term the code has multiple updates, with a focus on higher seismic and accessibility standards. Those raise the standards for new builds in those areas, but will also lead to substantial cost increases for new construction. On the other hand, the province promised to study legalization of single stair buildings above the current limit of 2 floors. If you’re not familiar with the importance of these type of buildings, I would recommend watching this video which gives a good overview. There is also a proposal to raise the height for mass timber buildings, but neither has a fixed timeline or guarantee of approval.

When will it take effect?

The new building code takes effect March 8th, 2024, but the major seismic and accessibility standards are delayed until March 10, 2025 to give the industry time to adjust.

Discussions on allowing single stair will happen in course of the next year, and the proposal for taller mass timber has no timeline or assurance it will be approved.

More information

Building code update and single stair discussion: https://news.gov.bc.ca/releases/2023HOUS0167-001923

Mass timber changes: https://news.gov.bc.ca/releases/2023HOUS0173-001959

Change in Development Fees

As the province pre-empts municipalities on some land use decisions, a key concern raised by municipalities is being able to fund amenities that will be required to support new growth. While most direct infrastructure costs are paid via Development Cost Charges (DCCs) that are collected at building permit time from all construction, some municipalities were also using Community Amenity Contributions (CACs) at the time of rezoning to collect money that could be used for a broad range of other expenses. While CACs had various downsides, the province moving away from spot rezoning also meant that CACs could no longer be collected for a lot of new housing. To replace CACs, the province introduced a new Amenity Cost Charge (ACC) fee that will allow municipalities to collect the incremental cost of amenities that aren’t covered by DCCs, such as fire, police, library, transportation, and waste treatment facilities needed for new residents. The new ACCs are not discretionary and have various restrictions that prevent municipalities setting them higher than justified by anticipated costs and the split between existing and new residents.

When does it take effect?

Changes take effect when local governments pass bylaws implementing ACCs in their community.

More information

Press release: https://news.gov.bc.ca/releases/2023HOUS0063-001737

Short term rental restrictions

The province brought in several new regulations relating to short term rentals, restricting them to a primary residence or suite in most areas of the province, increasing fines, and bringing in new enforcement tools for municipalities. That would have been a minor change bringing some units back into the long term market over time, but they also ended grandfathering that allowed short term rentals to operate legally in the City of Victoria in a number of buildings. That had a more immediate impact on the market with the short term rental premium likely evaporating overnight, and dozens of units being listed either for sale or for rent.

One issue that remains unclear is whether rentals over 30 days will still be allowed. Though the province defined short term rentals as 90 days or less, some cities defined them as 30 days or less. The recent release of regulations included a policy guide which states that cities can define short term rentals as a period longer or shorter than 90 days. That may mean that 30+ day rentals could continue to be allowed in some cities that use that definition (the City of Victoria comes to mind), however this remains to be confirmed.

When does it take effect?

Grandfathering for short term rentals is phased out as of May 1, 2024. The new enforcement tools are coming in late 2024 or 2025.

More information

The technical briefing is a concise summary: https://news.gov.bc.ca/files/ShortTermRental_Technical_Briefing.pdf

No more public hearings for projects compliant with the Official Community Plans

Municipalities have always been able to opt out of public hearings for OCP compliant projects, but this was rarely done in practice. In 2021 the province made a subtle change that switched the default for municipalities to not hold a public hearing for OCP compliant projects, and council must vote to hold the public hearing. This changed little, with most municipalities still opting to hold public hearings regardless. Part of bill 44 took this a step further and mandated that councils must not hold public hearings for projects that are compliant with the OCP.

While this sounds like a major change, in reality it will likely have only minor impact. There are many opportunities for a municipality to kill an OCP-compliant project before public hearing and those are still allowed. In some municipalities where the housing would have been approved anyway, it will save a few months between third reading and public hearing.

When does this take effect?

This requirement came into effect on royal assent of Bill 44.

More information

See the press release for Bill 44 (bottom) or the regulations: https://news.gov.bc.ca/releases/2023PREM0062-001706

Transit Oriented Development (TOD)

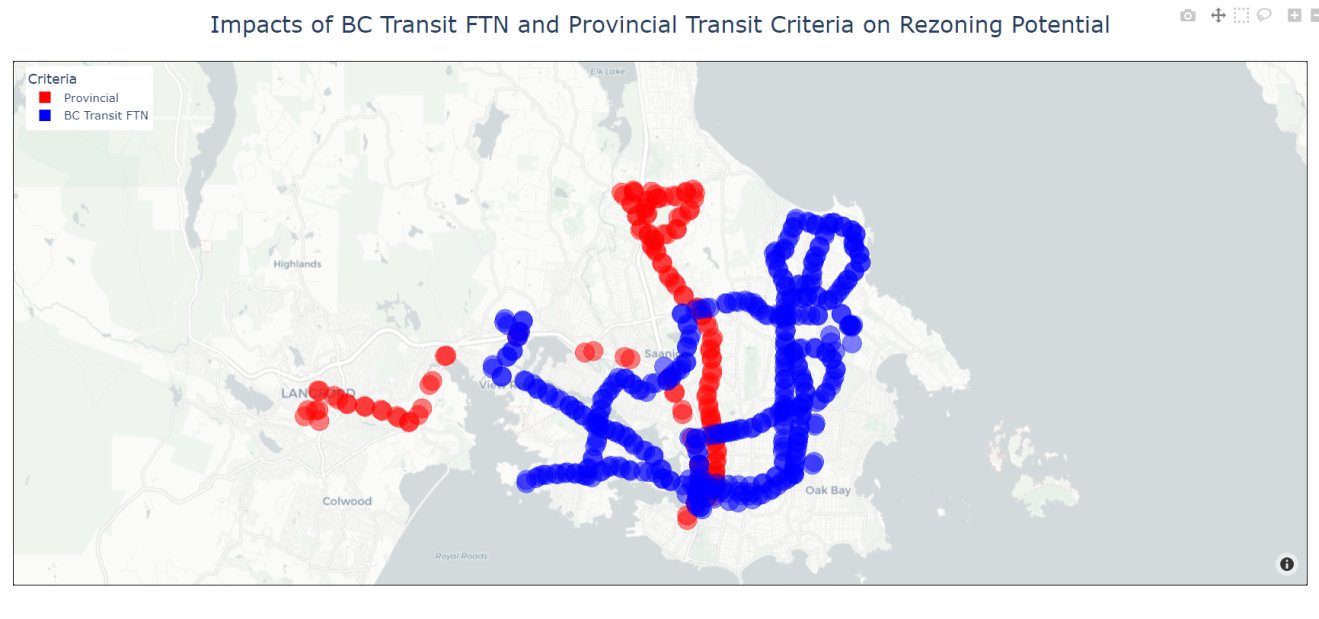

The province is mandating that municipalities cannot restrict density less than the prescribed minimums near what they consider to be frequent transit stations. We mostly don’t know what those are yet, and beyond Uptown and the Legislature exchange, the province has not designated any in Greater Victoria. While the list of bus exchanges as designated by BC Transit seems like a logical set of locations for this type of upzoning, we don’t yet know which locations will be included, as they must be designated by either the province or a municipality. In Victoria that means municipalities are not allowed to restrict buildings to less than 10 stories within 200m of the exchange and 6 stories within 400m. They also cannot impose parking minimums except for reasons of accessibility. If a lot is partially within the region it is considered to be inside the TOD area.

Saanich for example is proposing to designate the Royal Oak Exchange, Tillicum-Burnside Exchange, and the McKenzie-Shelbourne Exchange as TOD zones as part of their OCP update. I haven’t heard from the other municipalities about what areas may be included.

Note that the province is not mandating that cities match zoning to the allowed uses in these TODs, but cities also cannot reject applications that meet the height and FSR requirements there. The reason for that is to allow cities that have certain policies that apply on rezoning the ability to apply those policies (such as tenant assistance policies) in the short term. Note that in the long term zoning will likely be matched to include these TOD zones as part of the reforms to match zoning to OCPs by the end of 2025 (see below). Unclear is how strict the province will be on mandating approvals, and whether there will be an appeal body for developers to approach if they feel an application in a TOD zone has been rejected improperly (similar to what Ontario has).

When will it take effect?

The requirement for municipalities to not reject developments that meet the guidelines is in effect now, however most transit exchanges in Greater Victoria have not been identified. Municipalities must identify them by June 30, 2024 and adjust bylaws to remove parking requirements in those areas.

More information

The TOD policy manual includes detailed guidance on how these should be implemented by municipalities https://news.gov.bc.ca/files/TOAProvincialPolicyManual.pdf

Small Scale Multi-Unit (Missing Middle)

The province is ending single family zoning in much of the province by requiring municipalities to do a number of things to legalize low-rise infill housing including:

- Allowing secondary suites within homes or ADUs (garden suites). Local governments will be able to decide whether to allow suites, ADUs, or both.

- Allowing a minimum of 3 units on lots up to 280sqm (3014 sqft)

- Allowing a minimum of 4 units on lots over 280sqm

- Allowing a minimum of 6 units on lots within 400m of frequent transit. Municipalities cannot impose parking minimums in those areas. Frequent transit is defined in the regulations as a bus stop that has at least one route with an average of 15 minute service from Monday to Friday 7AM-7PM and 10AM-6PM on weekends.

These standards for suites apply everywhere, while the requirements for 3-6 units apply in any municipality over 5000 people, and on lots that are within the urban containment boundary, are on municipal sewer (not septic), and are not heritage protected.

In the modelling report on potential impacts of the reforms, there is a map that shows a broad list of transit stops showing frequent service bus routes and are thus potential areas to allow six-plexes. However this map is not accurate in terms of the regulatory requirements because most of the bus routes that BC transit considers frequent service do not meet the provincial regulations because they either:

- Don’t meet weekend requirements for service (They come at 16-20 minute intervals, not 15)

- Are split routes (for example the 27/28 combined meets the 15 minute requirement, but each individual one doesn’t).

Thus unless the regulations are changed, or they are interpreted more loosely by municipalities (discussion of this is underway), as of now only the 95 and 6 bus qualify as frequent service for the purpose of six-plexes.

Note that the province has released a lot of information for municipalities including a policy manual with suggested setbacks, parking requirements, and FSR limits for implementing the bill into their zoning codes. There are even suggested multiplex designs coming that could be pre-approved. However it’s important to remember that none of these are mandates, and are merely intended as best practice. Municipalities are free to create their own zoning amendments, which also means the viability of these infill housing forms remain up in the air. Through various additional requirements, municipalities could legalize these forms only on paper without making them practically buildable (as we saw in the first implementation of Victoria’s missing middle policy).

When will it take effect?

Municipalities are required to update their zoning by June 30, 2024 to allow SSMU housing.

Extensions are possible, with the one that cities are most likely to take advantage of being an extension in order to upgrade infrastructure to an area that otherwise couldn’t support SSMU housing. It remains to be seen how strict the province will be with those extensions.

More information

Press release: https://news.gov.bc.ca/releases/2023PREM0062-001706

Regulations: https://news.gov.bc.ca/releases/2023HOUS0171-001945

Reducing Spot Rezoning

What is it?

Bundled in to the SSMU reforms was a substantial change in how municipalities will plan for housing in the future. Currently municipalities create Official Community Plans on irregular schedules, where they outline many aspects of community priorities, including where housing density should be placed, and some guidelines on what heights and forms are supportable. However what is actually allowed is set by zoning, and developers that want to build housing that matches the OCP still need to request a rezoning which usually comes with long timelines and uncertain approvals.

Under the new process, municipalities will need to update their housing needs reports based on standard methodologies set by the province (guidance coming Feb 2024). They will then need to update their OCPs to accommodate at least 20 years of projected growth, and then update zoning to match the OCP. That would mean projects compliant with the official community plan (as captured in zoning) would proceed much more quickly without a discretionary rezoning process, while projects that aren’t OCP compliant would continue to require a rezoning. OCPs must be updated every 5 years.

This change received far less attention than the more controversial missing middle reforms, but it likely has the potential to create a lot more housing. While the province expected 130,000 new missing middle type homes in the next 10 years, the bulk of housing production will likely come from higher density apartments which will become substantially streamlined if OCPs must be operationalized in zoning.

When will it take effect?

Municipalities must complete their updated housing needs reports by Dec 31, 2024, and must have updated their OCPs and zoning to match by Dec 31, 2025.

More information

The technical briefing provides a good overview of the new planning process, starting on page 12: https://news.gov.bc.ca/files/Housing_Tech_Brief_Nov_01_2023.pdf

Municipal Housing Targets

What is it?

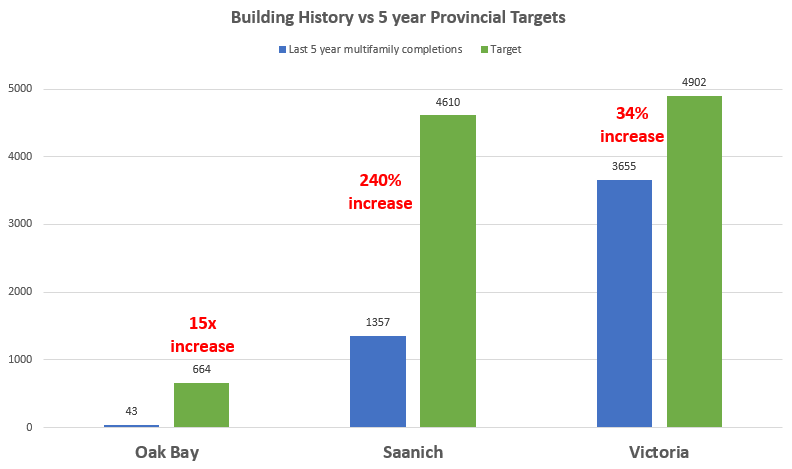

This was one of the first reforms announced, but it is fundamentally an accountability measure for the above housing reforms. While there are many ways for municipalities to comply with the land use reforms on paper while not actually increasing the new housing being built, there is no way to get around a requirement to hit a specific amount of new housing. In September the province selected 10 municipalities and gave them targets for housing that they must hit over the next 5 years. Locally the municipalities affected are Saanich, Victoria, and Oak Bay. Though the list has been dubbed the “naughty list” in the media, in reality it’s actually a mix of municipalities that have been doing reasonably well on housing like Victoria and those that have been underperforming (Saanich) or actively hostile to housing (Oak Bay).

The targets are in terms of net new homes, which means that gross completions as measured by CMHC will need to be higher than targets to account for demolitions (for which we have limited data).

The province has promised that this list will be expanded, and I’ve heard the next 10 could come as soon as this year, though that now seems unlikely. Look for a lot more cities to be added to this list in 2024, and likely eventually to capture most local municipalities.

When will it take effect?

The clock for the municipalities started ticking on October 1st, 2023, which means the first 6 month check-in will be April 1st, 2024 and the first year will end on September 30, 2024. The province has promised a series of escalating interventions ending with zoning overrides if municipalities do not hit their targets, however if there is a drastic economic downturn that tanks housing construction that may have to be adjusted.

More information

Press release: https://news.gov.bc.ca/releases/2023HOUS0123-001505

Detailed housing unit targets by municipality: https://news.gov.bc.ca/files/HousingTargetGuidlines.pdf

This isn’t the full list of reforms there are also things to do with expanding non-market housing like the $500M apartment buying fund but I don’t expect them to affect the market side substantially until the long term.

Also the weekly numbers

| December 2023 |

Dec

2022

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 39 | 128 | 320 | ||

| New Listings | 39 | 183 | 361 | ||

| Active Listings | 2517 | 2453 | 1688 | ||

| Sales to New Listings | 100% | 70% | 89% | ||

| Sales YoY Change | — | +2% | -72% | ||

| New Lists YoY Change | — | -1% | -10% | ||

| Inventory YoY Change | +24% | +24% | +159% | ||

| Months of Inventory | 5.3 | ||||

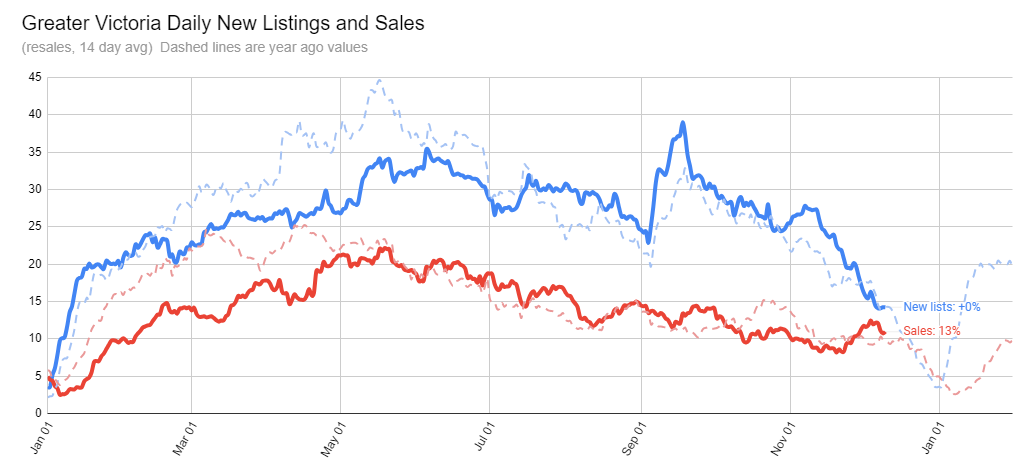

December is as usual dead quiet in the market, and so far we are tracking about the same as last year on sales and new listings, with about a quarter more properties on the market. There was a bit of an increase in resale activity in the core in the first week, but total reported sales are still very much in line with a year ago.

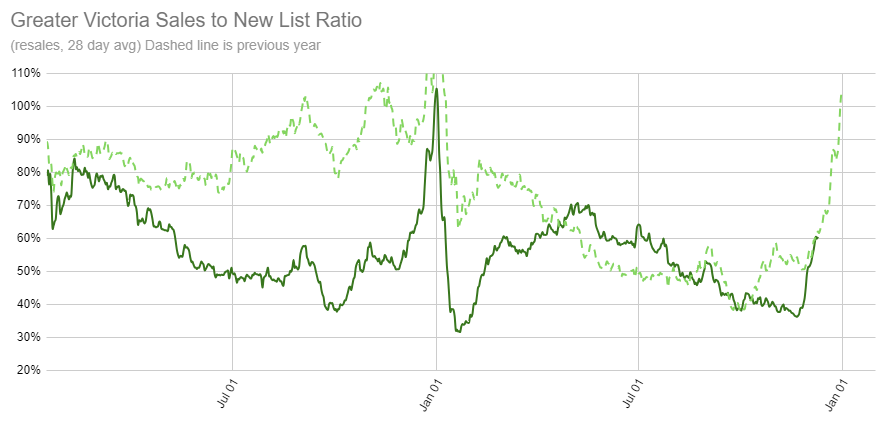

The small sales recovery and petering out of the new listings bump has put the sales to new list ratio back in line with a year ago. This is a time of year when new listings drop off a cliff, so don’t expect much new to hit the market until the first week of January.

I’ve talked about the potential impact on land values from all the provincial reforms, and the modelling report likewise predicted that while the price of multifamily housing is expected to be driven downward by the new supply, the price of land could rise. There’s anecdotal reports of some Vancouver-based developers buying a few lots in Victoria, but I don’t have a number for how many there might be yet. So far the median house is still going for 6% below current assessed value (similar to November) but once we get some more sales I’ll take a look to see if there’s evidence for some uptick in activity for lots that are mostly land value and might be suitable for redevelopment.

The modelling report – like most economic forecasts for a policy changes – makes predictions about value impacts relative to the counterfactual (business as usual scenario). In this case they predict a 6-12% decrease in multifamily prices in 5 years as well as a decrease in rents compared to what they would have been without policy intervention. While common for economic modelling, that’s not how most people think when assessing the impact of policies. If prices are up in 5 years, the government could argue that they would have been up even more without policy intervention, but this isn’t likely to convince most people. In this case with poor affordability pointing to an extended period of price stagnation or declines, the province may have gotten lucky on timing. If the modelling holds up (as usual, economic modelling is educated guessing at best), it may actually bring multifamily prices down on an absolute basis. However as I’ve mentioned before, 5 years in the future is likely outside the buying window of most people reading this sentence right now.

New post: https://househuntvictoria.ca/2023/12/18/how-are-things-holding-up/

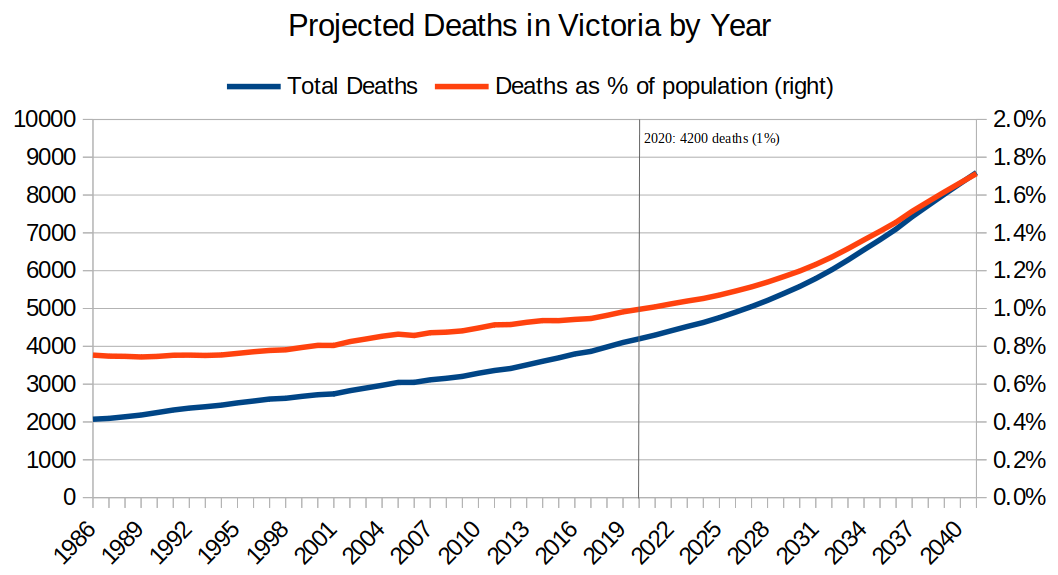

LeoS: Thank you for providing the chart projecting deaths and projections indicate a substantial increase.

You are right that the millianials are in prime buying years but their purchasing power is more salary based and less large capital fund from selling a house in Toronto or Vancouver. Strangely, or perhaps not, I think it will have a much greater negative effect on condos than SFH. Naturally there are a lot of moving parts.

Their 90+ day delinquency for their mortgage portfolio increased 78% on a year over year basis. I suspect most people are hanging on for now and if conditions continue or deteriorate then lots of people will get hit at once in a short span.

The fact they don’t seem to have had a spike in defaults makes me think people are figuring out how to handle the high rates. The 2024/2025 renewal pain may not lead to as many arrears as people expect.

The reason BNS (and National Bank) has high a higher provision for credit losses is that they don’t have the luxury of kicking the can down the road since their variable rates adjust immediately following BoC moves. This maintains the mortgage term with positive amortization as per the original contract terms. RBC is somewhat similar in that they don’t allow negative amortization.

All other banks will see the credit loss provisions go up substantially with renewals, may not renew risky mortgages, and/or charge a higher rate to recoup the credit losses.

No. Banks aren’t stupid, a lot of the loans are EUR or USD so not negative real rates. Some of the other “mortgages” are Islamic Mortgages where interest is not allowed so the principal is inflated and what appears to be interest is fees. .A Lot of purchases are big down payments or foreign all cash.

The main point is that the huge price rises are because It’s a housing craze in Turkey . Rent prices rose a staggering 157% last year,, and that’s not related to negative rates. Istanbul prices rose 480% in the last two years.

https://www.benoitproperties.com/news/turkey-house-prices-rose-51-last-year-after-adjusting-for-inflation/

Yes of course, that’s a very common reason that house prices rise during inflation – as a tax-free safe haven. Not just in Turkey but in Canada, USA and elsewhere. Canada house prices tripled during the inflation of the 1970s and doubled again in the 1980s.

Yet there are people here on HHV that think that higher rates and inflation will crush prices. Not me.

It stays until you mouseover the comment, then it’s gone. Not quite sure why it does that, default behaviour of the comment plugin, but it should not disappear on its own

Dang, missed that goodie!

Big banks hunkering down.

The negative real interest rate (-20%) is exactly the reason why house prices have gone up so much in nominal terms. Housing is seen as a safe haven in the face of hyperinflation.

LMAO another horrible take, but not surprising given all your content is from the internet with zero real world experience.

Do you have any idea how much money she made during her stint in the US with the jobs she had? Do you have any idea what RE prices are in Istanbul or Manhattan? You should know how to google those, now go ask yourself if what she is saying makes sense or is she saying some B.S. to fit the narrative.

Not to minimize the refugee problem, but the Inflation in Turkey is mainly due to political interference in the central bank (e.g. 2021:)

https://www.aljazeera.com/economy/2021/10/14/turkey-erdogan-central-bank-firing-clears-way-for-more-rate-cuts

Really? I thought it was Trudeau in the basement of Rideau Cottage sitting behind a Gestetner printing bank notes.

Just take a look at all the people flooding into Turkey from neighbouring war torn countries. That’s what causes house inflation, and inflation in general.

Most of those millennials are going to need that transfer of wealth to pay down their jumbo mortgages.

As bad as our housing market is, it looks like Turkey’s is worse! Their central bank chief had to move in with her parents because housing costs are too high in Istanbul!

Turkey has Inflation 60%, interest rates 40%, and yet house prices went up 100% YOY!

This is all contrary to the common HHV’er idea that inflation and high rates will lower nominal house prices. As I’ve said many times on HHV, history in Canada and elsewhere tells us that nominal house prices rise during rising rates/ inflation, and fall when rates are falling! Now noone is saying Canada is like Turkey, but there are plenty of examples in Canada/USA where inflation+rising rates have led to higher nominal house prices, and falling rates have seen falling nominal house prices.

Why?…Because the economy drives house prices more than interest rates.

https://www.barrons.com/news/inflation-forces-turkey-s-central-bank-chief-to-move-in-with-parents-c806d3ba

“Inflation Forces Turkey’s Central Bank Chief To Move In With Parents

The new head of Turkey’s central bank said she has been priced out of Istanbul’s property market by rampant inflation, leaving no choice for the former finance executive but to move back in with her parents.

“We haven’t found a home in Istanbul. It’s terribly expensive. We’ve moved in with my parents,” 44-year-old Hafize Gaye Erkan, who took up her post in June after two decades in the United States, told the Hurriyet newspaper.

Erkan previously worked at firms including Goldman Sachs and First Republic Bank — and is now getting a crash course in the soaring prices that have seen many young people struggling to find lodgings.

“Is it possible that Istanbul has gotten more expensive than Manhattan?” she said.“

The Gordon Head box is an efficient floor plan layout that maximizes space while reducing cost. The only more efficient design to maximize space and reduce construction costs would be a cube. But I have never heard the design called “character” as most lack ornamentation. They are functional and economical which characterized most of the 1970’s and 1980’s.

The homes built today are more lavish with copious amounts spent on kitchens and bathrooms. Who really needs a pot filler faucet in a kitchen? I saw a property last month with gold plated faucets. Houses today have become a statement of one’s personal wealth.

I wonder if the future of housing may revert back to austerity.

This is exactly happening in south Oak Bay right now on small lot, especially south of McNeil Ave, but almost all 1970s+ Gordon Head boxes still being flipped instead of tear down. If this tend continues for another 20 years, eventually south Oak Bay will look like Royal Bay today and Gordon Head will look like south Oak Bay today, where most of these 70s homes will be called “character homes”.

Forgive me, but when I see that graph, I see a ton of boomer-owners splitting $1-2M estates between their (average of two?) Gen X/millennial children. Huge wealth transfer.

I’m using Chrome and I do see the new/unread comments highlighted in blue, but it’s only blue for a few short seconds. Maybe if it stayed blue a little longer you’d notice it. IMO, it would be helpful if the blue didn’t disappear so fast — not sure how everyone else feels about it.

https://househuntvictoria.ca/2023/12/11/summary-of-housing-policy-actions/#comment-109219

That’s a wild gap in a short time. 1559 Ash (8,700 ft lot) @ around $160/ft versus 1554 right across the street (11,000 ft lot) at $77/ft, or less than half the price. If you can stomach the interest rates, or have lot-to-no borrowing, it’s a nice time for developers to stock up a bit. . . .

Barrister, I’m already seeing the effects on housing when it comes to the baby boomers that are now into their late 70’s. The Rockland neighborhood that you live in does not represent most of the market as the houses in your area tend to be architectural designed large homes that are worth preserving. The rest of Victoria is mostly small pre 1960’s houses that were built for retirees and that’s why they only have two-bedrooms on the main floor. These homes are an inefficient use of land. The homes built a decade later in the 1970’s were built to maximize space for growing families at the lowest cost per square foot. The Gordon Head box is an example which was built with an unfinished basement that the owner could develop later to meet the needs of an expanding family. The middle income family on a budget home.

The estates that have lately come to the market are pre 1975 houses that have had little updating or remodeling and like their owners are showing their age. The original owners were frugal and only made repairs as necessary. These were the properties that escaped the gentrification that was occurring a decade ago when every guy and his dog was remodeling and flipping old homes. The problem with financing these older homes is that most of property’s value is in the land component. So at times it is a challenge to meet the requirements to amortize the mortgage over their remaining economic life. The challenge stemming from a nostalgic desire for these old homes still exists with some buyers pouring bags of money into them when what they should be doing is demolishing them. I expect that to fade away as the cost to renovate at times is equivalent to the cost to build new. One can spend $300,000 to $400,000 to renovate a old home but a significant portion of those costs are not recoverable in the marketplace.

A lot of homes in the core districts are mostly comprised of land value. The baby boomers have owned these homes for 40 plus years. When these baby boomer home’s are sold they will most likely be demolished. My expectation is that the pace of demolishing these older homes will accelerate over the next couple of decades. In another decade or so, the character of these neighborhoods will change and Victoria will look more like Royal Bay is today. The neighborhoods will still be peppered with some character well preserved properties but there will be a lot fewer of them. Economics will trump nostalgia and we will see more homogenous housing built such as what happened in Vancouver with the “Vancouver Special” Entire city blocks of near identical homes built to maximize finished floor area.

-or not.

Month to date numbers:

Sales: 212 (up 1% over same time last year)

New lists: 292 (up 6%)

Inventory: 2333 (up 25%)

I did some modelling on the death rate in Victoria which should slowly increase over the coming decades. https://househuntvictoria.ca/2020/03/09/modelling-the-morbid/

But we have to remember that the boomers are going to be less relevant as millenials are in prime buying years, and gen-z are entering household formation years.

I’m using Chrome and that doesn’t work for me. Maybe I’ll have to try Edge or something… however as I was looking for dark mode (I already have it for my OS system and for the browser) I tried closing and reopening this page and the font is darker! Thanks Leo! Hopefully this isn’t too disturbing for the other readers.

I don’t think darkening the font is a bad idea overall. The main article text is already black, so doesn’t make sense to have the comment text so much lighter. Let’s be honest HHV isn’t winning any design awards.

Maybe we could have suggested that CuriousCat familiarize him/herself with Dark Mode and Page Zoom (browser settings) before we changed the way the website looks for everyone?

Arbutus, I suspect that a reasonable portion of the wealth transfer will be leaving the city since the kids more often than not do not live in Victoria. Historically, wealth transfer has mostly been squandered by the third generation.

Frank, neither of us is expecting to be here in Victoria for too much longer. Typically, in most cases the surviving spouse often downsizes or in a few years ends up in a nursing home. I suspect that the massive growth of government jobs will counterbalance the decrease of retirees although home purchase power might change.

“..anyone know what’s up with RateSpy? Used to be my go-to site for an overview of mortgage rates. They seem to have gone belly-up, or at least are no longer advertising available rates anymore.”

Rates.ca bought it and no longer seems to update it much, if at all.

Thanks CuriousCat. I darkened the font and will look into the numbering system. For now the unread comments are highlighted in blue, does that not work for you? It’s device specific though so if you are on different devices each one will show different blue highlights depending on the last time it was on that page.

Barrister, my theory:

With or without high immigration, more wealth to the haves (their offspring) continued demand in the form of home or second home (eg cottage, recreation, out of country) purchases, wider gap between haves and have nots. I hope I’m wrong.

“Inner-city infill sites, on the other hand, are all unique, and cannot be retrofitted with prototypical buildings.”

This isn’t really true. The 80/20 rule applies here, with a dozen typical sizes duplicated many times.

Interestingly enough, Kelowna had pre-approved designs for their RU-7 upzoning in 2017. It worked, but it got some backlash eventually because too many of the same designs were being built over and over. Now they are thinking of going a different way, keeping a binder of previously approved designs and allowing builders to pick those to get somewhat accelerated review, but not publishing a list of designs that is static. Seems like a better system, IMO.

Barrister- Why not simply ask your wife what she plans to do?

Physics has Laws for sure, but that doesn’t stop many arguments …

Like they say… you can’t count the number of irrational arguments on physics forums 🙂

The revival of pattern home designs will do little to solve the housing crisis

https://www.theglobeandmail.com/opinion/article-the-revival-of-pattern-home-designs-will-do-little-to-solve-the/

I looked a bit more into the baby boomers dying faster than retiring numbers and while the numbers are not clear to me, it does look like we will reach the tipping point in the next two years at the latest. Obviously by 2031, all of the baby boom will have reached retirement age.

My question is what happens to the housing market when here when this steady stream of old people with suitcases of money starts to slow down while at the same time houses start to empty out as they drop dead, downsize by the surviving spouse or enter nursing homes? I know that there is a complicated set of factors here but overall it seems to indicate a real change for the local housing market. Has anyone seen any modeling on this?

I don’t drink coke, even if it’s free.

[tips hat]

Patrick, all I have heard is gossip.

Back in the 80’s it was the speculators that ended up eating crow. I was a kid, there were signs on houses everywhere offering free Intelivision gaming consoles and free vcr’s with the sale of the house. Even with the moon shot interest rates the majority of the mortgage holders made it through. I remember a lot of belt tightening back then…kinda like what I’m seeing right now.

With that said, this cycle doesn’t scare me at all, just another bump in the road, buckle up enjoy the ride…we’ll see you on the other side.

Even if a house falls into foreclosure, as is where is, sight unseen…you’ll still end up paying fair market value.

Max and Frank seem like they could be siblings given their posts?

Others on HHV have been telling us about Vancouver buyers snapping up core Victoria lots for multiplexes. Do you see any sign of that, in view of these falling lot prices you’ve mentioned?

I’m still not buying your story, there are bumps in the road.

The key is hold…Even with the vacant land tax.

If you own a lot clear title and approach the bank for the build to construct a house they will approve the build mortgage no problem…why would they do that? Because the land is a tangible asset.

They don’t even care how much money you have in the bank, they want something tangible they can take back in the case of default. For the guy’s out there trying to sell in a down market…sucks to be them.

Land values have been already.

A lot sold at the peak at 1559 Ash Road for $1,425,000 . Which was way too much in my opinion. The property across the street at 1554 Ash just sold for $850,000.

A lot in the Marigold area of Saanich that sold near the peak at $800,000. Asking price for a vacant lot in the Marigold area is now $699,500.

Land values aren’t budging…ever.

Even if I owned a vacant lot I would still hold, Its tangible money in the bank that will just keep getting bigger and bigger and bigger.

I was around in the 70’s-80’s and land owners made bank…look at Eddy Ing the guy that sold out to west hills… He is just fragment among the many, many others who nailed it with land back in the day.

I would rather hold land than cash, stocks, bonds, or whatever….Land is solid, Its tangible.

We are about to revisit the zoning for the Songees Roundhouse lands over in Vic West. In stead of messing with endless arguments give the developers three or four extra towers, making it a total of about eight to ten towers, and make them up to four-five (45) floors each. In exchange for all the density have them build one tower of 15 floors for supportive housing. Half should be rental and half condos. Make it a condition that they have to complete them in under ten years.

Land values are not carved in stone. They can fall dramatically. And if we go into a recession – they will.

Unlike a house, that you can rent, there is a small to zero market to rent vacant land. The rental on a home sets a price floor. If home prices fall too low, then investors jump in to buy the cash flow that the property generates. There is no cash flow and no price floor for land. Its value is governed by market sentiment.

If one wants to develop missing middle homes then it has to come from the bottom up. And the better way to do so is to have those owners of properties that have improvements of nominal value to put their properties on the market. Thereby increasing the supply of developable land and lowering land prices.

The Victoria core has a lot of these properties with small pre 1960’s houses. They are just not being listed for sale in the numbers necessary to dramatically lower land values.

Remember gentrification? That sparked a lot of people to buy these old war shacks, update them and then flip them. That’s coming back to bite us on the arse.

.

I don’t think rental availability is the issue, I just don’t think people can afford these prices…and If they can they would just as soon buy. Not to mention you need a very solid resume to even qualify for the application process…pay stubs, credit score, In person interviews, references, iris scan, etc.

The developers need to come up with some kind of rent to own thing. Making the banks redundant altogether. Or the developer could take second position on the asset in the form of a second mortgage topping up what the banks won’t release.

Kinda like selling the asset, then being a landlord for the balance. The developers could probably bundle all these second mortgages up and sell them in the form of reits on the open market.

At the end of the day, construction costs are construction costs, land values are land values, and that is never going to change. Affordability needs to come from the top because the bottom just simply can’t afford it.

So how’s the rental market doing in December?

There are about 535 rental listings on Craigslist within a five mile radius of the downtown core. Which is a lot for December. The impact of the proposed changes to vacation rentals seems to be having an effect.

The lowest priced one-bedroom in a purpose built apartment in the city is $1,500 a month at 1022 Pandora which has been up for lease for the past 20 days. That’s about $3.00 per square foot for a suite that is comfortably within shopping, walking and biking to the downtown. But if you absolutely have to live downtown then the lowest rental starts at $1,850 per month for a condominium or about $3.60 a square foot not including parking at 1029 View Street.

The average rent for a one-bedroom downtown condo is about $2,150 per month but there are still condos half way through the month available for less. Enough space for someone and their snuggle bunny to live in.

Downtown two-bedrooms are more expensive but you can split the cost with a room mate. They are averaging about 40 percent more at around $2,950 a month. The lowest priced two-bedroom at 845 View Street being $2,295 per month or about $2.85 per square foot plus parking. No smoking but a cat would be allowed if it was only smoldering. It has been up for lease for about a month now.

In summary, the downtown rental market seems to be weakening since the announcement on vacation rentals. There seems to be a lot more supply of rentals and they are taking longer to lease up. That leads me to believe that the vacancy rate for downtown condos is slightly higher than the surrounding neighborhoods. That’s not good news for investors.

PS In this blog’s favorite complex – The Janion. A studio has been up for lease for about a month at $1,695 or $4.70 per square foot. Asking rent for a studio at the Hudson is $1,450 or $3.00 a square.

Do any of you think the Janion may be a bit high of an asking rent?

How are sales going so far this month? The next two weeks should be very quiet.

Didn’t realize many ground floor condos have grass on the patios. Big patios (100sqt+) on condos have always commanded a premium though as there just aren’t many of those around especially on newer buildings.

Barrister, when it comes to the Victoria Core condominium market, some 62 percent of the sales lay between $400,000 to $700,000. 80 percent are between $300,000 to $800,000.

If you want to build missing middle stratas in the $900,000 to $1,250,000 range that’s just 8 percent of the market. It works out to an averaged absorption rate of 10 freehold strata units per month over the course of a year.

It’s essential for the success of the missing middle to bring these prices down substantially to appeal to a greater proportion of prospective purchasers. My opinion is that we can’t just do this solely by reducing the soft costs related to pre-construction before a spade is put in the ground. It’s necessary to attack the root of the problem which is the cost of single family homes improved with old homes where the improvements exhibit a low contributory value to the property. As it is now, the land value of single family home is too high relative to land for redevelopment into a houseplex.

Early adopters of the missing middle should have some success, but as more developers enter into the market, the market may become saturated with unsold and unfinished projects. The common wisdom is that more supply will lower prices but it will come at the cost of developments that are completed or nearing completion that have sunk costs.

My opinion, is the best way to lower costs and not to compete with freehold condominium developers is through PPPs or private public partnerships to provide a different product from what is currently being offered in the marketplace. Hence my thoughts are leaning towards long term leasehold condominiums rather than freehold or pre-paid leasehold condominiums. As an example the False Creek development done by Vancouver. Perhaps including an initial ground lease at a low or zero rate for the first five or ten years of home occupied ownership. There are several ways this can be structured to a developer to reduce their land costs and/or provide a substantial injection of capital to be applied against their construction costs.

And it’s the reverse sentiment here.

Most insolvencies are credit card debt. Multiple cards when one is maxed out, too many Skip the dishes orders, Amazon and online shopping, internet gambling, on and on. Some people are living the dream, until they wake up to reality.

$275K in fines for real estate agents who allowed fraudsters to sell B.C. home that wasn’t theirs

https://bc.ctvnews.ca/275k-in-fines-for-real-estate-agents-who-allowed-fraudsters-to-sell-b-c-home-that-wasn-t-theirs-1.6688179

I think what the problem is here, we are in a huge debt bubble. Credit cards, car loans, student loans, cell phone bills, Disney channel, Netflix, financed a couch at the Brick, on and on…these things all add up at the end of the month.

I think people aren’t really over leveraged on mortgage obligations, rather they are over leveraged on personal debt.

I find it hard to have sympathy for these people. People know when they are f#cking up…Its a built in intuition, yet they still crossed that line. Every other ad on the Q FM is an insolvency ad…why?

The sentiment is pretty interesting. When condos are the same price as they were 15 years ago it’s smashed all expectations of profit out of people.

I think the people renting are those not able to get the mortgage approvals and those that aren’t planning to stay for 5+ years, but I’m surprised they’re still able to build new condos even at those prices. They don’t build as much as Calgary but they do still do it

I am curious, how is the condo market doing these days? What is selling?

Alberta is a meh market , I did a project there and wouldn’t do another one .

Pretty difficult to find a patch of grass with the none ground floor ones.

Probably because they can’t find affordable housing in the area because of STRs.

Aren’t there big patios for none ground floor condos? Like the Hudson for example

I hope that coke had some rye in it for $4.50.

As a kid I would work on construction sites as a labourer for $3 per hour (min wage at the time) slaving 8 hours per day for $24…Its all relative.

When I was a kid a can of coca cola was .45 cents now its $4.50 cents.

Housing has always been expensive. Renting has been a thing ever since I’ve been on this rock. Think View street towers, Blanchard courts, co-op housing, social housing, on and on.

Houses have never been cheap, rent has never been cheap.

Also, one more tidbit, starting to see more and more demand for ground floor condos with small fenced patios re dogs. I’ve just had a transaction go unconditional on a ground floor unit with fenced yard yesterday, an accepted offer on a similar unit ground floor unit today with a different dog owner buyer, and an email today from a new different buyer looking for such as well.

I think this is possibly a function of a lot of dog owners being priced out SFHs and townhomes.

I am actually thinking about buying a pre-sale ground floor unit in Croatia as the North American trend of pet ownership is blowing up in Croatia and when developer’s sell pre-sales in Croatia they charge 75% of the finished per square foot price for covered balconies, 50% for patios, and only 10% for ground floor condos with fenced grass yards so it’s great bang for buck buying a condo with a yard for the time being.

I wonder how these condo towers will fare in a big earthquake.

Edmonton is just a headscratcher. I saw a studio in a remediated condo building the other day for $50k. Why would anyone even rent? Are people there just because the have to be and hoping to flee to Toronto or Vancouver as soon as they can economically?

I watched a podcast a few months with two agents (one from Calgary and one from Toronto) where the Calgary agent was giving the Toronto agent some numbers like investors buying 225k units and renting them for $1,750 and the Toronto agent was like that makes zero sense. Calgary agent explained it as a lot of people have been burned in Calgary real estate the last 20 years on downturns so there is much more appetite to rent versus buy (and potentially lose money on the purchase). I thought it was kind of interest.

Totally agree. I am seeing compression in the condo market on the basis of affordability rather than value. What I mean by compression is I feel there are just complete crap units in problematic buildings in poor locations that are holding in there at >$400kish. I think the demand is huge from government/military/uvic/etc., employees and I don’t think that is going anywhere even in a recession in Victoria. The alternative of renting isn’t that appealing as rents are very high.

On the higher-end seeing some solid value, but a lot of buyers simple can’t qualify. For example, this is one of many condos I see really good value in at the moment -> https://www.realtor.ca/real-estate/26359088/1803-848-yates-st-victoria-downtown

What I am trying to convey is I think the bloated public sectors in Victoria will set a huge demand floor for any type of housing, including condos, going forward.

Been through Virginia , beautiful part of the U.S

Bobby K, good to know, although the post is telling about your character.

Virginia really varies, the coal mining western part of the state is economically depressed while the eastern part is extremely prosperous. Looking forward to seeing how things shake out after Christmas.

Physics is the law, everything else is a recommendation

LMAO

Barrister, I remenber seeing this survey last year and remembered it when I saw your post. It says Virgina is the grossest state in America.

https://www.zippia.com/advice/the-grossest-states/

Meanwhile in the real world people are desperate = huge demand for any type of housing.

Yes. And you’ve correctly included the necessary condition to cite the “law of supply and demand” which is “for a given type of housing”. So if we increase supply of “home type X” the law of supply and demand tells us the price of “home type X” goes down. And the “law of supply and demand” doesn’t tell us that the price of a different type of housing (“home type Y”) will also go down.

For a real world example, If we have more supply of “hotdogs” the law of supply of demand doesn’t tell us the price of “steak” will fall. For housing this means that the “law of supply and demand” doesn’t tell us that increasing micro-units supply will lower price of SFH.

There can be other theories of economics such as “substitutions” that would try to explain any effects of “increased hotdog supply” on the price of “steaks”, but “substitutions” isn’t the “law of supply and demand”. And substitution theory is complicated, and based on how similar the buyers consider the form & function of the different products to be.

Canadian doctors are head hunted constantly by the U.S. clinics and hospitals. Nothing weird about that. Plus real estate is cheaper and the U.S. dollar has a lot more buying power. It’s a no brainer.

I don’t live in Vancouver so I don’t know but their ERs are open is my understanding. In Osoyoos/Oliver the ER is regularly closed down due to lack of doctors. The nearest open ER is an hour away – long time to wait if you are having a heart attack.

Totoro, what is the hospital situation in Vancouver these days?

Just got off the phone with the munchkin who moved to Virginia. It took her a day to get a GP and two days before getting an appointment with him. The weird thing it is a doctor that is from Barrie, Ontario who graduated from UofT. She says he spent almost half an hour with her going over just about everything include diet and exercise. Doing an extensive panel of blood and spit tests as well a couple of things I dont understand. But, it sounded very comprehensive.

She seems thrilled with the new house and everything else. Apparently the search for a puppy is about to start this weekend. It is just nice to know that they are doing well.

I am concerned about the unintended consequences of the STR changes on some of our tourist areas. I suspect it will be catastrophic for many local businesses and workers and for municipal and provincial revenues.

A lot of the homes built in ex. Osoyoos would not be there but for the summer tourist market and are way more expensive than a local worker can afford. The lack of reliable hospital services makes it very unlikely that loads of Vancouver retirees will step in as full-time residents.

https://www.castanet.net/news/Oliver-Osoyoos/461695/Understaffing-continues-to-cause-closures-at-the-South-Okanagan-General-Hospital-ER

Spoke to a number of insider contacts at various businesses and sectors last week. Confirmed that the labour market and discretionary spending has dramatically turned in the last 6 month and likely recession incoming shortly. Might not show up in the stats yet, good luck to all!

Something is in demand if someone is willing to pay for it. There is demand for all types of housing. Increase supply for a given type of housing and its price will go down, for a given level of demand. And that’s the law of supply and demand in a nutshell.

From $2500 plus a week in the summer to $2200 a month long term. These units are worth more than a million so that is really low ROI.

Okanagan rentals and real estate sales have had way bigger drops than Victoria from the STR changes as they are dependent on summer tourism – not much going on Oct-May in the smaller towns.

Will be huge knock off effects to the local economy – more than the forest fires – but long term rentals sure are easier to find now.

LMAO

If suggestions are being taken on website design, I’ll agree with Max here. I only check this website once a day usually, while I have my morning coffee and I’m also spending quite a bit of time trying to figure out what the newest unread comment is. There can be 100+ new comments a day! A numbering system would be welcomed. Another teeeeny tiny suggestion… I wish the font for the comments was a lot darker on the white background. I’m finding this one difficult to read. Unless there is a dark mode that I haven’t seen? I find myself actually selecting the comment I’m about to read with my mouse to highlight it. I find the post itself very legible, it’s just the comments that are too light. (The dates and time are almost invisible to my poor eyes.)

I’m not complaining or anything, I just find newest like reading a book backwards.

I understand that. Is there a way in the settings to default to oldest? In settings is there a way to have the posts numbered linear?

The dropdown menu on the opposite side of the comment count that allows you to select oldest or newest……

From: https://financialpost.com/news/live-news-top-business-stories-december-15-2023

I imagine the same numbers will be reflected in Canada soon. Hopefully, it ends foolish mandates and subsidies. Especially mandates requiring charging infrastructure be included in new homes. Guess what, if it is a feature the builder thinks they can sell (or the customer is demanding), they will include it anyway.

Is there a way to default to oldest rather than newest? I find newest very non linear.

In a very, very kind way…this is just a suggestion for Leo S, could you number the posts.

Its easier to just scroll down to the last post number I have read.

Again, this is just a kind suggestion.

@ Whateveriwanttocallmyself.

The interest rates aren’t even that high, Its not like its double digit Armageddon. These are normalized interest rates. I thought that was what the stress test was for.

Not sure why you’d assume that isn’t already the case. Thanks for the advice, but I’ve got that covered.

Ok sure. Just like all the other things that “applied to housing” that HHV told us about – the money laundering hearings, beneficial registry, foreign buyers, satellite families, unexplained wealth, number companies and spec tax were big deals being dealt with by the NDP that would help housing. So now it’s the “Auckland upzoning experiment , with a made-in-BC bonus idea of reduced parking requirements ”, to be transplanted to Victoria . Of course you and Totoro may be 100% right and this is just-what-we-need, but forgive me if I’m skeptical.

For the record, you can ask any economist, the “law of supply and demand” that you cite frequently, only applies when the supplied product is the same as the one in demand . In the case of Victoria housing this isn’t at all the case, as the product in demand (SFH) isn’t the product being supplied (multi-units, where you are tearing down the SFH in demand ). So, as far as economics is concerned. the law of supply and demand doesn’t apply to our Victoria multi-units plans, and there are much more complex relationships between substitutions etc. which is a different area of economics than the law of supply and demand. Multi-units are the perfect product for the 5,000 or so that move to Victoria per year, and the extra availability will likely increase that number moving here. Likely higher numbers of well-heeled retiring boomers from Toronto and Alberta will be happy to buy in Victoria to take the supply of those expensive multi-units in the core near a golf course or marina.

But ask any Victoria HHVer looking for a SFH if they’re excited about the new supply of multi-units……. [silence]

Anyway, thanks for the comment , and good luck with the new project!

Busy working on a new project this week, so haven’t been keeping up with the comments.

As for the impact in Auckland, forgive me if I’m not super interested in debating whether supply and demand applies to housing or not. It does.

The reforms worked to produce a lot more housing in Auckland, and the people actually studying those markets have concluded it also improved affordability and rent growth. No doubt it will be interesting to monitor the data going forward to see the full spectrum of impacts but it’s not like this is some novel case where we are looking to learn about how more housing affects prices. Tons of examples from other cities that those with better supply elasticity have lower prices.

Why is Edmonton so cheap despite growing faster than Victoria? Because they have a lot of housing. It’s as simple as that.

Obviously what works in Edmonton (lots of sprawl) doesn’t work here, but that doesn’t change the factors at work.

I would take this with a grain of salt, but the Fed also started gently walking back the “higher for longer” rhetoric this week, and now anticipates 3 rate cuts in 2024.

Your article referenced on Auckland;s rents is out-of-date, ends early 2022. Doesn’t include the recent year YOY to Oct 2023 which data I posted,, with large Auckland rent increases of 11%. Which “laid a big egg” on the story of Auckland’s lowered rents. If you can find something current, that can explain that big rent increase away, I’ll be happy to continue the discussion.

As an aside, on the homeownership side, Auckland laid another housing “egg” with deteriorating affordability (price:income) as the 88th worst affordable city to buy housing out of 94 English speaking cities. Another reason we shouldn’t mimic their housing policies. But that’s a discussion for another day!

Next msg

The 5 year bond yield has free-fallen 117 basis points in 2 1/2 months. From 4.42% oct 3 to 3.25 today. If that sticks, that means the 5 year mortgage renewals should be 3.25 + 1.5 = 4.75 . All depends on the economy, if is OK then it’s clear sailing for the housing market in the spring.

The article you quote does not address the impact on rent. In fact, the author states he has not read that paper yet.

The article deals with whether upzoning creates more units that would have been created by a immigration and a boom cycle. I think there was some effect of low interest rates that may work against us here. Other authors have since weighed in including:

https://www.sciencedirect.com/science/article/abs/pii/S0094119023000244?via%3Dihub

I believe that Leo can point you to the data to support why building more new houses reduces housing costs overall. I am not an expert in this field of analysis.

I think we won’t see the effect of the higher interest rates until next Spring when the market was very busy during the spring of 3 and 5 years ago. A larger number of homeowners would be refinancing then.

I suspect we might not see rate cuts anytime soon unless there is serious restraint on government spending.

The changes to vacation rentals have had two effects on the market that I wasn’t expecting. There has been a significant increase in the number of furnished houses for rent and the number of Estate Sales.

The articles you posted have been “rejected as flawed and contradicted by the data “ by some experts in the field.

These articles you posted are both from the same author, and even they don’t say it’s anything more than an “argument” in favour of their position. You ignore than it’s merely a “argument” and state it as facts. ‘Here’s the intro to one of their articles.

“ Using a quasi-experimental framework, Greenaway-McGrevy and Phillips (2023) argue that the zoning reform generated a significant increase in residential housing permits over the five years subsequent to the policy change.

The conclusions in the specific articles have been “rejected as flawed and contradicted by the data “ in great detail, by articles like this:

“ The Auckland myth: There is no evidence that upzoning increased housing construction.The one study showing it did is methodologically flawed and contradicted by the data” https://www.fresheconomicthinking.com/p/the-auckland-myth-there-is-no-evidence

And they are talking about the two exact articles you posted. And they proceed to tear their apart in great detail, with PhD level charts only an economist would understand.

The authors are Dr. Cameron Murray and Dr. Tim Helm, both PhD , and employed and well published and specializing in housing and real estate matters in New Zealand and Australia.

If you are truly “excited” by this kind of article, you may enjoy their thorough rebuttal of the articles you posted. Good luck, this isn’t for the faint of heart!

Anyway, the point of this is : experts continue to disagree on the success or failure of the Auckland experiment. What we do have objectively is the rent data that I posted, showing continual rent increases and a 11% rent increase in the last year alone. Compared this year to Wellington (and New Zealand overall) , which wasn’t upzoned like this, and whose rents rose 5% YOY. (as I posted)

—===

Here’s a simple test for you to convince yourself if you’re right about your theories of Auckland’s housing success. . Please provide an answer, as if you have any confidence in what you’re saying about Auckland is correct, this should be an easy one. There are two cities, Auckland and Wellington, and we are measuring housing starts (consents) in each one (indexed as described in the article). Now one is Auckland that upzoned, and one is Wellington, that didn’t and is described as having a “racket to stop housing being built”.

So your easy job is to tell me which city is Auckland and which is Wellington?

The answer is here, but don’t peek! https://www.fresheconomicthinking.com/p/the-auckland-myth-there-is-no-evidence

Perhaps we should use Detroit as our model instead of Auckland.

/s

Annual pace of housing starts in Canada down 22% in November, says CMHC

https://www.cbc.ca/news/business/annual-pace-of-housing-starts-down-in-canada-1.7060588

Yes.

Far better than the pace of appreciation and increasing hardship for renters and first time buyers without these changes. And it is not just forward modelling from the province but also the analysis done on the past seven years in Auckland:

https://cdn.auckland.ac.nz/assets/business/about/our-research/research-institutes-and-centres/Economic-Policy-Centre–EPC-/WP015.pdf#:~:text=In%202016%2C%20Auckland%20upzoned%20approximately%20three-quarters%20of%20its,five%20years%20subse-%20quent%20to%20the%20policy%20change

and

https://cdn.auckland.ac.nz/assets/business/about/our-research/research-institutes-and-centres/Economic-Policy-Centre–EPC-/WP016.pdf

Can’t keep up, so much back and forth.

https://www.bnnbloomberg.ca/bank-of-canada-s-macklem-says-too-early-to-consider-rate-cuts-1.2012235?

Sorry, but saying “the data shows” and then your go to “data” is not data, but “modelling” from consultants hired by the government with an obvious goal in mind. Hardly data. Do you honestly think there was any chance of the models paid for by the government to come out with a conclusion that the government’s plans wouldn’t work? The shocker is that the models didn’t come out and say that prices would be lower, instead rents will keep rising, just by a “feeble” 6-12% less than they would. Is anyone really excited by that?

Anyway, I don’t want argue about it. If government “modelling” that rents will rise, but 6-12 % less than otherwise is good enough for you, to get rid of SFH zoning, which has been an important factor producing as many SFH as we have now, well OK you must be happy. I think that shortage of SFH is the main “crisis” in the “housing crisis”, and we will only worsen it. So we differ on this. Time will tell.

I guess more supply , with cheap rates and fast profits creates more demand . Hey it’s the Canadian economy lol

If densification produced more affordable housing, Vancouver would have some of the least expensive housing in North America.

“Vancouver has the highest population density in Canada, with more than 5,700 people per square kilometre, according to Statistics Canada figures. It also has the fourth-highest population density in North America after New York City, San Francisco, and Mexico City.

“The elimination of single-family zoning is the most recent fashion statement, but I think (the policy) makes a lot of mistakes,” said Schultz, a former director of planning in New York state.

https://vancouversun.com/business/real-estate/the-promise-and-pitfalls-of-upzoning-and-missing-middle-housing-policies

“Developers are going to produce the type of housing that gives them the greatest profit. So just because you remove regulations, it doesn’t mean it’s going to produce more affordable housing. What it’s going to do is encourage developers to buy undervalued property that used to be single-family zoned and then flip it into high-end more-expensive housing.”

Never been the story. The data shows that increased housing slows the pace of rent increases and prices – not lower them from what they are today or tomorrow. Increases will happen, just more slowly based on the modelling. Here is what the province actually said:

What this means is that there should be an improvement in affordability vs. what it would have been and this is what the data in Auckland shows has happened:

https://www.abc.net.au/news/2023-09-25/nz-auckland-house-supply-experiment-results-in-dramatic-change/102846126

As an aside, I think rents are down 5-10% since the reforms were announced and all the STRs came onto market.

https://househuntvictoria.ca/2023/12/11/summary-of-housing-policy-actions/#comment-109137

That is quite curious, that house prices and rents haven’t sagged much. Seattle too – has allowed multiplexing on SFH lots for many many years. It’s a slow transformation for sure, and won’t have an overnight impact (if at all).

Uh oh !…….Bad housing news from Auckland New Zealand. Rents have surged up 10.7% YOY to October 2023. This is 6 years after Auckland up zoned the whole place, and became the poster child city for BC politicians to spin the tale that increased density will improve affordability and LOWER rents.

One look at the Auckland rental chart from 2016-2022 (statsista.com) followed by the huge 10.7% rise in Auckland rents YOY to October 2023 (news hub.co.nz) paints a very different picture. Rising rents!

So let’s recap… even density advocates are predicting that Victoria SFH prices will rise from increased density (SFH scarcity). And as we can see, Auckland rents have risen consistently since 2016. And in the last year, Auckland rents have increased 10.7% almost double the average in the rest of New Zealand.

So after 7 years of this Victoria (BC) upzoning maybe Victoria can be a “success story” like Auckland, where our rents too have kept rising consistently since upzoning and then surge 11% in year 7. Won’t that be exciting and worth the wait! But is it worth tearing down SFH (making them more scarce), not requiring parking and giving a tax-free upzoning land lift to SFH owners? I don’t think so!

https://www.newshub.co.nz/home/money/2023/11/rental-price-index-auckland-weekly-rent-reaches-all-time-high-despite-national-median-stabilising.html

https://www.statista.com/statistics/1080383/new-zealand-mean-weekly-housing-rent-in-auckland/

We could have an early spring market , best to get a head start over everybody else

Peter sounds good but my understanding is that u can only build 4 units in oak bay . So you would more than likely build 2 level townhouses . I’m not sure but after 13000 u can build 6 units , either way they are going to big and they will be well north of 2 mil .

I am a bit surprised by the number of open houses the week before Christmas.

That’s actually why I was wondering before whether a developer could make money going a different route by buying one of those really large lots say in Rockland, even Uplands, maybe parts of Oak Bay, and building luxury concrete & steel condos. I don’t know enough about this, but say 2.5 million for a large lot with a tear-down, build say a 4-story nicely terraced concrete & steel luxury condo project (4 units one floor each, say 2000 square feet each) – is it reasonable to think dvpt. costs on something like that might be say 600/sq. ft including soft costs = about 4.8 million, total cost for project say 7.3-7.5 million, maybe as a really unique product these might sell for like $2.3 million a piece, $9.2 million total.

Are these figures nuts, or is that feasible? If so, you’d think a Jawl or someone like that would think about it. They’ve built some nice 2,000 sq. ft. condos like on the golf course.

It’s true that not many people would pay $2.3 million for a condo, but this would be a pretty unique project and you only need to sell 4 of them. I think there’s more and more wealth in Victoria, and this would have a market.

Doesn’t do much for missing middle!

Anyone have a price on recent sale of 4091 Beam Crescent?

The problem in some of the higher end neighborhoods of Oak Bay and Victoria is determining what is or is not a missing middle lot. Developers may be interested in finding an older home in need of updating that they may demolish, but there is still demand by home owners to find the same property and renovate the existing home to modern standards.

One can point to a property say in South Oak Bay that is improved with a small home and exclaim that’s a missing middle property! And yet a missing middle house plex won’t be built on that lot. Instead a prospective purchaser will just renovate the existing house.

I suspect that’s because prospective purchasers still desire these older homes as they want the nostalgia of old Oak Bay. As more new homes are constructed, I think that nostalgia will be lost in the future as the neighborhood transitions from old homes to modern houses.

Cambo I don’t think we will see any meaningful interest rate cuts unless we are in a recession having said that we really at historically normal interest rates today , and the economy can’t stick it

I’m curious how the convergence of all of these new rules, mixed with the most recent forecast by TD (example) of a 150 bps drop next year and a further 125 bps in 2025, will see a return to a more active market, both for buyers and developers (I’m neither – but do have a few rentals). https://economics.td.com/ca-mortgage-tides-canada-households

https://www.reddit.com/r/PersonalFinanceCanada/comments/18isirn/td_economics_expects_150_bps_next_year_and_a/

Patriotz, I am not familiar enough with Texas to even begin to guess. I do wonder about the wisdom of real estate investment that are completely dependent upon capital appreciation to show a real return. The capital appreciation, in turn, seems to be very dependent upon extremely high immigration numbers. At the same time, the real per capita worth of Canadians has been on a slow and steady decline. Before someone points out how much money people have made in Canadian real estate, I will completely agree that many a fortune has been made.

Somebody posted a chart on here showing that in spite of having a much lower income than Americans Canadians were happier. For some reason the much lower income worried them a lot less than perhaps it should.

Well RE in BC is far more expensive than in Texas, so clearly somebody thinks it’s a better place to invest for some reason. But I’m not claiming that metrics like rental yield are better in BC.

Texas is a very solid place to invest with a very growing dynamic business community. Not sure if I would say the same of BC

For the people saying that the market for long term furnished rentals is small.

I have had 4 of my units set up as long term furnished rentals for the last 2+ years with a 0% vacancy rate and have never advertised on Airbnb.

That being said, we just had our first month vacancy as the market is flooded over the airbnb change and December/January is the worst time to rent. this will eventually change when people decide to sell or rent long term

Our rates are 2850/month up to 5000k month for 1 bed 1 bath or 3 bed 1 bath units.

We started with one and I was very sceptical about doing it at first, but it’s been amazing this far and gives us some diversification.

An acquaintance of mine now has 300 long term furnished units between B.C/Alberta/Ontario all strata condos/townhouses. he stoped investing in Canada about a year ago and is now buying in Texas, he as well has never listed on any airbnb platform.

The problem with most peoples opinions is they have never actually done it themselves, do you how glad I am that I never listened to all those people telling me not to buy a rental property and I was going to be getting clogged toilet calls at all hours of the night haha, Yet to get one.

Just like the 24 plus months I’m into the dvp permit/B.P permit to legalize two rental units in an existing building that met all the zoning requirements and only needed a couple variances.

Do not hold your breath on all the fluff that Ravi is spewing, you will only know what I’m actually talking about, if you’ve actually gone through the permitting/dvp process in Victoria or sannich.

It’s ok though, sannich’s website says only 3 months turn around.

Barrister- I wouldn’t lose any sleep over when boomers are going to be extinct. For every one that dies, there are 5 more that can be imported to replace them.

Patrick, I wonder when the curve of retirements and deaths is supposed to cross. I am sure someone has figured that out. I suspect that the gross number reaching 65 drops pretty dramatically in the last few years judging by one boomer curve I saw and the death rate totals start to really pick up, judging by the American numbers you posted about 27% of all boomers are already dead. Most of my generation is already either gone or staring out a window into the dark.

On a different point on the airbnbs. It’s obvious that you love to use them when traveling. No need to apologize there, I love them too, and so do many if not most people. Would you like to see all these cities you stay in also ban airbnbs, so you are back to using hotels? I think there’s a basic principal that if Canadians are expecting other countries to have airbnb, Canada should reciprocate by allowing them too.

Canada can’t make repeated claims to be special, by banning foreign ownership, punitively taxing foreign second homes and now banning many airbnbs, without being willing to accept that foreigners might respond in kind by banning Canadians (snowbirds) from doing the same in their country – namely banning Canadians from owning homes, second homes or staying at airbnbs in their country. So far the Americans have been “nice” to us, but I wouldn’t expect that too much longer, given the spirit of their original “rattlesnake” flag is alive and well… with the message “don’t tread on me”

Anyway, I’ll bow out at this stage. Thanks for the discussion.

I don’t think it does. Your analysis pointed to the closing of STRs as “making the housing crisis” worse and this is objectively false.

For starters, people like Marko who only list their primary residence when they go away can still list on Airbnb so these will be available. Second, occupancy rates on Airbnb for active listings (which are not all listed year-round) are at about 55%. So for 30-day plus rentals this covers 1-5 bookings a year, not all of which will convert to long-term rentals for a variety of practical and economic reasons.

For example, sometimes when we vacation in winter we book 30 day plus furnished rentals, but we would never stay 90 days or want to do move-in move-out RTB style rentals that require us to both apply and set up utilities from a distance. Super impractical. We’d just choose a state/province/country that permitted a shorter time, or stay at home.

While the loss of the 30plus day bookings on Airbnb/VRBO may result in a small increase in demand for longer term executive rentals of 90 days or more, there is an absolute glut of furnished rentals on the market and more being added each day from the change in STR rules. The executive rental market has way more product than demand and the market will normalize around this demand while still returning the vast majority of STRs to the regular long-term rental market.

They aren’t. Your figure says it is for listings not number of stays. So 24% of the listings have a minimum stay of 30+ days. This makes sense. Victoria has a bylaw banning most STR with 30 days as threshold. Folks trying to comply with bylaw would advertise 30 day minimum.

looks like the remaining probate sale beside sarita wont go below $1mil.

The well moneyed boomers retired at 55. The one’s retiring now are the one’s that had to keep working to 65 to get a pension.

Yes US numbers. With the numbers as definitive as shown, I doubt that Canada is materially different on the point in question.

One article said that during the whole decade of the 2020s, five million Canadians will turn 65. That is like about half a million a year. I am finding the numbers confusing and all over the place.

I don’t know….better deals in the COV and the MM is much further along than the provincial push in terms of actually getting something built in the next five years….also can’t see a developer wanting to deal with the tree bylaw on Sarita. My best guess would be renovation.

I did not feel like they were dying that fast but I have no idea.