Property tax breaks and new inventory arrives

It’s election season and that means the vote-buying goodies are starting to flow. First time buyers have long been able to get a break on the property transfer tax, but the purchase price limit of up to $525,000 was woefully low for expensive markets like ours and hadn’t been updated since 2017. Even 15 years ago when many of my friends were buying, first time buyers were extremely hard pressed to find a house under the rebate limit.

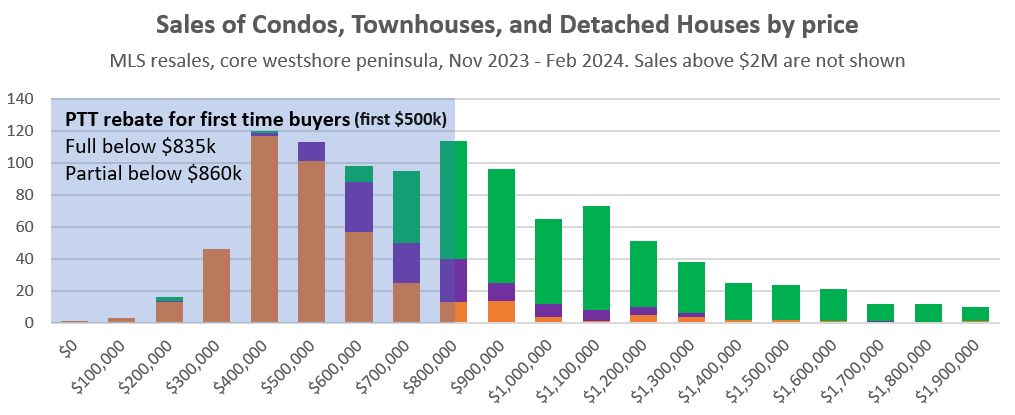

A couple weeks ago BC United promised to cut the Property Transfer Tax for first time home buyers for purchase prices up to one million dollars as part of their somewhat underwhelming housing plan. Not to be outdone on handouts, the NDP announced that the threshold for the full rebate would rise from $500,000 to $835,000 for first time buyers, with a gradual phaseout of the rebate to $860,000. However crucially the rebate is only on the first $500k of property transfer tax, they don’t get a full rebate. So a first time buyer buying a $800k home would not pay PTT on the first $500k, but would pay it on the $300k. That threshold is generally not enough for most detached houses, but it covers most condos and perhaps half of the townhouses on sale. That kicks in April 1st 2024. The proportion of first time buyers has been pretty steady between 20 and 25% of the market since 2010 according to the VREB agent survey data.

They also announced that the threshold for a PTT exemption on new homes would be raised from $750,000 to $1,100,000, with a phaseout to $1,150,000. With current pricing, that would cover about 65% of new home sales.

Don’t expect these moves to do anything for affordability, as demand subsidizes are generally reflected in higher prices. All things equal, buyers with more money to spend on the same number of homes will drive up prices, though it always takes a while for the market to adjust. The government claims this exemption for first time buyers and new homes will save British Columbians $100 million (in other words, they expect a PTT revenue hit by that amount). In 2022, the exemption for first time home buyers cost them 37 million while the new home exemption was 46 million. The new program would roughly double the cost of these two programs. They are projecting an increase in PTT revenues from increasing sales by about the same amount this fiscal year, which means net revenues should be about flat.

Another interesting tidbit out of the budget is that the government expects population growth to drop nearly in half, from 3% this year to 1.6% in fiscal 2026. That matches my view that we’re past peak population growth and we’re going to see the policy mistake of uncontrolled non-permanent resident admits mostly reversed by 2025.

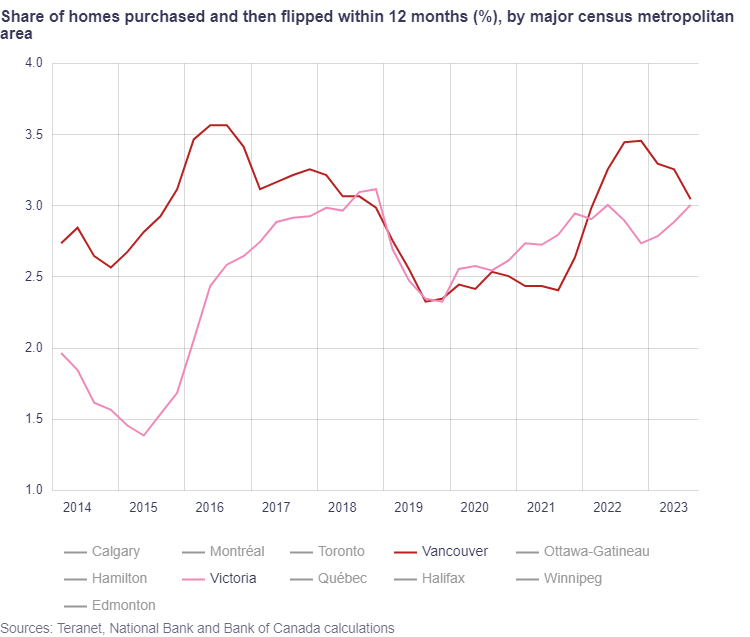

The province also piled on the flipping bandwagon, matching the federal move to tax flippers by introducing a 20% tax on flipping profits for properties sold within a year, to be gradually phased out for properties sold within two years. Don’t expect any impact on the market though, in Victoria only 3% of properties were resold within a year according to the land title office and tracked by the Bank of Canada.

Most of those are likely to fall under one of the exemptions for normal life events. The biggest trouble spot may be people selling pre-sales, where it’s still unclear whether the flipping tax will apply from when the purchase date or the completion of the building. There is a statement that “the purpose of this tax is to support housing supply, not impede it. Exemptions will be provided for those who add to the housing supply or engage in construction and real estate development” which makes me think there may be an exemption for this situation to avoid discouraging investors from financing condo construction. I wouldn’t be surprised if the net revenues from this tax were near zero.

Also the weekly numbers

| February 2024 |

Feb

2023

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 54 | 154 | 274 | 386 | 460 |

| New Listings | 160 | 400 | 678 | 929 | 811 |

| Active Listings | 2129 | 2186 | 2258 | 2344 | 1809 |

| Sales to New Listings | 34% | 39% | 40% | 42% | 57% |

| Sales YoY Change | — | -9% | -2% | -4% | -36% |

| New Lists YoY Change | — | +14% | +26% | +30% | -13% |

| Inventory YoY Change | +22% | 22% | +25% | +30% | +113% |

| Months of Inventory | |||||

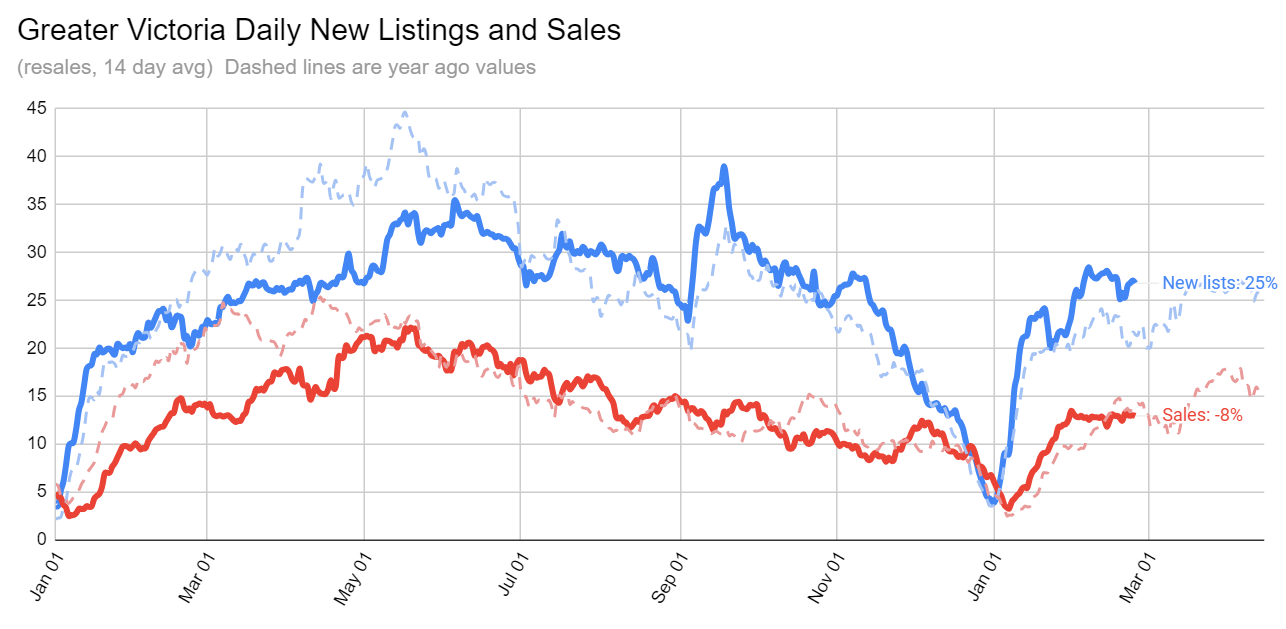

Pretty interesting shift in the market, with continued strong level of new listings while sales are unremarkable. We’ll see sales ramp up in March as we always do, but for now we’re going to end the month with the market a good bit weaker than we had a year ago. Sales will end unchanged from last year, but new listings are substantially healthier.

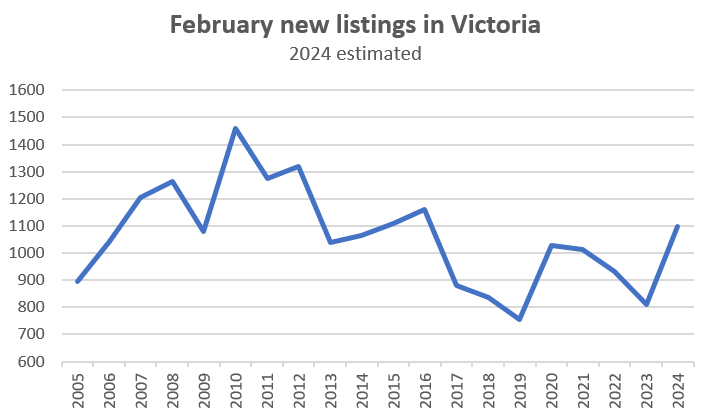

However it’s worth noting that last February was an unusually low new listings month, so the big jump this year is more of a return to normal than anything outside of normal ranges. It is more than we’ve seen in 8 years though, which is good news for buyers.

I was just listening to a real estate podcast and I totally didn’t pick up on one very important detail in the first time buyer PTT tax exemption increase to 835k (phase out to 860k). If you buy something for 750k as a first time buyer you are only exempt on the first 500k. You still have to pay 2% PTT on the difference between 500k and 750k, for example, if you are buying up to 835k.

The sliding scale between 835k and 860k I guess impacts how much of the tax you save up until 500k? This is different from the previous setup.

Leo, not sure if you had picked up on that when it was announced. I completely missed it or it wasn’t in the news releases.

I’m 100% sure they aren’t. At least not overall. Some pockets weaker than others for sure, but market has definitely picked up from last fall.

New post, February numbers: https://househuntvictoria.ca/2024/03/02/february-it-depends-on-where-you-look/

I would say most haven’t just because of…

Marko, I was using average price and HPI. Using your median numbers looks far worse from Sept to end of Jan at -13%, ouch!!

barrister, US to CAD was around 1.30 vs today so not much different.

Max of course 6% is before land transfer taxes, real estate fees (most people may have moved more then once!) mortgage interest, renovations, maintenance and on and on…..

It feels like long term home rates of return will revert to the mean of around 4% so I say prices continue to fall or go sideways for a few years.

Is Monty’s back? Like It used to be?

Probably will depend on the venue…. Monty’s, The Old Bailey, Steamers….. Lot’s to choose from.

Bobby, now figure out the rate of return in USD.

That’s not too shabby for a roof over your head…That you would otherwise have to rent.

I am not 100% sure SFH prices are falling based on what I am seeing on the ground and in the numbers. If March comes in above $1.1 median combined with on my ground impressions I think there might be a tiny bit of upward pressure actually.

Median for the last 13 months

Feb (2024) – $1,125,000

Jan (2024) – $1,047,450

Dec (2023) – $1,065,000

Nov (2023) – $1,086,500

Oct (2023) – $1,125,000

Sept (2023) – $1,210,000

Aug (2023) – $1,165,000

July (2023) – $1,190,000

June (2023) – $1,175,000

May (2023) – $1,172,353

April (2023) – $1,195,000

March (2023) – $1,080,000

February (2023) – $1,100,000

Looking at the Greater Victoria stats released today shows that in the last 6 months single familiy homes prices are down 5.2%, given that the expectations for interest rate cuts this year have been cut in half in the last 2 months with some analysts saying that the BOC may not cut rates at all this year it will be intersting to see if prices continue to fall.

Also noticed that the rate of return for the last 20 years averaged exactly 6%.

Oops I meant the latter

The former, day job pays pretty well especially for victoria but quite stressful and involves regular travel (this has gotten alot better since covid). Also want to spend more time with family and kids while they are still young.

As If…I can see It now.

VicREanalyst, are you near retirement age or just going to switch to something laid back or part-time once you’ve achieved “enough” to retire early

I battle with that concept, never a right answer of course

I am up for it once I retire from my day job (in ~5 years by my estimate), until then I’ll keep my anonymity.

A meeting would be nice but how would the “mute” function operate? A blackjack? Taser?

Leo, what was the median for SFH’s for February? Are they trending down?

Works for me, apart from Good Friday..

How is this news? BC Housing in 2016 introduced a complete non-sense “owner-builder” exam. The person that was consulted on putting together the exam for the government then comes up with a study course for the exam which is nearly $1,000.

Wrongs on so many levels, but yea the government will fixing housing.

It will as soon as the government stops forcing all of us EV owners into buying gas-free, near maintenance-free EVs. Only reason I am buying EVs is the last time I checked the government doesn’t allow me to buy a Dodge Ram.

Sure. Maybe some Friday in March?

Apropos of something I’d be up for a HHV beverage (caffeinated or alcoholic) thing in the flesh provided there’s a no-bickering proviso.

Wow. Incredible inept government procuring story on CBC.

Company awarded $200m of government contracts

Has 2 employees.

One of whom works for the government.

And due his 1/8th indigenous heritage qualifies as a native run business.

“partners” with other companies to bid on these aboriginal only contracts.

https://www.cbc.ca/news/politics/dalian-enterprise-millions-government-contracts-1.7130206

Think the government can fix our housing problems?

Barrister , on 4 acres I would think they can be 4 detached strata units . From what i am aware of u can’t sell 4 strata lots . The problem being is servicing 4 acres could be expensive

Thanks, March will be very interesting to watch, early Easter too which will throw some week over week comps off.

Down 3% if we did it by business day.

Caveat that with one extra day this year! Looks like pretty much even?

https://ca.finance.yahoo.com/news/cmhc-says-first-time-homebuyer-164740225.html

https://www.cmhc-schl.gc.ca/consumers/home-buying/first-time-home-buyer-incentive

Final February numbers

Sales: 470 (up 2% from last Feb)

New lists: 1088 (up 34%)

Inventory: 2364 (up 31%)

Under the new provincial missing middle guidelines, assuming there is any clarity at this point, are you allowed to build four stand alone houses on a large lot (lets say four acres). If so should they be strata units?

Can you take a four acre lot with a house on it and carve out three strata lots which are then sold without any houses built on them at that point? Or does it have to be a single structure with multiply units within? Can those units be strata units or do they have to be rental.

Patrick and VicREanalyst let’s all grab coffee and hug it out.

$1.95M

Why is not needing help relevant? Why post that?

Didn’t you just fabricate a story about helping your kid buy a house a week ago? Shouldn’t you know? Why do you even care if they don’t need your help and have a realtor already?

you were quite critical of hhv opinions in the past why do you want them now?

Get off the internet and start living a real life 😉

Would someone be kind enough to let me know how much 332 Dallas Road sold for?

https://www.theglobeandmail.com/canada/article-international-student-numbers-to-be-slashed-in-bc-but-public/

https://www.cbc.ca/news/canada/toronto/international-student-study-permits-data-1.7125827

Awesome charts Leo. Exactly what I’m looking for.

Thanks.

Total fad. Pure gas/diesel car sales are down 39% from Q3 2017 to 2023, but I’m sure it will reverse any year now

Core only by price range.

There are not many bidding wars in any price range. Only 1 in 10 sales going over ask. Sure the other ones could have multiple offers, but they’re at or below asking. Shouldn’t have any problem picking something up.

Not Thursday night for me. Friday afternoon, rum n’ coke in hand, hot/humid in beautiful Queensland Australia.

G’day!

Alberta Resource royalties are much closer to corporate income taxes than to pure royalties. Meaning they mostly pay royalties on net income after related expenses. If the resource companies paid their own maintenance expenses to fix roads they broke, they would then pay less royalties, because they are entitled to deduct maintenance expenses from gross income and not have to pay royalties on it. The government has factored these type of expenses in when negotiating “royalty” rates.

You just made him spend his Thursday night frantically googling in an attempt to redeem himself….

Telling us you don’t understand what a royalty is…

and good probability Lucid and Rivian don’t make it and go into bankruptcy in the next few years. If you can’t think analytically you would conclude that EVs are just a fad.

Apple just put the kybosh on their autonomous Ecar project after 10 years, billions of dollars and 2000 employees. Over 100 years ago, 2 bicycle mechanics produced the first airplane.

I would think it’s 7 months of winter in Alberta that’s taking its toll on the roads , not too sure it’s trucks

He doesn’t, but someone in his household does. Point is people such as myself that shouldn’t be getting rebates are getting rebates, not to mention the cost to administer the program(s). Best was when I bought my Model S for 100k 8 years ago and the government sent me a 5k rebate cheque on a 100k car (there was no max price cap back then) 🙂

At this point the EVs will sell with or without rebates, just let the market do its thing. The amount of pollution we produce in Canada is a rounding air in context to what China produces so not sure why we going nuts on trying to push EVs. If people want to buy Dodge Rams or Broncos or whatever I am 100% for a free unmanipulated marketplace.

However, eventually people will clue into why am I paying $100 each time at the gas station and paying $200-$300 for oil changes+maintenance and the market will shift on its own. There is no need for these non-sense 2030/2035 EV only mandates, rebates, etc.

One of my adult kids+spouse (living in Vancouver) is looking for a SFH to buy in Vancouver or Victoria. Doesn’t need my (or any) help financially, and they have an agent. In Victoria, is looking in $1.5m-$2.0m range. Not looking for a SFH with suite.

I’ve read on HHV that the lower priced SFH around $1m are most in demand with multiple bids etc. And that houses are not getting snapped up in that higher $1.5-2.0m range (in Victoria). Is that the general consensus or is that higher range also competitive with multiple bids etc. too?

Not really sure the point of this other than that your friend reports low enough T4 income and is eligible for the full EV rebate.

For perspective, the loan loss provisions are the bank’s own “estimate” on what loan losses might be. There is a strong incentive for the bank to massage that value as much as they can for reporting purposes. Investors can decide if 1/1000 loan loss is a reasonable assumption given RBC’s underwriting standards and loans outstanding across their entire loan portfolio.

Can’t speak for commercial applications but sold my Model S with 262,000 km and it was by far the most reliable car I’ve ever owned. Still had the original break pads and 8 years later the car was better than the day I purchsed it (via over the air software updates). If it wasn’t for the 45k Model Y would have never sold it and taken my chances with the battery but just didn’t make any sense to keep it out of warranty give how much they’ve dropped the price on the Y (plus the insanity of the 8k in rebates).

It’s like that all over the world. In Zagreb already 6 of us have Teslas in the building and then the redneck parts of the country you won’t see a Tesla/EV for next 30 years. The only difference between Canada and Europe is here rednecks drive Dodge Rams and in Europe they drive either BMW M or Mercedes AMG, but the same attitudes towards EVs. The thing I don’t understand is why anti-EV people are so passionate about being anti-EV? I hate Dodge Rams but I don’t waste my time on forums/FB commenting on why not to buy one. You want to spend 70k on a Dodge Ram, I could care less, fill your boots.

Downtown Vancouver is absolute crazy, every other car is EV. I am curious to where everyone is charging.

A friend that lives in a $3 million dollar home in Victoria texted me today

“BC Hydro just approved me for the L2 charger rebate of $350…..I really needed that!” He also got the $9k rebate on the Model Y……the EV subsidies do really need to stop, complete non-sense.

Um really, those two houses show up in the portal now with sold prices. The wessex one looks like they moved quite abit from asking.

Alberta Oil/Gas industry pays $25 billion per year royalty revenue, (33% of all tax revenue), that should cover their share of road repairs. Those big trucks burn lots of fuel so they’re already paying lots of fuel taxes for road repairs.

Every tax doesn’t need to be socially engineered to that level to be worthwhile. $200 per e-car sounds fine to me, because it’s simple, especially for year 1 implementation.

On the electric vehicle note..

https://bc.ctvnews.ca/canada-s-first-electric-fire-truck-was-in-service-less-than-a-month-before-it-needed-repairs-1.6787929

As well, I have an acquaintance that works for Coast Mountain and the electric buses they bought are basically bricks and they can’t risk sending them out on routes because of the reliability issues.

A fixed tax isn’t proportional to use and the resulting impact on road maintenance. It should be a tax per kilometre, increasing with GVW.

But the current Alberta government isn’t very logical about anything not oil or gas powered. I can also note I was in Calgary last summer and it was striking how uncommon electric cars were compared to Vancouver or Ottawa.

If you drive around rural Alberta you quickly see that it is wildly overloaded oilpatch trucks and heavy equipment destroying the roads not electric cars. Fuel taxes in Alberta and elsewhere only pay a fraction of road costs so e-vehicle owners and everybody else are already paying for most road maintenance through general taxation.

Ya, they have been looking at dwindling revenues from gas taxes for over 20 years now as fuel efficiency improved. To support infrastructure, it will likely end up in road usage charges by the km traveled and the region the travel occurs.

Alberta is introducing $200 annual tax on fully electric vehicles to help pay for road maintenance, which ICE and hybrid car drivers are already paying via fuel taxes. Makes sense to me (and I’ve driven an e-car for 10 years). With BC having announced $6 billion deficits annually for the next two years, we should stop all these subsidies to e-cars.

https://edmontonjournal.com/news/politics/alberta-budget-electric-vehicle-tax/wcm/e6ecc649-d848-48b0-8617-079a19c8a652/amp/

918 and 924 Jenkins are moving right along…But 936 Jenkins hasn’t moved In months. They have all the municipal work done…Sewer, water, sidewalks, fire hydrant, lamp standards. They have hundreds of thousands of dollars Into It.

918 and 924 Jenkins…

https://www.paradise-homes.com/projects/view/20-the-boardwalk

Anyone know what’s up with this development 936 Jenkins? They demolished the house, poured all the foundations, did all the rough In plumbing, ready for slab…Its been sitting that way for months. I thought “get It built and get It sold” was the mantra In this game?

“The applicant is proposing to rezone the subject property to RT1 (Residential Townhouse) to allow for

approximately 9 townhouses within three separate townhouse blocks. The existing dwelling would be

demolished”.

https://langford.ca/wp-content/uploads/2022/07/PZ-Report-20220711-jenkins.pdf

That explains the freehold/strata on it…

1205 Deeks: My husband grew up in this area and used to deliver the Times Colonist to the original house and he remembers Mr Deeks (who owned the oldest house) subdivided it in 1990 to add 3 more lots and that little access road that he named, Deeks Place.

This one was weird. It was only available to view on the Saturday the day after it listed and all offers were due within 24 hours and were to be unconditional. The kicker is they wanted a June close. So, I passed on the slot that was available to me to take a look. That, and it’s a few feet from one of the core’s most insanely busy streets, so, combine that with the sketchy conditions, I didn’t see the value for me. I imagine it sold that weekend and it should post after the recision period.

I have been watching that listing off and on for almost a year. They seem pretty stuck on price (waiting for it to move on price instead of trying negotiate it). It came off the market and it was painted and some updates done, so I think they locked in on their price expectation. So, I just keep watching to see if that changes.

The vast majority of those aren’t Canadian residential mortgages.

As we know, delinquency rates on Canadian residential mortgages are still tiny and near all-time lows.

e.g. RBC

https://ca.finance.yahoo.com/news/rbc-reports-3-58b-q1-113528493.html

“ The [RBC] bank’s provisions for credit losses totalled $813 million for its first quarter, up from $532 million a year earlier, as pockets of concern rose. Commercial real estate, especially U.S. offices, has been a big area of worry, while consumer strain in Canada has also been growing in areas like credit cards and auto loans, and in mortgages to a much lesser extent

=—-==

For perspective, the $813 million in RBC loan loss provisions is about 1/1000 of RBC’s $923 billion total loans. Tiny

Insider contacts say that in general the CRE loan portfolio mark to market is optimistic. When you look at some sales of office buildings in the states, the sale price is sometimes less than 50% of the loan value outstanding. Canadian transactions are much fewer and far in between.

Net writeoffs from the big banks

I have spoken many times with home inspectors about cracks in foundations. Most older homes will have some cracks due to settling. Generally, a single crack along a wall is not uncommon. A potential problem occurs if there are two cracks on opposing walls such as at a corner of the house which would cause that part of the house to settle unevenly from the rest of the home.

A crack may lead to water or insect infiltration so it should be filled. You might also see white stains on the inner concrete walls and detect a moldy smell due to effervescing. That could indicate a drain tile problem or in the case of many older homes a complete lack of drain tiles.

Homes that were built pre 1973 were not under a BC Building Code. The building codes were set by the municipalities that employed people with construction experience but no training as inspectors. I remember my grandfather explaining how he had to pay off city inspectors with a bottle of whiskey to pass the inspection.

I bought a house with a cracked foundation above grade, wasn’t bothered by it . It’s when you’re walking down hill inside the house that’s a non starter for me . I guess that and a saddle in the roof line

I’m pretty sure they will follow the lead of the feds on this, which deems that the holding period RESETS once a taxpayer secures ownership of the property.

From page 8 of the Explanatory Notes published by Chrystia Freeland, April 2023:

Subsection 12(13) is amended to extend the definition of “flipped property” to include a right to acquire a housing unit in Canada. As such, profits arising from an assignment sale would be deemed to be business income if the rights to purchase a property were assigned after having been held for less than 12 months.

The existing 365 day holding period related to the actual housing unit would continue to be a separate test that only commences when the taxpayer acquires ownership of the housing unit. This means that the residential property flipping rule could apply when selling a constructed property within one year of acquiring ownership, regardless of how long the taxpayer held the rights to purchase the property before it was constructed.

The definition has a number of exclusions that relate to the reason for the disposition. These exclusions will also apply in respect of a disposition of a right to acquire a housing unit.

Well I guess that’s on him/her then…..

Umm Really, I see some IMO decent “value” sales in the last couple of days. You look at any of those?

1205 Deeks: triple suited, 3600sqft 1992 house on 7500 sqft lot in maple wood for 1.175

3152 Wessex Close: 3500 sqft 1980 Henderson/foul bay house on 9100 sqft lot for 1.53. This one looks to be backing on to henderson road but looks like it has some monster hedges for noise and privacy.

I don’t think so.

I was actually inquiring for regular SFH lots in light of the provincial MM upscaling. (not highrise developments) Thanks.

Not limited to around Uvic, it will extend much further down Mckenzie. I believe I mentioned something big going down in saanich last summer via consultation with several big players according to insider contacts, and another poster (Thurston?) mentioned he heard the same thing. This is part of it.

Barrister there was an article in the TC today about Saanich OCP changes. From 18 story towers near UVic to gasp something like 4- 6 stories in Broadmead Village.

I’m on my way…This ones mine.

Back to your flipper neighbor with the foundation issues, did he/she not get an inspection prior to purchase?

Max is ready to make the call….

Has Sanaach changed the height for buildings on a SFH lot? Does anyone know the height limit?

Sorry, to get back to housing.

I liked It way better when you would just go pick up an mls paper outside the corner store, motorola flip phone In hand…ready to pounce.

Ok this whole handle debate seems pretty pointless. Time to move on I think

What exactly did this ks112 poster do to you Patrick that got you so upset? Like seriously, who remembers what some poster posted 5 years ago on a internet forum? Doesn’t seem like anyone else here remembers this poster but you….

LMAO, ks112 thinks people make business decisions based on “advanced warnings” posted on anonymous Internet blogs. But go ahead and keep congratulating yourself about it. Not pathetic at all.

Have you considered muting ks112? Just throwing it out as an option.

And so VicREanalyst (aka ks112) has regressed back to simply childish trolling (as he calls it). He’s been doing this 5+ years now.

LMAO! Buddy, its over no one really cares what some lonely guy (supposedly with adult children) that sits on the internet all day posting links and fabricating stories about his life posts. Serious question though, have you always been a prolific google link poster on HHV or did you start doing that after being called out for fabricating stories and got rattled?

I will correct my earlier statement of only “trolling” Frank, there was also that Westshore pumper (forgot their name) and that “Airbnb4me” poster. LMAO the latter was very entertaining, can you dig up his posts about Airbnb’s shortly before the legislation when I gave advanced warning?

For those that don’t own sure, I was just listing what I find of value on HHV, not a generalization.

Yes, legal or Illegal. They will just seize your bank statements from the previous 7 years and ask you where all this money was coming from. If they catch you after you sold they will want the capital gains exemption back too…With penalties and 10% Interest.

Curious if people go through making illegal suites legal after purchase, would it be possible for the government to go after capital gains and back taxes on rental income from the seller?

Homeowners should count too, since we have “boots on the ground” Intel of the rising costs of owning a house.

Like I said before, hhv is good for boots on the ground info from marko, Leo’s stats and other perspectives from actual contractor, landlord, developer, business owner posters. Rest of the discussions are rather pointless.

LMAO, what? I am just quoting something you posted, why so salty?

I found just jack , Leo and marko tone very informative back in 2014 when I was buying . I knew squat about what was happening in Vic . What I did know at that time coming from Van was that Victoria was cheap as chips

Leo should kick you off HHV.

I think it’s not renovated OR created another living unit, it’s AND. What I’m interested in is what happens if someone buys a house with an illegal suite, renovates it, and makes the suite legal. Does that avoid the flipping tax?

I’d ask the government but I think I know the answer

No rule against changing your handle.

Of course not. Never had a mortgage back then or even said that. You’re just being ridiculous and childishly trolling.

You trolled me for months in 2019, because i was describing how houses were affordable and provided a theoretical example of how anyone could buy a house. Of course I didn’t have a mortgage at all, my house was paid off 20+ years ago, and everyone including you was well aware of that. And so those numbers are just describing the prevailing rates for mortgages, as part of a discussion on affordability for first time buyers. You (ks112) became obsessed with the numbers used (70/30 principal/interest split on a 25 year mortgage at 3.5%), and turned that into dozens of trolling posts (as ks112). Now just the mention of those numbers has triggered you again as vicRE, just as it triggered you as KS112. And you will be unable to control yourself, and it will turn into ongoing childish trolling.

In memory of Just Jack. He made an impression on so many that they can’t forget

https://youtu.be/KTJbEFWI3Xs?si=02xhG5X4twH8lbLK

The coward is never gonna admit it.

Not sure what this is but I don’t think I ever “trolled” anyone here except maybe Frank a couple of times when he was clearly making b.s. up. Regardless, the content of this post is interesting, didn’t know you started a 25 year mortgage around Feb 2019, I guess you already refinanced? And how did you manage to negotiate the 70/30 principal/interest split on a 25 year mortgage at 3.5%? That seems quite high for principal at that rate, please teach the rest of us.

P.S. I am more than happy to troll you going forward if you like 😉

Not merely an accusation. It is a direct quote from you (KS112), telling the world that you are a “childish” “troll” that posts for your “own entertainment”

Here is your own HHV post, from 5 years ago (2019). You (KS112) were explaining why you were trolling Introvert, Patrick etc. and confessed to us all that you are a childish troll.

https://househuntvictoria.ca/2019/02/07/the-wealth-effect/#comment-56055

“Canada has introduced a new bill that aims to combat online abuse with steep penalties for hate crimes – including life in prison”.

“Other countries, including the UK, Australia and France, have recently introduced new laws intended to stem online hate content”.

“The bill must first be studied by a parliamentary committee and by the Senate – both of which may introduce changes to the final draft of the bill”.

https://www.bbc.com/news/world-us-canada-68409929

LMAO, quite the accusation! Just wondering if in your entire day and night of searching the internet, you thought about any other BS stories to fabricate about helping your kids buy houses?

Fast forward to Feb 13, 2024

LMAO, went from not knowing when and where to getting an accepted offer in a month. I think you and introvert should do the rest of the posters a favour and just text each other instead of pleasuring each other on HHV

We deal with Coast Capital and we have earthquake Insurance (5%deductible). We received a letter from our Insurance provider western coast saying our monthly payments were going up from $196 to almost $250 per month. This Is for a 2600 sq/ft house with a new 500 sq/ft accessory building In the back yard. We negotiated with them going to a 15% earthquake deductible bringing It back down to a little under $180 per month. He also said If we cancel earthquake Insurance altogether, we would have a very hard time getting It back…If at all.

Caveat,

You’re seriously defending an admitted “childish” troll, with multiple ID’s, who makes offensive posts like this for his “own entertainment” ?

Good edit, Sir Goof.

Just curious, are you planning on being a coward forever?

Feel free to ignore, just like everyone does when a topic arises that doesn’t interest them.

Oh really?

Muted by everyone but you, apparently.

As long as CRA gets a written directive from the applicant I dont see a problem . A reasonable very small charge would be appropriate. There is a public interest in keeping the integrity of the banking system.

LMAO, is this the poster muted by many making stuff up again? I am “daddy” to you by the way introvert 😉

Does anyone really care about this? We all know “whatever” is “Just Jack” reincarnated which doesn’t stop folks from engaging with him. Even Marko, now one of the most informative posters here, had a slightly shady start with HHV

Now do a full disclosure about being ks112 and lying about it.

re: PTT and Flipper tax

The PTT exemptions will create more demand hence higher prices! Note the flipper tax doesn’t seem to apply if seller has renovated or created additional housing (suite) “Exemptions will be provided for those who add to the housing supply or engage in construction and real estate development.” The amount of flippers who buy and sell in the same year without renovating is incredibly small IMO.

re: income verification

The banks have stated as a priority that they want OSFI to work with CRA to directly assist with independent income verification, instead of relying on applicant supplied documentation. To combat mortgage fraud, they want to use independent verified income sources that are difficult to falsify. OSFI have already said they’re working with CRA on that, so maybe it’s coming. So your bank will get the income records they need directly from CRA, which could include T1, T4 and other income related forms.

Full disclosure, I did not personally have the conversation with the “direct report to the C suite” my colleague did and told me when we were chatting the other day.

Exactly what VicREanalyst said.

Higher standard for income verification in general. Source: direct report to the the C suite at one of the Big 5 banks.

That’s expected given the rising rates, making it harder to pass the stress test. Did your banker friend mention any different factors than that?

Talking with a friend who is a manager of a mortgage group at one of the big banks and he said consumers qualifying for a mortgage is much tougher then in the past.

There won’t be a pinch on mortgages if that’s what you’re suggesting. The types of loans that had this small uptick in loss provisions are not mortgages, they are consumer (e.g. automobile ) and unsecured business loans. And many are outside Canada (South America). If there is a credit pinch because of this, it wouldn’t be in mortgages.

Pretty scary considering this mid-term requirement for earthquake insurance (not unreasonable IMO) comes just when many insurers have jacked up the premium for earthquake hugely or are getting out of it altogether…[oh, wait, do you mean – there’s an actual RISK here?? – well, then we don’t want that thanks!]

I’m actually kind of impressed by this lender being so proactive. My general experience with banks has been that they’re the most reactionary, calcified institutions that thrive only due to their near-monopoly. And that’s before we talk about insurers…

The pinch will be in credit availability and the increased charges for lending to account for borrower risk… Lol… Of course not a up front pinch for the bank, but it will be felt by consumers as banks will likely put even more cash aside for write downs and that will affect dividend payouts and overall share price (which definitely pinches the bank).

That rise of $40 million in provision for credit losses represents 1/200 of the $8 billion profit per year for Scotiabank. About two days profit. Not much of a “pinch”.

Sold at 830k

Did 1610 Haultain sell, and if so for how much? Must have been one of the lowest priced SFH in the core at $750k.

https://financialpost.com/fp-finance/banking/scotiabank-bmo-hit-by-rising-loan-delinquencies

Wow… I bet they thought they set aside pretty big piles of cash to cover, but…..

Half the reason Marko wants to build something is for the license to complain endlessly about this or that.

It would do his blood pressure and all of us a favour if he’d just take that cash and buy more TD stock.

Did the terms of the mortgage require earthquake insurance? Is that common?

Yep, getting close I figure… See what happens with some more inventory coming on.

Can’t do much better than that (beyond price of course).

Two offers is always super tricky as the other offer could be low or it could be over asking. Once you get into three, four, five offers then odds are typically it is going above ask.

Just the two offers on those ones, that’s how I knew. I have been going unconditional, with 30 close and a 10% deposit.

Were there only two offers including yours, othewise how would you know your offers were second? As of Jan 1st as listings agents we have to send the buyer’s agent a sheet, signed by the seller(s), with the names of the brokerages that submitted offers and when they were submitted but there is no ranking system.

I’ve now been on the losing end in quite a few multiple offer situations with buyer clients but I have no idea if my clients were 2nd or 3rd or 4th, I just have the sheet signed by the seller noting all the offering brokerages (without any other details other than date submitted). The first few I got in January agents were putting brokerage and realtor name, but the last few have been just the brokerage.

I personally offered above asking price and unconditional, 10 business day completion/possession last week on a MMI property and lost out in multiples. Pretty close to calling it a day on a MMI attempt, just not a lot of margin there given these land prices + construction costs.

Made two offers and had two others prepped that we didn’t proceed with when we got the number of other offers on the table. The two offers submitted came in second, so, horseshoes and hand grenades there… I would say they were value offers and not necessarily low balls because they would have taken it, if not for the one better offer on each of those attempts.

SFD in the core-ish areas (with some restrictions), also keeping an eye on value and quality a bit beyond those areas if a value option really pops where I just can’t say no. Mostly, it seems that there are still a few buyers that share the same targets on the value and location view with me. I will keep neighbourhoods, price and more granular considerations to myself. I will say those are on a sliding scale on how I view the value in a particular property.

You’d think the owners of vacant homes would get the message.

This is just a trial balloon. Depending on where the support / pushback comes from, they will form the rules. They want to appear to be doing something without actually doing anything. With all the exemptions and loopholes, minimal number of people will pay the flip tax.

No inspection or was the issue not able to be discovered without some destruction?

Folks seem to support more regulation and tax’s , so it’s a win win for the government and the angry mob

I wouldn’t say approving development of the second tallest building in the CRD, at the corner of Head St and Esquimalt Rd, is a no-brainer. If the developer didn’t want a battle, they could have proposed something more in line with the OCP.

Totally agree with you Patrick. The same tax from 3 levels of government is administratively insane and inefficient. The fact that it’s happened on more than one topic is even more insane.

One disturbing trend is different levels of government (city, province, federal) all coming up with their own new taxes on the same thing. Without considering the total tax that will be paid by the taxpayer.

—- For example, a spec tax home in city of Vancouver gets “double-dipped” in taxes with province (up to 2%) and city (3%). Resulting in an absurdly high (confiscatory) tax of 5% of the property value per year.

—— And now we have a 20% flipping tax for BC. But we also have a new separate federal flipping tax (full income tax on flip profits within 1 year, which could mean 53% tax in BC in top of the BC flipping tax). So what’s next???… is the city going to create their own flipping tax and add that to the others, so that total tax becomes 100% of profits or more?? Flipping a house isn’t some kind of crime.

I don’t think it’s even 5,000 steps each way? I would say 10,000 steps a day seems to be a consensus on a healthy lifestyle so not sure why you wouldn’t do the walk most days. It’s a relaxing walk, no cars/traffic. By the time you get into a car and cross the bridge and find parking and getting to office you aren’t saving a whole ton of time.

Esquimalt OCP is somewhat unique in that they don’t generally have height limits.

Marko, exactly how many government employees are actually fit enough to walk that far, maybe electric bicycle instead.

Such a great spot for density imo. The Songhees Walkway is such an amazing public amenity that is already in place and severely underutilized imo. From this project you can walk along the water to your office job downtown, doesn’t get much better than that.

Between 5,000 people they still are unable to update the PDFs a week later – https://www2.gov.bc.ca/gov/content/taxes/property-taxes/property-transfer-tax/exemptions/first-time-home-buyers

but sure, make fun of me again 🙂

GMC is going to have a fun time with their 26 floor 900 Esquimalt project. Public hearing Mar 4 https://www.900esquimalt.com/

No brainer approval IMO but I’m sure it’s going to be a big battle.

On the topic of flipping tax. Gov’t says:

Good morning,

Information about your question, regarding new development purchases and presales, is unavailable at this time.

Regards,

ITB Tax Team DW

BC Ministry of Finance

Very useful!

That’s a good question. Post-WWII province wide I don’t think so. Before that it’s a bit fuzzier since many larger houses functioned as rooming houses, so they weren’t “single family” although not multi-unit by today’s definition.

Fair point, then what about SFH+strata vs rentals. Was there ever a time in BC construction of SFH+strata<rentals?

Perhaps before your time, but there was an era within living memory when there were no stratas at all. 🙂

Finally, friend called me this morning with something I’ve never come across before. He owns a 4 year old SFH. Coast Capital, his lender, phoned his conveyancing lawyer (from time of mortgage registration years ago) to find out who the insurance company was. Concluded there was no earthquake insurance and then got in touch with my friend demanding earthquake insurance be placed on the home which will set him back almost another $1,000/year. Never heard of a lender doing an insurance audit mid-mortgage term, thought it was interesting.

I went in-front of Colwood Council last night asking to remove a suggested (by land use committee) rental building agreement from my rezoning application and was told that isn’t how things work and to negotiate a rental building agreement with the staff. Not the end of the world as my intent is to build a rental building and I just wanted flexibility in the event the rental is not financially feasible for whatever reason (my logic being a strata condo building is still better than nothing being built), but I can totally see people bitching in 10 years about too many rentals and nothing to buy. I am guessing this will be the first year ever on record in BC we see more rentals than strata units being built.

That being said my night as wasn’t as bad as the Pacific House developers in Esquimalt that got denied the extra two floors on a tie vote, that hurts big time. I can’t believe the meeting wasn’t deferred and they let something so important go down to a tie (not approved).

Works great when the market is rising, much harder when it isn’t.

Neighbour sold their place, now being renovated by someone looking to resell. So many issues popping up (cracked foundation). I suspect it’s going to be very difficult to break even on that one.

I live on a street with 2009, 2014, and 2019 yr built higher-end buildings (for Victoria) and there are kitchen/countertop/reno trucks on the street every week. Reality is when I show an absolutely mint well-kept mid 1980s to mid 1990s home, but all original, the majority of my buyers say “this place needs a complete renovation” EVEN if it is in immaculate shape and fully functional.

Buyers on average want turnkey and modern and I do think that someone buying a fixer upper and renovating (often with a ton of sweat equity) and then selling it to someone who wants a turnkey home is providing a service in society. [I do think a lot of flips for re-sale are poorly done, but that is a different story]

That all being said flipping is just so rare that it wouldn’t make any sort of impact on the marketplace. Friction costs in BC (PTT, commissions, legal fees, carrying costs, etc.) are so high that it is difficult to add enough value renovating (unless the market is appreciating during the reno) to make a profit. You see the occasional 1970s Gordon Head flip but not common.

Hope not. Investors financing condo construction is good actually. Have reached out to them on this.

The flippers tax doesn’t really impact on typical sfh in Victoria expect few multi-million flipping because most flippers name on the titles as individual. Once sold, they will claim relation; and exempted from the tax. I think the government is more targeting these pre-sale condo/townhouse investors that competing with first-time buyers in Metro and Okanagan.

I agree the flipping tax is useless, but it combined with by right multiplex approvals may actually help and incentivize those near teardowns to be rebuilt as du/tri/quadplexes instead of single family

Anyone capable of flipping million dollar properties are not interested in working by the hour.

The US has had a flipping tax for years, and prices there are no more immune to increases than here. Taxes and regulations add costs.

If I’m a flipper I’m calculating whether the ARV supports the additional tax, when it does, I would resume flipping.

“Deterring “flippers” from taking distressed properties and converting them into more marketable properties will only contribute to the housing crisis.”

I see it as giving a dream to the first time home buyers who are not scared to roll up their sleeves to make it their own .

Good. Get trades to work on building additional dwellings, not making existing ones more expensive.

Flipping tax should result in less demand for trades, atleast for renos. Especially since many of these flippers are trades people themselves.

Nice to have an opinion from a disinterested expert. 🙂

Real estate association economist asks if B.C.’s flipping tax is worth the trouble

https://www.bnnbloomberg.ca/real-estate-association-economist-asks-if-b-c-s-flipping-tax-is-worth-the-trouble-1.2039451

Deterring “flippers” from taking distressed properties and converting them into more marketable properties will only contribute to the housing crisis.

Great article Leo.

Zero net revenue from the new flipping tax sounds right, as there seems to be an exemption for everyone including many flippers.

Flippers also remain exempt from speculation tax in most cases. Of course they were never even a target in the first place.