More on westshore weakness

Last week I mentioned that despite the overall market remaining in a mild sellers market territory, market strength depends on where you’re looking. Rising rates sideline buyers, but only if those buyers are dependent on credit. Rising rates can also threaten owners, but only if those owners have large mortgages. In Victoria the rate of buyers and owners with mortgages varies drastically by area, with 70%+ of owners in much of the westshore having a mortgage, while only 30-50% of owners in the single family areas of Victoria, Oak Bay, and Saanich have one.

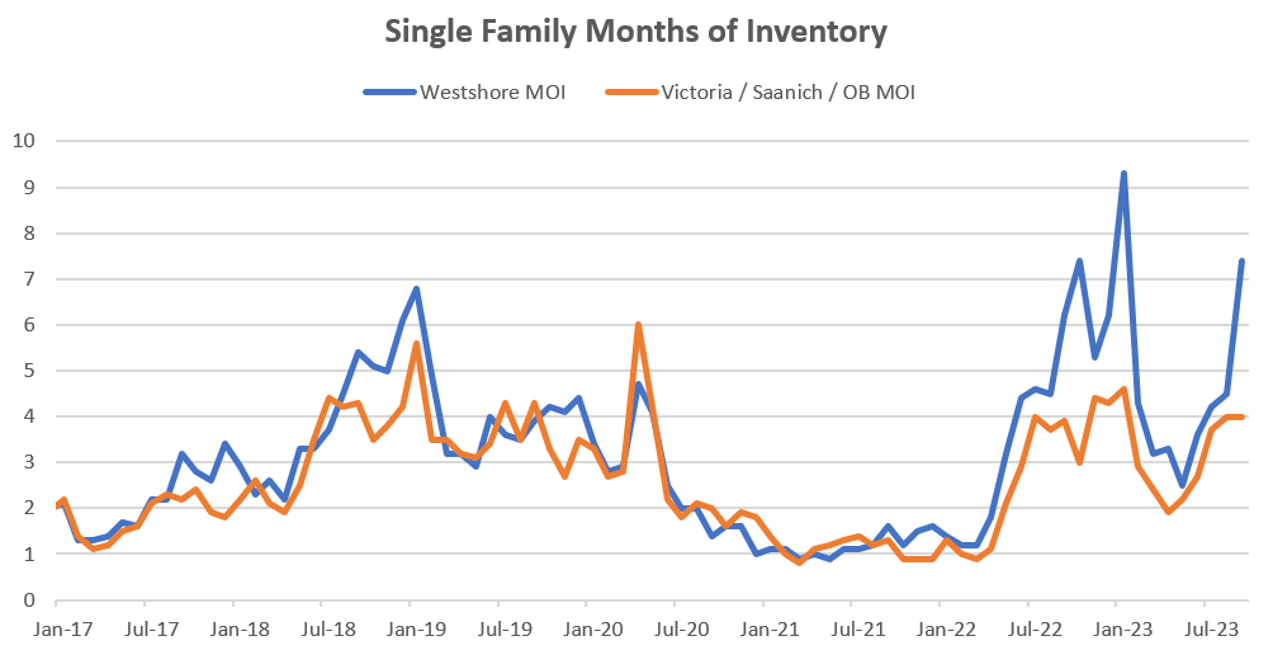

The market in the core and westshore tracked quite closely in recent years, but that changed when rates started rising. For the last year the market in the westshore has been substantially weaker than in the core. In September there were only 4 months of inventory for single family properties in the core (a mild sellers market) while there were over 7 in the westshore (on the cooler side of balanced).

Has that been reflected in prices? Well it’s hard to tell with prices being noisy month to month, but of the last 100 sales in the westshore, the median house has gone for 2% under assessment, while in the core it went for 1% over assessment. The median sale in both areas was 3% under the original asking price, but in the core it came slightly sooner at 22 days on market rather than 26.

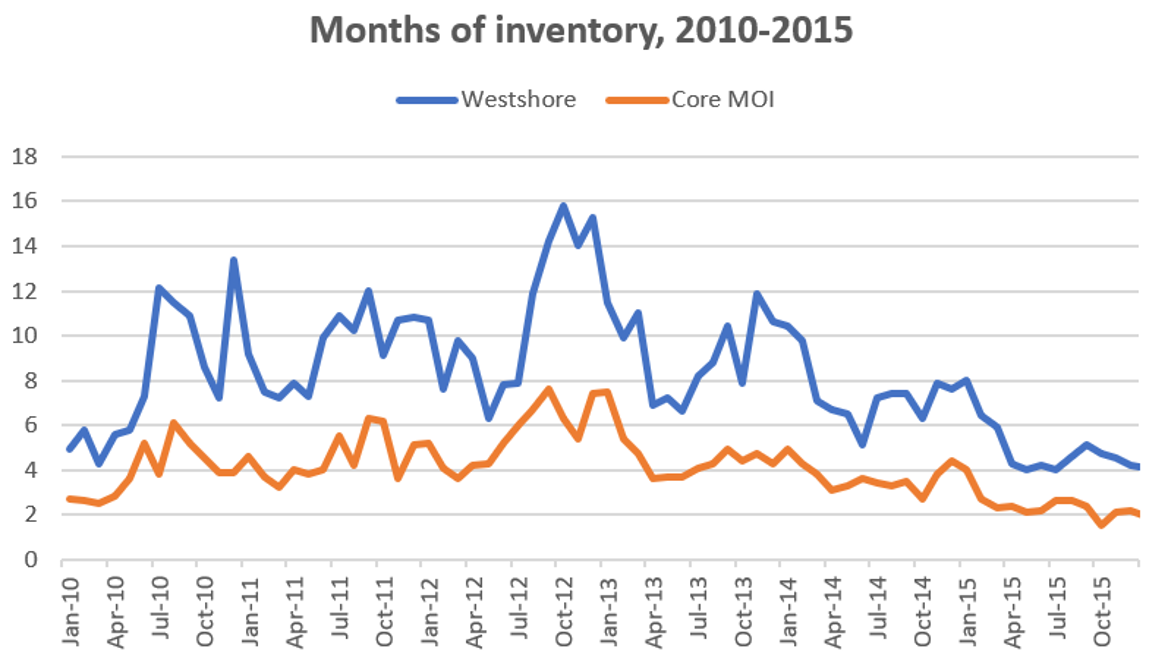

It’s worth noting that a similar thing happened during our last cool period in the Victoria market, which was in place from spring of 2010 and bottomed out 3-4 years later. Market conditions were cooler in the westshore during that entire period.

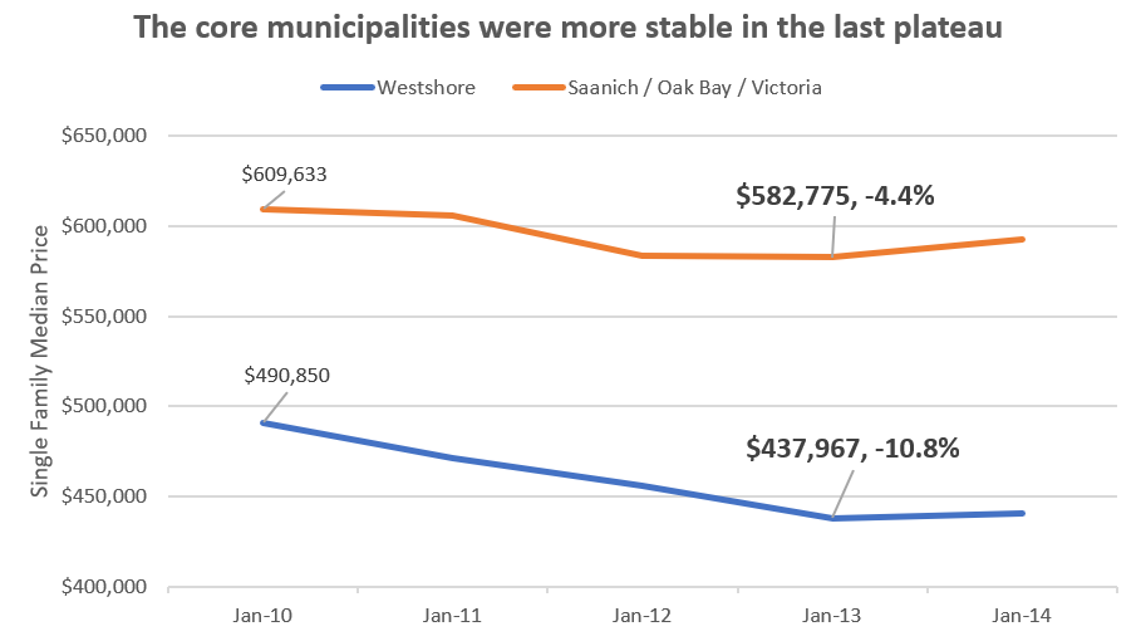

To no great surprise, that dynamic was also reflected in prices, which declined only 4% in the core from 2010 to 2013, but over twice as much in the westshore.

That’s no guarantee this pattern will repeat, but if you’re concerned about price declines it’s worth considering less leveraged neighbourhoods, while if you’re looking for more motivated sellers the opposite is true.

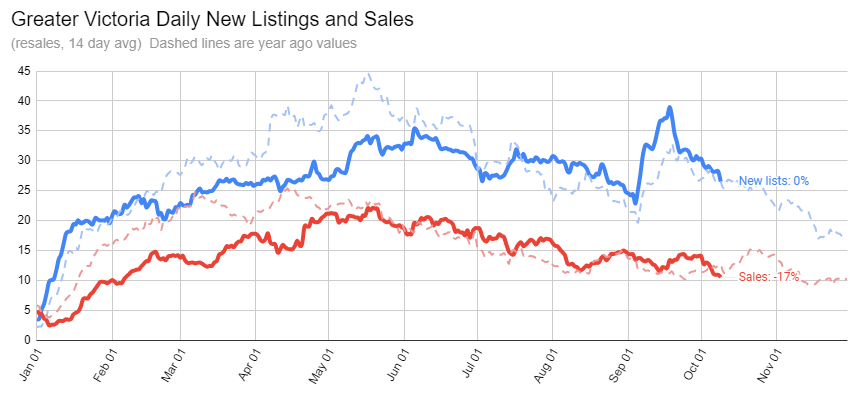

Meanwhile there’s no sign of the board’s weekly release of the sales numbers, but we can look at activity regardless. So far activity is coming in roughly in line with the figures from last October. New lists of resale properties in the last two weeks was exactly the same as the same day last October, while sales came in a bit more slowly. Things often change from week to week, but so far the figures are fairly unremarkable, unlike in markets like Toronto that have been experiencing a surge in new listings while sales are at multi-decade lows.

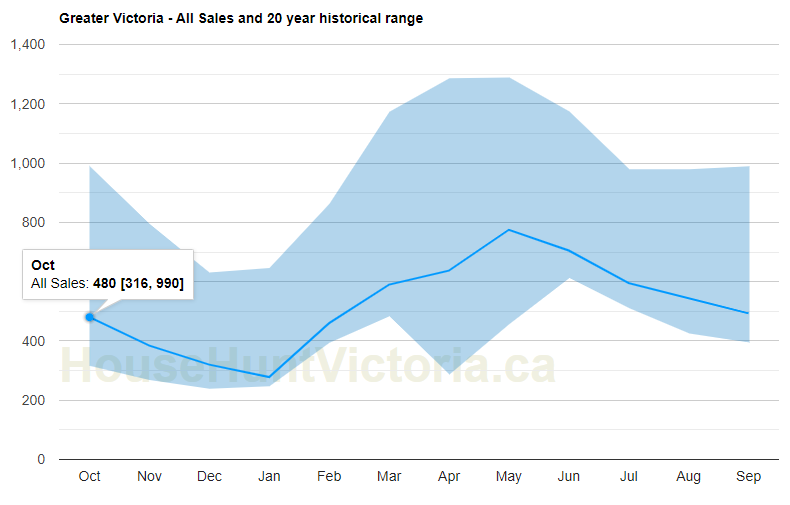

Last October was sluggish, but not overly so, with 480 sales well above the record of low of 316 observed in 2008.

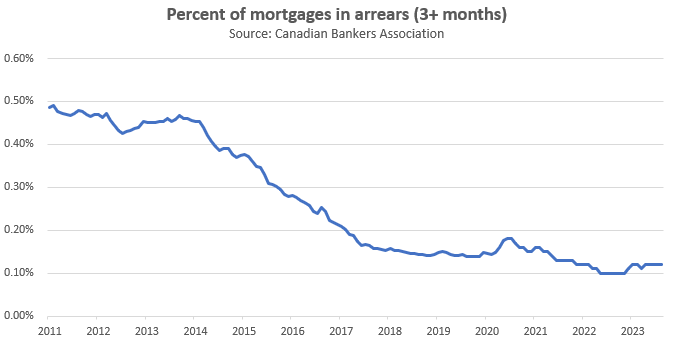

There is also some fixed rate relief coming as the 5 year bond pulled back to 4.18% from a recent peak of 4.41%. Reader IslandGirl asks if there is data on foreclosures and whether they are becoming more common as owners are under increasing rate stress. Foreclosures are difficult to find precisely in the listings as there is no specific flag identifying them in the system. However searching on common keywords used in foreclosure listings doesn’t show an uptick in their incidence in Victoria after rates started rising, with foreclosure listings numbering in the low single digits any given month. The same lack of uptick is visible in mortgage delinquency data, which remains near all time lows in BC. Though this is a severely lagging indicator, it’s still impressive that we’re 18 months into one of the fastest rate hiking cycles and mortgage delinquency rates remain at a quarter of what they were a decade ago. If owners are stressed, they’re finding ways to cope so far.

New post: https://househuntvictoria.ca/2023/10/16/whats-going-on-with-condo-affordability/

Don’t forget the biggest impact here, the Provincial Registry that has a data/info sharing agreement with the CRA. Meaning if you Air BnB your place, then the CRA will take their cut. I am sure this registry will expand in due time to include ALL RENTALS , meaning no more not claiming rental income on people’s primary residence.

lol……10, 20, or 50 more BC Government employees?

Instead of training more nurses, doctors, carpenters and plumbers of course we are adding more BC Government employees.

What areas are there like this?

Thanks

How is it going to work with the GST if owners convert to long term rental and then sell?

That market is not big enough to absorb the amount of inventory that will be available. I suspect a lot will end up on the long term market or be sold.

Maybe. However, Airbnb and VRBO offer important protections to both parties and reviews. A lot of people won’t want to do private short-term rentals – way too much room for scams on both sides.

There is probably going to be an uptick in value on legal suites in areas that allow short term rentals. A lot of areas don’t allow them at all so the provincial rules won’t supersede this. Sort of makes sense to permit them where the owner is on-site to supervise. There is a need for STRs and there is certainly a need for many with mortgages to generate more income at the higher rates.

I didn’t realize that. Agree there is some affect, but dueling studies with opposite conclusions… not really helpful. The City of Victoria, among other municipalities, cited the McGill study in making policy decisions and it certainly made headlines – everywhere.

The province’s legislation would apply where it is more restrictive I think.

Seems like it: https://www2.gov.bc.ca/gov/content/housing-tenancy/short-term-rentals#of

Provincial registry

The Province will establish a short-term rental registry. This will help ensure that short-term rental hosts and platforms are following the rules and provide local governments and the Province the information needed to follow up when they don’t.

Hosts will be required to include a provincial registration number on their listing. They will also have to include their business license number, if a business license is required by the local government. Platforms will be required to validate registration numbers on host listings against the Province’s registry data.

Provincial compliance and enforcement unit

In order to ensure the rules are being followed, the Province will establish a provincial compliance and enforcement unit. This unit will:

Track compliance

Issue orders

Administer penalties for violations

Of course, when the Air BnB owners sell, they are unlikely to be able to avoid charging GST on the FMV. So drop in price of these units to be comparable to used residential could be a bit larger than the premium they used to get.

Thought it was interesting that the McGill study which has been widely cited showing increase in rents from Airbnb was funded by the hotel industry. Not to say the conclusions are likely wrong (fewer rentals with the same demand increases rents) but it’s possible the effect is overstated

New topic for tomorrow. Such fun.

It’s a grand day for the hotel trade, deservedly: skin in the game, infrastructure, long-term capital commitments, and a healthy multi-employee payroll.

I think most air bnb units are <600sqft so the market for those condos will come under pressure for the next little while as listings come on.

Marko’s phone is gona be ringing!

Janion, Union, Falls, Era, Mermaid Wharf, Juliet, Astoria are the big ones, oh and that heritage thing on yates across from Lucky. I agree, your not getting thousands of units.

So Saanich’s definition is going to be 30 days and the provinces will be 90 days. This is going to be fun 🙂

While Saanich continues to take more than a year to process a garden suite permit.

The province is allowing an AirBnB suite in your primary residence but you will not be able to buy a condo and use it exclusively for AirBnB. But each municipality can impose further restrictions on it as has been done by Victoria.

With fines as high as 50k per night this will motivate the city to go after illegal units. I just checked and there are four units at the Janion for sale all above 450K. It will be interesting to see what is there a month from now.

Might be some real room for AirBnB by the first nations who could lease out units on long term leases for people who want to operate AirBnBs

That’s pretty accurate I think. I would guess closer to an average of 20% as a lot of buildings barely have any operators (Legato, for example). The big one is the Janion % and then it falls off the cliff.

All in all, we are talking hundreds of units here, not thousands.

That’s true, but Saanich already doesn’t allow short term rentals in suites or otherwise. So far zero interest in enforcement from them though.

Unclear to me what happens if Saanich does nothing. Will the province enforce it for them?

I thought the legislation applies to everywhere with a population above 10,000 or did I misread? I thought Saanich is over a 100,000?

Not a 1 for 1, but it could be a 1 for 2. Hotel prices will go up, 50% will accept it and book a hotel and 50% will be like okay I’ll drive 10 minutes to downtown and rent an Airbnb outside of downtown. I am just making up numbers here but if Airbnb is allowed in suites the market will generate substitutes to an extent.

maybe use an average of 25% across the 16-17 buildings currently under the legal non-confirm unit to be air bnb operators. Then assume that 5% of those will do some type of workaround and still operate STR and the remaining 20% will either sell or do the 90 day minimum thing.

The way I am reading it they are allowing suites and ADUs in primary residences to be used for STR.

aka if Victoria didn’t prohibit this the province would allow one to Airbnb a suite in their home.

Didn’t know about Saanich? I’ve seen a ton of Airbnb suites in Langford, will be interesting to see what they do. My point is if you shut down two units downtown which causes the market to add one Airbnb suite in Langford the net impact may not be as great as one may think.

Not exactly a substitute for a downtown condo.

Not sure about Saanich since I heard talk that they are going to essentially treat greater Victoria or the CRD as one area. Same applies for Greater Vancouver. Have to wait for the final legislation.

multiple legal opinions were sought prior to the legislation.

I think that the stress test may turn out to be a major factor in reducing the number of people who are destroyed by rising mortgages. Lots of people will be awfully tight but most should be able to get through it.

Definitely expecting some lawsuits from this. No idea if they have a chance.

But City of Victoria prohibits this, so it won’t change there.

Pretty sure STVRs are not a permitted use in Saanich. Whether the other munis will step up on enforcement once the platforms are forced to share data remains to be seen.

Driving Uber and watching NFL Sunday is likely equivalent for your health 🙂

A gas station has no other use other than being a gas station. An ABNB condo has legitimate use as home for a household. it’s a government’s job to ensure that its citizens have a place to live. Besides, governments change laws all the time to meet the basic needs of it citizens.

Requiring a license to run a business and where the business can run are basic functions of governments.

The market will sort it out…people will start Airbnbing suites in Saanich as they opted not to crack down on that.

I don’t disagree. I’m not sure how our hotel situation is here, but Vancouver was talking about a severe hotel shortage. Seems like all the bullshit that prevents housing from being built also applies to hotels.

Any guess as to how many extra units for greater Victoria?

Places called “hotels” have been doing this for a long time. And they are assessed at commercial property values and pay property taxes at commercial rates, And they have paid employees who pay taxes and have to enforce standards.

Letting residentially zoned and assessed properties operate as hotels is a pernicious subsidy at the expense of the broader economy. The market will sort things out, and if there are fewer jobs in the tourist industry for people who cant afford the city in the first place, so be it.

Dude, if that is your home then of course you will do everything you can to hold on to it.

https://financialpost.com/personal-finance/homeowners-selling-home-mortgage-payments-climb

A strangely funny article after the first para where a credit counselor gives some really odd advice on finding ways to direct more money towards your mortgage instead of selling….. Such as look at your time and work other jobs, and cut down on things like medical expenses and etc… Hopefully, people don’t get hung up on the sunk cost fallacy and harm themselves for the sake of trying to float an illiquid asset that is crushing their finances and quality of life.

Not really a scapegoat thought? Immigration seems like a legit factor.

Because then it will be seen as too invasive, telling what you can or can’t do in the house you live in. Going after entire condos is the easy target

Depending on how this unfolds I think a few units will end up on market and most will go into executive rentals (mid-term) as they are already furnished. I wouldn’t be surprised a small underground market emerged from this as well.

I find it odd thought that they are allowing suites and ADUs in primary residences to be used for STR. You would think that is a much bigger overall chunk than legal non-confirm units.

Immigration

They would love compensation, not likely to get a penny. Interesting to see if any of the units end up on the market.

Most units are 240 to 300 sqft. The Janion already had transient zoning along with 16-17 other buildings in Victoria. When the COV banned transient zoning these buildings became legal non-conforming.

I guess my best anology would be you have a strip of land zoned for gas stations with a bunch of operating gas stations. The zoning changes to no gas stations allowed but the existing gas stations are grandfathered and continue to operate. Now the government wants to shut those operating gas stations down…..I would think those gas station owners would want some compensation?

I wouldn’t be surprised if this ends up being a class action law suite. Government could be potentially creating a mess over a few hundred units.

What’s everyone’s best guess as to what the next scapegoat will be in two years when affordability hasn’t improved?

Mortgage coming up for renewal about the same time that one can no longer AirBnB might make for an interesting moment.

Should be some happy hotels.

Maybe the Janion can get rezoned as a hotel property? Dout it can done in time. How big are most of the units.

This will be very very interesting for the Janion specifically.

Marko, you getting calls for listings yet? My insider contacts said they’ve started getting calls now LMAO

Not initially but probably in the later phase.

From the government news release in Phase 3:

“requiring short-term rental platforms to include businesses licence numbers on listings where they are used by a local government, and to remove listings without them quickly to ensure local rules are being followed; and”

In Victoria you currently need a license for STVR (under 30 days) and do not need a license for over 30 days. Therefore I don’t see that you suddenly need a business license for a 31, 45, 60, 89 day rental.

However the government plans Phase 4 for late 2024:

“Creating a registry and requiring all short-term rental hosts to register their short-term rental properties, and require platforms to register their business operations with the Province. ”

So seemingly at some point you will have to “register” with the province even if the city bylaw doesn’t apply. Note that “late 2024” is government speak for sometime in 2025.

What a shit show. Wow.

Don’t see why not, just get a license and you are set.

Their exemption is ending May 1, 2024

Nope, that is one of the main points of the regulation is to remove the grandfathered transient zoning.

Can I rent out six bedrooms plus two units in my carriage house (I would still have the third floor suite for myself.) under this legislation?

Does anyone know if the new, proposed STR legislation exempts buildings that have a municipal ‘transient’ zoning classification, such as the Janion? Or if those buildings are excluded from the legislation since they are currently compliant with municipal zoning and STR licensing?

FYI -> transient zoned buildings in Victoria: https://www.irawilley.com/transient-zoned-condos-victoria/

If they are exempt, then I imagine their value increases, as they are sort of a golden egg, with a rare exemption, protected from competition. If not exempt, then it will be interesting to see how their value adjusts, when they pivot to either long-term rentals, or owner-occupied.

It can be quite substantial if one manages it themselves. Lets see the extent of the increased listings, the transient zoned condos have until May 2024.

I’ve mentioned a number of times the delta difference when you account for everything between long term rentals/ executive rentals (median-term rentals) and short term rentals is not as large as one would think.

I think if you rent it for less than 90 days period you need a license, obviously its harder to get caught if you do it through FB marketplace.

So if I want to put it on airbnb long term for 60 days I need a licence but if I want to rent it through the RTA for 60 days I don’t need a licence.

Yes you will need a business license if the municipality requires it. The max fine has increased from $2k to $50k

Will I not need a licence to post it on airbnb thought?

good luck renting out a basement in langford thinking it will get downtown condo nightly rates.

At the same time – imagine being able to rent out your principle residence and the pretty penny that will bring (if the legislation achieves its purpose of massively reducing Airbnb stock).

I’m hesitant to say I’m ok with the legislation because I think it’s likely to be quite disruptive – hard to tell what the impacts will be.

LMAO, if half of current air bnb’s go the long term rental route, wonder what they would do to rent prices

A month-to-month tenancy is ongoing until someone gives proper notice, so I don’t see how that gets captured. Even in the scenario you describe, it’s still a tenancy under the RTA, and I would guess the intent is to not capture those types of agreements? I wonder if there is a specific carve out for that in the proposed legislation.

No you can continue to rent out your principal residence while you’re away

what does that have to do with anything? I’ve already clarified before that it will impact those who depends on airbnb revenue to make the cashflows work.

IMO it’s going to create problems and confusion between STVR and the RTA and potentially erase supply of needed “medium-term accommodation”

Devil will be in the details of the final legislation. Especially since what I pasted out of the backgrounder is hardly a legal definition

I missed it too. That’s interest, technically don’t you need a licence to rent to someone month to month then? Like you could put up your unit month-to-month, no lease, tenant gives you notice as soon as you sign the tenancy agreement; therefore, creating a tenancy of 60 days.

I’ve rented to two travel nurses that were in my place for less than 90 days. I guess I’ll be leaving my place vacant…..makes sense?

That’s a biggie that I missed.

They are really going to have to struggle with how to provide short term accommodation. Like it or not AirBnB addressed a need.

Seemingly you will as they have a new definition of short term rental.

Short-term rental

Short-term rentals are accommodations provided to members of the public in a host’s property, in exchange for money, for a period of less than 90 consecutive days. They are generally tourist accommodations that are often found in residential or resort areas. They may be advertised via online platforms such as Airbnb, VRBO, Expedia and FlipKey, but may also include short-term rental offers on other web forums including Facebook Marketplace, or found in classified ads in newspapers.

Why would the muncipalieis/province eliminate positions? That is not how things work in real life.

Bye bye legal non-conforming STVRs. Going to be very interesting to see what happens to the values of places like the Janion

Not quite what I hoped for (onus of enforcement on the platforms) but mandating data sharing is close enough. Lack of data sharing is why enforcement is so resource intensive right now.

I personally use the word resilient in reference to price medians which continue to be resilient.

Once I see decisive movement in prices, yes.

Can we finally retire the word “resilient” as a description of the housing market?

Interesting. Looks like you could still AirBnB a suite or carriage house on the property of your principal residence under the provincial rules. Not in City of Victoria where local rules go further, but in many other places.

Wonder if I will I need a licence if I am using short-term rental platforms for long-term rentals? (>30 days). Will be interesting to know how many BC Government employees the NDP will hire to deal with these AirBnb regulations that I can long-term rent my condos to as a result 🙂

Just a bit of perspective as to how slow things are out there

October 2023 – approx. 400 sales

October 2022 – 480

October 2021 – 745

October 2020 – 990

It is going to be very tough 6 to 12 months out there.

Don’t have to guess!

https://news.gov.bc.ca/releases/2023HOUS0060-001598

Other than a bunch of applications on my Vic West condo were BC Government employees.

Good to see the monthly stats heading in the right direction .

Flipping onus of enforcement from the municipalities to the platforms. So forcing AirBnB to cooperate with munis that want to restrict short term rentals. Then the process becomes:

Enforcement effort evaporates overnight and compliance should be near 100% (if the system has basic checks for validation)

Already gave the heads up 3 months ago. Bye bye condos

Any one care to guess what the AirBnB policy is going to be?

Yes

Month to date numbers

Sales: 183 (down 13% over same time last year)

New lists: 529 (up 4%)

Inventory: 2708 (up 20%)

There’s not enough skilled trades at the moment, most companies especially larger ones would like a little contraction in the market.

Is the NDP announcing their AirBnB policy today?

This thinking goes against basic supply and demand curves.

Many residential subtrades aren’t qualified to do institutional work.

Just under a mil for a condo in Sooke? A condo in Sooke ? What were people on?

Yeah I thought by prices you meant prices of the end product.

Construction prices generally only go up. Not sure if we have had a period where we saw them drop substantially?

That said it only works if government infrastructure spending keeps up. No guarantees during recession and pressure to tame growing deficits. Assuming the CPC gets elected in 2025 they may come in on an austerity plan since I imagine the federal finances aren’t going to look too great for the next few years.

Since peak (March 2022ish), yes. Things is that particular peak was very short lived, maybe 3 months +/-, but when you do reference to that short peak there is quite a bit drop in some segments. I just sold a 7th floor condo downtown for $556,000 and the same stack/floorplan on the 5th floor went for $650,000 at peak.

Not sure if we are on the same topic here. What I am trying to say is you have companies like Gordon N Gordon (you’ve probably seen their signs on every other project in Victoria) that do, for example, steel studs/drywall/painting. Well Gordon N Gordon also does a ton of government projects (Duncan Hospital, etc.). So if a bunch of developers cancel their multi-family projects it isn’t like a subcontractor like that is out of work and suddenly dropping their prices substantially. Some of these companies have years worth of work on the books.

This would make sense if multifamily resale prices were set based on cost +margin, but they’re not.

No doubt governments will likely need to reduce the costs on their side to get some projects off the shelf, but the bigger issue they need to tackle is certainty, not cost.

Been watching the price changes on SFD out in Sooke. There has been some $200k swings (on the negative side) for neighborhoods out that way.

Marko, that Sooke condo took a hit. Is this the rare exception or is it the first of a storm brewing?

Pending sale on a two year old condo in Sooke over the weekend @ $880,000. Completed in 2021 at $980,000+GST.

I have a place in Zadar (Dalmatia) too. I could long term rent each for 1,000 euros/month but yes not interested because of hassle factor. Also, in Croatia no capital gains, no property taxes, no spec/vacancy tax, strata fees $52/month and $42/month. Place in Zagreb has gone from 168k Euros to over 425k Euros in 7 yrs so even keeping it vacant has been a decent investment even without renting. 54,000 vacant condos in Zagreb (population 800k) so I am not the only one. Crazy thing is no one cares and we are losing population every year as young people leave the country (salary 1000-2000 euros on average and 1000 euros to rent a condo). When I suggest that we need to bring in tax on vacant condos I get chewed out 🙂

Pretty much what I am seeing too. Material costs are down slightly this year, but labour costs are up with overall costs going up. Also, multi-family projects have to compete with the same subtrades as government infrastructure (hospitals, schools, etc.) so I don’t see prices coming down anytime soon. Combine with interest rates I think we will see a number of multi-family projects delayed for the time being.

Opposite on the institutional side.

Construction costs are only increasing, there have been done mistakes by subtrade estimates on tenders lately that caused abnormal low margins, but costs are not going down. Not even close

Peak volume of condominium sales in the Victoria Core districts occurred in the Spring market three out of the last five years and twice during the summer market. This will be when most condominiums purchased in the last five years will come up for mortgage renewal at today’s higher rates.

If prices were to decline in 2024, I would put the odds of that happening at 60 percent in the spring of 2024 and 40 percent in the summer of 2024.

The Gross Rent Multiplier (GRM)which is mathematically related to the Cap Rate does seem to be weakening. It was in the 20 to 22 range and is a little lower in the 18 to 20 range. GRMs are used for housing with less than four units. While the Cap Rate is used for Commercial and Industrial properties where there are income and expense statements to work from.

However, my opinion is that land prices have weakened while construction costs have yet to decline.

the selling price is softening… eventually it will pass on the pressure to the land price..with cap rate going down ( due to the NOI is not going up), so multi-family building owners are seeing their assets value is going down..same case is happening to the developers….

Perhaps realtors will start a new trend, salesmen on ebikes.

Can you not AirBnB it when you’re not using it? That’s what a lot of people in Dubrovnik seem to be doing. Is it harder in Zagreb, or you’re just not interested in the hassle factor?

Relatives in the US who have purchased two or three years ago are mostly just shrugging at the increase in interest rates.

I guess a thirty year term on your mortgage does provide some peace of mind.

Letter to G&M. And it occurred to me that pairing long term assets with short term debt is also what brought down Silicon Valley Bank.

These are still reasonably low rates. The question is whether house prices will adjust?

I know almost no one is going variable anymore, but I didn’t think I’d see 7%+ rates again

Me neither. Recently enjoyed this book and would recommend: https://www.amazon.ca/Die-Zero-Getting-Your-Money/dp/0358099765

Also super practical in urban areas with good bike infrastructure. I can literally ride downtown in less time than it takes to drive, along completely protected bike lanes. No road rage, no cursing poorly sequenced traffic lights, no driving around in circles trying to find paid parking, and no breaking a sweat on hot days.

Used to be on the fence about all the bike infrastructure, but I’m a huge proponent now. I would not have purchased an ebike without it.

As usual what are you even talking about?

A brand new 2023 house is on sale in the same area (2551 Obsidian Pl) for $1,375K. With GST, the price will be same as the older one but you get a brand new house for the same price. Since the houses in this area are not moving, there is room for negotiation. #2539 is also available for the same price.

https://www.realtor.ca/real-estate/26110387/2551-obsidian-pl-langford-bear-mountain

https://www.realtor.ca/real-estate/25579591/2539-obsidian-pl-langford-bear-mountain

Patrick, those last comments were so funny and you made me laugh. Hey….I didn’t know you worked in Emerg and ICU at one time.

Whatever: All those new unsold homes on Obsidian Pl and Mica Pl. have had a substantial price drop.

If only I were 10 years younger.

I’m a chicken. I spent a good part of my younger years working in the ER & ICU, so no-e-bikes or motorcycles for me.

It’s funny because cars and housing are literally the two biggest expenses for most people. If there’s one place to save or spend wisely it’s there.

Also e-bikes are awesome and I would ride mine even if it was more expensive than driving

Interesting. I’ve never been thrifty, at least about the small stuff. Always followed my Dad’s wisdom to not be “penny wise and pound foolish”.

I’ve got nothing against the thrifty. But you won’t see me driving around town on an e-bike to save a few dollars. I’ve got no desire to be the richest guy in the nursing home.

The OSFI announcement is interesting as it identifies heightened risk in lending practices regarding real estate investment trusts and syndicated mortgages due to the way they are structured using a combination of equity and debt financing that can be very creative and complicated to understand. For an unsophisticated investor some of the terminology used in the prospectus might be misunderstood, such as the difference between share value and market value. At times the terminology and definitions used in the financial world are slightly different than for real estate and may be a source of confusion for a less knowledgeable investor.

Most of this announcement pertains to commercial loans. A commercial loan for a residential multiplex is five units and more. In my opinion, it is very important for the BC government to understand the implications of opening a Pandora’s box when it comes to some of the creative financing that could be used for multiplexes of five units and more. I am glad that OSFI is addressing this issue. Hopefully the financial institutions, BC government, and the Appraisal Institute of Canada will be part of those discussions as they are directly involved with the implementation of any changes in regulations.

Most of us think of residential as very simplistic and easy to understand. And it is. But when you cross over into commercial it is different world of financing and gets very expensive and more complex. Including lower loan-to-value ratios, and shorter amortizations. With residential loans, most of the emphasis is on the ability of the borrower to make the payments. With commercial the emphasis is on the property to generate revenue. This might put a knife in the back for those that want to build a multi-plex of more than five units or they may have to put up more collateral and larger down payments.

Hard to shake that first-gen immigrant thriftyness. I have the same problem lol

Both, detached values took off that fall. Not sure which I would call primary though.

8!

Note this is active inventory as pulled from Matrix stats. Unlike the inventory numbers released by the board monthly which are point in time, this is number of listings that were active at any given point, so a $900k listing on Jan 15th that sold 2 days later would show up in “active listings” for the month but not in inventory at the end of the month

Ever hear of a tax write off? So you go negative cash flow on a property, it’s probably not your main source of income.

Oh I can really care less if you are over extended or not and the last thing on my mind is counting your pockets, my simple point is that it is hard to stay disciplined to a strategy as an investor and when you veer out of that is where you get exposed to more risks.

We are at or within weeks of peak inventory. But it’s been a good run.

Seasonally adjusting the inventory will show us the underlying trend, even when inventory declines in November.

I just sold my 20th listing a few days ago at 834 Johnson. I am an owner and was the strata treasurer at the 834 (aka for two years 115 owners received meeitng minutes every 6 weeks “Strata Treasurer…Marko Juras”)……on my end there is a lot more to that video than just the cash flow negative numbers, but I don’t get into that as it does not apply to the average investor. Love how people are worried about me being overextended when 5 videos earlier I am doing a tour of a brand new property I purchased in Croatia I just keep vacant so I can use it a few weeks a year. I think I’ll be okay 🙂

You could have a three story six-plex with two or three two level condos (pretty much a townhome) and then have three of four studios on the 3rd floor.

This is an example of a two level condo with its own patio (not seen in the photos) – https://www.realtor.ca/real-estate/26017601/103-757-tyee-rd-victoria-victoria-west

Nice honest video Marko, I remember you posting about going cashflow negative for the first time last year on this condo, but you gotta admit FOMO got to you a little bit eh. Very hard to be disciplined in an investment strategy long term.

Cool graph. The plummet in mid-2020 is that primarily because of price appreciation or inventory dwindling?

and is that single digits Dec 2021?

Next year yes, not this year. New listings seasonally plummet in November/December. Leo can comment but I just can’t see 3,000 by New Year.

Not this year.

3000 inventory is looking like a real possibility.

September just edged out last September.

Just depends on how the system is structured. In Auckland they got a lot of what they call townhouses, but I’m not 100% sure how the legalization worked, did they allow lot assemblies, or do they have a lot of large lots that can fit a townhouse development? I’m not sure if it matters too much. A bunch of lots together with townhouses is more efficient, but if people end up building tri to sixplexes there isn’t that much difference. Townhouses tend to have ground level access which I’m a fan of, but then again stacked townhouses exist as well. Lots of overlap in these terms.

I blame policy analysts. Their entire job seems to be to make things more complicated by introducing new policies aimed at “improvement.” They are so far removed from what happens on the ground (usually). Anyway, their proliferation in organizations of any size, and especially the impact of it, is kinda funny (in like a Douglas Adams way).

From: https://financialpost.com/real-estate/property-post/commercial-real-estate-bigger-risk-osfi

https://youtu.be/U7UBy1usnrg?feature=shared

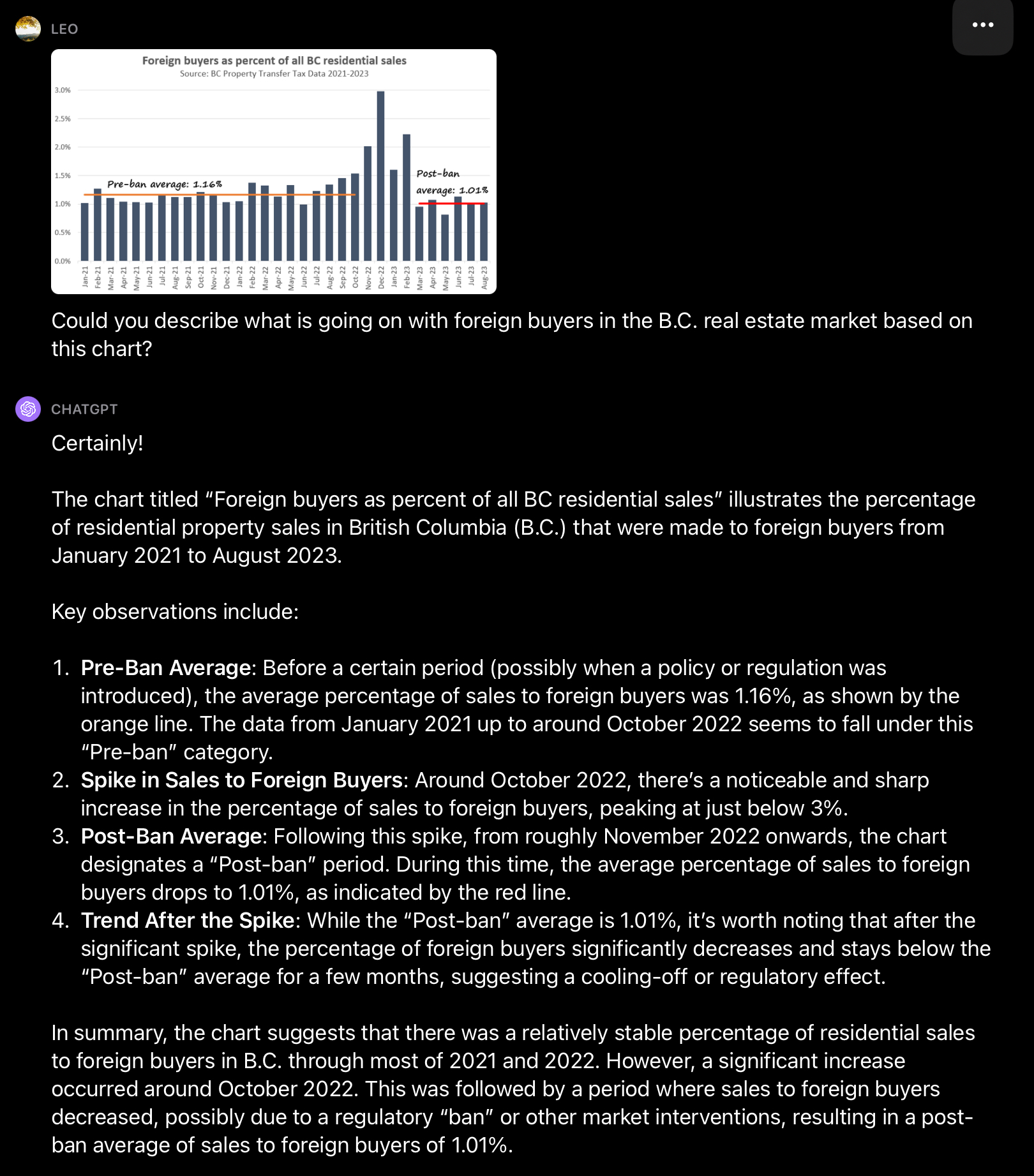

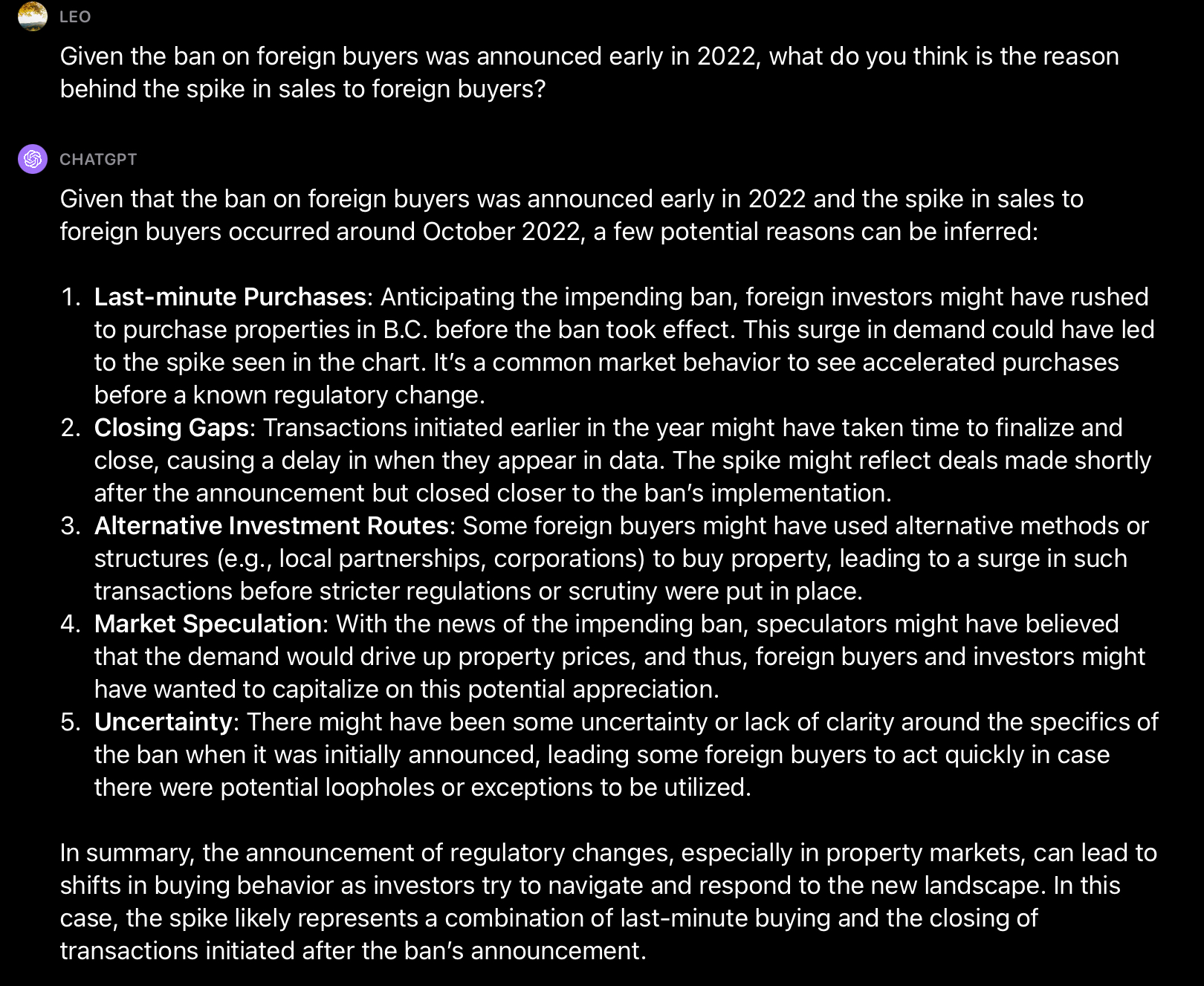

The advances in AI continue to impress.

The last two reasons given don’t make a lot of sense but still pretty cool

That flipper tried few different ways to make monkey, but all failed, just a bad timing to get in the market. The biggest problem is cheap and quick renovation without any permits. Any future upgrades go through permit application would be a nightmare.

Actually borrowed my neighbour and his truck and we dismantled the machines ourselves and got them back. With the help of a young neighbour next . Two of the machines were delivered by the guy selling them from Sooke for an extra fifty bucks. Most of the machines are the old APEX commercial machines. Such fun.

So they bought it for 1.27 last year, did renos and have been trying to flip it ever since? Basically just trying to break even and get out now?

Funny that the same rules seem to apply to immigrants (except my family that came x generations ago), and people coming to the island (should have closed up shop the day after I came).

Leo The problems with getting projects through rezoning is relatively new . You probaly can say it’s the times we live in that we are now seem to be in The everything crises. I pretty much hung up the hammer in the last 10 years cause it’s been so frustrating at the municipal level I don’t need the stress . I agree that they just keep piling more shit on all the time and I just can’t see that ever stopping

It was a rental in pretty rough shape (looked at it then). It was turned around in a few months and put up for sale. Initially, it was mostly done as spash and dash paint/fixture reno and listed (without doing the kitchen) and then it didn’t move on the market. It sat for while and it came down and they did out the kitchen. Then asked a much higher price and still didn’t move. Basically for the last 6-8 months it has moved from for sale and for rent (rent looking for around $5500). The pictures look good, but up close the finishing and work done is not the best.

Which part do you disagree with? Once a restrictive zoning system is in place it gets more restrictive every year as requirements are added on by each council.

For example, after 10 years Oak Bay approved the Quest building on Tuesday. 4 floors and 14 homes when the official community plan called for up to 8 floors. Literally the next day Oak Bay is advertising an open house for a bunch of new blasting fees and restrictions they are bringing in that will make future development harder and more expensive. I’m sure they will get overwhelming support for these new restrictions at the open house, because no one that shows up is directly affected by the housing shortage.

After all there’s a simple rule about trees and blasting. All trees are good except the ones cut down to build my house, and all blasting is bad except what was necessary to build my house (f**k those particular rocks and trees)

It might be safe to say that breakups could be the number one cause of a property coming onto the market. Any data?

Leo Sorry disagree dealt with the city from mid 80s and onward with rezoning and permits never a problem before early 2000. It’s so fuked up now I c very little hope in it getting any better as I feel it can only get worse . My real estate is safe from affordability

I knew someone was partnered for many years, upgraded to a SFH, updated it over a one year period, then partner left them for someone else. Then have to sell a year after buying. Divorce sucks.

Got nervous and wants to get out while breaking even I am guessing….. Anyone know what 824 Monterey Ave looked like when it was purchased in June 2022?

Someone bought their new home at 2528 Obsidian Pl. in February of this year. They paid $1,299,999 plus GST probably. They have it for sale now and asking $1,424,900. Wonder what happened.

How much did you pay someone to deliver said machines to your house?

Hah!

Thanks for the detailed response. You should maybe consider sending off a version of that to the Times Colonist.

How many of these were purchased in the last 2 years? Anyone who got in in 2020 or earlier should have no problem lowering prices as they should still be making a substantial profit if they really wanted out. The sticky ones are the ones who wants to “break even” at minimum.

Financial literacy plays a big part, at my firm there’s probably 20 people that is over or close to $1M a year in compensation and the most expensive car I seen in the parking lot is an AMG GTC (and this person’s comp is over $3M a year). Lots of folks over $500k a year driving 50k to 80k cars. I suppose some could be leaving their expensive cars at home. But the point is that people who are actually well off typically doesn’t feel the desire to show everyone how well off they are.

Totally agree. If we’re allowing a tear down of a family house, we’d need at least one family unit to replace it, or we will net lose family family units. I like the freehold townhouse idea, where two townhouses could be built on a single lot, with separate titles. They could legalize/rezone for that idea, and that would be an incentive to actually build family units.

Patrick is absolutely correct that multiplexs mostly with bachlor or one bedrooms are going to be built. I always assumed that the talk about townhouses for families was just spin.

Frankly, if the city wants more small condos they should just

approve a lot more highrises in places like the railway lands. Approve thirty-five stories instead of twenty. If the goal is more family units make your missing middle actually be real townhouses otherwise you are knocking down small family homes and replacing them with more small condo units.

The whole missing middle being built for family sized homes is total BS. The people advocating it know it is BS and basically are pushing a different agenda.

I grew up in a large family and I suspect being frugal is somewhere in my genetic code. My cars are a 2002 and a 2012 both of whom run perfectly and hopefully with another decade in them.

Put in a small gym in the basement during covid but bought professional machines dirt cheap on facebook and it was great fun haggling for them. Neighbour spent more on a new fancy exercise bike then I did for seven Apex weight machines. So I agree with Marko that I wonder about peoples choices.

Nevertheless a lot of people are going to feel the hit of inflation combined with low per capita productivity as reflected in a weak Canadian peso. If you are feeling poorer it is because you are.

I get why “multiplexes” might explode, but why townhouses? If profit is maximized with a multiplex, why build a townhouse? This would be the same reasoning that they aren’t going to build many detached houses or duplexes, when they can make more profit building multiplexes.

I follow the 2mil to 4mil market a little bit and I am noticing a number of price reductions just in the last week. But that is not really surprising this time of year.

64 SFH freehold homes in the core under $1 million currently. That is the highest I’ve seen since November of last year. A fair number of price reductions in these 64, not seeing a ton of homes between $1 and $1.1 moving their way down to $999k in terms of reductions.

One is a large variable mortgage other has a business tied to real estate with a renewal next year. I think the definition of “feeling the heat” has evolved over time. For a lot of people, I think it means getting $200 concert tickets instead of the $500 ones. I do think there are people struggling to put food on the table as well, but for home owners I think that may not be in mass.

My theory still is people had a lot of room heading into this. I’ll go back to my Kettle Creek example with loaded F150s/SUVS/Teslas parked infront of these homes. Seems like there was a ton of disposal income left over after mortgage/housing costs if you are going out and buying these types of vehicles.

I just saw some Toyota sales promotion at 7.79% interest rate!! and you see new cars all over the place. At 7.79% if my EV battery dies I am riding an e-bike.

Who will buy the units….lol. I stopped reading the non-sense at that point. Like we have an issue with projects being unsold? A pre-sale townhome in Cadboro Bay just sold for $1,930,000+GST. Someone will buy it and as you point out if no one could buy the buyers would win.

I don’t know how you have so much patience to answer this type of non-sense 🙂

No offense to any urban planners here, but retired ones have consistently the worst opinions on housing. I mean no surprise, their system of planning is one of the key reasons we have a housing shortage to start with.

Two problems with that:

Ignores that more market rentals helps those who can’t afford them as well, because it houses people that now won’t be competing for lower priced rentals against lower income tenants.

Yes. New housing is generally for more affluent people. If you don’t build it those people don’t evaporate, they just displace people out of older and cheaper housing.

I mean if we didn’t have an acute shortage of housing for seniors, young professionals, and seniors I guess this would be a problem?

That’s why the province is legalizing 3 units on every lot. Triplexes will mostly be larger units.

Sure, but whenever someone proposes a measure to make affordable housing easier to build, like allowing non-profits to bypass public hearing the same planners are out in opposition.

There’s smart ways and dumb ways to increase the number of 2 and 3 bed units:

Smart ways:

1. Legalize townhouses / multiplexes on every lot and watch the supply of them explode

2. Legalize single stair point access blocks and legalize 3-6 apartments broadly if they have a few 3 beds.

Dumb ways:

1. Mandate 3 bedroom units in every development without any changes and watch less housing being built.

Problem is the first 2 are controversial and take time, the last one is popular and quick, so most choose the ineffective ways.

Ah yes, speak up if you think people deserve a home and… push back against policies that create more homes? Makes perfect sense.

As we know, nurses, teachers, and trades people do not need homes and are doing just fine under the current system.

Good morning, Leo.

Love to get your reaction to this retired urban planner’s concerns:

Comment: Affordability still an issue with housing targets

https://www.timescolonist.com/opinion/comment-affordability-still-an-issue-with-housing-targets-7672149

The city of Vancouver actually used the same technique to estimate how many vacant homes there were there prior to the adoption of their vacancy tax: https://council.vancouver.ca/20160308/documents/rr1EcotagiousReport.pdf

They estimated 10,800 vacant units, and I think the vacancy tax identified a lot fewer but could be multiple reasons for that

How did you figure they were feeling the heat in the first place?

I am finding this to be a tough read. On one hand you look at the interest rates, price of gas and the gas guzzlers people are driving, $50 at the grocery store literally buys you nothing, and you would conclude that a ton of people are in trouble.

Then I was chatting with a client that drivers Uber as a side hustle the other day. He claims there is a shortage of Uber drivers, and he is making $38 to $40/hr + $2.70 average tip per ride. You would think people feeling the “heat” would be dumping their F150, Bronco, Jeep to buy a used Model 3, getting their class 4, and driving Uber in their spare time to supplement income.

Went for a hike on Sunday with some friends who I would think would be feeling the heat and they are asking me if I want to go with them to watch a Seahawks game in November. Just the tickets are around $500/pop….I’ll pass.

I don’t know what to make of it all.

The one thing I appreciate about spending time in Croatia is people don’t talk about real estate much. We argue about the quality of lamb from different regions of Croatia and what factors impact that quality of the lamb such as prevailing winds 🙂 While I was there the equivalent of BC Hydro released a report that approximately 54,000 condos in Zagreb (population 800k) were sitting vacant and no one really cared.

BTW, Leo….what are your thoughts on the hydro consumption methodology for assessing rough number of vacant condos/homes? In Croatia the equivalent of BC Hydro basically said if less than 500 kwh/year most likely vacant. BC Hydro would have this data at their fingertips, but I never remember it coming up during the spec tax implementation?

Nor Switzerland

Many young immigrants don’t bring bags of cash with them but are backed by parents with substantial financial resources who want a better life for their children. They see the government corruption, deteriorating living conditions, overcrowding, crime, etc… Basically, they’re going from the frying pan into the fire.

Yes, immigration is needed, It is needed to offset the drop in birth rates, pay taxes, work for many years and save for house down payment, pay for welfare and other benefits, help the boomers retire, and join the bottom rung of the Ponzi scheme.

https://nationalpost.com/opinion/canadas-birth-rate-has-dropped-off-a-cliff-and-its-because-nobody-can-afford-housing

Vast majority of the immigrants don’t bring any wealth.

Exactly what you wanted right?

You nailed it, Leo.

Expert figures we’re probably paying the highest gasoline prices on the continent:

https://www.cheknews.ca/gas-prices-on-vancouver-island-substantially-higher-than-lower-mainland-1172637/

Pank,

Yes, filled without problems. There is a $100,000 minimum purchase.

Great article Leo!

A strong case made for falling Westshore market. Early days, but likely more to come.

Kinda like how for 20 years we’ve been hearing how half of all households or whatever can’t come up with an extra $200 and now that everyone is being forced to pay more money where are all those insolvent households?

Not downplaying the stress that households are under and will be under for another year+ likely, but these polls don’t hold any value for me.

Lol must not be London, I was there for work couple of weeks ago and it certainly was not cheap compared to Vancouver.

Most people wouldn’t sell for a loss unless the cashflow is significantly negative or they think the prices won’t recover for a long time. Its the loss aversion psychology.

That’s quite a shocking poll. But it is just one poll.

Let’s assume it is accurate that would have a devastating effect on our real estate market as our sales activity is so low. In Saanich about 25,000 homes have mortgages but only about 100 homes have sold in the last 30 days. If another 45 homes were put on the market that would throw off our current balanced market and push us way into a buyers market.

I’m more optimistic about the market than what that poll shows, as that would put us into a market last seen in the 1980’s when foreclosures played a significant role in setting market values. The BC economy would have to be in the toilet for that to happen. And it isn’t.

We should be grateful that so many people want to immigrate to Canada and bring their wealth with them and spend their money here as this is keeping us from slipping into a recession. Yes there is a housing crisis and rising homelessness but to add a recession on to that crap heap would be worse.

B.C. plans to digitize building permit process in effort to speed up construction

https://vancouversun.com/news/local-news/bc-digitizing-building-permit-process

What was the saying? Buy now or be priced out forever?

The only thing nearly as desirable for a growing family than owning a SFH is owning a brand new SUV or truck.

Delayed gratification. “Pain” now for gain later. These are silly, outmoded concepts from our parents’ and grandparents’ time!

Always great to relax on your spacious balcony, after a long day at work, and enjoy the soothing sounds of thousands of cars and trucks roaring past you on the Trans-Canada Highway. The noxious gases and carcinogenic particulates going into your lungs make the experience that much better.

Patrick, have you successfully purchased TDB2914? I tried (in TD Direct Investing) and got “rejected”. Might be reserved for certain clients.

I feel as though a big part of what’s keeping Victoria from going the way of Toronto is our proportion of paid off mortgages. On my street in Saanich (near Swan Lake/Uptown), our house is the only one sold in the last 10 years. Most owners are 55+ years old and either have a fully paid off mortgage, bought in the 2000s and paid 1/3rd the price at similar wages, or bought 10 years ago at half the price (<$400k) than we did in 2020. So they just aren't feeling the crunch on the housing side at least.

Sure, groceries and consumer goods have gotten more expensive but it seems to me that so many of thse 50/60's builds haven't spent a cent on the house since the mid 1970s…..

People in my age bracket (30-40) are feeling the heat though, and all I talk about with my coworkers and group of friends is real estate, mortgage rates, and cost of living. It's exhausting, everyone doom scrolling and thinking it's going to be the end. Doesn't help that some of them bought $75k trucks along with the house in 2021 because "muh family needs a truck". Right, like you need a 4 door gas guzzling truck to take Timmy to soccer practice and move your lawnmower to dad's house once a year.

@umm…really – i always wondered the same – ie whether people would post on other platforms. That being said I do believe that large enough fines – enforced only a few times – would have a significant deterrent effect. Perhaps that approach wouldn’t fly in Canada but I can imagine some places fining huge amounts to get something like that under control.

I was surprised when BOC didn’t raise the rate last time. I’d be surprised again if the rate doesn’t notch up next time. I’m living in Europe and it really strikes me how bloody expensive everything is back home. Just the other day I got a beautiful fresh loaf of bread, a beautiful sandwich, and two treats – it was $12.97 Canadian all in. Same thing at home would be $20. No wonder people are hurting 🙁

I am not into speculation personally, so I don’t look at it from an angle of how much was the profit before/after fees. For me the takeaway is the pre-sale price was $509,900+GST and now that buyer is paying $582,500 at much higher interest rates. Affordability eroded irrelevant of how much profit/loss the seller made/didn’t make.

I think some sellers will eventually have to sell at the pre-sale price or lower and they will take a hefty loss; however, doesn’t really help the buyer. They are still paying what the seller paid.

As for the sellers potentially losing money….it has been an insane gravy train the last 15 years. You can’t buy every single pre-sale with the anticipating of making money.

I would guess closer to 20k gain after legals, land transfer. real estate fees and a purchase price that includes GST. But a profit is better than a loss. Six months from now you might actually be looking at losses.

No successful re-sales there, yet. There you have to compete with the developer’s inventory and developer is offering 5-year mortgages at 3.85%. Developer did sell one of the townhomes there a few days ago for a decent clip, $1,275,000+GST and I think initially those were offered at $1.1ish before construction started.

My personal thought on Vic West is as each building/development is completed the area becomes a bit nicer on the whole; therefore, a bit more attractive. As a random wood-frame is completed on the highway in Langford it doesn’t really make the area more attractive, imo, other than those driving by on the highway.

So is that like a 30k gain after realtor fees and land transfer tax?

What about the new rail yards building? Any luck with re-sales on that one?

Most sellers are asking more than their pre-sale purchase price but will see how long that lasts.

Yes, the MOD is one of the few that didn’t reach close to sell out during pre-sale. They started a bit late with the sales.

The couple of successful re-sales at Dockside so far selling above pre-sale price. For example, $509,900+GST pre-sale sold on re-sale a few days ago for $582,500.

Marko, any idea what the presale price was? I have also noticed that the MOD on Cook street is saying that it is only 60% sold. I dont follow condos the way you do but were not most new builds all presold (or at least 90%)a few years back?

12 re-sales listed so far in this newly completed building in Langford -> https://www.realtor.ca/real-estate/26148448/510-958-pharoah-mews-langford-florence-lake

Not one has sold. It will be interesting to watch if sellers adjust their prices or rent them out or what. At these interest rates+strata fees+property taxes can’t keep them vacant forever.

Good blog Leo.

One thing I have noticed is a number of offers falling through here in Sooke.

What I am hearing from realtors out here is that sellers are not yet getting the message that they have to drop their expectations.

A member of our family is looking for a house with a suite and a large workshop. (Not a regular sized garage that has been made into a garage …..but a proper workshop with power for several tool stations.)

Somewhere in the Sooke area and priced right. ( derykhouston@shaw.ca) (Not sure if posting my e mail here is allowed: )

Leo is it also the case that when prices rose throughout the pandemic that the Westshore rose faster than the core?

The core has always been more stable than the suburb. And, there is another factor of stability is that the suburb still have empty land for development while the core is fully developed.

The recovery and price ascend is the same. The core will rise in price first while the suburb lag behind a few years then play catch up.

Never put too much into polls, but the numbers below seem to show the stress piling up on some.

From: https://financialpost.com/news/economy/record-canadians-economy-wrong-track

From: https://www.wired.com/story/airbnb-ban-new-york-illegal-listings/

For those that think regulating short term rentals would be easy, don’t forget it existed well before AirBnB and governments usually prove to have a poor understanding of economics.

Thanks Leo for sharing what data you found regarding foreclosures. I feel as though in BC the data is very hush hush. Not like T.O and other Provinces. Excellent blog as usual.