September: It’s all about them rates

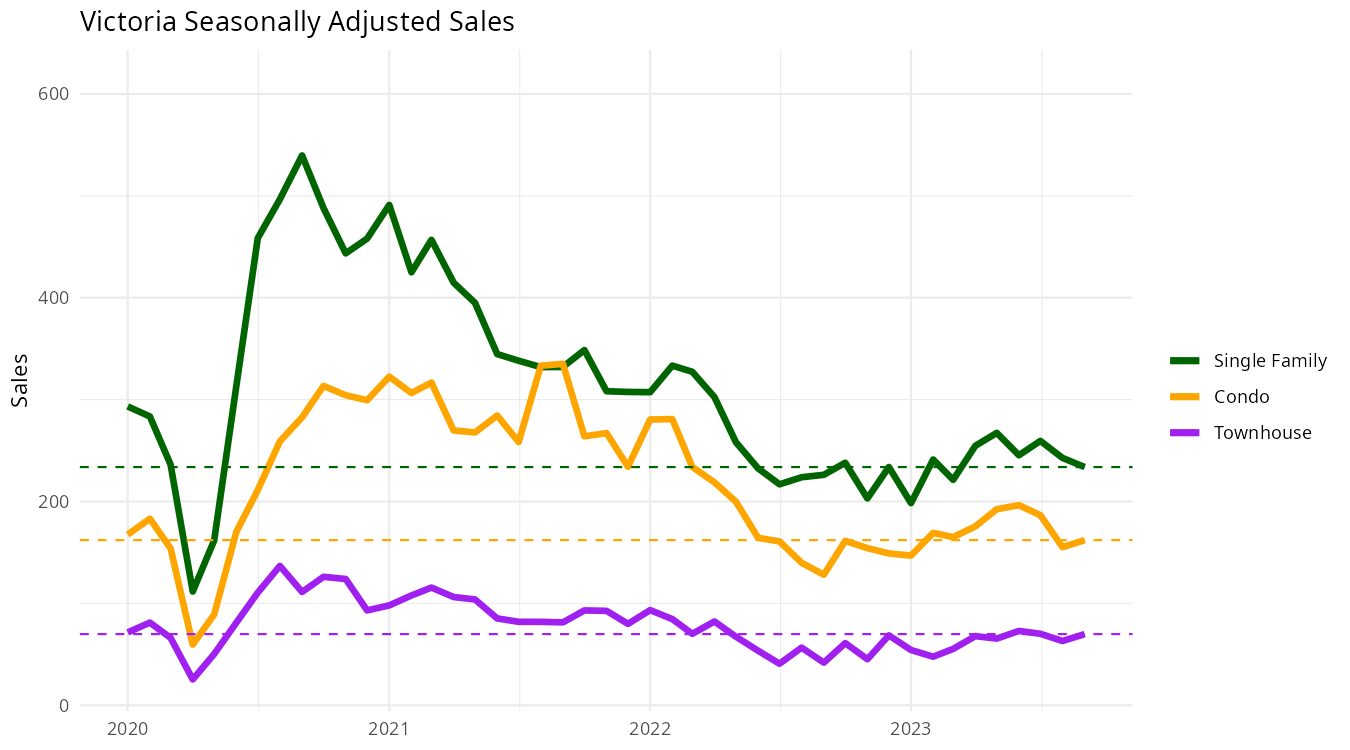

September is a wrap, and it’s clear that rising rates are putting a damper on the market, at least in terms of activity. Though the headline numbers look ok (reported sales at 493 are up 27% from last September’s dismal 410), it’s a continuation of the trend towards a weakening market that we’ve seen since fixed and variable rates resumed their rising path this spring. Single family sales were more or less unchanged from last September, while all the increase was in townhouse and condo activity which was very weak a year ago.

When rates started stabilizing last fall, we saw demand creep up slowly as buyers adjusted to the new reality. However those marginal buyers were driven out again in the last few months, and we’re back to bouncing around at the low levels we’ve seen since summer 2022.

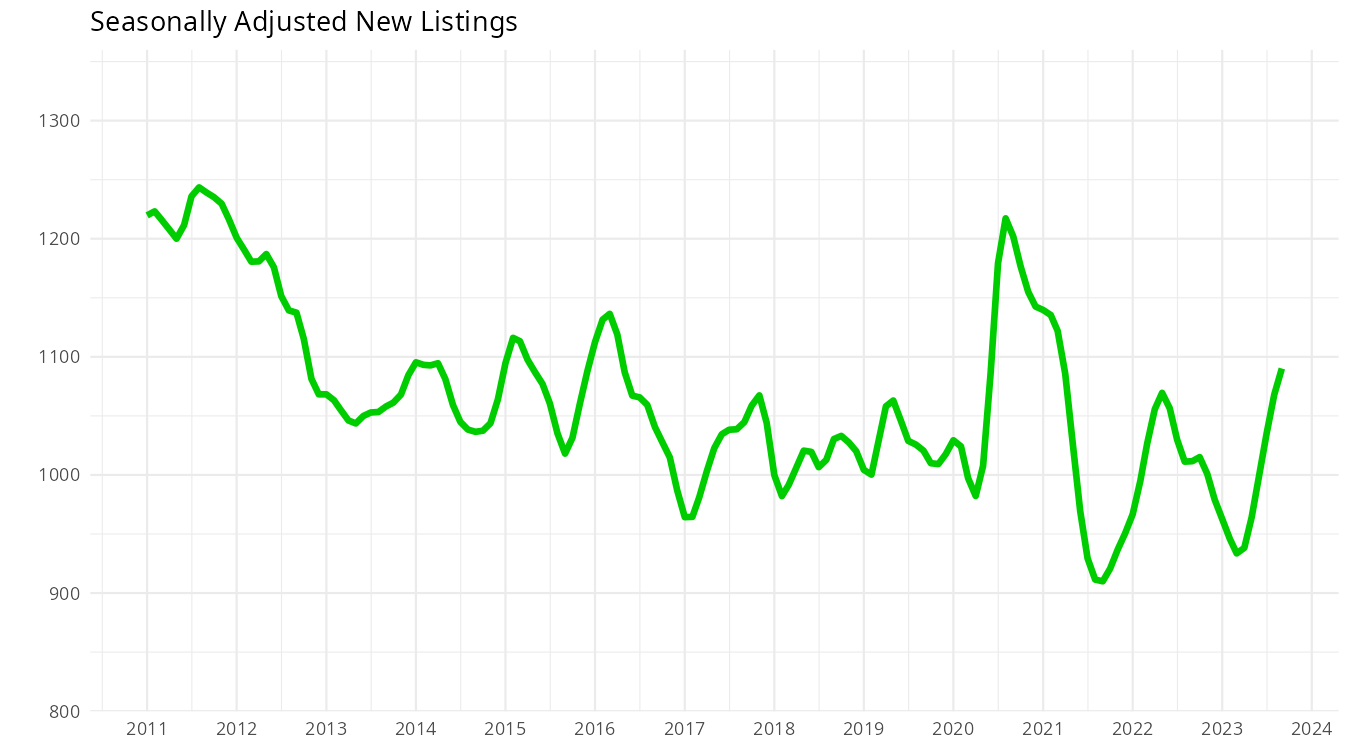

Though sales will decline as we go into the fall, we aren’t likely to see much more of a decrease in the underlying trend than where we are now. We don’t tend to get much slower than this unless it’s a real shock (COVID, GFC, etc). If we’re going to see a shift in the market it will be through more new listings. Those started out September strong, but fell back to roughly normal by the end of the month. We’re on an upswing in new lists, but at entirely unremarkable levels historically speaking. I’ve been keeping a close eye on new lists for signs of owner distress from rising rates, but so far the market is very stable.

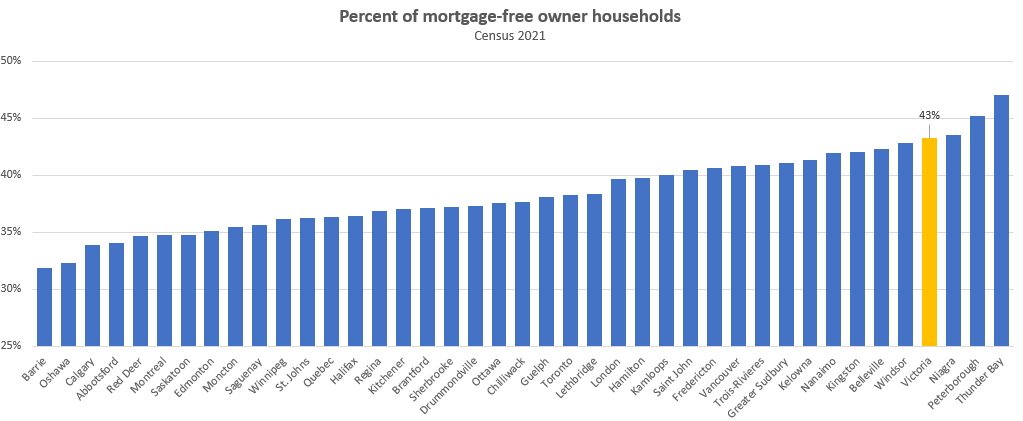

Part of that is likely due to the fact that fewer homeowners have a mortgage in Victoria than most other cities in Canada.

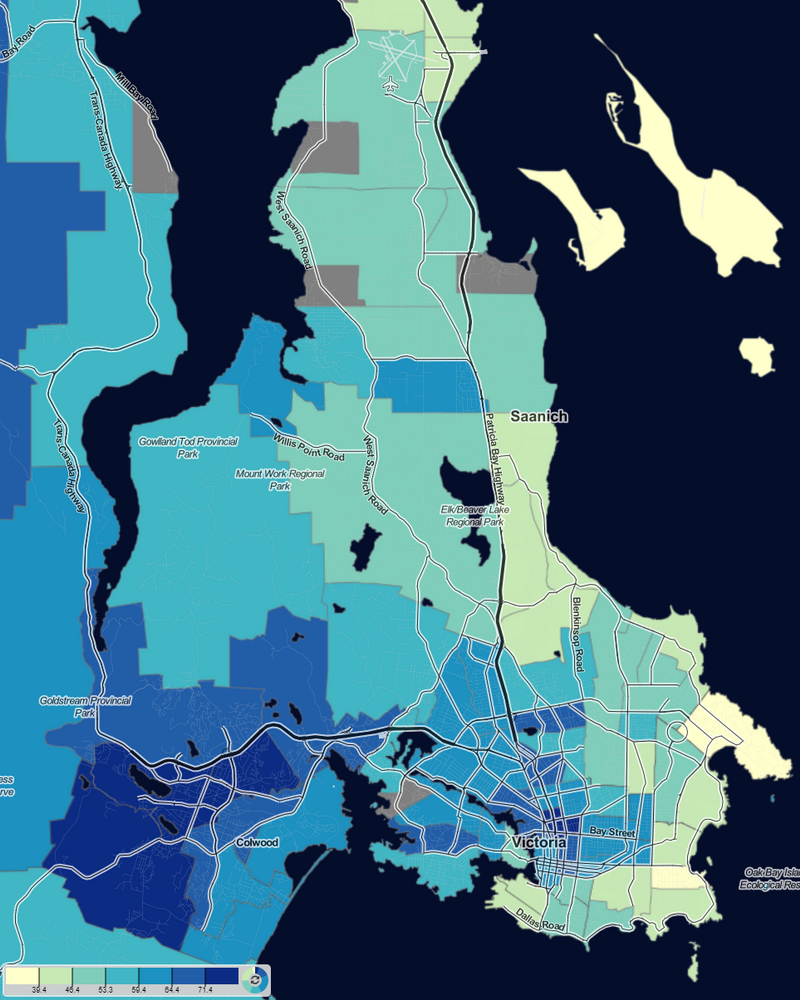

However that’s highly dependent on where you look. Waterfront Oak Bay or Saanich? We’re down to the 40% range of owners carrying a mortgage. New developments in Langford? Over 70%. The map below shows the percent of owners that have a mortgage, with the legend in the bottom left. You can also browse a live version of these data here.

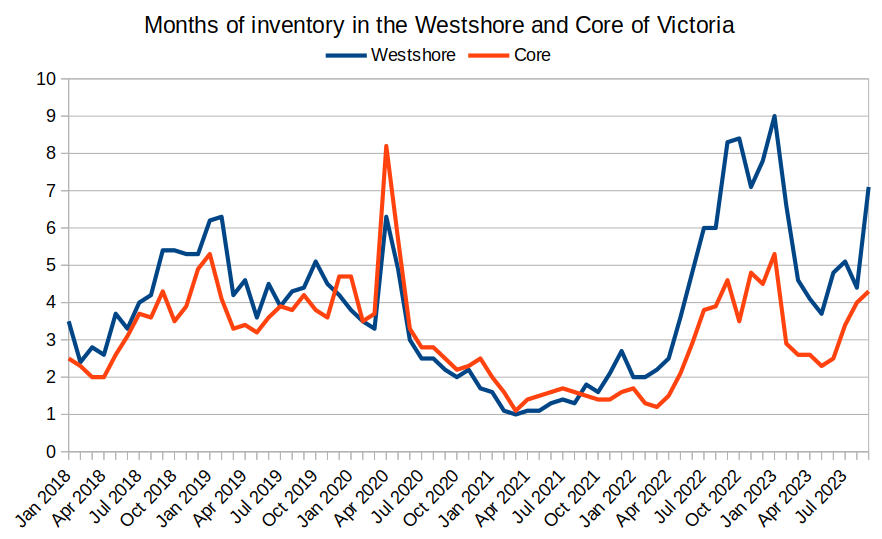

Is that dynamic visible in the market? Yes. In fact surprisingly strongly. The strength of the market in the westshore is usually pretty similar to that downtown. However as soon as rates started rising, the westshore weakened dramatically compared to a more muted reaction in the core (and strengthened more when rates stabilized). That’s not because owners out there have been forced to sell in great numbers, but because the buyers are much more credit dependent and therefore rate sensitive. If you’re looking for a deal in the market right now, look in Langford.

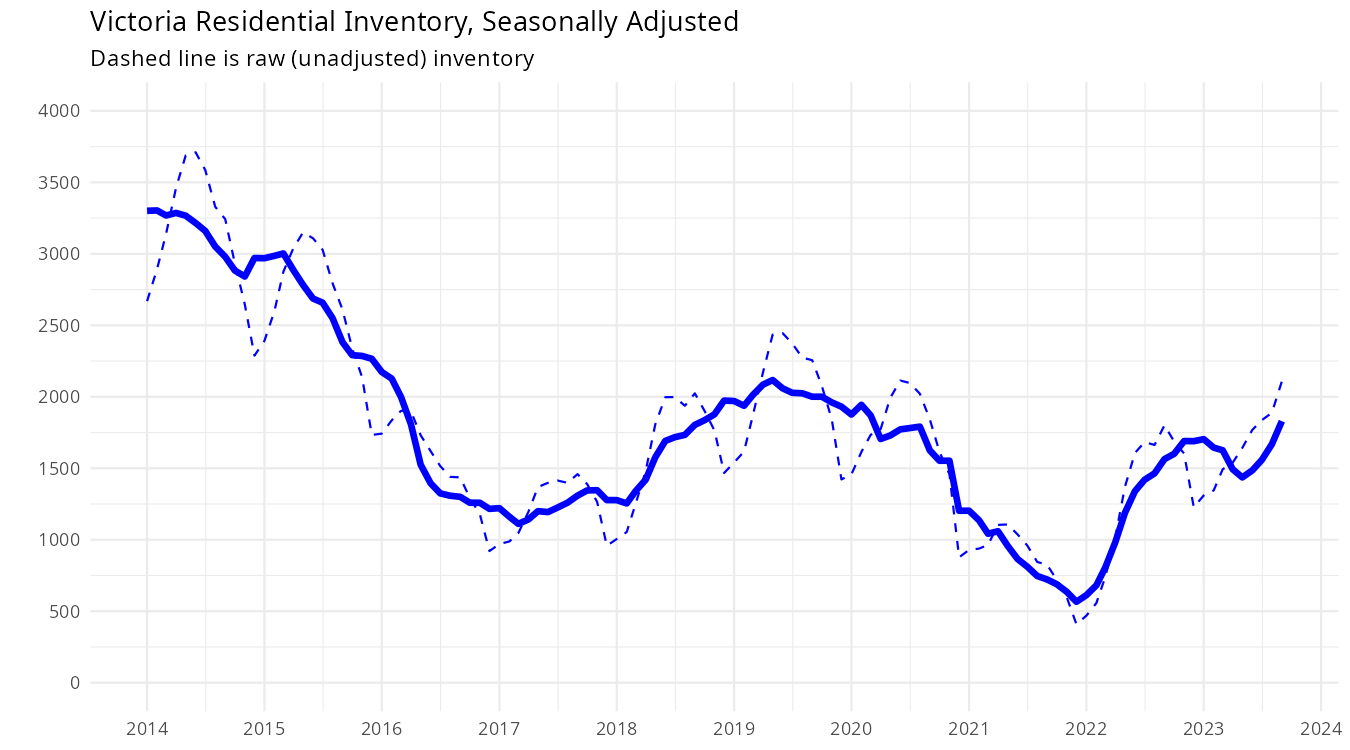

Sluggish sales and decent new listings means that inventory continues to build. It jumped in September, both the raw and seasonally adjusted figures. It’s pretty unusual to be building inventory this late in the year.

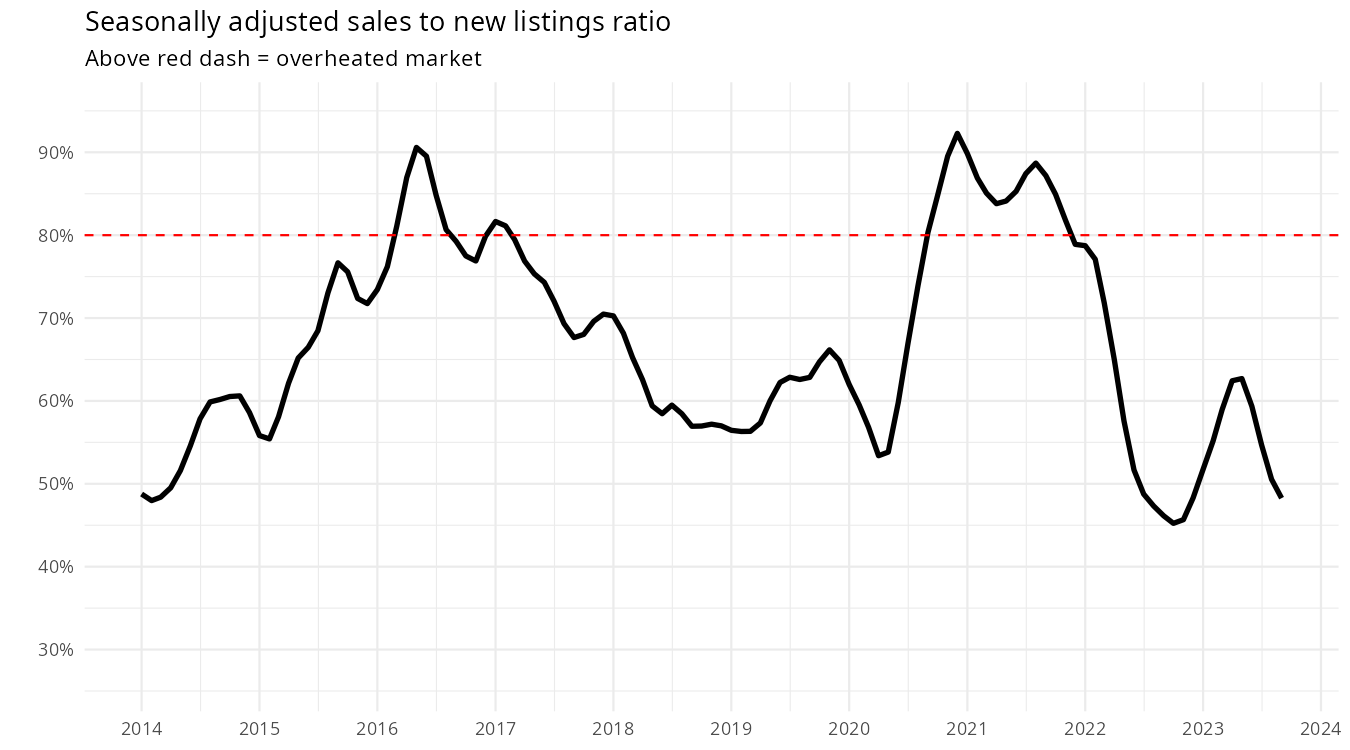

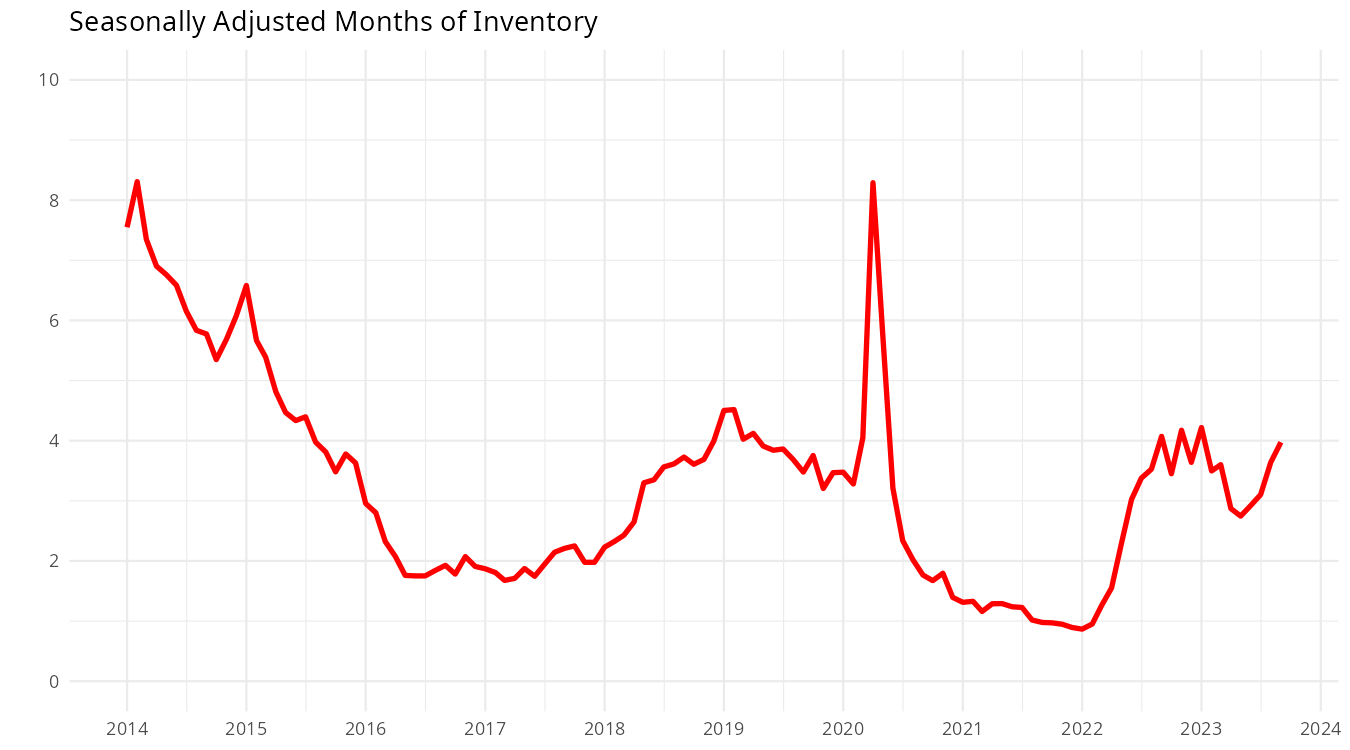

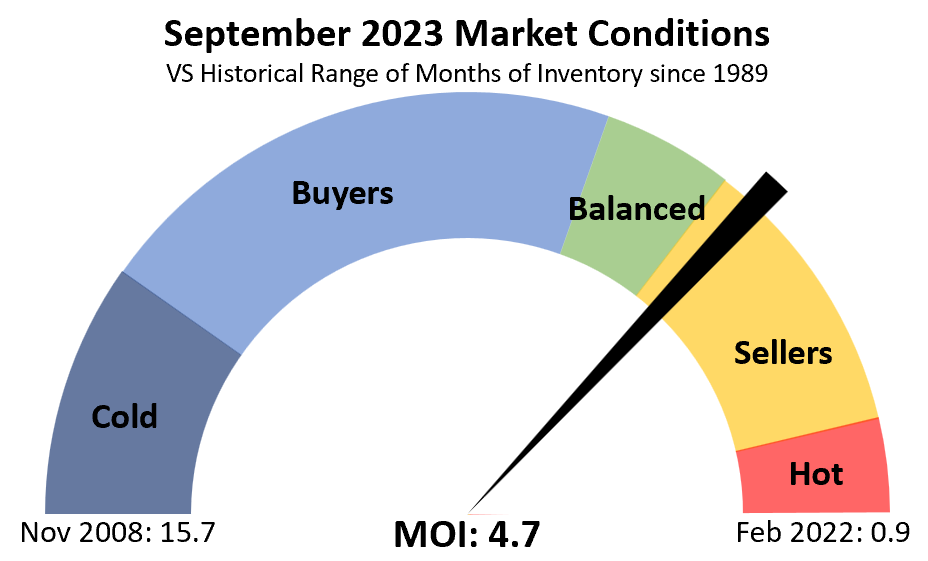

Months of inventory and the sales to new listings ratio both show the continued weakening trend in the market in response to rising rates.

However as always, weakening doesn’t mean weak. 10 years ago we had similar levels of sales with nearly twice the inventory, which was a real buyers market. Today we have a weakening trend that has driven months of inventory from 2.3 in May to 4.7 now, but that’s still technically a sellers market (with the proviso that the market is weaker in the Westshore and stronger in the Core as previously mentioned).

If you don’t believe me because your house isn’t moving, the price is too high.

Despite the weakening market, prices actually came in relatively strong for detached properties. Though there is a lot of noise in the monthly readings, a $1.2M median for detached properties is a high for the year and up from $1.06M last September. I wouldn’t read too much into it though given all the other signals are pointing to a weakening market. It’s worth noting that if cheaper neighbourhoods are disproportionately weaker due to high rates suppressing sales, that tends to push up the median and average.

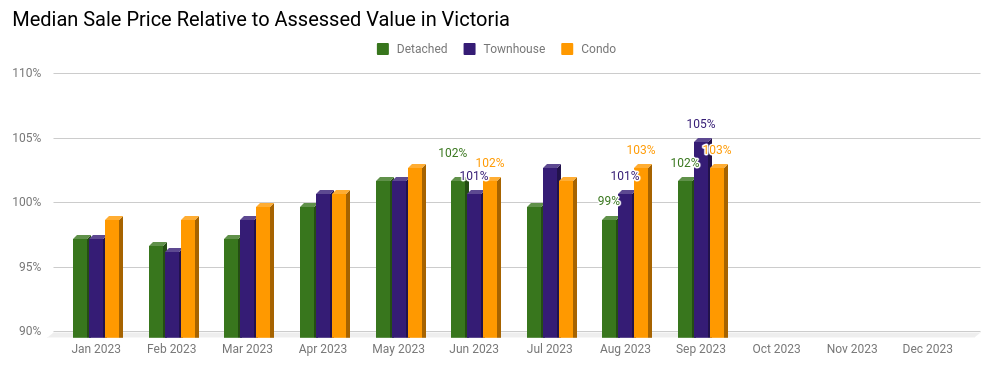

However the increase in price is also backed up by the median sale relative to assessed value. That measure increased in September for both single family and townhouse properties. I expect this to decline going into the fall as those higher bond rates filter through to buyers, but September bucked the trend.

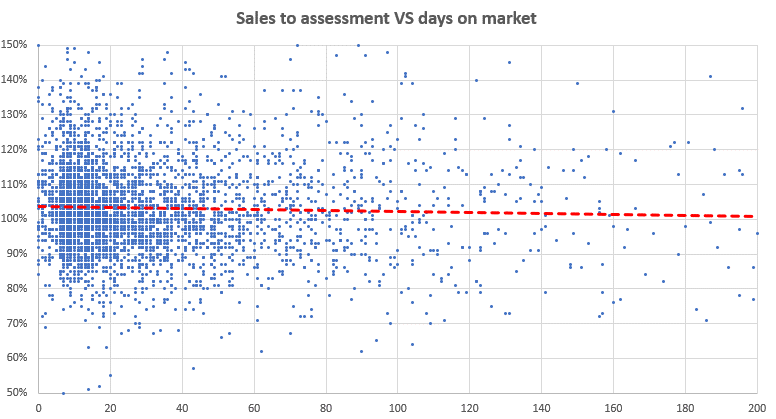

Buyers in September were still buying with rate holds in the 5% range, while with current bond rates hitting 4.4% today we are looking at fixed rates starting with a 6. That will definitely cut buyers out of the market starting this month no matter what the central bank decides. If you’re selling in this market I would price decisively rather than fishing for a higher price, given that we’ve likely got one month of reasonable activity left before the market goes into hibernation for the winter. Unless the market is locked up and dysfunctional (which has happened perhaps 3 times in Victoria’s history), there is little risk of selling below market value. For properties with broad appeal, there is no relationship between the sale price relative to assessment and time on the market. Sellers with good prices sell for market value quickly, and sellers with high prices sell for market value slowly (or don’t sell at all).

If you’re buying and haven’t been sidelined by the rates I would pay close attention this fall. No one knows what will happen next year, but for now the weakness we saw last fall is coming back. Happy hunting.

VREB weekly update is MIA but new post anyway: https://househuntvictoria.ca/2023/10/10/more-on-westshore-weakness/

Purpose Savings Account (ticker PSA on the TSE) has a 5.29% net yield and no minimum investment size. Similar/identical risk profile to the TD product.

https://www.purposeinvest.com/funds/purpose-high-interest-savings-fund

One of the many recent owner builder emails…..100% agreed, yet the government continues to bring in counter productive measures despite the lip service.

“I just watched your most recent youtube video on the subject of the Owner Builder exam.

I am currently studying to take the exam and I would love to have your study guide.

I am located in XXXXXX BC so we are definitely in one of those areas where it is difficult to find

good people to manage a home building project in a timely manner. Or good qualified people to

do the actual construction work in a timely manner at all for that matter.

This is a region where the irony of this situation is palpable. XXXXXX recently changed regulations

to permit people to build supplementary dwellings on their property to relieve a serious housing

shortage we have here. This is of course pretty much useless if there are not a sufficient number

of professionals to build them and there have been road blocks put in place to thwart people who

could otherwise build these homes themselves.

I don’t want to sound like I am generalizing or being disparaging because I definitely do not

mean to be but it has been my experience over many years that most of the best builders

I know are not at all comfortable in a class room or exam environment. Even someone who

knows all the answers can be seriously handicapped by exam anxiety. How could forcing these

people to take this exam be anything but counter productive?

Sorry about the rant.

I appreciate what you are doing.”

After fees.

Correct. Not CDIC insured, just like most other investments in a brokerage account. Minimum investment is $100k, which is CDIC limit, so it’s mainly targeting larger investors that aren’t concerned about cdic coverage. Many of their holdings are government or big five bank short-term paper (1-2 months). Some money market funds “broke the buck” in 2008 and were selling for $.97 on the dollar due to liquidity issues, and that could happen again, just like it can with any equity/bonds. If that’s a concern to you, stay away.

Do you have any better ideas (>5.03%) to park short-term cash?

Lmao more like prolific google link poster. Is that 5.03% pre or post the MER fee? Also this likely not eligible for the CDIC insurance… it’s a different product compared to the broker high interest savings account.

I know you’re trying to be funny, but to be clear I’m not a financial advisor, and my post isn’t financial advice.

We now turn to HHV’s personal financial advisor, Patrick.

People with idle cash sitting in a TD brokerage account can be getting 5.03% yield on a money market account. Liquid daily, no lockup. $100k minimum. RSP/TFSA eligible. Symbol:TDB2914 https://www.td.com/ca/en/asset-management/funds/solutions/mutual-funds/fundCard/TD%20Premium%20Money%20Market%20Fund%20-%20D/?fundId=7216

This yield is higher than some other money market accounts, as it tracks daily 30-60 day Canada T-Bill interest rates rather than bank prime rates like some other savings funds (e.g. TDB8150 , yielding 4.55%)

Honestly, Gorge Tillicum is probably the worst served area for transit in the city, and that’s despite the bus depot actually being located there. It also has a large population of people who could really use better bus service so that they wouldn’t have to own a car.

An interesting piece in the Times Colonist today about the intersection of CRD planning (and lack thereof), transit, and the identification of appropriate high density locations. As the Gorge Tillicum Community association president says, ” Higher density buildings with less parking are being built across Greater Victoria, and “those arguments are usually made on the availability of transit,” [yet] “If transit has been serving a community like ours for 50 years, where the same route can suddenly be taken away without consultation or notification, then how can you rely on rezoning designs that are built around transit?” he asked.https://www.timescolonist.com/local-news/newly-built-bus-shelters-in-saanich-dont-align-with-bc-transit-route-change-7661256

They’re called actuaries. They get paid well.

We now turn to HHV’s death reporter, James Soper.

We’ve gone from 220,000 deaths a year to 323,000 deaths a year in the past 20 years, a 46.8% increase, or an average increase of 2.34% per year (although it hasn’t been linear).

source: https://www.statista.com/statistics/443061/number-of-deaths-in-canada/

Yeah boomers entering their selling years is a factor but it’s cancelled by millennials and gen z in their net buying years.

Death rate increases somewhat as our population gets older so turnover will increase but this is a very slow moving factor that wont be observeable year to year.

Zach- Don’t be ridiculous, haven’t you heard? We need more immigrants to build the housing we so desperately need. Not to mention filling empty job positions that cannot service our ever growing needs. Get with the plan: Massive immigration is the solution to all our problems. According to Trudeau.

I would like as much as anyone for factors like this to make a dent in home availability. However, I think the “baby boomers retiring” theme has been oversold in too many areas. When I was trying to enter academia a decade ago this was a common refrain. What many people were ignoring was the 10x increase in trainees over the prior decades, leading to increased competition relative to jobs, despite the supposed demographic advantage of retiring baby boomers. Myself and many in my cohort realized quickly that it was time to look for greener pastures.

Similarly, our immigration policies over the past 8 years are likely to swamp the demographic effect of aging baby boomers. The millenial generation is already larger than the baby boomer generation, and odds are we see continued high rates of immigration for many years driving up housing demand.

Leo, can you make a chart, have stats on power of sales/foreclosures and share them monthly? I’m wondering if these are going up.

Happy Thanksgiving to one and all.

Well no it doesn’t, because that family would have the same health care and other social service needs whether they moved into the house or not.

Retirees just have to cut back one of their vacations overseas to pay their property taxes.

Let’s not kid ourselves, the property taxes on some of these retiree houses is substantial. Being able to defer their taxes is keeping many of retirees in large homes and keeping them from down sizing.

I doubt if there is any politician that would suggest revisiting the tax deferral. None of them want to end their career on that sword. I certainly wouldn’t want to bring up the subject with anyone retired. They may be old – but they’re feisty.

But for many people rising property taxes are a factor in determining to down size.

If one or two people living in one house is replaced by a multi generational family of 8-10 helps solve the housing problem, in turn it creates more stress on infrastructure such as the health care system.

I think the point of putting the language in the RTA is to make it clear that it does not apply to leaseholds, which after all are a form of renting.

If a property changes from being occupied by 2 (or maybe just 1) empty nesters to more people, that’s an increase in supply. Whether it’s owner-occupied (regardless of how the owners acquired it) or a rental.

Frank, did you keep your parent’s home? Not many do.

Here’s another scenario: As the baby boomers slowly die off in the next 40 years, their children inherit their home, move into it or keep it as a revenue property. In 20 years rents could exceed $10,000 a month. Waiting for the boomers demise to solve the housing crisis is an exercise in futility. Find a different strategy.

Assuming that most of the high end market are retirees, there may be a glut of high end housing already in Victoria. Currently about 15% of house sales are in the upper end in excess of $2.1 million, however about 30 percent of the active listings are priced above 2.1 million. On average for the last three months that’s about 8.5 months of inventory in the 2.1 million plus range.

In contrast the months of inventory for homes priced under 2.1 million was around 3 MOI

You would think that this kind of discrepancy would put downward pressure on prices but I’m guessing a lot of these high end houses are mortgage free. So perhaps the owners are not under the same pressure to sell as someone that has a monthly mortgage payment.

Someone looking to buy in the high end market has there pick of properties. There is no housing shortage for them.

Age 65 and over landlords are not long term residential investors. By the time they reach 75 most will sell their investment properties either through natural attrition or waning interest in continuing to be a landlord. I expect most of this change will be noticeable in the downtown condo market as these were the investments of choice by those desiring a rental property to augment their retirement income.

Not all of these investment condos were bought by people that live in Victoria. Downtown condos were purchased by people in other provinces and countries as an investment. And if one looks at the G7 countries the price and rent appreciation has been similar to what has happened in Victoria. Our current housing and rental shortage is a worldwide phenomenon that is rooted in the post 1946 baby boom in all these countries.

That’s not to say that the higher interest rates are not important to understanding the real estate market, but I would put demographics above interest rates in importance. Interest rates may change but you can’t escape mother nature. With the passage of time baby boomers and their estates will become net sellers of real estate.

Will that have an effect on market prices? I don’t know. Intuitively I would think that small retirement destination cities such as Victoria would experience a larger effect on prices as there are so few listings relative to the number of potential estate sales.

Baby boomers did have an affect on housing, they had fewer children than previous generations. Not mentioned in the video. Should be a glut of housing on the market.

Here is a well done video of the effect of Baby Boomers on the shortage of housing.

https://youtu.be/Dlid_zKQvcg

Air B&B has never made sense in Victoria. For the last 10 years it has been a consideration but the rental price per month comes close to the Air B&B income renting 20 days/month . The cost renting your place long term and the accompanying less hassle is the best comfort and economical decision in Victoria.

the definition of short term is often defined at the local government level, or from common law. Seems like 28 or 30 days are the common thresholds

@2wheels I did Airbnb for a short time. It was way more work than I thought it would be. Plus it was not ideal having a constant stream of strangers coming and going below us. Plus I will admit that I felt guilty about it (even though I only did it for 5 months) and never intended to do it long term. There are so many truly excellent long term tenants – I personally much prefer renting to them. We have two units rented right now to awesome tenants. Plus Airbnb is so much work – very annoying. That’s my 2c (unsolicited- in case you don’t mind).

We’ve reached the apex of Baby Boomers in Canada it will be interesting to see how this effects the real estate market in Canada and most of the G7 countries as Baby Boomers are not selling their homes and therefore contributing to the record-low supply of housing.

The long term trend in yields is up, primarily due to global macro factors. China has been getting rid of US Treasuries and our yields go up or down with the USTs. I expect the CA05-Y yields to drop in the short term to the 4.2% range.

Short term rentals do provide flexibility in that during periods when the unit is not occupied or a bad year for tourism you can quickly move to sell the unit.

I know it sounds like nonsense, but that’s what I’m aware of in BC. Our tenants just moved out and we are considering our options going forward. I think our priority is flexibility over consistent income.

I think the point made yesterday regarding the cost of renting short term furnished property vs market rents was really great. Of course it doesn’t prevent someone from not paying rent and making a claim through residential tenancy but overall I think it would reduce the chance of that happening.

@2wheels I seem to remember some time ago one of the tenant advocate groups trying to make that argument and it didn’t fly. I can’t find the source and it’s possible it could have been outside of BC. I don’t think a tenant could force someone into RTA (without even possibly their knowledge) just by listing an address as q primary residence. Again I could be wrong. Again I think it hosts start doing stuff outside the app that could perhaps be risky. Also, I wonder if there’s some wisdom to having all potential guests agree that they understand that the unit is a vacation rental and that it cannot be used as a primary residence. Imagine the shit show if they started calling Airbnb guests renters under the RTA.

My understanding is that neither the app used (Vrbo / Airbnb) or the duration of the stay automatically excludes a renter from being protected under the residential tenancy act. If the rental (example 3 days booked on Vrbo) is the renters ‘primary address’ (example the renter has a house that is being renovated and is currently uninhabitable / or has no other address), then they are covered by the act.

That is a possible interpretation. But the Residential Tenancy Act also says in s.4(e) that it doesn’t apply to living accommodation occupied as a vacation or travel accommodation.

Vacation or travel accommodation doesn’t look like it’s defined. Running a rental through Airbnb or VRBO could be viewed as in & of itself a pretty good sign that it’s intended for vacation or travel, since that’s the very purpose of these sites. And then especially if you provide other things normally provided to travellers but not normal ‘tenants’, like toilet paper, soap, bedding, towels, maybe kitchen utensils/stock and the like.

Here’s an interesting exclusion. “Rental agreements with terms of 20 years or longer” are not covered by the Residential Tenancy Act.

Wonder if anyone has ever tried a 20 year rental contract

My understanding is that the RTA does not apply to Airbnb, which are vacation rentals. I think it could apply if there was a tenancy agreement. It makes sense to me since a tenancy agreement would show an intention to create that kind of relationship and housing. Listing a place on Airbnb – and renting it – only shows intention to provide a vacation rental for a short term. I think there is a risk in ever doing anything outside the vacation platform as that could be evidence of a different kind of relationship (ie a landlord tenant one under the RTA). I could be wrong – I bet Landlord BC has info on this.

Great point!

I agree. This would be a theoretical risk for “medium term” rentals.

However most of the clientele/tenants seemingly have a fixed term in mind. Work assignment. Extended vacation etc. And as Marko points out the downside would be collecting stupidly high “rents” indefinitely.

I’ve been doing this for four years now on my principal residence condo when I go away. So far some of the guests I’ve had

Travel nurse

Federal immigration officer (he told me his per diem for accomodation was something insane like $220ish per night and he didn’t want to stay at a hotel so took my place even thought just a single guy)

Film industry director (this was a good setup as it wasn’t through a platform. Autodeposit $7k/month straight into my account).

Couple from Ontario that sold their house in Ontario and were waiting for their home here to complete

I’ve thought about this personally; however, the “rents” are so insane if one of my guests tried to pull this I would just roll with it. If you want to go $7,000/month, month-to-month, and not move out, sure, stay as long as you want. Long term rental market value is only $3,800ish.

What matters to the housing market is how wages are doing relative to mortgage payments, not general inflation.

It’s more the 5.3% wage growth out pacing inflation that’s going to make the big impact.. wouldn’t call the 5 year bond maintaining between 4.3 and 4.4 after poking through 4.4 dropping yet….

Appears to me that a one month lease is a fixed term tenancy under the RTA and the tenant has the right to remain month-to-month, except for landlord occupancy.

https://www2.gov.bc.ca/assets/gov/housing-and-tenancy/residential-tenancies/policy-guidelines/gl30.pdf

Where are vacant homes in Canada ? How about most of Canada! At least 90% (by area) of Canada has >5% of homes as “vacant” homes.

By “vacant” I mean statsCan definition as “unoccupied by usual residents”. These are homes that no census person is declaring as living in as their main residence. This is similar to the BC spec/vacant tax definition. StatsCan measures this exactly on the 2021 census.

You can see details of every area of Canada here and there’s a color coded pic of Canada below.

All the areas that “aren’t yellow” on this map have >5% “unoccupied by usual residents”. An “eyeball” guess is that >90% of Canada (by area) has more than 5% of dwellings vacant. A typical example would be a second home (cottage).

Relevant to our discussion about banning AirBnB. All of these vacant (“cottage”) homes could be rented out part of the year, either to tourists or seasonal workers. In any case, these would be considered STVR rentals, and there is no reason to ban them in areas with high vacancy rates to begin with.

For example, 36.8% of homes in the entire B.C. southern gulf islands (galiano, Pender etc.) are unoccupied according to StatsCan. Why should they be prohibited from an AirBnB/STVR rental, but be allowed to keep their home totally vacant? What if a galiano cottage owner doesn’t use the cottage during September, and wants to rent it out to a high-rise Victoria apartment dweller for 3 weeks. What’s so evil about that, requiring both the federal and provincial governments to target and try to stop that from happening?

Here’s the map of unoccupied homes in Canada https://censusmapper.ca/maps/3055#4/55.45/-112.98

Yellow=<5% vacant. Light green 5-10%, Shades of blue 10-40% + vacant. If you visit the link, you can click on a region to find the exact unoccupied rate.

A friend of mine in City of Victoria moved to doing that when the city announced its new STVR rules. She still makes pretty good money doing that and I understand still advertises through the AirBnB platform (but with the minimum 1 month restriction).

Less money than outright STVR, but also less hassle. Unit has not entered the long term rental supply, but you could argue that this sort of medium term rental fills a useful niche

Patrick is absolutely right; I have never known the Feds to screw anything up.

Way too many “it(s)” before coffee time.

It’s funny, Absentee landlords were the main reason PEI joined Canada in the first place. There’s no way that rent seeking behaviour contributes to the economy. It takes money from people who will spend it on goods and transfers it to people who already have enough.

For the record, I don’t see a single post by anyone on HHV that compares Singapore to Victoria. If I’m wrong, simply point one out.

The market is not buying it. The yields are dropping. Is it “sell the news” move or is the market thinking it is a manipulated number to make the govt look good?

Just calling it as I see it.

Unecessarily agressive.

Could be more than double if you like doing some work. Plus more tax write-off items for your principal residence.

Lmao, principal residence is fine , see new york model. Go get some more links, hope Google pays u for the efforts

Like where?

Now that’s a tricky question. Sure the landlords in question make more money (that’s why they do it), but there’s also the effect of reducing long term rental supply, which means other landlords make more money. Good if you’re a landlord, but Is more expensive housing good or bad for the broad economy?

The Feds aren’t looking at banning Airbnbs. They’ve got a few tax/regulation ideas, (incentivizing municipalities with grants, increasing GST on Airbnb etc.), but no talk of banning. Many areas of Canada have high vacancy rates and the economy benefits from Airbnb, so federal laws would screw that up. https://www.theglobeandmail.com/politics/article-ottawa-looks-at-limiting-number-of-airbnbs-to-free-up-rentals/

From: https://beta.ctvnews.ca/national/business/2023/10/6/1_6591512.amp.webview.android.html

From: https://apnews.com/article/jobs-inflation-rates-economy-federal-reserve-unemployment-8950494bcfcc717f7e6c18bc19ecaf6e

More one way news for interest rates….

Patrick: You will have to see what the Feds are going to do with it as well.

The question in my mind, regarding AirB&Bs is what is the income deferential between regular rent and renting them as ABBs. If regular rent is significantly less while expenses such as a mortgage is increasing than the math tells the story.

I am sure that most owners are already doing the math.

The BC government announced plans for this Airbnb legislation back in April. It will be regulating, not banning them. Yawn.

https://dailyhive.com/vancouver/bc-airbnb-regulate-short-term-rental

A short term rental ban will drop the price of long-term rentals for a period of time I’d think. When covid hit and STVRs were effectively sidelined this is what happened as a lot of new supply hit the market within a short period of time. Longer term there is probably still so much demand in the market that prices will climb again, but maybe not as quickly.

That spelling is ‘nonsense.’

Comment wasn’t directed at you but to the ones that thought the two cities are comparable, complete none sense.

Intent was that for those who rely on airbnb revenue to make the cashflows work then that bus will be coming to a stop. For those not in that boat, business as usual.

And if/when short term rentals are effectively banned people will still be able to rent for the month+ at a time. Medium term rentals

I still don’t understand your Airbnb warning….the zoning carries such a small premium even if the province banned Airbnb altogether the decrease in value would be backstopped by the straight up condo price which still has utility as an executive rental, long term rental, owner-occupier, etc. I had my personal 1,000 sq/ft unit rented for a couple of months earlier this year for $7,000/month to a movie industry director. It’s not like if you can’t Airbnb all utility of the unit is lost.

For example,

Let’s say a unit at the Legato (has Airbnb zoning) is $610k

Same unit at 989 Johnson (does not have Airbnb zoning) is $600k

You take away the zoning and there is a $10k decrease (if that, I personally can’t even see a difference in market value Legato vs 989 Johnson). Only a few buildings carrier any sort of premium such as Janion.

A warning that would actually make sense is to get out of condos altogether, for example.

Yes, Singapore is among the 9 out of 11 SEA countries that I’ve lived/been to.

I can’t believe people.are comparing victoria to Singapore…. have you ever been there?? I travel there for work on occasion, it’s a completely different tier of city compared to victoria, jesus go back to posting links.

Doesn’t matter, the province is announcing legislation soon for airbnb. I gave the warning months ago for ppl to get out if they wanted to.

Interest rates pushed his mortgage from 25 to 47 years

http://www.cbc.ca/player/play/2270164035676

Island Girl: Exactly what do you mean when you say the market is healing? Not saying you are wrong just not sure what you are saying.

I’m so excited to see the market finally healing can’t wait for the next 6-12 months. Hopefully some normalcy returns.

Depends on how you look at it. Sales to new list ratio is pretty weak for sure in September, but they still have about 4 months of inventory which is not a lot. If it stays super weak that will build, but for a true sustainable buyers market they need a lot more inventory.

Looks like the feds are gunning for AirBnB:

https://www.theglobeandmail.com/politics/article-ottawa-looks-at-limiting-number-of-airbnbs-to-free-up-rentals/

Things are getting interesting…

https://www.thestar.com/real-estate/toronto-real-estate-has-suddenly-shifted-to-an-official-buyers-market-will-a-price-drop/article_ed7fce41-0870-51e8-acca-7f37370a0cea.html

Toronto real estate has suddenly shifted to an official buyers’ market — will a price drop be next?

Toronto is officially in a buyers’ market. The only problem is, where are all the buyers? New listings are flooding the market but many are taking a long time to sell as potential buyers aren’t able to qualify for a mortgage and are waiting for interest rates to go down.

But some sellers aren’t able to wait.

In Singapore, you don’t technically “own a car”. you buy the right to drive it for 10 years. After 10 years, you have to get rid of it. Cars older than 10 years are not allowed. Similarly, you can’t own land (except for grandfathered land/houses). All new purchases are apartments on 99-year lease.

Victoria CMA 696.15 km2

Population 394,000

BC have 719,000 km worth of roads

Tiny little airport YYJ serve 2 million passengers per year.

Shipyards and port size are practically non-existent. (Port of Vancouver handle 3.5 million TEU per year).

Singapore 734.3 km2

Population 5.45 million

3500 km worth of roads

Changi airport 25 km2, serve 68+ million passengers per year.

Port of Singapore/shipyards is massive and handle 37.5 million TEU per year.

Additionally, there are an additional 450,000 people cross over from Malaysia to work in Singapore daily.

Above are some of the reasons it costs so much for housing and to use the roads in Singapore.

That’s what high density gets you, high (ridiculously) house prices. That’s also why millions of people want to move to Canada.

Detached houses in Singapore are rare. Average price $10 million. Also has the second highest density of any country. https://www.sheinterior.com.sg/how-much-is-landed-property-in-singapore/#:~:text=ft%3B%20a%20semi%2Ddetached%20property,million%20or%20more%20for%20bungalows.

Incredible. The Singapore $ is the same (1.00) as CAD, so that’s $250K CAD.

In case you thought there was a “war on cars” in Canada:

https://www.bbc.com/news/business-67014420

Or, the population is moving out, leaving many condos/suites empty.

Victoria voted (October 2023) best small city in the world to visit, by the 526,000 Condé Nast voters worldwide. It was the only USA/Canada city in the top 10.

Vancouver voted # 8 best big city to visit in the world.

https://www.cntraveler.com/gallery/2014-10-20top-25-cities-in-the-world-readers-choice-awards-2014

That’s correct

Even assessed values seem a little stretched to me. Am I correct in thinking most current assessed values are based on July 2022 prices? Which, based on your median prices plot, was just coming off the early 2022 peak? And when the BOC rate was 3% lower than what it is now?

Got some estimates for my dad.. $8k a month might get you the tiniest unit, most were closer to $10k/month. Not that that changes your point. One manager said many people stay only until they get a spot in the public homes, often 4-8 months.

Yeah if they were motivated they would drop the price. Who knows if we’ll get there, but I think people forget how slow the market was a decade ago. Rough transition for sellers coming off a few years where if a place was listed for more than a week it felt stale.

I’d keep a close eye after end of October though. The opportunists generally give up by then to try again next spring. The ones that hang on are more likely to have to sell for whatever reason.

We have been looking in Langford. Seems like mostly pandemic asking prices still. Not sure that the reality of an 8.5% stress test has sunk in with sellers / realtors.

Keep getting fed the line that “the sellers are motivated”, but obviously not motivated enough, yet.

Minus reverse mortgage, tax deferral and HELOC for those who didn’t plan for retirement……

Overall average length of stay in long-term care: 834 days (27.8 months or 2.3 years).

https://www.seniorsadvocatebc.ca/app/uploads/sites/4/2020/12/QuickFacts2020-Summary.pdf

Let’s say you’re paying $8K/month out of pocket for the swankiest resort-style retirement home:

27.8 x $8,000 = $222,400

Median detached home = $1.2M

Still a lot of money left over.

Maybe the Airbnbers are getting out of short term and moving to long term before new regulations come out.

300 rental listings on craigslist today within a six kilometer radius of downtown.

127 one-bedrooms at an average price of $1,870 per month

110 two-bedrooms at an average price of $2,760 per month.

Some have been listed since the third week of August. Interesting to find out if the vacancy rate has increased as it seems the listings are staying up for lease longer.

Remember to be good to your kids. They’re the ones picking the care home for you.

If both spouses are in a care home then the home equity can disappear rather quickly.

That’s a really good point. Those facilities are going to become in demand really damn quickly here. Prices will likely go up.

That’s quite true, that for many people their home equity covers their care home costs (if needed). The average time someone spends in a care home I think is around 3 years. So quite often people won’t spend all the funds from selling the home. This can vary if someone opted to move to independent or assisted living before needing the full on care. If you do that too early you can burn through cash a lot quicker. Care homes are over $10k/month, but independent/assisted living can be $5k to $7k kind of thing. The more of that you use before care home, the faster you spend your money.

Also, I’m not sure if I’d rely on public facilities? The waitlists can be long, and spots limited. I imagine that becomes more challenging as our aging population continues to age.

That’s if they are of sound mind and move into the Berwick.

Lots (probably most) will hunker down in their SFH till near the end, when dementia drags them into a publicly-subsidized assisted living residence, the monthly cost of which is calculated based on your income, not your assets. (This is my understanding, anyway.)

Thank-you for the graph plotting days-on-market v. the sales to assessment ratio.

A long standing real estate myth has been that if a property sells quickly then it sold for under market value. This assumption is used by plaintiffs and witnesses, in court, to dispute the reliability of sales data or as evidence that they were taken advantage of by an agent that underpriced their property for a quick sale. All that the DoM illustrates is that a property sold in 6 days or in 66 days. Not that the property under or over sold.

If your dad was born in ’46 and he bought them at the end of the 70s, he would be 33 when he bought the towels and currently 76. The towels would be 43 years old. Maybe they really don’t make things like they used to… because I can’t see any of my towels lasting much more than a decade.

Unless they’re planning on dying, most people will end up in a home at some point, those can be up to $6k a month. You’ll rip through any money that you made selling your house pretty quickly at that price.

Yes, most (insert here) I know. I think the statistics show that overall boomers have little besides their houses and pension assets which will be largely exhausted and subjected to taxation if they’re not.

Also – money is more than what it can be exchanged for – inheritance shows how money can be symbolic. disinheriting someone is a symbolic gesture – it means more than just not passing on wealth. It’s usually quite a mean thing to do. That’s my 2c. I plan to pass on all my wealth (assuming I have some) to my kids.

Frank plans to live forever or die trying.

Tell us about them, Soper.

Hate to spoil a good funeral, but the boomers, like myself, are going to be around for a long, long, time. Many of my cohorts from the class of 55 are still dealing with their parents who are in their 80’s and 90’s. Few of us ever smoked, were physically active when we were young (not like today’s couch slugs) and were educated enough to eat relatively healthy foods. This party is far from over.

Same. Boomers are my parents’ generation, and just about all the boomers I know have a paid-off home and no predilection for “spending it all.”

Most boomers I know will also be leaving significant wealth behind. As Peter said my dad cannot being himself to update even his towels, which I believe are from the 70s. I have heard of a few boomers who seem to intentionally want to spend all their money and leave nothing to their kids – but in my experience that is rare. I think most boomers are smart enough to understand that they were very lucky in terms of a very long financial timeline – like a blip in a long line where that generation was especially wealthy.

But the boomers have almost all their wealth in their houses. To pass on the wealth they have to sell the house, or just bequeath it to one (hopefully) of the kids. Either way that’s increased supply that offsets the increased demand from the wealth transfer.

Really? All boomers I know will be leaving substantial amounts to their kids, not necessarily by design but by default. Many who have built up significant equity have trouble changing their mindset to spending it. Not saying this is smart, but I do think it’s more the norm, for boomers, than spending every last penny.

So, in my view, this will help sustain housing (again) for years to come. Oak Bay will be just fine…

The problem is the creation of a two-class system where if you have money, you leave it to your kids and then they have money and opportunity, while others less so. Answer to that, I guess, is taxes, and charitable donations.

Most boomers I know plan to spend every last penny.

@Barrister I’m curious about that too. My parents both had modest jobs/incomes but they’re both boomers (divorced a long time ago). Even with their modest income they still had no mortgages and pensions. So yeah I can only imagine all the wealth that will flow down to the younger generation as the boomers move on.

I suspect that we wont see the real impact of mortgage rate increases until 24/25. But I dont think that they will be as dramatic as some people hope. On the other hand, I dont necessarily see interest rates going down very much either. Historically we are still on the lower end of mortgage rates and at times it feels like all this talk of major drops has the feel of wishful thinking. Your guess is probably better than mine.

We are on the cusp of the baby boomers starting to die off in larger numbers and I am really wondering what the impact is going to be over the next five years. Life expectancy for Canadian males in 2022 was 80 years. But that means half are dead and the remaining half will most likely be dead in the next ten years. (I read the obituaries in the Globe and Mail to see what my friends have been doing). People tend to downsize after losing a spouse so I wonder how many SFD in places like Oak Bay might be coming on the market in the next five years. No, I am not suggesting a market crash in any way but rather an interesting development.

It would appear, as expected, that the newer the area, the higher the debt. The older the area, apparently, the lower the debt. Therefore, to increase supply would necessitate increasing indebtedness. Not sure the current economic environment can accommodate this.

Don’t let anyone doubt your bay street insider contacts barrister. Especially not internet economists who got nothing better to do than post a bunch of links all day.

A good read , tough to tell where anything is going