Priced out forever?

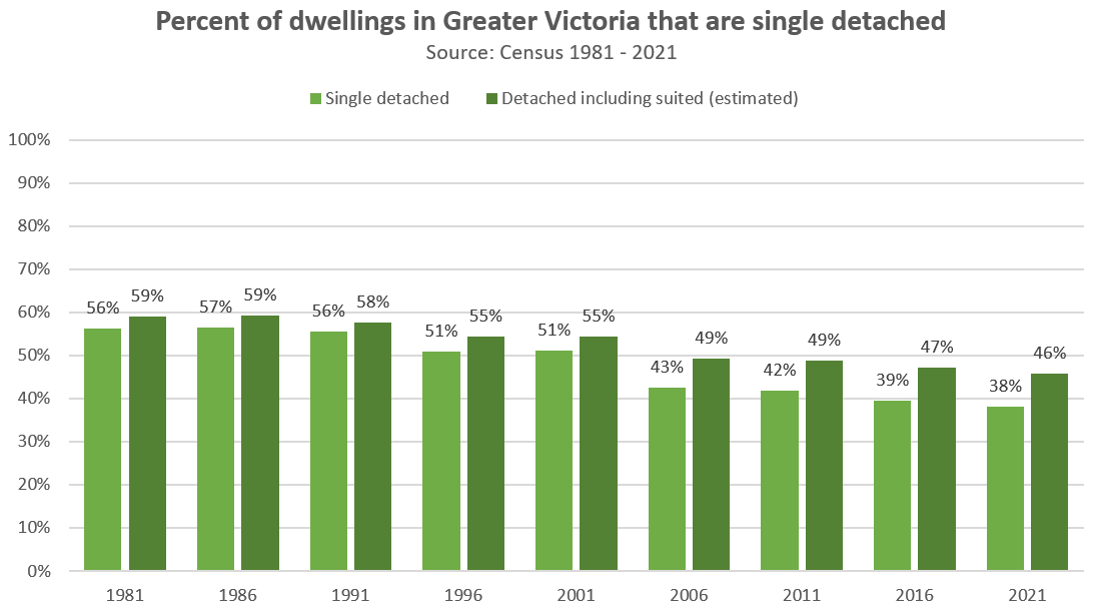

I’ve spilled a lot of virtual ink on affordability on this blog and why I believe it matters. In short, there are generally two affordability stories: For condos, affordability has oscillated between bad and good every 10-15 years or so, and when affordability is very poor, we tend to see prices fall or stagnate until affordability improves, and when affordability is good we see prices increase rapidly until it deteriorates. Affordability for single family houses also oscillates, and prices behave similarly in response. However every time affordability improves it improves a little less than in the last cycle. In other words over the long run affordability gets worse and buying a detached house gets further and further out of reach for an average family. Given we aren’t building many new detached houses while the population continues to expand, there is absolutely no reason to expect this trend to stop in the future. If anything it may accelerate as more new housing comes from replacing detached homes with higher density ones rather than greenfield development. Considering about 30-35% of the population rents (mostly not in a detached home), there’s been a big shift in the last 40 years already in the percentage of owners that are in a detached house.

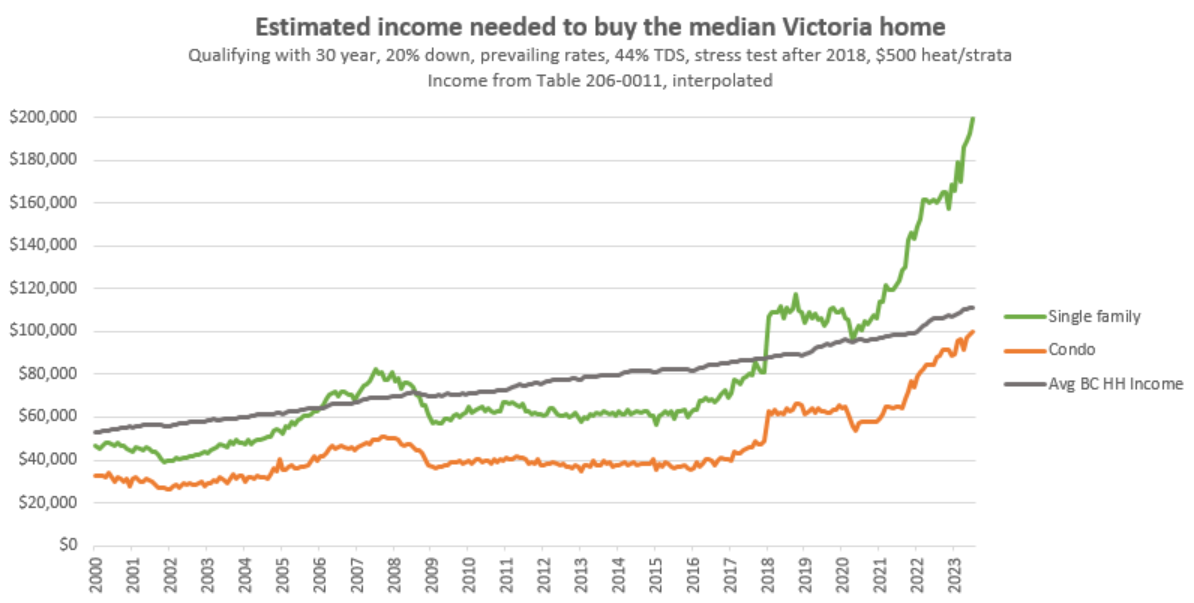

However affordability is somewhat difficult to visualize. What is the average household income? It’s easier to understand perhaps if we just show the income needed to qualify to buy a house. It looks like this, with the median house requiring an income of nearly $200,000, and the median condo just shy of $100,000.

Which brings up the issue of being priced out forever. The phrase “buy now or be priced out forever” is a scare tactic has been used to induce FOMO for decades, and the reason that it works so well is that it’s been backed up by rapid price appreciation for much of that time. It’s undeniably true that people have been priced out bit by bit as prices rose beyond their ability to pay them. Nevermind we could fill a few pages discussing the various tailwinds that the real estate market has enjoyed in the past and whether those are likely to repeat, but that doesn’t change the results. If you’re interested in a blast from the past, take a look at this website which explains why it’s not actually possible for everyone to be priced out. That US website from 15 years ago turned out to be dead on for the US market, while the Canadian market defied expectations and just kept rising.

However that doesn’t invalidate the fact that the market can’t price out all of it’s participants, it just means that enough people haven’t been priced out yet. As mentioned above, because single detached homes are becoming increasingly rare, the detached market can afford to price out more of the population and remain stable. That doesn’t mean prices can’t go sideways for years or drop, but it does mean that they will be more resistant to drops than condos with a higher supply elasticity. For condos (and to a lesser extent townhouses), there is no near-term limit to supply, even though supply response remains slow. Most of our current supply is artificially restricted by regulations, and could be opened up with enough political pressure. At the same time while demand is high right now, it would be a mistake to project that out forever. The narrative on immigration has flipped quite dramatically this year, going from a taboo subject to multiple cabinet ministers musing whether we need more controls or whether the sharp uptick in non-permanent residents could risk the integrity of the immigration system. Things can change quickly, and that’s doubly true if the economy turns downward.

For condos I’m maintaining my view that we are in for at best a long period of price stagnation if rates come down some next year, or price declines for a few years if rates stay high. Even under strong growth pressure, people need to somehow pay those mortgages, and I believe too many people have been priced out to keep the condo market as high as it is. Theoretically detached should face the same challenges, but I’m being prepared to be surprised to the upside.

Thoughts? Can the market sustain these high qualification rates? And if not will they be resolved through falling rates, falling prices, or rising incomes?

Also the weekly sales numbers:

| August 2023 |

Aug

2022

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 104 | 202 | 341 | 451 | 478 |

| New Listings | 231 | 465 | 712 | 958 | 980 |

| Active Listings | 2398 | 2454 | 2460 | 2504 | 2137 |

| Sales to New Listings | 45% | 43% | 48% | 47% | 49% |

| Sales YoY Change | +25% | +15% | +18% | +11% | -42% |

| New Lists YoY Change | -2% | +7% | +9% | +12% | +10% |

| Inventory YoY Change | +11% | +12% | +13% | +16% | +90% |

| Months of Inventory | 4.2 | ||||

With four business days to go in August, the month ended very similarly to last year with a small sales bump in the last two weeks. While sales will come in around 530 for the month, new listings have also remained a bit higher which made the market slightly weaker on the basis of the sales to new list ratio.

Realistically we have a very similar market to 12 months ago, with sales to list ratio around 50%, months of inventory around 4.5, a weakening trend, and prices essentially unchanged year over year.

Inventory cracked 2500 for the first time since fall of 2020. We’re at middling levels historically speaking (August 2012 there were 5034 properties on the market), but it’s somewhat unusual to have inventory linearly increase like this throughout the year. With September’s new listings bump we will likely continue the upward trend, but October should finally put an end to it. On average inventory peaks in June, but when the market is weakening it peaks later, and when it’s strengthening it peaks earlier (see 2019). After years of extremely low inventory it’s a welcome relief even though we are far from what we had 10 years ago. If I was house hunting, I would certainly be keeping my eyes open in the fall.

New post: https://househuntvictoria.ca/2023/09/04/august-market-stall-continues/

Check the hinges to make sure that they are not loose or slipped, or old/failed weatherstrip, and adjust and replace as needed. Use a long straight edge to check the door jamb and stop to make sure that the door is not warped.

Remove the casing and shim the jamb till it is straight/square (1/8″ space between door and frame), then fill the gap with foam backer rod.

I’m sorry that I do not know of anyone, but I’m sure that the hardware stores could recommend someone.

It is a simple DIY process that as easy as using a leaf blower and vacuum. Machine rental is free at HD if you buy over a certain amount, and make sure that you leave enough gap between the roof sheeting and soffit for air movement.

Solar or replace the gas hot water with hybrid. Insulation and windows are generally fine.

Solar is slightly compromised due to partial shading mostly in the winter, while the gen 5 Rheem hybrid tanks have a lot of complaints about noise and the ~$10k for the Sanden seems very difficult to justify.

That’s an excellent reduction! 3k/year buys quite a bit of insulation.

Generally, insulation and air sealing are the best bang-for-the-buck for savings and comfort, plus it’s a job that can sometimes be DIY.

What are the options?

I’ll also just plug the Canada Greener Homes Loan program – 10 year, interest-free loan for upgrades. It can be combined with the 5K grant. If you want to do upgrades that might qualify, now is an excellent time.

Hydro also has a flat monthly charge – around $10.

The Saanich fair was absolutely great.

There is a basic charge for natural gas – regardless of your consumption.

I’m not sure about houses, but for condos once you have signed up for gas, for say a fireplace, you can not end the service. You have to pay the basic charge even if you never intend to use the gas fireplace.

$2363 hydro here (heat pump + baseboards, ~8000km on the electric car)

$673 gas (hot water mostly, trying to phase this out).

~2100 sqft, 5 ppl. Someone basically always home so heated most of the winter.

Still haven’t figured out what to spend the $5k federal incentive on.

That’s interesting – I’m indeed hoping our costs will come in lower this heating season as we sealed a number of gaps, and did upgrade some windows.

We still have some known gaps, a couple of doors that aren’t closing tight enough, and a “euro” door that has a sizable gap, not sure how to best address it really. Can you recommend anyone on the Island who would be particularly good at sort of dealing with things like this? Preferably someone who can also do the attic insulation when we get around to it (I don’t want to do that attic insulation right now as it will all just be disturbed when we run some wiring updates that we just don’t want to do until next year).

Thanks

Cheers to Poland for choosing not to use FTBs as (more of) a cash cow.

That’s a very interesting proposal in Poland.

Also interesting was how many homes are vacant in a country with a housing shortage and high rental costs. Which begs the question why so many investors are keeping their properties vacant?

Housing is now predominantly valued as a commodity, traded and sold on markets, promoted and invested in as a secure place to park unprecedented amounts of excess capital. The view of housing as a human dwelling, a place to raise families and thrive within a community, has largely been eroded

https://notesfrompoland.com/2023/09/01/poland-cuts-tax-for-first-time-homebuyers-and-raises-it-for-those-buying-multiple-properties/

Poland has exempted first-time homebuyers from paying a 2% transaction tax when purchasing a property on the secondary market. It will also soon introduce a new 6% transaction tax on those who buy six or more properties in the same development.

The changes are part of the government’s efforts to help young people buy their first home and to discourage individuals from purchasing multiple properties for profit, as Poland grapples with a housing shortage.

—— With 2.1 million hectares burned, we are well above (+55%) the previous record year (2018) of 1.35 million hectares burned.

—- That 2018 record year was followed by two great years (2019,2020) of very low wildfires (only 0.021 million hectares or 2% of the previous year’s record burned in 2019). Hopefully this dreadful year will also be followed by tiny amounts next year.

https://www2.gov.bc.ca/gov/content/safety/wildfire-status/about-bcws/wildfire-statistics/wildfire-averages

That’s a tremendous amount of bridge financing. Bridge financing is only temporary financing to cover the period the time a buyer takes possession of a home until they sell their original residence. Back in February, appraisers were alerted to a problem with providing rental reports that are necessary for bridge financing. This was discussed on this blog at that time with many of the posters on this blog not understanding the harm which could result from reporting rents on properties that were not legally permitted to have suites.

This “bridge” financing allowed people to obtain financing to buy other properties by using estimated rents on their original property when their income was not sufficient to cover two mortgages.

Martel seems to have exploited this not easily understood area of financing duping both lenders and appraisers. Hopefully new lending regulations will come out of this and the lender will have to inform the appraiser that the intended use of the rental report is for bridge financing. In that way the appraiser will verify that the original home is listed which is a requirement for lenders to bridge a mortgage in their lending guidelines or to notify other parties, such as investors, that rely on those rental reports.

If the original home is not listed for sale, then the loan should not be bridged unless the loans/credit officer obtains a managerial override.

Qt I agree I have seen lots of foolish decisions made by very smart people young and old , not sure if anyone is immune

I’m sorry, but the lack of empathy is sad.

4 windows seals failed in my house, so I upgraded all 22 windows and doors 2 summer ago, and increase the attic insulation myself, plus insulated the 2-car garage attic (total blown-in attic surface was 2546 sqf and cost less than $900). The house is a bit larger than your place and the total hydro bill came to $2090.88 from April 2022 to Apr of 2023. Far less than the average of $5000 per year prior to the upgrade, and I’m on 100% electric baseboard heating.

I do not know how much you use the hot tub, but I think it is one of your large power consumption. Perhaps a plug load monitor device could give you a better picture of what appliance consumes the most power in your home.

That said, I might see at best a $500-600 a year saving if upgrade to ductless heat pump, and maintaining and replacement doesn’t justify the cost unless I want to splurge for AC comfort in the summer (even so, the highest was 26C inside the house for 3 days this summer, and the outdoor temperature at my place reached 33C.)

$5800 energy costs in that temperate climate! I hope you’re mining bitcoin.

In a letter, the three MPs say collectively they have heard from countless constituents who invested with Martel — many of whom are seniors — who have lost their homes and benefits in the fallout.

“Some now find themselves dependent on food banks and couch surfing,” says the letter, which was signed by Alistair MacGregor, MP for Cowichan-Malahat-Langford, Randall Garrison, MP for Esquimalt-Saanich-Sooke and Victoria MP Laurel Collins.

LOL LOL LOL!

I’ve said it before and I’ll say it again. I have no sympathy for these fools. If 100% annualized returns isn’t enough of a red flag for you, then you almost deserve to be swindled. Consider it a very hard lesson learned.

Also, I don’t care that many of them are seniors; being a senior doesn’t exempt you from the consequences of stupid decisions.

From: https://www.cbc.ca/news/canada/british-columbia/alleged-victoria-ponzi-schemer-ordered-into-personal-bankruptcy-1.6953676

No, because the whole surface area of the province is not equally prone to wildfires, or forested for that matter.

Are developers smart enough to apply for a bigger project than they need, so that they have room to compromise when the NIMBYS complain?

If so, what’s the big deal?

Well, I just added up the actual bills and for 2022 it was $5,800 for the year…

That is about 2,800 sq. ft. main floor heated to a nice & toasty temperature, plus additional spaces that are also heated electric but only intermittently when we have guests or kids. Otherwise just the two of us (so yeah, we are one of those terrible “overhoused” people who will no doubt be penalized soon enough!). Also Hot Tub. Windows have been upgraded. However, we also had a number of air leakage gaps that we’ve since fixed, so I’m expecting 2023 to be a bit better than 2022.

We had one of those inspections done (thinking of upgrades & maybe the provincial grant program for whatever), paid $700 just to have him basically tell us we should increase the attic insulation. Sigh. But yes, of course we should, and we will.

That equates to forest areas burning once every 43 years. Is that more or less frequent than would occur naturally?

The Hustle Culture or why employers want employees back into the office. My opinion is that this dominates the IT industry where employers pay huge salaries to make their start up companies look good on paper to a potential buyer of their company. It’s all about creating an impression to a potential buyer of productivity even if that means creating fake jobs and titles for employees. I went on line and actually found a site that makes up bullsh$t titles for employees.

https://www.bullshitjob.com/

But having an office with half filled desks does not give a good impression to a potential buyer.

When you speak to the “old timer” developers of high rise towers they would comment that it is the top two storeys of a complex where they make their profit. The other floors only paid the hard and soft costs. Cutting back from 1900 to 1500 units might make the development not currently profitable.

However, things are rarely that simple.

There are no shortage of papers, about previous markets after a correction, attempting to determine which factors were the better indicators to watch before a correction occurred. No two market corrections are ever identical but the general consensus was that market corrections began in the condominium market and the indicators to watch were the average days on market and the number of price decreases.

As I said in an earlier post, I’m astounded on how rock solid condominium prices have been the Victoria Core during these interest rate increases. My thoughts were that the pandemic brought demand forward as people cocooned in their cities and afterwards market prices would return to pre-pandemic prices. Does not seem to be happening.

What makes this market so different than so many others is that it isn’t a local phenomenon. This is mostly a global phenomenon. What has been happening in Victoria has been happening throughout most of the world.

PP can blame JT all he wants, but PP can do no better or worse. Neither of them have control over the real estate market. Neither the federal or provincial governments can control the real estate market. The best that they can do is provide the environment for investors, developers, contractors, and buyers to have confidence in the marketplace. They can lead a horse to water but they can’t make it drink.

Agreed. But in this case I would be optimistic. Because the developer was informed about the reduction (->fsr 4.4) back in May and redid the amended proposal which was recently approved. There are plenty of quotes from the developer in this article and he seems happy with the approval.

https://www.westerlynews.ca/news/massive-scope-of-skyline-changing-victoria-project-raising-concern-3100306

“Mariash said he has listened to everything council and staff have asked for. The decreased density removes approximately 400 units from the previously pitched 1,900-unit plan.”

2.3% of B.C.’s total land area has burned in this one fire season alone.

https://wildfiresituation.nrs.gov.bc.ca/currentStatistics

Surrey woman destroys neighbour’s cedar hedge, court hits her for $150K in damages

https://www.timescolonist.com/local-news/surrey-woman-destroys-neighbours-cedar-hedge-court-hits-her-for-150k-in-damages-7491958

Hustle culture has gone too far

Every time staff bargain down the density it reduces the chance that the thing will actually get built. Lots of projects approved but not moving forward right now because it no longer pencils

Peter

Our house is also all on hydro – heating (baseboard) and everything else. About 2700 sqft and 2.6 people + one cat. Our summer: winter hydro usage ratio is similar to yours, but about 40% of your usage. Thought about heat pump (mini split) too, but the savings won’t cover the cost for the first 15+ years, and the heat pump system may only last 15 years. So no change.

Disappointing housing starts news for families looking for bigger homes ….

—– 1,814 Greater Victoria housing starts in 2023-H1.

—— 80% (1,500) are apartments/condos and

—— only 20% (315) are SFH/duplexes/townhouses.

—– SFH starts fell 41% over 2022. Townhouses/Duplexes down 53%.

https://www.vrba.ca/news/missing-middle-housing-still-missing/

“MISSING MIDDLE HOUSING STILL MISSING

In the first six months of 2023, new housing has more than kept pace with 2022. According to CMHC, there were 1,814 new homes January to June 2023 compared to 1,713 units in 2022.

The largest segment is represented by apartments and condos (1,500 units) – a 33% increase over last year.

However, small multi-family housing for young families continues to be missing in many municipalities. In fact, there has been a 53% decline in townhomes and duplexes. Single family housing also declined 41%.

In 2022, there were zero duplexes, townhomes, etc constructed in many municipalities. In 2023, this new housing is still missing in Central Saanich, Oak Bay, North Saanich, Metchosin, Highlands, View Royal, Sidney and Victoria.

It’s too bad they didn’t go ahead with the full 1,900, but still impressive that they ”advanced” the plan of 1,500.

More important than 1,500 vs 1,900…., let’s hope that the project actually gets built.

Yep seeing a lot more opposition to sky sprawl in every city

I am a big fan of heatpump plus gas fireplace. Most homes these days are open concept you can heat most of the home in Victoria with just the fireplace cranked.

That way you have two energy sources. Electricity gets out of control you crank fireplace. Gas gets out of control you use heatpump more.

We can’t build a few townhomes because of a tree but somehow we would develop new cities, lol. People don’t live in reality.

I was travelling throughout Vietnam recently for a few months, and saw that they cleared what once was perfectly good orchards/farmlands, beautiful beachfronts, and lakes to accommodate solar farms and windmills for International Emissions Trading (carbon credits). And, their electricity costs have gone up dramatically within the last decade (more than BC per kWH).

Another fact is that Vietnam import 30% oil & gas for consumption because they do not produce enough domestically, and their regular gas at the pump is currently $1.26 CAD a litter, and we are paying $2.00 CAD a litter in a country that only consume 40% of its production.

I live in the Songhees (my unit faces the Roundhouse development) and this is a disappointment. I have to drive for work but other than that I walk a ton (over 10 km/day on average) and the Songhees area is dead aside from a bit of activity @ Boom & Batten. In my opinion it could handle a ton more density and you still wouldn’t be running into anyone on sidewalks. I walk from the Songhees across Esquimalt Rd thru Victoria West Park to grab groceries at Save-on-Foods and I would say 9/10 times I don’t run into anyone in either direction.

The reason they have to use BS arguments such as “microclimate issues” is they can’t use tangible arguments against the project as they don’t exist. Songhees, in my opinion, will be one of the nicest areas in all of Canada in 20-30 years once the build out is complete, David Foster Harbour Pathway is finished, etc. People just can’t really see the big picture. Unfortunately due to non-sense “microclimate” issues 400 units less means 600 +/- less people will get to enjoy the Songhees and a car free lifestyle it can provide.

On the flipside, seeing what is going on I am just piling into real estate into Vic West long term. I already have four condos in Vic West and plan on buying one unit in each subsequent Bosa pre-sale at Dockside. Spectacular area + anti-development anti-density attitudes can mean only one thing for prices long term. Also, every single one of my tenants that has rented one of my condos has loved the area. Someone that stayed in my personal unit airbnb long term bought a unit in the Songhees after the stay, etc.

The anti-development people in my building are just 100% nuts. They leave notices on cars (STOP THE REZONING AT ROUNDHOUSE) in my parkade and crap, I made this video about it last year https://www.youtube.com/watch?v=ZvnvWR_rlH8 (Can NIMBYism in Victoria, B.C. get any stupider?). So I get exposed to the anti-development attitude in my own near new building and then I see units going in crazy bidding wars (unit just went 100k over asking last week). People obviously love the area/product, but they don’t want any more of it.

I am in support of the Roundhouse but I don’t leave shit on peoples cars with my opinion.

Also, when someone gets a chance walk through the new public space inbetween the new Bosa buildings and take the new stairs down to Harbour Rd….sooooo nice. Not sure why people hate development so much.

I’m astounded by how rock sold condominium prices have been in Victoria since February. I expected that the increasing interest rates would have had an effect on condominiums first as they are mostly first time owners and that investors would be backing off from purchasing them.

A one-bedroom within a 6.6 kilometer radius of the downtown ranges between $1,600 to $2,500 per month with the average rent at $1,900 per month.

Most two-bedrooms fall between $2,200 to $3,100 with the average rent at $2,700

Most three-bedrooms range between $2,550 to $4,000 and average $3,000 per month

Houses with four-bedrooms and more range between $3,550 to $4,850 and average $4,350 per month.

Rents have been increasing over the last year and are likely up close to 10 percent.

There has been a consistent number of rentals available every month. The number of listings decrease from the start of the month to the end but they don’t drop substantially during the two time periods with the over priced rentals for the type of accommodation not getting leased. Some of those listings going back as far as July 19h, such as an older 1970’s one-bedroom apartment in Fairfield asking $2,000 a month or a 400 square feet suite along Fort Street asking $2,895 per month. These over priced rentals have remained vacant.

I’m wondering if Victoria has reached the maximum affordability for rentals. When it comes to rents there is a maximum that tenants can afford due to their wages. It is pointless to expect higher rents from someone that doesn’t have the resources.

Unfortunately, you can’t reason with unreasonable people that why we are paying more for energy.

So Peter your entire Hydro bill is around $4K per year? How many square feet are you heating and how many people using?

I have a 6000+ square foot commercial building in Winnipeg with 2 mid efficient natural gas furnaces My yearly gas bill is under $2000. That’s in -30C winter weather. The place is always toasty warm. Electricity rates are only going to get higher. If we don’t use the natural gas it’s only going to be burned off during oil production which will never end.

and that is for darn sure…we bought this house a few years ago, and after getting our first “winter” bill for electricity including the radiant in-floor hydronic electric heat (about $1,400 for 2 months), I was set & determined to switch to heat pump, which would mean air-to-water. First asked about it on this board, as it seems there are quite a few knowledgeable folks here (including QT, the poster of the quote above). Had a couple of reputable contractors give me a quote, and to do the system the way they said, it came out to about $25k. So decided to live with the electric. It’s about $700 a month in the winter, and about $150 in the summer, but that is for all electric (heat and everything else). And it’s a big main floor. Overall, I’m ok with it now, just used to it I guess…everything has a lifespan so I’ll look at replacing it when I need to

Who’d you get the 30yr mortgage from in Canada? and at what rate, even two years i suspect it would have been high

When two of the grandkids bought their first houses a couple of years ago I made sure that they took thirty year terms. We helped with a large down payment but at least they have a large measure of security. Ten years from now inflation will make the payments seem reasonable.

This is a bit of an exaggeration to say the least. Maybe if you take out the words “overwhelming”, “foolish” and “always”, then your argument might have a point, but as written this statement is pretty much something you made up.

But if you’d like to provide quotes that are representative of the “overwhelming sentiment” from that time to support this statement then I’ll happily recant.

As I recall, the sentiment was that variable rates looked promising due to the large premium being charged on fixed rates circa July, 2022, and most people were speculating that rates would not rise above 3-4%. That said: the fact that a premium existed represented the banks’ bet that rates would rise substantially. Plenty of people on this site, among others were clear that fixed rates are a sure thing and variable rates are a gamble.

I’m sure you’ll find someone to cherry pick who called fixed mortgages “foolish” at that time, but I highly doubt that you’ll find the “overwhelming majority” favouring this sentiment.

Moreover, I’m pretty certain that I pointed out here (and elsewhere) that the actual data show that variable rates outperform fixed a majority of the time (but not “always”), with the exception being that during some periods of rising interest rates fixed best variable. I’m sure that other people made this statement as well as it’s basically what a google search will tell you.

So, ~ 15% of all Canadian mortgages are >35 year amort? And things will get worse the longer rates are at these levels?

That.. seems like a pretty big deal.

Why not just rent out the entire house and then rent a condo…

From: https://bc.ctvnews.ca/b-c-woman-who-deliberately-damaged-neighbour-s-trees-ordered-to-pay-150k-in-compensation-1.6545096

Can you really put a price on having a crazy neighbour?

Scotia does have a higher rate of impaired mortgages, but it’s hard to find apples to apples data in the quarterly reports

Typical cast iron rad required 180F with boiler return at 160F. Therefore, you must upgrade the rad to fin type baseboard or fin type rad that design to work with 120F heatpump temperature.

I don’t think the cra would have a leg to stand on…would they?

What I’m trying to say is…I’m 50 the Wife is 48. By the time I am 55, I don’t want to have to pay a dime to have a roof over our head living comfortably in the 520 sq/ft garden suite in our back yard that we both very much enjoy.

“Max, you can only have one suite in Langford, secondary suite or garden suite, so if you have the garden suite you’d have to decommission a suite in your home in all likelihood. You could possibly live in the garden suite and rent your whole house, but not in a split-suite up and down way.”

I understand that, I haven’t rented the lower suite in over a decade. What I will do however…have my two sons roll a dice, they are teens 15 and 18… whoever wins the roll of the dice gets the pick of the suites, the son who loses the roll of the dice gets the other suite.

I won’t charge them any rent, but they will pay all utilities, property tax, maintenance, landscaping, and whatever else I see fit under the current market conditions.

Wonder how this will unwind. That said I haven’t heard too much about defaults at Scotia so maybe borrowers can handle it

I am not sure it is that simple. Air source seems to have pretty much caught up to geothermal but both are limited in how high a temperature they can raise the water to. Typically radiator style hot water heating takes much higher temperature water than a single stage heat pump can produce. Sanden makes a CO2 based air to water heat pump that can produce 175 degree F water but it does not use the traditional phase change refrigeration cycle and cannot be used for heating in this application. An Air to water HP would be excellent for a radiant floor heating system where the water temperature can be well below 100 degrees F.

Max, you can only have one suite in Langford, secondary suite or garden suite, so if you have the garden suite you’d have to decommission a suite in your home in all likelihood. You could possibly live in the garden suite and rent your whole house, but not in a split-suite up and down way.

It sounds like Langford gave permission to build an accessory building rather than a garden suite, which requires separately metered utilities usually, but my understanding is that the province may require Single Family Zoning to permit more than one dwelling in many areas come fall. Maybe you will be able to legalize it before your rate is renegotiated 🙂

It was 2020…everyone was working from home and most still are. All you need is an iphone.

Has to have a bona fide business operated in it.

No, its supposed to be a detached work space. We like it so much we want to live in it and rent out both levels of the main house. We love this area.

Max can u rent the garden suite

The purpose for the building was a detached work space. I think I can write off the heloc interest.

I’m not liking these rate hikes at all. We locked in 5 year fixed at 1.86% that comes up for renewal October 2025 on a balance of around 190k in the heart of Langford right between the lakes. 2500 sq/ft 1981 house 9000 sq/ft lot right across the street from Glen Lake. You can walk to anything its all right here…but I took out a 70k heloc to finance a garden suite in my back yard for future use.

The plan was for my wife and I to move into the 20’x26′ garden suite, then rent out the upper and lower main house. Langford says I have to rezone to occupy the garden suite, even though I can never sell the garden suite. The property needs to be rezoned to have two dwellings on the property, even though they gave me the building permit to build it…Its all hooked up to sewer and everything.

Now its costing me 500 per month to carry this 70k heloc.

It’s only .75% in that case, not overly large, but that would mean that you qualify for around $60,000-$80000 less with the same down payment, and when things are going in bidding wars…

So even at .25% difference, you’re still getting $20,000 difference, could be as simple of a thing as forgetting about closing costs.

Ah ok, I guess if the spread between fixed and variable was big enough, it could affect the amount the person qualifies for.

VR: You are absolutely right that the fixed rate would also have to renew.

Banks must use the higher interest rate of either: 5.25% or the interest rate you negotiate with your lender plus 2%.

If you have bad credit, and they would only give you a rate of 4% for fixed, or 3.25% for variable, you could qualify for more on a variable than they could with a fixed.

Why wouldn’t the fixed mortgages have to renew?

Ductless/mini split are eyesores in many situations. However, there are other solutions such as geothermal and air-source to water heat pumps, but it can be costly depends on the solution that you take, and can produce uneven heat unless plumbing is reverse return piping (which is unlikely in a retrofit).

There will probable be a slow trickle of condos and houses coming on the market as people have to renew. But it will only be a low fraction of people with variable rate renewals and it will be spread over a couple of years.

They could have the income but elected to just keep their payments the same due to various reasons

How is that possible with the stress test?

Or they only qualified by taking the variable.

August final numbers:

Sales: 544 (up 14%)

New lists: 1095 (up 12%)

Inventory: 2490 (up 17%)

Read that one.

Just a cool 128 billion dollars of loans not being paid off. I’m sure Royal & Scotia have to be similar. Interesting that the smallest of the big 5 has the largest amount of negatively amortized loans.

Wouldn’t say that at all. I for one was saying that those borrowing at a rate bottom short term were taking a big risk, and I recall Patrick pointing out that taking out a 10 year term at available rates protected you from future increases.

I also pointed out that the “long run” has to be taken in context with interest rate secular trends which last for decades – 40 years of almost consistently declining rates in fact. Until they don’t last.

Marko appeared to be the biggest promoter of variable rate but his personal situation made him more risk tolerant than someone going all in at once.

Globe and Mail:

DAD: I meant in addition to Site C, and ductless wont work in my heritage house either. (had a contractor actually look at it)

True, but two $90k a year government union employees with 200k can afford a house somewhere in the core. Of course if houses prices drop 10%, the ultra bears will just stay on the sidelines anyway, expecting a 30% drop.

If they skip the 25 points on 6th September, it will likely just mean 50 points between the 25 October and 6th December announcements. People looking for a rate pause should want the Sept bump, because it will likely set the conditions for a pause into the new year.

Base effect for high oil is over so likely that will show up in the next set of CPI numbers as inflationary.

Never understood this. Bears seem to forget that if everything goes to shit and RE crashes then they need to have either cash on hand or a source of income that’s immune to the macro economy. That 90k a year government union job with 100k downpayment saved still ain’t gona get you a house in oak bay.

I must have missed the part where Tiff specifically wanted people to take out mortgages. You do realize lowering interest rates affects other parts of the economy too right? Do you know how many companies issued long term bonds during that time and benefited from the low rates?

Dad I’m hopeful this is it for rate hikes and that the boc is getting its wish , the sooner the better

That’s what ductless heat pumps are for.

Uh, Site C?

Shrinking economy raises odds Bank of Canada rate hikes at end

https://financialpost.com/news/economy/canada-gdp-unexpectedly-shrinks-second-quarter

Doesn’t bode well for the rate hike the bears are hoping for.

You would be wrong in this context. Most terms are 5 years, mtgs are 25-30 years – 18 months is nothing. To add to that “In a policy statement Wednesday, officials led by Governor Tiff Macklem held the central bank’s overnight rate at 0.25 per cent, which they believe is the lowest it can go without disrupting the financial system, and said they will likely keep it there until 2023. “

I would say a year and half isn’t exactly short. It was actually 20 months. July 2020 to March 2022.

People have really short memories.

July 15, 2020:

“If you’ve got a mortgage of if you’re considering making a major purchase, or you’re a business and you’re considering making an investment, you can be confident rates will be low for a long time,” Macklem said.

https://www.bnnbloomberg.ca/interest-rates-will-be-low-for-a-long-time-macklem-1.1465901

Apparently ‘a long time’ was 18 months.

Good to see the economy taking a hit

Just a reminder that the overwhelming sentiment in comments on this blog before rate rises escalated was that people locking in fixed rates over variable were foolish because variable is always cheaper in the long run. And now it’s all people who took variable knew what they were doing because it was obvious rates would rise and were foolish to take variable. It’s obvious folks will try and make themselves out to be superior to the foolish masses no matter what the conditions are.

Re rates staying low for a really long time, people weren’t “taking it” that rates would stay low for months not years, I’m pretty sure they (BOC) actually said end of 2024 before rates would appreciably increase. That is a pretty long time from when the statement was made. And we’re talking about rates based off the BOC rate like variable mortgages that are based on the prime rate which banks set based on the BOC rate and which rise in tandem. Fixed rates are a different animal.

Bad gdp print, likely pause next week.

Heat pump is not going to work in my house since I have radiators. But you are allowed to replace a boiler if you are on natural gas. My guess is that the price of electricity is really going to climb as demand starts to really exceed capacity. We need to be building new dams and nobody is even talking about it.

I really think it depends on what happens. If unemployment stays low, then I think most people hang on. If it spikes, there will be pressure to cut rates. Some owners will be forced to sell in any case, but these doom and gloom bear narratives seem like wishful thinking.

I’m definitely learning a lesson. I had originally budgeted for 4% rates, which seemed outlandish at the time. Pandemic in full swing and panic around the globe. Businesses being forced to close etc.

And yet, here we are talking about > 5% rates. If there is a decent drop in RE prices, I suspect a lot of VAR mortgage holders are going to be in a bit of a pickle. I believe once you hit 80% LTV, you have to bump payments.

You’re correct, albeit heartless.

Nobody in their right mind would install an electric furnace. You’d switch to a heat pump if you are being forced to switch to electric heat, which you aren’t. Not yet anyway.

They are also an inferior product, and are obsolete. Zero reason to pick a mid efficiency unit over a high efficiency one even if you had the choice.

That’s on those people for believing that or think that was the case. It’s a simple concept, the more debt that exists on the market the higher rates need to be to sell the debt. If the BoC rate departs the market rates by too much, it risks lenders departing from pegging to the BoC rate and not to mention Canada would cease being able to to sell bonds which backs sending cheques to all those Canadians that feel entitled to their fellow citizens hard work. The BoC and it’s rate doesn’t actually set lending rate for the consumer, it’s only a reference point or benchmark that lenders can use. If the BoC never raised it’s rates, mortgage rates will still have gone up because lenders would have stopped using it as a benchmark on contracts. So, the reprieve would be for people on current variables if or where their contract references the BoC rate. However, on renewal, lenders prime rates would likely not longer be tied to the BoC rate because they would be losing money by lending out at lower than bond rates. So, unless we go back to QE, where government buys debt from lenders and itself, allowing them to send money out the door on the cheap, the BoC rate and the market rates only have one way to go. The solution is also simple, if there is a desire for lower rates, have less debt.

Dad-Have you tried to replace a mid-efficiency furnace? You can’t, you are forced to install a high efficiency furnace since mid-efficiency furnaces are not produced as they are banned. So when you go to replace your natural gas furnace, they may tell you it doesn’t meet the new code, and you’ll be hit with a huge bill for the electric furnace as your panel might not be able to handle the extra load. They can’t force someone to replace an existing furnace, but they can make you change if it needs replacing.

FTB’s might be at the bottom of the pyramid but they are mostly condominium owners. And prices have not been increasing for condominiums for the last five months. The gap between a condo and a single family home has been getting wider. It now takes 2.19 condos to buy the average single family home. In 2019 it was 1.97

Actually come to think of it, because the first time buyer exemption was meaningful in the past, that means older homeowners have benefited but FTBs now do not. So yet another mechanism for funneling money from young to old.

Not to mention that even if you were anticipating higher rates during the term, nobody could have predicted that the policy rate would go from .25% to 5% in a little over a year. Of course, that’s part of the risk you take with a variable rate mortgage.

But it’s nice to know the banks are willing to let people kick the can down the road (and by extension, whatever disinflationary impact higher mortgage payments would have).

Wasn’t that like almost two years between when the said rates will be low for a long time to when they hiked?

Eventually. But not immediately.

In any case it should be clear that PTT wasn’t used as a general tax until quite recently. And FTB had genuinely useful exemptions until quite recently.

To be fair, the BOC was promising rates would stay low for a long time. Many people took that to be years, not months.

Patriotz legislating more rent controls would likely defeat the purpose of creating more rental units as one needs investors. The market place will take care of itself without government intervention. Markets can go from boom to bust, from shortage to glut.

When market rents get too high then renters will give their notice and leave the city for better prospects and investors take a hit. As they should as this is how capitalism works. Sometimes when you reach for the brass ring – you miss.

If FTB are able to pay more then non-FTB are also able to pay more, since the FTB is at the bottom of the move-up pyramid.

Of course this is only happening to those who have variable rate mortgages. Shows you how many homeowners were betting on interest rates staying at unheard of lows, and were unwilling to pay a little more for a fixed term.

https://www.theglobeandmail.com/business/article-mortgage-borrowers-td-bmo-cibc-homeowners/

Not quite. It increases FTB reach but not non-FTB reach. And at least the money sits in property value instead of being lit on fire.

Long story short it’s never been worse to be FTB except for a six month period in 1980-1981. If that’s the new normal then that is a disaster and it demands a serious response. Not more headwinds for young people.

That would simply result in higher prices, since you would have more money chasing the same supply.

Hard disagree. At minimum the numbers ought to be vastly increased to match market growth in condo and tuned to region. As was the case until quite recently when PTT got turned from a wealth tax into a revenue generating mechanism. 2014 isn’t that long ago!

“Originally called the Property Purchase Tax, the PPT was first introduced in 1987 as a wealth tax to discourage speculation and cost 1% of the first $200,000 and 2% of the remainder, although 95% of home purchases did not qualify for the tax at the time as they were below the $200,000 mark.”

https://wowa.ca/calculators/bc-property-transfer-tax#

In 1994 the first-time buyer exemption was introduced and kicked in below 250k in greater Vancouver/Victoria (https://www.bclaws.gov.bc.ca/civix/document/id/hstats/hstats/1226346362). Average price of detached in Victoria at the time was 256k.

Do you read anything? It only applies to new construction.

Bend over and get a heatpump to replace it or go with mini split if you don’t have existing baseboard heaters.

I wonder what will happen in Nanaimo when your natural gas furnace craps out and you need a new one. Guess you’re SOL. That’ll go over big.

Yes but if you can afford a detached house as a FTB you don’t need extra help from the government IMHO.

Because it’s stupid. It would make the rental shortage even worse. He publicly opposed it before becoming premier.

Probably not, stupid policies are often popular, at least in the short term.

In case anyone is interested, i had a friend who owns a property up island and someone bought some large lots beside him and he wanted to know who it was. I said i’d pull the title at Land Titles and did so this afternoon. When i pulled the title i saw a numbered Co. as the registered owner. I thought this was weird given the new Land Owner Transparency Registry and thought owners had to be listed. So i wrote the LTSA about it and this was they said: “Hi Rush, the information does not show up on title because the Land Owner Transparency Registry is governed by the Ministry of Finance but run by us. You can read up more about LOTR here: http://www.landtransparency.ca”

You may recall some people saying ‘but now people will be able to find out who owns a home’ (which was already the case prior to) but it seems like the numbered company owners are only known by the Ministry and not actual specified on title.

So nice that the first-time buyer exemption for PTT has evolved with time. In 2014 it was increased to 475k when the average price of detached in greater Victoria was 609k. Now it’s 500k when the average price is 1.33m.

Eby was the one that called for the more than $1.5 billions a year Property Transfer Tax that BC collects to go directly to affordable housing in 2017.

And, now he is running the show, but hasn’t said a word about how they spend the PTT.

https://www.cbc.ca/news/canada/british-columbia/a-substantial-revenue-source-but-b-c-s-property-transfer-tax-barely-mentioned-in-campaign-1.4080752

Embarrassing.

It is in Eby’s power to to apply the rent control to the property itself and not just the tenant.

Why doesn’t he do that instead of appealing to the BoC?

Probably because it would cost him an election.

Right. A strange letter from Eby to the BOC. Because, since we have rent controls, why is Eby so concerned about tenants facing higher rents from landlords passing down higher costs from a rate increase. Rent controls limit the increase to inflation, and so Eby should be happy to see the BOC work to lower inflation. Why does he care about landlord’s mortgage rates so much to write a letter to BOC? And a single September rate increase is supposed have “ devastating” results for tenants”? Gimme a break.

“ Eby says a further [interest rate] increase will have “devastating” results for tenants, as residential and commercial landlords are pressured to offset costs.”

From: https://vancouver.citynews.ca/2023/08/31/bc-bank-of-canada-interest-rate-hikes/

Okay, really? Lol…. A letter from the premier…

Would love to see how that inventory graph shapes up by year end and how that compares to historical norms – Thanks Leo!

Can someone explain how porting a mortgage works on the statement of adjustments? Since the mortgage is not being paid off just moved, then do you get more money at closing? Or am I out to lunch?

Re developing the rest of Vancouver Island.

Vancouver Island is somewhat unique in BC because of the E&N land grant where pretty much all of the eastern half of Vancouver Island south of Cumberland was given to the Dunsmuirs in exchange for building the E&N railroad. I understand the crown title is huge with one single page on the top that basically says all the land to the east of a line from the mouth of Muir creek to the south end of Colmox (?) lake then east to the coast. That is followed by hundreds of save and excepts for all the small private parcels that have been carved off. Mineral rights were also a mess and granted differently from the rest of the province where the crown owns pretty much everything. I gather statusing land in the area can be a nightmare with a fair bit of expertise and history required. If you want mineral rights it is even more complex. Bottom line is that it is not Crown land. I believe the bulk of it ended up with CP logging and ultimately to Timber West so it is zoned forestry.

To improve affordable housing, a B.C. economist says the province needs a more progressive property tax system — one that raises levies on high-value properties and people who own multiple homes.

Such a policy, says Alex Hemingway, will raise billions of dollars for public housing projects while simultaneously dampening home price growth over the long term.

The policy proposal, laid out in a white paper published Wednesday with the Canadian Centre for Policy Alternatives of B.C., comes as residential property values have grown a “staggering” $1.7 trillion over the past two decades, leading to greater inequality among those who own a home and those who don’t, says Hemingway.

While not including it in his proposal, Hemingway says he supports a plan backed by the think-tank Generation Squeeze that would lower income and sales taxes to offset any hike in property taxes.

NOTE: Paul Kershaw of Generation Squeeze was one of the speakers at the recently held Liberal retreat.

-before some of the regulars go snaky bananas over this and start calling me a Communist or that “progressive property tax” is incorrect I want to make it clear that I am not in favor of such an approach. Sheath your knives.

Sometimes people just need a leg up to change their lives.

https://youtu.be/DSTd1LuiVUs?si=K7LVjRw5Bl6C_GF8

Who exactly funded the study? If you don’t give them the results they are looking for, you don’t get any more funding. How did they select the recipients, randomly? Could probably drive a truck through that study. I’m also in the majority of people (81%) who think that way. Believe what you want.

There are also studies that show that people winning a lottery end up broke in a few years. Better to teach them to fish.

Nanaimo bans natural gas as primary heat in new homes as of July 2024

https://www.timescolonist.com/local-news/nanaimo-bans-natural-gas-as-primary-heat-in-new-homes-as-of-july-2024-7479488

Saanich and Victoria were the first municipalities in the province to adopt zero-carbon step code regulations.

Others that have taken steps to combat emissions from new buildings include Central Saanich, Whistler, North Vancouver, West Vancouver, Squamish and Port Coquitlam.

Paging Frank:

$7,500 cash transfers reduced homelessness in Metro Vancouver, study finds

https://www.timescolonist.com/local-news/7500-cash-transfers-reduced-homelessness-in-metro-vancouver-study-finds-7478798

In the U.S. mortgage interest is tax deductible. As long as your employed, it doesn’t make sense to sell your house, factor renting and higher income taxes, it pays to stay put.

Nanaimo is the new Victoria.

That’s over five years (2016-21)

Nanaimo’s population increased by 10% the last five years (edited), while Greater Victoria increased by 8.2%. In terms of how much much more housing is needed, the CRD added 9,466 new residents in 2022, while Nanaimo added about 3,500.

https://www.cbc.ca/news/canada/british-columbia/census-data-population-growth-british-columbia-interior-1.6344994

All land for sale on the Island is subject to government oversight that I’m aware of. If not regulated by a city or municipality, it is regulated by the Regional District.

Maggie FTW again!

How many of these homeowners with negative amortizations actually can’t afford higher payments? For all we know, they are out spending money that should be going to the mortgage on European vacations and Teslas.

I think we’ve already made that pretty clear.

Roger not sure any of the measures are temporary I can c interest rates at 6 points or so for a few years . But I do think at some point banks cannot carry deadbeat borrowers and we will get the inventory for a normal functioning free market

The problem with smaller communities is health care, especially access to specialists. When I needed eye surgery, it was so convenient to get the operation and go to follow up appointments. I heard people in the waiting room telling their stories of traveling hours to come back and forth. The older you are, the less sense it makes to move away from a major centre.

The number one reason to move to Victoria is to be mortgage free.

That means you’re either very rich or homeless.

The US is currently dealing with a record low inventory due to the high mortgage rates (30 year fixed 7 – 7.5%). More than 90% of the existing mortgages are at < 5% and most of them are locked in for 30 years, especially for buyers who bought in 2020 to early 2022. They are not going give up their mortgages and they are forced to stay in their current houses whether they like it or not.

Canada is different due to the high usage of VRMs (fixed payments) rather than fixed rates for a long term. The federal government has temporarily supported the housing prices by coercing the lenders not to force the borrowers to pay at least the interest. This temporary support will expire around 2025 as the mortgages will have get on with original amortz schedule upon renewal. Look for Trudeau to call elections before this blows up.

Totoro: What you say is true but only up to a point. If you move a lot of the government jobs up island then people will move there for work instead of here.

The second big reason people move here is to retire, reproduce Oak Bay nd add excellent medical facilities along with a new medical school and nursing school somewhere like Cow Bay and you will see a lot of retirees pick Cow Bay over Oak Bay if it means better access to medical care and lower prices.

Duplicate the theater in Stradford Ont up island and create a new tourist center. Since we seem to lack imagination or bold initiatives why dont we look at places like Switzerland which have had great success with this, we dont have to reinvent the wheel.

Or we can just tell the younger generation too bad your screwed and we dont care.

Interesting? CP “Non-Permanent residents in Canada Underestimated by 1 Million”: CIBC

Houses purchased in Nanaimo (86) and the Cowichan Valley (87) compared to the Victoria Core (89) in the last 30 days.

Maybe the bloom is coming off the Victoria rose.

I’ve thought about this a bit now, and I don’t know that’s the case. If the rules in place there are the same as Victoria with regard to building new housing, then it’d be much easier to build a new place with no rules wouldn’t it?

Correct me if I’m wrong, but the Cowichan Valley and Nanaimo are both growing faster than Victoria (percent wise), not quite double for the Cowichan Valley and over double for Nanaimo. Edmonton also is about double, and Calgary was 4 times as fast as Victoria last year. Campbell River is also growing faster by .5% as well.

I don’t understand how developing new cities will assist with the housing crisis in Victoria.

We have freedom of movement in Canada and people are choosing Victoria over existing cities like Campbell River or Nanaimo or Duncan for many good reasons that can’t be magicked away and probably can’t be compensated for with realistic local incentives for growth. These are things like access to jobs/economic opportunities, infrastructure, access to transport hubs, urban amenities, and university/college access. And many people who have lived here for a long time have strong community and kinship ties to Victoria.

Remote work does make it easier for some people to relocate up island for less expensive housing. However, this is not universally available nor desirable. There has and will continue to be growth up island because it is desirable climate/environment wise and less expensive – primarily for housing. Along with this growth will come more opportunities and amenities to attract more people – but it is a slowish process for smaller towns usually.

In Victoria, many people will choose to live in smaller housing over moving away and the city will continue to grow faster than up Island I think.

If you’re bored, check out the Canadian Debt Clock, it goes up $1000 every second. Rapidly approaching $1.2 trillion.

From: https://www.abc.net.au/news/2023-08-28/new-data-shows-number-of-australians-facing-mortgage-stress/102757414

Looks like things are starting to catch up in one of the other Commonwealth runaway housing markets.

I feel like Campbell River has done pretty well considering their main employer shut down in 2010.

We have a lot of small towns but not a lot of folks want to live in them

Is anything wrong with all the existing communities? Why not just grow the ones we have? Easier to double the size of Campbell River for example than to make a new city out of nothing.

Frank is correct. If there is any surplus DND land it will be given to local First Nations as part of land claim settlement. FNs will eventually develop some of it but don’t hold your breath.

I’d expect some land in Esquimalt and around Royal Roads to eventually go to FN.

What exactly is the min. threshold for a top 1% earner in Victoria? And what house can you not afford?

Minuscule countries like Switzerland and New Zealand should never be used for comparisons to Canada.

Thanks for your thoughts, Leo.

I spent a better part of a decade being skeptical of the “nowhere but up” argument to housing, but I’ve changed my tune.

Over that ten years I went from being a struggling student in Vancouver, to, very recently, a top 1% income earner in Victoria.

And my family size has grown to the point where my 1 bedroom, 600 sqft Vancouver condo of last decade would be nowhere close to big enough to fit my family.

The problem with saying that it’s only SFHs becoming less affordable, but average condo prices always revert to being more affordable is the simple fact that condos are smaller than homes, and are shrinking in size with each subsequent year. As a result, Per sqft, condos cost more than SFHs in most cases. (The exception is old condos with high maintenance fees and potentially large, unknown future maintenance costs.)

So, in fact, I’ve actually found that across all home types, my ability to afford purchasing a home has not improved anywhere close to what I would have expected for my rise in income. I can only imagine what things look like for people earning a median income.

Both large condos and SFHs are not worth it to buy, compared to renting right now. (Hence why it’s now almost impossible to rent anything due to lack of rental supply.) And this has become the norm across BC in the past 5 years. The only segment to show any hope, is townhomes, which are just big enough to fit families, and just cheap enough to build without pricing out literally everyone, but unfortunately these are mostly still illegal across nearly all of BC.

The recent initiative in Victoria to legalize “missing middle housing” unfortunately has been a flop, and the national media has noted that zero properties have been proposed under this initiative to date. I’ve actually been waiting for you to post your thoughts on this policy again, as I saw at least one of these articles (in the walrus, I think) quote you on the topic!

So, at this point I’m not holding my breath on affordability. I think the pressure from multiple levels of government to increase housing demand, and restrict supply, is too strong even for the BOC’s recent bearish interest rate approach.

I think we might see at best another 10% haircut in prices and then eventually falling interest rates will temporarily improve affordability, but only for those who can raise the capital.

To the rest: you had better hope that immigration slows enough to allow the rental market to expand, otherwise it’s going to be a long future of rising rents and smaller non-housing budgets for everyone whose not a landlord.

The Swiss have managed to do a number of towns and small cities.

Barrister- Good idea, with one exception. The DND decommissioned Kapyong barracks in south Winnipeg in 2004. 168 acres of prime south Winnipeg real estate on a major thoroughfare next to Tuxedo, the most prestigious part of the city. Plans were made for redevelopment until the First Nations laid claim to the land. After 18 years of negotiations, the land was returned with a 15 year plan to create an Urban Reserve. That was December 2022, I don’t think one shovel is in the ground. This project is entirely Federally funded. Good luck with your plan.

As for building a city with no purpose, you’ll have to go to China.

I still thing it time to develop some new cities on the island.

The east side of the island has extremely temperate climate and is seriously underdeveloped.

Maybe it is time for the Dept of Defense to turn over that huge plot of land up towards Brentwood Bay for development. Anyone know how many empty acres are sitting there?

Winter is coming

Another huge incentive is you need a place to live.

If people think house prices and rent will stay high or even increase, they’ve got a huge incentive to hold on to the house.

I’ve been interested to see how some areas of the US with unaffordable housing/housing shortages are dealing with this scenario and how the markets are reacting to rising rates.

Most places have legalized accessory dwelling units, sometimes two additional units, in SFH zones. Most offer grants to build an ADU. In New York it is up to 125k for a median income homeowner. BC probably needs to do more with this, maybe this fall?

https://marketrealist.com/what-is-an-accessory-dwelling-units-or-adu/#:~:text=Households%20in%20New%20York%20can%20receive%20up%20to,is%20%2485%20million%20over%20the%20next%20five%20years

In popular areas in California inventory has dropped drastically. People are holding on to their homes because the rate hikes make moving unaffordable if it means taking on more of a mortgage, or losing the fixed rate they have. It is different there than BC though – the most popular mortgage in California/US is a 30-year FIXED term! The rate hikes are not causing prices to fall because of the lack of inventory and shortage of good rental options, but they have impacted the luxury market which is taking longer to sell.

I can’t imagine we are not going to see more people listing in Canada because they cannot or don’t want to pay an extra ex. 2k a month on their mortgage if they are variable, or when it comes up for renewal if rates don’t drop. Maybe this only shows up for recent condo, purchases, but maybe in SFHs to a degree.

As a personal aside, we moved here in September 2020 (agreed to join in May) and couldn’t buy until getting PR in November 2022. Then we had to wait for tenure and pay raises in July 2023 to enter the market. It’s fun to put those points in time on the affordability plot above. What a world.

Just an estimation, I would say that 90% of Canadians under the age of 45 are priced out at $750,000.

Mixing median sales price with average income in that chart makes it appear much more affordable than reality. Medians must be used across the board when there are massive outliers.

I really wonder if it’s this simple:

Supply/demand economics from first year university paint a pretty simple picture here – these properties (SFH w large yards) will continue to escalate in price until the wealthiest families can't afford them. Unless you have family income in excess of 300k per year (I know of many families where both are working professionals and family income is 300k or more) you just won't get to buy one of these houses. Families with "average income" will have to live in condo's/townhouses/SFH's w tiny yards for the majority, if not all, of their life.

I know lots of people will say it's not fair, but it's just economics. Edmonton, Calgary, Saskatoon, etc have higher wages and cheaper houses. If a house is that important to you, you might need to move. That said, I'd take a townhouse in Victoria over a mansion in Calgary 10 times out of 10!

Leo would you able to illustrate more on this? Thanks

I’ll stick with Marko’s original prediction of 3000 (but in October) if there is another 25bps hike next week.