August: Market stall continues

August ended with 544 sales, up 14% from last year’s total, and 21% below the 10 year average. Weak sales activity no doubt, though also a remarkable display of resilience given that mortgage rates haven’t been this high since 2007 when the average property cost less than half of what it does today. However it’s also clear that the spring rally was short lived and the market has stalled again, with conditions slowly deteriorating over the summer.

Sales simply don’t have a lot further to fall, so I wouldn’t expect a great collapse this fall. They will likely just continue petering out in line with seasonal trends. The reason why conditions have weakened somewhat is less the sales side, and more that new listings have come back to a certain extent after a very slow first half of the year. New lists are only 10% above the 10 year average for August, though I am seeing properties coming on the market where the owners clearly overpaid during the mania of 2021/22 and are now trying to get out.

Sales overall were unremarkable across home types, though the mid-year strength in condo sales seems to be over. The buyers that were slowly enticed back into the market when rates were relatively stable were driven out again as rates resumed rising in recent months.

That’s a little more clear when you look at all the sales together, where we see the spring bump fading back towards the activity levels of last year. Note that as always seasonal adjustment algorithms have some trouble with endpoints so determining the trend is always a little uncertain, but it’s clear that activity slowed this summer beyond normal seasonal patterns.

The inventory trend is also back on the upswing after taking a dive in the spring. Note that while inventory has been increasing all year, in the spring it increased more slowly than we would normally expect for that time of year, while in the summer it’s been increasing more quickly than seasonal norms.

Months of inventory and the sales to new listings ratio tell the same story, with both on weakening trends.

Months of inventory and the sales to new listings ratio tell the same story, with both on weakening trends.

Note that while months of inventory are again increasing, we are still technically in sellers market territory. While a cooling market can put downward pressure on prices, we still need to get to around 6 months of inventory for stable prices, and higher than that for consistent price declines. Until we are there, any price stabilization or declines are fragile, as we found out this spring when prices quickly reversed with just a bit of demand returning.

Prices have stalled out in recent months, which is evident both in average prices and the sales over assessment ratios.

By the latter measure, detached values are down a couple percent since the spring, while condos and townhouses are roughly flat.

The Bank of Canada is deciding on Wednesday whether to raise rates again. The consensus expectation given our recent disappointing GDP print seems to be for a pause, though inflation remains stubbornly above their target. Politicians have seemingly also noted the likelihood of a pause, with both David Eby and Doug Ford writing letters urging Tiff to stop hiking rates just when it’s likely that might happen. The most favourable interpretation is that it’s a political stunt, given that actually thinking it would work would imply they don’t understand the concept of an independent central bank.

The big question remains whether we will see more new listings. Due to the proliferation of variable mortgages post-pandemic followed by rising rates, most of the big banks have been kicking the can down the road on forcing their borrowers to absorb that new reality. More than a quarter of their mortgage book now has amortizations well beyond the max of 30 years that can be originated. “Longer than 35 years” in the chart below doesn’t sound so bad, but many of these mortgages are at 50, 60, 80 years, or even negative amortization (payments don’t even cover the interest). Getting them back on track at renewal time will require payment increases of 25-50% in many cases unless rates drop.

It raises 2 questions:

- Are borrowers unable to pay those higher rates or are they simply choosing not to?

- How are borrowers with Scotia or NBC mortgages reacting? (These two banks don’t have fixed payment variables and have been forcing borrowers to increase payments as rates rose).

On the second question, quarterly reports indicate that Scotia’s mortgage book is shrinking rather than growing, and the number of impaired mortgages are higher than at a bank like BMO. However the detailed data on how borrowers are handling those higher payments simply aren’t publicly available. I suspect that as long as employment holds up most people will find a way to manage, however it’s certainly a drag on both housing and the broader economy as rates suck money out of other sectors.

One thing I’m confident of is that the government will once again pull out all the stops to support borrowers if there is widespread distress. Many bearish forecasts in the last 15 years failed and were excused by the impact of “unprecedented” government support, but at this point we should expect the maximum if there’s trouble. I would be not at all surprised if there’s a one-time allowance for existing borrowers to renew at longer amortizations if they can’t return to the original schedule.

For now – though new listings have increased since the first half of the year (relative to seasonal norms) – they are well within the normal range. Given sales don’t have a lot of downside room, new lists remain the key indicator to watch for future market balance. In the near term, expect the usual bounce in new listings for the fall market before everything quiets right down by November.

They certainly do sell at a discount in Vancouver anyways, and the market there seems to be quite good at valuing them. A substantial percentage of the older part of the West End (the older high rise rental buildings around Denman/Stanley Park etc) is leasehold expiring in another 50 years, and you can easily buy a studio (big enough to use as a junior 1 bedroom), or even a proper 1 bedroom, there for say $350k – $400k, which is a substantial discount to what a normal strata property goes for (like say $150k less).

lol, surely you are not using Orchard House as representative of leasehold properties!

Congrats!

New post: https://househuntvictoria.ca/2023/09/11/fall-market-arrives-early/

FYI Mt. Tolmie

647 Michigan is a 1969 built hi-rise leasehold condominium complex with 50 years remaining on the lease. They typically sell at around $300,000 and the monthly ground lease fee is around $850 per month which includes, heat, water and the property taxes. No rental restrictions

620 Toronto is a 1971 built hi-rise freehold condominium complex that typically sell around $500,000 for a similar size suite. The monthly Strata Fee is $616 per month and the property taxes are another $175 per month. That’s about $800 per month.

Victoria and Oak Bay have several leasehold condominium complexes. They do tend to take twice as long to sell as a freehold complex.

Both the leasehold and the freehold condominiums rent at similar rates. Most people buying leaseholds in the last 25 years remaining on the lease are buying them as rental investment properties. They are buying the present value of the net income stream.

Formula to Calculate Present Value (PV), a concept based on time value of money, states that a sum of money today is worth much more than the same sum of money in the future and is calculated by dividing the future cash flow by one plus the discount rate raised to the number of periods. PV = FV / (1 + i)^n

The rest is Contract Law.

Well I can now pass along the news that we’ve successfully purchased a home on the edge of Saanich. 🙂

Conditions lifted tonight and so it’s official! Many thanks to all for the encouragement and insight and more in the discussion here. Thanks to you all we’ve learned far more than we ever thought we would and that knowledge ended up being instrumental in pulling this off. So many many many thanks!

Do they? Sometimes they resell for close to the freehold value, despite being well along in years. It would seem the market is not good at valuing them.

It could happen that way. Or it could be the land owner is required to buy the improvements from the leaseholder. Or it could be the land owner is required to extend the lease.

It is a veritable crapshoot as to what happens.

Leo’s in the news!

Oak Bay condo development gets another chance before council Monday

https://www.cheknews.ca/oak-bay-condo-development-gets-another-chance-before-council-monday-1167911/

A couple of points. BC’s rent controls, which were effective across tenancies, were on the books until abolished in 1983. Vacancy rate on controlled properties was zero. However there was a clause that exempted properties once the rent passed, I think, $500/month (that was a fair amount of rent in those days). That was before the bust.

After the bust you had no rent controls but you had over 10% unemployment and a weak rental market.

Yes, I think so.

@introvert didn’t his previous counsel do the same thing?

They will I’m sure, depends on the US… I think we’ll be the first into a recession this time, rather than the US leading us by nearly a year.

And wasn’t unaffordability already high even at the very low interest rates?

Month to date numbers:

Sales: 141 (Up 18% over same time last year)

New lists: 414 (Up 19%)

Inventory: 2543 (up 18%)

A very long time. But they could drop rates again.

yeah, unfortunately we have terrible data on that. All we have is CMHC which doesn’t capture rents of vacant units, and poor quality data from rentals.ca and the like which only go back a few years. Unclear exactly how high asking rents were in the 80s or the early 90s boom.

I still believe that Victoria affordability most closely follows net BC population change from interprovincial migration. So if BCers start moving out of province (net), then the cycle will resume. This applies especially to Victoria prices, as our population growth is mainly from ROCers (including vancouverites), and much less from immigration than other Canadian cities. That’s highly correlated to the economy too, so that an economic downturn could also result in the cycle returning to baseline affordability.

So far, no definitive signs of the economic downturn, but fwiw, many economists are sure that it’s coming.

You will have to factor in rent prices too, as the high rents are likely keeping some investors/owner afloat for now.

You failed to account for wage increases, like Marko said, lots of 90k a year jobs in in government which would equate to close to $200k hhi for a couple. so for a $1M house they are carrying between 4-5x mortgage to income. I don’t expect the multiple to drop below this for a sustained period of time at current rates. Sure if rates goto 8% then it could be a different story.

Firstly that’s a theory, and although backed by data, it may at some point meet a hard line of maximum unaffordability. It was also linear and we’re well above where he thought we’d be.

Prices flatlined, but affordability didn’t. We had a large decrease in interest rates following a recession in the US, and importantly China continued buying commodities through out the recession. In Canada the 2008-2009 recession was smaller than the ones 81-82 and 90-92. How long would it need to flatline before we get back to the affordability baseline?

From the jobs report, B.C. employment rose +12,000. That got people excited, since they annualized it, and it launched headlines about the awesome B.C. economy pulling up all of Canada.

However… That doesn’t happen when you look at the numbers though…. This +12,000 B.C. jobs consisted of +36,000 part-time and MINUS 24,000 full time jobs. On top of that, the Labour report flags this is as a very small sample size, with a huge MOM error range of +14%.

Even if you believe the numbers, if the B.C. economy is so awesome, why did B.C. lose full-time 24,000 jobs last month, despite a +13,000 population growth? YOY is even worse, a +2.3% population Labour force growth, but only+1.0% growth in full-time jobs. That means B.C. full-time jobs are falling as a %.

https://www150.statcan.gc.ca/n1/daily-quotidien/230908/t003a-eng.htm

Sorry by “baseline” I mean the the interpolating trend line Leo always puts on the affordability plots.

Sure but that baseline is what, 70% of current affordability?

1981 was quite a bit worse (on an absolute level for condos, and on a relative level for detached), but we’re worse now than we were in 2007 and early 90s. In those two cases prices more or less flatlined for several years. So maybe result somewhere in that range of outcomes? I’ll have to update those affordability graphs.

As Leo has bee pointing out for years SFH affordability always returns to a higher baseline (aka progressively SFHs become more and more unaffordable).

Who’s we? Public sector is getting less than inflation next year. Market dropped a fair bit last year, if employment drops off and a recession starts I think you’ll see more of a drop and affordability actually improve. We’ve never had horrible affordability for long.

Markets don’t move that fast and then we have another round of wage increases next year.

Prices could come down but for the median to drop below $1 million, I don’t know about that. I hope as I am still looking for two missing middle properties but realistically not counting on it.

I think aka complete guess we finish at $1.1 +/- median and then things flatline next year.

These numbers will be revised downwards in the coming months I’m sure.

Isn’t affordability at like 1980s lows? I don’t think it needs to get worse for prices to come down.

I’ve had 2x government employee couples, one couple being relatively recent immigrants to Canada, purchase in the 900s as first time buyers in the last few months. I think there is too much support under a million for SFHs. I am shocked people make it work at these interest rates, but they do.

I’ve also been caught by surprise with emails along the lines “we’ve been pre-approved at 5.79% and would like to buy XYZ.”

It seems maybe people are not phased by the very high rates. If they can qualify they buy which goes back to what you’ve been preaching the last 10+ years. Affordability is very key, and the fact that affordability will worsen over time for SFHs.

At this point unlikely rates go up substantially higher but who knows so affordability shouldn’t get much worse assuming prices stay flat.

Of those 12,000 jobs, how many were private sector as opposed to government or non-profits?

Hey Leo, is this the house? Wonder if it sold for very much over asking?

The B.C. labour market looks to be playing an outsized role in boosting national numbers with the West Coast adding 12,000 jobs in August, according to Statistics Canada data released Friday.

Canada as a whole added 40,000 jobs, with Alberta (+18,000 jobs) serving as the biggest contributor amid 9,000 job losses in Ontario.

The stats agency also revealed B.C.’s unemployment rate fell 0.2 percentage points to 5.2% compared with a month prior. The national rate remained static at 5.5%.

Employment within the finance, insurance, real estate, rental and leasing category took a hit in B.C., shedding 7,700 jobs amid high interest rates.

Under a million would be a boost for those needing CMHC financing.

Last year the median hit $999,900 in November, which was the first time it had been under $1M since February 2021. My prediction for 2023 was that the year would end with detached roughly at the same level ($1M-$1.05M) as at the end of 2022. That was quickly stymied when prices jumped closer to $1.15M but I think I still have a shot with my estimate by end of the year.

Median last month was $1.165M. Dropping to a million again would still be a sizeable drop, and I think there’s a step up in demand under that level that will keep prices from dropping any further.

There are lots that sold for under a million already. Just not any in gordon head that is on a 6000 sqf lot and readily suited.

Craigslist, ,Marketplace and property management sites mostly in the 3 bdrm+ and SFD categories, but other segments as well.. is with the caveat (anecdotally). Usually the fall is a much tighter market for selection.

Where are you finding the rental info?

Surprising amount of selection available for rent, especially for this time of year. The prices are high, but it seems like more (anecdotally) that what we were seeing the last while.

Leo, we will see detached for under a million. When rates are high people can’t borrow their brains out. The last of the lower rate holds are expiring. Let’s see what the next 6-12 months brings.

Without looking at it in person, that seems to be a 750k to 800k house in 2019.

Under a mil in Gordon Head… that would likely be 1743 San Juan. Listed under assessed and is already set up as an up down with two kitchens.

Leo- Without giving away the location of the Bat Cave, could you offer more info such as size of house and lot, approximate age, style of house, that’ll do. Thanks

House nearby listed last week. Tons of showings all week, busy open house and an accepted offer.

Just under a million but needs a lot of work.

I think we’ll see prices slide for a while but hard to imagine detached is ever going under a million again.

Well, things got to get normalized some way some how. Difficult to see a way to restore some measure of affordability without some pain.

I was told that the difference b/w Europe and many cities in Canada is that in Europe the outer rims of cities tend to be less desirable and this is where there is more issues with drug use, crime etc… whereas in Canada it is the opposite. I was at an event where we were making soup for a shelter and there were very wealthy women there. One of the women said she would not go in to downtown Victoria even with a ring of garlic around her neck! Some people’s perception of downtown Victoria is that it is not safe and there are so many people that are happy to never enter the core. This is really problematic from a climate perspective – since it relies on sprawl and commuting etc… I don’t know the solution – but I will say that the lady who made the comment about downtown Victoria was quite a bit older so perhaps it is also generational. Personally, I would 100% prefer to live in a walkable area (even if there are some social issues) than to spend hours per day/week driving in a car on a smelly sad highway.

Look at all the hearts the twitter post got. Schadenfreude

Lower mainland

I agree with you Patrick. In fact that’s how Victoria’s own infamous broker capitalized on home owners that wanted to keep their original home as a rental but did not have the personal income to cover both mortgages. Enter the not so temporary “bridge” financing scheme.

Yah, house hoarding is a “thing”. It applies to regular homeowners that keep collecting homes like some people collect vintage cars. And it’s about 20% of all homeowners.

“ House hoarding? Why some upsizing homebuyers aren’t selling their old homes

https://globalnews.ca/news/8029957/house-hoarding-canada-housing-market/

A 2019 analysis of Statistics Canada data by Andy Yan at Simon Fraser University found that 20 per cent of homeowners in Vancouver owned two or more homes with most of those properties located within the confines of the city. In Toronto that share was 17 per cent.

Mt. Tolmie, plenty of investors are willing to pay for a 20 year income stream.

How much would you pay today to receive two thousand a month for the next 20 years?

Leaseholds do sell at a discount from strata’s that’s what makes them affordable to buy. But they still rent at the same rate as a strata and that makes them profitable to buy. You might pay 18 times gross annual rent for a strata but only half that for similar age leasehold. $30,000 x 18 is $540,000 while $30,000 x 9 is $270,000.

Banks will still give you a mortgage. It’s just that the mortgage will be amortized over five years less than the remaining period of the lease. That would make your monthly mortgage payments higher but that is offset in that you will be buying the leasehold for less than a strata.

20 percent of the properties bought in the UK are leaseholds. We are not use to them because Canada being the second largest country in the world has historically never had a shortage of land. Only because half our population or about 20 million people live in about ten metropolitan areas across Canada has it now become a problem.

When the leasehold interest expires then the property is demolished and a new one built. How about when a strata condominium complex reaches the end of its life span? With 50 different owners in a strata that is really going to be messy trying to get enough of the owners to agree to dissolve the corporation. And some of these early strata condos date back to the early 1970’s now. They may be coming up to the end of their life span in the next 30 years too. But people still buy them.

However with a strata you still own a share in the land less of course the cost to demolish so you will get less than the cost of a vacant lot which is probably going to be substantial cost.

House hoarders, you say? I doubt that there is any such animal but if you wish to use a term for this chimera that has a little more resonance try “kulak”. You appear to share some views with the originators.

I’m sure 60 years seemed like a long time when the False Creek leaseholds were offered.

One problem is that the leaseholds became hard to resell after only 35 years. Would-be buyers could not get a mortgage with an amortization longer than the remainder of the lease.

In the coming decades, we’ll see more leaseholds approach their messy ends. I expect leaseholds will get a bad reputation and sell at a significant discount.

They probably are selling to REITs or smaller investor groups that buy up several units at the pre-construction stage and thereby get a discount for buying so many units.

REITs are a very strange animal and are complicated to understand as most investors are taking an equity position with no claim to the property itself. The Ontario superintendent of financial institutions has said that they don’t have the employees that understand them as they can be so different from one another and can be very complicated.

When things are made intentionally overly complicated it invites those with unscrupulous intentions to form a REIT.. If you wanted to invest in a REIT would you know what you’re buying into or would you just make an assumption? There is a difference between Share Value and Market Value. I think most wannabee investors would not understand the difference? Are you taking an equity position or a debt position in the investment? What complicates them even more is that the mortgages can be syndicated so you are not investing in one complex but many complexes and you won’t have a say on what is purchased, sold or mortgaged. Most REITs will be highly leveraged in that case they may have little equity left if they were foreclosed on for you to get back your original investment. The lender gets first claim on the buildings and the rents. The share holder gets what is left over at the end – if any equity is left.

Having said that, REITs usually provide a better than average rate of return to the investor.

You can google “Blackstone REIT” to get a better understanding.

Well if investors at 30% are “important”, the other 70% of buyers are also important. Many of these pre-sale condo investor buyers aren’t going to rent long term. They’re flippers, speculators and likely to evict tenants by selling.

If investors are needed, it’s better that the condo tower developers sells to “better” investors with “strong hands”, such as REITS or other major property companies that wouldn’t be subject to that tax. Then we’d end up with long term rentals, not condo flips.

Anyway, even under my investor surcharge idea, someone over the $3m limit would pay about 0.4% surcharge, so that’s not much – $2,400 extra property tax on a $600k unit.

Investors play an extremely important role in building new housing. They are mostly concentrated in the condominium market. If you are building a 100 unit complex, then 30 percent would be investors buying for rental purposes. Without those investors that new complex would have a tough time getting built.

For that reason rent controls may stifle demand by investors and new complexes would be put on hold. The majority of Economists consider rent controls as being bad for the long term growth of a city.

However high rents are also bad for the economy of a city as it causes a labor shortage in those jobs that pay lower wages. Those jobs are mostly in the service and tourism sector. And that causes inflation in the cost of goods and services. And that seems to be our current predicament with our low vacancy rate.

If the government can encourage a lot of new construction, then the vacancy rate for new buildings will increase and rents will decline. But I suspect it would take a lot of new construction to move our vacancy rate from one percent to say three percent.

Or we could just slip into a long term recession and the key age group of 20 to 34 year olds that tend to be renters would leave the city for better job opportunities and that would cause the vacancy rate to increase quickly. A recession would also slow down immigration as new immigrants would have a tough time finding work making Canada a less desirable place to immigrate.

I don’t agree with the rhetoric of the government of poaching trades people such as electricians and plumbers from other countries which also need these trades. We wouldn’t like it if the Americans were poaching our trades as they have always done for our brightest and most talented Canadians.

An idea to discourage house hoarding…

B.C. Property taxes get a surcharge for high value homes (over $3 million in B.C., rate of 0.2%, over $4m rate of 0.4%), which funds education. It applies to houses, condos and vacant land.

As taxes go, that one makes sense for lots of reasons.

One proposal that also makes sense to me is that this $3million threshold should apply to the total property (personal use + investment properties) owned by a person (or beneficial company owner).

So if someone owns 5 properties, each valued at $1 million, consisting of principal residence, vacation homes and 3 investment properties at $1 million each, they would have total $5m properties, and since that is more than $3 million and so they would pay a surtax (about $10k per year at current rates).

This wouldn’t apply to purpose built rentals or equivalent providing long-term rentals (such as non-profits, REITS)

Disappointing 2023 Canada housing sales stats showing falling first-time buyers and rising investor buyers.

https://www.theglobeandmail.com/business/article-investors-account-for-30-per-cent-of-home-buying-in-canada-data-show/

“Investors were responsible for 30 per cent of home purchases in the first three months of the [2023] year, according to data released by the Bank of Canada. That is up from 28 per cent in the first quarter of last year, and 22 per cent in the same period in 2020.

Meanwhile, the percentage of first-time homebuyers shrunk to 43 per cent in the first quarter of this year from 48 per cent in the same three months in 2020. Similarly, repeat buyers fell to 27.5 per cent from 30 per cent over the same period.”

If you look at an early 1980’s built condominium complex, I doubt that many on this board would consider them to be obsolete. Somewhat dated in appearance but not obsolete. The buildings would still have substantial value and would be renting at good rates. Not at rates as much as a new building but still a good return for those False Creek investors. It wouldn’t make economic sense to tear them down at this time as you would be tearing down a functional building somewhat dated in appearance to replace it with a modern efficient building.

If you had bought one of these five years ago as a rental investment , it would have been a good bet that the city would extend the lease. Most leaseholds are 99 year leases. A 60 year lease implies to me that the city back in the 1980’s was giving themselves some wiggle room to extend the lease. They might even do it again 20 years from now. Although less likely as by that time the buildings would be showing their age, just as a condominium built in 1965 is today.

You would not want to extend the lease indefinitely as False Creek could become a downtown ghetto.

They weren’t entitled to an extension in the first place. If you buy a leasehold you have to assume you’re giving the property back at the end of lease. IMHO they only got an extension because the lessor was the City and was responding to public pressure.

The main function of government is to keep lawyers employed and busy. They are experts at creating unnecessary information to complicate and confuse.

Because it is more important to sound smart by using jargon, ambiguity, unnecessary information to confuse and distract the public instead of problem solving.

It only took 15 years to negotiate the 20 year extension…

Their lease term was originally for 60 years and they have now gotten extensions to 2056, 2060, and 2066. Which made them into 80 year leases. That’s a bonus score for those that bought there anticipating that they did not have much time left on the lease.

When the leases end, then the entire 80 acres would be re-developed with a proposal for 6,660 units.

How often do cities get a chance to re-develop housing in the heart of their city on this scale?

True, the initial leaseholders may not have to worry, but someone will.

The False Creek South leaseholds are some of the first to approach their end date and have been quite problematic.

Also, leasehold terms can vary significantly.

Crazy yes, surprised no.

City of Victoria paid $10 million for that parcel on Pandora the developer paid $3.3 million only a few years earlier. No, the market did not appreciate 300% especially not on the 900 block of Pandora.

Province bought that hotel on Douglas for $26 million they are now tearing down for the joint venture with Chard Development. Chard Development, at a later date, in an ascending marketing, purchased the adjacent Whitespot site they are bringing into the joint venture for $7.5 million.

Government at all levels is just completely useless. Of course when it isn’t your own money no one cares about anything other than flex fridays.

$1 million a unit net housing? Who cares.

16 months to approve a garden suite permit in Saanich. Who cares.

Entire department at BC Housing running a 110% useless policy that increases housing costs and delays. Who cares.

Nothing to be surprised about imo.

You will be long dead before a 99 year lease comes up for renewal. After 99 years the building will likely be a tear down as will most of the strata town homes being built today. As the land will have become to0 valuable to retain the building.

In the last 20 years most would be bought by investors looking at the income stream and return on their investment. After that they get demolished and a new complex is built.

The Quadra property is a nice chunk of land. The 1965 built apartment building doesn’t add much significant value as it is obsolete. A mixed use building with ground floor commercial and four floors of residential will help to improve the neighborhood which is kind of crappy. At 40 units, the suites will be mostly small one-bedrooms that would likely rent for around $2,000 a month and the property if it were completed today would have a market value of say around $18,000,000.

That’s the problem with building rental apartments it costs 20.5 million to buy the land and build the building but it’s market value would be less than the cost to buy the land and build. Without government subsidies apartment buildings are not always economically feasible.

If instead if they were small one-bedroom strata condominiums selling at $625,000 each then the aggregate prices of the units would be greater than the construction costs.

It would have been better if it were six stories and 50 rental units.

Leasehold gets messy when approaching the end of the lease. We don’t enough field experience with leaseholds ending to be confident what happens.

Last chance to unload that airbnb condo..;)

Unfortunately the easiest place to build apartments is where apartments already exist. Our zoning system maximizes for displacement. We should definitely be building on the SFH lots first. That said some old buildings may just be end of life. Should definitely be 80 units instead of 40 though

Does anyone else think it is crazy to displace 19 units worth of people in order to house 40 units worth of people in the hospitality and hotel sector at a cost of $20.5 million? In terms of net housing that’s almost a million a unit? https://www.timescolonist.com/local-news/victoria-grants-25-million-for-hospitality-worker-housing-project-7519720

Slightly different search (I only include metro Victoria so core, west shore, and peninsula) not the islands or Malahat. I also only count resale listings because new construction is too volatile (sometimes there will be a dump of 20 new units listed on one day)

Why does marko have 50 more listings than you?

I’m working at the listing market on a bit of a different premise as I’m concentrating on how those that bought a condo as an investment are now judging the future market. Is the number of listings for re-sale condominiums that were purchased primarily as investments increasing in the core relative to those for home occupation?

The problem is that this information is not easily or readily available. So it is necessary to make assumptions on listings for re-sale as to what defines an investment property versus a property bought for home occupation. So this will be inaccurate but I’m not looking for small changes. I’m looking for large shifts. For example if a third of the listings today are investment properties being sold, I would be looking for a substantial shift from say 35% to 70% of total listings as what happened in the first three months of Covid as investors were bailing out of the market as they were assuming prices would drop.

That assumption turned out to be false but it threw a lot of renters onto the streets who then had to find a rental in a rental market with a vacancy rate of one percent. And we know what happened to rent prices then. KA-BOOM!.

And those higher rents then made investment condos attractive again. And we know what happened to condos prices after that. KA-BOOM!

I think it’s too early to tell. Could be just a blip given new lists always spike in September, just not always this early.

I think there is mounting stress on owners, and there will be some number that are forced to sell as they get to renewal and just can’t afford it. Impossible to say how many or if that will move the market, but new list numbers are the #1 indicator to watch in my opinion.

Sellers seeing the rate hold as opportunity to unload? Very interesting as it is the opposite behavior compared to the last rate hold early this year.

Have to assume that there are people whom are either stretched and wants out and those who just want to lock in their profit and quit the speculation game.

What I have yet to see in Victoria is another form of home ownership called the Leasehold townhouse. Leasehold land is basically a plot of land that has been rented out by say the developer to the town house owner of the improvements, the developer rents the land for a certain sum of money to the owner of the improvements. The leases on the plots of land are typically for extended periods of time of say 99 years.

The developer can also sell the land as a pre-paid lease to the home owner or to an investor such as an insurance company or REIT that are looking for long term investments and they would collects a ground rent. You can think of it along the lines of a long term bond of say 99 years. A 99 year pre-paid lease would have a similar value to a a freehold lot.

In 2020-21, there were an estimated 4.86 million leasehold dwellings in England. This equates to 20% of the English housing stock.

Some of the cons of leasehold include: If you did not buy the prepaid lease up front then you need to pay an annual ground rent or service charge, both of which could be expensive. You may not be allowed to carry out major refurbishment or extension works.

The pros of a leasehold town house that charges a ground rent is that they are far less expensive to purchase. I suppose the ground lease agreement could have a clause that the town house owner would have an option to purchase the land at renewal say in ten years. At that time the leasehold town house would become a freehold townhome.

Food for thought?

3 days after labour day:

2022: 157 new listings

2023: 217 new listings

Anyone know who built the project on Lobo Vale or Vision way, or any other freehold townhouse development?

Will write an article about this and would like to talk to the developers

Right. It looks like ten of the units on Lobo Vale are freehold (fee simple) townhouses.

https://mapliv.com/ca/address/959-lobo-vale-victoria-bc-v9c-2y2 “One of only 10 fee simple townhomes in Lobo Vale Mews”.

Not sure how many of these are re-lists but will be interesting to see if this trends sustains throughout September. One of the companies I regularly use for professional photos/floorplans is booked a week plus in advance (unusual for them as they have a lot of staff).

Last three days

New Listing (267)

Pending (63)

Price Decrease (79)

+1, also in Sidney there is a freehold townhome complex.

Reviewing that one sale of a Freehold town home it does appear that they do sell for slightly more than a strata town home as the buyer does not have to pay a monthly strata fee.

Since the profit margin is larger for a builder, we may indeed see more Freehold town homes built in the future.

It’s not that freehold townhouses don’t exist here, they’re just rare.

Here’s one that just sold: https://victoria.evrealestate.com/ListingDetails/955-Lobo-Vale-Langford-BC-V9C-0H8/940541

Active listing: https://www.realtor.ca/real-estate/25732631/3385-vision-way-langford-happy-valley

I think Paul and Ringo still live in one.

What you call a town house is called a terraced house in the UK. That nation is blessed with 6,930,000 of them – almost one quarter of all housing stock.

I am unaware of any deaths caused by sharing a wall with one’s neighbor.

OK, “mini detached” vs “SFH”, seems like now talking about the same thing, since they aren’t touching adjacent homes. Whatever we call it, sounds like a good idea. Thanks for the discussion.

No. A freehold townhouse is attached on at least one side. i’ve been talking about the Houston townhouses which you described as “basically townhouses but not touching.”

A Houston style townhouse that doesn’t touch adjacent housing is a SFH if freehold. That’s what we should build in Victoria, and that would mean more SFH.

https://www.bradleyhomes.ca/freehold-townhomes-what-are-they-and-are-they-right-for-you/

“ WHAT IS A FREEHOLD TOWNHOME? Simply put, a freehold townhome is a house that is attached on both sides and has the same features as a detached house”

No. Freehold townhouses are townhouses (or call them rowhouses if you like) that aren’t strata, not SFH.

“Houston townhouses” are just mini detached put very close together, that’s different

‘

I think about 800 were SFH or townhouses. I don’t think the term “freehold townhouses” makes sense, as those would just be considered a SFH if they aren’t touching . I expect a lot of the SFH were on small lots in Langford, and maybe some small lots in Saanich could be created by subdividing that would accommodate small SFH (“townhouses” that don’t touch). If we did that, it would increase the number of SFH in the core, despite you telling us on HHV last week that “It is literally impossible to increase the number of SFHs in the core”.

In any event, you were the one that started talking about Houston townhouses that don’t touch, and I think it’s a great idea, and smaller lot sizes should be legalized. I’m happy to leave it at that.

lol no.

No idea what your point is, but how many of those 4787 starts were freehold townhouses?

Before listening to “developers” you might want to qualify them, by asking them “Of the near record 4,787 ( * ) housing starts in Victoria in 2022, how many were yours?” . You may find the answer to be ZERO, and that you’re talking to “wannabe” or small-time “developers”.

The point being, like in most things, the “wannabe” developers are telling you all the reasons they can’t get it done. And the successful developers (4,787 units) will tell you how they got it done.

( * ) Years 2021-22 achieved modern era record Victoria housing starts: https://www2.gov.bc.ca/assets/gov/data/statistics/economy/building-permits/econ_housing_starts_urban_communities.pdf

But with a strata, the strata council has to maintain the structure and common areas, and enforce the bylaws.

While it’s nice to have ownership of the exterior appearance of your house, this also comes with the responsibility of regular upkeep of your property. Additionally, because you share your yard space with neighbors on each side, you don’t have control over what your neighbor decides to do with their yard or how they choose to keep their home. Let’s say you like to keep your grass freshly cut but your neighbor only wants to cut theirs every few months–unfortunately there isn’t any way to stop that from happening. Situations like this can create a bit of a mismatch for your curb appeal and could result in some difficulties down the line when you plan on selling. Your home is immaculate and the one beside you is a shi%box and that will have an effect on price when you go to sell.

Heck, I’m all for less governance even if it’s strata councils. If you don’t like what your neighbor is doing and you feel it is having a negative impact on your property’s value then take them to court. And that’s what you will have to do if your neighbor breaks the covenants as there is no strata council to enforce compliance. And we are becoming more litigious nation. I remember a case where the neighbor built a two level playhouse in their backyard and placed it so that it blocked his neighbors view. And he would not move it because it was his land and no one was going to tell him what to do with his land. Unfortunately his neighbor had a view corridor covenant. There was no strata council to enforce the covenant so he took him to Court. Thousands spent by both sides over sliding a playhouse over by six feet. Two people could have slid it over in under 10 minutes.

The Court will just be taking the place of the strata council as to enforcement over these ridiculous matters.

Isn’t a developer saying it [freehold townhouses] is “too complicated” simply code-speak for “there’s easier ways for me to make a buck”.

By analogy, when you need cardiac bypass surgery, does your cardiac surgeon tell you “sorry, that’s too complicated, and I can make more money inserting pacemakers”? Of course not.

If we want family housing… Let’s listen to developers that actually want to build family housing, and change zoning (eg. legalize smaller “Houston” lot sizes) and other needed changes to make it easier for them to build it. Instead of that, we currently make it easier for developers to tear down family housing (SFH) and build micro-units unsuitable for families

I’d be delighted if a neighbours house is torn down and replaced by two freehold townhouses for families.

But who wants a missing middle with 11 “micro units” and no parking next door? Let them put the micro-units in huge towers and put the family units in family neighbourhoods.

Probably. I think no one is immune to problematic neighbours but that’s one advantage of the Houston townhouses

And if they don’t fix their roof and it causes damages to the adjoining units then it becomes a court case.

The owners just fix the units when they need fixing.

Was in Ireland this summer, tons of 100 year old townhouses like this. People just fixing their roof when it needs fixing, no need to have the others agree.

Developers keep telling me it’s too complicated and buyers balk at the legal agreements around the party wall.

I keep saying I don’t want excuses I want results but so far it hasn’t worked haha

Ontario is full of them, in fact it appears to me that just about all new townhouses are freehold. Why – well you can sell them for more.

It’s a mystery to me why you don’t have them in BC.

Interesting to see what happens to these freehold town houses when they get to be 25 years old or so and the roof, windows, exterior painting, etc. need replacing at around the same time.

On the pro side, not being a strata they would not have to build up a reserve for replacement or have a reserve fund study done every couple of years. In a strata when you sell then all the money you put into the reserve fund each month doesn’t get paid back to you.

It makes economic sense to buy these freehold town homes when they are new or near new. I might be reluctant when they are 25 years and older as there is the chance of some big ticket items coming up that might have to be paid after your purchase.

Still it opens up an interesting way to build a rental building as investors would net more than if they were stratas.

Things that make you go hmmmmm.

Rodger- Covid started in 2020. Restrictions were on and off for 2 years.

Personally don’t know how you put up with just a 6000 sq.ft lot in the core of Saanich. Must feel like your neighbours are just peering in constantly, watching you watch tv.

Designs brought to you by small children whose food also can’t touch.

We do have some non-strata townhouses kicking around actually. See 998 through 982 Fire Hall Creek Road in Langford. I think they ended up having a ton of legal paperwork (covenants, easements, etc) to make it work, and in the end it’s almost like you may as well just do a strata maybe. It’s just a different legal approach to the same result I think… it’s just the nature of sharing buildings, you have to have legal agreements in place to take care of things. Good fences make for good neighbours, right? Leo, it sounds like you’re pretty familiar with other countries that have freehold townhouses, are you aware of how they take care of these legal aspects? Fire Hall Creek shows it can be done here, but for some reason developers are choosing not to build many of them.

All true, but once it’s a freehold not touching the property next door it’s no longer a townhouse, it’s a detached SFH.

Like Houston, allow smaller freehold lot sizes to build these. I think that’s a great idea that would appeal to lots of families.

No problem with detached on traditional lot sizes. I live in one it’s great.

We just shouldn’t be subsidizing our most expensive housing by banning sensible infill. Allow various options up to 3 floors and the people that want a detached house on a 6000sqft+ lot are free to pay for it. Others will have less expensive options to chose from.

That was basically Houston’s approach. They don’t have minimum lot sizes so they build a lot of detached that are basically townhouses but not touching.

In many ways it makes zero sense. You’re wasting space between the homes, they’re less energy efficient, and cost more to seperate than build together.

On the other hand it’s simple freehold. Other countries have tons of freehold townhouses that are touching but for some reason we can’t figure them out here.

Low interest rates and FOMO. Most of the restrictions were lifted in late 2020 and 2021.

I have 6+ story trees behind my yard and although it feels woodsy and private, man do they ever sway and freak me out in windstorms. We’ve had the fire department on our street twice in 2 years dealing with electrical fires on wires as well. Grass is always greener?

I try not to dwell on housing regrets but we once scoffed at a Royal Bay new build that was 560k. I told the showroom it was too high and I’d pay 515k. They offered to drop it 20k and we walked 🙁 boo-hoo. My partner definitely prefers the older house we’re in and the space and I do love it too, but I’d also move to RB today if I could.

I hear you on the lot sizes. There are 2 streets with compact lots at around 3,500ft2 and I think of these as non-strata townhomes. Those don’t interest me but there’s a market for them. Most people have 4,500-7,500ft2 lots and the house and garage footprints are designed to maximize backyard space so it feels like there’s plenty of room to entertain and have our 2 kids run around and have a trampoline etc. I do appreciate that a mid-size lot requires less landscaping costs and less mowing, but bigger backyards are also very nice and mature trees in older neighbourhoods would bring a feeling of more privacy.

Just wasn’t showing up for some reason. Lol ur buyer just set the ceiling for the Doncaster listing.

I agree, but the threat of a multiplex being constructed next door to you is increasing with time.

The trees in Royal Bay will grow over time, but the lot sizes won’t.

I much prefer the relative privacy and room to breathe that >6,000-sq.-ft. lots in the core provide.

As the cliché goes, they don’t make ’em like they used to.

Right but I thought that was bedrock, and gravel may behave more like sediment?

Anyway from dr Seuss it sounds like this isn’t really a concern so that’s awesome. I do like the idea of moving somewhere like Royal bay with that fantastic ocean view so close by, but the price not quite as insane as oak bay. So I definitely get the appeal there.

Not denying that bedrock is helpful in an earthquake when homes are anchored to it. But here’s a news story on a report commissioned by the City that says a major earthquake could damage or destroy 40% of Victoria buildings, and that pre-1972 homes, especially in Fairfield, Gonzales and James Bay are most at risk. I’d prefer not to be in the vicinity of that.

https://www.timescolonist.com/local-news/big-quake-could-damage-destroy-nearly-40-of-victoria-buildings-report-says-4646716#:~:text=Miner%20file%20photo)-,A%20major%20earthquake%20could%20severely%20damage%20or%20destroy%2038%20per,a%20database%20of%2013%2C000%20buildings.

Luv oak bay my place like so many here built on a rock no problem in an earthquake , some parts of Fairfield the grounds a lil mushy

Royal Bay would be very safe in terms of potential loss of life – new buildings are designed not to collapse. There may be property damage due to liquefaction but watching videos of liquefaction occurring during earthquakes shows only minor sink with no damage to the structure. Our house is also 100 feet above sea level so no tsunami risk. And it’s all underground servicing here so minimal risk of electrical or gas fires, falling live power lines etc. Risk of earthquake is relatively low but if it did happen and older homes in the core collapsed, there could be a Ground Zero effect like in NYC after Sep 11. I think you’re right R about family and friends being a draw, but at the same time I’m from a big city and a 20-25 min drive doesn’t register for me as a concern – it used to take that to drive 5km where I’m from. I’m not disagreeing that people love where they live in Victoria and make rational decisions to buy there based on things I didn’t mention. Just sharing housing quality factors that were really important to me.

Building on rock is good for earthquake safety.

Is Royal bay safe in an earthquake, even with seismic upgrades? I thought it was built on a gravel pit and is pretty close to the ocean?

Every neighbourhood has its pros and cons… whenever we go to colwood/Langford we find some neighbourhoods cute but we hate the need to drive everywhere and big box store vibes (more Langford than colwood of course) for us, all our family and friends are in the core so that’s where we want to be too. It might be different if everyone moved out there though.

But I also agree you tend to live where you live. I loved living in James bay (beautiful Dallas road access, quick walk downtown), but now when I go there I often notice how it’s super cold and windy even when everywhere else in Victoria is warm. I loved living in cedar hill (central, great access to the golf course trail and mt tolmie) but now I often just notice the frustrating shelbourne/north dairy traffic issues and the ambulance corridor noise. I loved living in Cadboro bay but now I think about earthquake risk and lack of walkability to any grocery store other than peppers. Probably the only place in Victoria I hated living in even when I was there was quadra village. And that was probably just because I was living in a crappy rental with no laundry and I had to work an evening shift and walk home through pandora/quadra late at night.

Tldr… Victoria is mostly great no matter where you are? And also I’m very curious about how safe Royal bay would be in an earthquake.

Re the Oak Bay vs Royal Bay comments. I very much understand the argument for living in the core for proximity to activities, services, and work. There’s definitely a nice aesthetic to Oak Bay that I would have enjoyed as a renter. But when I drive around, I also see that 80-90% of homes throughout the core are pretty rundown or dated and I just can’t imagine buying one. I’d prefer Oak Bay or other areas of the core if I could buy a new home for $2.5M+ but everyday homes seem like they’d require a lot of time, money, and renovation stress to upgrade and get anywhere near the aesthetic of my Royal Bay home. I’d also worry about asbestos, lack of seismic upgrades and toxic material emissions from a major earthquake, mould potential, basement water proofing breakdown, and general wear and tear from the weather. That doesn’t seem to bother a lot of people here – maybe it’s that people are used to their City and overlook things – the nostalgia mentioned definitely makes sense to me. I’m not from the Island (so many people in Royal Bay aren’t), and I just can’t relate to the desire for older housing.

The portal doesn’t lie 🙂

Minor detail to the minor detail is that $1.8MM purchaser is moving out of something. It could be an older $1.8MM outdated property in 10 mile point. The people that buy that property to renovate might sell a $1.2 million home in Gordon Head, etc, etc.

1.275 right?

Just looked through the floor plans of the newest condos about to be occupied on Shelbourne, the Affinity and quite a few of the floor plans have a 2nd or 3rd bedroom with no window. I used to think that was code but with sprinkler systems I think you can get away with it. Makes me feel claustrophobic just thinking about it.

Just saw an example of the much discussed urban densification. Did anyone notice the 14 unit townhouse development in Cadboro Bay Village? Seems to fit the government story line of knocking down a few old SFH’s and replacing with a whole bunch of 3 bedroom townhouses. Minor detail is that they’re all $1.8MM+.

Regarding the chart below- I still don’t understand why house sales were the highest during a pandemic, under lockdowns, travel restrictions, etc…. Especially when the nonessential private sector, small businesses, and self employed suffered loss of income. Many did not recover, some are still recovering in trying times that could still sink them. Yet housing remains strong in a higher interest rate environment. Any explanation?

Born and raised in Vancouver.

West side = West side of Vancouver

West Van = City of West Vancouver

What everyone says and never any confusion amongst locals.

Excellent summary. I am a huge fan of Royal Bay, for what it is. Royal Bay > Westhills, but South Oak Bay is pretty damn nice.

Good point re trees….starting to drive through some nice streets in Langford that looked like crap 10 years ago. Different being trees matures. Take a look at this street on Bear Mountain -> https://goo.gl/maps/U4Q5L91ZkcYFiHC19

Keep in mind that is a 2019 street view, keeps getting nicer and nicer as the trees mature.

I think fuel might be part of the reason for sure, but not sure how large of a factor it is. In Croatia people drive low consumption diesels or 999cc gas VWs/Toyotas. I think other larger factors such as social (people meet up a ton more to play sports, go to concerts, coffee, etc.) are behind the desire to live in the core. It would be difficult to drive home 30 minutes after work and then drive back to meet friends for drinks (including people with kids, you see kids outside at like 10 pm here). Also, people don’t accept crap food like we do in Canada and shopping once a week for groceries so you need to be closer a grocery store/bakery/etc., when you need to go grab stuff non-stop. In Canada we have more of a culture of go home to a SFH and watch TV and shop at Costco. Nothing wrong with that, but certainly very different.

100% agreed. I am still investigating this. Croatia is a poor country so there must be homeless people out there, I just haven’t seen them anywhere.

They do, but nothing like other countries. The equivalent of HHV but HHV Zagreb when people discuss condos the first thing people talk about is walking distance to kindergarten, school, parks, stores.

Yes, I agree. In many countries families accept living in condos. In Canada, we don’t.

Not sure about the window argument or the single stair buildings. It explains smaller buildings but when you have larger buildings the stair argument doesn’t work that well and larger building in other countries have a ton of three bedrooms.

I do agree with the approval times. If Colwood told me “hey if you build 100% three bedrooms will approve in 30 days without rezoning” instead of spending 5 years re-zone I would have rolled with 100% three bedrooms.

Part of the problem as well is the square footage. The typical 3 bedroom in Croatia is 85 m2 (914 sq.ft.). That won’t fly here. I would think most Canadian families would want at least 1,200 sq.ft. in a three bed condo.

Sold, no sure what’s going on with your portal.

Have they really? The need to be close to work has definitely shifted and reduced with remote work and that should benefit the burbs over the core. But aside from work places people still seem to value being close and even walking distance to things like stores, schools, parks and services

Marko, what’s going on with your cedar hill listing? Not showing up on the portal as pending

Oak Bay is great, I don’t think anyone can make a plausible case that it’s not. Royal Bay is great too but lots are smaller, trees aren’t mature yet, and fewer amenities nearby so the valuation will be less. In 30 years once the waterfront is built out and the trees have grown in it’s going to be a highly desirable neighbourhood

The close to schools, groceries etc argument made sense 5-10 years ago. Times have changed

You would know more than most of us on HHV, but could it be salary and fuel price is one of the main factor that people prefer to live in town centre than out in the suburb?

Another factor is that perhaps Zagreb don’t have an issue with homeless drugs camps in the core as we do.

We could start with 3 story buildings to start so that we can build small apartments under Part 9 and then look into 6 floors. In a modern sprinklered building it should be very safe. There are currently 2 requests to change exactly this at the national building code level

I don’t think the cultural differences are the major factor. There’s 3 bed apartments in many counties with diverse cultures.

But in Canada every bedroom needs a window and you aren’t allowed to do single stair buildings so it becomes very difficult to fit 3 bed units into a building. Legalize 3-6 story walk ups with a central stair and suddenly it becomes a lot easier layout wise. Drive down the cost and approval times and developers won’t focus so much on squeezing the maximum units out of every site. Solve the shortage of 1 bed units and developers will address other sizes.

On a site note re insurance. I’ve never bought condo insurance in my life (would not professionally recommend, personal choice), but I have people staying at my place sometimes so I am finally biting the bullet and buying it. Initial quote $778. Still tweaking everything but have it down to below $500 already

$75,000 Strata Deductible Loss Assessment limit lowers your premium to $678

$50,000 Strata Deductible Loss Assessment limit lowers your premium to $577

$25,000 Strata Deductible Loss Assessment limit lowers your premium to $477

In the US, whenever the buying vs renting curve was stretched, the prices came down much more than the rents went up. The normalization of the curve typically happens at the onset of recessions. Canada’s curve is much more stretched and with a recession in the horizon, I can’t see big increases in the rents.

These same people elect politicians. There is no way the housing crisis is ever solved, imo.

I think this is a two-fold problem.

i. Red tape and construction costs are simply insane. Tough to really understand it until you actually get involved in it. I am in year three of trying to rezone a property that fronts onto Sooke Rd and backs on to Veterans Memorial into rental apartments. Due to a small change in footprint to accommodate various requests by Colwood staff now wanted updated consultant reports. I had to email 10 different consultants yesterday including the biologist (keep in mind again, frontage Sooke Rd, back of property Veterans Memorial). Consultants replying along lines of

“I can certainly do that for you. I will need to check with our project directory to see if the project is still open because it has been quite a while since I submitted the original report. If its still open I can send you a quick Change Order (CO) otherwise I may need to send you a brief proposal to address the additional works. ”

The fact that the footprint changed by a few feet is probably going to cost 20k+ once all 10 consultants get back to me. Maybe I rezone by year 5, maybe the building is finished in 10 years. You would think rental stock on a busy road that is also a bus route, backing onto a busy road, without a SFH in close proximity would be an easy process in a “housing crisis,” nope.

ii. There is a cultural difference when it comes to three bedroom condos in Victoria/Canada. I follow the market in Zagreb, Croatia as closely as I do in Victoria and the vast majority of new buildings in Zagreb are loaded with three bedroom units.

For example, you can see the floorplans of a typical new condo pre-sale here -> https://www.mesic-com.hr/projekti/prilaz-baruna-filipovica-cankarova/

1 bedroom – 52 units

2 bedroom – 75 units

3 bedroom – 60 units

The reason is people really value being in the city center walking distance to everything including schools, groceries, etc.

Let’s say the price of a brand new 1,000 sq/ft three bedroom condo in Victoria is $1 million. The cost of brand new 2,000 sq/ft home in Sooke is maybe 900k and in Duncan it would be 750k. Equivalent here in Croatia would be $1 million for the condo, $500,000 for the house in Sooke, and $300,000 for the house in Duncan. Therefore, developers build three bedroom condos as people are willing to pay more than SFHs that require commuting.

In Victoria three bedroom condos don’t fly as people will rather drive from Sooke or Duncan, versus pay the same or more for a condo in town.

Yes, legalizing the single stairs seems like a good idea, especially since areas with it (Europe. Seattle) have no excess fire deaths.

Yes, you are correct. I didn’t consider that possibility.

That’s totally logical. If I lived in Colwood I’d likely go to Royal Bay frequently too. My point wasn’t to trash Royal Bay. I actually think it’s pretty nice and will continue to get a whole lot nicer as it increasingly looks more like a neighborhood and less like the giant gravel pit it previously was.

My original point was that there isn’t much in Royal Bay specifically that would have someone travel there from Victoria or Oak Bay (or frankly any of the other munis). However, it is quite close to some things that do pull in people from across the region, for instance (1) Witty’s Lagoon nearby in Metchosin, (2) RRU and Hatley Gardens, (3) big box stores in adjacent Langford

I like how they gave Esquimalt a D+ rating based on the statistics they made up.

Well, and crime. Something I appreciate about Oak Bay is the a+ crime rating. Closer you get to downtown the worse that gets. Colwood is a b-. Oak Bay schools are also rated higher. Colwood does a bit better on cost of living at a d- vs. the OB rank of f.

Colwood is 5th on that list, and, diving into it, will likely rate higher than Oak Bay once Royal Bay is completed, since the only thing bringing Colwood down is the amenities.

People usually end up attached to their own neighborhood unless it has some really detracting features. Negatives get downplayed and that is good I think. There are lots of objective measures to rate neighborhoods. Here is one that has Oak Bay at the top:

https://www.areavibes.com/best-places/british+columbia/?utm_source=new%20west%20record&utm_campaign=new%20west%20record%3A%20outbound&utm_medium=referral

Not following

I live in the core and I can’t think of a reason to visit Oak Bay. People who live there seem to like it though. Just not my cup of tea.

This would be my assumption. I am aware of at least two older woodframe buildings in Victoria that have two level condos. One is on on Hillside, and the other is on Craigflower. Not sure if something changed in the building code between then and now that would prevent these units from being built today, but it’s probably just cheaper to shove everything on one level anyway.

I’ve lived in Colwood for 2 years now and have visited Oak Bay once for a dentist appointment in that time. And now my Dentist has moved to Saanich so goodbye Oak Bay. We go to Royal Bay all the time it has an excellent playground, and I’m looking forward to the coffee shop / waterfront development. We hardly go into “town” now, there’s so much for families out here and beyond. My kid found a purple sea star at tower point last week and we’re heading back there this weekend to look for bioluminescence.

East Sooke has a beautiful and unique wilderness park, Royal Bay less so.

Absolutely. My claim was specific to Royal Bay. Nothing there that would make most Victoria or Oak Bay folks travel there to “spend an afternoon”. Of course the broader Westshore has lots of amenities, albeit many of those amenities exist because of regional or provincial funding (e.g. every sizeable park in or adjacent to the Westshore

Isn’t it true that maximum profit is in smaller units, and most devs want to maximize profit?

The fact that Canada doesn’t allow point access blocks (single stair buildings above 2 floors in height) makes large condos difficult to build.

And the fact we ban townhouses via zoning makes them difficult to build

The lack of family sized multifamily housing is entirely of our own making. Devs would build them if they weren’t effectively banned.

Well, not really. Negative amortization is when the payments don’t cover interest, but you don’t need to get there to increase your effective amortization. If your original payment was $2000 with half going to interest to hit a 25 year amort, then rates go up, you may be paying $1500 to interest and $500 to principal. You’re still covering the interest and it’s not negative amortization, but your effective amortization is now much longer than 25 years

Since you’re looking for an affordable townhouse with “ enough space for families ”…

What’s the matter with these townhouses?

$699k 4br/2bath 1,500sq ft tillicum https://www.realtor.ca/real-estate/26012223/16-3993-columbine-way-saanich-tillicum

$699k 3br/3 bath 1800 sq ft. Gordon head https://www.realtor.ca/real-estate/25922588/27-4061-larchwood-dr-saanich-lambrick-park

With 20% down , $560k mortgage @ 5 % (5 year/25) is $3,418/month.

And then suddenly…..

Mortgage term growing to 50, 60, 80 years is the result of negative amortization. Mortgages in canada generally start at 25 or 30 years of amortization. The amortization period shrinks when payment is more than interest and expands when payment doesn’t even cover interest.

They have that in Canada too. Just not Victoria apparently.

Source: lived in one in my youth.

I think a lot of people from Victoria and Oak Bay make use of the parks, beaches, and shopping in the Westshore.

The allure of Oak Bay is similar to going back in time. It’s a nostalgic trip back to the time of your grand-parents or even great grand-parents.

Looks like the spring market was a dead cat bounce as of right now.

They’re likely only holding until the fed increases again. We’re likely already in a recession though, so maybe not.

I have. East Sooke as well.

You have answered your own question re “allure”. Literally no-one in Vic or Oak Bay would go to Royal Bay to “spend an occasional afternoon”.

Not to say Royal Bay isn’t a great place to live or buy.

LMGTFY

https://www.oakbay.ca/our-community/about/community-maps

BOC Holds rates at 5% – https://www.bnnbloomberg.ca/bank-of-canada-holds-rates-at-5-sees-excess-demand-easing-1.1967700

Who is going to be the first to say something something “dead cat bounce”?

Any legislation that is made to lower the costs of building or land should consider the effects of market forces.

For example. some building lots are subject to GST but if you are carving off one lot from your property then GST is not applicable. So which lot of the two lots sells for more?

Neither, they both sell at the same price.

Removing the GST on a one lot severance only increases the price of the single lot by the amount of the GST. The market place determines the value of the site not government legislation.

The same for construction costs, if by some magic wand the government can reduce the cost to a builder there isn’t a reason for the builder to pass that reduction on to the home buyer. The builder will just take a larger profit as the end price is set by the marketplace. That’s how capitalism works to maximize profits.

We could lower the costs of construction by reducing the energy efficiency of buildings or return to 2 x 4 construction. But home buyers are predominantly paying for livable space. A reduction in building costs is not likely to translate into an equal reduction in the purchase price.

@Zach – that’s a good point. In other countries they have two level condos that are family friendly. There are some places where there simply are no sf homes and even no townhouses. What do people with kids do in these places? The wealthier ones have multi-level condos.

It’s a little disingenuous to imply the issue is that people are “not willing to settle”.

Until a year ago we were in a hotdog with 800 sqft. It was great with 1 kid and terrible with 3 kids. I’m sorry but it’s just not enough space.

The market for “hotdogs” with enough space for families simply does not exist in Victoria. I spent a year looking. The premium on spacious hotdogs without huge maintenance fees and crumbling structural supports is exceptional and it’s actually cheaper to get the same space from a townhome the it is from a condo.

But if you’re open to building large, spacious condos and marking down the price point to compete with townhomes I’d love to buy one from you…

Agreed. However, it’s unfortunate when the politicians with the most freedom to break the political deadlock in support of persistent housing in affordability are resigned to scoring cheap political points instead of taking bold action.

It seems increasingly clear that politicians are unwilling to target the most obvious demand sided drivers of housing prices (I.e. low property taxes, principal mortgage deduction, TFHSA, massive immigration, lenient enforcement of mortgage terms).

Provincial leaders could at least address the supply side without risking their political futures by popping the bubble.

How about a policy where all CMAs greater than 50k must allow “as of right” construction of 4-5 storey units including apartment blocks without any restrictions on setbacks, parking, FSRs, etc etc and for CMAs <50k, a similar policy up to 3 stories including townhomes and apartments. Ideally, the province would block all excessive development fees and taxes for various amenities and other things that cities pass on to developers but really should pay for from general revenues and property taxes.

The provincial government can wield a stick against communities that don’t comply by reducing transfers from higher up to municipalities that don’t play ball (inevitably those towns will either join in or raise their own property taxes to make up the shortfall).

Anyways, it sounds like a pipe dream when we see our leaders at all levels grandstanding about things that are meaningless, like premiers begging the BOC to essentially just follow its independent mandate, rather than having a real conversation about what is needed to achieve change.

It’s too bad anyone with substance and a willingness to openly discuss real solutions seems to be automatically ineligible or unwilling to pursue higher political office.

Right. Nobody in Greater Vancouver would ever confuse the two (unless maybe they’re a recent arrival).

What are the boundaries of Oak Bay?

It’s my experience that people who use the term “west side Vancouver” know exactly what they are talking about, i.e. City of Vancouver west of Main Street (or Ontario Street if you want to get technical).

On the other hand I have heard the term “West Van” used to refer to west side Vancouver. But people who live in the City of West Vancouver, or CIty of Vancouver themselves, would not use this.

we became mortgage free last year after buying our new build for “cash” that was possible only after a few lucky timings on real estate purchases starting in 2015 and putting large chunks of our income/bonuses towards the previous mortgage.

My investments would have provided a better “return” but hindsight is 2020 and i have no regrets either way. Mortgage free is an awesome feeling; not everyone has the risk tolerance in the stock market with large chunks of change, myself included, so paying down debt was a safe way to security and be able to take risks from here or semi-retire by 40 if we chose that route. For now….i’ll wait for a housing crash that will likely never happen.

Thanks Leo!

Pretty sure he means west side of Vancouver, not municipality of West Vancouver.

I wanna join this club! ETA: 1-2 years.

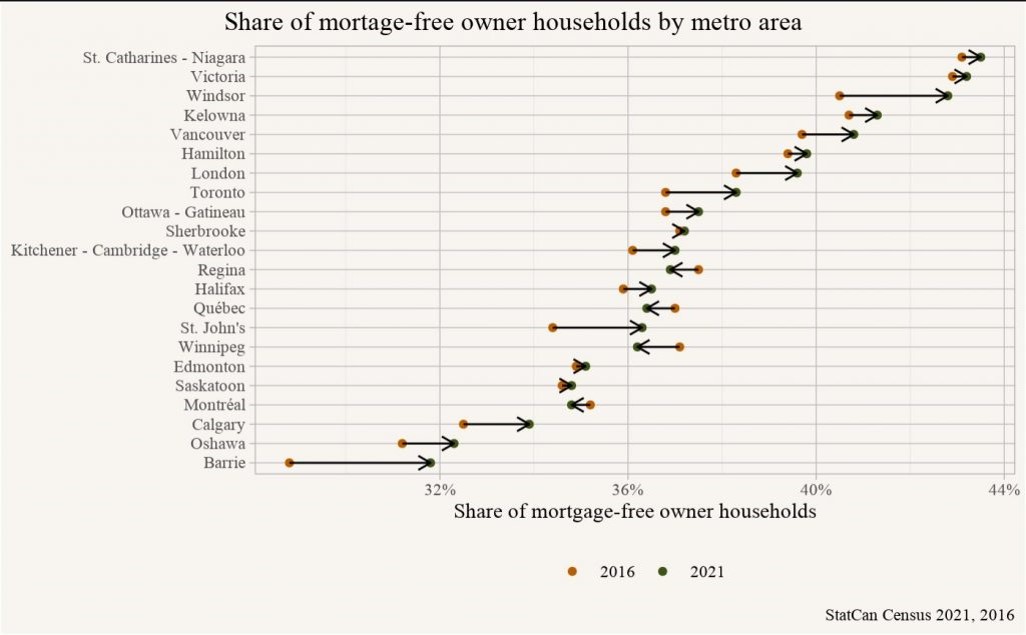

Second highest percentage of mortgage free households in Canada. Note for all properties not just single family

I wonder if they mean the west side of Vancouver or West Van (separate municipality). I am guessing West Van which includes British Properties. FWIW, as I understand it, the developer of the British Properties built the Lions Gate Bridge so his (her?) potential customers had ready access to Vancouver. Anybody remember the tolls on the bridge?

So a median West-side Vancouver house buys you two median houses in Oak Bay. Not too shabby!

High for the same reason Calgary rates low for mortgage free houses. Older owners are more likely to be mortgage free, anywhere.

I’ve never lived in Oak Bay, only drive thru it and spend the occasional afternoon there but can’t understand its allure outside of the really nice pockets. Particularly compared to new neighborhoods like Royal Bay. Obviously biased but wonder if anyone else sees the upside potential in colwood or langford for its better overall quality of life for raising children as the amenities continue to pile up including hybrid/remote work no longer having much reason to go “into the core”

I recall seeing a stat on the high proportion of single family home owners in greater Victoria being mortgage free. If the data is available, does anyone know how it stacks up with other major cities in Canada?

Lot of talk on renewals in a couple years likely hitting many with the higher rates if they stay, but wonder if some areas this could be less meaningful. Probably a wild shot on its impact but more curious if anything.

I would not say that the FV appeals to those wishing to downside from Vancouver. Too much of a culture shock. 🙂

It appeals to those who couldn’t afford Vancouver in the first place.

WW3 …does anyone have any idea what that would look like for the real estate market?

I would not dismiss this comment outright as we are closer than at any time since WW2 and it should be factored in thoughtfully.

I like hot dogs. Nothing better than a smokie with sauerkraut from a road side vendor. Lots of onions too. But I digest.

Governments should be cautious when they announce stimulus programs in Real Estate. Drop the interest rate in the Spring Market and the real estate market could catch fire like a flaming smokie. Do the same in the Fall/winter market and you are likely to get a turkey wiener reaction.

Victoria’s trouble is that the developers are making lots of “hotdogs” (condos, apartments).

But the buyers don’t want hotdogs, they want “prime rib “(SFH/townhouses).