Unemployment is likely about to increase, will it drag on housing?

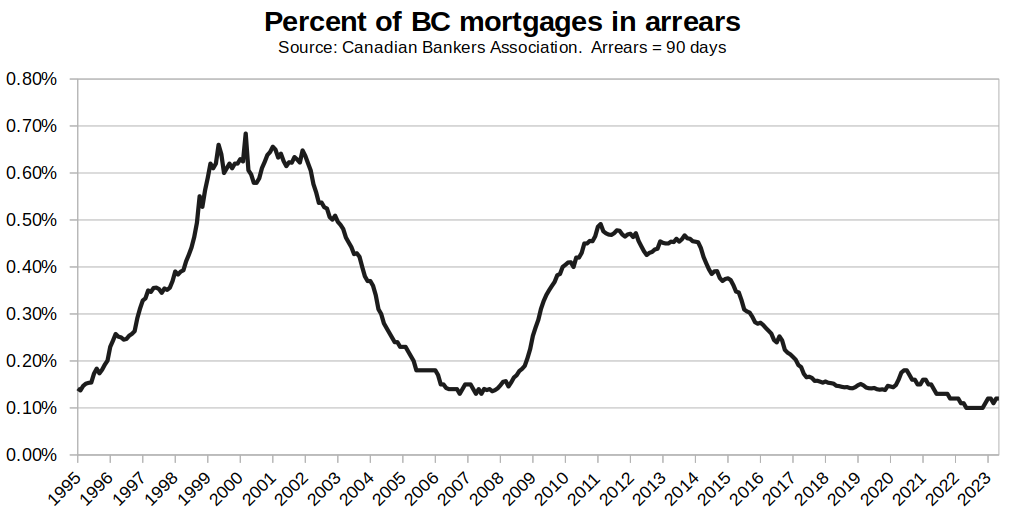

Despite an epic rise in rates in the last year, the rates of mortgages in arrears have barely budged in BC. At 0.12% we are just barely off the all time lows of 0.10% from the end of last year.

Of course we know part of the reason: most mortgage holders have not yet been exposed to those higher rates. Fixed borrowers are still largely on low rates negotiated in past years, while banks have kicked the can down the road for their variable mortgage holders by extending amortizations. Both of those factors are only delaying the inevitable, and short of a rapid reduction in rates (which is seeming less and less likely), existing borrowers will need to face substantially higher payments over the next several years.

The perhaps bigger factor is that there is little reason to default on your mortgage payments when you can cash out for a profit. Mortgage arrears are low now when prices have increased 40% in the last 3 years, and were similarly low in 2008 (prices up 36%) and 1995 (prices up 12% over 3 years, but had more than doubled in the last decade). Though prices are still down a bit from the peak of 2022, most people would have bought at lower prices than today and could sell for a profit rather than go into foreclosure. You can see that arrears rate rise when prices stay flat as in 1995 – 2002, and 2008 – 2014.

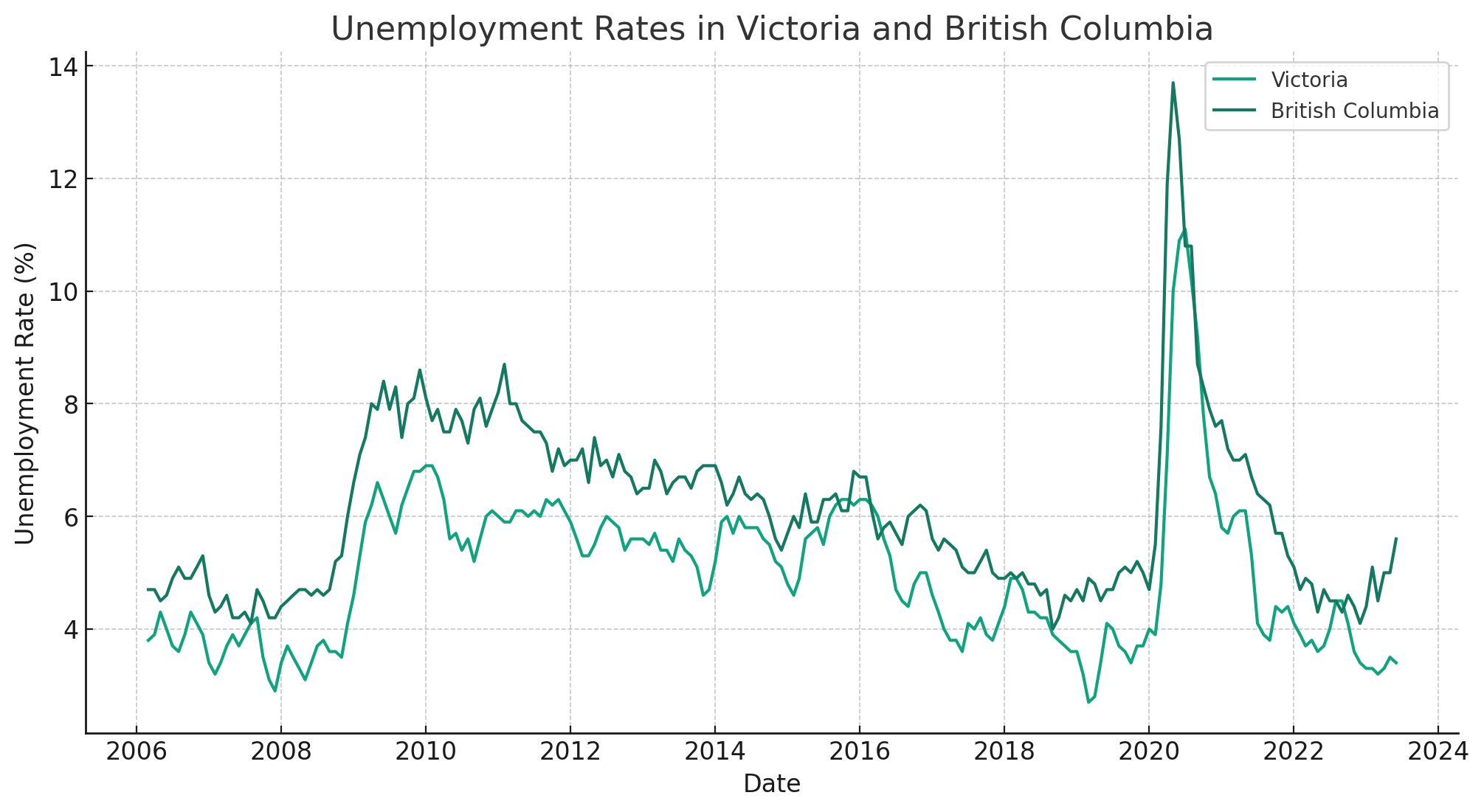

Others will say the most important thing is employment. After all, as long as you have a job you can carry a higher mortgage, or even hang on to those negative cash flowing properties, but once your income is gone that becomes impossible. That makes logical sense, but does it actually bear out in terms of house price appreciation? Are times of higher unemployment correlated with lower appreciation rates in Victoria real estate? Right now, Victoria unemployment is still near all time lows, though BC’s unemployment has turned upward in recent months. Note that in the chart below, Greater Victoria’s unemployment rate is a 3 month average because that’s what StatsCan provides at the municipality level.

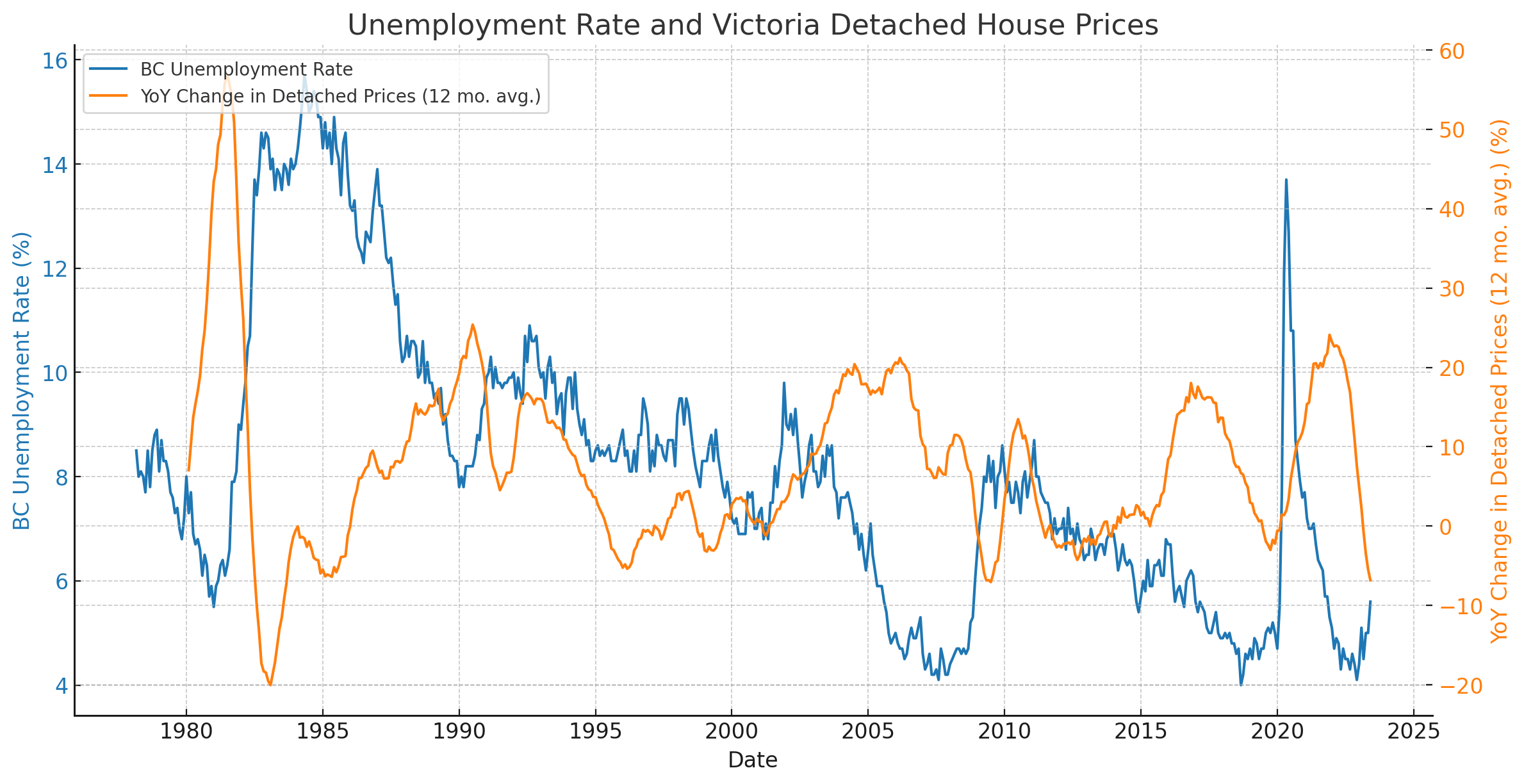

Easily accessible unemployment rates for Victoria only go back to 2006, but we can see that Victoria’s unemployment rate trackes well with the provincial average over time so we’ll use BC’s unemployment rate which is available further back. Next to house price appreciation, it looks like this.

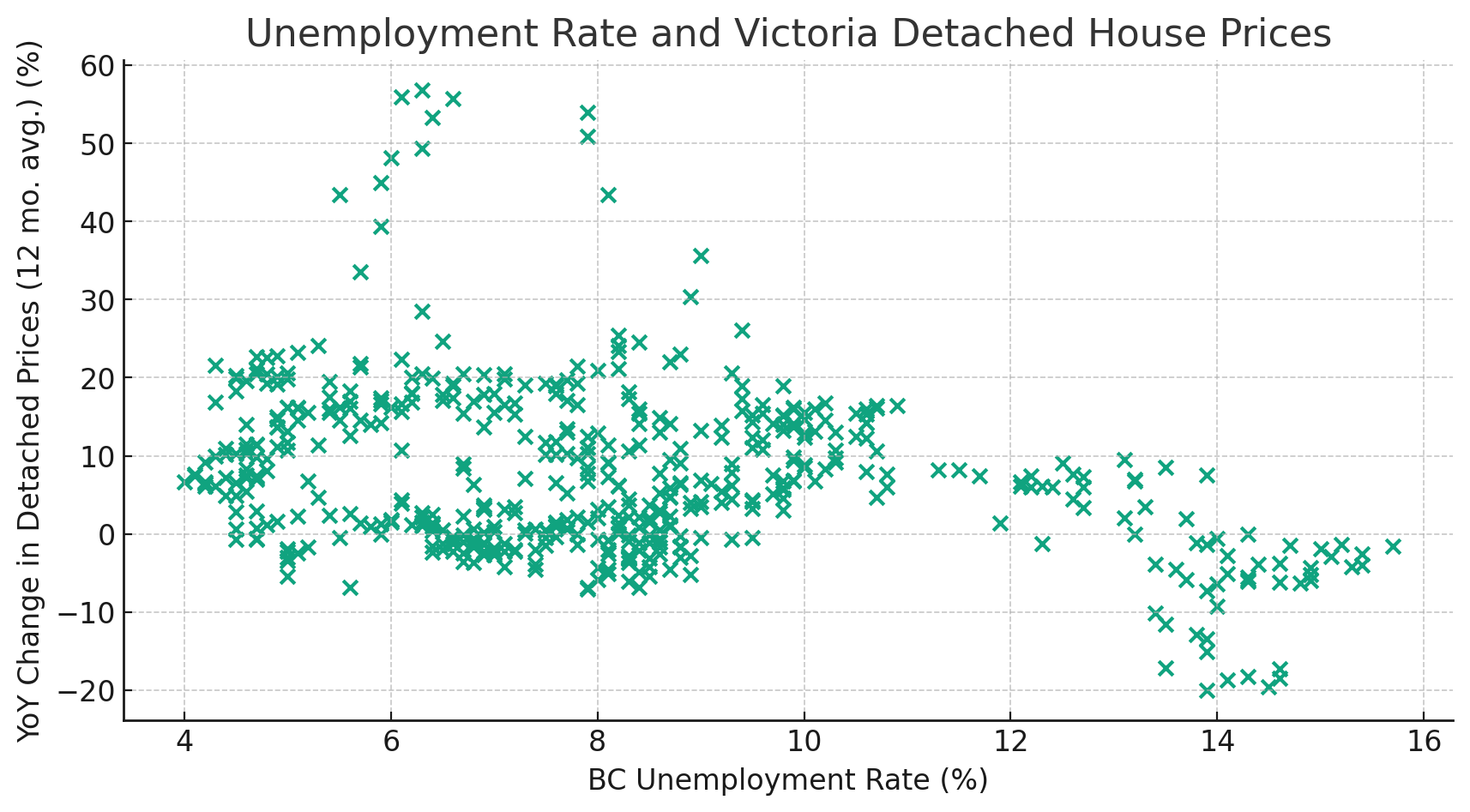

In some periods you can see the correlation. Clearly house prices and the economy both collapsed in the early 80s, however during other periods the connection is far less clear. In the early 90s prices were rocketing upwards at around 8% unemployment rates. 10 years later prices had flatlined despite unemployment at similar rates. In the early 2000s prices actually took off at the same time as unemployment spiked, but then continued rising as unemployment dropped down lower than the 90s level. Between 2010 and 2020 appreciation rates varied quite a bit despite steadily dropping unemployment. And of course during COVID we had a spike in prices despite the short lived unemployment shock.

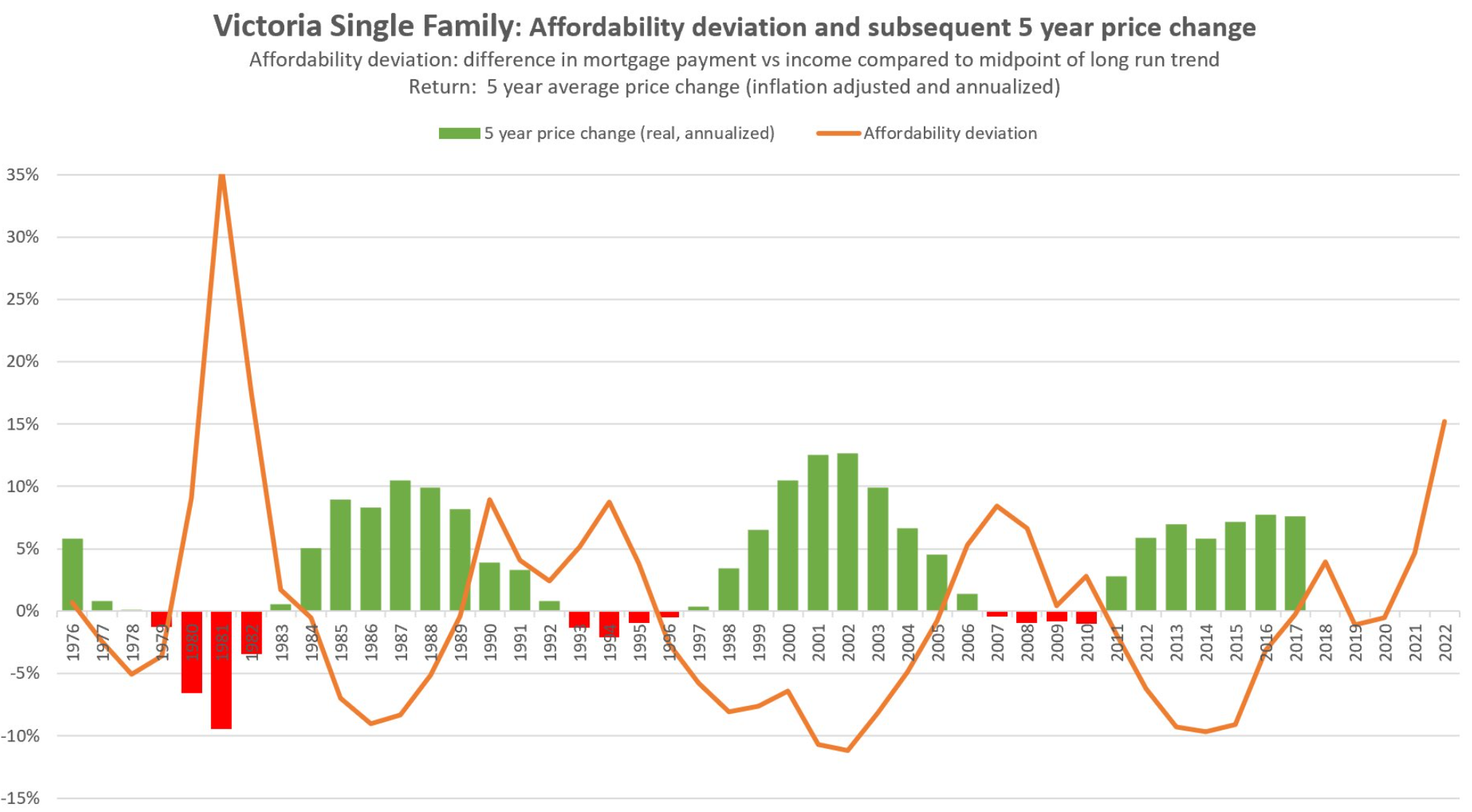

Overall it’s certainly true that a high unemployment rate is going to sideline some buyers and add supply from owners forced to sell. Less demand and more supply is bad for prices all else equal, but of course it’s not all equal, and unemployment on its own doesn’t seem like the most powerful factor when it’s within normal ranges. Affordability still seems to do a lot better as a signal for future price changes.

Also the weekly sales numbers:

| July 2023 |

July

2022

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 148 | 276 | 510 | ||

| New Listings | 283 | 557 | 1101 | ||

| Active Listings | 2344 | 2385 | 2162 | ||

| Sales to New Listings | 52% | 50% | 46% | ||

| Sales YoY Change | +12% | +3% | -39% | ||

| New Lists YoY Change | -9% | -6% | +13% | ||

| Inventory YoY Change | +12% | +11% | +70% | ||

| Months of Inventory | 4.2 | ||||

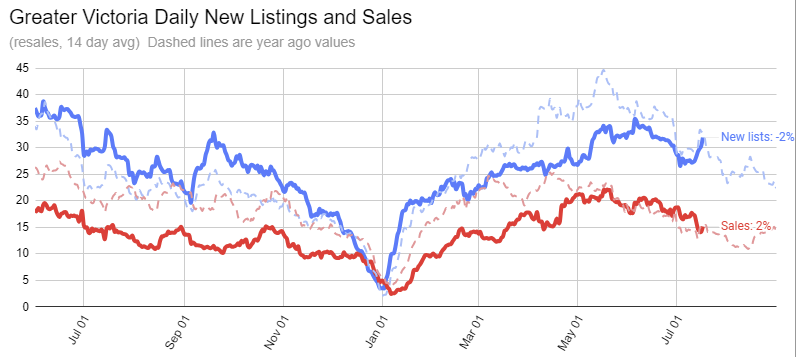

Looks like we may be continuing our slowing trend that we’ve been on, both the more or less normal seasonal pattern as we go deeper into the summer, and eroding the year over year increase in sales that we’ve seen for the past couple months. Looking at only residential resales, both sales and new lists are basically the same as this time last year.

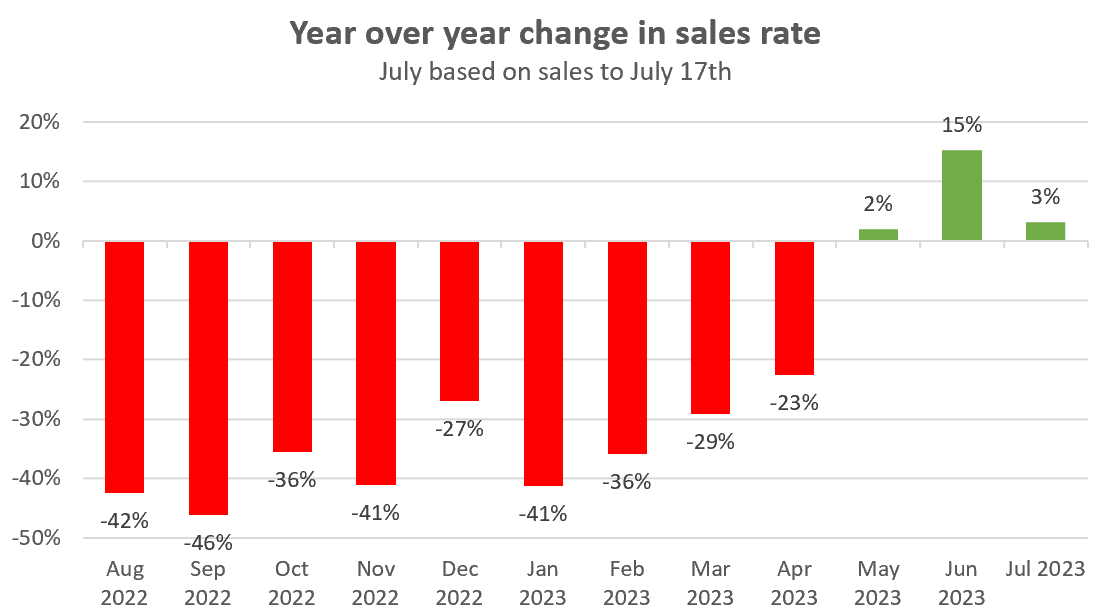

As of Monday we were at 3% higher sales rate than the same day last July, compared to a 15% bump in June.

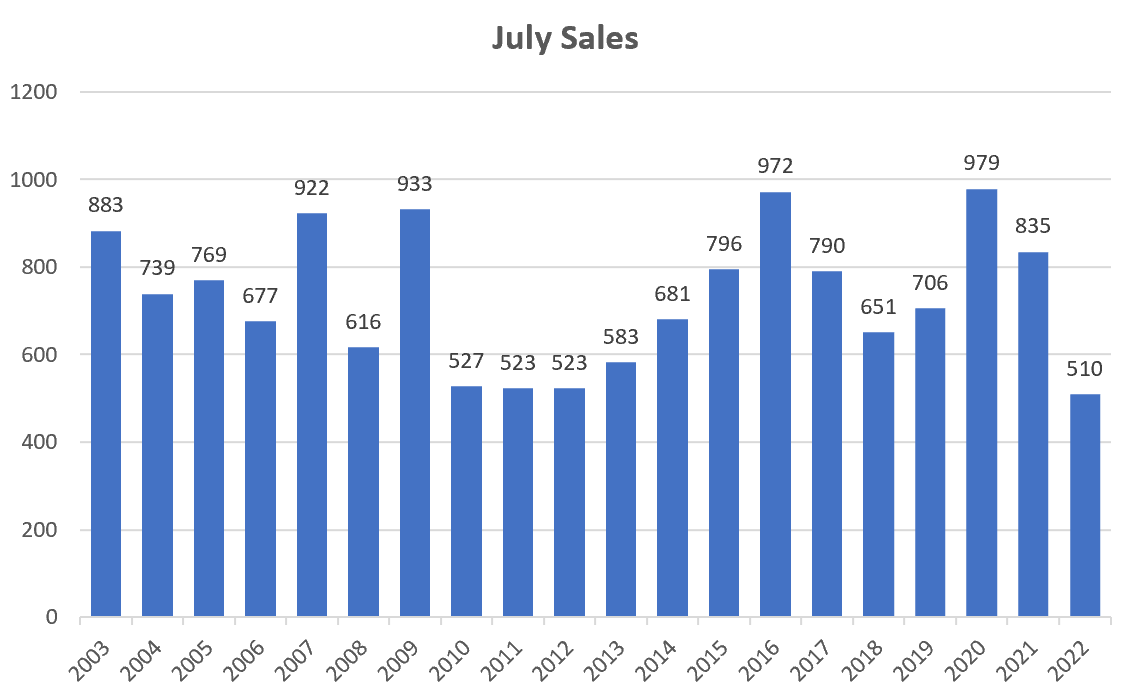

Last July was a 20 year sales low. A 3% increase (if it is maintained for the rest of the month) would put us near the same level as 2010 to 2012. With reports of other markets also turning downwards, setting a new 20 year low remains in reach as well. However it’s worth noting that in those years we had an average of 4000 properties on the market in July, or about 65% more than we have right now. Back then we had a pretty steady buyers market with slow price declines of a few percent a year so in general we would need substantial further inventory growth before one would expect to see price declines despite the low level of demand.

Definitely at least spring for the MLS listing.

New post: https://househuntvictoria.ca/2023/07/24/what-happened-to-the-values-of-seniors-only-condos/

You can skip around the brokerage, just like you can skip around the hpo for building your own home, you borrow the number for a small fee. People do it all the time…here in Victoria.

I understand this is a real estate board, but why would anyone hire an agent to sell your property when all you need is the following:

docuSign.

https://www.docusign.ca/

propertyguys.

https://propertyguys.com/

touchbase.

https://services.touchbaserealestate.com/

There is no need for a face when selling…open houses are a thing of the past.

Thanks Leo!

The one in North Saanich sold 375k over assessed. Incredible. OTOH the Esquimalt one was on the edge of our reach which is encouraging (although the wife would like to be out more in the country)..

You can imagine how many people would sell if there were capital gains taxes on primary residences. None, properties would be passed down from generation to generation.

482 Lampson: $1,295,000

103 – 1964 John Rd: $1,350,000

Out of curiosity what did 432 Lampson and 103 – 1964 John Rd sell for?

The taxes and commission alone make selling stupid, and I’m talking principle residence of 20+ years. Even buying down makes no sense.

“I don’t either, but not because of the policy demands of an unelectable third party.”

I won’t matter the party, whoever it is will do something. Its no wonder there is no inventory, people are stuck…so they ain’t moving.

Listen to this Canadian…

https://www.youtube.com/watch?v=acOpcuuRrV0

Good question. Seems like some pretty basic due diligence on the part of the listing agent, and yet of the 344 pending sales this month, 64 of them still indicated an assessment with a year other than 2023. Marko, what happens when you upload a new listing? Does it pull in the 2023 assessment automatically, or is it still pulling in the 2022 assessment and you have to manually update it?

How have they not fixed this problem? Where an old assessment shows up in the listing? How about a fine for the listing agent if they don’t update the assessment in the listing?

Here: https://www.bcassessment.ca/

Note that when I do median sales/assessment charts I only use sales with the correct 2023 assessment in the listing.

Ahh, got it REaddict, never mind!

Good grief. Federal NDP talking about subsidies for over-indebted mortgagors with 25 year, 5 year variable rate mortgages. “we’re here for you”

What happened to the traditional NDP, that was out to help below average income people?

NDP should be “here for” lower income Canadians struggling to pay rent and buy food.

Ahh. How do you check the actual number then, an important number with sale price vs assessed being such an important gauge of the market these days? thanks!

I don’t either, but not because of the policy demands of an unelectable third party.

https://www.youtube.com/watch?v=PfFUFUH85WY

I don’t think this ship is going down any time soon.

Another source.

A lot of MLS listings still have last year’s assessed value, which was, $1,272,000 in this case. Not sure when their system updates but when you can just look it up on BC Assessment, there’s really no excuse.

If “debt is imploding”, there won’t be inflation.

The debt won’t implode.

https://twitter.com/i/status/1681865281189339136

Really? Huh. There’s an error in the MLS listing then.

4153 Beckwith is assessed at 1.452M not 1.27M

Just incredible timing for the roofers to take our roof off today smh

Oh right I think by panorama street there is that big power line. I would consider lakehill neighborhood to be on par with Gordon Head (between shelbourn and gordon head road not including the ones closer to the water), Mt Tolmi and Maplewood.

Aww, adorable…

VicRE that Lakehill house is pretty close to the big power lines. Deters a lot of people. I’ve seen houses near there sell for quite a bit less in the past.

Sales drop first, followed by listings increasing as investors switch from net buyers to net sellers. The condominium market is the most sensitive to change as investors are highly concentrated in this market segment and less so in the house market.

That is the original lap siding. Looks like the house has had some cosmetic updates in the last decade or two but I wouldn’t call it a refresh.

Ya, strange refresh on that one. Slap on the Hardie board and some new stone on the outside and do some clean up on the inside. However, leave the cheesy stamped textured ceiling and the gawdy interiorer stone work. I guess some like strong contrasts.

If “debt is imploding”, there won’t be inflation.

< Debt won’t implode. At the the first sign of a downturn, governments will print more money, leading to more debt. They did that in 2008 and 2020, and it worked remarkably well, so there’s no reason they won’t keep doing it.

I think the difference between those times and 2023 is the inflation. In fact, money printing in 2020 has proved that sky is not the limit.

If they print more, inflation will ramp up again. There are many factors outside of Fed's and BOC's control: BRICS wants an alternate currency, China wants to avoid the middle income trap (a la Mexico, Brazil, etc.) and grow rich, North America wants to inshore manufacturing, etc. All of these factors will keep inflation high while keeping productivity gains down.

And that’s why real estate prices go higher. Sky’s the limit I guess.

Debt won’t implode. At the the first sign of a downturn, governments will print more money, leading to more debt. They did that in 2008 and 2020, and it worked remarkably well, so there’s no reason they won’t keep doing it.

Look at the pictures. It’s a bit quirky and doesn’t have a suite. Assessed is 1.27m so it’s not a terribly low list. Ought to sell in the 1.2-1.35 range.

Not sure what the deal with this one is in lakehill, I am assuming the sellers want a bidding war. https://www.realtor.ca/real-estate/25830960/4153-beckwith-pl-saanich-lake-hill

Also, it’s strange in what is getting bid up and what seems to be floundering on market.

That or if the pre approval rate is running out.

The scary part of the massive world debt is who it is owed to.

Pretty interesting when set against the malaise of stagnating productivity in Canada. Apparently we’re getting poorer but it certainly doesn’t feel that way with what people are spending!

I think the growth rate is papering over a lot of the weakness. Not that most of the newcomers can afford Victoria, but at 1% of Canada by population and at top 3 munis by price the migration is definitely a big factor. But still, condo market also holding up despite I suspect it is a lot more local buyer driven.

House in Fairfield 328k over asking price….I just find it mind boggling personally. There must be a lot of cash out there that isn’t sensitive to interest rates when purchasing?

Different chart, but I talk about it in this article: https://househuntvictoria.ca/2021/04/06/dusting-off-the-crystal-ball/

Yeah pretty solid week of activity

Month to date:

Sales: 433 (up 14% VS same time last year)

New lists: 843 (up 1%)

Inventory: 2417 (up 12%)

New post tonight

Not sure what Leo will say but my napkin math is now penciling out at a >15% increase in sales over last year?

The secret of success in the last 40 years shown below. When (?) this implodes, watch out.

My guess is that average age of houses sold in Langford / Westshore is less than 10 years but in the core, it is greater than 40 years. But still, houses are about 10 – 20% cheaper in Langford, which can be attributed to smaller lots among other factors.

Anecdotally, younger families prefer the newer houses and they don’t mind living in Langford despite the inconvenience.

Patrick take those raw numbers with a grain of salt. Victoria is an established area of housing with little new construction. Langford is a neighborhood in transition from older homes of nominal value to new subdivisions. That can throw the analysis way off.

Anyone know what 3931 Cadboro Bay sold for? Assessed at $3.5m, recently listed at $6m and now has a sold sign.

I think this is more for investors. Primary residence should not be treated as an investment, who cares if it doesn’t go up as long as you like the house and enjoy it.

That Langford info is incredible.

I notice that a few people have mentioned just putting their cash into a guaranteed investment like GIC’s instead of investing in housing. Obviously this works better for people who are happy renting and may not believe that housing (or the stock market) is going up in value for the next while. If that is you, I just saw that Oaken Financial now has 1 year and up GIC’s at 5.5%. Not a bad deal considering a financial advisor would have to make you pretty close to 7% to meet that after allowing for their fees.

QT, I’m just not a happy commuter. I’d always hope to live within a 15-20 minute drive of work.

.

Sold Price, Median

Area 2019 2020 2021 2022 2023

Victoria $877,000 $945,000 $1,100,000 $1,322,500 $1,216,000

Langford $679,000 $767,500 $938,000 $1,162,500 $1,140,000

source VREB

Home prices in Victoria are up 39 percent since 2019.

In Langford they are up 68 percent.

House prices in Victoria are down 8 percent from last year

In Langford they are down by 2 percent.

This year $1,140,000 in Langford would have bought a 2,526 square foot home on a 5,925 square foot lot built in 2011

In Victoria $1,216,000 would have bought a 2,080 square foot home on a 5,600 square foot lot built in 1929 but most likely remodeled.

I’m not saying I feel this way. However, if I were to put myself in a couple’s shoes that are now 38 years old. Say they bought a brand new home in a nicer area of Langford/Colwood when they were 30. They paid $500K. It had and still has all the bells and whistles. Open floor plan, quartz counters, 3 gorgeous bathrooms, huge kitchen with island, thermal windows, double garage and a lower level that could easily be made into an income producing suite. They’ve gotten used to using the shopping centre three blocks away and Costco. Their kids are happy with their school. Now their house may sell for $1,100K. They think they want to upgrade (heaven knows to what), and they have been looking in Victoria because everyone says it is better to live in town. Would they really feel they were upgrading by paying $1.8 million for a old house in Fairfield? I mean they are used to all this fancy stuff. Yikes, now they’ll have to live with only 2 baths, one single old detached garage and they can’t upgrade the kitchen and baths without spending a fortune on re-doing all the plumbing through out the entire house and right down to the street as well as have the entire place rewired. I would say many couples in their late 30’s to early 50’s are faced with this dilemma.

Each to their own.

Many people including myself chose to live outside the city for many reasons.

For me,

1. First and foremost is a much nicer view, peaceful, no petty crimes, no homeless, or filth/needles on the streets.

2. Much more value for my money (1/2 acre lot, and almost 4000 sfh).

3. Coffee shops, bakeries, shopping within walking distance or 5-10 minutes drive and plenty of parking.

4. Commute to/from work is exactly the same amount of time as living in the core/Oak Bay.

5. Quick access to the highway.

Perhaps those are the one of the many reasons that drive the price of housing higher outside the core. And, perhaps prices outside the core are catching up, since the core has been rising at a faster pace for the last several decades.

I feel like the areas outside the core were where people turned when the core got too expensive and the house prices accelerated more there. The core, particularly Victoria listings, stalled a bit in comparison and now they seem higher on the west shore,but of course aren’t really comparable because they are newer. I’m surprised they’re not falling faster now but perhaps we’re not there yet. I saw the affordability draw but don’t really see it now when I compare occasional listings. Unless I worked out there I can’t really see living there myself.

That question is interesting Barrister. If you have a PCS for both areas, you can look at a home in Bear Mountain.

Say MLS 934201, 1135 Timer View. Now if you go into “view details” then into Trends, there is a lot of information in the graphs and tables there. If you compare say the average sale price in the past 12 months for a 4 or 5 bedroom home with the same in Fairfield, you’ll see that Bear Mountain homes are going for a little more than the Fairfield ones. That particular home on Timber View sold for $690K in 2014. Now they are asking $1,750K.

Houses on Bear Mountain seem to be both selling well and commanding a really good price. I am wondering if over the last five years whether these Bear Mountain homes have increased in price at a faster rate than homes in Fairfield or other parts of greater Victoria. Is there any charts or stats for neighbourhood comparisons?.

Your point about demand is correct, but the discussion was about rate of investor ownership, not demand.

We often compare the stock market to the real estate market. But it isn’t a perfect comparison. Every common stock in a company that you purchase is identical to every other stock. That’s not true with Real Estate. There is a large variety among houses in house size, lot size, condition, location, and other amenities. Housing, especially in older neighborhoods, are far from identical.

Houses in newer subdivisions in the Westshore have less variety as they are similar in most physical and locational aspects but they still vary from each other. One may front along a residential collector road and the other may be on less travelled cul-de-sac lot within the same development. Even in these homogenous neighborhoods, near identical homes can vary in price by 20 percent.

A lot is masked by simply looking at average home prices. The average price today may be the same as it was six months ago, but what people are buying may have changed. If they are now buying smaller and older homes than they were six months ago that is a decrease in value, although the average price would indicate prices are stable.

For example, six months ago prices for a new 2,000 square foot without a suite may have been higher than for a home that is similar in most other aspects but the home had a suite. Today that could have changed and the 2,000 square foot home with a basement suite is more than the near identical home without a suite.

One storey no step ranchers are popular among retirees if we are having a surge of retirees coming to Victoria that will push those ranchers up in price. If the need is shifted to younger families that need additional rental income from a suite that will shift prices higher for homes with suites.

Both the stock market and the real estate market use the same mathematics and economic principles, but there is an additional complexity with real estate as well as subjectivity in any analysis.

As an old boss said to me . You’re only an expert in real estate for six months at a time. Then things change and you have to start all over again.

Well the stock market always has 100% investor ownership through booms and busts. But the people buying aren’t the same people selling at any given time.

Same with RE investors. If added supply from investors selling isn’t matched by added demand, prices are going to go down. Investor ownership could well go up, but that doesn’t mean higher investor demand. Remember demand is how many people are willing to pay how much, not just how many people are buying.

When home prices fall to the point that investors receive a positive return then investors will re-enter the market and stabilize prices. But the return on their down payment would have to be at least equivalent to other non real estate investments such as GIC’s or long term bonds.

Today it’s necessary to put a large down payment on a condo so that the rent covers the annual expenses. Instead you could put the down payment into a GIC and get a 4 percent safe and secure return or REITs at 7 percent. Prices would have to fall significantly before investors would step in to stabilize prices to obtain an equivalent return on their equity.

Other factors would also effect real estate investors decisions. What you’d likely find that is that price declines would overshoot before investors re-enter the market. After taking losses on real estate, investors’ confidence in real estate would be shaken and it may take a long time for their confidence to return. The price has to be so good, that an investor would say to themselves that they couldn’t pass on buying the property as there was no where else that they could get a better return.

It depends on what effect the increasing rates have on employment and vacancy rates. If interest rates and employment are rising and vacancy rates are falling then we have price increases. If interest rates are rising and unemployment is rising and vacancy rates are rising then we have falling prices.

It’s not just one factor alone. It’s a combination of factors that leads to price increases or decreases.

In the beginning of 1980’s interest rates were rising but employment was good. Not until employment fell and people were leaving BC for jobs in Alberta and Ontario did prices fall.

We saw falling interest rates with falling home prices because unemployment and vacancy rates were not improving in BC.

It’s the combination of factors and not just one factor alone.

The same for immigration. What type of immigrant is moving to BC. Retirees or 20 to 34 year olds. It makes a difference to the economy. Younger people are spenders and older people tend to be savers.

Housing busts have seen falling home ownership rates (HOR). Which means rising investor ownership rates. Recent examples are USA (HOR 69->63%) and Ireland (HOR 76->70%). I’d expect the same thing in Canada, if there’s a housing bust, home ownership rates will fall (and that means investor ownership will rise).

Teranet house index for June up big again. https://housepriceindex.ca/2023/07/june2023/

+ 3.03% MOM for Victoria. This puts Victoria +8.24% for the last three months of Teranet (march 2023 vs June 2023), and down only -5.59% from the May 2022 peak.

other MOM changes ….

2.57% for Canada

+3.95% for Vancouver

+1.96% for Toronto

Many people here have expected prices to keep falling with rising rates. We saw that with the mostly bearish HHV predictions for house prices in 2023. But historically, it’s been more common to see rising prices with rising rates. Typically, prices fall most after rates have peaked and are falling. That was the case in the 1980s in B.C. Historically, if we see a failing economy with unemployment that will lead to lower prices (despite falling interest rates).

——

Anyway, so far in 2023 we’ve seen another example of rising interest rates and rising house prices.

It is interesting to read this blog’s articles and the comments on the speculation of whether house prices will rise or fall. However, even if we have a bit of a recession and median price of house decreases, it appears unlikely to solve some of the underlying problems that have got us to where we are.

More people wish to buy a home in Greater Victoria than can afford to and prices have been rising accordingly.

There are well intentioned members of the public and politicians who hear about a reasonably sounding goal and don’t stop to consider that some goals are at odds with each other.

High immigration AND less demand for housing

Anti fossil fuel policies that drive up fuel prices (carbon taxes/higher gas taxes/limiting pipelines/divestment) AND lower costs of housing materials that are impacted by increased preparation costs (mining/logging/manufacturing/milling/transport)

High pace of affordable housing builds AND tight regulations on where, when, and how to build (ALR, slow and expensive rezoning, nimby, hand deconstruction, tree bylaws, extensive building codes)

Investors are the key to the real estate market all across Canada. In Victoria thousands of condos have been built in the last decade and some estimates have investors owning 40 percent of them.

If BC were to slip into a recession that’s a lot of condos that could come onto the market. But which would happen first? Would investors selling their condos push us into a recession or would a recession cause investors to sell their condos?

Condominiums have always been the weakest link in the real estate food chain.

@Kristan – what I’ve learned from this is that you get a lot more value for your money in Sidney or North Saanich! My crappy old house is worth near some of those given it’s location only and is much less nice.

Regardless, I think you’ve got a point. Why would these people sell so quickly, and at a loss? Obviously some people need to move for major life changes such as work, family health etc., but there can’t be so many and I would doubt that any of these are tenanted houses being sold by investors.

Here’s some examples (not under serious consideration by us but that I noticed along the way):

https://tinyurl.com/yy3dcu9u

https://tinyurl.com/syxadv6d

https://tinyurl.com/3ndvfww2

https://tinyurl.com/2p8c37k2

https://tinyurl.com/2jp5y4w3

(I converted the realtor.ca listings to tiny url’s so that there’s no way web crawlers can pull up this discussion if someone searches for the address; I’m putting them down though to ground this subthread in some data.)

The third one is the only good candidate for an investment property I see. The last one is actually on our list if the owners regain sanity (they’re trying to sell at 500k over assessed). 1-4 look like good candidates for distressed sellers.

This set of four-five houses is drawn from the subset of 31 3+ bed 1 bath+ houses in central or north saanich/Sidney listed below 1.4m. Not great statistics, but a decent sample.

What I’m really curious to see how it plays out is if these people are able to recoup something close to or even above their 2021/2022 purchase prices. Seems crazy to me, but with inventory being so poor..

@Dad, yes I also consulted my crystal ball this morning! I’ll continue to remain bear-ish while admitting that I won’t be surprised if somehow by the summer of 2024 house prices are up another 5-10%.

@Kristan, I’ve noticed the same, especially in the lower end condos and whatnot. Bought in 2021/2022 and selling now for roughly the same. After fees and whatnot, it’ll be a loss and I can only speculate that they are investors taking losses.

Already mentioned per Insider contacts

https://househuntvictoria.ca/2023/07/10/ai-guest-post-is-there-seasonality-in-house-prices/#comment-103756

Something I’m noticing a decent amount in our search are people that bought in 2021 and are trying to sell very close (or sometimes in wild excess of) their purchase price at that time. There’s three properties that have shown up on our radar in that category, out of the 1-2 dozen that have been under more serious consideration. With friction, selling at the same price as then is taking a loss, so perhaps we’re already seeing some effect of distressed sales?

I thought last year that prices might decline a bit more, and that we would be in a recession by now. lol.

I continue to lean bearish though, mostly because of the moral panic about post-pandemic inflation and aggressive rate hiking in response. Turns out that some part, maybe a large part of inflation was driven by transitory factors. So now you have inflation coming down close to target — in Canada and the US at least — without the full force of these aggressive rate hikes coming to bear.

I figure the recession will start once there is a broad consensus among economists and central banks that a soft landing has been achieved.

Then why do you whine about it so much?

Maybe hang out somewhere else than a housing blog.

You’d think less people would live in less desirable cities… but apparently three times as many do.

I said this on the last post but I’m becoming a bear on both housing and the economy in the short term (6months-1year). I’m seeing cracks in a lot of areas of the economy. While Victoria might be insulated from it somewhat with our amazing weather and livable location, I’m calling a small pullback or at least a levelling out of prices in the local market, and potentially market drops in less desirable cities (Edmonton, Regina etc.)

I just can’t see the charade keeping up for much longer as people’s pandemic savings run out and mortgages come up for renewal, and a small thing of spinach is $5 at Superstore.

Whatever-You must have gone to the same school as Trudeau. I’m fine with immigration, I’m just fed up with listening to people whine about high real estate prices, ridiculous rents, a broken health care system, homelessness, and inflation. Inflation is caused by increased demand, but I guess they didn’t teach that at your school. Bringing in a million people a year is not going to solve any problems. Get that straight.

Didn’t you just state (read your own post) that there is going to be an increase in unemployment? Be consistent.

Introvert-Sounds like my cottage. Only 800 sq. ft. $700 a year property taxes, $123 a year hydro. Can’t live any cheaper.

local chinese money is here to stay and invest in land development no matter what the immigration from other places coming or not – one guy holds about 100M cash( made his money from vancouver development) just moved here and first thing he is thinking to put his money into dirt around town.

a few other deep pockets from Vancouver with china’s land developer also moved here on the island. they are using cmhc’s money to built 2500 units in next 10 -15 yrs. we shall see what is coming up as rentals

Well Frank, one way to lower the Canadian debt would be to increase the tax base through immigration. More workers results in more taxes paid and an increase in spending on goods and services.

Bet you don’t like that answer.

100 square feet, composting toilet, no running water(?) for $1,000 a month.

https://www.facebook.com/marketplace/item/818348209919750/?ref=browse_tab&referral_code=marketplace_top_picks&referral_story_type=top_picks

What do you think our government is using to keep the lights on? Credit. That’s getting more expensive with every rate hike.

New data ta show financial stress is forcing more Canadian businesses to fall back on credit cards to make ends meet.

Equifax Canada says its business credit trends report for the first quarter shows an “alarming” pattern of credit expansion and “significant” shift in credit use among Canadian businesses.

The outstanding balance on bank-issued instalment loans fell by 2.4 per cent, the first decline since 2019 when the credit reporting agency began monitoring this data.

At the same time, credit card balances rose by 15 per cent and lines of credit increased 11 per cent.

“It’s never a good sign if you’re using a credit card to keep the lights on,” said Jeff Brown, head of commercial solutions at Equifax Canada.

The report says this is occurring mainly in trades located in British Columbia and Alberta, suggesting that businesses in these regions are particularly challenged .

For the past two years, business starts have increased in the first three months of the year as the economy recovered from the pandemic, but this year there was a “noticeable dip” at the start of 2023. At the end of February, startups were down year over year by 16.5 per cent in Ontario, 14.2 per cent in British Columbia, 11.4 per cent in Alberta and 7.5 per cent in Quebec.

It will be the case until later in the year. Those year over year cpi figures are subject to base effect (what were moetgage rates last june?), annualizing the month over month numbers often provides a more accurate picture.

BoC – BOHICA 06 September 2023

Let’s selectively ignore inflation from some components, and there will be deflation. Let’s exclude food – who needs to eat? Now, we are at 1.7%.

https://www150.statcan.gc.ca/n1/daily-quotidien/230718/cg-a002-png-eng.htm

The purpose of measuring inflation is to estimate the cost increases faced by the citizens regardless of the source of the cost increase. Services are still running high at > 4%. Almost 2/3rd of the economy is services. This component is unlikely to go to 2% anytime soon.

But the Bank must continue to “act forcefully” to “restore credibility” because narratives are more meaningful to people than data.

Reading news articles on Canada’s inflation for June, and there’s reference to mortgage costs being one of the remaining high inflationary pressures. But this is only because of BOC inflationary policy. So now BOC is a main cause of inflation and also raising interest rates in response. Baffling!

Barrister- My point is a response to Leo’s post concerning unemployment. Hundred of thousands of seniors are still working well into their seventies. I know 2 guys who are 70 and still work. One has been with the railways since he was 15. He’s loaded, makes a huge salary and collects a pension. The other has worked at the same place for 43 years, was going to retire but after a two week break, he was bored so he decided not to retire. My medical doctor friends are still working, most of them part time. Their services are desperately needed and replacing them is extremely difficult. Let’s not forget the government’s “need” for more bureaucrats. If you have the right skills ( and want to work), there will always be a demand.

As for being envious, I’m not a traveller, it’s a pain in the ass. Plus I stopped working full time at 42, 25 years ago. Turned my hobby into a business that requires minimal time to make a decent income.

The COV moves pretty quickly on the important things. I noticed at my library branch today that they have installed a menstrual-products dispenser in the men’s room.

But of course 4.5% interest isn’t enough for Marko, so he will always choose to put himself through hell to make x percent more, with the added benefit of getting to complain endlessly about dozens of things, which seems to be half the fun for people like this.

Try to stay on the topic Jimmy.

Hi Leo, I am having a hard time understanding graph number 5,” Victoria Single Family Affordability Deviation and Subsequent Five Year Price Change”. When you have the time I would appreciate if you could explain it a bit more. Thanks!

We had even less inventory last year and still saw price declines.

Then MJ make the City an offer of $100,000 to expedite your approval.

Talk is cheap.

Also the uncertainty. As someone looking to buy a MMHI property I would pay >100k more if I could buy a property and get a permit issued for a stock plan within 30 days, but such is not the case. I am estimating 1 to 2 years of BS to get a MMHI project approved. The non-sense is just mind boggling in terms of how the COV operates. They will email you after 6 months that hose bibs need to be drawn on the plans. It will take 2 minutes for the designer to add the hose bibs and re-submit and then the COV will take another 3 months to get back to you.

Then you have to deal with removing the tenants in the teardown and being the bad developer. Then there is the aggravation of the construction, etc.

Might as well just have cash sitting in a bank at 4.5%.

I am calculating more like 10% increase over last year at the current pace. The last day of the month is a Monday which is typically good for 30-35 sales.

Is this a late April Fool’s post? You think something as trivial as people not having jobs would slow down housing in Victoria? Ha ha, please! Nothing will slow down RE in Victoria – people will just borrow more from their parents’ HELOCs and the market will keep chugging along. 1,000,000 new RE fans are brought in to the country each year… half of them are students and they seem to be able to buy houses alright. This post is too silly, bring back the AI.

Frank, other than describing what sounds like some hard working successful seniors (with what sounds suspiciously like envy) exactly what is your point.

I know, interest rates are no longer free money, that gravy train has left, but interest rates should be a couple of points above inflation. Buying a house has never been easy and I am not sure that it is any harder yet but lets repeat all the arguments again.

Just heard this on BNN- U.s. home builders are building fancy homes for fancy people. Luxury markets have higher profit margins, would you rather run a Dollar Store or a Tiffany’s? There seems to be lots of money for travel, I know a few friends that are spending tens of thousands on overseas trips. In fact, my neighbors at the lake have just purchased a new condo in Mexico. Coincidentally, they have all lived in their long paid for houses for decades. They also welcome higher interest rates on their savings.