Mortgage rates are up, does it make sense to pay it down?

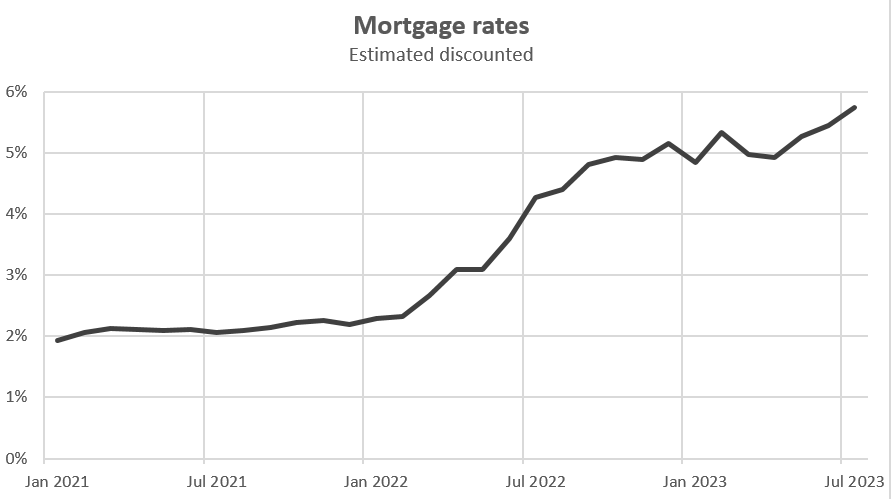

Two years ago the average Canadian borrower was paying just under 2% for a new mortgage while bank accounts were paying near zero interest and GICs were in the 1% range. Convential wisdom was that this rewarded borrowers who could borrow for essentially free while punishing savers that had money molding away instead of growing. No one was interested in paying down mortgages, because after all why pay down that so called “good debt” at historically low rates?

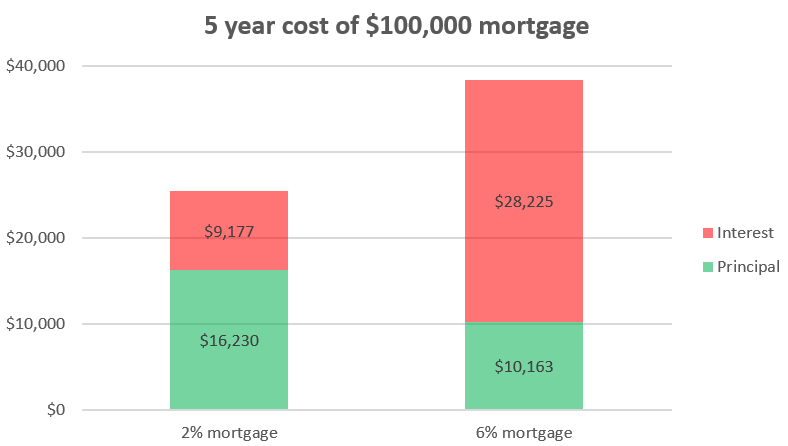

Well the situation has changed, and now the average new mortgage is approaching 6%. That bank account is still paying squat, but you can get a GIC or HISA ETF for 5%. With Canadians being squeezed at renewal and a lot more of that payment going to interest, reducing those debt loads starts to look a lot more attractive. After all, 5 years on a $100,000 mortgage at 6% will cost you $28k in interest, compared to only $9k at 2% interest.

Of course if you are squeezed on cash flow or forced by your lender to pay down some principal, there is no choice in the matter. In addition there’s non-financial impacts of debt and if you’re not sleeping because of the mortgage payment that may tilt the scales towards paydown. But what if you simply want to decide which is the better use of extra money? Has the situation actually changed between the days of 2% mortgages and today’s 6% reality? It’s less clear than you might think, but I’d say there’s a good case to be made that there’s little difference.

Firstly, it’s not a question of pay down the mortgage or not, it’s a question of paying down the mortgage or investing the money elsewhere. Paying down the mortgage is both a guaranteed and after tax return in exchange for a loss of liquidity. Due to that after-tax nature, it’s worth noting that whatever the mortgage rate is, you would have to earn more in an alternative investment to match it. How much more? Depends on your effective tax rate, which hinges on where those investments are held (TFSA, RRSP, RESP, taxable accounts), what they are (Canadian stocks, US stocks, international stocks, bonds, etc), your income, and the source of the returns (dividends, capital gains, interest, etc). Talk to your investment advisor and accountant to get the estimate for your own situation, but it’s a significant factor.

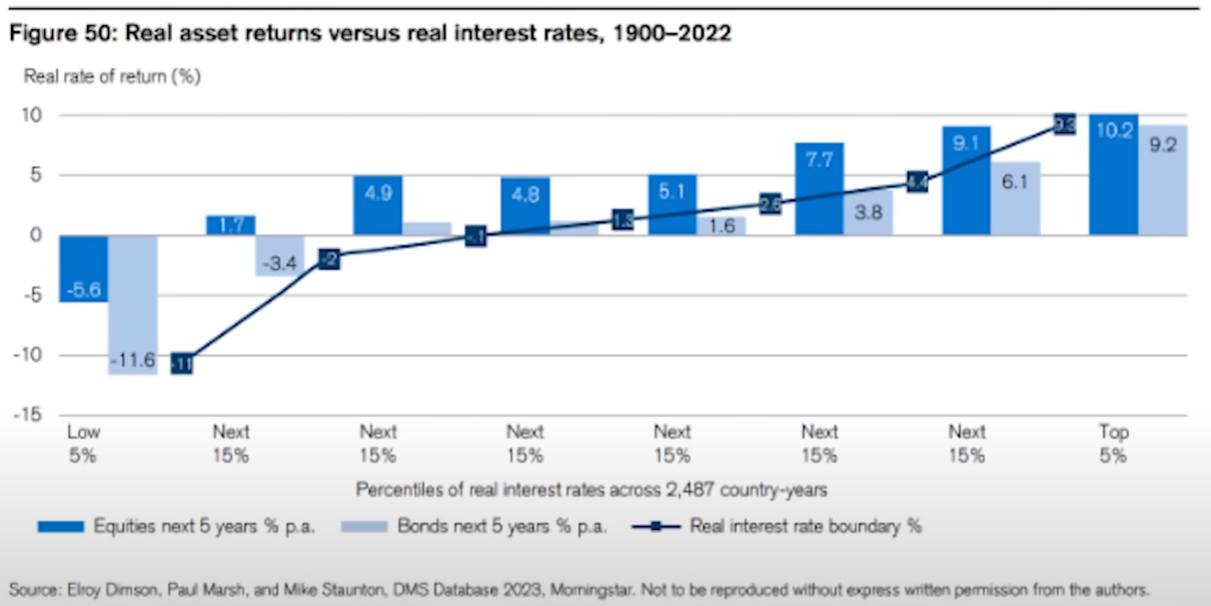

There are a lot of different perspectives on expected returns in investable assets, but generally estimates and data fall in the 5-10% rate over time depending on many factors. That implies that it makes zero sense to pay down a 2% mortgage, but a lot more to pay down the same at 6% especially considering it’s risk free nature. However to look a little deeper we have to examine where those returns in riskier assets are coming from. In theory, when you hold equities, you are being paid to take risk. Equity returns in the long run are expected to be:

Expected return = risk free rate + equity risk premium

With the risk free rate being the return on cash or short term bills, and the equity risk premium the market value of you taking the risk of holding an asset with volatility. Thus when rates and the risk free return goes up (as they have done), the expected return for equities also goes up. Arguing that expected returns don’t increase would imply that the equity risk premium shrinks or disappears in a higher rate environment, which seems unlikely. This is born out in the data on global returns, where real returns increase with increasing real rates (chart below). For a longer discussion of this, please listen to this episode of the Rational Reminder podcast where they go through the evidence in more detail in relation to cash but the logic is the same.

So the choice to pay down a mortgage may not be as dependent on the actual rate of today’s mortgages, and more by your risk tolerance for your other investments and personal values. An exception would be if your mortgage rate is out of step with current rates. In other words if you’re riding a 2% mortgage from before rates jumped it would make little sense to pay it down, and conversely if rates drop and you’re locked in to a high rate it may be worth accelerating payments (especially if you have a high penalty to break the mortgage).

Personally, we value the peace of mind, so we paid extra on the mortgage regardless of when the rate was 3%, 2%, or 5%.

If you have a mortgage or plan to have one, how do you prioritize mortgage paydown relative to other investments?

Also the weekly sales numbers:

| August 2023 |

Aug

2022

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 104 | 202 | 341 | 478 | |

| New Listings | 231 | 465 | 712 | 980 | |

| Active Listings | 2398 | 2454 | 2460 | 2137 | |

| Sales to New Listings | 45% | 43% | 48% | 49% | |

| Sales YoY Change | +25% | +15% | +18% | -42% | |

| New Lists YoY Change | -2% | +7% | +9% | +10% | |

| Inventory YoY Change | +11% | +12% | +13% | +90% | |

| Months of Inventory | 4.2 | ||||

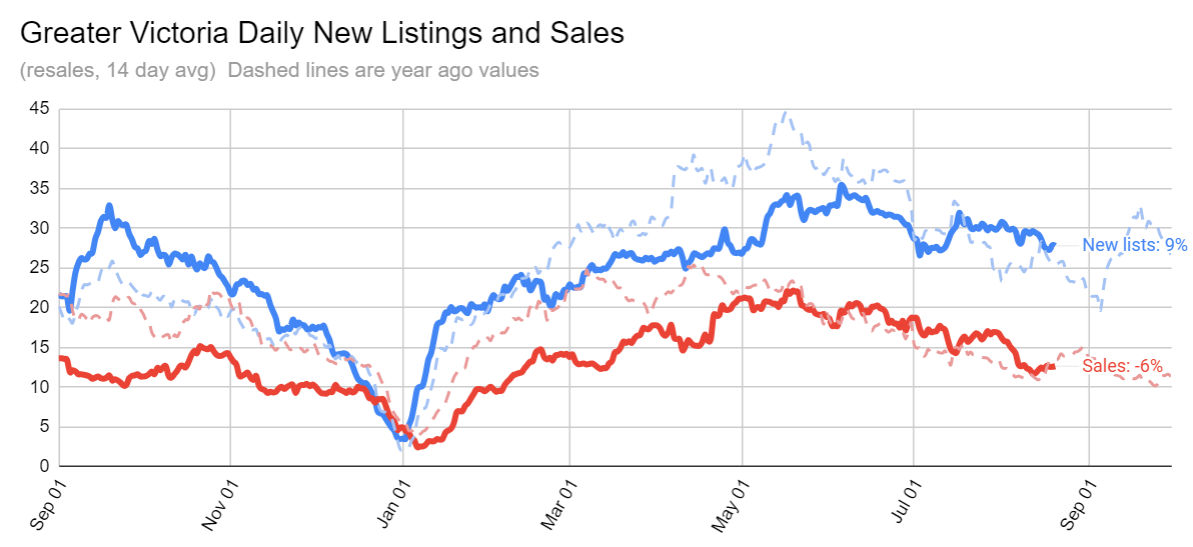

A bump in the sales rate last week looks very similar to last August, where there was a bump in activity in the latter half of the month. At a 48% sales to list ratio, we are close to the conditions a year ago, and will likely end just a bit tighter.

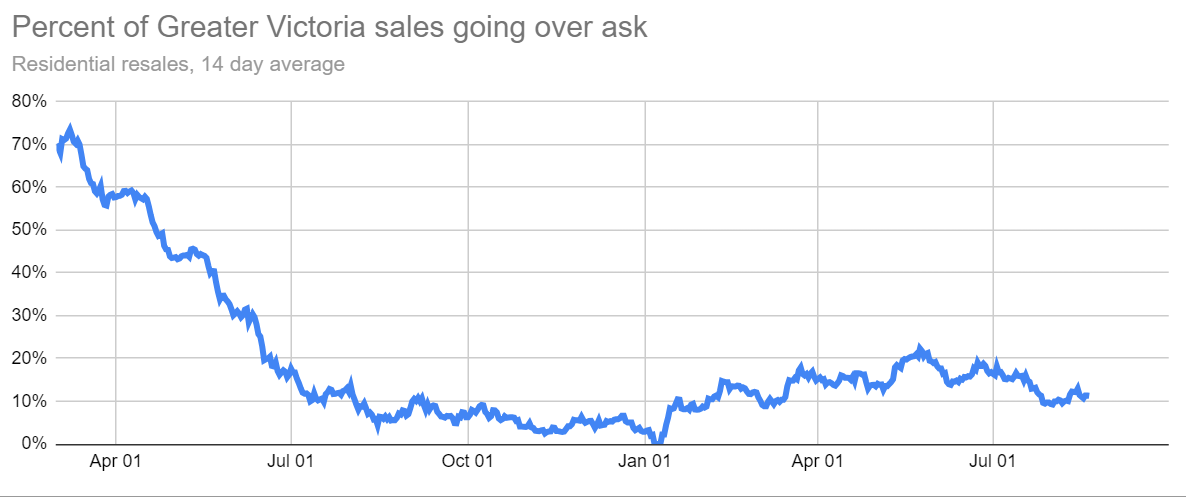

The rate of over-asks has been hovering around 11% this month, slightly higher than last August’s ~6%.

Meanwhile bond yields are on a bit of run, moving outside the range they’ve been in for the prior year. That’s pushing up fixed rates, while somewhat higher than expected inflation prints are keeping the chance of another rate increase in play for September.

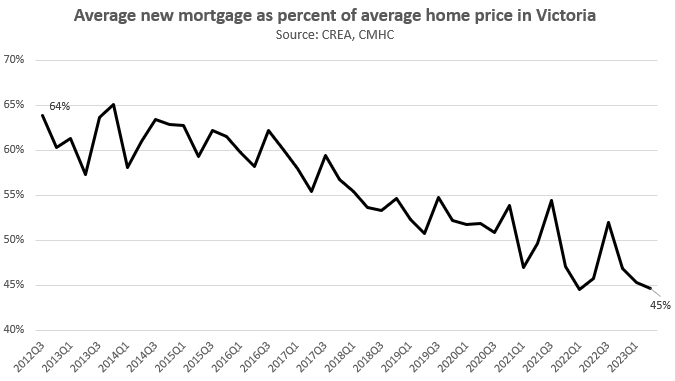

Will it slow the market into the fall? Probably, though we’re already pretty sluggish so there isn’t much room on the downside for market activity. Thanks also to reader Patrick for linking to the updated data on the size of new mortgages in Victoria. Those are up some 55% in 10 years, but house prices in the same period have doubled. That means on average buyers are less dependent on credit from banks than they were in the past. Whether that’s because the buyers are wealthier, or the less wealthy buyers have been squeezed out (ultimately the same thing), I will note that the declines started when we saw the first surge in buyers from the lower mainland arrive in 2016. Coincidence?

New post: https://househuntvictoria.ca/2023/08/29/priced-out-forever/

Lmao, looks like my BNS loan loss comment yesterday was timely.

Small delay, new post tomorrow.

It’s too bad the same rationale, to “mitigate microclimate issues” and “support community stability” isn’t applied to our immigration policies.

So on the Roundhouse site where the developer is donating a $15M chunk of land for non-profit housing, the developer wanted to build a 4.75 FSR project with 1900 homes. Staff wanted to cut that to 4 FSR, but was open to up to 4.4FSR. Council moved to advance the 4.4FSR design which cut 400 homes out of the project compared to what the developer wanted.

What was the rationale for cutting out 400 homes?

Well you can watch the video here: https://twitter.com/LeoSpalteholz/status/1696363356373008427?s=20

Apparently the smaller design will “mitigate microclimate issues” and “support community stability”, whatever that means.

funny response on Canadian Finance subreddit:

Likely will require provincial intervention. That said changes to Victoria’s policy is coming this fall so fingers crossed.

Leo,

I found the answer to this, and you’re right, it is an explosion of townhouses in New Zealand. Let’s hope we see an explosion of family-friendly townhouses in Victoria too.

https://www.opespartners.co.nz/new-builds/too-many-townhouses

Mortimer as an investment property would require a much larger down payment of say 40 to 50% to obtain a positive cash flow from rent. In the past people would put a larger payment down as there weren’t many better returns to be found in non real estate investments. Now you can get close to 6% on a safe and secure GIC.

There are still potential buyers that are very bullish on real estate and they may see this as an opportunity especially if they already own several properties that have an offsetting cash flow. But the head offices of the banks get very skittish about lending to people that might be over exposed in the marketplace by owning a lot of real estate.

In upward trending markets, real estate agents and contractors get their arses kissed by the banks. In down trending markets these same people have a lot of difficulty obtaining financing. As both their source of personal income from sales and the lackluster performance of the real estate market makes them riskier clients.

Mortimer, while an older home in a middle income neighbourhood, is super close to UVIc. I think there would be a high demand for that type of home/location from faculty or parents buying a home for their student children. I’m thinking the Oak Bay equivalent sized home would be rather more expensive and further from the campus (the Oak Bay homes near UVIC are in higher income areas and larger). I would think $875K would be a good deal.

From: https://www.cbc.ca/news/canada/british-columbia/bc-family-evicted-1.6947614

This property wouldn’t make sense to an investor. Mortgage with 20% down would be ~ $5,000 and the rental income would be about $3,000 as the house is old with only one bathroom.

I will have to double check, but I believe they previously offered that product and stopped offering it about 4-6 months ago.

Don’t think Scotia do fixed payment variable rate mortgages, their delinquency rates should be a leading indicator of what happens when ppl have to cope with higher payments as there is no kicking the can down the road.

The Auckland chart shows an explosion of “townhouses, flats and units”. Do you have data breaking that out, to support that this was indeed an “explosion of townhouses” and not an explosion of the smaller non-family “flats and units”

I believe that you can apply for a basement suite on proposed new housing or if you are stripping the existing house down to the interior stud partition walls. In that way the city inspector can be assured that the suite meets the current building codes.

Legalizing existing suites are a bigger problem. No one can inspect what is hidden in those walls.

From: https://financialpost.com/real-estate/mortgages/homeowners-extend-amortization-banks-mortgage-data

That 23% number is massive and is the one to worry about, I wonder what that number is like at the more lax lending banks like Scotia? Also, since many higher risk borrows jumped to credit unions and alternative lenders, it would be interesting to see those numbers of extended amortizations broken down by lenders across the board (they are probably worse there).

God this is exhausting. Victorias MMHI is so obstructive it has received zero applications. And there are a million other examples that have been given on this site how local governments obstruct housing. Yes obviously it’s a fair comment to make.

I want more housing

You want more housing “BUT”

We are not the same

Here’s how to actually get more housing. Legalize it.

That’s what Auckland did in 2016, and they got an absolute explosion of family friendly townhouses. Meanwhile no city in the world has increased family housing by banning housing for singles

COV legalized missing middle (Jan 2023).

Yet today you bash them with “but it’s truly incredible how hard local government works to get less housing and almost no one notices. “.

Given the record housing starts and approval of upzoning, I think they deserve some credit

Anyway, most people (including you and me) want more housing. And I think the city also wants more housing and they are working to make that happen. OK, not as fast as you’d like. But they are listening to the voters too.

And I hope the cities listen to people like me telling them they need to encourage more bigger units for families (with parking!) and less of the tiny “profit maximizing” micro-units.

Yes.

Never said there wasn’t.

That’s why we need to legalize housing to reduce risk and costs. Big developers will stall projects if they think the risk is too great, but mom & pop builders can continue to put up multiplexes and townhouses if they’re allowed because the time, risk, and capital requirements are much lower. Also we can increase countercyclical social housing spending during downturns. Again, every dollar of public housing money goes much farther if we reduce the barriers to housing.

Are you sure about that? I think there are bigger factors at play. For example, if house prices start falling, construction will fall and housing starts will fall. And then we really will have “less housing”.

Personally I think we are currently building too many small units and not enough bigger family units. Not enough “foot-long” hotdogs which is what HHVers want.

For example, housing starts are already down this year (2023) compared to last. Do you think this is because the cities have stopped approving projects or it is less developers wanting to build?

Canadian builders report a “slowdown” leading to 22% of builders cancelling projects and 67% are Building less

https://www.chba.ca/CHBA/News/Low_builder_confidence_improves_slightly_but_lack_of_buyers_still_hurting_overall_industry_sentiment.aspx

And if we didn’t make most forms of housing illegal on most of our land and if we didn’t pile hundreds of thousands in fees and requirements on new housing and stall it for years in process we’d have more.

Not a difficult counterfactual.

Also see hotdog analogy

Very little on average.

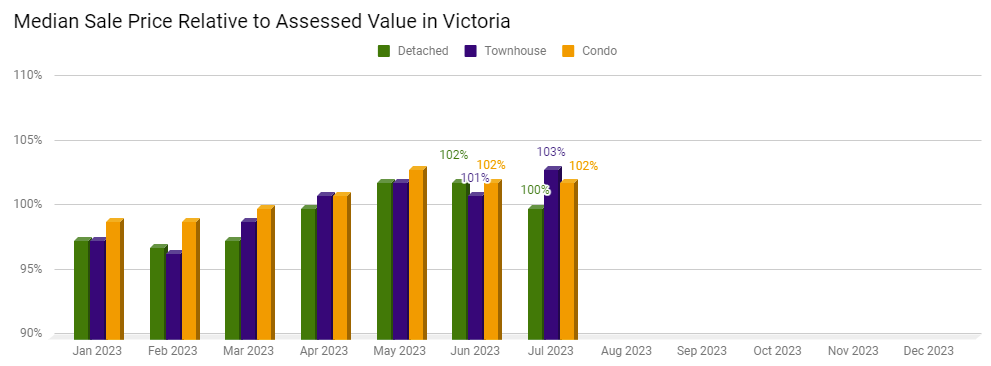

I post these charts every month

I think the days of moving from house to house in the same city could be a thing of the past. Homeowners are glad to own anything and the prospect of trying to find a property that is better than what you have is difficult unless you have tons of money for an upgrade. The transition costs, land transfer taxes, real estate fees, are imposing enough in this price bracket.

I know some people that wanted to downsize from an older house to something smaller and newer, but it was going to cost them more. So they stay put.

Victoria is mostly condominiums while the Westshore is single family houses and some condominiums.

Replacing an existing house and replacing it with a new home is not a gain in the number of houses, but I would expect that most new builds include a suite so there could be a gain in the number of self contained housing units. If the home owner chooses to lease out part of their home. I guess the answer to your question when it comes to single family housing is probably there has been an increase in the number of self contained housing units, but we don’t know.

I can’t tell you what BC Assessment is likely to do. They have expensive computer system that determine the results. But this is my summation of what has happened in our market place.

A shortage of listings led to a rapid increase in prices during the first quarter of 2022 with multiple offers presented over the asking prices. Market prices stabilized during the second quarter of 2022 due to quantitative tightening increases in mortgage interest rates. The third quarter of 2022 had further interest rate increases, resulting in some softening of market prices as the number of sales declined, the average days-on-market increased, and the months of inventory increased. This resulted in the market place transitioning from a market heavily in favor of sellers to a more balanced position between buyers and sellers. The fourth quarter (Q4) of 2022 and Q1 & Q2 of 2023 had further interest increases, however a decline in listings caused a return to a sellers market and prices rebounded from levels in the last half of 2021 to price levels in Q2 of 2022.

So my guess is that there won’t be many surprises in next year’s assessments.

How many are SFH that were built on a tear down lot? Those should not be considered a net gain of housing.

Do the new housing starts also include all the new tents on Pandora?

Yes, all of the above.

What comprises the 4800 new “housing starts”.?Does it include condos, townhouses, and apartments?

Will next year’s assessment rise again? i.e., how is the July 1st market value compared to current assessment? Thanks

Yet we aren’t getting “less housing”, we are getting more.

—- A record number (modern era) of Greater Victoria housing starts in 2021 (4,808) and about the same (4,782) in 2022.

https://www2.gov.bc.ca/assets/gov/data/statistics/economy/building-permits/econ_housing_starts_urban_communities.pdf

—- And also same record housing starts for B.C. overall in 2021-2022 https://www.statista.com/statistics/198076/total-number-of-housing-starts-in-british-columbia-since-1995/

Time to get a building permit in Toronto for an average SFH: 2 months

https://albohomes.ca/how-long-does-it-take-to-build-a-house-in-toronto/

Mortimer is a property that would appeal to developers, first time house owners, and investors desiring a rental property.

This was a property that was strongly in demand a year or two back, but now the demand for this type of property has weakened significantly as developers and investors have backed off from buying.

This is a late 1950’s home with two bedrooms on the main floor and a partially finished basement. To replace this home with a modern house of the same size but built to today’s building codes would be over $400,000 but the improvements that are there only contribute about $100,000 to the property as a whole. That’s 75 percent depreciation for a home in average condition for its age.

The house is obsolete by today’s standards. Even if the buyer were to remodel the home with a kitchen and bathroom it would still be too small, and 2×4 construction. That obsolescence can’t be fixed without expanding the house or a better solution of tearing it down and building a contemporary dwelling that fits the needs of today’s buyers. That’s a gamble for a contractor building on speculation, as the contractor would need to get about $2,000,000 +/- 10 percent for a new home of say 2,700 square feet. That puts the property up into the upper income household bracket of buyers for what is really just a middle income neighborhood.

Yes. And if you don’t care about market housing built by greedy Markos, it’s the same or worse impact for affordable housing.

And yet when asked, the majority of Canadians blame the federal and provincial governments for housing. Only 6% blame local government. Sure the feds and provinces should spend more money on social housing and such, but it’s truly incredible how hard local government works to get less housing and almost no one notices. Fascinating blindspot.

You get a reply two months later that they will look into it. You can complain to the manager who won’t do sh*t all because they are not accountable either. They just update their website and add 10 business days to processing applications as they are “experiencing delays.” The whole short staffed excused is 110% complete bs. They aren’t short staffed, they just make up so much non-sense in terms of policies that they end up short staffed as a result of their own non-sense make work policies and projects.

Not sure if the mayors or council have any power over how building departments are run, but if they did no one strikes me as a personality that would actually go down there and demand accountability. More concerned about setting max parking restrictions.

To quote Viclandlord

I’ve also dealt with matters that are so convoluted and stupid that when that one staff member leaves the people replacing literally have no idea wtf is going on, which bond agreements were signed, etc. I have yet to receive a compliance deposit on a DP on a property where occupancy has been obtained 16 months ago and house was sold 15 months ago. I email the COV every month. Not even in compliance anymore as new owners have made changes to the landscaping.

In the middle of the housing crisis, lol. There is a huge disconnect about the bullshit politicians spew every day about how they are working to solve issues and actual reality. Housing crisis and existing units should not take more than 14 business days, imo.

Month to date numbers:

Sales: 451 (up 11% compared to same time last year)

New lists: 958 (up 12%)

Inventory: 2504 (up 16%)

It is common sense that if someone submits a building application that the city says exceeds FAR maximums, and then wants to argue with them about it, that this is going to delay their application. Nothing wrong with “fighting city hall”, but even though it’s likely that “you’re right and the city is wrong”, don’t expect the city to resolve that overnight.

Anyone been to 1580 mortimer? Assessed at 1.056 and sold for 875k. 6600 sqft lot, looks liveable and in a pretty decent neighborhood.

What happens if you email them every day about it?

Better than last year.

Define good?

Imagine it has been a good month for sales.

Well after 19 months our small variances were approved to legalize two existing units in a small apartment building.

Now we can go ahead and apply for a building permit, let’s see how long this takes, we applied the day after it was approved.

Got a call from the civil engineer, the city would like to see an underground electrical service……I seriously can not make this shit up, the building has an existing 400amp 3 phase service that could handle another 10 units our electrical engineer tells us.

Anyone that has actually dealt with the cov knows how fucked we actually are.

Oh and this is not our first time and hired architect,elec,mech,civil & structural engineer

Add on the parking study.

The last submission on our Dp permit only took 5 months, it had taken our architect 15 mins to make the changes that they wanted, prior to re submission.

Everyone seems to beat on Marko because he’s a realtor and has a vested interest, but he’s correct and we are fu#ked.

Out of the 6 new single family houses I’ve built in the cov, I’ve yet to have a building permit issued in 2 -3 months.

Langford: 2 days to get a building permit. Langford had 26% of Greater Victoria housing starts in 2022.

https://businessexaminer.ca/victoria-articles/item/langford-sets-high-standard-for-building-development-permits/

“Wayne Robinson, Manager of Building Services, notes “We [Langford] have a 48-hour turnaround for building permits once they are received by the building department, however a lot of responsibility lies with the builder or developer.

“We have a robust permit application process. We have a checklist detailing everything that’s required to be completed at time of application, including all relevant documents for a specific project to ensure the quickest possible turnaround. If something is needed outside of that or the submittal is not complete, then it moves to a longer process. That’s still only a couple of weeks turnaround, but that wait is typically the result of an incomplete submittal, not staff.”

Up-island custom home builder Ballard says usually only 4-6 weeks to get a building permit (up-island, not Victoria).

https://www.ballardfinehomes.com/faqs

“Once you write your purchase agreement with a Ballard Fine Homes sales representative we can proceed to complete your drawings and then apply for a building permit. This usually takes approx. 4-6 weeks to get. After that, the average build time is approx. 135 days from issued permit date”

I could literally touch on all of these and my experiences but let’s keep it short, FAR. I recently submitted plans (designed and drawn by a reputable architect) where the municipality was not happy with the way the architect calculated the FAR.

So we go staff and say hey the project literally next door you approved is the FAR calculation that we used.

Staff comment: Next door the lot is bigger.

Architect: Yes it is, but so is there building, we used the exact same FAR calculation.

Staff comment: Sorry I wasn’t involved in approving next door, we will look into our definition of FAR or you can ask for an OCP amendment.

Will probably take 3-4-5-6 months for staff to get back to us while project is in limbo.

These two-three months comments are hilarious. Do you really think the COV would have this on their website if they were anywhere close to three months.

https://www.victoria.ca/EN/main/residents/planning-development/permits-inspections.html

“We are currently experiencing delays in processing times because of a staff shortage and our review timelines are approaching 40 business days. Please note that these review timelines are based on current staffing conditions and permit volumes and this information is updated frequently. We sincerely apologize for the delay and appreciate your patience.”

When they say approach 40 business you know what that really means in government lingo, 60 days. Then add the fact that 90% are being rejected (that seems very low to me). I would be shocked if anyone in the last 10 years has had a SFH permit in the COV be accepted as submitted with zero revisions.

This is how it works in reality. You’ve built 20 houses, maybe five in municipality XYZ. You hire an experienced designer or architect that has worked with municipality XYZ many times and you submit plans along with all the other supplements (engineering, home warranty, etc.). Three or four months later you get a list of revisions from various departments. Even thought you’ve never ever had exterior hose bibs drawn on any set of residential SFH plans including municipality XYZ that is what they want from the building department. It literally takes 5 minutes to add these hose bibs and “bubble” them and then you wait another three months for all the departments to review the revisions before they find something else which takes 5 minutes to address.

There is zero accountability and why should there be any accountability? The longer your plans are stuck at city hall the better the job security for everyone there.

A standard permit application done by experienced person is easy, shouldn’t take more than three months regardless in Saanich or Oak Bay. Most longer process usually from developers and investors who try to maximize their profits by walk around the building code and zoning bylaw such as below minimum setbacks, over maximum building size, put a none sfh in the middle of sfh zoning. Imo, this is not a permit application problem, it’s a rezoning problem.

Yes, I don’t have any details, I was just driving by the house seeing demolition after two months of the sold sign removed. Maybe some things got started early or had been previously approved. The builder is very active in our area building lots of homes.

More often than not it is zoning regulations that hold up the project not the quality of the building design drawings. FAR, maximum lot coverage, setbacks, parking, covenants, are the most common hold ups. A predesign building still has to be sited in accordance with the zoning of the property. It still needs the foundation details provided. It’s a hassle to coordinate as well. The other hold up is often the clients want to push the boundaries and no matter how hard the designer tries to steer the client towards compliance sometimes they just want to see what they can get away with. at least 50% of my projects require variances because of client wants/needs. I just designed my first ADU as the zoning was recently changed to allow it. Our town fast tracks them so it was really quick.

Just because someone is a “professional” doesn’t mean they are good. See it all the time on the institutional side, can’t even imagine what it’s like for residential stuff.

When it comes to designing a home, there are architects, designers, and draftspeople. Each can all perform that role, but they each have different skills and will perform the task differently.

There are many types of designers working in the home building industry. Some are licensed professionals; others are builders who have expanded their services into design as well as construction of custom homes and home renovations.

I suspect the vast majority of plans submitted to any CRD municipality are done by professionals. I think it speaks volumes that they’re rejecting 90% of them. My experience was the turn-around for plan review by each CoV department was ~2 months (ie, Building and Planning, then zoning, then parks, then engineering etc.). Zoning did take issue with something silly, but it only required ‘bubble-noting’ the 3 sets of plans already submitted.

I wonder if in your case (Patrick), your neighbours purchased the property which had pre-existing approved plans?

What is the most popular condominium unit size that buyers want in the Victoria Core?

It’s a two-bedroom, two bathroom 918 square feet condominium.

But what are we building?

One bedroom , one bathroom 600 square feet units.

The reason is costs. A first time owner is constrained by price and for most $600,000 is their upper limit. So that’s what contractors build. And that may cause a problem for the long term stability of the condo market as we are building condos that most people don’t want but due to affordability reasons are buying. That’s an unhappy home owner who is more likely to keep the property only for a short term. After six months most experience buyer’s remorse.

I can see that Patrick. The person having the home built blames city hall for delaying the project when they should be blaming their house designer.

In the case of Accessory Dwelling Units if there were standardized designs where the ADU could be prefabricated in a factory with quality control over the construction and then delivered to the building site that would increase the number of housing units rapidly.

Re: one year for SFH approval (o variances, no rezoning)

According to Saanich, most (90%) building permit applications filed first time have errors/omissions or other issues and are rejected, requiring them to be fixed. (Issues with building codes, submitted drawings/plans, trees etc) The 10% of applications that aren’t found to have any issues are approved within 1-2 months (according to Saanich). So when someone says “it took a year to get approval”, my question is “was that because there were errors/omissions on initial filing requiring repeated filings”, and if so, of course that takes longer than 1-2 months.

The “pros” are better at this kind of paperwork than mom-n-pop developers doing it as a one-off, so the pros “get it right the first time” more often and end up with faster approvals. Such as the house near me that started demolition about two months after the sold sign was removed.

In the 1960’s the grocery chain Safeway rapidly expanded its chain of stores by changing the way they financed their construction.

They would buy the land and then sell the land to a private investor who would then lease it back to them. That gave them the additional capital necessary to offset the costs to build the store.

This makes sense if you are building rental apartments as renters pay the same rent for a leasehold apartment as they do for a freehold apartment. It makes sense for the developer as his construction costs are reduced and the project is more likely to be profitable sooner and that reduces the developers risk.

Today we can do the same using REITs where the upfront pre-construction costs are financed by REITs. That could be as much as 30% of the total construction costs. These investors are taking an equity position in the development as opposed to a lender that takes a debt position which puts the lender in first position of any claims against the property including the assignments of rents paid.

I am not saying REITs as they are now are a possible solution to the housing crisis. The problem being that an unscrupulous person could enrich themselves with these upfront costs with the funds mysteriously disappearing. Leaving the equity investors with an undeveloped lot which they have no claim against. But this may provide a model for the government to adapt and adopt.

One scenario might be that the government could sell government backed REITs to equity investors. Kind of like a government backed bonds. A product that Unions and Pension funds would gobble up as they would be long term, safe, and secure But unlike government backed bonds they would not have an effect on our national interest rate. That would give the government working capital in a public/private joint ventures with developers with the government retaining the freehold interest in the land. Actual terms and conditions between the different parties would need to be determined. This may be something to explore in more depth.

Yes, this makes sense. Especially with high-speed internet (Starlink) available everywhere and the growth of remote work.

Warren, I was one of nine children and we were not considered a huge family.

Explain why nobody lives on the west coast of the island. Nobody wants to, it’s a harsh environment. Cities are created to serve a purpose and perform a function such as housing workers needed to exploit the region’s resources, not just house people playing video games.

I lived in a well-kept suburb of ’50s bungalows in Calgary, full of happy families enjoying their 730 sq ft of living space. I recall no deaths as a result of squeezing.

I think I have read at least twice in the last few weeks that if young people want to have a SFH to raise a family in then they should move to Alberta. There is at least some element of truth in that. But it makes me wonder about whether we are going about it wrong in BC.

Is offering a 900 sq ft three bedroom really the best that we can do for young families? If you have four kids are you really supposed to squeeze into 800 or 900 sq. ft. (I suspect Marko is going to whip out his happy Croatian family model but like a German friend of mine pointed out all the good houses in Croatia are nowadays owned by Germans.)

We have a massive amount of empty land on just Vancouver Island maybe it is time to think about about creating new vibrant small cities and towns instead of focusing on never ending densification of a handful of cities.

In a neighborhood with 100 year old houses, the residents would probably form a lynch mob. Plus the houses would most likely have heritage status. Maybe change it to 70 year old houses then make the comparison. The updated house would sell for more and probably to someone wanting to live in it. Developers must have a difficult time finding two houses next to each other that are tear down candidates. I don’t think there are many examples of this happening though. Maybe on busy streets.

Looking for thoughts/advice. Say if there are two similar houses right next door to each other, both are 100 years old. House A has been reno’d, House B hasn’t been touched in 50 years (but the condition is good – it has been maintained well just not updated – so like going into a time capsule). Both houses are on the same size lots and both houses are zoned for multi-family. Say a developer comes and wants to buy the houses to put townhouses/an apartment on the lots. Will they pay more for House A that has had all the updates? Perhaps the answer should seem obvious – but I want to check in here to see what ppl’s thoughts are.

My project was no variances, no rezoning. Just BP and some other red tape.

I believe Marko is saying 5 Years is for rezoning, which seems about right.

Probably is Gosig, unless it has had a stripped down to the studs renovation. 1908 was not a good era of housing. knob and tube wiring, crumbling foundation, dry rot, sagging porches, poor or sometimes no insulation but crumpled up newspapers, oil tanks, no drain tiles, moisture problems in a poorly vented attic, rat infestations, etc. The cast iron plumbing is likely so constricted that it would be difficult to get a turd down it. All built by a sailor on his sober weekends.

And it is functionally obsolete with outdated kitchens and bathrooms.

Too expensive to repair today.

Better to sell it before it falls down around your head.

When your demo team is done send them over to my place to get rid of this 1912 hunk o’ junk.

“ most houses built before 1970 are obsolete and have lost half their house value to depreciation”

I’m so embarrassed. My 1908 house must be the laughing stock of the neighbourhood. I thought it was a nice place to call home. I had no idea. Now I know. I’ll look into getting it torn down.

No, not from the “unconditional offer” date, as I don’t know when that was. I’m just driving by the house, I don’t have those kind of details. The house got demolished about 2 months after the “sold” sign was removed from the house. And construction started soon after that.

Greater Victoria has a lot of old housing that underutilizes their lots. I’ve wondered why Victoria never had its equivalent of the Vancouver Special. A house design that maximized square footage and provided for a basement suite. A design that was used over and over again in Vancouver and made the approval by the city easier. And made contractors more competitive in their bids as most home owners had a good idea of the costs to build before they started. They just had to ask their neighbor that just built one. The contractors had to be very competitive in their bids to get the job.

Perhaps it was the expansion of the sewer and highway system into the Westshore where contractors found it easier to build new and the Victoria Core was left to the handyman house flippers that could put lipstick on the old pig houses and sell them at a profit.

Anyway the core has been left with a legacy of old homes that are well past their prime. I would opine that most houses built before 1970 are obsolete and have lost half their house value to depreciation. That could make a lot of the older neighborhoods good candidates for re-development. Take a drive through places like Oaklands, Fernwood, Hillside, Gorge, and Tillicum and ask yourself why are all these war shacks still here?

In the 1990’s mortgage approvals were being centralized out of Toronto and it was difficult for them to understand that a lot of the stock of housing in Victoria only had two bedrooms on the main floor when the standard for most of Canada was to have three. They considered the lack of a third bedroom to be a detrimental factor. But that was the character of housing in Victoria that was built primarily for the retiree market up until the 1970’s.

We could increase SFH outside the core, in greenfield sites, which would help.

Two months, one year (“maybe faster”) what’s the difference. You’re saying 5 years.

Thank god for the mute button, less non-sense to read.

You must by lying, house close to Patrick was able to get it done in two months from unconditional offer to starting construction.

Yes, because all my clients I’ve helped buy in Saanich are lying to me when they say it took a year to obtain a garden suite permit that required no variances.

We literally had a HHVer post a few months ago about how a super minor item on building plans took 6 months to process.

I don’t understand your point. It is literally impossible to increase the number of SFHs in the core. Unfortunately people will need to accept they cannot have a steak and need to settle for a hotdog. Or they can move to Calgary and eat steak.

At the end of the day people need a roof over their head and that doesn’t need to be 3,000 sq.ft.

Looks like Leo backs off this claim on twitter

https://twitter.com/LeoSpalteholz/status/1694770748886503829

About a year in 2017 in the CoV. I’m sure someone more experienced could do it a few months faster. I was in OB hall a few months ago and it sounded like they haven’t caught up to the same level (of red tape) as CoV.

The anecdote is immaterial. Simple projects requiring no rezoning and no variances get approved much faster than ones requiring those. Maybe someone else on HHV can let you know how long it took them, and is prepared to share the details with you.

Of course it’s a problem . But it’s not a new problem. Just like surgery wait times which can be a year or more. Yes, this terrible, but it’s the way it is, and it’s shorter for emergencies. And they’re working on it, But it doesn’t mean that we are “soooooooooo screwed” and similar hyperbolic statements that you make.

If they approved 20,000 unit housing permits tomorrow, they’d find that there aren’t the construction/contractor workers available to build them. As I’m sure you know, most construction firms already have long waiting lists.

Meanwhile, there are lots of housing starts…. 4,782 starts in 2022 x 2.5 people per household = homes for 12,000 people. Victoria gets 0.6% of immigrants, so 500,000 x 0.6 = 3,000 people. So we will end up after ROCers migrate here with maybe 8,000 population growth.

The big problem is that so few of those are SFH (net, after tear downs). Using Leo’s hotdog analogy, the only housing type many HHVers here consider as “hotdogs” are SFH. And we aren’t making many more hotdogs (only 95 net SFH in core Victoria, for 3,000 new households to fight over).

Your story unfortunately doesn’t add up in terms of timelines.

Sorry, I’ve already said it was a house near to me, and I value my anonymity more than I need my story “verified”.

I am not sure I really understand why an application to rezone is the best way to do it. I would have thought a better approach would be to develop a 5 year OCP, spend the 5 years lobbying to change it, getting used to the parts you don’t like, or selling and moving if you really don’t want to live next door to the proposed use and then after 5 years it automatically becomes the new zoning for that area and the next OCP is developed. I see the need for variances for things like a foot or two encroachment on setbacks if the site makes it an obvious exception but I would make rezoning and broader variances a less common thing. The current system springs surprises on people so there is a large confrontation over every application.

100% agreed, and that is where the problem is, but I don’t think you view it as a problem. Aryze and Abstract both own over 30 properties (they manage to get a few rezoned per year) and they have entire teams to work on the paperwork. Just look at the post Aryze put on Linkedin yesterday re all the positions they are hiring for…..how exactly does this lead to affordable housing? Not only do Aryze and Abstract have to pay these people (plus consultants) but it also creates such an insane barrier to entry that there is very little competition in the marketplace.

MLS number please, shouldn’t be difficult to verify you story if true.

If someone here has had a garden suite in Saanich (no rezoning or variances) approved in less than a year please speak and state your timeline, thanks.

The larger development companies build the costs of a five year rezoning into their panning process. The smaller developers of say 20 units have it a lot tougher as the cost of carrying a property for five years or so would be challenging for them at today’s higher interest rates.

The land assembly at Howard and Bay illustrates the problem. Possibly a project of around 20 units with the land listed at 2.5 million. There are two houses on the site that could be rented during the re-zoning process but the developer would still have negative cash flow at today’s rates. If condo prices were rising it would be worth the risk. As it is now, small developers don’t have the deep pockets such as the larger developers who can spread the risk over hundreds of units.

If the government (s) truly wants more small scale infill developments then they will have to figure out a way to lower the risk for small developers.

I’m thinking that the government is just running the clock out on the housing issue. Waiting for the next recession to solve the housing problem or hand it over to the next government. Neither JT or PP currently have a solution. They have lots of rhetoric but no plans.

A recession might drop home prices by 20 or 30 percent and then followed by lower interest rates would re-vamp the building cycle and most of our housing issues would go away as it did in the excited states of America during their 2008 recession.

Sometimes the best solution is just to do nothing and let the marketplace take care of itself. Capitalism is a cruel mistress.

A house near to me sold 4 months ago via MLS. Two months later, the new buyer demolished it and started on building a new custom home. Point is, that didn’t take them years. And yes, I know that’s an easy project not requiring a rezoning or variances etc. but lots of small projects fall into that category and get approved quickly.

Not sure what this means. I don’t work for the government, and never have.

Most homes don’t get built by real estate agents as a side hustle, who complain about the hours of red tape. Yes, it should be real easy for you to get approvals, but it isn’t. So there are professional developers that have full-time people working on the paperwork. And they got 4,787 homes started in 2022 in Victoria, which is near a record.

When you have to spend 5 years in the rezoning process you have to go for the most profitable product otherwise the numbers simply don’t work. As Leo pointed out you can’t spend years rezoning and hire 14 consultants for a small number of three bedroom units.

Problem is many of these approvals took upwards of 6 years and cost a small fortune to carry out.

Do things get approved? Yes. Should OCP compliant rental buildings be consistently voted against in a housing crisis? Absolutely not in my opinion.

It’s easy to discuss this theoretically from a government job position. Once you try to actually rezoning something first hand you truly get an understanding of how screwed the system it.

Leo is slowing learning, 99% never will and the system will continued to be screwed indentifitnely.

Frank, I think most economists got the Covid impact on housing wrong. A book by Faith Popcorn called the Popcorn Report discussed the cocooning effect and that may help explain why prices increased rather than decreased during the pandemic.

Definitely would not want to live beside a six-plex. Street parking is already becoming an an issue without them.

How would a developer know prices are going to rise? The pandemic could have caused a collapse of our entire economy. Instead, it had the opposite effects on housing . I still can’t figure that one out.

Just in case anyone thinking of purchasing a GIC, Tangerine bank is offering a one year @5.9%, and 18month@6%.

Others may follow.

Increasing prices certainly would make projects viable sooner.

Labor and material costs were also increasing since 2015, but since all contractors were faced with similar rising costs they could pass those costs onto consumers.

We are in a different market today as home prices appear to have flat lined and some material costs have come down. That makes it a bit more difficult to sell a home that is nearing completion as a proposed building would have lower material costs to build.

The governments would like to see more homes built on speculation of selling the house when it is completed. That’s a bit more riskier today. A lot safer to build a house with a written contract. If the government wants to increase housing for speculation then the governments are going to have to figure out a way to lower the risk for spec builders.

sure, it bothers the self-righteous social-engineering types who know better & want to micro-manage the rest of us. Unfortunately, I think there’s a surplus of those people in Victoria and that many of them want to be in government.

You got the cause and effect mixed up. Developers will build only if they think that the prices are rising.

It seems strange that the run up of prices starting in 2015 coincided with an increased rate of construction. One would think that should have met demand and averted a crisis.

A “sixplex with two three bedroom” condos would be fine with me, and that’s what Saanich OCP is targeting..Remember, you told us not to expect 3-bedroom units because the micro units are more profitable (Marko:“ There is a super simple reason they won’t build them [3 bdr]. The micro units are renting for $1,500/month. Trying renting a 900 sq/ft three bedroom for $4,500/month.”.) So now you tell us to expect two 3-bedroom units per sixplex. Which is it?

Despite your “we have only two options”, today’s discussion was around reality, which was a third option of the building with 11 micro-units. In your preferred “hotdog” terms, those 300 sq foot micro-units is feeding people an appetizer that still leaves them hungry for a hotdog. I like Saanich’ s OCP approach, which is to insist that they build the type of sixplexes you describe (“ sixplexes featuring a couple of three bedrooms”).

The point of posting the 4,781 housing starts in Victoria (2022) was to counter the HHV narrative that nothing is getting approved by the cities. When in reality the data shows they are approving at or near record levels. If we see a downturn in housing starts it will be because there are less applications, not that the cities have stopped approving them.

My preference is we build mega towers (e.g. Harris green, 1,500 units, 1/3 have 2+ bdr), and insist that missing middle builds have at least two family friendly (2-3 bdr) units – which is similar to what Saanich draft OCP proposes.

That’s it for me on this topic. Thanks for the discussion.

I don’t think anyone wants to live next to a six-plex.

@R re: the Amblewood listing, I think it’s just too expensive to create a frenzy like they seem to want. There’s a certain pricepoint that seems to be accessible to many potential buyers and in that price point there can be a lot of demand – but the Amblewood house is outside of that. The more expensive the house the smaller the market. So yeah the strategy/wording seems odd to me too.

+1, everyone on my street in the Songhees is shitting on the roundhouse development how it will ruin everything, bla bla bla.

One lady the lives in my building (17 story newest building in Songhees) posted how the roundhouse will ruin Victoria on the residents of Oak Bay facebook page, just wild. Promontory and Encore didn’t ruin Victoria because she lives there, next batch of towers certainly will.

Unit comes up in my building and goes in an unconditional bidding war for an insane price imo. Obviously people want to live in condos, why would they be trying to outbid eachother?

As I said in an earlier post. Everyone shitting on towers and condos being too small but when I throw up one of my condo rentals I get a ton of rental applications, how does that work.

We are also setting immigration records. Back to Leo’s brilliant hot dog example which no one seems to grasp whatsoever despite it being grade two common sense.

A SFH in the core will soon be over $2 million and planning cannot change that. We have two options; old SFH stock is replaced by new SFH luxury builds (which will be well over $3 million in 10-15 years) or they are replacee by sixplexes featuring a couple of three bedroom $1.2 million dollar condos. Both scenarios end product is very expensive and not for the average family with kids but last time I checked 1.2 is better than >3.

As far as SFH housing outside the core that will become extremely expensive too as Langford/Sooke crack down on appetite for development.

If you want a SFH in the future you’ll have to move to Calgary where I believe they will just continue to expend outwards with massive cookie cutter subdivision.

————————-

if you’re referring to Greater Victoria, I’m not seeing that when looking at housing starts in Greater Victoria.

Yes, there are low numbers for Saanich and Oak Bay. But overall, the data shows the last two years of Greater Victoria housing starts (2021-2022) at or near record levels, and much higher (+37%) than pre-Covid (2019).,

4,787 approved units in Greater Victoria leading to housing starts in 2022. The only problem I see is that they are mostly small units, unsuitable for families (including most HHVers)

Highlights:

– COV Victoria set a record in 2022 with 1,727 housing starts, more than double pre-Covid year (2019)

– Greater Victoria up 35% in 2022 from pre-Covid (2019) and near the 2021 record.

https://www2.gov.bc.ca/assets/gov/data/statistics/economy/building-permits/econ_housing_starts_urban_communities.pdf

When the possible presence of a discarded clam shell is sufficient to halt any development, we are indeed screwed.

Seems a little presumptuous for 2 weeks on the market for sure.

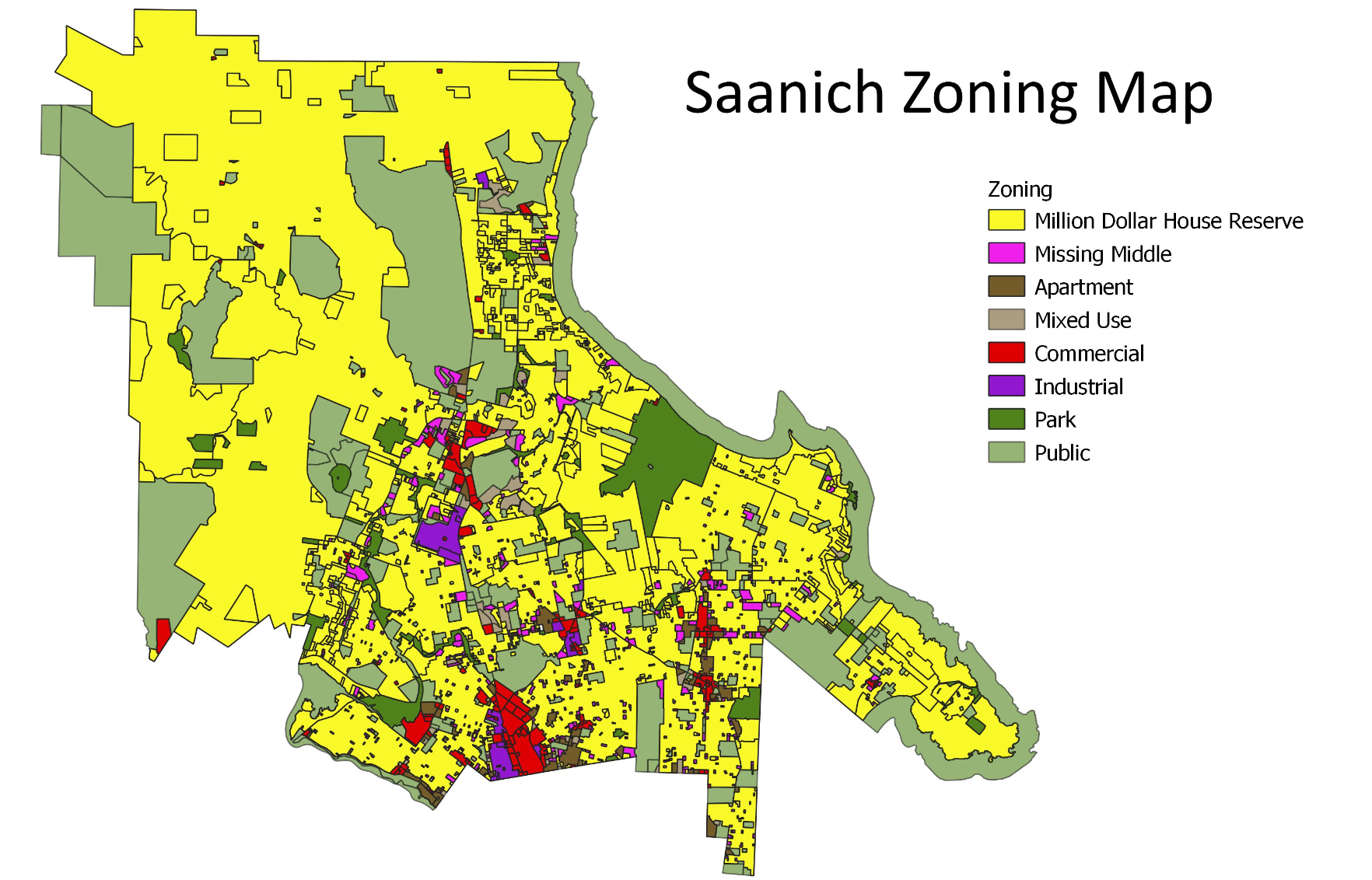

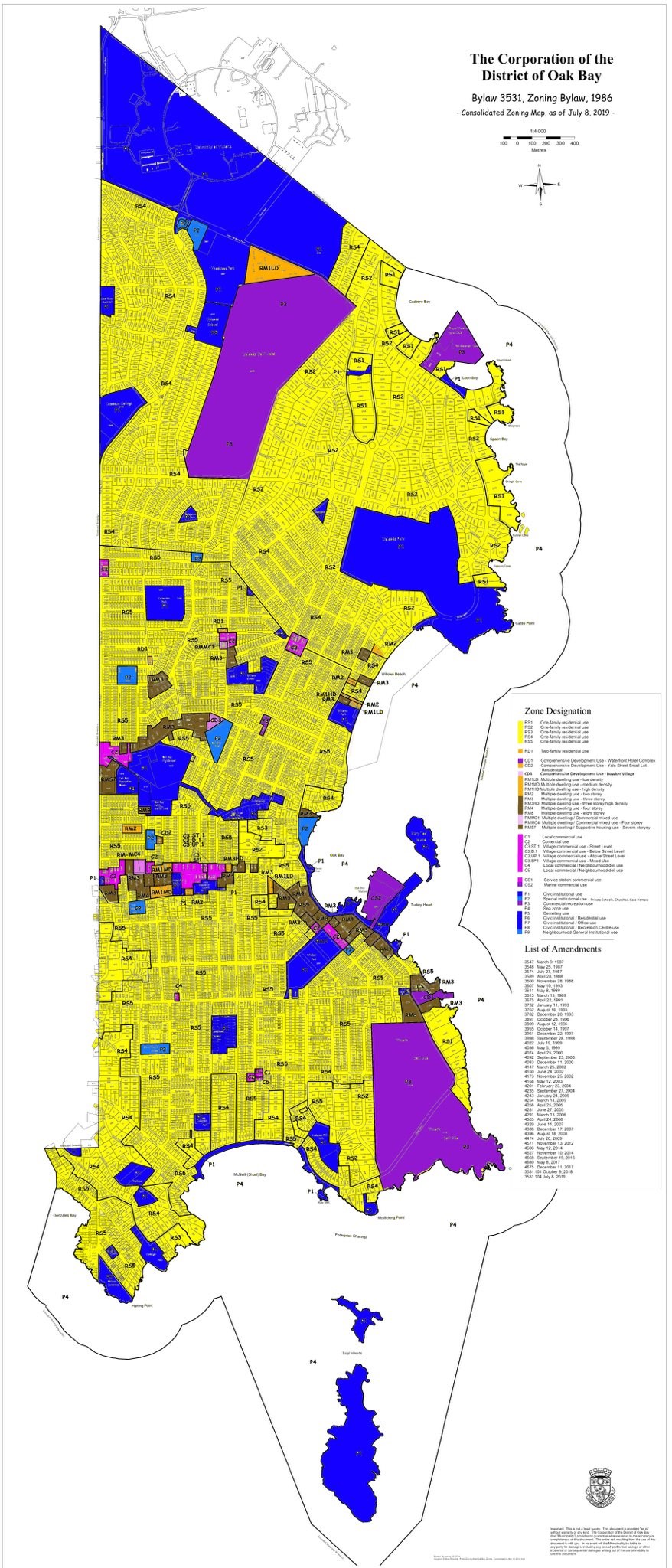

Easy to miss, but if you take a close look for the yellow areas on this map you can still find a few building lots for multifamily housing.

Is it just me or is the wording on this listing a bit bold in this cooling market. It’s a decent house but it’s not exactly cheap. Do they expect to whip up a frenzy of buyers? Or maybe they actually will and I’m out of touch?

https://www.realtor.ca/real-estate/25935600/4750-amblewood-dr-saanich-broadmead

“Your best offer … minimum 5% …. Seller reserves right to refuse… august 31 deadline”

It’s also been on the market for a bit, I think this is their second open house.

Curious the thought process behind this on the realtor’s part. I think if I were a buyer it would turn me off making an offer at all, because it makes me think the sellers will be picky and not accept anything under ask/expect a bidding war.

On CBC- Quebec is short 8000 teachers. How does that happen?

Volatility does not equal risk. Equating the two is a very common mistake made even by people in the financial industry who should know better.

It is not critical that we build shoe boxes for every student and single person that wants their own place, instead of living with roommates.

Our building lots in the core are limited, especially for family suitable housing, which homesforliving.ca points out needs to be “ground level”.

Let the students and single people find a high rise shoe box downtown.

These singles in shoe boxes will likely have kids some day, and then be searching for a SFH. Too bad there won’t be any SFH for them due to poor planning.

Anyone ever think about moving somewhere you can afford?

And that’s why we have a housing shortage. Most common phrase at a public hearing: “I support more housing but..”

It’s never about figuring out how to build more housing, it’s always about how do we punish the housing we don’t like. Always something wrong with every project.

But it’s always something. Seen it a million times.

Other than the people gladly living there. But screw them. If they were real people they would have families.

I don’t recall making any comment about that, and don’t really know what you’re referring to. If Saanich has somehow criticized a project for too many family sized units, that is something I would oppose, as I’d like to see a project like that go through asap. So I don’t know what I’m supposed to “accept”. My only comments about Saanich have been about the OCP rule they’ve drafted to provide a minimum number of family units, which as I’ve said I see as a good thing.and you consider that to be a bad thing.

I completely disagree with your idea that the cities should approve whatever mix of units the developers come up with. You’ve been excited for years about all the 1 bedroom units being built in Langford, and that has got us nowhere. I’ve been the one pointing out that we only add a net 95 SFH per year in core Victoria – a tiny fraction of what’s needed, and it won’t be helped by more 300 square foot micro-units.

So no, I don’t consider the shortage of units to be pervasive and equal, as I consider family units to be much more important to build than these silly 300 square foot “shoe boxes”. And so should other advocates for family homes!

Patrick, these targets are literally being applied per project TODAY and then used to oppose the project because it doesn’t match the target

Incorporating those targets into the OCP with that practice is a serious problem, because now staff can say a project is not OCP compliant which makes it ineligible to bypass public hearing.

Never!

Zero sum thinking again. Saying no to someone that believes there is a demand for 1 bed homes has nothing but negative effects, and certainly doesn’t get us any more 3 bed units.

The current shortage is literally because we love to say no to housing that we believe is sub-optimal. What’s the worst case here? Developers build too many small units so prices and rents go down and some developers go bust? Oh no terrible outcome.

Legalize townhouses and reform the building code to allow single stair and I bet that suddenly you don’t have a shortage of 3 beds anymore

I’m just tired of the bad faith arguments you launch into.

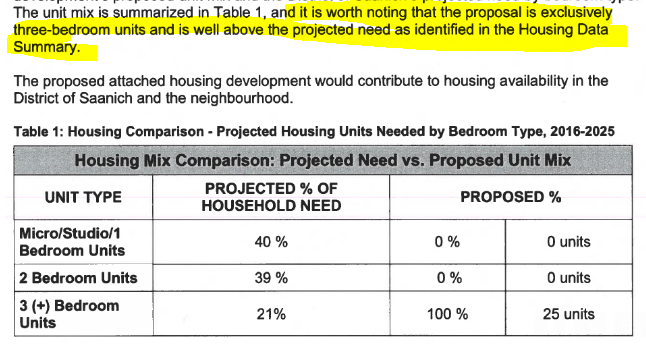

Saanich is criticizing a townhouse development for having too many family sized units.

If you can’t accept that this absurd I don’t know what to say.

It’s difficult to make any type of multi-family development make sense. The cost of acquiring land sufficient in size or to assemble single family houses to be torn down is expensive. And the economy of scale for building multi-family doesn’t start to kick in until at least six units.

Let’s throw out a hypothetical. Suppose you could buy a lot tomorrow morning, get all the approvals by the afternoon and start building the next day and have it all built in 12 months. I don’t think it would be economically viable to do so. The cost of the land and construction would be greater than the price you could sell the condominiums and make a reasonable profit.

To make the project viable you need the market to appreciate and that means holding the property for a couple of years until prices for the end product increase. I’m not convinced that speeding up the approvals will have a substantial effect of increasing the supply. If you got all the approvals in one day, you still might hold the property for five years until it makes economic sense to build.

Blame as much as you want on city hall, but their slowness likely added to the builder’s bottom line.

That’s the problem I think most builder’s are having today. The market isn’t appreciating during construction so there is less profit in building. So they don’t start a new project right away. The longer they wait the better chance in making a profit.

An airbnb micro condo building is essentially a hotel where potentially each unit is owned and serviced by a different entity.

I agree this is the practical way of looking at it, Everyone would fight and try to build whatever is the most profitable first if the target was the entire building stock. Better to provide carefully balanced incentives to encourage whatever gets built is what’s required.

Yes, this is mind boggling. An eco-agenda to create a “car light” COV gets in the way of a much needed mega project to help the housing crisis. Will likely get solved, but of course delay the whole thing. Odds are 100% of those councilors have cars and 1+ parking spots. If they want a car-light COV, let them lead the way and give up their cars and parking spots.

Sounds like these micro apartments are perfect for Airbnb.

We can’t even allow Harris Green to be approved in peace. Now the COV wants the developer to have a ridiculously low number of maxium parking spots, simply wtf. If the developer wants to excavate 10 floors of below grade parkade and go bankrupt who cares. Does underground parking bother anyone?

5 years ago they were shutting down projects because of not enough parking now they are trying to shut down projects by not letting developers build enough parking. Why can’t government just get out of the way?

I don’t think building micro or small one-bedroom suites are good for the long term sustainability of the city. They are a specific target market of purchasers being the empty nesters in the 20 to 34 age group and retirees.

Currently there is a demand for them as there is a shortage of housing but during a recession they will go vacant and are more likely to be foreclosed on. During a sustained economic downturn they become almost unsellable.

Once they are built they are going to be with us for the next 75 years or more. One has to think of the future and build housing stock that suits all markets so that people do not have to leave the city for more practical accommodation. They are at best a band-aid solution to the current housing problem.

All cities undergo cycles of development and decay. Victoria is a small city with big city problems and is no exception. These problems are not going to go away especially in the downtown core as more homeless and criminal elements from the surrounding districts gravitate to the downtown area with the ever increasing population.

This happened to New York City. Economic stagnation in the 1970s hit New York City particularly hard, amplified by a large movement of middle-class residents to the suburbs, which drained the city of tax revenue.

Yeah and

Too inefficient and small numbers . Better to build towers, like Harris Green, with 1,500 units. And somehow they don’t need all of them to be profit-maximized micro units and “ 1/3 of units will be family-oriented (2 bedrooms +)” https://www.harrisgreen.com/

We’d need to build 200 +missing middle buildings to match that one Harris Green project. How many years will it take before we see 200 missing middle devs in Victoria?

There is a super simple reason they won’t build them. The micro units are renting for $1,500/month. Trying renting a 900 sq/ft three bedroom for $4,500/month.

Allow the microunits to be built to bring down the price a bit and give a bit of incentive on approval times and or tax breaks for three beds and problem solved. It isn’t that complicated.

Current approach is let’s not allow more micro units while doing nothing to promote three bedrooms. We are better off with a bunch of micro units and no three bedrooms than neither.

This implies there is a reason they won’t build three bedrooms, and would need an incentive like 14-day automatic approval. That’s my point – it’s more profitable to build smaller units. So the Saanich OCP mandate makes sense to me. btw) Your idea for the 14-day stock approval also sounds good . But c’mon, maybe it’s on an archeological site etc., it’s hard to imagine all that gets ruled out in 14 days.

Sure, for 1-2 people. Not for a family of 3+ (in Victoria, in 2023). I don’t consider it a housing crisis when small households of 1-2 people can’t find housing. They have lots of options, including sharing home with another 1-2 household. When families with children can’t find housing, that’s a crisis to me.

Buy a missing middle property, design it with two three bedrooms units and then wait years for a building permit.

Do you think if COV/Saanich came out with stock six-plex plans features two three bedrooms units and a turnaround permit approval for 14 days that builders/developers wouldn’t go for it because of the three bedroom component?

Just look at all the hate Abstract received on the 3 bed townhome development next to the Pat Bay Highway in Saanich. It took what like 5 or 6 years to re-zone?

The free market to date has produced only 3% of purpose built rental stock being 3+ bedroom.

But that’s “not at all clear” that this is too few for you?

Do you have a single example of multiple 3 bedroom affordable units being created under missing middle?

https://www.homesforliving.ca/

“ Current purpose built rental stock is 97% studio, 1, or 2 bed apartments not suitable for families. We need more rental units of all types, but we especially need ground-oriented, family-suitable rental housing in all areas of the region to ensure families have a secure place to live. ”

It is also a government environment with zero accountability. If city staff are lazy and incompetent and delay a development a year or two who cares? You still get your salary, flex days, pension, etc.

If garden suite approvals in Saanich were carried out by a private for profit business the turnaround time would be one week, not one year.

Owner builder exam…..imagine if Tesla started a department for ABSOLUTELY NO REASON that required anyone purchasing a Tesla Wall Charger that isn’t a certified electrician to write an electrical exam that was administered by Tesla? only to have an electrician install the wall charger in the end.

If this crossed Elon’s desk no only would the entire department be dissolved immediately to cut costs and to increase sales of wall chargers but the person who brought in the idea would immediately be fired.

What has the government down about the owner builder exam? Nothing. Why? Well it would mean cutting an entirely useless department, lowering cost of construction, and increasing speed of construction. Can’t have that.

That is why we are soooooooooo soooooooooo screwed on housing. Everything you hear from the government is just complete non-sense to buy votes. They can’t even do basic things to help with housing, let alone complicated things.

So are these micro units sitting vacant? I don’t see why two people can’t live in 300 to 370 sq/ft. I lived with my significant other in 530 sq/ft (poorly laid out too) with no parking spot and it was totally adequate.

I own a 430 sq/ft unit in Vic West that I’ve rented to many couples over the years. It has a pretty cool layout for such small square footage I touch on in this view – https://www.youtube.com/watch?v=idzGz0MXXoY

Personally I think the government just needs to get out of the way and crap would get built including micro units, two beds, and three beds.

Personally, I would love to build a couple of missing middle six-plexes with a mix of units including three bedrooms unit. The problem is not the unit mix but waiting two years for a building permit that should take two weeks.

Ironically this is literally how many munis see housing. Carbon bad must tax. Housing bad must tax.

I fundamentally disagree with the net zero approach to housing where to get more 3 beds we must tax more 1 beds out of existence. We need the 1 beds just as badly as evidenced by a desperately low vacancy rate for all unit types.

If it turns out that the unencumbered market produces too few 3 bed units (this is not at all clear) then we can talk about adding incentives, until that point it makes zero sense to micromanage broad targets onto individual projects

If the aim is to reduce building construction costs one way is to lower the interest rate for contractors building speculation homes. A lender would provide low interest rates to builders during construction with the catch that the lender received a percentage of the sale price. The lender would be back end loading the loans. That allowed the contractor to have more working capital during the year or so construction period.

You may have something there Leo. If it were applied to the entire housing stock then those that do not meet the guidelines would have to pay higher development charges. And those extra charges could then be applied to new buildings that exceed the requirements making them profitable to build.

A carbon like tax on housing? Things that make you go hmmmm.

A college of mine in Nanaimo mentioned that they are only now starting to see lay-offs in the construction industry and it will take more interest rate increases and higher unemployment before prices moderate lower.

A double digit unemployment rate in construction would be one way to lower labor costs and housing prices.

Is that what realtors are calling the laundered funds?

Right. And if they tore down a family-suitable house to build the micro-unit$, they’ve worsened the housing shortage for families.

Since a typical missing middle is going to tear down a family-suitable house, it makes sense that there should at least be one family-suitable unit in the missing middle that replaces it. Actually we need two family-suitable units if we want to have a net increase in family units. Thank you Saanich for trying to make that happen.

The rental suites on Doncaster are small between 300 to 370 square feet each or about the size of a large single wide garage and are best suited for students. They are not going to be cheap to rent as the developer will want a reasonable return on their 3.5 to 4 million dollar investment. I don’t know the developers anticipated rent, but my guess is that the developer may need to achieve a rent between $2,000 to $2,400 per month each. Given the shortage for short term student housing that might be possible. The vacancy rate should be higher as most students only rent over the school year. If one is looking for a long term rental there are less expensive alternatives.

This could be a good investment but not likely for the initial purchaser. I would wait until it came back on the market as a re-sale.

In my opinion these micro rental suites don’t directly contribute to reducing the housing shortage for families.

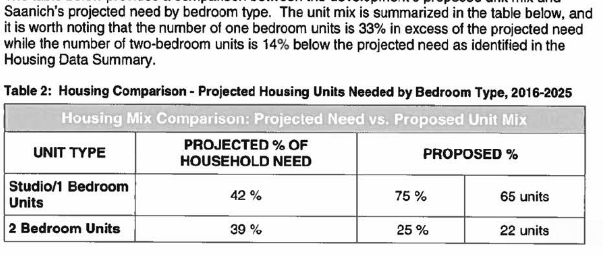

Well you need to re-read the OCP amendment. It doesn’t say they require the 30% 2+ bedroom, it says they “target” it. Big difference. Just like the BOC “targets” 2% inflation doesn’t mean they require it at all times. This “targeting” wording means Saanich has the discretion to approve the 11-micro unit building if they want, destroying your “it’s unbelievably dumb” conclusion.

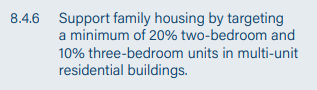

OCP: “8.4.6 Support family housing by targeting a minimum of 20% two-bedroom and 10% three-bedroom units in multi-unit residential buildings. “

If instead, they did as you want, they would be targeting the ”entire building stock”. So a guy wants a 11 micro-unit building. And they look at the entire building stock, which is 3% family suitable (according to homes for living.ca). OK, so they approve it or disapprove it? And the next guy in line wants another 11 micro-unit. At what point will they say NO, and actually require some family suitable units?

Leo, I think ad-hominem attacks like this are beneath you. I’ve developed two properties in my life. Admittedly that’s not a lot, but it’s “something” and how many have you developed?

it seems your assumption is that people will lie en-masses on tax filings, so we shouldn’t bother with the tax in the first place.

First off you have no evidence for this. Instead of providing evidence you give us a “LOL”. Which is a lame response from a “data and numbers” guy.

Second, you are a proponent of the spec tax. If you want to be consistent you should be LOL’ing about it as well, because people can just make up statements that their place was occupied. And by your reasoning we should get rid of that tax too.

In reality, people can lie on any tax forms. But most are honest. And some of the dishonest ones get audited. This fact shouldn’t (and doesn’t) stop governments from employing tax policy.

lol, and by those counts we will suddenly have 60 million Canadians instead of 40

Might help if you knew something about how development works and also you didn’t read my comment at all. Applying these overall ratios to individual projects is unbelievably dumb as per my comment below

Huh? The banner headline of your homes for living is “Build abundant family-suitable rentals”.

And if I understand you correctly, you’re now objecting to the Saanich OCP idea of mandating 20%+ units being 2+ bedrooms, and 10% being 3+ bedrooms in each new building?

Seems like a case of not taking yes for an answer.

Here’s an excerpt from your homes for living site, where you make the plea for 3+ bedrooms, declaring 1-2 bedroom “not suitable for families”

https://www.homesforliving.ca/

“Current purpose built rental stock is 97% studio, 1, or 2 bed apartments not suitable for families. We need more rental units of all types, but we especially need ground-oriented, family-suitable rental housing in all areas of the region to ensure families have a secure place to live. “

So there you’re telling us that only 3% of existing rental stock is suitable for families. And then you’re saying that Saanich should look at the entire building stock when approving new multi-units? So yah, you want to build 11 micro-units, which will lower the family-suitable stock below 3% – sure go ahead.

Bravo to Saanich for this OCP mandate of targeting 30%+ 2-3 bedrooms in every MURB!

Saanich again, a few months ago they approve this small apartment zone modelled after the micro apartments on Doncaster. Functionally useless, but at least they are signalling intent for infill in low rise areas

Then they are revamping the OCP and this is in the draft

Which kills the type of building they just said they wanted.

Sure a charitable interpretation of that clause could be that those ratios should be applied to the entire building stock but as we know staff is not doing that they are applying it to each building

Big issue is staff too, not just council. Many planners and directors of planning are outright NIMBY.

Most recent insanity I came across: Saanich has targets for how much of the new housing stock should be 1 bed, 2 bed, 3 bed units based on their estimate of anticipated demand. Fine, good to keep track of this and if one unit type is lagging then they can look at incentivizing them.

Except that’s not what happens, instead those overall targets get applied to each project, and each project gets criticized for not meeting it.

For example, dev proposes apartments and Saanich says that’s a lot of small units what about bigger units?

Later dev proposes townhouses and Saanich is like whoa whoa whoa why is it all 3 beds?

And then council picks up on it. Literally at the public hearing for those townhouses a councillor asked why all 3 beds and what about single people that need housing.

It’s beyond parody

It would only be “too complicated to administer” if they over-administered it as foolishly as they do the spec tax.

The property tax idea based on occupied density would be trivial to administer

It could be a one-liner on property tax invoice, with the tax filer self-declaring number of square feet in dwelling and number of people living in house, and then using a table lookup (on back of form, or online) that would give them a premium or discount %. For example, 4,000 square feet, one occupant on lookup table might see +25% premium to pay. Another filer with 4,000 square feet, 6 occupants might see -20% reduction of tax to pay. If that owner getting the -20% reduction was a landlord, he’d think “great, I’m saving money, was I ever smart to rent to that big family instead of that single airline pilot”. Instead of the situation now where a landlord would be disinclined to rent to a six person family over a single airline pilot, based on expected wear and tear of the home.

Self-declaration is used for many taxes, including personal and corporate taxes. Of course they are subject to audit, and the government has a good idea of what square footage is in people’s houses, since they list it in detail on yearly assessments.

What if it’s impossible to fix the supply side? That might be the reality.

Ok perhaps more semantics about who to blame, the person or the policy they are taking advantage of.

Definitely there should be a cap on capital gains, but it’s hard to fix housing policy that 65% of voters (and likely closer to 80%) benefit from. I have a lot more hope that supply side will be fixed than tax side

Too complicated to administer.

Just upzone everything and values in places where more people want to live will rise and those owners will pay more tax, increasing pressure to put more people there.

I might be imagining it but I seem to be seeing a slow creep upwards of prices being asked?

You are absolutely right, however 9 people paying 1/9 of the property tax each and each uses 1/9 of the municipalities services while the single person is taking the full on hit of property tax still equate to the single person paying more at the end of the day. That said, are you suggesting that the government should change the law to benefit slum lords to maximize space, like Hong Kong cage home rentals?

Great find. Impossible to say how big those revisions are in the later data.

Then again, there’s also this chart from the realtor survey on buyer financing. Substantial dropoff in high ratio mortgages in recent years (with the proviso that prior to 2015, “Unknown” financing was not an option, so presumably realtors just guessed if they didn’t know.

Still, only 9% of purchases today are high ratio.

Patriotz, depending on what class of property you own the municipal tax rates are a flat rate. The municipal tax rate does not increase with household income. As the property value increases then the property taxes paid within that class of property increases. Property taxes in Canada are considered regressive because house- hold incomes are distributed more unequally than the assessed home values on which property taxes are based. The GST and PST are a examples of a regressive tax while Income tax is a progressive tax.

So I will amend my conclusion to read that properties with nominal improvements could be taxed higher to encourage upgrading or redevelopment of the site if the personal income of the owner is also higher. In other words we should not tax the property at a higher amount if the owner/investor has a low personal income.

I hope this clears up any confusion for the readers. We wouldn’t want that to happen or want to move the conversation off the topic just to be an annoyance.

I was a landlord in Vancouver in the 1980s and I can tell you that there was no crisis for renters, provided they had a job of course. Prospective tenants were very fussy. Things picked up during and after Expo, but still not comparable to today.