The Vancouver Connection is Alive and Well

Vancouver buyers have been a significant force in the Victoria market in the last few years, starting to increase quickly in 2016 and playing a substantial role in the upswing in Victoria prices at that time. After the mortgage stress test cut the legs out from under that market in both cities, Vancouver buyers receded somewhat, but came back (especially in the luxury market) after the pandemic hit.

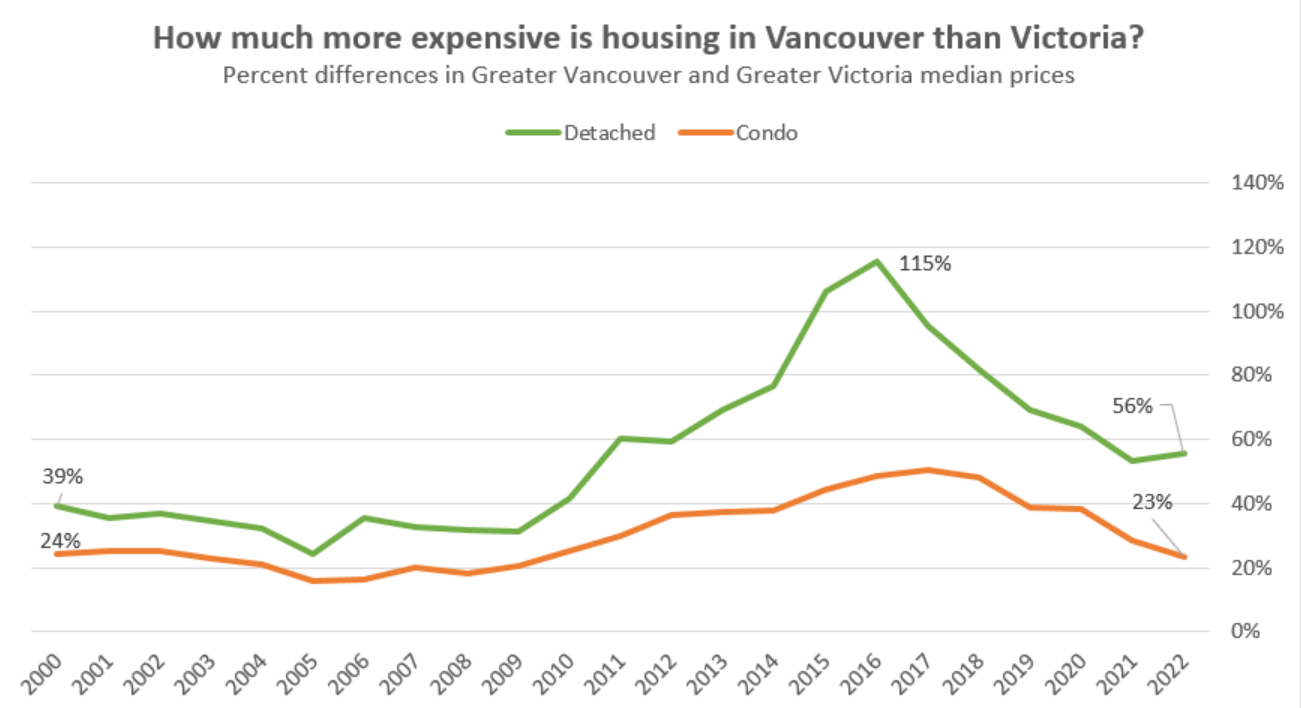

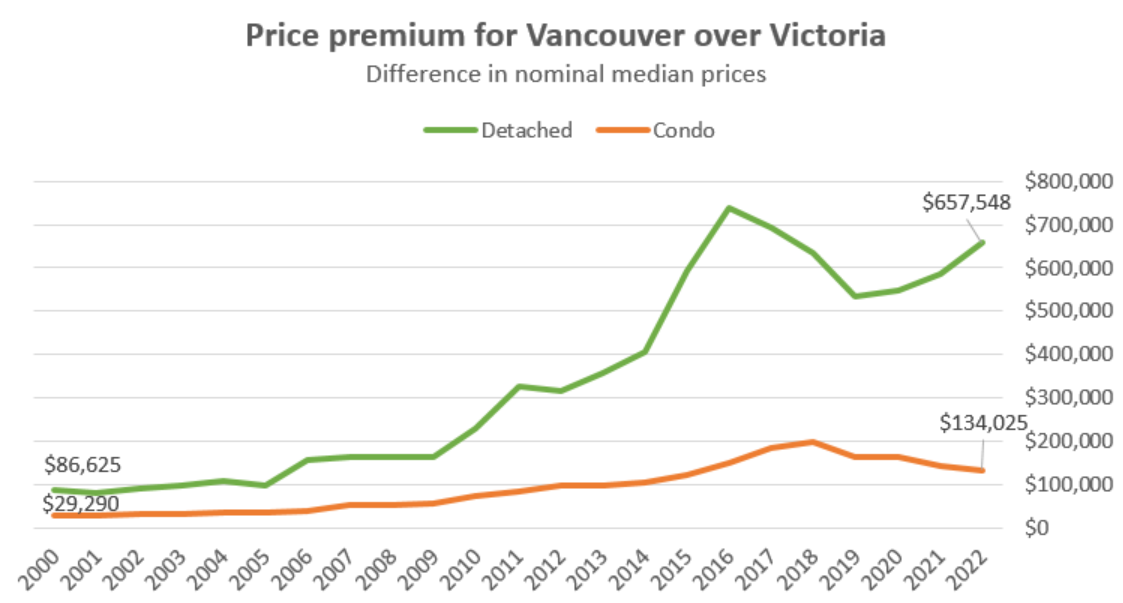

Vancouver property has always been more expensive than Victoria, but that premium used to be relatively small. 20 years ago, the median Vancouver condo was about 25% more expensive, while the median house cost about 35-40% more. That premium exploded during the 2010s as Vancouver prices kept appreciating while ours stagnated. Eventually in 2016 prices for houses in Vancouver cost more than double what they did here.

The foreign buyers tax killed the high end home market in Vancouver which drove down the price premium overall while Victoria prices turned up and closed the gap. Last year a detached house was 56% more expensive in Vancouver, while a condo went for 23% more, essentially unchanged from the turn of the century.

However what buyers seem to be paying attention to is not the percent but the dollar difference in prices. Because of relentless increases in the price of homes in both cities, that difference has been increasing again and for detached homes is nearing the 2016 peak.

That price premium for detached properties correlates very clearly with the proportion of buyers coming from the lower mainland. After dropping from 2016 to 2019 with the narrowing price gap, the number of lower mainland buyers picked right up again when Vancouver market activity returned and prices recovered.

Now we have to keep in mind that the majority of buyers are still local, and though out of town buyers were relatively active last year, that didn’t stop prices from declining. However out of town buyers are pure demand, so they tend to be more important in driving market conditions than local buyers. If you want to know how many there will be, looking at our prices relative to the markets people are moving from will give you a big clue.

Also the weekly sales

| May 2023 |

May

2022

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 177 | 348 | 540 | 761 | |

| New Listings | 292 | 614 | 928 | 1531 | |

| Active Listings | 2037 | 2108 | 2120 | 1776 | |

| Sales to New Listings | 61% | 57% | 58% | 50% | |

| Sales YoY Change | 0% | -4% | -5% | -27% | |

| New Lists YoY Change | -17% | -18% | -17% | +15% | |

| Inventory YoY Change | +40% | +33% | +27% | +22% | |

| Months of Inventory | 2.3 | ||||

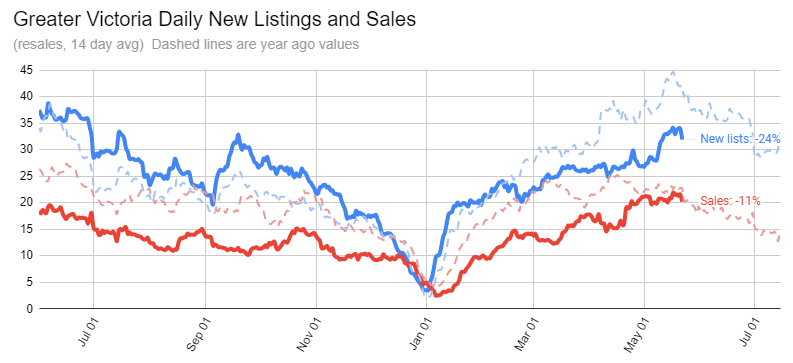

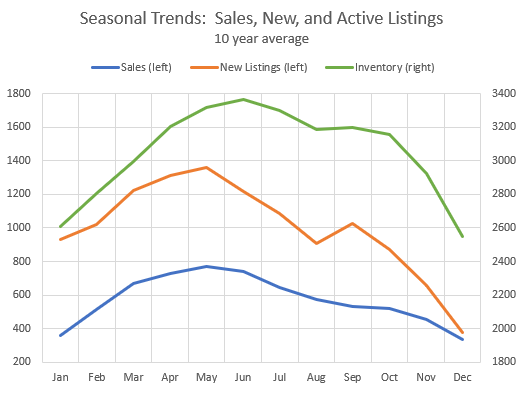

The story of the year continues: OK demand set against lacklustre supply. Sales are just a few percent below the year ago levels while new listings lag more significantly. We’ve got an extra business day this May compared to last year, so we may end up matching or exceeding last May’s total sales. Inventory is still increasing slowly, but it started the month up 40% from a year ago and is now only 27% higher.

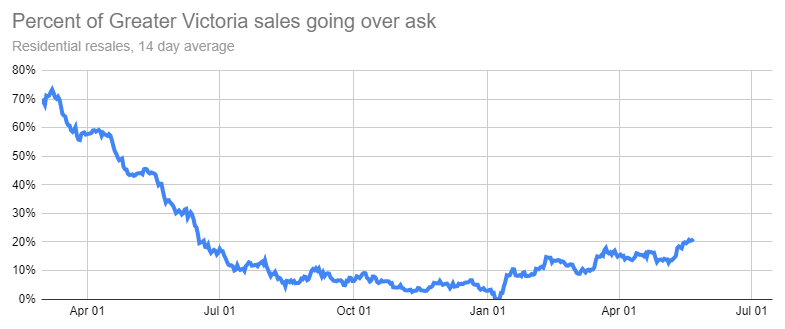

That’s pushed the rate of over-ask sales to 20%, which is a high for the year. Normally it takes less than 2 months of inventory to push much above 20%, so I doubt we will see this go much higher before the end of the spring market, but it’s another clear market of the sellers market even if prices haven’t regained their peak.

That’s pushed the rate of over-ask sales to 20%, which is a high for the year. Normally it takes less than 2 months of inventory to push much above 20%, so I doubt we will see this go much higher before the end of the spring market, but it’s another clear market of the sellers market even if prices haven’t regained their peak.

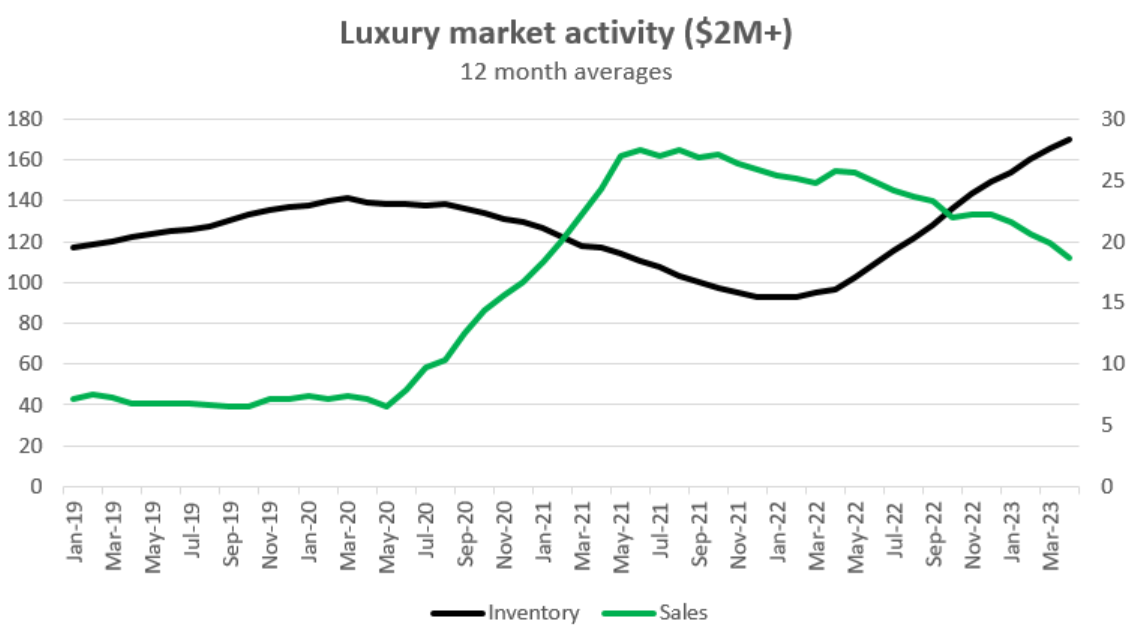

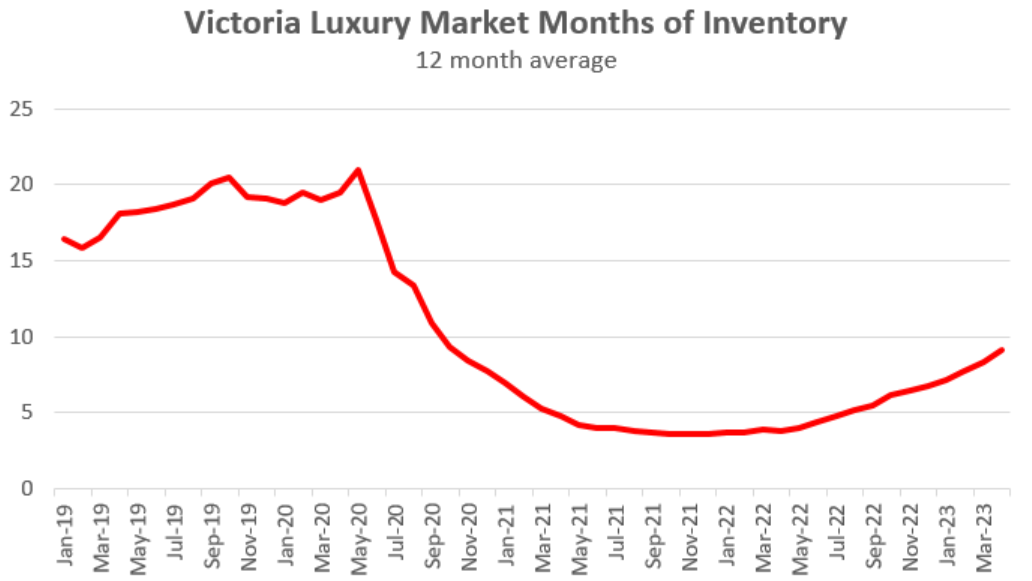

In the high end market, conditions have relaxed somewhat from the absolute frenzy we saw post-COVID when luxury sales increased fivefold. Inventory is up and sales are drifting down, but the market overall is still very active for the segment.

An average of 9 months of inventory for the trailing 12 months is double what it was last year, but in this segment time on market is often measured in years instead of days, so that still represents healthy activity. This market is linked to the flow of Vancouver buyers, and while those stay high it should keep the expensive properties moving as well, even if it sometimes takes a lot of price cuts.

Certainly since Canada is a constitutional monarchy public officers can be said to represent the monarch and the L-G is the highest ranking officer of the province.

The point is that L-Gs are appointed by the federal cabinet just as judges are. The is no involvement by the monarch, not even formally, in contrast to the G-G. This distinction was put into the BNA Act to ground the principle that the provinces are not sovereign.

This weeks posts are hilarious With many unhinged opinions and speculative posts. Some of you would be better off buying property in the Metaverse I think. Can you imagine your home and this comment section only a browser tab away? Hajaha

As much as gov’ts may want to (or are forced to) increase housing availability, if the project is not economically profitable the buildings will not get built…unless our gov’ts put some money on the table. Hard to say if that would be good or bad politics.

A developer is blaming the rising interest rates – among other things – for putting the brakes on a 400-unit condo project in the centre of Richmond. pre-sale buyers of Minoru Square were told this week the developer has “paused” the project and will return their 20 per cent deposit.

“Due to unforeseen circumstances, rising interest rates, and development challenges, we have made the hard decision to pause the project at this time,” …The company said it will work with the City of Richmond to “make changes to the design, residential and commercial make-up of the development.

-https://biv.com/article/2023/06/metro-vancouver-condo-development-hits-brakes-due-rising-interest-rates

Definitely not.

https://www.canada.ca/en/canadian-heritage/services/crown-canada/lieutenant-governors.html

Lieutenant governors are the highest-ranking officers of their province and represent His Majesty The King in their jurisdictions.

You got it.

That’s the popular conception, but the L-G actually represents the federal government.

https://www.merriam-webster.com/dictionary/wrote

Sorry, Merriam-Webster says I can use it as past participle if I like.

edit: guessing that it’s supposed to be past perfect?

Leo, throw up the next blog post, wouldya.

written 🙂

“Sorry, you’re right, I made a mistake and should have wrote “Child of Incest”.

You mean hereditary chief…

With respect to building costs, (I heard) the Aryze project on the corner of Foul Bay and Quamichan was on hold due to not being financially viable at the current time. Going to be an uphill battle to get affordable structures built in the current environment.

Sorry, you’re right, I made a mistake and should have wrote “Child of Incest”.

Minimum wage earners getting a 7% raise this year.

You mean the king 🙂

They should pin a notice regardless of whether they’re serious or not.

It’s ridiculous that we pay millions for representatives of the queen for every province.

Final May figures vs last May

Sales: 775 (up 2% or down 3% accounting for the additional business day)

New lists: 1356 (down 11%/15%)

Inventory: 2189 (up 23%)

“Rocket moon emoji”

Does this mean you think prices will eventually come crashing down to Earth? 🙂

[Rocket moon emoji]

What direction are prices going?

87 sales reported so far since Monday, so we’ll end around 785 vs 761 last May. 1 extra business day, so same sales pace overall

I guess no regular team meetings etc.

Tomorrow

There are 34 realtors at Fair Realty (my brokerage). I’ve only ever met four in person. Other than myself I have no idea what is going on with them until I see their listings/sales in our database.

As I said, Leo’s anaylsis is far better than what any brokerage could ever put together as Leo looks at the entire market not a small sample size.

Leo, where’s you new blog? Patiently waiting.

Got so greedy that he can’t even put atleast the down payment in a safer place….

Technically true, but a brokerage with >20 realtors working in different market segments in victoria should be able to provide somewhat of a sample on what is happening in the market. Not much different than channel checks at select retail stores that securities analysts often conduct prior to forecasting earnings.

Let’s see if you report the same thing in the next couple weeks.

At this point it would almost be easier to invent a way to decouple economic growth from population growth than to try to build a bazillion new homes.

https://www.cbc.ca/news/canada/british-columbia/victoria-mortgage-broker-misses-deadline-1.6859020?fbclid=IwAR3-o5uDOHCL9LgGulH3pQsOcYIdtbWZVu3SL6QqO8nRQy68UnoE_7dNjEE

Man that sucks.

lol, no it won’t be interesting. Oak Bay will claim infrastructure won’t support density. Victoria will hire 6 more “tree preservation officers” and kill or delay projects years over some non-sense no-value tree.

Let me know when something gets built. Even better, just let me know when something gets built under the already approved missing middle initiative.

Not talking about the Burrard site. The site by the University Golf course and UEL

As someone who knows the inner workings of a brokerage, your “insider contact” is not very good for the purposes of assessing market conditions going forward. Not to mention even the largest brokerage in Victoria has realtively small market share.

Leo’s weekly update analysis is far better in terms of TRYING to draw some conclusion moving forward than what any managing broker could ever offer. Listing paperwork to the brokerage is uploaded a day or two before a property goes to market and offers are uploaded at time of acceptance so they don’t have much insight into the future whatsoever.

Not sure I would bet against residential real estate in Victoria, but there is a possibility it was a dead cat bounce. Thing is even if we are in a dead cat bounce the inventory still sucks. June will be a decent month as at least the first two weeks will be strong. July and August I could see things slowing down a lot (still better than last year thought), problem is we aren’t at 5,000 listings like we were 10 years ago.

When I see SFH in the 800k to $1.2 mill not going in multiple offers, I’ll report, but right now same story for all my buyers in this price range. Weekend showings with them and then things going into multiples.

Clover Residential (formerly Duttons).

Not the Musqueams. The Burrard Bridge site belongs to what used to be called the Burrard Band on the North Shore, don’t recall their current name.

How about the BC government put some skin in the game. Government House. We don’t need the Lt. Governor living on a a 33 acre site. That’s a larger site than the Musqueam Lands in Vancouver who are developing their site into high rise towers and townhouse developments.

There is lots of land available that can be re-developed into comprehensive developments instead of demolishing existing homes that are used as rentals on a small lot here and a small lot there basis. And each one of them will take years to get approvals on a one by one basis displacing home owners and renters. Do a CD and get it over with.

What I notice is there are lots of people that want change but when it comes down to it, the same people will find lots of reasons why it can’t be done.

If the BC government is truly serious then pin an eviction notice on the door of Government House.

Vancouver eliminated SFH zoning a few years ago. Allowing an increase in homebuilding and making it happen are two different things. How is a city supposed to make it happen? Sounds like – well you know what. Although as Harry Rankin once said, it makes no sense to describe a city government as socialist since cities don’t have the power to enact actual socialist policies.

And just how do you know what I was supposed to be thinking 20+ years ago? In any case, the accuracy of anyone’s predictions has nothing to do with whether they are getting simple facts right. And it’s a simple fact that money supply increases when central banks buy bonds (aka QE) and decreases when they sell bonds or let them mature. And lower bond prices resulting from lower demand for bonds means higher rates, by definition.

Talked to some policy wonks from Minister Freeland’s office a while ago, my suggestions for the feds were:

No need to use agricultural land when we have hundreds of acres of land that can be rezoned multifamily within the urban containment boundary.

From: https://www.ctvnews.ca/business/what-slowdown-economy-outperforms-raising-odds-of-a-rate-hike-1.6420627

The Blenkinsop Valley is about the size of Vic West and comprises hundreds of acres close in to the City that is zoned agricultural. How many would be in favor of rezoning that neighborhood to a comprehensive development of high rises and town homes?

“The reference was to PP, not Patrick. I will edit my comment to make that more clear.”

Thank you for clarifying.

The reference was to PP, not Patrick. I think Patrick is a very serious person. I will edit my comment to make that more clear.

The Feds have the power to reduce the investment demand for housing. They could make residential RE a less attractive investment through aggressive and significant taxation changes. They choose not to. Maybe in the future… but for now they are taking the easy route, kicking the can down the road.

“As for the messenger, I would agree with that if the messenger came across as a serious person.”

That’s not very kind or constructive, Dad. Your last sentence was not needed and I would assume you are letting your emotions get the best of you.

Ok – it’s just not really easy to have a policy discussion on 6 ideas contained in exactly 6 bullet points taken from a populist platform. I’ll say that in principle, I have nothing against the idea of using federal funding as a carrot/stick.

On the other hand, the money printing thing is just silly. Cutting federal spending has nothing to do with the Bank of Canada’s independence and will not end whatever “inflationary bubbles” the BoC supposedly created. In fact, you would expect capping federal spending to be disinflationary, which could actually put downward pressure on rates.

As for the messenger, I would agree with that if the messenger (meaning Pierre) came across as a serious person.

Carrot VS stick is debatable, but your specific criticism was that the 6 month check-ins were not fast enough. However many of your proposals are variants of “mandate more housing and attach sticks”. Ok, but think about the timelines here. First you have to come up with the targets, then you have to set them. The province is proposing that happens within 6 weeks which seems reasonable.

Before you hit someone with a stick you need to give them a chance to hit your targets, and even if the approvals delay is zero, a new home requires land acquisition, design, and construction. Absolute minimum of 2 years there, so you certainly can’t have a deadline with sticks before then. Realistically you need zoning reform, so a super-accelerated process would be 6-12 months for substantial reforms (Victoria’s missing middle was like 4 years). So we are 3 years out for a date where we can really evaluate a municipality against a target and punish them.

As fun as the gatekeepers rhetoric is, I doubt it’s a winning strategy. Great way to galvanize the cities against the federal government though. Can you imagine if Trudeau threatened mayors of conservative cities that they would cut off funding? Is it fair to punish a city’s citizens by withholding federal funding when the council they likely didn’t vote for is continuing decades of restrictive planning like they’ve always done? Makes absolutely no sense to say that Victoria shouldn’t have a sewage treatment plant or an interchange because they didn’t build enough housing.

Realistically the federal government is simply the wrong level to make those reforms. The provincial government has land use powers, and that’s where the reforms need to happen. The province shouldn’t punish cities for not building housing, the province should simply set the minimum zoning standards and then pony up the cash to ensure cities have the money for the infrastructure required to keep up with growth.

Off topic, but there is nothing wrong with the CPC or PP. Anyone who still thinks JT has been doing a good job and is worthy of being our PM: give your head a shake. He has ruined our country and he should be an incredible embarrassment for us all.

Not sure why a 20+ year BC housing perma-bear would consider himself in a position to tell anyone how the monetary system works.

We’ve agreed around here that “housing is non-partisan”. That means you should respond to the ideas and not the messenger.

And for the record, provincially I like the NDP, though not on the housing platforms. But they’re doing fine on health, social and (so far) economy.

The ideas I listed are intended for federal and provincial governments to do. Ideally to be done together, but I don’t care which one does them.

I disagree that many of those same ideas are being done. And the ones that overlap are being proposed using the “stick” instead of the “carrot”.

For example the province aren’t doing this:

Require unaffordable big cities like Vancouver to increase homebuilding by 15% annually or face big financial penalties and have portions of their federal funding withheld.

And if they did that and it worked, that would be a big thing and bigger than anything the province is planning, which is why I think it would help quicker.

I think he’s just a fan of Pierre and the CPC.

EDIT: Would the federal government even have jurisdiction to set municipal housing targets for municipalities and then levy “financial penalties” against a them if they don’t follow through? Province has already legislated in this sphere, and there might be a little something about interjurisdictional immunity.

Most of those they’re currently already doing and you didn’t address at all why they would be faster.

Which is the same as increasing interest rates, but it sounds a lot better to those who don’t understand how the monetary system works.

Require this how? There was a recent article in the G&M on how unsuitable most office buildings are for residential conversions. You’d probably have to give them away.

https://www.theglobeandmail.com/business/industry-news/property-report/article-office-conversion-to-housing-costly-say-developers/

There’s plenty else that’s questionable – for example failing to take account the differences between multi-municipality metros like Victoria and Vancouver and even Toronto, and unicities like Calgary.

But PP knows his supporters want simplistic answers.

Oh by the way, PP wants to increase immigration. But he doesn’t say that on Twitter, just when he’s talking to ethnic groups.

Great ideas Patrick, but where exactly are you going to build all these properties? Farmland? In 25 years we will lose 1/2 our agricultural production and one of our prime sources of revenue. Best solution is to decrease demand.

Some good ideas Patrick, thanks for sharing.

My pleasure…

—- Require unaffordable big cities like Vancouver to increase homebuilding by 15% annually or face big financial penalties and have portions of their federal funding withheld.

—- Impose a NIMBY penalty on big city gatekeepers for egregious cases of NIMBYism. We will empower residents to file complaints about NIMBYism with the federal infrastructure department. When complaints are well-founded, we will withhold infrastructure dollars until municipalities remove the blockage and allow homebuilding to take place.

—- Reward cities who are removing gatekeepers and getting homes built by providing a building bonus for municipalities who boost homebuilding.

—- Require cities seeking federal funds pre-approve building permits for high-density housing and employment on all available land surrounding transit stations.

—- Sell off 15 percent of the federal government’s 37,000 buildings. We will require these buildings to be turned into affordable housing.

—- Stop printing money. We will require every dollar of new spending to be matched by a dollar of savings. This will end the inflationary bubbles the Bank of Canada created, fueling a crisis in the housing market.

https://www.conservative.ca/fire-gatekeepers-build-homes-fast/

I think that’s why their target list of munis included a few that will be keen to build housing anyway and will be very glad to use the provincial directive as cover to make the changes that would otherwise be politically infeasible to make. Those munis will publicly support the move from the province, and then work with them in good faith to make those reforms.

Then when Oak Bay drags their feet it will be much easier to say look we are working cooperatively with 7 munis and getting things done, but on this one we are forced to bring the hammer down. If they choose 10 munis that are solidly anti-growth then the optics are a lot worse if all of them push back on the province.

Feel free to propose a solution that will fix the problem we’ve spent the last 5 decades creating more quickly.

Wanna take your own advice and adjust your “cost per sqft to build”?

Sounds slow and weak to me. First “progress update” isn’t due for 7 months, and then they just need to show that “progress is being made”, not “specific targets have been met.”

For governments, “progress” can be merely “a committee has been formed” or “a consultant has been hired”

The surprising thing isn’t that governments keep pumping out these do-nothing plans, it’s that there are people here who keep believing them.

I think BoC will hold in June but may hike another .25% in July. Not that their forward guidance means much, but the threshold given for raising rates again was “an accumulation of evidence” that inflation is not subsiding. So it would seem prudent and consistent with that approach to hold off until May CPI is released, particularly since the hotter-than-expected April CPI was mostly because of gas, mortgage interest and rent.

The Province may be able to override the City, but that’s a long way away before any may be built. Any new development has to be economically feasible to the developer. The market value of the end product has to be in excess of the land and construction costs to provide a reasonable profit to the developer or it does not get built.

If it cost 3 million to build but you can only sell it for 2.5 million it’s just not going to happen.

LMAO, uhhh where is the profit?

So not much will be built and the province and municipalities will start going toe to toe that won’t go well

Me too.

It will require some political nerve should it come to that.

Already shared my “insider contact” insight last week.

https://househuntvictoria.ca/2023/05/15/stocks-and-flows/#comment-101806

“The Housing Supply Act also enables compliance options as a last resort if municipalities are unable to create conditions necessary to ensure housing gets built.”

I interpreted that more like they will directly override the zoning powers of that municipality to get things built

Without the aid of hindsight, the terms dead cat bounce and bulltrap are nothing more than wishful thinking.

I doubt if the NDP were planning on winning the Oak Bay seat in the next election anyway so this is not going to hurt them.

If a municipality is naughty the province will be like, “Don’t make me stop this car!”

Can anyone recommend a good site or agency for long term full house rentals? Does not need to be furnished.

Classic bulltrap right?

the last 2 mos have been a dead cat bounce… who agrees?

Interesting indeed

Province just announced the municipalities that will be required to meet their housing targets. Here they include Victoria, Saanich, and Oak Bay.

Gonna be interesting.

Well let’s test the market for new housing to find a cost per square foot is build. These are asking prices and I have made no allowance for an increase in lot value and it assumes the property will sell at list price. This is RAW data.

1) 1157 Spirit Court in Langford is a new 3,525 square foot on a 6,272 square foot lot for sale in Langford.

Listed at $2,099,900

The lot was purchased at $565,000 plus GST or $593,250

The residual amount of the improvements is $1,506,650 which works out to $427 per square foot.

2) 2519 Obsidian s a more modest middle income new house of 2,774 square feet on a 6,878 square foot lot

Listed at $1,399,900

The lot was purchased at $336,000 including GST

The residual for the improvements is $1,063,900 or $389 per square foot

3) 3424 Caldera is a new 3,374 square feet home on a 4,883 square feet lot in Langford.

Listed at $1,699,900

Lot purchased at $566,895

Residual value to the Improvements is $1,133,301 or $336 per square foot.

Averaged cost of construction is $384 per square foot.

And following on the Toronto story that Whatever referred to earlier, Garth Turner mentions that…

“As for owning vs renting, the numbers speak for themselves. You can buy it [average new TO condo] and occupy the unit for five grand a month, or rent it and live in exactly the same place for half that, banking the rest.

And yet we consider loser investors to be smarter than those that they house.”

I wonder who you are calling the shoeshine boy 🙂

Carrying the analogy further, realtors are like sell-side analysts who rate everything as Buy or Strong Buy. If you ask realtors, when is a good time NOT to buy, the answer will be never.

A tale of indentured servitude from Lord Garth:

“Remember that the Canadian economy is more than 65% based on consumer spending. Add in residential real estate, and you get the picture – we’ve built a nation teetering on the pillars of indenture.

The cost of debt has exploded. Indebtedness is increasing. The toll is greatest on those of least income. By fostering the myth that there’s only one path to financial security – real estate – we have led so many families into a borrowing trap that is reducing, not building, wealth.”

Depends a little what you are looking at, but I would hesitate to say it’s cooling off per se until I saw a bit more, but yes lots of anecdotes around the country mentioning it in different markets. What’s almost certainly true is that we’re past the seasonal peak in sales and so we should expect them to decrease more or less for the rest of the year. I think that does influence a lot of the anecdotes, but remains to be seen if any decline in activity is beyond what we would expect for the season.

Kristan and I hear people still quote 250 bucks a square to build today lol

“”The run of sturdy data undoubtedly raises the odds that the Bank of Canada needs to go back to the well of rate hikes, and even puts some chance on a move as early as next week’s policy decision,” BMO chief economist Douglas Porter said in a client note.”

https://www.bnnbloomberg.ca/what-slowdown-economy-continues-to-outperform-1.1926930

Rate hike incoming? I’ve got feeling they are going to really try to crush things and maybe even do a .5% hike in July.

Sometimes it does, and sometimes it goes the other way…only your Ouija Board knows for sure.

Also, my God:

https://twitter.com/TalktoARYZE/status/1663300402325118977

“A basic 6 storey light wood frame apartment with no parking, free land, no financing fees, and no profit costs around $725psf net residential to build. With pending building code changes coming this number is gonna increase by 10-20%.”

Leo: along the lines of your plot, I’ve been noticing anecdotal comments that things are cooling off a bit. Eg Saretsky’s twitter. What say you?

Greetings from sunny Santa Barbara all! (We’re here for a month for a long term scientific program at this lovely place called the KITP; they put us up and everything..)

Interesting

I’m assuming Pierre would have a rather lais·sez-faire approach to the housing market. Yet I know he would at least help reduce inflation and get control over our economy and national debt. Perhaps, he won’t do anything to bring housing prices down, but if he can stop our money from continuously losing value, then that would be great. Yes we need more supply is a simple explenation. Another simple explanation is that the rise in Canadian house prices is a reflection of the decline in the value of the Canadian dollar. Our RE prices are going up, but the actual value of RE is not. It is just the value of our money that is going down.

Those damn government gatekeepers. Why do they keep doing this to us…

The responses here have provided me with many considerations that I would not have thought of on my own & are showing me a pathway forward.

My conclusion, with my visual design skills as a photographer & previously as a prop stylist is that I will be able to doll the place up quite a bit & quite inexpensively. My old home already has a cosy & very cool vibe & the garden is gorgeous. People love to visit & are mostly wowed by my decorating “effects”. Think Bohemian style.

I can definitely see a first time buyer being interested in my place with a little refreshing & smaller modifications on my part. Targeting first time buyers also seems way less stressful than thinking of my home as a tear down only & having to deal with developers. Although, as I will list MLS open to all I would definitely still be open to the right offer from a developer if it came along .

Absolutely, I will disclose all “known defects” – they have been very well known to me for almost 3 decades & my conscience just wouldn’t let me do otherwise.

Thanks everyone for sharing your knowledge!

The story took place in 1929 : Joseph Patrick “Joe” Kennedy, Sr. JFK’s father, claimed that he knew it was time to get out of the stock market when he got investment tips from a shoeshine boy. On that moment Joe Kennedy had the intuition that we were at the end of the bull market and subsequently he decided to short the market and became .. multi-millionaire !

Ever since, the shoeshine boy has been the metaphor for “time to get out”; for the end of the mania phase in which everyone, even the shoeshine boy, wants in.

“build, build, build”…”get the gatekeepers out of the way” “allow builders to build”

https://twitter.com/RE_MarketWatch/status/1663716310453239808

How do they know they are losing money on these condos? Are they basing it on average rental rates? How many of these condos are airbnbs and getting double average rental rates? Most Toronto condo investors are very well off and can use the write off anyway. Don’t lose any sleep over it.

Last year marked the first time that more than half of investors in newly-completed Greater Toronto Area condos were losing money on their rental properties — and authors of the report that reached that conclusion expect the trend to persist.

The research from the Canadian Imperial Bank of Commerce and real estate research firm Urbanation found 48 per cent of leveraged condo investors who bought pre-construction units to rent out were cash flow positive in 2022.

For the majority of investors, rent generated by newly-completed units was lower than mortgage costs, condo fees and property taxes.

Urbanation calls this a “substantial” shift in cash flow that may cause investors to shorten their time holding a unit and/or think twice about investing in the Toronto area, and notes that 59 per cent of condos built in the last five years are used as rentals as of 2021 (compared to 37 per cent in 2011).

Please buy a home! I am sick of people aiming for a 50% market crash… you just had your market crash. Congratulations to anyone who bought in November 2022. I am not thinking (hoping) that real-estate goes up or down. Just buy a home … that is it . Stop trying for your market crash.

Stupid and shortsighted. At least on the mountain bike side of things the trails were all built and maintained by volunteers. Those volunteers aren’t going to be paying 45 bucks a day to maintain trails that no one is allowed to use.

End result – residents will have exclusive use of crappy trails that no one maintains. Volunteers will build trails at Hartland, JLBP and Sooke Mountain instead.

No, there is big difference. It appears to me that Mr. Martel is likely guilty of criminal conduct in a similar manner to Bernie Madoff.

Swindling someone is far different than not permitting them to cut a foot out our your siding for testing as part of a deal they can then walk away from. Again, many people are going to be fine to cover over siding with asbestos in it and it is not considered dangerous, and there are other houses available. Just move on.

However, if you know about a hidden defect like past basement flooding and you lie on the disclosure form, that is something you can be sued for damages for – as it should be.

If you know about a material hidden defect you are required to disclose it.

Sellers are not required to test all their home materials prior to sale, nor are they required to allow invasive testing requiring significant repairs prior to sale. Siding with asbestos in it might be something a seller worries about, but doesn’t know about. Asbestos is not a big risk if you don’t plan to remove it and the recommended course of action is to reside over top and not remove I believe. If a prospective buyer wants to test the siding and the request is refused they can simply move on – they do not have to purchase the property.

Disclosure requirements for a specific matter might change some day if our knowledge about specific environmental risk changes. In the past the testing for buried oil tanks was not considered a big risk – until it was.

The limit right now is that the hidden defect is known based on the information available to them ie. unauthorized renos, prior grow op… these things are specifically identified on the required property disclosure form plus any other known material latent risk. Seems reasonable to me.

The rules are here: https://www.bcfsa.ca/public-resources/real-estate/consumer-resources/consumer-guide-material-latent-defects

Bear Mountain to start charging $45/day trail fee to non-residents

https://www.cheknews.ca/bear-mountain-to-start-charging-45-day-trail-fee-to-non-residents-1154357/

People, wealthy people, are always paying too much for art, classic cars, sports memorabilia, etc… Even sports franchises. In one year a work of art that sold for $50 million can easily drop to $25 million. Or, it can jump to $200 million in 10 years. Markets are very unpredictable, especially in commodities that have no real use. Real estate, however, is a necessity, therefore has intrinsic value. There is no rational explanation why a sports card, which is a piece of cardboard with a picture on it, is worth $12 million.

When it comes to real estate, finding the ideal house in an ideal location is a difficult thing to accomplish. When it is presented to you, do you “cheap out” and not buy it on some principle or do you bite the bullet and pay too much? Especially when that particular property might not come up for sale again in half a century. For decades Canadians have had the luxury of having an ample inventory of properties to choose from. That ship has sailed and families are holding on to what they have and will probably be passing the property down within their own family.

No Frank, you just would not have bought that house. You still would have bought a house but not gotten caught up in a bidding war over that home and over paid. Not all homes selling today are having bidding wars.

I don’t know why when it comes to real estate people can not understand that over paying means that when you go to sell you will net less than if you had not gotten caught up in a bidding war and bought a different property. Just change real estate to any other commodity and people understand. Call it real estate and their minds go numb.

For the sake of argument let’s call it the Elon musk / Twitter syndrome

Assuming you remain a homeowner for life…

That $100k loss only matters for the “final sale”, either when you’re dead or going into a nursing home.

Other sales before that are going to probably involve selling and buying a better home. In those cases, the $100k loss isn’t going to mean much, because the better house you want has fallen more than $100k.

It’s worse if you over pay and your house goes down $500,000 in ten years. A lot worse. If you didn’t buy a house and it did double, your even further in the hole. By not overpaying, your out of the game which has proven to be a huge mistake. It’s only money. People thought I was crazy when I “overpaid” 30 years ago.

Say you were to buy a house today and got into a bidding war and “won” but ended up paying $100,000 too much. Say in ten years from now house prices double. Does it really matter?

Fu^&ing right it matters!!

You’ll net less on the future sale and will have paid principle and interest on that $100,000.

In ten years Canada might not exist.

Frank, and in ten years the dollar will drop half in value. Just a thought.

My friends daughter bought a townhouse in the Toronto area and a few months later they had to repair the sewer under their driveway for $8000. The joys of homeownership, they also bought at the peak of the market, more joy. In ten years their property will probably double in value and it will all be water under the bridge.

This is exactly how we end up with the Greg Martels of the world. People prey on people who are in positions of weakness, and we’ve put in rules and regulations to try to thwart it.

A homebuyer from Victoria, B.C., is upset over being hit with $50,000 worth of unexpected repairs to his basement, after the seller and his realtor didn’t tell him about previous water leakage problems.

“We don’t care — between the seller and the realtor — who was responsible for disclosing or who didn’t disclose. The two of them knew there had been an issue with this house,”

His dilemma is similar to those of hundreds of Canadians who’ve gone to court in recent years, claiming they weren’t told about known defects in homes they purchased. Sellers in every province are supposed to disclose any major, hidden defects to prospective buyers.

-CBC News · Posted: Nov 07, 2011

It applies to private sales as well. Not sure why government did not exclude private sales.

Thanks totoro. I think I get it. Sellers are not required to look for, test, confirm or quantify the contaminant.

Would you also say there is nothing wrong with a real estate agent telling their client, who’s interest they represent, to keep their mouth shut about any defects, issues, contaminants that they know of or suspect? This would be in the interest of their client as long as there is no legal liability for issues that will be discovered by the buyer at a future date and which the buyer can’t prove the seller knew about… It sounds like this never happens anyway.

We can all rest assured that this industry has strong oversight/regulations and no issues with ethics.

I’m not sure if I’m opposed to dual agency. How many agents, desperate for a sale, are advising their buyers to put in an offer far above asking to ensure they get the sale? Some agents specialize in one area and have a list of buyers looking for a property. If they happen to get a listing in that area, they could inform the seller that they have interested buyers and could negotiate a sale without bringing the property to market. Some sellers might not want a public open house or have agents bringing in buyers while their not home. It is an invasion of privacy. As long as there is no transparency in the offer system, buyers will pay too much.

Does the rescission period apply to private sales? Is it only enforceable when a property is listed by an agent?

People should be free to act on their own behalf, just as they are with complicated legal or accounting matters, but they do so at their own risk and liability. Most people are not going to do that with a house purchase because they do not have the expertise and would rather not pay by the hour for a lawyer to review documents. However, for those with the right skill set/experience, they can save ex. 30k and should be able to do this – it should not be restricted.

What I do take issue with is Re agents stating that the buyer representation is “free”. It is not, nor should it be. The buyer’s agent gets paid a commission from the sales price. If I buy without a realtor but using, ex. a lawyer, the buyer’s commission can be requested as a discount from the purchase price. The selling realtor doesn’t need to agree, but it does not cost them extra to do so. In a hot market I can make an offer without this request and double the selling agents commission – making my offer potentially more attractive and it is then up to the listing realtor to decide whether they will keep this amount or give some back to their client.

I am strongly in favour of the restriction on dual agency for obvious reasons. Your agent should be acting in your best interests and they cannot do so when they are representing both parties who have different interests.

There is absolutely nothing wrong with Marko advising his client not to agree to asbestos testing given the need for a repair and impact on future sales prices should the deal collapse. The buyer does not have to buy the property and can walk based on this. This type of advice is why you might want to hire an experienced agent.

There is definitely an irrational exuberance among prospective purchasers in the $1,000,000 to $1,600,000 range with multiple bids over asking price. It isn’t clear if this trend is sustainable, but if you are looking for a home in this price range today you are going to need deeper pockets. My guestimate is that, if this recent trend fails to be sustainable, these buyers will find that they paid between 10 to 15 percent too much. Just as those that bought during Covid found out.

Just listend to a podcast with an agent in Calgary in he says he double ends 18% of his listings so yes strong outside of BC. They also have no rental controls in Alberta, amazing what supply does.

That is a really good point, I can’t think of anything else I am happy with in terms of red tape. I just don’t understand how one is suppose to give solid advice in dual agency? The two parties might as well do a private deal at that point and split the $30k commission savings.

Sorry, I didn’t mean you specifically, but industry as a whole. Unless things have changed recently, this is only a BC rule too. Dual agency still exists in many other provinces (if not all). I remember something about Ontario considering putting in some rules, but don’t remember if they actually did.

Fair to say, that this is the only government red tape you’re happy with?

Not sure about “advantage” for a seller but lots of things I can think of to help the situation. For example, if they have an attractive property (offer delay scenario) don’t do the offer delay on a Wednesday/Thursday/Friday as the rescission period then takes you across a weekend (you have to wait 5 days instead of 3). Aka have the offer review Monday or Tuesday so rescission expires Thursday or Friday.

Get the deposit on acceptance so you aren’t chasing the buyer for 0.25% penalty fee if they rescind.

If the buyer asks for access for inspection during rescission period do you as the seller agree, or not? Etc., etc.

There are a million scenarios out there, the seller needs some good counsel and advice that best represents THEIR interests.

I find a lot of people in the industry struggle with the concept of who they are actually representing. Just on Sunday I was negotating an offer for a client (buyer) and the listing agent wanted technical changes made to the contract which are kind of non-sense, but the more important thing is the technical changes she wanted in the contract were for the benefit of the buyer (my client), not the seller (her client). I was like, sure, you just send me over those changes and I will have my buyer initial asap.

“Tons of different ways to play this depending on the situation and who you are representing (buyer or seller).”

You described how a buyer can use the recission policy to their advantage, so do you have any ways sellers can use it to their advantage? I have friends listing soon and just wondered what they’ll be up against.

Even before it was forced upon the industry I always believed both parties should have their own representation. I’ve explained my thoughts many times on HHV why everyone should be represented, I know Toroto will disagree :). I absolutely HATED dealing with unrepresented parties (I was doing unrepresented 13 years ago when everyone was still offering dual agency). I was probably the only agent that was really really happy with these changes.

Dual agency was simply idiotic imo.

I mean… that was forced down your throat because of slimy practices, so it shouldn’t be THAT much of a surprise.

I don’t understand the comment regarding slimy practices. The other party is ALWAYS represented by a different professional that they are paying $10k, $20k, $30k or more in real estate fees to represent their best interests? Is it my fault if someone opts for professional representation that gives them poor advise during negotiations.

What I am exactly suppose to do? Not look out for the best interests of my own client because the other party is poorly represented. Of course, I am going to try and negotiate asbestos testing for a teardown buyer client. It is up to the listing agent representing the seller to give them appropriate advise as to weather to agree to the testing, or not. If I am the listing agent I am advising my client to not agree under most circumstances.

I am not in favour if the rescission period but a lot of new strategies and tactics have opened up with in place. I am finding when sellers receive an “unconditional” offer they still view it as an unconditional offer even thought it is not in reality due to the rescission period. I’ve still seen sellers willing to take substantially less for an unconditional vs conditional. Not sure what kind of advise the listing agents are giving their clients?

When I write up an “unconditional” offer for a buyer I write into the contract “this is an unconditional offer” into two different sections for the seller to read even I know it isn’t really an unconditional offer (thank the government). As a buyer you can employ a number of strategies to take advantage of these perceived unconditional offers. For example, write up an unconditional offer to gain an advantage over conditional offers, or to obtain a better price point. Add a clause (not a subject) in the contract that the seller agrees to provide access to the home for inspection during the three day rescission period. If the inspection is a disaster collapse the offer and pay the 0.25% fee ($2,500 on $1,000,000) and continue searching.

Tons of different ways to play this depending on the situation and who you are representing (buyer or seller).

Lots of things I haven’t come across yet that will be interesting to see how they play out when they do come up. What happens if during the three-day rescission period a material latent defect not disclosed by the seller is discovered by the buyer. Does the buyer still have to pay the 0.25% fee?

Etc., etc.

Now let me tell you about car salesmen Rich…

It would be a windfall for current homeowners.

Still trying to find out what the problem is with a 40-100 year amortization? I talked to three AFC’s and they said there is no problem. Why don’t you find someone who can tell you the problem with 40-100 year amortization. Or you can spend a lot of time and waste everyone’s time knowing what a AFC is. ( opposite of a CFA)

That’s true. We were buyers in late 2020 when the market was hot, but not completely insane.

Then you weren’t shopping in the recent market. Conditional offers weren’t being accepted, even looked at or considered. It was even tough to get time to get inspections in. Hopefully, the recision period helps that side of it.

Most people, me included, would make the offer conditional on inspection. That way, we don’t waste $500 before the offer is even accepted.

“It is why I think the whole legislation about recession misses the point that what should be allowed is a five day window for inspections to occur including engineer, electrical, perimeter drain and plumbing inspections”

Thanks, Barrister. I am unclear, though – what exactly is the whole legislation about recession, please ?

What a slimy industry.

Seemed when things were really fired up during the pandemic most of the disclosure reports I read before making offers just had line through them and just stated “as is, where is” really no matter what the condition of the property. Before making any offer, I just spent the money for my own inspection (which I assume people do anyways). Probably made my offers lower because what was found and likely resulted in not being the accepted offers.

Marko and I disagree on a lot of points but he is perfectly correct about not advising clients to go looking for latent defects or to allow for testing. That would not benefit his client the seller. Houses have always been a matter of buyer beware. If you are a buyer, in spite of the legal requirement for a seller to disclose, you better assume that you are on your own in terms of inspections.

It is why I think the whole legislation about recession misses the point that what should be allowed is a five day window for inspections to occur including engineer, electrical, perimeter drain and plumbing inspections.

Just one more:

“I’ve always advised my sellers to take this stance (not allow) within reason, and for my buyers I’ve always pushed for asbestos testing on teardowns if I don’t think it will be compromise their offer. When the results come back positive then the seller is in a crappy situation… It is called negotiating for the best interests of your clients. I don’t believe in “win-win” non-sense”

So he clearly acknowledges that it is in the best interest of his buyers to have the seller test to confirm the presence of the contamination (assuming this is to get an estimate of the cost to deal with it).

Slimy in my opinion. I don’t care whether it is common practice.

$140,000 for a 1,000 sq.ft space close to beautiful Victoria. Now that is affordable! and you don’t have to live in Saskatchewan. There is potential here for those wanting to get into the market. We should look at building more trailer parks.

Nevermind.

I like this one and it is cheap as hell: https://www.rew.ca/properties/5016248/37a-2500-florence-lake-road-langford-bc?search_params%5Bproperty_type%5D=mfd_mobile_home&search_params%5Bquery%5D=Langford%2C+BC&searchable_id=731&searchable_type=Geography

Frank not to worry the trailer was more likely to be full of urea formaldehyde the bogeyman of the day

Marko, I know you are reading my comments – don’t pretend like you are not.

I think my question was legitimate. As someone who isn’t a lawyer or a real estate sales person, I admit I don’t know anything about asbestos or latent defect law.

All I know is that you do have a responsibility to disclose contamination issues that you know of.

“I wouldn’t advise allowing any testing of asbestos.”

Followed by:

“Same with vermiculite… I had 10 deals +/- collapse 2010-2014 over vermiculite issues (approx 10 to 15k to remove). Haven’t had one vermiculite related collapse since 2015.”

From Marko’s poorly worded and constructed ramblings, it seems like he is saying that he stopped advising his clients to disclose vermiculite issues in 2015 and he hasn’t had a problem since…

Anyhow, I still think it sounds like the real estate industry’s practice is don’t look because you might find something that you will have to disclose.

You can’t disclose what you don’t know – right?

This property might have asbestos, but we don’t know for sure and we don’t know how much. Also we don’t know whether it has leaking roofs or vermin infestation (but we haven’t looked either).

Caveat emptor indeed.

Thank you Marko for the lesson on how you make your money.

The asbestos tiles cover the exterior in a shingle-type pattern that is obvious to anyone – can’t hide the fact.

They were likely added when the second addition was built in the 1950’s – covering over the existing wooden clapboard of the rest of the house to unify the appearance.

When I bought this house 28 years ago multiple sources advised to just paint the tiles but to otherwise leave them alone. One surprising positive is how incredibly well that original multi-coat painting has held up on this surface to this day.

When selling I’m just going to be honest and disclose what I know but I definitely won’t be hunting around looking for more issues.

Rich- There are more trailer parks up Island. I’ve seen them advertised in Ladysmith, they typically start around $300,000. Even that is beyond reach for some people. I lived in one when I went to school on the outskirts of Atlanta, it was far better than an apartment. It was $10,000 and got all my money back when it sold 3 years later. It was probably full of asbestos.

Buyers should understand that asbestos was a component of many construction products decades ago. My friend had to have an inspection on his brother’s house prior to demolition and they even found asbestos in the caulking around the windows. Stucco, tiles, who knows what else, contains asbestos. I see all the OSB that all houses are being sheeted with and cringe. That stuff is full of toxic and flammable adhesives. Bring a half sheet of it into your house, it’ll make you sick.

I’m not sure when asbestos was eliminated from use, I doubt anyone really knows.

In this case the potential seller seems to already know he has asbestos in exterior tiles so disclosure would be mandatory I think? And testing superfluous.

In the given case I still think it would be valid to not allow asbestos testing of the interior (taking chunks of plaster or drywall)

I agree that advising clients NOT to look for latent defects before they list is sound advice

Once you become aware of a material latent defect that needs to be disclosed, you must promptly (or at least before any agreement to rent, acquire or dispose of the real estate is agreed upon) disclose that defect in writing to all other parties to the transaction. Should a client instruct you not to disclose a material latent defect, you must inform them you cannot provide further services to them unless the disclosure is made.

-BC Financial Services Authority

“The mute function has vastly improved my HHV experience not having to read non-sense.”

It has transformed the site. Now when I scroll past the half-dozen named and offenders and their multiple, daily, gaseous, inanities it amplifies the pleasure of reading posts from a small core of articulate and reasoned observers.

Yes, I am going to advise my clients to specifically spend time looking for problems to disclose, lol, what planet do you live on? “Hey seller client, literally no one tests for asbestos prior to going to market but I am going to advise you to test for asbestos so when it comes back positive we can disclose it and decrease the market value of your home.” The common sense on here is abysmal.

As far as not allowing testing of asbestos I believe that to be a valid seller position. Testing of asbestos requires pieces of material sometimes as large as 1”x1” to be cut out from your home and you can simply reject such a request as a seller. I’ve always advised my sellers to take this stance (not allow) within reason, and for my buyers I’ve always pushed for asbestos testing on teardowns if I don’t think it will be compromise their offer. When the results come back positive then the seller is in a crappy situation. If they don’t accept a concession, they have disclosure issue (aka they should be disclosing) going forward if the deal collapses.

It is called negotiating for the best interests of your clients. I don’t believe in “win-win” non-sense where the only winners are agents walking away with their respective commissions. I actually believe in trying to represent the best interests of MY client in the real world, not some theoretical BS. Every house built prior to 1980 has varying degree of asbestos, common sense needs to be exercised.

There needs to be a function to mute quotes from people I already have muted. The mute function has vastly improved my HHV experience not having to read non-sense.

Doesn’t make a lot of sense anyway given it sounds like he already knows there’s asbestos. Whether you have a test in hand or know by some other means doesn’t affect the disclosure requirements

“I wouldn’t advise allowing any testing of asbestos on a teardown property if I am representing the seller. You’ll have a disclosure issue if you allow it and the deal collapses.”

This doesn’t sound right to me. Call me crazy, but it sounds like Marko is advising sellers to not look for or disclose significant issues that may exist in/on their property?

If I misunderstood his comment, please let me know.

Can someone please post a link to any desirable trailer park homes available for sale here? This might be helpful for non property owning Victorian’s to consider? People just need to lower their expectations.

$235,000 for that little home in Tisdale, Saskatchewan? I think those with a budget of $235,000 could do much better buying into a trailer park in Langford, Sooke or further up Island.

Crumbling Declutter and paint sell it to a first time buyer u will get more money than a builder will ever shake at u

Come on June 7th…

Yeah, no kidding. I’m at a loss for words about these things.

We will exceed last years total for sure. Should have 70 to 85 these last three days. Lots of deals out there waiting for the rescission period to pass to be reported.

Unfortunately the width of your frontage isn’t very attractive to developers/builders. I am personally shopping for a missing middle teardown and I am currently passing on 50′ lots in hopes of finding a 60′ for a reasonable price. You have to keep in mind everyone now qualifies for the missing middle initiative and the majority of lots are 50′, not 44′ like your lot.

As for a SFH 44′ isn’t great on that front either. Problem is unlike Langford/Colwood the offset in Victoria is 15′ combined which leaves you with a 29′ house which is narrow. Something people will accept in Fairfield/South Oak Bay/Rockland but at a million bucks land + million or more to build not sure if buyers/builders are going to be satisfied with their value for $ with a $2 million+ narrow home in the Jubilee area; therefore, that will influence their decision on how much they wish to pay for your teardown on a narrowish lot.

If your lot was 60’x120′ that is a whole different story, but it isn’t. I don’t think you’ll be swamped with interest from developers, imo.

You need to put it on the MLS® and see what the market can absorb. Also, you need someone to assess the home to see if it is truly a teardown. Often what people think is a teardown is not a teardown and there is a market from first time buyers. Recently I had a listing in the Oaklands area for $799k which I thought was a teardown, but all the interest was from first time buyers and it sold to first time buyers in the end.

I wouldn’t advise allowing any testing of asbestos on a teardown property if I am representing the seller. You’ll have a disclosure issue if you allow it and the deal collapses. If you are six months on market with no interest and get an offer which wants to test maybe consider it at that point.

Asbestos testing/removal was moreso part of due diligence for builders/developers 10+ years ago. The numbers (land costs + constructiosn costs) are simply so huge now that most builders/developers just assume 30 to 100k to teardown the existing home and role with that.

Same with vermiculite on the owner-occupier end. I had 10 deals +/- collapse 2010-2014 over vermiculite issues (approx 10 to 15k to remove). Haven’t had one vermiculite related collapse since 2015. When you are paying $1.2 million for a house the 10 to 15k seems to be less of an issue. Also, lack of inventory doesn’t help. 10 years ago you could collapse a deal and go look at a bunch of other houses. Now you collapse a deal and wait three months for something else to come to market.

From what you have said, it sounds like you need someone to take a look at the property to determine if it simply a matter of cosmetic changes to make the home appealing to a first time house buyer or if there is something that is structural that would make the property a tear down.

ie cracked foundations, sloping floors, roof sagging, 60 amp service, dry rot, poor condition, etc.

or is it cosmetic such as paint, floor coverings, cabinetry? The type of work a handyman could do.

What tends to make a property a tear down is the cost to cure, the ratio of land to improvements, and the remaining economic life of the improvements. In that case, you would need to determine the value of the site under the hypothetical condition as if the site was vacant and available for construction as well as the value of the property as it is currently improved.

It can make a huge difference in the market value of the property.

You can do a kind of thought experiment on your property. Is there considerable deferred maintenance and need of costly immediate repairs to make the home livable? How much would it cost to bring the home up to the condition of other properties in your neighborhood. Would a lender approve a 30 year mortgage on the property given its current condition? Or is it in such a state of disrepair that the lender would decline the mortgage?

Depending on the answers then the property might have a value of the site less the cost to demolish to a developer or a home that a first time buyer is willing to put some sweat equity into to make it livable or at least to a condition that it could be rented.

A local client of mine sent me a link to a home she is selling in Tisdale, Saskatchewan – https://www.realtor.ca/real-estate/25640500/1117-98th-street-tisdale

2009 build, 4 bed 2 bath, looks like 2,000 sq/ft? (I don’t think the count basement sq.ft. there) $235,000. Seems a little more affordable than Victoria.

Attended a handful of open houses in the 1.2-1.6 range over the weekend and they were busy. One property already had an unconditional offer the owners had accepted even before the first open house. I lived through the YVR housing boom since 2011, and it seems Vancouver’s housing market psychology is starting to ingrain itself in Victoria.

Ideally, you’re making a fully public listing and have a competitive bidding process. That should mitigate any dirty tricks. As well, having a competent realtor and having your lawyer reviewing all contracts you are signing. On two occasions, over 15 year period, the worst thing I heard that persons in your situation went to realtors that offered to buy the properties directly without going to market. On those two occasions, the realtors built their personal homes on the choice property sites they got at well under market value. So, avoid anything and anyone who wants you sell without sending it to the open market that say they have the best deal for you if you just offer to them directly. As for the condition of your home, whether it be hand dissembling or asbestos removal, well, that’s something anyone looking to build has to deal with, so it’s not your concern what their future costs are and if there’s multiple people or developers interested in your property, that will mitigate any discount or low-ball offers. However, if you only get one offer on the open market, that might lead to a discount on those factors you mentioned.

Thanks Patrioz,

My query is not about pricing dollar amounts for sale but rather the factors that would affect the price – such as tear down costs, asbestos removal & considerations that one might not think of if not in the know like folks here.

It would also be so helpful to be aware of any maneuvering an interested developer might try to play out – any dirty tricks.

The market price is what you are able and willing to sell it for. Market price is defined as the price at which the number of willing sellers (i.e. you) equals the number of willing buyers (i.e. the high bidder).

Dear Crumbling,

Your property sounds like the a lot of our housing stock, past its prime and in dire need of replacing. Sounds like a decent area but the value would depend on lot placement and potential views. If market conditions continue to improve your land will increase in value over the next few years. Any realtor will do a comparable analysis and arrive at a price range. Maybe get a few assessments. It’s up to you to decide if you want to price on the high side or the low side. Either way you’re going to make enough money for the rest of your life, tax free! Don’t sweat it.

Hire Marko?

So looks like weekly sales in May are: 177 for week one, 171 for week two, 192 for week three and 155 for week 4. Does week 4 of May historically have a drop off, or is it due to the long weekend?

Thanks for your response, Leo – Much appreciated!

I hope its OK to repost this because I wrote it 3 days again and it was hidden and waiting approval until now. I’d really like to expose my questions to all HHV folks to get all possible viewpoints.

I’m hoping to get some guidance. I read HHV regularly & have not seen this issue discussed. I’m planning (well ahead of time) for the day in the next year or two when I will be selling my home.

I believe that my house has definitely reached the point of being a tear down. It was an original farmhouse in the Jubilee area. The oldest part was built in 1901 – very cheaply & poorly & is where the most degradation has occurred – it is also the smallest part of the house. The middle of the house was built in the 1930’s & the front living area was built in the 1950’s.

The 2022 assessment was for $1,077,000

Land – $ 965,000

Building – $ 112,000

Lot size – 44 x 168 = 7392 sq. ft.

Single story – first floor area = 1208 sq. ft.

My query from everyone in the know is how I go about determining pricing in this situation – ie. what would likely come off the market price?

Also things I would need to watch out for which a potential developer might try to screw me over with.

Could the size of the property support development of more than one home or should I focus on presenting it as more suited to a SFH?

Oh, the house also has asbestos tiles covering the entirety of the clapboard that was the original siding – which I’m sure will require special care when hand deconstructing the house & wonder what sort of cost all that might entail.

I really appreciate any advice that folks might be able to provide to my questions.

Yikes. That’s 14% over $1.2m assessment. Last we saw of Leo’s’ sales to assessment chart SFH were right at assessment 100% (or maybe 1-2% higher). That +14% sale looks to be one of Marko’s “multiple bid” scenarios. I hope these are outliers, and we return to the “good ole days” of April 2023 when SFH were selling at assessments.

Oof (170k over assessed), thanks!

$1.37M

Neopolitan house, nice

Theoretically yes, but will require some fixes to the city’s missing middle policy most likely before something is viable. Currently a lot width below 46 feet has some issues related to parking. I think your timing is good because in the year or two when you plan to sell, the guidelines around that should be a lot clearer and hopefully feasibility improved.

https://www.victoria.ca/assets/Departments/Planning~Development/Development~Services/Zoning/Bylaws/Schedule%20P.pdf

Garden suite may be easier.

Developers are looking on MLS just like consumers are. I would definitely list on MLS. Proper exposure to the market will generally beat any amount of research on what the market price may be. If you’ve underlisted, you will attract multiple offers, if you’ve over-listed it will sit.

Sorry to ask again, but of curiosity what did 7254 E Saanich go for?

Thanks!

Thanks. What Marko has been describing is a substantial bump, with multiple bids and sale prices way over asking. In the 900-1200k range.

Month to date sales: 695 (same pace as last year, we have 3 business days to get 66 sales to beat last May’s total. Mon to Wed last week we had 65 sales reported but I’ve noticed there’s usually a small bump at the end of the month so we will likely exceed last May’s total)

New lists: 1228 (down 12%)

Inventory: 2177 (up 22%)

Well sales/assessment was clearly rising last month so likely still is. I can take a look at how that differs by price band though.

Nice, and right in peak demand price range.

HHV what a great place best of luck

Assuming at least 1 out of the 4 offers is competitive, any mention from the seller realtors articulating what kind of offers would be reasonably considered and everything else is a waste of time?

Leo mentioned to post our listing here when it goes live, so here it is!

https://www.realtor.ca/real-estate/25641934/644-head-st-esquimalt-old-esquimalt

Thank you Whateveriwanttocallmyself for taking the time to outline the processes and variables. Complicated indeed.

And beyond the facts & figures I cringe at the thought of the possible underlying reasons for the court ordered disposal and just how complicated the lives of some folks must be. Then again, maybe my heart is too soft at the human story level.

Thanks again for the your insights and willingness to share.

Should be interesting to see if this shows up on Leo’s sales-to-assessment for SFH or if it’s just a narrow range of SFH.

SFHs I showed this weekend still going strong in multiples….”We now have 4 offers in hand. Please advise if your client is writing”

Who establishes the asking price?

To answer that question requires defining terms first and then a discussion as to the process that lenders have to follow. If I tried to abbreviate the answer that would just invite criticism as I would be glossing over many points. Court Ordered Sales in BC are highly regulated and the process is generally in favor of the home owner. As opposed to foreclosures / judicial sales that are used in some other provinces and predominantly in the USA.

Ultimately it is a collaboration between the lender, the law firm, the appraiser and the agent. Depending on the lender, the amount of remaining equity in the home, and if the mortgage is insured the process can be quick or it can take many months before the lender/law firm obtains a Conduct of Sale from the court to sell the property.

At the beginning of the process, the home owner may still be occupy the home and hire their own real estate agent. If the property does not sell in a reasonable time period, then the law firm will hire an appraiser to estimate the market value while the home owner still occupies the residence. The law firm may instruct the appraiser to provide two valuations at this time. One assuming the property is to be marketed under normal market conditions which assumes a willing buyer and a willing seller not acting under duress. Or a forced sale value assuming a shorter marketing period and the owner is no longer acting in their best interests.

After the lender obtains Conduct of Sale, the law firm will hire their own agent or request the appraiser to submit a short list of potential agents for the law firm to select from. The agent may then market the property and if the lender/law firm agrees they can use a marketing option that may achieve the best responses. But that does not mean the court will accept a low offer. The court will consider the offer relative to the appraised value taking into consideration various conditions such as when the appraisal was performed. The law firm may also opt for a more current appraisal at this time and the appraiser will inspect the property in it’s vacant condition. The condition of the property and marketplace may have changed since the original inspection which may and most often does have an effect on the value estimate.

I have missed many points such as redemption period, etc. This is an abbreviation of the process.

So the answer to who sets the asking price is… It’s complicated.

Nice ‘court ordered sale’ extracts ‘Whatevericallmyself’.

Curious: how/who establishes the asking price of properties like these?

Do properties like these stay on the market longer (due to due diligence, etc)?

“Does this mean banks in Canada will never be exposed to the risk of making bad loans?”

No.

There is always the risk of a major shock to the financial system leading to a decline in property values and leading some owners to realize that their mortgage is more than the value of their property. This could lead such owners to pack up and head for greener pastures.

Also systemic risk… Maybe at some point in the future, the government won’t be able to bail the banks out. In the future maybe the government will have to allow banks to fail.

Again, the issue of moral hazzard.

https://www.ft.com/content/f32d0f08-b99b-4544-baf2-1dde22025d5b

Does this mean banks in Canada will never be exposed to the risk of making bad loans?

Thank you

Senseless tragedy in Hamilton…

https://www.thestar.com/news/canada/2023/05/28/police-in-hamilton-investigate-double-homicide-involving-landlord-and-tenants.html

A brazen double homicide in which an engaged couple was allegedly gunned down by their landlord as they fled their rental home has shaken residents of their southern Ontario city and raised questions about how a landlord-tenant dispute could explode into such violence, Hamilton police said Sunday.

Ya I was being sarcastic, charter is so watered down now.

It’s a problem when they are up for renewal.

Officially they would like to be / must be called CFA Charterholder.

VicRE CFA= Chartered Financial Analyst.

Lmao, what the hell is a CFA graduate??

A new risk assessment by Canada’s bank regulator is raising concerns that current variable-rate mortgage holders, who stretched their amortizations to grapple with rising interest rates, could face significantly higher payments upon renewal.

The Office of the Superintendent of Financial Institutions released its Annual Risk Outlook in April, highlighting that the steep increase in interest rates by the Bank of Canada has spurred many borrowers with fixed-payment, variable-rate mortgages to extend their amortization.

Information taken from four current listings

“Great location just a short walk to the Gorge waterway. The house has great bones. Renovation is currently partially complete just needs somebody to come do the finishing. New 200amp electric service Three bedrooms up and 1 bathroom. Lower has a suite that needs to be finished. Note this is a court ordered sale.”

This home sits on a 5000 sq ft lot on a no-thru road and just steps to the water, in lovely North Sidney. The home itself is in disrepair and would suit those wanting to take on an extensive renovation, tear down for a new home. The value mostly in the land. Court Ordered Sale.

House severely damaged by fire. LAND VALUE ONLY. COURT ORDERED SALE.

Court ordered sale. R2 zoning developer special 2 proposed lots, 2 homes 5 BD, 3 BA located on very quiet parkland location includes a 2 BD, 1 BA partially completed house. Main house features a sunken living room, rock fireplace, vaulted ceilings, separate dining room, spacious family room with sliders doors to a sundeck. There is a recreation room downstairs with fireplace, Primary BD with a 4 Piece ensuite & a private patio. This property is a court ordered sale ad is being sold in “As-is, Where-is” Condition. This is a great opportunity for developers.

FYI – there will be little to no delinquency or foreclosures in Canada I just talked to three CFA graduates and asked them what is the problem with 40 or 50 year amortizations. They said the only issue is the consumer ( house owner) will now be paying way more interest. So they can foreclose and the bank will lose a lot of money or maybe the bank will offer a longer amortization. Then the homeowners

keep the same payment and their house. Sorry no problem here, but keep trying, I like you all trying to soothsay Macroeconomics and the Canadian $. Leo am I #3.

FYI

The delinquency rate is one of several factors that may be combined and weighted to provide an indication of which cities are most poised for a housing crisis.

-Mortgage delinquency rate 30 to 89 days (weighted 2x’s)

-Mortgage delinquency rate 90 plus days (2x’s)

-Home owner vacancy rate (1x’s)

-Rental vacancy rate (0.5x’s)

The delinquency rate is the most heavily weighted but as what was seen in the USA those cities that had greater declines also had a higher proportion of vacation homes relative to cities with higher permanent owner occupancy. In the USA these cities were mostly coastal cities along the West Coast and Florida. The cities where people liked to take vacations and higher rates of non owner occupied residential investments.