Suites and home values

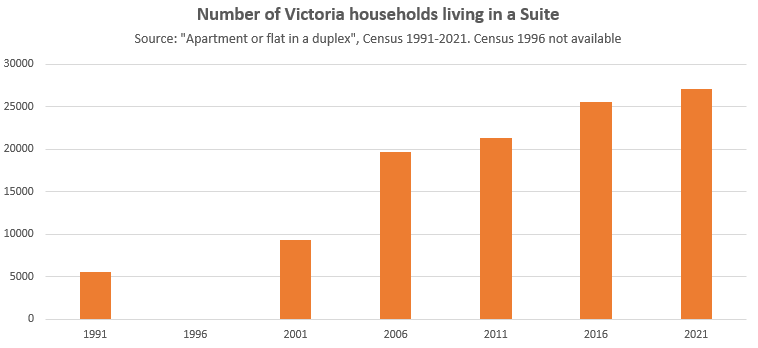

Suites are extremely common in Victoria. With a stagnation in purpose built rental construction (until recent years), chronically low rental vacancy rates driving rents up, and high house prices that drive many people to mortgage helpers, the prevalence of suites has increased substantially. In the census a suite is captured as an “apartment in a duplex”. You can see that growth of this type of dwelling over the years below. Note that in 2006 StatsCan got a lot better at identifying suites, so the jump in suites in that year is partially due to better data collection.

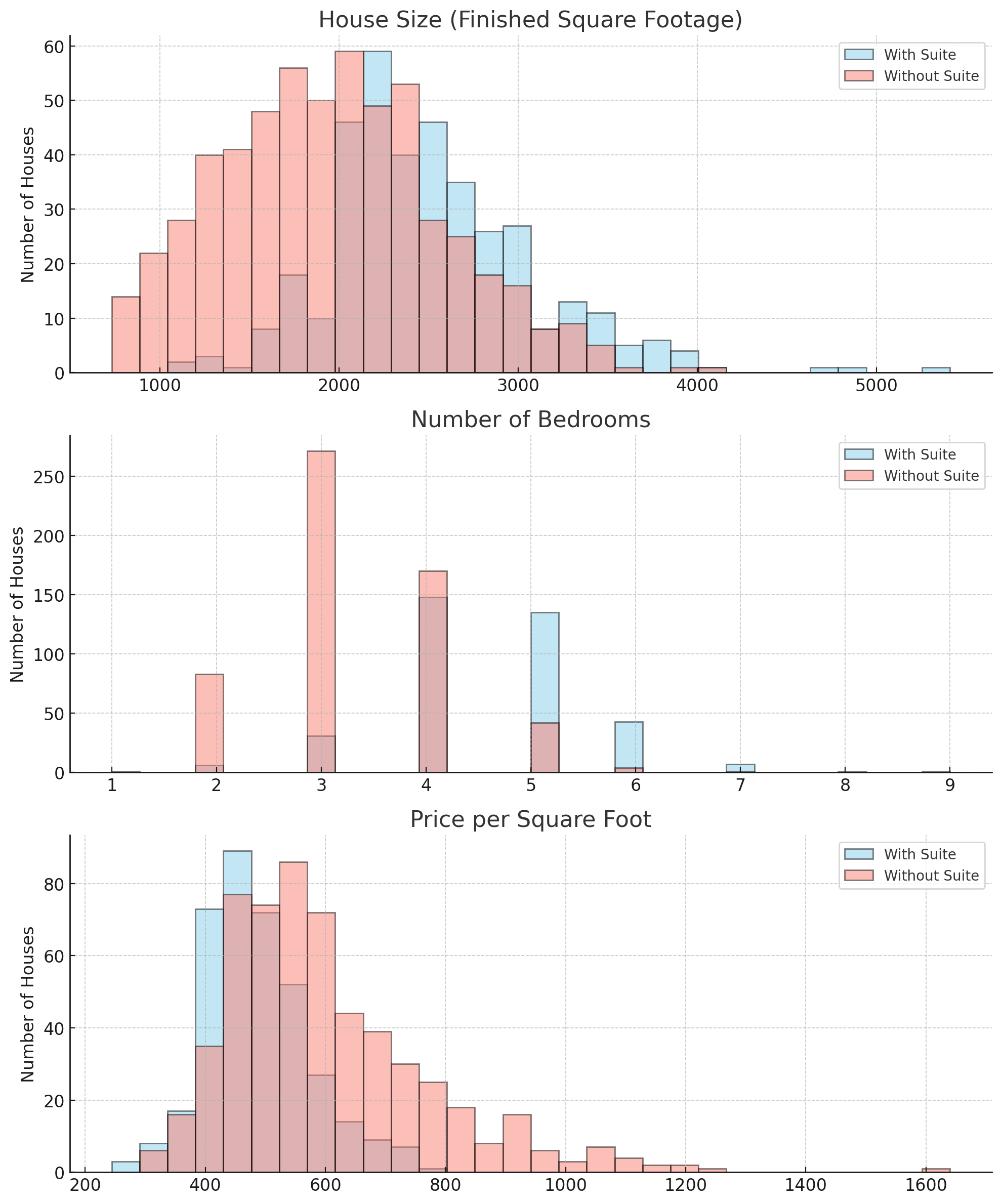

But what is the value of a suite? Let’s take a look at every sale of a detached house in Saanich, Victoria, Esquimalt, and the Westshore this year (I excluded Oak Bay because suites were effectively banned there until recently). The average sale price of a property with a suite is $1,381,012, while the average price of one without is $1,323,688, meaning that the average house with a suite sold for $57,324 more. However it’s something of an apples to oranges comparison, given that houses with suites tend to be bigger and have more bedrooms than those without.

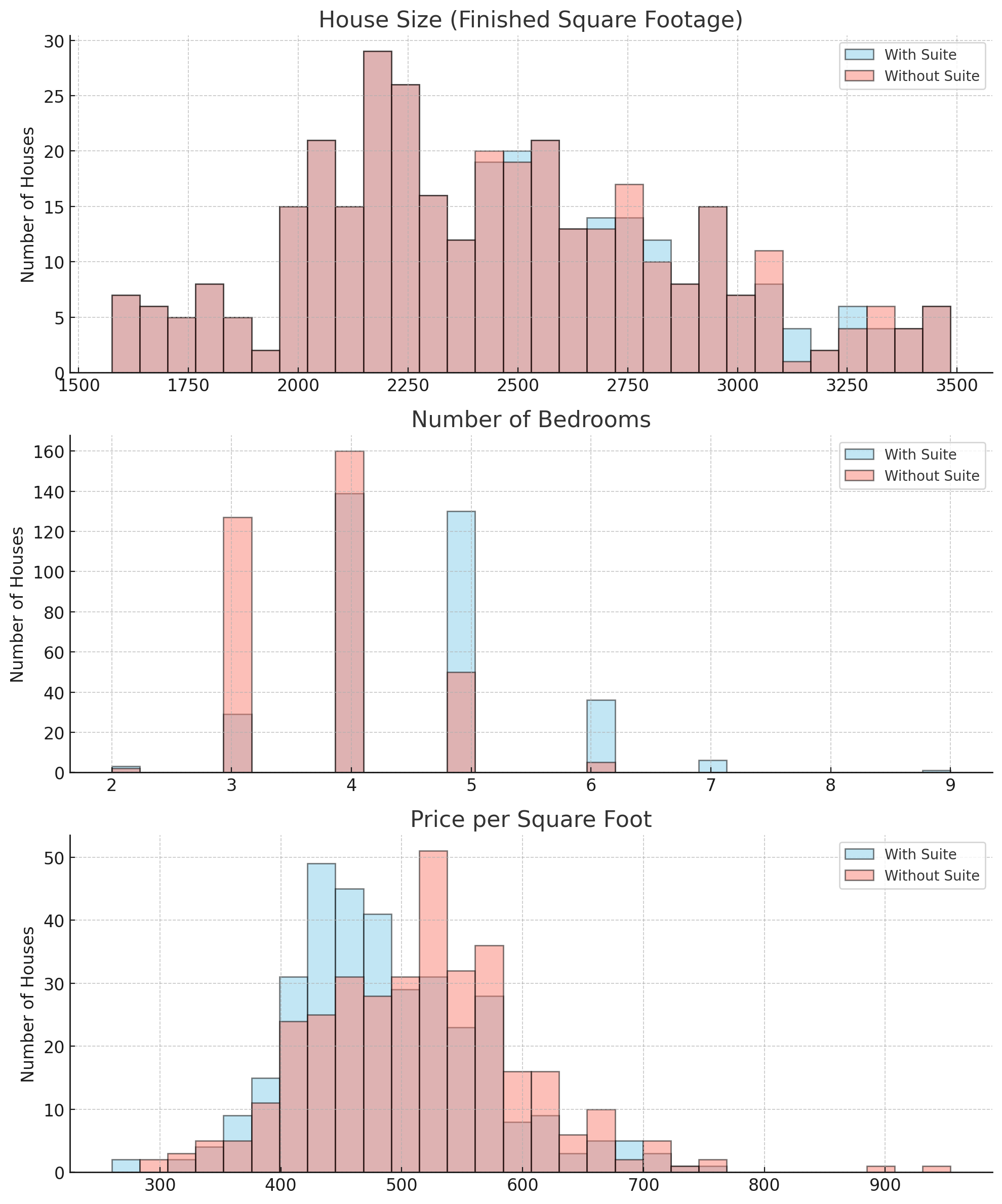

To narrow in on the bulk of the housing stock where suites may be an option, we remove luxury sales, and exclude houses with less than 1500 or more than 3500 sqft of space. Then we match each sale of a suited house with a non-suited house of very similar size. That creates a matched set of sales of houses with and without suites that have a very similar distribution of sizes.

In the matched set, both the suited and non-suited houses have an average of ~2450 sqft. In addition the average year built is nearly identical at 1973 (suited) and 1975 (unsuited). The suited properties still have more bedrooms on average as bedrooms are presumably either smaller on average, or other rooms (den, family room, theatre, gym, office) are converted to bedrooms for suites.

Surprisingly enough, when we match samples the price premium for suites completely disappears. In fact non-suited properties in the matched set sold for a median of $1,252,500 while the median for suited properties was $1,175,000. The result even holds up if we match samples by total square feet (to account for the fact that non-suited properties may be just as large but have unfinished basements). Regression analysis also yields consistently negative coefficients for the existence of a suite with various slices of the sales data. From that, one might conclude that simply converting space to a suite doesn’t add value, in fact it seems to decrease it.

However this counterintuitive result makes me think there are other factors at work that are obscuring the value of suites. Possibly quality differences in finishing or other amenities (like the aforementioned gym or theatre room) are obscuring the suite premium. I’ll note that another analysis of the impact of suites on sales price found positive impacts in the lower mainland, but they neglected to create matched sets and thus were comparing sales with different characteristics. Other perspectives from the US believe that the square footage in the suite is worth less than in the main house (so a 3000 sqft house is worth more than a 2000 sqft house with a 1000 sqft suite) but that is more in relation to detached suites. There’s surprisingly little solid research on something that is generally considered a common sense assumption (“suites add value”).

As a second check I looked into sales in my cookie-cutter neighbourhood of Gordon Head where a good chunk of the houses are built from just a few different floorplans. Out of 40 sales this year between 1900 and 2700 sqft, the average sale price for suited vs unsuited properties was essentially identical at $1,250,000 even though the average suited house was a bit bigger (~2400 vs ~2300 sqft).

As mentioned, it’s obvious that suited houses in general sell for more than non-suited ones. It’s also obvious that if you have a house with a finished (suited or not) basement it will be worth more than the same with an unfinished basement. However once you control for the basic physical differences, its less clear in the data that the mere existence of a suite has a big impact on value. Given suites are income sources that can provide flexibility and increase buying power, it still makes logical sense that they would push prices up. Whether the effect is obscured by other factors, or whether buying power simply isn’t as big of a factor anymore at today’s detached prices is unclear. If it’s there, you would likely need to look at individual sales to see it.

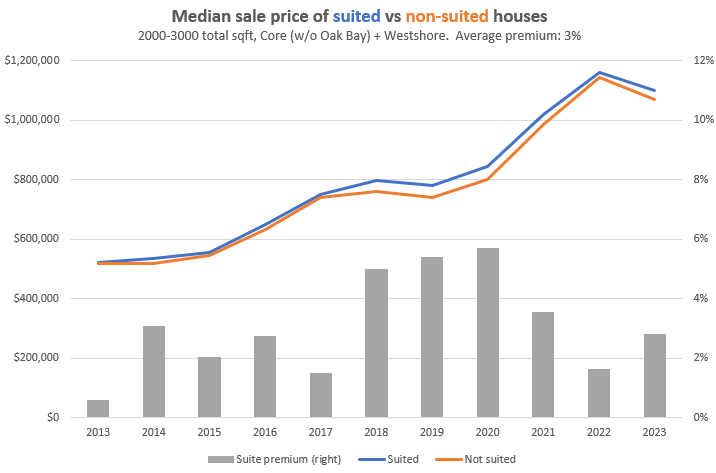

If we look at a longer term comparison with thousands of sales of houses between 2000 and 3000 sqft, there is a slight premium for suited properties but the difference is small (houses with suites sold for 3% more on average in the last 10 years). Those are not matched samples though, so the change could be explained by suited homes being somewhat bigger even within that 2000-3000 sqft constraint. However it’s interesting to note that the largest premiums came after the introduction of the mortgage stress test in 2018 which slashed buying power and may have made buyers more reliant on suite income.

What is clear is that appraisers also have a difficult time valuing houses with suites. Of the sales this year, the median house with a suite went for 2% over the current assessed value, while the median sale without a suite was 1% under assessment. Properties with suites also sold 4 days faster on average, at 21 days on market versus 25 for those without.

Either way, if you’re thinking of building or buying a house with a suite especially if it’s a detached garden suite, I’d recommend reading this article on the potential tax impacts.

What do you think is the impact of having a suite on the value of the house? How much more (or less) would you pay for a house with a suite, versus the same size finished house without?

Also the weekly sales numbers:

| August 2023 |

Aug

2022

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 104 | 202 | 478 | ||

| New Listings | 231 | 465 | 980 | ||

| Active Listings | 2398 | 2454 | 2137 | ||

| Sales to New Listings | 45% | 43% | 49% | ||

| Sales YoY Change | +25% | +15% | -42% | ||

| New Lists YoY Change | -2% | +7% | +10% | ||

| Inventory YoY Change | +11% | +12% | +90% | ||

| Months of Inventory | 4.2 | ||||

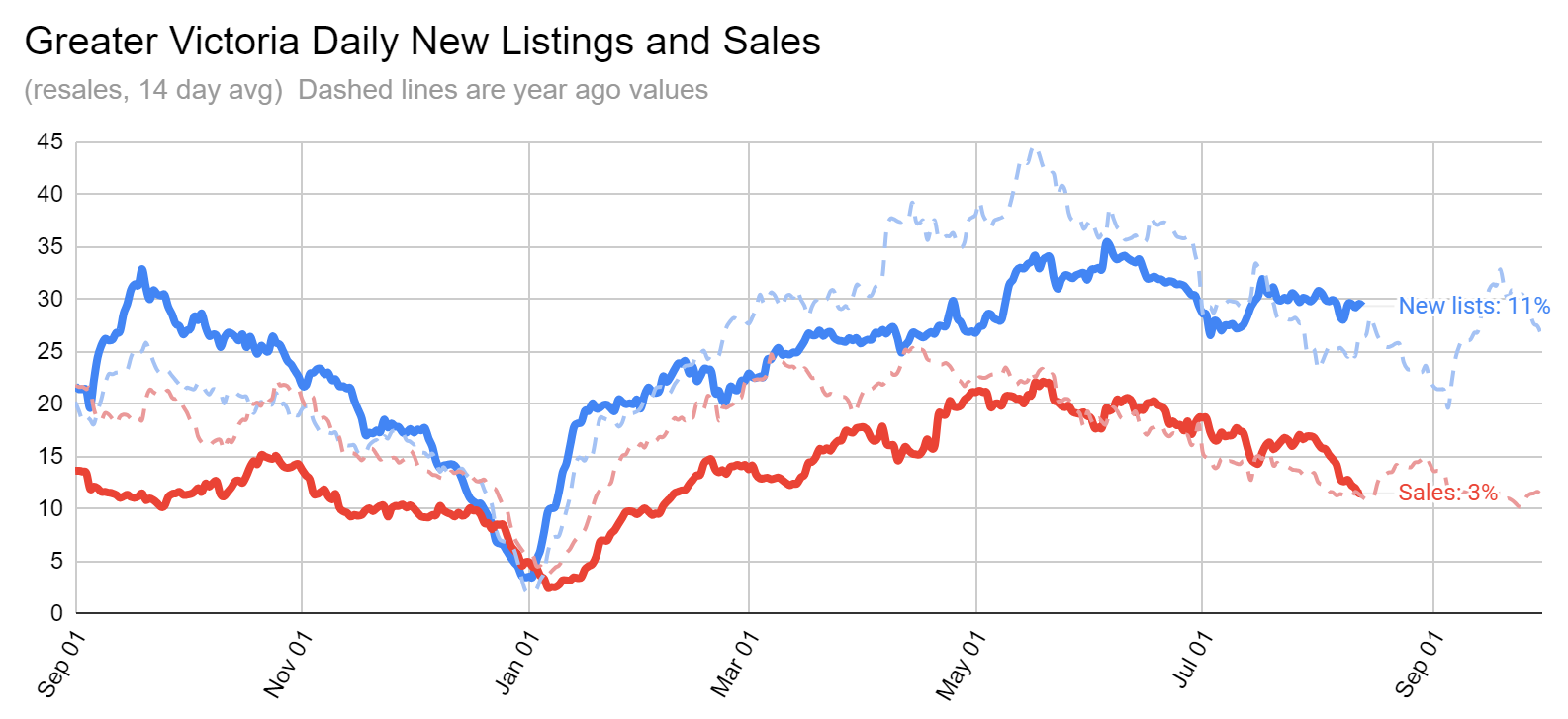

The sales rate is converging on last year’s as sales slow into August. Last August we had a revival in the latter half of the month, so though sales for the first half are ahead of last August, unless we see a repeat sales bump this year we may end up at a similar total.

The combination of dropping sales and somewhat recovered rate of new listings means that the sales to new list ratio for the last month has now dropped to last year’s levels after a period of outperformance.

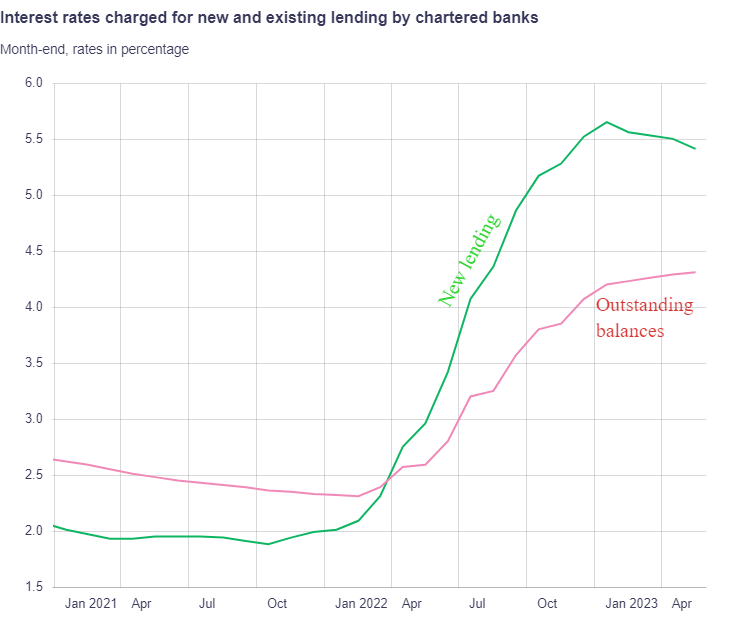

With bond rates still hovering at 4% and expectations for rate drops pushed back to late next year, that sluggishness is likely to persist. Borrowers are facing huge payment hikes and that will take years to fully filter through. While the average existing mortgage is already at 4.32%, fixed borrowers were still only paying 2.77% as of May, and variable borrowers have been largely extending amortizations instead of facing the full brunt. As usual if any of that leads to owner stress, it will be first visible in new listings numbers. For now they maintain remarkably normal as they have been since the pandemic.

New post: https://househuntvictoria.ca/2023/08/21/mortgage-rates-are-up-does-it-make-sense-to-pay-it-down/

Exactly the same as Victoria’s inclusionary zoning policy. Introduced in 2019, zero affordable units in 2023, staff said that’s fine no changes.recommended.

Yes Frank, you can lead a horse to water but you can’t make them drink.

Montreal passed a bylaw to impose developers to provide affordable housing as a part of their large apartment projects. They ignored it and merely paid the fine and zero affordable units were built.

Had a chance to sit down and listen to Mike Moffatt and I mostly agree with what he has to say. Interesting that so much of what he had to say has been discussed on this blog.

Hey Patrick,

Interesting! Do you think it would be fair to describe these market conditions then as closer to “equity driven” rather than “income driven”?

If rates are down sales are up because it’s cheaper to buy

If rates are up sales are up because people are frontrunning the rate increases

Funny how that works (and no I don’t buy it either)

Average new mortgage in Victoria actually fell in the last 5 years (in real terms), as average new mortgage rose 16%, and cpi rose 17%). Likely reflects ongoing Victoria gentrification with wealthy buyers,

—- Average Victoria home selling Prices are up 52% over last five years (2017-22, SFH +53%,condo +52%.) .

—- We might expect the average new mortgage to have also gone up 52% over those 5 years .

—- But according to CMHC data it didn’t, and only rose by 16%. Average new mortgage in Victoria in 2017-Q4 was $377,208. In 2022-Q4 it was $435,833 https://assets.cmhc-schl.gc.ca/sites/cmhc/professional/housing-markets-data-and-research/housing-data-tables/mortgage-debt/average-value-new-mortgage-loans-canada-provinces-cmas/average-value-new-mortgage-loans-ca-prov-cmas-2012-q3-2023-q2-en.xlsx?rev=346b03c8-f7a6-48a4-b230-1aa6fc9750ec

—- this likely means that down payments have risen substantially, in absolute terms and percent of total price.

—- Inflation CPI was up 17% over last five years, so average new Victoria mortgage FELL in real terms over last years.

This all helps explain the robustness to the high prices. Buyers have the money, and are actually borrowing less in real terms. This isn’t the narrative we hear from many HHVers about people borrowing more.

I would guess that most buyers who do understand this don’t need to borrow, or don’t need to borrow much. 🙂

Marko- Are the buyers you’re working with mostly locals or out of towers? Do the buyers usually have a property to sell or have already sold? Thanks for the updates.

Working on quite a few accepted offers right now and not one falls into that category so while I thought this might have pushed some sales forward two months ago not sure at this point how long we keep peddling the same theory. If rates keep going up you could say the same thing every week as pre-approvals would be lower than existing rates.

Not sure if it is that, I think people simply just buy if they can qualify/afford for what they want whether it be 2% or 5.79%.

Needless to say I thought August would be very slow and it has had a large bounce in sales.

Perhaps people realized that below 6% still is a damn good rate historically.

In the event that a First Nation did want to build high density, another of the 13 separate First Nations on Salt Spring could stop the project by raising the same “sensible” objection.

One issue that came to my mind re federal incentives aka carrots or sticks. The local projects that receive the lion’s share of federal funding are not performed by the cities themselves. They are performed by provincial or regional agencies. That greatly complicates issues of accountability. Are the feds (of whatever party) going to pick over the policies of every local government in a region before contributing to a project? What if there’s just one city they don’t like out of a dozen?

The job of knocking heads at the local level belongs to the provincial governments. I think that any federal incentive scheme would quickly run into conflicts with provincial governments, not the least Quebec. Of course talk is easy but delivering on it is harder.

Listened to PPs plan pretty much the same as JTs. Lots of verbiage but no ideas of how we can get from here to there.

I do get tired of the carrot and stick approach to solving the housing problem. I think of them as idle threats. Every municipality has its own unique circumstances, threatening their funding isn’t going to solve their unique problems.

As one poster wrote about the Gulf Islands where there may not be enough potable water for a large development. Then home owners will be stuck trucking in water to their homes forever. It’s the same for parts of Sooke and Metchosin that rely on drilled wells and septic fields.

I’ve got a C1 zoned zoned lot. I’m willing to consider selling it to the government with a 99 year lease back. Terms and conditions to be determined.

They’re just requiring munis to legalize them, not converting existing unpermitted suites to permitted ones.

I’ve heard lots of people with pre-approvals buying now.

Sales pace up 40% from previous week. Kinds of nuts given the recent spike in mortgage rates but people still want to buy even with pre-approvals as high as 5.79%.

I doubt that the province could legislate that all suites in BC could be made legal by a simple stroke of a pen.

It would be necessary for a safety inspector/building inspector/structural engineer to inspect each existing house and make recommendations to the home owner and municipal planning department as to what work would be necessary to comply with municipal regulations.

There may be a housing crisis but the solution is not to have substandard rental housing that may jeopardize lives.

Regarding Michael Burry, hedge fund managers say many things to test the reaction (trial balloons) and see if the market agrees. It’s mostly about manipulating public opinions. What matters is the actual returns. Cathy Wood talked and believed her own BS and lost 80% of her and other people’s money (OPM). Most of Burry’s recently disclosed positions are derivatives – highly leveraged. He mainly manages his own funds (not OPM) and he is till worth almost $2 billion.

https://whalewisdom.com/filer/scion-asset-management-llc

Market activity month to date:

Sales: 341 (up 18% compared to same time last year)

New lists: 712 (up 9%)

Inventory: 2460 (up 13%)

Mike Moffatt is top notch and has a great grasp of the issues and how to solve them. Government would be well served listening to him.

Paul Kershaw has some good ideas and some bad ones. Have not been very impressed with his Generation Squeeze.

Haven’t read too much from Tim Richter, will look him up.

Patriotz the article makes it sound like only separate dwellings or an ADU over garage is the change but it also includes secondary suites in all existing houses in the zoning area which is huge. Of course I have no idea if the provincial changes planned in terms of secondary suites being “legal” in all of BC would apply to the Gulf Islands in any event down the road. I was looking at a property there that had a natural wing that had suite potential which has now sold that currently can only be used as a single family home or bed and breakfast. The earlier press was that the bylaw was for sure going to be changed because of the critical shortage of housing. That it wasn’t changing much because the large properties were always expected to have large families or number of people on them which most do not.

Regarding Salt Spring, I suspect that this is a sensible objection by the First Nations. There is limited water on this island and if the First Nations in the future want to build high density on their reserve then it is important to stop other people building before them.

Now would be a good time for Trudeau to invoke the Emergency Measures Act to deal with the wildfire crisis. However, it’s not on his doorstep so I guess it’s not that important. There are reports of sabotage of the sprinkler system set up to protect Yellowknife. Also looting. I have a sickening feeling that some of these fires are being intentionally set.

Spoke to my friend in West Kelowna yesterday, his area is safe for now but visibility is poor, the city looks like a ghost town as everyone is trapped inside by the smoke. Anyone planning to move to the Okanogan will definitely be looking elsewhere, including current residents.

https://www.theglobeandmail.com/canada/british-columbia/article-indigenous-group-opposes-housing-density-on-bcs-salt-spring-island/

JT is set to deliver a new mission for his cabinet at a three-day retreat In Charlottetown. The housing affordability crisis is to take on new levels of importance.

Paul Kershaw, founder of think tank at UBC, Tim Richter, of the Canadian Alliance to End Homelessness, and Mike Moffatt an economist and housing expert will address the cabinet.

You can youtube these people to learn their views.

-no big policy announcements are expected following the retreat.

https://youtu.be/HXuBnz6vtuI

“Round up the usual suspects”

-Captain Renault from Casablanca

Agreed – get the Globe Weekender every week. A lot of very interesting, well written, well researched pieces. Don’t always agree, but always get a lot of good food for thought.

Oh, just about any Postmedia publication any day of the week. Or the Globe and Mail lately for that matter:

https://www.theglobeandmail.com/politics/article-trudeau-to-meet-with-new-cabinet-as-liberal-support-wanes-both-in-and/

Actually there is a lot of money being printed. Counterfeiting is alive and well.

I wonder how insurance risk assessment would affect property insurance?

Will insurance companies increase everyone insurance to pay for the fire insurance claims, or increase insurance on wildfire prone areas to pay for it?

And, will Victoria housing price increase from environment refugees?

Frank, most of the money in the economy is created, not by printing presses at the central bank, but by banks when they provide loans.

Buying bonds injects money into the money market, increasing the money supply. When the central bank wants interest rates to be higher, it sells off bonds, pulling money out of the money market and decreasing the money supply.

Currently, the federal government is tightening monetary policy and not easing access to money. The actual physical printing of bank notes is mostly to replace damaged currency.

JT isn’t in a basement hand cranking bank notes on a Gestetner.

A typical new house in the Westshore is about 1.3 million and a likely breakdown between land and improvements is $600,000 for the land and $700,000 for the improvements.

When you consider the cost of financing the land is about $3,750 per month and the improvements are about $4,375 per month excluding any down payment. In this example, some 45 to 50 percent of someone’s mortgage payment is attributable just to the land. If that can be reduced then through competition by house contractors the cost of housing can be substantially lowered.

Any government program can not do much about the cost of construction. Builders face similar costs of materials and labor and a desire to make a profit. Remove the profit incentive and the home does not get built.

But the various levels of governments do have control over the land base. Land development on a large scale that the government seems to be proposing is a high risk game. Build the wrong type of land development in the wrong location and the land development would face bankruptcy.

In my opinion, this is where the governments should be concentrating all of their efforts to reduce the risk to land developers through public/private ventures where the government retains a stake in the developments and control over the marketing and pricing of the lots. This is where innovative solutions are needed to address the housing shortage to bring down the cost of land to smaller scale contractors or those wanting to build their own home with their own contractor.

Personally, I favor a model similar to that Grosvenor International uses but with the government (s) retaining an interest in the land and financing the purchase and development of land through real estate investment trusts and ground rent leases that can be adjusted over time.

Might be behind a paywall but no matter where you sit on the political spectrum it’s a melancholy reminder of what a newspaper article should look like. Where would a Canadian go to read home-grown content anything like this?

https://www.telegraph.co.uk/business/2023/08/20/justin-trudeau-legacy-unravels-canada-disillusion-liberals/

Election years in the U. S. can be interesting to say the least. Lots of concern over U.S bank’s exposure to commercial real estate. I wouldn’t be surprised if there is another financial collapse that will require more stimulus which will mean more money printing.

Correct, and his fund (Scion) holds $1.7 billion long in stocks. So it’s just a routine hedge, not a short.

Talking more about his public statements. Pops up regularly and says there’s a massive crash coming. Maybe this time he’ll be right, but so far he hasn’t been.

https://news.bitcoin.com/big-short-investor-michael-burry-says-he-was-wrong-to-advise-selling-congratulates-btfd-generation/

I don’t think you end up with $1.6 billion by luck.

Maybe prediction was the wrong word, he accessed information that made it obvious to him that things were terribly wrong with the financial system. He acted on it and was greatly rewarded for his observations. He must see something in the data today that he is willing to put an enormous amount of money at risk. Time will tell how accurate he is this time.

Is his fund underperforming vs the sp500 for say the last 10 years?

The 1.6B also isn’t what he wagered, it’s the notional value of his put positions, the capital he actually has at risk is a fraction of that amount, probably less than 50M is my guess.

The individual who predicted the crash of 2008 has spent the last 15 years proving he got lucky rather than having any particular predictive abilities

That’s assuming you’re talking about Michael Burry

The individual who predicted the crash of 2008 has put a $1.6 billion short on the market recently. He’s not afraid to make predictions and he puts his money where his mouth is.

Impossible even

Both markets are difficult to predict accurately.

Tempting as it is to compare the stock market to the real estate market , it’s a mistake to do so. For one, stocks are historically more volatile than real estate, meaning that those higher returns may also come with higher risk.

Coincidentally, this was in the G&M this morning:

Does market forecasting have any value?

https://www.theglobeandmail.com/investing/markets/inside-the-market/article-does-market-forecasting-have-any-value/?rel=premium

PDF: https://docdro.id/cwk3VWG

The increased interest rates are having an effect on single family housing as the rates have eliminated buyers with 20 percent down payments. The interest rates are culling the herd of prospective purchasers. I suspect that mortgage applications have decreased substantially due to the tightening of interest rates .

Today’s buyers are the ones that are left, from the culling, that have substantial down payments , likely from the sale of a property or other investments. Because of the larger down payments this group of buyers is not as sensitive to interest rate changes as those that were putting down a smaller down payment. That’s possibly the reason why house prices are not increasing despite the months of inventory, sales to listings ratio, and average days-on-market being strongly in favor of sellers. Those metrics that worked well in the past when house buyers and investors could put down 20 percent may not necessarily apply in today’s market place.

And that makes it difficult or maybe impossible to forecast what may happen to house prices in the next year due to the low sales activity as market prices are being supported by a much, much smaller group of prospective purchasers. The market could change quickly depending on local or external events, other than interest rates, that would have an effect on this group of buyers.

-or not.

I’ve been saying for years here on HHV that previous periods of interest rate rises saw prices go UP, not down.

For example, US house prices rose continuously throughout the inflation of the 1970’s and early 80’s. https://fred.stlouisfed.org/series/MSPUS . As did much of Canada (Toronto). It seems to me that we are seeing this play out now, much to the suprise of many HHVers. It is only when the economy turns down w/unemployment rising that prices come down. And this occurs as rates are falling..

I don’t think that correlation exists. Affordability yes. My bet remains that given terrible affordability it’s going to be a long mostly boring market until it improves at least for multifamily.

Single family affordability will continue to worsen over the long run and that trend likely to accelerate with greater population growth and upzoning

What happened to interest rates go up prices come down. Seems like there was the shock last year and then no correlation post initial shock.

What did I say?? Can’t predict this stuff

Strangely enough sales pace has picked up this week again crazy interest rates and all. This market appears to have 9 lives.

No idea what you’re talking about airbnb4me. You clearly didn’t understand my comment. Back on topic

So, they are calling it an “Infinity” mortgage now..

From: https://www.ctvnews.ca/business/is-an-infinity-mortgage-really-infinite-experts-say-probably-not-but-it-s-not-good-1.6523934

Isn’t “Happy wife, happy life” sexist? I sure hear it often.

If you thought my comment was directed at Leo, then you obviously didn’t understand my comment.

On a more pleasant note, we took the wife up island for a day trip to celebrate her birthday today. What a lovely day of it. Pleasant temperatures, clean air, and no fire evacuation unlike our family in eastern WA. I guess I want to echo comments from above, that we have an awful lot to be thankful for here.

Didn’t Leo already ban you once from HHV (when you were using another pseudonym) after making base and personal attacks on him in the context of MMHI?

When you take the high ground in a debate, it puts the other person into a moral double bind: if they argue against you, then they do not recognize what is moral. If they do as you say, then they are admitting to being immoral. Using morality allows you to attack the other person, which itself may well be an immoral act.

You are more likely to generate ethos by asking a succinct thoughtful question, receiving an answer, and moving on to a different part of the debate. Circling back to a flag you have already planted can undermine your ethos and show that you don’t know when you’ve won.

-a dumb construction worker

“It is sexist, but furthermore the error is assuming that choosing a home for its features is not logical. What’s the point of buying a house if you hate the kitchen? Renos are not for everyone, and if you hate the place it’s probably not a good idea to drop a million dollars on it.

Decent kitchen was definitely on my list.”

Maggie’s comment was the most real post I’ve seen on here and Even a dumb construction worker can see the dismissal of this comment in hopes of saving credibility as another low point for this site. “but furthermore……your not logical because” LoL wrote that from your man cave?

“Go copy the link to the comment and then send it to Justin Trudeau, he will be on it in no time!”

This is clown resume material

Oh and we know it. Terrifying to watch. I’ve spent a couple fire seasons there and know how nerve wracking it is when everything is tinder dry

Also this article is more true than ever: https://househuntvictoria.ca/2021/08/16/will-climate-change-lead-to-an-island-population-explosion/

Amen. It is time for a reckoning. My guess is that the lawsuits start in the states.

https://househuntvictoria.ca/2023/08/14/suites-and-home-values/#comment-104544

Just tell them the house has good bones, sewer, city water, roughed in suite… bring your hammer.

Leo, your folks left Salmon Arm not a year too soon.

Arrived in Calgary yesterday. Smoke from Hope all the way to Calgary, but the Interior was the worst. Shuswap Lake was literally invisible even when driving right beside it. For hundreds of kilometres visibility was so poor that it felt like driving through a tunnel. Air in the car was good, thanks to a HEPA cabin air filter and keeping the recirculation on. But had to wear N95 masks whenever we got out. Not to mention, it was 33° or above in most places.

Very thankful we live in Victoria. Very worried, as I’ve been for a long time, about our changing climate.

Maggie wins the comments section today IMO

There are two issues relating to a property.

The first is zoning which applies to the land and neighborhood. Just because the hood is blanket zoned for two-family does not mean that the lot meets the minimal requirements of size, frontage and set backs for a duplex. The neighborhood would be zoned two-family but the actual site would still be non-conforming to the zoning bylaws.

The second is permitted uses which relates to the improvements. The property could be in an area of single family homes but it is on permit for a suite (s). Old character homes that have been converted to triplexes is an example. A legal non-conforming use. If the triplex was damaged and had to be demolished then you would have to apply for suite permits again.

OSFI and lenders have determined that it is the permitted use of the building that is to be used. There have been court cases that have been tried on this issue where the lender/broker used illegal income to qualify a buyer for a larger mortgage than they should have received. A suite complaint was made and the suite had to be removed. The owner could no longer service the mortgage without the suite income and the property went into foreclosure.

Now the lender/broker is looking for some other party to pay damages if the mortgager has suffered a loss. Even the most frivolous court cases cost money to defend which could be thousands of dollars. Best business practices would be not to get involved in the first place with illegal rents.

It is sexist, but furthermore the error is assuming that choosing a home for its features is not logical. What’s the point of buying a house if you hate the kitchen? Renos are not for everyone, and if you hate the place it’s probably not a good idea to drop a million dollars on it.

Decent kitchen was definitely on my list.

There is also another field for “additional accomodation” but it is very inconsistently filled in. Kitchens is the most reliable.

As for permitted or not. I think you said that you can only count suite income for the buyer if suites are permitted in general in that area. Does it matter if that specific suite is legal or not?

I would appreciate if the board made it mandatory for the agent to state if the suite is on permit from the city or not. When I last spoke with Victoria City they would only give out that information if I had written consent from the owner. I suppose Canadians are becoming more litigious as we follow the path of the excited states of America.

A listing provided by an agent is not to be misconstrued as a statement of fact. The listing is an advertisement to entice a prospective purchaser to make further enquires. Agents in their listings are forthright in their advertising but the purpose of an advertisement is to highlight the best of a property. The onus is on the buyer to satisfy themselves as to the accuracy of the information provided.

We are dealing with contract law when buying a home and as such there is no implied consumer protection or warranty such as when buying a toaster or a TV. If it isn’t written or attached/fastened to the Contract of Purchase and Sale then in most case the buyer is SOL.

To find a house with a suite or not, there is an input for number of kitchens where one may input 1,2,3… That works the best for me. But there is no input for permitted or not permitted.

That is so funny about the kitchen thing. We all know not too long ago that the guy needed a “ManCave” All the reno shows would have them say about the Rec room “well here’s my ManCave”. And then there is ” wow love that double garage ” he says, ” can’t wait to turn it into my shop” (where he does no work) and or put his ancient 55 Chev that has been meaning to restore for the past 20 years. And of course her car sits out in the rain and snow just to accommodate all of this.

The kitchen is shared by everyone.

You must be new here. You’ve landed on the planet Mansplainia. Sit back and enjoy watching the egos collide.

Go copy the link to the comment and then send it to Justin Trudeau, he will be on it in no time!

As someone in the hunt for a house, that comment is an accurate reflection of my experience to date.

Suite = places with exactly 2 kitchens

No suites = places with 1 kitchen.

It’s possible that some listings hide the existence of a suite but that’s why I excluded Oak Bay as well. The board has another flag where they try to guess at the existence of a suite by using keyword searches like “inlaw” or “mortgage helper” but I didn’t find this particularly helpful at identifying actual existing suites. If there is one kitchen listed and the description contains those words it’s usually because there is suite potential, but no suite.

I’m not sure how to report a comment, but to me this is unacceptably sexist.

The post makes sense to me. I think there are some people that would prefer a place without a suite – probably there are more of these kinds of shoppers in areas like oak bay. It signals wealth to be able to say that you bought a detached house without a suite – some people are into that.

Id be curious to see how the numbers change from one area to the other. Perhaps suites add no (or negative) value in oak bay but they have positive value in Esquimalt.

Who is betting on another BOC rate hike announcement in September? I’m guessing it will go up .25 to .5.

…..

Dream client of a real estate agent might be one of the harshest insults I’ve heard

Also really appreciate all the amazing, insightful, knowledgeable, intelligent, informative, relevant and non biased comments on airbnbs. Can’t believe commenters here are just giving this advice away for free lol!

You’re the dream client of a real estate agent.

ya but you can buy a house with a suite without renting it out. What It does is provide the future buyer with the flexibility to do so, so I do think there is a premium on suites. For an identical house otherwise, I would pay more for a suite than without provided I don’t need the additional room downstairs.

Lots of examples of houses with legal suites and without suites in Royal Bay.

3498 Sparrowhawk

2,006 square feet no suite sold at $1,091,000

252 Caspian Drive

2,063 square feet including a 610 square feet suite sold at $1,074,000

It looks like it comes down to six of these or a half dozen of those. You may be getting a mortgage helper but you are losing privacy.

Since I some times enjoy poking the bear.

As an owner you have a Fee Simple Interest in the property. When you rent out part of your home you are assigning some of those property rights to the tenant by granting them a Leasehold interest in the property.

That could be why house prices increased by so much too. The banks were at one time adding all of the suite’s income to a person’s income to qualify for a loan. They have since cut back on the percentage of the income applied and most lenders only want income from a legally permitted suite now.

If you’re buying a home with an illegal suite then you’re still risking that the suite might have those same problems. Most often found in pre 1991 built homes where the home owner has added the suite over a long weekend without electrical or plumbing permits. After 1984 you will find that most family rooms in basements were pre plumbed for a wet bar as the builder and city inspectors knew people would likely put a suite in at some time.

If the suite is over 25 years old, then it’s likely time to upgrade it anyway. You might pay more for a new legal suite but not much for a dated illegal suite.

Once the area is prepped, it takes little time to install cabinets. I’ve done upper and lower cabinets in a weekend. Order them from Ikea and have them delivered to your door.

Assuming that you can assess the renos are of reasonable quality and meet your needs it could well be rational to pay a smallish premium for the reno’d place over the hypothetical cost of renos.

1) You don’t bear the risk of unpleasant surprises like discovering asbestos where you though there was none

2) You are spared the hassle of dealing with contractors who range from scrupulously honest and skillful to incompetent and dishonest

3) No multi-week, multi-month period of disruption while renos are completed

4) Design decisions have been made for you (for better or worse – but you can steer clear of the amateurish efforts)

People might also pay a lot more than the cost of adding a suite for a suited house VS a comparable non-suited house simply because of how bank financing works. Having a $2k/month suite buys a lot of mortgage and often people are maxing out on the purchase and couldn’t afford to also throw $50k in after the sale goes through. Speaking from experience, sadly!

@justjack

Given the interest rate environment and even perhaps a negative sentiment towards RE…what do you see in term of LOT/unimproved Land Sales?

Remember seeing a while back you posted 2 lot sales in the last 3 months.

Financial institutions are not lending against land now, or it is very difficult. What discount to assessed Land value would a buyer offer? 90% of assessed? or less?

This will only compound to the housing shortage in Vic.

Sounds like a high maintenance issue of the spouse not the house. Just because you’re willing to pay that more, doesn’t mean the lender has to finance your spouse’s whims.

Probably the same reason some people will pay a premium for a reno’d house over what it would cost to reno the house. Usually it’s the wife falling in love with the new kitchen and washroom that pushes the rational thoughts out the window.

Gregory, why would a buyer pay $200,000 more for a home with a suite over than of an identical home with a finished basement when the cost to install kitchen cabinets and appliances would be under $50,000?

Or another way of looking at the difference is by rental income. What is the rent difference between a 2000 square foot home as a single tenancy versus a home with a 1,200 square feet main floor and an 800 square feet basement suite?

I’d be interested if Leo could do that type of statistical analysis.

Presently, there is only one acceptable method of doing such an analysis and that is a paired sales comparison using suites in the same building that sold with and without an operating airbnb. Adjusting for date of sale, views, condition, floor level, and unit size.

The last problem being the efficacy of management, quality of furnishings and intangibles included will be different for each airbnb sold. That data is not usually obtainable.

The poster that has a 2 percent mortgage with two years remaining brings up a good topic of buying a home when you can assume the remaining mortgage term. If the lender permits the buyer to assume the mortgage this may have an effect on price as well as increased salability of the home.

This is an example of when market value is not the same as the price paid as a buyer may pay more for a property because of the special terms and conditions.

I think it’s worth considering how different the buyers are for a 4bed/3bath home if one is suited. Because I’ve found the buyers are so different in needs I’d argue they’re different markets. If you had a home that would appeal to a 4/3 buyer (new kitchen, nice yard), you possibly do reduce its value by suiting and reducing privacy in the back yard. Or, if the house needs some minor updates you’d get more return from updating the kitchen in that Gordon Head house.

But if we’re talking suite buyers I’d rather calculate the value of a 3/2 home, compared to another 3/2 home with a 1/1 suite. Often that’s what they’re comparing, and it’s in areas with simpler yards in younger neighbourhoods. In those situations I could see it being worth $200k to the buyer for the suite, and it often costs them less than that difference in purchasing price. ‘Suites add value’ may be that suited homes have more appeal to people who would have opted to purchase a smaller home instead, because they financially work out to be similar (or cheaper) monthly but allow them to leverage their investment more heavily.

As an aside I’ve found that price per sqft drops as house size increases. Possibly why your third chart has the larger suited homes listed so low in price/sqft. Can we see price/sqft for the two when they are the same size (instead of number of sales)?

Escher is also 30 sqft bigger with better views (until concert starts work lol). Maybe Leo can do some $/sqf stats on Airbnb vs none condos like what he did with the suited versus none suited houses.

And for airbnb’s in most if not all cases you are buying the land and improvements as well as the furnishing, linen, cups, saucers, and other intangible assets.

What’s debatable is if there is any goodwill associated with the sale of an airbnb? From what I have been led to believe is that the rating of the previous owner is not transferable to the new owner. Therefore no goodwill. However an established airbnb will have repeat customers that want the same airbnb every year which is goodwill.

If you are buying an airbnb without any goodwill then you have to reestablish yourself which may result in less bookings, higher vacancy rate, and possibly a slightly lower per night rate for the first couple of years. And you won’t be at full occupancy for the entire year if you are charging market rates. The summer you’ll be fully booked but in the winter the bookings will be fewer.

The Hotel industry typically aims for a 60 to 70 percent occupancy rate over a calendar year.

If you are intending to buy an airbnb you should get the income and expense statements for the last two or three years to review. Then you are going to have to normalize the accounts for the anticipated increases in taxes, permits, insurance and new cleaner and management contracts.

Or you can just wing it.

Then there is obtaining financing. A lender is typically limited to lending on the land and improvements only. However there is not a consistency among lenders or appraisers on this issue.

To the best of my knowledge there has yet to be a court case in Canada to establish this issue.

For me, I have to have written instructions from the lender as to their policy on airbnbs or I will decline the assignment. I only appraise land and improvements. Not furnishings and not businesses. If they want a business valuation then the lender will have to hire an accountant to determine the value of the business. Otherwise a purchaser should be considering a larger down payment than 20% to cover the business, chattels, and intangibles.

Other appraisers may take the gamble in order to make a couple hundred bucks. But they are risking a lawsuit and possibly denial of insurance coverage, which can cost them tens of thousands of bucks to defend themselves in a court action.

And where are are the agents that were involved? Their car tail lights are long gone over the hill never to be seen again.

In my opinion the 600k Era unit is a better unit overall (due south exposure and Era slightly nicer building with on-site caretaker) vs the 572k Escher unit; therefore, exactly my point. Extremely small premium for airbnb, if any.

I was surprised that suites didn’t add as much value as I’d imagined – but I do have 2 questions

Did the data only include registered ‘legal’ suites? In my observation, the vast majority of suites tend to be unauthorized. Were unauthorized units included in the ‘suite’ group or the ‘non-suited’ group?

I wonder if houses with suites tend to sell more quickly, than those without?

Here is a comp of air bnb vs none air bnb downtown. Hard to find an apples to apples comparison but I am looking at buildings of the similar age and units of similar square footage, similar floor/views, within 3 blocks.

https://www.realtor.ca/real-estate/25882943/903-838-broughton-st-victoria-downtown

https://www.realtor.ca/real-estate/25726986/1008-728-yates-st-victoria-downtown

https://www.realtor.ca/real-estate/25815464/1201-728-yates-st-victoria-downtown

People looking to buy that has a rate hold in place which will expire, not people with existing mortgages.

Not sure what you mean by “the last of the cheap rate holds will run out in the next couple weeks”. If you are talking about cheap rate mortgages, I’ve got another 2 years on a 2%.

Not sure if aria and Astoria is a valid comparison as the the aria is luxury. Legato vs 989 Johnson is interesting, I didn’t know legato is zoned. What do u figure the premium is currently on air bnb zoned condos?

Not sure I understand your logic. Airbnb zoned buildings, other than the Janion, sell for a very small premium, if any. Compare Legato (zoned) vs 989 Johnson (not zoned), or Astoria (zoned) vs Aria (not zoned), etc.

For all intents purposes they move with the condo market as a whole not something specifically tied to air bnb reason being even if airbnb was 100% banned an owner occupier can still purchase the unit, or it can be a long term rental, or executive rental, etc.

People pay for the condo, and then a very small premium for the zoning.

Last of the cheap rate holds will run out in the next couple weeks. No one knows what’s going to happen in the future but I know for sure that air bnb condos only has one way to go and its not up.

Please explain why you think so?

I am getting the suspicion that sales will actually be rather strong this fall.

20,000 people, on CBC news someone from the region said that 2/3’s of the N.W.T. are on fire.

“That’s a lot, but could be reasonable depending on the coverage you have.”

Earthquakes, disability if I hurt myself mountain biking or something, other stupid possession coverage for things that never happen.

Look at Maui, now Yellowknife…I don’t think they would cover it anyway.

Its hotter here right now than the equator.

Wow, the entire city of Yellowknife has been ordered to evacuate due to forest fire risk.

That’s a lot, but could be reasonable depending on the coverage you have.

I will allow you to conduct and operate your business providing you follow and meet all of my rules and regulations.

I will provide you with absolutely no working capital, no assurance what so ever, and you will take on all of the capital risk.

If you fail, that is not my problem…and I will make it very difficult for you not to fail.

I will throw up so much red tape… just to test you out…just to see if you fit.

I have every council member in my pocket…I will destroy you.

Compliance is vital…break one simple rule…I will bankrupt you.

Do you understand?

54% off the top…now do we have a deal here or what?

COV.

https://househuntvictoria.ca/2023/08/14/suites-and-home-values/#comment-104485

You defiantly seem tuned in on development strategies…are you Mike Miller?

It costs me $196 per month for house insurance…Is that normal?

Its supposed to be a deal because we have life insurance, vehicle insurance and house insurance as a bundle with our financial institution.

Bonds Bonds Bonds……..

Starting to really price in a September central bank increase.

I would say those who are willing to skirt rules typically recieve the benefits. One of the reasons why immigrants love coming to Canada.

You mean CEWS was forced on employers? Including the Conservative Party of Canada? Why this government is even more dictatorial than I imagined. 🙂

Trudeau’s crony friends will be outta luck.

Very good chance that the Conservatives will be triumphant in the next Federal Election here. I wonder what will happen then in terms of financial handouts.

All printed money can not be recall without pain once it is in circulation.

The solution is that the government has to balance the budget. And, the BoC must let the market absorb the extra cash in circulation through time, or recall all printed money by increase interest to ultra-high rates.

So far the solution that the government has come up with is increase interest rates by a small to moderate margin and let inflation run it course, and increase population to absorb the extra cash (dilute debt by increase tax paying bodies).

I recalled that it was the renters and social justice warriors that wanted CERB and CEWS handouts.

The chicken has come home to roost, because the myopic advocates ignored all signs of warning.

Where is all this money floating around coming from? Maybe other countries.

Seems like a no brainer to me but maybe I am missing something.

There is plenty of money circulating in the economy, and that’s the reason for the inflation. The problem is that the money is in the wrong hands. This is the result of decades of crony capitalism (not real capitalism) practiced by US and Canada. In real capitalism, people taking the risk with other people’s money will not be bailed out. In crony capitalism, rich people get bailed out when they run into trouble, but not the common people; People in the top of the ladder receive all the benefits and people in the bottom get all the pain.

Lots of discussion about the cost of living rising and inflation ripping again. What I can’t understand is if the federal government stepped in during COVID to help people stay afloat, why can’t they do the same now? Shouldn’t we be giving out money proactively to prevent a recession?

Seems like a no brainer to me but maybe I am missing something.

A gulag would be an improvement over some parts of this country.

Yes, clearly that is the solution. I would start with gulags to house most of the people who comment regularly on this web site.

There are no efficiency experts in government. Just tax and spend experts.

lol….bunch of non-sense bs talk. This is the same government that grew the number of federal government employees by 39% from 2015 to 2023 and now they will cut back, yea right.

This is like the BC Government posturing like they will do something on the housing front when they will do crap all in the end. They can’t even do something super super simple like scrap the owner builder exam (something that is 110% useless and increases cost of construction and delays construction). 11 people emailed me yesterday for the study guide that BC housing refuses to put together and provide to people…wtf.

People with no common sense electing officials with no common sense = housing crisis.

Are you censoring my posts because they question a 1.2 million people at a time of housing shortage and massive inflation and interest rate hikes???

https://www.youtube.com/watch?v=791_NBFTgPQ

[Admin note: No, you were just stuck in moderation for a few days because you had changed your username from what you had used before. Approved now]

So Communism is the answer? Guess what countries people are fleeing to come to Canada.

Listening to the political pundits speaking about the housing crisis and pointing fingers at each other on who is to blame and whose responsibility it lays. Yet no solutions have come forward for a federal or provincial plan.

I think there is a solution, but it won’t be the same way we are building homes today. Capitalism fails when it comes to building affordable housing. One has to look to other social democratic nations that have found long term solutions for social housing and then adapt their solutions to a made in Canada approach.

And so it begins….

From: https://www.cbc.ca/news/politics/public-sector-union-federal-cuts-1.6937217

Coming soon to another level of government near you.

I question the quality of journalism on the housing crisis. If you are serious about housing, you have to seriously doubt the Trudeau policy of letting in 1,000,000 immigrants in one year. It’s insane. And Orwellian. Only a massive political agenda could deny the demand side of a crisis so deep that all Canadians are becoming deeply affected. What a disgrace. What a scandal. It makes me sick. I feel the elites have deeply sold out Canada for the sake of horrible agendas. It’s evil.

Yes but the land has to be a lot lower. Less than the cost of a single family zoned lot. For example the urban zoned lot at Howard and Bay listed at 2.5 million consists of two legal lots that have homes on each lot. Just as they are now they would sell for about 1.7 million in total as single family residences. You would have to get the land for under a million or $500,000 a piece before it started to make sense as a rental apartment development. Who is going to sell their home in Victoria to a developer for $500,000 when they can sell it for a lot more to a first time home owner?

You would go berserk if the city re-zoned your property to multi-family rental only. In fact you would sue the City for loss in value. And you would win.

You are not going to be able to assemble single family properties at those prices. No one would sell.

Re-zoning is just one part of the process. The lot has to be large enough to allow for a condo or rental complex. The ground has to be stable to support the building (ie the Apartment building in Langford that has been condemned) and it has to be economically viable.

The last one is the most important. If it isn’t economically viable then it doesn’t get built.

That’s the problem that the province is having, they can force re-zoning onto the city but that doesn’t mean anything will get built. How many applications for four or six unit complexes have been submitted to the city? Zero? Duh, I wonder why.

Quite right, but if condos can’t be built on the land, its market value will be a lot lower. You explained why yourself.

Patriotz that’s not going to work.

The cost to build a 30 unit apartment building or a 30 unit condominium complex are nearly the same.

Developers are building condominiums because the profits are greater.

One way that has worked in the past is to allow a greater density. But it has to be a large increase in density. The missing middle initiative has only increased density for rentals from 1.2 to 2.0 for an urban C1 zoned lot. To make that profitable for a developer as a rental apartment the density would have to be over 3. Victoria City council is not going to accept that. If they did that then cost of the land is going to increase as you purchase multi-family land on price per buildable square foot basis.

There is an 11,500 square foot lot that I have been looking at, near the corner of Howard and Bay Street. Asking price is 2.5 million. The location kind of sucks as it is corner lot and the set backs are going to reduce the buildable area. Construction cost to build say a 23,000 square feet building at land to building ratio of 2.0:1 is going to be around $8,500,000. But you’re not going to get 23,000 with the set backs it would be more like 21,800 square feet less interior hallways, elevators and stairways. That’s 11 million so far. It’s not going to work as a purpose built rental apartment as I would be under water by a couple of million as a rental as the cap rate on rentals is not sufficient to make it profitable. I would need to get over $3,000 a month in rent for a small one bedroom to cover construction costs.

If I tried to go obtain a higher density and a couple of more floor levels then the government will want concessions on market rents to keep the rentals as “affordable”. Whatever affordable means. It’s a double edged sword, I need a higher density for a rental building buy I get knifed in the back on what I can charge for rents.

This is the same problem that people will be facing when they are thinking about their single family zoned lot to build 4 or 6 rental units. The costs to build are going to be more than what the property will be worth when it is completed. No bank is going to finance that.

Zoning alone is not the answer. The project has to be profitable or it will not get built.

From the “Financial Post”, no less.

From: https://financialpost.com/news/economy/canada-inflation-rate-higher-than-expected

BOHICA – 6 September 2023

There’s already a way – rental only zoning.

I will give you an example why it isn’t economical to build rentals over that of building condos.

A 30 unit apartment building sold in Esquimalt for around $6,250,000 which is about $210,000 per suite. If that had been a strata titled condominium complex then it would have sold close to $10,000,000 in the aggregate.

That’s the problem with building rentals, you get far less for a purpose built apartment rental building in the marketplace than individually strata titled condominium complex.

If the government wants to encourage more rental housing then the government has to find a way to bridge that gap.

Fires, floods, hurricanes affect the areas of higher density, a high percentage of the population. Time to move to Montana, Wyoming and North Dakota.

Whenever I see newscasts about floods I often wonder who put that river so close to those houses.

Raising awareness of geographic climate risk is now part of the social policy conversation in the US regarding home ownership. One tool is to outright prohibit further development in high risk areas ie. fires, floods & hurricanes. That would affect values. Climate risk is eventually going to be a neighbourhood measure like walkscore imo.

https://www.brookings.edu/articles/how-to-nudge-americans-to-reduce-their-housing-exposure-to-climate-risks/

Half way through the month so its time to look at rental rates again. There are currently about 360 postings for places to rent on Craigslist within a six kilometer radius of downtown.

The average asking price has increased to $1,928 per month for a one-bedroom with around 130 postings ranging from a low of $1,620 to a high of $2,360 per month.

Two-bedrooms clock in at an average of $2,681 per month but can range between $1,960 to $3,400 per month.

I have noticed that those at the higher end of the range have been posted for close to 30 days with no takers.

Anyway you look at it, for someone starting out on life’s journey, this is a lot of one’s paycheck going to rent.

According to Trudeau it’s not the government’s responsibility. Do you watch the news?

It is governments’ responsibility to resolve housing issues, but considering the current crisis and seeing so many young people having hard time finding accommodations, it makes sense and feels right to free up underutilized space to share (not on AirBnb), done with care (small or minimum impact to self) of course. So a suite in the house is a good idea now, even if one might not need the rental income. You only need one bed to sleep on at the end of the day 😉

Actually it isn’t that difficult to estimate the value of a suite over that of a fully finished basement for an appraiser. Most of the finishing and plumbing are already in-place. The main difference are the kitchen cabinets. Some home owners choose to update their main floor cabinets and then re-use those older cabinets in the basement suite. For others they tend to choose the more economical kitchen cabinets and have the better quality on the main living space. it’s simply a matter of the cost of cabinets in most cases. That’s a very small percentage of the value of the entire property. When you get down to the one or two percent range difference, it becomes immaterial. It’s about what staging a house will contribute to the value or a fresh coat of paint to the property,

That’s why there isn’t a significant difference between a fully finished basement and a suite.

There is also the effect of buyer’s preferences for homes with suites and those without suites. Not everyone wants a suite as they value their privacy over the passive income that a suite generates. And that can vary by neighborhood. Obviously one doesn’t have to use the kitchen in the basement if they don’t want or need to, but then why would you pay for something you don’t want? It’s like buying a house with a hot tub.

Gordon Head is the poster card child picture of homes with suites. 1970’s basement entry homes easily converted to suites. Over the last 90 days 31 homes have sold in Gordon Head but only 10 had suites. Not everyone wants a suite. It’s half of dozen of these versus six of those.

I suspected at one point that houses with suites might not carry enough of a premium but I was surprised to see that there might not be any premium.

I know we looked at a couple of houses that had suites and I just added the cost of ripping them out to obtain more floor space. (really had no use for three kitchens.).

That isn’t in the COV plus would prefer a street that’s half decent (has sidewalks, etc.).

There was one on Darwin not too long ago but its swan lake uptown, did that go for 750k? Can’t remember.

Not sure how many dual income professionals (200k plus hh) are looking at these almost tear downs though. But you know better than I.

I would pay low 700s for a 50 footer in the Oaklands/Fernwood areas and high 700s for a 60 footer (preferable) that is a good candidate. Otherwise numbers do not add up.

Problem is I think first time buyers will set the floor above where the numbers work. Too many dual income professionals qualify for shockingly large numbers even at current rates. If there is a buying opportunity it will be short lived (interest rates squeeze things before wage growth starts to compound/and or rates drop a bit).

What is your price point for those? I am assuming core and on 6000 sqf+ lots?

I had 12 sales in July and have quite a few accepted conditional offers on my listings right now.

Excluding mere postings (which I let do whatever they want in terms of pricing) I only have one full service listing that is more than 30 days on market without an offer in place so I don’t have a huge need for price reductions on my listings.

Slow doesn’t mean nothing sells or downward pressure on pricing. I’ve been through slower sales on double the inventory 2010-2014 and prices didn’t go anywhere for all intents purposes.

480 sellers will still sell in August on relatively low inventory.

Could we see downward pressure on prices, sure. I would love to purchase one or two missing middle teardowns for reasonable prices but no where close to it right now. I think we would need to see sustained 6% +/- mortage rates for 6 months to start seeing sellers buckle and “deals” in the marketplace.

Likely because it was bigger.

Yes…..of course. Shite…..i missed that:)

I’m surprised that a suite doesn’t add more to the purchase price.

There must be a divide in the market as to who wants/needs a suite and who doesn’t? Ie. a significant percentage of buyers don’t want a suite – they want extra finished space for their personal use. And then people who view a home for suite potential given that not that many houses with suites are available at any given time. As interest rates rise I wonder if this will change as more buyers may need suite income right away.

It would be great if we could have a Leo analysis on ROI of other types of home renovations/features — but I don’t think the data is there for this.

Are you telegraphing price reductions on your listings?

Likely because it was bigger.

I am somewhat surprised that the stats point to suites not adding much value because when we were considering buying in Sooke ten years ago…..a new house with a legal suite was “always” pretty close to one hundred thousand dollars more than the ones without. Of course back then houses in Sooke (like everywhere) were more than half of what they are today.

We bought a new home with a legal suite at that time for $378,000.00 (April 2012) .

I need another coffee to figure this one out.

Inflation jumped higher last month, to 3.3%

Was 2.8% the previous month.

https://www.cbc.ca/news/business/canada-inflation-july-1.6936557

Hmmm anecdotally many people I know who bought a house in the last 10 years converted part of their house to a suite to rent out. But they’re all locals. So it seems to me younger first time buyers want suites. But maybe out of town buyers or older affluent buyers have different behaviour?

Our first home was a two bedroom with no suite and we rented out the extra bedroom to a student. It was cramped but we were young and childless so it felt like a good financial decision. The only reason we didn’t buy a place with a suite for our first home is because we couldn’t afford one.

I’ve been commenting on this for the last 10+ years on HHV. The big difference is finished basement vs unfinished basement. Finished basement (without a kitchen) versus finished basement (with a kitchen/separate entrance) is small. That has always been my personal observation. Looks like your scientific analysis supports my observations.

Weird, after giving it some thought I don’t have a good explanation for this.

I cannot see any reason for a bump whatsoever. It will be a slow August.