A mix of good and bad indicators on debt

There’s a new tool out there for monitoring indicators around mortgages, housing, and financial vulnerability on a national level. The Bank of Canada has a new page with indicators of financial vulnerability that shows up to date quarterly data on those topics. There’s lots of interesting charts on there, but perhaps more importantly it’s great that the Bank of Canada is committing to updating these on a regular basis instead of just periodically releasing some tidbits as part of a financial system review. In this article I take a look at some that stood out to me.

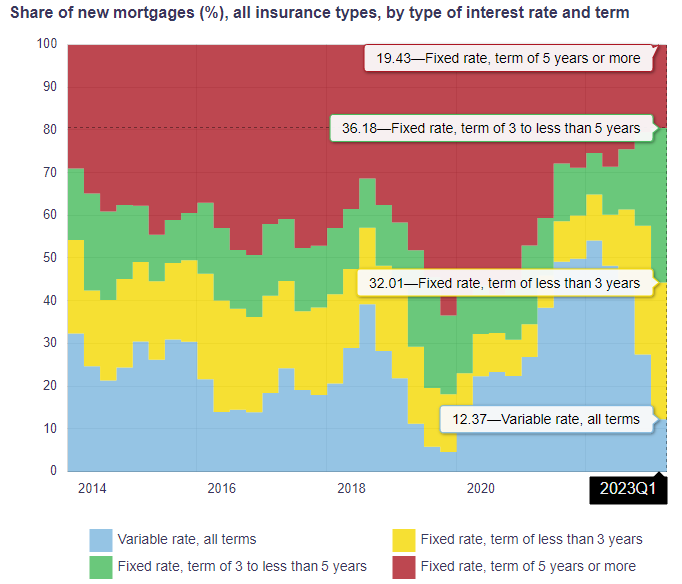

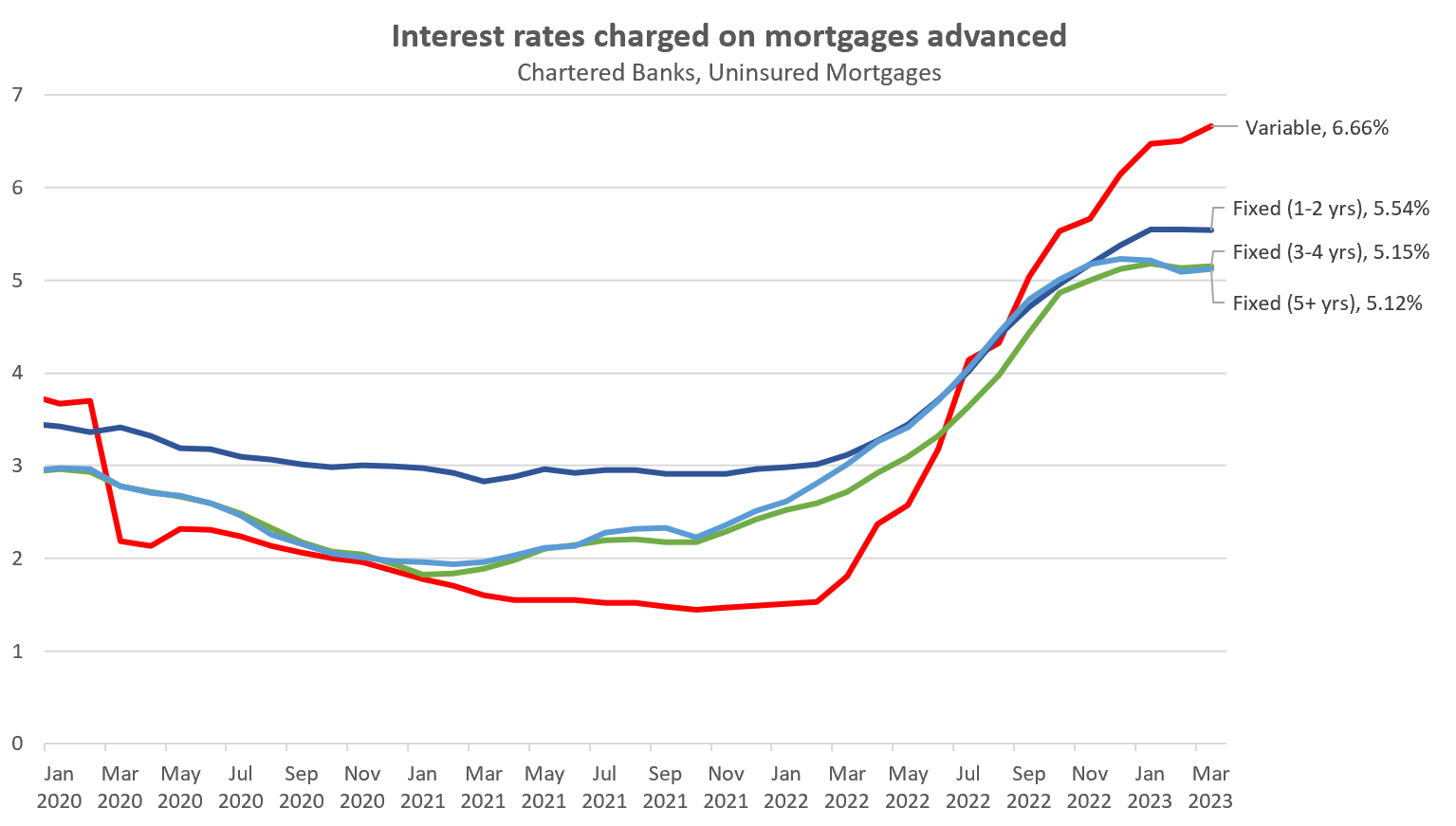

I’ve posted my own chart of these data before, but it shows again that after reaching a high of over 50% of all loans, the take rate for variable mortgages has collapsed to just 12% in the most recent quarter. That’s no surprise given that variable rates went from a full 1% discount over the average 5 year rate to a 1.5% premium as of March. Only the hardcore few that are betting on the Bank of Canada dropping rates quickly, are expecting to have to break their mortgage and can’t tolerate fixed rate penalties, or simply got bad advice from their mortgage broker.

Those variable-rate refugees, rather than returning to the old stalwart of 5 year fixed rates, have poured into shorter term rates from 1 to 4 years. As of the first quarter, two thirds of borrowers were choosing a fixed rate with a term of under 5 years, taking a small rate hit in exchange for the bet that they would be able to renew into lower fixed rates sooner. That seems like a sound bet if you’re paying about the same as a 5 year for a 3-4 year rate, but personally I would be cautious about paying a substantial premium for a 1 or 2 year rate in the hopes that we’ll be back to free money funtime by then. The Bank of Canada is certainly doing some work to throw cold water on the idea that rates will quickly drop back to very low levels.

The Bank of Canada has often talked about the Loan to Income (LTI) ratio, paying special attention to borrowers with an LTI of over 450% which it calls especially vulnerable to losses of income or rate shocks. That (and the median LTI ratio) have dropped off a cliff, and in fact the median LTI is now back to pre-pandemic levels.

That’s true across the board with LTI for all types of homebuyers declining, though note that the data below are 2 quarters behind the data for all mortgages. What does it mean? It’s not that Canadians have suddenly found additional wealth and need to leverage less, it’s just that those taking on large debt loads have been sidelined by rising rates, while remaining buyers either have larger down payments or larger incomes to enable them to continue buying.

Interestingly enough when looking at initial Loan to Value (percent of the property value that is mortgaged at purchase) the average ratio has been declining for a decade. You could read that as good news, given that a lower LTV means buyers have more equity to withstand price declines.

However that decrease in LTV ratios is concentrated almost entirely in repeat buyers. Those have been able to leverage exploding home values post-pandemic into newer and bigger homes, while first time buyers didn’t benefit.

The overall improving trend of loan to value ratios have also benefited from first time buyers being squeezed from 50% of buyers to 42% in the last decade (investors have made up most of the difference). Interestingly enough investors have not pulled back nationally since the rate increases. Perhaps the surge in nationwide rents has kept them interested, even if local data seems to indicate a pullback.

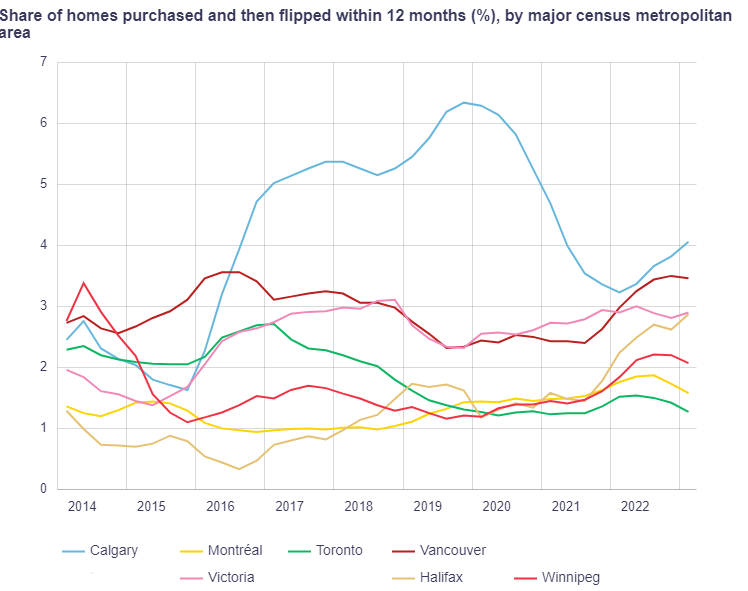

Flipping activity in Victoria is middle of the pack nationally, with 2.9% of home sales representing a flip (resale within 12 months). Note that with the feds cracking down on flips, the province threatening the same, and a pause to the rampant price gains, I expect that the incidence of flips will slowly decrease. However these data are reported as 12 month averages so that will take some time to show up.

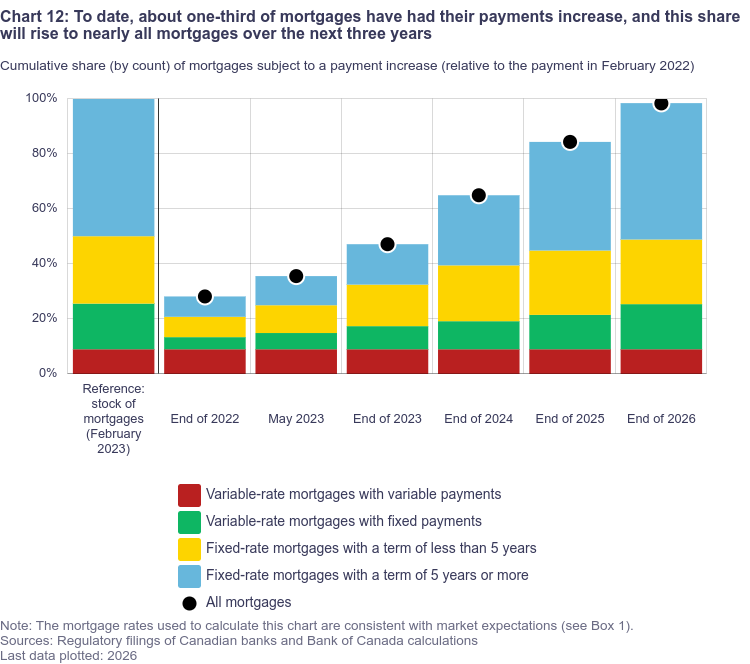

Probably the most concerning indicator for mortgage holders is the debt service ratio, which spiked with rising interest rates. For housing stability what’s important is not so much the average home owner (who will be OK no matter what happens), but the ones on the margins. The Bank of Canada considers borrowers with a DSR of over 25% to be financially vulnerable. “All else being equal, a household that spends a large portion of its income on mortgage payments may be more vulnerable to financial stress—it may be more likely to fall behind on debt payments if a negative income shock or a rise in mortgage interest rates were to occur”. Though the chart below is for new mortgages, rising rates are currently trickling through all borrowers and will have a similar sharp impact on carrying costs. That’s probably fine as long as the economy is running ticketyboo, everyone has a job, and banks remain unconcerned about infinite amortizations. However it seems the Bank of Canada may not be satisfied that rising rates have done their job until that is no longer the case.

Will it lead to instability among existing owners and as a result more listings? Quite possibly. However Victoria should be more resilient than most markets given our low share of owners that carry mortgages.

Speaking of resilience, our market so far has not been deterred by the Bank of Canada’s rate hiking antics or poor affordability, and sales continued at a decent clip last week.

| June 2023 |

June

2022

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 95 | 264 | 612 | ||

| New Listings | 159 | 473 | 1380 | ||

| Active Listings | 2173 | 2228 | 2059 | ||

| Sales to New Listings | 60% | 56% | 44% | ||

| Sales YoY Change | +7% | +23% | -35% | ||

| New Lists YoY Change | -11% | -6% | +14% | ||

| Inventory YoY Change | +21% | +19% | +50% | ||

| Months of Inventory | 2.3 | ||||

Inventory is still increasing, but more sales and fewer new listings means the market is certainly tighter than this point last year. The sub-market that most people are looking in (residential resales in Metro Victoria excluding the Malahat and Islands) is showing a smaller year over year increase (up only 5% for the last 2 weeks), so I’m withholding judgement for the time being as to how the month might play out. Over asks are also down a bit to 15% of sales in the last couple weeks.

Either way we will certainly outperform last June for sales. Currently we are some 900 sales down from this time last year, so it will take some catching up to exceed the annual total, however given how lame the second half of 2022 was, that should be possible while at the same time being no great trick. While buyers have been slowly returning to the market, we know that our resilience is not due to particularly high sales, but rather low new and active listings. There’s little reason to expect buyers to come roaring back this year with none of the affordability challenges resolved.

Maybe we need to stop foreigners posing as new immigrants to stop investing in real estate. There are millions of wealthy people in the world looking for a place to park their money and Canada has been very obliging. Only wealthy people can afford to send their children to university in a different country, allowing them to buy property. Maybe we should make becoming a Canadian citizen mandatory within 2 years. Maybe we should tax the hell out of airbnbs.

After saying all that, property taxes for investors is only 5% higher than a resident owner receiving the senior’s discount. The taxes for investment properties could be $1000 more, but that would possibly increase rents more. I doubt that extra money would result in the creation of affordable housing, instead it would create more government bureaucracy. Until you hear that they are reducing immigration by 50%, don’t expect housing to go anywhere but up.

New post: https://househuntvictoria.ca/2023/06/19/the-impact-of-months-of-inventory/

I was anticipating that investors might start to sell their rental condominiums. Of the 267 NON NEW condos for sale in the Victoria Core 55 are either vacant or tenant occupied. That’s about 20%. It could be higher as 162 condos for sale did not report the occupant type. Of those 105 that did report the occupant type it was about 50%

Interesting or meaningless – you be the judge.

Meanwhile Saanich is applying for the federal Housing Accelerator Funds and one of their reforms is to legalize missing middle infill. They say in 3 years they will incentivize 105 additional units (which they get paid for). At the same time they are starting a 2 year process to just consult about it. Just bald faced lying to the feds.

If you taxed the current selling prices of housing aggressively it would stop new construction overnight. It would be interesting to see what would happen if you applied your aggressive tax to the land only portion of the assessment. Not sure but my guess is that it would shift the premium for more desirable parts of the country even further. Seniors would all defer their property taxes. Property transfer tax would suffer.

My guess is that powers that be wouldn’t really like the outcome so would not enact it. If they did they would be voted out pretty quickly but it would be an interesting premise to explore.

Oh, so no new purpose-built rental housing then?

I wouldn’t immediately dismiss Frank’s comment.

According to Craigslist asking rents have gone up by about $100 per month for one-bedrooms within a 6 kilometer radius of the downtown core – just in the last month. As of today the average rent for a one-bedroom is now $1,870 per month.

That puts most couples that are each making minimum wage on the edge of not being able to afford a one-bedroom. This is why we have a labor shortage in Victoria and people living in their vans.

Here is more basic economics: if you tax the hell out of a particular asset class then that asset class ceases to become a good investment. We need to stop investment in homes. We need to stop the flow of money into non productive assets. We need to stop people from parking all their savings in real estate. Is it really that complicated?

How does it work? More rental properties get sold, less inventory (already happening) and rents go up. More basic economics.

“What would happen if property taxes went up? Rents would go up. Another failed “solution “.”

How about a 10% federal property tax. That would shake things up. The housing market problem is not as complex as you think it is. Just need a political party in charge that has balls.

How does that work again?

What would happen if property taxes went up? Rents would go up. Another failed “solution “.

Well this did happen:

Ontario tried a speculation tax on property, and the market ‘collapsed overnight’

More recently, the RE industry in Toronto blamed declining RE prices in 2008 on a new property transfer tax, although in all likelihood they would have fallen anyway.

Thought experiment: what would happen if the total property tax rate went up to over 2%, as it is in major Texas cities?

Yep, the world of people that some how think they can make things efficient through more government regulation and management that goes along with folks that think you can tax things into being cheaper. We see the success with healthcare (facetious) where they have tried to solve the problem of shortages of doctors, nurses and specialist by adding administrative staff, rules and new layers processes that surprisingly (for those that did it) made the problem worse. In the end, you just can’t fix stupid.

Nah, turns out this guy was the chump:

Here’s the revered leader of the bears being completely wrong about Victoria RE, as always:

https://www.theglobeandmail.com/business/article-changing-amortization-cap-on-insured-mortgages-not-the-answer-to/

Extending the amortization on an insured mortgage requires requalification and payment of a new insurance premium. Of course if equity has risen to over 20% a new uninsured mortgage can be taken out.

Their vantage point was more on the listing side originally which has played out pretty much exactly as predicted so far since May as confirmed by Leo’s data prior to rate hike.

My personal non insider contact view is that the yoy comps will look better as you get later in the year due to base effect.

I dont understand why it is taking so long to develop the Vic West Rai lands. It seems an idea location for four or five more 40 story highrises.

Problem is how do you isolate their vantage point versus BOC/interest rate impact on the market. I think August is going to be a very slow month, but it has nothing to do with my vantage point because I don’t have a vantage point to look that far out. If I talked to 500 local colleagues, I still wouldn’t have a vantage point for August.

The original “insider contact” calls was made before the rate hike. Again, you see the information once its solidified but not all the ones currently in the works but aren’t in the system yet. That’s where talking and discussing with others in the industry could offer a better vantage point for whats potentially to come going forward.

Sales can only go up/flat/down so chances of randomly making a prediction are high. It would be like me saying August is going to be slow in terms of sales (which is my prediction) and then someone saying an insider said August will be slow when I don’t have any inside information whatsoever but I can see the obvious that everyone else can see…..i.e., interest rates are trending up which will supress the market in August substantially. There is no inside information better than Leo’s analysis, imo, and this is being an insider.

I do admit, I am having an incredibly busy month with my own transactions which may have influenced me to overestimate my 750 sales prediction. I think we are on pace for 720ish from what I can see at this point.

It’s not reserve land and as the story notes it requires the same municipal approval as any development. However it’s easier to approve high density when it’s not in an existing neighbourhood.

According the Leo’s stats comparing the same days, the YOY increased sales dropped over 50%, from 23% to 10% last week. I think my insider contacts are pretty bang on so far. Lets see how the month finishes off, your call was 30% increase and my insider contacts was 15% or less

I’ve been saying this here for more than a decade. Here is my post from seven years ago.

and you are right, this was one response

However, I never participate in the annual guestimates/poll here. I have some confidence in long term appreciation, but hard for me to predict what will happen over the next 12 months. I always think that if you are ready to buy and can afford it you make the best decision you can and don’t hold out for better times.

So far, our home has appreciated well above 4% a year btw – works out to 6.5% – however my bet is the rate will slow a bit going forward. As far as rents go, turns out we have exceeded 4% per year I think – as much as 27% in one year from 2021-2022 according to this: https://www.victoriabuzz.com/2022/08/victorias-average-rent-had-the-highest-year-over-year-increase-on-all-properties/

In some ways, housing is like climate change. It takes catastrophic effects in near proximity before people believe what science and data shows well in advance. Human nature I guess.

“169 to 147 sales/week a bit slower but a some of that is seasonal.”

So when there is a decrease in sales it is due to seasonality, but when there is an increase in sales it is due to a bewildering strong resilient market. Noted. Thank you Marko for your non-biased insight.

169 to 147 sales/week a bit slower but a some of that is seasonal.

At a missing middle talk with a city planner present…still no applications received as of today.

……………

It’s funny (to me) because, not that many years ago, if someone on HHV suggested that folks buy a SFH now or be priced-out forever they’d be mercilessly ridiculed by some very angry bears.

So what ended up happening — and is still happening?

Many, many people have been…priced-out forever.

The number of house sales in the core resembles last year. But the distribution of the sales does not. The number of sales in the upper income and luxury market for housing has fallen from last year.

I suspect that those considering purchasing an upper income / luxury market have downsized their expectations to the middle band of housing because of the higher interest rates. That has boosted sales in the middle band housing which is in the 1 million to 1.5 million range. At the same time prices in the lower band, which are mostly condominiums, has not been rising. It now takes about to 2.4 condominiums to buy one house in the middle band range in the Victoria Core.

It’s called the substitution effect. When the price of steak gets too high then people buy chicken. That causes the price of chicken to rise. Chicken relative to steak becomes over valued, for the short term, until the price of steak comes down as fewer people are now buying steak.

That’s what I suspect is happening in real estate. Buyers in the middle band are not getting the same value for their money as they received in previous years. The prices may be higher but they are getting less quality for their money.

There are two possible future scenarios for the long term. That condos and the upper income market are under priced and will increase in value or the middle band market is over priced and will decline in the long term.

My best guess is that prices in the upper end market will adjust lower. And then the middle band will begin to decline to compete with the new pricing in the upper band market. The market is not expanding even though listings are increasing somewhat, but it is contracting due to changing buyer’s preferences.

Quality is not typically accounted for in most published trend analysis. But if you are paying the same price for a home as last year but now the home is lower quality that is a decline in value for your money.

What was the peak inventory in 2022? was it around 2300 or something? Looks like we will pass that this week.

Or..

From: https://fortune.com/2023/06/18/housing-market-loses-appeal-for-wall-street-type-home-buyer/

It’s all very entertaining

Isn’t the slow down already in effect based on Leo’s stats? Went from 23% increase MTD the first week of June to 10% increase last week?

Month to date activity:

Sales: 410 (up 10% same time last year)

New lists: 781 (down 6%)

Inventory: 2293 (up 19%)

https://househuntvictoria.ca/2023/06/06/wheres-the-most-action/#comment-102689

It isn’t the norm though, minimum wage earners had a bigger bump this year than unionized public sector workers.

Yes.

Ten years from now, I think Vic detached house prices will have doubled. That would be prices +7% per year, from a combination of inflation+ real price growth.

Only 95 net SFH additions per year in “core” Victoria (COV,OB,Saanich), yet SFH are the preferred dwelling type for 70% of house hunters.

Short term (6 to 24 months) who knows but long term I am very bullish. Wage growth, immigration, and anti-development policies does not bode well for lower or flat prices long term.

I see the BC government salary grids for both union and non-union staff just took a ~7% jump year over year. It’s hard to get too bearish on local prices with that kind of raise being the norm.

https://www2.gov.bc.ca/gov/content/careers-myhr/all-employees/pay-benefits/salaries/salarylookuptool

Month to date activity:

Sales: 410 (up 10% same time last year)

New lists: 781 (down 6%)

Inventory: 2293 (up 19%)

I’ve heard you have to be in the country for 5 years to qualify for a security guard position.

be a disaster in many cases. Medical training is not standardized across countries. Foreign-trained professionals need to demonstrate both that they meet the knowledge requirements and standard of care in Canada (MCCQE exam) plus they need to be supervised for a period of time so they are familiar with Canadian systems.

Canada has a branch of government that deals with this: https://www.cicic.ca/

There may be ways to make this process easier but the standards need to be upheld.

Not to harp on this but there is a Globe and Mail articles that alleges that BC is actually sending thousands of cancer patients to the US. Originally I was under the impression it was just a handful. Somehow we need to figure out how to link additional housing with expanded medical facilities here in BC.

The two are interlinked whether we like it or not.

From a G&M column this morning:

Of the 10 costliest years Canadian insurance companies have ever had to bear, nine have occurred since 2011.

+1

And the resilience is not just Victoria . Big turnaround in US House Indexes for builder sentiment, prospective buyers etc. NAHB index now 55 indicating growth (up from 32 at start of 2023)

https://www.fxempire.com/news/article/nahb-housing-market-rebounds-builder-confidence-hits-highest-level-in-a-year-1355414

Maybe condo owners are typically older people and have a higher turnover rate. Any stats on average age of condo owners vs. SFH owners age?

Despite intense pressure, due to lack of supply, the median price for a condominium has not increased over the last 3.5 months. Neither has the average days-on-market fallen below 30 which is different from past markets that had low months of inventory.

The average days-on-market is a good indicator of the market place. It is generally the leading indicator showing a change is happening in the marketplace. What we are seeing is that For Sale signs are up for longer. That’s a visual cue to those looking to buy not to be in a hurry to purchase. Condominiums are not selling in a few days or a week or two weeks when the market was hot. Now it typically takes a month to find a purchaser.

Condo prices are still stable, but if you’re a developer you may want to give incentives, other than a price reduction, to attract a purchaser. Being creative in the financing options, free upgrades, a TV, air fare to Hawaii?

Hate to get back to housing but I noticed that Abstract seems to be offering condos with only 5% down and the balance not due until completion. I am guessing Abstract is self financing at this point?

Canadian doctors have been poached by the U.S. for decades. They get paid ridiculous sums of money. Nurses also.

Nothing wrong with that. Our main immigration program is “economic immigrants” which is Canada getting talented people from other countries. I’ve not heard anyone other than you complain that this was “poaching”.

Sure, but accepting doctors trained in their home country directly into Canada’s medical system would likely increase the number of doctors jumping ship. sort of like global labour arbitrage, but in reverse.

And we actively poach nurses:

“Work will include a new marketing campaign to promote B.C. and a new provincial website to provide information on available supports. Health Match BC will also provide recruitment navigation support and administer bursaries to help IENS overcome barriers and encourage them build their future in B.C.”

“Removing some financial barriers and streamlining the assessment process will facilitate pathways to employment in the province and ensure British Columbians have access to the health care they deserve with even more nurses and health-care assistants.”

You can’t expect that Canada takes in 500,000 immigrants per year, but shouldn’t take in trained physicians, because that would be “poaching”. Most of the immigrants are trained in something, so we’d be guilty of poaching more than doctors.

FYI, the Canadian doctors that get trained overseas are not subsidized. They pay big bucks for their medical education.

I know, and if my mute would stay on I wouldn’t have to read your inane ideological rants against those who do not live in a way that you approve of.

Case in point:

Rebecca Chen·Reporter

Sun, June 18, 2023 at 12:30 p.m. PDT·3 min read

While buyers in more affordable ranges are experiencing massive housing shortages, that’s not the case for the Los Angeles luxury home market.

“We have a good amount of inventory,” Josh Altman, co-founder of the Altman Brothers, a real estate agent firm that focuses on luxury homes, told Yahoo Finance LIVE (video above). “Good houses still are selling.”

In Los Angeles, there are 400 available listings for single families over $5 million, representing 18% of the total single-family inventory of around 2,200 homes, according to a filter search on Redfin.com.

But there are a lot fewer buyers in this price range. A $5 million home requires buyers to earn around $850,000 a year, a bracketed range that includes less than 1% of Californians, based on data analyzed by SmartAsset.

Victoria’s real estate market is top heavy too. I suspect that is likely in most cities across Canada as the higher interest rates have made prospective purchasers lower their expectations and increasing demand in the mid-band range of homes.

On the lower end we have an affordability problem and on the upper end a liquidity problem.

Arrow- I’m not referring to the elderly, I’m referring to drug addicts that overdose on a weekly basis. Get private funding and set up a system that deals effectively with them. Unfortunately our pill popping society and doctors writing endless prescriptions for pain killers feed the very problem they’re trying to solve. As for apartment dwellers, they always have money for beer and smokes, which also causes health problems.

Maybe like realtors?

https://www.bcfsa.ca/industry-resources/real-estate-professional-resources/education-and-licensing/becoming-licensed/real-estate-careers

The real estate industry in B.C. achieves high standards in licensing by requiring individuals to fulfill comprehensive education and experience requirements………………….You should expect to take up to one year to complete the required licensing course and examination before applying for licensing.

Our health care should be Federally administered and not provincially. The way one could move from province to province without any interruptions to their plan.

Read the obits and see how many seniors pass a way here who were originally from other provinces. Once you are over 55 years old and develop major health problems such as diabetes, heart & lung diseases, dementia etc. etc., the real costs of your health care explodes. Even mild forms of diabetes requiring taking 500 mg of Metformin per day and or the onset of high blood pressure taking 2.5 mg of say Amlodipine per day requires a visit every three months to your doctor. Not to mention having lab work done evert three months as well. Most seniors eventually go into some form of LTC facilities. If they are on a low income, their care is greatly subsidized. If you aren’t there (age 55 and up), you will be one day.

It would be if that other country subsidized their medical education with the expectation that the training would be used to better lives there, as Canada does.

Are you referring to the elderly?

…and as for $50 charges & plumbers, that’s irrelevant. Many renting families don’t pay plumbers and just scrape by without an extra $50 to spend if an ER visit is needed…it is called a universal healthcare system for a reason.

The only problem is that BoC will be happy with a RE crash, sooner the better. It will correct their original mistake of creating the huge RE bubble. Even if the economy crashes, they will have to wait until inflation drops to 2% before dropping rates.

Getting lots of updates on properties I showed in the last few days that had offers delayed for today with 2,3 or 4 offers coming in.

Not seeing the second half June slowdown many insides predicted. The resiliency of this market is bewildering to me. I am going to be way off on all my 2023 predictions that way things are going.

I have a friend that was an ICU nurse, then she went to work in the private sector, and now that ICU nurse compensation has improved ($60 hr given her experience) she is going back to ICU shortly and I think she mentioned it will be going up towards $70 hr.

On the real estate side of things, I’ve now worked with 15 +/- GPs (all younger) in my career and not one has had a practice. I am curious as to what the shortage would be if compensation was $500,000/year? Seems like a lot but I mean as a society we are running entire departments of government workers doing absolutely nothing (in the case of the owner-builder exam at BC Housing an entire department being counter productive for the good of society). Plenty of resources to compensate GPs $500,000. Just let go a few “tree preservation coordinators” at each municipality.

Personally, I would rather have medical care than a few branches missing here and there on municipal trees. Being a rich country we have the resources for good health care, we just choose to prioritize other things such as a huge bureaucracy even on a health care level. More than half of Island Health employees are non-clinical in nature. What was that stat 40 years ago? Like 20%?

Or just lower the education requirement for a Family Physician in Canada so they wouldn’t need an undergraduate degree. A two year diploma in Health Science instead of bachelor’s degree.

In Canada, the term IMG (International Medical Graduate) typically refers to a doctor that’s already in Canada, just unable to practice Medicine. There are thousands of them. Some are driving cabs. Many of them are Canadian born and raised. They just got their MD abroad. So training them wouldn’t be “poaching” them from another country.

Set up a separate system to deal with chronic abusers, and there’ll be plenty of access for the general public. What most people don’t realize is that our health care is rationed to limit the amount of money that is spent. I believe in user fees to supplement the system. $50 to go to emergency is a lot cheaper than $100 to get a plumber to look at a problem.

Maybe effective, but definitely selfish poaching of human talent from the country that educated them and needs them too.

How about more spaces and incentives to train Canadian youth as is currently underway, albeit a tad too little too late.

A big part of the problem is a shortage of family doctors (and nurse practitioners). When this shortage exists, a doctor in the private system is seen as taking away a needed doctor from the public system. Which is a good point.

Federal and provincial governments should cooperate to create a path to licensure for the thousands of internationally trained doctors (IMG) in Canada.

“A system based on the ability to pay rather than the urgency need of treatment.”

Just like our current housing market. Housing not based on need but rather based on profit…the ability to pay rather than the need for shelter.

We could have a private medical system with agents/brokers selling access to Healthcare. Yes, you could see certain professionals and procedures lead to multiple offer scenarios.

If more money makes the system better then…

Why not an online auction to see a doctor? The next doctor visit will be at 1:00 PM. The bidding will start at $250. Do I hear $300?

I would hope that most readers would say this is ridiculous. But isn’t that what you’re suggesting. Those that can pay more get priority over those that can not. You’re paying to take someone else’s place in the queue. A system based on the ability to pay rather than the urgency need of treatment.

I find the edit button more valuable than the mute button.

It’s funny that when it comes to health care many of you think a public government run system is best, but when it comes to housing/shelter many of you also think that a private capitalist system is the only choice.

Why are we talking about how shitty Canadian Healthcare is? I thought that was offtopic, Leo?

Actually not based on politics.

Absolutely agree with Marko.

Why are we always comparing to the US, the worst example of private health care.

I quite like the system in Croatia. A lot of specialist work the in the public system and then run private clinics in even afternoon/evening. I quite like it, money is a solid motivator. Most specialist you can see privately within two days for approximately $100 CND in top notch clinics.

Same thing here for dental. I wanted to get a CT on a tooth I had a root canal/crown put on in Croatia a few years ago. Phoned endodontist office here in Victoria at 9 am, they got me in at 11 am for a consult. It was ridiculously expensive at $300 for 20 minutes but I rather have an expensive option versus no option at all.

I think we should give GPs one day where they can charge whatever the market can bare (assuming they work minimum amount of hours under MSP). I would gladly pay $200-$300 for an appointment when I need it.

A long time friend of mine just had bypass surgery in Minneapolis. He’s 68, I’ll have to ask him about costs. His wife is a nurse with a high level administrative position in a hospital. That helps.

Couldn’t agree more. I have retired friends in the U.S., both not yet eligible for Medicare. As of three years ago, they were paying $20,000 (i.e. $26,000 Canadian) for health insurance each year, even with the “Affordable” Care Act. They also pay large deductibles. If they ever have to wait too long, they can expedite things by going out of their insurance network, but that entails even more money. They never thought about it until they retired, because their employers provided their health insurance. That tends to hide the true cost of privatized health care from most Americans. As much as people complain about the state of things here, I wonder how fully they understand the alternatives. I’d like to fix and improve what we have. It’ll still be much cheaper than privatization.

A good point Barrister.

I understand that some property developments are faced with an infrastructure fee, from small (new sidewalks) to big (money for water, sewer, & road upgrades). Seems to me that Hospitals and their staffing are equally or more important infrastructure needs as an area’s population increases.

Just another unaccounted for externality that society needs to reset, I suppose.

Thats great Patrick but somehow in spite of all that we still have a major shortage of hospital beds in Victoria. The province is sending cancer patients to the US for treatment which might be a sign that all is not well.

Patrick I appreciate that your comments are founded on politics.

On a totally different note, the mute button seems to be a good feature and does Leo have a stats on its use?

The provincial government already is doing that. Health spending is rising fast and last budget has $6 billion extra, with spending rising 20% to $30 billion per year by 2026. Health will be 1/3 of the entire budget.

I’ll leave the allocation up to BC Health, I think they do a great job putting the money where it’s needed. Recent focus is on addictions and training/retention of health care workers, which makes sense. If you’re interested, there are some details here https://globalnews.ca/news/9515174/b-c-budget-health-2023-health-care-addictions/#

Victoria ends up getting more health care money per capita spent here than other areas of BC, because it’s a center for administration and tertiary care.

Current “levy” is taxes of $24 billion per year for health care, about $5,000 per person in B.C. which will rise to $30 billion, about $6,000 per person in 3 years. Money well spent. Taxes are a good way to fund it.

If we are planning major developments or continuing to create more highrises we need to seriously consider some sort of levy to fund additional hospital beds. I know that is supposed to be a provincial concern but we cannot ignore the major hospital deficit that the city has when the population base is increased.

Canada is getting too complicated.

Have you heard the plaintive call of “…Coalition of Vancouver Neighbourhoods and a Kitsilano resident, said he worries the tower development will inspire other building owners in the area to “get stars in their eyes” and want to level older buildings and build higher as well.”

There is no end to the variety of warbles heard from Chicken Littles

Yes I would, along with any other underutilized federal, provincial & regional government properties inside municipal boundaries.

Arrow would you be suggesting pinning an eviction notice to the door of Government House? That’s a 33 acre site that could be a similar development to Vancouver which could house 5,000 people within walking and biking distance to the downtown core. That’s about 3/4″s of the population of Oak Bay.

Developed with 99 year prepaid ground leases that can be sold to developers to build high rises, leasehold strata homes sold to individuals and rentals. A development like this would make the lək̓ʷəŋən People the wealthiest land developers on Vancouver Island, as they would own the head lease in perpetuity.

And it would be a new community, likely with a native theme, which would be much more appealing than a piecemeal solution of one house here and one house there.

And it would be ironic for the City of Victoria to turn to the Province that has been threatening the city to comply to then cause the eviction of the Lieutenant Governor.

I can already hear the dulcet tones of an incoming throng of screeching, indignant NIMBYs in their native habitat. They’re easy to spot in the wild, with their designer Stefano Ricci polo shirts and throbbing neck veins.

And now, back to housing & development…

This seems like a much better use for underutilized DoD lands (i.e. CFB Esquimalt’s 10,000 acres), bet the public consultation process will be complicated by powerful factions…

“A housing proposal spearheaded by three First Nations that would double the population of Vancouver’s West Point Grey neighbourhood begins its public consultations this week…Set to more than double the area’s population with the promise of 13,000 new homes.

The Jericho Lands area is currently home to a former garrison, several dozen homes leased to military families and a private school. The site itself is owned by the Musqueam, Squamish and Tsleil-Waututh First Nations — whose unceded territories Vancouver is built on — in partnership with the Canada Lands Company, a federal Crown corporation.”

https://www.cbc.ca/news/canada/british-columbia/jericho-lands-proposal-1.6880445

Getting some great owner builder emails lately

“Hi Marko.

Just watched your 2023 update. Very interesting!

I have to write on Thursday. Your help would be very much appreciated with respect to providing the study guide.

I renovated my garage into a carriage house with carport as outlined and required by the City of XXXXXX for a ‘secondary suite’. They issued a building permit, inspected as required regularly and gave me an occupancy permit in October 2020. I rented out my main house and moved into the carriage house as I’d just retired and wanted to travel – unfortunately COVID hit. I hired the contractors and trades but didn’t realize I needed this Owner Builder Authorization until I went to sell my property a few months ago and the property declaration form asked for a yes/no regarding the owner builder authorization or warranty.

I looked into it and was told to apply ($450+ later) so filled out a very detailed application form with my hand drawn plans (first career was a draftsperson, second and current an engineer) and they evaluated whether or not, two years later, that I could retroactively obtain authorization by writing the exam. They gave me three months to write and pass the exam.

My biggest issue was WHY do the requirements apply to my build as it was just a renovation of an existing building! I guess the renovation was substantial enough to warrant the compliance with the reg/act.

Final rant: do builders, architects, etc., whether residential or other, memorize the BC Building Code, or do they look shit up when designing?? Does this OBA program help provide MORE housing or just delay building rental suites? The 250 new BC Govt employees will enforce the Act/Regulation or just help owners/developers get their building & development permits – walk through the red tape with all the local governments? I’m so curious what they will actually be doing. Anyway, looking forward to hearing from you.

Thanks a million.”

This is the same province that will solve our housing crisis, lol. Obviously someone in the permits department of this city didn’t do their job and now this poor lady is stuck with non-sense to sell her home thanks to the province.

He’s a great money maker, but he is also a master bull shiter. Talking about ridiculous nonsense… No your 8 year old Tesla is not safer than a brand new Tesla. He’s either dillusional or he is full of shite. Either way I can’t trust people who have to win every argument and can never admit when they are wrong.

Re: Tesla phantom braking

Only 2% of Teslas have AP1/MobilEye, so need to factor that in when analyzing data. Phantom Braking has been seen in AP1/radar teslas too. E.g. https://teslamotorsclub.com/tmc/threads/ap1-ms-braking-inappropriately-driving-on-the-continent.245850/

Ive read about it. I’ve never seen it myself. Most reports I’ve read have been people using autoPilot, cruise control or FSD, and I don’t use any of those much. It seems to be in certain areas – e.g. like Texas where it’s very hot and “mirages” are seen commonly. I think it will be a software fix.

——-

A nice Tesla safety enhancement that’s recently come to standard Model S, X Y and 3 is the inside drivers airbag. – that means the driver (and passenger) gets a “full cocoon” – 3 airbags and the seat back making 4 sides that they’re protected. https://www.tesla.com/ownersmanual/modely/en_eu/GUID-0943510B-B8A7-4E0E-8998-62ACB9BD4D12.html

Look up phantom breaking on brand new Teslas. Do I think a 2030 Tesla will be way safer than a 2015? Yes. Do I think a non-beta 2 camera + radar 2015 Tesla is any less safe than a phantom breaking 2023 Tesla with 9 camera that is still in FSD Beta….not so much. If the 9 cameras actually worked that would be great but applying emergency braking at 160 km/h for someone to rear-end you at high speed is not safe imo.

For the most part we are accepting highly educated immigrants that are coming from already decent lives; therefore, there is an opportunity for them to go back easily. This wouldn’t be the case if we accepted less educated immigrants to work on construction sites, etc. You aren’t going to leave a Canadian construction site at $40/hr to go back to Napal to work for $2/hr.

If you are a French computer programmer, you aren’t taking a huge pay cut going back home and the Canadian company even might let you work remotely back in France if they need your talent.

Getting away from the car topic, I’ve gone to look at two used vehicles in the last couple months and in both cases the sellers were moving back to their countries of origin. One couple were from France, the other a family from India. Both lived in apartments. Maybe the Canadian dream isn’t what some people imagine. I don’t think everyone who comes to Canada is enamoured with the place. However, my mechanic’s brother is moving here from Guyana. I don’t think we’ll see a net loss any time soon.

It does seem that we agree that Teslas are the safest cars out there. And I’m happy to leave it there.

Man I’m in trouble my daily driver is a sports car from the 50s zero safety

Will just ignore all the cost saving measures Tesla has carried out? The deletion of the proximity sensor, radar delete, etc. You can’t tell me the 9 cameras are better than the proximity sellers for purposes of parking, for example.

AP1 I’ve never had do anything incredibly dangerous. Earlier this year in Europe 2023 Tesla there applied emergency phantom breaking on me twice. Once at 160km/h and once at 110km/h in a tunnel. If you do a bit of research AP1 is regarded as actually quite bug free compared to the new stuff.

Finally my primary reason for the Tesla is fundamental such as no engine, almost impossible to roll over due to weight distribution, etc.

Even cheap cars have most of these preventative safety features but good luck when someone on Sooke Rd isn’t pay attention and leaves their lane and you are in a head on collision.

OK. So it’s a 2015. Why is that relevant? You said it’s Ap1 which means it’s MobilEye and only one camera (front) used for safety, (rear camera not used for safety).

Compared to 9 cameras and much better hardware/software now. Developed directly by Tesla, not by MobilEye. If you think that MobilEye dinosaur system is “best safety in the world”, you’re kidding yourself.

Except I don’t have a 2014 Tesla…it would help if your math was a little better.

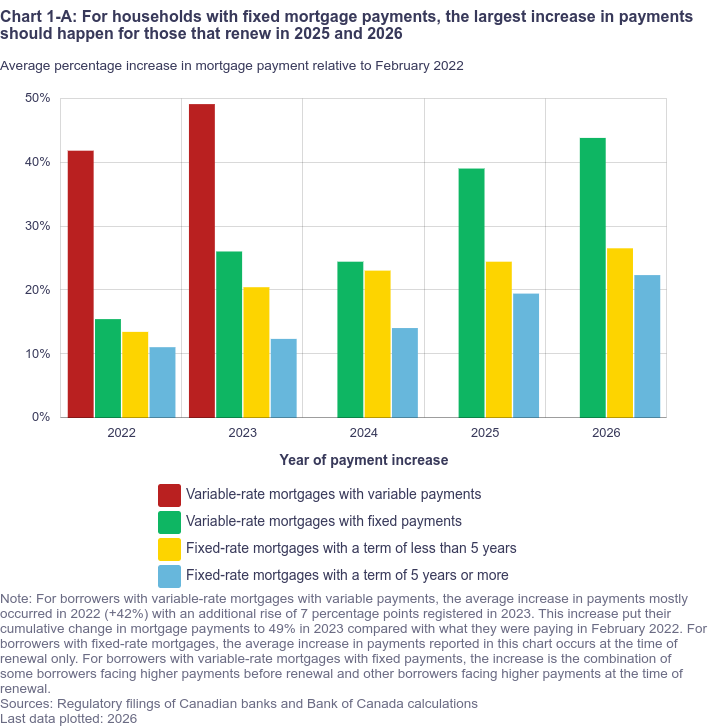

If one looks back over the last five years, there are certain months with peak sales. Those peak sales are typically March, April, and May and would have the largest amount of annual renewals at the higher interest rates. I suspect that if our market were to have a correction that would be around the time we would have a dramatic increase in listings. Historically, the Spring market is one to watch as it is an indicator for the remainder of the year.

We didn’t have a significant increase in listings this Spring. However if one looks back three and to a lesser degree four years ago in 2020 and 2019 there was a period of sustained high level of sales beyond the Spring market from June to October. Those that took out a short term financing during that period will be having to make some hard decisions which may include selling or down sizing.

At this time I see that our market is top heavy in listings in the upper income and luxury markets of say 1.7 million plus, we may see that trend continue as home owners in that market segment chose to down size to lower their payments. However there is not much selection in the mid band of housing to purchase. I would expect the need for bridge financing to increase as home owners may have difficulty selling their properties in the upper and luxury market as the days-on-market and months of inventory increases in that higher price range.

We may be experiencing the start of this down sizing trend. For example in Oak Bay, which most of us believe to be an area of our highest priced properties, now has as the highest number of active listings since October 2020. If my guess work is reasonable then we should see the months of inventory and days-on-market increase in Oak Bay more than the surrounding areas over the summer.

Or not.

——- Your 2014 Tesla with AP1 is definitely not the safest car in the world. I’d give that award to the 2023 Tesla.

——- a 2014 Tesla doesn’t have the anywhere near same safety features as a 2023 Tesla. The software and hardware for safety on a 2023 Tesla is much improved.

——- Comparing safety features of a 2014 Tesla AP1 (w/ 1 safety camera) to a 2023 Tesla AP 4.0 (w/ 9 safety cameras and 800 times faster chip) is like comparing an iPhone 4 to a iPhone 14 Pro. And you can’t say your iPhone 4 is the best mobile phone in the world when there are iPhone 15’s around.

——- Your Tesla only has one camera (front facing) used for safety features (the rear camera isn’t used for safety).

——- Newest teslas have 8 outside cameras+1 inside cameras (all used for safety), as well as 800 X (800 times) faster hardware chip to process. All of the safety systems depend on these chips to process, so 800 times faster chips is a big deal. Consequently many of the safety software updates only apply to newer hardware (AP2 to AP 4.0) , and not to your old ap1 hardware.

——- your old tesla has primitive versions of the safety features, compared to the newest tesla. The AP1 doesn’t get many of the over the air updates that apply to newer hardware (AP4) because they depend on the 9 cameras.

——- Newer teslas Activate seat belt pre-tensioners and deploy airbags BEFORE a crash using “Autopilot AI”.

——- Things like altering for lane changes are much improved, since the old teslas have no side camera, and use ultrasound with a small range, where the new teslas have 8 cameras with 360 degree view.

——- New teslas Change the way airbags will deploy based on who is sitting in the car and where. (Due to added hardware pressure sensors in the seats of newer teslas).

——- Your MobilEye AP1 doesn’t have full 360 vision on cameras,

—— new hardware added like Advanced Front-Structure Castings (safer during crash),

——- Automatic Airbag Suppression (protects child in car seat),

——- Added hardware airbag. Far-Side Airbag (protects against head injuries from side movements),

——- Collision Avoidance Driver Monitoring System(monitors for distracted driver, using the cabin camera not present on a 2014 ap1 Tesla)

In my inbox yesterday:

Very close to doubling the payment now, which definitely stings. This is the highest interest rate I’ve ever paid (going back to 2003), and would have locked in earlier if there wasn’t a high chance of selling the house. I’m definitely learning a lesson!

I think there are a lot of folks who will not be able to soak up >2k/mo adjustment come renewal time. The question in my mind is how quickly (if at all) the BoC drops rates as the RE market/economy starts to falter.

Except my Tesla isn’t ten years old, but eight years old as I noted and comes with AP1 hardware including cameras + radar and all the safety features associated with that.

Have houses on Bear Mountain tripled in price over the last seven years?

Sorry, but your “safest 5,000 lb car in the world” claim for your older 2013 Tesla is the same type of “hilarious nonsense” HHV post that you (frequently) complain about.

Car safety is more than protecting yourself and your passengers from injuries in a crash. It is also preventing the crash in the first place, and subsequent damage to other cars and pedestrians.

Your ten year old 2013 Tesla S has good crash protection for your occupants, but lacks many of the modern safety features present on newer cars on the road. Such as Forward Collision Warning, Automatic Emergency Braking, Obstacle-Aware Acceleration, Blind spot detection, lane departure warning, 360 degree vision, center airbags, intersection scanning auto-braking, adaptive cruise, night vision, safety exit assist, pedestrian warning sounds etc.

If you want to be able to boast on HHV that you drive the “safest car in the world”, pay up and buy a newer car that has these modern safety features. Such as a new Tesla 🙂

Some of these are pretty funny:

https://twitter.com/seabusmemes/status/1669846450556256256

Sweden’s property prices are facing a serious drop as the country’s former central bank governor warns of lofty household debt levels.

House prices in Sweden have risen fairly reliably over the last decade. This has been buoyed by ultra-low interest rates in a system where around half of people’s mortgages are financed with variable rates and many of the rest are on short-term fixed rates.

But now property prices are tumbling. And this downturn is not surprising given the “dysfunctional” nature of the market, according to Stefan Ingves, who headed Sweden’s Riksbank from 2006 to 2022.

“I’ve persistently time and time again said that the debt level in the household sector is just way, way too high and there will be a day of reckoning and eventually rates will go up, and now rates have gone up,” Ingves told CNBC’s “Squawk Box Europe” in an exclusive interview Tuesday.

During the Covid-19 pandemic, house prices across Europe continued to rise, and Sweden was no exception. Demand for property skyrocketed as working from home and a preference for domestic vacations prompted people to upsize their spaces.

On average, house prices were up as much as 30% compared to the pre-pandemic level of January 2020, according to Nordea Bank, as the Riksbank started purchasing mortgage bonds, trying to bring rates down and adding fire to an already hot housing market.

But now prices are falling, dramatically.

What price bracket? And what are you looking for? People tend to go crazy for quartz and a million-btu cooktop, but personally I wouldn’t equate that with quality.

Yikes. That and heritage status will def reduce the number of buyers. Fewer for an arch site than a heritage home as there are heritage home buffs at least, but a home that cannot be renovated without an arch permit and special insurance? I guess that is one way to get into a SFH in OB…

Josh- Now you got me started. Search “Car and Driver car fires” and read the article. Apparently those stats cannot be verified. There are over 250 million passenger cars in the U.S., if 1500 out of every 100,000 cars were catching fire every year, there would be 4 million fires a year, or 11,000 every day. If that were true we would be riding horse and buggy’s again. The actual number of car fires every year is 117,000. Something doesn’t add up.

What I didn’t find in that paper is a definition of each of the building forms. I would like to see what their assumptions are regarding lot size, unit size, etc.

https://househuntvictoria.ca/2023/06/12/a-mix-of-good-and-bad-indicators-on-debt/#comment-102867

It is on a registered archaeological site (DcRt-25: shell midden since 1991). Anything disturbing the ground requires a provincial heritage permit. Specialty insurance likely necessary.

The Babylonian Empire’s Code of Hammurabi – 1750 BC aka BC’s next building code.

-If a builder build a house for a man and complete it, that man shall pay him two shekels of silver per sar (approximately 12 square feet) of house as his wage

-If a builder has built a house for a man and if the house he has built falls in and kills the householder, that builder shall be slain.

-If the child of the householder be killed, the child of that builder shall be slain.

-If the slave of the householder be killed, he shall give slave for slave to the householder.

-If goods have been destroyed: he shall restore the fallen house out of his own material.

-If a builder has built a house for a man, and his work is not done properly and a wall shifts, then that builder shall make that good with his own silver.

I would take a newbuild over a 100 year old any day of the week. Because, newbuild come with 1, 2, 5, and 10 year warranty.

So what are the things to look out for in a new build? For example, is the brand of windows important? Should one ask about the roofing tiles?

No one is “starting” you. It’s in the stats.

I once spent a fascinating hour talking to Jim S?, one of the original Vintage Woodwork owners when they were in Fan Tan Alley. Very bright guy that loved old buildings and went the extra mile to understand why they did things the way they did. The details are a bit fuzzy now but he did all the replacement windows for St. Ann’s Academy when it was restored. Apparently there were three vintages of windows in the building and they all lasted about the same amount of time. The original batch were through tenons that drained any water intrusion out and rotted much slower. The last batch were done with glue about 80 years later and they did not last at all well but were quicker to assemble. Unfortunately I suspect that the trade off between a new window and an old one is longevity vs draft stopping. My double hung windows have lasted but I suspect they are responsible for a large part of my heat loss.

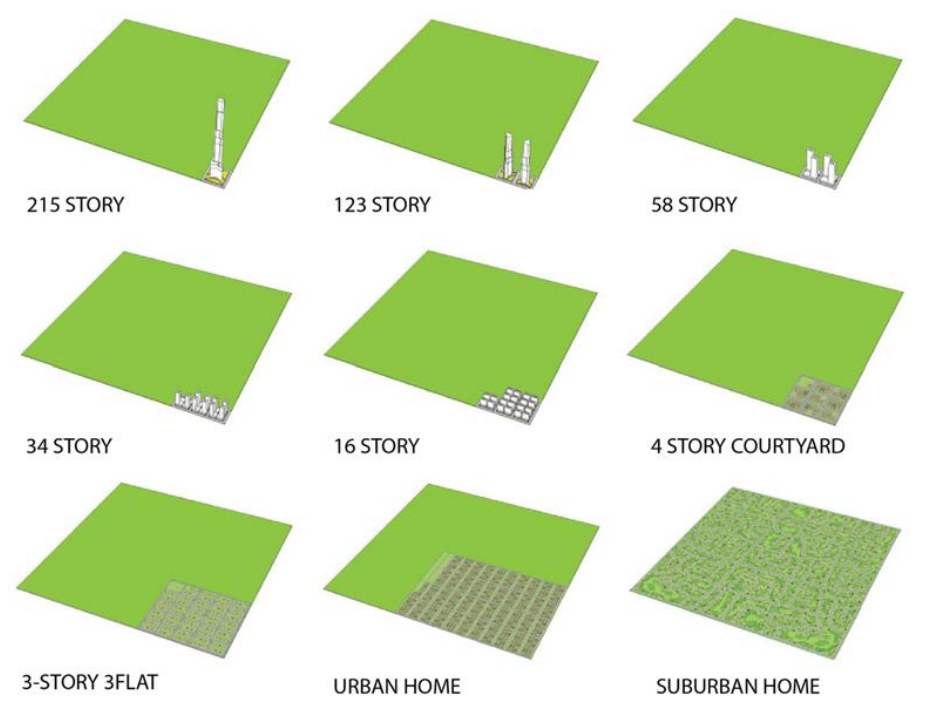

So based on that paper, they fit 2000 people on 3 sq. km in the suburban home model, and based on Greater Victoria being 696 sq. kms we should be at 464,000 people to even fit that model.

Also means if everyone lived in courtyard style housing we could fit all of Gordon Head into half of UVic’s campus.

Same.

I own a typical mid century box. There was a building code in effect at the time, and some clear indications that it was sorta being followed. Looks and feels like a solid house, but there were lots of little liberties taken, some obvious framing errors, etc.

All things being equal, I’d 100% take a newbuild home over a post war stucco box. But its not equal, because you have to pay for the higher build quality on new homes.

That’s the one! Thanks! You really forced me to be patient there… 😐

Houses built in the early 1900’s were probably built by new immigrants who were given a piece of land providing they build a house on it. Some of them are early farmhouses. I would avoid these properties. My preference would be post war 1950-1970 houses that were built by professionals.

What I don’t understand is the houses in Europe that are hundreds of years old and still being used. Getting any improvements done would be a nightmare. Right Barrister?

This one?

From this article: https://househuntvictoria.ca/2020/02/24/nimbyism-is-incompatible-with-victorias-environmentalism-and-other-progressive-ideas/

I have a few charts implemented in Google Charts that fetch their data from google sheets. The google sheets data is periodically updated by me, so it uses the latest data.

Since I wrote that code, there is now a REST api for statscan data, so that would be much smarter to use in the future.

Hey Leo,

2 questions – I was trying to look for an old post where you showed how many people could fit in a certain area when it was all single family homes vs townhouses vs condos, any idea where that graphic is?

Also, while doing that I found this:

https://househuntvictoria.ca/2021/11/16/how-many-homes-do-we-need/

And I noticed that the SVG is actually up to date on a post that is 2 years old. How are you doing that?

My house built in 1912. Echo everything Boomer said. Sure the old growth rough cut Douglas fir is nice wood better than anything you can find at the lumber yard today. But other than that the construction is not good.

Little to no cross bracing, skimpy use of fasteners, non-existent footings, undersized overspaced framing, unsupported cantilevered loads. Yikes the list goes on.

When we did some work upstairs and stripped to the rafters my first thought was: “How did this house not collapse in 1996 under a metre of snow?”

Thank you so much Introvert and Leo for the roofing plugs!

I live on a street with relatively new buildings. 2009, 2014, 2019 and there is a kitchen or countertop van/truck parked out front every week. People aren’t renovating because the kitchens are falling apart but because of style/bordem. While doordash is dropping off food on the street non-stop.

When I show 80s/90s houses and people “need” to renovate the kitchen/bathrooms are perfectly functional, they just don’t like the look.

So not sure what the point of a super durable kitchen is as most people will want to renovate it and unlike some other countries people don’t really buy a multi generational forever homes in Canada.

.

I’m gonna get crushed!

Tools today are far superior buildings materials where better back in the day and labour today is so so

My house was built in 1905 but in fairness, there is very little of the original left. There is a saying in the renovation industry that goes something like “They don’t build houses the way they used to. Thank goodness.” There are many things that would be prohibitively labour expensive to do today but lots of the basic construction is far superior today. You can bring in an excavator and dig a proper hole down to something solid and install proper drainage at very little cost over the bare minimum. If you are doing it by hand with a shovel there is a real temptation to go to a 6 foot basement and the bare minimum of footings. Settling is very common in old houses. It is not a big deal in anything built in the last 50 years. When you are pouring the foundations you call the cement truck and they bring whatever mix you order. The wouldn’t sell concrete that is shy on cement powder. If you are mixing it by hand and using whatever gravel you can find (beach gravel anybody) you are going to be tempted to skimp on the footings and not pour the wall any higher than it needs to be which explains why rotting out sills are a big deal in old houses and much less common in new. You have probably heard stories of veterans returning from the war, getting married and building a war time special themselves. The wife straightened used nails and the husband nailed them up. Today they are using nail guns with new galvanized nails and the tendency is to fire in a few too many rather than just enough to hold it up. Simpson strong ties are an amazing invention that adds an enormous amount of strength to a structure. You never see them or anything older. I am not an engineer but I suspect that building codes have gone a little overboard with the fresh new engineer deciding that just to be safe he better add another 30% to the old code. “You know, you can’t buy material like you used to and we don’t want a building settling on my watch.” Do that a couple of times and you end up well overbuilt. I used to look at the soil, calculate the loading per square foot, estimate the weight, add 50% or 100% and build accordingly. Looking at new buildings now they seem to just pour what looks like twice or three times that much. I am assuming they get less hassle from the inspectors and the cost of an extra yard of concrete is a rounding error if you have a crew and pumper truck there anyway. There are many more examples that are similar in nature.

The story flips when it comes to finishing. There are lots of solid wood cabinets that were built in the 30’s or 40’s that are perfectly serviceable today even if they are well out of style. Same goes for wood trim. The same can’t be said for particle board anything. Hands down I would go for a modern structure right out to the drywall. From there out the older stuff was far superior from a durability point of view but how many kitchens and bathrooms don’t get renovated after 30 years or so.

I’ve stated before, in the 1970’s when inflation was high, housing quality suffered, IMO. Many other products were poorly made such as furniture, cars, etc…

My house is our a hundred and is doing surprisingly well. Not to say that it does not need constant maintence. I doubt whether the floors or the windows will last as well in the new houses.

In fairness, I dont think you really could afford to build houses these days using the same materials.

It would be interesting to know what others think of todays new builds in terms of quality? In particular what should one look out for in a new built, Bad windows, cheap floors. Type of exterior envelope. What should one look for or at least look out for in a new build. Marko should have a few thoughts here.

I’m wondering how well new houses are being built today. Construction materials have come down but are still high compared to 10 years ago. Every builder’s objective is to make money and is tempted to cut corners or use less expensive materials. I’ve looked at the exterior of some houses that may be 10 years old and they are starting to look a little shabby. Hopefully they won’t need replacing in a few decades.

I also am concerned with the quality of some of the tradespeople doing the work. Everything is a rush.

https://househuntvictoria.ca/2023/06/12/a-mix-of-good-and-bad-indicators-on-debt/#comment-102864

My policy starts June 20.

From: https://www.cbc.ca/news/business/fed-core-column-don-pittis-1.6875879

Let’s see if Tiff and the BoC go for 50 points in our July announcement now.

You can get a WCB clearance letter for a contractor in like 10 seconds online. Without that I don’t allow anyone on our construction sites.

Which rolls us nicely back to the topic of liability insurance. If the employee of an uninsured contractor is injured while working on your property, some responsibility is going to flow your way…

That’s interesting, I will have to check that out, thanks. No, I am not an employer. They well knew that when we registered. Maybe the rules have changed, I will find out.

Now you know what to expect in January!

A case of someone finding a old pot that’s having a real impact on property value here in our own backyard

Umm really when a sewer replacement was being done they found an artifact on the property take that for what its worth

Interesting one on Deal St. In Oak Bay… Started at 1.5 mil ask, over it’s 76 days on market dropped to a 1.2 mil ask and posted as sold today at 1.15 mil at about 400k under assessed.

Admirals Roofing did ours in 2021. A co-worker recommended them. Theirs was the lowest quote we got, and we were very pleased with everything.

It doesn’t seem like any insurance provider includes tsunami coverage. Perhaps it’s because the tsunami risk area is well defined. So everyone in rhe “tsunami zone” wants insurance, and everyone out of it doesn’t. Not a great model for insurance.

On the bright side, the tsunami zone risk map for Victoria is quite detailed, and includes outlines of specific houses. Very few oceanfront houses seem to be at tsunami risk. So, in lieu of insurance, at least you can see if your house is in the zone.

https://capital-region-tsunami-information-portal-bcgov03.hub.arcgis.com/ menu: interactive map.

If you have your eye on an oceanfront Cordova bay beach house, you might want to check if the tsunami zone tells you your uninsurable $2m dream home might get washed away.

A tsunami would wipe out a house, no repairs needed. And your house could float away down the Salish sea. Likely we will never see that.

When did your policy start for this year? Because your numbers are very similar to Leo’s, but mine are way lower.

This (sort of) helps explain why my SFH somehow changed to a duplex in their system, which I just happened to catch when asking about something else.

TD is just flying by the seat of its pants, as is consistently clear.

Good idea if you employ a worker, but:

“As a homeowner, you’re not eligible to register with WorkSafeBC unless you are an employer. If you hire an independent business and are a customer of that business, then you are not eligible for WorkSafeBC insurance coverage. An independent business might look like a business that provides services to multiple customers. When you hire an independent business, you are a customer of that business and not their employer.

https://www.worksafebc.com/en/insurance/need-coverage/who-needs-coverage/homeowners

Thanks for the info Leo. Am not planning on going with metal. Does anyone else on HHV have any recommendations for a roof replacement company?

REPORT TO COUNCIL

DATE: June 1, 2023

TO: Mayor & Council

FROM: Acting Chief Administrative Officer

SUBJECT: State of Local Emergency

“Following the devastating wildfire that swept through the Village of Lytton on June 30, 2021, Council enacted a State of Local Emergency (SOLE). The SOLE has been renewed weekly since that time, the most recent SOLE set to expire on June 19, 2023.

…The SOLE was deemed necessary by the VOL due to the extensive remediation and archaeological work that was taking place over the last 18 months. The shift of focus from recovery to rebuild means the SOLE is no longer necessary.

…As the remediation, backfilling and archaeological work continues in specific areas, additional measures may be required to periodically restrict access to certain locations in the VOL. Recovery staff will work with property owners to coordinate these activities on a site-by-site basis.”

https://lyttonbc.civicweb.net/document/14050/2023-06-14%20RTC%20SOLE%20Declaration%20Removal.docx?handle=AF633B62490849D7A10C015AD42EA81A

Anyone want to guess how long Victoria City Council and CRD Directors would keep a “State of Local Emergency” in place following a (potential) major earth quake here…

I get that part – I drive a substantial SUV for the same reason. But liability insurance is a pretty cheap add-on, relative to most types of insurance. To me, it makes sense to insure for catastrophic things, even if remote, especially if the premium is cheap.

I’ll give you another example: I have WCB coverage for home services on our property. Had a situation many years ago where a service provider fell backwards down our stairs and had a real problem & it was touch and go for a while as to whether he’d be suing us (sure, then we could argue about fault). Ever since then, WCB coverage. Costs about $200 or less a year, but almost nobody does this. I can tell you with certainty that some significant percentage of the service providers out there have no WCB of their own, even the ones that claim they do. Sure, I could check out every one of them before they come to the house, and only deal with those that do, but why bother? e.g. our landscape company claims they have WCB but I know they don’t. But we like them. Get your own WCB and no worries. Just an example of a different approach I guess.

Side benefit. I’m tired of scraping moss off my roof, and I like the look of metal.

But yes will likely toss some panels on myself after the roof is replaced.

Another article said the province claims this isn’t the source of the delays. Hard to know what to believe but the results (exactly none in 2 years) are hard to argue with

Does TD actually allow you to drop earthquake insurance? I asked about it a few years ago, and the TD rep on the phone alluded to it being a mandatory component.

This isn’t a new development in BC, and I suspect it is old news in parts of the world where ancient civilizations are respected (i.e. Europe & Egypt).

Have you ever spent time in or around Lytton?

I have earthquake insurance with TD Meloche Monnex as well. It doubled this year! I called to ask why and they said TD wasn’t provided with any reason for why it went up. What a joke. My total premium this year is $2,015 for a 70s box assessed at 1.2M. More than half ($1,192) is for the earthquake coverage.

I still choose to have earthquake insurance. I want the peace of mind that if my house needs to be rebuilt after an earthquake I am covered (after paying the large $75,000 deductible of course).

Also, a large caution to people calling into TD about their insurance. They moved to a new software system sometime last year and some property details did not transfer over. So what they did was just put basic details for a lot of homes. For example, I just replaced my natural gas furnace with a heat pump and I asked if removing the old nat gas furnace would lower my premium. They said “hmmm, we don’t have a nat gas furnace or nat gas fireplace listed on your property due to software system upgrade”. Because I called in to ask that one question my premium went up $200 after they updated everything. Brutal!

Did you go with metal primarily because of the ease of attaching solar panels?

Would now need to be tested and handled like drywall I have never seen so much brick and cement rubble advertised in marketplace lol

Sidekick I think the change came about in March

Typically smaller quakes do not generate tsunamis. While the new fault is very close to Victoria and potentially very dangerous it is not likely to generate a LARGE quake like the subduction zone off the west coast.

https://www.usgs.gov/faqs/what-it-about-earthquake-causes-a-tsunami

I assume that’s if you want to dispose of it (they’re checking for a report)?

Used to be you didn’t need any permit/permission to take down a chimney.

Asbestos is probably in our food from the sounds of it. We’ll never be able to meet housing demands, especially if we now need archeologist reports to verify we’re not disrupting an ancient gravesite. The world has gone completely insane.

Sidekick most red brick and cinder block now needs to be tested for asbestos it’s being treated like drywall and more than likely requires a permit and hazmat removal

How much?

Metal from Irwin Industries.

Oh yes, I’ve been given a few pauses by them as well.

Keep us posted.

Yes. The map shown includes all tsunami risk, including from the west coast (reflected) and local. Specifically…

https://capital-region-tsunami-information-portal-bcgov03.hub.arcgis.com/

“ The capital region is an at risk area to tsunami hazards from a number of potential sources including the Cascadia Subduction Zone, the Alaska-Aleutian Subduction Zone and local shallow crustal faults.”

Maybe not as safe as a horse and carriage Frank. As someone who worked emerg/icu and saw things first hand I am a big believer in that having no engine allowing for a much bigger crumble zone is a huge feature.

Deceleration force can shear your aorta no problem. I’ve done chest compressions on people in emerg that didn’t make and they looked total fine externally.

The other insurance provider also excluded this. Does anyone know if the tsunami map linked below is for a quake off the west coast? Or does it also include the newly discovered fault due south of Victoria?

A Tesla is the safest 5000 lbs. car in the world? Don’t get me started.

Right. I also like that Wimbledon collected $141 million for pandemic insurance after paying it each year for 17 years. https://www.usatoday.com/story/sports/tennis/2020/04/09/wimbledon-pandemic-insurance-policy-payout-141-million/5123987002/

TD earthquake insurance excludes tsunami damage (as do many others) https://www.tdinsurance.com/products-services/home-insurance/tips-advice/earthquake “ Please note that damage caused by tidal waves and tsunamis is excluded from this coverage”

Tsunami is not any concern for most of Victoria, except some waterfront shown in yellow here https://www.capitaldaily.ca/news/greater-victoria-tsunami-risk

This conversation reminds me of the dentist(s) who made bank by having pandemic insurance. Who saw that one coming…

Climate would be the biggest factor in Victoria property taxes. No (or little) snow removal, streets don’t require the same amount of repairs like most cities where frost gets in and destroys the concrete, and many other joys winter provides most of the country. IMO.

When was the last time a modern condo building in Victoria had a substantial fire? Keep in mind that a modern condo would have between 50 and 200 units. What are the odds the super rare fire originates from my unit? Well multiply the non-existent fires by 1/50 to 1/200. What are the odds the strata is able to pin in on me and be legally successful? This is not something that keeps me awake at night. Floods on the other hand happen all the time, so I do insure my 10th floor rental as there is a lot of units below mine to flood.

Do you know what statistically can actually happen to you? A car accident where you are serious injured or killed. That is where I personally put my money…I drive arguably the safest 5,000 lb car in the world. People obsess with liability insurance and then drive an ICE car (much less safe in a front-end accident as you don’t have the massive crumple zone of an electric car and if something is going to kill you it will be deceleration forces). Accidents take place every day, modern day condo fires, not so much.

There were a few extra minor exclusions, but the TD policy seemed equivalent (the TD flat deductible was better IMHO). They did not ask nearly the same number of questions as Coast Capital/Western, which does give me pause…

This ‘loss prevention specialist’ they’re sending around may change the equation though.

My ancient Toyota is probably worth $4K at most, and every time I look into removing collision and comprehensive it doesn’t lower my premium by any appreciable margin; so I just keep collision and comprehensive because why not.

And did you find out the why?

Agree with Frank on this one – don’t you want/need insurance for the liability component?

Even if you insist that your renters have tenant insurance with liability coverage, that won’t protect you in case some of that liability falls on you as owner. e.g. electrical short in the walls starts a fire, or some trip & fall coma claim due to some “design flaw”, ie. owner’s liability not because of something the tenant did. Yes it’s a remote circumstance, but with a potentially sizable number.

For most of our insurance, liability coverage is the #1 thing I focus on. I care a lot less about smaller things for which I’m happy to self-insure. We jack up our deductibles for the same reason (I’ll never make some small claim anyways – view insurance as being for catastrophic events primarly)

Tell me you’re in the 0.1% without telling me you’re in the 0.1% 🙂

From the same story,

“According to the study, this demonstrates a weak relationship between income tax and owned property value in Vancouver when compared to U.S. metropolitan areas. In addition, the study said this points to most luxury homes being bought with money “from sources other than earnings taxed in Canada.”

Those are “low” because they are expressed as a percentage of the property value. Which is high. The $ amount paid isn’t low compared to other cities.

“[BC] is home to four out the five cities with the lowest property taxes in the country.

Vancouver, Victoria, Abbotsford and Kelowna all have property tax rates under 0.5 per cent.

“Although at first glance it sounds like lower property taxes are really good and appealing to buyers, it can make conditions quite difficult for the average homebuyer,” said Zoocasa spokeswoman Patti Cosgarea. “Lower property taxes are appealing to investors. So this really brings a lot of competition to Vancouver and surrounding markets.”

https://biv.com/article/2023/06/four-bc-cities-have-canadas-lowest-property-tax-rates-zoocasa