Where’s the most action?

Just a brief update, if you missed it you can read more about the current state of the market in the monthly update posted last Thursday.

We know that with only 2.3 months of inventory, the market is favouring sellers and prices are increasing, up about 5% this year. But which segments of the market are most in demand right now? In general you can think of market segments as being connected by rubber bands. Sometimes price bands, neighbourhoods, property types, or even neighbouring cities can rise or fall in price faster than other segments for a few months. However the substitution effect pulls on those rubber bands and the further markets diverge, the harder they get pulled back together and eventually things equalize. During COVID the outlying regions increased in price first and then the core caught up. The same happened with detached properties that jumped before condos did the same. Similarly, some price bands can heat up more than others but eventually rising prices drive people to other segments and it evens out.

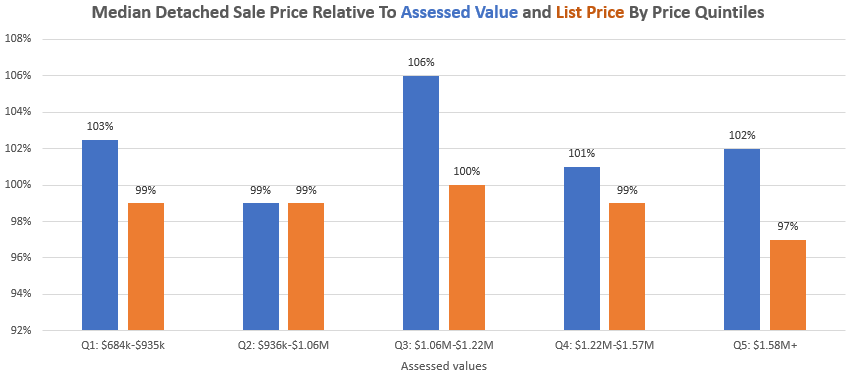

Right now if we look at the quintiles of sales in the detached market for May, the segment just above a million looks to be the most active, selling for a median of 6% above current assessment and at full asking price.

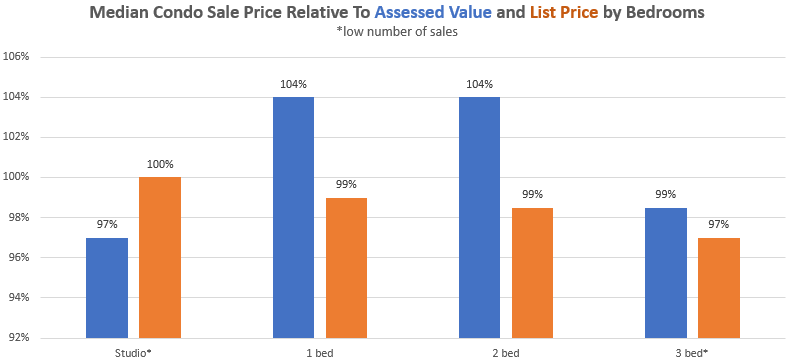

For condos, activity is pretty evenly spread, with both 1 bed and 2 beds (which together made up 91% of condo sales in May) selling for a median of 4% above their 2023 assessments. Studios and 3 bed condos appear weaker, but because there were only 8 of each I wouldn’t read too much into the median there.

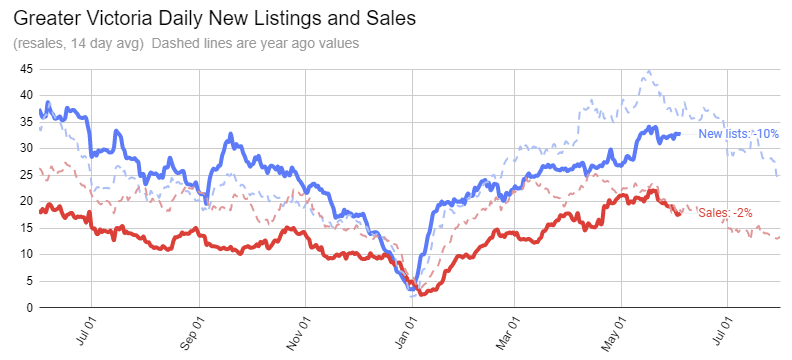

Overall sales are continuing very similarly to May, coming in at the same pace as a year ago while new listings remain some 10-15% lower.

| June 2023 |

June

2022

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 95 | 612 | |||

| New Listings | 159 | 1380 | |||

| Active Listings | 2173 | 2059 | |||

| Sales to New Listings | 60% | 44% | |||

| Sales YoY Change | +7% | -35% | |||

| New Lists YoY Change | -11% | +14% | |||

| Inventory YoY Change | +21% | +50% | |||

| Months of Inventory | 2.3 | ||||

However despite closing the gap to last year, sales have not exceeded the year ago levels and now seem to be declining at about the same pace. Remains to be seen if new listings manage to stay elevated a little longer and take some pressure off the supply situation going into the summer. A 10% year over year decline in new lists is better than the 30% drop we saw in mid April. For now the sales to list ratio – though still higher than last year – has relaxed somewhat and turned down similar to last year.

New post: https://househuntvictoria.ca/2023/06/12/a-mix-of-good-and-bad-indicators-on-debt/

IMO what we’re experiencing currently in the housing market is a dead cat bounce.

There has been a curious and somewhat surprising mini-bounce May into June, but there is a lot of seasonality in housing data. What that means is prices statistically tend to rise through multiple months because that’s like a very strong demand part of the cycle (Spring/Summer market). Then come the Fall/Winter market, interest rate hikes have been funneled through, and seasonally the market slows, my guess is inventory takes off and prices decline. Time will tell.

Wasn’t last August when things slowed significantly also due to the 1% jumbo hike in July? May have some lower base effect.

$1950 for $2M coverage, $10k deductible.

~$1250 of which is earthquake w/ 75k deductible

3 years ago it was $1150.

10 years ago it was $900

Maybe time to call around again.

No, you just have to be rich to be middle class. The rich are ultra-rich.

It used to be most people were middle class, with smaller numbers of rich and poor.

But it seems the middle class has been split up and now there are just rich and poor.

Restaurants that have pivoted to serving the rich are doing well.

Slowdown is coming for sure given the interest rate environment but impossible to pinpoint if 2nd half of June or into summer. Still lots of places going in multiples (had multiple clients outbid over the weekend going in excess of 75k over ask) and now receiving offers on my downtown condos that have been lagging. I still think we clear 750 for June and then things slow to a crawl by August (still better than last year but below 10 year average).

I wouldn’t confuse the slowdown in sales that is likely coming with lower prices especially for SFHs. I think there is a scenario where everything comes to a crawl come August both new listings and sales. Inventory of SFHs is already poor and it won’t get any better of the summer.

A little over $800 per year. No earthquake and high deductibles. Last year the quote came back at over $1200 so I called and went through the list of things to lower it. Had all the usual like smoke alarms etc., no mortgage, no claims, newish roof, hw tank etc. The only thing I did not have was permission to do a credit check. I figured that with no mortgage that it wouldn’t make any difference but told them to go ahead anyway. Dropped the premium to $800. Who would have thought?

Wondering what people are paying for house insurance in Victoria. I’m paying about $100/month for an average size SFH.

Insider contact say to take the under on that due to weakness in the 2nd half of June. More likely in the +15% range or less.

Good update on the bc resturant spending Patrick. Be interesting to see what the data for the rest of the year says as that one is to March 31.

“Home insurance up 30% from last year.”

I think the current best practice is to have no insurance. Show those greedy insurance companies who’s the boss! Rely on crowdfunding if the place burns to the ground. “I couldn’t afford the rates says distraught home owner” Then you can still have the $25 burger! And a beer.

Home insurance up 30% from last year. And that’s after calling them and getting 10% off the renewal quote.

Case in point: Canada’s largest port places 2nd last in global efficiency ranking

…”The last few years have reinforced the need to continue to invest in port infrastructure and technology to accommodate Canada’s growing trade and keep supply chains moving efficiently,”

–CBC BC

And it is going to get worst unless there is a change in political attitude, business mind set, investment in technology R&D (not giving away money), and investment/streamline infrastructures.

https://www.queensu.ca/gazette/stories/canada-s-lagging-productivity-affects-us-all-and-will-take-years-remedy

And before any snide remarks from the local peanut gallery. Yes, the Canadian economy has something to do with the price of local housing over that of the cost of a burger.

Yes.

Canadians are now paying 7.66% of disposable income on mortgages. And they were paying less than (7.14%) pre-Covid;

https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1110006501&pickMembers%5B0%5D=2.1&cubeTimeFrame.startMonth=10&cubeTimeFrame.startYear=2019&cubeTimeFrame.endMonth=10&cubeTimeFrame.endYear=2022&referencePeriods=20191001%2C20221001

Are Canadians, in aggregate, actually paying higher mortgage payments than pre-Covid? Many had a couple of years to renew at historically low rates. And as we know many with floating rates aren’t actually making higher payments.

And there are many people who don’t have mortgages, and actually have something called savings, which are yielding higher interest.

I do not think that HHV is representative of the overall population.

Many people use credit in an attempt to have an equal or better standard of living than their parents enjoyed. While this headline (Consumer Credit Surges to a New Record High Led by Credit Card Debt) is from an American writer, I wouldn’t discount its validity regarding Canadian consumers.

“Who Has Spending Cash?

Anybody with an existing mortgage prior to 2022 was able to refinance at or below 3.0 percent has extra hundreds of dollars to spend, every month, even if they overpaid for their houses. Inflation has eaten up some of that refinance dividend, but it has certainly cushioned the blow.

Renters and those who more recently took out a mortgage are hit by higher mortgage or rent prices in addition to rising food prices, insurance costs, etc.

For those whose wages have not kept up with the price of rent and food (nearly everyone), credit cards or tapping savings is the only way to maintain lifestyles.

https://mishtalk.com/economics/consumer-credit-surges-to-a-new-record-high-led-by-credit-card-debt

Fair enough. You did say that the restaurant sales chart was “not surprising”. I sure found it surprising. I think we were referring to different parts of the chart, so sorry about that!

To be clear, my point is… All we hear on HHV is how people are strapped for money, struggling to pay mortgages and cutting back on spending like restaurants. And so many restaurants are closing.

So I was pleasantly surprised to see BC restaurant sales in 2023 up +36% from 2018.

That seems like good news to me!

Well Patrick, I didn’t completely miss your point (even thought it was unclear).

The savings rate graph that I attached addresses that: surplus savings looking for somewhere to be spent.

You’ve missed the point. Sales are way UP (higher) from pre-COVID. That means BCers are spending MORE not less. And that’s +36% more in 2023 than 2018.

And as your chart shows, Canadians are doing that, paying higher mortgage payments and still SAVING same or more than pre-Covid (2018-2019)

Leading me to conclude that for most Canadians your “$25 burger” concern is a “nothing”-burger.

That’s hardly surprising, many restaurants closed during the covid days because people were isolating.

“The household savings rate: 2018: 0% (we saved nothing); 2020 Q1: 26.5% (lockdowns, couldn’t spend, so big savings); 2023 Q1: 2.9%.” ?x77405

?x77405

Not sure what your point is, since BC restaurant sales are also up (+25%) since pre Covid (2019 to March 2023). And +36% since 2018.

https://www150.statcan.gc.ca/n1/pub/71-607-x/71-607-x2017003-eng.htm

BC data….

I am pretty sure that the new carbon taxes should really lower the cost of new houses being built.

nice one, quoting U.S. data when people are talking about local 25 dollar burgers. LMAO

Yeah a bit of a disconnect between the full region sales and the “Metro Victoria” which I usually chart (Core, Peninsula, Westshore) which seems a bit less active. You’re right about the pace of sales.

Month to date activity:

Sales: 264 (+23% VS same week last year)

New Lists: 473 (-6%)

Inventory: 2228 (+19%)

Right, restaurant prices are way up. And people are paying them. Total restaurant revenue up 38% since pre-Covid.

I burn some brush in the fall at my cottage. Anything with needles (spruce, pine, fir, etc) almost explodes when exposed to fire, and generates an enormous amount of heat, it’s scary. I wouldn’t go near any of those fires, it’s suicidal.

Note to self: never move to a municipality surrounded by forest.

I think a mortgage growth question came up sometime earlier..

From: https://financialpost.com/fp-finance/banking/mortgage-growth-slowing-canada-banks-not-worried

We still go out for dinner & dancing occasionally, but now we eat dinner at home first. A burger & a beer on a patio overlooking the lake [harbour now] has been an enjoyable routine for us for years, but at $25 a burger, we’ll share one and enjoy the view.

I don’t have the sophistication or intelligence you do but here is my 5 second napkin math.

We have 95 sales so far. Four weeks left at 175 sales x 4 + 95 = 30% increase over last year. That is the current pace.

We will need to see a solid slow down in second half of June to be at 9%.

Hmm. So far we’re 9% up on last June same weekdays. But true that all it would take for a bigger beat is for sales to stay steady instead of dropping like last year. Overall I have the same forecast, weakness in second half, but likely still beating last year’s dismal second half for sales.

“What’s needed is to create lots and lots of affordable housing fast”.-Impossible. Marko will respond when his uncontrollable laughter stops. Might take a couple days.

No need to explain Barrister. I grew up there and know it well.

Patriotz, it would not make sense to use land zoned for single family to build an RV park for a transient workforce. That would be reducing the amount of developable land.

A solution may never be found by those that refuse to draw outside of the box. What we have been doing for the last two decades has not worked. Why would you think repeating the status quo for another decade will change the outcome?

What’s needed is to create lots and lots of affordable housing fast. We can not do that in the same way we provide housing today. If that means allowing a farmer to take 20 acres of land used to grow pumpkins temporarily out of production to provide housing well then some pumpkins will have to suffer.

Alexandra: Check out the BC assessment site for Rockland Ave and you will see how many of the properties are actually broken into suites. Those are only the legal suites. A number of the BandBs are actually full time rentals as well. A lot of the conversions are not new and many occurred during the depression. Still the neighborhood looks great for tourists.

I see that happening a bit, but more so with myself and my cohort, we can afford it, but just refusing to pay it because we just don’t see the value in it. ” What really, you want how much? Good luck with that! We will be moving on, I hope you find your sucker”.

It is unlikely, but is a possibility.

If BoC rate is 5.5%, then 5 years amortize rate could be, 5.5% + standard prime at 3% + 1% = 9.5%

Which brings me back to my previous comment about today’s version of predatory capitalism and its societal costs. If externalities were truly accounted for, the diminishing returns would force a change in the property development game plan.

That’s a major reason why we don’t see more parks, and why existing parks are disappearing. It’s just the market – the property is more valuable developed as conventional housing.

Do you think one government agency (BoC) would screw another government agency (CMHC)?

I think it is highly an unlikely scenario.

I would like to know what the prediction is based up on. Personally, I do not see much more increase from the BoC unless they truly want to see an economic catastrophe, because the market tend to lag 12-18 months behind M1 and M2 money supply that currently is on a steady decline.

sure

Actually, most of my neighbours live in little condos (inside of some of the older homes). I would also guess about half are renters. A number of garden suites and a fair number of basement suites. The person I was talking with works two retail jobs.

https://househuntvictoria.ca/2023/06/06/wheres-the-most-action/#comment-102641

Perhaps it will be a positive impact, because owners have more skin in the game than the past.

🙂

No, do not put me in the same camp with Marko.

I’m for a solution even though developers will make far less on a park and not one dime will be spent on real estate agent’s commissions. As it is now, our western culture is all about maximizing profits. The least costly solution is never considered as the municipality, province and feds get less fees and taxes, and far fewer people get a piece of the pie.

That’s the problem in the way we provide housing. It’s the ‘what’s in it for me” mentality. If they don’t see money for themselves, they will try their best to obstruct a solution and quash any discussion.

Far less money is paid in city fees, taxes, etc. on building a 100 unit park than 100 houses. That’s why a park while it would be a simple, quick and economic has as much chance as a snowball in hell.

<Municipalities are loath to approve manufactured home parks

Which brings to light a commonalty of perspectives shared by Whatever and Marko: Westerners striving for "the American dream" of home ownership must adapt and begin to expect less

oops

I’m surprised there isn’t more talk on here about Greg Martel. Are people not concerned that $250 million was stolen from real estate investors by one of the stars of the Victoria RE industry. This scam went on for so many years with everyone including the authorities, turning a blind eye to Greg’s unexplained success. No one questioned how it was possible for Greg to secure such incredible rates of return. The connection between Greg and the Agency needs to be examined. Just because Greg and Jason Binab were good friends and can be seen in many photos over the years partying and driving around in incredible cars, does not mean that Jason was part of the scam or that he knew what Greg was doing. But, I think it is fair to ask Jason to explain why him and his staff were seen in photos driving Greg’s Carshair vehicles. Was the Agency sending Greg clients to invest in Greg’s fund? There are legitimate questions that deserve answers, not silence.

Thank-you Arrow, but it doesn’t have to be driveways. A rapid solution to the housing shortage would be to permit manufactured and R V parks. It takes far less time to pave and service leased rental pads than it does to build a house; and one can get a lot more manufactured homes on acreage than you can houses.

The question is do we have a home price affordability problem or do we have a rental affordability problem? That makes a difference in what type of park to develop. A permanent one with manufactured and pre-fabricated homes for sale or build a temporary permitted park that has rental pads that allow someone to buy or move their own RV onto a rental pad. Construction time for an RV park is months instead of years.

Municipalities are loathe to approve manufactured home parks because of the stigma attached to them. ie “Trailer Trash”

My belief is that if we fix the rental affordability problem first then the home price problem will fix itself. A municipality may be more favorable to an RV park that could be used to house transient workers and their families. When their job is finished they hook up their RV and move on to the next job or buy a home and keep the RV at their new address for travel. The RV park is then closed and the site remediated.

This comes from personal experience. I use to work for North American Road building highways. We could not rely on a small town to house 200 workers. The towns didn’t have the rental capability. We had to bring our town with us and when we had to move on to the next section of the highway, the trailers came with us and the site was remediated.

Barrister: If your neighbour in Rockland….. owner (no doubt outright) of a 2.5 Million plus dollar home can’t afford a burger, can he imagine how it must feel for the remaining 95% of the population?

“Canada’s largest landlord says manufactured home parks hold the solution to soaring rental and housing costs – and are also ripe for investors…

CAPREIT, says manufactured home offer a viable solution to the housing shortage and soaring prices that characterize Canada’s current housing environment. “We have a housing crisis with a historical solution sitting right in front of us, it is absolutely staring us in the face…

Kenney agreed that the perception of manufactured homes has stunted their uptake, since most people think of homes that were built years ago. “The reality is the quality of new manufactured homes is better than conventional detached houses built in subdivisions because the manufactured] homes are built in a controlled environment. The new manufactured homes are also probably the most eco-friendly homes you can buy.” ”

https://biv.com/article/2023/06/affordable-housing-solution-right-front-us

Not quite Whatever’s trailers in the driveway solution, but close.

At this pace both; however, what my prediction is we see a big increase in June over June (30% or so) and then even thought every month will be better than last year for the remainder of the year I don’t think it will be 30% each month. I am guessing we see a substantial slowdown come August (still better than last year’s August but smaller gab).

The resilence of the market continues to shock me. I don’t think will have an issue clearly 750 sales this month (last year was 612).

You think BoC rate will increase 0.75% and rates will basically double from 5ish to 10ish percent? Unlikely. Maybe 7%.

This is hilarious.

Receiver finds little of $226M invested in Martel’s firm

https://www.timescolonist.com/local-news/receiver-finds-little-of-226m-invested-in-martelrsquos-firm-7126329

There’s an election in the U.S. in less than 18 months. They don’t want to run during a recession. Inflation and high interest rates will magically disappear several months before the election. Higher rates would bankrupt most western countries due to the enormous debt we continue to rack up.

You mean in June or for the year?

So far Jan-May we are 870 sales behind last years pace. I expect we will exceed last years sales for every month in the second half of the year so probably will get a year over year increase but probably not a huge increase

Is it? I think CMHC has made a pile of money for the taxpayer. And if the system gets in trouble we’ll be bailing out the banks anyway. It does seem like OSFI sets some pretty strict standards though so it’s probably unlikely.

My prediction: BoC rate will be up to 5.5% by end of the year, rates for 5 year fixed (25 year amortization) will be close to 10%. It’s going to be a rough ride. If it was left where it was that would be a different story. But, from what I read, it seems that there are global factors playing in here, the details of which are frankly beyond my knowledge/understanding.

I suspect that one of my neighbours comments might reflect what a lot of people are feeling.

“I am starting to feel like I cant even afford to buy a burger at the pub anymore. Everything seems a lot more expensive.”

LMAO, it’s like I am at the circus. So fun to see this play out.

It’s nice that Victoria is known for something other than cherry blossoms.

Looking at the Market Watch from VREB at 6:17 PM and the number of new listing and price decreases over the last seven days are consistent with yesterday at this time. And 2 were back on the market listings.

As Leo said not a spike in listings but a small step towards a more balanced market as listings over the last seven days have been out pacing sales.

Does everyone feel better now?

I love this guy and his spiralling delusions:

First he makes up loan recipients, and today “a bizarre email from Martel was read into the record. In it, Martel accuses court-appointed receiver PricewaterhouseCoopers of being the reason he hasn’t complied with court orders to provide banking information and financial documents. He also references the FBI and threatens to “file charges to PwC and a formal complaint to the judge.”…In a related twist, Martel’s lawyer Ritchie Clark announced in court Friday he was withdrawing from the case, citing “ethical reasons.”

-CBC BC

Rodger the m2 data is interesting. However, I would be careful using historical trends until most of the excess m2 from the pandemic is reduced. (2024?)

Wild guess, but I don’t think very many mortgage-holders played their cards this well.

There is a strong correlation between M2 growth rate and inflation, with a 1-2 years lag. Since M2 growth has just gone negative (which never happened in the last 80 years), inflation is likely bottom out in one or two years.

Side note: The last time when M2 reached such negative growth rates in the USA (negative 5% as of April 2023), it resulted in great depression. At that time, the velocity of money went below 1 – meaning $1 of money supply produced less than $1 of economic activity. I think difficult times are ahead.

https://www.longtermtrends.net/m2-money-supply-vs-inflation/

Excellent news for taxpayers though.

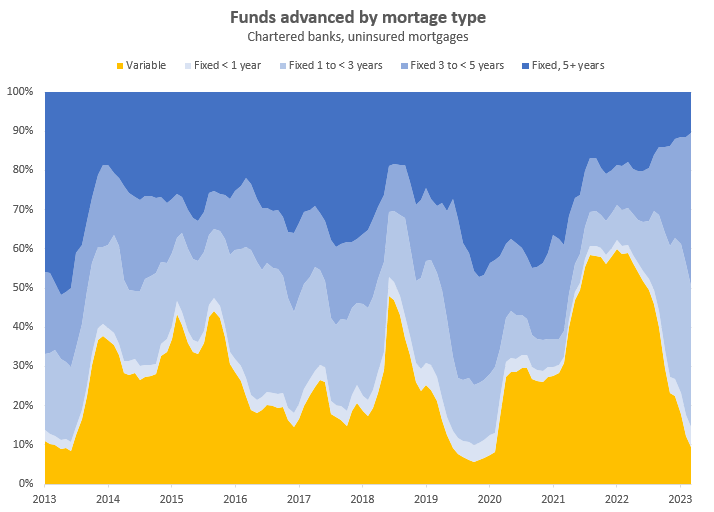

Note that’s share of total funds advanced not share of individual mortgages. No doubt influenced by median prices rising above $1 Mil (i.e. not eligible) in metro Vancouver and Toronto.

Looks corrrect!

https://www.bankofcanada.ca/rates/banking-and-financial-statistics/selected-monetary-aggregates-and-their-components-formerly-e1/

Share of insured mortgages has halved in the last decade. CMHC share of insured market has also collapsed. I wonder if this could impact the stability of our market

Same. I understand the economic case is sub-optimal, but I don’t care.

By the same metric, many homeowners took advantage of the ultra low interest rates in the last 15-20 years to invest aggressively in the stock market and now have more than enough money to pay off their mortgage if they chose to do so.

The painful end of free money as real interest rates start to rise

In away, Guaranteed Investment Certificates is a time deposit, hence M2 does include GIC.

https://courses.lumenlearning.com/suny-macroeconomics/chapter/measuring-money-currency-m1-and-m2/

That mayoral candidate will never be elected. I believe they are proposing raising property taxes 25%. What would $100 million buy? A hundred houses, that wouldn’t make a dent. Typical political twisted logic.

How will this fly in court when the homeowner has to hold the property for an additional 60 days, while the winning bid/buyer has to wait for 60 days to find out if their offer is accepted or not before they can make an offer on another house?

Real contrarian move. I look forward to your self-congratulation for securing a family doctor when everyone else was just using Walk-In Clinics.

My sister-in-law makes buckets of money but she chose to extend her mortgage rather than pay the higher payment. So that got me thinking….

The below chart shows what would happen during amortization periods from 25-40 years on a $600,000 mortgage with an interest rate of 5.39%. As you can see, the longer the amortization, the more interest you will pay to borrow the same amount.

Amortization Period (Years) Mortgage Amount Interest Rate Monthly Payment Amount Total Interest Paid (on the principal) Total Amount Paid (over the life of the mortgage)

25 $600,000 5.39% $3,624.03 $487,203.75 $1,087,204.75

30 $600,000 5.39% $3,343.19 $603,542.82 $1,203,542.82

35 $600,000 5.39% $3,155.74 $725,409.63 $1,325,409.63

40 $600,000 5.39% $3,025.71 $852,337.58 $1,452,337.58

In my opinion, extending the amortization period in excess of 30 years makes these loans sub-prime. Because…

-It will take longer to pay off the mortgage in full.

-You will pay more interest over the life of the mortgage.

-It will take longer to build equity in the home.

-Interest rates will be higher.

-Additional costs are involved if refinancing.

-may not be able to port the mortgage or change lenders

…to pre-pandemic levels. I don’t read that statement as saying not to expect rates to come down. They will come down at some point. They might also go higher before they come down.

HoHoHo,

If you think the BC govt’s foray into city planning is over reach, check out this bit about Toronto’s next (maybe) mayor:

“…Pass a law forcing owners listing a property to give the city “the pre-emptive right to acquire properties that are already listed for sale in order to secure them as affordable units.” The local government would have up to 60 days to match any offer – raising questions about quasi-expropriation. This would be funded annually with $100 million – coming out of property taxes.”

–Lord Garth

Forget about quasi-expropriation and think about sales grinding to a halt (60 days to match any offer!)

https://www.greaterfool.ca/2023/06/09/cough-it-up/

Very glad I paid down my mortgage as aggressively as I did when no one else was doing that.

Bank of Canada cautioning people to prepare for rates not to come down

< We are also going to see a huge increase in sales compared to last year.

That's a bold prediction 🙂

Marko can’t take any more nonsense!

Can’t believe you have the patience to answer this non-sense after putting together the best real estate anaylsis in Canada, imo, every single Monday! What do people think changed in three or four days? Just wait for the Monday update.

We are also going to see a huge increase in sales compared to last year.

This is reminiscent of a post Whatever made recently. (Unfortunately I am unable to find it again to review your reason why the gap closes.)

The substitution effect is the decrease in sales for a product that can be attributed to consumers switching to cheaper alternatives when its price rises. A product may lose market share for many reasons, but the substitution effect is purely a reflection of frugality. If a brand raises its price, some consumers will select a cheaper alternative. If beef prices rise, many consumers will eat more chicken.

Classic head and shoulders pattern. Take appropriate action.

I get similar (303). Of which 282 residential.

I wouldn’t call it a spike, but we’re slowly closing the gap to last year’s new listings.

“One of the first things buyers are compromising on is the density of their future home. Instead of aiming for a single-family home, they are opting for condos or townhouses…Another big compromise people are making is their preferred location. Klein is seeing buyers opt for different neighbourhoods that may be considered less desirable but have lower prices. However, prices are appreciating in these areas too.

“The percentage gap between nice neighbourhoods and traditionally rougher neighbourhoods has closed,” he said. “As areas get more expensive, the lower end neighbourhoods tend to get lifted up … a lot more than the higher-end neighbourhoods.”

https://biv.com/article/2023/06/metro-vancouver-buyers-compromising-housing-type-location-find-home

Yeah right now the 5 year is lower I was just surprised at the super low offer for 2 years

They are on Martel’s borrowers list but never borrowed a cent

https://www.timescolonist.com/local-news/they-are-on-martels-borrowers-list-but-never-borrowed-a-cent-7120511

How many new listings are relistings?

Very interested to know how many new listings were up this week Leo.

While Leo is checking you can also have him verify 110 price decreases.

Seems a bit weird to have almost doubled on a weekly basis. I wonder if you are using same criteria as Leo.

Leo are you able to please give us a read of number of new listings Monday to Thursday this week?

308 new listings in the last seven days.

A Rate Hold is simply the amount of time that a lender will guarantee a loan’s interest rate. If you get pre-qualified for a mortgage at a certain rate, then a lender will hold that rate for a given period of time, usually between 60 and 120 days.

I’ve have multiple differing clients secure sub 5% 5-year fixed products in the last week or so.

Their website says 6.09% for a 2 year.

https://www.vancity.com/borrow/mortgages/fixed-term-fixed-rate/

That’s a pretty big discount.

The answer is that it’s believed to be the lowest target that doesn’t run the risk of deflation. Those with ideological axes to grind may come up with other answers of course.

M2 does not include GICs unless they are cashable. Nor debt instruments such as bonds. M2 includes M1 (currency and chequing accounts basically) plus savings accounts and other instruments cashable at face value.

https://househuntvictoria.ca/2023/06/06/wheres-the-most-action/#comment-102601

I agree, soon the economy going to see a lot of pain, because M1 pullback has started since the fall of 2022 and M2 is not far behind.

https://www.bankofcanada.ca/rates/indicators/key-variables/monetary-aggregates/

That is surprising. 2 year bond rate is 4.5%. https://www.marketwatch.com/investing/bond/tmbmkca-02y?countrycode=bx

And 5 year is 3.7% https://www.marketwatch.com/investing/bond/tmbmkca-02y?countrycode=bx

And the BOC rate is 4.75% !

Maybe it’s a loss leader where the bank loses money for two years, but figures they’ll have your renewal business for the next 23 years.

Well if you want to contract the money supply then raising interest rates is going to do it. The major source of increasing the money supply comes from banks issuing new mortgages not from printing money.

While M1 (most liquid money) has gone down a little, it has moved on to M2 (GICs, etc.). Until M2 goes down, don’t expect any relief from BoC.

You know that’s what I thought. And then I just got a call from someone that got offered a 2 year rate from Vancity for under 5%. Was pretty surprised as I thought there was a big premium.

The reason we are in the current situation is: 20-30% increase in money supply in a very short time. BoC is frantically trying to withdraw all that money supply but hasn’t made much progress. It might take another year to happen. In the meantime, it is going to cause a bad recession.

Great chart. Given that two year big bank rates (6%) https://www.ratehub.ca/best-mortgage-rates/2-year/fixed are higher than 5 year rates(5.00%), that’s sounds like a surprising bet to me. People are opting to pay more now in hopes of MAYBE paying less in the future.

Whatever happened to “instant gratification”? 🙂

That chart is incredible. Wow.

Yup!

Maybe I should auto-mute that abbreviation

Maggie,

The best cure for “bad threads” is a good thread. And I see ummReally->Dad-> and now Leo just made one about variable mortgages.

This seems unlikely given take rate of variables has been dropping precipitously for a year. What people are actually doing is rushing to short term fixed rates in the hope that rates will drop in 1-3 years.

Ya lots of gibberish

ROTFLMAO, my insider contacts are telling me that the quality of the comments on this web site has been decaying at a slightly more aggressive pace than a helium isotope, LMAO. Not that I don’t enjoy reading updates every fifteen minutes from various budding Nostradamuses, or the occasional non sequitur screed about which segments of society should be allowed to suffer and die, but I’m amazed that content of this quality isn’t behind a paywall. LMAO, etc. etc.

Canada is a producer of raw materials that we sell to the world while importing a lot of our food and finished products. The inflation rate is tied to our exchange rate which currently is $1.34 to one US dollar. If that exchange rate were to go higher than $1.40 we would have a much more serious problem in Canada in obtaining financing to pay our debt and to feed the people. The BoC has to fight inflation and that means higher interest rates.

The cost of housing while important to most of us, is just collateral damage in the bigger scheme of things. It is monumentally more important to save Canadian businesses from closing their doors than to save individual home owners.

And that’s the rub. We need construction to keep a lot of Canadians employed but we need higher unemployment to fight inflation. It’s counterproductive to do both. I think it is better to announce grandiose projects on how to solve the housing problem but behind the screen to do nothing. In that way one can keep Canadians thinking that everything is okay so that they don’t panic and risk falling into a deeper and prolonged recession.

Skipper the Penguin : Just smile and wave, boys. Smile and wave.

Lol it’s actually 9 to 10 figure transactions, If you actually know anything about transactions that size then you know. We have a large presence in town actually with significant head count.

Generally, it’s the last ones to arrive at the party are the first to suffer in a market downturn. That’s typically the first time buyers.

However, those parents that used their Home Equity to give their children a down payment may also be at risk as the parents near retirement. At 6.95% the cost of one-hundred thousand is around $700 a month which is substantially higher than some that were only paying $400 per hundred thousand a couple years back.

One might look back over the last five years at periods of peak sales as these properties would be renewing at one, three and five year intervals. Some of those mortgagees may be considering selling before their renewal is up.

When I look at the condo market for investors wanting rental income, they will have to have a large down payment in excess of 20 percent to make the property cash flow positive given today’s rental market rates. That’s why I am paying more attention to condos than to single family homes. I am speculating that condos are the weakest link in the marketplace in terms of first time buyers and investors.

If the condo market were to stumble, it might be an idea for the province to allow tax concessions on new condo complexes that convert from strata units to long term rental units. Without concessions, I doubt developers would like to make the switch from being a builder of condos to being a landlord.

I am literally in awe of your insider contacts and the epic three figure transactions that you facilitate.

Sorry for the sweeping macroeconomic rhetoric: This is a good article on the 2 % Inflation Target. And yes, inflation is why they are raising rates. Inflation is over as soon as we have a 3-4% target. This is a not my quote but hits exactly what I have been babbling about.

“By choosing a inflation target of 2 percent, the field of economics spent several decades barely advancing”

Inflation targets are part and parcel of central banking policy, the Fed’s mandate centering around the 2 percent inflation target. But when was the last time anyone asked why a 2 percent inflation target?

To address this while avoiding potential “bias,” we can look at history through the lens of one of the largest mainstream newspapers in the world, the New York Times. The following article takes us back to 2014 when the paper published “Of Kiwis and Currencies: How a 2% Inflation Target Became Global Economic Gospel.”

It all started in 1989, when Don Brash, managing director of the New Zealand Kiwifruit Authority accepted the position of head of the Central Bank of New Zealand. Appearing to have no understanding of Austrian economics, he and his finance minister devised a plan to combat the surging price inflation of the ’70s and ’80s.

As fate would have it, Mr. Brash remembered the former finance minister telling the media he was “aiming for inflation of around zero to 1 percent.” Brash recalls that “it was almost a chance remark,” yet it sparked one of the most destructive policy decisions of all time, which has only worsened since. He admitted:

The figure was plucked out of the air to influence the public’s expectations.

Ultimately the bank settled on an “inflation target” between 0 and 2 percent. The announcement was considered a “radical idea” at the time, but lo and behold:

It created a kind of magic of its own. Merely by announcing its goals for inflation…New Zealand made that result a reality.

Of course, no proof has ever been offered of how an “inflation target” can be met simply by stating it as a goal. If it were that easy, the Fed would have met the target decades ago.

Luckily for Brash, inflation in New Zealand was 7.6 percent in 1989 when the target started and only 2 percent by the end of 1991. This bit of providence accelerated the idea as the head of the central bank

did a bit of a global campaigning, describing New Zealand’s success to his fellow central bankers at a conference in Jackson Hole, Wyoming.

Canada, Sweden, and Britain soon followed in New Zealand’s footsteps and eventually even the Fed. Our fate was sealed on the whim of policymakers.

It was not without opposition, though, as there were some naysayers who believed that

A dollar today should have the same buying power as a dollar in a decade, or two or three.

However, the “alternate” view was that keeping inflation low could be dangerous. This was championed by an up and coming Fed governor, Janet Yellen, who expressed concern that zero inflation could “paralyze the economy,” especially during economic downturns. In a 1996 July Federal Open Market Committee (FOMC) meeting she offered an idea to support targeting:

To my mind the most important argument for some low inflation rate, is the “greasing-the-wheels argument” on the grounds that a little inflation lowers unemployment by facilitating adjustments in relative pay in a world where individuals deeply dislike nominal pay cuts.

Here we see the “Phillips curve” argument that is used to justify inflation by linking it to unemployment. This is move that now, twenty-four years later, the Fed is shying away from by claiming that the “Phillips curve is flat”—in other words, it’s not working as planned. Or, as Fed vice chair Clarida expressed it, models of maximum employment “can be and have been wrong.”

Adding to the prophetic quotes, Yellen said in 1996:

A little inflation permits real interest rates to become negative on the rare occasions when required to counter a recession. This could be important.

The rest, as they say, is history. In time, the idea of a 2 percent target became economic orthodoxy—so much so that former Fed vice chair and Princeton economist Alan Blinder declared that

Central bankers have invested a lot and established a great deal of credibility on their 2 percent inflation target, and I think they’re right to be very hesitant to give it up.

By choosing an inflation target of 2 percent, the field of economics spent several decades barely advancing. Instead, academics and planners remained preoccupied with manipulating the data and providing guidance fueled by a narrative that was plucked out of thin air, aided by catchy phrases such as “greasing the wheels,” and propagated by outdated economic models like the Phillips curve. Sadly, with 2 percent inflation the conclusion came first, followed by the theory. Economic explanation was only needed to support the theory at all costs.

Image source: Wikimedia

The Origins of the 2 Percent Inflation Target | Mises Institute

Mortgage brokers are a good source of information as are Real Estate Appraisers. They provide a good source of the number of mortgages that are being processed as they are the bridge between home owners, purchasers and the lenders. At this time the number of mortgages being processed seems to be low. That may infer that the number of home owners refinancing their homes to obtain a mortgage to free up equity to buy an investment property has declined and those that are seeking a mortgage in excess of 60% of the purchase price is also lower.

Similarly a real estate appraiser is a good source for new construction costs. When an appraiser receives an assignment for proposed construction. The appraiser will be sent the building plans and the detailed cost estimate provided by the builder. Those estimates vary considerable from builder to builder, some are well detailed and can be from various cost estimating software applications. Some of which are good and others bad. Others are just a “back of an envelope” guestimates by the contractor or person building their own house. The appraiser has to review those cost estimates to determine if they fall within a reasonable range, excluding any costs that are not attributable to actual construction or costs that have not been included in the estimates. Contactors are reluctant to break out their profit on a separate line in their estimates for the obvious reasons that this may put them at a competitive disadvantage when the client is determining which contractor to use. They are more forthcoming with that information in a verbal conversation with the bank’s appraiser.

And then the appraiser will re-format those builder’s estimates into a schedule so that construction draws may be paid out at different stages of the construction. For example electrical and plumbing. These trades will rough in their work at one stage and then weeks or months later return to do the finishing such as installing sinks and light fixtures. So it is necessary to break those cost estimates into two stages. The roughed in stage and the finishing stage.

The problem is that appraisers are paid per job and are not paid to develop data bases which is time consuming and they don’t get paid for doing so even though they may have dozens or hundreds of cost estimates provided by builders to them during the course of a year. I would love to hire someone whose only job was to review cost estimates, however I would have to charge between $750 to $1,000 per home appraisal to cover those additional employee and management costs. Lenders, brokers, and home owners will not pay those fees for an appraisal. They do pay those fees in the USA, but not in Canada. In that way Canada is behind America and other countries when it comes to appraisals as the appraisers in those countries can provide a better service and are thus held in a higher professional standing. There have been a few attempts in the past for the different Appraisal Companies in Victoria to share data on rents and construction costs but the problem is cost sharing to develop these data bases. And that if you have a meeting with the owners of Appraisal Companies someone always brings up anti combines legislation. As long as the owners don’t discuss fees it should be okay, but the perception of collusion always remains. The perception alone may be enough for the Appraisal Institute to launch an investigation. So while it would be a betterment for the banking industry and public, it is doubtful that this will ever happen.

It is rare for an appraiser to be invited to give their opinion on the market today. That wasn’t so in the past as the appraisers would meet with the branch managers and give presentation to new loans officers on what an appraisal is and what they can expect from an appraisal. In some cases when a new branch was opened, the appraiser was invited to the opening so that the depositors and investors could meet them and ask them questions. But with Appraisal Management Companies (AMC’s) that has ended. In Canada when applying for a loan you are limited to basically one of three AMC’s and you don’t get to choose which AMC or which appraiser. This system sucks as the appraiser is cut out of the feed back loop and can’t improve on their service if they are not informed as to any problems that have cropped up. Most problems with an appraisal can be dealt with a few minutes of conversation when each side has an opportunity to ask questions and clarify points. Direct contact with each other is discouraged by the AMCs.

The invitation exception being Amanda Mills, as she has been on the Tony Joe Home show on CFAX. She is a wonderful and articulate person. It’s nice to hear someone else’s perspective on the market rather than that of a person in sales.

LMAO, this was actually a term barrister first started using when referring to his bay street contacts and got a lot of hate for it. So I decided to use it for fun for people like you 😉

umm hello, anecdotes don’t count, provide data!

We did? First I’ve heard of it. One year variables are uncommon and expensive. One to three year fixed-terms are only marginally more expensive than 5 year fixed terms. If you took out a one year fixed last year on the expectation that rates might be lower when you renew, wouldn’t you just take out another short term fixed loan on the expectation that rates might be lower when you renew? No idea why people would start testing the market.

Your best source for forced selling was first time buyers who took out variable rate mortgages at or near the peak. But with the banks allowing these buyers to kick the can down the road for another 3 or 4 years, it doesn’t look like that’s happening anytime soon.

Mainly a way to give a sheen of credibility to whatever BS one was going to spout anyhow.

Yes, seeing the same.

From: https://vancouversun.com/news/local-news/major-developer-asks-to-delay-10-million-payment-to-vancouver-city-hall

Frank, builder’s profit is a soft cost that is part of construction as is the cost of financing during the 18 months or so of construction. You can take the exam and be your own contractor to reduce the cost. But, if you chose to be your own contractor, it will likely take you longer to build and you won’t be getting wholesale prices that are offered to builders.

As for what percentage builders profit might be that will vary from contractor to contractor. The contractor that is better at selling their service will obtain a larger profit. Your insider will say 20 someone else’s insider will say 25% and yet another will say 15%

These are also custom homes and will vary in the materials used and items like yard improvements, or upgrades such as going from a double to a triple garage. This is also infill housing within established neighborhoods which is different from building in a new subdivision. That generally means that an older home has to be demolished and approvals take longer before construction may begin.

So I would go back to your insider and ask them about how much did they allow for cost over runs, financing, and site preparation, demolition, etc. before construction begins? My guess is that they will say they didn’t.

You can provide the same set of plans to three different contractors and get three widely different estimates as there is no reason why one contractor will charge the same as the other.

Nor does the average rate account for diminishing marginal utility. Smaller homes cost a higher price per square foot to build than large homes. Kitchens and bathrooms are expensive but as the home gets larger all you are doing is making the rooms bigger. The RAW numbers are what they are, a guestimate of how much you should budget to build a custom house in the Victoria Core.

Budget too low and you will run out of money before the house is finished. If you go over your budget then you will have a property that will have cost more to build than what it will sell for in the market.

Your actual mileage may vary.

I am seeing a lot more listings than sales in the two to four million properties but I am not analyzing the stats rather just an impression.

Usually you have to hire a builder unless we are talking do it yourself. 500 a sq sounds pretty reasonable to me for any sort of custom house of average quality. Real high end is going to end up a lot more.

Whatever- The RAW data you use to calculate building costs does not take into consideration the builder’s profit, usually 20%. That would bring costs down to around $450, the number my realtor/ property manager gave me. Maybe we also need an actual builder providing RAW data.

If mortgage brokers are “a bit slow “, what is the general consensus of realtors? On average, how many deals would they be involved in per month? Are any of them starving?

Yeah, but Leo’s a unionized government worker, so who can trust anything he does?

If mortgage brokers are a bit slow, that’s a good sign, they aren’t running around looking for refinancing on properties that are under water. It also means that many buyers aren’t in need of their services. If the market was tanking, brokers would be going crazy.

From: https://storeys.com/canada-highest-risk-mortgage-defaults-imf/

Doesn’t bode well for interest rates coming down anytime soon. Since markets price based on risk, mortgage bonds for Canadian lending are going to need to pay a premium to maintain liquidity for lending.

I mean what are you expecting to hear? At the last meeting the question was put to the mortgage broker, so how’s it out there? “A bit slow” was the answer.

I would say like 2 out of 1000 emails are from Victoria so not much of a lead generator. I work on the study guide on a monthly basis and I don’t mind reading the emails to see the trends and non-sense people are dealing with. It’s a hobby and I have some long term ideas for it.

BC Housing filed complaints against me with the real estate council and I had to take the videos down but after a year it was deemed I wasn’t doing anything wrong so I put the videos back up. Haven’t been bothered in years but then again I haven’t been peppering BC Housing with FOI requests in years either.

A couple of weeks back I showed some RAW data using a residual analysis to approximate building costs in Langford.

I thought I should do the same for housing in the core. Once again this is RAW data using asking prices. Asking prices may not reflect the eventual sale price.

770 Pemberton listed at $2,245,000. Lot purchased at $850,000. Residual amount is $1,395,000 for a 2,529 Square foot home or $552 per square foot.

2268 Windsor Road listed at $2,350,000. Lot purchased at $925,000. Residual is $1,425,000 for a 2,507 square feet home or $568 per square foot.

2501 Wootton listed at $2,980,000. Lot purchased at $950,000. Residual is $2,030,000 or $580 per square foot for a 3,500 square feet home

1721 Oak Shade. Asking $3,795,000. Lot purchased at $1,150,000. Residual is $2,645,000 or $512 per square foot for a 5,161 square feet home.

Averaged cost is about $550 per square foot. This is expensive, but these are custom built homes with high end quality of finish.

Once more I will add for the sake of one of the posters, this is RAW data that assumes the property will sell close to asking price. This is just to give some of the more astute readers on this blog an idea of the approximate cost to budget if they are planning to having a contractor build a custom home in the Victoria core.

Your actual mileage may vary.

You ever think of putting your database on a website somewhere to allow people easy access or is this a lead generator for you? And are you still getting shit from the province for saying the exam is dumb?

I present at one of those on a regular basis.

I think the on-the ground experience is very useful because there’s lots of things that don’t end up in stats. Like when you’re talking to sellers why are they selling? If you’re working with buyers where are they coming from and how well qualified are they? Many other things. However the reality of personal experience is that’s a narrow view of the market so often things are happening in one segment that are not representative of the market as a whole, or it’s just noise (more or less activity in one market segment that doesn’t last). I also often find that anecdotes like “photographers are booked way out must be lots of listings coming” don’t actually translate into anything unusual when those listings hit the market. Again many factors like seasonality can masquerade as trends unless you’re really aware of them.

Mortgage brokers do the heavy lifting in the real estate industry working their ass off to make deals work. Especially given the time constraints they work under. Again, any brokers on this site to comment. I didn’t think so. It would sure beat the second and third hand information some people offer.

It seems that mortgage brokers don’t have the time to waste on market speculation.

LMAO, what about realtors that are friends with mortgage brokers? Or is that second hand anecodate no good?

Any mortgage brokers out there? They usually have a handle on how the market is doing. They would have a hand in more deals than realtors.

LMAO…

+1

The idea that brokers would have meetings with “ Other industry people (lawyers, mortgage brokers, developers etc.)” to “discuss what everyone is seeing” is absurd. They don’t waste time like that.

JUNE 2, 2023

The days of Canada having a reputation of conservative bank practices are coming to an end. In a new research note from the IMF, the global financial agency ranked mortgage default risks for households. Canada’s combination of high household debt, frothy home prices, and floating rate loans makes it the riskiest advanced economy in the world.

Canadian mortgages have the highest risk of default in the world, according to the IMF. A combination of high household debt and frothy home prices have increased risk in the market. Households embracing floating, or fixed rate, loans turned it from just overpriced housing into over priced housing with a high risk of default.

The combination of factors amplifies mortgage default risk. “…countries with high levels of household debt and a large share of borrowing issued at floating rates are more exposed to higher mortgage payments resulting in a higher risk of defaults,” wrote Nina Biljanovska, an economist with the IMF.

Defaults aren’t likely in tight markets where home prices are rising, since a home can sell before defaulting. Adding falling home prices into the mix raises the risk of default, since it becomes more difficult to exit in a timely manner, and maintain a profit.

The IMF is basing the risk on Canada’s banks following global standards. Banks have been extending mortgage repayment terms decades longer than the maximum allowed, preventing delinquencies, and reinforcing high home prices. The only thing it cost Canada is the reputation of having prudent bank regulation, and increased moral hazard which experts warn can spark a financial crisis.

I never said it’s data, the whole point is trying to forecast the direction of the market before the actual data.

Btw, Have you brushed up on how to accurately find rental prices for purpose built apartments yet? Or refined your analysis to back out profit/margin and carry costs if you want to use list price to figure out build costs?

Banks tend to report mortgage originations with applications and pre-approvals quarterly with their required corporate reporting, I haven’t seen any for summer yet.

The plural of anecdote is not data.

you don’t need substantial market share because the product being sold is the same (houses and condos), a cross sectional sample should represent the overall market to a degree. Plus agents also have friends and contacts at other brokerages also.

my understanding is that this is just a short regular zoom call, so not sure how many are so busy they can’t even do that. I am sure it takes less time than posting on HHV on a daily basis 🙂

Marko is making sense here. No magic foresight here.

This would make sense if any brokerage had substantial market share but that isn’t the case.

Secondly, agents busy with listing presentations don’t have time to attend these meetings.

Not to mention the spin at these meetings is ALWAYS positive as the brokerage business model is to collect a monthly fee from each agent. They don’t want agents leaving the industy/brokerage.

Anyone have stats on mortgage applications?

I tend to watch the number of pending sales over the last week and they seem low.

The whole point is to predict the direction of the actual stats before Leo provides them. So the only way to do that is get insight from what people are seeing before they become official stats. Example, an increase in listing presentations that is experienced by a collective group of agents would likely point to more supply coming to the market.

You may have more sales on an individual basis but not on a collective basis.

So far looks like it is reconciling with Leo’s stats couple weeks later.

Last year we started getting the reporting of the massive increase of one year variables being taken in hopes of rates to be dropping this year; I wonder now with those expiring, what will happen? Will they lock in at a higher fixed rate that is better than the variable? Will they gamble on another 1 year term? or will they decide to test the resilient market by listing?

Yes I know exactly how these meetings work. I know exactly which lawyers from which law firms come to do presentations and what their angle is, etc. And I can tell you as someone that is involved in more transactions than 99.8% of individuals attending these meetings Leo’s analysis is a much better pulse on the market then one could ever gather from attending these meetings.

There seems to be conflicting reports in the media about prices in the Okanagon. ie Alberta’s playground.

In the condo market, prices were down by more than $67,000 in the North Okanagan, up by $34,200 in the Central Okanagan and up by $19,700 in the South Okanagan.

Kamloops condo prices fell by $17,200.

Sales for the region totaled 1,662 in May, up from 1,226 in April but down 3.4% from last year. The association data also covers the Shuswap, Revelstoke, Kootenay and South Peace regions.

The total number of active listings were up 25.5% from May of 2022 and new listings were up in May compared to April.

“The upward trajectory of new listings from just a month ago is a promising sign that inventory may be rebounding and starting to replenish at a healthier pace than before,” Mann said in the release. “It will be interesting to see if this momentum continues to help bring a more balanced market.”

I wonder if our condo market will see a rebound in listings as investors opt out of the market due to the high(er) interest rate?

If they waited to July, folks would be saying “rate shock” because waiting would likely lead to a 50 point or more increase from the July meeting.

Money has gotten expensive.

I was speaking with a neighbor that built and moved into an ADU right before COVID. She chose not to rent out the original house as she did not want strangers living on the property. She could do this because the mortgage payments were so low. Well she just got her renewal notice and her mortgage is going up by $850 per month.

I guess she’ll be renting out the older home now.

I wonder how many other people chose not to rent out their suite during COVID because money was so cheap?

Some brokerages have regular meetings to discuss what’s happening, what everyone is seeing, what their other industry contacts are seeing. Other industry people (lawyers, mortgage brokers, developers etc.) are also invited from time to time.

Not sure what to make of it? It’s simple, people in B.C. have a lot of money.

My prediction is both sales and new listings drop in the summer (adjusting for seasonality). I think June will have an okay sales month and then will be slower for the rest of the year on all fronts (listings and sales).

Sometimes I think everything is going to shit but then yesterday I was at an inspection in a non-descript street in Langford with 1,600-1,800 sq sf homes and it was 50k cars parked infront of every single one. Restaurants still busy even thought it is like $80 for two people.

Not sure what to make of it all.

I still don’t understand the “insider contacts.” Leo has all the statistics they do and does the best real estate analysis in the entire country, imo.

An agent uploads new listing paperwork the the brokerage system the day of or day before the listing. There isn’t much your “insider contacts” would have in relation to what Leo has.

I agree, they even turn on each other. Remember the CRD wastewater treatment plant where Esquimalt voted no, that probably ended up costing the whole project at least $50M due to delays.

This has been one of my core arguments for years. You can fix the politics, but almost impossible to fix the entrenched bureaucracy. Who on earth is going to come along and say, “hey this 14 consultant non-sense for a townhome development is a little crazy, let’s bring it down to 8 consultants.”

What municiaplity is going to fire their tree preserveration coordinators? They will add positions instead.

Thanks Leo!

The reality of housing I see every days from the emails I receive.

“Hello Marko,

After going through all my permitting for building our home up here in Northern British Columbia we were told at the end of the process that I need to get my owner builder exam.

Frustrating to say the least it would’ve been nice to know a year ago when I was talking to the building inspector about this whole process but that is water under the bridge lol

I just watched your YouTube video and I’m wondering if you could forward me any information in regards to the exam? BC Housing isn’t offering anything”

And people think Province will come down hard on municipalities, ha ha. They can’t even clean up their own mess.

Just Thursday to Sunday

You can’t teach an old dog new tricks…

You can lead a horse to water…

Hi Leo, are week one sales in the table for Thursday – Sunday or the full 7 days last week?

Mute button to the rescue 🙂

I wonder how many other ponzi schemes are being run in Victoria right now because people are too afraid to point fingers and ask questions.

Defamation threats are often used to try to silence those who criticize people with money and power.

Silence is easy. Silence is cheap.

Just so all posters know, defamation is any untrue comment that is published/posted that could bring a person’s reputation into disrepute. I personally despise this conduct. It has proliferated with ‘anonymous’ chat boards. It is the reason I would never run for public office despite having a skill set and aptitude that could be useful for this. I can’t be the only one. Dealing with people who treat others this way is a huge disincentive to public service.

“Named Mortgage Broker of the Year in Canada and mentored by top business strategist Tony Robbins, Martel has quickly soared as a leading expert. Martel’s work ethic is unparalleled as he inspires a generation of entrepreneurs; he is surging forward to cultivate a community of change.”

I would recommend far more care when making suggestions or allegations which could be suggestive of illegal or dishonest dealings.

Except you absolutely are and this is illegal. You are also not as anonymous as you think should he pursue legal action.

Right in your link

Which is significantly different that Mortgage Broker of the year, and which no one from a municipality of 400,000 people is ever winning. He likely also had to pay for the award, since that’s how most award shows actually work.

https://lastylemagazine.com/featured/greg-martel/

Paragraph 3: Mortgage Broker of the year…

Thanks for that James – I think you are correct with regards to the fastest growing mortgage brokerage at the time (2010) being Dominion rather than Greg’s company Harbour View Mortgages. However, Greg did win an award around that time: “Mortgage Broker of the Year in Canada.” You can read this in that LA magazine article which he may have paid for.

And yet that’s all you’ve done all day?

And continue to do.

That’s interesting.

That’s Dominion, not Greg’s company that won an award as top broker, and it doesn’t look like either won an award for fastest growing brokerage.

It is not at all my intention to defame Mr. Binab, but it is not hard to find videos of him driving Lamborghinis in Victoria. For example watch the video in this article: https://www.oakbaynews.com/community/jason-binab-makes-waves-in-the-real-estate-world/

Methinks, Mr. Binab has a few things in common with Mr. Martel. They both made a ton of money fast and they both like to influence others with their money and super cars. Both red flags in my opinion.

Well I didn’t have to look far to find a video of Greg and Jason Binab together, talking about his business: https://vimeo.com/13088234

In the video, Binab recommends Greg. This is a decade old? But at the time, Greg’s company had recently won an award for the fastest growing brokerage and he won an award as top broker in Canada. He definitely advertised himself as the best in town. Where did all his clients come from?

Per Capita, it seems like Alberta is still lower than BC. Seems weird that Alberta hasn’t been in a perma bull market for the last decade. It’s almost like the Active listings #s don’t really matter as much as the direction that they’re going.

My apologies to Mr. James Soper

Let’s avoid personal insults please

I don’t even think Greg did a lot of business in town, I certainly don’t think anyone would confuse him with the best broker in town, and he’s never been an investment advisor.

Because Jason isn’t the Owner/Managing broker of every real estate franchise in town. Is this a serious question?

No need, I can tell the caliber of jobs you are able to obtain by the type of math you use.

That mute button is a thing of beauty.

“Why not every realtor in town?”

That’s why I brought this up… I asked whether it was common practice for RE agents to refer their clients to the best broker and investment advisor in town: Mr. Martel.

Sorry to single out Jason but I heard he was good friends with Mr. Martel.

“LMAO, wow nice math. Let me guess you are a union worker for the government.”

Low blow. I presume that on average gov union workers can do simple math. They might not have a good grasp of the English language, but I presume they can use a calculator.

Why not every realtor in town?

No need to guess, just ask your insider contacts.

Seems like you’re full of asses.

Year over year in April 2022 the price change was 19.44% according to Teranet for all of Canada.

Year over year in April 2023 the price change is -8.52%.

That’s 53% of the pandemic bump that’s disappeared.

LMAO, why not?

LMAO, wow nice math. Let me guess you are a union worker for the government.

Why don’t you ask your insider contacts, since you don’t know anything yourself.

So now it’s other realtors at the Agency that are also sending clients to Greg Martel as well?

The $0 that he’s gonna get back certainly is.

If you take the amount owed and the # of investors, simple math tells you that your insider contact is made up.

“Majority of investments I’ve heard of is people investing $50k or less, and it just happened to be all of their life savings.”

200 million + and maybe 2,000 investors? That’s $100,000 on average but we can’t be sure those assumptions are accurate.

Perhaps the more sympathetic victims who’s life savings were $50,000 might have been more vocal and public about their loss. Those with bigger pockets, who didn’t cash out early, might be embarrassed.

Funny, majority of the investments I heard were in the 6 figure+ range (Insider Contact – partner at local accounting firm). Perhaps because you only associate with people in certain income brackets so you assume only those are the victims?

Let’s see how much pressure the market can take, but man has it ever been resilient

Not all realtors at the Agency are solely selling luxury homes. Oh and the dude that can’t close his condo is owned like $400k, but maybe thats chump change for people praying for a housing crash like you 🙂

Are you retarded? Go read your questions again and give your head a shake. “How would sending people to Greg net him any money” LMAO jesus….

Don’t know exactly how long he’s been paying the ex-wife but separation was couple of years ago.

This isn’t my story, its just some things off the top of my head in response to your claim “Doubtful, Binab’s family has members working as mortgage brokers. Doesn’t make sense that he’d sent them to Greg Martel instead of his own family.”

“How would sending people to Greg net him any money?”

Well, for one to keep this thing going for so many years there had to be a flow of new investors. So referring clients to Greg might have benefitted early investors/friends of Greg because they were being paid huge returns and they wanted to keep this ponzi going.

Secondly, it could have benefiited RE agents if Greg was paying them a significant referral fee.

Perhaps some of the early investors had enough common sense to realize something was off with the crazy interest returns, but they didn’t speak up because they were making a killing.

Yeah, a numbered company based in Alberta being owed $17 million, must have put it in there after getting a sneaky tip from a realtor when they bought their place in the uplands.

Majority of investments I’ve heard of is people investing $50k or less, and it just happened to be all of their life savings.

One dude can’t close on his condo purchase because he invested the down payment with Martel. These aren’t people buying $2-$9.9 million dollar houses, which is what you get when you look on MLS for what Binab’s selling.

LMAO, all those people being owed hundreds of thousands to tens of millions sure seem like bottom feeders…

“People buying from Binab, and the people investing in Greg’s ponzi scheme are in very different income brackets judging by the people who’ve come forward in the lawsuit.”

I don’t think this is accurate. There’s been public claims made between $40,000 to 17 million.

I have heard that many of Greg’s victims are concerned that Greg’s family/friends including Jason Binab, were in the scheme early and cashed out early… with their ill-gotten gains.

People buying from Binab, and the people investing in Greg’s ponzi scheme are in very different income brackets judging by the people who’ve come forward in the lawsuit.

How would sending people to Greg net him any money?

How long has he been paying alimony to his ex-wife?

Your story starts to unravel pretty quickly.

My understanding is that people would be reffered to Greg for a mortgage and then he would turn up the charm and convince them to take equity out of their new property to give him funds to invest in his ponzi scheme.

Can you ever make too much money? Perhaps he’s always done it, also he needs to pay alimony to his ex wife, so maybe he’s getting money from Greg off the books.

Why though? He’s the busiest agent in town. There’s zero incentive, and a lot of drawbacks.

Maybe he suggested that his clients take out HELOCs and use that to invest with Greg. My understanding is that the actual mortgage borrowing business Greg ran was legit, it’s the investment side that is sketchy.

Doubtful, Binab’s family has members working as mortgage brokers. Doesn’t make sense that he’d sent them to Greg Martel instead of his own family.

As expected, banks hiked Prime by 0.25% . RBC is 6.95%

5 year bond also spiked 20 bps on the news. To 3.73%

https://www.newswire.ca/news-releases/rbc-royal-bank-increases-prime-rate-803259356.html

“RBC Royal Bank is increasing its prime rate by 25 basis points to 6.95 per cent from 6.70 per cent, effective June 8, 2023“

Yes, totoro has given some good tips on that topic. I recall the term used is co-ownership.

Hearing rumours that Jason Binab, of Binab group/the Agency, is implicated in the Greg Martel ponzi scheme. Perhaps as an early investor and or in sending clients to Greg? Any truth to these rumors? Were local mortgage brokers and RE agents sending their clients to Greg over the last 10 years?

Priced in already in the FI market. I’ll see if there is another insider contact update. Last month there were more and more people starting to relist after failing to unload last year. I suspect the rate hike will just add more motivation.

I know this is changing the focus a bit here but I have been thinking about what Totoro has mentioned many times. She has talked about purchasing a home with others and the benefits of that.

I found a very good article on this topic. It is about building a multigenerational home and I think there is a lot to be said for it. I know, especially years ago being a single working mom and being very close to my parents and aunt and uncle that this could have really worked and been beneficial for us all on so many fronts. If you are interested, google: 7 Benefits of building a Multigenerational Custom Home. It could solve a lot of housing problems.

“First-Time Buyers, Second Thoughts: Starter Homes Long Past Affordability, Even in Secondary Markets

…In 41 of the 100 largest secondary cities in the U.S., renters earn half or less than half of the income they would need to buy a median-priced starter home.

https://www.point2homes.com/news/us-real-estate-news/starter-homes-secondary-cities-us.html

With less parking being approved there may be a business model to build secured vertical urban parkades either for purchase, rent or a combination of both. All one would need is to develop or lease a small section of the surface parking being used at say a Mall.

Question retracted

I’m with you on expectations for another hike in July. With inflation ticking up to 4.4% in April, that’s nowhere near their 2% target. And the recent upswing to the housing market likely played a big factor too.

It looks like the market is expecting a July hike now.

https://www.reuters.com/markets/rates-bonds/bank-canada-hikes-rates-475-highest-22-years-2023-06-07/

“ “We expect another 25 basis points coming in July,” said Derek Holt, vice president of capital markets economics at Scotiabank. “It is like a bag of chips, you open one and just can’t have one.”

——

I like the “bag of chips” metaphor 🙂

“This” is a canary in the coalmine of societal decay. As with housing shortages & high personal debt loads, emotional trauma & social dysfunction are the externalized costs of the current stage of predatory capitalism –as they used to say, there is no free lunch (i.e. externalized costs cost).

I’m surprised they didn’t wait until July. Has me thinking they anticipate another 25 bps hike at the next meeting. At least they didn’t give any forward guidance this time, so we can be sure they are just winging it now.

It seem that it is not always the elected politicians slowing down housing development, in this case it is an entrenched bureaucracy unable to keep up with the times:

“He said the biggest challenge is that Saanich staff aren’t able to recommend a project of that size that has only surface parking because district policy has not been established for it. “Staff don’t have the tools to recommend this type of creativity yet,” Lee said