Has the rental market peaked?

Right off the bat you can probably tell that Betteridge’s Law will apply here, but let’s dig into the rental market a bit and see if there might be some relief coming.

First we have to acknowledge that rental data is absolutely atrocious in Canada. We essentially have only three sources of rental data, two of which are available in Victoria:

- CMHC – Thorough, consistently collected for decades, this is generally data you can rely on. However they only do their Rental Market Survey once a year, they’re still frustratingly opaque on some of their data, and they confuse everyone (including city planning staff) by publishing the average rent of occupied units as the headline rent number. Data on vacant and turnover rents are available in recent years, but it’s pretty hidden. The easiest way to access CMHC rental data is using their Housing Market Information Portal.

- MLS – In some cities like Toronto, it’s customary to list rentals on MLS just like sales. That gives them good rental data, but unfortunately around here no one seems to use MLS to rent residential properties, so we get no data.

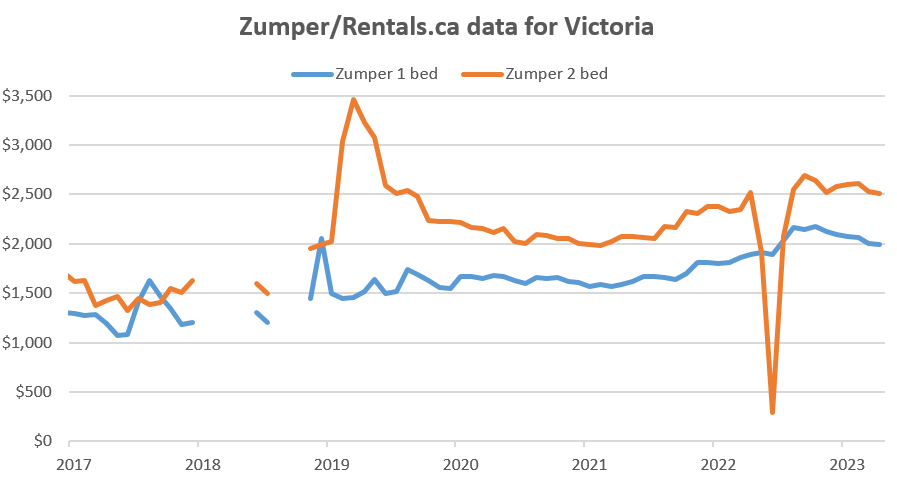

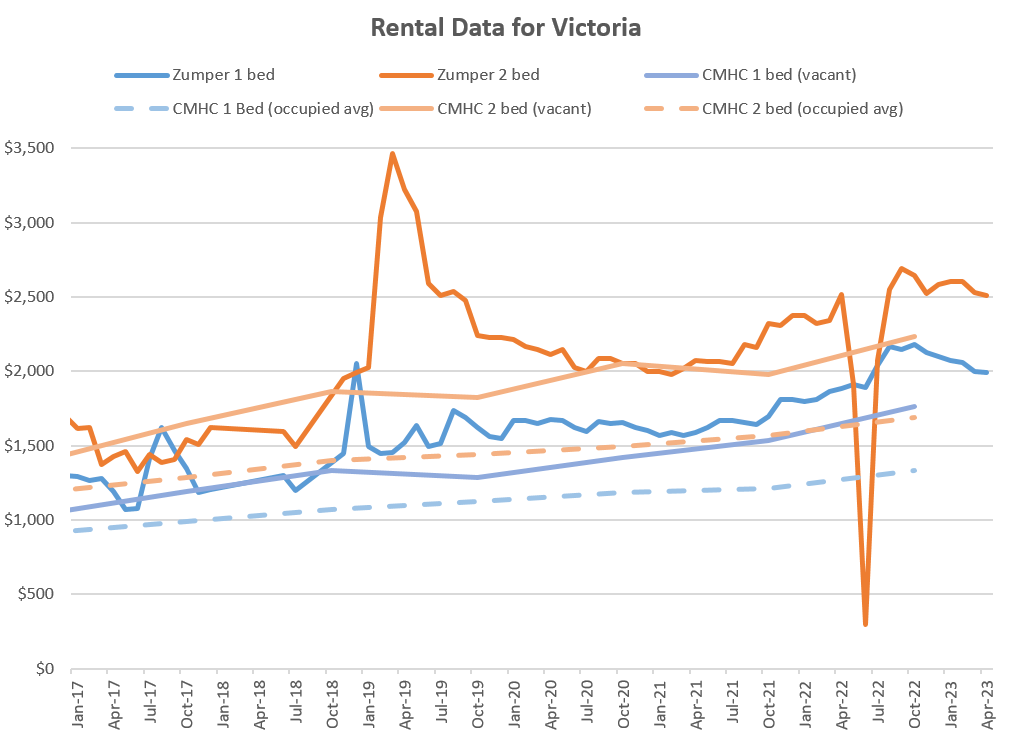

- Various private rental listing platforms – Padmapper and Rentals.ca (owned by Zumper) are the two main ones and both publish a monthly rental market report. The problem is that the purpose of those reports is advertising, and the data is predictably pretty bad and until recently only the current month’s figures were available. You can now access the Rentals/Zumper data here, but the quality is still pretty miserable, with inexplicable spikes and data gaps for Victoria. Before 2019, the data is half missing, and 2 bed rents are clearly out to lunch during 2019. Perhaps there is some validity to the data 2020 onwards, at least for 1 bed apartments?

Data quality aside, the Zumper data does seem to indicate that asking rents have been dropping since late last year. Is it real? Perhaps, but the evidence is sparse.

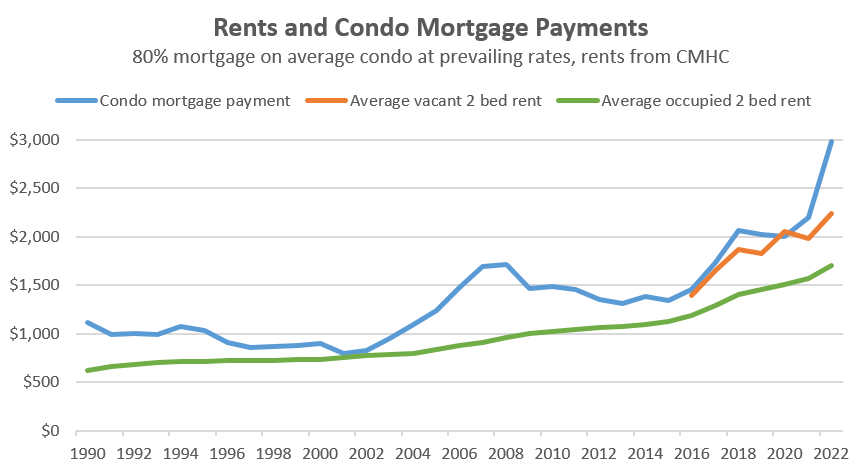

If we fold in CMHC data, we can see that the Zumper data roughly matches to the vacant advertised rents as surveyed by our national housing corporation (though perhaps within a few hundred dollars a month is not particularly close). Note however that we are still comparing oranges to mandarins here, as the CMHC data is only for purpose built rentals, while Zumper will be a mix (but likely mostly rental condos).

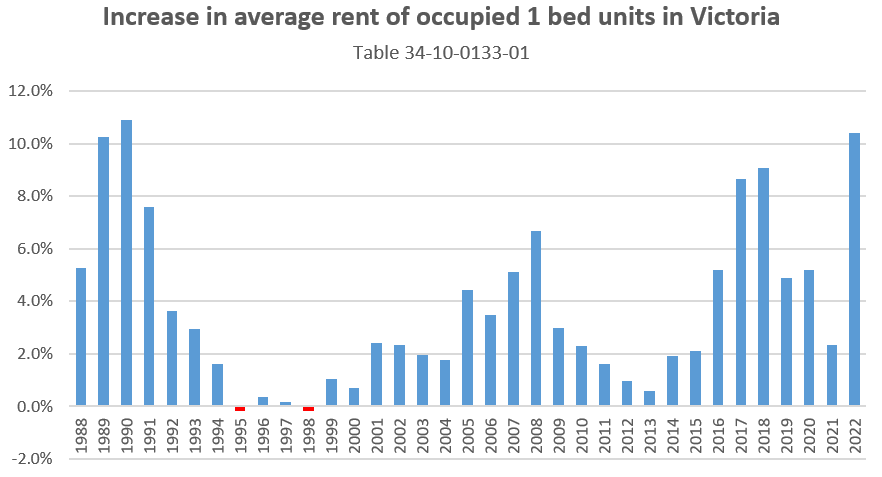

So what does it mean for rents to go down? If we define it that the advertised asking rent of rentals drops, then that does happen regularly, recently in the acute phase of the pandemic. If we define it that the average rent of occupied units drops, then we can essentially forget about it. The only time that happened in Victoria was in the mid 90s, and then only by a miniscule 0.2% (it took a vacancy rate of about 4% to get that drop while our current vacancy rate is 1%).

Also note that the gap between the rents of vacant units and occupied units acts as a sort of buffer. Market rents for a one bed apartment would have to plunge by over $400/month before vacant rents were less than occupied ones, and the average could decrease. We could get there with a lot more rental completions and much slower population growth (after all it happened after the 90s boom), but rent growth is much more likely to slow gradually than suddenly.

Why do rents matter to the resale market? Well rents are essentially pressure on the bottom end of the market. When they’re high relative to mortgage costs, there’s a lot of incentive for people to buy. Conversely if they’re low, it’s less attractive for buyers to greatly increase their housing costs by buying. In the past when the cost to buy a condo got very high relative to rents, we saw mortgage costs come down over the subsequent years until that gap closed.

Will the same happen again this time around, or will rents just keep surging upwards to close the gap from below? Well the strengthening of the condo market despite higher rates isn’t pointing at lower carrying costs for condos, but we’re talking about a pattern that in the past has played out over years, not months. Either way, these two markets will continue to be linked through costs in the future.

Also the weekly sales

| May 2023 |

May

2022

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 177 | 761 | |||

| New Listings | 292 | 1531 | |||

| Active Listings | 2037 | 1776 | |||

| Sales to New Listings | 61% | 50% | |||

| Sales YoY Change | 0% | -27% | |||

| New Lists YoY Change | -17% | +15% | |||

| Inventory YoY Change | +40% | +22% | |||

| Months of Inventory | 2.3 | ||||

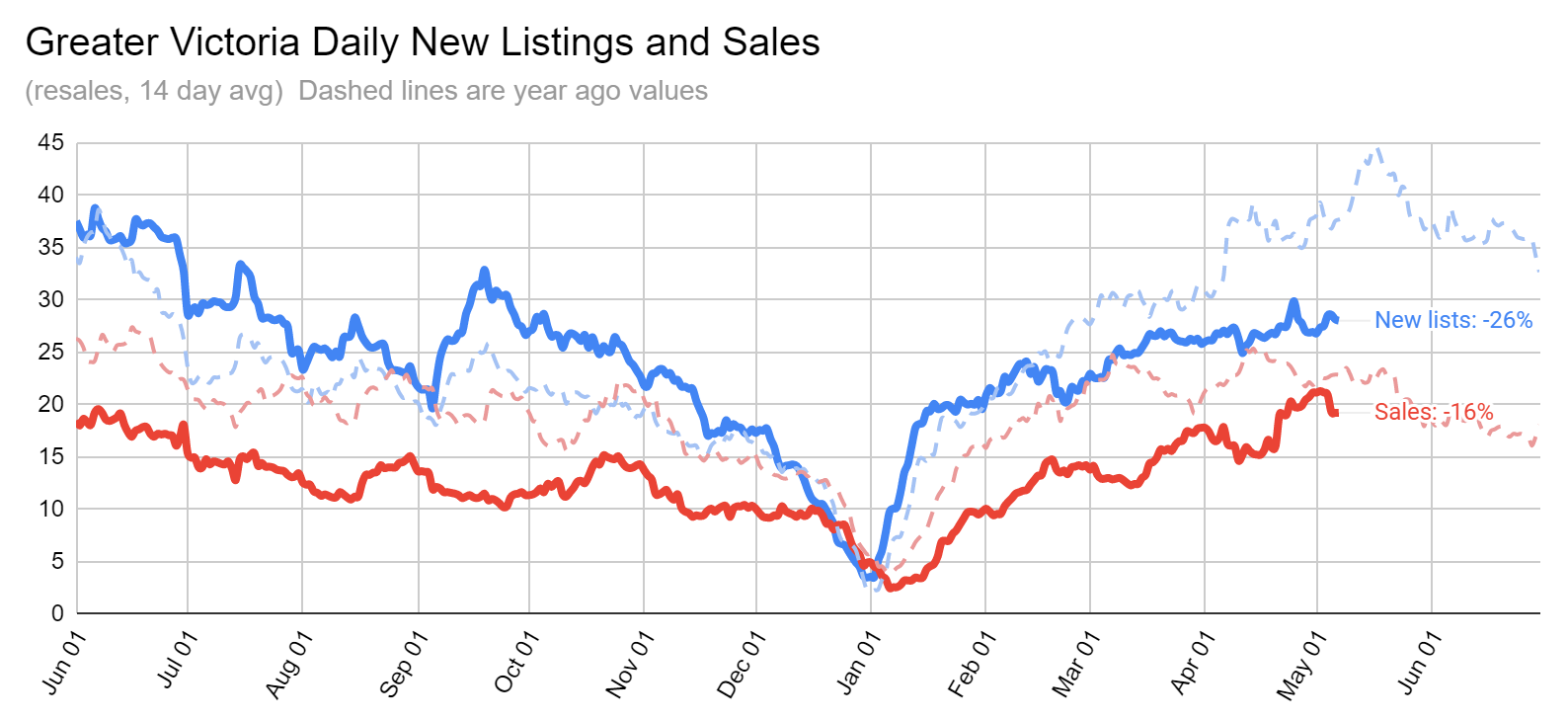

It looks like we are just going to skate through the entire spring selling season with lacklustre new listings. Granted we are comparing against last May, when we had a rush to the exits as the market turned and everyone wanted to get those sweet sweet peak prices and bidding wars before they disappeared. Even comparing against 2021 though, we are lagging on the pace of new listings.

This is when the market really got hit last year, with sales dropping and inventory starting to grow from rock bottom levels. Last year from the end of March to May 9th we added 388 listings to the inventory. This year we’re only up by 67 in the same period and it doesn’t look like that will improve. For the first time in over a year, our sales to list ratio has exceeded the year ago value, and given the trends, that gap is likely to grow substantially in the coming weeks.

According to Rosenberg, out of 14 rate hiking cycles since 1950, 11 caused a recession. The logical bet would still be on a pullback sometime in the latter half of the year, but if housing takes off again nationwide that might take a couple more rate hikes to push us over. As with rents, it looks likely to get worse before it gets better.

[May 15, 2023] Canada house prices UP. … Globe and mail reports… “Swift turnaround”, “competition is back”, “multiple offers”, “market has definitely picked up”

https://www.theglobeandmail.com/business/article-canada-housing-market-rebound-april/

“ The national home price index, which excludes the priciest homes, climbed 1.6 per cent to $723,900 from March to April, according to the Canadian Real Estate Association (CREA) . That was the second consecutive monthly increase after higher mortgage costs triggered a year-long slump in prices. … Canada’s housing market rebound firmed up in April, with sales increasing across the country and home prices soaring in parts of Southern Ontario.… The turnaround in the housing market has been swift. Real estate agents say competition is back and multiple offers have returned in the Toronto region and nearby cities.“The market has definitely picked up,”

At this point it seems that buyers have returned to the market before sellers. I suspect that those looking to upgrade to their next tier of home are choosing to buy first and then list their property once they have secured a new residence.

In the past it was possible to buy the next tier of home and keep their present residence as a rental. As the rents achieved provided the necessary income to offset the blended mortgage rates. The current high(er) interest rate have likely cut into the ability for many people to do this.

If my assumptions are correct, I would expect to see a spike in future listings as we head into the summer market.

One of our friends gave notice to the tenants for owner moving-back. The tenant didn’t want to move and offered to pay $3500/m (it is a whole 4beds SFH with current rent ~$2600/m) for another year. The owner didn’t take the offer as they do need to move in (retired from another province). So the tenant went to RTB to dispute. I guess the tenant just wants to delay the move as there is no reason that RTB will side with them.

Not in the right market segments thought…messages I am getting this morning from listing agents on SFHs around a million +/- I showed this weekend…

Vicanalyst, enough room for two adults and three children, all under 12, within 10 minutes drive of downtown.

The vast economic data on rent controls has historically considered rent controls bad for encouraging new supply of rental housing. Past rental housing was developed by small to medium sized private investors using conventional financing to construct four-plexes and apartment buildings of 50 units or so. A lot of small to medium sized investors competing against themselves for renters kept rent prices down while encouraging the building to be fully leased quickly after completion.

But those times have changed, the new rental market is dominated by large developers using a combination of creative equity and debt financing. This is a change from considering the value of a property based on full occupancy at market rates to a min/max equation in order maximize the highest rate of return.

Is it better to rent out all 500 units at $1,900 per month immediately or 400 of those 500 units at $2,400 per month and accept a longer lease up period before attaining full occupancy and thereby maximizing the return to the investors say in a two year time to lease up?

how many bedrooms?

Leo, here is a point to ponder when looking at the Sales to New Listings Ratio. It is necessary to have more listings than sales to account for properties that are over priced. Are over priced properties really competitive listings in the marketplace? If one excluded those over priced properties then the “true” Sales to New Listings Ratio would be much lower.

But what happens when the number of properties that are not new listings reduce their price and become competitive? These price reduced listings are not included in the SNL, yet with their reduced price should they be considered new listings? Should we be considering price decreases and the possible effect they have on the marketplace?

The beauty of the SNL is that it is so simple to calculate but if you were to introduce price decreases then the SNL would be very difficult to estimate and yet to not consider price decreases may obscure changes in the marketplace.

Things that make you go hmmmmm.

Oh they are actively cold calling/emailing past clients to see if they want to list.

Get your insiders to list some more places!

The debate about rent control always seems very black and white. Rent freezes are bad because they kill housing production, but allowing 30% rent hikes is also bad for social stability. There’s a clear case for rent stabilization.

Anecdotally speaking. A neighbor rented the main floor of a house at the start of Covid at $2,000 per month and today it would rent for $3,500 per month. They came to Victoria, from Alberta, and spent most of that first year looking for work. In hind sight if a young couple was intending to move to another city for work, the payments made it much easier to do so.

Which makes me wonder if there is a co-relation in the astonishing increase in rents with Covid government payments?

Now that the government transfer payments have ended will there be an effect on rents? How long can the rents remain high when the average 20 to 40 year old wage earner moving to Victoria to find work now has to spend 50, 60 percent of their income on rent?

Come on Leo, I called this already last thursday 🙂

https://househuntvictoria.ca/2023/05/08/has-the-rental-market-peaked/#comment-101388

The last sentence in that article is a winner: “Landlords like to see people thrive”

Note that Alberta has no rent controls so everyone is paying market rent – or more precisely market rent within the last year. Rent can only be increased once a year for a sitting tenant.

https://globalnews.ca/news/9570422/no-rent-cap-alberta/

Calgary rents:

Finally a few listings

Feels like Peachland in Victoria today — and it’s the middle of May.

Might have to summer in Rupert in retirement — or this summer (yeesh)!

I used to absolutely love Peachland!! Used to have a trailer and camped there with my daughter and a friend as well has his three kids. That is when I was young and beautiful, ha ha. The kids slept in a tent and us (separately of course :-)) in the trailer. We used to take a couple of ten speeds with us as well. The lake and wharf were right across from the camp ground. Also, there was this really neat country western type bar with dancing right in town on the weekends. Fun.

Depends on how fast you want to get there.. Taking the southern route (hwy 3) is great for a slow drive with stops like Manning park, the farm stands around the Similkameen (some Similkameen wineries are really underated) and then work your way up from Osoyoos hitting all the vineyards you can (or parks, lol) before you reach Kelowna. Going for fast, taking the Coq to Merritt and cutting across to Peachland on hwy 97C gets it done.

I’m visiting Kelowna in a few weeks. The hotel accommodations are ridiculously expensive. Haven’t been there for awhile. Used to always take the Hope Princeton Highway. Anybody have opinion on the best/enjoyable driving route?

Usually going to Kamloops we will take the Coquihalla going and the Fraser Canyon on the way back.

quite a few first month free ads for rentals in Victoria.

Fair enough. My contribution to your “rents in Kelowna are tumbling” discussion is to point out that Kelowna two bdr rents actually rose 2.1% in the “tumbling” month under discussion. I’m happy to leave it there.

Na, it was just interesting to see… Recognized it was a small data set,but it is topical, I didn’t really assert anything based on it other than some mild speculation on why it would be occuring in that particular market. Larger data sets are required for anything substantive, but not for a discussion. Where the data can be used, even with limited sample, is the movement in Kelowna relative to other markets on the same sampling such as Vancouver, Victoria, Burnaby and etc…. Seeing Kelowna moving from 4th to 8th on the list. So, question is will the pattern persist when larger data sets are examined? Hence a topical discussion. Nice try on ascribing motivations though.

For those here who get excited about tiny drops in rent seen in the fall/winter months. And so each fall, they declare the sky to be falling in rent prices. ..

Let me introduce you to the known seasonal effects on rent prices. Many more people searching and wanting homes to rent in spring/summer months. Leading to falling rents (and fewer applications) in the fall/winter and rising rents in the spring/summer. As zumper.com Canadian Rent Report describes it “ As we head into the [2023] warmer months, rents will likely only continue to rise.”

https://www.apartmentlist.com/research/best-time-of-year-to-rent

You’re being fooled by articles relying on small data sets. If you look at the the zumper rental data for Kelowna, the MOM rent change was -down -$100 for a 1 bedroom. But it was up +$50 for a two bedroom in the same month in Kelowna. Vancouver was up +5% in the month for a two bedroom. Do you think that’s real or a skewed sample?

Overall in 23 Canadian cities surveyed, in the most recent month (April) rents went UP by average 1% MOM. Not surprising given the seasonal effect that rents get in the summer.

https://www.zumper.com/blog/rental-price-data-canada/

From: https://www.kelownanow.com/watercooler/news/news/Real_Estate/Apartment_rents_tumble_in_Kelowna/#fs_124839

Interesting to see the move in rents in Kelowna; wonder how it lines up with their real estate market. I guess it makes sense to see it happen in a community like Kelowna where there are a lot of secondary and recreation types of properties.

How about those that used the “bridge” financing to buy a second property but never sold their primary home? The money used to finance the “bridge” has to be paid back to the investors. It may be difficult for most /some owners to obtain traditional financing on the properties as their debt service ratio will be too high. If the owners can’t obtain traditional financing then one or more of the properties will have to be sold either voluntarily or under a court order.

I’m using bridge in quotes because technically this isn’t bridge financing. Bridge financing by a traditional lender requires a firm Contract of Purchase and Sale on the primary property along with a Market Rental Report to determine if the rents can cover the bridged mortgage. It is short term financing. Sometimes the closing dates on the properties don’t match up, so it is necessary to bridge the gap. This type of financing is meant to bridge the gap between the sale of the primary home and the purchase of the next home.

If there is no firm Contract of Purchase and Sale then this type of financing is not bridge financing but allowed purchasers to own two or more properties without adhering to conventional debt service ratios. All of those “bridge” loans will have to be paid back so that the investors can get their money back. A non traditional lender may not fall under OSFI regulations but these types of loans would be high risk sub prime loans with high interest rates being charged.

Vicreanalyst so early investors could potentially be sued wow that would be a shit show Doesn’t sound like there was a whole lot of bookkeeping there so it could be they’re saving grace

If the whole thing turns out to be a scam then the investors who cashed out early will have to pay back their profits too.

A controversial plan for a six-unit houseplex in Vic West took a leap forward Thursday night when Victoria city council gave its rezoning application third reading and approved it in principle, subject to a series of legal agreements.

Following a three-hour public hearing, council voted 6-3 to move the project toward adoption, despite pleas from neighbouring residents to reconsider the plans.

Belton Avenue residents argued the Urban Thrive project was just too much for the dead-end street.

“A six-plex is double the number of housing units articulated in the community plan for this area of Vic West,” resident Terry Chyzowski said in a written submission.

Chyzowski also took issue with the project’s lack of parking on a street where parking is already a serious issue.

“The problematic aspect is that there will be no policy or legal structure for citizens to pursue grievances or hold anyone to account if parking becomes an issue given the developer’s insistence that the new residence will be car-free,” Chyzowski said.

The six-unit houseplex would replace an existing single-family home. City staff had initially recommended council turn down the rezoning application in January due to the lack of off-street vehicle parking, but council instead decided to move it forward.

Why would it be a scam? He was posting instagram photos of himself on private jets. Recently bought a 4.7 million USD home in LA. Obviously that could only lead you to believe it was legit.

Receiver paints bleak picture for Martel investors at town hall meeting

https://www.timescolonist.com/local-news/receiver-paints-bleak-picture-for-martel-investors-at-town-hall-meeting-6996494

City moves forward with Vic West six-plex on single-family lot despite neighbours’ objections

https://www.timescolonist.com/local-news/city-moves-forward-with-vic-west-six-plex-on-single-family-lot-despite-neighbours-objections-6996492

How can you not think it was a scam? 100 + % returns a year, like come on. I knew it was going to be in the 100’s of millions.

Grey has been really overdone over the past ten years. It looks outdated to me now – especially on walls.

I suspect that a lot of people may have been badly hurt by this scam.

From: https://www.cbc.ca/news/canada/british-columbia/victoria-my-mortgage-broker-greg-martel-missing-records-1.6841378

The MMAC scam keeps getting more hilarious.

The main difference between equilibrium and disequilibrium in economics is that equilibrium refers to a situation in which a market or economy is operating efficiently, while disequilibrium refers to a situation in which a market or economy is not operating efficiently.

One of the causes disequilibrium is an unequal distribution of resources. For Victoria we have a shortage of middle income houses in the million to 1.5 million dollar range and and oversupply of houses over 1.6 million dollars .

So will houses in the 1.6 million and over range come down in price or will middle income households substitute houses for condominiums or a combination of both?

Migration

Or the old tenants are displaced. Happens all the time.

Supply – of anything – always equals demand at the market price.

Let’s suppose all the landlords of the lower 10% market priced apartments in the city give them super upgrades so that they are now the new top 10%. Where are the tenants going to come from? The former top 10%. And so on. The tenants for the new bottom 10% are going to be the same tenants as for the old bottom 10%. And the market price will not change, because it’s the same number of units and the same number of tenants.

Is it just me or does 3354 Harriet look super underpriced? To attract a bidding war?

Why are so many cities facing an acute shortage of affordable housing? For starters, rents in many parts have risen faster than incomes throughout much of the current economic boom. Meanwhile, developers have tended to focus on high-end apartments, largely because of construction costs. In recent years, publicly traded apartment REITs have mostly exited the middle of the country and concentrated on fast-growing coastal markets, where construction costs are especially high.

“Big developers need to make their math pencil and to do that you need to charge higher rents,” explains John Pawlowski, a senior analyst covering residential REITs at Green Street Advisors.

As asset prices have climbed, many private investors have moved farther up the risk spectrum, searching for higher returns in value-add properties that have long served low- and moderate-income renters.

$300,000?

Not sure I see that playing out here. Demand for affordable rental units will always exceed supply, and affordable rental units are usually A.) Old B.) Shitty and C.) Purpose-built

REITs like to buy old, shitty purpose-built rentals because they have upside. Nothing wrong with buying older apartment buildings and fixing them up, but it does mean affordable units are lost.

if consumers are able to find substitutions, but have less of an impact on demand when alternatives are not available.

For those particular units, likely yes. But if there’s the same amount of total rental demand, that’s going to be balanced by a drop in demand elsewhere and lower rents than for the default case.

This guy is looking for an income stream, BRK doesn’t pay a dividend.

It does if the new owner invests in upgrades to increase the market rent for the units.

Open market rental rates are determined by supply and demand. A change in ownership of a rental property does not affect this.

I found the screencap that I did a year ago.

Six out of 10 buyers of rental apartment buildings in Greater Victoria and Metro Vancouver in 2021 were large institutional investors and real estate investment trusts, because they have the financial depth to weather B.C.’s rental policies, Coulson suggested,

Big players in Victoria include Starlight Investments, which has $20 billion in assets with more than 70,000 rental units across North America, and Canadian Apartment Properties Real Estate Investment Trust (CAPREIT), Canada’s largest landlord.

Starlight has bought 10 older Victoria apartment buildings with a total of 592 rental units; CAPREIT has purchased six existing buildings totaling 335 residential suites in Victoria.

In a report on the city’s housing strategy presented at council’s committee of the whole, city staff said that massive increase in investment is putting upward pressure on rental rates.

While the involvement of REITs and institutions in the marketplace is not new, the report noted the high purchase prices – the current average is north of $275,000 per unit – often result in new owners raising rents.

“This trend has the potential to significantly affect affordability in Victoria’s rental housing market in the coming years, particularly where older, more affordable rental buildings are acquired,” the report said.

I’m surprised you can get away with doing a reno of that scale without permits!

Some odd style choices, but looks amazing compared to before.

Anyone care to guess when the cold grey flooring is going to go out of fashion? IMO it’s going to date places.

Correct, but I would disagree with the “reliable” characterization. Short term return has been very volatile.

https://ycharts.com/companies/BRK.A/one_year_total_return

https://ca.finance.yahoo.com/news/the-truth-about-warren-buffetts-investment-track-record-morning-brief-113829049.html

Less than it would have been if they took out permits.

where’d you find that?

Thanks. That’s so handy!

Asking price was $799,900.

Berkshire Hathaway has given on average a 10.91% return for the last decade.

You must be joking, right @MIC?

It sold for $908,000, it’s on the listing.

The offer is still available if you can get a hold of him. He’s really busy now, his company is blowing up.

It was offered in April 2023

I think Greg Martel was offering something like this a year or two ago. You might want to check with him.

I think I remember this one. As a wreck, it sold for >$1M, if I recall. Looking at these new photos, who wants to ballpark the reno cost?

And people will label the seller as a greedy flipper even thought they provided a valuable service imo.

Not imo. High end SFH market and condos are a lot slower right now versus 900 to 1.3k SFH. Overall I think we might actually see an increase in the median price with 1.15-1.2ish houses being bid up in multiple offers.

How would an individual realtor out of 1613 realtors in the VREB be able to predict incoming supply? That makes zero sense. Based on them having two listing presentations last week versus one the week before that?

For our annual predictions I predicted we would be at 3,000 listings right now. We are at 2,000 so I was horribly off. Realtors don’t have a clue just like everyone else doesn’t have a clue.

I am going to guess we get a tad more new listings maybe investory creeps up to 2,200 but then we are in the summer months when things slow down.

This is a complete guess thought.

Who, marko?

Whatever, I am actually a bit surprised that Joan has not sold yet. They had an Open House last weekend and I did a walk through with my wife and while there were some improvement needed the house seemed pretty nice overall.

Wondering if this is the canary in the coal mine for pricing?

That’s an oxymoron.

Agree, they’d probably stink up the place.

FYI… been introducing Australians, 100’s of them to Victoria and Canada mainly in the last couple weeks.

Everyone is blown away by how green we are.. and that’s just from the airport to downtown. We live in a Beautiful spot, my friends. Do not underestimate what we have…

Fascinating to see the transformation from that house that got news coverage because it was a wreck to this 12 months later https://www.realtor.ca/real-estate/25576833/1611-hawthorne-st-saanich-gordon-head

a little bit of the topic here… is there any good mortgage investment companies/firms in town? I have just saved up 300k, have one older clean title house, pension kicked in last year…. now I think I am ready to retire and stop working on the side but also want to earn about 8-9 percent reliable return for the 300k and I do not want to rent my place to international students or local prawns.. any feedback is greatly appreciated.

Barrister , I’m still watching that home on Joan Crescent near you. If I were looking for a house that one would be on my list. It will be interesting to see what it eventually sells for as there is about 7 months of inventory in that price bracket.

I have noticed a fair number of new listings in the 2 to 4 million range but not very many sales. Strangely there does not seem to be a lot of price reductions either.

I was told from my realtor that much needed inventory is on its way. Hopefully this makes a dent in our supply

Nice, post it here once it’s up if you like

“more inventory incoming -> insider contact.”

As someone in process of listing our house in vic for sale, I can confirm 😉

Small business owners across Canada are calling for an extension to the deadline for repaying the Canada Emergency Business Account (CEBA) loan interest-free by the end of the year. According to a press release from the Canadian Federation of Independent Business (CFIB), 78% of small business owners believe that getting more time to repay their CEBA loan would increase their business’s likelihood of survival.

“Many small businesses are trying to repay their COVID-related debt while facing an onslaught of additional challenges,” said CFIB president Dan Kelly. “High-interest rates, inflation and labour costs are all making it hard for small businesses to keep their head above water, let alone make any dent in the debt they were forced to take on to survive pandemic restrictions. If the government helped ease their debt burden, small businesses could reinvest the money into employees or back in their business. Otherwise, we may see more business failures as businesses realize they can’t afford to stay open.”

CFIB data reveals that almost half (49%) of small businesses are still experiencing below-normal revenues, with those in the hospitality, arts and recreation, retail, and social services sectors hit the hardest.

Proposals apparently spiking in Canada as a whole, but not yet in Victoria. https://www.bloomberg.com/news/articles/2023-05-10/interest-rates-record-number-of-canadians-are-trying-to-restructure-their-debts

FUBAR, Why are the building’s value so low?

There are few buyers for properties like Senanus. Consequently the property is likely an over improvement for the marketplace. An over improvement is a form of diminished utility/depreciation. Since land does not depreciate all of the loss in value for an over improvements is attributable to the improvements.

At least that’s what BC Assessment will tell you. The truth is they don’t know what its “fu^&ing worth. It’s their best guess.

“more inventory incoming -> insider contact.”

I also saw multiple realtors post this on Twitter if that’s what you mean 🙂

@VicREanalyst

Here’s Microsoft CEO on wage increases this year:

They had doubled their budget last year for wage increases.

more inventory incoming -> insider contact.

“Farm land – value set by BC regulation 411/95”

https://info.bcassessment.ca/services-and-products/Shared%20Documents/BCAL15102%20BCA_farm_brochure_digital.pdf

605 Senanus Dr has been on the market for a while and is at just under 14M currently. It’s located on the water off the west end of Mt Newton X Rd. BC Assessment has two units for it. The unit with the main house and most of the buildings on it is assessed at ~895k with all but 4k of the assessed value being attributed to the buildings. The other unit is of negligible assessed value and is for the boat house. Neither unit is in the ALR according to the ALC maps but it does have farm status.

Other parcels on the south side of Senanus, east of 605 also have this farm status however their assessments are much higher because of the relatively large building values.

Why is the assessed value of 605’s buildings so low?

Bingo.

https://www.theglobeandmail.com/business/article-cmhc-max-length-new-insured-mortgages/

Sample size of 1 admittedly but my wife is a WFH tech person and keeps getting big raises (and more work). Still hard to hire people for the medical adjacent tech she does.

Get’s paid in Canadian $$ though. Slightly below what her American peers get paid ( after converting to common currency). More than the Europeans for some reason.

You’re the only one complaining here. People choose the public sector for a wide variety of reasons. Some of the absolute smartest people I’ve met work in government because they burnt out in the public sector. They got paid a lot more in the private sector. So we’re clear Marko, they also complain about the bureaucracy.

what I am saying is that all the supposed WFH tech people in Victoria earning huge USD salaries buying up local houses that HHV was raving about a year ago are close to extinct.

What he means is that the public sector unions (and many private sector unions for that matter) are working under multi year contracts that were negotiated years ago when inflation was low and consequently wage increases have lagged inflation to a large degree. Whereas in non union sectors wages are normally adjusted year by year – like those big increases the tech sector was getting until recently.

Whether you think the public sector is overpaid is a different issue.

》 they are delayed compared to private sector raises since there is a contract in place

What are you talking about? Most of those union jobs are overpaid compared to the private sector in the first place. If people can do better in the private sector compared to the union jobs they will leave. They can’t leave so they complain.

@Marko @Whateveriwanttocallmyself – it’s not that I want to so much as it would be a nice to have. Could add it to my listing next time and be in compliance with local bylaws and code, which would be nice. But why would I with headaches and years long process? Why does Saanich or anyone even offer this service to convert suites in existing homes to “legal” or “permitted” status. With all the red tape and costs, everyone just leeps their illegal suite and hopes nobody ever complains about it. Not that they would, 9/10 homes on my block have suites in the basements.

They’re not even raises first of all, secondly, they are delayed compared to private sector raises since there is a contract in place. People at Microsoft got paid the last 3 years, people working in unions had the wages already set in the contract. Of course they’re going to negotiate based on what they’ve lost. Union got better deals from the liberals to be honest.

What does that have to do with anything? Only thing that matter is when and how much raises are getting handed out, what the raises are for is irrelevant.

If you live in Saanich in an existing home and want to get a permit for a suite then go on to Saanich’s web site and search for basement suites.

All the information is there.

Why a legal suite? Here is a comment I lifted off a listing.

This home offers tile floors with In-Floor Radiant Heat, a large, open living/dining area, laundry, 2 pc bath, nice kitchen & patio doors to the covered balcony. The upper level has 3 large bedrooms incl the master w/ ensuite, a full bathroom & a huge, partially enclosed balcony where there are views. On the ground level there is additional 2 beds, bathroom, in-suite laundry & a private patio area. Also on the ground level is a large loft, 3-pce bath or use for storage or take back as garage space. THE NEW BUYER HAS TO CONVERT AND TAKE OUT SUITES AS PER VICTORIA BYLAW INFRACTIONS & COMPLY TO ZONING! SEE district comments. Schedule A must be attached to all offers.

Raises are based on past year’s inflation. Microsoft employees have already got these and more. I’m sure you already knew that though.

This is exactly what I am seeing. Government gives us lip service about how they are working on housing and at the same time they hold back 7 rental units for 6 months over something that takes 2 minutes to review/approve. I am not betting on this nonsense to ever change; therefore, I’ve become super bullish on real estate long term.

while all the talk about union workers getting fat raises, Microsoft is foregoing raises and limiting bonuses for all full time staff. LMAO

It feels like this happens way more than it should for a city of 400 thousand. Off the top of my head, there’s Greg Martel, Ian Thow, Harold Backer.

Thanks for another great article Leo. I truly hope rents continue to get more affordable. Otherwise, I think there will be very bad outcomes for our society, especially for those at the bottom.

I just said it is interesting people would do that, I never said I didn’t believe him. In hindsight I never should have questioned it given people are willing to give hundreds of thousands to millions of dollars to Greg Martel LMAO.

Why?

@Viclandlord – these types of situations are so disheartening. Makes me think we will NEVER catch up with housing needs on the South Island unless some major structural and process changes in gov’t happen. I’ve been considering getting a “permitted” suite licence (I think Saanich calls it that – it’s not a legal suite, but an existing non-conforming suite that can be given an occupation permit for), but I’m scared to apply and open the can of worms that is an inspector coming to look at it. Despite the fact that my suite checks 95% of the boxes on their form, and I’d like to do things properly and legally, I know of others who have gone through the process and had to spend years and $$$$ to make it happen.

This is why we can’t have nice things!

Marlo is correct, it was built in the 70’s, its essentially a brand new building now and we have increased the energy efficiency by 45%.

It’s a legal 8 unit building that has 8 off street parking spots, we also added 2 EV chargers.

Guess how many vehicles there is, 6 total.

There was two illegal units in the building that we are trying to legalize, one is already built out without a stove and being used as storage lol, someone could move in with 2hrs work but we are waiting on approval. I think we are at about 17 months since we first applied lol, Marko has said it a million times, we are so Fukd for housing.

We have also spent about 40k now in professional fees and 100’s of wasted hours, our last submission took our architect 30min to make the change that they wanted and it took them 6 months to review it again.

We meet all the zoning requirements and need a couple small variances and one is for a couple parking spots and yes we paid a parking consultant 10k to show that the building supports it.

These units have been there for the last 30 plus years and we are only trying to bring them up to code and do it properly.

Any day. Cook Street is way better imo. And renovated plus will likely have parking – normally required by bylaw for apts – not sure why you think it doesn’t.

Thanks Marko – I actually hadn’t approached our realtor about it. In my head, rentals are different than house buying, so I figured I’d need to start asking people who have rentals. But I’ll run it past him too. We are hoping to take in college students because we work with young adults in general and have a Vietnamese international student from camosun living with us right now (we do the homestay thing and always have 2-3 students living in our house, but this will be our first time renting a separate suite. (Except our house in Alberta – but we have a property manager handling that – we’ve never had to do it ourselves). We’re hoping to still have some contact with the tenants, & since our house is full of young people anyways, we thought renting to college students and then offering them a free meal once a week might help that along. But it’s hard to know what’s a fair price for renting by the room. It’s crazy what landlords are asking.

He said gutted to the studs so essentially it is new and I am assuming if older building it had some off-street parking when built which is retains to this day.

Hopefully got it this time. Thanks Introvert, James Soper and rush for life!

Edit: Yay, it worked!

So basically people are willing to pay more to live in a reno’d old place in cookstreet village with likely street parking than a new condo downtown of the same size with parking. That is very interesting.

https://www.realstar.ca/apartments/bc/victoria/yello-on-yates/floorplans

Off the Martel subject, another great article Leo.

We just leased 7 units in cook street village @

630 sq’ 1 & Den for $2500 plus utilities x 4

530 sq’ 1 Bed for $2300 plus utilities x 3

This was 2 months ago so we were also competing with the new Hudson rentals, it took us about 1.5 months to find the right people.

This is in a building that was gutted down to the studs and rebuilt to a high quality, quartz counters, heated tile floors, heat pumps, In suite laundry, built in appliances.

To determine rents we usually start at Devon properties website and then have a look at the private market, kijijji, used vic, and Facebook.

The data on rents is usually garbage and outdated we have found, you really don’t know until you list the unit and gauge the response/applicants

We have been living in a low return environment for a while now so not too hard to get people’s attention with a higher return besides real estate is a safe can’t lose investment

Did you ever try charging an even higher rate than is normal?

I think there is one engineering firm or something that invested.

Marko: I am sending you 500,000 Lebanese pounds and looking forward to getting regular reports.

ughh. Sorry. I edit my comment a bunch of times to try to make it make sense, and screwed it up in the end.

You NEED the space. Eg:

I should have some money to invest with you. Just as soon as the Nigerian prince that I gave my banking info to transfers me a few million.

Your agent that helped you purchase the home had no input whatsoever?

Fyi, more and more property management companies are starting to offer a service where they just market and rent out a property without the monthly management. I believe Jonesco, Pemberton, and Brown Bros are all offering it now.

https://www.timescolonist.com/local-news/saanich-homeowners-face-719-per-cent-tax-increase-6977200

here is what is looks like before i ‘post comment’

[img

just use the arrow without the quotes. And the space she meant was a line between the quote and your comment (use enter to create the space).

and where is the PID of the “subject property.”

Why doesn’t everyone send me $500k today and I’ll invest it in a profitable hotel in Croatia with a 14% return. Repeat business, I once ate at the hotel. That is all the info you need. lol

One investor notes she came into funds through a car accident settlement. As I said these millions must be inheritances and other avenues. No person that actually has to make money from scratch would fall for this and in Victoria/Vancouver Island we don’t really have high paying no education required professions such as professional athletes.

Not sure why this surprises me really. When I look at my own career I was losing listings 11-12 years ago as sellers thought my lower commission model was suspicious. People just have zero common sense. People want to be fed BS and it is sad that people fall for it over and over and over again.

no spaces. eg:

>Edit: I’m bad at this, didn’t work

Other option is:

<blockquote></blockquote>

At least that’s how it works on edits.

“>” Type “>” followed by a space followed by the text you want to quote

Thanks for advising Introvert!

We’ll see if this works

Edit: I’m bad at this, didn’t work

In a world where one in six people believe in chemtrails and one in five think 9/11 was an inside job is it that surprising that people fall for financial scams?

** above figures are for Americans, but are Canadians actually less gullible?

In examining investment fraud in Canada, the definition of investment fraud was limited to fraud involving securities that directly affect individual retail investors. These include Ponzi schemes, pump and dumps, forex scams, real estate investment scams and other related schemes such as affinity fraud, boiler rooms, advance fee scams, and internet fraud.

Numerous regulators, police agencies, and other organizations across the country share responsibility for preventing, deterring and detecting fraud, and taking enforcement action against it. Despite these disparate organizations’ overlapping duties to protect Canadian investors against fraud, no formal strategy or framework exists to ensure that the system works efficiently. The securities regulatory system in Canada has been criticized for its lack of effective regulation, particularly in the area of enforcement and fraud prevention. Independent studies have criticized the Canadian system for its inadequate enforcement and inconsistent investor protection across the different jurisdictions within Canada.

Canada does not have a framework in place to collect, track and report on investment fraud complaints and aggregate that information at a national level. Those responsible for dealing with investment fraud in Canada publish only limited information relating to complaints; securities regulators publish varying amounts of information while there do not appear to have been any publications in recent years by police agencies. This is problematic, as investors have been found to have a low awareness of securities regulators, and appear to be more likely to report investment fraud to police agencies. As a result, it is likely that only a small portion of actual complaints are accounted for in publically-available reports.

Further, reporting rates have generally been found to be extremely low, so the number of complaints received would likely only be the tip of the iceberg in measuring the prevalence of investment fraud in Canada.

https://www.pwc.com/ca/en/car/my-mortgage-auction/assets/mymortgage-006_090523.pdf

“Investment Summary – Funds to assist with the completion of the construction of a medical building. The

exit is an approved mortgage. The security is the subject property and another commercial building. New clients.”

I wonder how this will play out with those that used “bridge financing” to purchase another property? Bridge financing is only to be short term financing when there is a firm Contract of Purchase and Sale on the primary home. I wonder if some purchasers were using this form of private financing to skirt the debt ratio to buy a second property?

With bridge financing it is necessary to determine the economic rent of the primary property as the loan is secured by the rental income. The number of requests originating from brokers to perform Stand Alone Market Rent reports skyrocketed over the last few years. Some of those requests were for properties that were not listed for sale.

Things that make you go hmmmmm.

Hi all – I was reading an article here a while back that mentioned a website or service that helps give landlords and tenants a better idea of what current rental units are going for. I think there was maybe some debate over it, but it seemed to me like it could be useful to have more accurate data. We recently bought a house in view royal and will need to take our first foray into renting out a suite. Anyone remember what the website was? Thanks!

Leo, does your “new” listings include Westshore & Sooke?

Aren’t you a lawyer? Also, rumor on the street is that Fisgard mortgages is now fielding a bunch of redemption requests as a result of this. Be interesting to see how this all unfolds….

@Introvert – we’ve been doing the exact same thing for the last few years. No CCA and 50% of house being claimed as suite. No issues.

Thanks Introvert. That is exactly what my accountant has always said. Just do not ever claim CCA. I’d would always keep the rental portion smaller than 50% of the total area….but it looks like that was okay with them as well.

That is excellent news Introvert. Huge savings.

Got my Notice of Assessment from CRA. No capital gain owing. Suite was 50% of my house’s square-footage, and I never claimed CCA.

In past PRE/suite discussions, we had a paucity of current, real-life Victoria examples to point to, so wanted to share.

BTW, here’s Leo’s good post on this from three years ago:

https://househuntvictoria.ca/2020/10/15/does-a-suite-risk-capital-gains-tax-a-professional-perspective/

What I dont understand is why the police had not investigated this company years ago?

This Martel thing will turn out to be a classic Ponzi, the only thing the receiver has found so far is a bank account with a few hundred in it and a couple houses with massive mortgages.

A friend who was tracking this over the last couple years said the biggest month was 250mill in deals funded.

This has been going on for 10 years plus and the 8 to 20% interest that’s being thrown around is not annualized, the people I know that were in it were not going into a deal unless it was 3% a WEEK.

Just listened to a bit of the court hearing with one of the in house counsels at work. Looks like at least a significant chunk of $ is gone….. sucks for the investors.

Were you advertising 8% returns minimum? He’s advertising was actually fairly slick for the uneducated individual, $50k investment will almost double in 5 years at minimum.

58 million went into the account the last few months, current balance $279 dollars. When I was buying pre-sale condos for $200k that were renting for $1,150 people weren’t interested in such an investment. How does someone get people to invest millions with them and they literally don’t know where the money is going? I don’t get it.

ya but they might as well be, when is the last time someone got canned working in government for being lazy?

I wonder how many of them posts on here…. take out heloc and invest in this and then watch the rates get hiked and think immigration and ukarine refugees will save everything.

None of the managers are part of the union.

VicREanalyst, I have no worries about Marko. He has a very healthy portfolio in RE and stock market lol

One of the investor speakers…..”we are not wealthy people.” Shocking how much money there is in Victoria…wow.

Chat

Ohhh there is some good stuff in this court hearing

600sq.ft

How big is the unit Marko?

Yea, I agree. I am about to go into a cash flow negative purchase for the first time in my life later this year. I bought a $560k unit in one of the new dockside towers that will only rent for $2,300-2,400/month? Not ideal by any means but I am betting on inflation and lack of housing supply means in 5 years it will be renting for $2,600. In 10 years it will be renting for $3,000 and so on. At some point it will cross over to cash flow positive.

I think Marko bought this in the low 200k’s as presale.

OMG, $2,000 for a 520 sq/ft! But with today’s housing price and interest rate, $2000 would not cover the cost to own that unit in Victoria West unless you have huge down payment. Cash flow NEGATIVE…

We desperately need more affordable rental apartments!

For all you government union workers with time to kill, you can watch greg martel’s court appearance here LMAO.

https://teams.microsoft.com/l/meetup-join/19%3ameeting_NmRhNjcwMGEtZTZkYy00Njg4LWEyODEtOTcyNTRlNmQzMWE0%40thread.v2/0?context=%7b%22Tid%22%3a%2288c2f485-81c9-4402-a143-70d7ce08aec5%22%2c%22Oid%22%3a%224761383e-f7f3-4177-bfaa-fdb01cf0093c%22%7d

LMAO, ohhh what happen to can’t compare Victoria to the states? Pretty sure Marko was the only that had some agreement when I initially posted the rental peak while your were saying its seasonality or some other b.s. It’s ok though, I don’t got time to waste to find and quote posts from months ago like you 🙂

Same experience as Adam and Totoro recently, less demand but still found a great tenant @ $2,000 for a 520 sq/ft condo in Vic West. Last time I had way more inquiries; however, I was asking $1,700/month two years ago.

The only thing that prevented me listing at $2,200/month was the new Hudson building received occupancy when I put my unit up for rent and they had 200+ apartments to rent out.

The one thing that surprised me was I also rented out a room in my parents’ basement suite for $1,000 recently with solid demand. Reason this surprised me is I figured more owners would be renting out rooms in their homes to keep up with higher mortgage payments and as a result I figured out the room market would be flooded. Not the case.

We desperately need more apartment rental supply imo. That is the only thing that will stabilize rents especially with everyone getting 10-12% raises over the next few years.

Also, back to Patrick’s point from the previous thread. On these rental properties I am paying back sometimes 2011 mortgages with 2023 rent money so it isn’t really an issue to pay them off faster.

Yes, that was mainstream news in the USA financial networks since last September. USA rents peaked in August 2022. And have fallen about 4% since then, taking them back to May 2022 levels. Rents are still up 20% over the last 2 years in the USA, so most landlords are in good shape.

Sep 13 : Prices fell in 27 of the 40 cities tracked by the firm, signaling the recent price surge is broadly easing. “We’re seeing a complete reversal of market conditions in just 12 months,” one analyst said. https://www.businessinsider.com/rent-prices-fell-august-first-time-in-20-months-2022-9

Sep 26: Rents Drop For The First Time In Nearly Two Years As The Housing Market Cools https://www.forbes.com/sites/brendarichardson/2022/09/26/rents-drop-for-the-first-time-in-nearly-two-years-as-the-housing-market-cools/?sh=12ebd8025ed6

There seems to be less demand now than the height of the rental shortage, but this is also not an ideal time to be renting due to the higher than average numbers of units vacated by students.

We had no problem renting a unit recently. I think that even if there is less demand you are going to still have qualified applicants if you price at or slightly below market.

Rental prices might not escalate from here on out, which is a good thing imo, but they are not affordable and unlikely to drop much unless and until we have more units on the market.

Any weakness or decline in prices in the rental market probably shows in less than desirable properties first.

Anecdotally, we just re-rented our basement suite. We upped the price slightly, but still a couple hundred dollars below what I was seeing in the market. Not nearly as many inquiries as two years ago (78 then vs 23 now), and people were flaky and we were actually worried we wouldn’t find anyone. In the end we received only 3 applications compared to 10 two years ago. The suite is bright and large (1200sqft) with access to a backyard, two on-property parkings spots, in-suite laundry, lots of storage and newly painted with new floors throughout. It’s also soundproofed.

So far our new tenants are great but I did NOT see the demand that there was a couple years ago. Either my suite isn’t as nice as I think relative to the price or there was actually less demand – which is what I think is going on.

Yup, been calling the rental peak since October/Nov last year while some people on here keeps yapping immigration this, immigration that. Makes me wonder if some of these ppl are just Imaginary landlords.

Ciena,

Type “>” followed by a space followed by the text you want to quote.

Report finds mismanagement, risk to public funds at BC Housing under former CEO

https://www.timescolonist.com/local-news/report-finds-mismanagement-risk-to-public-funds-at-bc-housing-under-former-ceo-6970638

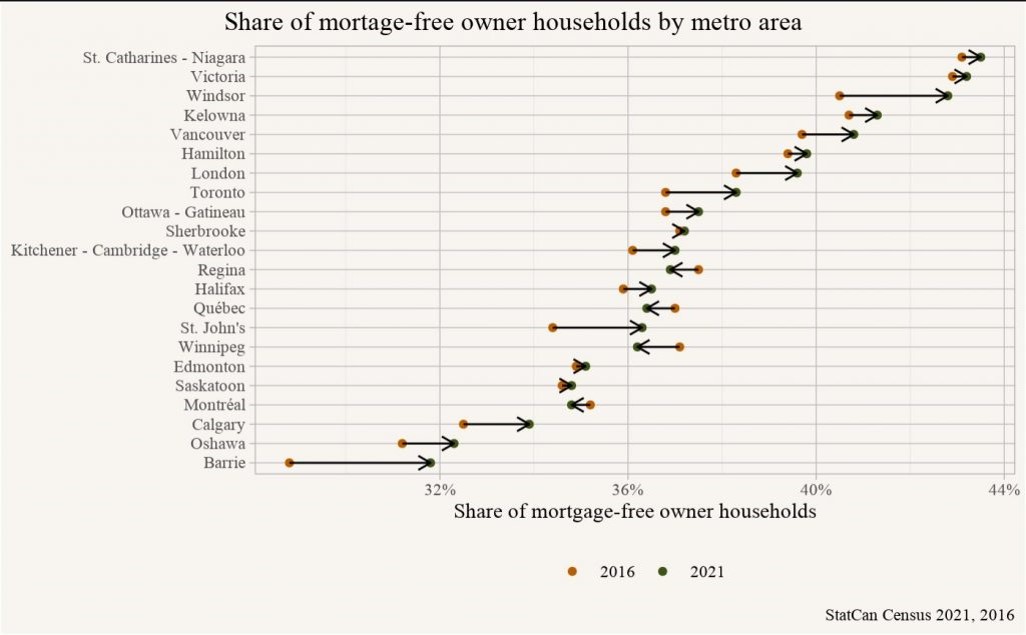

Victoria is nearly the oldest CMA in Canada. Kelowna and Niagara are also among the oldest. Older households are more likely to be mortgage free, everywhere.

What matters in markets is flow not stock. That is, it’s not how many properties are mortgage free, it’s how properties are being bought right now. As well for cash purchases, where that cash is coming from, e.g. selling a house somewhere else that is being bought with borrowed money. Is borrowed money the bottom rung on the ladder?

There you have it folks. It’s pointless to predict a drop of future housing price in Victoria, because houses are not bought with credit (or at least not a large amount) in this market, especially SFH.

Perhaps we should focus on analyzing the cause and effect to figure out a more predictable ascending rate of price in Victoria.

From: https://www.timescolonist.com/local-news/tenant-eviction-rulings-head-to-court-as-bcs-tougher-rules-and-higher-fines-take-hold-6966082

Some interesting stories in the article about eviction battles and compansation rulings from RTB and the resulting court challenges.

Victoria has nearly the most mortgage free households in Canada