April: New listings shortage gets critical

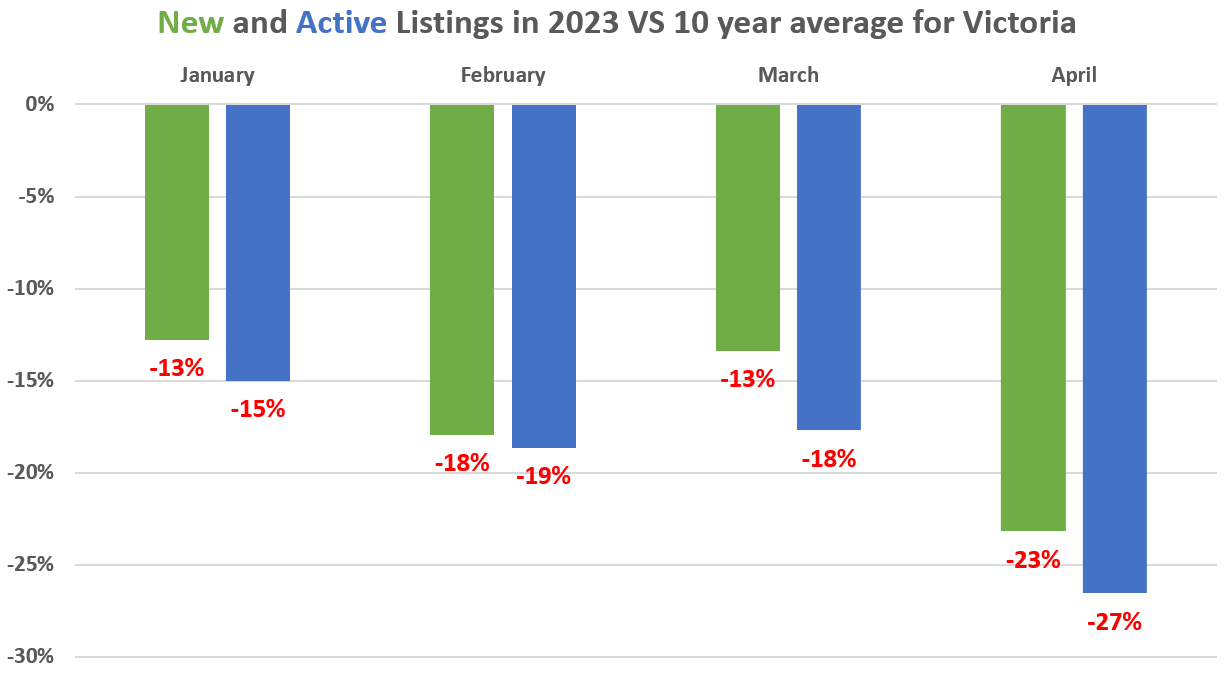

I’ve been banging on about the shortage of new listings for months, but in April things really got critical for the flow of supply on the market. That combined with a gradual return of demand to the market accelerated the trend driving the balance of the market towards sellers. New listings in April were down when usually we would expect them to grow by 5% from March. Compared to the 10 year average, the situation for both new and existing supply is deteriorating quickly.

The year started off at a standoff between the remaining buyers that hadn’t been sidelined by rising rates pitted against sellers that were reluctant to take anything below peak pricing. With April’s data, it appears that for now the sellers have won, with the listing strike driving continued improvement in market conditions on all measures and putting upward pressure on prices.

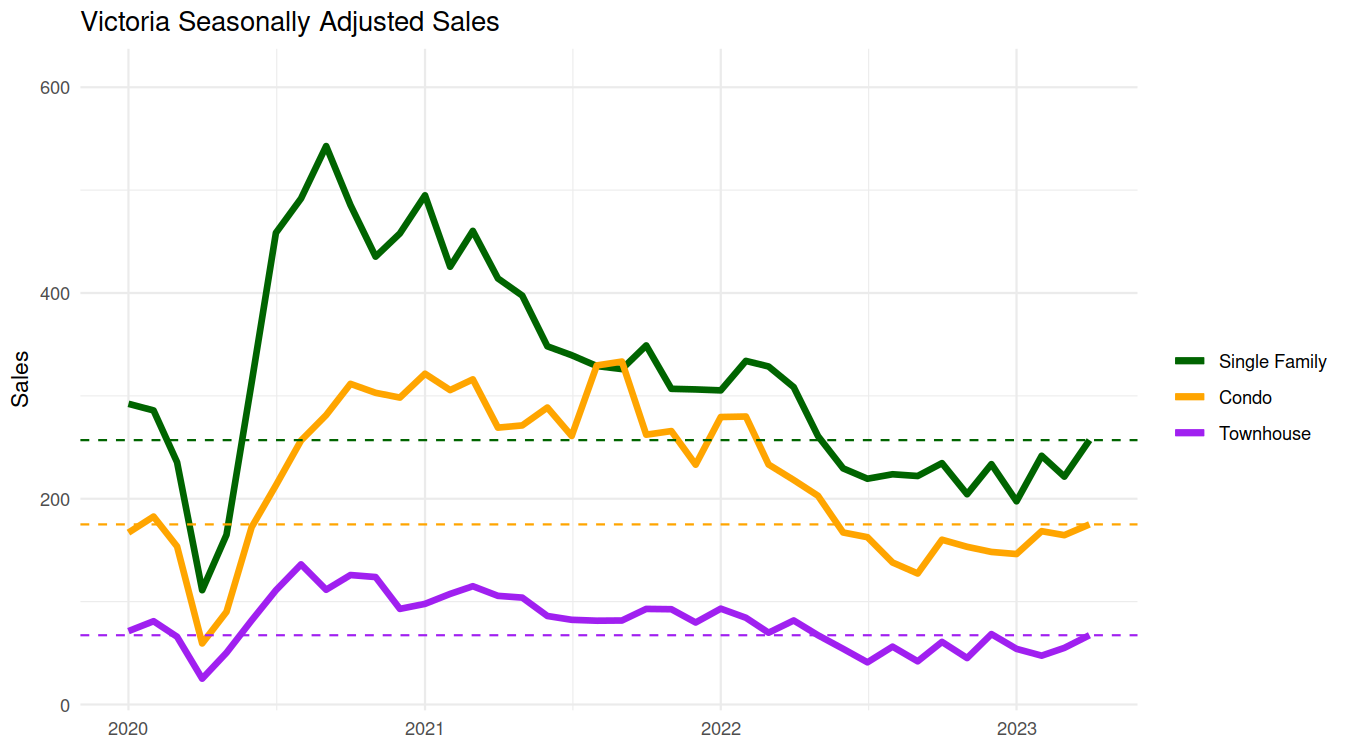

The new listings drought is the primary reason for the shift, but it’s also true that buyers are slowly returning to the market. While the rate of sales is still slow, with interest rate stability we are seeing a gradual return of buyers to the market across all property types.

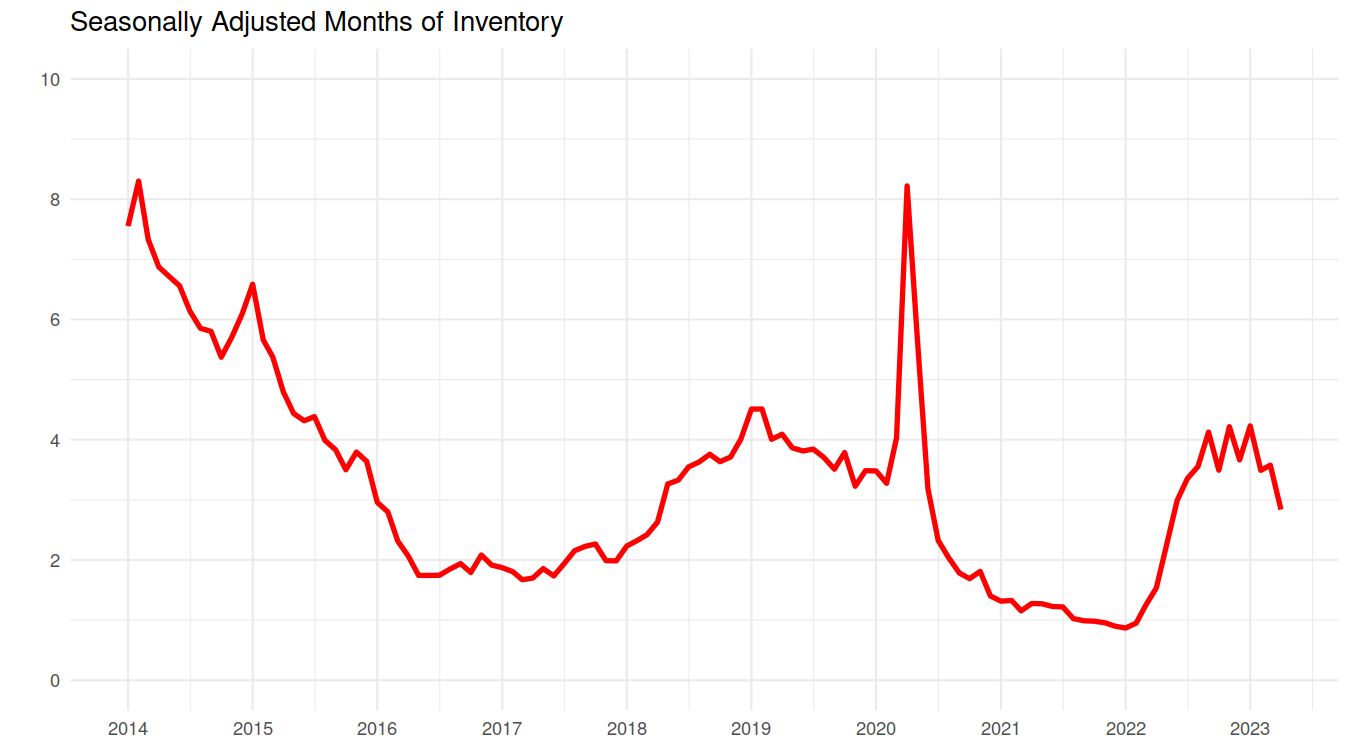

Last month I was surprised the seasonally adjusted inventory wasn’t dropping yet, and I chalked it up to the fact that seasonal adjustment algorithms have some trouble with endpoints in a time series. Sure enough, with the sharp decrease in new listings leading to a lesser than expected increase in active listings from March, the seasonally adjusted inventory trend has now turned around and is looking substantially negative.

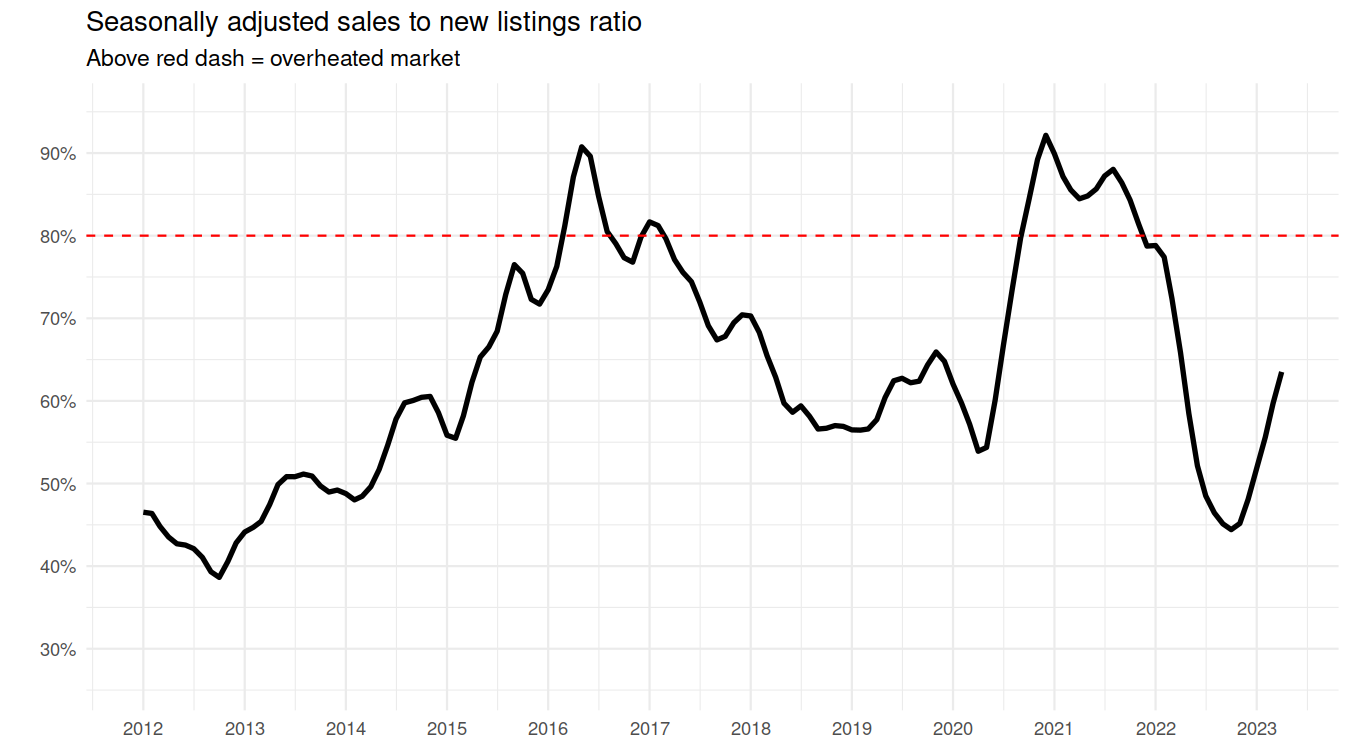

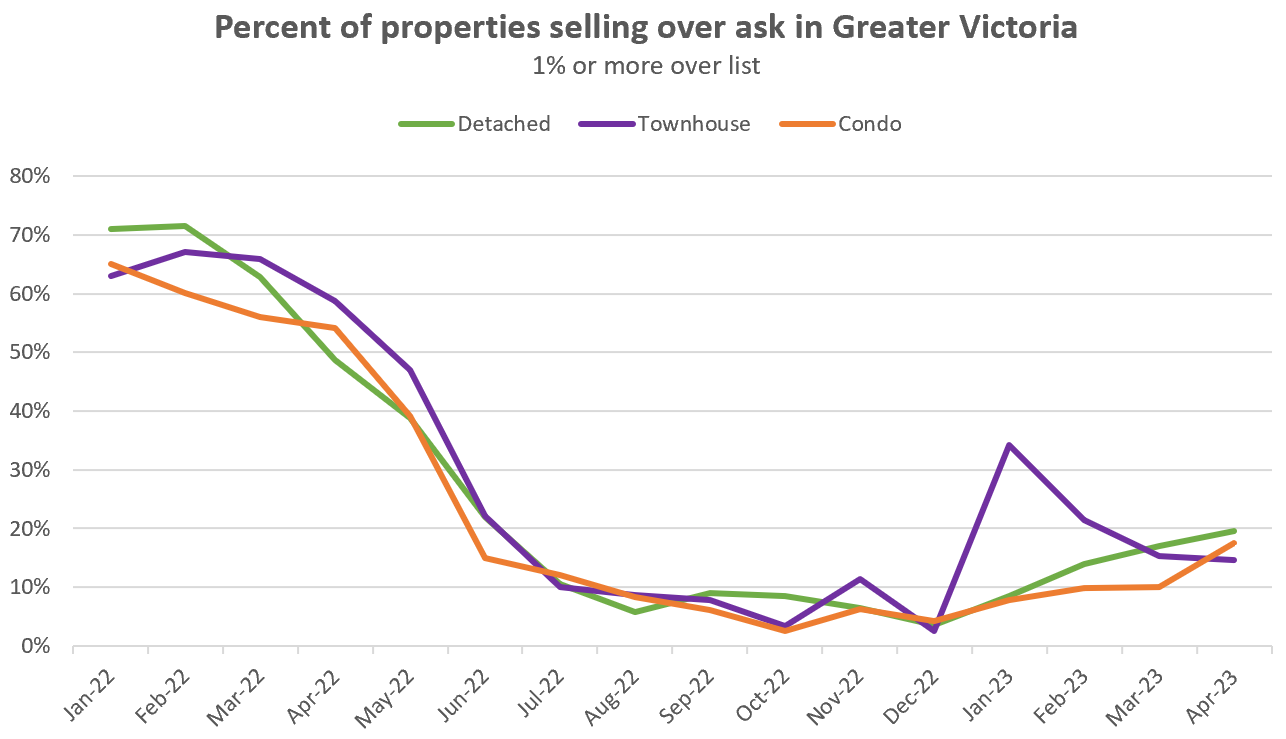

Market conditions have been tightening for some months, but again the situation in April turned more sharply towards sellers both when looking at months of inventory which fell, and sales to list ratio which rose. We’re still a long way from where we were before rates started rising, but the trend is unmistakeable.

Nearly one in five detached properties went for over the asking price in April. Again, a far cry from the levels of early 2022, but it’s another signal pointing to a market that is strong, even if not manic.

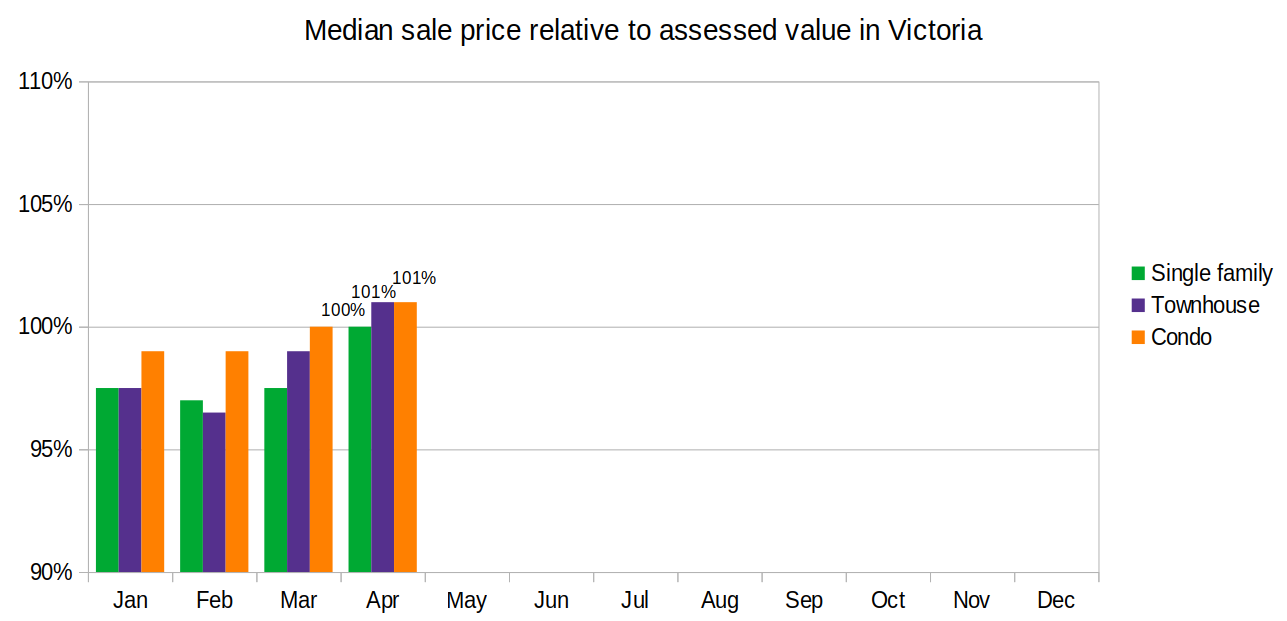

Prices continue to trend upwards since the fall, most strongly for detached properties, but all types are up since the end of last year.

April’s data on sales relative to assessed value confirmed the increase, with the median property of all types selling close to it’s assessed value, an increase of about 3 percent since the start of the year.

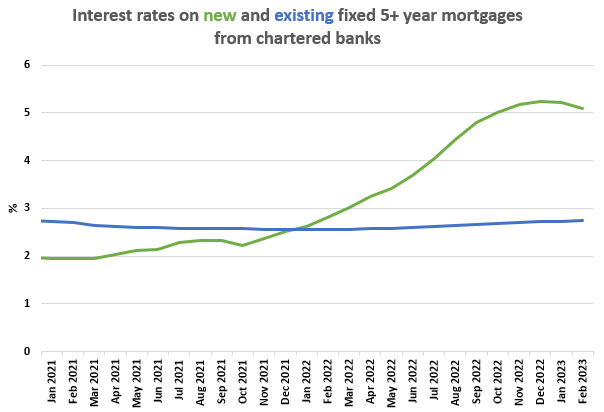

As we’ve been discussing since the peak of the market last year, the fall in prices we saw was highly unusual given we never had very high inventory or particularly poor market conditions. We never hit a traditional buyers’ market where we would expect prices to fall, but prices came down anyway because the shock of rising rates was so severe. With 6 months of effective rate stability that shock has now been absorbed by buyers and they are slowly returning to the market. At the same time, while the economy has definitely been slowing in response to higher rates, that has been absorbed by declining job vacancies rather than a rise in unemployment rates thus far. Meanwhile existing owners have mostly not had to face rising rates, partially by extended amortization variables and partially by low existing fixed rates.

Every month about $20 Billion of those fixed mortgages come up for renewal, costing Canadians an extra ~$40 million a month in interest at higher rates. Big numbers that are likely to accelerate in 2024 and 2025 as more of those super low rate fixed mortgages come up for renewal.

Will the Canadian consumer finally flinch under that additional load? Maybe, but when COVID hit I mentioned that despite the unknowns, our market was strongly positioned to absorb the shock. Again we have a lot of unknowns in front of us, but every month we fail to build inventory the market is building up defenses for the next shock, whenever it may arrive.

New post: https://househuntvictoria.ca/2023/05/08/has-the-rental-market-peaked/

Don’t quite yet have the hang of properly quoting commenters on here lol … someone please advise

“https://househuntvictoria.ca/2023/05/01/april-new-listings-shortage-gets-critical/#comment-101300”

Or people are just buying with equity. We have a lot of mortgage free households in Canada … 43% or more. Article is reporting 2016 but from other more recent articles it seems around 40-50% in BC.

https://www150.statcan.gc.ca/n1/pub/75-006-x/2019001/article/00012-eng.htm

“Debt driven”… Thats only first time buyers, and it’s always been the case. Canadian homeowners (in 2021) overall have 73% equity and 27% debt in their home. While 25% of home purchases are first time buyers, tho other 75% are resales, and those are going to be much closer to 73% equity and a smaller amount of debt. So most transactions are equity driven, not debt.

To illustrate how high 73% equity is, that is a $1 million house with $270k owing.

And if it “hawk chart”-crashes by 50% in price, it’s a $500k house with $270k owing. Which is 230/500= 46% equity – still a value that’s similar to many countries (both Australia and USA were below 50% in the last decade). !

Equity driven means debt driven. To realize that equity you have to sell, and the buyer has to borrow. Or if that buyer is also selling, their buyer has to borrow. Etc.

Or you’re just borrowing directly against equity to buy a second property.

I hate really big trees on urban residential lots and would not buy a house with one that could not be removed. They are a hazard for many reasons and often preclude other types of biodiverse plantings/gardens. Lots of other things you can do with your lot that are good for you and the wildlife/environment. Agree with them in parks/boulevards.

Leo,

Thanks!

By the way, Patrick, about your comments regarding competition between families with kids and families without. Yeah, we have three young boys (3, 5, 8), and so are in the market for SFH. Out of the core though. I’m sympathetic to what you’re getting at — if it wasn’t for kids we’d be good candidates for a condo — although

1.I don’t have a good sense of how much of a problem it is in practice.

2.Personally, I’m very cautious about additional measures to pump more money into the housing market, like the first-time home buyers initiative or the FHSA or some such. Those programs seem to make affordability worse and/or grant officials the right to pat themselves on the back for “doing something” while accomplishing nothing. (Think the first-time home buyers initiative which has had something like 300 people use it in Victoria/Vancouver/GTA.)

3.All that being said, given how much major Canadian markets are equity driven, if we’re not going to kneecap affordability back to the growth curve pre-COVID, then maybe what you suggest is the lesser of two evils. I defer to smarter people than me like Leo on such matters. 🙂

Rates started to really bite, and new listings were pretty good. Totally agree doesn’t look like we are building any inventory this month.

Noted…how did we add so much inventory during May last year? Can’t see inventory budging this May up or down.

I always use the closest week exactly a year ago.

In this case:

This is the way. I’ve moved completely away from logins so implementing blocks and such isn’t really possible. I prefer the super light weight guest post + remember your name approach

Honestly if you use something like GreasyMonkey or TamperMonkey (add ons in Firefox or Chrome) it’s literally one line:

window.jQuery(“.comment:contains(USERNAME)”).remove()

The only thing it doesn’t prevent is when people quote their stuff. If they include their name in the quote, then it works!

Curious, what number you using? 1,776 to 2,037 I am only get 14%.

I don’t know if people notice or not but almost every new development in greater Victoria the municipality forces the developer to give up a portion of their lot to pull the sidewalk off the road and to install a boulevard with grass/trees. Same thing with mine, I have to give 3.6 meters (12′) of the property to Colwood and I’ll have to pay for the bike lanes, sidewalks, etc.

As someone who likes to walk it is a much nicer experience walking 10-20 feet off the road with a greenspace inbetween versus right next to cars passing by.

This is what I am talking about -> https://goo.gl/maps/y2qsnwpMrWt2jiAc9

In 10-15 years those trees will be grown and it will look half decent.

Did anyone else think it was CLEAR that “the yard is literally grass” = “I’m trying to develop a SFH into a 42 unit rental building”?

I’ll take that as a “Yes, I flattened a bunch of trees to build my Central Saanich mansion.”

Don’t get me wrong, I understand the tree thing. It’s Singer’s shallow pond. The tree you can see is more emotionally salient than the 20 being cut down for sprawl far away.

Density and trees are not incompatible, it means prioritizing street trees, often over parking or wide roads. Vancouver’s west end is a good example of a green, dense neighbourhood. But it doesn’t happen by preserving each tree currently on a single family lot, it happens by planning for new trees.

$1.735M

You’re preventing trees from growing on your lawn, by constantly mowing them down as they start to grow. If you are a “tree lover”, show it, and let your lawn become a forest. Until then, sorry but you’re a hypocrite without the moral high ground to tell others what to do with their trees.

Instead, let’s be sensible about trees, and allow new housing developments that preserve some trees and plant new ones. To end up with a new neighborhood with some old trees and plenty of well-placed new trees.

This was out of our price range by a lot, but I’m curious what 831 melody sold for? (Willis Point is on our radar, but it has an extremely low rate of listings and sales and so all data is useful.)

“There were trees where my house is, but they deserved to die.” But most people buy houses that were built some time ago. So the moral problem is similar to eating meat where you can say – well that animal was dead already, I didn’t kill it and if I didn’t eat it someone else would. Or, you could focus on the trees that are still on the lots that people buy. I have a friend with a nice property that “loves trees” but keeps cutting the ones on her property down bc she’s afraid they might fall onto her house one day. Ummm….ok?!?! I myself have a gigantic cedar right next to my house that I preserve. Isn’t that enough to entitle me to complain about trees being cut down for new housing ( 😉 ) Or, perhaps us tree lovers can say – fine, cut them down if necessary – BUT you must replace all that greenery on that same lot. So maybe there would be many more green roofs or something.

I expected positive year over year sales this year, but not until later into the summer when we are comparing against weak months last year. May 2022 wasn’t that bad for sales, maybe at the 35% percentile or so. Might get to nearly average this May. Crazy!

Based on all the accepted offers this weekend (not yet reported as pending) I think we may end the month higher YOY in terms of sales. Certainly didn’t see that coming when we made predictions 5 months ago.

Lol…and when your house was built it was a desert right? Reading your posts has reached a waste of time equivalent to Whateveriwanttocallmyself so going forward I won’t be reading any of your posts either.

Leo…it would be a really useful tool if one could block comments from certain posters, it would save me a few seconds scrolling every day.

Sorry that I have a develoment and the “the yard is literally grass.” wasn’t clear enough for you that I wasn’t cutting down any trees.

meh, many of introvert’s neighbors probably have like 6 to 8 people living in a single house so I think over all that neighborhood isn’t that bad as it meets the eye in terms of density.

I understand you live in Vic West now, but were any trees harmed when you built your Central Saanich mansion?

Maybe you could have mentioned that it’s a 42-unit rental building a little earlier on in the conversation?

Kind of pertinent information, seeing as how 99.9% of the time “I have a development property” doesn’t mean “I’m building a 42-unit rental.”

Month to date activity:

Sales: 177 (equal to this week last year)

New lists: 292 (down 17%)

Inventory: 2037 (up 40%)

I am guessing that we must be down to the last ten thousand trees on the island.

I guess we’re just skipping the spring listings this year.

There were trees where my house is, but they deserved to die.

I think historically it was densely forested before the Douglas treaties. Maybe that was your point.

You have no shortage of complete non-sense arguments. Yes, I am in favour of density over clearcutting, that is well documented. How is me trying to develop a SFH into a 42 unit rental building on a transit route supporting clearcutting in the first place? I also literally wrote

What part did you miss about the yard literally being grass?

I live, along with 200 people, on 32,000 sq/ft. You live, along with 2 or 3 family members, on 8,000 sq/ft. Of course, you aren’t the problem. There were no trees in Gordon Head before your house was built.

Marko, you have no shortage of rationalizations. That’s for sure.

greed!

I always wonder what makes people not protect their hard earned money more. I tend to agree with Marko.

Someone missed their morning coffee.

“Wouldn’t an increased amortization decrease the monthly interest payment allowing more to be applied to the principal? I’m not sure. It could be a savvy financial move.

What in the world??? What a wild place HHV is…….”

It is Frank though.

Gant could never get into Wharton, I think he took a class from there that anyone can do if they pay. Only developer in town that I know who went to Wharton is Rob Jawl, he worked at goldman sachs and blackstone afterwards prior to coming back to take over the family business.

If you are going to be great at anything, probably good to accel in self promotion. That will only take you so far, until you show your incompetence to the world. Gant……..still putting himself out there as affiliated with Wharton??? M&A and Financial Management??? By all accounts he flunked out of that program having allegedly attended in 2008-2009 BEFORE he shit the bed with his lack of ability in Leage. A salesman pure and simple.

Same reason as why people get scammed on other get rich opportunities, they get greedy when they see something too good to be true.

Banks are better off the longer you have a loan with them, best scenario is if you keep paying the mortgage until death. As long as the LTV is acceptable to them they are good. For the consumer it’s obviously not good because instead of saving and enjoying retirement, you might be paying a mortgage instead.

nope, Gant is back in the game advising others with his knowledge. https://adamgant.com/

What in the world??? What a wild place HHV is…….

League – Gant should be in jail, period.

With respect to the comment about one posters prediction of 39% price correction, perhaps it would have been closer to reality had the banks’ normal principles remained intact. When has it ever been the case that banks allowed payments on VRMs to stay the same, extending AMs up to 30 and even 60/70 years plus in the face of rising rates to help out their clients? Irrelevant for the time being I guess, but what about on renewal. If the can is really being kicked down the road, is there something inevitable on the horizon? Or will this behavior of the banks be part of the new normal? Remember when Carney was the BOC man in charge? He was stern in his expectations of the people taking on debt to ensure they had the means to support their borrowings on the terms they signed up for. What happened, seriously.

Head guy of League had a 5 million dollar personal property in Central Saanich when all the company had done was raise money and buy random properties…how does that work? Then they wanted to pre-sell Colwood corners at the same price per square foot Bosa was selling the Bayview Promontory for at the time, LOL. Then when people started posting concerns about the company online right away they engaged lawyers to shut them down. Then they started building an insanely large underground parkade at Colwood corners and anyone with common sense would be like why isn’t the parkade being built in phases? You don’t sink 10s of millons underground. It was so obvious it is hard to feel bad for investors who lost $300 million.

If you gave anyone $300 million 2011-2014 to buy random properties in Victoria they would have been fine by 2016/2017.

+1, paid off two condos last year. TD took 26 days to process one payout and then charged me interest on those 26 days they dragged their feet (plus the three month’s interest of course).

My only worry about paying off mortgages is trying to aquire that debt again should an opportunity come up where I need funds.

Sure, but you’re making a prediction for 20 years in the future, as to whether they will have paid off their mortgage or not. You can’t extrapolate that from one data point. We’ve had fabulous economic growth and prosperity over the last 20 years -Canada is #7 of g20 countries gdp per capita. https://tradingeconomics.com/country-list/gdp-per-capita?continent=g20 , And that’s helped people to pay off mortgages early. If that continues, we’ll keep doing that.

btw) There were 40 year amortizations available prior to 2008, and that didn’t stop many of them from paying them off early.

Do the people against clear cutting have lawns and do they mow them? Don’t they realize if they stopped clearcutting their lawns every few weeks that a beautiful BC forest would grow back? How about they do that, and then they can shame others about clearcutting.

But they mean people can pay down more slowly. And not everyone is like you, or me. The numbers I’m seeing from the banks tell me that most people aren’t.

Uh no. If you’re paying off the principal more slowly – which is what increased amortization means – that means the principal owed at any given time is higher and you’re paying more interest.

Showed 7 properties earlier today, 10 yesterday, more earlier in the week and out of no where it is absolute chaos again in the 800k to 1.25 million segment. Unlike previous markets HUGE disconnect between condos and SFHs and luxury SFHs. Condos very slow, some of the around million SFHs I showed this weekend receiving upwards of 8 offers. Then as you approach $2 million slow again.

As there was a ton of overlapping bookings the last three days pretty much same story. I arrive with my clients (typically young couple), before us young couple leaving. During our showing the next buyers show up, young couple again.

Funny, foreign buyer ban didn’t do anything. Based on what I am seeing I don’t think an investor ban would do much in the SFH home market in Victoria at this point, condos different story. Simply too many young families that somehow qualify for $1 million +/- and not enough supply of SFHs.

Prices up >10% on SFHs since the rescission period went in January 3rd, 2023. Odd that people aren’t using the rescission period to back out of offers where they bid 100k over asking? Of wait, I wonder if it could have something to do with supply and demand. If they back out of their 100k over asking offer there is nothing else available. Funny how that works.

Wonder how much more non-sense will be introduced before there is finally a conclusion reached the we need more housing. Like not talk about more housing, actually more housing being built.

I don’t see what the problem is?

I’ve had an electrical vechile for 8 years. I’ve saved over 40k in gas. Almost no maintenance. I’ve would never in a million years buy an ICE, but I invest in shares of Embridge and profit from the dividends. I don’t currently own shares of Suncor but I have in the past and would again if I saw a good opportunity to profit of Alberta oil sands.

I personally think in Canada we get ripped on cellular plans and the government should do something about it, but it won’t, so I am happy to be profit from the oligopoly (that I am against) by receiving $800 every three months from Telus, $200 every three months from Rogers and that covers my cellphone bill plus some.

Do I think we should go up in the air (towers) versus clearcutting? Yes, I do. Does what I think change anything? Absolutely not so why wouldn’t I legally profit from clearcutting if I can? Me being pro-density, anti-clearcutting results in the exact same amount of clearcutting so why wouldn’t I profit? Living in a condo, which I do, is the only tangible thing I can do.

On a sidenote, as I noted the backyard of the property is grass (there is nothing to cut); however, if I did have to cut down trees I would have no issues doing so.

My fundamental frustration is the roadblocks to building housing and people complaining about cost of housing. The biologist and other consultants end up costing hundreds of thousands, delay projects years, and then people blame foreign buyers and AirBnb on the lack of affordable housing.

In 10 years when this rental is finally finished and I put the two-bedroom units up for rent for $5,000 per month as there is no inventory of housing everyone is going to be like wow….Marko he is such a greedy investor when the reason there is lack of housing is something that should have taken 2 years took 10 years (for everyone, not just my development).

I look at different data. Such as how much Canadians overall are paying in mortgage interest. Of course not everyone has a mortgage (e.g. renters indirectly pay their landlords mortgage) , but the comparison between years is valid. https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1110006501&pickMembers%5B0%5D=2.1&cubeTimeFrame.startMonth=10&cubeTimeFrame.startYear=2003&cubeTimeFrame.endMonth=10&cubeTimeFrame.endYear=2022&referencePeriods=20031001%2C20221001

Mortgage interest payments amount to only 4.5% of disposable income for Canadians in 2022. That’s up from 3.9% pre-pandemic 2019 Q4. This number has been low and stable, and in the 3-5% range for 30 years of recorded data. If Canadians could payoff their mortgages in 20 years in 2019 paying 3.9% of disposable income as mortgage interest (or 2007 when they were also paying 4.5%) , they can continue to do so in 2023. And they’ll have lots leftover to pay down mortgages and still spend 6% on restaurants and entertainment for example. This also helps explain why mortgage delinquencies remain at/near record lows, about 1 in 1,500 mortgages in Victoria are delinquent.

Taking a 30 year is a good option if you need to qualify for a slightly higher amount, and just for the flexibility. I would always opt for this and double up and lump sum as permitted if rates are high and incomes increase over time. It also provides more breathing room financially for future unknowns. Thirty year terms don’t mean people won’t pay down faster.

Wouldn’t an increased amortization decrease the monthly interest payment allowing more to be applied to the principal? I’m not sure. It could be a savvy financial move.

https://househuntvictoria.ca/2023/05/01/april-new-listings-shortage-gets-critical/#comment-101219

Hey Marko,

I wouldn’t consider yourself an unsophisticated investor, but it really shouldn’t take a sophisticated investor to filter out what may be a potential scam.

How on earth is is 15%-18% guaranteed on a “bridge loan”, with a ‘maybe’ opportunity for higher returns?? This in and of itself makes no sense.

The obvious questions to ask are:

Why is a bridge needed, and why are so many bridge loans coming up as opportunities??

Who in their right mind would pay 15-18% on a bridge when comparable private offerings are significantly cheaper?

Who is the borrower?

Where is the property? PID?

What is the LTV?

Are supporting documents available to confirm a transaction is taking place?

Can we see the registered mortgage charge on title?

As a comparable, if a large >$1M investor wanted this info from known/well recognized private lender Fisgard, I’m sure they would be happy to oblige to satisfy the investor’s diligence.

I really hope for everyone’s sake this isn’t a ponzi, but if this does turn out to be the case I’m not sure everyone involved can say they exercised an appropriate level of diligence.

Such interesting perspective, directly contradictory to the mortgage amortization in excess of 30 years stats provided by the banks themselves.

Most Canadians opt for Bi-monthly payments. That’s 13 payments rather than 12 payments per year. That alone knocks off a couple of years of the mortgage.

I expect that Canadians will continue to payoff mortgages in under twenty years, probably pay them off FASTER

For two reasons:

—-1. Inflation means mortgage payment falls FASTER relative to income. Periods of higher rates occur during inflation and rising wages. Since the mortgage payment stays level (assuming rates stay level), they have excess money to pay down their mortgage. A $5,000 mortgage payment may seem like a lot, and be 30% of their $200k income. But in 10 years, their income risen by inflation may be $300k, and they can more easily pay that $5,000 and throw $2,500 more at it to be at 30%% of their income. So they’ll pay it off faster.

—- 2. When rates are high, paying down a mortgage becomes a SMARTER use of money that investing it.. When rates were low, there were HHV discussions about what to do with excess money. The people that said “pay off your mortgage” got laughed at by many. One guy told us he couldn’t sleep at night unless he was INCREASING his mortgage debt to invest in stocks. And how all his clients were doing that. When rates rose, that guy had a few “sleepless nights” after all, and completely bailed on that idea, and started paying down his mortgage.

and

Hi Marko. So you’re against clearcutting, but not against profiting from clearcutting?

And when government wants a biologist to check what animals might be affected by clearcutting (which you’re against), you’re against that too?

Are you sure this is a scam and not a case of investors not knowing what they got themselves into?

Depends on where the risk free rate is, there were 5 year GIC’s close to 6% being offered by National Bank 3 -4 months ago. Problem with league was a combination of lack of experience and shitty timing. Had they been able to hobble along for another year or two and caught the RE upswing in 2016/2017 they would have been fine.

A bridge loan is a temporary financing option. It is designed to help homeowners “bridge” the gap between the sale of an existing home and the purchase of a new one. You can use the equity in your current home for the down payment on your next property while you wait for your home to sell.

Bridge loan terms are typically six months but can range from 90 days to 12 months or longer. To qualify for a bridge loan, a firm sale agreement must be in place on your existing home.

This type of financing is most common in hot real estate markets where bidding wars are the norm. They work when you need to make a quick decision about your dream home without worrying if your existing home has sold. When you do sell, you can use the proceeds to pay off the bridge loan and any interest.

Generally, regulated lenders can not offer a bridge loan unless there is a firm sale agreement on the purchaser’s existing place.

So what happens if the purchaser does NOT have a firm sale agreement on their existing home?

Then they will have to obtain financing from a private lender for the interim period at a high interest rate. According to the exact meaning this financing is not a bridge loan. As the purchaser, without a firm sale agreement, actually owns two homes and would not qualify with a traditional lender as the debt ratio would be too high.

Past research from Mortgage Professionals Canada indicates that the average Canadian has paid off a mortgage in less than 20 years.

That’s better. And that’s largely because… a 40 year secular decline in interest rates makes it easy to pay off your mortgage ahead of schedule just by keeping up the original payments. Been there, done that.

But that’s history.

There will always be scams. People are greedy as **** (want unrealistic returns) and have zero common sense. Just in Victoria alone there was Ian Thow then there was League Assets (https://vancouversun.com/business/your%20money/victorias-league-assets-group-crashes-leaving-investors-to-absorb-more-than-300-million-in-losses), etc, etc.

This is a key point Leo made

I am guessing a lot of this invested money being must be inherited or something as I can’t see someone that had to start from $0 beyond this stupid. Anything beyond 6% there is large risk or it is a scam, how people fall for it and have the capacity to invest 6 or 7 figures is beyond me. You would literally have to be a complete moron to invest into something in excess of 8% without some insane due diligence. Like I would want to know exactly what SPECIFIC property I am lending on, a detailed financial situation/networth of the borrower, complete due diligence of all charges on title/my own charge on title re mortgage/and like 10 other things.

I won’t mention any names but I was approached by someone at League Assets into investing in Colwood Corners/buying pre-sales/whatever and I asked sure, but given you aren’t Bosa and I don’t have a track record of anything show me your books and if I am happy with the books I’ll invest….”we can’t do that….” lol, yea obviously. Investors lost $300 million a year later.

I wouldn’t consider myself intelligent, but just with common sense a year before League went under I saw it coming it was so obvious.

People don’t want to hear the reality of being successful via investing. You buy a quality dividend paying stock and the see the results in 20 or 30 years. Same with real estate. You buy a quality rental property and in 25 years you see the results.

In light of this Greg Martel news think are there other mortgage brokers or MICs that are running similar scam?

Interesting:

Are millions of home owners now taking over 30 years to pay off their mortgage? Not exactly

https://docdro.id/ZxNrupM

https://www.theglobeandmail.com/investing/personal-finance/household-finances/article-mortgage-amortization-interest-rates/

Can someone please share how much 2690 Arbutus Road sold for?

Sounds like we’ll colonize Mars faster.

Premier David Eby’s Housing Supply Act, which will take effect later this year, will set housing targets for municipalities, reinforced through a carrot and stick approach. The carrot for municipalities that meet those targets include provincial cash for amenities such as parks, bike lanes and recreation centres. The stick will be that the B.C. government can overrule local governments and rezone entire neighbourhoods to create more density.

What isn’t known is if such a development (s) will be financially feasible. David Eby’s Housing Supply Act is making the following first point achievable. Point 2 is up to the market place. If the development (s) are not financially feasible then they won’t get built.

Point #1: Criteria to consider in an H&BU analysis include first both tests of legal permissibility and physical possibility. Only when there is reasonable probability that the H&BU is legally permissible and physically possible can analyses continue.

Point #2: The test of financial feasibility must be supportable by an analysis of market demand for the proposed land use. If the net revenue is deemed to be sufficient to satisfy the required market return on the investment and provide a requisite return on the land, the use is financially feasible.

As an example if the cost of the land and improvements to build a four-plex is $3,000,000 but the Market Value is $2,500,000 upon completion then the development (s) won’t get built.

In order to meet the test of financially feasible, the developer can not do much about their construction costs, the developer has to get the land cheaper. This often means purchasing existing older houses on busy streets. And that’s a conflicting circumstance when it comes to developing residential. As newly constructed homes that front along busy streets also tend to sell for less.

Or they can land bank older homes until the development becomes financially feasible which could result in the development not proceeding for years into the future.

That’s the CMA population, which includes Kelowna, West Kelowna, Westbank, Lake Country (Winfield etc.) and Peachland.

Guess somebody likes living there, having been there just a year ago I wouldn’t. A friend of mine from school retired to Vernon and said he wouldn’t consider Kelowna. We both grew up in the Southern Interior.

My friend is in from Kelowna, he moved there Feb. 2020. He mentioned they are getting lots ready in his neighbourhood. $1 million per lot.

Great insights, totoro.

And while you weren’t looking another city has surpassed Victoria.

Kelowna, and with it the Central Okanagan, has the fastest-growing population in Canada, posting a 14 per cent increase from 2021 to 2026, according to Statistics Canada.

With 224,000 people, the city of Kelowna has twice the population of Nanaimo, Kamloops or Prince George as the second-largest B.C. city outside of the Lower Mainland.

The broader Thompson-Okanagan region is currently growing at about 1.6 per cent per year, hitting 620,000 in 2021 and adding roughly 10,000 new residents annually.

I know this market well and enjoy the town at certain times of year, but prices are not that much of a discount from Victoria now as they doubled over the pandemic. North of Victoria is now less expensive than Penticton.

There is also not much buildable land left as there are huge lakes north and south and mountains which are not insurable for fire service coverage as they are high risk and outside of city limits, or Indian reserve lands, to the west and east. Forest fire smoke every summer to contend with as well.

My guess is that the spec and vacancy tax will be extended to Penticton soon.

CMHC reports there was zero new missing middle housing (townhomes, duplexes, etc) in six CRD municipalities in 2022.

The municipalities are Central Saanich, Saanich, Oak Bay, North Saanich, Metchosin, and Highlands.

There were only 6 new units built in View Royal.

As usual, 42% of the 481 missing middle total was in Langford.

New housing in Central Saanich totaled only 39, North Saanich – 27 and Oak Bay – 27. Much of Oak Bay’s new housing are replacement homes on existing lots, not new supply.

Greater Victoria’s largest municipality Saanich has been in a new housing decline since 2017 when 625 new homes were built. In 2022, there were 338 new homes – a reduction of 46%. However, they continue to post big surpluses from permit fees charged on the cost of construction, not the actual inspection work.

The BC government’s promise to improve housing affordability will require reining in these costs, improving lengthy rezoning processes, and mandating missing middle density for municipalities. So far, the province has been reluctant to impose substantive changes on municipalities

I definitely would not want a 4-6 plex built next to my house in the Henderson area. Most houses are one level with walkout basements and good sized lots. Suddenly having 6 families living next door with all their vehicles and traffic and noise would piss me off. Along with everyone else in the neighbourhood. I guess I’m a NIMBY.

The missing middle initiative allowing 4 or 5 suites on a lot would be ideal for REITs to develop as either rentals or individual multi-family co-operatively owned suites. As they can finance by selling shares to investors with a syndicated mortgage. Creative financing is the key to REITs as you can front end load a good percentage of the construction to pre-construction soft costs. Essentially taking the profits at the beginning and not at completion. That takes a lot out of the risk out of building for the developer.

Depending on the sophistication of the investor it would be prudent for the less sophisticated investor to educate themselves as to the difference between Share Value and Market Value of the property.

I am definitely not a intelligent or sophisticated investor, but I’ve done ok using common sense picking my own stocks over the years. I know Telus pays me 5% per year, everyone is glued to their phones, out of 500,000 immigrants 499,999 will get a plan with data and only three companies, etc. Same for the other 12 or so individual stock I own. Enbridge pays my 6.6% dividend looks to be safe. CNR people will continue to consume like crazy and crap needs to be shipped. QSR (tim hortons) people need their coffee.

Patrick- Quit making sense and suggesting rational solutions. You’ll never make it in government.

The whole Greg Martel bridge loan ponzi scam is going to be huge, my guess 500mill plus.

I have a few friends that are owed 3 million collectively and I’ve been warning them for about 7 years, a couple have their original investment out.

They were all making 2-3% a week, last I heard he had 2200 investors and the 11 lawsuits are only 11 of them.

They have been trying to get their money out the last few months.

You’re still investing in individual stocks Marko? That’s very ‘last decade’ for someone known for reason and contemporary nous. Here in the 21st century all you need is VGRO or VBAL and if you have a hankering for property exposure buy a REIT. In 40 years of property ownership my REIT has never ONCE phoned me at 11:00 pm to tell me that the toilet is leaking.

Kristan, One of the problems is that households with no children are competing with families with children. You’ve mentioned that you have kids. You’re competing against a similar income household to you that has no kids. They can afford to spend more on housing and outbid you.

Government should target their housing incentives to families with children, perhaps getting them better buyer incentives, lower property taxes, and higher renter rebates.

These may seem like obvious ideas. Yet I can’t find ideas like this from advocacy groups like homes for living https://www.homesforliving.ca/ They advocate for bigger homes and more density. But that doesn’t help a household with kids to outbid a household with no kids. A 3 bedroom unit might just get bought or rented by a single rich businessman wanting a home office and exercise room, out bidding a family with four kids. That’s a big part of the problem.

Penticton opens the door to growth touting lower-cost housing and lifestyle choices

https://docdro.id/NXyNiQV

https://www.theglobeandmail.com/real-estate/vancouver/article-penticton-opens-the-door-to-growth-touting-lower-cost-housing-and/

https://www.reddit.com/r/SYOMLegalAction/comments/137teaw/rsyomlegalaction_lounge/

Wow, a lot of people impacted by this. People commenting they have >$1 million owned…..hard to believe people have that kind of cash sitting around to invest. I didn’t know people in invested in things other than Fortis and Telus stock and 1-one bedroom pre-sale condos to rent out 🙂

Ontario woman, 39, moved 3,400 kilometres to northern B.C. for a government job and bought two houses: ‘It was a huge move’

Sounds like Valemount or the vicinity. Do note their house was bought 6 years ago, I doubt even that neck of the woods is still so affordable.

Cornwall is a lot more expensive than that. I also have a general problem with “average home price”, since a “home” could be a house, condo, or just a trailer. Not that I think these towns would have a lot of condos.

https://www.realtor.ca/map#ZoomLevel=13&Center=45.037812%2C-74.732040&LatitudeMax=45.08110&LongitudeMax=-74.59462&LatitudeMin=44.99449&LongitudeMin=-74.86945&Sort=6-D&PGeoIds=g30_f24b5nt2&GeoName=Cornwall%2C%20ON&PropertyTypeGroupID=1&PropertySearchTypeId=0&TransactionTypeId=2&Currency=CAD

Well that’s pretty much the point. Households without children are outbidding families for SFH. It’s not about a shortage of SFH relative to the number of families per se, it’s more about inequality.

Yes, most immigrants (and most Canadians) could never afford to live in Vancouver, Toronto, or Victoria. However, they still put pressure on the other markets causing those prices to escalate. This allows more established Canadians to scrape up enough cash to get a decent condo at least. I’ve mentioned before how many Canadians own cottages and/or condos in warmer places. Sell all three and you’ve got the money to buy something in Victoria or up Island.

10 Best Canadian cities for Housing Affordability and Job Growth (average home price)

Sept-Îles, Quebec, $204,042

Bécancour, Quebec, $206,748

Quesnel, British Columbia, $209,133

Cornwall, Ontario, $211,715

Timmins, Ontario, $212,922

Saint-Georges, Quebec, $219,124

Rimouski, Quebec, $227,673

Sault Ste. Marie, Ontario, $238,013

Rouyn-Noranda, Quebec, $240,191

Sainte-Marie, Quebec, $243,980

That’s my point exactly. Everyone is now acting like they knew all along prices would be this resilient when in December only 3 made such prediction.

Greg martel is too busy trying to run a turo knockoff in California called carshair. Why anyone would invest with him is a mystery.

Immigrants can afford housing in most cities in Canada. If they can’t afford Vancouver, Toronto or Victoria, instead of “not coming to Canada”, they can just choose a different city. My family emigrated to Canada many years ago, and they didn’t pick one of those three cities.

Victoria mortgage company Shop Your Own Mortgage going under https://www.cheknews.ca/victoria-mortgage-company-put-in-receivership-amid-flurry-of-lawsuits-1151378/

I remember a guy from VV talking about how he invested in private mortgages at like 10-20% rates and claimed there was no risk. LOL

By now, most or the readers of this blog should realize there is an affordability problem in single family housing. But what is likely to happen to the condo market?

The higher interest rates are going to have an effect on those that purchased condos as an investment to pay their bills. Landlords will be motivated to sell their rental stock as the rents won’t cover the higher expenses at renewal time.

And as for immigration…

CIBC economist Benjamin Tal said

“We take for granted the fact that the immigrants will arrive, but if they cannot afford to live in Toronto, Vancouver and many other cities because rent is rising and the price of homes rising, they will not come,” he said.

How this will effect condominium prices is unclear as we don’t know how many mom and pop investors will choose to sell. Condo prices could just stabilize while the months of inventory and average days-on-market increases. Or what happened to the condo market in American coastal cities in 2008 when there was a glut of condos for sale.

We will have to wait for the tide to go out to see how many people have been swimming naked.

Yes.

However a family earning 90k a year qualifies for a mortgage of about 375k (plus 15k CMHC insurance fee) currently without student loans/car payments/debt of any kind.

Whether you are talking about a house, a townhouse, or a condo, they are not going to buy something that works for a child without a very significant down payment. Hard to save a significant down payment with incomes in this range and median rental prices where they are. So external financial assistance or equity from a previous home is required imo.

Legitimate LMAO

The key is to just do it. Start that project, fight through the obstacles and reap the benefits. Might not work every time but at least you tried. That’s the only way to be successful. Hesitation is a killer, and gets you nowhere.

Frustrated, not burned. Last project COV delayed by a year approximately including the famous side walk to nowhere….well in that year of delays the market value of the final product increased by $250,000 so financially it worked out really well.

Not the first time that has happened, also benefited approx $250,000 due to COV delays on a project in 2016/2017 during that market run up.

The consumer gets burned, the builders/developers are just frustrated. Am I frustrated how things are moving along on my rezoning in Colwood? Yes. Can’t ignore the fact that the property has doubled in value and when the final product is finally built there will be such a supply crunch that it will rent for way more than initialled planned.

You’ve been burned so many times, and yet you still choose to touch the hot stove.

The fact is, if you are a “doer,” the West Coast is not for you. You will be thwarted. You will be sad. And mad.

That’s why I plan to never “do” anything — and will only buy what others have already done. Far less sadness. Far less madness.

VicRE, have you forgotten that many of us posted numeric predictions, and this was in December, right in the middle of your time period where you ask “where were you in November – January” post

Here’s a sampling of the posted predictions on the comment thread from end of December.

So you can see that for SFH only three people were bullish, and the rest bearish.

Of course VicRE you were very bearish at a drop of -17%.

And VicRE, the posters that you often ridicule with a “LMAO” reply are these boomers—> (Frank, Barrister, Patrick) and they are the only ones bullish for 2023 SFH prices on this list. Who knows where we end up at Dec 2023, but looks like so far in 2023, the bullish call has been correct (SFH is +3% so far in 2023 in Leo’s price to assessment chart)

=== Prediction for SFH at Dec 31, 2023, compared to 2022 Q4 median of $1,060k === (the $,1060k median was the 2022 year-end estimate provided by Leo in the article, and all of the predictions were comments to the article here https://househuntvictoria.ca/2022/12/27/2023-predictions/ note this list is from scanning the posted predictions, and it isn’t complete.

==== Bulls ===

Frank +18% ( 18% above 2022 SFH median of $1,060k ) = $1,250k (prediction for SFH median Dec 2023)

Barrister +13% $1,200k

Patrick +4% $1,100k

=== 2022 median was $1,060k (as posted by Leo’s article – link above ====

== Bears ====

Leo -6% $999k

Alexandra -7% $985k

( median HHVer prediction for 2023 = -9% $960k )

Marko -9% $960k

Duran -9% $960k

Caveat -10% $950k

VicRE -17% $875K

Umm..really -20% $850k

Rodger -20% $850k

Debt Monster -39% $650k. <——- Hey Debt Monster, don’t be shy, how’s this -39% prediction for SFH 2023 looking so far????

That’s hilarious, don’t stop. I can’t imagine what the report for my cottage would look like. That is beyond ridiculous. But hey, what else would a government biologist do? Count sheep.

Want the pages of incidental observations?

INCIDENTAL OBSERVATIONS

A black-tailed deer (Odocoileus hemonionus ssp. columbiana) was observed on the

property; the majority of the deer sign was north half of the Site. Multiple grey squirrels

were observed. Raccoon (Procyon lotor) scat was also observed in this area

Marko- Can you post a couple pages from that biologist’s report, I’d like to read the nonsense they created. Probably produced by Ai in 10 seconds. The level of control the government wants to lord over us is getting obnoxious. Housing will never meet demand or be affordable except for the top 10%, or higher. What are the prospects for the next 10 years? Double? Triple?

And 15 years ago I remember we torn down a house by calling an excavator that came two days later to tear down the house. Now you have to test the crap out of every singe material, hand deconstruct it, and the landfill won’t take it soon enough so you’ll have to pay for shipping to Alberta. I didn’t mention the year long wait for a permit and all the other non-sense just as the owner-builder exam.

I have a development property on Sooke Rd and just the biologist report is 54 pages and that is one out of 10+ consultants. The yard is literally grass. I don’t see things going for 12 consultants to 8 in the next 10-20 years but rather 12 consultants to 24 and then everyone is going to be shocked why housing supply is constrained.

Don’t hold your breath

VicRE,

I made the call prior to the fact by purchasing multiple properties. As did many others. Although I don’t comment often here, I’ve been consistent in my stances.

Patriotz,

So if 38% of homes are SFH, with the assumption that the majority of high income earners in Canada want to own a SFH rather than another property type, a 50th percentile income is priced out. That doesn’t even factor in that in Victoria itself the percentage of SFH is only around 13%.

How soon we forget.

So where was all this confidence talk back in November to Jan?? Everyone can make calls after the fact, it’s pointless.

Barrister that is a really nice place on Joan for just 2.5 million.

SFH still represent 38% of all dwellings in Victoria CMA. That is about the same % of households excluding singles and childless couples. It’s not simply a matter of too few SFH relative to the number of families.

https://www12.statcan.gc.ca/census-recensement/2021/as-sa/fogs-spg/page.cfm?lang=E&topic=3&dguid=2021S0503935

SomeGuy, they probable have the expectation since until recently SFH were available for middle income earners. In my dads generation SFH were available to lower skilled blue collar workers.

Totoro,

You say that the median income in BC can’t afford “housing”, but seem to be referring to SFH pricing. Just based on the number of SFH available and our population we can see that a family with median income should not have the expectation of owning a SFH in the city (without external financial assistance).

People in Canada seem to, for a variety of reasons, have the expectation that a SFH should be available to median income earners. Outside of the US, this is not the reality for highly developed countries.

My real life experience is buying what we could afford in 2015 on an ~$80k family income, putting some sweat equity into it, letting wage increases, promotions and inflation do their thing, and building enough equity to buy an SFD. Similar to what you described.

No massive mortgage, and done with a modest family income.

From: https://financialpost.com/news/economy/jobs-beat-signals-higher-interest-rates-longer

Let’s get that June interest rate bump.

Meh, even after the Great Recession, there weren’t many layoffs in the public sector…and that was in the Harper/Campbell era. My guess is that there will be a hiring freeze at some point and downsizing through attrition. Just like last time.

I personally would prefer more density and less clear cutting. Yes, density makes places more attractive and worsens affordability.

Just like housing, a lot of lip service.

A lot of Gen Z’s will end up in the median income band even with a university education, which makes home ownership here a struggle. And half will be below this mark. And I also don’t believe that affordability will improve much.

Parents, with accumulated home equity, are going to need to consider multi-gen housing/ co-ownership/cosigning if they want to have their children and any grandchildren to be able to stay here.

And Marko’s examples ring true. Once a FTB gets in the market they start accumulating equity that can be used to move up later on. It is getting in that is key and not getting in that creates a compounding problem as appreciation outpaces gains in income.

If affordability will be shit irrespective of what we do, I’d opt for the less building, less density, less busyness, less noisiness, less hectic path for Victoria.

Some DND folks are looking at a near 10k loss from the removal of the PLD benefit (might need more rentals because a few depended on it to make mortgages). The accompanying pay raise they will be getting won’t make of the difference for those once in the home buying pay bands. As for the other FEDs, there’s already chatter on the expected staff reductions to meet deficit reduction goals and that will likely be starting with those hired during the pandemic.

I have family members in their 20s here who are building their careers and finding it tough-going housing-wise.

Even so, I don’t think the solution is to build the crap out of Victoria. We’ll just end up becoming a mini-Vancouver and housing will — surprise, surprise! — not be any more affordable.

A ton of my buyers are government or government related employment so it does change the situtation in my opinion maybe not today but long term it does.

Also, it isn’t just the raises on paper. For example, I have a close friend that works for the feds in Victoria and his department is opening a regional office downtown Victoria he claims there is absolutely zero need for. As a result of the new positions and shuffling of positions he went from a 90s salary well into the 6 figures.

The number of people increases. I keep on renting my places in Vic West to military folks. I don’t know the numbers but I am guessing in the last 5 – 10 – 15 – 20 year the number of people working at the base just keeps on increasing likely at a much higher rate than housing being built. I can see the incomes on the applications and the applicants can defintively afford the $2k/month I am asking for a 1 bedroom and after the 10-11-12% raises work their way through the system they will be able to afford $2,200/month.

Majority of the government workers I know have lived here a long time and already own a house. Don’t know how the raises change that situation.

Unfortunately, this is the reality people don’t want to hear. The vast majority of my transactions involve VIHA/BC Ferries/Military/BC Government/BCI (some very solid salaries at BCI)/UVIC/etc.,

and everyone is getting raises. There is a lot of demand fueled by the government from my personal observations.

Two nurses with a tad of overtime can still go buy a nice $899+GST home in the new phase of Royal Bay. Unaffordability is bad, but it is still achievable if you make it a goal. South Oak Bay is reserved for two doctors and in 20 years it will be reserved for two high paying specialist doctors + family wealth on top of that.

This is why I’ve become super bullish on real estate long term in the last few years. In my opinion, other than lip service there is little tangible effort being made to increase supply. Population keeps growing, government just keeps on hiring and expanding, throw in inflation. It is a receipt for higher rents and higher market value.

The good news is that the baby boomers are now dying as fast as they are retiring. The trend should accelerate over the next few years. These should start to free up more housing. The bad news is the immigration rate will more than make up these numbers.

My real life experiences are more along the lines of I helped a client buy a duplex in 2013 for $500,000. We sold it earlier this year for $1,000,000 so I am assuming $700 to 800k in equity. Purchased a SFH home subsequently for $1,300,000. Another one was townhome bought around 400ish 10 years ago, nearly paid off, sold for $930ish, and bought SFH for $1,340,000 so younger couple (under 40 yrs old) with typical government jobs (policy anaylst, etc.) buying a $1,340,000 with a relatively small mortgage.

I’ve had a couple 1st time buyers (dual income professionals) this year buy in the $1 to $1.5 million range but pretty much it is all moving up with equity in previous property.

I am not seeing at ton of people take on massive mortgages.

Regarding higher salaries, has this not always been the case? I remember when I graduated with my Respiratory Therapy Diploma RTs made $8/hr more in Alberta + better weekend/night shift differentials and this was back in 2007.

What I am getting at is does it make sense to use these differences between the two provinces to explain Calgary hitting an all time high in prices when the same differences were in place at 2% interest rates and 5% interest rates.

The median family income here is about 90k pre-tax. Households that can afford 5k/month for a mortgage are in the minority. Pointing to outliers doesn’t change the fact that housing here is not affordable for the majority.

Most of our young adult children’s friends have moved, or are planning to move away post-university. Housing costs make it a logical choice. The ones that are staying are living with family still.

Ya, market rent, not fantasy rent.

I just noticed that 961 Joan Cres. just got got listed for 2.5 million. It is a great house, really well built and this seems like a bargain price compared to a number of other listings in the area. It will be interesting to see how quickly it sells.

https://www.theglobeandmail.com/business/article-underwater-mortgages-rising-cmhc/

5000/month mortgage means, playing by the rules (including qualifying for stress test), >~ 226k/year household income. That’s top ~2% income in BC according to CRA.

Look, anyone who has spent any amount of time in greater Victoria and has eyes and a functioning brain knows there’s a lot of money here. That’s not the issue. That’s been true for a long time. Even so the market is quite distorted right now, something visible in a number of ways: historically poor affordability, historically low sales (especially with population increase since the last lull near 2008), historically low inventory, an aberration in super-duper long amort mortgages, high rents pushing back. I get it, people have complained about housing since time immemorial here, but it seems hard to stare at that data and just say “business as usual.” Maybe it’s the new normal. Hopefully not. Certainly in the long run things will get worse (everything Marko says on that makes 100% sense), but are we there now? We’ll find out I guess.

Leo had a great post on this some time ago.

https://househuntvictoria.ca/2022/10/17/what-would-it-take-to-get-affordability-back/

I agree. Some people are caught up in the online posts that $5000 is a big mortgage payment and “omg who could possibly manage that?”. Meanwhile, throughout Victoria people are easily managing those payments and too busy with kids, events and social activities to pay attention to what the havenots are posting online,

I’ll just say it again for those in the back that couldn’t hear the construction guy or want to ignore him. This is why personal stories like the ones Marko and other tell about real life experiences matter more than little snippet quotes from articles that fit peoples current way of thinking.

I don’t know who needs to hear this but right now $5000 is not a large mortgage payment. Have a good night team

Marko, anecdotally in our kids’ friends , there are petroleum engineers-smart kids who got jobs even though it was tough to do so, teachers who start at 10K higher than BC, computer software designers who work from home for companies in other parts of Canada, dental techs, consultants with the Big 5 working at home out of the Toronto office, etc. Our realtor has sold to several young people this past year moving to Calgary to work remotely. Even with 5% interest rates, the mortgage costs are affordable for these young couples who are both working reasonably good jobs- some are much more well paid of course, but the two-teacher couple with the well-located 400K 1500 sq foot townhouse with 3 beds/4 baths/double garage and 3 outdoor areas has very do-able monthly costs.

Looks like it’s getting worse before it gets better…

From : https://www.reuters.com/markets/us/pressure-grows-us-regulatory-intervention-bank-rout-deepens-2023-05-04/

TD doing it’s part in taking down a US regional bank.

Unsurprised at the resilency of housing prices here, particularly given that many professions have received significant pay increases over the past couple years to mitigate inflation. With the new BCNU contract two nurses can easily pull in over 200k/yr family income. As always, population increases and the number of SFH stays (approximately) the same. At this point it’s still certainly feasible for a couple consisting of two professionals to purchase a place if they make it a goal.

VicREanalyst, I don’t have to assume any of those. I’m just assuming a competent landlord that will charge market rents when they lease the home.

Got it – I misunderstood what the chart was measuring.

There is a big difference in what Leo is measuring from overall median prices. Leo’s is much better and not subject to much error if the sales mix is skewed, unlike median.

Leo’s chart measures each sale, and compares it to its own assessment.

So if the sale mix is skewed towards high end houses:

Leo’s chart will still come up with a valid number because it is comparing to the high prices assessments.

– the overall median sales price will be skewed high

Fair enough.

You are not renting out a typical GH home at 6k a month, you are also assuming that at mortgage renewal the current tenant magically gets up and vacates. Are you also implying that you always knew the market would be resilient at 5% mortgage rates?

VicRealanalyst, why wouldn’t the market be resilient to a 5% mortgage rate? Mortgage renewals are spread out over one, three and five year terms.

If you look at peak prices that happened in April of last year, not everyone will be affected equally as their one, three and five year mortgage comes up for renewal. Median price for a house in the Victoria Core is $1,251,000 as at April 2023. If you bought prior to 2021 and have a Gordon Head home with a suite it will rent out at $6,000 or more a month which will cover the mortgage. There aren’t many people that are hard pressed by the interest rate to sell their homes.

April 2022 (peak prices) $1,400,000

April 2021 $1,100,000

April 2020 $865,000

April 2019 $870,000

April 2018 $898,778

@Patrick re: “Also, the two month notice period for eviction for landlord use (including the new owner) is too short. It should be longer – maybe six months.” I’ve seen you argue to extend this period to six months before. I think the risk with doing that is that it would discourage people from renting. This is especially the case here where we have so many mom and pop type landlords renting out basement suites. In many cases they don’t really rely on the income and so the tenancy is inherently somewhat precarious (for the renter). The solution isn’t to forever increase the period to convert a unit from a tenanted one back to landlord’s use (essentially at some point almost criminalizing it) as this introduces a significant disincentive agains offering this type of housing (which many rely on). The solution is to build more purpose built rentals.

Frank, we are already seeing a personal home care crisis as the oldest boomer is now 77. We are likely to see more Boomers living on their own as they lose their spouse and an increasing trend for Estate Sales.

Well that’s one way to add more inventory.

The baby boom card is going to play on for a couple more decades, then there will be a personal care home crisis like we’ve never seen.

I agree that is the best gauge. And like everyone else I am very surprised at how resilient the market is at 5% mortgage rates combined with the rising cost of living. Minimum $200k plus HHI is probably required to start a family here.

Leo’s chart uses the median sale price in comparison to assessed value. I’m not sure why you would trust the median in that circumstance, but not in the other. The median price can bounce around a bit from month to month (which I assume is why it’s a 3 month average of the monthly median in the above chart).

Anyway, we can probably leave it at that. I think a ~20% decline in the median price is significant. You don’t.

Yes, but it is contradicted by other data as I pointed out. And I’ve seen huge volatility in median and benchmark prices that make no sense. The only metric that does make sense is Leo’s price to assessment SFH chart which is what I compared to. If you want to conclude that prices are down 20% from the peak go for it. I don’t see that.

I myself see another leg down with prices but don’t think it will be significant I’m thinking we are just experiencing a little spring bump but it will fade with crappy economic news

Look above, and you will see a ~20% peak to trough decline in the 3 month rolling median for SFH. And yes, I understand that prices are up again, but a 20% decline is significant in my books.

Frank, I think we are coming to end of using the Baby Boomer card.

Although an official definition of the baby boom does not exist, it generally describes a period of increased birthrates lasting from 1946 to about 1965. The Great Depression of the 1930s had prolonged the decline in Canada’s birthrate, as it had in most Western countries. Improved economic conditions caused a recovery that began to accelerate during the Second World War. By 1945 the birthrate had risen to 24.3; by 1946 it had jumped to 27.2, and it remained between 27 and 28.5 per 1,000 inhabitants until 1959, after which it began to gradually decline.

Those retiring today, would have been born in 1958 which is close to the end of the baby boomers.

According to Leo’s excellent price to assessment chart prices are 100% of their July 2022 assessment. The BC assessment office claims that their assessments are accurate to within 2% as measured by back testing with sale prices. If they are correct, I don’t see where detached house prices have fallen significantly -at least not on the last ten months since July 1,2022. Of course they can always be a fall if you get to pick the start and stop points

I think it’s both Patrick. House prices declined significantly and that coincided with a 425 bps bump in rates. But I also agree that whether the bank raises rates another 25 bps in June (which it won’t unless inflation and employment data is way out of line with expectations) won’t make much difference at this point. I don’t see anything giving until there is a recession and unemployment picks up. And then central banks will start cutting rates.

Dad is right. BC’s economy was heavily weighted towards mining and forestry and got nailed hard in the recession which led to high unemployment. The interest rate did play a role in the price decline but add a high vacancy rate from those leaving the province for jobs and BC got smashed. A home owner could wait out the time to their mortgage renewal, but if they lost the income from their suite or condo then they fell behind in their mortgage payments in just a few months. That higher vacancy rate was felt over a larger number of home owners all at once which led to an explosion of homes coming onto the market.

BC’s economy has changed since the 1980’s and is less dependent on mining and forestry. However BC is more heavily weighted in the construction and real estate industries than it has ever been before.

BC seems to be caught up in this endless loop. We need construction to keep our economy rolling which means we need to import more labor and immigrants to fill those jobs which leads to higher demand and higher prices.

So are we putting all of our eggs in one basket?

Regarding jobs, we are no longer dependent on local economic conditions to provide employment. More people are working remotely, like the young Polish fellow I met a couple weeks ago. He still works for his employer in Poland, who needs his skill and knowledge. If that comes to an end he might find employment in Chattanooga, Tennessee. It all depends on your skill set and experience. Emphasis on experience. University education is ridiculously expensive yet demand for educated individuals is endless. I think that job demand will remain high given the number of boomers that retire every day.

Well yes, that’s my point. It is economic factors that determine house prices, not “rates”. Instead of HHVers waiting to see if the next rate rise will 0 or 25bp, they should be focusing on how the BC economy is doing. And it seems the BC economy is doing “OK, but not great” right now. But yes, if a recession/unemployment hits hard, especially if BC is hit harder than ROC, BC house prices will fall.

Summary: No BC house crash on the horizon.

It’s the 20 to 40 year age group that will feel the brunt of an economic recession. They are the most indebted group and have always been the worst hit in an economic recession. We may have more retirees and mortgage free home owners than other cities but their inactions won’t have an effect on prices. Demand is only comprised of those actively looking to buy ie prospective purchasers and those that have listed their homes for sale. It’s erroneous to think that the entire stock of housing makes up the real estate market place as the real estate market is a small fraction of the size of total inventory at any given time. I think a lot of home owners, especially on this blog, are under the fallacy that the market is too big to fail and that their property values are insulated from what happens in other neighborhoods. What happens in the Westshore which has a higher population of young home owners, will have an effect on prices in other neighborhoods.

At the other end of the spectrum, I think there is a belief among prospective purchasers with upper incomes that they should be able to buy into upper income neighborhoods. But when they try to match their incomes to the neighborhood most find that they are priced out of those neighborhoods. The number of sales of properties in upper income neighborhoods has fallen substantially from a year ago which has led to an increasing supply as more listings are added. There is about 7 months of inventory available in the upper income neighborhoods as those selling in the upper income neighborhoods are reluctant to lower their asking price. It seems that interest rate increases are hammering the upper income market a lot more than the first time HOME owner or middle income market.

For those out of town buyers with deep pockets from the sale of their properties that would like to retire to Victoria, they are also affected as it doesn’t make sense for them to sell and have to reduce their expectations or to take on a mortgage. The reason to move to Victoria from say Vancouver or the Fraser valley was that they could upgrade from say a middle income neighborhood to an upper income neighborhood. That’s not as likely to happen today as it was in the past.

But they didn’t have the same run up in prices before rates increased. And correct me if I’m wrong, but didn’t the early 80s recession hit BC particularly hard in terms of unemployment?

Here’s some food for thought for those thinking that high rates will lead to a crash in house prices “with a delay”.

The huge rise in rates leading up to 20% rates in 1981 occured throughout Canada. That means that BC and Toronto had the same rates.

During the early 1980’s, BC prices crashed (1981-84), yet Toronto prices doubled (1980-86). Not even a single year of falling prices in Toronto.

Eventually, Toronto prices crashed (1989-95) and BC prices didn’t. Also a period with similar interest rates.

The point being, house prices don’t seem to be that well co-related with interest rates. With or without “a delay”.

Here are Toronto prices during the 1980’s

Oil is $68 U.S., not far from $100 a barrel Canadian. Our properties are also 35% on sale to anyone with U.S. dollars. I’m sure lots of Americans are looking at Canada as a safe place to raise their families away from the nonstop mass shootings. They can work remotely, earn U.S. dollars and sleep better at night.

Lots of counterfactuals going around here with regard to density, interest rate hikes..

One I’d love to know the answer to is what would have happened if major banks weren’t allowing variable mortgages to go into >35 year amort territory.

House prices will fall with the loss of jobs as inventory increases imo

Right. So tell that to the HHVers who are doing a countdown to every rate hike, expecting prices to fall immediately, not “delayed until the recession” like you say.

Yes but the rate increase has less of an effect when there’s less money involved.

$450000 mortgage ~ $700 a month increase

$800000 mortgage ~ $1400 a month increase

You also can qualify for more if you make more… clearly you’re aware of that though so I don’t understand the question.

But the recession is a result of previous rising rates. Rising rates have a delayed effect, not a simultaneous one.

That’s because of their young population. Take a look at the age group analysis below to see how age matters. You really have to look at debt for the same age cohort to get a relevant comparison between provinces, which they don’t report on.

Equifax report

Agreed.

And previous periods of rising rates also didn’t see a price crash. They usually see rising prices. For example, house prices tripled in the 1970’s during rising inflation and rising rates. The main times that house prices fall is during a recession, where rates are usually FALLING.

Wouldn’t that have been the case as well before rates started climbing last year?

Albertans have the highest consumer debt.

The average Calgary homeowner makes more and pays like half the amount for housing.

If interest rates were flat, I would agree. But in the context of what happened with interest rates I do think it is a big deal that the market was able to absorb the dramatic increase in carrying costs. I would imagine the average Calgary homeowner is more exposed to interest rates than the average Victoria homeowner where a lot of properties are free and clear title.

From: https://financialpost.com/news/more-consumers-fall-behind-debt-payments-rbc

As I pointed out, the “all time record” prices in Calgary aren’t that big a deal, considering Teranet is only up about 20% from the peak of July 2007.

Did the economic situation in Calgary improve that much since rates started going up a year ago? Oil is $68/barrel which isn’t bad but it isn’t $140/barrel. If you told me a year ago that interest rates would go from 2% to 5% I wouldn’t have thought that Calgary would be hitting all time record prices. I would have thought interest rates would have had a bigger impact on the Calgary demographic versus a place like Victoria.

The narrative on HHV and other blogs for the last 10 years has been once interest rates finally come off record lows the markets are doomed but it would appear the markets across Canada are handling 5% okay.

I feel like you can’t win with these old 50-60-70 year old apartment buildings with below market rents. As the property owner either you leave the building as is and everyone complains about how decrepit the property is or someone dies in a fire or similar, or if you want to rebuild with more density, better energy efficient and safety you are a villain because you are booting the existing tenants.

“Kind of crazy given how much interest rates have come up”

Calgary’s rents have shot up too – we moved back to Victoria 2.5 years ago after being there for 25 years & holding rental properties there. Rents are up substantially and starter SFD, even with higher interest rates, are manageable. Our kids are mid/late twenties and they and most of their friends have bought housing over the past few months. Duplex, SFD with basement suite, large townhouse with good yard space, apartment condo. Good jobs, lower cost of living, great lifestyle. They’re staying.

Sounds like the government needs to amend provincial tenancy rules to prevent this. They already have a “good faith”clause – where the landlord needs to be acting in good faith when evicting for landlord use- and they could change the definition to address issues like this.

Also, the two month notice period for eviction for landlord use (including the new owner) is too short. It should be longer – maybe six months. This extra time for notice would reduce the impact of these types of evictions on tenants, and also discourage buyers from buying homes and evicting tenants in the first place. A change of ownership should reset the clock, so a new owner would have to wait six months after taking possession to evict a tenant.

Will US Fed latest hike push Bank of Canada to do same given inflation is still not in expected range and lead to more demand / supply gap and higher prices ? Or this is all dead cat bounce we are seeing prior to further flattening of prices ?

How many of those homes in Uplands are tear downs? I’d think that only the ultra rich can afford to take on a project of that magnitude. The area was started in 1907 so only a few would meet today’s standards. Not many buyers in that category. I doubt any multi-unit developments would be allowed. One of my tenants inherited a property in Uplands and needed a place to stay while their new home was being built. They initially wanted a 6 month tenancy but ended up staying 2 years. They were a high level government employee. Definitely an exclusive area that will never densify.

How?

Wonder how common such buildings are.

https://www.theglobeandmail.com/canada/british-columbia/article-bc-landlord-demands-tenants-pony-up-double-digit-rent-increases-or/

https://www.bcassessment.ca//Property/Info/QTAwMDA3N0s5OA==

Took a drive through Uplands. The most “For Sale” signs that I have ever seen. No shortage of housing in that price range.