NIMBYism is incompatible with Victoria’s environmentalism and other progressive ideas

Our city has gradually drifted politically left, going from electing Conservatives in the 1970s and 80s, to Liberals in the 90s, NDP in the 2000s, and NDP/Greens now. Thus it seems many in Victoria value social progressivism, environmental and climate protections. Looking around, it’s clear that this is the case, with Victoria having the highest proportion of trips by bicycle, the major municipalities adopting the energy efficient stepped building code, pushing for plastic bag bans, and many local governments pushing hard to tackle greenhouse gas emissions. That lines up well with my values so in general I’m pleased with the political and social atmosphere in Victoria (downtown would be great if it wasn’t for all the car lanes).

What’s odd to me is that by and large this progressivism and environmentalism doesn’t extend into attitudes on housing. NIMBYism (the attitude that new housing should Not be built In My Backyard) runs rampant amongst home owners in the city, with nearly every public hearing overrun with negative comments from neighbouring owners that want to block the development. Every project is too high, removes too many trees, disturbs some old bricks, will worsen traffic, cast shade, or could bring undesirables to the neighbourhood. Projects are alternately criticized as too affordable (might bring yucky renters) or too expensive (where’s the affordable housing?). In the end even those with the best intentions to provide affordable housing for their community often just give up. The delays of course drive up the cost of any new housing where developers are forced to revise designs countless times and carry land while fighting for approval. In one particularly egregious recent example, a paltry 20 unit townhouse development went through 3 years of community consultations before approval, only for neighbours to sue in the supreme court because the townhouses were half of a story taller than they wanted (luckily dismissed). Is it really any wonder why we can’t build enough and why new housing is so expensive when 20 townhouses take 3 years and a court fight to get approved?

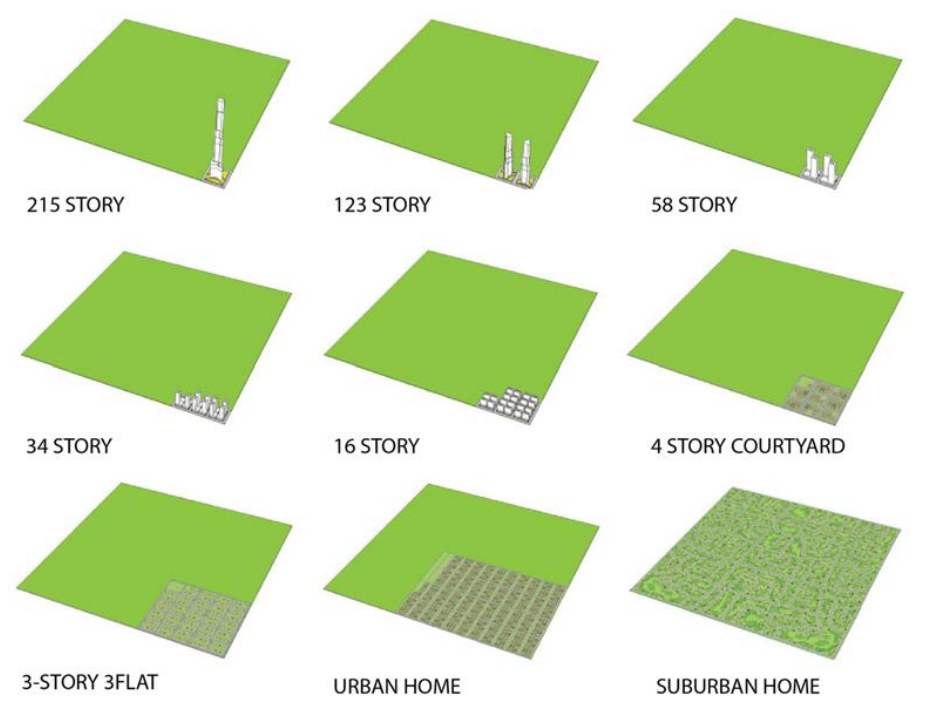

Many people think density means big condo towers, and it’s understandable that you may not want a tower built next to your house. But increased density also encompasses anything from garden suites to townhomes to walkups to mixed developments, often referred to as the missing middle housing.

Missing Middle housing (source)

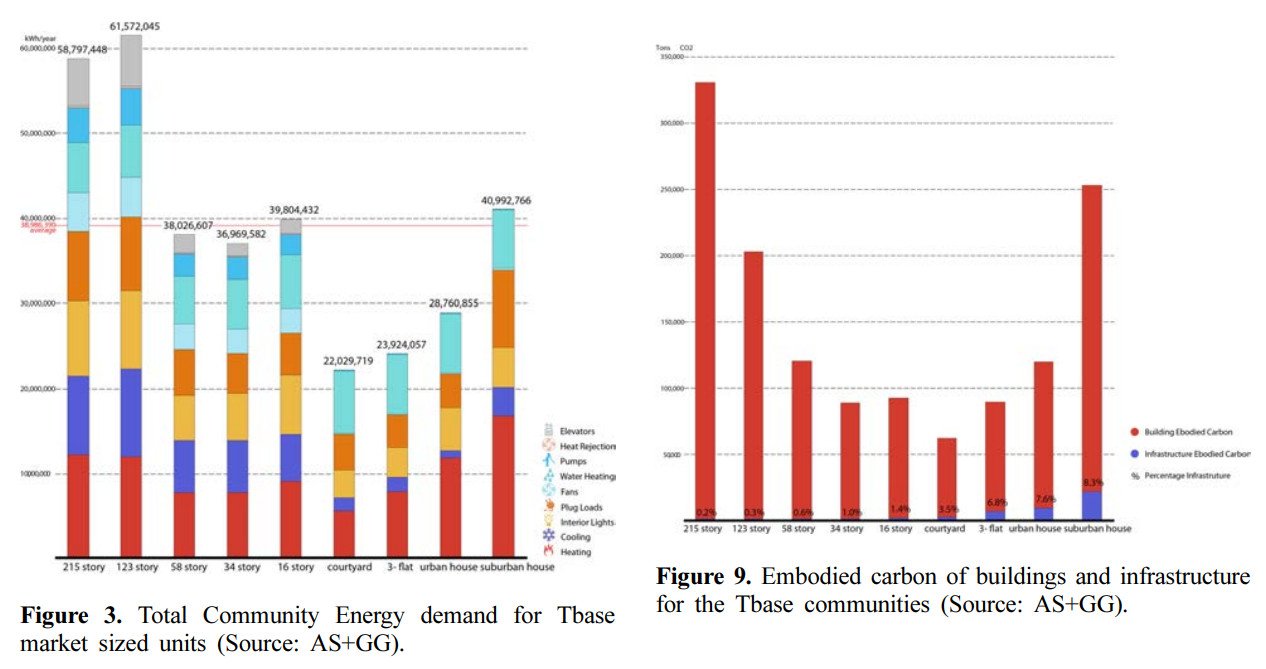

A recent paper on the environmental impact of housing types also drives home that while of course high rises take the least space, you get the land use benefits of space efficiency even with comparatively mild density and low heights. A mix of 3-story 3-flats and urban single family housing would cut the area required by 75% compared to the equivalent community of suburban single family homes (which make up most of Greater Victoria). Yes more density may also mean taking out some trees or grass where the single family homes stood previously. But it reduces a lot of space pressure that allows the preservation of dedicated green space which is a lot more valuable than the privately owned, maintenance intensive monoculture that is people’s yards.

Land used for equal number of housing units by housing type (source)

Housing policy is climate policy

A similar picture emerges when discussing emissions. Both from an energy use perspective and from an embodied carbon perspective, housing types on either end of the spectrum do very poorly. Single family housing is inefficient and oversized, while tall towers suffer from a lot of embodied carbon in their materials and can be quite wasteful of energy as well. The sweet spot, as with space usage, is gentle density like townhouses and walkups. And that’s before accounting for the fact that those new residents in Royal Bay, or Sunriver, or even Duncan will be entirely car dependent and commuting long distances into Victoria while new residents in Victoria have a chance to shift their travel away from private vehicles. With buildings accounting for about a third of our GHG emissions, we can’t really afford to ignore the climate impact of our housing preferences.

Gentle density has the lowest climate impact (source)

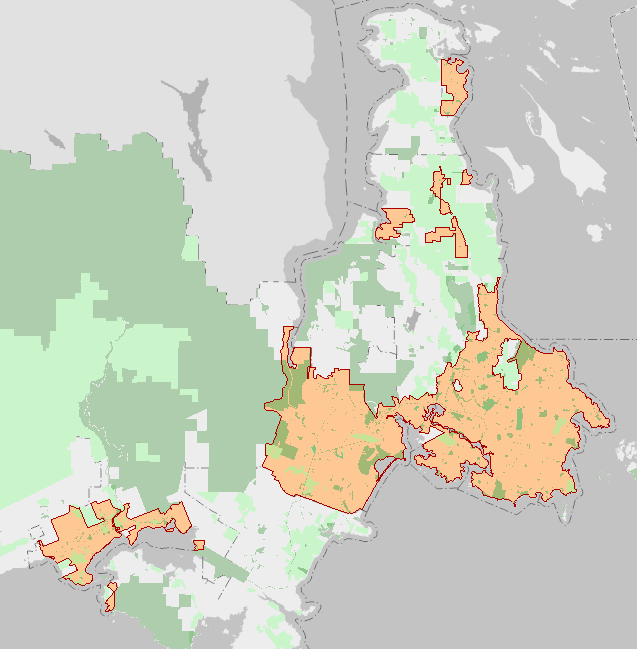

Exclusionary zoning is also problematic from a social equality perspective. Rooted in racist policies (covenants prohibiting buyers of “asiatic” descent still exist in Victoria), restrictive zoning is now used to keep lower income earners out of neighbourhoods and push density on poorer areas which increases displacement. This topic is outside my area of knowledge but there are many good articles out there. Occasionally we see strong pushback against development from advocates for the poor, who argue that development will lead to gentrification and displacement. However new research indicates that new housing doesn’t lead to displacement, finding that new market-rate rentals “did not drive up neighbourhood rents; in fact, rents were lower up to three years out than they were in comparable neighbourhoods where no development occurred”. It’s not to say that development can’t cause displacement (we shouldn’t be tearing down affordable housing to build new stock) but it’s a reassuring indicator that the basic laws of supply and demand do in fact apply to housing as well.

Resisting development won’t stop Victoria’s growth

Victoria is growing because it’s an attractive place to live and preventing housing development will do little to stop that growth. The idea that population growth could be stopped by simply failing to plan for it goes back at least to 1965 when the biologist Raymond Dasmann decried the population growth in California which he saw as destroying the state’s natural beauty. Dasmann suggested “not developing water resources… not building those new power stations or those new freeways”, reasoning that if amenities were not provided “people will not come where there are no new jobs or new housing, or if they do come they will not stay”. However despite exclusionary zoning and a strong anti-development attitude in California, people did come and instead of living compactly in the major centres they sprawled out in massive car-dependent suburbs built on top of the pristine countryside that Dasmann wanted to protect.

The same as happening here in Victoria. People are coming at increasing rates and many of them would love to live in the core, but because there are so few options between the too-expensive detached single family home and the too-small condo, they buy up new developments in Langford instead. And what stood where those new developments are now? Well you only have to drive to Costco to see.

Eventually of course the higher prices from an exclusionary zoning policy will deter some people from coming altogether but from an environmental perspective that’s not a win either. Those people are still living somewhere, and chances are the place they are living is less environmentally friendly than Victoria which will make their environmental footprint at least as large or larger than if they had moved here.

For true protection of the heritage of our city, we already have tools like heritage designation and the protections that come with it. However just because a house is old doesn’t make it have heritage value. To me much of the charm of areas like Oak Bay or Fairfield is that the houses are largely unassuming homes suitable for families. Many parts of those areas could slowly migrate to small townhome developments with walkups near the main arteries as homes reach end of life in order to keep allowing new families to live in the area. That doesn’t have to change the charm of those areas and missing middle housing can be just as attractive as single family, as evidenced by the beauty pictured below. But restrictive zoning and the associated high land value means that’s not possible, and instead we see the homes being replaced by ultra-modern builds maxed out on size.

Let’s be honest with ourselves

In some ways I have no problem with someone that reads the above and decides that they don’t care about these issues and would rather fight to keep their neighbourhood exactly as it is. While not my preference, at least it’s intellectually honest. But if you do care about those progressive issues, then at some point you must come to terms with the fact that zoning policy has large impacts on those issues too. I see some signs that the tide is shifting there, with new councils increasingly considering not just the views of the existing residents of a neighbourhood but also those unrepresented many that will live in there in the future. Personally I hope that shift continues.

New post: https://househuntvictoria.ca/2020/03/02/february-market-report/

And nor should you be. If you get it, stay at home, rest up and drink plenty of fluids – and odds are almost certain you’ll be just fine. 🙂

Not a bad price for those shoes. That’d be a bit less than $140.00 today…

As you are so fond of saying, no it’s not. A year from now people will probably have something else they’ll be afraid of.

Looks like most African nations(aka shithole countries) are more prepared than the US at this point. 200 test kits for the whole state of California… give me a break. I feel like out of any western nation, they’ll be the hardest hit, simply because their health care system. Who’s gonna pay $4000 to get a test done…

It’s unfortunate they’re our biggest trading partner. Can’t see things being too rosy here if they start quarantining cities like China. Looks like Seattle will be first up, and San Fran close behind.

“I’m guessing this condo insurance problem is gonna add a bit more demand to SFHs, on top of all the other factors.”

Maybe, but If folks can’t sell their condos, then demand from move up buyers would fall, no?

I’m guessing this condo insurance problem is gonna add a bit more demand to SFHs, on top of all the other factors.

I’m thinking some buyers may opt to stretch their budget to get into a SFH, purposely avoiding a townhouse strata and that uncertainty.

My impression is that Canada (or at least B.C. anyway) is being more proactive than the U.S. in terms of testing people with symptoms and generally trying to keep a lid on it. But that doesn’t mean that cases here won’t go up, possibly significantly.

Interesting times!

I’m not concerned about the coronavirus, I have good shoes.

From: https://twitter.com/yvryimby/status/1234315769330032640?s=20

Looks like the market is might go negative again.

Short rally following Trumps tweet (btw I don’t do after market trading myself)

A live look at the Nasdaq Futures.

Fun watching it react to market news, like I said very volatile. Most analysts think easing monetary supply (helpful for mortgages) is not going to change the supply chain shock coming this week (manufacturing).

https://www.investing.com/indices/nq-100-futures

two. And 9 cases of transmission in various parts of the states that haven’t been involved w/ travel, or other cases. Seems like the states is going to be over-run with it within the week. Canada likely won’t be far behind.

What’s a rate cut going to do really…

Already happening, over asks in single family are off the hook.

Not necessarily due to condo insurance though just continuation of what we’ve seen the last few months. Some funny stuff happening in the market.

Might all this uncertainty in the strata/condo market lead to somewhat increased interest (demand) in SFHs, at least over the short term?

These “unprecedented, temporary, emergency” low interest rates (as info liked to say) have more or less continued for 11 years now, and they’re still going strong (weak?).

Waiting for interest rates to “normalize” and cause a price correction (before buying in) has been an utterly devastating gamble for those who played that game.

Well I guess we’ll get a rate cut on wednesday

one confirmed death in Washington state now ..

I work hospital.. and i can assure you we dont have that capacity . .. lets not forget .. if patients requires ventilators .. it wont be shared .. first come first served lol .. but wait .. there is more .. only certain housing capacity in the hospital is suitable for isolation. .. but dont worry .. we will never fill those beds up .. we dont have the correct staffing to work on them. Only RJH is designated to be used as catastrophe response hospital. There is an empty floor that can be converted into patient care area but we dont have the staffing to run them. but dont worry .. we dont have the housing to house those staff either . short staffed through out the island

Ks112:

Pre-markets, or after market trading

https://www.cnbc.com/pre-markets/

Four things are almost guaranteed for March.

Escalating number of COVID-19 cases in USA and Canada

Escalating declines in the stock market as COVID-19 deaths increase in the USA.

Escalating strata property insurance news will become front page news and the ‘hardship’ facing condo owners will be the theme.

Escalating number of condos listed for sale with no buyers until the uncertainty about strata insurance is clearer, this is just the beginning of this news story.

elouai, you do realize the Dow futures don’t start trading again until tonight right? It wasn’t trading yesterday….. Lol oh man……

The biggest investment mistake I’ve ever made was not buying more stocks in 2008. I only bought about 20k during that time. I’ve already upped my monthly contributions thus time so hopefully the drops continue for a while here.

The futures market for Dow Jones is currently up +139, on Friday aftermarket jumped an additional 300, then dropped on Saturday morning 300 on death now up 169, very volatile. But was expecting the dead cat bounce, long term trend at the moment is negative as is expected.

Predicting that someone in the US was going to die of Covid-19 …

I predict that the sun will rise on Monday and if that happens, the market will rebound 😉

http://spanishfluvictoriabc.com/wp-content/uploads/2016/10/Deaths-due-to-influenza-recorded-in-Greater-Victoria.jpg

Interesting site

http://spanishfluvictoriabc.com/

Well looks like catalysts for my “game over” call has materialized. Let’s see what the market does on Monday. Maybe the feds would do an emergency rate cut on Sunday.

First coronavirus death in the U.S. happens in Washington state

https://www.nbcnews.com/news/us-news/1st-coronavirus-death-u-s-officials-say-n1145931

Well done to the premier/Prov. Govt and Medical teams, they seem to be well organized on the CoVid-19 preparations.

“B.C. has tested more people for COVID-19 than the entire United States, premier says”

https://globalnews.ca/news/6610416/bc-covid-19-testing-more-than-united-states-premier/

62-year-old woman with net worth of $3.26M. Retirement readiness: 4/5.

https://business.financialpost.com/personal-finance/family-finance/woman-who-splits-year-between-prairies-mexico-mulls-b-c-retirement-but-high-house-costs-a-risk

Nonsense.

You are describing secondary trading, which is the bulk (>90%) of the ETF trades but the other ETF trades <10%) are primary trades where you are in fact buying/selling from/to the ETF (through a bank intermediary like Goldman Sachs) So the ETF is creating or removing shares constantly, based on the demand in the market. The net creation-removal is called the “ETF flow” and this is what people are measuring and what my posts are referring to. So if “money is flowing into ETFs”, it means that the ETF is creating new shares and lots of people buying that day are in fact buying a brand new share just created by the ETF (working with its intermediary market maker/ bank).

So when you buy (sell) an ETF share you don’t know if you were buying from (selling to) the ETF (through its partner bank) or from another individual.

—————-

If you’re still not sure how it works, I’ll explain it ….

The ETF creates or removes new shares constantly, to arbitrage the price to insure that it is trading close to NAV (Net Asset Value). Trading in ETF shares is a combination of

— primary trading : (where you end up buying/selling your ETF shares From/to the ETF who creates or destroys them

– or secondary trading : you end up buying/selling your ETF shares from another individual

— For example, consider a day where the stock market is flat (not moving up or down).

— if there is a large demand to buy the ETF, more than want to sell it, the price will begin to rise above NAV (Fair Value) and so the ETF creates new shares and sells them into the market lowering the price to where it should be (close to NAV). In this case, the new shares are sold by the ETF to the people in the market that bought them.

— On a day when a lot of people want to sell the ETF the price will fall below NAV, and the ETF will then start buying shares to remove them from the market. In this case the ETF is buying shares from people selling the ETF.

The ETF creates or removes these new shares working with a bank/market maker as intermediary. This would be a bank like GoldmanSachs, and they are licensed/regulated specifically to be able to do this. They are called Authorized participants (AP). When the ETF wants to create a new share, the AP (e.g, Goldman Sachs) goes out and buys all the needed shares (AAPL, MSFT) and swaps them for the ETF creates share which it can then sell. Same idea to remove a share – the ETF swaps the shares it holds (AAPL,MSFT etc) for shares in its ETF. The AP buys ETF shares in the market and swaps them with the ETF who then removes them from the market.

So when a typical investor (individual) is buying an ETF, they may be either:

—buying the ETF from another individual selling the ETF. That’s called the secondary market and the AP (eg Goldman Sachs) and the ETF play no role in this transaction.

— buying the ETF share from the AP (eg Goldman Sachs) who is selling them a newly created ETF shares. That’s called the primary market.

On days when a lot of people are buying ETFs, a high % of them will end up buying them from the AP as a newly created ETF share (primary trade) and in a big day of selling they will be selling them to the AP who then hands them over to the ETF to be removed from the market.

I’ve heard estimates that 90% of trades are secondary (ETF/AP not involved) and 10% are primary (ETF/AP is directly involved). The bank (e.g, GoldmanSachs) makes money on the arbitrage (difference between the NAV and the price it gets for the shares it buys/sells from/to the individual investor on behalf of the ETF.

ETF’s do not work this way. The ETF owns shares. If I want to sell my units in the ETF, someone else pays me for them. The ETF itself does not buy or sell shares in such a transaction. In fact, it’s trading in individual shares that determines the market price of ETF’s, not the other way around.

What you are describing is what happens with mutual funds. When I sell my units in a MF, the MF itself buys them back, and it has to sell shares if it does not have cash on hand.

https://twitter.com/EveryCityCanada

The favourite word to describe property for sale was “snap”

“If this is not a snap, what is?”

“Robertson St. A real snap”

“Snap – Quadra St”

“$2800 – Snap. 120 feet on Moss st”

Back then (1913) it was 25% down and up to a 3 year mortgage. $850 for that lot being about $19,400 in today’s dollars. Looking at prices advertised a couple years later it seemed that they dropped by about half, but that lot would be worth about $650,000 -$700,000 today

Former Landlord, the healthier or lower risk companies typically have lower betas.

I was looking at a house just listed, 2008 Romney for about 2.1MM, I see that their using last years assessment on a new listing which happens to be about 55K less then the year before assessment, 1.784 vs 1.729, I guess this is still happening.

Short term stock price change is not indicative of the health of a company

Agree, but playing devils advocate I’m wondering about what is really stopping the CRD from redrawing that urban containment boundary and just make more land available. Lots of land out there that is designated as “Rural / Rural Residential” (i.e. not ALR or other crown land, parks, environmental protection area, etc) but the distinction seems quite arbitrary.

I went to a strata insurance talk today and there was a panel of representatives from insurance industry, law firm, mortgage, etc.

These were some of the factors that increase premiums substantially

i/ Previous claims history is by far the biggest one

ii/ Depreciation report or lack of and if strata has been following the depreciation report or not.

iii/ Buildings with large replacement value (over $50 million) are hard hit

Picked up some really good points….for example “carpets are cool.” One guy in the insurance industry was saying if a building with carpets floods 5 stories it is a lot cheaper to remediate versus same scenario with laminate/solid flooring, etc.

Strata lawyer brought up a good point in that a special assessment for insurance does not require a 3/4 vote and that special assessment takes priority over a mortgage if the owner of the unit cannot come up with the funds. Could be a cause for lenders going forward; however, lenders haven’t put any major policies into place yet pertaining to this whole situation.

Just go density….I am sure we can easily double the population within the current built out area. Replace SFHs with duplexes and put up a few more tours. Like why isn’t there a bunch of towers around Uptown?

Once Langford is built out there won’t be much land left outside of the urban containment boundary.

Thoughts on whether that is likely to change in the future? What would it take for the CRD to expand the boundary? How is it set?

As large as the daily market drops have been, going to cash AFTER the drop is always a mistake. Markets have breathtaking, one day increases too. If you panic and go to cash, you miss the recovery. Market timing is a fool’s errand; losses are only crystallized when underlying equities are sold, and you’ll probably miss significant upside. Volatility cuts both ways, and isn’t necessarily a bad thing. It is difficult to see what amounts to a year’s salary vanish from the accounts, though.

Largest Daily Point Gains

Rank Date Close Net Change % Change

1 2018-12-26 2,467.70 +116.60 +4.96

2 2008-10-13 1,003.35 +104.14 +11.58

3 2008-10-28 940.51 +91.59 +10.79

4 2019-01-04 2,531.94 +84.05 +3.43

5 2015-08-26 1,940.51 +72.90 +3.90

6 2018-03-26 2,658.55 +70.29 +2.72

7 2000-03-16 1,458.47 +66.32 +4.76

8 2001-01-03 1,347.56 +64.29 +5.01

9 2018-11-28 2,743.84 +61.65 +2.30

10 2008-09-30 1,166.36 +59.97 +5.42

11 2018-10-16 2809.92 +59.13 +2.15

12 2008-11-13 911.29 +58.99 +6.92

13 2019-06-04 2,803.27 +58.82 +2.14

14 2018-11-07 2,813.89 +58.44 +2.12

15 2009-03-23 822.92 +54.37 +7.07

16 2008-03-18 1,330.74 +54.14 +4.24i

17 2019-08-08 2,938.09 +54.11 +1.88

18 2011-08-09 1,172.53 +53.07 +4.74

19 2011-08-11 1,172.64 +51.88 +4.63

20 2008-11-24 851.81 +51.78 +6.47

Largest daily point losses[2]

Rank Date Close Net Change % Change

1 2020-02-27 2,978.76 −137.63 −4.42

2 2018-02-05 2,648.94 −113.19 −4.10

3 2020-02-24 3,225.89 −111.86 −3.35

4 2008-09-29 1,106.39 −106.62 −8.79

5 2018-02-08 2,581.00 −100.66 −3.75

6 2020-02-25 3,128.21 −97.68 −3.03

7 2018-10-10 2,785.68 −94.66 −3.29

8 2018-12-04 2,700.06 −90.30 −3.24

9 2008-10-15 907.84 −90.17 −9.04

10 2019-08-05 2,844.74 −87.31 −2.98

11 2019-08-14 2,840.60 −85.72 −2.93

12 2018-10-24 2,656.10 −84.59 −3.09

13 2000-04-14 1,356.56 −83.95 −5.83

14 2008-12-01 816.21 −80.03 −8.93

15 2011-08-08 1,119.46 −79.91 −6.66

16 2015-08-24 1,893.21 −77.68 −3.94

17 2016-06-24 2,037.41 −75.92 −3.5918 2019-08-23 2,847.24 −75.71 −2.59

19 2008-10-09 909.92 −75.02 −7.62

20 1998-08-31 957.28 −69.86 −6.80

Yes, but what evidence do you have that this isn’t true of all stocks, or that a stock that happens to be in an index is being impacted more than one that is not? If you look at just the last week, the non-S&P 500 stocks are actually down slightly more than the S&P stocks. Why is that the case if the problem is index funds?

Marko, I assume out of the 50 ventilators there are probably at least 10 being used for some other illness or injury at any given time, so really there are probably at most 40 available for an outbreak. So given the 5% figure we can’t have more than 800 infections in Victoria. lol how interesting

Hawk is that you????

Someone needs a chill pill

When I was a respiratory therapist we had less than 50 adult ventilators in Victoria. If 5% of the infected had to be intubated that would be just an insane shit show.

I spent 4 years running ventilators in ICU….I hope I am not on a list to get called back in if there is an outbreak.

Virginie,

To be part of the S&P 500 index, certain criteria must be met (e.g. market cap, float, positive earnings etc.). As a result you would expect the companies in the index to be more resilient to an economic shock and perform better than other ones. I believe your example below shows the opposite.

No, because the ETFS that people are piling into are not just S&P 500, they are for the small stocks too. For example, look at this weeks flow into ETFs.

https://www.etf.com/etfanalytics/etf-fund-flows-tool

The leading flow into any stock ETF is into VTI (see link) which is the Vanguard Total Market which covers every investable stock in the US (small to big companies). Now how stupid is that… every company with a ticker symbol of some kind gets indiscriminately bought (according to market cap) regardless of what they did last week. Another big one in top 10 is into Russell 2000 (small stocks). So a bubble is determined by the flow of these “passive” investors who don’t know or care anything about what they’re buying.

But now look at the recent flow OUT of these funds…. it has turned negative this week, an inflection point which means the same group of is now pulling money out, after years of piling in. Maybe they need the money or are worried about losing their job or falling stock values. This worsened the downturn in 2008 and may be doing the same thing here.

These “investors” proudly announce they don’t even know or care what they’re investing in or in some cases what is happening to their stock values.

“The lunatics are running the asylum”

The number of infections in other countries via Iran is very interesting. For a country that only had 100 cases couple of days ago they sure are infecting a lot of other countries.

Anyone here work at VIHA ? Curious to hear how many ventilators we have in Victoria. From what I have read that is the only thing keeping you alive if you are the unlucky 5% that gets infected as there are no clinically proven drugs at this time.

If this were more true for S&P 500 stocks than for non-S&P 500 stocks, then I would expect the decline in the former to be much greater than the latter. The YTD decline in S&P 500 stocks at this moment is 7.8%. Is there evidence that stocks that aren’t in an index have fared better? There is an S&P completion index, which tracks the total market index minus the S&P 500, and it’s down 7.53%. Not a huge difference.

https://us.spindices.com/indices/equity/sp-500

https://us.spindices.com/indices/equity/sp-completion-index-ci

Inreallove said:

““for which BC strictly limits annual rate increases”

Maybe now, but what if they remove them because landlords are closing whole apartment blocks”

There’s absolutely zero indication right now that will or even can ever happen.

Anyways, renters are the last group in the real estate ecosystem that would be able to handle sudden such large monthly increases. Many of them live on income or disability assistance, and are barely making ends meet as it is.

If you think the Victoria homeless problem and related taxpayer costs are big now, that pales in comparison to what it would become if apartment building owners were allowed to raise rent willy nilly.

And why would an apartment building owner close a whole apartment block, anyways? Here’s something no apartment building owner has ever said: “My income stream has shrunk somwhat recently, so instead of just selling or riding this out, I’m going to just shut down completely and obliterate every last dollar coming in”

Great post….spot on!

Oh snap… so like the markets going to 0? Every one of the companies listed on the TSX and Dow will have no value and will cease all production of goods and services? Just giving you a hard time. I know that is not what you mean.

Yes, things will get ugly but if you have a balanced and diversified portfolio with a long term outlook… your DRIPs will take advantage of the correction and in 5 to 10 years you wont remember this blip. Unloading all your positions today before the weekend just solidifies losses. Most people if panicking and selling today will not be able to time the bottom, and prob wont have the stomach to buy at the bottom (plus wont know where it is) and will miss out on future appreciation.

If you need the cash for a DP for a house or something i hope it wasnt resting in all equities. If you were looking at retirement within the next 5 years your portfolio should have been focused more on fixed income. If you have 20 years to retirement and the money in there is for retirement, turn off the computer and go for a walk. Much like housing, in the long term all is well.

If you need to really calm down, go to the globe and mail, look at a 10 year return chart for the tsx.

I was summarizing a bunch of items, and didn’t put full information for all of them. It was the fastest 10% correction in history from a market peak

Same story with this Bloomberg headline, which was similar to mine and clarifies it in the body of the article, as I have done above.

Bloomberg: “We Just Witnessed The Fastest Stock Market Correction on Record”

https://www.bloomberg.com/news/articles/2020-02-27/we-just-witnessed-the-fastest-stock-market-correction-on-record “ Six days. That’s all the time it took for the S&P 500 to fall more than 10% from a record into a correction. That’s the quickest turnaround of the sort ever, according to data from Deutsche Bank Global Research. “

Generally when yields drop as they are in bonds, that means lower rates everywhere.

Because of the current market sell off, do you think that the banks will increase their GIC rates to grab some of that money or will those rates fall as well?

That’s a pretty good summary on the ETF there Patrick, I am quite impressed and I work in the industry (although not on the equities side). Most retail investment advisors are just glorified salesman, they don’t know jack shit. They recite to their clients what their brokerage research group sends out everyday. You don’t need many credentials to be a retail investment advisor, just some bs classes from the CSI, not too different from what you need to be a realtor (no offense Marko). Most clients are dumb as rocks too, they just want to see absolute returns and have zero concept of performance relative to market.

If any of you are trying to trade the market currently I would not recommend holding large positions through this weekend, too much risk. If it spreads more throughout europe over the weekend then next week will be just as ugly. If that woman currently in ICU in California dies (where they can’t trace how she got sick) and more cases pop up in the states then its game over next week.

I think the bear analogy holds here:

Fake news alert.

In 87 the DJIA fell 22% in a day

The dumbest money in the market is the huge passive investment that occurs with the ETF buying . That money forces buying of all index stocks proportional to market cap. This flow then becomes a big factor determining market direction, instead of earnings and valuations. Problem is it helps to create bubbles and crashes.

For example, since 2011 S&P 500 earnings have risen 33%, but the S&P500 has risen 134%, increasing the PE into bubble territory, where it is now. Dumb money flowing in via ETF is one cause of this. And the trouble with this, is when a big shock comes along, with falling prices, this ETF money flow reverses, and money is pulled out of all stocks as forced selling of every stock in the index occurs. So far, the ETF flows have slowed, but continued into the market, but this will likely change if the downturn continues, accelerating the losses.

And so you’ve discovered why most DIY investors lag the market. They think that because they spent a couple hours researching they can beat the people who live and breathe this stuff and have armies of analysts and racks of ultra fast trading computers at their disposal. And then they make random Buys and sells based on their hunches, based on what their uncle told them, and based on what they read on the Internet. They win some, they lose some, but they only talk about the wins online.

This tweet sums it up nicely.

Can’t deduct fees in RRSP, and different marginal tax brackets (40% marginal rate is likely top quar or quintile), so effective management rates are likely more than 60bps for most people.

True, people do silly things. But the lessons can be “don’t sell in a down market, keep regularly contributing, don’t time the market”. If you can learn them, you can retire years earlier.

There are lots of DIY investors, and if they are “grossly underperforming the market”, that means that another group of investors must be “grossly outperforming the market.” Which undercuts the argument by you and LeoS that almost no one can beat the market, and passive investing is the best strategy. It isn’t if you are one of the people that can beat the market, and you won’t know until you try.

It’s very hard for most money managers to do this, because they have huge amounts to invest, and need to spread it over lots of stocks. An individual has a better chance of getting lucky combined with some good picks. For example, if they’d researched and bought Apple shares, and focused on that, they’d be rich now. This doesn’t work for everyone, but since Kenny has pointed out all the people that underperform, I’m talking about the balance of people outperforming that must be out there.

The best advice a financial advisor can give most people starting out is “don’t hire me, set up Questrade for VGRO instead”

‘

‘

In a perfect world I would agree with you unfortunately study after study, several by unbiased low cost ETF providers, show that DIY investors grossly underperform the market so an after tax 0.60% management fee is a bargain by comparison. Here the old saying penny wise pound foolish would apply.

https://www.thebalance.com/why-average-investors-earn-below-average-market-returns-2388519

This is the end of my lessons.

Accepting a 1% fee is a poor decision which will cost 19-25% of your portfolio over 30-40 years (https://www.nerdwallet.com/blog/investing/millennial-retirement-fees-one-percent-half-million-savings-impact/). The best advice a financial advisor can give most people starting out is “don’t hire me, set up Questrade for VGRO instead”

If you’re renting at worst you pay the increased costs monthly. If you own a condo you not only pay the increased monthly cost but get hit with a decline in the market value of the property because it’s less attractive to buyers. Putting it another way you get hit with the present value of anticipated future insurance payments.

Also I don’t accept that apartments buildings have the same problems. It’s pretty clear that one owner is going to be better at managing damage risk than dozens of them.

The last thing most people need is a financial advisor who makes an income from hidden fees charged on the purchase of “investments”. Not to mention that there is no regulation of financial advisors, anyone can call themselves a “financial advisor” or “financial planner” outside of Quebec.

If you are confused with all the information, open a Questrade account and follow the model Canadian Couch Potato portfolio using dollar cost averaging. Fill up your RSP first if you get a good tax advantage from it, then your TFSA, and finally other taxable investments. Google and read what you don’t understand. When markets drop, buy more and hold what you have – don’t sell. If you still feel you need a financial adviser, pay them by the hour for advice, not based on a commission. https://canadiancouchpotato.com/2018/02/05/vanguards-one-fund-solution

‘

‘

Looks like I missed this one

‘

‘

I totally agree with you unfortunately most people cant help themselves and make poor decisions due to lack of knowledge or experience. Most clients with a decent size portfolio , say over 300K should be paying around 1%, this is also tax deductable. Here’s a little secret – THE VALUE OF ADVISOR IS NOT TO OUTPERFORM THE MARKET, it’s to help you navigate your finances and stop you from making poor or emotional decisions. Think of it like someone who hires a personal trainer, compared to the personal who joins a gym and does the same exercises with poor form and wonders why their body never changes or they get hurt.

“for which BC strictly limits annual rate increases”

Maybe now, but what if they remove them because landlords are closing whole apartment blocks…………….

Marko said: “Same insurance problems will apply to apartment buildings so whether you own or rent you’ll be paying for insurance one way or another.”

I don’t follow how those two things are the same at all.

When an apartment building unit has a flood, the repairs are completely covered by the apartment building owner’s insurance. The repair costs are not covered by the tenant (unless it is negligence or intentional — which is very rare). The tenant’s insurance — if the tenant even has any — mainly covers replacement of their personal belongings, loss of use.

Or are your referring to the apartment owner’s insurance rates also going up? Existing renters are in lease contracts, for which BC strictly limits annual rate increases, so existing renters will not be paying for the new insurance rates, or at least only veeeery gradually doing so. Many renters have been in the same apartment for over a decade. New apartment renters could theoretically pay for the new insurance rates by signing up at a higher rent cost, but many new renters are not willing or able to absorb such a boost to price of new rentals.

Moreover, for obvious reasons, renters are the last group people in the real estate ecosystem that one should expect to be able to easily absorb huge sudden monthly increases. And new Victoria apartment rental prices are already quite high.

Lastly, an apartment renter can always walk away anytime, at no cost (or if within the lease term, minimal cost) . A condo owner is stuck until a buyer is found.

The benefit of dollar cost averaging when you have a lump sum is largely psychological, not real from a statistical perspective. You stand to lose more by holding and investing smaller amounts over time than you gain. If you have come into a lump sum inheritance it is probably wiser to invest it all at once if the stock market is where you have chosen to put it. Read the data for yourself: https://personal.vanguard.com/pdf/ISGDCA.pdf

‘

‘

Well, geez you needed an article to tell you that, of course your USUALLY better off investing today then $ cost averaging, but lets see how well that worked for you investing that lump sum last week. The reason you don’t put it all in at once is to spread the risk, I assume you also think life insurance is a waste as you wont likely need it or the same with home insurance, now dont get me started on earth quake insurance.

When most people have a large lump sum from selling a house or inheritance, lets say 1MM, what happens if I invest it all and it falls 3 % in the first month, most people with little knowledge panic, then sell taking a loss then complain about the stock market and go buy a rental property which they think is always “safe”.

**** Warning: There’s a guy here that might want to scroll to the next message, because he’s told us that “You know what I do when the markets falls, nothing, in fact I don’t even look at it” ****

‘

‘

‘

‘

Nope still haven’t looked, I’m guessing i’m down around 3% as my bonds have surged as well as foreign currency increased, and cash is cash, which most likely puts me back to the level I was at 2 months ago. You know why I don’t care, its because I don’t invest money I need to access, we also have 2 secure high paying jobs, one with a Gov’t DB pension. In fact I would love a big selloff as I have a large PLC which is mostly unused at the moment to invest with.

When you invest in established companies your investing in companies that make things that people need and consume, so if you think that people will stop buying computers, cell phones, food, health care, automobiles, home builders, or need mortgages etc.. then yes the stock market will collapse but then go so will your house.

Same insurance problems will apply to apartment buildings so whether you own or rent you’ll be paying for insurance one way or another.

Leo S said: [Re: Shoal Point condo increase in insurance rates] At 3% over 25 years, $307/month translates to $65,000. One might expect rational buyers to want to pay that much less for the place given the increase. Of course most buyers aren’t doing that calculation

But the mortgage lenders sure are doing that calculation. If it suddenly costs an extra $307/month more to own that place, and any money has to be borrowed, it will make a difference in what people can afford.

Not only that, but now that the Pandora’s Box of condo insurance hell has reared its head , who is to say insurance rates won’t keep going higher?

Other condo building owners are reportedly “happy” that their rates have only gone up 30%-40%? Yikes! Again, nobody can guarantee that the insurance rates won’t keep going higher.

If I knew anybody interested in buying a condo right now, at any price point, I would point them to all the recent condo insurance nightmares and advise them to exercise extreme caution.

The insurance companies have clearly shown they are the ones who are in control here, and the condo owners are completely at their mercy. Why would anybody want to enter into a market segment where it is becoming common to have a sudden unexpected large rise in monthly insurance fees?

Even more reason to be in real estate 🙂

When you mentioned they were having trouble getting insurance they had already secured insurance. There are a number of reasons why Shoal point had a 300% increase; however, at the end of the day 65k over 25 years as per Leo’s caculations is not the end of the world in a building where the average sale price has been $1.4 million over the last few years.

Local Story from Marko – I mentioned a few posts back that the rumor was Shoal point was having trouble getting insurance and Marko said he looked into it and it was fake news – i guess his contact failed to mention that they found it but it was 300% increased. May have not been fake news based on the amount they are paying.

Even better is buy the most house you can’t afford. You can show off your big house on Instagram and gloat about your equity…your potential equity…hopefully there’ll be some equity…eventually…maybe.

Quite a day on the markets

**** Warning: There’s a guy here that might want to scroll to the next message, because he’s told us that “You know what I do when the markets falls, nothing, in fact I don’t even look at it” ****

Anyway, for people who do look at it (these are mainly about the US market)

I’m thinking most people, young or old, do not have 100K saved. A lot may have that in equity but I don’t think many have that amount saved that is liquid. I would like to be proven wrong but have a gut feeling I’m not.

Now it’s time for younger folks to get some reasonably priced equities.

‘

‘

Unfortunately most younger people have large mortgages, I would argue that when your young your portfolio grows mostly by contributions and the rate of return doesn’t matter as much, compared to what you putting away, for example if you have a small amount saved like 100K a 10% return rate is small compared to when your in your later 40’s and maybe your mortgage is paid off and you can now put away 50K + per year, then when you have a larger amount you hope for a bull market.

I have to admit I’m kind of cheerleading for the stock markets to keep falling. Nothing epic just a run of the mill 30-40% bear market. Boomers have enjoyed some amazing runups in equities. Now it’s time for younger folks to get some reasonably priced equities.

Yup. Definitely they should not be all in equities. Open question whether the stock market will suffer from boomers selling to finance their retirement.

I would say both in stocks and housing, expect future returns to be less than past.

So Shoal Point. Insurance now $817,000 from $265,000, increase of $552,000.

150 units so $3680/year extra for insurance, or an additional $307/month.

At 3% over 25 years, $307/month translates to $65,000. One might expect rational buyers to want to pay that much less for the place given the increase. Of course most buyers aren’t doing that calculation, but will be interesting to see if prices suffer as a result.

Marko condo fees up to 1k a month. 44% nice

Also

Cheap money going to just make this housing market even higher.

Its all good. Can’t see how this would affect the Victoria market at all. Increased insurance costs wont deter the purchasers of entry level housing in this market and therefore there will be no knock on effects up the property ladder.

As well, COVID-19 is a non issue, the resulting supply chain issues steming from COVID-19 will be a non-issue and will have no effect on the world economy or our economy so nothing to worry about there. No trickle affects whatsoever.

Schools being shut down wont happen here. Besides, if they did no big deal, most people can easily find child care. If not, very easy for one spouse to take a month or two off work to watch the kids. Its not like two salaries are required to pay a mortgage here

Protests? All good. No effect whatsoever. All those container ships hanging out waiting to get into ports will eventually get there. Might be a small lag in getting stuff to its intended place but that wont cause any harm.

Money will get cheaper and people will still buy condos and houses and any change in costs related to this can easily be absorbed by upcoming rate cuts.

Nothing to see here folks. Except the blossoms.

That’s only true for young people. Boomers are heavily invested in stocks. They shouldn’t be, but they are (see link) The point being they aren’t “dollar averaging”, they have their nest egg invested. And they’ll pull it out fast if stocks fall, regardless of what their advisor tells them on the phone, as they don’t want to wait 5-10 years for a recovery.

https://www.bentley.edu/news/survey-shows-baby-boomers-may-invest-too-much-stocks

“A FeeX user analysis that consisted of 10,000 participants showed that among people between 60 and 65 years old, 30 percent of individuals have invested nearly all of their assets in stocks. Adding to that figure, 52 percent have invested 70 percent or more of their savings in stocks, CNN Money reported. That lack of diversification can be very dangerous for older individuals facing retirement so soon.“

Local story -> https://www.timescolonist.com/opinion/columnists/les-leyne-insurance-jump-for-victoria-condo-building-817-000-from-265-000-1.24085281

Source: https://onthisspot.ca/cities/vancouver/realestate

You are forgetting that people don’t generally invest one lump sum and then leave it. Most people use dollar cost averaging, not on purpose, but because that’s how money comes in. So you invest a little bit regularly over a long period of time.

Even in the great depression that wasn’t a bit hit for buy and holders. We can argue semantics about how much money someone has in the market when, but even during historic crashes the DCA approach comes out just fine.

“If you started dollar cost averaging on the market’s peak day before the Depression hit, you’d be even by 1933. And by 1936, you would have doubled your money” https://clark.com/personal-finance-credit/investing-retirement/dollar-cost-averaging-through-the-great-depression/

Of course you could make more by timing the tops and bottoms, but no evidence anyone can do that.

If you literally buy the most house you can afford you won’t have any money left over for investments. You will also have all your savings in one asset. Plus if you buy more house than you need or want you are saddled with unnecessary maintenance and other expenses.

Instead buy the least house that you think will meet your needs for a good long time. If that leaves extra cash, then use that extra cash to invest and to enjoy life. There is so much more to life than owning the “most house you can afford”.

Look, this just is not true. First of all, there is no definition of a “decent advisor” because there are no standards to apply to advisors. Second, your investment window matters. You need to plan to be in for a longer term to manage greater risk and if you can’t hold longer term you probably shouldn’t be in stocks.

The benefit of dollar cost averaging when you have a lump sum is largely psychological, not real from a statistical perspective. You stand to lose more by holding and investing smaller amounts over time than you gain. If you have come into a lump sum inheritance it is probably wiser to invest it all at once if the stock market is where you have chosen to put it. Read the data for yourself: https://personal.vanguard.com/pdf/ISGDCA.pdf

And to be fair, let’s visit the 2017 purchaser of a Vancouver home in 2024-2027 and see where they are. I don’t follow the Vancouver market so I have no idea where they are now, but it seems likely that if things are down they will improve longer-term barring unforeseen factors.

Including Dow dividends (assuming tax-free) only changes the number of years to get back to break even from 25 to 16. And if you started in 1934 instead of 1929, after 25 years you ended up with 10X more money.

https://dqydj.com/dow-jones-return-calculator/

Years from 1929, total return including divs, return/yr

5 years : -67% (-19% /yr)

10 years : -38% (-4.7% per year)

15 years: -14% (-1% /yr)

16 years: 0% (0% per year)

20 years: 35% (1.5%)

25 years : 255% (5.2%/yr)

——

Compared to …..25 years starting in 1934: 2466% return, 14%/yr. (10X higher return than 1929)

Since we don’t have Hawk around now, looks like it’s up to me to remind the “buy-n-holders” of the worst that can (and did!) happen to stock prices …

‘

‘

The steel frame construction of the World Tower (today’s Sun Tower). It was one of Vancouver’s first skyscrapers and for a time the tallest building in the British Empire. It was representative of a time of phenomenal growth and optimism, when the population quadrupled in ten years to over 100,000 and a real estate bubble flew out of control. Property prices rose faster than at any time in Vancouver’s history before or since. The boom was so stunning that many people at the time concluded it could only end with Vancouver as one of the leading global centres of trade and finance.17 It’s of considerable interest to us today then that that is not how the boom ended. Instead, in 1913, the colossal real estate bubble popped, sending Vancouver’s economy into a tailspin that would take almost 40 to recover from.

It took 25 years (1929-1954) to get back to the 1929 peak.

‘

‘

Again, anyone who is foolish enough to invest a large sum of money all in one day runs the risk of this happening, any decent advisor would never recommend this. Just as buying a house at the top of the market, say Vancouver in 2017 has resulted I am sure of many people losing 100% of their original investment at this point.

There is always a possibility of a cataclysmic event that causes a big drop in the stock market or the housing market.

The question is whether this is going to stop you from investing. If it is, make that decision and stop dwelling on it. If it isn’t, stop waffling. Analysis paralysis is no place to hang out.

If we are talking about odds though, if you have a hold window of at least seven years there is a far greater risk of losing money by not investing in a primary residence or through a balanced ETF portfolio than there is by investing.

“ Thirty years of doing that (reinvesting dividends) from the market top in 1929 would have delivered returns of about 7.5% compounded annually up to 1960. ”

http://www.thecompoundinvestor.com/stock-returns-great-depression/

Since we don’t have Hawk around now, looks like it’s up to me to remind the “buy-n-holders” of the worst that can (and did!) happen to stock prices … ?itok=FvzOIsn7

?itok=FvzOIsn7

It took 25 years (1929-1954) to get back to the 1929 peak.

Single family median dropped about 10% in 6-8 months. Teranet index dropped the same amount.

LeoS said: “Buyers dried up and market was made up entirely of desperate sellers so price is really came down for 3 to 4 months.”

It must have been chaotic, but generally speaking how much did prices go down?

Yeah it is so easy these days with the new all in one ETFs. To do better than most stock investors the advice can be as simple as “Buy VBAL”. Historical returns here https://cdn.canadiancouchpotato.com/wp-content/uploads/2020/01/CCP-Model-Portfolios-Vanguard-ETFs-2019.pdf

Fee based advisor is useful if you have a more complex situation or want someone to give you dispassionate advice to stay the course during a big downturn. I tend not to pay attention to my investment balances so if I lost 25% I would hardly notice. Just buy more when money is available.

That’s even more reason to keep your powder dry.

Maybe, but it is from markets which have low appreciation rates and higher rent to values like the American mid-west. In these markets this works and makes sense and buying without good rental returns doesn’t work because you are not going to get the appreciation so you’d be subsidizing tenants otherwise.

The past doesn’t predict the future for investment returns with certainty, but when you have a long record to analyze those results are the best data you have to make decisions from whether it is for the stock market or local real estate market. And you need a place to live and your life is time limit so your investment window is too. The risk of not making a decision and investing in nothing is higher than taking on some risk by making an informed decision and stepping in.

The last thing most people need is a financial advisor who makes an income from hidden fees charged on the purchase of “investments”. Not to mention that there is no regulation of financial advisors, anyone can call themselves a “financial advisor” or “financial planner” outside of Quebec.

If you are confused with all the information, open a Questrade account and follow the model Canadian Couch Potato portfolio using dollar cost averaging. Fill up your RSP first if you get a good tax advantage from it, then your TFSA, and finally other taxable investments. Google and read what you don’t understand. When markets drop, buy more and hold what you have – don’t sell. If you still feel you need a financial adviser, pay them by the hour for advice, not based on a commission. https://canadiancouchpotato.com/2018/02/05/vanguards-one-fund-solution/

Sure, could happen. Former Landlord explained that you’ll likely have much bigger concerns if it does though and you’ll likely want to stock up on guns.

Similar to land and by extension housing on that land. Prices go up or down in the short and medium term but in the long run they go up if population and incomes grow. Could be that this reverses going forward, but we have 60 years of data that indicate it likely won’t so I’m ok with the buy and hold strategy for both of them for similar reasons

The buy and hold strategy vs trying to time the market argument doesn’t really have to do with past performance predicting the future.

It has to do with missing out on the run up of the market after a downturn/crash and avoiding capital gains taxes when pulling your money out. Maybe you can argue that “just because in the past markets go up after coming down, does not mean this will happen in the future.”. However if we end up in a world where stocks never go up again, then the whole financial system has probably collapsed and your cash and home will probably also be worthless.

I know of people who pulled out there money just before the US election in 2016, trying to time the market, because they thought a potential Trump presidency would crash the market. They are probably still sitting on their cash, because there has not been a “good” time to get back in since then and they have missed out on a huge run-up.

Totoro said:

“Buy the most house you can afford as your primary residence. …” Etc

Excellent points all around – thank you for your well thought out reply.

The big question is of course whether past Victoria performance (like you’ve been able to do well with) will actually be a good indicator of future gains.

To partially answer my own question about the 2% rule, in addition to what you and Leo S have said, I wonder if the 2% rule was also first thought up at a time with much higher interest rates being the norm.

Patrick said: “Why would anyone buy a home now, close to peak prices? Seems to be no discount offered for this black-swan uncertainty. ”

VERY interesting. If there are enough people out there thinking like this, then that in itself is a reason to sit back and wait.

However, even if corona virus were to subside in the next month or two, it is quite possible that it comes back in full force for the next flu season. That’s a long time to wait and see what happens…

That’s all backwards looking research, and true for looking backwards. That doesn’t mean it’s true going forward.

The money managers always list this as a disclaimer “Past Performance is Not Indicative of Future Results” – yet some then proceed to ignore that and give advice as if past performance IS in fact indicative of future results. And in this case, it might mean that “buy and hold” worked in the past, but won’t work for the future.

Agreed. And the worst time to buy a home would be before any price drops have actually happened, which is what we have now. Risk without reward!

Stocks have cycles just like houses, and it’s a lot easier to get in and out of stocks than houses to profit from your theories.

–

Good luck with that one, easy to sell hard to get back in, i have lost track of how many times i have met people that think their smart timing the market then they sit in cash for years, that is why most people need a financial advisor. Other problem with selling is taxes, pretty hard to justify liquidating non-reg portfolio to take a few 100K in capital gains on top of an income in the 40-50% tax bracket, again this is why most do it yourself investors vastly under perform the market

Based on my research it’s usually best to buy and hold. Very very few manage to outperform the market. Same as my point of view on the housing market but I can’t dollar cost average the housing market so I’m more interested in timing entries there.

That would be the time to buy because there are always people that need to sell and when buyers dry up those sellers get quite desperate. Seems a bit evil of course… we saw similar effect during the great financial crisis. Buyers dried up and market was made up entirely of desperate sellers so price is really came down for 3 to 4 months.

LOL. I was about to ask you the same thing when you reported your approach to investing is to buy and never sell, regardless of the data. Stocks have cycles just like houses, and it’s a lot easier to get in and out of stocks than houses to profit from your theories.

But for the record, I think this would be a terrible time to buy a home. Wait for Covid-19 to get resolved. Just look at the empty streets, restaurants and piazzas in Northern Italy , and that’s happened in just the past two weeks. And the few people walking around are wearing masks. And explain why that won’t be coming here, and If it does what do you think the impact on the economy, jobs, house prices, bank lending etc would be.

In health/medicine, there are observed phenomena- facts. And then they try to explain them. In this case, the phenomenon is that most Coronavirus FAMILY infections ( not necessarily a Covid-19) have seasonal pattern, peaking in the spring. No one disputes that. So don’t get hung up on the theories as to why they are seasonal, because the explanations (heat, sun etc) are just theories, whereas the seasonality is a fact for most of the Coronavirus family infections. Victoria has the same seasonal patterns with peak viral infections in spring – that’s a fact.

What isn’t known, is if the Covid-19 is one of the Coronaviruses that is seasonal, or more like SARS that wasn’t seasonal.

Typically these markets have lower appreciation rates but higher ROI on rent. After many years of considering the matter, I’d rather have the opposite myself for a number of reasons. The ideal of course is to have both and to do that you need to buy in a depreciated high rent market which doesn’t exist in Canada so you’d have to have been comfortable investing in the US during the big bust.

Are you trying to rely on pithy sayings to make financial decisions? The information is out there, but it is market specific so you need to know your local market conditions, lending environment, and taxation laws – among other things. Just because some guy who wrote an article for biggerpockets or some other blog and lives in a US market and a reality where the 1% or 2% rule applies doesn’t mean that all RE markets behave this way. We are just one of many that don’t. Real estate is highly influenced by local conditions which are largely not national in nature, never mind international.

So, yes, I’m saying it is different here than markets in which the 1% or 2% rule is a possibility. And yes I’m saying it is still a good market in which to be a homeowner. But we all get to live with the financial consequences of our decisions and I’m not trying to sell you anything nor are you paying me anything so make your own choices.

Buy the most house you can afford as your primary residence. If you are saying you have extra to invest in rental housing after this and you are looking to be cash flow positive you might want to consider another market but depends on factors such as your tax situation as to whether a cash flow negative but otherwise appreciating and leveraged investment in RE in Victoria is a good bet. Use historical returns (long-term) and create some spreadsheets and project forward. That is what I did when I was starting out. It is fundamentally a question of math once you account for all the variables based on reasonable assumptions. No magic or easy universal rules I’m afraid.

Cold is relative. I wouldn’t say that highs of +20 are cold. It’s also sunny for the next week at least. But dry yes.

The weather in Iran now is similar to a Victoria summer. We don’t get hot weather here very often, and never anything compared to hot weather in Iran.

I forgot to ask last week whether someone had taken over your account

As I said a week ago … Why would anyone buy a home now, close to peak prices? Seems to be no discount offered for this black-swan uncertainty. Back then it was just bonds and gold pointing to Armageddon, and now the stocks are turning down too. https://househuntvictoria.ca/2020/02/18/whats-really-going-on-in-the-victoria-economy/#comment-66213

The seasonality findings of some coranaviruses are based on the finding that the virus transmissibility falls in heat, humidity and sunlight.

In the case of Qom Iran, Jan and feb are cold, dry humidity and cloudy according to this weather summary. https://weatherspark.com/y/104978/Average-Weather-in-Qom-Iran-Year-Round None of those factors help to get rid of the Coronavirus.

Anyway, I understood your point was to state that Iran is so hot now that this coranavirus can’t be affected by weather, because they have cases. Their hot weather hasn’t hit yet so it would be too early to say that.

It remains to be seen if this Coronavirus has any response to warmer, sunnier and humid weather, but IMO the cases in Iran don’t shed any light on that.

Little birdie tells me the Danbrook One tower will be very difficult it not impossible to fix. May have to be demolished

Another thing about the 2% rule.. in a market where that rule applies, why would anyone in their right mind not buy?

2% rule doesn’t work here (or most markets outside perhaps flyover states US). For condos I like the rent ratio as an indicator of where resale prices are relative to fundamentals housing demand https://househuntvictoria.ca/2020/02/10/the-rent-ratio-as-an-indicator-for-condo-investments/

I don’t think 2% rule ever worked here. Maybe 30 years ago?

Simple guideline? Cash flow positive.

Totoro said: “The 2% or 1% or whatever “rule” you apply for rental income doesn’t work here.”

Are you saying, ‘It’s different here’ ? Certainly, that’s a common real estate trope/punchline known to be used by the industry just about anywhere.

If 2% is not a good guideline, and 1% is not a good guideline, and 0.5% is not a good guideline, then what is a good guideline for an investment property rent income as a proportion of value?

Or is there no good guideline for Victoria, and it doesn’t matter what the rental income is as a proportion of value?

The 2% or 1% or whatever “rule” you apply for rental income doesn’t work here. Doesn’t make real estate a bad investment in our market. Just means the rule is as out of place here as using 1% for maintenance costs is given valuations.

One more sign that Victoria prices are seriously out of whack? Outside of condos/townhouses, Victoria most often doesn’t even meet a “0.5 %” rule.

‘

‘

‘

Yup, I advise older clients, over 70, all the time to sell their house, if they need more money and rent and enjoy the money as renting is much cheaper then owning, I also always advise homeowners to defer their property taxes.

Anybody else every hear of the “2% rule for investment properties”? “The 2% rule says that for a rental property investment to be “good”, the monthly rent should be equal to or higher than 2% of the purchase price. For a $100,000 property, the monthly rent collected needs to be $2,000/month or higher to meet this guideline. ” https://www.biggerpockets.com/blog/2013-04-14-the-2-percent-rule

One more sign that Victoria prices are seriously out of whack? Outside of condos/townhouses, Victoria most often doesn’t even meet a “0.5 %” rule.

/ I’ll bet the 2% rule can’t be met in many places these days, but Victoria is probably among the farthest from it

For what it’s worth, here’s a timeline of the 1918 flu epidemic. The first wave happened in March, it tapered off for six months, then the second deadlier wave kicked in.

https://www.cdc.gov/flu/pandemic-resources/1918-commemoration/pandemic-timeline-1918.htm

Neither is $850K + 5% or + 10% or + 25%.

Sounds insane, of course, but I’ll remind readers of the certitude expressed by so many in the early years of HHV that not only was it damn near impossible that prices could increase but that they were almost certain to crater.

Probably.

However that’s not quite how it played out with SARS. Per capita more people died of SARS in Canada than in China.

There’s an element of randomness to an epidemic. For instance did anyone predict a few weeks ago that Italy would be one of the countries hardest hit by coronavirus?

Kung Fu kicks work better, look cooler and don’t risk dirtying your knuckles

I’m sure that’s when it’s spreading patrick. In the middle of the night. Here’s Qom where it’s been actually going down:

https://darksky.net/forecast/34.6401,50.8764/ca24/en

Highs of 17C – 21C.

Basically summer weather for Victoria.

I feel like a local outbreak will have a greater effect on Victoria than most places. About 20% of our population falls in the severely impacted zone (above age 65). Our already overwhelmed health services wouldn’t be in a good spot.

That’s not a good place to be in when you’re living on an island.

I’m not sure, but it seems unlikely that a global pandemic will cause local house prices to fall. If there is a local outbreak I imagine fewer people will be out house-shopping for a few months. What will happen is that tourism related businesses like restaurants will be severely impacted, as will in-person attendance at public events. Many scheduled and non-essential events will be cancelled. Some businesses will shut down temporarily or lay off workers. Food supply chains may be impacted. If it is the same as in Asia people will stay home. Canada seems like a good place to be during a pandemic though. Low public transit use, low density, high internet use, plus public health care mean that we should be better positioned for voluntary quarantines with good information flow.

Furthermore you should consider the banks don’t want rates to drop. You may remember the last two rate cuts we had when oil prices bottomed out the banks did not match the rate cuts in full. In fact the latter cut TD originally came out first and said they weren’t matching any of the drop. The other Banks said they would match 15 of the 25 basis points and so TD had to follow suit. If you are thinking bond rates are gonna fall out and suddenly mortgage rates will follow suit history shows you would be wrong.

Not currently, at least in Saanich (I don’t know for other munis). There is talk that this may change to permit multiple suites and greater flexibility, but has not happened yet, despite multiple suites in town being fairly common.

https://www.saanich.ca/EN/main/local-government/development-applications/secondary-suites.html

10% on 850k is nothing to sneeze at, Introvert.

The goddamn world economy nearly melting down in 2008 caused, what, a 5-10% dip in Victoria prices? And the aftermath of the crisis helped cause a 40% increase in prices due to rock-bottom interest rates that always attend large economic slowdowns.

I’m not a medical expert, but the information I have is from medical reports on coronavirus and influenza.

Cold weather, humidity, and the way people behave during winter (staying indoors more together with less air circulation) can all affect the trajectory of an epidemic. Cold air causes irritation in the nasal passages and airways, which makes people more susceptible to viral infection. When the air is cold, airborne droplets are more likely to float in the air for longer – travelling further and infecting more people. Less sunlight exposure may also undermine the bodies ability to fight viruses.

But coronavirus might not respond to summer conditions like the flu does. Just speculation at this point.

More and more local strength in the market set against more global uncertainty. Gonna be an interesting one.

“I have a feeling it’s going to be a good spring for Victoria real estate.”

Except in this case rates are dropping due to fear of economic impacts to Canada. Rates can drop but if employment and inflation fall with it then you will likely be wrong. Not saying it can’t happen – i realize Victoria is more insulated than most other places in Canada but if a global slowdown occurs my guess is it will be felt in Victoria and in housing in particular.

If Hawk was here he would say this is part of the bull trap section – and I wouldn’t disagree.

On the flip side of that coin my wife and i just got preapproved for a home price of 875K with a suite. So if the right opportunity comes along we will pull the trigger. And on that note – is two suites ever legal in Greater Victoria? I have seen a couple houses as of late with two suites and i figure if i’m fine with one person living below me may as well make it two and have even more of my mtg paid.

Thanks!

OK. Tehran is 2 degrees C right now. https://www.theweathernetwork.com/ir/weather/tehran/tehran

Sincerely doubt this.

Look at the weather in Iran right now. They’re having a full on outbreak (disregard their official number of confirmed cases, if they had 19 deaths yesterday, they have way more than 100 cases going on.)

Bond Yields and Fixed Rates Falling Further on Coronavirus Fears

https://www.canadianmortgagetrends.com/2020/02/bond-yields-and-fixed-rates-falling-further-on-coronavirus-fears/

I have a feeling it’s going to be a good spring for Victoria real estate.

Totoro,

Great list… thanks.

I’d add…

– wear some latex or nitrile disposable gloves (avoids touching public keypads/ATM etc. with your fingers)

– for transactions, use more “tap”/less cash (in China, they sterilize cash as virus may transfer that way)

Sorry, not housing specific but just a reminder to get ready just in case. Having seen the impact of smaller outbreaks in Asia, people here might want to:

We’ve also postponed all non-Canadian travel plans and won’t be attending any concerts or other large public events. Transmission rates should decline as the weather warms and estimates are that a vaccine is 12-18 months away.

That’s not how Victoria rolls.

BUT

Kind of odd that you treat losses in these two investments so differently. I’d suggest that in both cases you have a minimum potential hold period of seven years and focus on the long-term.

For the average investor investing in either ETFs or low cost mutual funds the ONLY exit strategy they should have is starting to sell holdings when they need the money in retirement.

For any investor still in their prime earning and saving years a dip in the market is your friend not you enemy. If the market falls a few percent (or even many percent) your monthly ETF or fund purchases just buy more units.

A big market fall is more worrisome if you are actually in your retirement years drawing on those investments. However at that point you should have moved to a more conservative allocation (certainly not 100% equities) that won’t be as susceptible to market plunges.

Liberals proposed an amendment to Strata act to deal with insurance situation. It includes

Maybe I’m dense but I don’t see any of those measures decreasing costs and the last one will increase costs for those who currently don’t have insurance (Good idea to have it of course)

Kenny you are wrong in that scenario – the bank doesn’t do that. If that were the case when oil tanked in Alberta mortgages would not have been renewed after many Albertans lost their jobs – which didn’t happen. I used to work at a bank and even though that is part of our credit agreement it’s never exercised.

With a house mortgage, the bank doesn’t call. Just keep paying your mortgage, and you’ll be fine.

The stock brokerage not only calls (margin calls), if you don’t answer, they sell for you, typically within a day.

–

–

Who said anything about a margin loan, that’s not the most efficient way to borrow.

I may have exaggerated for effect the bank calling but still stands that with 5% down you have lost 100% of your money if house falls 5%. Now lets say your house is down 15% on renewal, i’m pretty sure the bank is going to look deeper into your overall financial situation and if you have lost a job which can happen in a downturn pretty sure your not getting your renewal.

I don’t even have an enter strategy.

It is really important to do the math before posting conclusions. If you haven’t, you run the risk of being just plain wrong and obviously so.

With real estate you can leverage with much lower risk. For example, you probably won’t deal with a margin call when your property is worth less at the 5 year refinance mark.

With a house mortgage, the bank doesn’t call. Just keep paying your mortgage, and you’ll be fine.

The stock brokerage not only calls (margin calls), if you don’t answer, they sell for you, typically within a day.

OK, I’ll mark you down as a “hold’. In practice, it’s not so easy to stick to that plan as you watch your money (on paper) melting away.

‘

‘

‘

Now what if that house you bought for 500K with 25K down in 2009 goes down just 5% you’ve now lost 100% of your investment, oh and your friendly realtor wants 20K to sell it on top of that, do you stick with the plan as your money has just melted away and what if the bank calls?

I’ve done okay on both, but yea real estate just crushes stock returns based on leverage not to mention you can live in it too and tax free for your principal residence.

‘

‘

‘

Leverage works both ways of course, pretty sure there’s people losing 100% or more of there original investment in Vancouver real estate over the past 2 years

I will agree that most people are better off when they first start out getting into the housing market as its a forced saving and if they have a secure job then all is good, now there have been times when people lost their jobs and house in 70’s, 80’s and 90’s, 00’s. Most people make bad investors because they swing for the fence and look at their investments way too much, you need to buy quality and be patient and of course leveraging is the prudent thing to do.