Garden Suites

While suites are hugely common in our area, the idea of a detached so called Garden Suite has been picking up steam in Greater Victoria recently. Victoria proper has allowed the concept of garden suites since 2004 but because putting one in required an onerous rezoning application there was essentially zero uptake for years. That changed in 2017 when the process shifted to what is called a delegated development permit process, which allowed staff to approve applications instead of having to go to council and public consultation. Though that didn’t exactly open the floodgates, it did increase applications by an order of magnitude (that is, from a pathetic 2 per year to a modest 24).

A garden suite plan rendering

Now Saanich is clearly moving in the same direction. At Monday’s council meeting, the staff report on garden suites was approved to move towards bylaw amendments that will allow garden suites on nearly all residential zoned single family properties.

What’s behind all the government interest in garden suites? Well as Saanich council noted, outside of the pressures of strained housing affordability there’s been a surge in support, with public support for garden suites rising from less than 50% five years ago, to over 80% now. It seems like people are starting to accept that some moderate infill will be required to accommodate more residents in all neighbourhoods, and this is a gentle way to do it.

I dug through the Victoria garden suite bylaw as well as the proposed Saanich ones to summarize the key requirements and constraints for garden suites in both municipalities. What I didn’t know was that Colwood also allows garden suites and unlike the other two has done away with a development permit entirely, requiring only a building permit. I haven’t added Colwood’s program to the table yet but have reached out to them to see what the uptake has been in that municipality with streamlined regulations.

Note that the information below is believed correct as of Oct 23, 2019. However, do not rely on this information if you are planning on building a garden suite. Please consult the appropriate bylaws and city hall to confirm all information.

| Victoria | Saanich (proposed) | |

|---|---|---|

| Zones permitted | Residential single family | Residential single family (RS, Broadmead excluded) |

| Can convert existing accessory building? | No | Yes - if meets all requirements and code. |

| Allowed if house has existing suite? | No | No |

| Suite location | Rear yard | Rear yard unless variance granted. |

| Max rear yard coverage | 25% | 25% |

| Parking | No dedicated parking required for suite | 1 space required for suite |

| Uses | Regular zoning restrictions apply. | No short term rental or B&B. Owner must occupy main house. |

| Setbacks | ||

| Rear | 0.6m | 1.5m (3m for 2 story suites) |

| Side | 0.6m | 1.5m (3m for 2 story suites) |

| Suite to house | 2.4m | 4m |

| Lot classifications (see below) | Regular, Plus | Small, Medium, Large |

| Victoria Regular Lot Lots smaller than 557m^2 (~6000 sqft) |

||

| Max suite size | 37m^2 (~400sqft) | |

| Max height | 3.5m | |

| Victoria Plus Lot Lots over ~6000sqft or lot with 2 road accesses (laneway, 2 frontages, or corner) |

||

| Max suite size | 56m^2 (~600sqft) | |

| Max height | 4.2m | |

| Saanich Small Lot Lots 400 - 559m^2 (~4300 - 6000 sqft) |

||

| Max suite size | 46.5m^2 (500sqft) | |

| Max height | 3.75m flat roof, 4.2m sloped | |

| Saanich Medium Lot Lots 560 - 559m^2 (~6000 - 10,700 sqft) |

||

| Max suite size | 65m^2 (~700sqft) | |

| Max height | 3.75m flat roof, 4.2m sloped | |

| Saanich Large Lot Lots 1000m^2 and larger (~10700sqft+) |

||

| Max suite size | 93m^2 (~1000sqft) | |

| Max height | 5.5m flat roof, 6.5m sloped | |

| More information | Victoria Garden Suite Policy | Proposed Saanich Garden Suite Policy |

The regulations are broadly similar, with Saanich requiring larger setbacks and spacing overall as well as mandating parking while allowing significantly taller structures on the medium and large sized lots. Looking at our relatively small 6000sqft lot, it would be tough to fit a garden suite given the restrictions on setback and spacing, so I suspect that the more suitable locations would be on 8000sqft and up properties.

What’s next?

It was pretty clear from the council meeting that not only is Saanich in support of suites, but they are also already thinking about how to increase adoption. No one is kidding themselves that the current approvals will result in a flood of garden suites constructed, but they are already directing staff to examine removing the requirement for the development permit entirely and going to the Colwood model of just requiring a building permit. In addition they are looking at allowing garden suites on properties where there is already a suite in the house (as Vancouver does). That would essentially allow 3 dwellings on a “single” family property which would make that term even more of a misnomer than it already is.

Why are there so few garden suites?

I’m excited about the potential for garden suites in the long term. There are 6500 single family houses in Victoria and 22,000 in Saanich. A large percentage of those could support a garden suite with the right regulation and a sensible way to build them. However with current regulatory restrictions, construction costs, and the custom approach to building these suites we aren’t likely to see a big uptake. I would be shocked if there were more than 50 built in the first couple years of them being approved in Saanich.

The primary obstacle is cost, with applications in Victoria apparently averaging $180,000 (and I suspect that’s only for the building and not site prep nor design and the application itself). Dropping a quarter million on a little house in the backyard is just not within the means of most people even though the cap rate may not be terrible. I believe to really drive adoption we would need to see some innovation on the building and regulatory side to make the process seamless. A prefab lower cost structure that is designed to code and to meet municipal regulations, combined with a municipal fast-track process for structures that have been pre-approved. If total hassle could be minimized and cost brought down to more like the $150k level I think there could be real potential here.

Regarding the taxes, that is what can add disproportional costs. I’m sure GST is also due upon occupancy permit, which would be calculated on the value of the improvements plus land. Add in the capital gains tax, higher property tax, rental income taxes, PTT if selling.

Take the scenario where a small developer buys an old house for $800k, fully renovates it to current code, adds a garden suite, then sells. By the time the new owner takes possession at $1.4M+, it could reach $185,000 in taxes/fees paid by all parties.

$14k Acquisition PTT

$10k Property tax during redevelopment

$70k GST

$26k Sale PTT

$40k Capital gains tax (est)

$25k Misc mandatory red tape costs (tenant buyouts, permit fees, licensing, hearings, etc)

Total additional cost: $185,000.

Taxes are obviously necessary, but maybe progressive taxation is pushing up high home costs far higher than necessary. It costs a lot to buy a new house – the high price shouldn’t make housing a “luxury” item subject to an avalanche of taxes to “capture the gains”.

Monday numbers. Basically unchanged from last week https://househuntvictoria.ca/2019/10/28/province-passes-legislation-for-benecial-ownership-registry/

What would really make it cheap is if it were automated (robotic) assembly. Modular panels, or something like that. Sure the municipal fees are a lot, but you have to have an engineer and designer for a one-off house anyway (and there’s no obligation for a blower test). What kills you during the build is your $60/hr project manager and $35-40/hr framing crew, not the $5k for the engineering. And no, the employees don’t make those rates, but you’re paying them as a client. The semi-standardization of roof trusses, for instance, has already dropped prices somewhat on roof construction.

The fact is, without an underclass of slave-wage employees, anything labour-heavy today is very expensive. It’s the flip side of low unemployment. It’s kind of a good thing, as it means people are making a decent wage, but it also means you should learn how to do anything skilled yourself, because good luck finding (and affording) trades to do those one-off tiling or paving jobs.

I’m not saying it’s a good thing, I’m saying the revenue is made up in some way regardless. They can drop all those fees but then raise prop taxes 2% for everyone.

The only way to actually drop real cost (rather than shift it onto someone else) is to stop doing things. And that’s where I think pre-design and pre-fab has more potential to save money. Drop most of the engineering and design, drop the energy modelling, drop the blower. Of course some people will always want fully custom places but there should be a substantially cheaper COTS option. I imagine the scale isn’t there to make it feasible.

I think unless you’ve been through a build, you can’t really pass judgment on these things. City permitting fees at 30k+, Engineering 6k+, Drafting/Architect 6k+ on a good day, Demo permit, hazmat sampling 4k+ (no disposal cost), Energy modeling 4k+, Blower door testing (2k+), Sidewalk replacement (5k+) etc. Before you even break ground, throw close to 60k into the fire. If you’re going for a rezoning, well better put some extra on the fire.

Then, might as well budget 15-20k for “city contingencies”. Things the inspector is (dubiously) calling you out on (like upgrading 4″ to 6″ just because), or perhaps you’re trying something a little different that needs special approval etc.

Keep in mind any build starting now is under the new, more stringent, structural engineering requirements (earthquake resistance), so better buy some stock in Simpson and Hilti.

I figure I’m near as cheap as it’s possible to get on a SFH build and I’m running about $150/sq ft. That is all DIY except for slab finishing, stucco, and drywall+paint. Probably knock $5/sq-ft off that if you go non-passive.

I would not be surprised at all if the Liberal promises for increased first time buyer cap and speculation tax never happen.

Their regulators (CMHC) hate the idea of goosing the market and they can do easily push it down the priority list now. I bet we see almost no action on housing demand focused measures for a while now that demand has picked up a bit. And nationwide vacancy tax is an administrative nightmare and will lead to a ton of bad press. Won’t happen

I doubt further efforts to stimulate are going to prove fruitful. They generally haven’t been historically. Falling interest rates don’t arrest housing declines, sentiment by banks and consumers do.

Could a loosening of credit cause a run up from here? Keep in mind, it’s not just about the availability of credit, it’s about a buyer willing and able to avail themselves of it. At some point it doesn’t matter if the interest rate is zero; if it’s too much debt, it becomes a long term drag and vulnerability upon the economy.

I do think they’ll drop rates and maybe encourage the banks to lend, which we can see a real-life and current example of in Australia. Once again though, there isn’t anything unusual about political leaders trying through policy to “save” the housing market. IMO, truly saving it means stop meddling in it with inflationary policies and just let the correction clear out the excesses in the market. There is no other way to get a vibrant and sustainable market, IMO…

It’s a zero sum game. Let’s say there are no development charges. Completely free.

That blows a small hole into the city budget (as far as I can tell from the budget it might be a million or two). What happens? They raise property taxes to make up the difference and all the same things happen that you described. Except now it’s everyone paying instead of just those buying the new homes. Is that a better system? Not so sure about that.

Sewer only connection is $8600 in Victoria. The $11,800 is for sewer/stormwater in same trench.

So $8600 sewer vs $16k in Langford. Doesn’t really matter how they split the fees up, in the end you are paying way more in Langford.

Garden suite servicing goes off the main house (at least in Saanich) so unless you need a bigger pipe you won’t need to do anything in both cases.

Condo prices haven’t really softened at all. Unless this slowdown turns out to be just mid-cycle weakness it would be unprecedented to have a slowdown reverse after only 2 years.

Anyway I would make this decision not on where prices are going, but on whether the investment makes sense. Is the cap rate on those investment condos something you are happy with? If not then buying them is just speculation on future price increases. If it is then you hardly need to care what happens to prices.

Local Fool- Watch credit indicators

Could you expand? If credit loosens shall we anticipate another run up in prices, or is this a last ditch effort to save a dying economy?

Exactly! Supply and demand. One would think there would be a shortage of skill workers if wages doesn’t keep up with costs of housing, as we are seeing with the present condition in Van/Vic. Therefore either wages has to rise (even those it is quite high as many on here have said in the past) or house prices has drop to compensate for the imbalace.

Would you care to explain the flaws? And, perhaps some insight at solving the costs of living?

Residential construction is non-union (at least excluding high rises) and wages are determined by simple supply and demand. They don’t get raises because the cost of living has gone up. They get whatever the builders are willing to pay to get the labour they want at current market conditions.

Your other examples have similar flaws.

I’m not sure how much exactly less the cost would be. But, similar size Southpoint Ridge development with same number of bed/bath townhouses on Flint Ave in Langford is starting at $524,000. A slightly larger unit at 2010 Lansdowne Walk that is next to Pearl Block is presently on MLS# 416435 for $695,000.

Do you really think that developers going to eat the added costs that carve away theirs time and profit with out passing it onto the buyers?

And, why would buyers eat the higher cost of investment without passing it onto renters?

And in turn, construction workers would demand higher salary because of higher costs of living, and so on.

The local government simple little action may not look like much, but the knock on effect that they cause, exacerbate and drive up the price of housing.

Sewer connection fee shouldn’t be that expensive in Victoria for the work as demonstrated by Langford. The capital recovery fee is a one time fee. Therefore the fee shouldn’t apply to subsequent repair or upgrade such as adding a garden suite.

All in all, the total costs of construction is a whopping $180,000 for 600 sqf or less for a suite on existing land is insane. At a cost of $300 sqf or possibly $400 spf or more as suggested.

IMHO, finish cost shouldn’t be anywhere near what we are seeing if there were less red tapes. We may not see NB house prices at less than $100 sqf, but I’ll be damn if it much more than $150 sqf if the local authority keeps their hands out of our pockets.

New NB houses: MLS# M124541 and M125438

The Sewer Capital Recovery Fee is a one-time fee charged to the applicant by West Shore Environmental Services at the time of the sewer connection application in order to recover the cost of the installation of sewer lines and related infrastructure in general. Often, this SCRF will be charged to property owners wishing to connect an existing structure to a West Shore Environmental Services constructed sewer; other times, it will be charged to a developer if the application is for a new development or subdivision wishing to connect to a West Shore Environmental Services constructed sewer.

https://www.corix.com/langford/resources/FAQs

I would wait at least that long before making a determination. The market is generally going sideways right now which usually means it’s about to change direction. Watch credit indicators.

So sewer connection

Victoria: $11800

Langford $6000 connection fee + $10,291 capital recovery fee = $16,291

Doesn’t look good so far.

I am thinking of pulling the trigger on an investment re-sale condo ($400-700k) in the next 12 months. I have my eyes on both Vancouver and Victoria. It seems that even Steve Saretsky has become less bearish and perhaps is even now a little bullish (https://www.youtube.com/watch?v=wBjE53KAjyY&t=12s). Similarly, CMHC paints a more rosy picture, esp. for prices <$700k (https://www.vancourier.com/real-estate/metro-vancouver-home-prices-could-return-to-peak-levels-in-a-year-cmhc-1.23988230)

Given that there has been some softening in Vancouver (10-15% off peak) and perhaps Victoria, it might be a good time to jump in before prices start going north. What do people forecast for the major BC markets over short-medium term? Is a Vancouver condo a better investment than a unit here in Victoria?

True, but I wonder if that is more a function of the neighbours than the city.

Ok so those $799k townhomes. How much less will those exact builds cost in Langford assuming land cost is the same?

Tough to say as everything would need to be adjusted included financial charges. You wouldn’t be sitting on vacant land for years waiting for re-zoning.

Also in Langford you would design the complex so you don’t need an architect, just a designer. Or maybe you do need an architect but Langford doesn’t notice ->

https://www.vicnews.com/news/architectural-institute-sues-langford-over-building-not-designed-by-architect/

Ok so those $799k townhomes. How much less will those exact builds cost in Langford assuming land cost is the same?

Isn’t PR great? It sounds like the city is trying to make more afordable housing available to the uninformed person, but in reality the city is doing everything in their power to grab more money from the residents and be damn with the cost of housing.

I’ve been saying exactly this for years; however, you average voter doesn’t get what is really going on. All they see the price of homes, the price of gas that pump, and their resturant bills (which killed the super simple HST system we had).

For someone building a carriage house this will be be a huge added cost as they will most likely have to upgrade water,sewer,storm

Wouldn’t be surprised if they asked owners to replace 50′ of sideway/curb as well. We’ve had to do it on every single build in the City of Victoria even though the sideway/curb were totally serviceable and safe.

I’m not a big fan of the adversarial thinking. Gets us nowhere. The city is trying to improve the housing situation as well. It’s not like a bunch of evil people trying to make housing less affordable. It’s a fine line between getting revenue from developers in order to reduce pressure on residents and encouraging development, just as there is a fine line between little regulation to make it easier to build and more regulation to make places more cohesive. We can see in our area the effect of both policies with each municipality taking their own tack.

I’m pro development, but I’m against big government, red tape, cash grab, nepotism, and untrained/unqualified policy makers who make decisions on subject matters that aren’t related to their qualification.

if you dont build , they wont grab money from you .. so why does it matter if it is cash grab .. maybe having extra neighbors really kills your mood

Isn’t PR great? It sounds like the city is trying to make more afordable housing available to the uninformed person, but in reality the city is doing everything in their power to grab more money from the residents and be damn with the cost of housing.

There is a clause in the building code that read subject to local authority/jurisdiction, which apply to every single code. Therefore the local city council/local bylaw override building codes and engineering practice. The clause can lead to abuse, because inspectors and law makers aren’t required to have engineering education.

@ Qt

We knew going into it that the site services only go to the lot line, but why not have a choice to use another qualified contractor to put the services in ? Like other municipalities, city of vic has a monopoly on it.

We did a 3 plex character conversion two years ago that had a standard 4” storm drain connection, city of vic made us upgrade to 6” storm drain at the cost of 15k, we did not change the foot print of the house or change the water run off in anyway ! Nothing at all changed other then more units within the existing building.

Also I did not mention the costs for the demo permit and other fees that went along with that including caping the old services.

For someone building a carriage house this will be be a huge added cost as they will most likely have to upgrade water,sewer,storm

Add: 4″ pipe, yield 160 fixture units on vertical run, and 100 fixture units on horizontal.

Standard 4″ drainage can serve up to 160 fixture units (can easily service a small condo building in layman term). 5″ or 6″ isn’t much more than 4″ price wise for short runs.

1″ type K copper tubing costs is neglectable over that of standard 3/4″ type K, fittings prices aren’t that different, and they typically wouldn’t need more than 1-2 lenght of copper. Upsize from 3/4″ to 1″ water meter can be substantial in price difference, but a meter of 1″ or smaller shouldn’t cost more than $500.

Total supply costs shount be much more than $1000 per unit, muc less per unit if they combine the services.

LOL, costs of living is high so they have to keep the goverment workers employed somehow.

Plumbing services connections stop at the property line, while the gas connections are longer runs, that run to the house.

You are lucky if they didn’t charge for caping the existing services.

If you ask me the city workers are not efficient at all, it took them a week and few days to put those services in and that was on a dead end street with minimal traffic control.

Canadian utilities ( fortis gas install contractor)

Were there for 3/4 of a day to do both gas line installs including running the meters to both houses.

Pretty much the same depth as the storm/sewer

Thanks. That’s in line with what they are saying then at $31k.

So the question is what is their cost on those connections? Are they making a massive profit on it? They claim the larger size services are done at cost but I wonder what the work actually costs them for standard servicing

As for the lots we serviced in the core last year

Permit app fee = 100.00

Permit fee = 9800.00

1” water = 6500.00

Storm/sewer = 11,800 ( in same trench )

New works deposit 5000.00 ( deposit per lot for sidewalks )

These were the costs per lot with services to the lot line only.

One lot had existing servicing but they made us put new services in anyway, also existing driveway flairs did not meet today’s standard so the whole frontage needed to be replaced at our cost.

It was a class action suit, so no reason to expect that the plaintiff is paying anything. Those are typically contingency fees.

You mean the same lawyers whose arguments against the FBT were rejected by the judge? Wonder who was paying them – not Jing Li I would think.

I read site connections as mostly labour for actual site servicing (trenching, electrical, water/sewer Infra on site). You really think the city is charging $186k for hookups? Doesn’t seem realistic but you know more about it than me

Also one would think they would be incented to put more cost into the municipal bucket to put pressure on the city to reduce fees

$11k for municipal fees eh? Seems… somewhat reasonable

But check out the site connection costs (would be mostly municipal).

It is a fair breakdown, it would appear they are planning on spending less than 6%+3% for real estate commissions + marketing combined so I doesn’t appear like the are fudging any numbers in my opinion.

The same lawyers involved in the case just decided have this 2016 article about discussing the clear NAFTA violations. (And NAFTA violations were mentioned/discussed in this case). So NAFTA is clearly on their radar. I’d expect that they fight one case at a time, and may launch a NAFTA case directly next. If so, you could consider the legal challenges to the BC foreign buyer tax as “ongoing”. I don’t see any internet articles yet about other NAFTA cases, but I expect articles soon given Trudeau’s upcoming foreigners tax. https://betterdwelling.com/bc-foreign-buyer-tax-might-actually-cost-canadian-taxpayers-billions/#_

That’s nice. That’s one of the articles I was talking about. How about a reference to an actual challenge right now?

Here’s a good 2016 fin.post article from a NAFTA expert Toronto lawyer describing FB tax as a clear NAFTA violation. With Trudeau’s proposed Canada-wide foreigners-only spec tax, I’d expect we will start seeing more articles like this.

“ B.C. just violated NAFTA with its foreign property tax — and we could all pay for it. Mass claims by affected foreigners with trade rights would mean Canadian taxpayers could be on the hook for hundreds of millions, or even billions, of dollars”

https://business.financialpost.com/opinion/barry-appleton-b-c-just-violated-nafta-with-its-foreign-property-tax-and-we-could-all-pay-for-it

“That discrimination is a glaring violation of our trade treaties. The North American Free Trade Agreement (NAFTA) and other Canadian trade agreements prohibit governments from imposing discriminatory policies that punish foreigners while exempting locals. NAFTA’s national treatment obligation requires that citizens from other NAFTA partners investing in B.C. receive the same treatment from the government as the very best treatment received by Canadian investors.

Americans and Mexicans forced to pay the 15 per cent penalty tax would be able to pursue direct compensation for B.C.’s discriminatory tax from an independent international tribunal.Those claims would be against the Canadian government, the signatory to NAFTA and the other international trade treaties, not B.C. Canadian taxpayers could be on the hook for hundreds of millions, or even billions, of dollars. It’s an unfair action that violates international legal norms of fairness, protected under treaties… In addition, the anti-foreigner tax has the potential to lead to trade disputes, as the national treatment provision permits foreign governments to seek retaliation against Canada.

The article’s writer is a NAFTA expert lawyer and “author of two treatises on the North American Free Trade Agreement.”

Right, though status unknown. The case decided was an ethnicity discrimination case against the BC govt re: foreign buyer tax. This “discrimination” idea seemed like a weak/invalid argument, and I wouldn’t have expected that argument to win. The discrimination case made a brief mention of other arguments against the tax, including various treaties, but it wasn’t the correct venue for a case against the BC govt, as they aren’t a signatory to NAFTA, and not all of NAFTA is also law in Canada

This is different than a NAFTA challenge, NAFTA challenges typically need to be made against govt of Canada (not against BC govt like this one) either by individuals (using a NAFTA tribunal), or govt against govt. Those types of cases take a long time. Americans would sue Canada govt because of BC tax, and Canada govt would pay if they lost (not BC).

I suspect that those challenges couldn’t begin until other pending cases are completed. I can’t find any information on status of NAFTA challenge to either the foreign buyer tax or the spec tax, other than these articles with the NAFTA expert lawyers talking about them. With Trudeau’s Canada wide foreigners only spec tax, I’d expect we will start seeing articles like this one from expert lawyers (see next post), and hopefully they’ll provide current info.

I think Patrick mentioned one? Or WTO?

A Google search on “nafta challenge bc foreign buyers tax” (without the quotes) comes up with nothing, except some articles from 2016 which quote some people claiming the tax is contrary to NAFTA. Try it.

So there is still a NAFTA challenge against the foreign buyers tax remaining right?

B.C. Supreme Court rejects class action suit over foreign buyers tax

Justice Gregory Bowden dismissed Jing Li’s claim after finding that the 20 per cent tax levied against foreign purchasers of residential property in B.C.’s hottest housing markets does not discriminate against either Asian or Chinese buyers.

In a 43-page decision released Friday, Bowden found that the tax draws distinctions based on citizenship — not ethnic or national origin.

$170/sqft construction cost

$11k for municipal fees eh? Seems… somewhat reasonable

Cool breakdown.

Came across this on a development website for 6 townhomes on Shelbourne. Kind of interesting ->

well then that simply does not apply to those owners if they dont want to apply .. but going forward with tiny homes and garden suites will allow OTHER owners to legally build one – thus adding supply regardless

Yup. That’s why I said I was hopeful about the direction they are going. Listening to the councillors they do seem to get it. City is slow moving but they are taking this as the first step then I bet they will loosen restrictions after the 1 or 2 year review.

If you listened to Saanich meeting (wrt garden suite) or watched the meeting video afterwards, you would have noticed that the Council has asked the planning department for a supplementary study on allowing tiny homes and allowing both secondary suite and garden suite in one SFH.

The reason for the request: Tiny home would be much cheaper to build than garden suite; And there are so many SFH already have (legal or illegal) suites, allow garden suite only on non-suited SFH wouldn’t add much to housing stock, thus not very meaningful.

But even if the city allows both suites in one SFH, not sure people with a suited SFH would apply for a garden suite, as that would expose their current suite, regardless if the suite is rented out or not.

I wonder if it also has to do with 75% of Colwood being on septic. The most ideal location for most garden suites would probably be on top of the septic field.

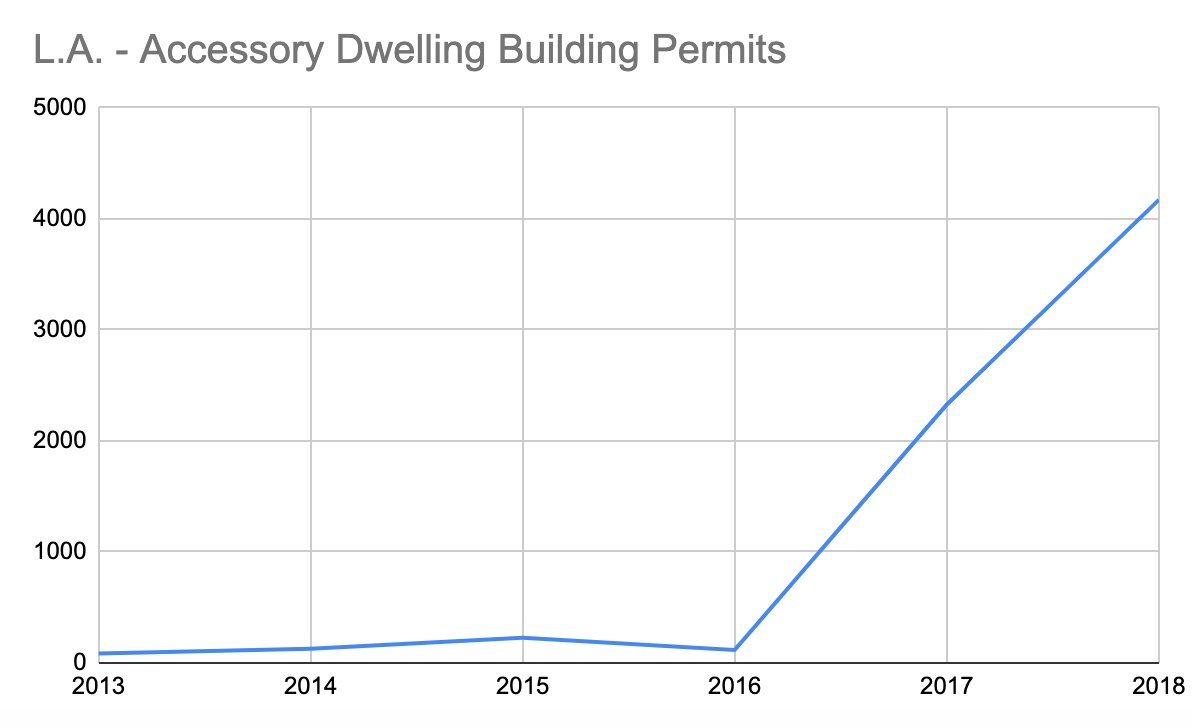

Somehow LA figured out how to get accessory dwellings built. But how?

https://www.sightline.org/2019/04/05/la-adu-story-how-a-state-law-sent-granny-flats-off-the-charts/

Edit: Never mind, looks like Accessory Dwelling units includes basement suites which is likely most of those numbers.

I do like the idea of the province stepping in and telling municipalities they can’t restrict suites though.

I’m thinking several steps further than this. Not just prefab wall segments, but the entire design so they can quote an actual price. Have 3 or 4 pre-approved designs that work on common lot sizes and exact specs for slab + servicing. Once they’ve built a couple approval should be streamlined too.

As soon as a builder starts out with “we design and build custom…” I know it’s already going to be too expensive. The whole fully custom approach to building is wrong-headed in my view.

The rents people are getting for these carriage houses are insane

There’s two new builds on Oakland Ave beside hillside mall, both have carriage houses

One was listed on used vic and Facebook market place for 2300 plus utilities, it was only up for about two weeks, so they most likely rented it for full price or they probably would have just RE listed it

Then Again we rented a 550sq ft 1/bed1/bath for 1600 plus utilities

We took the add down after 24/hrs due to requests, 14 showings over two days

This city needs more rentals & tenancy laws to help protect the landlords

You may be correct. However almost no one in the world predicted the 30 year bond bull market we’ve just seen. The only one I can think of is a guy named Gary Shilling, and I remember him getting laughed at whenever he was on TV.

If there is a housing crash, there can also be a rate spike too, despite efforts by the central banks. Witness Ireland, where During the crash, rates spiked to 6-7%, and underwriting standards tightened up so that you needed to be a great credit risk to even think about getting a loan.

I wouldn’t be as complacent as you about low “Japan level” rates forever.

Sure it increases the value of the whole property. I was talking about the decrease in the value of your use of the property when you build a second dwelling and rent it out to somebody.

I’m not really concerned about inflation at all. I think we are much more likely to see Japan style stagnation than runaway inflation again. I don’t think the 80s example is a pattern, more like an anomaly

Talked to city of colwood staff. They’ve had about 7 Garden Suites approved in the last 3 years. So it seems that the simplified building permit only process is not enough to entice more owners to put in garden suites.

I’ll add Colwood’s criteria to the table in the article.

The scary thing about rates, is that when inflation rises above the target ~2% range, the central banks don’t just raise rates to “just above” 2%. Historically they keep raising them and only stop when inflation falls (a process that rose rates to 20%+ in the early 80s, far above the inflation rate).

While househunters focus on prices, homeowners with a mortgage should pay more attention to rates, since those could spell disaster for them at renewal time. IMO, anyone ill-equipped to handle mortgage rates in the 5-10% range should look at a 10yt term, and then rest easy for 10 years.

ratehub.ca lists the best 10 year mortgage rate at an amazingly low 2.99%. Given inflation running close to 2.5%, in real terms that’s close to free money. https://www.ratehub.ca/best-mortgage-rates/10-year/fixed?scenario=purchase&home_price=400000&down_payment_percent=0.05&amount=395200&amortization=25&live_in_property=true&pre_approval=false

Supreme court dismisses class action claim that foreign buyers tax discriminates https://www.cbc.ca/news/canada/british-columbia/foreign-buyers-tax-housing-chinese-1.5336201

“”The structure of the tax is not responsible for any unequal burden on Asian persons,” Bowden wrote.

“It is not a numbers game. Buyers from Asian countries, such as China, receive equal treatment that is proportionate to the demand from those countries.”

Yeah not a lot of downside potential on rates but there is some.

Lots of people are convinced BoC must reduce rates but then every month some positive bit of news comes out that pushes the rate decrease back.

Introvert – I’m curious, could you expand that chart to show about 8 years prior to 2010?

Thanks. At least you’re still willing to imply I’m neurotic. I was actually worried you thought I came to my senses, which is never going to happen.

And then rose 50-70%.

Yes such cushion.

As we can see, rates have lots of room to drop from where they are today.

That rates can’t drop any further is classic bear magical thinking.

LF –

But how was the sushi??

Because it was. Then prices fell about 10% with the rest of the correction being absorbed by precipitous interest rate drops. No such cushion this time, so…good luck.

Most people can’t wrap their heads around this, but sooo many thought the market was gross 10 years ago. And look what’s happened since.

Ha. I think the prices will fall anyways, but my presence may well make it worse.

Local Fool: I am not familiar with Mt Newton, I will try to look it up. I can understand you being cagey since you dont want prices to crash when people find out you live there. I am gently pulling your leg. It is always best to be a bit closed about the matter until the house closes.

I have had some great trades work on my house, lots of work on a hundred year old house, so if you need some names let me know.

Local Fool: Hey Mrs Fool, Look at this listing. I think it’s what we’re looking for. Do you want to go see it?

Mrs Fool: Eeeh you really want to buy right now? It’s nice but…the market is still so gross.

Local Fool: Ya who knows. Let’s just go see the OH. Good way to kill a few spare hours,

Mrs Fool: Fine. Whatever you say. Can we get sushi on the way back home?

(goes to open house)

Fools: Oh wow. Hmmmm….

That, or the wives of these bears said, “Hey, numb nuts. We’ve waited a long time. The crash isn’t coming. I want to buy a house.”

I suppose, unless it increases the use for you and therefore the value. Just like building a garage that you will use, a garden house for a family member or caregiver adds value to the use of the land. Seems an odd argument when you retain ownership of the land, unless you are actually giving up some valuable use.

Barrister,

Please forgive me being a little cagey with the details on here. We’re in the Mt Newton area.

Local Fool: I may have missed it from an earlier post but what part of town did you end up selecting? When do you close?

It almost seems random. Piles of garbage can still go quickly while nicer units can sit, or vice versa. You really never know, but there are a few “deals” at this point if you look.

I should clarify and say I meant broker – as I never spoke with the actual lender.

There wasn’t much to it, really.

We talked about the price history of the market and the different ways you can spin the tale of the current one to say whatever you like. She said this October felt more akin to a spring market in terms of the amount of applications she was pushing through and said it was “very unusual”. She didn’t say what demographic or category of buyer was the most active.

In terms of pricing itself, it was just idle conjecture. We talked a bit on the different housing tiers and how they might fare in a correction. We supposed that places like ordinary condos going for 550k or 850k Eaglehurst boxes would probably get chewed out more than other types and tiers of housing. She simply thought the prices were far too high and a correction was inevitable. Apparently though, the lenders still aren’t shy on lending on any of them.

It’s funny haven spoken to people in finance, how candid some of them actually are about things.

“Who’s going to be buying houses at these prices? Answer: the bears.”

It’s fairly clear that the market has slowed enough to entice the bears who did not buy earlier. I would be more concerned that if the bulls and bears have all bought, who will be left to keep the market afloat?

Labour deficits tend to be most acute at or near the top of an economic cycle.

It’ll reverse over time as the economy slows and the labour pool grows. I think this is especially true this cycle, as the “expansion” has been so buoyed by excessive housing market growth. People, myself included, seem to have forgotten a time when not every fast food or retail outlet had a “Help Wanted” sign in the window.

But as the housing market has been slowing in BC, the labour market has already started to shrink. It’s been doing so for the last 4 consecutive months, for the first time in about 6 years. We’ll see what happens from here though, as nationally the housing market is almost looking schizophrenic. It doesn’t know what to do with itself.

Local Fool- congrats. That is exciting.

I’m curious what this conversation with your lender sounded like? What were her points?

Oh and please don’t stop commenting on here. Your rational and big pictures perspective is very much appreciated on here.

cost of housing too costly to get people to work here .. not just trades talent, hospitals are constantly short staffed .. thanks to that .. i have over 2 month of banked time to get paid or use as holidays

http://www.lanefab.com/laneway-house-built-projects

That’s because you’re not costing the land that is going into it.

That’s a valid point.

That’s because you’re not costing the land that is going into it. Part of the property you used to have to yourself is going into the investment. That makes your own use less valuable. It’s up to you to decide how much that loss of use is worth as a non-cash expense, but it is worth something.

There is also the capital gains issue which has already been raised.

That’s because you’re not costing the land that is going into it. Part of the property you used to have to yourself is going into the investment. That makes your own use less valuable. It’s up to you to decide how much that loss of use is worth as a non-cash expense, but it is worth something.

There is also the capital gains issue which has already been raised.

Local Fool bought; time for me to sell. Congratulations. Many happy decades for you and yours.

Depending on location in Victoria and new seismic requirements new wood frame costs are over $300/sq/ft and some concrete buildings over $600/sq/ft and that does not even include the cost of land. The labour shortage has been getting worse year after year and the cost to recruit quality talent to work in the downtown core is even more expensive.

Not sure why they are talking about garden suites now .. drive along the highway between uptown and Tillicum, all those small garden sheds are really full size garden suites .. no body did any about it

I’m also a fan of this type of arrangement if you have kids. Way easier to afford something like this than another home in Victoria.

Especially once you get into the 600 sq/ft suites you can do a large bathroom, etc.

It is about cash flow and risk/return over the investment period. A garden suite beats an ETF on both imo.

Marko Juras– this is a reasonable rationale for the investment. However, your risks are known different than being invested in any other asset class. I don’t think you should look at it on a cash flow basis but on a risk/return basis. Just my opinion

As I said I wouldn’t borrow against my principal house to invest in other asset classes so a mute point in my opinion. It is more along the lines of to do the garden suite or not to do the garden suite.

Congrats LF – and welcome to the dark side 😉

Marko Juras– this is a reasonable rationale for the investment. However, your risks are known different than being invested in any other asset class. I don’t think you should look at it on a cash flow basis but on a risk/return basis. Just my opinion 🙂

I would definitely build a garden suite if we had the right lot.

The leveraged investment is more than worth it. This will have a greater ROI given the leverage than the stock market as I’m not going to borrow to invest in the stock market. The capital gains tax would apply on a % basis if you rent it out, but the math still works imo.

I’m also a fan of this type of arrangement if you have kids. Way easier to afford something like this than another home in Victoria. You could make the space senior friendly and move in and if you have grandkids, and let them have the bigger house. Also a good way to age in place and provide accommodation for a caregiver so you can stay at home longer.

Overlisting and chasing the market down

1906 Fairfield Road

2018 02 20 $1,095,000

2018 03 06 $1,149,000

2019 05 02 $1,000,000

201905 20 $ 995,000

2019 06 10 $ 975,000

2019 08 27 $ 950,000

2019 10 03 $ 938.898

2019 10 09 $ 928,898

Marko Juras— your netting 3.6% before taxes?

I don’t look at it that way as I wouldn’t borrow against my principal residence to invest in a GIC, ETFS, stocks, etc. I look at it on a cash flow basis. It would be cash flow positive plus principal repayment.

Marko: Can the average home owner (whose dad is not a builder) get it done for 200k. On average how many square feet are we talking about?

Marko Juras— your netting 3.6% before taxes?

I actually don’t think it’s so bad compared to another rental. Of course there is a lot of complexity there with risk of cost overruns, tax implications, loss of privacy, navigating approval process, which makes the situation more complicated.

You won’t find a $200,000 condo that will rent for $1600/month. If my lot was bigger, and not already built up with a couple sheds I would seriously consider it.

At $200,000 cost and rent out for let’s say $2,000/mth (Is that reasonable?)

I was thinking more like rent it out for $1,600 +/- and financing costs of $1,000 +/- per month.

Personally, if I am going to borrow 200k against my house I am putting it into a garden suite and not ETFs. If ETFs are the only option I am probably not borrowing 200k against the house.

Does your house value increase by $200,000?

Not enough data on this. Very few garden suite property sales and most have been on brand new builds. I would think maybe in Fairfield you get your 200k back but in a less desirable area like Tillicum you might have a hard time getting 200k back.

being a landlord.

By far the easiest money I’ve made in my life, nothing compares. Everything else from my health care job to real estate you actually have to do something to make money. $1,500 is like 4 +/- shifts as a nurse.

At $200,000 cost and rent out for let’s say $2,000/mth (Is that reasonable?) That gives you a gross return of just over 8%. Depending on how you finance this or not, expenses, income taxes, and other costs this seems like a really bad investment. Your net return if lucky might be around 5% for all that hassle and being a landlord. Does your house value increase by $200,000? Property taxes go up? You would probably better off buying a simple ETF like ZWU with a yield of over 6% plus very liquid.

If total hassle could be minimized and cost brought down to more like the $150k level I think there could be real potential here.

Too many people in 80-120k positions are various municipalities for this to happen. If they drag out your building permit application 3-6 months bouncing it around various departments the more secure their jobs are.

I was having lunch with a builder friend the other day and the lenghty bouncing around city hall process cost him $7,200 in interest on a single lot.

Helpful post. I agree that there is a market for a start to finish prefab garden suite/carriage house service. Would be greater uptake if the process wasn’t so expensive and onerous. A good option for extended family or adult children who can’t afford to buy too.

Congrats local fool I hope you still come back to comment on the blog I really appreciate your posts.

$180,00= $300 per square foot. Is that not crazy expensive?

Building two homes in Colwood right now and the red tape is getting to be out of control. Not to mention construction costs are still close to peak despite the slower market. As I’ve been saying on the blog since 2009….absolute shortage of trades people. It was difficult to find reliable tradespeople to build a house in 2012 let alone now. I’ve been going to step code lectures and that will be interesting, but certainly won’t make anything cheaper going forward.

I don’t think you will be able to build a garden suite under $200,000 ($150,000 to build and $50,000 for BS). There are so many costs people don’t think about. For example, most older houses have a 0.5” or .75” main water line, but the plumbing inspector will determine based on the increased fixture load (kitchen/bathroom in garden suite) you need to upgrade your water main to 1”. Depending on the municipality for the city to pull the 1” line just to the PROPERTY LINE is between $3,000 to $4,000. Then you have to do all the trenching etc., on your property.

Tons of fees/complications people don’t think about. That being said even at 200k the cashflow from the rental should more than cover the additional 200k mortgage.

While we are listing all the costs we should not forget taxes. If you include the income tax paid on all the labour it becomes a large portion of the costs. We tend to focus on the final sales tax and ignore the multi levels of tax (such as gasoline tax) that need to be paid in but manufacturing and delivering material and labour to the job site.

My neighbour who just finished a garden suite said it ran over 400 a square.

Great Post as usual. Can anyone recommend a designer? Thanks

For a garden suite or something else? For a garden suite I would try someone like Ron McNeil Building Designs.

@guest_64029

Absolutely not crazy. People here predicting a ‘crash’ don’t realize how expensive physical building + city red tape costs have become.

$300/sqft is fairly routine these days. I’ve even heard 400-500!

I assume that would be an existing legal suite.

98% of suites in Saanich are illegal. Wouldn’t applying for a garden suite put the homeowner’s illegal suite at risk of discovery by the city?

It’s estimated that one-third of all Saanich SFHs have an illegal suite. So that takes one-third of all Saanich properties off the table for garden suites, I think.

Therefore, cost isn’t the only barrier…

A question asked repeatedly by bears the last few years: “Who’s going to be buying houses at these prices?”

Answer: the bears.

Congrats LF! And welcome to a never-ending list of small fixes/tweaks/etc 🙂

Previous thread,

thanks all for the kind words. 😀

Oh right of course I forgot to put that in. We’ve discussed this extensively on the blog and while there may still be some room for debate about whether you can claim full principle residence exemption on an internal suite, there is likely no chance that a dedicated garden suite won’t result in being liable for capital gains on that portion of the property when selling.

Although my suspicion is that most regular suites have the same effect and are just poorly enforced

https://househuntvictoria.ca/2017/09/28/capital-suite/

Actually I bet all in cost is more than this.

Many costs are fixed so per sqft cost are higher for small structures. That’s why usually you see people building the max size allowed on a lot

$180,00= $300 per square foot. Is that not crazy expensive?

There are are also huge tax implications which stop most garden suites before they even start.

Great Post as usual. Can anyone recommend a designer? Thanks