Construction is riding high, but will it last?

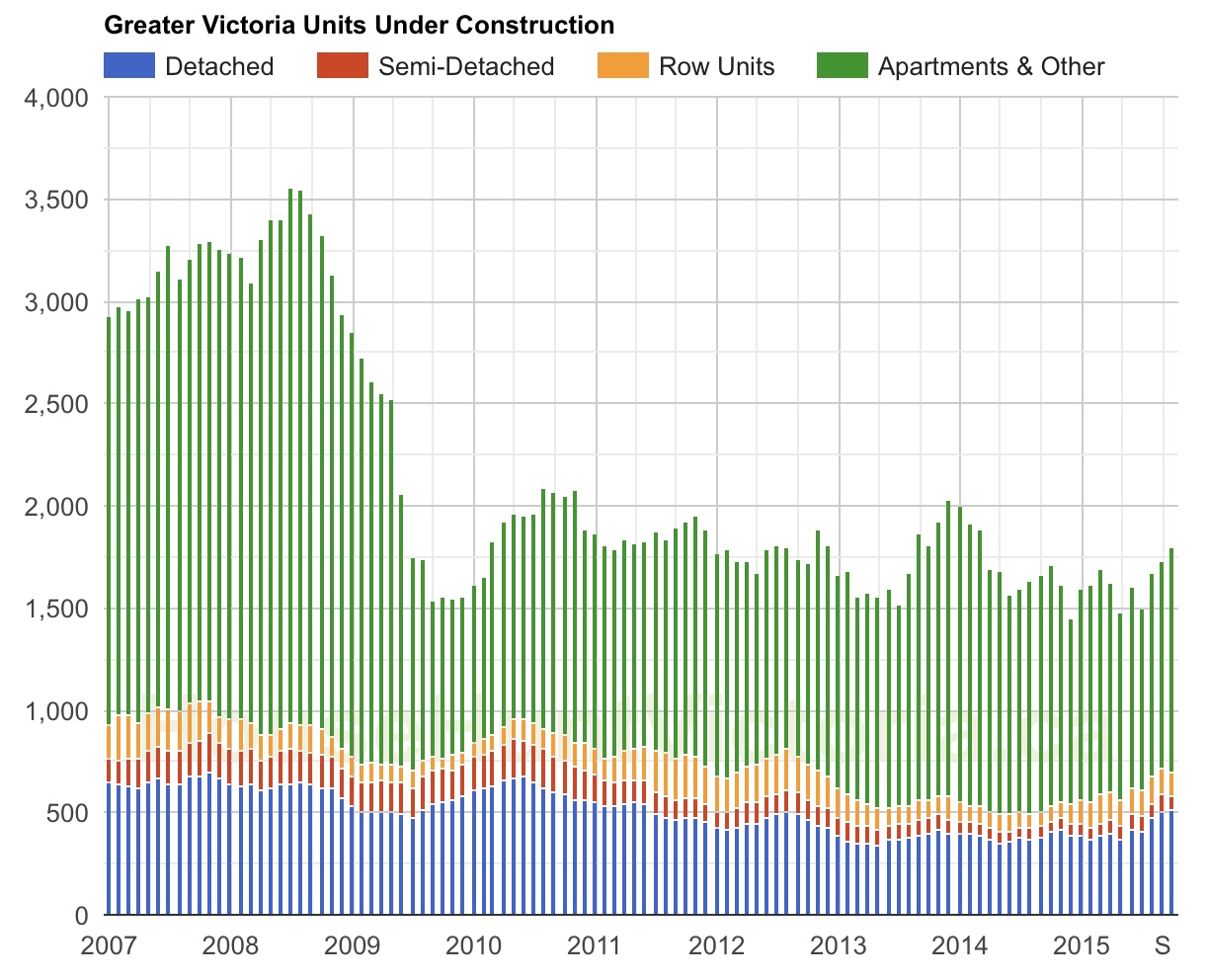

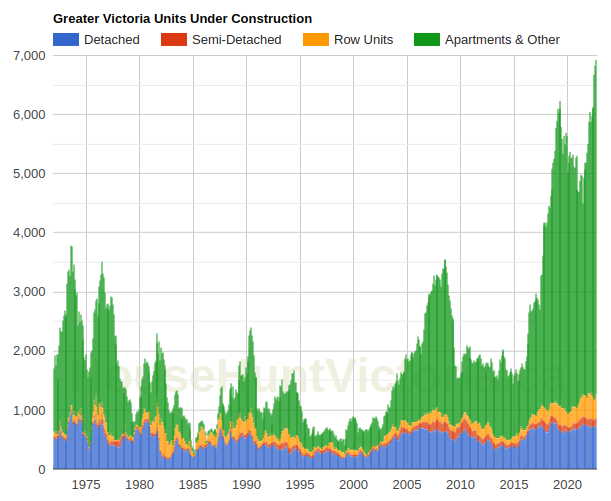

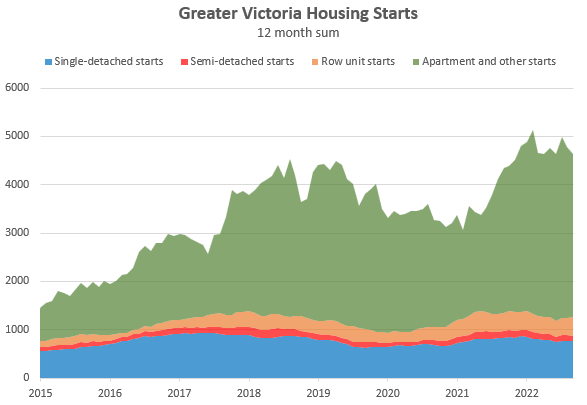

Despite gathering dark clouds for the economy, the number of units under construction has been hitting an all time high in recent months. That’s not just for the past few years, it’s the highest level of construction activity in the data series which starts in 1972.

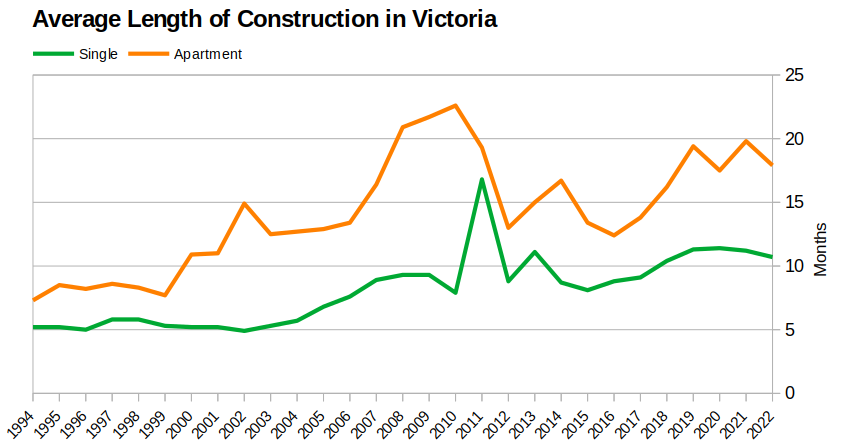

Part of this is due to an increasing average construction time as buildings and regulations get more complex and labour shortages cause delays.

However it’s mostly due to high levels of starts on an absolute basis. About half of the apartment starts are rentals while the rest are condos.

Thats good news for the housing shortage, though based on CMHC’s projections of need we would need to be building about 8000 units a year in the region to bring back affordability.

However rather than thinking about how to increase home building, the big question is whether we can maintain it at a high level if we’re riding into a recession. I‘ve heard from several developers that financing costs on one side and high construction costs on the other are threatening the viability of projects and many have been shelved. That’s a particular challenge for rental projects and affordable housing which have boomed in recent years due to low rates but are now facing cancellation or being scaled back.

What happens to construction in a downturn?

Or put another way: What usually happens to construction in a downturn? Let’s look at the last three in Victoria.

2008: Most recently the great financial crisis brought an end to our last construction boom. Though accompanied by a recession and moderate rise in unemployment rate in BC, the proximate cause of that construction bust was an evaporation of credit and high level of uncertainty as financial institutions went bust or were bailed out. Units under construction fell by half as many projects got cancelled and remained as holes in the ground for years. Somewhat unique about 2008 was that multifamily starts literally went to zero for 10 months during the crisis.

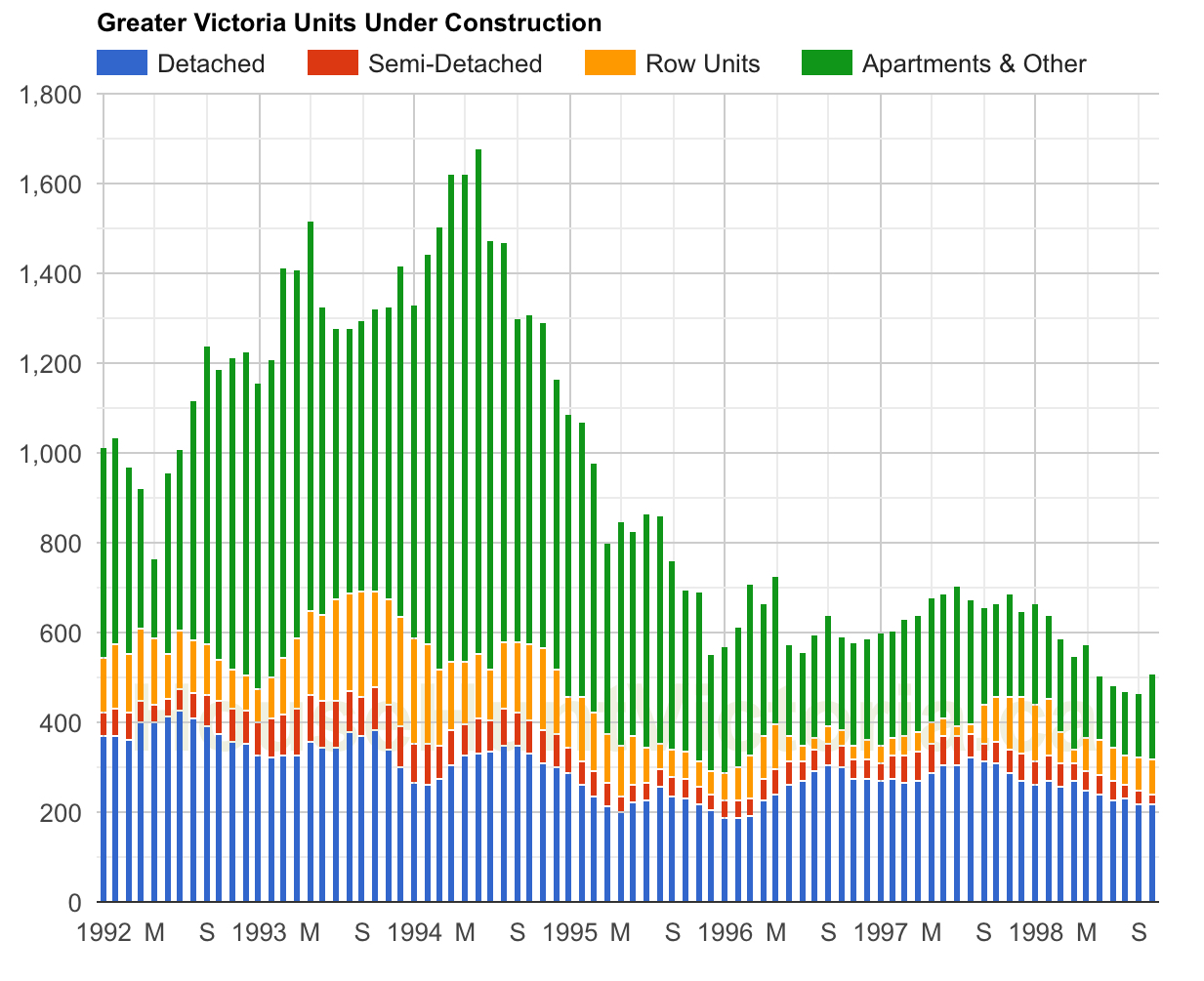

1994: The mid 90s were in some ways similar to today. Migration to BC and Victoria was booming, and there was a home sales and construction boom to match. A souring economy and deteriorating affordability killed that boom, and units under construction dropped by more than half and stayed low for years.

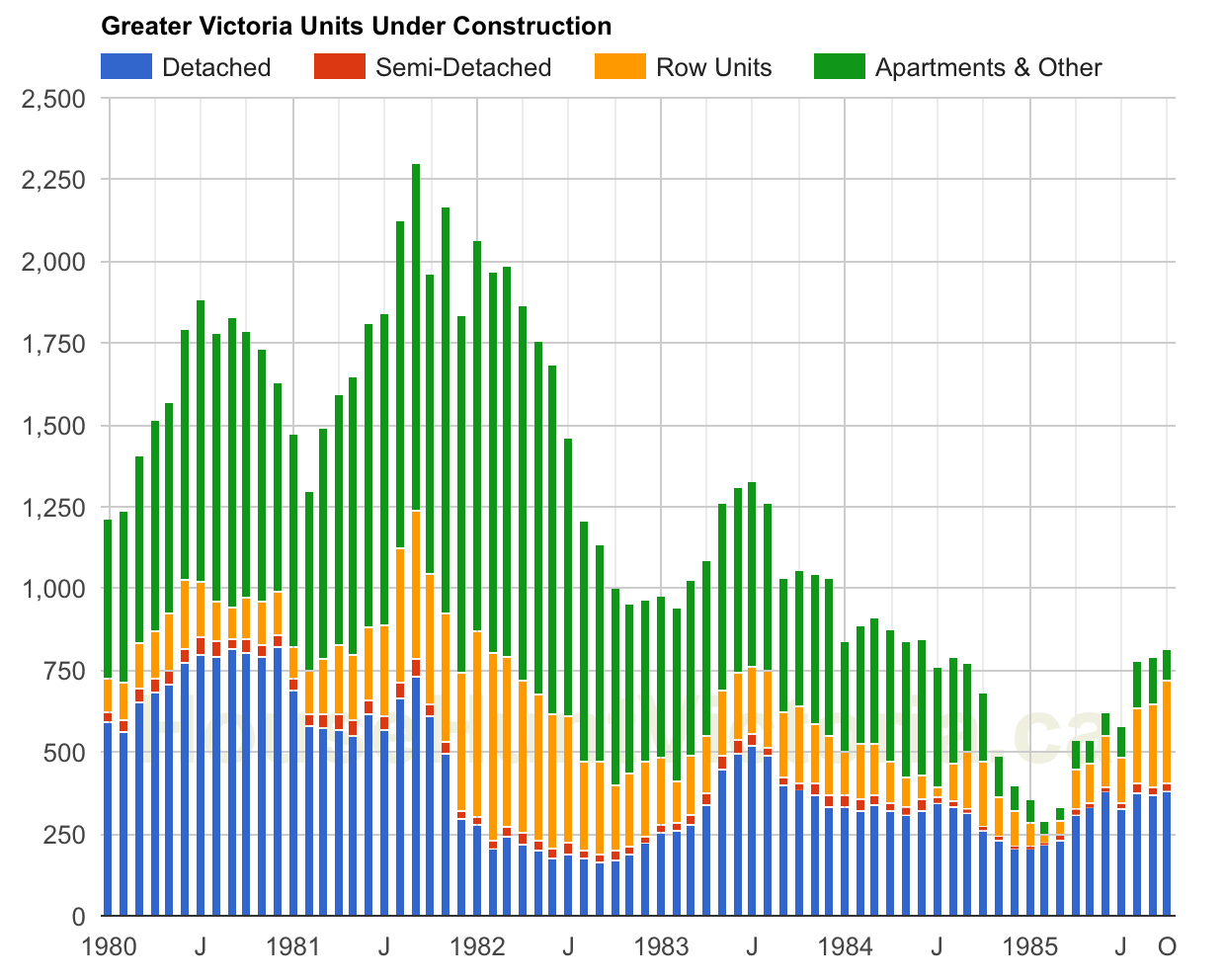

1981: We’ve talked about Victorias only real price crash several times from a sales perspective, but construction also took a major hit. When the market got slammed and unemployment jumped, construction activity was decimated. Units under construction first dropped by half, and multifamily nearly stopped being built entirely in the mid 80s when inventory of existing homes was plentiful.

So if history is any guide and a recession really is coming, we should expect construction to rapidly fall back down from current heights. The last three corrections saw units being built drop by at least half and not return to boom times for years. Worth noting is that in all those declines single detached construction actually fared pretty well, dropping much less while apartment builds were crushed. Why? Bigger developments are expensive and take a long time from inception to completion of sales. That means they require bigger pockets and more sophistication to build, and carry a lot more financing, government approval, and market risk. In uncertain times those developers pull back and wait for the situation to improve before moving ahead on development again.

That’s a characteristic of the market that the BC government may have to struggle with if this downturn spreads to housing construction. Investing more in building non-market homes in the down-cycle or reforming zoning and approval processes to reduce risk are steps that will likely need to be taken to reduce the pullback. So far the news is mixed though. Contractors still report full pipelines until mid next year, and some projects are still moving ahead. We’ll have to wait and see if the future ends up mirroring past patterns or if this boom still has some legs.

Also here are the weekly numbers courtesy of the VREB.

| November 2022 |

Nov

2021

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 83 | 156 | 249 | 653 | |

| New Listings | 205 | 375 | 541 | 696 | |

| Active Listings | 2161 | 2186 | 2147 | 887 | |

| Sales to New Listings | 40% | 42% | 46% | 94% | |

| Sales YoY Change | -41% | -46% | -41% | ||

| Months of Inventory | 1.4 | ||||

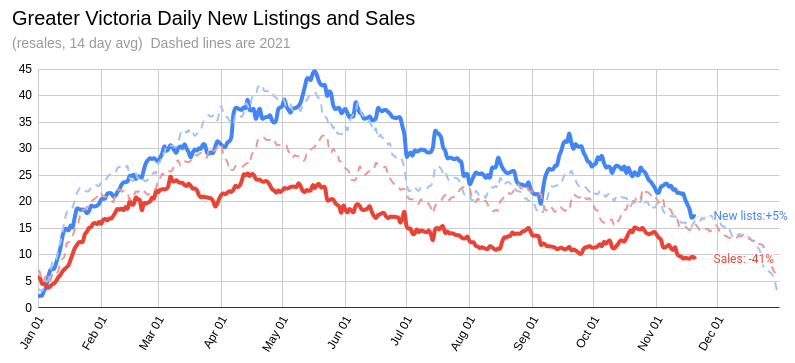

New lists took a dive last week, falling close to last year’s level for the past two weeks, though still up 17% for the month. Sales remain very slow at 41% below the year ago pace while inventory dropped from last week which we should expect to continue for the remainder of the year.

Big news on housing today from the province implementing some of the changes promised by David Eby in his housing platform which I examined some weeks back. First up was a ban on age restrictions in strata buildings that have been used to ban children or young adults from living in condos. Seniors-only condos (55+) will still be allowed, but adults-only (18+ or similar) restrictions will immediately no longer be in effect. That change won’t greatly impact the market as a whole, but it will prevent tragic stories like parents being forced out of their homes and make the house hunt a little easier for families looking for condos.

Rental restrictions will also be banned, which will have a dual impact.

- It will open up current rental-restricted condos to be rented out. That will dilute investor interest from just the current unrestricted condos to the entire stock of condos, putting upward price pressure on the formerly restricted condos while reducing price pressure on the formerly unrestricted condos. Prices will meet somewhere in the middle. It may also bring some more affordable rentals on the market as investors shift to older condos that previously could not be rented out, and it should reduce the concentration of rentals in newer builds which will help stratas dealing with absentee landlords. 42% of condo sales in the past year had either a total (18%) or partial (24%) restriction on rentals.

- It will allow owners of empty condos that were formerly rental restricted to rent them out. Up until last year an owner of a vacant condo did not have to pay the speculation and vacancy tax if rentals were not allowed in their strata. That exemption expired after 2021, so these owners would have had to pay the tax or sell their condos this year. Now they will have a third option which is to rent out the condo. Back in 2020 there were 767 condos that were empty but rental-restricted, which is no small amount if most of them hit the rental market. However I suspect some of those have already been disposed of this year in anticipation of the spec tax, and it’s already too late to rent out your condo this year as it would need to be rented for 6 months out of the year. Adult-only (not seniors only) condos made up 15% of sales in the past year in Victoria.

Those changes take effect as soon as the bill is passed (expected Thursday). It will be interesting to see how quickly the market adjusts and prices equalize.

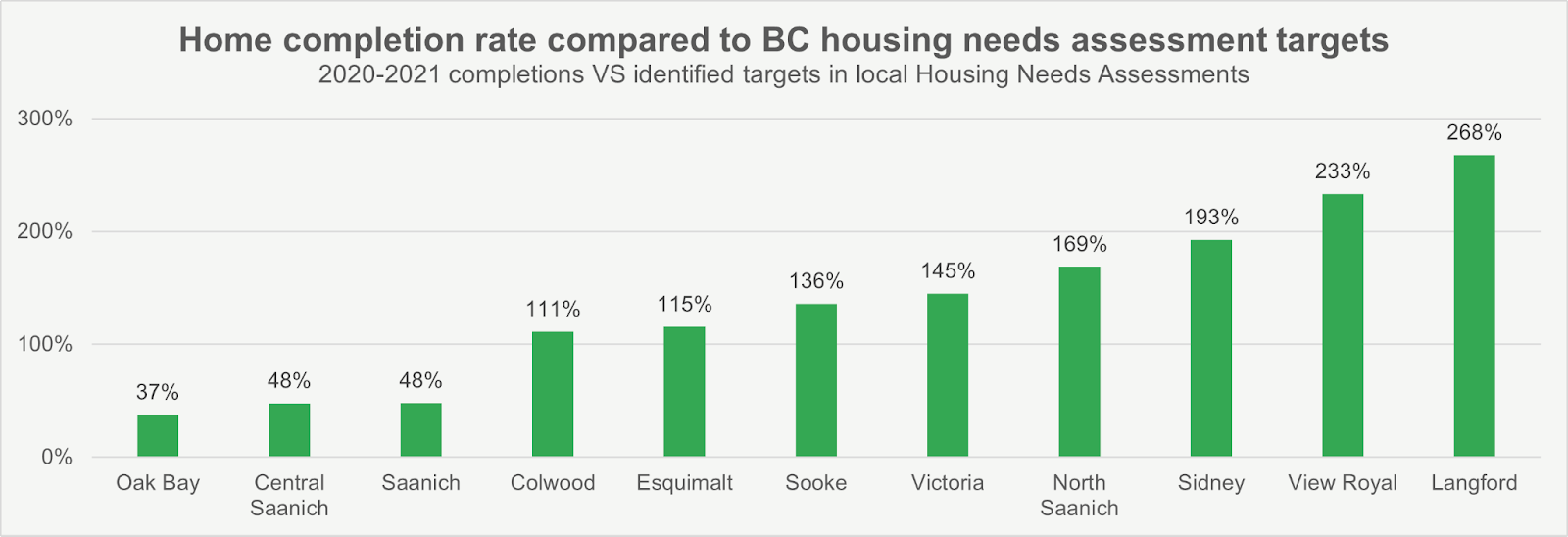

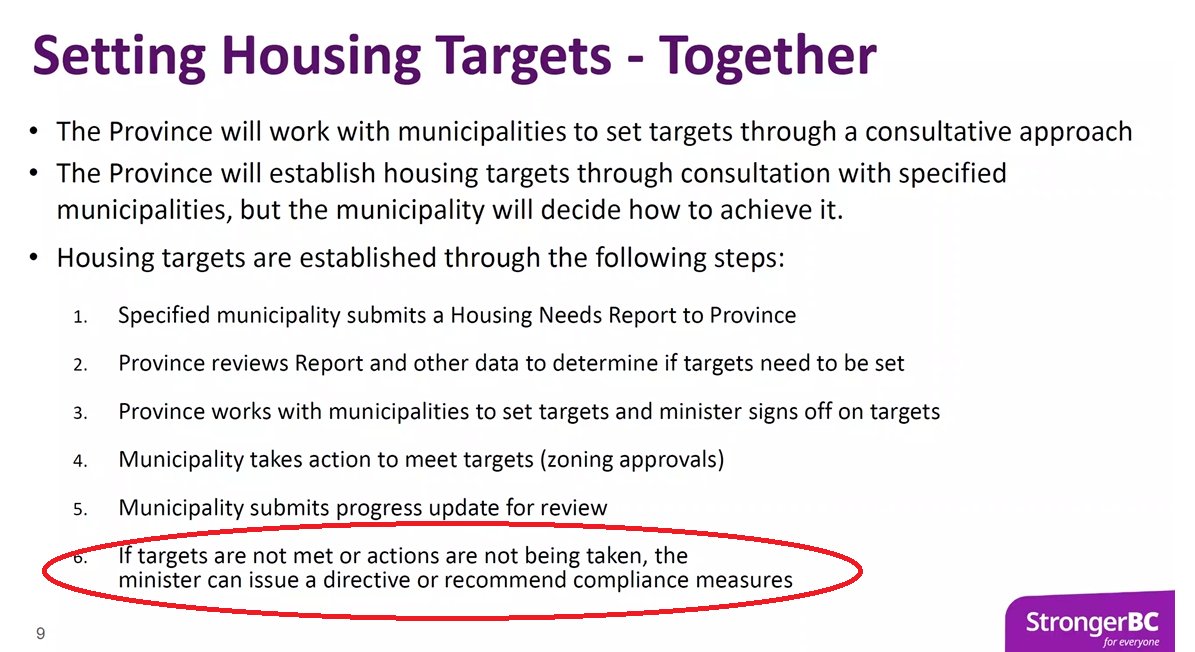

In addition the province announced they will be setting mandatory minimum housing production targets starting with 8-10 municipalities in high growth areas of the province (municipalities in Victoria, Vancouver, Nanaimo, and Kelowna are likely early targets). As a starting point they are examining the mandatory Housing Needs Reports that each municipality produced which estimated housing needs and comparing them to actual results. Though the reports are fundamentally flawed and underestimate true housing needs, it signals that the province is no longer prepared to put up with municipalities that say no to all growth. The province says they will do their best to work with cities, but in the end the minister of housing will appoint either an advisor to help the city meet targets, or simply override their zoning to get the housing built.

Who will get hit with housing targets? Well the details are all up in the air, but if I had to guess the cities currently not even hitting their own conservative housing needs are likely to be at the top of the list.

Don’t expect to see any impact from those changes in the short term though. Zoning reform is about medium and long term impact, and hopefully other changes with more immediate effect will be introduced in the coming year.

“When? The entry level house I am referring to is a ~1500 square foot two-level home on a ~3600 square foot lot. I was wrong about the date though. It was 2019 when that house was starting at $620k, not 2018. Now it starts at $950k. Ouch.”

They bought in 2017.

New post: https://househuntvictoria.ca/2022/11/28/the-market-impact-of-lifting-rental-restrictions/

When? The entry level house I am referring to is a ~1500 square foot two-level home on a ~3600 square foot lot. I was wrong about the date though. It was 2019 when that house was starting at $620k, not 2018. Now it starts at $950k. Ouch.

“Why do you think the entry level house in Royal Bay was ~$650k circa 2018?”

My best friend bought one of the largest house floor plans house on Sparrowhawk with every upgrade she could for $750,000. Original price for it was $625,000.

New lists seem to be very consistent and I guess pretty good for this time of year

Why do you think the entry level house in Royal Bay was ~$650k circa 2018?

Sorry, was speaking specifically about Royal bay. Made a mistake on my quote.

BCIMC bought Royal bay land in 2012, divested of it in 2018.

It’s a shame that they didn’t build houses closer together in town, so that they didn’t have to build Royal Bay at all.

Month to date numbers:

Sales: 339 (down 42% VS same time last year)

New lists: 713 (up 12%)

Inventory: 2129 (up 127%)

New post tonight.

“Westhills and Royal Bay bought their land years ago”

“They bought it in 2018 fyi.”

It’s been far longer then 2018 for the Westhills. I have friends that bought 11 years ago there. Another good friend of mine bought in Royal Bay a year or so after they started building and this was in 2016/2017.

I don’t understand with so much land out that way, why houses have to be built so close together. It’s a shame.

If you strictly adhered to the so-called Taylor rule, then you might conclude the policy rate is not yet sufficiently restrictive and actually needs to rise quite a bit further.

BoC’s mandate is to target consumer price inflation, although they do take into consideration the potential influence of the factors you’ve mentioned on CPI.

They bought it in 2018 fyi.

Curious about this. Rates are not below wage inflation and AFAIK affordability is the worst since the 80s spike.

Hey Marko, do you even bother celebrating that win?

“ If so, the prices should still be about $800k – $900k adjusted by 6 or so years (to 2023/2024) inflation.”

Not sure, even with 20% down, 30 year ammo on $850,000 many can afford to pay $4200 a month. This is using a variable 5 year rate which is potentially going up another 50bps Dec 7th.

I guess we’ll find out in a about a year.

If so, the prices should still be about $800k – $900k adjusted by 6 or so years (to 2023/2024) inflation.

I wouldn’t call interest rates that are still below yoy inflation particularly restrictive.

Businesses that borrow at super low rates to expand are thinking like homeowners IHMO.

If that’s been happening in fact, they’re going to have a lot of land or properties nearing completion to unload when they and buyers get hit by higher rates.

Expecting prices to return to 2019 levels is wishful thinking in my opinion. You’ve had five years of wage gains for one thing, and interest rates aren’t going to stay in restrictive territory forever.

There will be a buying opportunity in the next year or two when rates start falling but I wouldn’t bet on being able to snag a house in Royal bay for $650k ever again. That was a good deal though. Definitely considered buying there in 2018/19.

I personally like Royal Bay, we’re interested in a house which should be ready Spring 2023. By then I gather prices will be reduced further. Not many can get financing for $1 million + when stress tested at 7%.

And no, many haven’t sold. They’ve switched up their marketing and am no longer advertising on MLS. Considering these houses were selling for $650,000-$750,000 five or so years ago, when interest rates were lower, I can see prices returning. Gablecraft bought that land a long time ago, and will continue to build as they have a contract to do so.

https://info.gablecraft.ca/hubfs/Price%20Lists/Royal%20Bay%20Phase%204C%20Info%20Package%202022.09.16.pdf?utm_campaign=Single%20Family%20sign%20ups&utm_medium=email&_hsmi=234412433&_hsenc=p2ANqtz-_pPWOEe9pBC0Yzu94PK6ggXB80awq_i-Hd8vjuCkKPilLBbop5P9yPkczabPecFVc5WLxRY7bK2KDZHH8MGr7EbYeuIw&utm_content=234412433&utm_source=hs_email

Westhills and Royal Bay bought their land years ago, but you have assumed that these companies have not re-financed the land over the ensuing years to take advantage of the low interest rates. With the cost of money so low in the past, It would have been wiser to use the bank’s money than the profit from sales to expand operations.

You’re thinking like a home owner – not a business.

I got a SSL error earlier but seems ok now

Still now? Migrated servers and DNS is still propagating so that could be it, though if you ended up here it should be OK. Please post the error it gives if it’s still a problem.

Royal Bay delivers a good product for young families and it looks like a community that will develop. I dont think people should beat up on it.

No, short-term (less then a month) rental is only permitted in a few specially zoned areas. The min length in other areas are (or to be) set by the strata.

55+ or not, the age limits (before or after) are for the residents, not for buyers. I am sure one is allowed to buy a condo for his/her parents or grandparents to live in, even before this amendment.

Firefox is reporting this site as a security risk due to an invalid certificate. Most likely a maintenance issue on the server rather than a real security issue, site displays OK.

…

Good luck to them if they can still qualify for about $1 million. Not for me, but I know lots of young families that love it there. Just went and got pre-approved for another property, but looking for something where my neighbour and I aren’t doing the dishes staring at one another from about 6 feet away while in separate kitchens, so no Westhills or RB for me.

Mmmmkay Facebook

It’s because they already own the land. Westhills and Royal Bay bought their land years ago so they can continue building and keep their inventory coming up for sale somewhat “reactive” to interest rates so buyers feel like they’re getting a deal. All the developers and builders that bought small subdivisions/lots in 2021 are all coming to market now and need to get a certain price point, but are in no means panicking yet as there’s very little emotion involved in building a house vs. selling the home you live in.

Wouldn’t a bunch of those already be sold?

That information may be out of date. Below is a chart from a Globe and Mail 2019 article. I’m sure foreign enrolment dropped during the pandemic but has since increased. Wikipedia info isn’t always updated.

Ya there are a lot of homes for sale in royal bay Maybe some good buys out there next year for someone

Circa 1870!

Here’s hoping Canada never even approaches a quarter of the United States’ current population of 332 million.

The problem with getting any price reduction on a new home in Royal Bay is that there are only 2 real estate agencies that are selling them. That almost eliminates any negotiation room you have when making an offer.

They have reduced their average asking prices from $556 to $520 per square foot which has made them very competitive with other new homes in the area that are asking around $533 a square. The adjoining subdivisions have been outselling Royal Bay but now they are a lot closer in asking prices.

Personally, I kind of like Royal Bay a little bit more than say Olympic View or Willow Park.

Interesting thing though, Willow Park is offering a free appliance package. Generally, builders don’t like to lower their asking prices. They will try other things like free appliance packages or trips to Hawaii before they lower their asking price. But it does show that they are concerned about the slump in new house sales by offering concessions.

You heard wrong.

https://en.wikipedia.org/wiki/Cape_Breton_University#Enrollment

Heard that Cape Breton U in Nova Scotia has approximately 4000 foreign students and 2000 non foreign students. Apparently this is happening across the country. Most of them would come from affluent families who are probably looking to purchase property given the scarcity of rental units. That should help affordability.

There are some people on here really sensitive to Royal Bay lol.

The rate increases take months to funnel into the market, we will be seeing far more reductions in my opinion. Have you drove through Royal Bay lately? There must be 30+ SFH new builds ready to hit the market, and no one buying them. Even with their “1 million dollar house promo”. Prices will fall and continue to do so for the foreseeable future.

Agreed. Similar surveys have recent immigrants planning to migrate to other provinces. But most don’t. Over time, “roots” get formed where people are living, and thoughts of moving elsewhere fade.

The study didn’t say where they would like to move to. You added that.

That wasn’t my conclusion at all. I said we hear that a lot of them would like to move to the US, but that doesn’t mean it happens.

Could it be part of the parade?

https://vancouverisland.ctvnews.ca/road-closures-temporary-surveillance-planned-for-victoria-santa-claus-parade-1.6169580

The only stats we have is the number of Canadians that left Canada from June of 2021 to July of 2022 which was around 49,000.

The stats did not say where they went. So I’m not jumping to your conclusion that it is the USA.

Yes but do they? I haven’t seen any stats backing that up. Certainly a lot of them aspire to move to the US but hopes don’t equal outcomes.

A new poll suggests 30 per cent of new, young immigrants to Canada could leave the country in the next two years.

According to a national survey conducted by Leger for the Institute for Canadian Citizenship (ICC), 30 per cent of new Canadians aged 18-34, and 23 per cent of university-educated new Canadians, said they are likely to move to another country in the next two years.

The police closed off part of Hollywood Cres. does anyone know what happened?

Yes, this is spot on. While I’m a “Democrat” on most US issues, I’m baffled by their support of “illegal immigration”. It would seem that most everyone should be opposed to the idea of people breaking the law and just staying in the country.

Even stranger, they could greatly reduce illegal immigration in the US by reducing the opportunities for illegals to work. But neither party (dems or repub) does this. Fortune 500 companies employ them. For example, they could add a single line to the US federal tax return to list your status (citizen/green card ‘visa), but there’s a law that they cannot ask people this on the tax return. Yes of course it would discourage illegals filing returns, but it would be much easier to catch people that aren’t filing tax returns.

And there are “amnesty” cities etc. Imagine if “Nanaimo” declared itself a safe harbour “amnesty” city, where illegals could live and not be hassled by authorities asking them about their immigration status. So if you lived there, and the house next door had 10 illegals from Honduras there, you couldn’t report them so they’d get deported. Just a bunch of nonsense, and that’s what makes otherwise reasonable voters to support right wing anti-immigrant voices.

And then there isn’t much discussion of “legal” immigration in the US. Both parties like it, as they should. But they don’t let in as many “legals” as they should.

Patriotz there is nothing comparable.

The only answer is……

No one knows.

The buying opportunity will happen when the bank begins cutting rates again in the next year or two.

Giving up the rest of the pandemic gains would require another ~20% drop in prices. The only way I see that happening is a deep and painful recession with high unemployment. And even then, Victoria is somewhat insulated by its large public sector workforce. Rates would also be returned to stimulative levels.

You must keep in mind that almost all refugees in the Middle East have no path to citizenship in their host countries. For example, in Lebanon and other countries you have multiple generations of Palestinians born there who aren’t citizens. This puts them at a great disadvantage with regard to jobs and social services.

Anyone admitted to Canada as a refugee, or granted refugee status while in Canada, has a path to citizenship. So the situations really aren’t comparable.

Keep in mind in the US when the “immigration” issue is raised more often than not it means illegal immigration, which is not significant in Canada. Legal immigration, which per capita is much smaller in the US than in Canada, is much less of an issue. For example:

https://www.pewresearch.org/fact-tank/2022/09/08/republicans-and-democrats-have-different-top-priorities-for-u-s-immigration-policy/

You cannot win a Canadian election without doing well in the Toronto and Vancouver metro areas, and that means appealing to the immigrant vote. That’s not just my view, it’s the view of the study the Conservatives commissioned to analyze why they have lost the last 3 elections.

More cynically, I think the Conservatives get most of the anti-immigrant vote and want to keep it, but they appeal to this group on other issues that appeal to them, ie. guns, anti-drugs, anti-“woke”, etc.

And it should be noted that the PPC is open about significantly reducing immigration, but it doesn’t appear to be a big vote-getter.

How many refugees would return home? None. People have been trying to flee their countries every day. Prior to the war in Ukraine the population had been declining, now they have the opportunity for a mass exodus and are going to take full advantage of it.

For many of the millions forced to flee, returning home concludes an often traumatic time in exile. It may happen months, years or even decades after they left – and sometimes not at all. Over the years, UNHCR has managed numerous voluntary repatriation programmes that have brought millions of displaced people home.

We simply do not have the data to estimate how many refugees and immigrants would return home if hostilities in their home country ended. Syrian refugees living in Lebanon tend to be the source of most studies. Less than 30 percent said they expected to return to Syria, but 60 percent said they wished they could return to Syria.

Overall, while many Syrian refugees do not think it will be realistic to return to Syria soon, many wish they could go back.

Would this be the same for refugees in Canada? We don’t know. If we reversed the situation and Canadians were refugees living in Syria, how many of us would want to return to Canada?

More or less my bet for detached. Less confident about attached which I think has more downside potential during protracted slow period.

I do find it interesting that in the US the Democrats are generally pro immigration while the Republicans are for reducing it, while in Canada all parties are pro immigration. I haven’t even heard anything out of the conservatives that they think the level should be different than that set by the Liberals.

For context though, when the US had the same population that we have in Canada today (~39 million), they were growing by about 1.16 million people a year.

We’ve had very very few no non-resident buyers in BC due to 20% foreign buyer tax

Mortgage rates trended up in 2018 towards 3%; therefore, at least for the next 12 months a lot of renewals will be 3% to 5%

Agree re stress test but clients I am working with somehow still qualifying for million dollar purchases on 2x staple Victoria jobs (government, military, uvic, BC Ferries, etc.) with 150-200k down.

Things seems to be holding in there for now re recession.

While I agree next 2 to 12 months could be great buying opportunity I don’t know about huge drops from here going forward. Rates might be close to stabilizing and as the months pass wage growth slowly builds. Just look at BCGEU. 3.24% increase a couple of months ago then another 5.5-6.75% increase in just four months from now. It could help stabilize the market on the basis of slightly better affordability.

(Interest increases in 3 of the next 4 announcements)

+ (Non-resident buyer ban)

+ (A wave of mortgage renewals that will be going from 2-3% now to 6-7% on renewal)

+ (Stress test in the 7-9% range)

+ (A recession)

= (A spring normalization of inventory, a give back of the of the remainder of the pandemic gains and maybe an additional market retreat after that)

Wonder when the bubble will burst Looks like a population crisis

Canada wants to welcome 500,000 more immigrants in 2025. Can our country keep up?

https://docdro.id/fOQayQo

https://www.theglobeandmail.com/business/article-canada-immigration-population-boom/

If he was I’m sure he’d never admit it given the way James carries himself here

Is this a play on the “those who can, do, those who can’t, teach”? I actually had decent Math teachers, so likely not.

Hey Soper, he might have been your teacher (P), you never know.

It’s fun, isn’t it? It’s ironic he goes to all that trouble to block us but still thinks about us all day 🙂

It appears I’m living rent-free inside Soper’s head

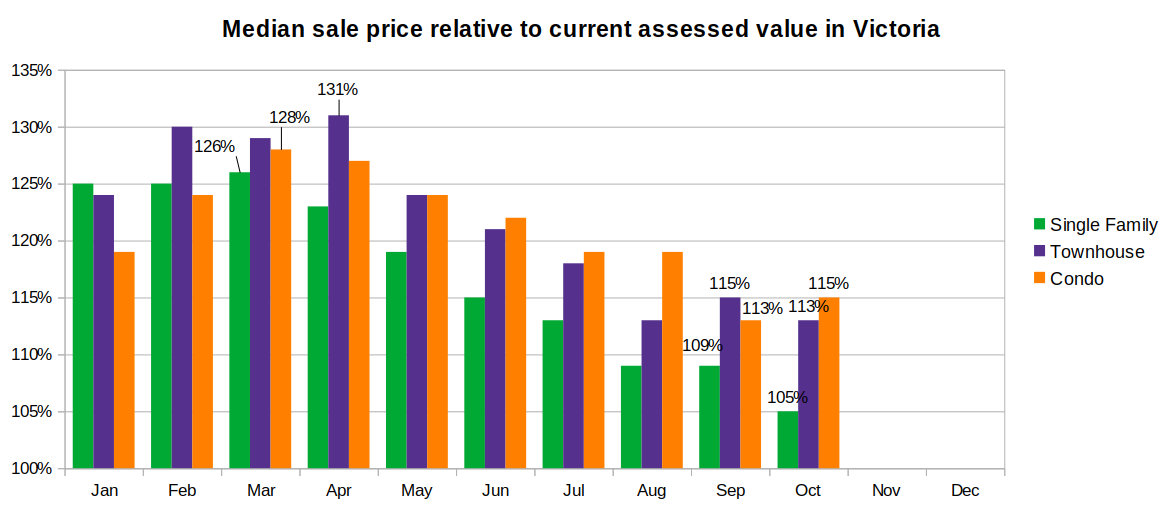

Ah ok, I get it now. Also shows about a 16% decline from peak for SFD.

That October reading indicates that sales prices are still 5-15% above July 2021 assessments.

Sounds alright to me. Salmo is located in one of the most beautiful regions of the Province. I often considered moving out that way when I was younger and less encumbered.

I don’t think I’ve seen it lately. Using a 3-month rolling median shows the decline from peak is about 16%. That seems about right.

lol Patrick presumably?

I’m guessing he’s doing math really wrong here, since I haven’t seen anything showing prices being up 60% since mid 2021.

Here it is for you in case you’re confused:

(1M – 626K)/1M = 37.4% -> Down 37.4%

626k * (374k/626k) = 59.7% -> Up 59.7% –> 626k * 1.597 = 1M.

B.C. residents priced out of housing market flock to Salmo, a sleepy village of 1,000

So it’s come to this.

How about Leo’s excellent “sales price over assessment”, which shows current prices still about 5% (SFH) – 15% (condos) above that? And those assessments were done based on July 2021.

I don’t think so. The current median house price is already back to where it was in mid 2021. The ultra bearish view seems to be that prices will decline another 20 per cent or so and give up all the pandemic gains.

Apparently there is still a lot of provincial $ available to support all the new initiatives and announcements (like an increase in physician salaries and a new Housing ministry, to name two). No sign yet of any fiscal belt tightening / hiring freezes at the provincial level which would really hit the local housing market.

Up $5B in a single quarter?!

https://globalnews.ca/news/9304799/bc-government-financial-fiscal-year-update/

“The Building and Strata Act Statutes Amendment Act 2022 was passed. The changes to the Strata Property Act about rentals, age and electronic meetings are now in effect.”

Few questions, any views?

Post removal of rental restriction can units now be rented for weeks to few months like AirBnb or strata can still dictate duration of rental?

Oak Bay condos (except with age restriction of 55+) and other places can be bought now by people less than 55 yrs of age ?

Any possibility of this act be challenged and repealed in court of law ?

I think he meant Canada was going “face” Croatia next 🙂

Or expressed another way, it brings prices back to where they were in mid 2021 (when the July 1 assessments were made)

The Building and Strata Act Statutes Amendment Act 2022 was passed. The changes to the Strata Property Act about rentals, age and electronic meetings are now in effect.

If you hate your TCH-bordering town-home you aren’t going to be envying the SFH’s on the south side of the TCH that are equally noisy plus shady in winter

That’s a 37.4% drop for unit #163.

That brings your average million dollar fixer upper down to $626,000.

Marko interesting price history I have no problem with 2020 prices if that’s the bottom

The court decided that the property was not her primary residence and that the disposition was taxable. However it also decided it was taxable as a capital investment (capital gains), not a flip (business income). This is often a grey area. Note also “The taxpayer was reassessed by the CRA for her 2011, 2015 and 2016 taxation years in connection with the sale of four properties she owned at various times during that period. ”

Yeah but, not your typical townhome in Langford. Some townhouses in Langford face a busy road, but these literally have the Trans Canada Highway as your backyard.

Those townhomes were avoided like the plague until people got desperate in 2020. Those on the north side of the TCH that have to look across at the SFHs on Lone Oak must feel sick to see what a couple hundred more could have gotten them.

Thank you Marko. Interesting times as they say.

Sales history in this townhome complex in Langford a good reflection of the market. While the drops from peak are large, market still above early 2021 prices when mortgage rates were substantially lower and the market still up substantially over 2020 prices.

145 – 300 Phelps Ave $655,000 2022/11/23

133 – 300 Phelps Ave $810,000 2022/05/16

163 – 300 Phelps Ave $810,000 2022/05/07

151 – 300 Phelps Ave $825,300 2022/03/16

115 – 300 Phelps Ave $760,000 2021/12/17

155 – 300 Phelps Ave $607,000 2021/03/04

111 – 300 Phelps Ave $610,000 2021/02/24

117 – 300 Phelps Ave $600,000 2021/02/02

113 – 300 Phelps Ave $585,000 2021/01/14

123 – 300 Phelps Ave $562,000 2020/11/23

151 – 300 Phelps Ave $534,000 2020/06/02

165 – 300 Phelps Ave $514,900 2020/04/20

163 – 300 Phelps Ave $507,000 2020/02/26

I certainly hope you’re right.

So you highlight a story of a woman escaping an abusive marriage that sold a property as her primary residence and got dinged by the mostly inept CRA? Didn’t someone in the comments just call for the schadenfreude to begin? Taxes are easy when you you rent and don’t own multiple properties.

Uh oh, James is having a bad day and going after Frank again. He must not have gotten his union mandated break, had a car cut him off while he was on his bike or been kicked off another housing blog site.

Isn’t Canada last in the group? Confident Canadian coach thought who noted Canada was going to “f” Croatia next. Croatia is in a bit of a transition and fielding a crap team for our standards. The best Croatian player is pushing 40 and the team based on my eye ball test is the slowest at the world cup.

I didn’t account for the factor of immigration. On one end Croatia is losing population every year and now below 4 million while Canada is adding 500k/year. It translates to soccer too, just look at the best Canadian players. Davies, born outside of Canada family immigrated when he was 5 yrs old. David, born outside of Canada, family immigrated when he was 6. A number of solid players from the UK. You even have guys like Borjan born in Croatia and immigrated when he was 13.

It is only a matter of time before Canada has a better national team. At some point Canada will have a population of 100 million and Croatia will be at 2.5 mill with 1/2 the GDP per capita, but I still think for the next few decades Croatia can field an outside chance to win the world cup as we trend towards 3.5 mill population. Not realisical for us to be on the level of Brazil (population 214 million) or some other powerhouses.

1:42 a.m.

Friday, November 25, 2022 (GMT+1)

Time in Croatia right now.

Good chance that there is no way of knowing but do we have any general idea about how many houses with a mortgage are now actually underwater. I am pretty sure that some of the ones bought at Peak in March of 2022 with low down payments are probably underwater but is there a general feel that this is starting to spread?

Happy Thanksgiving to all the Americans that might be here.

Hey Marko

Did you watch the Canada Belgium World Cup game. 1-0 for Belgium?

Last year you were dissing Canadian soccer, when you said …

“Marko : Soccer; Croatia>Canada, not even close. It would literally be a 10-0 game”

The last time Croatia played Belgium Croatia lost 1-0. Are you sticking with that “literally a” 10-0 Croatia Canada score when they play on Sunday nov 27 8am pst at the World Cup in Qatar ? https://www.sportingnews.com/ca/amp/soccer/news/canada-croatia-date-time-2022-world-cup-game/jhpvcc7ff1r8hhaa48uclxct

From: https://financialpost.com/personal-finance/taxes/cra-anti-flipping-rules-challenging-transactions

The taxman cometh, even for transactions going back a decade.

Yeah that seems more realistic for the scenario of a 1m house with 800k mortgage.

And for the original scenario of a 1m mortgage I imagine the average Hh is 180-200.

I would say the average HH buying that median house are probably ~160k to 180K household income with a kid or two and a dog.

Where are you implying that it came from that adds more stress?

Maybe people buying the > 1Mil houses are well above the median. I’m sure there are many many households making more than 100k.

I’m not saying it’s not stressful to suddenly pay another 20-30 k per year. Im sure it is for some of these people! I’m just saying I think you are underestimating the incomes of people with that level of mortgage debt.

Charter of Rights applies only to governments.

“If they have a million dollar mortgage their household income is probably much higher than 100k? Even when rates were super low I don’t think you’d qualify for a 1m mortgage with 100k household income.

According to my rough calculations based on a debt servicing ratio calculator that my mortgage broker gave me, the bare minimum gross income to qualify for a 1m mortgage with the stress test of 5.25% is something like $137,000”

If that’s the case, people with the median household income of $100K could never buy a SFD house. But I am pretty sure that’s not true.

Adjusting for $800K mortgage ($1 mil house), minimum income would be $110 K as per your calcs, not far off from the $100K median household income. Median house price in Victoria is more than $1 mil. The financial stress being felt by recent buyers (2021 & 2022) is real, not an imaginary construct. Now if you take into account where the 20% down payment (for most people) came from, the stress in unreal.

If that’s the case, the public is paying far too much for “professional “ services. I prefer dealing with someone who is focused and highly trained. Apparently, some realtors are neither.

Frank, your info is so out of date! 😉

That rule has been changed since Oct 2018 in the Capital and largest city of Manitoba. See:

https://realestatemagazine.ca/winnipegrealtors-ends-other-occupation-bylaw/

“Winnipeg Realtors can now have another job aside from selling real estate, after members of WinnipegRealtors approved an amendment to a longstanding bylaw.”

Ahh I see that Frank has shared with the forum some wisdom once again….. I think this one also deserves an “LMAO”

I think I need to apologize to everyone on here. I know I’ve been here a while, and so there really is no excuse, but I truly didn’t understand that this was Manitoba real estate discussion board. So I’m so so very sorry. I’ll show myself out. Thanks for all the fish.

Wouldn’t be a rule with the individual real estate boards anyway. This would be under the authority of the agency that licenses agents and brokerages in BC. BCFSA

Not the case in Manitoba.

Thanks for clarifying the matter Marko.

Hard to imagine how a broad rule like that would survive a charter of rights challenge.

Why would he care? He’s established and has a client base. Don’t be surprised if your skip the dishes driver hands you their RE card along with your meal in 2023. I’ve already had biz cards dropped in mailboxes this summer/fall. Not paid brochure mailouts, door-to-door hand-delivered biz cards.

No such rule with the Victoria Real Estate Board. You can have a second or third job if you wish including that second job being full time.

I’m sure Marko would be delighted to see a guy with a hotdog cart handing out his card to a guy dripping mustard on his shirt. Marko will clarify this matter.

..

Huh? There are plenty of people that do it “on the side”. Firefighters or others with shift work, even those with fulltime office jobs. I’m sure if you’re part of a Remax team or something they expect you to at least make it seem like you’re doing something proactive even when you’re not (see FB and Instagram posts on how to stage your home) but why would anyone expect you to take a 6 month course and throw yourself at it full time?

Wow ….today I learned. That’s pretty unfortunate for them… I’d hate being in an industry where your income is feast-or-famine, seems stressful. Although I guess there are some people who have done very well for themselves in real estate.

Most real estate boards do not allow agents to have a second job, you have to be committed to your profession. I’m sure Marko can clarify.

How many realtors have a second job? I thought lots of them use real estate as extra income rather than a primary income? But maybe I’m totally wrong. (Of course some of the people you see on every freaking sign probably do it full time, but I thought that was probably the minority)

Marko- Thanks to a crazy first half of the year, I’m sure most realtors can coast for a while. How many months can someone last without making a sale? I’m sure some are starting to worry if things don’t pick up in the spring. Unless they own a couple rentals.

Any way of guessing how many people have houses that are actually underwater at this point?

If they have a million dollar mortgage their household income is probably much higher than 100k? Even when rates were super low I don’t think you’d qualify for a 1m mortgage with 100k household income.

According to my rough calculations based on a debt servicing ratio calculator that my mortgage broker gave me, the bare minimum gross income to qualify for a 1m mortgage with the stress test of 5.25% is something like $137,000

And that’s assuming people are absolutely maxing out. I think lots of people buy a bit under their max because it’s scary (for obvious reasons) buying right on the edge.

A 2k increase in payments is nothing to sneeze at though for sure. I’m sure for lots of people in that situation that is very painful.

It’s just a couple hundred bucks Rodger, I’m sure they’ll all be fine.

“While this isn’t my scenario, 20% down on a 1 mil (average Vic) property was running ~3.2k mortgage at the beginning of the year. It’s now almost 5k. For those in rate-tracking variables, that’s roughly equivalent to 20k of before tax dollars gone.”

That’s 20K after-tax and ~30K before tax. If the household income is 100K, their after-tax income is probably 70K, and their mortgage payment went from 40K to 60K after taxes.

I would feel much more optimistic about this if the central banks were taking a more measured approach to raising interest rates instead of panicking. Soft landings are elusive at the best of times, probably impossible in an environment where central banks are blindly raising rates and guessing.

You mean the luxury furnished rental 3 bed 3 bath with concierge service built last year in a condo worth over 1.4 million? Yeah, I’m sure that a pre-1970s stick built 2 bed 2 bath for $600,000 is going to fetch the same rent.

https://www.realtor.ca/real-estate/25090968/205-1201-fort-st-victoria-rockland

This year will end as the second highest sales volume ever which means second highest gross commissions earned for the industry. It isn’t as bad as it would appear.

I can’t see much unemployment any time soon. There are shortages everywhere, even tradespeople are in demand. Heavy equipment operators, truck drivers, mechanics, anyone with specialized training is in very short supply. Construction doesn’t seem to be slowing across the country. The only sectors that could cut employment is the government (not going to happen) and realtors. Hundreds of realtors are not selling anything each month. How many months can they go without a sale? High tech companies are also making deep cuts, don’t know how much that affects Canada. Our government is spending like crazy to attract workers in health care, personal care, and administration to continue supporting our socialist society. Wish I had an orchard of money trees.

The real problem is if spending dries up to the point that serious job losses occur. Having a mortgage when you are out of work results in bad things Most people are too young to really remember what a major recession looks like and lets hope that we dont have to find out.

While I agree, I suspect we’re a lot closer than the markets/economy are showing. While this isn’t my scenario, 20% down on a 1 mil (average Vic) property was running ~3.2k mortgage at the beginning of the year. It’s now almost 5k. For those in rate-tracking variables, that’s roughly equivalent to 20k of before tax dollars gone.

For those in fixed rate, and fixed-payment mortgages, it’s really just a waiting game. I’m sure there is a huge number of folks hoping we hit recession with subsequent rate drops before they have to renew. I’m optimistic the economy holds, but I would not be surprised if we’re in for some pain. The flip side is the malls all seem to be jam-packed with shoppers, so maybe they all know something I don’t.

With respect to trigger rates and their impact, I would hypothesize that most aren’t on the brink of insolvency and being pushed into a situation where they have to sell. However, what I would imagine might be only slightly less depressing is watching your equity decline while at the same time paying only interest. Pure backwards movement. Ugh!

I don’t think there are many households that can’t afford a couple hundred extra bucks towards paying their mortgage, it’s just something those outside the market tell themselves, then lock themselves in their echo chambers with like-minded people, so they’ll all feel better.

And I hope that Debt Monster was Garth Turner, they’re both hyperbolic, pouting bears with thin skin. DM ran away from this blog and GT constantly deletes posts that point out how often he’s wrong, kinda lines up…..

You’re also doing your part to help people like me retire. Depends on which side of the balance sheet you’re on.

My own bear narrative has always been that entry level buyers being shut out, or existing owners unable to move up, at current prices has far more impact than those foreclosed or forced to sell.

For sure. I am also paying significantly more mortgage interest and mentioned previously that I have cut spending and am saving aggressively in response. I guess you could say I’m doing my part to help the Bank of Canada achieve its objective of a recession and rising unemployment.

The Garth story was about a family that was unable to afford their mortgage payment rising from $3,000 to $3,200. Since Garth is a charlatan, it is probably just a bunch of made up shit anyway. The official housing bear narrative is that households are up to their titties in debt and barely hanging on after financing lavish lifestyles and investment condos with cheap money. Obviously some households are in this situation, but it’s unclear to me how many. Guess we’ll find out soon.

As a matter of fact life expectancy at birth in Canada in 1960 was about 70, and almost all of the increase since then has been due to a drop in infant and child mortality. The reason we have so many more older people today isn’t because people are living a lot longer, but because we have far fewer children.

https://www150.statcan.gc.ca/n1/pub/11-630-x/11-630-x2016002-eng.htm

Talked to a guy just finishing off a spec home in Cowichan. $200/sqft for 2600sqft.

He said if it wasn’t in cowichan it would have been around $180.

1201 Fort Street , 1,300 square feet $4,000 a month.

Oswego near superior, 1400 square feet $4,825 per month

559 Niagara 1,100 square feet remodeled 1960’s rancher at $3,250 per month

A 1400 square foot half duplex in Rockland at $5,000 per month.

Bear Mountain is impressive. The ones that back onto the Golf course are very nice. They are asking 3.9 million for a condo on Hannington! I gotta go up there and see them when they are finished.

Good luck with that. Very few people are interested in paying $3500-4 grand a month for 2 bed condo with poor soundproofing. The average 2 bed is $2600. Renovated with a bit more space is maybe going to get you to 3k imo with a much smaller market for this.

3k a month currently services a 500k mortgage at 5% – not counting the strata fees, property taxes, and any repairs.

These condos are not going to exceed the price of condos that are currently rentable imo and the differential doesn’t seem to be more than 10%. For example, this 2 bed 2 bath 980 square foot rentable child-friendly condo in the core is $469k https://www.realtor.ca/real-estate/25036259/512-1745-leighton-rd-victoria-jubilee

As I’ve mentioned previously, one of my mortgages is up $1600/month. The other should be up by the same amount, but it’s TD and I’ve opted to pay less down on that. +38k/year interest cost in less than a year is definitely affecting my family’s spending habits.

I just drove up Bear Mountain and around that area today and am still gobsmacked at the way mountains are blasted away to make room for houses. I’m not talking about small areas…. the scale is enormous. And you can see other large areas with freshly chopped down trees getting ready for more blasting. It sure doesn’t feel like developers are holding back.

I’ve been watching this for years now….. but am still blown away by the scale.

I’m not making a judgement either way… just making an observation.

The only thing I gleamed from your posts Marko is that it would be too expensive to buy out the condo owners. And that’s probably true for most of these older complexes unless there is something special about them that gives that little extra. Views, lot size, large suites, increased density are all game changers.

One of the hardest things to change is land in the ALR when the lot size is 10 acre minimum. I listened to one person’s proposal to allow him to subdivide down to two five acre parcels. Like you – I said not a chance is this going to happen. But he had a good proposal that gifted land to extending a public trail. And he got his subdivision.

After that I never say never. There are lots of ways to skin a cat.

I guess that work involves taking out the drywall and creating noise, so better to let the strata (and your neighbours) know and get buy-in beforehand, instead of someone knocking and complaining at your door.

Typically with a condo you own the inside and can’t change anything on the outside such as an exterior door lock without approval. You own only up to the inside paint on the exterior walls. If a rock from the outside breaks your window then it is the strata that pays for it. If the window is broken from the inside then you pay for it. Installing hardwood floors in an older condo is a pain as noise travels easily between floors and that can disturb the other owners’ enjoyment. I never heard one about the backsplash though.

The chances are not as bad as before. The BC government wants the municipalities to approve more zoning. These are already zoned multi-family. And there is condo building or it might be an apartment block in that neighborhood that is more than four storeys. Going from four to six is easier than going from four to 20 and would meet or maybe surpass Eby’s proposal for municipalities. But you could get more. I chose six because its wood frame construction and not steel and concrete. Wood frame is generally cheaper than concrete to build which could bring down the cost of construction from $500 to say $350 a square foot. Depending on parking and finishing. Underground parking stalls are expensive. Heck throw in a mountain bike with ever sale and call it even. Look at the project on Hillside as an example they get a year’s bus pass.

But who knows. If you don’t ask – you don’t get. Ask for 12 and settle for six. Zoning bylaws are not carved in stone. Depends on the OCP, city council, and if the project will positively impact the neighborhood. There is older multi-family in that neighborhood and others that aren’t very pretty to look at. The area could use some revitalization or should I call it gentrification?

You could build a new complex that looks very pretty. Definitely an improvement over what is there now.

FYI: Stratas normally have strict policy wrt reno (e.g. some don’t allow hard surface flooring) and the owner has to send an application for approval before any work. For example, in the building where we own a unit, one owner changed their door lock to a keypad lock without approval and was ordered by the Strata to change it back or face a penalty. Another owner wanted to change their kitchen backsplash but needed to send an application first (and got approved by the Strata). Again, your home is not your castle and you can’t just do whatever you want to do in a condo.

You found two that clearly aren’t close to working.

Whatever reno it will be (has to be approved by the strata), to pay $4k/m in an old wood frame building to listen to the sound of neighbours’ footsteps each and everyday? Nah. You can rent a bigger (than 1200 sqft) SFH in similar areas for less than that.

I don’t about that. My neighbor rented out her 1,000 sq/ft 2 bed 2 bath partial ocean view in a three year old building with a pool, large gym, A/C, etc., for $3,500 in September and she didn’t have a lot of interest. Rental market in Victoria is VERY sensitive to price points. Once you go over $3k for a condo the demand drops off a cliff and same for SFH over $5k per month. I had clients a couple of years ago renting a $4 million dollar home in the Uplands for $5k/month. Taxes alone were more than 4 months rent.

You can renovate but a lot of things you can’t change. For example, older condos have 8′ ceilings and newer condos are 8’6” to 8’10” totally different feel.

I don’t know if you can build underground parking on Bushby. It’s pretty close to the ocean. Then you’re building an inground pool not a garage. But you are missing the point. Bushby is but an example.

I chose them by looking for ten minutes to find an older complex with big suites in a premium location that has a feature such as water view or a very large lot that adds value to any re-development. Ten minutes and I found two.

Major understatement. That is the biggest flaw with Jack/whatever’s plan. If you can’t get 6 stories approved in CSV what are the chances on the Ross Bay waterfront (almost waterfront)

Totoro it won’t be $600,000. You’re dreaming. If I can go in there and renovate 1,100 or 1,200 square feet to modern standards. I’ll be getting at least $3,500 a month. Maybe even four grand a month. 1,100 or 1,200 square feet is about the size of the main floor of a Gordon Head house but in Fairfield or James Bay. That services a huge mortgage. Investors are paying $600,000 just for condos that get $2,200 a month and hoping for a 3 percent return. These condos are not going to double in price but they are going to be worth a lot more than $600,000.

Which is going to make them unaffordable for most young families to buy or to rent. And then we are back to where we started.

Let me know when one of these “pros” terminates a condo strata successfully. As I said, I am not aware of a single condo strata termination in Victoria, someone on HHV can correct me if I am wrong.

The odds of finding 3 homes side by side are much higher than getting 11 out of 13 owners to agree to sell. Not only that, you only have to pay above market for three properties instead of 13 properties.

Secondly, the three homes you would target on Bushby would not be over $2 million. You are throwing out numbers like we are talking TVs here. There is a new build on Dallas Road at $3.2 that recently reduced their price. Their is a new build on Clifford at $2.465 that is 65 days on market. An older house in Fairfield is not automatically 2 to 2.5 million. That would be reserved for a pretty special character renovation.

Finally, you are overlooking so many things. The Bushby lot is only 17,000 sq/ft which makes parking difficult for the number of units you are suggesting. The smaller the lot the higher the % of the parkade is eaten up by ramp which means you would have to go 2 levels down which becomes very expensive assuming it can be done geotechnically in that area. Also, I have a hard time seeing 6 stories getting approved on Bushby.

Will it though? Still waiting to see evidence of this. I assume most households could easily absorb an extra $200 per month in interest payments. There may be additional pain at renewal time though as payments are adjusted to keep amortizations on track.

Garth is also not credible.

The developer can do that too. This isn’t an either or situation. If you can find three homes side by side with nominal value to the improvements. Homes along Bushby are usually well kept and in the 2 million to 2.5 million dollar range.

Beside this site is already zoned multi-family and you get to rent it out. That could be a half a million in rent each year and you get to keep whatever is in the reserve fund. Try making that return on three houses.

What I’m illustrating is that these numbers are not impossible. In fact they are pretty frigging close.

Worse case scenario – you now own a rental building which is worth about 20 times gross income today. Lenders like to see a steady cash flow and it makes it easier to sell them on financing the project. Lenders don’t like vacant land.

I’m not telling you to go out and buy them today. There is a little thing called “timing” Yes timing. That little thing that no one seems to believe on this blog. You should be buying an investment on an upswing when the market is appreciating which will add value during the time it takes to get approval and during construction. Maybe over 3 or 4 years.

But I doubt most developers, today, are willing to take the risk on the market when it could be declining. It’s a time for them to pause. That doesn’t mean you shouldn’t look. Sometimes good things happen. I wouldn’t just poo poo the idea. These buildings are eventually going to have to be demolished. Wood frame doesn’t last forever and the cost to repair and maintain them increases as they age. Those on this blog that have done renovations know what I mean. A 1970’s Gordon Head house will cost $350,000 to substantially renovate. And it won’t look much different afterwards. Well at least not $350,000 worth of difference.

There’s an example of a bank’s trigger/mandatory-mortgage-payment-increase letter on Garth today. Quite a jaunty little epistle considering that it will tip many households over the brink.

Maybe that 26 year extra life expectancy is one of the main issues impacting our systems today, be it healthcare or housing. What is the % of people over 58 and below 58 needing 55+ buildings, healthcare and nursing homes? We just have much more people to share the limited resources than it was 60 or 70 years ago. The government could definitely manage it better, but people live longer and use up more resources in old age is a fact that we didn’t have to face 60 years ago.

I thought Marko is one (or at least half) of the pros, not just as a realtor, but also a builder with his father?

13 is not an ideal number as you need 11/13 of the owner on board.

Why wouldn’t a developer just buy three houses on Bushby? It would cost a lot less and be a lot easier to pull off.

Another one I like is 137 Bushby. 13 suites that are around 1,350 square feet each and the building is less than 100 feet from the water front. Go to six storey and the top three floors have water views. The building is subject to a Special Assessment which has probably been voted on by now. That would be say 30 or 40 condos some with unobstructed water views

What’s nice about these rather than vacant multifamily land is that you have an income stream of say $30,000 to $40,000 a month renting them out while obtaining re-zoning approval that may take 18 to 24 months and you get to keep the reserve fund. Probably cost $8,000,000 to buy out the owners and another $15,000,000 to build. Projected gross selling price for the units depending on the size and number of the units – maybe $30,000,000. Maybe more.

You would have to dig into the details and firm up the numbers but the back of the envelope figures indicates its worth doing a more in depth analysis.

Doesn’t take long to find likely candidates and I’m an ammateur. Think of what the pros can do.

Despite increased building activity there is a housing affordability and availability crisis in Victoria. Particularly affordable rental or owned houses for families.

https://www.vicnews.com/news/victoria-housing-review-finds-stark-shortage-in-family-spaces-being-approved/

And provincially in many cities.

https://www.cmhc-schl.gc.ca/en/professionals/housing-markets-data-and-research/housing-research/research-reports/accelerate-supply/housing-shortages-canada-solving-affordability-crisis

Developer is not going to shell out 15 million for a 35,800 sqft lot where max height is realistically 6 stories, if lucky with the nimybs/city hall.

To make a performa work that site has to be under 8 million.

I wouldn’t myself put all the blame on the municipality’s Victoria has been building more housing than ever so not too sure we have a housing crisis

I think this is a benefit to municipal councils who are facing neighborhood pushback campaigns and then they get personally lambasted on social media and in person. I’d hate to be in their shoes. If you want a municipality to meet the need for long-term housing you need to make it clear to their voters that they are not the final decision-makers and that it is a provincial mandate.

Because there are very few affordable condos that accept families in the core currently and those with larger square footage are age restricted. A 2 bed 2 bath 1100 square foot condo that is 550,000 now is still way more affordable at 600k than a house that is a million dollars to start. The median family can afford 600k with 20% down (this is max affordability) and could live in 1100 square feet and build equity. Also less risky if they know they can rent it out if they have to move for work or other reasons.

Fair point. It would be a discretionary decision. Having said that, I think the political headwinds are firmly against municipalities who don’t get serious about approving housing, not the minister. I don’t think this is game-changing legislation, but allowing the minister and cabinet to override local government decisions around land use is a big policy change. We’ll see if it works.

Sure Marko. Look up 1145 Hilda. A 1974 built 30 unit four storey complex that fronts and backs on two streets. Wouldn’t be a stretch to get to at least two new six storey buildings as there are six storey buildings in the neighborhood. Probably looking at 100 or 120 new one and two bedroom units maybe more.

The policy intent of removing age restrictions would seem to be to expand the availability of existing supply for purchase to families with children. What does that have to do with vacant units?

Insider contact news – Manulife lays off entire CDN real estate team.

The proforma isn’t even close to working. Not sure if I am bad at explaining concepts or you don’t want to accept the realities of basic math.

A developer cannot go into James Bay or Fairfield and pay 20 strata owners in a 4 story building 500k each (aka 10 million dollars) to rebuild a 4 story condo building or at best 5 or 6 stories.

The reason it works in Vancouver in limited circumstances is a developer can pay 20 owners 1 millon (aka 20 millon) and then rezone to a 40 story tower that they sell at $2,000 per foot.

Can anyone give me an accurate and modern stab at cost per sqft construction in the core for a 1 level duplex? My insurance is bugging me to ensure the amount I’m covered for is actually enough. (Somehow that falls on me and not the local insurance people?)

I think it is a bad assumption that once the age restrictions are lifted these condos will stay less expensive. These buildings should have a spike in value. How that then makes them affordable is not clear to me. Young families will be priced out of these buildings too.

There are not many three-bedroom condominiums in Victoria and they are mostly in the older complexes. These older buildings tend to have two-bedroom suites in the 1,000 to 1,200 square foot range and some are even larger. That makes them desirable for an investor to convert them into three-bedrooms or two-bedrooms and a den while updating the interiors. $3,500 to $4,000 a month potential rent on a $600,000 purchase. That will drive the price of these condos up.

I don’t see how this makes them affordable for young families. It’s a bonus score for the current owner that wants to sell but not to a buyer or a renter.

DAD: My facts are based upon what the government has told us unless you are suggesting they are lying to us. Dad, you seeming to be slipping with your comments but your life must be hard.

We don’t know the particulars of why that project failed. But with the proposed changes that may accelerate developers targeting these older, inefficient buildings on large lots in premium locations like James Bay and Fairfield.

My experience has been that those living in these older buildings tend to be retired and living on pensions. They are not rich folks and have usually voted down increases in their strata fees or taken the least expensive route in repairs. These buildings therefore tend to have more deferred maintenance. Faced with a Special Assessment for repairs, some have a difficult time coming up with the cash or at their age taking on a mortgage. A developer or group of investors would provide a solution. A purchase with a lease back option is one that comes to mind. But there are many ways to skin a cat. An investor may not have voting rights on the strata council, but they can always sue the strata council. That can make the complex less desirable for prospective purchasers and effect the value of the condominiums. It only takes one zealous litigious owner to make the complex less appealing. to the marketplace.

It would be naïve to think a developer or group of investors would not see this as an opportunity. It’s more desirable to not create dissension by making an offer of 15 or 20% over assessed value with an option to lease back for 18 to 24 months. Providing that 80% of the owners accept the offer.

For those condo owners that don’t want their building to change there is the Poison Pill. Raise the age limit to 55. There is a chance this may effect the market value of their unit but it will make the complex less desirable to developers/investors.

A house and a cottage and a family doctor all sound good. However, a life of expectancy of 58 vs 84 today and very poor career prospects for women and minorities make me glad I was born much later. Some things have improved a lot, others have not.

I agree things have gone badly wrong with addictions and mental illness policy and this is frustrating.

Opening up 55 plus condos to rentals is not a tragedy and will increase rental options for this group without what I would consider an unacceptable impact.

Making condos for those under 55 open to all is a bigger issue in terms of potential noise and conflict, but there is greater hardship occurring for people who cannot afford to buy or rent based on median incomes. Not everyone can just move away and we need workers in median and lower paid fields for all sorts of necessary services that have to be performed in person and in town. Like teachers, medical and hospital support staff, retirement home staff, waste management…

We know objectively that the median family in Victoria starting out cannot afford to buy a single family home and rents are also not affordable. Government has an obligation to address housing supply. This is one step and encouraging supply is another, but we really need more purpose-built rentals with rent geared to income.

Putting myself in the shoes of a young family starting out I would now be looking at formerly rent and age restricted condos as a way into the market. Unfortunately, many of these buildings have very poor sound-proofing.

I am in favor of the new legislation but there will be some crap situations for people out there. Some of these older buildings I’ve been in you can literally hear every footstep above. If you’ve been there for two decades and then a family with kids moves in above you that kind of sucks.

Quite frankly I am shocked the NDP made the move. It won’t help the housing crisis much and it will piss off a ton of people.

Don’t developers just build what the market wants? Problem is in Canada/North America people will rather commute to Sooke/Duncan than live with kids in a three bedroom condo in town as the two products have to be equivalent in price for the developer (in town) to cover his or her construction costs plus make a bit of a profit. The developer can’t sell three bedroom condos at a loss to try to swing SFH Sooke people into town.

In the end the market settles out at average 550 sq/ft one beds and 800 sq/ft two beds.

He said, immediately after accusing another poster of making comments unsupported by facts.

Just screaming that we are in a housing crisis does not justify what appears to be really bad policy in terms of getting rid of age restrictions. And before Totoro, with no facts to support the comments, leaps into personal attacks I dont live in a condo or an apartment,

All these sopposed vacant units are not really vacant but rather they were being used part time by their owners. Regardless the exemption was expiring this year and the vast majority have either already been sold or would be taxed onto the market in the next year or two. In short, at best, a very small gain that would have occurred in the next year or two in any event. (Note, for those people that are wiling to pay the tax this legislation does not change anything.) Besides he could have allowed rentals while keeping the age restriction as a compromise.

But there is a very real cost to a lot of people in that not everyone wants to live with your screaming kids and teenagers. It is not like all or even most of the condos in Victoria are age restricted. Everything build after 2010 has no age restrictions and that accounts for a large percentage of the buildings and not everything before is age restricted either.

What truly bothers me is that we seem to have lost sight of making life better for people while charging forward on some mindless crusades governed by the rallying cry of “Crisis”. Ebby in his announcement also tossed in the fact that this would address the “homeless” crisis. That the homeless is issue is actually a drug addition and mental illness problem is carefully ignored.

Well great for developers I really wonder if shoving people, including families into ever smaller condo cubes is really the best that we can do for Canadians? My dads generation had a vision of better lives for people. He was a working man who supported a large family on one salary, had a modest house and even a ramshackle cottage for all us kids and this was in Toronto. And we all had a family doctor back then. Things have gone badly wrong.

We should be making peoples lives better not worse. If we are building more condos they should be bigger, much bigger if you expect families to live in them, instead of smaller.

The attitude of the government seems to have become that people should just suck it up and expect less from life. I just dont think that we are doing good enough and the agenda so often seems to have coincidentally benefited my old Bay Street friends who are developers.

And as I said, the economic don’t work. If you wish to explain how the economics do work please elaborate with concrete numbers. I know what developers are paying for land and I know what the market value of condos in Victoria is and it simply isn’t close to terminate a condo strata corporation in terms of economics, yet. Maybe in 20-30-40-50 years. The reason the economics don’t work is you can’t uplift the density like you can in Vancouver. The tallest building in Victoria is only 25 stories.

Maybe maybe there is a 4 or 5 (would be easier to hit the 80% vote with 5) unit strata townhome complex with large surface parking that becomes economically feasible to buy out somewhere around Cook Street in the next 10 years, maybe. If you think there is a strata condo complex in Victoria that could work let me know and we can quickly run the numbers based on BC Assessments and we will have a rough idea for density based on the OCP. You need to keep in mind the developer’s offer needs to be substantially above market to get 80% of the owners to vote to sell.

btw, your example is a townhome development with a massive footprint and Anthem Properties is not know for small projects (aka they were planning a huge density uplift).

The owners of a Coquitlam condo will not be able to to wind-up their strata and sell it to a developer, a Supreme Court judge has ruled. The owners who wanted to wind up amounted to 78.6 per cent of ownership, but despite the “high threshold” of support, Justice Geoffrey Gomery said there were too many uncertainties to proceed with the plan.

Key to his ruling is the fact that a developer backed out of the deal this past summer, which changed a number of factors. The owners who wanted to wind up amounted to 78.6 per cent of ownership, but despite the “high threshold” of support, Justice Geoffrey Gomery said there were too many uncertainties to proceed with the plan.

Last summer, the condo owners discussed selling the property — which consists of six two-storey residential buildings built in 1982.

They engaged with a realtor, and by Nov. 5, 2021, had reached a deal with Anthem Properties Group Ltd. — a prominent developer in Coquitlam.

Key to his ruling is the fact that a developer backed out of the deal this past summer, which changed a number of factors.

So, these older condominiums are of interest to developers. This one failed but the economics of winding up condominiums follows along the same rational as buying and assembling older houses to build new condominium complexes.

I know in theory the prices of newer condos should come down as a result of investors being able to buy into older condos now, it makes perfect sense. But my gut feel tells it is more complicated than that and we won’t see newer condos budge too much.

As a condo investor personally who buys 400-500 sq/ft brand new condos I don’t see myself substituting that with a 1,200 sq/ft 1970s condo in Cook Street village or Oak Bay.

I get this feeling this older buildings may attract a few “investors” who previously weren’t in the downtown newer condo game. Like someone involved in trades pr handy that has a principal residence SFH and buy a 1,200 sq/ft 1970s condo, renovates it, and then puts it up for rent.

Just some random thoughts. Will be interesting to see how it plays out.

Given the “economy” aka government of Victoria a lot of people will be seeing wage increases in the next 3 years. This is why I wouldn’t wait forever to buy, if looking to buy. I think the next 2 to 12 months could be an opportunity to purchase while interest rates are high and incomes haven’t seen multiple years of 3%/year wage growth.

If interest rates were to turn, combined with wage growth, combined with lack of inventory look out again.

Not only that but the investor absorption of current rental restricted condos will be much lower than the invenstor absorption of current unrestricted condo rentals. Let’s say if a newer building downtown 1/3 of the purchasers are investors my best guess is that a 1970s 1,200 sq/ft unit with shared laundry and $600 a month strata fees 1/5th to 1/8th of purchasers will be investors. Investors don’t want to deal with special assessments and problems either.

So turnover x lower investor absorption rate = this will take 10+ years to manifest.

Market value correct will manifest much quicker thought. High interest rates (very few investors out there) will mask things for the next little bit for adjusting accordingly but give it 1 or 2 years tops.

Demolishing strata buildings only works in certain spots in Vancouver. For example, a developer buys a 4-story 20 unit building somewhere downtown or close to skytrain and replaces it with a 45 story tower.

To be the best of my knowledge a condo strata has never been terminated (also know as winding down) in Victoria. I’ve seen apartments demolished, but never a condo strata. I did see one townhome strata in Langford terminated but it had a massive surface parking lot and not that many units so made sense for the developer.

I can’t even identify buildings that are even remotely close to being terminated economically. Unlike Vancouver for the most part 4-story buildings in Victoria can only be replaced with a 4-story buildings.

It would have to be something downtown and there isn’t much downtown that is small with a decent footprint.

Maybe something like 1975 Lee Street (corner of Lee and Fort next to Save On Foods) in 50 years as they have a big surface parking area in the back? Right now it doesn’t work. If market value of each unit is 300k plus 20% premium to get 80% on board (you need 80% vote in favor to terminate a strata) = 360k x 41 units = $15 million. Not going to happen.

Don’t be an ass Totoro. No need to do personal attacks. This is worthy of a discussion if only to play Devil’s advocate.

Your whole line of thought is illogical and not well-researched.

It sounds like you live in a rent-restricted condo and, now that you understand that there is no grandfathering or other way out of the changes, you are creating paper tigers because you don’t want things to change.

There is no evil league of investors waiting in the wings, trying to take over your building and raise strata fees and then demolish your building (which would require the unanimous agreement of owners). In buildings where rentals are already allowed this has not happened. Very few units will turn over each year because very few units are listed each year. All owners have an interest in keeping strata fees low while doing necessary repairs. And in a time of higher interest rates fewer people are going to be viewing condos as having a reasonable return based on rents.

Demolishing old buildings and building new condos is not a good idea for the reasons that Leo has already set out. Building new condos on land formerly occupied by low rise makes much greater economic and environmental sense.

In my view, the new changes, while possibly raising values, are not what a lot of existing owners wanted because they prefer to live only with other adults who are also owners. I get that, but we are in a housing crisis and any empty units that are not being rented out because of rental restrictions are hard to justify imo.

Your view that people can just go out and rent something elsewhere is incorrect because of affordability and supply and there is lots of data on this. It is really hard for families in particular to find affordable housing, and condos are generally more affordable rentals than houses.

I agree with the changes that have been brought in, but I wonder what the backlash is going to look like – especially come election time.

One certain outcome of new government regulations is the formation of more government bureaucracy: new positions, new offices, more paperwork, enforcement, ie. more government spending. Splendid.

There is only so much rental demand. Putting more capital into existing rentals will not increase total rental demand, and will not increase total rental proceeds. Yes the rent of an individual unit may go up but that will be at the expense of another. Granted I’m talking about market rents, if someone has been paying below market due to rent controls and has to move due to a reno they are likely to pay more.

That goes for sale prices of properties too.

Hey Dad:

I could well be wrong! But I’m worried about the vagueness of the wording. The minister can issue a directive; can make an order. What are the precise criteria that will lead to the minister doing so? It reads as a matter of discretion, which may flutter in the face of political headwinds.

Anyone reading this blog can go onto Craigslist and find a rental immediately. They are expensive but they are available. Don’t like it then don’t move here.