Do bidding wars still work?

Not too long ago bidding wars were prominent and I looked at whether they actually work in getting the sellers higher prices on top of faster sales. Based on sales in the spring of 2021 – about half of which went over ask – my conclusion was that they do work. Though differences in selling prices vary depending on how you measure them, the data suggested that sellers who underlisted and successfully sold in bidding wars were netting around 5% more than those properties listed at market value. Of course conditions were perfect for engineered bidding wars at that time, with the BCREA estimating that there were nine buyers for every potential seller.

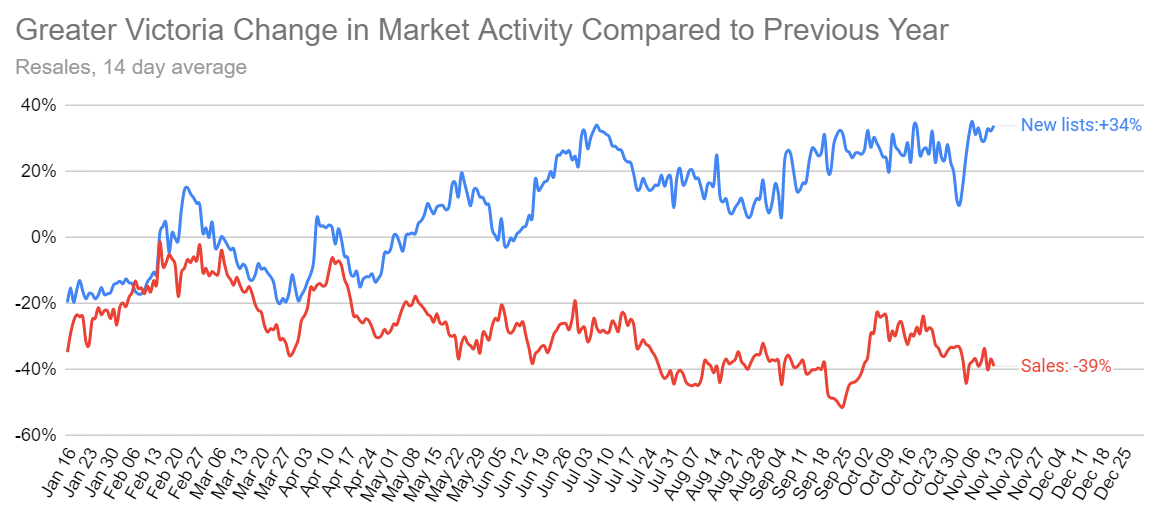

But today we’re in a wildly different market, and engineered bidding wars have clearly fallen out of favour with agents and sellers, dropping to less than 5% of sales from over 70% in March.

Not all of those over-asks will involve a bidding war, with some simply being listed somewhat low and attracting one offer over the asking price, or finding one buyer that may prefer the listing a bit more than the broader market.

So do bidding wars still work when the market is slow? To examine that question I looked at sales since August 1st, where sales going over the asking price represented just 6.4% of all sales.

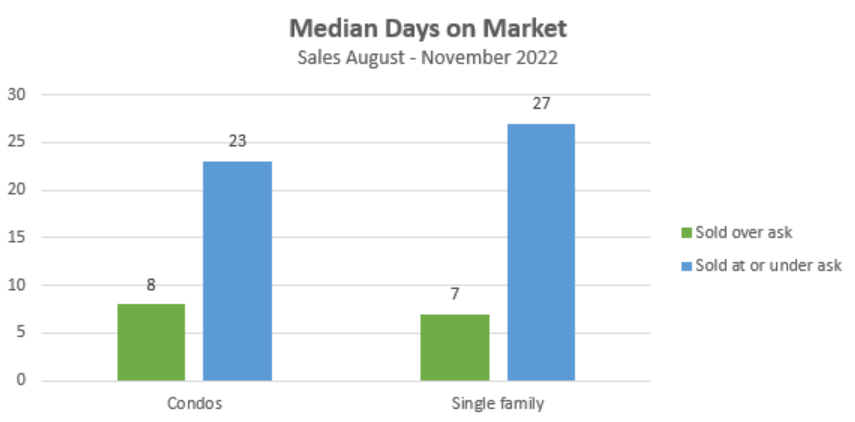

If the question is whether underpricing still works in driving fast sales, the answer is a resounding yes. Properties that sold for over the list price sold in about a week, while those that sold under the list price took three to four weeks to sell.

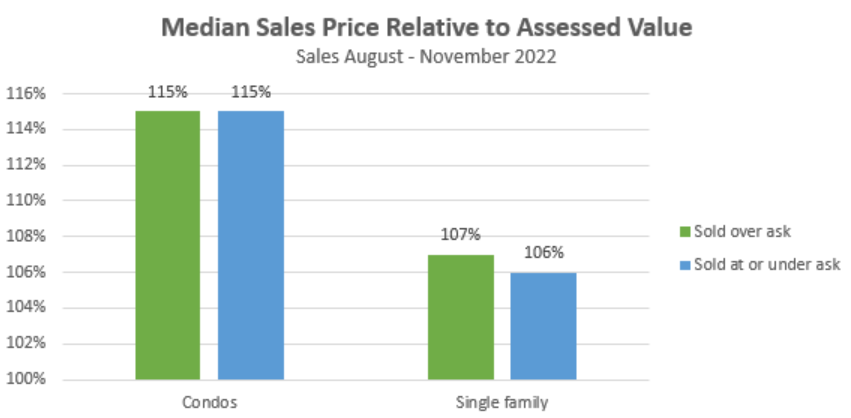

However when it comes to price it looks like all benefits of bidding wars are gone. Sales prices under both strategies were the same, with no statistically significant differences between them.

An intentionally underpriced listing will still attract enough buyers to sell at market value, but the ability to attract a frenzy or irrational bids is gone. If you have a property with broad appeal, you should still be able to underprice and capture market value while selling more quickly. However for niche properties with a smaller buyer pool or in an even slower market than today (for example the winter market we are entering) this could backfire if there simply aren’t enough buyers looking for that kind of place, even at below market value.

Also here are the weekly numbers courtesy of the VREB.

| November 2022 |

Nov

2021

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 83 | 156 | 653 | ||

| New Listings | 205 | 375 | 696 | ||

| Active Listings | 2161 | 2186 | 887 | ||

| Sales to New Listings | 40% | 42% | 94% | ||

| Sales YoY Change | -41% | -46% | |||

| Months of Inventory | 1.4 | ||||

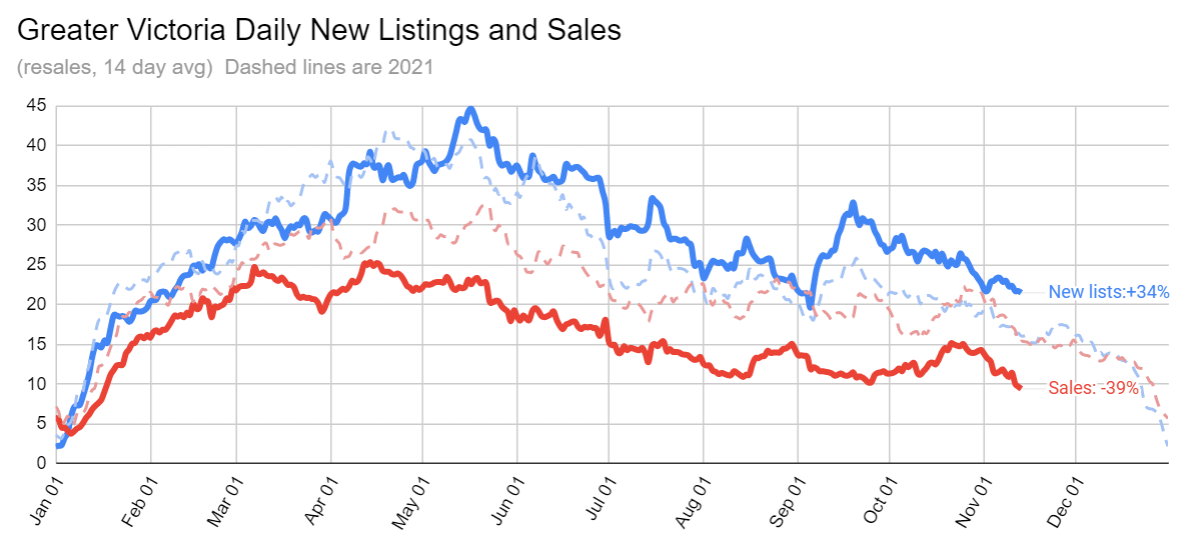

It’s a sluggish first half of November, with sales down by nearly half from last year while new listings are up by about a third. Resale transactions for the last 2 weeks (in the chart below) aren’t down quite as much possibly because non-residential and new build transactions are taking a bigger hit right now.

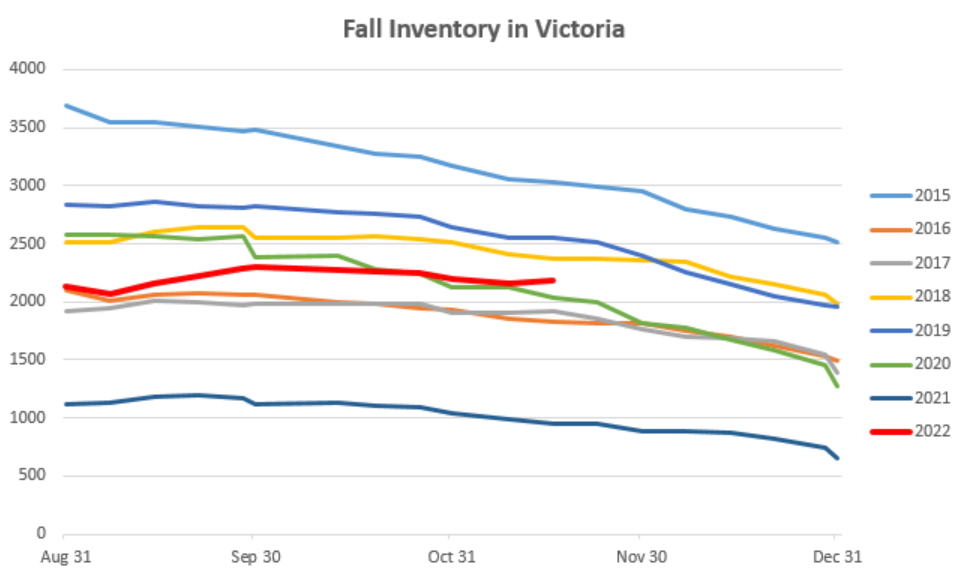

Normally this time of year inventory is dropping, but this year it’s held quite steady since the start of September. The difference is not wildly outside historical norms, but it’s certainly unusual for inventory in mid November to be higher than the start of September. In about a week or two is when the steep decline of inventory usually starts which continues to the end of the year. On a seasonally adjusted basis inventory is still moving upwards and likely will continue to do so for the foreseeable future. We are still at pretty low levels for this time of year, about half of where we were 10 years ago.

New listings growth has increased this year, and while that’s against a weak baseline (696 new lists last November VS the 10 year average of 753), if they end the month up by a third that would mark a multi-decade high. That would be welcome news for buyers still faced with historically low inventory, and could bring some interesting deals in the fall and winter market from motivated sellers.

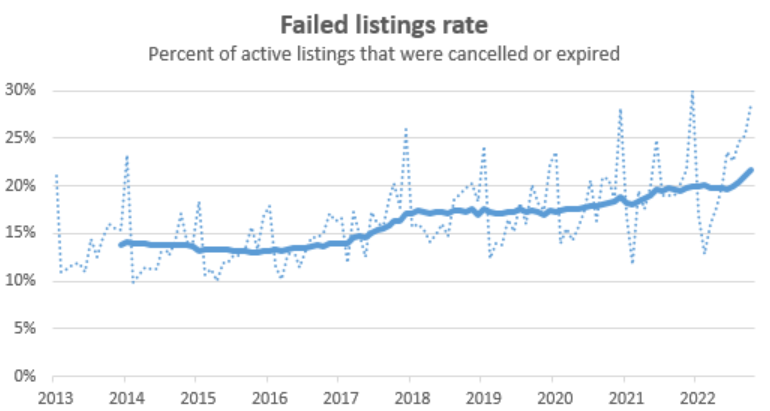

For those trying to sell (but not willing to sufficiently lower prices to the new reality) it’s been a frustrating year. Despite an increase in inventory, the percentage of listings that fail to sell every month increased sharply. In most years the strategy of cancelling listings to try again in the spring would yield success as the market caught up to overly optimistic list prices, but if rates stay high that strategy may not work for some time to come.

New post: https://househuntvictoria.ca/2022/11/21/construction-is-riding-high-but-will-it-last/

Bingo! My insider sources tell me that Eby is even going to force Oak Bay to host a Hell’s Angels club house.

Frank, you don’t live here. They’ve removed nothing of yours.

Their water shortage problem is entirely to do with the farming in that State.

It bothers me that the government’s solution to a problem is to remove one of our freedoms, like choosing how we want to live.

Isn’t that only because existing legislation explicitly allowed stratas to do so? Changing the laws should take care of that problem.

California also has water shortage problems, how is building more going to solve that problem?

That’s going to happen to Victoria eventually. The Island will eventually need a nuclear power plant. We just can’t keep putting a band aid on the problems and hoping they will go away. We saw what happened when the Malahat was nearly completely shut down. That’s going to happen more often. We can’t keep densifying the same cities making them bigger and bigger. We will run out of power and potable water. And we will need a bridge to the mainland.

But this is what happens when you put all of your cans of worms in one basket.

+1. Critical

Oh definitely. Ending age restrictions won’t really do anything except equalize the price of condos that previously had them to those that didn’t. The purpose of that is to end that particular type of age discrimination not solve the housing shortage.

Ending rental restrictions will bring units to the rental or sale market (perhaps 2000 units in our highest priced markets). Net positive and maybe even big enough of an effect that we will notice in the data but it won’t solve the problem.

Long run realistic housing targets with teeth have the biggest chance of actually making a difference.

California has had housing targets for decades and until recently they were almost useless because the cities wrote their own very low housing targets and the state didn’t do much to enforce them. Just in the past couple years have they standardized on housing needs assessments that reflect actual need and added teeth to enforcement (basically if a city is out of compliance builders can just ignore zoning and build whatever they like as long as it’s 20% affordable). Now they’re starting to get results

Maybe if the government spent all these millions and millions on making Duncan or Port Alberni a new mid size city with increased shopping, box stores, banking, schools and hospitals and leave Vancouver and Victoria alone. Does everything have to be in either Victoria or Vancouver? Spread the wealth out. Make a new city.

You’ve taught us that “you can’t solve a housing crisis by redistribution”. Doesn’t this idea of playing with strata age restrictions merely achieve redistribution?

And at the very least, setting land aside for future parks as density increases and private back yards are reduced. I see lots of clamor for higher density like European cities but I am not seeing any public hearings for designating land for park space. The European cities I have visited had very generous park systems and often the land along waterways was preserved as public space. Here waterfront is seen as higher value and developers are reluctant to give it up for greenspace.

If you want to make an omelette you need to open a couple cans of worms

Oh Boy, what a can of worms to open. There is lots of legal precedence in BC that allows a strata corporation to set age limits. Age restrictions have been challenged and the restrictions upheld in BC Courts.

A strata corporation has to now sue the BC Government. And that should happen pretty quickly. This change in my opinion is significantly unfair to the owners of the condominium complex. What is strange is that they will not likely have a diminishment in value but a loss in enjoyment and privacy.

Then there would also be an increase in nuisance complaints with the strata corporations fining occupants for crying babies, noisy toddlers, parties, etc.

I don’t think this change has been well thought out.

I am just glad that I am living in my little cottage and not in a strata. As an aside, maybe they need to start thinking about building new hospitals before they go on a housing binge.

That’s correct, the exemption expired last year. So this year they would have had to pay the tax or sell. Now they have a third option to rent it out.

I was just reading further and it says, if approved, “the changed to the Strata Property Act would take effect immediately.” So apartment style condo’s, townhouses, single homes on bare land strata, all come under this act..

The Government also expects some owners in strata’s would choose to rent out a room in their condo if given the opportunity to do so. I think this is good. Many single people, young and old would like to be able to do this and aren’t allowed under their strata rules.

For the poster who said, “People with mortgages pay only 7% of their income in interest costs and even doubling interest costs means only 14% of income will go to mortgage interests” (I am paraphrasing here).

Property prices are set at the margin. Only 5-7% of the properties come to the market annually. These 5-7% transactions set the price for the entire market. All the buyers who maxed out their limit on their purchase price, with many of them using HELOCs on their existing properties, pay something like 50% or more of their income to mortgage. They will set the market price in the next three years. With inflation unlikely to reach 2% in the near future, interest rates will not come down for a while. It takes a while to see the effect of higher interest rates. At many Canadian banks, mortgages with more than 30 year amortization has gone from a very low number to > 25% in a short few months. They are basically using “extend and pretend” but you can only extend so much. Many of the mortgages are already reaching 105% LTV, which is the OSFI limit. The unemployment rate is projected to reach at least 2% higher (probably BoC’s goal to bring inflation down). Al these factors point to a long hangover period.

hmmm….The Canadian Press Article @1:15 today said they’ll be Removing Rental Restrictions on Apartment Complexes. However, I believe Eby said all Strata’s. Clarity would be nice.

Makes sense. My bad, I thought for some reason that exemption ran out or was going to run out.

Also backed up by the data. Job vacancy rate on the island is extremely high, tied with Vancouver. It’s an important buffer in case of economic slowdown. Unemployment rate should be pretty resilient to slowdown because vacancies will decline first.

They could always sell but previous to this change there was really no reason to. I assume they enjoyed keeping an empty condo that they used periodically, and because of the exemption for rental restrictions it didn’t cost them any spec tax.

They’ll sell now instead of paying the vacancy tax.

The owners were never restricted to sell? You think the owners were waiting for an uplift due to legislation or will be upset that kids might live in their building?

Province wide I view it out of 2,900 2,500 will rent out and 400 will pay the vacancy tax.

So in Victoria maybe 600 rentals and 167 pay vacancy tax.

Also interesting Reddit Thread -> https://www.reddit.com/r/VictoriaBC/comments/z0pt03/is_your_place_of_work_understaffed/

2020 Vacancy tax data: 767 vacant units in Victoria that couldn’t be rented out due to strata restrictions. Those will either:

1. Be rented out

2. Be sold

3. Owners will pay the vacancy tax.

This will be the minority. Most people that are thinking about a family or want to leave the option on the table haven’t bought into 18+ in the past. Same Reddit Thread -> https://www.reddit.com/r/VictoriaBC/comments/z1a5ed/new_bc_housing_laws_will_lift_rental_restrictions/

“Not stoked to live next to children again, which is half the reason living in a 19+ building is so great.”

As I said this will create a ton of friction on the ground.

I agree in that this won’t solve the housing crisis. I think the best we can hope for is the 2,900 units that are sitting vacant in rental restricted buildings maybe 2,500 get rented out and that is that. That is the tangible change.

However, this has implications on strata living and in my opinion it will make some buildings less affordable to purchase.

I haven’t had time to study the 174 currently active rental restricted condos in the Victoria core but few stick out as

For example, this building with no rentals and 25+ age restriction has always sold for less than the comparable 1990s buildings on the same street without those restrictions

https://www.realtor.ca/real-estate/24997612/307-1715-richmond-rd-victoria-jubilee

If these changes become legislation I think this building pops 10%. Not enough to flip or profit but it makes it 10% more expensive to an owner-occupier purchaser that was 25+ not considering a family.

Leo did bring up a condo point a few weeks ago, does this decrease the value of the buildings with no current restrictions as it might spread investors out a bit? Will be interesting to see how this plays out.

Just saw a post in reddit that this makes him/her very happy as they are in a 18+ building and are thinking to start a family.

Eby said in the meeting that is the next topic they will address, and it is also area specific, as cities like Tofino and Whilstler do need short term rentals to sopport their main industry – tourism.

Oak Bay or Langford, housing density in our cities will be all more and more like cities in Europe in 50 to 100 years, unless something stops population growth.

But maybe you could build a “Oak Bay Wall” to stop people building and moving in? Haha

Good question. But I think the age restriction is for the resident, not the person on title.

It won’t be just apartment style strata’s, there are townhomes & bare land strata’s etc. that currently have age restrictions and/or rental restrictions.

Maybe one day, because of my age, I wouldn’t mind moving into a one-level townhome which I could rent rather than purchase. Currently, many of those types have the age/rental restrictions.

Not possible. Short term rentals don’t fall under this and more action to restrict them is coming in a future bill.

What if someone buys a unit and turns it into an AirBnB? That’ll really go over big with the residents. More government involvement = more problems. As usual, but they have to make it look like they’re doing something when in reality they’re not.

Wouldn’t those buyers/investors need to 55+ as well? Wouldn’t it be funny when a person is allowed to buy and can’t live in the unit?

I believe age restriction remains but rental restriction goes. But good question. Will there be a market in buying investment homes to rent to seniors? I do think they need to look closely at corporate ownership to prevent unintended outcomes.

Don’t think having rentals or not in a building is going to make much difference on how people live Might move the market a bit but see this as a non starter IMO Of course who knows if any of this stuff comes to fruition

Currently there are buildings with a 55+ restriction that allow rentals do you would think the rental restriction would be removed from the 55+ too but who knows. It will be interesting to see this unfold. I can’t see 300,000 people lightly taking this given my experience on strata councils, reading 100s of strata document packages, etc.

What about if you are in a 55 plus building. Are they letting the age restriction remain and the rental restriction? Or can you rent out to seniors over 55?

Yes.

I think it will be impossible to challenge the age restriction change given it’s a human right. Not allowing rental restrictions is commonplace in new construction but maybe better chance there.

Apparently yes, those that are under 55+, but 55+ and higher stays? So the way I understand 16+, 19+, 40+, etc. will be removed?

This is an absolutely huge move on the part of the government.

For example,

All Active Condo Listings in Victoria Core – 382

Age Restrictions (between 1 and 54 yrs old) – 60

No rentals or rental restrictions – 174

Both age restrictions (between 1 and 54 yrs old) and no rentals or some rentals – 51

^If I was an investor right now I would be taking a VERY CLOSE look at these 51 options. Potential upside.

I am 100% in support of this legislation but this will cause so much friction and hate on the ground. Just think about it, you’ve been living in Oak Bay on Beach Drive for 40 years (think crap acoustic insulation, older building) in an owner-occupied buildings with no kids. This spring an investor comes and buys a unit in your all owner-occupied building and rents it to a young couple with a newborn above your unit. Fun times ahead.

With 300,000 people being impacted and 99% of those 300,000 will view this as a negative impact I am guess there is going to be legal challenge to this legislation in the courts? Anyone have any thoughts?

Oh good, thanks JG for telling me.

Alexandracdn – correct.

“It would also make it illegal for strata to have 19-plus age restrictions that force out young families when they have a child. “Seniors only” strata will still be allowed.”

https://vancouversun.com/news/local-news/new-b-c-housing-laws-will-lift-rental-restrictions-in-strata-set-housing-targets-for-municipalities

Will strata’s need to remove age restrictions as well as rental restrictions?

Basically the province will be taking over most of the municipal housing decisions.

Oak Bay is going to end up looking like Langford. Also an ever increasing amount of provincially owned housing. It will be interesting to see where all the tax dollars actually come from.

Re: the housing announcement. David Eby discussed two upcoming changes which will happen in the next few months: 1. removal of stratas. and 2. ensuring munis are building more homes.

For the strata item there was some discussion on this blog around how having a strata that would not allow rentals would benefit by removing that rule – IE. if homeowners are purchasing those places would it not be a zero sum game? David Eby answered by saying there are around 2900 spec tax allowances for people who own units they are not living in for these rental restricted buildings. Basically the owners saying ‘i would rent it out but i can’t due to strata’ and there is an exemption in the spec tax for this. So now the owners will be able to – or they will have to pay the spec tax. So they are hopeful that will bring on 3000 units almost immediately which will help renters. Someone suggested that removing STRs would be a lot more effective and David noted that they were working on related issues currently which they would bring out in the near future. It didn’t sound like an outright ban – and in fact he noted the challenges in places like Tofino and Whistler where they relied on STRs to house tourists which needed to be considered.

On the municipal front he basically said they want to work with the munis to get homes built. They are starting with 8-10 munis where they will roll this out. Someone asked what would happen if the muni’s were not approving housing and he basically said that the new legislation will allow for the Province to force approvals or to rezone etc where needed. He was hopeful that it would never come to this and that they muni’s would basically be doing this on their own free will after hearing about the housing issues for BCers over the last couple years (yah right).

Other people asked about the 3 suites on a property, or the property flipping plan and he said those things were still in the works and they will bring them out as work out the details. He did say at one point, i think it was specifically around the 3 units, that they need to make sure that the changes would lead to more housing before enacting anything. To me it sort of seemed like this item wasn’t a slam dunk item that would go through.

Someone asked if they were waiting to bring out all the other items to around election time (Oct 2024) and he just said they would more meetings for other items in the future. No timing was mentioned for anything else other than the two items today (stratas is imminent and muni legislation would be out in spring of 2023 I think). THats off the top of the head.

Cheers.

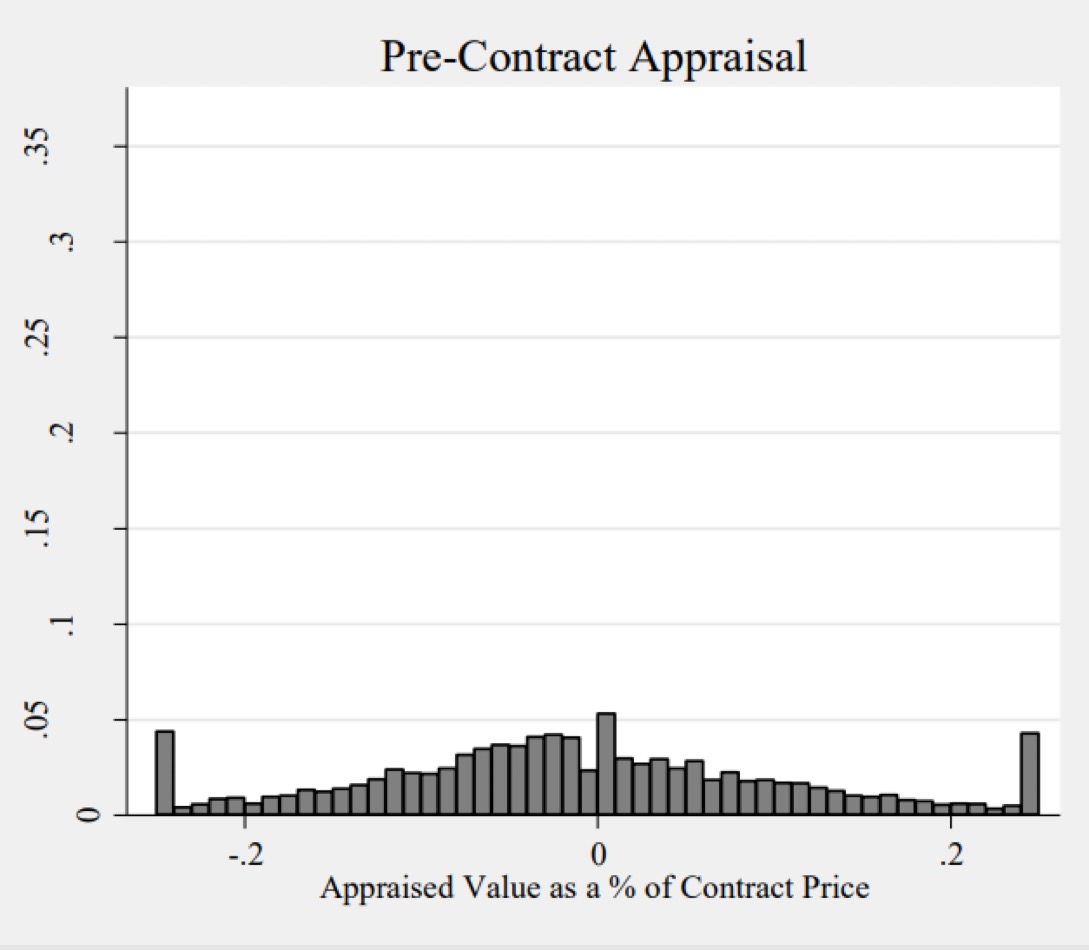

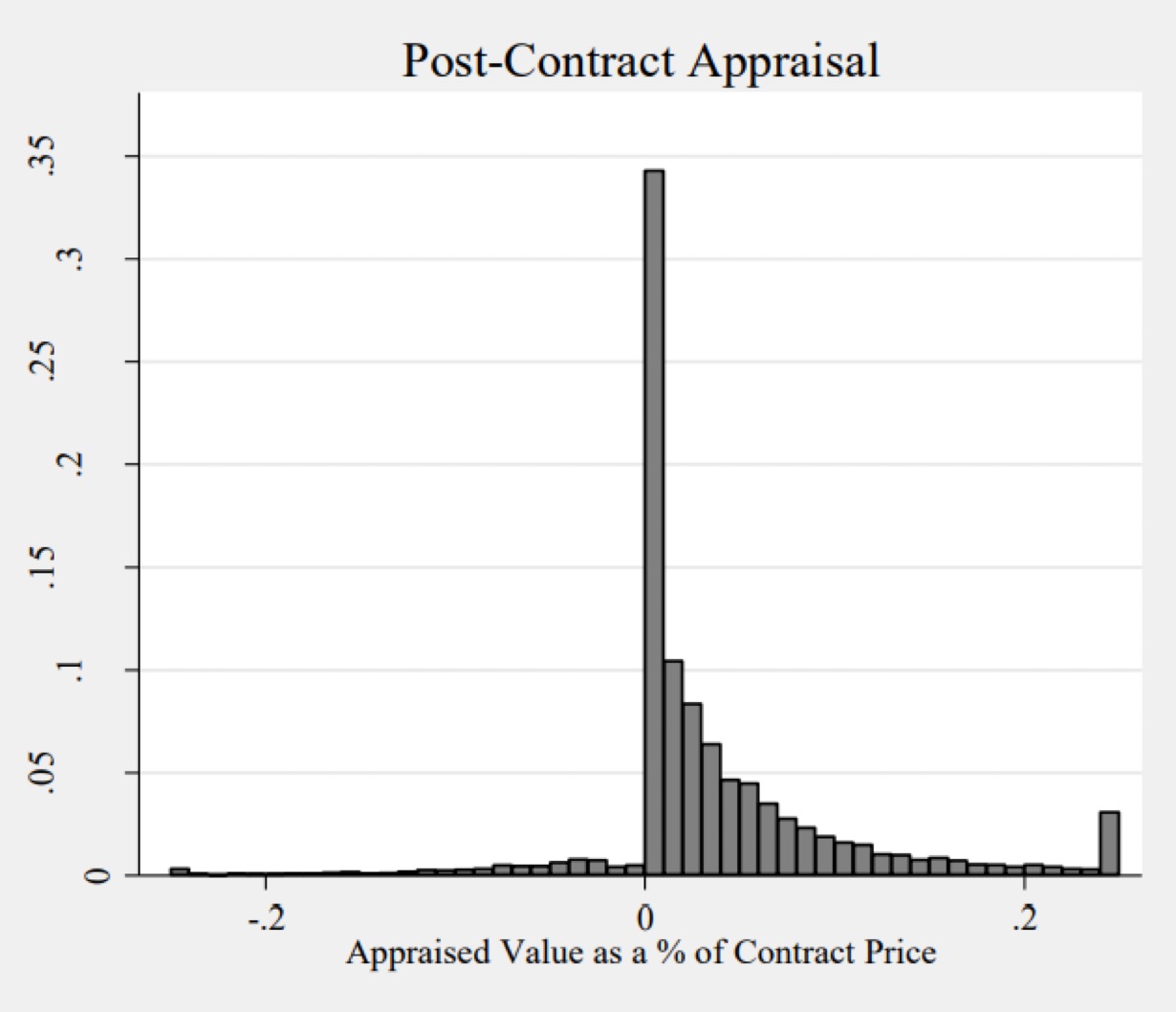

I would like to read the source and methodology that was used to determine the graphs. I suspect that there is a confirmation bias, but I wouldn’t know unless I knew the purpose and intended use of the graphs. If the assumption being made is that the purchase price is correct and the appraisals that differ from this presupposition are therefore inaccurate – that’s a bias. It could be the other way. The appraisal could be correct and the offer to purchase is not.

Are the pre-contract appraisals being performed for the same intended use? The appraisals that Marko has most likely seen or heard of are for one intended us and that is for financing. But if the intended use is not the same such as the appraisal is being performed to estimate a “forced sale value” to effect a sale in the next 30 to 90 days then that’s a different type of appraisal.

If the property is not currently listed but was a year ago, that also has to be presented in the report. Up to three years of listing and sales activity has to be shown. If the appraiser calls up Marko about the property’s expired listing then anything Marko tells them is going to be put in the report or the work file with the name of the source. If Marko refuses to speak with the appraiser, that also goes into the report. If anything unusual happens during the property’s inspection occurs then that also goes in the report. During the appraisal of Trump’s residence, the appraiser documented on how the they were hurried through the inspection and that certain rooms were not allowed by the home owner to be inspected. That goes in the report too.

The source of the pre-contract has to be clarified. I have to make an assumption on this one that the appraiser performed the appraisal and then at some time in the future the property went under contract. If the appraisal was done in November of 2021 and then six months later the property was listed then the appraisal is not a current appraisal as properties in Greater Victoria increased by 15 to 20 percent during that time. That will throw that pre-contract graph way off.

It just isn’t the end number. All appraisals have a reconciliation. In that reconciliation, the appraiser will identify difficulties in valuing the property and how these may effect the margin of error in the estimate. Water front, acreage all have a higher margin of error to that of properties where there are more sales information available such as in residential subdivision with lots of data of similar homes that have recently sold. The appraiser will show a range of value where the Property’s market value lays and give their opinion of what they consider to be the most probable value. That’s a lender’s requirement. The lender is not permitted to select from the range. There has to be one number to multiply by 80%. This is the Bank Act, the banker can only loan on the lesser of the Purchase Price or the appraised value. But in reality, anything in that range would be considered at market value as the appraiser does not know the motivation of the seller or the prospective purchaser. No one does. Knowing just the appraised value isn’t going to be enough to develop these graphs. You need to know the market value range and what is written in that reconciliation.

Then there are factors that are unknown that the appraiser is not aware of or the home owner has not disclosed or has intentionally hidden from the appraiser. Collapsed drain tiles, aluminum wiring, asbestos, oil tanks, etc. The appraiser in not a building inspector and is not trained or has the necessary education to conduct a building inspection or determine the costs to cure. All of which is outside of the scope of mortgage appraisals. Neither does the agent, but as the property is exposed to the market that information may become available as purchasers hire building inspectors. The appraiser has therefore had to make assumptions which they state in the appraisal report. If a leaking oil tank is found at a later time and the cost to cure is $100,000, then the appraised value will not be reliable.

Then there are the lender’s guidelines that have to be followed by the appraiser. The perfect comparable may be across the street. Built by the same builder, same floor plan, same age, same condition, same size. But sold nine months ago. The lender won’t accept that comparable sale to be used as the date of sale is outsider of their 90 or 180 day guideline with some exceptions. Or the house is on a double lot and the area is being redeveloped. The lender’s guidelines will not permit the appraiser to value the property as a residential development which may be its highest and best use. The lender’s guidelines stipulate that the appraisal is to be done for residential mortgage purposes only – not for future development use that is no longer a residential mortgage but a commercial mortgage. The appraiser by the lenders’ guidelines can only value the property as a house on a large lot.

And lastly mortgage appraisals for sale purposes are at the bottom of the ladder of appraisals. Everything has already been decided by the lender at that point and the appraiser is called in at the very end of the lending process to verify that the offer to purchase is fair, equitable, reliable and reasonable. There is little or no time left as the subjects are about to be removed. Mortgage appraisal are the McDonalds of appraisal services they have to be done fast and they have to be cheap as the appraiser is now only confirming that the offer is reasonable for conventional or high ratio financing. There are appraisal companies that are set up for this volume type of work and they can get an appraisal to the lender in a couple of hours. Then there are appraisal companies that will not do mortgage appraisals as the profit margin is slim and the turn around time is too short to investigate the property in detail or dig deep into any analysis.

Do I think mortgage appraisals can be improved? Oh yes, most certainly there is always room for improvement. I think most people have a good idea of where their home values lays. But take them out of their home and ask them what a 10,000 square foot home on four acres of water front on Mayne Island is worth and they are going to be stumped. And then tell that person that if the value is outlandishly inaccurate and the lender takes a loss from your estimate, they will sue you for damages. Appraisers are sued all the time and pay five times that of a real estate agent for errors and omission insurance. Because an agents opinion of value has no repercussions as that opinion is not used to lend sums of money. But a legal document from an appraiser does just that.

Being an appraiser can be a rewarding career. Some appraisers get to travel around the world valuing hotel chains, lumber mills, potash mines, airports, etc. I’ve done that. It’s a good life when you’re single. Expense account, nice suits. Most will start out doing residential mortgages and move on to other career choices that are corporate internal or government. It can be a good life. But working just for lenders can suck. But if you are interested you should check out the educational requirements and then compare those to a real estate agent. Then consider the compensation received. You will earn a lot more selling real estate than you will appraising it. If that doesn’t discourage you, then give it a try.

Person buying the home will likely benefit. Especially in the case where it’s an investor, it seems like the exact opposite of what they want to promote, which is letting the market take care of pricing.

The “house of cards” must never be allowed to collapse: no matter the stress on borrowers’ mental and physical well being…

Why do “so many owe so much to so few”? In the past, that was in Churchill’s reference to “freedom”. These days, eye watering debts seem to be an unlikely path towards freedom and peace of mind.

I missed the first 15 min…sounds like they are removing the no rental bylaw from stratas….that is insane! Never thought they would follow through with that.

Watch it live – https://youtu.be/dgA2YrpsaDE – at 10:30 – in about 10 min

The few appraisals I’ve been involved in without the appraiser knowing the accepted offer price or no accepted offer have been nothing short of a disaster. One was like 430k on what I guessed was a 500k property and it sold for 492k on the open market.

I think purpose of appraisals is to avoid major fraud but otherwise not much use. Industry standard seems to be take the accepted offer price and go from -1% to +2% of the contract price and call it a day.

Yes, bad labels

If house appraisers ran a “Guess your weight” booth at a carnival…

you: OK, here’s a dollar, guess my weight.

carny: “ how much do you think you weigh?”

you: 185 pounds

carny: “OK. I’m guessing you weigh 185”

you: Wow, I think you’re right! 🙂

Then the X axis numbering is clearly not %, but simple proportion.

The appraisal charts are remarkable, serving as “case closed” for what many believe these house appraisers are doing.

On the original ( b/w) posted charts, I also like the little spike up at both the high (>20% above) and low (-20%) points. These “extreme” appraisers must be busy, and “the right guy to call” when you’re looking for a high or low appraisal.

Some appraiser should advertise showing that chart, with an arrow pointed to the spike at the end with the +20% appraisals and say “That was me!”. 🙂 Wow, he’d be busy!

Sensible approach I think. No one benefits from forcing people out of their homes. If lenders can work with people over the next few years and try to find a way to handle renewal payments gradually rather than a sudden shock then that’s good.

In the end the people who truly can’t afford their homes anymore will have to sell anyway, but spreading out forced listings keeps the market more stable. Given what happened after the US’s market instability (lots of corporate acquisitions of houses) I think it’s in society’s interest to avoid a big shock of distressed sellers even if prices end up at the same point several years into the future

In the past, one of the main arguments against this is that it leads to higher house prices. But now that house prices are falling, then same reasoning should suggest it will reduce house prices from falling as much. Which it probably will. There’s a confluence of interests (homeowners, banks, governments) that don’t want to see house prices falling, albeit for different reasons. So I’d expect to see more of this. Seems like a good thing.

20%

Here’s another view of the same data with some stats. 60% of appraisals done before contract come in within 10% of the contract

Excuse my stupidity but when it says .2 is that .2 as in 20% or is it 0.2%?

Provincial housing legislation lands today

I’ve also seen letters from RBC, where instead of getting people back on the original amortization they just ask for enough additional monthly payment to cover the interest. Less of a payment shock now, more at renewal. Of course most of these mortgages being triggered won’t renew for 2-4 years from now

Kicking the can…

https://www.theglobeandmail.com/business/article-major-mortgage-lenders-let-borrowers-shift-unpaid-interest-onto/

This is for you Marko and whateveriwanttocallmyself.

Distribution of appraisal values when the purchase price is not known to the appraiser.

And when it is known

That’s good news about the population growth, and the Salish ferry approval for heavier weights.

It’s impressive that they saw this population growth, since there’s almost no housing available. Businesses can’t hire off islanders because there’s nowhere for them to live, so the jobs go unfilled .

https://www.ctvnews.ca/business/analysis-the-income-you-need-to-buy-a-house-in-these-major-canadian-cities-1.6159269

Some interactive media for charts and Victoria is in there at just under $180k

Heavy construction loads adding weight to B.C. Ferries trips to Gulf Islands

https://www.timescolonist.com/local-news/heavy-construction-loads-adding-weight-to-bc-ferries-trips-to-gulf-islands-6129888

Canadian Inflation was 4-12% in the 1980’s, average 6.4%. Canada average 7.4% inflation during the 1970s.

USA averaged 5.4% during the 1980s. And 7.2% inflation in 1970s.

Moreover, 5 year mortgage rates stayed 10%+ during entire period 1975-1990 https://www.ratehub.ca/5-year-fixed-mortgage-rate-history

———-

https://www.worlddata.info/america/canada/inflation-rates.php

Here are Canadian inflation rates by year, 1970-89, a two decade inflation period where Victoria prices ROSE 6X.

Next msg

Unsure of methodology but thought this chart was pretty interesting https://www.visionrealestatevr.com/contact-8-1

As of July 1, 2022, the average Canadian household spends a tiny 3.32% of their after-tax (disposable) income on mortgage interest. That’s about the same as they spend on restaurants. Including mortgage principal (forced savings), they spend 7.04 % of after-tax income on mortgage payments. Both of these are tiny numbers, both in absolute terms and compared to historical norms. For example, in 1990 when the series started, they spent 6% on interest payments alone. https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1110006501&pickMembers%5B0%5D=2.1&cubeTimeFrame.startMonth=01&cubeTimeFrame.startYear=2021&cubeTimeFrame.endMonth=04&cubeTimeFrame.endYear=2022&referencePeriods=20210101%2C20220401

Now this number includes the 33% Canadian households that don’t own homes. And it contains the 33% of homeowners that don’t have mortgages. That means the average homeowner with a mortgage probably spends 2.25*3.32= 7.47% of after-tax income in mortgage interest. If mortgage interest doubles (unlikely) from where they were in June 2022, that means average mortgage holder would pay an extra 7.47% of their after-tax income in mortgage interest.

The point being, in the household balance sheet, these are small numbers. If they need to find an extra 7% of after-tax income, they can cut other expenses, or simply save less (current savings rate is 6%, above average). Of course these are averages, and there are some people with huge mortgages and huge payments. But we know from other data that 0.0% of all homeowners are declaring insolvency (hoyes index) and almost 0% are delinquent on mortgage payments.

With a bunch of tiny numbers like this, and something close to 0% of mortgage holders in arrears… I just don’t see the doom-n-gloom that you are seeing

In fact at least one of the banks was offering 25 year terms not too many years ago. They stopped offering them because – surprise – borrowers weren’t willing to pay the interest rate premium.

In the 1970’s most households relied on a single income as the spouse stayed at home to raise the family. Women found it difficult to obtain mortgages or get a loan without their husband’s approval. Rising inflation caused more women to enter the workforce as it took two incomes to pay the bills. Income from basement suites were either not included or included at a fraction of the rent.

In the early 1990’s Home Equity Lines of Credit became a mortgage product that would allow home owner’s to tap into the equity easily without going through a new loan application. That made it much easier to buy a rental property as the HELOC would provide the down payment for the property being purchased.

CMHC approvals changed the emphasis from having the asset backing the mortgage to that of the household income being the primary concern and included 100 percent of rental income to be added to the household income. That made a difference in debt servicing ratios and allowed more people to qualify at higher amounts.

The rule of thumb of a mortgage being 3 or 4 times income in the 1970’s became irrelevant with all these changes.

As I said, my comments apply to Canada and the USA. Same price trends (up during inflation) happened in Canada and the USA . USA charts are just easier to call up.

But since this seems to be important for you, check out this Victoria price chart and you’ll see the same 6X price change during the inflation of the 1970s, 1980s.

If you are correct about prices falling during inflation, kindly explain why Victoria house prices didn’t fall during these two decades of inflation, and instead went up 6X!

———

https://www.vreb.org/media/attachments/view/doc/2_2021_historic_average_selling_price_graphs/pdf/2_2021_historic_average_selling_price_graphs.pdf

US RE market and Canada market are different. 30 year mortgages blunt the effect of interest rate changes. Leverage was much lower in 70s and 80s in the US as SFD house prices were 2 or 3 times annual salary.

The inflation was brought down from 15% in 1980 to 2.5% in 1983. This combined with financialization (MBS, etc. invented in early 80s) led to a boom in house prices – doubled from 1983 to 1990.

?g=WzUc

?g=WzUc ?g=WzVu

?g=WzVu

In 1970s average house price was $30,000 to 60,000. How much leverage was needed to buy a house? This was barely 3 times individual income and 2 times household income – for a SFD. Now compare that to Canada. SFD in Canada is 12 times income and 20 times income in Victoria. How much leverage is in the RE system now? And how does the rise in interest rate affect that leverage is the question that’s being answered now in the market.

Canada should move to US style mortgages, with 30 year fixed terms. The rates are higher (current rate is 6.6% 30 year term in USA vs 5.4% 5 year term in Canada https://www.pbs.org/newshour/economy/average-long-term-u-s-mortgage-rates-fall-to-6-61-percent), but it provides certainty of payments, with favorable refinancing options for the entire 30 year term.

If we wanted to measure “affordability” properly, it would include the entire 25 year term of the mortgage. An “affordable” home in year 1 could become unaffordable in year 6 if rates rise. The affordability charts show 1976 as a wonderfully affordable year to buy, yet in year 6 (1981) they would be refinancing at 20% rates and may have lost their homes due to unaffordabikity.

All those problems go away with a 30 year fixed term. No stress test, no sleepness nights worrying about interest rates and “trigger points”. If you can pay on day 1, you’re good as long as you keep your job/income up to that level. And inflation makes that easy since salaries rise with inflation.

No. Current House prices (Oct 2022) are up 25% since start of current inflation https://fred.stlouisfed.org/series/CSUSHPINSA

Current House prices (Oct 2022) are up 25% since start of current inflation https://fred.stlouisfed.org/series/CSUSHPINSA

—- House prices tripled in the 1970s’s inflation. And doubled again in the 1980’s inflation. Ended up 6X from 1970 to 1989, despite high inflation and high rates. No support of your “RE prices fall with inflation” claim.

—- The only period of substantial fall in us house prices was 2007-2012, a period of low inflation and low rates.

—- Current inflation problem started Jan 2021.

—-These are US house prices, Canada results similar. https://fred.stlouisfed.org/series/MSPUS

rates https://fred.stlouisfed.org/series/FEDFUNDS

inflation: https://fred.stlouisfed.org/series/FPCPITOTLZGUSA

There’s three decades with inflation and rising house prices (1970’s 3X , 1980’s 2X, 2020’s +25%).

” inflation can become your friend, as prices tend to grow with inflation”

Leveraged assets, such as Real Estate, fall with inflation, as inflation forces interest rates higher. Only uncontrolled inflation will result in higher prices for leveraged assets as seen in 2021 & early 2022.

Victoria builders unfazed by housing market headwinds

https://www.timescolonist.com/business/victoria-builders-unfazed-by-housing-market-headwinds-6128052

If Victoria homebuilders are panicking about rising interest rates, the high cost of supplies, high cost of land, scarcity of skilled trades and labour they’re not showing it around here.

Builders in Greater Victoria started 604 new homes last month, well above the number started in October 2021…

Well there is the other school of thought, also expressed here, that Victoria is less dependent on local incomes than on capital transfers from elsewhere in Canada, which would mean if Vancouver and Toronto get hit, so will Victoria.

We do know that Victoria is much more expensive than Canada’s other “government towns” of comparable or larger size – i.e. Edmonton, Winnipeg, Ottawa, Halifax.

Right, but that was also the conclusion one year or two years ago. How many buyers took it up? Didn’t the opposite happen – that it was the floating rate mortgages that gained in popularity? Not optimistic that many buyers will choose other than the lowest possible payment right now.

Oh right, that fancy whiskey and cigar soiree with the drunken mortgage broker everyone said was fake. Still a cool story, but many people (not FTHBs) have gone out and secured new mortgage rate approvals and are now waiting to see what the 2020/21 undisciplined new landlords might need to offload after Dec. 7

Another 25% from here is just hopes (spite for current homeowners/landlords) and prayers

Not much to celebrate in an inverted yield curve.

Except that the 10 year fixed mortgage rate is low by historic standards (compared to the 5 year fixed, and the variable rate ). Because the funding of the 10 year mortgage rates follows the 10 year bond yield, just as the 5 year fixed rate follows the 5 year bond. And the variable rate follows short-term rates.

—— 10 year fixed mortgage rate big 5 bank = 6.00% TD https://www.ratehub.ca/best-mortgage-rates/10-year/fixed

—— 5 year fixed mortgage rate big 5 bank = 5.37% CIBC https://www.ratehub.ca/best-mortgage-rates/5-year/fixed

—— 5 year variable mortgage rate big 5 bank = 5.50% RBC https://www.ratehub.ca/best-mortgage-rates/5-year/variable

That’s only a 0.63% differential from 5 year fixed rate, and only 0.5% higher than a variable rate, to give you these advantages of 10 year fixed vs 5 year fixed or variable

—- sleep easy for 10 years, knowing what your payments are

—- no risk of losing your home to rising rates (for 10 years). At the end of 10 years, you’ve got sizable equity and have good options.

—- optional ability to refinance to a lower rate, with no interest rate differential penalty after 5 years (just 3 months interest, = 1.5% penalty. Just the same penalties as with a 5 year term, except you get to choose to keep your current 10 year rate or refinance to a lower rate. This advantage to optionally refinance is a main reason that the 10 year rate is higher than the 5 year rate. Because the investor funding your mortgage needs higher rates to absorb the risk of you refinancing after 5 years if rates fall.

—- inflation can become your friend, as prices tend to grow with inflation, yet your mortgage payments stay the same for 10 years.

Conclusion: If you’re taking out a mortgage, take a 10 year term. If rates fall, refinance to a lower rate after 5 years. If rates rise, sleep easy for ten years, as your mortgage payment falls every year relative to your rising inflation adjusted income.

A little off topic perhaps but interesting: “Today was hard.” B.C. Based Coast Capital Savings announces layoffs.

Their biggest mistake was going Federally regulated. A complete failure trying to compete with the big banks.

I hope you’re right. But the BC government can’t run massive deficits as easily with high interest rates. So if there is a recession, they may have to (gasp!) cut their own spending. If they do that, Victoria is “ground zero” for job cuts. We’ve enjoyed a “virtuous circle” on the way up of growth->rising RE prices->higher government tax revenue,->more Victoria jobs.-> growth . Let’s hope that doesn’t reverse to a “vicious circle”

Government jobs are stabilizing but there will be lay-offs in the government sector too. Without construction there is no need for a large bureaucracy to administer over it. If the government doesn’t do some trimming that will have an impact on property taxes as the cash cow of development cost charges dries up.

But it’s true governments are slow to react to change and unlike private companies they will be slow to lay-off workers.

We are NOT in a recession, talking about this stuff is way to early. Too much doom and gloom.

Houses are just one segment of the marketplace. I think you would have to look at all segments and how wealth is accumulated in order to purchase a house. For this reason I would look at condominiums as being a better indicator of how the market may decline.

Given a 10 percent down payment and an income of say $75,000 what could a person afford to pay to buy a condominium so that they can start to build equity over the next few years to purchase a modest house. Using rough rounded numbers that would be around $250,000 for an average condominium in Victoria. But the typical one-bedroom condominium today is around $450,000.

This is a really rough calculation as everyone will have a different down payment and a different income and we don’t know what the interest rate might be at any time. But it does illustrate how inflated prices are relative to incomes for those making their first purchase. Or put it another way, this is what one-bedroom condominiums were selling for 5 years ago. Incidentally houses in Victoria were selling for about $800,000 back then.

This is all navel gazing, no one can predict when or at what price the market will bottom out as so much depends on the economy which is always changing. Just looking way too far into the future for this rough guess to have any meaning.

I suspect that Victoria will be less hit than other parts of the country considering the number of government jobs here.

Yeah, I think a recession and job losses are coming, but don’t know what that will actually look like for Victoria. To get down to a median price of $750k I think it would have to be pretty hard times.

My bet is cov detached prices come down to a median of maybe $950k and sit there until the next leg up. Seems reasonable for this market.

All indications are that it’s coming. Canadian 2-10 year bond yield inversion is nearing 1%.

Imo I think that there might be another 10/15 points there to go next year Then the economy and real estate market will be in a long funk until conditions are right for another bubble again. I’m hopeful Canada is not so screwed up this time that we will follow the same path out of a recession as we have in the past

A decline over two years doesn’t necessarily mean that people have to move away. It just means people will not be moving here, in the same numbers as in the past, for jobs that are no longer in demand.

We will still have refugees and immigrants to BC but they will fill up the minimum wage jobs where they have to have two jobs to make ends meet and pool their resources to live in modest intergenerational housing but they will be far less likely to buy new housing. Homes like the those built circa 1970’s in Gordon Head with basement suites would be more desirable than a new(er) home or a condominium.

Which raises a question in my mind of who will be buying all of these small downtown condominiums? In addition, these newer condominiums are not attractive to investors as the return is so low. Will that cause the supply of these small units to go from a shortage to a glut on the market?

Things that make you go Hmmm.

A price decline of 25% over a couple of years is not harsh. Companies can adapt when the decrease is over a long period of time. As they just scale back operations over time. What hurts is if the drop is rapid over a couple of months. Kind of like what Elon has gotten himself into at the moment.

As a side note. Elon has gifted a start up company with the ability to hire experienced employees to compete against Twitter. I question his judgement on how he went about doing this slash and burn of Twitter in a service industry where the individual is what makes the company succeed and not a product like cans of soup.

Twitter was probably over staffed, but it’s a service industry where sometimes it is wise to hire someone just so the competition doesn’t hire them. Maybe it will work out for Elon or maybe it will be a 44 billion dollar mistake. Either way it will become a topic of debate in business schools for years to come.

Lumber doesn’t make up the majority of cost to build a home today. But you can physically see the lumber inventory grow as the commercial yards are filling to capacity of unsold lumber. I don’t know if that is happening now as I haven’t been up island to look at the stock yards. Filled to capacity yards will have an impact on those in the forestry industry as these companies scale back their operations. No need to harvest trees if you can’t sell them.

That reverberates into other companies that supply the materials that it takes to build a home like quartz and granite counter tops, flooring, appliances, concrete, glass, etc. These companies will also scale back operations as their inventories grow.

I agree. I don’t see house prices falling another 25% without substantial job losses. You need people to move away, back into their parent’s basements etc.

If you’re a builder and have unsold homes, the lower material and labor costs are going to be to your disadvantage. Those starting to build will have lower costs than what you have already spent. Your competition can now deliver a new home in six or nine months for less than your finished home.

When material and labor costs were rising, all builders were effected equally and those increased costs could be passed onto the consumer. You also got a good bump in the land while the home was under construction which became profit. But with declining costs and perhaps declining land prices a home to be built six months from now will be less costly than a finished home today.

That puts a knife in the back of contractors that are building homes on speculation (without a contract from a buyer). That will slow down new construction as fewer builders will take the risk to build on speculation.

Yes. Fwiw, house prices would need to fall an additional 25%+ from here to get near to to pre-pandemic levels. I don’t see that happening, unless there’s a bad recession/unemployment.

Nice to see people coming around to the market giving back the pandemic gains not being too far of a stretch now. Hmm, it might have been said the pandemic growth was an anomaly brought on by a unique set of circumstances that forced some market artificialities such as extremely low inventory and massive market subsidies that was inevitably going to end in inflation, interest rate increases, debt crisis and a real estate devaluation.

From: https://dailyhive.com/vancouver/coast-capital-layoffs

It will be interesting to see if and how much BC credit unions may be over exposed to the real estate financing market in this province.

Looks like wood prices are back down to pre pandemic prices. Not good if you are a builder and paid the elevated prices 8 months ago and are now stuck with a house where assuming everything else being the same someone can build for cheaper.

Signicantly lower trades cost coming very soon also along with depressed land prices.

With GST the Gablecraft homes are well over a million dollars and then add in Land Transfer Tax. My vague (and probably incorrect) recollection is that they were about half that price five years ago.

Gablecraft

Am I correct in assuming the builder would have to pay the GST as soon as he decided to rent and set some sort of valuation to pay income tax on? Any transfer tax or would that be considered selling it to yourself? (ie development company to self or rental holding company) Capital gain or loss depending on when you actually do sell it? Makes be glad I never entertained the thought of becoming a developer!

We see the same drop off in pending sales. Pending Sales for Greater Victoria is down to 331 for the last 30 days. I think it was near a thousand in the first quarter of this year. But I can’t exactly remember as I didn’t think it was something to watch at that time.

VicREanalyst it’s the lesser of two evils. Rent or have the bank force a sale.

From: https://www.ctvnews.ca/canada/what-the-latest-canadian-mortgage-quote-data-shows-1.6157886

That mortgage manager at that social wasn’t too far off….

Tax and financing implications if they do young grasshopper

They can always rent the homes in Royal Bay. The land developers with vacant lots that are not selling are the ones that will have to lower prices first.

Ya, that’s what I figured. lets see how long the smaller developers there can hold on before they have to unload at a loss.

My guess is the housing correction here on the Island is just beginning. Another rate hike or two into 2023, then the rate hikes funnel through the market (generally takes 6 months for each one to be felt), the next year or two should hopefully get us back to 2020 prices. Could potentially go lower, will have to wait and find out.

I don’t see much happening until April 2023 as that’s when those that took out a three year term or going to face renewals at a higher interest rate and it will take another two years for this payment shock to work itself through the market.

In the first quarter of 2020 before the interest dropped the median house price in Victoria was $927,000. The current 90 day median is $1,154,000. That would require the market to mark down by 20% from current prices. In the first quarter of 2018 the median was $893,000 which is a 23% mark down from today.

I do expect prices to drift downwards starting in April as the higher interest rates effects more home owners at renewal time and they are forced to sell or come up with a huge sum to pay down the mortgage. And I am not saying that this is a crash as it will be over a couple of years.

So I agree with Barristers neighbor. We haven’t seen the effect of the higher interest rates yet. All that happened this year was to blow off the froth that happened at the beginning of the year.

If you bought your home prior to April of 2018, you are going to be just fine unless you added to your mortgage during the last few years or bought a pre-construction condo and can’t afford the payments at the current interest rate. That’s likely the next shoe to drop as people scramble to get financing for their pre-construction purchases.

Nothing is selling in Royal Bay, they’ve dropped some of the brand new builds to $999,000 and still they sit.

Current prices up 120% since publication of “The Troubled Future of Real Estate”

Among owners not shopping actively my take is that there is now at least awareness that the market has turned, limited awareness that prices have fallen. Expectations of major price falls are not widespread that I hear.

Don’t forget that us Victoria folk are pretty slow (according to VicRE). We’d rather swap recipes for cooking roadkill squirrels on the exhaust manifold of our trucks and not worry about high-falutin things like “interest rates” and “housing policy”.

Can anyone that dogmatic really be happy though?

Haven’t checked that lately. He must be happy now. The stopped clock that is right approximately once per decade.

If I was not so lazy I would try calculating what sort interest hikes are necessary for a 25% drop in house prices. I was actually more curious on how prevalent this view of dropping prices is in Victoria?

Barristers young neighbor commenting on prices maybe dropping by a quarter by next summer….

Perhaps they are reading Garth Turner’s blog.

I’m sure they’re still convinced they’re “timing the market” despite all the contradicting evidence. People locked in their own echo chambers are often doomed to repeat their mistakes over and over again.

From a talk yesterday. Break even non-profit new build rents at $1900. And that was in 2018.

How is royal bay doing anyways? Any sales under $1M yet?

Sorry, phone error

https://vancouverisland.ctvnews.ca/victoria-tops-vancouver-as-most-expensive-city-in-b-c-says-living-wage-report-1.6157444

Link please

Right. Makes me nostalgic for the good old days, like 2019, pre Covid, pre inflation, pre latest house price insanity.

For example. I recall a HHV discussion in 2019 where it was pointed that hundreds of Langford SFH had recently sold at/under $500-600k. And the typical reply was, “yeah but I don’t want to live in Langford”.

Some of those commenters are still here, still waiting, and prices are still up 50%+ from then. .

Whether it was the bidding wars, CPI, assessed values or having to buy children’s tylenol online at inflated prices, a report just came out that says Victoria just surpassed Vancouver as BC’s most expensive city to live in.

The sledge hammer approach would be to increase the down payments from 20 to 25% , reduce amortizations from 30 to 25 years and not to include income from basement suites in the loan applications.

I suspect that we have an interesting year ahead of us. That is sort of like the Chinese curse thing. I strongly suspect that the housing market has yet to see the full impact of the interest rates hikes with a few more to likely come in the year ahead,

A young neighbor stated that she has stopped looking because why buy today when by next summer the prices might have dropped by a quarter. (I am not saying that this is going to happen but it was an interesting take on the market by someone that actually is in a position to buy their first home). It gave me pause.

Obviously a lot of people that are buying today dont see it that way but it makes me wonder.

Interesting. That question (“do bidding wars ever work?”) could likely be answered by measuring condos and SFH separately. Because the effect you’re talking about (SFH non-permitted renos adding suites etc.) increasing value above assessment would be mostly seen in SFH. In general condo assessed value should be more closer to correct value than SFH. So, as you said, looking at condos removes a lot of variables.

Leo did separate those (SFH and condo) for the recent calculations, and there was no difference. But of course the bidding war strategy is over. But for the charts he did during the hot market, I think he only measured SFH, not condos. If Leo still has data for the previous charts he did, perhaps these could be redone and separated condo vs SFH. Because if the effect holds up for condos of “priced for a bidding war leads to a higher sale price in a hot market ” , that would remove your rebuttal that it was due to a low assessment (due to SFH renos and adding suites).

Until then, we’re left with Leo saying bidding wars work (in hot markets, resulting in higher sale price), and Marko saying bidding wars don’t work. Over you to you Leo!

I wonder if sale price to assessed value could have some issues in this assessment.

From my experience more desirable properties are likely to be set up for a bidding war. More desirable properties can often be under assessed. For example, if someone does a nice renovation or adds a basement suite without a permit this becomes a prime underlist candidate (broad appeal) and at the same time an underassessed property; therefore, it will sell much higher over assessed.

Personally I am not convinced that bidding wars work, on average. I’ve focused on underlists/bidding wars in condo buildings as that removes a ton of variables and I haven’t noticed an advantage to underlisting/multiple offers versus price at market or slightly higher and waiting for the one offer.

When they’re using a sledgehammer to do the clipping, they usually make a fine mess.

Yeah, I see it now, because Core was up .3% but overall CPI was down .1%. When the October chunk was mostly gas prices, I don’t see that having a positive effect on the rest of goods going forward unless it moderates.

$1,110,000

Anyone know the sale price for 1487 Edgemont?

Curious how it compares to the recent 1499 $2M+ sale in June (albeit very different house) and the neighboring 1483 flip from January.

Because CPI fell between November 2021(144.2) and December 2021 (144). So the base effect would result in December headline inflation being higher than in October and November, assuming a “normal” hypothetical month-over-month change in CPI between October – November and November – December of 0.2%. The opposite could happen in winter/spring 2023 because month-over-month inflation was abnormally high between January-May 2022, e.g., month-over-month CPI ticks up, but headline inflation falls.

I guess my only point was that it’s good to look at both the year-over-year and month-over-month data.

It was just an example of how month-over-month vs. year-over-year data can tell different stories. And if 3 months of data don’t make a trend, then one month definitely doesn’t.

Allow inventories to build and that should ease the supply chain problems. Have some of those laid-off construction workers employed in retail stores to ease the labor shortage. That may lower core inflation too.

You just want to clip the wings of the Golden Goose. Not kill it.

Personally, I don’t think the majority of people buying homes today are going for big mortgages. Those buying today are likely putting down very large down payments. Some have been caught between a rock and a hard place, but they are the few. Notably those that went high ratio over the last two or three years are going to find things difficult at renewal time. But the majority can still sell at a good profit.

Again, my opinion is that we won’t see any easing of the interest rates until the vacancy rate increases and rents decline. Nothing that I have seen indicates that this has happened yet. My opinion is that most of our social problems in the larger cities are tied to high rents. If the rents decline most of these problems will also decline.

Month-over-month inflation of 0.2% would be annualized as 1-(1.002)^12 = 2.43%. Today’s MoM inflation reading of 0.7% (for October from September) is annualized as 1-(1.007)^12 = 8.73% annual inflation.

I think the weak hands in the retail sector are already gone due to the pandemic. Anyway I don’t think there are that many households who are overly sensitive to interest rate increases short term. Yes there are an awful lot of people with credit card debt but if the rate on that goes up 1% that’s not big proportionally.

Sure you hear a lot of squawking from the buy-at-the-top-with-floating-mortgage crowd but how many of them are there really?

It’s a balancing act Patriotz. How badly do you want businesses to suffer over what is typically their best season? It’s one thing to get prices lower. It’s another to bankrupt businesses.

IF we go into a prolonged recession, it will be consumer spending that pulls us out. But that won’t help if the retail stores are boarded up.

This is just core data but the last 3 months have been exactly the same as the aug-oct in 2021 – .3%, .4%, .2%

I’d need to see some hard numbers here. Doesn’t make sense to me, when core was .2% in November & .3% in December that the inflation rate would tick up.

It shows the short term trend which can be useful. Just looking at big scary headline inflation numbers can be misleading: for example, let’s say month-over-month inflation goes up 0.2% in each of November and December. Headline inflation would come in at about 6.9% in November, and then tick up to 7.2% in December. People would see this as evidence that inflation is sticky and persistent, but the short/medium term trend is telling you that price increases have actually stabilized. If that trend continued into the spring of 2023, then you would see very sharp drops in headline inflation… Not suggesting that this is what will actually be the case since the future is unknown, and month-to-month CPI bounces around. But I do think the current short term trend is reason for cautious optimism.

That would lead to lower prices, would it not? Remember the BoC’s job is to get consumer price inflation under control.

Great! Thanks for posting that.

It’s all about inflation so I’m not sure there is a pause in there I would venture to guess they will keep going Inflation will be high throughout 2023 imo This recession will be no shorter or different from others. Rinse and repeat

My opinion is that any further interest rate increases are likely to hurt the Christmas retail market. Better to hold off on any further increases until January.

The retail market is vastly more important than the real estate market. Have to keep consumers buying as they are the ones keeping Canada from slipping into a recession.

One way to look at the effectiveness of intentionally under pricing a property to attract multiple bids is to look at price increases. If the strategy fails to create an auction environment then the agent will switch to the traditional method of setting a list price.

3-month inflation annualized is not a reliable indicator of actual inflation, and it is much more volatile. I would like to see the prediction ability of this short term indicator over long periods. A short term pause in inflation does not assure the BoC that inflation is going down. What prevents them looking at 1-month inflation annualized? In many months in 2022, the month-over-month inflation was 0 or 0.1% but the annual inflation was 7-8%.

Because the target range has nothing to do with 3 month average of only core inflation. It’s specifically the range that they’re targeting for CPI which is still at 6.9%.

https://financialpost.com/news/economy/canada-inflation-rate-6-9-gas-prices

https://www.bankofcanada.ca/rates/indicators/key-variables/inflation-control-target/

This call aged poorly last time, hopefully it goes better this time.

Yes. I linked to that article at the beginning of this one. Definitely they worked in the hot market: https://househuntvictoria.ca/2021/04/19/do-bidding-wars-work/

In other words sellers and agents are largely logical actors pursuing sensible strategies to maximize sale price.

How?

That graph is so misleading with it’s target range.

Inflation going in the right direction. Looks promising for us being near the top of rates

Great article. And the charts (sale price for below ask vs above ask) definitely support your point, namely “the benefits of bidding wars are gone”. Have you also run those same charts for the crazy bidding war period, to answer the question “how much benefit (if any) was there for bidding wars (ie sold above ask prices) during the hot market?” Most people (myself included) assume that bidding war (sold above ask) pricing led to higher sale prices during the hot market, but it wouldn’t hurt to test this theory out, using the same chart you used above, but for the crazy hot market.

with pediatric oxycodone available why bother?

PS -I am sure this discussion is highly relevant to Victoria real estate but somehow I can’t figure out why. But I’ll always take the piss out of parental virtue-signalling till Leo rightly shuts me down.

My kids are in elementary. Youngest has never had Tylenol or Advil. Eldest has had one dose maybe five times ever. Teething was a non-issue for both, and their fevers seem always to be low-grade (knock on wood).

Our first kid was lucky with teething and while we did use motrin from time to time we thankfully didn’t need to rely on it. That being said for some kids it’s quite a bit more painful and if the option is to have your kid up half the night crying when you have to work in the AM I think most people choose pain reliever. 20 baby teeth many coming in at different times all the way up to around 2 and a half years old. That doesn’t include fevers etc they pick up regularly from daycare.

For the Wade rentals: try googling “The Wade” Rentals. There are a few past rentals on there you can see for instance asking $1850 for one bed in April, 2021 incl cable and internet for a year and another Sept 2022, $1900 incl some utilities. Parking not mentioned so maybe not available.

Junior bedroom without a window and not enough space for a queen size bed, and no parking, Max $1800/m? Note the strata fee has just increased ~15% this month (we have one bigger unit there).

I know a friend rented out her 650ft 1 bed at 989 Johnson for $2400/m in Spet (12th floor facing south with ocean and mountain views, furnished but not “fully”, with one underground parking), but it was to a couple (both working).

One thing about very small condo/studio is that it may not fit for a couple, thus limitation on renters’ range and rent amount.

Anybody know what a 412ft2 1-bed unit at the Wade should rent for?

Introvert:

My wife is an RN; she alternates acetaminophen and ibuprofen as fever reducers when the boys are very sick. Not as painkillers. This go around, on meds, the oldest reached +40 fever a couple of times. Without meds, he would have likely gotten at or above +41 which is considered a medical emergency.

My personal preferences in terms of most desirable to least

i/ Super small 1 bedroom (430 to 450 sq/ft). This is my favorite layout concept of all time -> https://www.youtube.com/watch?v=idzGz0MXXoY

ii/ Studio 350 to 420 sq/ft

iii/ 550-650 sq/ft true one bedroom

I have a completely open concept 390 sq/ft studio at Ironworks, no issues renting it out whatsoever. A lot of pushback I always get with investors is “who would want to live in a studio.”

It’s off-topic, but just to answer this from the previous thread: it’s not the dosage that I’m wondering about but rather the frequency that I’m guessing some parents administer painkillers to their kids.

Marko, what’s your opinion on bachelor/studio units versus true one-bedroom units for rental investments?

Honestly, same goes for some arguments we hear about wage increases. Cauliflower prices might have gone up 25% but that doesn’t mean your $80K salary needs to go up by 25% to keep up.

That should give you a very reasonable profit.

“Fully furnished,” sure. I do only “furnished.” I have my formula….Ikea Malm queen bed (I’ve assembled over 10 now ), etc.

Fully furnished usually the internet, Hydro, etc., is included too. With my setup tenant is responsible for all of that.

Taxes – $139/month. Taxes have gone down on a number of my units over the years. Explained in my video here -> https://www.youtube.com/watch?v=RFTdI2KTyL4&t=2s

Strata – $253/month. I try to buy very small units in buildings that have much larger units on average. In BC strata fees are calculated (for the most part) based on square footage. In this same building as this particular unit you have 1,200 sq/ft units paying $750 a month so in effect they subsidize me. My tenant can use the gym just as much as the $750/month unit.

Insurance – $42/month.

Since 2014 the strata fees on this unit have gone up 58% compared to the rent which has gone up 52%; however, these are the absolute numbers

Strata $160 to $253

Rent $1,150 to $1,750

This is what annoys me when landlords complain about everything increase in cost, sure, maybe % wise.

Hasn’t furnished condos always been a premium to unfurnished ones?

I find furnished decreases the market pool of potential tenants but I like turn over every two years so I can adjust to market rent. I find furnished tenants are more likely to turn over versus unfurnished unit. Also, unit gets beat up less with less move-ins and move-outs. If I had to sell any of my units the furniture is size appropriate, etc.

After strata, property taxes and insurance what does that leave you for the mortgage. Marko?

Could this year be the start of the old saying in real estate …….7up

Looks like your condo comes furnished.

Rental market still crazy. I have a tenant moving out of one of my 450 sq/ft Vic West condos end of December. Current rent $1,500. I put the ad up at $1,750 with 42 inquiries. Same old story in terms or applicants; military relocation, bc government, IT, etc. I think I could have comfortably gone $1,850 or $1,875.

My parents put up a room in their basement suite for $950 with over 100 inquiries. That’s $1,900 for a small two bed suite in a 1950s house. Insane.

A few huge rental buildings completing in 2023…Hudson (250 units), Dockside, Wedge, etc. which I think will stabilize the rental market but we aren’t seeing the new starts now. Will be a problematic situation again come 2025/2026.