Updated: Do property assessments have a bias?

Update note: The previous version of this article incorrectly indicated a systematic error in assessments where lower priced properties were over-assessed and higher priced properties were under-assessed. I was puzzled by this result, as it didn’t feel right that BC Assessment would make such an obvious error and not catch it, so I ended the article with the question: “Is it real or is there another explanation?”. As it turns out, the bias was not real but rather it was an artifact of the way the quartiles were initially constructed. Thanks to reader ForeignBuyer for explaining my mistake in this comment and taking the time to even create a model spreadsheet that demonstrated the error very clearly. The corrected article is below.

I recently read an article about the inequity and potential corruption embedded in property assessments in New York. In short, due to the way property assessments are done there, some luxury condos ended up with very low property taxes while regular homes paid more than their fair share. The Bloomberg news investigation showed that tax assessments systematically favored higher end properties by valuing them lower than their market value.

In BC we have a totally different method of assessing property values, but is there still a bias for or against certain properties? To properly analyze this question we’d need access to the raw assessment data, but even though BC Assessment is a crown corporation, their data is jealously guarded. Access costs thousands, and research access is only possible via a very restrictive NDA.

Instead we’ll do a less thorough spot check using data I can access. To determine whether there is an assessment bias, we will examine a sample of sales for each price quartile in single family and condo sales and compare those against their assessed value. To get a reasonable number of sales in each group we’ll need to collect them over the course of a few months. That means we can’t use current data since prices are rapidly rising across the board which would confound the results.

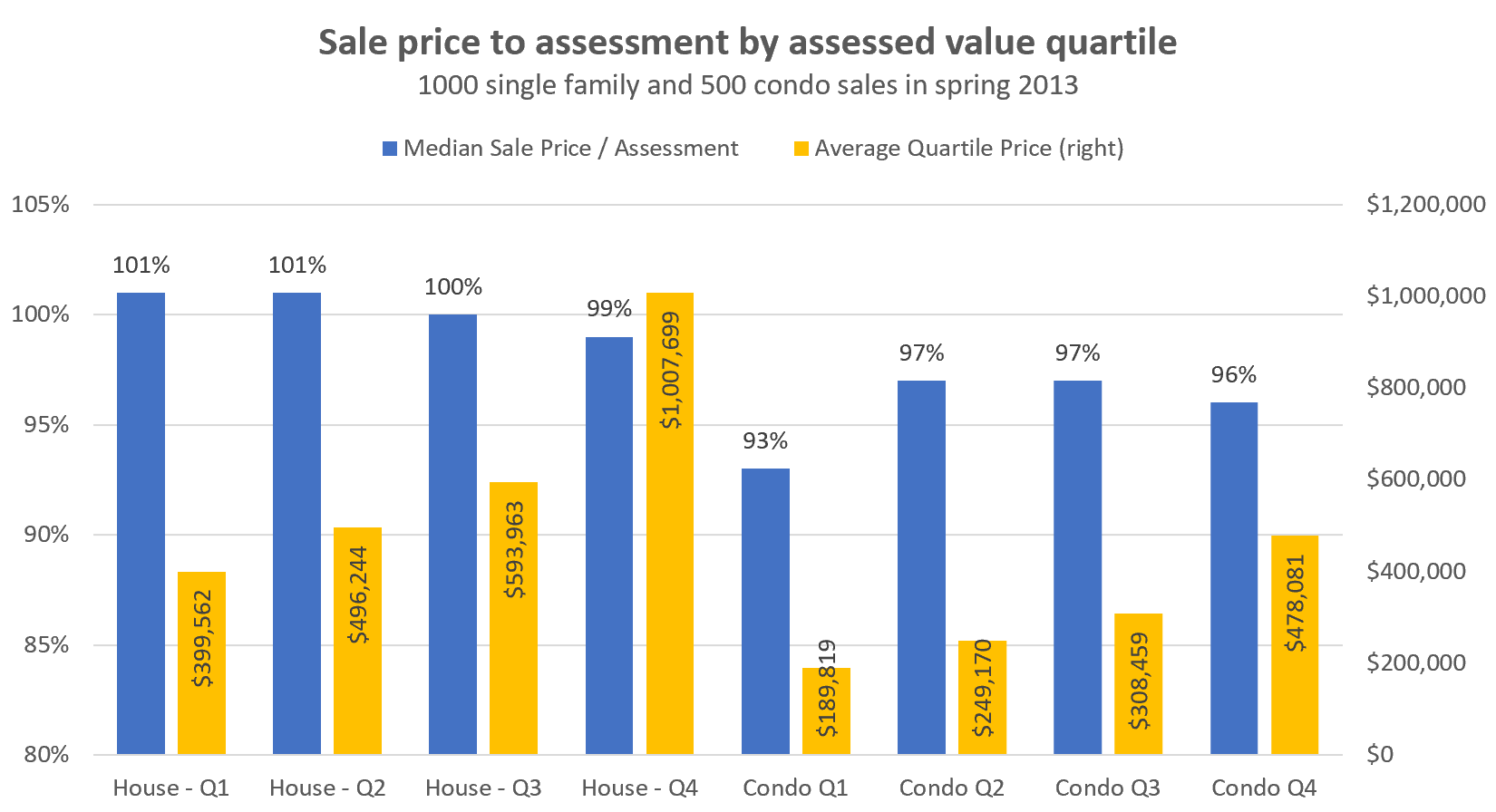

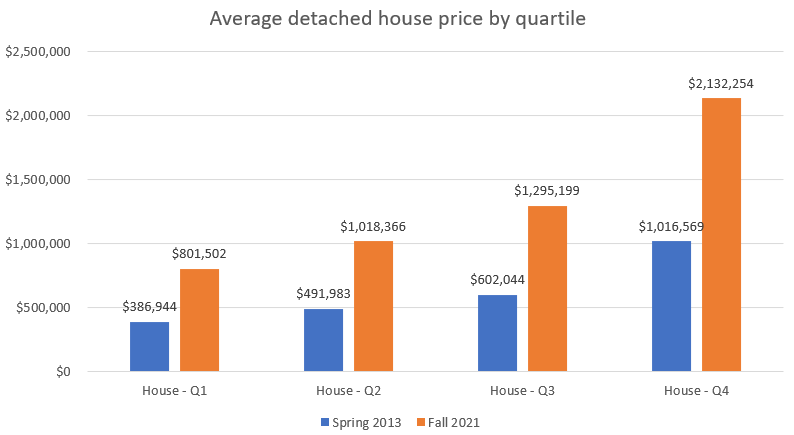

Instead I went back to the spring market of 2013, when prices for single family properties were nearly flat, and condo prices were dropping very slowly. More importantly, market conditions were very stable and not changing much, if at all. In a similar period from April to July I extracted 1000 single family and 500 condo resales (condos were selling at about half the rate of houses). Those were sorted by assessed value and divided into quartiles. The median sale price to assessment in each quartile is shown below.

The results indicate that there is no evidence of an error or bias across price bands in the assessed values of either single family houses or condos. While the median property in the cheapest price quartile sold for 1% over assessment and the median property in the highest price quartile sold for 1% under, this difference was not statistically significant.

For condos the picture was the same. Sales in the middle two quartiles had identical median sales prices of 3% under assessment, and the 4% under for the highest price quartile was not statistically different. In the lowest price quartile, the median property sold for 7% under assessment, however the difference in means between the lowest (94.3%) and highest (96.1%) quartiles were not statistically significant.

I double checked this result with another 1000 single family sales and 500 condo sales from 2012 and got very similar results. For single family properties, the highest quartile went for 1.5% over assessment while the lowest went for 0.5% over, not statistically different. For condos, the median sale in the lowest quartile went for exactly assessed value, while in the highest priced quartile it went for 1% over.

Therefore we can rest easy that BC Assessment seems to be doing a good job being fair with their assessments across price bands. We can also see that while oftentimes the assessed value has little to do with market value, this is not because assessments are wildly inaccurate, but rather because they are always 6-18 months out of date, and prices in most 6-18 month periods in Victoria have gone up. In a flat market the assessments as a group are relatively good at estimating fair market value (though individually they still vary).

Also weekly numbers courtesy of the VREB.

| November 2021 |

Nov

2020

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 165 | 310 | 444 | 795 | |

| New Listings | 170 | 316 | 484 | 823 | |

| Active Listings | 993 | 954 | 954 | 1813 | |

| Sales to New Listings | 97% | 98% | 92% | 96% | |

| Sales YoY Change | -14% | -22% | -23% | ||

| Months of Inventory | 2.3 | ||||

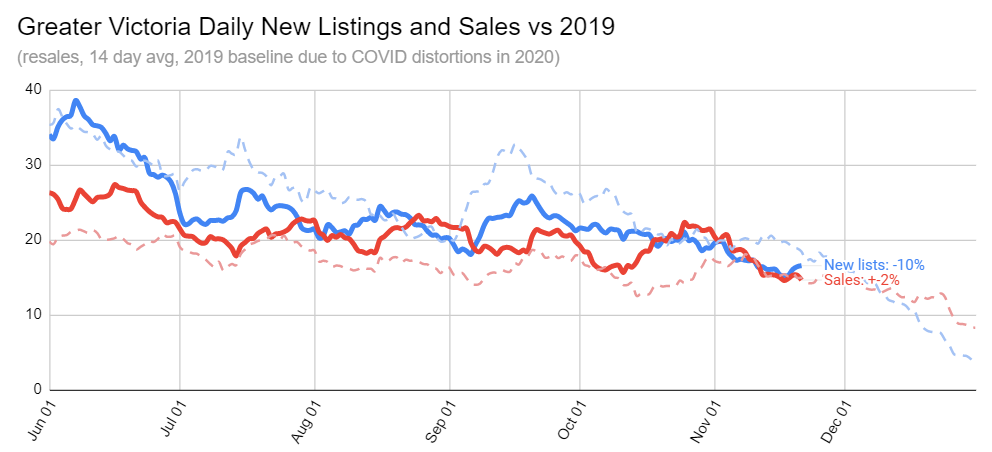

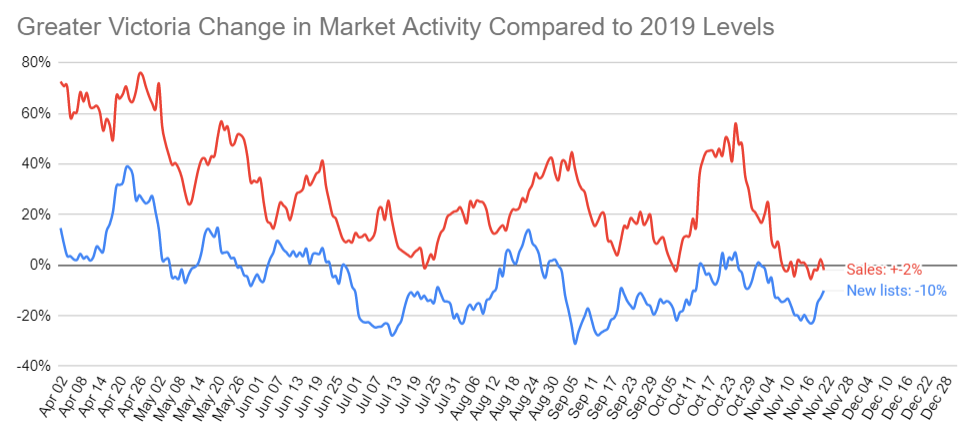

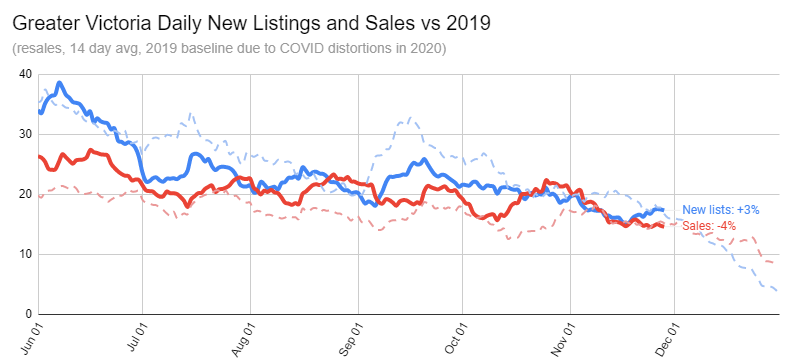

A few more listings came on to the market than were absorbed last week, relaxing the sales to new listings ratio somewhat. That brings us to a rate of sales that is 23% below that of this week last year, with equally 23% fewer new listings. However we are in a situation with 52% fewer properties on the market so overall market conditions remain much hotter than a year ago. Inventory didn’t decline further last week, not that there’s much further to go. We should get to about 625 sales for the month, which is about 1 month of residential inventory.

Now that even condo inventories are drawn way down, it’s unlikely we’ll see another surge in sales levels way above what I would call “normal” levels. However with the lack of inventory available it’s also impossible to tell how much demand there truly is. The first clue of any slackening demand would be a reduction in over-ask sales, and we haven’t seen that yet. I wouldn’t expect much change in the market until mid to late January.

November numbers: https://househuntvictoria.ca/2021/12/01/november-sales-slowing-with-season-but-no-relief-in-market-conditions/

3895 savannah will be a fun one to watch. Looks as if they didn’t even bother posting pictures

Interesting note about the Tresah, the company that decided to build out have no experience on mass timber or multi unit concrete buildings. Campbell who is used to doing concrete didn’t even submit a bid on the concrete cores for the mad timber and Farmer was running into site issues. High turnover in the workforce and less experienced staff on hand is going to make things messy from the two biggest contractors and a few other companies in town for the next few years.

patriotz- Communities were built on rivers so they could transport the timber from the forests to the town’s sawmills (built near rivers) to create the lumber needed to build the town. Remote roads were nonexistent and logging trucks did not exist, the river was the only way to transport the giant trees Canada is blessed with. This is still being done today. The benefits of being located on a waterway is why we have to live with the threat of flooding. Communities should locate housing and commercial properties a safe distance from rivers, leaving a buffer zone of parks and undeveloped land that can absorb occasional flooding. However, our love of waterfront property and need for housing is not conducive to this practice. I would never buy waterfront property, the risk of flooding and constant erosion is a real pain.

Condo owners face growing insurance bills for damage to common areas

Those interior towns (Merritt, etc.) were built close to the rivers because the railways that they depended on were built close to the rivers, and that’s because railways need gentle grades. True all over North America, except when the older towns came before the railway and depended on the river first.

From a local developer below…..I had a feeling local expertise would be an issue. Can’t wait to see how the Step Code 5 for the “Missing Middle” goes. Between bureaucracy and lack of expertise/cost we will see the first Missing Middle Initiative unit delivered sometime in 2035.

“Dear Tresah West homebuyers,

I’d like to thank you for your purchase and your ongoing enthusiasm for Tresah. This is a project that has attracted homebuyers and investors because of its beautiful design, value and the opportunity to be part of the first major residential development in Victoria’s growing Midtown neighbourhood.

As we’ve been planning for the upcoming construction of Tresah West, we’ve come to a decision that mass timber is no longer the best structural material for this building. There are challenges related to the mass timber supply chain, market demand, lack of local mass timber expertise and materials pricing that have led us to the decision to build with another structural material. This change will ensure we can deliver this building effectively and in a timely manner.

I’m very excited to announce that Tresah West will be built with recycled, lightweight steel and concrete. We’ve chosen this innovative approach because it’s sustainable, durable and has many benefits when it comes to the speed and simplicity of construction, home design and building maintenance and operations.

Though we are changing the building’s structural material, the overall design and quality will remain the same, as will your home’s floor plan and pricing. However, you will see some benefits to your space because of this move away from mass timber. In addition to a more open and airy home design, steel and concrete will also offer the benefits of superior soundproofing, building longevity and easy, cost-effective maintenance.

Our building schedule for Tresah will also remain the same. As a builder with more than 50 years of experience in this local market, we are very happy to have a construction plan in place to deliver your new home to you without delay. Tresah West will be a signature building in Victoria’s Midtown, and we look forward to showcasing this innovative and beautiful structure as we begin construction in the months ahead.

We will be closing our presentation centre for a brief period to refresh it with a bright and spacious new look and will reopen in early December. In the meantime, please don’t hesitate to get in touch with our sales team with any questions you have. “

Post from owner builder on FB…

“For anybody applying for a building permit from the Regional District of Nanaimo, you may want adjust your timelines. I sure wish I had. I applied May 7th, and the permit was granted on Nov 17th. 28 weeks. I talked with a local contractor who does many projects each year, and for him, it has been 24 weeks. ”

This is after you go through the owner-builder exam non-sense with BC Housing.

And have fun lining up trades when the permit is approx 28 weeks out, but you don’t know if it is going to be 22, 28, or 36 weeks.

On a previous census if the resident lived in a home with a separate suite, legal or otherwise and they reported that as two separate dwellings, then the mailing address’s for the 2021 census would be 1920-A William Street and the other 1920-B William Street for example. Otherwise the 2021 mailout would have simply read 1920 William St. So, any resident having their adult kids living in their separate basement suite or over the garage this time around, the new stat info would depend on whether they reported as having 4 adults and two children living in the home or if they reported it correctly saying there were two separate accommodations having 2 adults in one and two adults and 2 children in the other.

Small increase in new listings to end the month

Monday numbers:

603 sales ( down 20% from same week last year )

659 new lists ( down 15% )

936 inventory ( down 48%)

I’ve heard that Justin is going to commission a study to find out who put all these rivers so close to all these houses.

It is hard to figure where all the floodplains are. A lot of places don’t have accurate mapping, or haven’t accounted for climate change.

Except how the stats are collected for dwellings is subject to a high degree of inaccuracy it seems, while the vacant homes tax is not.

The census doesn’t count “homes”, it counts dwellings, defined as any self-contained place to live. Whereas a property is a piece of RE with its own title. Really no conflict to resolve as they are not counting the same thing. They also have different definitions of “vacant” as totoro pointed out.

Latest article from patriotz’s favourite journalist:

After a year that saw catastrophic fires and floods, B.C. homebuyers face a new reality

https://docdro.id/ImwAyPv

https://www.theglobeandmail.com/real-estate/vancouver/article-fire-and-floods-bc-home-buyers-face-new-reality/

1.3 million vacant homes based on census is probably 10x the actual amount of homes that are really “vacant” and could be rented out. Leo did an overview of this with a great analysis here: https://househuntvictoria.ca/2021/09/27/how-many-empty-homes-are-there-in-victoria/

In Victoria the census put the number of vacant homes at 8330, but the vacant homes tax revealed that there are only 809 vacant properties. This is because homes are classed as vacant if the owner dies or they are under construction, have a commuter spouse using the property part time, or have student tenants that use another address for their residence (like parents house). And the census is not an accurate measure as:

“It’s an objective fact whether someone is a Canadian citizen, permanent resident…”

Yes, but it is not an objective fact whether they are residents of Canada for income tax purposes. There are many factors that are considered in determining residency for income tax purposes. Whether they filed an income tax return or not, doesn’t tell you whether they filed it properly. It is a system based on self-declaration and the government doesn’t often investigate whether people living here should be paying more income taxes due to their global income sources.

” However, they have no idea who is a non-resident ”

It’s an objective fact whether someone is a Canadian citizen, permanent resident, or otherwise and BC’s FBT is based on this. It’s also an objective fact whether one files their income taxes in BC, some other province, or not in Canada at all and this is used for BC’s spec tax as well.

So I really don’t know what this is getting at.

“Canada might have non-resident taxes, but they’re mostly just a PR tool to dismiss the issue. The taxes only apply to a small region, which can be avoided by investing outside of the boundary. The country’s re-elected leadership promised to outright ban non-resident purchasing. However, they have no idea who is a non-resident, and would prefer to keep it that way.”

Ya, that sums up the BC speculation tax. Good in theory, but not really working. Was it even intended to work?

“When prices advance faster than carrying costs, it makes sense to hold vacant homes. Especially in a housing crisis, since it creates an artificial supply shortage. The vacant units don’t just rise in value, they also contribute to the rise in home prices.”

https://betterdwelling.com/the-world-has-millions-of-vacant-homes-and-1-3-million-are-in-canada-oecd/#_

“Not sure if that 1.3M vacant homes number in Canada came from StatsCan census or not. StatsCan numbers are dewling based…”

Better Dwelling is the source (which I don’t trust), which cites the OECD.

You are correct that for the census, a house with a suite is considered a duplex, and each dwelling unit is classified as a flat or apartment in a duplex.

We technically occupy our suite, but it will be classified as vacant in the census.

Not sure if that 1.3M vacant homes number in Canada came from StatsCan census or not. StatsCan numbers are dewling based, and a suite in a house is conuted as a separated dewling from the main house, and students rental sutes are conuted as vacant dewling for census purpose, if students go back home in summer.

It is either that or cut off immigration.

Leo, any thoughts on the article noting that we have 1.3 million vacant homes in Canada?

Maybe it was a grow-op.

Now here’s a goshdarn mystery. How did this typical Gordon Head house only sell for $121K in 2001? Extremely generous family-to-family deal?

Another good read explaining how the real problem with our housing market is demand rather than supply: https://vancouversun.com/opinion/columnists/douglas-todd-why-more-housing-supply-wont-solve-unaffordability

Interesting that the Canada has less housing per capita than Europe story turned out to be garbage.

And it makes perfect sense that the real estate industry is championing the let’s build ourselves out of this mess “solution”.

Me too, deer. Me too.

Deer prefer Oak Bay’s large, lush lots, study finds

https://www.timescolonist.com/local-news/deer-prefer-oak-bayas-large-lush-lots-study-finds-4800908

“but this project got dropped so I no longer am paying the fee to access it.“

This sounds like something you should have. Would you allow us to crowdfund it for you? What’s the cost?

From : https://financialpost.com/real-estate/up-up-up-canada-house-prices-poised-to-surge-again-despite-central-bank-warning

I know these statements from the BoC have been posted in the discussion already. However, reading the 3rd or 4th variation of stories written about the statements from Tuesdays BoC talk, my perspective is starting to change. I was once legitimately worried about the harm to people and the economy about the excessive risk that so much debt could have and the problems that may eventually happen. I am now of the opinion to let it burn as hot as it can, increase the CMHC borrowing limits, bring that weird new tax free house savings thing and whatever gimics that will continue to spike the market. Let’s push this thing as far as it can go until it does collapse under it’s own weight of insanity. Let it wipe out multiple generations of family finances and because they pulled money out HELOCs and daisy chained it through their kids to buy investment properties they couldn’t otherwise afford. Then, when they start whining for help and complaining of financial ruin as the economy slips into recession, we collectively answer, no, you don’t get help, you did this to yourself. Bring on getting the money supply and inflation under control with the 8 interest rate hikes (or more) in the next 24 months and let those variable rate dependant investor/borrows bear the brunt and have them become desperate for positive cash flow they just don’t have in an illiquid heavily indebted asset.

Downpayment is a small part of it; however, psychology is huge imo.

For example, you buy a condo with 150k down for 400k purchase price.

A year later the condo is worth 390k and a townhome is 600k. Most people are not upgrading even if they have equity and can qualify because they would be taking a loss on the condo.

However, if a year later the condo is worth 500k and the townhome is 800k you’ll have people upgrading as they feel they made “100k” on their condo, even thought the townhome is 200k more.

Wouldn't the house have gone up 400-500k over the same time? Seems to me if they could afford to upgrade to SFH they could have afforded a SFH in the first place. Or is is just about being able to meet the down payment now, rather than about meeting the monthly payments? You’re going to need 200K down for a 1 mil property.

They probably wouldn’t divulge anything good anyway, so it doesn’t really matter, but you’d be the right person to ask about their algorithms, for example.

What are you curious about?

I don’t see too many house flippers on the ground. The friction costs are just so massive in BC (PTT, legal, real estate commission) then throw in very difficult to find tradespeople, material costs are through the roof, etc.

What I see is people buy a townhome, for example, it goes up 200-300k in 12 months and then they want to upgrade to a SFH with all the equity so they are selling within a year or two of buying, but not sure I would call them “flippers.”

Leo, I dont know what is wrong with you. You could never get a job as an expert with the city. You actually admitted that you were wrong and actually made a mistake. Talk about incompetent. you then went ahead and actually acknowledged who corrected you.

Certainly builds my respect.

I believe house flippers greatest impact is the fact that they are putting offers on multiple properties all year round. If those offers were not there, many properties might not look as “hot”. Instead of 2 or 3 serious buyers, you’ve got 10 other offers from flippers, most of them lowball, and that puts more pressure on the end buyers . I’m sure many agents have a relationship with such bidders for their own listings.

You should have taken the meeting. You could have asked them about lots of other stuff.

A number of years ago I did an analysis regressing the selling price of townhouses in Saanich East on property tax and features of the units, regarding property tax as a proportion of assessment. The regression was highly significant with an adjusted R-square of .913 & a standard error just under $13 thousand (n=194). Most of the features were non-significant indicating that the assessors had done a fair job of taking them into account. Two features, however, were significant — finished square feet and age — indicating that smaller & older units to be over-assessed relative to their market value. My inferences tend to support those of Leo.

Leo – I was reading your article again and thinking about the spread between quartiles. You picked a time when prices were fairly flat*, but I would assume BC Assessment would assume gradual price growth over time, say at the long term inflation rate, or some other long term value.

When there is a steady price growth in percentage terms, you expect the spread between quartiles to increase over time. That means getting the assessment right for each quartile is simply a matter of estimating price growth correctly, which we know is spectacularly hard to do. So isn’t it most likely that their method just underestimates the long-term price growth rate, which then squeezes the quartiles together?

*The interesting thing is that you actually picked the only time in the past decade when prices were dropping noticeably. I checked Teranet’s index for Victoria and they show negative values y/y (prices declining), according to their methods, from Feb 2013 all the way until July 2014.

BC Assessment also reached out very promptly and offered a meeting with one of their senior appraisers. No longer necessary but nice to see willingness to engage.

There are two levels of access. Realtors have access to the internal portal where there is a stats module that can spit out summary statistics, and a search function that can display individual property details, but can’t be exported en masse. I have this access, but it’s cumbersome to work with transaction level data (basically have to scrape it out into external tools to analyze).

There is also a data feed that you can license from the board which gives you the raw transaction level data back to about 1990. Every sale, every change to a listing, all with a decent API so you can integrate it into products like custom listings sites. This can be queried with a SQL-like language, and I licensed it for a while when I built a custom dashboard for analytics, but this project got dropped so I no longer am paying the fee to access it.

UPDATE. Huge thanks to ForeignBuyer for finding and correcting the error in my analysis. Grateful to have this help checking my work!

I’ve rewritten the article above.

“ I no longer have the raw data feed”

Thanks again for you hard work, Leo. Is this ‘raw data feed’ something that all realtors have access to? Why do you not have access anymore? Why is this not public information?

Less than one year, most likely a flip. Up to two years, still a high probability (over 50%). After two years, less than 50%. More than 3 years shouldn’t be considered a flip. I’ve done one flip, hardest I’ve ever worked, held the property for around 18 months. Monthly expenses, interest, insurance, all eat away profits. Did make a profit, don’t really want to know how small it really was.

Yes. It’s a bit of work to get this data out now that I no longer have the raw data feed, but not rocket science.

What would people consider to be a flip? What max time between consecutive sales?

@leo thanks for all your amazing work on this site + research. Have you considered an article on house flipping? It would be interesting to understand it’s prevalence over the years.

The little gas heater cranks out 10,000 BTU, too bad it’s such an eye sore.

The little gas heater likely needs a plug for a blower fan.

Don’t worry, we can still reach for the top with earthquakes and tsunamis. Also, there hasn’t been a good burn on the island in about 30 years. There is loads of fuel ready to go in the well ignored island forest fire prevention planning.

100% that is a gas heater (like a small furnace). The one downstairs must be as well, just not sure why plugged in.

There’s another one in a different room:

The listing is 1958 Hampshire Rd.

Climate change is going to be such a big consideration going forward when it comes to choosing where to live.

Much of Vancouver Island will experience worsening summer drought conditions, rising sea levels, and heat waves. We are still pretty lucky though when we look at the risks in many areas of BC for landslides, flooding, drought, and wildfire.

The Province released a risk assessment report on climate change in 2019 – and the wildfires, heat dome, flooding and landslides we have experienced this year were identified. If you are interested in reading the report it is here: https://www2.gov.bc.ca/assets/gov/environment/climate-change/adaptation/prelim-strat-climate-risk-assessment.pdf

Mystery Machine- Definitely not a dehumidifier, no place for the water. Possibly an ionizer, not an ozone generator. Or maybe an air purifier. Something smells fishy.

It also looks like (since it’s plugged in) a dehumidifier. It’s a basement, so they might be trying to keep the moisture down if something wasn’t done properly in putting everything together (we know that short cuts never happen in construction and everything is done by honest professionals).

That looks to be a rannai gas heater direct vent usaully not hardwired

New home purchased in happy valley for 533k+GST in 2015 just resold in bidding war for $1.31 millon. I guess that would make it 3 million by 2028.

BC Assessment has a budget of $77 million annually it appears. How many individual properties in BC (residential and commercial)? Must be millions. You get what you pay for.

Excellent post, you can throw out widespread corruption as they aren’t that smart. Honestly, when I receive phone calls from BC Assessments staff (questioning me if transaction was at arm’s length, etc.) 10% of the time person on the other line understands simple concepts, the other 90% of the time they are completely clueless where I’ve just given up on trying to explain why something sold for X amount. What can you expect, government. It is like the geniuses at COV paying $10 million for a property developer bought a couple of years earlier for $3 million and change.

So many issues with BC Assessments, for example, on condos they don’t factor in parking and parking is now going for 50k/spot.

Right now I own a unit downtown assessed at 326k, market value 350k. I own a unit in Vic West also assessed at 326k, market value 450k. BC Assessments overlooking some simple things such as one unit has parking, other one does not, etc.

Looks wise it looks like a gas heater, but I haven’t seen those plugged in.

“How many basement suites are there in the top quartile of the market?”

No idea. I was thinking about the second and third quartiles, which is where I assume the majority would be.

Very thought-provoking post Leo – thank you as always for sharing your insights.

I have a theory for why the data shows higher sales to assessment ratio for homes in the upper quartile compared to lower quartile, and I don’t think it is (necessarily) because of bias in assessed values.

You are establishing your quartiles based on sales price. When a home sells for “a lot” (relative to some undefined measure of value – be it assessed value or some other measure), this could be reflected in your data in two ways:

1) Homes that would otherwise be on the boundary between two quartiles could be bumped up into the higher quartile for home price; and

2) These homes will be more likely to have a high sales price to assessed value ratio.

The opposite is true for homes that sell for “a little” relative to some measure of value. Together these effects could increase the sales price to assessed value for homes in the higher quartiles and decrease it in the lower quartiles.

Take an extreme example, where someone pays $2M for a home with a market value (or assessed value) of $1M. This home may ordinarily have been in the third quartile (had the buyer paid market value), but this extreme sales price bumps it into fourth quartile. This home will also have an extreme sales price to assessed value ratio (of 200%, if the assessed value is also $1M). Higher quartiles may be (on average) more likely to be skewed by people overpaying; likewise lower quartiles may have (on average) more people getting a bargain.

Such extreme examples are obviously rare, but this effect on a smaller scale could potentially create the sorts of differences you see in your analysis.

If you worked out your quartiles based on assessed value, my suspicion is this effect would decrease (or potentially even disappear).

How many basement suites are there in the top quartile of the market?

“One thing that can push a place towards higher quartile prices is excellent maintenance, recent upgrades to finishing and recent renovations. Permitted renovations are captured in assessments but a huge number of even very major renovations are unpermitted and thus not reflected in assessments. Hence higher quartile places could have assessments that are biased low.”

In addition to what you’ve pointed out, a basement suite would also seemingly have this effect. The vast majority of basement suites in the core are unauthorized, and I’m guessing that the existence of unauthorized suites would generally not be captured in the assessment data.

Hey, can anyone tell what this machine is?

One thing that will push a place towards a lower quartile price is disrepair/neglect/massively outdated finishing. These factors aren’t captured well in the assessment process so the assessment for lower quartile places could bias high.

One thing that can push a place towards higher quartile prices is excellent maintenance, recent upgrades to finishing and recent renovations. Permitted renovations are captured in assessments but a huge number of even very major renovations are unpermitted and thus not reflected in assessments. Hence higher quartile places could have assessments that are biased low.

I don’t think this is the whole answer but maybe it is part of the answer?

Bank of Canada calls out investors for boosting home prices, warns of household debt with interest rates set to rise

Last paragraph is scholarly language for “bubble”.

The CPR admitted defeat in the Coquihalla 60 years ago. I think that the roads along the same routes as the railways will be up very soon.

It’s amazing the railways are almost ready to reopen. They must know what they’re doing. The roads and bridges are a different matter. Hopefully little further precipitation occurs.

Maybe there is a discount value applied to high value properties as there is more variation in sales prices?

$1.11M

Can someone please provide what 2358 Tanner went for? Thanks for the great post, Leo!

It wouldn’t work to do the same analysis really because prices are changing rapidly, but here are the price quartiles.

Maybe, but I wouldn’t call the top 25% of properties the luxury market. If we took out the top 5% or so the same trend would hold.

Thanks for the analysis, Leo. Are you able to extrapolate what these pricing thresholds would be in 2021 numbers? Or does that skew the piece?

My theory – in the years leading up to 2013, the luxury market was much thinner resulting in a higher standard deviation in terms of sale prices. The higher end properties probably stayed on the market longer than the less expensive properties. The software probably gives the benefit of the doubt on the low side and factors in a longer sale time to give a lower overall price to avoid unfairness.