The death of family-affordable housing

I’ve often talked about how single family houses aren’t affordable to the average family, that it hasn’t been that way for years or decades, and that there’s no reason to believe they will get anything but less affordable in the long term. That doesn’t mean that prices can’t come down or they can’t get more affordable in the short term – they can and have in the past – but on the order of decades they will get less and less affordable as they become a smaller and smaller proportion of the total housing stock.

That is a difficult reality for many families, but there isn’t anything fundamentally that can be done about it. In a city that can’t sprawl with a growing population, the amount of land per person decreases over time and thus the relative value of a fixed 6000sqft plot increases.

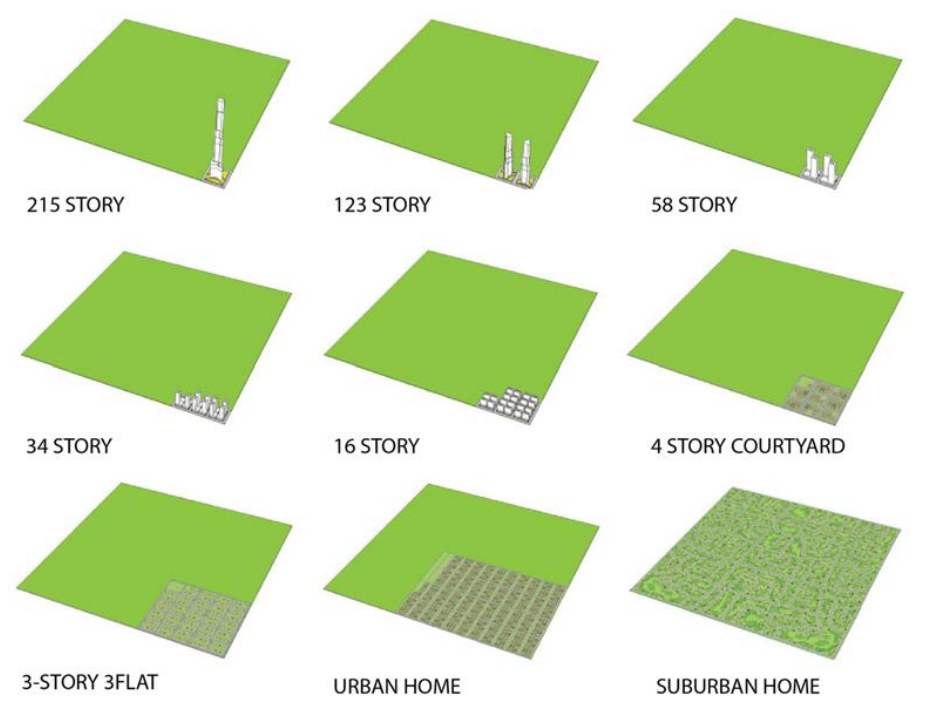

That reality though doesn’t mean that we have any shortage of land for family housing in this city. It’s worth reposting a visualization I used in a previous article, that shows how differences in building form changes land use. The bottom row in this picture are all ground oriented family-suitable housing types that wouldn’t substantially change the residential character of our city’s low density areas, but would give homes to many times as many people on the same land.

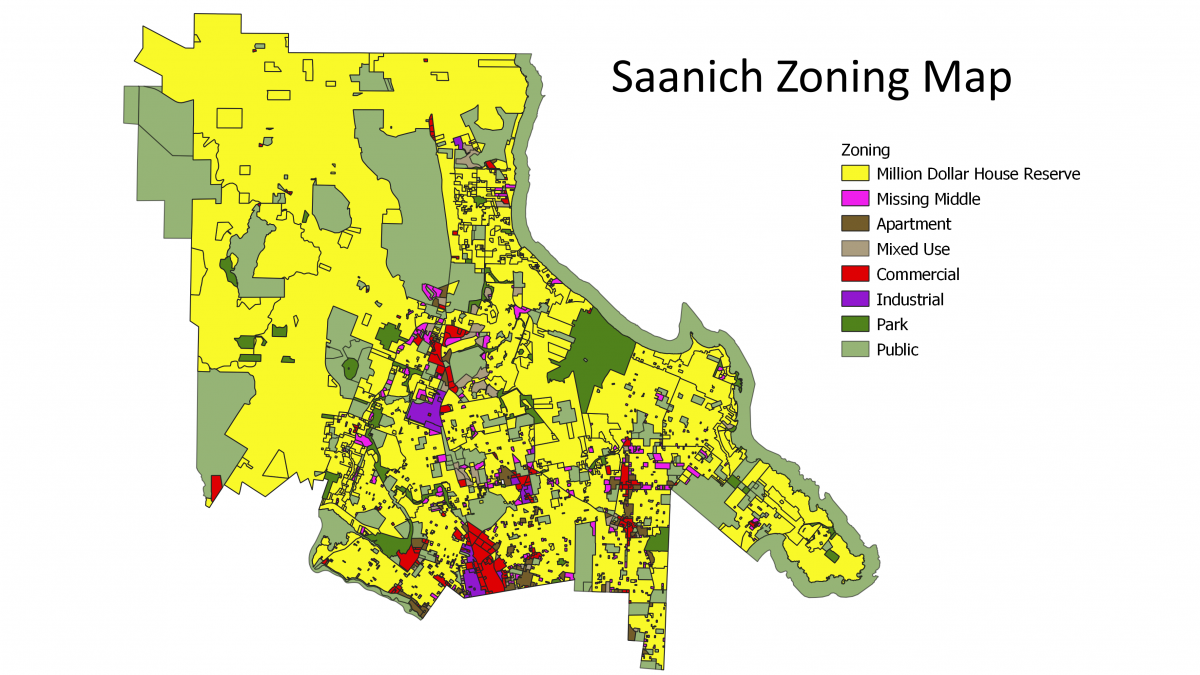

So there is no physical barrier to creating family suitable housing that is more space efficient than the typical detached house. Why don’t we have plenty of this housing? Because it’s illegal to build almost everywhere in the city.

For a long time Victoria was able to get away with this because a single family house remained somewhat affordable, and there was still plenty of greenfield land in all the municipalities to put up more of them. Now that greenfield land is essentially only available in Langford and Colwood, and unsurprisingly those regions have carried the region’s growth for the past couple decades. As I’ve said before, if you think we have a housing crisis now, just wait until the westshore runs out of land to build on.

New construction sells for market value, and if there isn’t enough of it to keep inventories available, that market value keeps going up. It wasn’t long ago that you could buy a new house in the westshore for a reasonable price, but median prices there have recently cracked a million too.

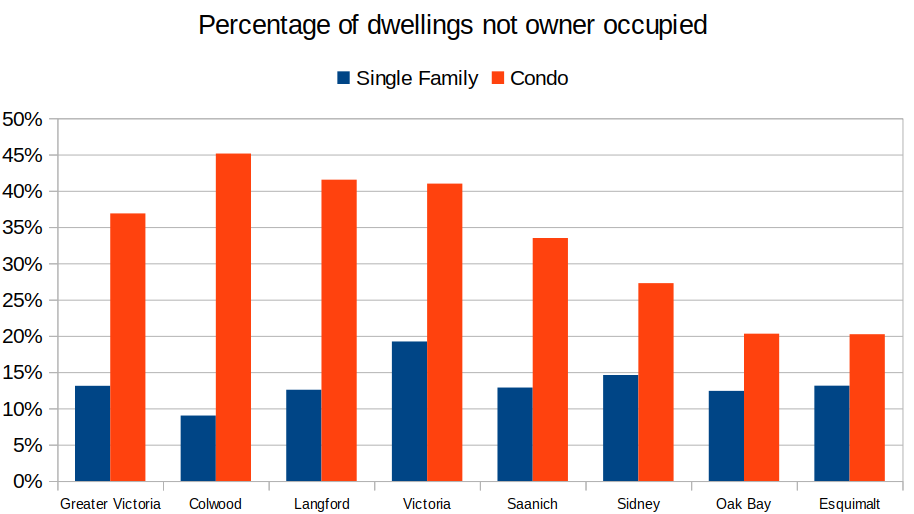

Ok, so everyone should adjust their expectations and settle for a townhouse or a 3 bedroom condo since single family house prices have moved out of reach, right? Well let’s look at what’s affordable, and what’s available to buy. The CMHC defines an affordable level of housing expense as 30% of your income, so based on a 5% down payment and prevailing interest rates we can calculate a maximum affordable house price. As for space, we’ll define a family suitable unit as any housing type that has at least 1200 sqft and 3 bedrooms. Not exactly luxurious, but doable. Here’s how many of those are available in Victoria.

In 2021, despite low rates bringing the affordable house price up to nearly $600k, there were only an average of 5 family suitable units on the market every month. Only 8 years ago, despite the average family only being able to afford a $460,000 place, there was 50 times the selection. That’s not even accounting for the stress test which of course has made it much more difficult to actually qualify for those amounts since 2018.

Of course despite this, families are buying. Some higher incomes, extended debt ratios, help from mom and dad, or equity from a previous place. But that’s a zero sum game. Every dollar poured into housing is a dollar not available for something else and as affordable housing options dwindle, it will push more people into homelessness which will be a further drain on public finances. For buyers, those extended debt ratios are no problem when everything goes well, but it means when life happens (illness, job loss, divorce, a forced move), those families are that much more vulnerable than they have been in the past.

For this we have no one to blame but ourselves. The only family suitable housing we generally build are single family homes, and those are out of reach. We could build more affordable housing but we have chosen not to for decades. Every bit of dithering, every vote for more consultation, every long rezoning process no matter the outcome is a vote for the housing crisis.

Also the weekly numbers courtesy of the VREB:

| April 2021 |

Apr

2020

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 111 | 327 | 598 | 879 | 287 |

| New Listings | 176 | 499 | 853 | 1201 | 667 |

| Active Listings | 1357 | 1416 | 1449 | 1458 | 2305 |

| Sales to New Listings | 63% | 65% | 70% | 73% | 43% |

| Sales YoY Change | +208% | +343% | +318% | 301% | |

| Months of Inventory | 8.0 | ||||

Market is continuing similar to before, with inventory building very slowly in April, but still 37% below this time last year. In the last week 56% of houses and a quarter of condos went for over the asking price. It’s an interesting market, where there are still many bidding wars but occasionally a listing or two seems to fall through the cracks and sell for substantially under ask in a short time. The pool of buyers seems to be getting shallower.

For the first time this year, new lists are running substantially above the 2019 levels. Part of this is due to the Easter weekend which in 2019 happened at the end of April and so we are comparing to a lower base. We’ll have to wait another couple weeks to see the true magnitude of the increase but it’s clear there is some more new listing activity than there was two years ago.

There is nothing massive about Victoria. It doesn’t even qualify as a big city.

The city’s road-namer got a little carried away.

I bet GH, SOB, and Fairfield have very comparable density. Westhills and Happy Valley are the hellholes.

Before you know it Gordon Head could have population density and overcrowding just as bad as urban hellholes like South Oak Bay or Fairfield.

But Introvert railed against Site C so is obviously an exemplary environmental citizen.

what was the plan exactly? Gordon head road, turning into Ferndale, turning into Grandview, turning into Ash road all in the space of a kilometer and a half?

Which is literally the antithesis of environmentalism.

It’s massive urban sprawl which means you have to drive everywhere.

1613 new lists April 2008 (record)

1516 new lists April 2021

New listings within 7% of a record. Can’t blame much of the high prices on lack of supply.

Points to huge demand as the issue.

Still a moot point because price were still at unattainable level for the great unwashed.

1613 April 2008

Real estate sales tactics under fire as Canadian home prices spiral out of control

What’s the record for highest April lists?

1116 sales (second highest April after 2016)

1516 new lists

1454 active listings to end the month (-37%)

Sure, but Westhills of the ’70s = good spacing between houses, relatively large lots, and generous numbers of parks and green spaces sprinkled throughout the neighbourhood.

I’ll take ’70s Westhills any day over today’s Westhills, even factoring in the arguably poorer quality houses of the ’70s.

Agreed, which makes GH (and other core neighbourhoods) more valuable. They’re valuable precisely because they don’t build neighbourhoods like this anymore.

The addition of “missing middle” housing will slowly erode those positive aspects that many people appreciate, namely good space between dwellings, decent sized yards, not feeling crowded, relatively more privacy, more tranquility, and less noise).

Vancouver prices overall were soft in 2018-19 (Vancouver Teranet dropped 4%) and it’s typical for the highest price properties to make a larger move (numbers and percentages) on the way up and down.

As LeoS charts have shown, foreigners aren’t the house-price boogeymen, as their numbers are too small. No reason to believe that the BC Liberals’ 2016 foreign buyer tax (increased in 2018 from 15% to 20%) had any significant effect on prices. Same with the foreigner targeted spec taxes. Vancouver prices are up 40% since 2016 when foreign buyers tax was introduced.

The house price boogeymen are low interest rates, government insured mortgages, and Canadians lust for owning houses. All of them “Made in Canada.”

I don’t mind 70s homes either underrated as well. Decent basement ceiling heights engineer trusses makes it easy to open up walls and renovate, etc. However, don’t be mistaken they were built as cheap as possible just like homes today are built as cheap as possible. They were the Westhills before the Westhills.

Gordon Head is just horrible imo. You also would not be able to building anything like GH today as the city would require so much extra civil engineering work and other from the developer that the costs would be astronomical and you would end up with lots half the size, basically what we have now in the Westshore.

Prices went down significantly in the most expensive districts in Vancouver in 2018-19, which is where these taxes had the greatest effect.

The boxes themselves don’t matter so much as the way the neighbourhood was planned. The core has a price premium not just because it’s geographically closer to downtown but because the lots are relatively more spacious and the houses don’t feel crowded together.

As for the quality of GH boxes, I can only speak to my house which does have crap insulation; it had no bathroom fan when we bought it, so we installed one; the drain tiles seem to be working just fine; there’s no asbestos or aluminum wiring; and the furnace is still the original electric forced air, which apparently will never die.

BTW, kinda funny that you’re maligning baseboard heaters when in several prior posts you’ve suggested they’re underrated and touted their virtues.

I like my carriage house. room for the extra car and my shop.

It’s a nice little buffer that many people value highly.

Sounds awful.

What are you talking about — in Croatia, Marko used to take himself to the park when he was still in diapers 🙂

THIS IS SPARTA!!!!

Yeah I think big supply is more of a long term solution. That’s why it’s been so deprioritized because the effects go beyond the term of any city councilor. It’s not that a major zoning change will do much on the 0-5 year timeframe, but in my opinion it’s necessary to save the city long term. Sure we could turn it into a retirement nest for the wealthy by doing nothing but that’s not where I want to see the city going.

Yes, confusing graph, but shows the point nonetheless.

I don’t think flooding the market with supply would budge prices much as the flood would take years; however, it would help a lot more than other policies imo.

Foreign buyer taxes prices went up. Spec tax prices went up. It’s not like these policies caused prices to go up it’s just that they were such small factors in shaping the market. Supply would be a bigger factor imo but still would not be enough to overcome massive immigration.

People don’t move to cities because housing is cheap. If they did Detroit would be booming. They move to cities because jobs are there. Now there’s a case to be made that increased building resulting in more affordable housing will make it easier to hire people and thus attract more business and create more jobs. But I don’t think that effect is going to take prices back up on its own (i.e. net of CPI-level increases). The reaction time is much too slow and equilibrium would occur well before the old price level is restored.

But I wonder just how much more housing can be built given the constraints on labour supply. Might take a bust elsewhere to free up the labour. But it there’s a bust in, say, Vancouver you’re certain to see Victoria prices go down anyway.

In transportation theory there’s the induced demand phenomenon that basically functions as “if you build it, they will come.” At its heart, it’s an argument for more efficient modes of transportation (such as bus/train/bike lanes) because road expansions undertaken to reduce traffic are actually counterproductive. It’s centred around the Marchetti Constant, which is the average maximum time people are willing to spend commuting in a day (around an hour if I recall correctly). Heavy traffic -> Build larger roads -> less traffic -> more people move out into suburbs/people choose to drive instead of transit due to shorter commute time -> heavy traffic.

As far as I’m aware there’s not any research into a similar effect into housing, but I do wonder if there’s a similar effect in housing and what equilibrium would actually be acheived. If more condos/townhomes/SFHs etc. are built and prices begin to increase, perhaps the lower prices look appealing to those living outside of the city, they move here, and prices reach a new and similar equilibrium (based on what the wealth/income of those buying allows them to afford). This isn’t an argument against building more supply, I’m just not convinced that doing so will have a huge impact on prices if nothing else changes.

Why do condo towers downtown have to accommodate families? Plenty of people weather it be young professionals or retirees that don’t have 2 kids between the ages of 0 and 18. Let these people fill the towers and build low rise condos and townhomes is residential neighborhoods that are more geared towards families. Add in subdivisions on the Westshore for those who cannot wrap their head around not living in anything other than a SFHs. Attack the supply problem from every angle.

IMHO it would be difficult to isolate the effect of rezoning on prices from that of market cycles.

Ahh yes the gold ol’ 70 boxes in Gordon Head. 2″x4″ framing with crap insulation, aluminum wiring, no bathroom fans, concrete drain tiles prone to collapse resulting in flooded basements, full of asbestos and oil heat or baseboards. Throw in a right of way to Saanich for sewer/storm in the back yard. What is there not to like, obviously no greed existed when these were built 50 yrs ago.

I don’t think it’s been done so no studies. But if you find any let me know. Seems like cities either went full sprawl mode with cheaper prices or constrained growth with restrictive zoning that ended up with high prices. I bet there’s something out of Europe though

I think there is massive value in ground oriented housing. Our kids spend hours playing in front of the house with the neighbours. That works in a townhouse (and in fact works better because there’s more likely to be kids nearby). Doesn’t work downtown in a condo tower. There’s quite a few years where you can let kids play by the house but they’re not old enough to go to the park by themselves.

The space between houses is dead space anyway generally without windows. Make it 6 feet or better yet connect the two and put a home in the middle. Big yards are overrated too. Only reason I would like a bigger lot is to drop down a carriage house.

I understand the concept of why densification would lead to a reduction in prices but Leo do you or anyone else have any real world examples of a city rezoning for densification and it leading to reduced prices? I have done some googling and haven’t haven’t found any literature with studies etc in it.

Yes, please. Put the density downtown, where it belongs.

Build 3- and 4-bedroom condos suitable for families right in downtown. There’s that nice playground by the courthouse for the kids.

A house from the good ol’ days, when they weren’t built 6 feet apart from one another and didn’t have micro front and backyards.

Totally missed that sentence….great point! Supply is supply even if built for greed 50 yrs ago.

I simply fail to understand any anti-supply arguments. Yes, there are huge strains on demand such as massive immigration numbers, low interest rates, etc., but if you flooded the market with supply (let us say you had 10 more subdivisions like Royal Bay/Westhills) how would that not shift the supply/demand equation if you kept demand side factors the same (i.e. didn’t increase immigration, etc.). Is supply the only solution? No, but trading two trees for 20 families living in the core seems like a no brainer, yet the opposition is insane.

“we need more density downtown” “As for space we define a family suitable unit as any housing type that is at least 1200 Sq.ft. and 3 bedrooms.” “we need more pedestrian structure everywhere” “Our house is cookie cutter slapped together by a greedy developer and it’s lovely”

Some of Leo’s quotes here. Also on your recent u-tube video (which I thoroughly enjoyed!!…..you are so humble, smart, logical and simply a nice guy), you said something like you feel building duplexes are the way to go for families in the future.

I think we have plenty of condo’s downtown maybe room for more but they certainly aren’t for the most part family or pet friendly. What we do need is more ways of transportation to the downtown core. In the summer especially, there is not enough parking. Many living out in the Saanich Peninsula, Langford, Colwood even Sooke would love to come back home and walk around the “vibrant” down town, have lunch, window shop etc. but they can’t get parking and when they do luck out….it is as expensive as hell. When they started the condo building downtown years ago I was excited and truly thought that it would improve upon what it was. But it hasn’t. The streets are filthy and it is scary walking around after dark.

James Bay and West Fairfield have certainly done their part to provide multi family dwellings. Most of the 1910-1914 era homes have been converted to having several rental suites or to apartment type condo’s. They also have their fair share of 50’s,60’s&70’s rental apartment blocks.

Saanich needs to amend some of its building by-laws. Most of the lots out in Gordon Head are huge in comparison to downtown lots. In the Saxe Point area of Esquimalt, most of the homes there were also built on similar size lots. For the most part they were bungalows put up in the mid 50’s. I’m not saying its nice but Esquimalt allowed pretty well EVERY corner lot facing two streets to have a strata duplex built on it. Gordon Head could do the same. Those lots are all flat and easy to build on. Also, why not allow for legal up and down duplexes in that area? After all most of those homes built in the 70’s are bi-level homes so the bottom one is at ground level. The upper level of the homes are usually 1150-1300Sq. Ft. 3 bedrooms, 1-1/2 baths, L.R separate D.R and eating area in the kitchen. I would think young couples in the Victoria area wanting to buy a home are not particularly needing to buy in the City of Victoria. Gordon Head would be great. Funny how governments can legally confiscate your land after paying fair market value if they deem the need to build a road or highway extension. Yet families here desperately needing appropriate and affordable housing are out of luck.

Tax season next year will be interesting. A lot more 3m properties and the so called rich tax will be added. Going to be a lot of shocked people especially in those area that had higher appreciation.

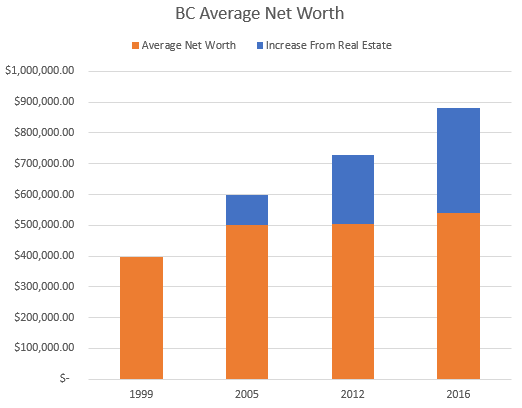

Great graph Leo! Clearly for the last 15 years we have been ploughing our dollars into RE instead of into investments which will actually make Canada a better place and actually make us wealthier society. What good is it for me when my house increases in value with the rest of the houses in my area? The only way I can capitalize on that is if I move somewhere else. Will the majority of us move elsewhere? No! Other than that it just means more money for the government and for the banks. So the RE wealth is mostly virtual. Having said that RE sector is obviously very important for the economy but it shouldn’t be the only pillar which our economy stands on as it currently seems to be.

The way the media covers any potential rezoning doesn’t help. It’s always Developer VS Community. David VS Goliath. It’s an easy sell. Nevermind that the community associations don’t represent the actual community, they’re just a special interest group, and the existing community doesn’t represent the potential future community.

Also that.

No change there. Most of the gains in the past 2 decades has come from real estate. Everything else stagnant. Note the graph is confusingly labeled. The total column is the net worth, the blue is the increase from real estate since 1999.

“Years of rezoning process plus costs mean we don’t have adequate inventory, but obviously there is demand for those minoscule lots and that is how they end up at 500k.”

Marko, the problem is that people don’t have a choice when there is a major shortage of available housing. They will stretch beyond their limits because they need space for their family. We need to remove the bureaucracy preventing rezoning and development to provide supply of land and housing. This is Canada – the land is plentiful. It’s insane that it takes as long as you describe. Again the only way you can explain it is corruption because nobody can’t be so incompetent not to understand that there is a shortage of housing.

It’s clear that the real estate price jumps we have come to see in the last few years were primarily caused by the FED/BAC manipulating the interest rates. When they significantly lower they cause a large sudden influx of new buyers into the real estate market which has a very limited supply capacity. The new purchasing power is quickly reflected by the sellers/developers inflating the prices to match the newly increased purchasing power of the buyers, who are hoping to take advantage of lower interest rates. An additional supply would go a long way here and should be our #1 concern but it also wouldn’t be a complete solution. Another way could be to decouple the retail housing mortgage rates from the BAC interest rate moves to help the economy. The stress test is a sort of very simplified and incomplete move in that direction. I could imagine some ways to do that but there would have to be some political will which we simply won’t have until we hit a major real estate crash which is almost guaranteed to come in the not so distant future with our almost zero rates.

That’s the average of everyone of course. The rich have more in financial assets and the middle class have more in RE. And the middle class have more in RE versus financial assets than they used to.

Calling this vibrant is a joke. We need way more density downtown.

I don’t understand the greedy developer mentality. Literally everyone is greedy including the lovely older couple that tried to squeeze more money out of James the other day, despite loving his letter.

When I purchased the property (single family home on busy road) I am trying to rezone in Colwood the sellers want approximately $500,000 more than what it was worth without any development potential. A few months later we settled on $315,000 above what it was worth as a standalone SFH. I don’t consider them greedy, they tried to get the most amount of money the market would provide for the best interest of their family, how is that greedy?

The 10+ consultants (surveyor, arborist, civil engineer, environmentalist, geotech, traffic impact study engineer, architect, etc.) everyone is out to make as much money as possible. I had architectural quotes ranging from $146,000 to $350,000. I don’t consider the architect asking $350,000 greedy, they tried a high quote and I went with someone cheaper. That is how markets function.

The national balance sheet of Canadians is interesting. $50 trillion in gross assets, $38 trillion in liabilities, for a net worth of $12 trillion, up 6% over 2020 (up $700 billion). Not the easiest data to interpret, but it seems most of the 2020 gains are from (surprise!) real estate. But the total value of RE assets is $7 trillion (land + residential building), which is only 14% of total assets. $2 trillion in mortgages so net value $5 trillion. That puts roughly half of Canadian net assets are RE. The rest are financial (bonds/shares/insurance).

A funny line in the balance sheet, amongst the trillions in paper wealth, is government holdings of “gold”, of which it is listed as $0. The government of Canada, fifth largest gold producing country, hasn’t bothered to keep any of the gold that we’ve dug up over the last 150+ years.

https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3610058001

323k is like a 600 sqft garden suite plus you have $ left over.

I think this has a lot to do with it. Also decades of the lowest inflation on the planet.

https://www.japantimes.co.jp/news/2020/05/26/business/japan-worlds-top-creditor/

Which shows us that spot rezonings are not the way to handle densification. They are an inefficient use of funds, human resources, and political capital. What is needed is citywide planning, Give it a decent hearing and get it over with. I think it’s likely that the municipal fragmentation of greater Victoria is part of the problem. Short of amalgamation the provincial government needs to lean on municipalities to get things done.

Agreed.

What does seem different is the high degree to which our government is prepared to spend and borrow huge amounts of money to support failing parts of the economy. I recall in 2008 it being controversial when they bailed out GM with $5bn to save thousands of jobs. Now they are borrowing hundreds of billions supporting all parts of the economy, especially housing with the printing they’re doing to support low rates.

I’m in favour of the money spent on COVID and the people that lost jobs with Covid.

But the government has gone way beyond this, and created a big money bubble based on borrowed funds. The government finances don’t even make sense any more, the deficits are so big. It was a big deal when Greece owed $300 billion in bonds a few years back. Requiring fiscal restraint overseen by the “troika.” And then Canada borrows that much in one year, with outstanding debt over 1 trillion. And we follow up it up with, not restraint, but huge new long term spending programs. For example, $101 billion for daycare over three years. All borrowed money.

Canada has been there before. Huge deficits in the 1990s led to falling CAD$ and rising interest rates. And we needed an IMF bailout to borrow money from them (under strict terms of government restraint https://halifaxinitiative.org/content/imfs-structural-adjustment-programme-canada-1994-1995-december-1995) . The WSJ called Canada “Bankrupt Canada” and a “third world country” in 1995. We are likely headed there again.

IMO, Scott st should have sold for a hefty premium over Myrtle. Especially if you don’t want/need a suite.

It’s the opposite. People supposedly calling for more affordable housing actively spread misinformation and mock new supply. See Better Dwelling for example. Spreading tons of nonsense about how more supply actually drives prices up and it’s just evil developers scamming the government. Saretsky has veered off into conspiracy thinking, supply can never keep up with engineered credit creation and QE, Bitcoin blah blah.

Many people hate developers so much they’d rather vote against them in all areas even if that makes themselves worse off. I’m not kidding myself that developers are not generally out to maximize profit, but I don’t see why I should care about their profits. Competition limits those.

But like I said before, our house is a cookie cutter design slapped together by a greedy developer. It’s been standing for 50 years and it’s lovely. What do I care what money they made on it when they built it

And yes interest rates at near free don’t help this insanity I just don’t see how less regulations/costs to build and piling on inventory can hurt. It’s a free market and developers will compete. If prices remained at x but costs dropped x amount it would result in more construction.

I dunno. Japan has similarly low rates. Bigger GDP sure but not sure if that’s really it. We could also go down along with the US. I’m not predicting it but I’m not counting it out.

The development costs for those miniscule lots are insane due to regulations. I am trying to rezone a property in Colwood to a small apartment building and I am already over $100,000 in non-sense reports and I still haven’t filed the application which could very well be rejected by council. The developer next to me spent $300,000 on pulling the sewer alone.

Years of rezoning process plus costs mean we don’t have adequate inventory, but obviously there is demand for those minoscule lots and that is how they end up at 500k.

Then look at 908 foul bay and the save the trees campaign. Two trees are preventing 20 families from living there. Makes sense. Interesting thing is I don’t see anyone that has been priced out complaining about situations like this. It’s more along the lines of these 20 townhomes will be outrageously priced failing to recognize that 20 families buying these 20 townhomes will be vacanting lower priced townhomes creating for more overall inventory.

The problem is the regulations/costs restrict inventory during flat markets and then when the market takes off such as it has now you end up with a bigger spike due to no inventory. We had no major pre-sale launches downtown for two years even before covid at record prices. It took this insane market and blowing through record high for new launches to come to market now…Dockside by Bosa, Nest by Chard, Skyview by Lefevre, new tower at Pluto’s dinner. Because they are all hitting the market at the same time they will have to sharpen their pencils and compete which keeps prices down.

If you look at my HHV comments 2010-2014 one thing I mentioned over and over again is how the one market segment that had not softened was vacant building lots and that is heavily tied to regulations/costs. It literally takes years and years to subdivide one lot in most municipalities, let alone a subdivision. That’s like a 5 yrs process in COV and Saanich.

Who are Canada’s real estate billionaires? A field guide to the secretive and super-rich

The fundamental is that they have the Euro which is the world’s 2nd biggest currency and we have the CAD whose value is strongly dependent on commodities especially oil. You are always going to see a premium in CAD interest rates to make up for that risk.

You mean wage inflation. Consumer price inflation without wages keeping up will just make things worse for debtors. And I think that the likelihood of flat rates combined with wages outpacing consumer price inflation going forward is pretty slim.

Never happened the the past, and this is biggest bubble Canada has even seen by a long shot.

Well one exception – the mortgage deferral we saw last year. But notice this was not a spending item by the government, but just kicking the can down the road for the borrower. You might possibly see something like that again. But it will not head off a major price decline, because the primary cause of price declines is people being unable to buy, not existing homeowners being unable to meet payments.

The environmental, economic, and health benefits of robust pedestrian and bicycle infrastructure are proven. In addition, it’s basically a requirement have infrastructure like this as residential densification increases to prevent complete gridlock. Mixed-use developments tie right into this too.

The city has been, I think, doing quite a good job getting the AAA network built despite what feels like endless complaining. It’s another instance where many people vote and argue against their own best interests.

Strollerland sounds like urban hell where the majority of space and priority is given over to cars to drive through as quickly as possible instead of to people spending time enjoying. Optimizing for the latter seems like a better use of the space.

You see a vibrancy, I see a street which has had its’ efficiency cut in half, parking eradicated, and further corrupted by limiting the utility of right turns at a red light.

In Strollerland everything you’re looking at would be removed so that the road could do what it was meant to do.

A chacun son gout.

na

All that complaining about bike lanes, but that’s how you get amazing vibrant streets. We need more pedestrian infrastructure everywhere.

https://twitter.com/brantastic5/status/1388593091678851072?s=21

Only if the slowdown in the economy is high enough to offset the high inflation. I am have feeling if rates do go up suddenly and alot of home owners are in trouble then there will be probably some type of arrangement worked out with the lenders so people don’t lose their homes or primary residence atleast. So essentially another bail out.

“Biggest risk to rates I think is the US completely leaving us in the dust and driving up bond yields. We are weighed down by debt and have never been great about being competitive with the US. If their economy takes off it will take bond yields with it and our fixed rates with it whether we like it or not.”

Yes, I 100% agree that this is the single biggest risk. If US increase their rates Canada will have to follow or let our dollar tank. Either way leads to poor outcome for us. The best we can hope for are flat rates over the next decade and hope that inflation will take care of our real estate bubble problem. This may as well happen but the scary thing is that everyone seems be hoping for this which is never a good thing. Yes, we can still bring rates lower to deal with a problem but it’s sucker play. What will the next generation do when the rates are at -1% – are they going to go to -5% and keep going? The Ponzi will fall apart eventually. The sad thing is that we could have done much better.

The politicians are completely failing us. They could have supported rental housing development over the last 20-30 years – through many different means – tax incentives, low interest loans etc. Instead they allowed residential real estate owners to rent out basements which only resulted in a proportional real estate price jump = inflation. Seemingly real estate owners got richer but in reality our society as a whole got poorer and our rental housing stock quality declined. Is it right for lower income people to live in moldy basements? Wouldn’t it better if you could enjoy your house for yourself and your family instead of having to rely on a stranger helping you pay for your mortgage? Isn’t it why it’s called SFH? Is this REALLY the best that best we can do? We need to start treating affordable housing as a priority = something that we want our kids to have without having to make huge sacrifices.

You’re right, rate risk is not captured although I’ve written a few articles about how the impact of declining rates on house prices in the past 40 years is still wildly underappreciated. If rates rise quickly the market will absolutely tank.

However I don’t think this will happen anytime soon. Let’s say inflation heats up and the government raises rates. We are so highly indebted that will immediately slow down the housing market, drive up insolvencies, and slow down the economy which then removes rate pressure. I think our most likely scenario is that rates are quite low for a decade (flat +- 1% or so). That is still a massive change from the previous decade where rates dropped substantially, so just because rates don’t go up doesn’t mean something hasn’t fundamentally changed from what everyone has gotten use to for 40 years.

Some chance that we hit the next crisis and go to negative rates. German has mortgages around 0.6%. Not sure if there’s anything fundamental stopping ours from going just as low other than we haven’t done it before.

Biggest risk to rates I think is the US completely leaving us in the dust and driving up bond yields. We are weighed down by debt and have never been great about being competitive with the US. If their economy takes off it will take bond yields with it and our fixed rates with it whether we like it or not.

Millennials, not boomers, are now the biggest voting bloc in Canada.

Many millennials own and presumably also support “this atrocity.”

As always great analysis Leo! There are a few things that I find incredible:

#1 Canada is one of the least populated countries in the world with one of the most expensive real estate in the world. This paradox doesn’t make any logical sense in a truly free market economy. So the only explanation is a collusion of politics and business at a cost to young Canadians. The boomer voting majority who are mostly home owners quietly support this atrocity because that’s the only way they were able to acquire any sort of wealth at least on paper. This corruption will cost Canada going forward (massive economic risks, costs to young families who will spend all their earnings on their houses instead of their kids, immobile workforce, huge extra costs to businesses etc etc). It’s shocking that you can drive 10 mins out of Langford and you are in the middle of nowhere yet people pay half a million dollars for miniscule lots there. Canada is an empty country and there is NO excuse for this.

#2 – with the extremely low interest rates the lenders have effectively transferred the future interest rate risk to the consumers. This is happening all over the world but in Canada it has reached extreme levels. Your affordability charts don’t take into account flat forward interest rates as the best case scenario and potential steep interest rates jumps due to inflation as a high probability scenario. Who is going to bail out the home owners if the rates jump suddenly? Oh wait a minute, everyone thinks this can’t ever happen.

#3 – the decreasing interest rates over the last 30 years effectively transferred wealth from the future generations to the current home owners. The young Canadians still don’t understand this fact and when they finally realize what happened, we will see the principal residence tax exemption eliminated and most likely many other taxes on long-term investments implemented. This is again very bad for the future of Canada.

We can only pray that the politicians finally wake up and start acting for a better future of our country instead of just their short-term gain.

Funny how the price of housing has soared all over the country in an unprecedented manner. Did building regulations get tougher across the country all of a sudden?

I do think provincial and federal government policies are responsible for inflated housing prices, but probably not in the manner this person thinks.

for all it is worth common opinion I get from people writing the owner builder exam

Oakland’s seem extremely volatile.

Three blocks away Mrytle sold for $927,000 yesterday with a three-bedroom suite.

Market is simply all over the place.

KS112: Absolutely agree that it is a shitty deal. But it no longer surprises me.

From: https://www.cbc.ca/news/business/analysis-real-estate-bad-things-1.6009035

Governments may be afraid to use the fiscal policy hammer to slow the market, but they just might take a hard swipe at realtors (for easy political points) to play for the frustrated voters trying to buy into the market. It’s unlikely to have a substantial affect, but If it does anything, it may be funny to watch realtors complain about government leaning into how they conduct business (making things difficult and awkward) because I doubt any real anti-trust rules or data transparency will come out of the effort.

Lol… The cost of writing a letter saying how much you want the place and need it for your family.. Not the best negotiation tactic (simply says, look these suckers are desperate, let’s run it up some more). Good on these folks for walking away.

Barrister relative value wise it’s a shitty deal imo.

James: Does this really surprise you?

Barrister, that upper Douglas area is going to turn into East Hastings in Vancouver the way this is going. Government bought another hotel there for the homeless.

Seriously?

To end the month.

Two more of my neighbours are looking to move out of Victoria. Two friends have recently sold. It seems that a number of people feel that the city core is less than desirable. I wonder if this is just coincidental or is there a growing feeling that downtown is simply slipping? For my friends it does not seem to be driven by Covid.

“It seems that most people I know who are in their first home in the 1 -1.4MM are looking to move up to a bigger and nicer home in the 1.4 – 1.7MM range, but there just isn’t much out there in that price range that qualifies as bigger and better even at the best of times. It’s like their is a missing middle of quality larger homes in the middle price range with most bigger and better homes built in the last 20 years going for 2MM plus, we just bit the bullet and bought a nearly new home and are glad we spent more then originally planned.”

Yes I agree it’s a tricky price range. Interesting point about reaching a bit to get out of that zone. I’m afraid it might be either that or try to renovate a fixer upper with enough space.

Seems like the 1635 priced it at what they thought was market after someone way overpaid for 1575. Now they are trying to start a bidding war since pricing at “market’ didn’t work. Good luck to them, I think they have the better house out of the 2.

Hi all. I’ve watched this site on and off for years, including when we bought our first home a decade ago (at a price we thought was totally exorbitant at the time). Now we’re hoping to find a larger home closer to kiddos’ schools, however we’re facing the same issue as a lot of people that there are hardly any houses in the areas we’re looking at.

‘

‘

‘

It seems that most people I know who are in their first home in the 1 -1.4MM are looking to move up to a bigger and nicer home in the 1.4 – 1.7MM range, but there just isn’t much out there in that price range that qualifies as bigger and better even at the best of times. It’s like their is a missing middle of quality larger homes in the middle price range with most bigger and better homes built in the last 20 years going for 2MM plus, we just bit the bullet and bought a nearly new home and are glad we spent more then originally planned.

Hi all. I’ve watched this site on and off for years, including when we bought our first home a decade ago (at a price we thought was totally exorbitant at the time). Now we’re hoping to find a larger home closer to kiddos’ schools, however we’re facing the same issue as a lot of people that there are hardly any houses in the areas we’re looking at. What do people think inventory is going to do in the next few months? Isn’t May usually the peak for listings? I wonder how COVID might affect that this year. Thanks for all the great content and discussion.

Elementary-school kids stopping to jump up and down on a discarded couch: must be the last day of April in Gordon Head.

The dumped box springs, mattresses, and piles of knick-knacks are also adding that je ne sais quoi to the neighbourhood.

Watching Kenmore..

1575 Kenmore. Listed $1.08M, SOLD $1.301M

1635 Kenmore. Listed $1.3M, dropped to $1.288M, dropped to $1.088M

Ask $1.15M

Sold $1.128M

Could any one of the realtors tell me what 1661 fell st. Sold for?

Thanks in advance!

$1.425M

Anyone catch the sale price on 2275 Allenby?

Here’s an idea: Why can’t the buyers pay their agent to find them a house and negotiate a price? They hired them, they should pay for their invaluable services, why should the seller pay both commissions. That could encourage more fee negotiations and lower commission rates.

So a client wants to see a place and the agents tells the client I won’t show you because there is no realtor on the other side? I would fire that realtor on the spot.

But California is doing a lot better than the US average. US had 59K. So Canada is doing worse than the US per capita but not a lot worse. Keep in mind that although the US is well ahead of Canada in vaccinations, the rate varies a lot by state, and the number of doses per day is now declining.

https://ourworldindata.org/us-states-vaccinations

Canada as a whole isn’t much better. Canada (pop 38 million) had 8,500 cases yesterday, that’s 5X the number in California (pop 39 million, 1700 cases, double the testing rate of Canada)

The spread is pretty interesting. We could end up dropping a lot. Given Spain and Ireland at the top which crashed shortly after, very high rates may not be a good thing

As far as I know a lawyer doesn’t receive the buyer’s agent split of the commission, unless they are also a real estate agent of course.

You also have the issue of sellers’ agents refusing to show without a buyers’ agent as Marko has described. Protecting their turf you know.

Agreed. In the end we need to unleash the market developers to work in parallel. Broad upzoning + near free financing for rental projects may be enough to get rental to compete with ownership builds

I don’t see it as practical. Not clear we want to push all rental into certain zones, and problematic to essentially downzone properties. I think we are better off doing broad upzoning. It could start with rental upzoning first to get it off the ground fast.

One thing I’ve never understood is why people don’t use real-estate lawyers instead of real estate agents for buying (or even selling these days). You could pay the top real estate lawyer in Victoria their top hourly rate and still save 10s of thousands of dollars if they gave you a cash back on the commission.

From a regulatory perspective, they can do everything a realtor can do, and they’ve got much better liability insurance if they screw up. 🙂

BC now allows rental-only zoning. Any municipality can zone for increased density with the restriction that only rental construction is allowed. Curiously municipalities don’t seem to be taking up the offer. Vancouver seems to be going for upzoning with a given number of affordable rental units, which is not the same thing.

Alberta is a COVID shit show right now.

The City of Calgary currently has more active cases (8,962) than the entire province of British Columbia (7,996).

Solving the single home problem could be a simple as buying a printer: https://www.theguardian.com/technology/2021/apr/30/dutch-couple-move-into-europe-first-fully-3d-printed-house-eindhoven

That’s a good idea. But inefficient for government to be the ones buying and selling lots. The same could be accomplished by allowing a land owner to pay the govt to upzone his land, on the condition that it stays upzoned. Then the govt gets the same revenue from the up zone , but doesn’t need to setup a bureaucracy buying and selling land.

What doesn’t make sense is the government upzoning land for free. That seems like a reward to speculators sitting on land waiting for up zoning. If Victoria announces that every lot can be a duplex lot, for free, (as Vancouver has done https://vancouversun.com/business/local-business/making-room) they’re missing out on revenue by not charging someone to upzone. The amount charged could be a “discount to increased value” similar to the one you propose above. The advantage being that existing SFH lot prices (including tear-down house prices) would likely fall, and government would get revenue from the upzone fee, instead of it all going to the speculator. If over time, 5,000 lots get upzoned, and they pay $50k to the city to do it, that’s $250 million revenue to the city, instead of money to speculators or lucky SFH landowners.

Thanks Leo. This blog has helped me with decisions over the past. To that I am grateful. Marko has also been helpful even though he hates my letters! Thanks Marko 🙂

Just buggin ya 🙂 Congrats on the house!

People are paying these fees listing $1.1 – $1.2 million homes for $899,900. If I was a seller I would try to negotiate the commission in a scenario where you I am willing to underlist and go for a bidding war as the sale is essentially guaranteed.

I only purchased one place before I become licenced in 2009 but I just went on usedvictoria and posted in the real estate services section “I already know the pre-sale unit I want to purchase at 834 Johnson by Chard, how much cash back can you offer” and I got a reply. Saved $3,000 on the $198,900 purchase in 10 minutes work.

I think the solution to insecure tenure is not to smoke out private investors. It’s to ensure that we have an abundance of purpose built rental housing that is suitable for families in all parts of the city. So that’s lots of 3 and 4 bed townhouses everywhere that are secure tenure and close to transit, schools, etc.

When there’s an abundance of secure rentals available the market for private investor owned rentals dries up. Then we’ll naturally just see less of them.

We could do that pretty easily too and with minimal investment. Just abuse the zoning powers of municipal government. Buy single family lots, upzone them to increase value, then sell the land to a builder at a discount in exchange for building rental townhouses that will then be managed by a non-profit agency.

No worries Marko. I do see your point and appreciate it. I agree that our offer was probably one of the highest. I was trying to be positive with the chances that the letter worked. It has been a painful process trying to secure a house over the last few years, we bid on Shakespeare which went for crazy money, bid on Forbes which went also crazy, so this going for 150k over assessed felt good to get finally. Now let’s hope the market doesn’t crash :)).

Cheers for the conversation Marko. Hope you’re long Tesla shares :))

But Marko, that 39k could be made in one weekend of work or 6 months of work or never right? When things are slow you can go through 20 showings have the listing pulled and get paid zero for your time. So doesn’t it somewhat balance out in the long run?

James, sorry to pick on you. I am happy that you secured a house.

It is just painful to see people wasting the equivalent of Tesla Model 3s on real estate transaction fees believing in non-sense myths whether it be from the buyer or seller perspective. If people didn’t believe non-sense it wouldn’t cost 39k to sell an average home, but they do. commissions may vary

If buyers were smart they would hunt out cash back buyer’s agent but there seems to be zero appetite for that.

I can’t disclose the other offers so by holding back the truth I am actually doing my job. As for telling the buyer’s agent the sellers loved the letter that isn’t lying….what seller doesn’t like an offer above asking? Sometimes way above asking. I would be happy whether a family of 1, 2, 3, 4, 4.2, or 5.7 was moving into my house, assuming they offered me 200k above ask unconditional.

If the buyers use an agent that isn’t 100% honest with them that is their fault. All my buyers I tell them straight up based on my experiences letters don’t work, I send them my YouTube video explaining why letters don’t work, etc., etc.

That being said majority of my buyers write letters in multiples and I often help them edit the letters. After all I am making 1000s of dollars and it is a customer service business but at least they know where I stand on the matter.

It is like open house, 99% waste of time (evidenced by record breaking sales for months on end with no open houses) but if a seller asks me to do it I’ll explain why it is a waste of time and if after the explanation they still want me to do an open house I’ll do it.

I would say if the offers are within a certain narrow $ amount and the sellers are financially set and made out like bandits regardless then maybe a letter would work. But not many people will leave 5k or 10k on the table just because someone they don’t know wrote a letter.

“I am not lying thought. Just omitting the fact it was also the best offer.”

Ok, so you’re withholding the truth and misleading the buyer’s agent. Why? You come across as a fairly straightforward guy on here…I don’t understand what is to be gained by blowing smoke up the buyer’s agent’s ass.

You’re helping to perpetuate something that you claim doesn’t work.

Come on Leo, be on my side hehe.

Valid points. Money talks.

That nice older couple wasn’t born yesterday.

“I said 1000s of offers presented to my sellers, not 1000s of offers presented for my buyers“

Fair. My bad. You’re European. Come on , be nice :))

@marko

Maybe 2 letters were very close

I said 1000s of offers presented to my sellers, not 1000s of offers presented for my buyers.

They loved your letter so much they tried to squeeze more money out of you?

@marko

You raise an interesting point. As a realtor representing the buyer, I thought you would never know what the offers are. Only the listing agent would know.

Is this correct or would my realtor actually know what the offers were?

I’m confused 🙂

“I’ve honestly never seen a letter truly work in my career having presented my sellers with 1000s of offers yet it would appear everyone secures their house via a letter. Something doesn’t add up”

@marko

They asked us to increase our offer as my realtor told me the offers are very close. We did not increase our final offer as didn’t want to go into bidding wars. We ended up getting the house.

When I spoke with the owners, they said the offers were very close and our letter helped in finalizing their decision.

Super nice older couple, so yes, I believe them and trust them.

Was our offer 25k more than the other one? Yes, it could have been….but all I am saying is what they told us.

I am not lying thought. Just omitting the fact it was also the best offer.

“I’ve made so many phone calls this year “congrats Suzy your lovely clients got the house, the sellers loved the letter. They are so thrilled it is going to you a young family.”

So you lie and then complain about how letters are a waste of time on here? Interesting.

If you were the best offer by 25k do you think the owner is going to tell you this, or they are going to tell you that the letter made all the difference?

I’ve made so many phone calls this year “congrats Suzy your lovely clients got the house, the sellers loved the letter. They are so thrilled it is going to you a young family.”

I am not going to phone Suzy and say “next highest offer was 82k lower than yours, congrats.”

Or I’ll phone Suzy and say “we had a higher offer, but my clients loved the letter.”

I’ll omit the fact the higher offer was subject to sale of a home and Suzy’s clients were unconditional.

I’ve honestly never seen a letter truly work in my career having presented my sellers with 1000s of offers yet it would appear everyone secures their house via a letter. Something doesn’t add up.

@marko

The letter made the difference considering the 6 offers were all very close.

The listing agent disclosed the terms of the 6 offers?

No Marko. The owners told us that the letter made all the difference. 5 offers had letters except one.

“And why are fixed-term tenancies disallowed? They protect both parties.”

They aren’t. Vacate clauses at the end of a fixed term tenancy aren’t allowed except as prescribed, because landlords used them to avoid rent control.

If everyone upped their pay, you’d still get the same number who can afford and the same number who can’t. Think about it.

Interesting that you’ve picked your cutoff for “lower income” to be well above the median family income.

Not a direct handout, but our government and the one south of the border look like they’re putting us on the road to higher interest rates. And that would help a lot.

I think a lot of folks are being too absolutist here. Many of the great cities of the world have a vibrant mix of private and public housing (google ‘New York City Housing Corporation’). Yes, governments can and do provide massive amounts of below-market housing in these areas, and help keep neighborhoods diverse. Victoria should do the same. But it’s inevitable that if the housing is actually ‘affordable’ (and, you know, the neighborhood doesn’t decay in the process), the demand will instantly outstrip supply. That’s ok, wait lists for these places are part of life. So you put your family on the wait list, and maybe in 2 years you get lucky and get a place. (Housing co-ops are often like this too, I believe). So – that would suck terribly if that were the only option, but it isn’t – the rest of the demand has to be met by private investors, and will by definition by at-market.

What I’ve always been frustrated by as a renter, and now landlord, is how rigid the rental rules are. You rent a place for a year? You give 30 days notice to move out. You rent for 8 years, 30 days notice. Similarly, as a landlord, notice requirements to vacate are the same regardless of the length of tenancy. This is lousy! If you’re a settled household, you shouldn’t be evicted haphazardly, in the middle of your kids school year, etc. And if you’re a landlord with long-term tenants, you should have the right to specify some more notice, or at least a penalty for a rapid move. And why are fixed-term tenancies disallowed? They protect both parties.

So I think there’s room for both much more public housing as well as much better rules that provide incentives and flexibility for landlords to provide things public housing can’t. This includes rental houses, as well as the whole gamut of options that Air BnB has shown can be successful (short-term, shared rooms, campers, boats, parking spots, etc.).

The listing agent disclosed the terms of the 6 offers?

Just got an accepted offer on a house. Thanked the sellers personally after. The letter made the difference considering the 6 offers were all very close.

It took us an hour drafting it and making it personal so spend time on it :))

Marko, it looks you were right that house sold on Langford for 100k less. Was it a local buyer? Feel bad for the owners.

I wonder how many realtors in town clear 200k plus in pre tax take home pay?

Hah. Here’s one of them:

We’re all pullin’ for you Caddy!

Thanks Alexandracdn & I’ve been watching that Selwyn mod, I thought it would have sold by now but might go see it this weekend. Price is appealing at 599k, 40 years old is not appealing, but I don’t know much about modulars because there’s so few of them so who knows, maybe it’s well maintained.

I’m really excited for the day I get to tell this blog we found something.

Exactly, but if everyone else wanting a house is upping their pay so they can afford one then the ones that don’t will be left behind.

You bet Caddy. I honestly have been looking for you. I wasn’t trying to drum up sympathy for my friends daughter and her husband. They are doing very well. They didn’t purchase the condo outright. They had to get a mortgage on it of course. They probably have some income now after nearly 14 years of payments. But, when it comes time for them to retire, they are hoping that the income from the condo will help fund their retirement. When people don’t have the privilege of a pension plan at work, they are wise to plan as best they can for their retirement. He is quite handy so any painting, carpet cleaning, minor repairs etc. can be performed by him. Everybody is not comfortable with purchasing stocks or mutual funds so they have to think of some other way to fund their retirement years. I give these kind of people credit. They probably will never have to apply for the “seniors supplement” or take advantage of the Safer for renters.

p.s. there is a modular 3 bedroom home on a nice piece of property in Langford for sale. It is well within your price range. I don’t know much about them. I think they are well built in that they build each room separately in the factory and insulate the walls. Then they deliver the “rooms” to the property and the house is assembled from there. I was in one in the summer off Admirals road many years ago and I found it quite hot. But the house does look very nice and the property its on will go up in value.

“This is what I have been saying to people since I started posting here but it is also a tough thing to do since it is human nature to just become complacent working in a comfy/secure job.”

There’s also the happiness vs. ambition vs. pay conundrum. I’m sure I could make more money if I wanted to, but that would involve trading off the things I currently enjoy about my position, for things I don’t like (sitting in endless meetings, for example).

From my perspective, it wouldn’t be worth taking a position with higher pay to buy a house if it meant being unhappy. Contrary to what others might believe, the joys of homeownership are unlikely to make up for spending one third of your time being miserable.

Cadbro, I think that is the exact issue because if your income doubled then this problem wouldn’t exist. the fact of the matter is that over the past 5 years there is a rush for real estate in Victoria (along with other parts of Canada) and it pushed the price up and reduced the amount of the population can afford it. People are spending more and more of their income on housing but for right or wrong it comes down to supply and demand and when demand exceeds supply people are going to be left out.

What a twist on empathy Alexandracdn. You were just trying to drum up sympathy for your friend’s kids who are landlords, but I’m supposed to look at everyone who makes less than me to feel better about being priced out? I rally for those beneath us too, because we do make more than the average greater Vic family.. and we’re even priced out of townhouses now. Stratas of $250-450 must be included in affordability calculations.

For the record you’ve posted some under priced townhouses and small homes a couple of times, and I’ve followed up here with their sale prices showing how much over-ask they actually sell for because we’ve been to some and I follow the rest on PCS. I appreciate that you feel for us but it still is a bit out of touch. One of us is on parental with full top-up (thanks union jobs) so there’s no additional money to be made at the moment by returning to work. Our income isn’t the issue IMO, lack of affordable entry level housing is.

This is what I have been saying to people since I started posting here but it is also a tough thing to do since it is human nature to just become complacent working in a comfy/secure job. Quick google search for 100k jobs currently hiring below:

https://ca.indeed.com/$100,000-jobs-in-Victoria,-BC

Caddy, I would be so happy if you and your family were able to purchase a nice single family home in the Victoria area. But you are smart and you know this is likely not going to happen.

From what I can remember about your posts; you and your spouse are both university educated and that your spouse is currently working and you have opted to stay home with the children. You also have a considerable amount of funds saved. Enough that you would qualify to purchase a home for around $650K?

I doubt you are going to be compensated or helped out in any way in the near future by the Federal or the Provincial governments by ensuring that your dream of SFD ownership in the Victoria area will come to fruition. The thing is, you could go back to work and increase your family income, you could move another province and purchase a beautiful home there or you could purchase a townhome in this area. You have options. To many living in Victoria you and your spouse are part of the “fortunate ones”. Just as you look at some of us who have what you want (after a lot of blood, sweat, tears and years to get there). They, “the others” look at you in that same way. They will NEVER have the opportunities that you have.

What is drastically needed here in Victoria and in many parts of Canada is help for the homeless. Assisting low income single parents and their children find safe, clean and stable accommodation. Next would be to build affordable and suitable accommodation for couples and families who are in the lower income bracket. i.e. say making less than $125K per annum. There are a lot of couples out there, both working at jobs at a gas station, Walmart, a dress shop, a coffee shop etc. and receiving $15-$20 per hour each.

Not everybody in this world is capable of achieving academically. Life is not fair. We are not all dealt the same hand.

“Communism does not work last time I checked.”

Last time I checked, communism was a dead ideology. Using tax policy to discourage/encourage behaviour has absolutely nothing to do with communism.

“And probably only 1 in 100 of those actually have the leverage to make that demand to their employer. It all depends on if there is a net benefit to the employer, if not they will not hesitate to show you the door if you make that demand and they deem you replaceable (which almost everyone is).”

I think you are right that the number of employees who could make that demand if an employer is dead set against it and be successful might be low but the type of jobs that have been done successfully from home tend to be professional level jobs where employees have transferable skills, job options, and often tight knit professional relationships outside of their current employers. I think the conversation would be more along the lines of an ask, not demand, which if not met would result in the employee starting to seek out an employer who would accomodate them.

Seems to be working fine in China.

Yes the Fraser Institute, a bastion of non partisan think pieces.

They can, just stop subsidizing housing with my taxes.

How many snowbirds own property throughout the southern U.S. and other countries like Mexico, Costa Rica, Belize, the list goes on. Are they depriving millions of impoverished people from owning a home? Or are they contributing the economy, keeping some people employed. There is massive inequity in the world, get used to it. If you can’t afford to live somewhere, move to somewhere else. Removing the rental housing would create more buyers and drive prices even higher. The government cannot solve this problem, you’re dreaming if you think they can.

For those of you on here that love numbers and statistics you may want to read:

The Fraser Institute “Comparing Government and Private Sector Compensation in B.C.” It is an enlightening read but keep in mind the results of the study were written in 2015.

Agreed Patriotz. I should have read that more carefully. I do note that a lifetime capital gains tax exemption of 100k applicable to rental property was passed before this change was made. I guess what you’ll get if this happens today with no exemption limit is people not selling at all and transferring assets to their children prior to death through the use of trusts and other mechanisms.

We have a shortage of rental housing. Until this is addressed, the private owners of rental housing are also providers of housing to those who would not otherwise buy and this is a necessary thing. Not everyone renting wants to live in an apartment either. Why should renters be relegated to condos?

You’re not reading that properly. What they did was increase the inclusion rate to 66% for any sale from Jan 1, 1988 onward. That inclusion rate applied to the entire capital gain. There was no pro-rating.

https://www.canada.ca/en/revenue-agency/services/forms-publications/tax-packages-years/archived-income-tax-package-1988/british-columbia/5010-s3.html

My personal experience is you need a large income (often requires hard work) to qualify for investment properties. You can’t pick up investment properties just on the basis of them cash flowing neutrally.

I am aware. I plan accordingly. As do most people I know. The “retroactive change” was only to the same tax year in 1988. That is fine and could happen again imo as you are dealing with almost no gain in most cases over a three-month period. Past gains from prior years were not affected and anything more than the same tax year is going to be problematic from a fairness perspective imo.

Sure does. But you are creating a bogus connection between being a “true hard worker” and being a landlord.

Are you aware that the capital gains inclusion rate has been changed in the past, without any such adjustment? Don’t you think any investor in taxable assets should be aware of this and plan accordingly?

https://www.timescolonist.com/business/kevin-greenard-capital-gain-inclusion-rate-could-change-quickly-1.24274691

Exactly.

On the other hand, shelter is pretty important if it is going to be unaffordable to own a SFH in some areas we need alternatives. Ex. the Netherlands has a load of social housing – a full 35% of the housing stock – plus a very significant rent rebate program based on income and family size – and it is pretty normal to rent forever. Private investment in housing is encouraged by the government as well through widespread rent subsidies – about 40% of tenants get them. http://www.cahdco.org/dutch-housing/

Who does that? Literally no-one who owns a rental property is saying this that I’m aware of. Everyone knows what happened in the past might be modified by tax policies. You deal with what is and adjust as things change. Just like with investments of any kind. Or changes in the economy or housing prices – if it is not in your control and legal it is up to the individual to accept or lobby for change. If it is a widespread issue government should prioritize it.

Marko you are describing the union workers at government, most of whom are priced out of the SFH if they don’t already own. I don’t think this is “punishing”, the carpenter is making an investment for his future, no different than someone who worked their ass off saved and bought a taxi license 10 years ago thinking that is their retirement plan. Due to government policy (accommodative in this circumstance) to let ridesharing in, that $1M taxi license is essentially worthless today.

Changes in government policy is a risk inherent in every investment, that is just a fact of life. Sometimes they go in your favor and sometimes they don’t so the only thing you can do is diversify your investments across asset classes to minimize this.

Hypothetical questions get hypothetical answers. If employers, on average, do reduce their remote workforces, where are these people going to find new remote positions?

You guys do realize not everyone has a government job working 36.5 hr per week with flex days, family days, vacation, pension, etc.

“Punishing” a hard working carpenter with no pension who works 50 hours a week and on top of that purchases a fixer up he or she puts in sweat equity so they can rent it out so they have something when they retire makes no sense to me. Not only is he or she helping themselves but they also help the 36.5 hr a week person by adding more rental inventory.

I am in favour of higher down payments for investment properties and a few other tweaks but punishing true hard workers (60-70 hrs per week) creates market inefficiency. Communism does not work last time I checked.

And probably only 1 in 100 of those actually have the leverage to make that demand to their employer. It all depends on if there is a net benefit to the employer, if not they will not hesitate to show you the door if you make that demand and they deem you replaceable (which almost everyone is).

Pay for the commuting costs of coming to the office, providing child care, ability to set your own hours? lol I would love to see the reaction from an employer when an average employee make these demands.

Where did I say go backwards in time for retroactive taxes? I agree with your suggestions Totoro but my opinion of fair tax law is making changes now going forward. Planning retirement on the assumption your rental property will always be taxed the same as when you bought it is irresponsible. If the government changes the cap gains rate, if interest rates change etc… These investments should not be protected, they can always be sold.

Your suggestions on how I can get into the market are already being explored by us but as the above article points out, 5(!) Affordable homes available in this city is appalling. There are more than 5 families like mine.

That’s a good point. Mom n pop landlords make for “lousy rentals.” And this has contributed to BC becoming the “eviction capital of Canada”. https://thetyee.ca/News/2019/11/26/BC-Eviction-Capital/

Yet we have people here advocating things like more zoning for basement suites and garden suites which will just lead to more “lousy rentals” and evictions, subject to the whims of the landlords. Government should focus instead on incentives for purpose rentals, as they provide long term “eviction safe” rentals, which are a solution for many.

To address this, how about a tax penalty for selling/buying a home of any kind that involves evicting a tenant living there? Including a principle residence with a basement suite.

Yeah, punishing people for following tax laws by changing tax laws retroactively is in no way “fair”. If there are going to be changes to the capital gains inclusion rate they will likely not be applied to past gains, only to future gains. The reason for this is that the law says that people are entitled to plan their lives and retirements in accordance with current rules and have notice of changes so they can adjust. Those with a lot of assets or income are or will already be liable for a lot of tax.

For you, fair seems to be stopping people from owning a second home because you are not able to afford a first one. I would suggest that the answer to this issue is not punishing those who own a second home in accordance with current tax law, but approaching the issue from all angles. That may involve changes to the capital gains rules going forward (but not back), government investment in affordable housing, changes to zoning to encourage townhouses/missing middle, restricting foreign ownership, and your own personal adjustment to changes such as:

I would be looking at all of these options for secure housing if in your shoes today.

I would suggest that expectations need to adjust to changing circumstances and this can be difficult. My parents’ generation had it easier than I did in many ways. Land was way more affordable. Education was relatively less expensive. They needed to earn less when adjusted to todays dollars to have a better quality of life in many ways – particularly for home ownership. Objectively, I could have done so much better financially had I just been born earlier.

As you age your net worth will rise if you plan and work for it. You shouldn’t be punished for planning and working for it or for benefitting from it. At the same time, it is a failure of all levels of government not to build enough affordable rental housing over the years, or to have a coordinated approach to housing.

Sorry but owning a rental property is completely different then owning stocks. Land and housing is a finite resource in urban areas, when someone owns multiple properties they are squeezing out other buyers with less resources. I believe at some point in the future the market may will take care of this when interest rates rise and or housing prices collapse and rentals will be put back on the market but until then the government should step in which I believe they will do in the next few years based on information I have heard

Agreed. And it looks like Canadians are “hooked” and plan on sticking with remote work

https://www.bnnbloomberg.ca/1-in-3-workers-would-seek-new-job-if-asked-to-return-to-office-full-time-survey-1.1586644

“ One in three remote workers would quit their job and look for a new one if their employer asked them to return to the office on a full-time basis, a new survey has found.”

Right, and it’s not just limited to lumber. There are widespread shortages of many products throughout the world, as we are at a point with surging demand exceeding supply. This is expected to last until the end of the year (at least) and should raise prices of many things. Including food, computer chips (and related technology products including cars). And a ripple effect – Used cars prices for example have risen 20% already because of a shortage of new cars because of the chip shortage. This should show up in inflation numbers and put upward pressure on interest rates.

If an economist was describing the ideal conditions to produce inflation, it would be zero interest rates (✓), huge money printing (✓), and this global surge in demand exceeding supply (✓). Buckle up!

https://www.nytimes.com/2021/03/06/business/global-shipping.html

‘I’ve Never Seen Anything Like This’: Chaos Strikes Global Shipping

The pandemic has disrupted international trade, driving up the cost of shipping goods and adding a fresh challenge to the global economic recovery.

I judge. My family works just as hard as this one (probably harder, seeing as how part of their "income" is just owning property) and we can't buy a home right now because of actions like this. What is a retirement fund for one family is a decrease in available supply for another family to purchase to live in. Mom & pop landlords drive up rents by snapping up available entry level supply. It's also precarious housing for renters, because the owners (or their kids) can move in anytime with just 2 months notice, uprooting the renter family, as happened to us last year. Landlording like this is being the middle man of a resource everyone needs, supplying housing to people who could have otherwise bought it but have been squeezed out by opportunists seeking rent money.

But who cares about judgment, people buy property because it makes money. They're not going to stop on moral grounds when they're bringing in 8% appreciation per year and paying paltry taxes on their gains. But they should be prepared for taxation and policy to change to address the housing imbalance.

I have sympathy for families with high costs / no pension and own 1 home, or 0. The sympathy ends when you own 2. "Punish" them with fair taxation to make this less lucrative until other hard working families can own something to live in too.