April: Hot or top?

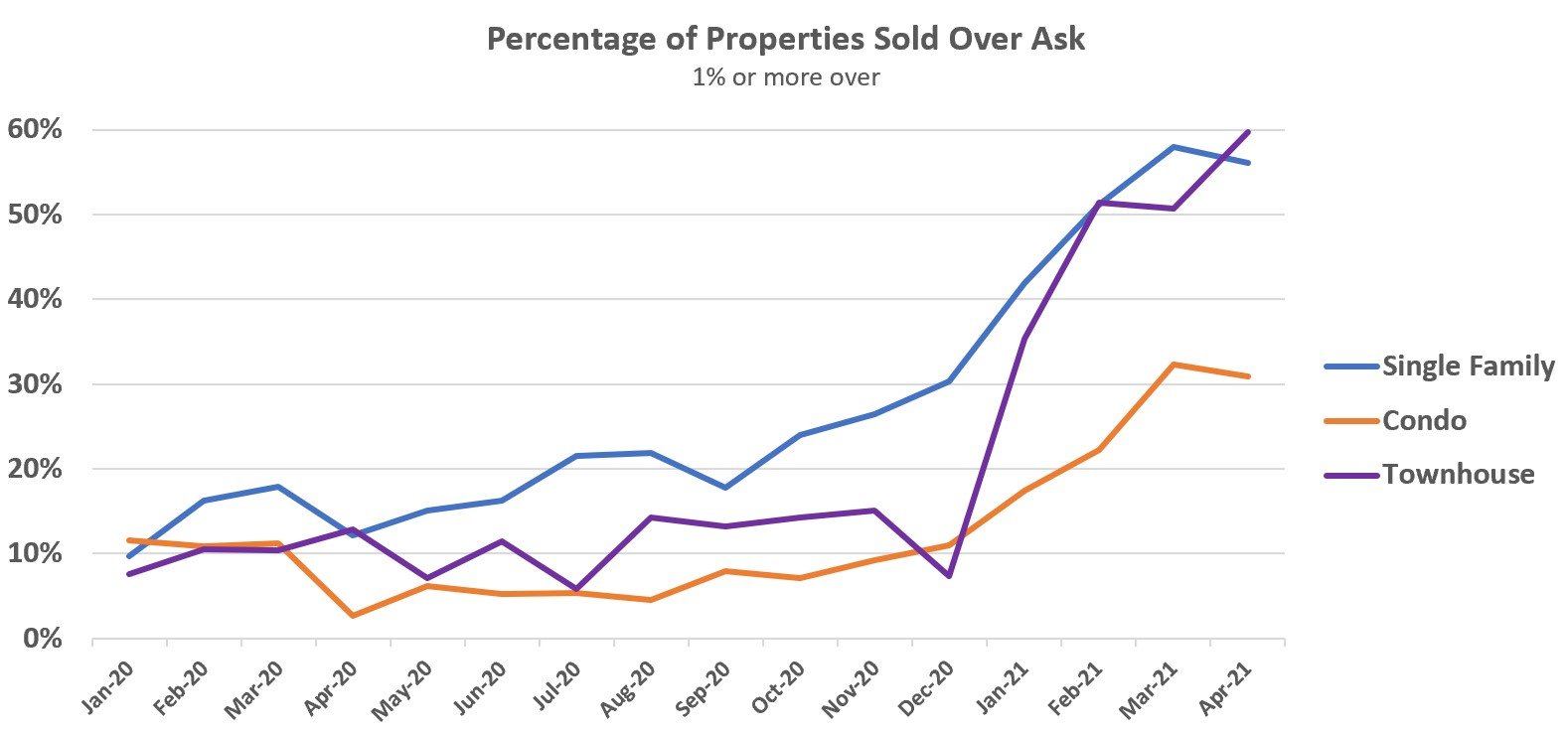

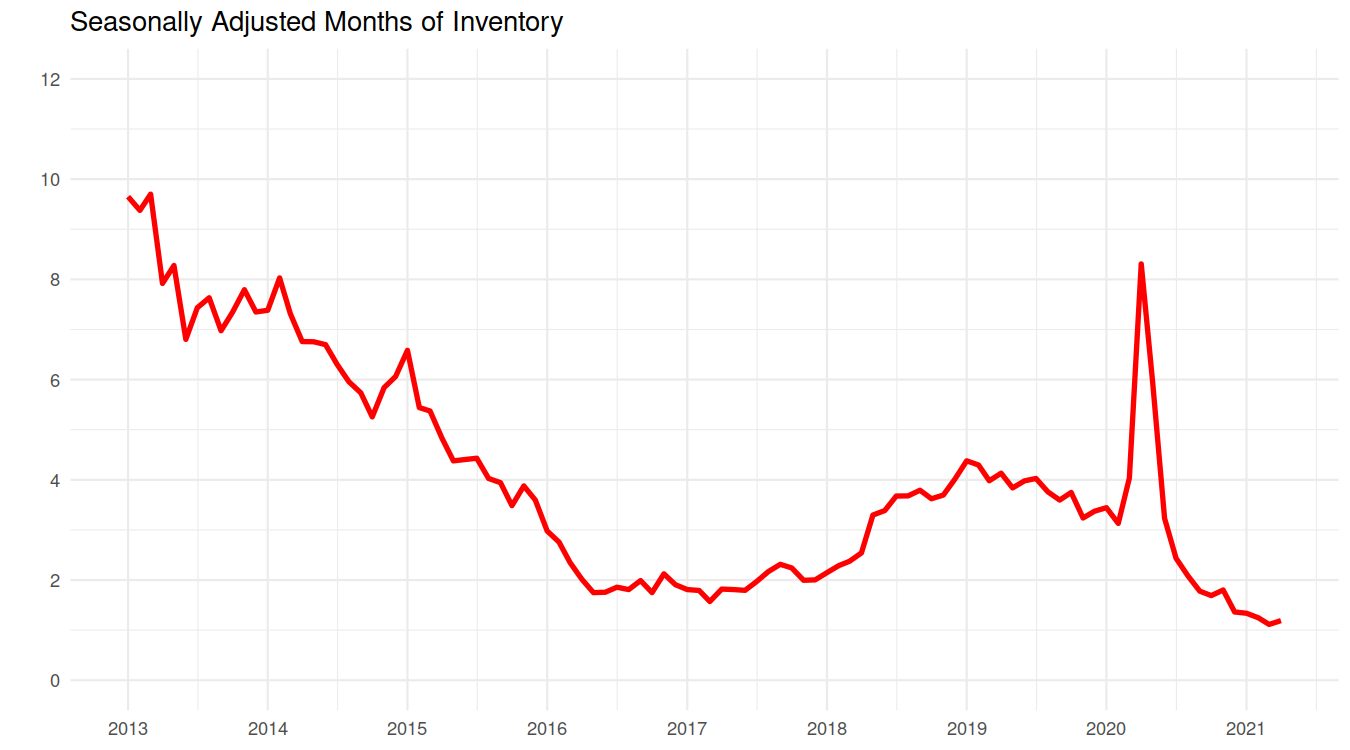

The 1116 April sales were nearly 4 times last year’s total, and well over half of houses and townhouses went for over their asking price. There was a mere one month of residential inventory, which is a scorching sellers market by any measure. There will be many excited headlines in the news today about real estate. And yet at the same time the small signs that the market has topped out and is starting to slow have also increased. Let’s see what the month looked like in numbers.

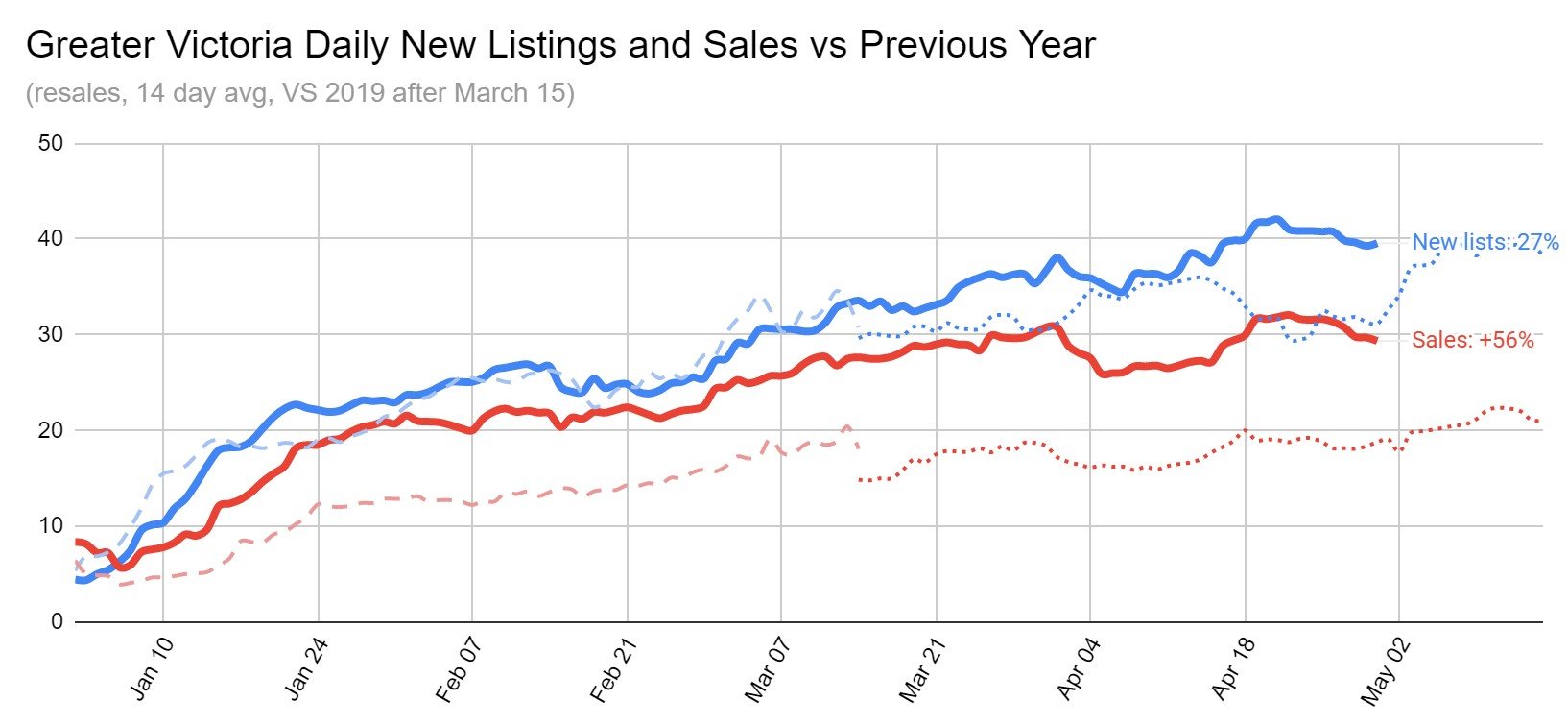

The month started with a gap finally beginning to open up between new listings and sales that we hadn’t seen all year.

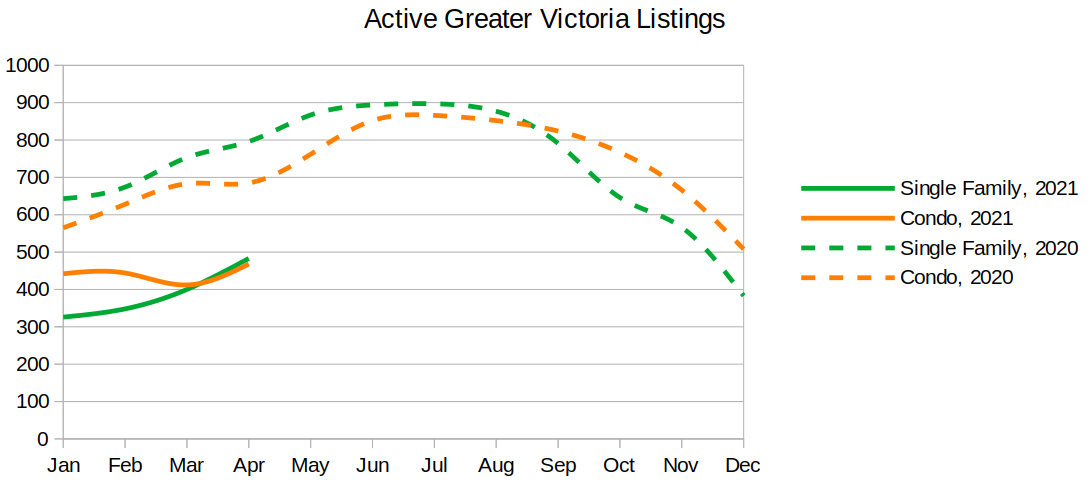

Sales still remained exceedingly strong, but it was enough to allow inventory to build a little bit for the first time. Both single family and condo inventory increased somewhat in April.

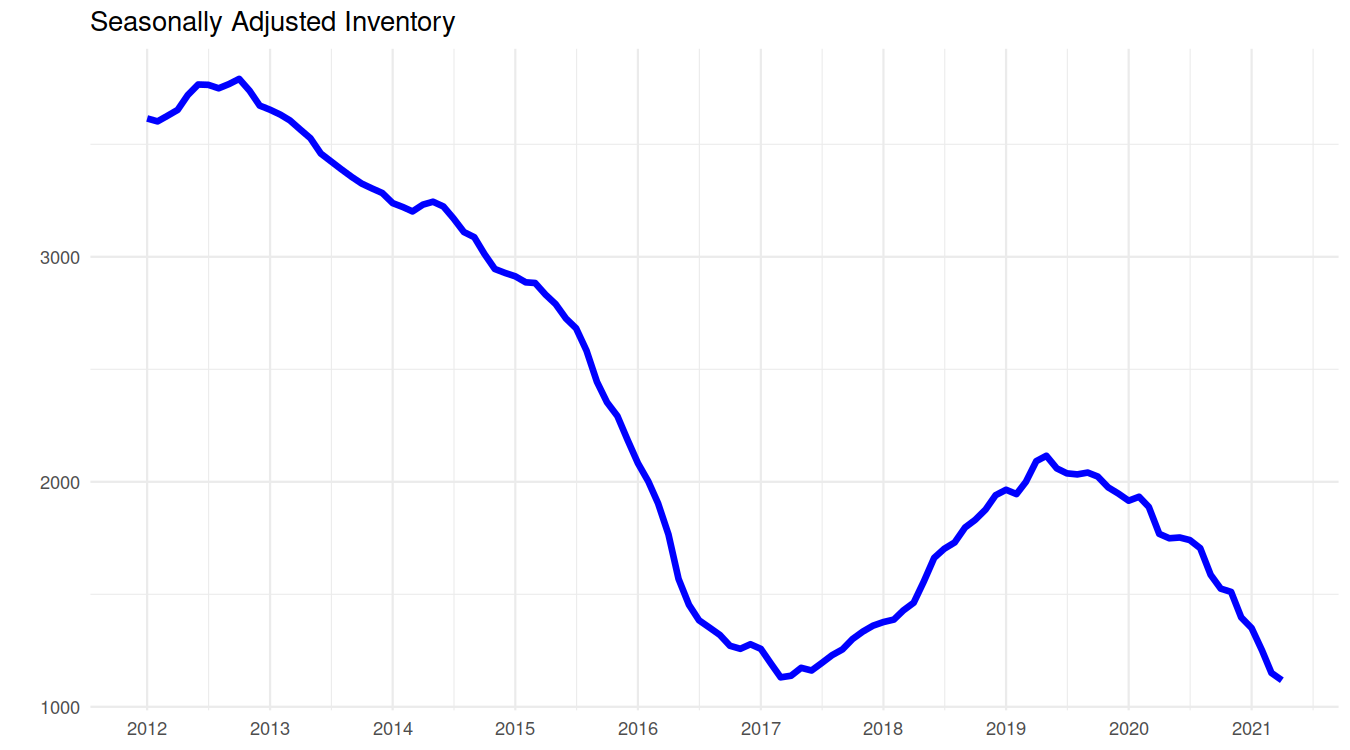

However, while the small climb in inventory in April was a heartening sign for house hunters, it was still not as much as we would normally expect this time of year. Seasonally adjusted, inventory continued the decline it’s been on for 2 years even if it was a slightly slower pace.

As mentioned, bidding wars remained at extremely high levels, with 60% of townhouses (the only semi-affordable family-suitable housing left) going for over the asking price. The over-ask rate for detached houses and condos both declined somewhat from March.

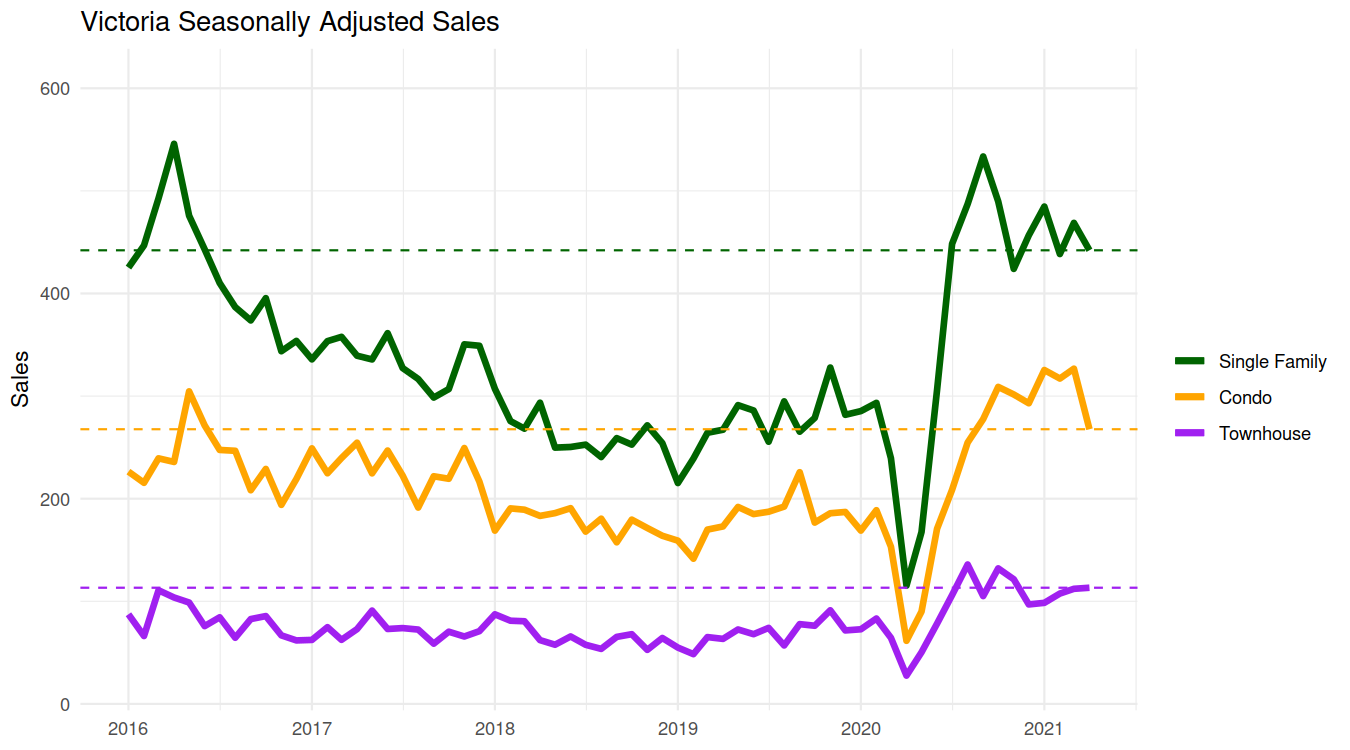

Sales for townhouses and single family homes remained near all time highs, but surprisingly condo sales fell back somewhat from the level we saw in the last few months.

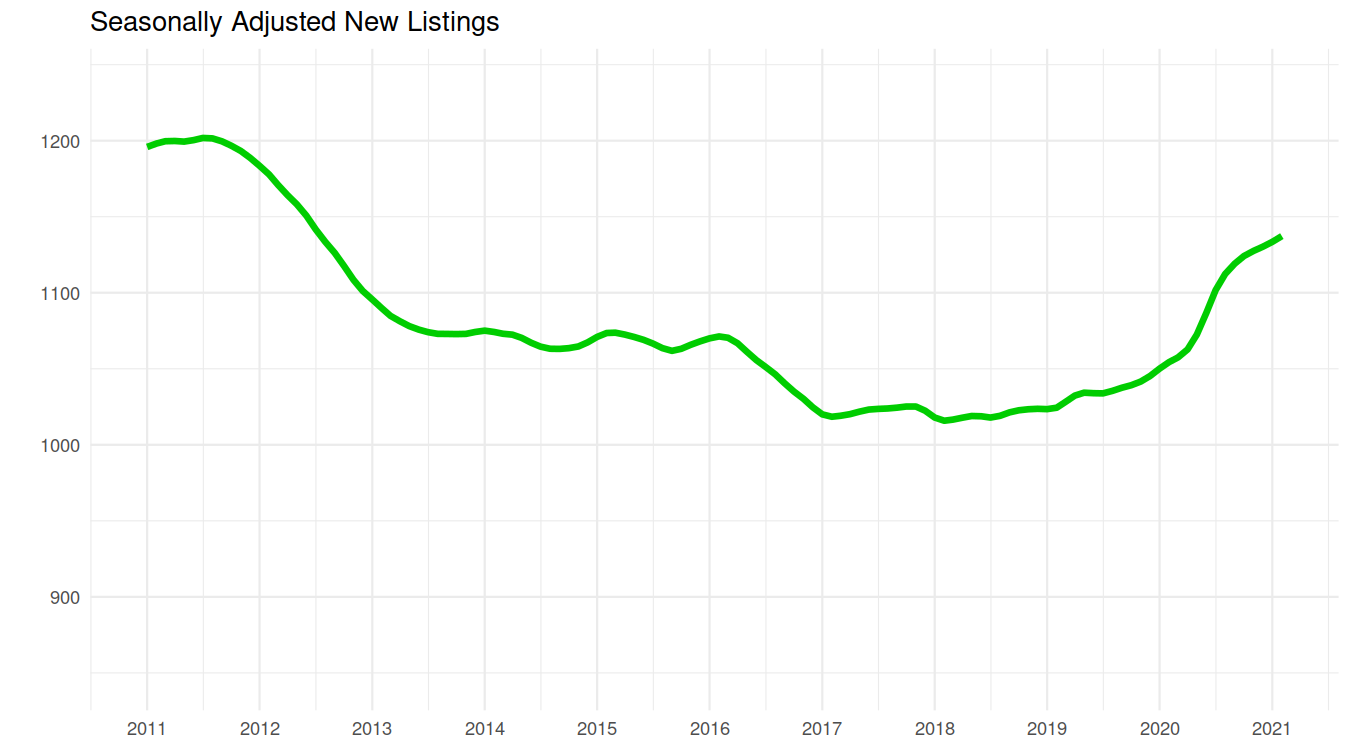

New listings are continuing to respond to the increase in prices, with another increase in April. New listings don’t move a whole lot over time, but it’s a respectable 10% higher than April two years ago. That’s mostly come from condos, with April new lists up only 4% from April 2019 for single family (-1% year to date), while condo new listings are up 25% (+30% YTD).

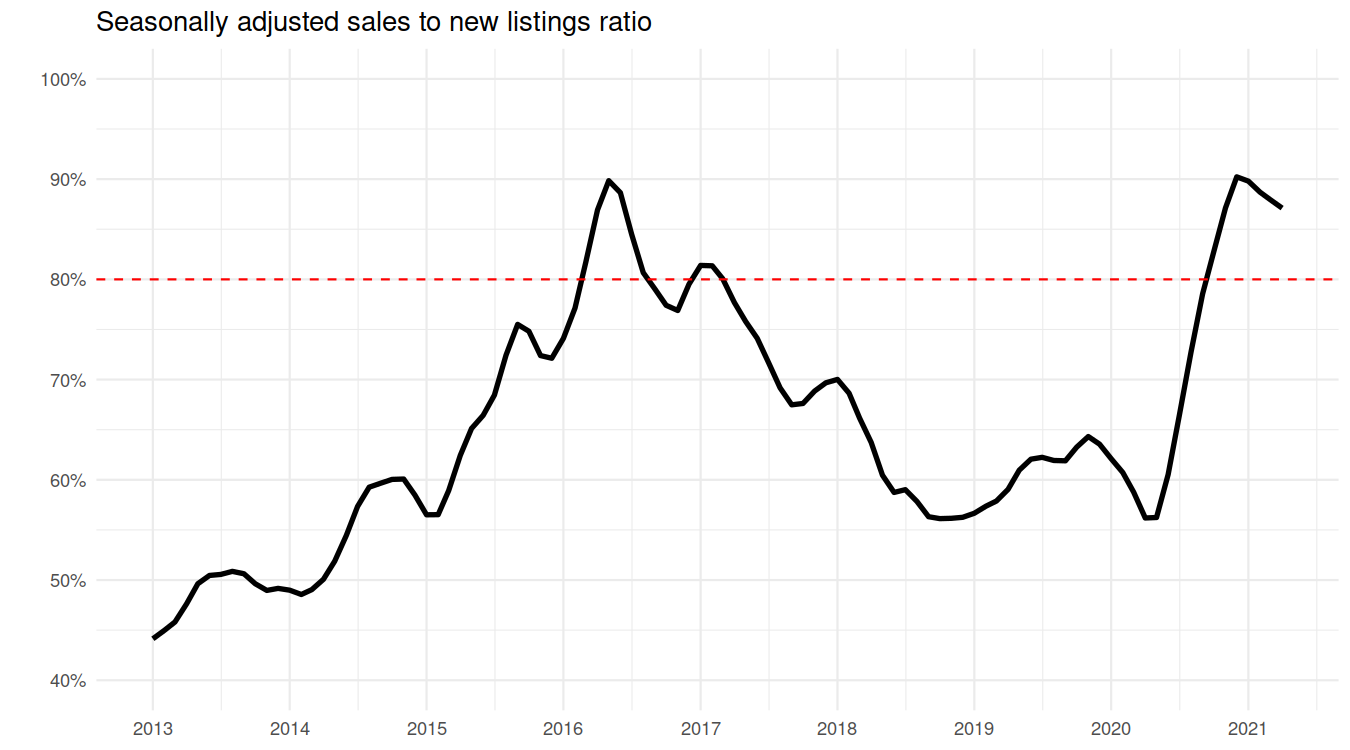

The sales to new list ratio remained firmly in overheated territory, but has shown a small decline the last few months while the months of inventory posted a teensy uptick in April (could well be noise).

Single family average prices have stayed between $1.1M and $1.2M this year, but that’s mostly due to noise. The 6 month smoothed median price continues to move up while median prices for townhouses really jumped in April and condos also continued to move up.

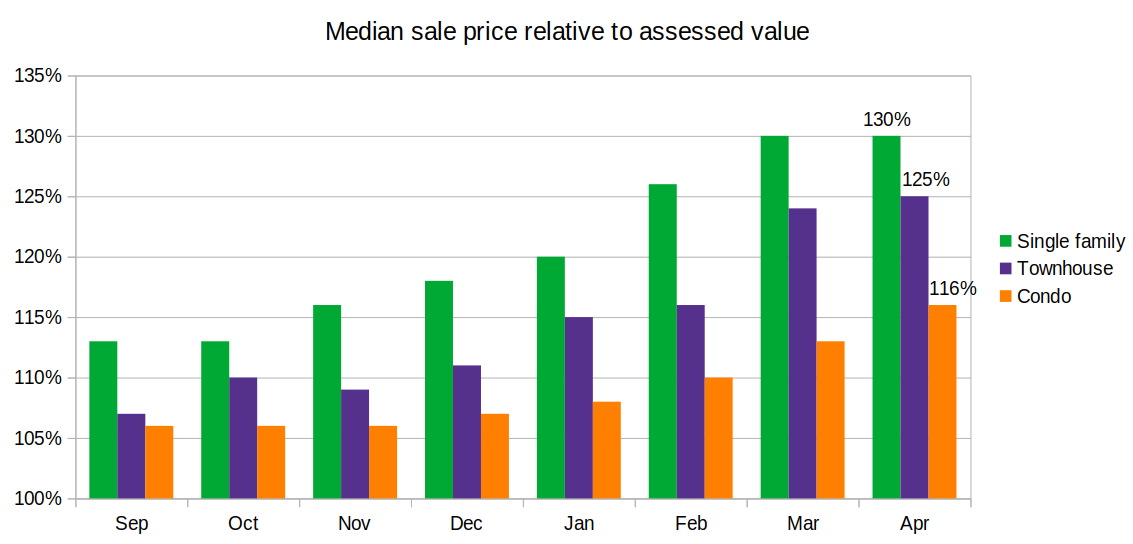

When measured by the sales to assessed value ratio, single family did not record an increase for the first time since last October. Townhouses were also pretty flat month to month after a big jump in March, while condo prices kept increasing.

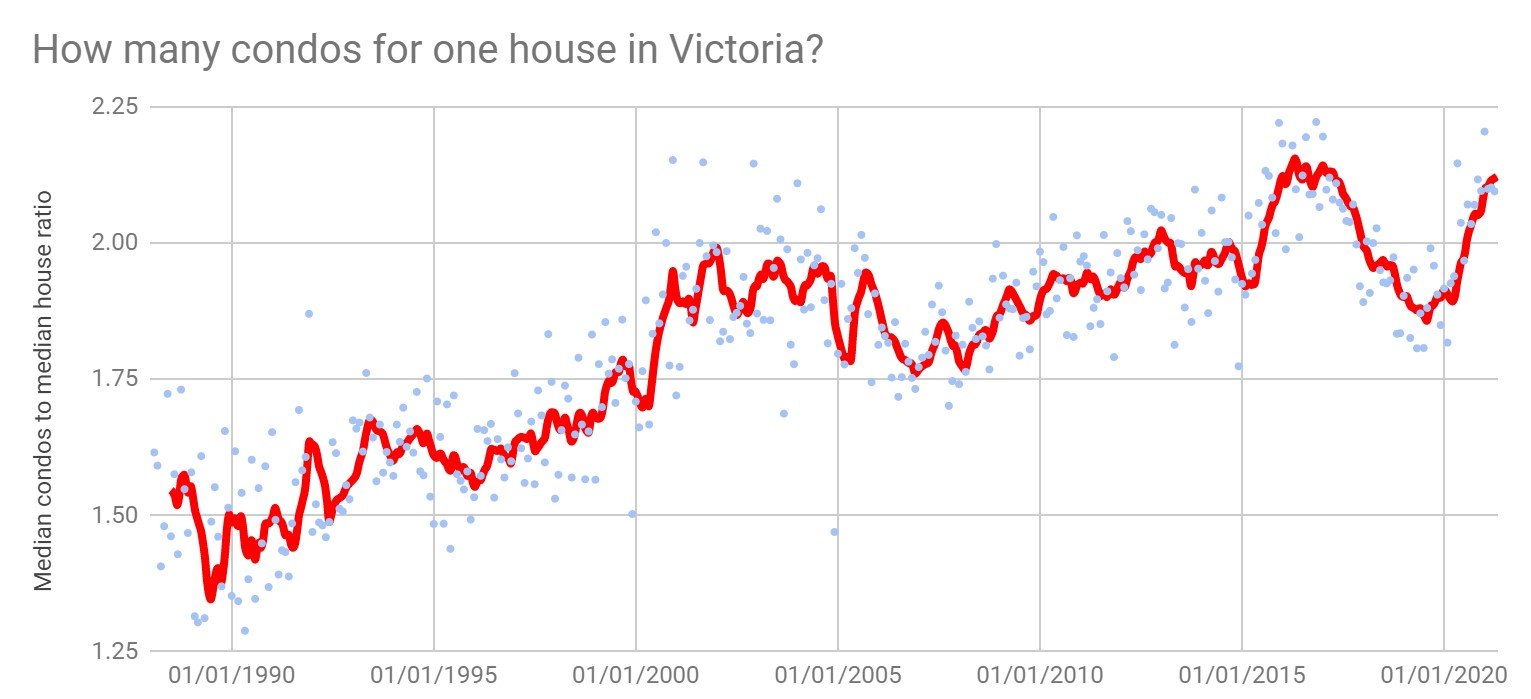

After single family prices ran away from the market in late 2020, condos have made up some of that ground with large price gains in the last few months. Still the relationship between the two may equalize a bit more looking at the long term trend.

My take

The market unquestionably remains red hot, but there are enough small cracks that I think this may mark the start of some cooling off instead of the relentless heating we’ve seen in the past year. From individual sales it seems the pool of buyers is more shallow than it was. Tons of places are still going over ask, but occasionally some will fail to attract offers despite seemingly being relatively good value. Part of the problem is that determining market value is difficult in a market as tight as this. Did the last comparable sell for market value or was there an irrational bid involved? When looking at the spread of sales relative to assessed value, it’s a lot higher now than in a slower market like 2019.

Two months ago I thought we don’t have much more than another two months of the overheated market ahead of us based on previous market behaviour. We’re there now and still super-hot, but I still think we’re going to see cooling soon. Vancouver and Toronto is showing a pullback in activity in their stats, which means we shouldn’t be far behind if the unusual national synchronization continues that we’ve seen during the pandemic. In June we get a tightening of the stress test which should further constrain some borrowers on the margin. Impossible to say how fast the pullback will be, but in the past when sentiment turned it was fairly abrupt (in market activity terms, any impact on prices is usually very slow).

Many people have floated the theory of the roaring twenties as we come out of the pandemic and are expecting the roaring real estate market to continue. The idea is that after a year of staying at home doing nothing, the public will jump back into social activities and spending with a frenzy. That may be for restaurants and travel, but I see no reason it would extend to real estate. In fact I think we’ll see a housing hangover as the money that had been redirected to housing flows back into consumer spending. You can’t have pent up demand when nothing has been pent up, in fact quite the opposite as the pandemic brought a lot of demand forward.

Have never seen a paper that says northern dams behave like tropical ones wrt GHGs. If you find one post it.

New post: https://househuntvictoria.ca/2021/05/10/employment-and-other-updates/

Statistics Canada considers a house to be an investment!

No we didn’t end up viewing the Selica modular, felt like it should have been cheaper for what it was. Glad someone didn’t pay way over.

Why inflation numbers don’t reflect Canada’s red-hot housing market

You read all of it?

Because there isn’t really anything unique about the temperature stratification of the water column w/r to tropics vs here, which was the main factor.

Wasn’t that a dressed up double wide trailer?

I see 340 Selica just sold for $615K, which was around the original asking price. Did you view this property Caddy? I know you said you may look at it.

I actually see some sales picking up in the past couple days, still all over the place. Not sure if u can consistently get a suited sfh with some updates on a normal sized lot for under $1m in sannich yet.

Leo, we start to see some 900K sale prices, although neighbouring may stay at 1.2M ask. What is your best guess on price movements in the second half of the year? Thanks!

1635 started at $1.3M and dropped to $1.088M

1591 was listed at $899k and sold for $1.075M

I thought there was another recent sale around 1583 address (might be a house or two off left or right). This would have been the one listed at 1.3M then dropped down to 900-something if memory serves.

Do you mean 1635? Accepted offer, conditions off on the 10th

Anyone know sale price of 1583 Kenmore? Curious how it shook out relative to the eye watering sale price of 1575…

Calgary’s real estate market turns red hot, prompting bidding wars, rising prices

https://calgaryherald.com/news/local-news/only-the-strongest-make-it-through-as-calgarys-real-estate-market-turns-red-hot

And a case of a letter beating out a higher offer. Based on Marko’s experience, I wonder if that’s what really happened…

To get an edge up on the competition, they included a family photo and a story about themselves and their two young children, three-year-old Warner and eight-month-old Griffin.

“That was the deciding factor,” Nick said. “The house has a wood-burning fireplace and our realtor told a story about how we were looking forward to Christmases around that fireplace. We were actually not the highest offer, but that was what did it.”

Perhaps the retirees should read about the area first. Tofino is one of the most at risk communities on the island.

https://tofinoresortandmarina.com/tsunamis-and-the-big-one-a-tofino-history-lesson/

https://www.citynews1130.com/2020/07/22/earthquake-tofino-massive-shaker-alaska/

$930k

How much did 2508 Shakespeare go for?

Perhaps inflation is a contribution factor in the current rise of lumber price, but it came as a bit of a shock for me when I had to pay $9.65 per 8′ stick of 2×4″ yesterday at Home Depot.

I don’t know patriotz, why don’t you tell me?

I’m not a Vietnamese citizen, and is a proud tax paying Canadian citizen for more than 4 decades, so like the rest of the foreigners I can’t buy property in communist Vietnam. And, I’m sad to see extremist Canadians are pushing my beloved Canada to become the repressive communist system that my family risked death to escaped from.

CMHC on Victoria

https://www.timescolonist.com/real-estate/victoria-s-housing-outlook-likely-to-remain-hot-till-2023-says-cmhc-report-1.24316218

I wonder if it will turn out like most of CMHC’s predictions over the last year or so?

For at least 2 decades or more RE has been very expensive over its neighbours Ucluelet and Port Alberni, because it is billed as a resort like/retirement town.

What is the explanation for the property in Tofino selling for such a ridiculous price? Must be some reason. Thanks

Anyone else find the recent BoC video on inflation a little condescending? Yikes…

https://youtu.be/TnOxnjm5yjk

Hey SP, we used these guys just a couple of weeks ago and we’re super pleased with results and quality. Hard working family business, knows concrete very well:

https://www.facebook.com/marketplace/profile/100032373886718/?ref=permalink&tab=listings

I’ve read it. Unique case not applicable to our dams that aren’t in the tropics.

That wasn’t the take.

Without bringing it up all the way again, since it’s clearly not for this site, BC has it’s own problem.

They were sucked out as co2, and are being emitted as ch4. One is 25 times worse than the other w/r to trapping heat.

It’s really not. They’ve done studies on dams in Brazil where the ghg emissions for the dam are the double those that would come from an equivalent coal power plant. This is 25 years after the creation of the dam. This will continue for the lifetime of the dam. If you’d like the paper I’ll find it for you.

It’s not a “not liking hydro” thing, it’s a “it’s not actually clean, but people bill it as clean”. We could have the dirtiest source of energy in the country, we just don’t measure it.

No risk on that investment lol. Some people are in for a rude awakening.

Are you still bothered by my Saskatchewan-is-pretty-darn-racist-and-dangerous-for-Indigenous-peoples take, which I presented in the wake of Colten Boushie’s murder?

https://www150.statcan.gc.ca/n1/pub/85-002-x/2019001/article/00016-eng.htm

Condo/townhouse at 860 Craig in Tofino.

List $1.415M, Sold $2.4M

Assessed $946k

Next highest price for a similar sized unit sold for $862k last fall.

Making upzoning non-profitable for property owners means that there will be no upzoning. And no revenue for the city.

So? Those are GHGs that were sucked out not long before by those same trees. Sure would be better to log first but either way integrated over a 100+ year lifetime of the dam it’s very low. Fossil fuel emissions that were previously locked away for hundreds of millions of years is what drives climate change, not emissions from trees.

Nevermind that if you don’t like hydro you can put solar up to run your heat pump if you like. Electrification is crucial either way

Interesting discussion about heat supply…

Recent house I bought is full of baseboard heaters. Was thinking changing downstairs to a natural gas furnace as thought it would heat the whole downstairs.

Worried electrical bills will be through the roof!

The Anti-Asian Hate Crime Capital of North America Is Vancouver

This one’s for you Introvert.

Again, that’s only the case if you count BC hydro’s ghg contribution as 0.

They flooded a massively treed valley while building the W.A.C. Bennett Dam, 1,761 km2.

Each of those trees takes 3-5 times longer to decompose anaerobically, and produce methane gas the entire time.

How much do people pay for broom finished concrete driveway? I have about 1000 sft old driveway with 55 linear ft retaining wall, got three estimates: 18k, 20k and 44k(yes, not a typo)

If you don’t have 200 Amp then that’s probably a wise upgrade anyway. You’ll probably get it back on resale, and may be required for insurance in the future anyway. That said we have 100 amp service and a heat pump.

In my case, the electrical service would have to be upgraded. It’s also currently cheaper to run a gas furnace than it is to run a heat pump, and living in Victoria, AC is not a requirement. Based on the quotes I received, and the additional load requirements, it was no contest.

It helps buyers but not enough. Problem is that a $1.8M teardown gets turned into 2 new $2M duplexes. That’s still progress, because previously that $1.8M teardown would have been turned into a $3M new build, but it doesn’t feel like progress to the public.

If you go to townhouse density then each new build is substantially cheaper than the single family teardown it replaced.

As for the escalation in land values, there are definitely ways to counteract it as you say, but the danger is that we’re so focused on keeping land values constant that we add massive fees that then kill the new housing. Land values are escalating regardless and we get zero housing. We have to recognize that the profit needs to be there for builders to build, and government is notoriously bad at setting policies that match economic reality.

Also factor in that natural gas will increasingly be disincentivized as all levels of government try to meet climate targets in the years ahead.

I had my oil furnace replaced with a natural gas furnace a few years ago in Oak Bay Henderson. The cost for hooking up to the gas line: $25.

I’m referring to the “every house gets up zoned to duplex” laws passed by city councils. Like Vancouver in 2018 that upzoned 99% of SFH. And no fees or hearing required to get it. That’s a tax-free gift to existing homeowners that just increases prices for buyers. Most houses will stay SFH, why should we be happy with everyone’s house going up in value with the speculation value of the up zoning? https://www.cbc.ca/news/canada/british-columbia/vancouver-s-new-duplex-rules-explained-1.4831741

Makes zero sense in my opinion. Heat pump is cleaner, you get AC, running costs similar to gas currently and will be cheaper when the carbon tax ramps up, and big rebates from both the provincial and federal governments. As the number of gas customers decline the fixed costs will increase to pay for the infrastructure. https://househuntvictoria.ca/2020/11/23/invest-in-heat-pumps-and-solar/

Gas is end of life as a heating source. Sure keep your existing gas furnaces running until they die, but new installs are pointless.

There is some complexity here because if it’s an actual rezoning then I believe the public hearing is mandatory. But I believe it can be built into the building permit process. This is also a way you can prevent the undue escalation of land values because those fees will come out of the price of the land (has to be reasonable of course to avoid making the projects uneconomic). Then you could also waive those fees for rental density to encourage that. Right now developers are squeezed for unspecified Community Amenity Contributions, and those are an individual negotiation for each project. Not only is that a catastrophic waste of time, but because it’s totally unknown what it might be it increases uncertainty and risk, and it can’t be taken into account during assessment.

Right, the idea is that the whole neighbourhood would do it together, or “no deal”.

btw) the government shouldn’t be dangling a carrot of “free future up-zoning” to SFH owners. As you’ve pointed out, this possibility increases SFH resale value which makes SFH more unaffordable. And makes for more speculators buying into SFH.

Instead of “free”, the city councils should pass/keep the upzoning laws, but $$ charge people to upzone when the time comes. If they did that tomorrow, SFH prices would fall by the embedded premium you refer to above, speculators would be less interested in SFH, and the city would get lots of revenue from the up zoning fees.

“Looking for input on the total price to have a gas line brought to a home, a gas furnace and any other costs associated with it. It would be replacing an oil furnace. Is gas the best way to go?”

If there is gas on the street, and it is within a certain distance from your house it costs $15. Furnace, somewhere around ~$5,000. And if you are bringing gas in, you may as well switch over to gas hot water as well.

Yes, in my opinion it is the best way to go if you are switching from oil. Looked at doing a heat pump and the numbers made no sense.

I’m sure you are probably aware of this rebate:

https://www.fortisbc.com/rebates/home/connect-to-natural-gas-space-water-heating-rebates

Sounds like you would get $1,700 back on the furnace.

Great article about house moving, sorry about the paywall.

https://www.theglobeandmail.com/real-estate/vancouver/article-road-blocks-for-house-movers-and-heritage-advocates/

They may be going for some sort of BC Housing affordable ownership program here which comes with income limits. https://vibrantvictoria.ca/forum/index.php?/topic/6664-fernwood-haven-nest-haven-condos-office-retail-12-6-storeys-approved/?p=528794

“We know 20% down payment is a lot” doesn’t make sense either. Given these are condos many will likely be $500k or lower so 5% down is the minimum you need unless they are marketing these to investors. Pretty sure you cannot evade CMHC insurance requirements like this.

Looking for input on the total price to have a gas line brought to a home, a gas furnace and any other costs associated with it. It would be replacing an oil furnace. Is gas the best way to go?

“The Conservative Party of Canada is also polling very poorly under new leader Erin O’Toole, and well behind the Liberals”

maybe they should borrow some tactics from our very popular leader

Provide free drinks for everyone at the pub!

then knock on your door early the next morning, with the bar bill, to be paid (with interest) by your children

“You put in 10%. We’ll match that”

Aren’t lenders supposed to subtract seller givebacks like this to get FMV?

Big if. Putting a covenant on your own property reduces its resale value, but without the neighbours joining in it doesn’t prevent densification.

Prisoner’s dilemma.

https://havenbychard.com/

Not exactly a new idea

https://www.vicnews.com/news/land-title-forbidding-east-indian-or-asiatic-people-raises-concerns-in-victoria/

Not really.

Oak Bay’s population has literally only grown by something like 50 people in the past 60 years. In other words, it probably has, by far, the best track record of the core municipalities in terms of avoiding densification.

And although it’s extremely unlikely OB will be able to match that achievement over the next 60 years, I would bet that it will densify at a much slower rate than surrounding municipalities.

“Yes, “very popular” among Canadians that don’t have to pay them.”

This makes it sound like some Canadians would have to pay the tax.

Good question. I wanted to check the median by age but it isn’t available, at least not in that table.

I forgot about covenants. Interesting tactic.

Yes, “very popular” among Canadians that don’t have to pay them.

As George Bernard Shaw said, “A government that robs Peter to pay Paul can always depend on the support of Paul” 🙂

CAD is 82 cents now, interested to see how that impacts real estate prices. Unload in Victoria/Vancouver and buy in California/Florida becomes more attractive for snowbirds, opposite is true for foreign buyers. Last downturn we had the CAD was around par.

I think introvert just wants to tell people that she lives in Oak Bay more than actually wanting to live in Oak Bay 😉

I wonder how much was driven by the increase in minimum wage?

Hey Introvert,

Maybe you don’t need to move to Oak Bay to permanently keep the low density neighbourhood you have now in Saanich. If your neighbours are like-minded, put some covenants on your lots to prevent up-zoning. There are many areas of Core Victoria that have them, and I haven’t seen any upzoning happen there. It isn’t foolproof, and ultimately the government could pierce through it, but it would take years in the courts to settle it. Why should Broadmead be allowed to stay low density due to their covenants, and your ‘hood not have the same rights?

Here’s an Edmonton lawyer’s take on the issue…

https://www.mondaq.com/canada/real-estate/813010/use-of-restrictive-covenants-in-residential-developments

“Neighbourhoods and their residents can make restrictive covenants on their properties to prevent lot splitting, impose height or setback restrictions, or state that only single-family homes can exist on the property. Restrictive covenants, once attached to a Land Title, provide little leniency. We have seen that whereas in the past restrictive covenants converged with zoning to protect certain land uses from the negative externalities of other activities, such covenants may well foil emerging planning objectives. As the number of developments they burden increases, restrictive covenants make it increasingly more difficult to reach planning goals. For cities like Edmonton and Calgary that are changing and evolving, this is shaping up to be a growing issue moving forward.”

For sure the median is low, but this is individual, not household and includes everyone with non-zero income. Not sure how many people are aware that the median is up that much. Decent income growth of 3%/year annualized

That is a net take home pay of around $2800 a month, would be tight to live on your own in something decent with no roommates.

Victoria median total income

2000: $24,700

2018: $41,770

Disappointing to read this…

https://www.bloomberg.com/features/2021-vancouver-canada-asian-hate-crimes/

“ Last year, more anti-Asian hate crimes were reported to police in Vancouver, a city of 700,000 people, than in the top 10 most populous U.S. cities combined. With almost 1 out of every 2 residents of Asian descent in British Columbia experiencing a hate incident in the past year, the region is confronting an undercurrent of racism that runs as long and deep as the historical links stretching across the Pacific.”

The Conservative Party of Canada is also polling very poorly under new leader Erin O’Toole, and well behind the Liberals.

While the warehouse shortage is most acute in Toronto, other major cities in Canada aren’t far behind, with Victoria, Vancouver and Montreal rounding out North America’s top four tightest warehouse markets

https://financialpost.com/real-estate/amazon-fuels-north-americas-most-severe-warehouse-shortage

…which explains this:

Huge distribution centre proposed for Victoria airport lands

https://www.timescolonist.com/business/huge-distribution-centre-proposed-for-victoria-airport-lands-1.24312484

Just think what we could achieve with upzoning. Broad upzoning in exchange for accelerated step code compliance. Some of the hundreds of thousands of dollars in wasted time that go into spot rezoning could go into building better and saving money down the road in operations

Foreigners can’t buy land in Vietnam at all. Are they a bunch of bigots or something? Or maybe they just have a thing about foreigners taking over their country?

A cost cutting measure is to have your own gas line from the house to the meter. All in will be less than $1000 for mini excavator rental and copper tubing.

I’ll let Ian Young speak to that. https://www.vanmag.com/the-van-mag-qa-ian-young

Well yeah, because of the foreign buyers tax. It reduced foreign buying by 70% in Vancouver and 80% in Victoria. Of course it’s low now.

If we weren’t so horrible at building in Canada I don’t see a problem with foreign buyers being able to buy condos, we can just build more of those whenever we like. But given we apparently can’t it’s a sensible move to reserve homes for residents.

For all the flack the step code takes, you wouldn’t get situations like @Peter’s house. A newer build with substantial heating requirements, which is most likely not easily mitigated. If you do have an energy audit done, keep us updated on the results. Would be curious what the blower door results are. Does your house have an energuide sticker?

Next thing you will find where all the jobs have gone, when the nut case protests all foreign investments and turn the country inward like North Korea.

Because most are hiding behind a thin veil of bigotry.

B.C. economist says foreign buyer share in home sales drops to near zero in 2020 — https://tinyurl.com/y3t3e8fk

.

Canada is the only G7 member that has no inheritance tax.

Not too long ago the federal NDP had an election platform that proposed an inheritance tax and I, in a Frank-moment, also raised a glass in celebration of the colossal fatuity of the enemy.

Foreign buyers taxes are very popular

Read in the paper that the Federal NDP are proposing a 20% foreign buyers tax. I am delighted to read this, it ensures they will never be voted into office.

So if someone uses the CMHC first time home buyer program, they have to pay back 5% of the value of the home when it sells. But the seller has to pay all the selling costs. CMHC getting a free ride on the sale.

Red Blue is good and helpful with the rebates. Always a good idea to get few quotes.

We’ve been using RedBlue Heating and A/C lately on our new builds, haven’t had any issues so far.

We actually have an HRV.

Bringing gas in would be nice, but it’s almost cost-prohibitive given the length of the driveway.

An energy audit is a good idea. And I’m sure upgrading the attic insulation is a sound plan anyways…

Does anyone know someone who would be good for the heat pump & also knows their way around these rebates? Responses I’ve had so far from people in the industry have been sort of “meh”…

Really appreciate all the feedback!

What is a heat recovery system? Do you mean an HRV? If so, that will not reduce the consumption unless OP has windows/doors open.

Even simpler than a heat pump, you might just want to change the electric boiler out for natural gas and add a heat recovery system. Or add the heat recovery system and see what that does for the bill before looking at a heat pump or changing the boiler out. The heat pump install usually comes with a heat recovery system as well to assist in air circulation, along with helping with cost on heating (so adding the heat pump after is still an option). There are lots of options instead of making an immediate all or nothing choice. Unless your neighbour has an extension cord running to your house to power their hot tub, there should be a solution.

It’s still awfully high for this time of year. I’d definitely get an energy audit done prior to any major purchases (I think the feds will subsidize them soon). And your new heat pump will become the primary heat source but keep the boiler as backup.

Wow Peter. Your house sounds beautiful.

thanks for all that. We did have a draw test, they said the only substantial draw was the radiant heat (electric boiler). And yes, I guess it sounds stupid to have the heat on at all when the house is more or less unoccupied (as it also was in the winter), but we just got possession end of January, and since then we go there on & off almost like it’s the cottage, while waiting for our own place in Vancouver to sell so we can do the move. In the meantime, we are also doing some reno work on the house (so yes, there is extra draw once in a while). What it amounts to is, there’s someone there sort of 3-4 days every other week, sometimes staying overnight sometimes not, and all intermittently and random enough that we didn’t want to turn the heat on & off all the time, as we’d been told that’s exactly the wrong thing to do with radiant heat on slab.

I do agree it makes sense as a test to turn everything completely off and then just turn the heat back on & monitor to make sure that’s the problem – though I’m already pretty sure that’s the problem, having been told by 3 guys who checked it out.

At the moment, though, I can’t do that, because we’re getting new hardwood installed soon, and the wood needs to acclimate to the house etc….there’s always something!

The house isn’t very old, seems well insulated, isn’t drafty. But it is in a forest and north-facing and in a colder setting (on the water).

I think I have to bite the bullet and replace that electric radiant heat system with a heat pump, but I will double check on the grant situation again first.

Run a draw test to see where the power is going. If you don’t have the gear or skill to do it, an electrician should be able to get it done for about $150 (sounds like $150 would be a good deal to get it sorted). A lot of time it is a faulty hot water tank causing a constant draw, but with intermittent bigger surges eating up energy.

You are probably correct that it is the slab. Slabs are generally very slow to react to temperature changes, so they take while to heat up (and may overshoot) and they take a while to cool off.

20kWh with no one living there is a pretty bad baseline. I’d have a hard look at what that is. If it turns out it’s all heat, then you’ll be way better off mitigating heat loss than dumping a bunch of cash into a new heat pump.

“Even though it’s high and the pattern looks abnormal, is it really that terrible? the bill just in for February and March is just over $700, so say $360 a month for a couple of months that were still pretty cold. I mean, the house is quite large, is that terrible?”

We have a not-too-efficient house that is about 2400 sq ft up and down, previously on oil heat and electric hot water, with a shitty ~25 year old furnace and a large stupid hot water tank. Worst month was probably ~$400-450 for heat and hydro, for three people, which I thought was atrocious.

From: https://www.cbc.ca/amp/1.6015748

Folks, spend the extra money and have your lawyer review any contracts that you sign. Especially contracts that deal in thousands, tens of thousands and hundreds of thousands. In the end, never trust a salesperson… All you are is a mark or sucker they are looking to get all the money from that they can to support themselves.

Leo is right Peter. Try turning the breaker switch off for a couple of days. Then turn back on to see. Then turn it back home while turning the floor heat right down. Is there a thermostat? Put it at 50 degrees F.

I should have mentioned, with baseboard heating, we close doors and turn heat right down in room we aren’t using.

@Peter.

91kWh in one day is insane with no one in the house. Our house only exceeded 90kWh on two days all winter, and that was with baseboards + heat pump + many loads of laundry + probably the car charging.

The obvious question is why you have the radiant floors on if no one is in the house, and if you turn the floor heat off, does it stop spiking? To make investigation easier you can easily monitor live consumption with the HydroHome app + hub https://www.bchydro.com/powersmart/energy-management-trials/hydrohome-smart-home-trial.html

It was occupied in the winter? We pay about $225/month in the winter, and our house isn’t wildly efficient. I’d say it’s a lot.

Federal grants out I believe this summer. $5k grants + $40 interest free loans for bigger upgrades or solar installs.

Q1 Out of town buyer update

I think that is a lot Peter. My house is slightly larger than yours, all baseboard heating and electric HWT. The bill from Feb 6 to Apr 8 was $439.20. During the night, the usage is always around .04 kWh. each hour.

yes, thanks. The days when it spikes, it does so mostly between midnight and about 10 a.m.

it’s kind of a pattern. it sort of tends to spike about every second or third day.

and no, it’s not laundry – there is nobody living in the house right now, just people there on & off.

It’s super-frustrating. But I was thinking three things:

Even though it’s high and the pattern looks abnormal, is it really that terrible? the bill just in for February and March is just over $700, so say $360 a month for a couple of months that were still pretty cold. I mean, the house is quite large, is that terrible?

I really do intend to get the heat pump, but I’m damned if I do it just after missing some $ grant deadline!

Thanks

For the budget will balance itself, perpetual deficits aren’t a problem and you need to borrow then spend for success folks out there.. It appears that NFLD gets to be the “canary in the coal mine” for a Canadian sovereign debt crisis for a second time. They led with the debt problems in the 90s before it was felt elsewhere and it looks to be that way again.

https://www.cbc.ca/news/canada/newfoundland-labrador/report-greene-recovery-1.6016005

Those that believe that government has to be there to backstop consumer debt or if there ends up being a debt crisis coming out of excessive borrowing in the real estate market might be in for cruel surprise when the government has no fiscal capacity to assist as it is in a crisis mode just trying to fund and maintain core services.

“91kWh?

Something is definitely up. It’s not even cold out!”

This does seem very high. Multiple loads of laundry in hot water? That was a thing when we had a tenant, and on laundry days consumption would be pushing ~70 kwh.

BC Hydro also allows you to see consumption broken down by hour, which may provide some additional clues about the cause of your high electricity use…

1877 Feltham rd, suited GH house with updates sold for 905k.

1841 st ann, suited updated oakbay house for $1.41M

https://victoria.evrealestate.com/ListingDetails/1841-St-Ann-St-Oak-Bay-BC-V8R-5V9/873872

I wonder how long until the oakland buyers start kicking themselves.

I see some creative solutions posed here to reduce the people residing on the streets.a

It seems to have been missed that the solution is contained within the Speculation Tax. The cynics amongst us saw it as just the latest dog-whistle pandering from the NDP and an assault on property rights but the ethos is much more lofty. In an egalitarian society such as ours we cannot permit individuals to withhold needed resources from others for no reason. Can’t afford the tax? Pony up or get out of BC.

From an observation post near at hand I can tell you that the street people:

-have the AMBITION and DRIVE to get to Victoria

-have the CONSTRUCTION SKILLS to build shelter out of almost nothing

-have the FINANCIAL EXPERTISE to confidently critique the amounts given to them

-have the TASTE to complain knowledgeably about free meals

-have the MOBILITY to travel between city motels and downtown

-have the PUNCTUALITY to reach various venues at the precise time to receive largesse

There are any number of employers on Indeed who would immediately pay $20 an hour for these skills in our labor-short city, yet the individuals with this skill set do not make themselves available. Going forward, when any of them comes to sign in to their free accommodation they will be required sign up for our new government-sponsored plan. Like an RRSP, we will now have the RRPP, the Registered Retributive Penalization Plan. The individual will have their CRA accounts debited $100 a day for each day they receive housing, amounts to be carried forward through their lifetime at prime – 1%.

In an egalitarian society such as ours we cannot permit individuals to withhold needed resources from others for no reason. Can’t afford the tax? Pony up or get out of BC.

91kWh?

Something is definitely up. It’s not even cold out!

meanwhile, BC Hydro consumption last 7 days (kw):

25

23

22

90

28

23

91

This is with no-one living at the house, nothing being used except the stupid electric radiant floor heat. Yes it’s a large house (2,700 sq. ft. just on the main), but still, this is nuts. And the floor is kept of course at just a constant moderate temperature, so why does the consumption vary so wildly? It’s like, either something is plain wrong, or something is scheduled to cycle on and off. Except that nothing is, apparently.

We’ve now had 3 different people come and look at this, and all have told us that everything appears to be operating normally and to achieve anything much, we just have to bite the bullet and replace the electric boiler with air-to-water heat pump.

Which we’re willing to do, but the quote came in at $21k, and apparently we’ve just missed some kind of grant.

So my current plan is to wait for the next grant. But not wait too long…

Unbelievable.

Not specifically anti-rental. Just zoning in general that kills a lot of projects including rental, and I daresay neighbourhood opposition is fiercest against rentals. It’s going to be very hard politically to get broad upzoning through, but one way to do it at first is to upzone broadly for rental first so rental projects don’t have to go through rezoning. Vancouver just passed a limited form of this in some areas. Rental projects up to 6 floors go straight to building permit.

Will do. Very unlikely this will be coming to BC anytime soon.

Nice article in the Capital following up on a previous homeless shelter https://www.capitaldaily.ca/news/supportive-housing-mount-edwards-victoria

I drive 40,000 km/year so that would work out to $1,000 per year travel tax. So even after I factor in my cost to charge I am still saving $4k-5k per year compared to buying gas. That’s not even factoring in that I am still on my original brake pads with lots of life left in them @ 200k.

Enjoy your free ride while it last folks.

To make up lost of fuel tax revenue, the Australian government is introducing $0.025/km for EV and hybrid at $0.02/km travel tax. California is looking to do the same, and I assume that our copy cat environmentalist government will soon to follow the trend.

Vic set to jolt EV drivers with new tax — https://tinyurl.com/9vjn2khy

You’re saying that local governments in BC have the power to impose “no rental” zoning? Sounds strange, do you have any examples?

Ash, the lesson I learned from this is that the journey is more interesting then the destination. I highly recommend if people can swing it to take a long leave from your job and hit reset, the thing that used to bother me no longer do as I know what retirement is like and it’s great to have all that free time but it’s more interesting to still be in the day to day working world, especially if your in the FU position.

Right, so when you realized you had surplus $ in your 40s, you didn’t by default just dive back into more debt and work stress. You hit pause and tried something different, realized it wasn’t for you and went back to work with a whole new perspective. I think that’s awesome.

Consumption for the last 7 days

kilowatt hours (kWh)

16

12

12

14

19

14

16

Wed 28

Thu 29

Fri 30

Sat 1

Sun 2

Mon 3

Tue 4

0

10

20

View detailed consumption

Learn when you’re using the most electricity and find ways to save.

Current billing period

Apr 14 – Jun 11, 2021

Cost to date (21 days):

$33* or 302kWh*

Projected cost: $93*

Hiya–does anyone know the best month to rent out a 3 bedroom property? June? July?

Kenny G Take a pic of that hydro bill and show it to all. Good for you!!

This is where I think a lot of people fall into the trap of thinking they need that bigger/fancier house instead of just enjoying life, working less (or not at all), etc.

‘

‘

Let me tell you, we moved to a bigger fancier house and i’m enjoying life even more now that the kids have a full finished basement to hang out in and I have a double garage. I did the work less thing, retiring in my 40’s it’s not all it’s cracked up to be, its quite odd to think you may have over 40 years left and never work again, I happily went back to work.

Introvert couldn’t sleep at night borrowing more money, I couldn’t sleep at night not borrowing at these low rates .

Re: Solar panels pay for themselves.

We moved into a 2 year old, 3,700 sq foot home a few months ago and I was shocked by the hydro bill, that is to say I was shocked how low it was as we have a heat pump and gas on demand water heater as well back of house has a ton of windows and faces south. First bill for Feb and March was around $200 and that included transfer fees, gas averaged $45 month (we take a lot of long showers). The projection for the next 2 months hydro bill on the BC hydro site is $90. House temp was at 21 degrees. I have no idea how much electricity will be if we choose to use cooling in the summer?

I have a better idea, the government should buy the empty cruise ships and put the dangerous people on them a few miles off the coast. Food could be airlifted in. That’s what the English did when they sent their undesirables to Australia, somehow, they worked things out. Tough love works I guess.

I like the idea of putting a giant shelter in a secluded compound in Metchosin, with a non-scalable fence around the perimeter, where we would send the homeless people who hit people with hammers, tape dirty needles to staircase railings in parkades, smash car windows, chase people with baseball bats, refuse treatment, utter threats, etc.

We would still provide them with all the help and support they require, but we’d keep all the nuisance and crime and drama way the hell away from the rest of functioning society.

The other shelters, in Victoria, could then be for those homeless who are harmless and just down on their luck.

Interest rate is only a big deal if your principal is large and/or you plan to pay off your mortgage as slowly as possible (or not at all).

No rent increases.

True.

We briefly looked into refinancing but soon realized that our remaining principal is so small, and we’re paying it down so fast, that the savings would be negligible.

How does that work if the tenant has been there 9 years with minimal rent increases? The tenant is probably currently paying a little over $1000 for a basement suite in GH. Considering you bought in 2009 and assuming 5 year renewals your latest renewal would have been in 2019, you weren’t able to take advantage of the current low rates back then.

We have the best tenant in the world in our suite…been there coming up on 9 years, on a month-to-month agreement!

With our latest mortgage renewal, the rent covers the mortgage payment and then some. Unlike in the early years, we no longer need the rental income. But it’s helping us pay down the mortgage aggressively and we don’t need the extra space just yet, although it’s getting close.

With this tenant, landlording isn’t stressful at all. But finding a quality tenant to live in your home is stressful. And the prospect of having to find new tenants on a semiregular basis, as would be the case if we owned a second house that we rented, would be stressful. As an introvert, it’s a lot of interactions with people that I’d rather not have.

I’ll be happy to never landlord again after this tenancy. It was a means to an end, and it served its purpose.

That shows the province’s power to get shit done. It’s the answer for housing too. All munis have failed on the housing front so the province should step in and override. Housing is no less a crisis than homelessness.

Start with removing local govt zoning power to stop rentals as a first step

Want to rezone a R2 in Vic West to a R2 with secondary suites? It will take years of rezoning process, neighbor backlash, a ton of upgrades/demands from the COV before staff recommend it goes to hearing, etc., etc. My friend ditched it after spend 50k on consultants/reports/etc. Will just build a duplex without suites now as per R2 bylaw.

Two shelters you just announce they are going in, done deal.

I like the guy’s idea of putting the next few shelters in oak bay though.

Everyone always cries out for more consultation but this is a no win situation. Not like they’re going to find any place in the city where neighbours are in support.

Zoom meeting re shelters in Vic West live right now -> https://zoom.us/j/98408467024?pwd=S1hRQU5PZFNLUGVoNGVBcEx3S0xXUT09

David Eby and city councillors talking.

Being a landlord I did find stressful. Did it for 9 years and was worth it financially, but glad we don’t need that income anymore.

Having my money in stocks knowing it is growing is not stressful to me. Even the big drop at the beginning of the pandemic felt like an opportunity for it to bounce back which it did. I would probably stress a lot more about spending my money wisely/saving enough without a mortgage. Now I am forced to save paying down my mortgage and my stocks are making multiples in percentage of what I am paying in interest on my mortgage.

Also now the stock portfolio has grown to more than what is remaining on my mortgage, so no stress about potentially losing my income.

To each their own

Yeah and it isn’t worth it to me.

Would probably only move after the kids graduate high school, which is quite a ways off.

Just say a Sold sign on that Kenmore property that went through the $1.3M list and then bidding war pricing change. Any idea what it sold for in the end?

I think it depends on the type of person you are, If you have a big family and love to entertain then you probably need a big fancy house to enjoy life. if you live solo or with a partner but you are never home anyways then maybe you should just get a condo. Stretching yourself to buy a big fancy house when you are never home just so you can impress people is not wise (unless you are certain the market is going up)

I wouldn’t say its an attempt to maximizing your net worth if you are buying the house purely for your own personal enjoyment. I think the decision Is whether the added stress of landlording and extra debt is worth the Henderson address 5/10 years earlier.

This is where I think a lot of people fall into the trap of thinking they need that bigger/fancier house instead of just enjoying life, working less (or not at all), etc.

That would probably be the smarter financial decision. But I don’t really want to take on debt (even though I could take on tons if I chose to). And I’m also not keen on landlording forever.

If I ever move, the plan is to sell and pay cash for the next place. Again, probably not the most financially profitable decision, but not having to manage multiple properties and not having a cent of debt and keeping things simple is personally worth way more to me than maximizing my net worth at the cost of more stress.

Why don’t you just do that right now with the low rates? Get your parents/inlaws to cosign then rent out your entire GH house, you might not be out of pocket that much more on a monthly basis to a point where you can’t afford it (and no i haven’t done any calculations). That way you can post you live in “Oak Bay” 😉

That GH versus Henderson delta was probably less than 200k before the run up I think.

hi ks, my point isn’t that Victoria and Vancouver per se are comparable, it’s the fact that someone from Vancouver can move to Victoria, to a neighbourhood that is pretty directly comparable, for about half price – that’s a crazy good deal from that particular perspective.

The attractiveness of that alternative I think will only provide more fuel to the fire over time as baby boomers retire. Sure, I understand the stats show only a pretty steady flow from Vancouver & not a disproportionate one that would explain recent moves in pricing, but I think you’ll see this flow increase. I’m moving to the Island and retiring early (58), imagine the cohort that is the baby boomer bubble coming up behind me.

Sure, there will be a bunch of other factors, and maybe once the free money train even starts to slow down just a little bit, all the wheels will come off, but other factors remaining the same, I do think this Vancouver factor will only grow in importance and will underwrite much of the Island, or more so Oak Bay/Fairfield/James Bay maybe

Yes, that makes sense. Mortgage payments end after 20-25 years (or fall as a % of income), and that leaves much of the 50+ crowd with grown-up kids, and nowhere else to put their money but stocks. If you go to a seminar on “investing in ETFs”, you’ll notice all the grey hair!

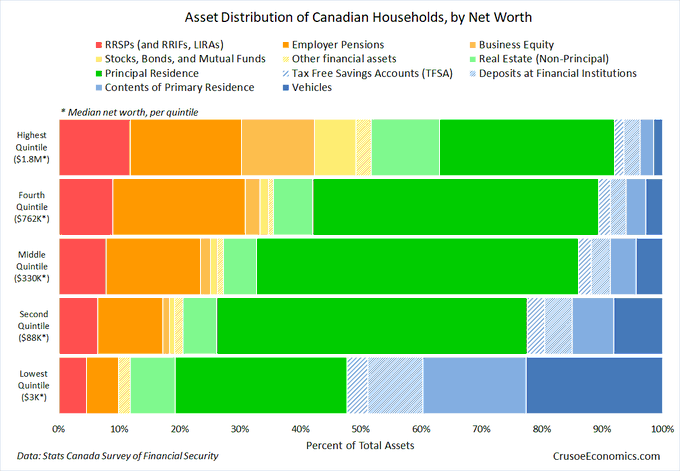

Thanks for that graph Patrick. Distribution of wealth also varies in age groups. I was reading in Canada in 2016 that adults under the age of 35, 75% of their net worth was in their home, ages 35-44 – 49%; ages 45-54 – 40%, ages 55-65 -26% and over age 65 was 36%.

This chart (stats can data, from the same site crusoeeconomics.com) shows the constituents of wealth of Canadians over time. The two orange ones are housing (land, house). This chart dispels the narrative that Canadians net worth has become dangerously concentrated in housing. It has only risen from 37% in 1990, to 40% in 2020. Meanwhile stocks/ETF (two shades of green) , for example, have risen much more , by 16% ( 4% to 20%). Bank savings/GIC/Vehicles (grey, blue and red) have fallen in %.

As BMO might put it, we’re richer than we think, and only 40% is housing.

This is a potential way I get myself into Oak Bay someday (pardon the rhyming).

That Henderson house is only $300K-ish more than my house. After I pay off my place, a few years of saving or one inheritance would cover the difference (assuming the GH-Henderson delta stays roughly the same). Then I could live in a municipality that isn’t gung-ho on allowing 3-storey townhouses to go up right beside anyone’s house, no questions asked.

quintile i mean

I don’t take it that way Introvert. The total asset distribution for principal residence is greatest in the middle percentile.

The lowest quintile non-principal real estate is 8% of their household assets?

Right on! Move to Port Alberni, folks, if you can WFH and a SFH in Victoria is out of reach for you. Added bonus: you only need one good income to buy in Alberni, so one parent can stay home if desired and no daycare costs. Maybe convince Gramma and Grampa to cash out their Strawberry Vale house and join you there, close to the grandkids and to Nature!

If I’m understanding that graph correctly, it looks like anyone who owns their own house in Victoria (and many who don’t) are in the 4th quintile of Canadian household net worth (that is, >$762K).

That’s amazing.

Nice chart Leo. It dispels the theory some here have that the Canadian middle class net worth is almost all in RE. Looks to be only 55% from that chart (3rd,4th) quintile. And no quintile higher than 60% in RE. It would be higher among homeowners, but they likely have same or higher non re assets as non homeowners as well

Same comparison can be made for anyone going from Victoria to anywhere else up island. Vancouver and Victoria are not comparable, IMO one big game changer would be direct trans Atlantic and trans Pacific flights to and from Victoria.

Looking at things from a Vancouver perspective (where I realize it’s nuts), it sure looks like Victoria still has lots of room to run. I realize that’s not what many want to hear, from the point of view of maintaining a livable city for the majority of the people, but I think it’s true.

Look at 958 Oliver as an example, just popped up on realtor.ca, I mean, it’s a decent house, decent size lot, nice back yard, beautiful neighbourhood, couple of blocks from the village, couple of blocks from the ocean, south oak bay, $1,299? Even if this goes for $1,500, it looks like kid-in-a-candystore for anyone coming from Vancouver. An equivalent house in say Ambleside or Kerrisdale would run closer to $3 million. Deryk’s advice continues to be sound in my view.

You also have to take into consideration most south asian families have 4 or more working adults living in one house, this generates substantial savings and cashflow which is often used to buy more rental properties.

That’s the catch: incomes have not kept up with inflation/devaluation/etc. I’ve always been a proponent of buying a home to live in when you really want to own a home and you can afford it for the foreseeable future (reasonable rate hikes, etc).

Semantics, but upper quintile is not what I’d call wealthy, IMO. Would be interesting to see a couple more buckets, covering 1%, 0.1%, and 0.01%.

“However, this doesn’t really apply to some of the wealthy immigrant Asian/ esp. South Asian families I know in Vancouver. You will often see net worth statements with a huge amount of real estate equity and maybe $50,000 in mutual funds/RRSPs (and that $50,000 is only there to help a friend or family member financial advisor) with not much in self directed stock.”

‘

‘

Quite true, and they generally have no idea what they are invested in and only put money in an RRSP so they didn’t have to pay taxes some years.

This one on henderson also been sitting for a long time while people are going nuts and paying more for crappier houses on smaller lots in Oaklands. I know henderson is considered a main road but it is a nice area nonetheless.

https://www.realtor.ca/real-estate/23030266/3372-henderson-rd-oak-bay-henderson

My parents have a paid off house worth $1M+ and $1M+ other liquid assets, I definitely consider them middle class, but they are also half retired. if you are in your late 30’s/early 40’s with the paid off house and a 7 figure portfolio then maybe that could be considered upper middle class? But most people would just buy a bigger house and take on more debt.

“I wouldn’t have thought Arbutus as a neighborhood where people needed a suite to make it work. If someone just wanted space for WFH, this would be a pretty good choice, nice big clean lot with no trees breaking up the back yard.”

Yes, I don’t understand why that one hasn’t sold. It’s a bargain for the area and in reasonable shape. Arguably, it’s in the best part of Arbutus, too, really the Cadboro Bay area. Close to the Village, bus routes UVIC and bordering some really fancy neighbourhooods.

“Not in real estate. That’s a middle class game. The wealthier you are the less important real estate is as an investment”

Agreed and those wealthy people will often have substantial equity in their small business and/or hold those seven figure stock portfolios in their corporations.

However, this doesn’t really apply to some of the wealthy immigrant Asian/ esp. South Asian families I know in Vancouver. You will often see net worth statements with a huge amount of real estate equity and maybe $50,000 in mutual funds/RRSPs (and that $50,000 is only there to help a friend or family member financial advisor) with not much in self directed stock. Sometimes, this amount of real estate wealth often in farmland and commercial property such as apartment buildings and shopping plazas is staggering.

Yeah. Here’s the stats. From https://twitter.com/CrusoeEconomics/status/1376752820511117313

“I am really wondering where all the money is coming from for all the SFH sales above the two million mark? It is no longer just one or two sales a month. Two mil does not exactly buy you a mansion these days.”

‘

‘

There’s so much money out there from among other things inheritance, literally every other week I run into someone in their late 50’s or 60’s getting 500K, 1M or more. Also you’d be crazy not to borrow at 1.5% interest to buy a nicer house and leave your investments untouched.

“Not in real estate. That’s a middle class game. The wealthier you are the less important real estate is as an investment”

‘

‘

Agreed to a point, I work with lots of clients with several properties usually a PR, a recreation property and maybe a rental unit but the difference is the wealthy also have investment portfolios equal to or worth more then their real estate. I t’s funny how you can have to people living side by side in a 1 -1.5MM house and one neighbour has a large mortgage and just enough money to meet their needs while their neighbour has a paid for house and a million or two in an investment portfolio but you’d never no the difference between them by appearances.

Not in real estate. That’s a middle class game. The wealthier you are the less important real estate is as an investment

I still think the extremely low covid numbers and deaths due to it are not going unnoticed across the country and people are going to continue to want to relocate to a safer environment. It’s only human nature to behave that way under current conditions. The people who have the means to do so, have made their millions and finances are not an obstacle. When travel restrictions are eased, expect even more pressure on the market and as hard as it is to believe, higher prices.

Agreed.

Gambling (lotteries and casinos) are a regressive tax on the poor. While it is “voluntary”, it preys upon the vulnerable and addicted gamblers, and for those it isn’t so voluntary. https://policyoptions.irpp.org/magazines/july-2020/ontarios-gambling-profits-flow-from-a-hidden-tax-on-the-vulnerable/

Our NDP government shouldn’t be allowing expansion of gambling, and bravo to Saanich for slapping this lame idea down and sending the BC Lottery Commission packing!

Boom in Port Alberni. Was the cheapest and still is but has already jumped a lot https://www.cheknews.ca/its-a-steal-of-a-deal-soaring-house-prices-on-vancouver-island-send-buyers-to-port-alberni-778681/

I am really wondering where all the money is coming from for all the SFH sales above the two million mark? It is no longer just one or two sales a month. Two mil does not exactly buy you a mansion these days.

“Truck on” all buyers out there! Just an encouragement, don’t despair!

OK now I’m going to go after you for misrepresenting what I said. I said precisely, “The best time to buy is when prices have adjusted to once in a lifetime high rates”. As well, I did not say say that anyone should wait for a particular point in the interest rate cycle to buy. Those points are not known until after the fact. Just what the high and low points represent.

And I’m not going to be generous enough to assume that was an accident.

You’d be 96 today, assuming you were still around. It was a different era in many ways. Particularly, the norm in 1955 was for a family to have only one income. The norm changed to two incomes over the next generation. Plus, wages outpaced inflation until about 1980. These factors were much more important than changes in interest rates which were relatively minor.

Plus, plus, plus – housing was reasonably priced as a multiple of family income, even with only one earner.

I was talking about the post-1981 era, i.e. our own life experience as potential or actual buyers.

R Hysom- I’ve said all along: House aren’t going up in value, money is going down in value. It simply takes more paper money, which is being created out of thin air, to buy a tangible asset that there is a need for, like a place to live, work and grow food on. Serviced land that is habitable is the most valuable, l would argue the only, asset on the planet. Where do you think billionaires invest the majority of their money? Not in GICs. Blame government policy for the uncontrolled money creation and the resultant astronomical house prices. Don’t look for them to solve the problem, they are the problem.

THE BEST TIME TO BUY A HOME IS WHEN YOU CAN AFFORD IT AND ARE READY TO DO SO.

Waiting for the market to do this or that will be a loosing strategy. I can appreciate how stressful it must be trying to buy right now but persist until you are successful, you will not regret it. Consider looking for a home as a full time job until you succeed.

I have regrettably come to the conclusion that what we are now experiencing is something none of us have experienced before here in Canada, but there have been examples elsewhere in the world. We are experiencing currency debasement as opposed to inflation which is very different.

Currency debasement is a direct result of government “printing” too much money. Our Federal Government has in just 4 short years doubled the national debt accumulated since Confederation and shows no sign of deterring from this practice. The introduction of all this borrowed money into our economy without an equivalent increase in productivity has reduced the value of our currency. We already have seen in certain sectors dramatic price increases and housing is one of them. It won’t be long till all sectors follow suit and where will this lead? Eventually it will lead to higher wages and I predict within 8-10 years a minimum wage of $25/hour. For those who buy now will in 10 years look back and be very glad they did. Because in 10 years house prices will shock anyone by today’s standards just as they do now by looking back 10 years.

“I wouldn’t have thought Arbutus as a neighborhood where people needed a suite to make it work. If someone just wanted space for WFH, this would be a pretty good choice, nice big clean lot with no trees breaking up the back yard.”

A surprising number of houses in that area have suites. But yes, the square footage and flat yard are definitely selling features.

Good!

Saanich rejects casino and hotel development proposal

https://vancouverisland.ctvnews.ca/saanich-rejects-casino-and-hotel-development-proposal-1.5413761

Let’s see how that might have worked out…

If you were 30 years old in 1955, looking to buy a house in Canada, and you were an economic genius (like many here in the forum), you might have realized that interest rates had bottomed, and were going to head upwards for the next 26 years (to peak in 1981). (Rate history https://www.ratehub.ca/prime-mortgage-rate-history )

Yes, you could have cleverly realized that 1955 was not “not the best time to buy” and waited for the “best time to buy”, which came a “mere” 26 years later, when you’re 56, in 1981. And so you realize that “yes!”, 1981 is the “best time to buy” your first house at peak interest rates. What fun, to be 56 and buying your first house, at 10-20% interest rates. And the joy of having watched your family grow up and your children are moving away, after growing up with you in various rentals around the city. And knowing the house you passed on buying is worth 2-4x what you would have paid, and the mortgage would have just have been paid off at the time you’ve finally decided to buy.

The point being, don’t be too clever. In 25 years, your million dollar house you buy will be paid off, and likely be worth millions. But that’s not the important part. If your family needs a house now and you can afford it, buy it and enjoy it. And forget about how much you are to make or lose when you sell it. There will be plenty of other more important things in your family life to worry about than that.

I wouldn’t have thought Arbutus as a neighborhood where people needed a suite to make it work. If someone just wanted space for WFH, this would be a pretty good choice, nice big clean lot with no trees breaking up the back yard.

“Also, what is wrong with this house in arbutus? https://www.realtor.ca/real-estate/23078960/3969-sequoia-pl-saanich-queenswood

Its been sitting forever at this price, which seems like really good value given what else has sold around $1.3M.”

No suite, and the renovations are mediocre at best. But I agree — surprising to see it sit so long given the location. It started out at $1,600,000 and clearly has farther to fall.

915 Kingsmill underwent substantial renovations, including the addition of a legal suite. That place was a construction zone for over a year. Hundreds of thousands of renovations. Owners still certainly did well if they sold for 1.3 mil, but it definitely can’t be compared to the 730k purchase price in 2018.

Was that pre renos? Is this what it looked like when it was bought for $730k?

Also incredible is 915 Kingsmill sold in July 2018 for $730,000.

915 Kingsmill in Esquimalt. 2320 Sq.Ft. Assessed at $936,000 just sold for $1,300,000. Incredible.

I agree, if you can afford it and like the house then absolutely go for it. But stretching yourself to buy something you don’t really like at a time when valuation measured by traditional sense is at the highest just for the sake of getting in is not wise in my opinion.

Best time to buy is when rates just got lowered but market pricing has not yet adjusted (see spring 2020). But usually this happens when there is a severe economic shock happening which the eventual outcome in uncertain, so far it has created a situation of higher house prices but that is not guaranteed to happen in the future.

Any updates on the kenmore house yet? https://www.realtor.ca/real-estate/23076321/1635-kenmore-rd-saanich-gordon-head

If this goes for around asking then I think it could mark a turning point for GH houses where the peak has passed.

Also, what is wrong with this house in arbutus? https://www.realtor.ca/real-estate/23078960/3969-sequoia-pl-saanich-queenswood

Its been sitting forever at this price, which seems like really good value given what else has sold around $1.3M.

$1M even

Hi gang, can someone please tell me what 2524 BELMONT sold for? Cheers

“The best time to buy is when you are ready and can afford it ”

What I said is that people who think that all time low rates make the best time to buy have it backwards. And no an all time low in interest rates is not the best time to buy for anyone. We don’t know future rates of course. I’m not claiming that I have a crystal ball, just pointing out the faulty logic.

$1.05M

If someone kind would post the sales price of 1320 Queensbury it would be helpful, thanks

I’ve seen it a lot in various articles and podcasts. I think lots of people are used to spending $10-$20k on food/entertainment/travel a year that has now been plowed into housing. I assume it will go back to the consumption sector post-pandemic, but of course if you’ve substantially upgraded your mortgage there may be less left over in the future.

The best time to buy is when you are ready and can afford it at current stress-tested market conditions – whatever they are. Your life is time limited. Waiting for the all time high or low or better times is generally foolish because the market is not predictable, except that prices generally rise faster than inflation over the long term. If you are burnt out with trying to compete with multiple offers that is different – too much stress can make it worth it to wait a bit.

That is the deadly fallacy. The best time to buy is when prices have adjusted to once in a lifetime high rates, not once in a lifetime low rates.

Keep in mind that we are experiencing extreme market conditions created by combined effects of COVID and the BOC intervention. On one hand potential sellers are not selling due to COVID uncertainty and on the other many people are trying to take advantage of once in a life-time interest rates. The fall and especially next spring will be very interesting as the situation reverses – with the economy fully reopened and potentially higher interest rates on the horizon we might end up facing the exact opposite scenario. Market flooded with “unexpected” supply and not enough buyers to compensate. RE crash? I wouldn’t bet on it – but I would be shocked if we didn’t hit some significant softening in the market.

Exactly. When it is fully built out maybe it will be at Fairfield levels of density. Hardly awful especially when you consider the amazingly close access to nature there.

Most of the area included in “West HIlls” is undeveloped.

https://www.areavibes.com/langford-bc/west+hills/real-estate/

Something doesn’t add up.

Westhills population density 6.24 persons/hectare.

https://www.areavibes.com/langford-bc/west+hills/demographics/

It depends, might be some traps out there for folks if they are not paying attention. For example, my rate from January expires 31 May; however, from discussions with my broker, realtor and lawyer, it is unlikely that I could close a transaction before 31 May with any offer from this point . The result would be a need for a new financing approval and the stress test because it would carry into June (someone making an offer right now based in their pre-approval might not be able to make the obligation with their new rate and stress test when processed in June). So, with that uncertainty, and lack of selection options with inventory, I am waiting to see what my new stress tested pre-approval brings me in June. At that point, I might as well wait for late summer and early fall to see if MOI and quality of inventory improves.

Fairfield population density 43 persons/hectare. Gordon Head population density 22 persons/hectare

Wow, who’s saying that? By all measures, the crazy spending was during the pandemic.

Translated to the heat is on for the next 4 weeks.

The transaction has to be completed by June 1st to avoid the stress test. Any pre-approvals from before June 1st that have the transaction completed after that date will have the new test applied. Additionally, the interest rate increases on fixed rate mortgages started about 2 months ago and new pre-approvals are being hit with that now as well.

Imagine if all environmental demand were implemented to sastisfy environmentalists (logging, fossil fuel, pipeline, transportation, carbon tax, etc…), the price of supplies and housing would sky rocket much more than the present.

Don’t the bank give 3 months pre approval, so wouldn’t it take an additional 2-3 months after June if there is a slow down of the buying frenzied?

Business Insider (U.S.) today: “Expensive lumber costs have added $36K to the average price of a new home in the U.S.” “Lumber prices have increased 340% compared to last year.”

I am still curious if the pandemic and low interest rates pulled a large number of buyers forward into the market that would have been buying in the next two years and possibly impacting sales in the coming years.