October: Steady as she goes

Well it was a close one all month but with an active week before Halloween we pulled off a small beat compared to last October after all. With 619 reported sales, that puts us slightly above the long term average for October sales.

Inventory is still in the lower third of the historical range, while new listings were quite low for October. However as always monthly data is noisy, and if you take a step back you see that year to date new listings for single family homes are unchanged from the previous two years, while condo and townhouse listings are up a bit. You might think that condo listings are up because of the spec tax, and there certainly have been sellers offloading empty condos to avoid that tax, but the reason behind the increase in 2019 was more to do with a big jump in the number of new construction units. New units listed on MLS went from an average of 370 in the last three years to 650 so far in 2019. Part of this is the increased rate of completions, and part of this is likely developers marketing more aggressively as the market cools.

Sales wise, condos dropped down from the crazy performance in September when we read that condo sales were surging. Perhaps today they will print the headline “October condo sales demonstrate mean reversion”? Somehow I doubt it.

Prices meanwhile continue to be flat modulo the monthly noise. You’ll notice that after a period of strong cooling (green line below), conditions have flattened out are still just below that of an overall balanced market. Though sales are down, and some segments (higher end) are weaker than others, the persistent low inventory is keeping the market hotter than you might expect it after such regulatory intervention.

Another way to look at prices that controls somewhat for sales mix is to compare them to the assessed values. While assessments are not individually all that accurate, as a group they capture the market value (at the time of assessment) relatively well, so it can serve as a proxy of a repeat sales index that’s a little easier to apply when you’re looking at individual properties. Remember that these assessments would have been the estimate of market value as of July 2018 so at this point they are 16 months old. Although there may be some drifting downwards of pricing in the condo market, the differences between 6 months ago and now are minimal indicating essentially flat pricing overall.

The reality is that not a whole lot has changed in the market in the now nearly 2 years since the mortgage stress test was introduced. A few buyers trickled back into the market this summer, but overall sales are still depressed compared to conditions before the regulatory intervention. The economy both provincially, nationally, and internationally is showing more cracks which is causing the central bankers to fret about whether to lower rates. Or rather, the world is lowering rates while the Bank of Canada frets about the potential of those lower rates to re-ignite the housing bubble. What is being re-iterated again and again though is the value of the mortgage stress test in preventing the expansion of speculative bubbles in real estate from low rates. It reinforces my view that despite some half-hearted election promises that would have loosened credit and boosted demand, there is no real appetite for such actions at this point and (thankfully) I expect those promises to be broken.

Monday numbers: https://househuntvictoria.ca/2019/11/12/sales-remain-strong-and-bankruptcies-turn-upwards/

ya down with china.. they are all killers and organ harvesters .. now lets get back to boarding school

Because the voters don’t care, or care a bit but care more about money. Nothing new about that. Plenty worse things happened in the past and the public were just as indifferent. Or worse, were (and are) opposed to Canada being a refuge for those facing persecution.

Local Fool: Yes, but don’t forget also that people enjoying more than anyone all the benefits Canada has to offer are China’s richest. And now it is very well known how some of them made their money. Why aren’t these nice Canadian politicians caring that China harvests human organs from its persecuted minorities (20 million Muslims)? Staying silent and opening the doors to them so that Canadians have a “good life” doesn’t make these politicians beautiful, hypocrites, yes!

Yes indeed. A different context yet another valuable reason to look back at history. As living memory of an event fades and finally dies off, having the initiative to learn from the past and the mistakes of others might make a calamity less likely today.

You ever heard the saying, “You should act this way because it’s [insert current year]”, as though all previous notions of society’s proper functioning were held by primitive fools?

That sharp-tongued yet bankrupt statement is part of the notion that every generation thinks it’s smarter and more learned than the previous – that financial folly, war, genocide, are all things that happened to our uneducated, bumbling forefathers.

“It couldn’t possibly happen now.”

This is wrong. Believing that we’ve somehow gotten smarter is one of the most dangerous, hubris-laden fallacies of our species. Within living memory or not, remembering, or at least learning about what happened and why is always worthwhile.

Thanks to all, living or dead, that made our way of life and governing institutions what they are today. We might dislike the “Conservatives”, the “NDP” or the “Liberals”, but believe me, they’re a beautiful thing compared to what’s out there…

lest we forget

Thanks LeoS, that link is perfect.

You mean citified? https://victoria.citified.ca/condos/

3565 Upper Terrace

Assessed: $2,874,000

Original List: $4,199,900 in January 2018

Last List: $2,500,000

Sold: $2,450,000

The extensive renos still got them up $1M since last sale in 2014 though.

Could someone post the link again that lists all the local major highrise condo projects with the total number of units per project and the expected completion dates? Thanks.

Victoria Born – could you please post the sale price of the Upper Terrace home that just sold at 15% below assessed value? Thank you very much!

I guess that depends on location. This development in Sidney has tried to fire sale units, but is currently stalled. No crews seen for several weeks.

https://www.strideproperties.com/pf/current1/

I am not seeing a lot of price drops and sales seem to be fairly steady. I am getting the impression that the flood of new condos is being absorbed by the market.

@Hawk ever on here anymore?

Interesting stuff coming out of China

https://gnseconomics.com/en_US/2019/01/23/the-gray-rhino-known-as-china/

There was another few on financial times but I lost them.

We also bought a place that we could be at least okay with living in long term so we didn’t (and still don’t) really care about any reasonably likely corrections.

I have the same issue with Chrome. Seems like it’s intermittent though, sometimes hard refreshes will work (like this time).

Squamish First Nations is putting up 6000 units in 11 towers on their land. This is pretty interesting. I wonder if our local First Nations are considering similar projects. I’ve toured the Spirit Bay development out near Sooke which is cool but of course much smaller scale.

https://vancouversun.com/news/local-news/metro-vancouver-first-nations-buying-their-own-land-back-thousands-more-housing-units-ready-to-break-ground

@LF

Re: if currency exchange has made a difference.

In 2008 CAD/USD 1.05-1 , now ~0.81-1.

IMHO a ~ 30% loss in the $CAD might have had something to do with our house prices not crashing.

@LF

Interesting thought “For example, you can look at American M1 data prior to the RE bubble bursting, and it shows nothing remarkable until after it popped. Whether M1 grows and how is also tied to a myriad of other global factors and monetary supercycles that most people including myself struggle to understand completely.”

So… would you be increasing Money Supply in a Bubble? No … In 2008 they did what was needed to stop a depression. I get it US Housing prices did not coordinate in that recovery with Money printing but their whole scheme with mortgage backed securities yada yada

@NH

RE: Real estate can increase $ supply…. for sure… anything that adds 80-95% leverage on a potential loan that is held a fractional reserve requirement of 10% can fuel a lot of something… not M1 Maybe M3 or 4. Great article, Thanks

“They are comparing total return for stocks with price appreciation only for RE. Granted the yield for RE isn’t very high these days, but it will narrow the gap.”

Although this may be cxl out when you consider that rent is taxed as interest income at the highest rate and dividends at no tax for a couple with 100K income. Also I have never had to pay renovations costs on my stock portfolio

@Buck2

https://www.managementstudyguide.com/real-estate-and-money-supply.htm

IMHO, it is a direct relationship between RE prices and Money Supply. Read the above link and evidence shows it can be recursive “increase in RE increases Money supply”. Kind of like the cart leading the horse argument, but worth the short read nevertheless. Everyone can make their own conclusions.

Gross. Seems this commenting system isn’t as well supported as I had hoped. Will probably revert to the standard WordPress comments although works for me on Chrome

Yeah when we bought i was pricing in another $50k drop and was fine with that. Didn’t happen but of it wouldn’t have bothered me because I was already taking it into account

Hi Leo. After Chrome’s latest update (version 78.0.3904.97) I can no longer thumbs-up comments or post comments. I’m using Microsoft Edge (ugh) to write this.

Not sure if anyone else is experiencing this.

Yeah that wouldn’t be much appreciation historically speaking. We’re at about 7% nominal average over last 60 years but of course that is through some high inflation times.

7% nominal is doubling in 10 years so doubling in 25 would be well off the pace but very likely to much slower price growth given structural factors working against us

Yes, and various money metrics (M1,M2,M3) are up 5X since 1995. Maybe not a great short term indicator, but points to much higher home prices in the long run. Nominal GDP grows about 4% per year, and that will double the nominal GDP every 18 years, and double the nominal GDP per capita every 24 years (given 1% pop. growth). Hard for that not to end up with your home being worth double in 25 yrs when you pay off your mortgage (or your rent being double if you don’t buy a home).

https://tradingeconomics.com/canada/money-supply-m2

I’ve found it’s a bit of a bigger picture than most people want, and Leo doesn’t think there’s anything concrete to base an article on with. I agree there are larger factors at play, and like I’ve said when I was considering my own views (right or wrong) on Victoria the last thing I was looking at was the local data.

While M1 is one underappreciated consideration in the housing market, just because it grows, it is not in and of itself predictive. For example, you can look at American M1 data prior to the RE bubble bursting, and it shows nothing remarkable until after it popped. Whether M1 grows and how is also tied to a myriad of other global factors and monetary supercycles that most people including myself struggle to understand completely. Some people suspect that rapid money growth and perpetually low rates signal a reduction in monetary policy relevance – meaning central banks are losing their power.

It’s really tough to say whether the value of the CAD relative to other currencies is playing into the housing market. IMO it probably did to a degree, but then again there a number of countries that have seen a relative drop in their currencies that haven’t had the same problems. Part of that issue has been the opacity of the dynamics you are talking about – we haven’t had enough data in BC or Canada to know who is buying the homes or how, but that will be changing. However, market forces are changing too, so by the time the policy tools are in place to really answer those questions, determining what was going on here in the 5 years or so preceding may not be possible.

I wonder if Beancounter is still around.

Thanks for everyone’s input here . I appreciate the reads. IMHO its been a long time since anyone ever mentioned what is actually happening. 1-500( ~) posts actually mentions. QE (money printing) , M1 Money Supply or anything related to Macroeconomic effects on house pricing . I have not even read any comments on how the $ CAD has been doing these are big factors in supply and demand for Vancouver and Toronto .. maybe Vic.

I think ignoring what is the Elephant, or Dinosaur or way bigger the largestasor ( Sp?) is misleading.

IMHO we are missing the bigger picture. Canada’s M1 Money supply for the last 20 years has increased every year between 3 and 20 % ( cannot give references re Copy-write) Please be nice …

Yes, that means the value of that money is decreasing that much each year. Value of $ decreases hard assets increase..

Patriotz,

Good point.

Any comparisons of RE vs stocks should be based on investment-RE vs stocks, where similar factors of yield, leverage and risk are included.

I don’t have investment RE but that’s just because I’m lazy (it’s too easy to buy a REIT ETF like XRE that yields 4%, and they don’t phone you at midnight with problems). But I think that people who do will fare better overall than stocks, all things considered. Both are risky though.

Investing in your home RE is an entirely different question for me, because it’s not just about money, leverage or “total return”. It’s more a “you only live once, you should own a home” issue, especially when you have kids. No kid grows up and says “I loved my parents’ ETF when I was growing up”.

They are comparing total return for stocks with price appreciation only for RE. Granted the yield for RE isn’t very high these days, but it will narrow the gap.

The age old question for RE investors and RE owners: what provides a better return RE or Stocks. I have always known the answer, even posted it once here to a chorus of jeers. Here is an analysis that looked at Toronto’s red hot RE market vs stocks since 2008 [same time frame] – one would think that Toronto RE would have left stocks in the dust. Not so.

https://www.bnnbloomberg.ca/toronto-property-investors-take-note-stocks-performed-better-over-past-decade-1.1344494

Vancouver West isn’t West Vancouver. Or do you not understand the negative there?

Well yes, you do need to say it at least one more time. Because your post about it included you mentioning these cities:

So that’s what you mean when you say “Vancouver”, and it should just include that, and be obvious to everyone? Yet you’re including North Vancouver etc. which are different cities than City of Vancouver. Yet you apparently don’t want to include Richmond or any other city in Greater Vancouver?

The funny part (aka swing-and-a-miss strike 2) is even when you use your cherry picked cities to try to show that Vancouver prices have fallen over the last 3 years – they don’t show that. As you can see from the numbers, only West Vancouver is down, and it has a tiny population (40K) compared to City of Vancouver (700K) which is slightly up. Average them out and its flat – even letting you choose the cities.

Mako: Basically you are correct that it is a matter of walking through the house. bring a measuring tape if some rooms need to be a required size (large dining room table; California King bed with large night tables or whatever).Just dont relie on the advertised sq ft. being correct. I wont bother to mention that you cannot rely on anything that is presented by most real estate agents (the “most” is for your benefit Marko and LeoS) since everyone on here has already figured that out.

I think most people would include more than just Vancouver City when talking about “Vancouver real estate prices…”, and it’s best to be specific if you’re just talking about Vancouver City. Same with our neck of the woods. I would expect a lot of people to take “Victoria real estate prices…” to mean Victoria city, Oak Bay, Esquimalt, southern parts of Saanich, etc.

Back in the 70’s maybe even in the 80’s they never used to count basement areas in square footage. Even the Gordon Head homes that had above the ground entry ways with no crawl space. Typically the houses were be advertised: 1200 sq ft. 3bd, 1-1/2 baths with lower level completely finished. Those were the bi-levels, The “cathedral entrance” homes…..same thing. A bungalow, i.e. a home with a full basement having the main level entered by going up stairs on the outside, would be listed as such. If there were added bedrooms in the attic, it would say finished attic having two additional bedrooms.

Marko: Maybe not enough coffee but correct me if I am wrong but it appears that you are including the thickness of walls in finished square area?

Yes that is the standard.

In rooms (attic rooms) are including all the square footage even if it is only a a few feet high?

Million grey areas….walk through the house and either it works for your or it doesn’t or just get your own measurements done plus a survey as part of due diligence if super important.

Likely because it wasn’t unfair.

I already have, Vancouver = Vancouver, not Greater Vancouver. If I wanted to say Greater Vancouver I would have. I have already pointed it out, more than once. Do you understand now??? Vancouver != Greater Vancouver, otherwise people wouldn’t say Greater Vancouver, they’d just say Vancouver, and there would be another word for just Vancouver. Is that understandable? or do I need to say it a few more times?

Marko: Maybe not enough coffee but correct me if I am wrong but it appears that you are including the thickness of walls in finished square area? In rooms (attic rooms) are including all the square footage even if it is only a a few feet high?

Coming from Ontario I was surprised to discouver that basements where included in square footage (explained why that 2400 sq ft house seemed so small.

In Ontario (and likely in Alberta), finished (below-grade) basement area are not counted in house square footage, regardless how lavish and livable.

Also see MS article: “What’s the square footage of your home? Are you sure” at: https://www.moneysense.ca/columns/whats-the-square-footage-of-your-home-are-you-sure/

@Cadborosaurus we did the same math and knocked off mid 5-figures to the price of a house to address the value of having housing stability, quality of life, etc w/ a kiddo (congrats on yr 2nd!).

I don’t see the issue with believing that house prices are going to drop further but still buying because it makes sense for your life. Even bears come across caves that they like.

is there a standard that you guys go by when report floor plan areas on PCS and listings?

For Strata Properties

The square footage you enter here shall be the heated, livable space with floor coverings, finished walls and a finished ceiling that is part of the strata lot, as per the Strata Plan registered at the Land Titles Office. Finished areas not part of the strata lot must be excluded. In the case of properties not yet registered at Land Titles, the square footage you enter here shall be from the proposed Strata Plan as submitted to the Superintendent of Real Estate.

Should Members wish to refer to measurements obtained from professional measurement companies or other sources, they may do so in fields reserved for remarks, provided such information is in addition to the information obtained from the Strata Plan and provided the source of the information is clearly stated.

For Other Properties

Finished space is defined as heated, livable space with floor coverings, finished walls and a finished ceiling. It excludes unenclosed decks, patios and balconies.

Ideally, the figure you enter here should represent the sum of the externally measured footprint of the finished square footage on each level of the dwelling. Imagine a set of plans showing each level. The sum of the areas enclosed by a line drawn around the perimeter of finished areas area on each level is what you’re aiming for. It’s recognized that this figure may be very difficult to obtain in the real world and that some approximating is inevitable. Note that the figure you arrive at for each level in this exercise goes in the corresponding SqFt Per Level field atop the Finished Rooms matrix on the Rooms (Units) page.

Finished Square Footage in Auxiliary Buildings Where your listing includes finished square footage in an auxiliary building such as a carriage house or garden suite, the figure you enter here must include it. In other words, “Total Finished SqFt” must be the sum of the finished square footage of the “Fin SqFt Main Bldg” field and the finished square footage in “Fin SqFt Aux Building”. If your listing doesn’t have an auxiliary building, enter the finished square footage both in this field and in the “Fin SqFt Main Bldg”, while putting 0 in “Fin SqFt Aux Building”.

got a question for the licensed realtors here – is there a standard that you guys go by when report floor plan areas on PCS and listings? –

i was just curious on how finished floor areas are reported in PCS – did some browsing on Zolo and there was an article that states only Alberta had standardization in floor plan measurements (lawsuits happened )

https://www.zolo.ca/news/standard-for-measurements

more things to make me cautious in this shark tank – so naturally i like to fact check – grab a bunch of plans off PCS and punch in the numbers – some reported only the interior sqf, others reported all the exterior wall spaces as footage , then there are ones that reported patios

A by product of cheap money, uncontrolled government spending, and cash printing. And, 5 year rate in 1991 was 10%, fast forward to 2019 5 year rate is less than 3%.

At home with my folks…

I’ve previously said they bought their 160 acre property in the Okanagan for $75,000 in 1991.

Dad says he build the house (2 story, ~3500 sqft) for $90,000.

Granted he did much of the work himself outside of foundation, framing, plumbing, and electrical, but still. $90k! Remember that the average cost for a ~500sqft garden suite was $180,000 in Victoria.

Insanity where construction and land values have gone in 30 years.

So because Soper isn’t unfairly attacking an idea by calling someone a moron, no admonishment from you is warranted.

Got it.

I might admonish a comment if it attacks an idea unfairly. You seem to have a special proclivity for ad hominem, which most of the time I just ignore it. When you’re not doing that I actually think you express your ideas very well. I just wish you’d do more of that than this silly, polarizing bull/bear nonsense.

But if people want to hurl insults at each other, or assert themselves as the alpha via never-ending show of haughty, badgering, pretentious one-upsmanship, then go for it. What is there to say that’s going to stop them?

Over time I’ve learned to develop a habit of simply skipping over it. Engaging it just makes it worse, and it provides little value to the comments.

Patiently waiting for Local Fool to call out Soper’s personal remarks (“idiot,” “moron,” “dunce”).

Or perhaps Local Fool only sees fit to admonish the tone of my comments.

Well here’s what your “position” said, stated In post 64341.

Seems reasonable to conclude your position is “ Vancouver prices haven’t gone up since 2016.”, which is demonstrably false.

But feel free to enlighten us on what your position is, if not that.

Or accept some free advice… when you’re in a hole… stop digging!

That wasn’t my position you dunce.

Same link… just look at the 1yr change. -6% overall YOY.

https://www.rebgv.org/market-watch/MLS-HPI-home-price-comparison.hpi.all.all.2019-10-1.html

-9%. Same link. You’re welcome.

Warning: Bears should close their eyes….

5 year Vancouver price change.. +53%.

what is the detached HOUSE price changes since 2016 for GV?

so what are the changes in the since 2018? cherry picking is fun

You got that right Kenny.

btw, if anyone wants to know how much a specific BC Dr. has billed Medicare it’s right there for all voyeurs to see pg.7 https://www2.gov.bc.ca/assets/gov/health/practitioner-pro/medical-services-plan/blue-book-2016-17.pdf

Those tiny areas amount to 60k people total, about 2.5% of Greater Vancouver 2.4m population.

Since it seems important to you, I’ve removed them from the calculation based on the GVREB.org numbers, and it changes the +6.1% overall Greater Vancouver home price increase since 2016 to 6.1% – (20%x2.5%)= +5.6% increase. Hardly a material difference to justify you clinging to your position that Greater Vancouver prices have fallen since 2016.

Any other areas you’d cherry pick for me to remove?

Prices never fall, especially in Victoria:

https://www.youtube.com/watch?v=TbPemdKLDBU

But history proves otherwise. And Victoria [1981] proves it. We were here. We witnessed it, but it is different this time, of course. House sold in Uplands today [Upper Terrace] – far below the asking price and 15% below the inflated tax assessment value. House sold on Beach drive for $500K below the tax assessment and way, way below the initial asking price – was on the market a long time – nice house – we looked at it. The luxury end of the detached SF market is experiencing a serious adjustment downward. This is true in Vancouver and Victoria. Sellers are fixated on prices from 2 years ago. Then they are fixated on the tax assessment values. Then, they throw up their hands and face reality – this is not 2016-17. Looking forward to seeing the assessments in January 2020.

Some below say Vancouver is rising. Really? Mortimer dares to differ:

https://twitter.com/mortimer_1?lang=en

OUCH !!!!

Daniel is right and history says so. Just saying…………..

I’m more interested in the substance of his discussion than his looks. Don’t judge a book by its cover.

In what world?

I’m just using “Greater Vancouver” definition from the “RE board of Greater Vancouver”

https://www.rebgv.org/market-watch/MLS-HPI-home-price-comparison.hpi.all.all.2019-10-1.html

If you prefer, you can use Teranet Greater Vancouver, which is up +12%. So that’s two “worlds” for you to pick from.

“Our family doctor left in 2018 after 3 years in Victoria as he couldn’t afford housing here (he is his 50s and moved to Mill Bay area).”

Doctors will be the first to admit that many of them are terrible with their money, easy come easy go, either that or he is divorced.

Why? Because you said so?

In what world does Greater Vancouver include the sunshine coast, squamish and whistler.

Your stats are stupid.

Well if you’re talking about Vancouver prices, that means Greater Vancouver, and not just West Vancouver. Or is that just more of your cherry picking “shtick”?

fwiw. City of Vancouver (Van West and Van East) prices were flat last 3 years and Greater Vancouver was +6.1%. Not much basis for you to claim “Vancouver prices” were down.

LOL. Swing and a miss indeed. Parts of Greater Vancouver with the biggest increases in the last 3 years are …. drum roll please … Whistler and Squamish.

Still “deals” out there.

There was a 3 bedroom on Hillcrest renting for $1890 a month through a property management group on Craigslist just a couple days ago.

They aren’t.

North Vancouver 1.7%

Vancouver East 2.3%

Vancouver West – 1.8 %

West Vancouver -19.4 %

That’s from the link you posted for all types of residential in the 3 year category.

Nice. I think that improves your situation considerably.

In that case, you may wish to simply continue to rent at market rates (if need be) until affordability improves to a degree that your family is comfortable with. Consider that extra rent a sunk cost. A lot of people out there now have pretty limited ability to save for a down payment considering their rent costs, so you are very fortunate.

Congratulations on the upcoming little one. May he or she allow you to sleep…once in a while. 🙂

Windy days in Victoria are strongly correlated with Soper discussing real estate.

Keep looking, hopefully the right house at a good deal will come along. Good luck.

Vancouver home prices are up since 2016.

MSL HPI Composite + 6.1% (Oct 2016 to Oct 2019)

https://www.rebgv.org/market-watch/MLS-HPI-home-price-comparison.hpi.all.all.2019-10-1.html

Teranet (composite) +12% (241 Dec. 2016->271 Oct 2019) https://www.nbc.ca/content/dam/bnc/en/rates-and-analysis/economic-analysis/economic-news-teranet.pdf

Looks like another swing-and-a-miss there James.

LF yes we have saved up a downpayment, which wouldn’t have been attainable paying today’s market rent so I do get a bit of relief knowing we could jump if need be. (for a bottom rung SFH in happy valley… Not ideal but better than our other option of renting again). We’ll just be holding out as long as possible, hoping that prices adjust a bit this spring so that we have more options than a handful of dregs. And hoping that the for sale sign stays far away from our lawn, or else things will get moving rather quickly.

That schtik was just to call you a moron.

Probably housed, since the only reason for the run up here was people coming from Vancouver.

any one know any family doctors that are taking patients? .. hard to find one these days .. most of them only work part time or dont have time to look at patients .. walk in clinics just give you basic service that you can look up on web.md

You did buy a house here. You travelled back in time and bought, remember? Or are you all done with that schtik?

Where would Victoria bears be without Vancouver?

When it suits them, they’ll say: “It’s happening in Vancouver, so it can—and will—happen here!”

Also when it suits them: “Victoria and Vancouver can’t be compared. They’re completely different!”

If he’s been a doctor for 20+ years and can’t afford Victoria, it sounds like he hasn’t managed his money well.

Our family doctor left in 2018 after 3 years in Victoria as he couldn’t afford housing here (he is his 50s and moved to Mill Bay area).

In 2016, a great many thought prices in Vancouver could only go up. So where are prices today compared to 2016?

Prove it.

I guarantee that if I do end up buying a house here, I won’t be on here gloating about it for a decade.

You sound exactly the same.

In 2009, a great many thought prices could only go down. So where are prices today compared to 2009?

“The only direction prices can go is down” is similar to this notion that the only direction interest rates can go is up: they’re both untrue, and making decisions based on them may lead to further disappointment.

That is such a lie.

Guess that’s the difference, I’m not here to get my jollies.

We also had a positive experience with a two-year-old at VGH’s Emergency Department. We were looked after quite quickly.

Adding supply to in-demand cities isn’t working, so why not try to make crappy cities more appealing?

Your situation does sound stressful. I think there are a great deal of people out there right now that would be having a similar or worse experience. I would say though, nothing is happening with your rental situation unless and until your landlord sells. Even if s/he does sell, also consider how much money you’ve saved over the last few years in paying non-market rent. Small comfort, perhaps – but those numbers are real.

Do you have a down payment at this point? IE are you otherwise ready to buy, aside from the prices still being above your comfort level?

That’s a good point. Interestingly the Labour Force Survey tells us that Victoria’s falling unemployment rate is more a factor of reduced total number of people in the work force than more jobs available. Either way, there’s definitely a shortage of Labour affecting businesses here. CBC National had a segment last night on it being a country-wide issue, with a problem of workers not even showing up for jobs after they’ve accepted – so called “ghosting” https://www.forbes.com/sites/forbeshumanresourcescouncil/2019/03/14/the-causes-and-consequences-of-ghosting-in-todays-job-market/#467ed3185f3f

Anything we can do to attract people to come here to work would be good, and that obviously includes affordable housing and overall cost of living. The completed construction numbers are ramping up now, and that will lead to some combination of higher vacancy and more people coming here, which should be good for the labour situation, and affordable housing options.

You are right.. but , imagine what happens when we can only pay manager level employee to work here..

one guy hired 7 years ago was 5th down the list but we had to take him because 4 other bailed after accepted job offers .. but he is gone now (thank God) . He cant seem to find a way to make numbers work with cost and union salary does not budge ,

Another guy with experience left because he want semi retirement work, but we can’t offer him part time job, the cost of on job training can be expensive – it was not possible for part time . So he moved back to his home town.

If it is a non-life threatening injury or does not need to be treated right away to avoid lasting damage, expect to wait. However when we came in to VGH with an infant that was dehydrated from vomiting and diarrhea, we were seen within the hour.

On jumping in now…

I think you can jump in to this market while still pointing out gross lack of affordability and the only direction prices can go is down. Some of our situations just don’t have the time to wait for what our brains feel will be an inevitable crash.

I’m renting for a deal by today’s prices and my landlord has hinted at selling my place. We rent the whole thing not a suite, so I’m pretty much guaranteed eviction by a new owner for personal use. My spouse and I have had to come up with a valuation for the actual cost of renting elsewhere if our home is sold out from under us, and the mental cost of home showings, moving to another rental, paying a disgusting amount of rent there, and then buying later so add another move. We value this at 50k.

Baby on the way, and the stress that’s going to bring in a too – small place just adds fuel to the fire. Also the fear we will we be looked over for the next rental because we have 2 kids and 1 cries in the middle of the night. Or pay more for a self contained. I value my current calm in this regard at another 25k if I was to lose it.

What this results in, is that while ideally if we had no kids and rents hadn’t jumped so high in the past few years, we’d easily just move to another rental and wait out the housing prices until they get to a level im more comfortable paying, after a crash I’m predicting. But with our extra personal factors, I’ll pay around 75k more than I’m comfortable with to spare my family a rental hunt / move / sacrifice a bedroom etc. If a for sale sign were to land on our lawn.

Maybe the factor is ideal location near work or friends, or perfect layout, looming eviction, or time pressures from a growing family. All of us house hunters have at least one factor that’d make us take a deep breath and jump in right now if a wrench was thrown into our calm, or if the ideal house was listed. I don’t think buying removes our ability to critique market conditions and prices.

Long wait time has been around for more than 2 decades.

20 years ago, my nephew (7 year old at the time) broke both the radius and ulna at the school play ground at 10:30 am. He sat in RJH emergency for 12.5 hours with a clearly shown broken arm before someone take a look at it, and we didn’t get home till 1:30 am.

Hm. I remember taking a few people to the hospital probably about 10 years ago and the wait times were similar (at least in my experience) as they are now. Be prepared to wait 5 to 8 hours to get in unless you come in on an ambulance. Maybe it’s worse now, but it’s been a problem for many years.

Sale of $1 housing lots spells success for New Brunswick village

“One of the conditions of sale is a two-year deadline for building a house that is at least 1,200 square feet. Developers tried to snatch up all 16 properties, but Stannix told them the village, about 70 kilometres southwest of Fredericton, wasn’t interested.”

same in Victoria, hard to find tech and health care people to work in the hospital due to salary ranges .. unlike engineers in private sectors , public sector jobs are non negotiable in terms of salary. we had some qualified people applied but did not take job due to cost of living and housing selections. can’t offer the job the new grads due to the experience requirements .. so welcome to the 7 hours wait time in hospital when you get a broken toe

One place in penticton said they hired an engineer from Ontario and he left after 6 months because he just couldn’t find an affordable place to live. That’s in a town of 37,000.

Travelling in the interior all this week. One thing I’ve learned from talking to builders and engineers is that the cities are the same everywhere in terms of being frustrating to deal with and slow to get new places built.

And many of these cities have similar problems with housing affordability and low vacancy. Coincidence?

Thanks. I’d like to frame “it” (you buying a home in this market), by using your own prior words. You felt comfortable dishing this “ugly reality” out to any homeowners in hundreds of posts, so I hope you’ll have a similar reaction when your own comments are addressed back to you as a rookie homeowner.

There are hundreds of posts to choose one, how about just one …

LF Jan 31, 2019: https://househuntvictoria.ca/2019/01/31/january-mediocre-sales-condo-prices-stumble/#comment-55800 “The ugly reality is local people made a desperate attempt to play catch up with a fleeting, global force they thought was permanent, and which economically, they couldn’t possibly hope to match. Now, and predictably, the deluge of cash pouring into the region with reckless abandon has almost entirely disappeared in an ethereal puff of smoke.

What we have developing in southwestern BC is a rapidly growing, smoking hole of a crater being blasted out by what may be one of the largest unfolding housing market corrections Canada has ever seen. In fact, it was Poloz himself that said – There’s a crater under every bubble. Every one.Can’t say there weren’t people that tried to warn you.

May Mr. Market have mercy on our souls, because bursting housing bubbles cause real harm to the people that live there.”

\<<\

Hopefully none of the bolded comments offend you, as they are your own words, from a single post. For the record, I think and hope that you made a great decision to buy at this time. And in case I’m wrong, I’ll close like you did, with your nice comment that I hope Mr. Market has mercy on your soul.

I hope you reconsider. It’s no fun if everyone’s on the same team.

If you say so. People can frame it however they want, I couldn’t care less. It was a distressed seller and was an excellent value relative to the market. Having said that, short to medium term I think we’ll lose financially, and the longer term return prospects aren’t that great. But I didn’t buy it for that.

I don’t think I’ll fare worse than those folks now dropping 600k on a 700 square foot condo in the middle of Johnson Street. What the heck are people thinking? That doesn’t even include strata costs, or your medical costs once you prick your big toe with the discarded Hep-C needles sitting in front of the main entrance.

The only thing worse than downtown Victoria IMO, is downtown Vancouver. Ugh.

I really think the condo segment of the market is going to be hit very hard during the next recession and many of them will be hobbled from moving up the property ladder. IMHO, many of those condos should be 50% less than they are.

I prefer the term “filthy”, thanks.

It’s a cool story, not that I trust anything coming from a dirty capitulator.

Random historical trivia:

Most residents will be familiar with the Hillside/Blanshard intersection. See here:

https://goo.gl/maps/2fPkMwNoshhngfJ3A

But did you that the site where “Freedom Rent to Own” is now, was once home to William Coburn, a man who made local headlines for days for refusing expropriation of his single family home during the 1960’s?

At the time, the city was implementing an “Urban Renewal” project, which saw an entire neighborhood of homes along that Blanshard corridor expropriated to make way for larger and newer infrastructure.

All of the owners along the corridor accepted payouts and left – except Mr. Coburn. Himself and his 5 kids and tenants, had lived in the 1898 built home on 2640 Blanshard St for years. He wasn’t satisfied with what the city offered him as a payout and when the city officials and police arrived to evict him, they were greeted by broomsticks and actually chased away at gunpoint.

A mob of spectators formed around the home, apparently in support of the Coburns. It was front page of the Victoria Daily Times on February 1, 1969, and for a few subsequent days in both the morning and evening publications. It was quite the buzz back then.

A month later Mr. Coburn agreed to leave under the condition that he could seek a court appeal of the payout amount. He later won his case. The house was demolished soon after, and now – you’d never even know he was ever there.

Flat is a correction. Nice of you to see the light.

Got that localfool, you capitulated!

I also don’t see myself as a housing bear.

Totally. That’s why localfool said they got the house they wanted at a price they could afford (ie: reduced) so they went for it, and that he still sees the market going down…. because he saw something.

Yes, and the “peak price” I referred to was August 2019 Teranet for Greater Victoria for all home types, based on resales of the same home. You linking to data quoting “core only” “SFH only” numbers isn’t Apple to Apples. More like Apples to Cherries 🙂

Instead, look at Greater Victoria Oct 2019…

MLS® HPI Oct 2019 benchmark for Greater Victoria SFH was flat YOY ($756k 2019 vs $757k 2018) (SFH price was up $4k MOM) , and condo benchmark was up 1% YOY ($500k vs $495k 2018).

To me, that averages out to flat overall. But feel free to continue to believe in “the correction.” That likely puts you at odds with many of your fellow bears who have capitulated recently at these near all time high prices. Maybe they see something that you don’t.

Page 2 of https://www.vreb.org/pdf/VREBNewsReleaseAndSummary.pdf

https://www.vicnews.com/news/softening-real-estate-prices-across-greater-victoria-except-on-the-west-shore/

Hey Patrick, if you could just go ahead and let them know that we’re at an all time record, that would be great.

Agreed, and that US dollar shortage is a worldwide issue, estimated around $10 trillion. Countries outside the US (like the UK) have banks loaning USD in a fractional reserve system outside of the Fed. Just the interest on those loans creates a big ongoing need for dollars, printed or otherwise. I don’t see these repos as any indication of instability or a collapse.

I don’t think that’s what anyone is implying. QE was the response to the collapse, not the cause of it. The question would be why are they implementing QE now if everything is hunky-dory?

Oh man, you can lead a horse to water…

Of course I read the article LeoM, and I also understand that these stresses in the repo market, while part of the mechanics of how the Fed operates, DO NOT have anything to do with the CAUSE of the financial collapse in 2008. (This is what you and others are implying and it is completely misguided.)

In 08 the repo market was a shitshow because JPMorgan literally just stopped underwriting repos out of concern over the overnight stability of the banks asking for funding. In today’s market there’s a ton of demand and an actual shortage of dollars to lend out. This shortage of dollars is what they are talking about fixing via a new tool which would be the overnight repo facility.

So to repeat – the drivers of the current liquidity mismatch just couldn’t be more different than they were in the GFC. This is more similar to 05, 01, or 98 when the Fed also entered the repo markets to provide liquidity.

NDP slow to fulfil affordable housing targets, report says

Only 71 rental housing units have been completed by B.C. Housing out of a promised 1,598, according to the first quarter 2019-20 report.

https://vancouversun.com/news/politics/ndp-slow-to-fulfil-affordable-housing-targets-report-says

Grant, did you actually read the article you posted? Your assertion that ‘anyone who asserts there is a crisis in the making is operating with a fundamental misunderstanding’ is clearly refuted by the article you posted.

Here are a few quotes from the article you posted:

“It (the NY Fed) also beefed up its overnight operations to $100 billion in the days leading to the end of the quarter — a milestone often accompanied by increased volatility. Those actions may be sufficient for a temporary patch, if the liquidity squeeze really just reflected a temporary crunch. But as the Fed intervention dragged on, strategists, economists and some former Fed officials voiced the belief that the repo turmoil is a sign of a longer-term problem.”

“But as the Fed intervention dragged on, strategists, economists and some former Fed officials voiced the belief that the repo turmoil is a sign of a longer-term problem.”

“But the broadest view is that the financial system has run low on bank reserves — excess money that banks park at the Fed — and that the current repo turmoil is a sign that the banking system lacks the buffers markets need in times of stress.”

“All of this funding market gyration points to the increasingly obvious fact that the end of Fed reserve draining is insufficient to stabilize these markets.”

It couldn’t be articulated any more clearly that the experts you pointed us to, all believe there is a fundamental instability in these markets that may be a sign of a serious long term problem in the main part of the financial system that was responsible for the last major financial meltdown in September 2008.

I took interest in this when it was in the news. One of the best articles explaining things comes from Bloomberg.

https://www.bloomberg.com/news/articles/2019-09-19/the-repo-market-s-a-mess-what-s-the-repo-market-quicktake

Essentially, what the Fed did was more a matter of cleaning up the mechanics of maintaining its balance sheet, as opposed to expanding or re-initiating QE which was meant to broadly support the economy. The Bloomberg article goes into much more detail for those who want to understand more. But, if any individuals such as this Michael Campbell chap are trying to claim a crisis is in the making because of this then they are operating with a fundamental misunderstanding of what is actually happening and why, or they are pushing their own narrative.

Even though the math works out worse for DCA, it’s usually the right choice when volatility + psychology factor in. https://awealthofcommonsense.com/2018/05/the-lump-sum-vs-dollar-cost-averaging-decision/

And if you’re going to DCA, the most important thing is to formulate a plan and stick with it to avoid market timing.

The BC spec/vacancy (SVT) tax is set to apply to some “residential zoned air space” starting next year. There was a one year exemption, but the govt haven’t said if they’re going to extend it, and if they don’t it seems the tax would apply. This would mean certain areas (Vancouver) that tax “air space”, would see spec tax applied to the empty space above their existing commercial/residential zoned buildings , because they should have torn them down and built taller buildings with more residential units in that airspace. Hopefully the govt will cancel implementation of that bad idea.

https://www.westerninvestor.com/news/british-columbia/b-c-speculation-and-vacancy-tax-still-open-to-change-finance-minister-1.23944160

“Taxing “residential airspace” above commercial

At the same time as the press briefing, immediately next door in the Pan Pacific Hotel in Vancouver, the Urban Development Institute (UDI) was holding a breakfast panel seminar with property tax and assessment experts from Burgess, Cawley, Sullivan & Associates to discuss the slate of new B.C. housing-related taxes. One issue raised at the event was how commercial properties could be affected by the SVT because of zoning that allows for potential residential use above commercial properties — effectively taxing the “residential” airspace above a commercial or retail unit.

Airspace that is classed as for residential use is currently exempted from SVT, but only for year one. When asked at press conference about whether the residential airspace exemption would be extended next year, Minister James replied that this was also part of the mayor’s meeting and decisions on this and any other exemptions and improvements to the tax would be addressed this fall.

The UDI panel added that the tax similarly applies to any residential portion of a property that has mixed residential and commercial/retail uses”.

My wife has interests and a few kids in the US; not having stuff in Canada is going to simplify matters a lot.

I have enjoyed my time in Victoria but i cannot say that I will miss it any.

Barrister – just out of curiosity – why convert your money into USD if you are moving to Switzerland? Won’t that just cause more currency exchange fees?

In the case at hand, hubby is apparently neither a Canadian nor an immigrant. Being married to someone who lives in a foreign country is asking for trouble IMHO and there are plenty of things that can go wrong besides the spec tax issue. Lots of possible problems on the US side with regard to community property for example.

Taxing on the basis of citizenship rather than residency creates big problems for a lot of people (ask Andrew Scheer), and only the US does it.

I have got the painter coming in January to freshen up the house for sale on the spring market. Hopefully the contractors will have finished the work in Lugano by then. That might be wishful thinking. I am hoping after all transaction costs and improvements, inflation costs and after converting funds back into USD that we might break even.

Cheers to all

Actually, I have often wondered what “evil” the satellitte surtax is directed at? Was there a flood of UVic profs taking teaching jobs in the US while leaving their families here.

Or was it just maybe the perception that a lot of rich Chinese got immigration papers and dumped the families here while they went back to their companies in China?

The real solution would to tax all Canadians and immigrants on their world wide income.

Actually we also really need a complete overhaul of our immigration system including but not limited to a much longer probationary period.

Majority of people who live here agree with the tax, so it’s implemented. Nothing in life is fair. If they don’t like it, there’s the very available option of selling the house, or renting it out. Or just pay the tax, and quit whinging about it.

Same person accused others on this site of murdering their children. Frankly she’s just not a good person, and I don’t know why you’d think otherwise. Operating in the gutter is her M.O, and the only reason she is on the site at all.

I agree. There’s always examples that the media tends to pick up on as well, that take really unusual and extreme examples of folks being affected, when the reality the population of those affected many be very tiny.

I thought his presentation was pretty well put together. Always nice to look at history. It would be good to get some local media articles from the early to mid 90’s though, but I haven’t gotten that far. The 80’s were easier to find things because it was such a fast moving and extreme example. 😀

People interested in the market would be wise to at least consider what he says, as well as other, credible arguments rebutting him. There’s plenty to go around. Otherwise, why pay any attention to anyone at all?

The other option of course, is for you to degrade yourself by cheaply hurling meaningless ad hominem attacks at people you don’t even know. I don’t know why you like to operate in the gutter despite an ability to do otherwise. And for people that choose to upvote that kind of garbage, you ought to be ashamed of yourselves.

Bears are taking lessons from this dude?

It’s all making sense now.

LF and Leo, and the Group, you are getting some good press:

https://www.youtube.com/watch?v=TbPemdKLDBU

poor people arent entitle to buy in , rich people arent entitled to keep their nice toys-

curse this social – capital democratic systems – socialized the loses and monopolized the gains –

it is damned if you do and damned if you dont .. in the end votes counts more

Not many millennials would have inherited yet; that’s going to make them richer when the time comes.

Any millennial willing to move for their career and work hard 5 days a week will do well.

Even the lazy ones can do well just by playing video games on youtube.

According to the article you linked, it seems to have an awful lot to do with how rich their parents are and where they live.

LeoS I agree that is not about gender discrimination but rather that with the new independance of women one cannot assume that just because one is married that it is necessarily an economic union.This assumption of economic union is a hangover from before the days of equal rights for men.

I did an awful lot of prenupts, particularly for second marriages where the parties keep their finances as separate entities.

Millennials gonna malinger:

Not all of them, though:

I’m thinking the millennials that try will be exceptionally successful at life. Those that don’t…

People do complain about that. it’s a subsidy to owner-occupiers at the expense of renters. We don’t need even more distortion by increasing it.

I agree. They should promote it as a luxury tax, and just have a higher rate for all with second homes, equal to a 50% surcharge of property tax bill, as a one-liner on the property tax form. They do something smaller already by denying the homeowner grant on a second home, and no one complains about that. This would just be adding a surcharge. and would get rid of the yearly declarations-for-all, and ending the burden for people caught up in the “too-high“ 2% rates.

I think it’s bad public policy to create a tax with the goal that it will be so big that it will force some people to sell their homes, thereby helping the housing crisis.

The tax system treats couples as an economic unit and you can’t opt out of that when it suits you. What you can opt out of is being married.

They’re not continuing their old mortgage, they are typically cashing out and getting a brand new mortgage. Anyway, I’m happy to leave it there, and thanks for the discussion.

If the government were honest (haha), they would not call it a “speculation tax”.

It’s a sin tax, like taxes on alcohol and tobacco.

Renters have seen rent go up by over 500/month or more in some cases. This is the “granny situation” most sympathetic to me. People on fixed incomes with no million dollar house to sell and live off the equity. People in their 80s facing homelessness have my sympathy not rich people with multiple homes.

You’re looking at this in a vacuum but not doesn’t really match real life. Sure you may sell after 10 years, but then what do you do? Disapear to the Cayman islands with your equity? The majority of people will just buy another house at a similar or higher price. It doesn’t change the outcome of the chart at all (except for pushing everything back as you’re spending a bunch of money on transaction costs).

I think spinning this as gender discrimination doesn’t fly just like the attempt to challenge the foreign buyers tax as racist didn’t work. It’s not about race, it’s about being a non-citizen. It’s also not about gender, it’s about majority of income from out of the country and applies equally to any gender.

To be clear, I don’t think this particular person should be taxed. They are clearly not the target. Also seems like a simple fix to consider history of income in Canada and not tax if that is present. Not sure if they are considering any tweaks to the spec tax based on what they have learned in the first year. I guess it could be legally problematic to make a change that is subject to a lawsuit.

I know that something bothered me about the fairness of the satellite family provisions of the tax but I really had to mull over what bothered me.

Lets take the granny situation where the woman who is retired and her husband lives in the US but whose house here in BC is in her name and was bought and paid for bu her own money earned in Canada.

The heart of the problem is that you are imposing a high tax on her based not on any economic decision that she has made or any activity that she is doing but solely based on on a decision made by a third party namely her husband over whom she has no control. This view that married people are one economic unit harkens back to the days of when women were considered the chattel of the husband. I think it may be long overdue that we revise our thinking and acknowledge, particularly in an era of independent women, that people need to be taxed as individuals. Moreover, we need to recognize that in an era of increasing second marriages people are actually keeping their finances separate and distinct.

Incidentally I was rather appalled by the governments response that this should not be a concern since it only affects a small portion of the population. Since when is it acceptable to pass bad or unfair laws as long as they dont affect the majority of voters.

I am still working on my first cup of coffee so the grammar Nazis need to safe their comments.

“If I look at the S&P 500 index”

I assumed investing in the TSX, since were in Canada, I’ve been talking about a balanced portfolio which was also back to original value within 2 years. The US market downturn was actually less than the Canadian market as the USD/CAD was up 30% during the worst of the downturn.

If I look at the S&P 500 index it reached its local peak at the start of 2008. It didn’t reach that same level again until 2012. I am not a very sofisticated investor so not exactly sure how index tracker funds work and how dividends factor in, but to me that seems like 4+ years. I am sure there were scenarios under which you could have gotten back to where you were in 1.75 years, but the average investor probably took longer to recover.

Another advantage of investing in a house is that you can enjoy it by living in it even when the price goes down. Not sure there would be any enjoyment about owning a stock that goes down in price, especially if you are leveraged in it.

“However, I would have had 3-5 years of a lot of financial stress. ”

Actually if you invested everything at once in June 2008 at the top of the market, 1.75 years later you were back to the same level including dividends.

No one who borrows to invest should put everything in at once, I always recommend that people dollar cost average.

If someone buys a house or condo for 400K and puts down 80K, if they had to sell it right after they bought it, perhaps they lost their job or were moving and the only way they could sell it was for 20K less and they had to pay real estate fees they have lost 50% of their investment overnight. Kinda like whats playing out in Vancouver right now with higher end homes, i’m sure there are plenty of people who have lost close to 100% of their equity.

I guess at the end of the day i’m posting investment information on a site called house hunting where the cult of real estate is the only thing people really believe in..

By definition higher volatility means higher risk.

Let’s say just before the stock market crash a decade ago, instead of using my $100k for a down payment, I decided to leverage and invest that money in the stockmarket and stay in my rental house. For comparison sake I am going to assume the bank was willing to lend me an additional $400k to invest. I put the $500k in an S&P 500 index tracker and then it drops by 40%. My investment is now only worth 300k and instead of owning 100k, I am 100k in the hole. Assuming I left my money in there it would get back to its original value within 5 years, and in the long run it may still outperform investing in a house.

However, I would have had 3-5 years of a lot of financial stress. Also Mrs. Landlord might be inclined to remind her husband of their financial situation on a regular basis. For a lot of people leveraging to invest in the stock market is not worth the stress associated with the volatility, even if the longer term return may be better. In the end most people invest to improve their enjoyment in life. Sacrificing years of lower enjoyment of life is worth it for some, but others want to enjoy life most of the time.

“Or just realize that the RE investment return is much higher because it levered 5X because of the 20% down payment. Unlike a stock investment. And the typical person who bought a Victoria house 25 years ago and has paid it off is now a millionaire (or close). Unlike most stock investors.”

Are you sure about that, $100,000 invested into a balanced fund at the same time would be worth over 900K. I am not anti house it’s just that people seem to think that the stock market is extreme risk while housing is low risk. People should have both and leverage works well for both housing and high quality stocks, now of course the stock market is more volatile because of the ease of liquidity but it has also returned a higher rate than housing has

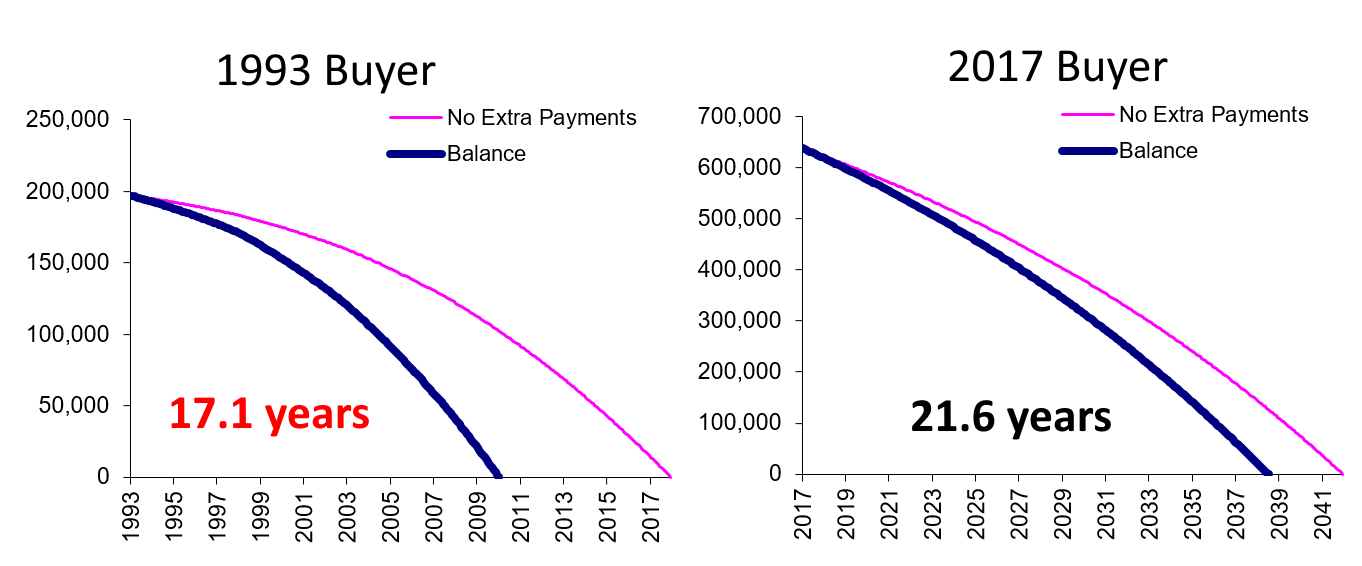

That statement is only true after 10 years of the mortgage, according to your own posted chart. Even with extra payments, the 2017 buyer is ahead of the 1993 buyer (more equity) for the first ten years, and then the situation reverses. So anyone selling at <10 years would be better off in today’s lowrate scenario than 1993 highrate. The easiest proof of this is to use your own posted chart. If you look at it, you can see that the your claim that the 1993 is better off with extra mortgage payments is definitely true at the end of the chart. But it isn’t true for the first 10 years, where the 2017 buyer is ahead, even when they are both making extra payments.

For example, at 5 years the 1993 buyer making extra payments has 15% equity vs 19% equity for the 2017 buyer. Thats 19/15= 17% more equity at 5 years. A 2017 buyer selling at that point will net cash out with 17% more equity (money), than the 1993 buyer because of the lower rates.

If you dispute the statements above, there’s an easy solution. Repost your chart, with the two years 1993 vs 2017 superimposed (with % as the Y axis). I think you’ll see my point, where

– (with normal mortgage payments) the 2017 low rate buyer is ahead at all times (higher equity)

– (with extra mortgage payments) the 2017 buyer is ahead for the first 10 years, then it reverses and the 1993 buyer is ahead.

21 is fine. 17 lands you in jail.

What about double-up payment privilege?

Stress-testing for 10% rates is crazy overkill, that’s all. My point is that spending any amount of time thinking about an event that unlikely is too much time spent.

20% without penalty.

That’s entirely the point.

It’s not. It annoys me too, like it probably does others. But what do you do if you want a home? While I suspect that affordability is going to be improving, the era of larger principles and lower rates is likely going to be here for a fairly long while yet. By the time I wait for those ratios to be like they were in 1993, I’d have the home paid off. There is a certain amount of birthday luck involved here – some decades it’s simply better to own a home than others.

Has anyone been following the emerging financial turmoil in the USA with the banks repo rate bouncing like a yo-yo up to 10% and the Fed stepping in to fund over $100 BILLION to calm the market and bring the repo rate back down? Vancouver investor Michael Campbell thinks a crisis is brewing in an area of the financial market that is obscure to most people.

I don’t understand any of it, it’s way beyond my comprehension.

Let’s step back a minute.

What do most people want when they buy a house?

They want a house

Preferably a paid off one.

So we know that the output is one house to live in, free and clear.

Now consider the input in two times when affordability was equal: 1993 and now.

With similar scenarios (Small additional payments which is typical for Canadians) the buyer now requires a much larger down payment, and will be paying for the house much longer (nearly 5 additional years in the scenario charted below) compared to the buyer in ‘93.

Same result (one paid off house to live in) and much more money paid for the privilege. There’s no way to argue that’s a better deal.

Well I’ll give you one thing it’s certainly a new argument that higher prices are more affordable than lower prices.

Your scenario is a tautology. More money in means more equity. But more forced savings into a low-return asset is not a good thing. Let’s say a bank forced you to invest $250,000 into a GIC yielding 2.5% and another bank forced you to save $750,000 in the same GIC. You can get 5% elsewhere. Which do you prefer?

Well sure, just like it’s better to payoff high interest credit card debt than a low interest mortgage, because it’s always better/wiser to get out of a bad deal than getting out of a good deal.

I just don’t see why that point seems more important to you than the obvious advantages of faster/higher equity buildup that occurs with lower interest rate mortgages, to lead you to conclude that “ it’s better to pay more interest as a percentage of the payment than more principal”.

There’s also that little matter of him not paying income tax in Canada.

Versus 17 years for the same buyer in 1993 when affordability was equal. Would you like to argue that 21 years is better than 17?

Often? No, rarely. Married or common law couples get a lot of tax breaks and benefits. For example, CPP survivor’s benefits, RRSP/RRIF tax free rollover, rollover of other assets capital gains free, assignment of deductions such as tuition. Those benefits aren’t peanuts.

In the case of the couple under discussion – whose situation is very rare – I have to wonder whether they are married in other than the legal sense, anyway.

You can ignore that post, I wasn’t quite awake. 🙂

Do you have double-up payment privileges? And what’s the max annual lump sum you’re allowed to make?

Stress-testing your mortgage like that can’t hurt, but the likelihood of an asteroid hitting Earth in the next 15 years is higher than seeing 10% interest rates in that time, IMO.

7.5% strikes me as nearly as unlikely.

And I would give it, at best, 50-50 odds that we’ll see 5% in 5 years’ time.

I think the reasons behind low interest rates for the past 10 years—and their continuation—are structural rather than cyclical.

Agree with you there. In this case it makes no sense for her to pay the tax. There should be consideration for whether you have worked your whole life and are now lower income for the purpose of satellite family designation.

Your posted 1993 vs 2017 chart contradicts that, by showing how extra forced savings makes you mortgage free in 21.6 years instead of 25, so that’s “does them good without extracting equity.”

The 2017 person with a low rate mortgage has built up more equity than the 1993 person, because today more of the mortgage payments go to equity.

For example, let’s look at the amount of equity built up, comparing mortgages at 5% (highrate) vs 2.5 % (lowrate) (assume $500k mortgage, so the %values are based in $500k)

The lowrate mortgage will have 25-38% more equity buildup in years 1-10 vs the highrate. This highly relevant if someone sells their home to buy a better one, because this is cash extracted that they can apply to their next home (or whatever).

It’s always interesting to read your reality-based analysis after scratching my head over the nonsensical cheerleading coming from the Times Colonist. Their headline is “Low inventory, consistent demand keeps real estate prices climbing”, but their own article refutes that if you bother to pay attention.

Yes, agreed. To us it underscored the principle of doing lump sum payments in addition to the regular, accelerated repayment schedule. With principals this size and no suite in our house, the risk upon the first 5 year renewal is comparatively high.

We’re at 2.69% right now. Our calculations for lump sum repayment were done in a manner which presumes (all 5 year terms):

5% interest at 1st renewal

7.5% at second

10% at third – with 10% being the general upper bound.

We don’t think that speed and level of rate hiking is particularly realistic, but if that happened, the extra lump sum payments would result in our monthly cost upon renewal being very similar to now. If the rates didn’t rise by that amount, we’d be out from under the mortgage in a very short period of time. Win/win.

I am beginning to wonder if it is often disadvantageous to be married or telling the government that you are living common law from a tax point of view. Even if one partner is not working I am not sure that the dependent deduction is actually not outweighed by the possible government benefits for being without an income. Not a tax lawyer and am actually far too lazy to do the math.

Maybe the woman in the example should consider a quickie divorce.

It’s not material for the purpose of the chart. The measure is for affordability at time of purchase and the actual values are meaningless (we could use lower rates, we could use higher or lower incomes (economic families only or disposable income instead of gross), lower down payments, or longer amortizations. Each of those would shift the chart up or down but wouldn’t change the shape of it.

Quite right. And unlike what you are inferring here, the situation in the past was more beneficial. In other words, it’s better to pay more interest as a percentage of the payment than more principal. Counterintuitive but true. If you are paying a large percentage of principal in the beginning it means interest rates are low and have little room to drop. It also means you have a massive principal to pay off and there’s no way around that.

I wrote about this earlier here: https://househuntvictoria.ca/2017/02/16/equal-affordability-but-some-affordability-is-more-equal-than-others/

Comes down to two things.

Now that is some doublespeak. In the end what comes out of your account is principal + interest. The forced savings does me no good whatsoever unless I extract the equity and in that case it’s a very low return way to park a ton of money and a high-cost way to get it back.

Thanks for the info and explanation. The metric that does change over time not reflected in your affordability chart is the proportion of the “interest only” (aka “down the drain”) portion of the Mortgage payment. Two points in time may have identical values on your affordability chart, but (for example) today only 1/3 of mortgage payments are interest, whereas in the past it was much higher (more than double).

If you added a new line to the affordability chart graphing “interest portion only” it would show a non-cyclical demonstration that houses have become more affordable over the last 30 years because of falling rates. For example now, where (as I’ve calculated) it takes 40% of median income to buy a median home, that might sound bad, but it’s really only 1/3 of that mortgage payment (13%) over the life of the mortgage that is “down the drain” money, the rest is forced savings (equity).

Many renters are paying more than that 13% to rent, and could realize that buying a home is the more affordable option for them than renting. It surprises me to see posts from some bears here that happily pour much more than the interest portion of a mortgage down the drain each month in rent because they think that “homes are too expensive and prices will fall”.

If she was single and living alone in her BC home (paying no BC taxes) she would be fine and paying no spec tax. She pays BC taxes (retired professor) and lives in the house. It is because she’s married and her husband earns more than her that she is turned into a satellite family. That sounds like a law out of the 1950s, where the lower spouse income (typically the woman) would get ignored – hard to believe the NDP came up with that. Of course this could affect people of any age and sex, the example given happens to be a woman senior.

If they find a sympathetic judge, the govt will need to explain why they don’t properly consider the taxes paid by the lower earning member(s) of the satellite family. Should at least make for some bad publicity for the govt., and I wouldn’t be surprised to see that convince the govt to tweak the law.

Granny defense!

“But she says she’s considered a member of a “satellite family” under the act, because his retirement income is higher than hers and he pays taxes in the U.S..”

In other words he doesn’t want to pay Canadian and BC income tax because it’s higher. Sounds to me his “retirement income” is a lot more than just CPP/OAS. Well actually we know it’s higher than a pension for a Canadian university professor.

“LW & Associates is a boutique law firm with a focus on corporate, real estate, immigration, and civil litigation.”

https://www.lwacorp.com/

Not always, it’s just what you get when there’s a long term decline in interest rates. Sure wasn’t the case in 1981.

Vancouver sales up 46% in October. Also just above 10 year average

Looks like I missed that comment Patrick

The difference is interest rates. I use a series from stats can that purports to show average rates paid by people by is always higher than the lowest rate available at any given point.

So your calculation using discount rates is fine but then you cannot plot it against my chart. That would be meaningless. You would need to plot your own chart with discount rates which would just move the line down overall and not change the picture (which is that current affordability is middle of the range approximately)

Or just realize that the RE investment return is much higher because it levered 5X because of the 20% down payment. Unlike a stock investment. And the typical person who bought a Victoria house 25 years ago and has paid it off is now a millionaire (or close). Unlike most stock investors.

“I recall kind of snickering at the price that the previous owners paid for it, when they bought it in 1993. It was nearly 1/3 the price I just paid. But is it that because homes have somehow become more “valuable”?”

You realize that’s only around 5% rate of return over 26 years, houses in the long run appreciate around inflation plus a couple of percent, that period was a little higher, of course you have to factor in renovation and maintenance costs which would have lowered the rate of return

I’ve been making various versions of this “low rates = affordable houses” argument here for some time, to challenge the conventional wisdom of the “affordability crisis”. For example, this post a few weeks ago pointing out that Victoria median SFH is currently at the best range of affordability for median income family according to LeoS graph https://househuntvictoria.ca/2019/10/01/september-trend-reverses-but-for-how-long/#comment-63531

And yes, it depends on low rates. Hopefully you lock in for a long term.

A new class action filed, this time against the BC govt re: spec tax. Representing nine Vancouver and Victoria families, mainly satellite families that are getting charged the 2% rate. It seems to be targeting the “satellite family” definition, which is an invention by the govt, and the lawsuit alleges it unfairly targets women and seniors, with a rate so high that it forces them out of their homes (“irreparable harm”). The cases they have seem to be BCers (with foreign spouses) living full time in their BC house, but caught up (“bycatch”) in the definition of satellite families. In defense, the govt would likely need to convince the judge that there is an acceptable reasoning behind this. (This case doesn’t seem to involve NAFTA). Hopefully this case will, at a minimum, lead to a govt tweaking of their rules, as these people are clearly not speculators or leaving their home vacant.

https://www.cbc.ca/news/canada/british-columbia/proposed-class-action-lawsuit-alleges-b-c-s-housing-speculation-tax-unfairly-targets-women-and-seniors-1.5345331

“ The lawsuit also seeks an interim injunction to halt collection of the tax while the case is considered, arguing the levy is causing “irreparable harm”— forcing some people who can’t afford the assessments to sell their homes.

It also alleges women and seniors are unfairly targeted, caught up in an overly broad tax designed to penalize foreign and domestic real estate speculators and turn empty homes into affordable housing.“

Funny little observation I just made with respect to the home I’ve purchased and general home appreciation in Victoria.

I recall kind of snickering at the price that the previous owners paid for it, when they bought it in 1993. It was nearly 1/3 the price I just paid. But is it that because homes have somehow become more “valuable”?