September: Trend reverses, but for how long?

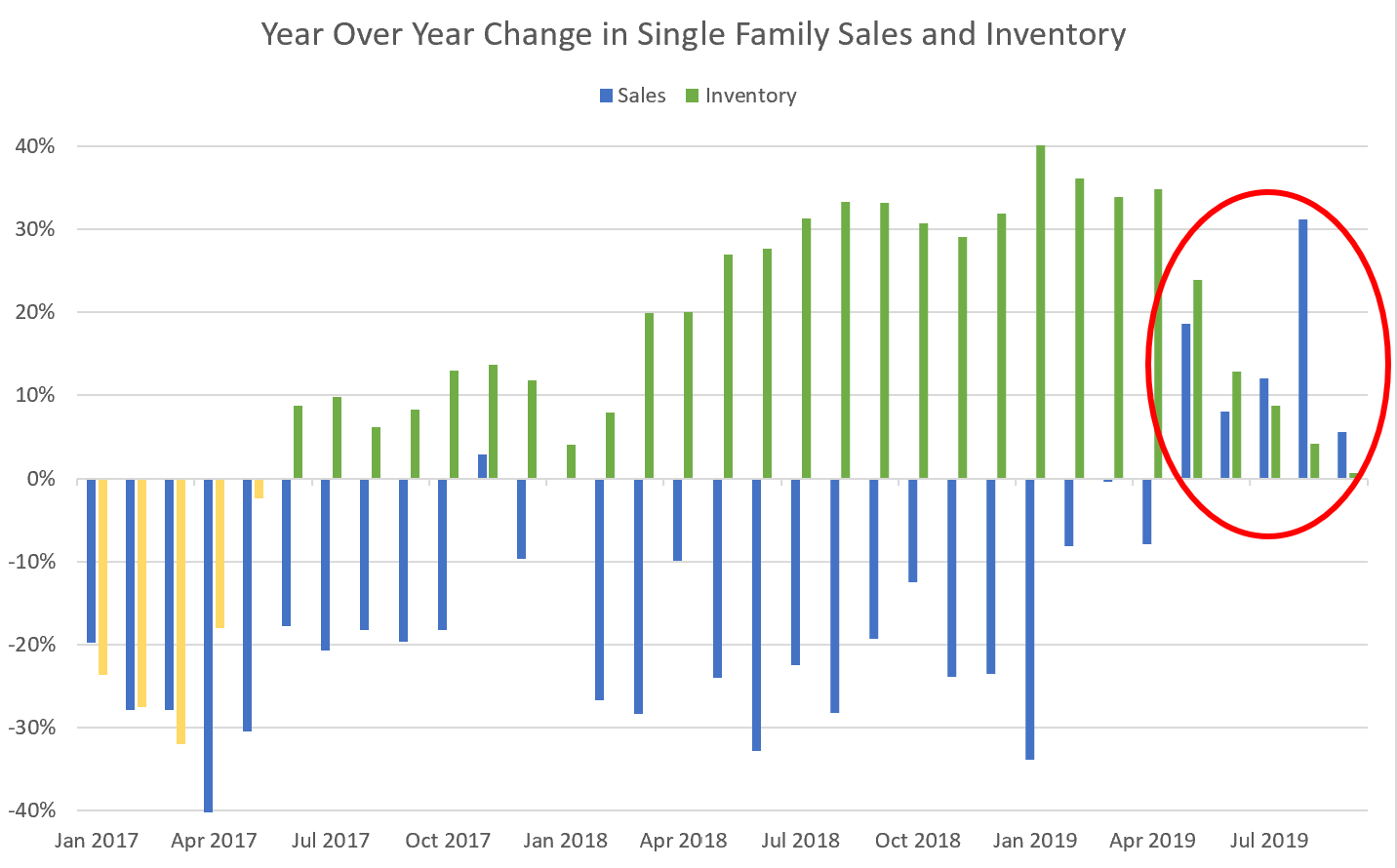

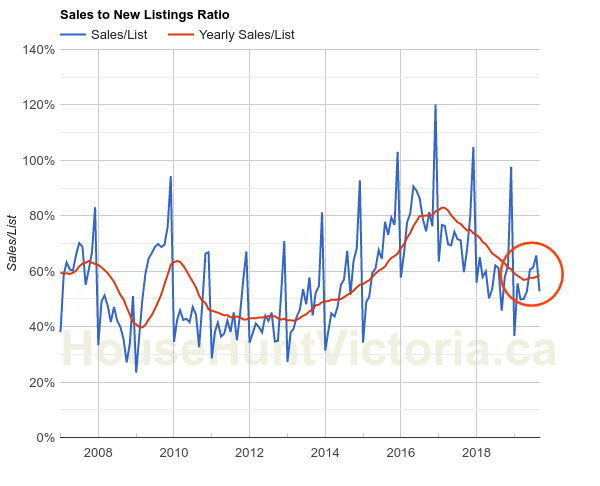

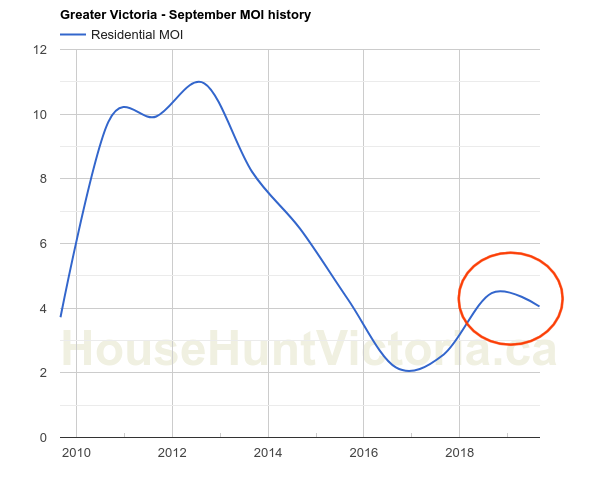

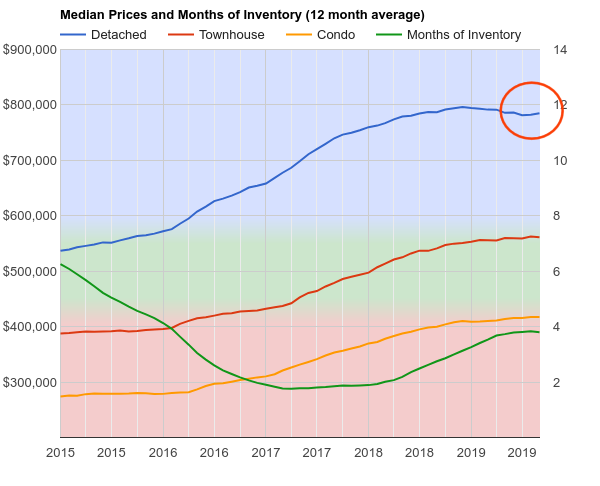

September numbers are in, and it’s more of what we’ve been seeing for 4 months now. Sales are up compared to last year, and although we still have more inventory on the market compared to last year, market conditions are now moving slightly back towards a sellers market instead of continuing the nearly 2 year old cooling trend.

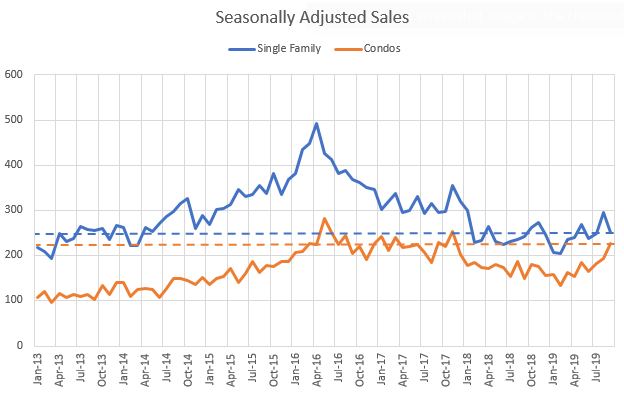

After a big gain in single family sales in August, single family volume has dropped back, while momentum has swung back to condos. Those swings are mostly noise and a reflection of a very weak condo month last September, however the signal is clearly that there is more demand floating around the market than this time last year. As I’ve said before, although the stress test sideswiped the market, it wasn’t actually ready to peter out naturally yet and a combination of full employment, dropping interest rates, and consumer confidence is bringing some buyers back into the market.

One or two months of increased sales is noise, but we’re on month 5 now of this reversal so it’s hard to argue that the trend hasn’t shifted. That’s pretty clear from a variety of market indicators that have reversed direction and are now indicating at least a stable market, if not an improving one.

Heck even the yearly average of prices ticked up a bit after declining all year. Now, I think single family home valuations are basically flat, just like I thought they were essentially flat before as average prices were drifting downwards. But it’s clear that the market is feeling the increase in activity, especially on the lower end.

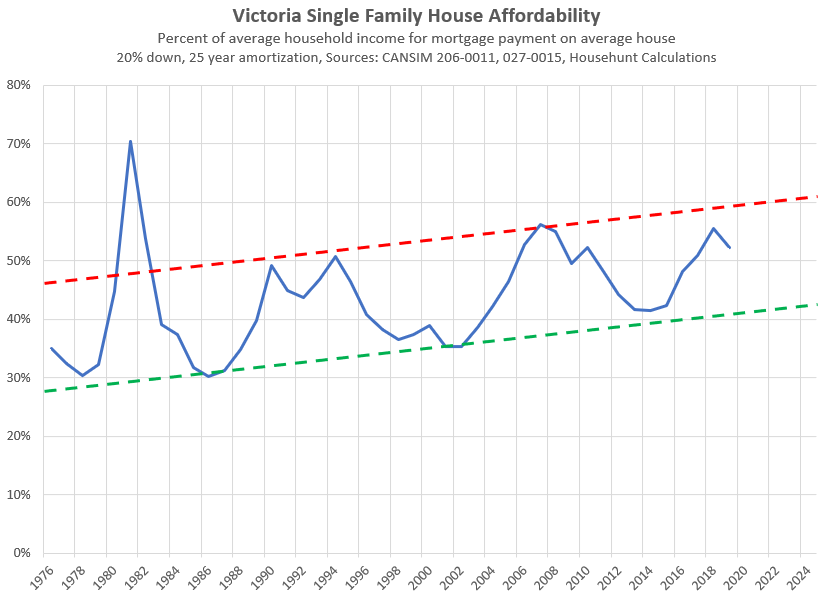

So the million dollar question is how long will this last? Perhaps I’m being stubborn in the face of positive data, but I’ve said before and still believe that we’re not at the end of the correction yet. That said the market can reverse direction temporarily, and that temporary could be many months long. In 1991 affordability got very bad, then improved, and peaked out again in 1994. In 2008 the market crashed in response to the great financial crisis, then came roaring back, before peaking more naturally in 2010. In both cases the market didn’t start sustainably recovering until affordability improved substantially. However real estate markets move slowly and we could very well see several more months on this path of stabilized market before any further cooling. The next shift downward, if it arrives, will likely require a deterioration of consumer confidence.

New post: https://househuntvictoria.ca/2019/10/07/oct-7-market-update

Greater Victoria SFH Median Sept 2019 is $820k.

This is within 0.6% of all time high (may 2018 $825k).

Moreover

– this SFH median price is up 11% YTD

– SFH median prices are on a tear for the last three months. up 9% in just 3 months

July 2019 – $750k (Victoria SFH Median)

Aug 2019 – $789k (Victoria SFH Median)

Sep 2019- $820k (Victoria SFH Median)

Page 2

https://www.vreb.org/media/attachments/view/doc/statsrelease2019_09/pdf/statsrelease2019_09.pdf

Other indexes are different. VREB HPI benchmark -3.8% From peak (SFH only). Teranet Victoria at all-time-high (SFH, condos composite)

I would say there are market segments that are 10% down but you also have some market segments that are or near peak prices. I wouldn’t say we’ve seen any sort of “correction.” We’ve flatlined in my opinion and some market segments that went a bit irrational during 2016/2017 have pulled back a bit.

In summary, just like what I have been trying to preach all along, if you want a nice house then its better to spend your time figuring out how to make more money than praying for a crash, but the former involves actually doing work and not many people like doing that.

+1

In Gordon head where I and a few others on this board own, I would say probably closer to 10% decline since the peak (I would consider that an outlier because there were some homes that sold in a bidding war for $1M in summer of 2017 that would probably fetch $800k right now). Overall in Victoria, i think it has been fairly resilient, I am sure Patrick will probably quote you some terenet index numbers before noon today.

James, Do you see homes in the core in LA, San-Fran or Seattle being cheaper than Vancouver? Those are really the only comparables to Vancouver on the west coast of North America.

Aren’t we already at like a 5% drop in Victoria?

The VREB benchmark house is a SFH in the core – something like the holy grail for many here. So let’s measure it’s current affordability, using the formula on LeoS affordability graph, and see where we stand. Woah…. when I look at it, the benchmark Victoria house seems at the best part (40%, most affordable) of the affordability graph, near or below the lowest bands. Why is that different than the 52% shown on LeoS chart?

From LeoS famous affordability chart, we see the affordability red and green bands between 40 and 60%, and we are not expected to stray from that. This is a measure of % of mortgage payment / % of average income.

If I measure the benchmark Victoria house $846,500, with 20% down that would be a $677,200 mortgage. Best 5 year rate at ratehub.ca is 2.49%, and a $3,030 monthly mortgage (25 year)

– At a 96k household income, that’s 3030/8000 = 37.8% of income (lower than the lower band of affordability)

– at a 84K household income that’s 3030/7000= 43% of income, close to the 40% lower band.

– and best of all, the interest only portion is only $16,870 per year ($1,400 per month), only 18% of household income, the rest is savings ($20k per year equity pay down)

Now it s possible LeoS is using something different to measure these things, but perhaps he could let us know which of my three numbers (av. House price $846k, mortgage rate 2.49%, av. Income $84-96k) he uses using that’s so different from mine to give his value of affordability at 52%, instead of 38-43% as in my calculation.

Tier 1 global city for money laundering, sure.

Programmers are in demand, you could get an extra job to afford to buy a home.

James, although home prices have dropped in the Vancouver, homes around the core are no where near close to being affordable by people making the median income there, and will almost certain never happen. It is safe to say, a household making $90k a year will never be able to afford a SFH in kitsilano outside of a major one-time cash windfall.

As Leo has pointed out, the last run up also coincided with affordability being somewhat reasonable. Now that the price has plateaued, wages will need some time to catch up before the next run up in a normal economy. Conversely there could be a 10%-20% drop should we go into a recession. Home prices are downward sticky just like everything else so I wouldn’t be counting on a fire sale right off the bat.

In summary, just like what I have been trying to preach all along, if you want a nice house then its better to spend your time figuring out how to make more money than praying for a crash, but the former involves actually doing work and not many people like doing that.

We should be focused things relative to others in the present, not the past. Someone can’t tell me we should be happy with indoor plumbing when they have the luxury of empty vacation homes.

Most bots are about 7-10 lines of python and run in the background. Not exactly breaking the bank.

Complaints that I didn’t get back to them? Automated email response one day later saying it’s been rented. “Sorry, we had a lot of interest, and it’s been rented. Good luck in your search :)”. No one complains about that.

What would possibly drive that?

People here seem to forget that the run up a few years ago was driven by people from Vancouver. That’s dead now that Vancouver is cratering. So honestly, what is going to cause a run up here?

Sure explains why houses there are dropping precipitously.

“Sure, but mortgage payments for the house I live in currently would equal nearly twice what I pay in rent. Add in the CMHC fees, and taxes and you’re at over double. Which means that you need double the income just to make it affordable, and you didn’t make any money at all on your biggest investment last year.”

James, what you are witnessing isn’t new. back in 2013, there were people paying $2000 a month for a house in oakbay that would sell for $800k. So for them, it wouldn’t make any sense to buy. However, now that same house is $1.2M and if they are still there then there is more reason not to buy. But you run the risk of a further run up to where that house becomes $1.5M. Had that person bought at $800k or $1.2M then they would be better off. Opposite is true if the prices decline.

I was in Vancouver for work last week, had meetings with bunch of lawyers and bankers there. The consensus is that Vancouver is a tier 1 global city now and any home (condo, SFH, townhouse) there in the core is considered a luxury item and therefore the prices does not need the support of the local median income to be sustainable. I have a friend whom works downtown and has a household income of around $220K a year and he ended up buying a townhouse in richmond for ~900k with his wife. How that translates into Victoria? i don’t know.

The mortgage on my first house in Vancouver was in fact interest only. But I did put 40% down.

Let me ask this question: if the tax doesn’t apply to you, why are you (and people like you) so worked up about it? The answer that suggests itself is that you are afraid that it, and other measures such as the increased FBT, will be effective in bringing down prices. And we do have that carnage in Vancouver as a preview.

No, what I’m saying is prices are generally what they are advertised for with a rental and have been for the last 20 years in Victoria that I know of, but buying a house usually involves some bargaining and this is an expected part of the process.

Landlords don’t generally want tenants who are offering less than list because it may point to an inability to pay and if you are pricing fairly it is definitely a warning sign imo. It is better to do what Marko did and lower your price and get more offers to choose from, turning down those who try to bargain.

I don’t recall you ever renting out your suite, but if you do you’ll see it is not like selling a house.

Sure, but mortgage payments for the house I live in currently would equal nearly twice what I pay in rent. Add in the CMHC fees, and taxes and you’re at over double. Which means that you need double the income just to make it affordable, and you didn’t make any money at all on your biggest investment last year.

Yeah, at 2009 prices.

I rent it to myself for $1900 for tax purposes.

Sorry, when are you taking me for dinner and drinks?

Remember the range of discounts on resale units is 0% (i.e. no discount or pay a premium) in hot markets to about 3% in slower markets. Rental discounts are in this range too. 3% on rent is $30 per $1000 rent. In slow markets you certainly can get ~$50 off (or someone throws in the pet premium for free). Things like one month free rent (common perk in slow markets) is equivalent to 3% off on a 3 year stay.

I’ve never made an offer on an advertised rental price, nor have I had an offer that differed from the rental price I set.

I’ve had people email me about a lower rent but I’ve never replied to the emails, just delete.

I’ve never been in a situation where I haven’t had applications but there have been a couple of instances where I didn’t have a good gut feel about anyone and I re-listed the condo at $50 less per month to get more applications. So I won’t negotiate on the listed price but I’ll adjust the list price need be.

Seems pretty much definition of democracy.. politicians need to sell votes. There are more people who wants cheap housing that rich people who pay tax on the million dollar second home.. oh. Not the democracy you wanted? It’s not helping you.? Better make a protest group or rally with you numerous millionaire friends.. maybe some one will feel sorry for you

Think you are looking for the un-capitalist word

So what you’re saying is that in a hot market you can’t get a discount and in a slow market you can.

That’s different from the resale market how?

And the tax solved afordability or housing shortage?

The tax/politicians knee jerk reaction is caterring to the few that blames their demise on everyone but themselves for their failure to keep up with their peers. To me the tax, and xenaphobic ageism mentality is so un democratic and un Canadian that we should be ashamed of.

I truely belive that those empty house owners contribute more to our local economy than they use.

Speaking as someone with a lot of experience renting (as a renter and landlord) and buying/selling in Victoria, I say that is absolutely untrue.

I would never expect to pay asking price for a house without assessing the market and the ask against various factors. I’ve always made offers on a purchase and had offers on a sale. In my opinion, a lot of prices are set with some room for this factor ie. initial price is should be within the range but at the high side in most markets.

I’ve never made an offer on an advertised rental price, nor have I had an offer that differed from the rental price I set. I’m not saying it couldn’t happen, but it is not the norm in a low vacancy market, as it is in the buy/sell market. Ask a property manager if you need a bigger sample size than me or the other landlords I know.

A landlord might, however, reduce their price if they don’t get a tenant due to mis-pricing, but pricing is way easier to set on a rental by using comparisons that are readily available in the same area.

You just need to look at the beginning of the month when places are posted as this is when people look and give notice. It takes time to schedule viewings and select tenants so places are generally posted for a week. At any given time there are only so many places available and they tend to set market. I regularly check and prices are generally within a band. Under market prices are rare.

I’d say experienced landlords looking for good tenants generally set prices at slightly under market because it is, imo, way better to have choice and someone in place who thinks things are fair.

Renting is not the same as buying.

Here’s the thing QT. If the stories in the TC were about people like you that were now being taxed out of their only home, there would be lots of sympathy and likely a public backlash against the tax. Instead we get people with million dollar second homes that they would like to leave empty and so there is little sympathy. That’s what the kids these days call first world problems. https://knowyourmeme.com/memes/first-world-problems

I’m sorry to disapoint you, but if you open your eyes and read what I wrote you would know that I’m not a Boomer.

Boomer is going to do Boomer things again

But in metro Vancouver and Victoria, it’s lower. Beyond that, Nanaimo is safe for the NDP and Kelowna is a writeoff.

It really comes down to the swing ridings and it’s likely that in them the spec tax is a winner. It isn’t in the likes of Vancouver Quilchena or Oak Bay-GH but they would never go NDP anyway. The 2015 NDP campaign was won in metro Vancouver ridings where housing affordability was a big issue.

And in case someone wants to bring up protesting homeowners in Vancouver Point Grey, that riding is actually majority renters.

The millenial who penned that opinion piece lack experience and the wisdom.

I can’t speak for the boomers or housing situation pre 1980 on Vancouver Island, but from 1980 onward I have lived here in the CRD and Vancouver. Housing pretty much has always been an issue as well as the cost of living here in Victoria.

People now are living in much better accommodations and economic environment than the past, because in the past many people out in the outlier areas of the CRD (Sooke, Metchosin, Langford, Colwood, Malahat, Sidney, Gulf Islands), didn’t have garbage pickup service, or own a phone (some areas had party line), and many families didn’t own or have access to a car. Many sfh and trailer parks do not have indoor plumbing even in the core (outhouse and/or outside washer if they have the luxury of owning one). Even fruits and vegetables were a luxury to have in the winter, and standard items such as banana, coffee, etc… (avocado was nonexistent) that are standard items in today grocery stores weren’t that readily available in the past.

Millenials cries of hardship when they don’t even know what hardship is like.

An example, and I’m sure my family of 8 have it better than some people here in Victoria, because my dad had a job that pay $3.50 an hour (and I helped with earning money for the family starting from 12 year old) and our rent for a 2 bedroom apartment in Esquimalt was $290 a month, when unemployment was at an all time high averaging at 12% unemployment rate. At that time many people lives in squalor in the Gulf Islands and Sombrio Beach (if I recall correctly the population at Sombrio was as high as a 100 families of more than 400 people at peak, and at one point a writer for the Monday Magazine was a resident/squatter for several years at the beach). And, these people/older generation didn’t complaints, but they prevailed by trying and good work ethic.

That’s why it’s so perfect that it doesn’t move the needle 🙂

And yet, in BC 65% or more already own their homes, no? So you expect a majority of voters to be at least somewhat concerned about prices dropping and reducing their equity, along with jeopardizing their chances of renewing their mortgages (and risking insolvency) if prices were to dip too far.

I believe millennials are now the biggest voting group no? Or at least biggest potential voting group. As I said, spec tax is a home run politically even if won’t do much to move the needle affordability wise. Sense of fairness in the market is important

Rent is a set price just as much as asking prices are a set price in the resale market.

I don’t believe so. CMHC requirement is based on own funds.

The problem with looking at asking rents on a board like CL or UsedVic is that the reasonable ones disappear fast, while the unreasonable ones persist until the asking rent is reduced or the landlord settles for an undesirable renter. Thus looking at all the asking rents posted at any given time isn’t representative of what new tenants on the whole are paying.

Would first time buyer avoid CMHC insurance if they put 10% of their own money down plus 10% loan from CMHC to make a total of 20%?

Additionally, would non penalty withdraw from RRSP at $35,000 ($70,000 for couple), and low interest rate possibly creating an environment for an upside RE market in the new year?

Continuing the discussion Re- spec tax and non-residents’ entitlement:

https://www.timescolonist.com/opinion/op-ed/island-voices-a-millennial-s-complaint-boomers-gonna-boomer-1.23967738

Sales $2.5M+ January -> September

2016 2017 2018 2019

45 52 47 31

Active listings September

2016 2017 2018 2019

72 71 88 117

In short. Luxury market is about 40% less active than last year.

An unappreciated increasing supply side factor in a city with an elderly demographic.

Why can’t people make the move sooner.. no maintenance fees

LeoS: Besides at ninety most people have moved into their 18 sq foot luxury basement unit. Marble optional.

When I was twenty I remember reading about how many people are just two pay cheques from disaster. Not totally new.

LeoS: How are house sales in the 2.5 and up bracket compared with last year?

$1,900 is very low rent for GH. Is the house a rancher or maybe just a crawl space for the basement?

Yeah – rent is a set price, usually non-negotiable in a low vacancy locale.

If you want to write a bot that sets a low price you’ll be inundated with requests – and then complaints – and then removed from the site. But hey, whatever floats your boat. Could turn into an (unpaid) full-time job for the greater good.

I am sure he is just talking about the cost of carrying that mortgage .. but ks112 didn’t factor in that not all people can carry the cost and still pay for the principal. hence reports are indicating many Canadian’s are only hundreds of dollars monthly from insolvency

And opportunity costs of the down payment, transaction costs amortized over ownership period, maintenance, taxes, add’l utilities, etc. But yeah principal paydown is a form of savings.

By the way there’s always a lot of hubbub about increasing use of reverse mortgages. I have zero problems with them. People do a lot of handwringing about that it’s relatively expensive, but when you’re 80 being able to stay in your house is much more valuable than a couple extra bucks at 90

Does anyone know how the luxury home market is doing (the over 2,5 million houses: two mil no longer puts you in the luxury category).

Currently you can get interest rates as low as 2.5% 5 year fixed. On a 500k house, assuming your mortgage is 400k your interest (in the first year) is about $833 per month, even if you are paying 3% interest it would still be $1000 a month. I don’t think many landlords are renting 500k places for that low.

True the renter could put the 100k downpayment in a GIC. Let’s say they get 2.4%. The renter gets an extra $200 in income from this. It would be pretty rare to get rent as low $1200 a month for a 500k place.

I used to rent out a 450k house in Sooke for $2400 (850 for 2 bedroom suite, 1550 for 3 bedroom main house, utilities incl). This covered mortgage, utilities, property taxes and I had a little cashflow left over for maintenance. My 90k investment (downpayment) was returning me over 10% a year (almost 10k in principal paid in first year) even with prices staying flat.

Even a 1% increase in the house price would translate into an additional 5% return on my investment (4.5k on 90k initial investment).

James didn’t you buy a place?

James: Actually you are both making the same point but are coming at it from different ends. When comparing renting to buying only the interest portion of a mortgage should be used in calculating the costs of buying a house.

I was responding to comment 63468 by @guest_63468 in which he stated

Mortgage payments in Canada always include principal payments. We don’t have interest only mortgages here.

How? If you have that money in the first place you could put it in a GIC instead. Mortgage payments aren’t equal to rent, interest alone is.

Is that how you determine housing prices too? by what price people are asking?

Cool, then I’ll just write a bot to post a bunch of places just below what the current rate is and lower it by $25 every month. Voila, rents are going down by $300 next year. You’re welcome everyone.

There is no need to suspect or speculate without data. You cannot determine market rent by comparing your 3 bed price from two years ago. In order to determine average market rent you can just check CL and UsedVic. This is also how most landlords set rents. You are not paying market rent right now unless your place has some serious deficiencies.

Started renting it 2 years ago. So clearly rates haven’t gone up as much as you all suspect.

Yeah, I’ve thought for a while that there’s a big difference in ‘Rent vs buy’ calculations if you’re in an existing, long-term rental vs someone getting into a new rental contract. It’s no secret that landlords often don’t raise rents over time (various reasons, particularly to retain good renters), and even if they do they’re constrained by the provincial rent-control increase percentage. So rental turnover is when rents get corrected to market rates.

In other words, due to regulations and the risks of having bad renters, long-term rental rates represent something of a market distortion.

Yeah, a 3 bed in GH is generally in the range of 2500-3000 now, not including utilities. And often that is just for the upper floor and not the whole house. Getting hosed implies that this is above the market rate – it isn’t as this is what you get these days – go look on CL or usedvic.

A smoking deal. We paid $1850 for a whole house in 2012 which was already a good deal. Rents substantially up since then.

You forgot to factor in paying down your mortgage. If your mortgage payments are equal to rent, on a 500k house (400k mortgage), you are paying down almost 10k in the first year. So even with 5k in additional fees you are still coming out ahead owning.

You can rent nicer than a $400k condo for $1500 a month. I know people that rent a 3 bedroom upper for $1350 in GH. I current rent a 3 bedroom whole house in GH for $1900. If you’re renting a $400k condo for 1500 you’re getting hosed.

I am renting a 370ish condo for $1,495.

The thing is you can rent a $800,000-$1,000,000 for <$2,800. You get much more bang for buck as you go over $2,000/month but you get very little bang for buck under $1,500/month as a renter.

You can rent nicer than a $400k condo for $1500 a month. I know people that rent a 3 bedroom upper for $1350 in GH. I current rent a 3 bedroom whole house in GH for $1900. If you’re renting a $400k condo for 1500 you’re getting hosed.

Flip:

207 Obed Ave

Bought: 5/15/2019 for $470k (After 102 days on market, maybe more.)

For sale: $949k

Good luck! Way over priced IMO for that neighbourhood & house.

Jamal,

You’ve arrived late, and apparently missed the earlier discussion where ks112 factored those in the 1.2% appreciation of the condo . I’m just replying to James statement that you could rent elsewhere cheaper than the mortgage interest charges.

And yes, if you can’t qualify for a $400k mortgage, renting is likely the best option if you want to live in core Victoria. Nothing wrong with renting.

you forgot about strata fees and insurance and random levies.. unless you got 80k income — good luck getting 400k mort

Assuming you’re referring to renting a similar place…

3% mortgage Interest on a $400k condo is $12k per year or $1,000 per month. You can’t rent a typical $400k condo for less than $1,000 per month, it would be more like $1,300-$1,500 rent.

Except that you could rent somewhere for less than what you’re paying in interest that year. So you’re coming out ahead.

1.2% isn’t much to get excited about either way.

Agreed. Also we saw what happened to the market when they went from 40 to 35 to 30 to 25 year amorts. Almost nothing. People think that it will have a bigger effect, but I challenge anyone to actually find to impact in the data from those changes in policy when they happened just a few years ago.

That’s why the OSFI stress test was so unusual. It was really the first government policy where we saw immediate and clear impact on the market.

“Yes, and if you’re waiting to buy a condo, you should expect to to pay about 1.2% more than if you’d bought last year. (not including the one year of rent poured down-the-drain)”

Not completely accurate, lets just assume the over-all purchase is 1.2% more (or say $5K) and that your mortgage payments = that of the rent. You will also need to net out from that other incremental costs associated with only owning the condo (e.g. strata, property tax etc..) which will probably be close to $5k. And I suppose if you want to get technical also the opportunity cost of the down payment and any delta in interest rates (lower now compared to last year). So over-all, although the purchase price is 1.2% more a year later I suspect the purchaser is better off by waiting that one year.

Yes, and if you’re waiting to buy a condo, you should expect to to pay about 1.2% more than if you’d bought last year. (not including the one year of rent poured down-the-drain).

I have a hunch if the Teranet index was down 25% for a year, we’d see the bears quoting it. But I can understand with it at all-time-highs, you dismiss it as too “fancy” and “see no reason to adopt its use.”

So, the salient point is that condos have increased by less than the rate of inflation at 1.9% (Aug 2019).

I’ve always viewed the HPI as one of those fancy realtor tools; as I’m not a realtor, I see no reason to adopt its use.

My statement was “Victoria house prices (Teranet) have risen 6%” … kindly don’t remove the word Teranet if you’re going to quote me, since that made it clear I was referring to the Teranet House price Index, which is a composite of SFH, condos, townhouses.

I and many others (including LeoS and Teranet themselves) often use the generic term “house” to refer to the housing market overall (condos, SFH etc). As does the title of this blog… HOUSEhuntvictoria.ca

The Teranet index does the same thing, they are called a “Teranet House price index” and their website is HOUSEpriceindex.ca but they measure a composite of single-family house, condos, townhouses.

Most people can deal with this, hopefully you can become one of them.

I addressed your statement as it read.

The VREB numbers you are quoting above are for SFH only. As LeoS has pointed out, condo prices have fared better than SFH recently. VREB condo index was up 1.2% YOY.

The Teranet index (now at all-time-high price index for Victoria) is a single number, composite of condos, apartments, townhouses and SFH as described in their methodology. I like the Teranet index because it’s a single number, based on repeat sales pairs, less volatile due to 3 month rolling average, measured since 2006, and same methodology across Canada, allowing comparisons with different cities. btw) Teranet is also at all-time-high for many other Canadian cities and Canada overall. No index is perfect, so choose the one that you like.

https://housepriceindex.ca/wp-content/uploads/2017/08/Teranet-National-Bank-House-Price-Index-Methodology-Overview.pdf

“The indices are estimated on a monthly basis by tracking the sale prices of condominiums, row/town houses and single family homes”

Prices are up from 20 years ago, down from last year, and flat from yesterday. I think the coffee table is a productive idea 🙂

Cost of labour plays a major role in construction.. unfortunately it is a catch 22 situation, we need people to work reduce cost but more people come here to works drives up cost of housing

For the dear bears

https://www.bnnbloomberg.ca/canada-s-housing-market-is-roaring-back-with-black-tie-condo-launches-1.1326505

Depending on which post i read prices are either up, down or flat. Something to please everyone. I think I will go back and focus on refinishing the coffee table that has been sitting in my shop for the past two years.

It seems to me like the policies they are proposing are net stimulative.

30 year mortgages

Tinkering with the stress test in unspecified ways.

Thing is though, housing is way less of an election issue than I thought it would be. Conservatives don’t have a platform yet but in the Liberal platform it is hardly mentioned. Spec tax nationwide I bet won’t happen. Administrative nightmare. So what’s left? Almost nothing.

I was really hoping to see proposals for massive construction programs and investing a lot of money into construction R&D for new building techniques to drive down the cost of construction..

Keep in mind the principle of momentum. Remember when we were nearing the peak and every wrench they threw at the market in a desperate attempt to cool it had either little or no effect? People thought it meant the market was bulletproof and indomitable. This works both ways, and it’s what makes fear and the subsequent belief that the market will never recover again. Both are fallacies.

Ergo, I think the correction will continue to proceed. Bumping amortizations and grabbing equity stakes may alter the angle of that trajectory, but the housing cycle, consumer sentiment and the economic realities in which both function are IMO, a greater force. In the USA, they threw trillions (with a T) of dollars to try to bump the housing market and keep it from going down, but prices still fell around 40%.

If preventing a housing downturn was simply a matter of policy, housing downturns wouldn’t occur as most politicians wanting to stay in office would move to prevent them. Mind you, Horgan’s NDP borders on being the first party in the western world I can recall campaigning, and winning, on a platform of neutering the RE market. An odd exception.

Anyways.

In the long run, the policy measures the federal parties are proposing are stimulative. Each of them, in terms of housing, appears to be a choice between bad and marginally worse. The market will simply adjust to compensate, and in this case, that will ultimately mean higher prices. I don’t believe any of them are trying to make homes more affordable, as their platforms will eventually do the opposite. There’s no way they don’t realize this. What they are trying to do IMO, is buy the votes of people who don’t know better and subsequently try to hold up the house of cards as long as they are in power. History across the western world shows these repetitive efforts aren’t successful, either.

Comox Valley, September update:

Despite strengthening sales of single family houses in July, August, and September, sales to date are on track for about 672 or still the lowest year since 2001.

Prices remain elevated for homes selling over $500k. For the 12 most recent sales with Assessment Authority confirmed prices the relevant ratios are: Price/ask is .98, price/2018 assessed is 1.06 and price/2017 assessed is 1.25.

More and more homes appear to be selling for over $1million. Of the latest 12 sales (prices as yet unconfirmed) there are 4 that have sold over this figure. These prices would have been unthinkable here just four years ago.

According to VREB, Vic core SFD HPI Sept/2018 = 228.3, Sept/2019 = 220, a drop of 3.6%. Greater Vic 2018 = 212.8, 2019 = 210.1. Peninsula down 2.8% yoy, Westshore has the only yoy gain = 4.0%. How are we at an all time high?

victoria born- I don’t think for a minute that the soft spell is over for Victoria.

I’m curious what people think could happen with real estate if either of our wonderful candidates for prime minister follows through with their little ‘treats’ for the real estate industry. Is this going to be a big nothingness or a little more fuel for the fire?

TERANET KNOWS ALL. ALL HAIL THE TERANET METRIC.

Victoria house prices (Teranet) have risen 6% since 2017 (dec2017=197 to august2019=210) and are now at all time high. Given that, and the costs of selling, buying, moving and renting for two years, why so “happy” to have sold, only to re-enter in two years? Was it always part of the “happy” plan to buy in at a higher price? Or are you hoping to pull off the so-called “Hawk Manoeuvre” where you sell and buy back at a lower price?

I disagree that >$2m homes are selling under assessment. I measured that Victoria sales >$2m are averaging 5% above assessment in a post a month ago. Details here https://househuntvictoria.ca/2019/08/26/august-26-market-update-get-low/#comment-62661

Your other comments about price drops, long time to sell and delisting are normal events in good-and-bad times for listed luxury homes in the >$2m market.

Foreign Buyers:

https://capnews.ca/foreign-capital-money-laundering-victoria-real-estate/

Thanks, also, for the above, Leo. A couple of points, if I may and the third that was not discussed:

(1) Aunt Joe selling her Victoria home and buying in Oak Bay, contrary to what you say, does indeed impact RE prices. The multiplier effect causes a change / ripple. The seller of the home to Aunt Joe will do something with the money [may even buy a home, thereby impacting prices, and the seller to him / her will do the same…..]. The same for the person who bought Aunt Joe’s home [perhaps he or she sold one too…….].

(2) With the literal carnage in Vancouver, if that is now the main outside injection for Victoria’s RE market, one can presume going forward that “demand” for the once “hot” RE will be subdued significantly. The end result should be rising inventory and softening prices, all other things being equal. Inventory is indeed rising. Luxury RE prices are falling. People can’t afford detached SFHs – so condos are the go to RE.

I think your analysis of what happened on the mainland is spot on re foreign money and money laundering – many here opposed that view.

Excellent article, Leo. It is a supply & demand story, regardless of the source of capital. Exogenous capital injection does this, BUT also internal purchasing due to the multiplier effect. (3) A third part of the demand story is a non-current-home-owner living in Victoria either as a renter, student or in Mom/Dad’s basement who can now buy a home [the local first time home buyer or like us, who sold 2 years ago and are back in the market] – he or she too adds to demand. These are local buyers.

James – Vancouver has been dropping now for almost 2 years. The lag time is evaporating and Victoria is certainly softer. You missed the import of my statement [even the sarcasm]. I don’t think for a minute that the soft spell is over for Victoria.

VB

Ahh yes, the 9 months that Vancouver has been going down. How has Victoria done it!?!

Thanks, Leo;

It has indeed been a 2 year slow “correction” but the fuse is likely a long one. Prices and activity peaked this time in 2017 [or thereabouts]. We sold and are happy that we did. We are now, given the passage of 2 years for this slowdown, back in the market.

The ultra low interest rates [Marko said his clients are getting 5 year fixed rates of 2.69% – thanks for the update Marko] are supporting this market, but you will see that sales are concentrated in the condo segment. Yes, SFH-detached are selling but at a slower rate because of lack of affordability.

In looking at the luxury segment [$2M and above], that is where I am seeing the real slowdown. We saw sharp price-drops and then these homes being delisted. Many sit on the market for years now. Those that sell are below the assessed property tax values.

I looked at mortimer-1 on Twitter and his Vancouver sales for losses are staggering – take a look:

https://twitter.com/mortimer_1?lang=en

Victoria’s resilience in the face of what is taking place in Vancouver is truly impressive. Perhaps the correction is over for Victoria.

Trudeau’s first time homebuyer’s plan will simply stoke prices more so in the median prices – it won’t help affordability, it will just bring demand forward and spike in prices:

https://betterdwelling.com/canadian-politicians-promise-to-bring-more-risk-to-housing-part-one-the-liberals/#_

I think I am with Marko on this one.

VB

Hey all the bulls out there .. buy now

From VanRE:

You can see from one metric, average pricing, what’s going on. If you look carefully in the green line, you can see a similar up-ticking phenomenon occurring in the condo segment that Leo was commenting on in Victoria.

Of course, pricing is but one metric among many and doesn’t tell the whole tale. Nevertheless, perhaps it demonstrates where it’s important to back off a brief period of data to take a bit of a wider view on what we’re seeing. There is no real push back upwards, at least not yet.

FWIW, my own two cents is supposing that much of this activity may be from previously fenced end-users, as opposed to investors. The latter group probably knows that an avalanche of supply is coming online this year and next, some of which will probably be needing a lot of incentives to clear.

You’d better buy!

Vancouver sales at 10yr average for September (up 46% from low levels YOY, and 4% MOM). Prices down 8% YOY, flat MOM.

https://www.rebgv.org/content/dam/rebgv_org_content/pdfs/monthly-stats-packages/REBGV-Stats-Pkg-September-2019.pdf

Right now it’s more about volume than prices. There’s probably a few reasons for this, but again, Victoria isn’t unique in seeing this jump. Vancouver’s may have been even larger. In some respects, the contemplation is pretty simple – will banks open the floodgates to new credit, and will the population be willing to accept it. There’s definitely room for this in many Canadian markets, but the issue is – there isn’t in the larger and surrounding markets, where a very sizable portion of the population resides. Moreover, banks don’t adjust their activities away from mortgages and grow their loan loss provisions if they’re expecting another leg up. Pretty sure they’ve got an idea where we are in the cycle.

They may have to. Poloz’s hold-off in the face of almost global CB cutting has been impressive, but I would be surprised if he hasn’t cut at least 25BP from the overnight by spring. I don’t think rate cuts will make much difference to RE now, as they can’t really go lower and the markets have already priced them in. QE is another story – despite what some people think, the US Fed is actually continuing to tighten. But if they do more QE – who knows. I still think that’s really the wild card in this whole thing.

Pessimist! 😛

How much hot air can you blow in near bottom out rates ?

As for dead cat bounce, does a cat that floats down as gently as a feather actually bounce?

Yeah I think the same. But it’s a marked change from 2 years of steady slowdown.

It’s a dead cat bounce. The market is flat in my opinon, no uptick depsite what the numbers might say. I think the next three months will show the flatness which I don’t mind at all.

I would agree that interest rates will be flat or down over the next few years. Ask anyone what has been Canada’s economic driver for decades and the answer will almost certainly be natural resources.

Every level of government is eager to respond politically to climate change as fast as possible, regardless of the financial havoc it wreaks on families working in those sectors.

The weakened economy will bring house prices down but the lower interest rate will balance out any losses. I predict prices in the low and middle income bands will fluctuate around current levels for the next ten years.

Saavy buyers are more concern with fundamentals over that of hype. A good time to buy is when you need it and have the funds to do so with out taking on too much risk.

And, due to herd mentality the majority of the populous (buy high and sell low) tries to time the market and rush in to buy when everyone are buying and sell when everyone are selling.

It is possible that the up tick could simply be a dead cat bounce as many bears like to believe. To me, the market condition is flat that may continue to stay at the current level or increase in small increment because of low interest rate with strong local employment.

Local Fool – The correction has definitely started, but it’s far, far too early IMO for a reversal.

I think that you are right, the correction has started and may very well be sizeable given what is going on in broader markets. I do think it is entirely possible however that we see another uptick in sales and prices (much like the one in 1992 referring to the affordability graph you put up). I think it is likely that the BOC will have to start cutting rates, and quite soon. And if/when QE is thrown on the table there may be a little more wind thrown behind this sail.