Sept 23 Market Update

Big week in the market with a surge to 160 sales last week compared to only 115 in the same week last September. It seems this bounce has some legs in it and we will post bigger year over year sales gains in September compared to previous months. However this month the situation has reversed from what we saw since May where the driver of sales growth was the single family market. Single family sales in the first 3 weeks of the month are tracking pretty close to last year but condo sales are up nearly 50% in the same time.

What’s behind the big surge in condo sales? We can speculate about low interest rates and the recent activation of the CMHC First Time Homebuyers Incentive which might be driving a couple sales (not many according to brokers), but as usual, before reading too much into you have to look at the baseline which is last year’s numbers. With percentage changes, it’s not possible to tell if the current year is especially strong or the last was especially weak. Looking at sales we can see it’s primarily the latter, because last September we saw a big dip in condo sales from August.

However it is clear that demand as a whole is definitely up over last year and is sloshing around between the property types to drive a relatively solid increase in number of sales.

Here are the weekly numbers courtesy of the VREB.

| September 2019 |

Sep

2018

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 130 | 285 | 445 | 533 | |

| New Listings | 311 | 619 | 871 | 1165 | |

| Active Listings | 2827 | 2860 | 2818 | 2646 | |

| Sales to New Listings | 42% | 46% | 51% | 46% | |

| Sales Projection | — | 635 | 687 | ||

| Months of Inventory | 5.0 | ||||

100k loss was at 1400 Newport Ave. Perfect storm of another condo in same building selling for a low price and brining the rest down with it.

New post: Some musings on the everything bubble.

https://househuntvictoria.ca/2019/09/25/where-to-invest-in-the-everything-bubble/

This is all Patrick does on here. He’s not even having a conversation with you. He’s talking to himself.

2008 to 2014 would make more sense for a 100k loss. A 2008 to 2017 loss really has to be a special circumstance.

I find that it is odd that some young people on this board constantly bemoaning how hard it is to buy a place when conditions are much easier to buy now in my experience than it has in the past.

In the early 2K, my ex was a nurse and I an IT employee purchased our first home at 6.75% and we stretched our affordability ratio to 33%. I restarted things from scratch after a messy separation and bought a SFH in 2014 with a single income at an affordability ratio of 18% (include property tax).

IMHO, it would be more productive to be positive and focus on finding solutions, than being negative.

Where was this? Victoria? There would need to be some fact checking as this has not occurred here as far as I’ve seen, unless perhaps the place was bought on leased land near the end of its term which creates a foreseeable risk.

Thanks

Wow. Which property was this? The Falls? Bear Mtn.? Generally condos dropped from 2010-2015, and by 2016 they were shooting up again.

Throw a basement suite into the calculations and the numbers get even better.

It is not about what you save in the bank each month though. It is about return on investment of scenario A vs. scenario B.

If you can afford to buy or rent, you really need to do the math and using reasonable assumptions based on savings rates and historic average long-term returns from the stock market vs. real estate in our market, net of transaction fees and taxes.

In our market over a five to ten-year period your ROI for owning is likely to dramatically exceed renting and investing any savings in almost all scenarios if you are leveraged, ie. you have a mortgage.

Thanks.

And to be clear, I post these things when they are brand-new-news to me, not a rehash of something old. For example, in the original post I showed how 54% of mortgage payments go to equity (forced savings) in the first year of a mortgage @ 2.49%. (And higher each year after that) That was a “wow” moment for me, because that % is very high (and way less at higher rates).

If someone already knew that 54% number, congrats to you. I’m just thinking a lot of people didn’t realize that, since they don’t acknowledge it when comparing rents to mortgages.

Nope. Just a happy long time Victoria homeowner, unaffiliated with anything in RE or related industries, and no plans to sell.

Why you so worked up?.. if we are talking about condos, then we have to assume the short term risks in buying condos.. if we are buying houses .. we have to assume the long term holding gains .. so…

Which one is it?.. can you imagine I sell you a Lamborghini and you got a Toyota.. well a car is a car?

There are a few discussions going on. I wouldn’t get too excited about the term “house” being used when it should have been “home”. If you’re unclear as to the meaning, please ask for a clarification, but don’t merely nitpick. Especially on a site called HOUSEhuntvictoria.ca that clearly includes condos.

Wait . I thought we are talking about the 500sqf condo at 450k..so we are talking about houses now ?

Deb,

Estimating 2% inflation per year for 5 years (based on previous years inflation) and estimating 1.6% population growth per year for Victoria (about what it’s been for last couple of years). The exact amounts aren’t material to my point, which is that 5 years from now Victoria population will be up, and cost of everything (via inflation) and incomes will also be up. Population rises increases demand for certain desired houses (SFH in core, nice neighbourhood etc.) because the supply of those types of SFH homes is falling, yet demand is rising,

Even the perma-bears here acknowledge inflation effect on nominal house prices, since they insist on “inflation adjusted” house price charts.

Great. Here I thought (from your posts) you were someone that was priced out of the home you need and want for your family, and now you clear it up by announcing that you know where prices and interest rates are headed, and that’s prices down and rates up.

You’re likely smarter than me in that regard. Because I made money in the housing market from “dumb luck”, just happening to own over a long period, not timing it right. Every single homeowner in Victoria during 2015-2017 had the same ride up in prices regardless if they bought at a great time (2009) or not so great (1981). But they were all geniuses in 2015-17, regardless of when they bought. You may buy now, and it’s a stupid time, but in 25 years it will all be forgotten as your house is paid off and it’s worth what it’s worth. You can’t win the lottery unless you buy a ticket, and you can’t expect to make money from houses if you don’t own one.

Patrick

You’re ignoring price corrections. Friends of mine lost 100k between purchase price on a condo in 2008 vs sale price in 2017, and walked away with only 15k equity after realtor fees, and only because they were doubling up on mortgage payments. Renting over the same period and banking the difference would have netted them larger savings but no one had a crystal ball about what would happen to our market or their life situation in that time.

Buying a condo as a first time buyer at today’s prices in Victoria is ludicrous unless you plan to stay in it for 10 years and ride out the next correction, or have the ability (in my 1st example no rentals were allowed in their building) and the finances (like not needing all of the equity from the 1st place to buy the next one) to rent it out later.

I do not think a Victoria condo will be worth even what it sells for in 2019 vs 2024. And I also don’t think we’ll be at 2.49% interest rates in 5 years.

Depends on who you call the last one in… IMO that’s whoever buys this fall.

Please could you tell me where you get these facts from? Thank you

I will have to agree with Patrick’s math in this example. However, if prices drop then any equity would be easily wiped out at time of the sale. Whether or not property taxes are included in the mortgage is transaction specific.

But is it smarter to buy a newish one bedroom condo downtown for $450K or is it better to add in some more and buy a older house.

Lol but the tone in Patrick’s last post sounds like he’s either a realtor or desperate to sell.

Once you decide that you are going to be a homeowner for your entire life, then you should hop on board the train (buy) and see where it takes you. Don’t count yourself out-of-luck based on year of birth. I bought first home at the peak out East, and lost money, and bought at a peak in the 90s in Victoria and stayed flat a long time. Didn’t make a nickel out of home-buying for at least ten years. So what, it never crossed my mind, as I was too busy raising a young family and living life, enjoying my house and the neighbourhood. I’m glad my family didn’t get bounced around the city renting houses when my kids were growing up. And money isn’t everything.

And what will you do those with those savings after 5 years of renting …. buy a home of course. ( and if you wait 5 years before buying, you’ll then pay for it for 25 years, instead of only having 20 years left if you bought now). And do you expect to pay the same for that home as you could get now? In five years….We will have about 10% of inflation, and about 8% higher population in Victoria, that adds up to higher prices to me. Don’t be the last millennial to buy, the last-one-in pays the highest!

If I was born 10years earlier than I am now .. I will regret not buying.. but. Damn.. I can only blame my parents for not getting busy in the bedroom soon enough.. that is the problem with you Patrick..not every one is in the same boat as you.. don’t expect every one to have the same financial conditions

And 5 years ago were you also “not sure”?

Makes sense to buy 5years ago.. but not sure now

Patrick

You’re original argument was that a 450k condo was “affordable” for first time buyers but you’ve morphed that into “it’s a good idea because of forced savings”. I pay $1600 to rent 800 sq ft of living space (no condo fees no property tax) and can save more in 5 years than I could with a 2k+ mortgage payment.

And yes ks112 I’m pretty sure property taxes are included when applying for a mortgage as well, to make sure you can cover them in the housing carrying cost. I left that out of my calculation- what’s the property tax on a 450k condo?

Again I don’t even think a person or a couple making 84k gross combined can even buy a condo with your numbers.

Your carrying cost is the interest portion of the mortgage you paid, which is (even with condo fees and prop tax included) less than the wasted rent money. But, hey, if you want to keep on paying off your landlord’s mortgage, go ahead.

@Patrick ,

Unless your price can increase in 80k ish.. you are loosing money in carrying cost when you sell

.. not counting selling buying fees.. just monthly fees @400k at 2.65 % at30 year, borrowed . You are looking at 1450 in fees alone, does not include your principle payments

So buy a $400k condo and in 5 years you’ll have about $55K in equity paid off (+ equity from your original down payment), a nice nest egg to upgrade to something better, and not 5 years of wasted rent money with nothing to show for it.

You can’t rent that same condo for under the interest portion of the mortgage. In the example I gave, the interest portion of the mortgage is $887 per month and a $450k condo likely rents for $1,500+ . Doesn’t make sense to me to ignore the equity pay down (savings) on a mortgage when comparing to rent (no equity). (Not to mention equity increase from house price inflation over time).

Cmhc Stress test also requires you to be qualify at 5.19%right now and @84k with no other debts , your max allow borrowing power with big five banks is around 400k

The elephant in the room you are missing is the huge equity payment you achieve right from the start with a mortgage as low as 2.49%. A mortgage rate as low as 2.49% changes the math dramatically on a mortgage.

Over the life of the 2.49%/5yr fixed over 25 year mortgage, 75% of all payments go straight to equity (forced savings), only 25% go down the drain to interest payments. With rent 100% is down the drain, no equity build. Even in year 1 of the mortgage, 54% of mortgage payments go to equity pay down (calc details below) . And that number increases every year. You’ve got $12k equity in year 1, approx $65 equity after 5 years and finally have 427k equity paid off when the house is paid off in 25 years. And that ignores any change in house value which is very likely higher with inflation after 25 years. That $65k equity after 5 years represents 65/427=15% of the mortgage paid off, so that’s a cushion to help with falling prices or rising rates.

( * calc details arriving at 54%). On the example I provided below of a $1913/month on a $427k mortgage, that’s

– 1913*12=22,956 paid per year on mortgage

– 427k * 2.49% interest = $10,644 interest paid

– Equity paid off therefore = 22956- 10644= $12311 forced savings year 1.

– Equity % = 12311/22956= 54% of mortgAge payments go to equity (savings)

First time buyers looking at 450k condos are usually single income buyers ..I assume .. don’t think anyone with good dual income family want to get into a 500sqf that is hard to start family with kids

“NDP will add a federal 15% foreign ownership tax, increase funding for police specific to money laundering and create a registry for company ownership to prevent hidden ownership, similar to UK measures” – VIF FB group

https://twitter.com/MercedesGlobal/status/1176888937656094720?s=19&fbclid=IwAR1DWAuHLx4lwZ2tJetTMlqqYBe35N1Mu8yZi0_X6phWXqTECSc8hHwIQZQ

https://www.huffingtonpost.ca/entry/jagmeet-singh-bc-housing_ca_5d8baeece4b01c02ca629ef8?fbclid=IwAR3B-QvSwE0MYaZWKVwulWo0jKjtyB8EugKyDEroKFyg-uD36fFr1OEH5Zk

Cadbro, you are also forgetting about property tax in your numbers below.

However, are your after tax numbers based on two people earning $42k a year?

Assuming the above is true, $42k a year job does not require a university degree, or frankly any education in the current market. A new university grad starting a job that specifies the requirement of a degree will typically start around $50k currently in Victoria (except if you are an auditor at KPMG, however you will quickly reach/surpass that after 1.5 years).

Obviously this doesn’t apply if you have a sociology degree working as a barista at starbucks.

Doesn’t make much sense to buy in a market where you can still rent that same condo for under the cost of the mortgage.

Mystery surrounds Vancouver’s millionaire receptionist

https://www.nsnews.com/mystery-surrounds-vancouver-s-millionaire-receptionist-1.23956377

Patrick

Net income on 84k gross is $63,500

With only 5% down, there’d be 17k in CMHC, the interest on which is 4% (an extra $76/m)

Condo? Add mandatory condo fees, I’ll go low at $250/m

Now you get a mortgage (incl. CMHC) of $1989/m plus $250 fees, on $5,239/m income. 42% of take home pay going to just the mortgage and condo fee.

Let’s add to that a decent job requires a university degree, and most grads have debt to payback before they can even start saving up that 5% downpayment (plus fees and closing costs). My spouse and I owed 70k when we finished our degrees.

Let’s also add that at 2.49% interest rate on the mortgage, they’re in hotwater when rates go up. I don’t even think you can qualify for that mortgage on 84k gross income due to the stress test.

So no, a 450k condo is not affordable for most first time buyers. It’s also not practical (or even available at that price) for most millenial families looking for that 3rd bedroom for their 1.5 kids.

Not really. Numbers have been dropping since 2016.

https://househuntvictoria.ca/2019/04/08/april-8-market-update-vancouver-buyers-dry-up/

On a $450k home, with 5% down ($22,500) the $427,500 mortgage would be $1,913/month (2.49% 25 yr ratehub.ca)

Assuming a household income of $84,000, Expressed in “affordability” terms, that would be

Monthly mortgage payment/monthly household income = 1913/(84000/12)= 27%.

That 27% affordability number is well within the typical affordable range for condos.

Sellers in Vancouver aren’t so numerous, and if they bought in the last 3 years they’ve likely lost money(sometimes a lot of money). Doubt they’d be rushing back in…

or downsizers .. 450K pricing .. it is still hard for first time young buyers to have the down payment and allowable bank loan to get a place

I’d think it is locals, but it would be interesting to see a breakdown by age.

Millennials are the largest demographic population after boomers, and they are moving up into the buying years. They also love/choose big-city living, especially in the core where they can walk/bike to work without commuting. It would be interesting to see Victoria statistics broken down by age to see if the increase in sales is skewed towards the large and growing number of young millennial (potential) buyers. Leo has pointed out that the increased sales are skewing to condos which would fit the idea that they are younger people buying a first-time home.

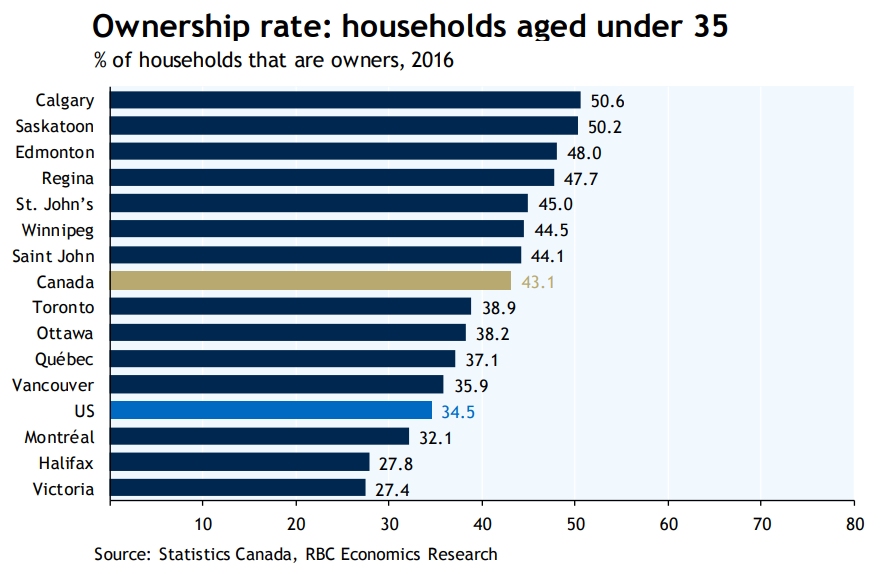

As we’ve read, Victoria has low millennial home ownership rates to start with ( 27% compared to ROC at 43%) and so maybe they’re catching up! LeoS posted an article on this June 12,2019 and here is the chart …

We seem to be getting strong sales numbers so the question is who are the buyers? Is it mostly local buyers or is there still a stream of Vancouver refugees?

My first house was in California and I had a 30yr fixed rate, open mortgage. It was glorious. On moving back go Canada and buying real estate, there was a fair bit of shock and consternation at the lack of options. At first I heard “there isn’t enough competition in Canada like the US”, which at first blush makes sense but I’ve since found a better explanation.

Eric Lascelles, who used to be Chief Canada Macro Strategist with TD (and he’s now with RBC I believe) put out an article in 2010 which touches on why Canadian mortgages are structured the way they. Of particular note:

The full article, which is very information, can be read at:

https://www.td.com/document/PDF/economics/special/td-economics-special-el0610-cdn-mort-market-di.pdf

TD Meloche Monnex.

True, though practically we can’t expect the banks to do it (25-30 yr term) until the creation of a private market for mortgage-backed securities (MBS) in Canada (hopefully with a better outcome than what happened in the US in 2008). That requires govt approval with regulations etc. An MBS market lets the bank offload the risk/liabilities to investors. As it stands, you can’t expect banks to take on 30yr risk of rates rising, BOC chairman Poloz is on board. https://www.cbc.ca/news/business/poloz-bank-of-canada-mortgage-market-1.5124593

Hsbc in the US is charging 3.46 for a 30 year term. If we limited it to 1 million Canadian (750 USD) then it would couver most first time home buyers even in the expensive markets and most Canadian home purchases in all markets. Because of the longer term the monthly payments would not be a lot more.

You could limit it to the purchase of principal residences only or even consider limiting it to first time buyers initially. If you also make the mortgages transferable this would create a real cushion of financial security both for individuals and the Canadian economy.

Who is your insurer?

My house is on a rock, and my insurer is Coast Capital that wanted $600 for earthquake with 10% deductible that I opted out when purchased the house a few years back.

There is nothing stopping banks from offering 30 year terms on uninsured mortgages or 25 year terms on insured mortgages. I think 25 year terms were still being offered not long ago. They don’t offer them because borrowers are not willing or able to pay the higher rates required to compensate for the higher risk to the banks.

Even in the US, where the federal agencies intervene by buying the 30 year mortgages, the current rate is about 4%. In addition, there are upper limits which are far below current house prices in expensive markets – $727K is the highest country wide.

https://www.fhfa.gov/DataTools/Downloads/Pages/Conforming-Loan-Limits.aspx

“Province announces about $720 million has been recouped from real estate audits in the past four years”

Holy moly. Just the tip of the iceberg I imagine

https://www.cbc.ca/news/canada/british-columbia/money-laundering-ubcm-event-2019-1.5294543

+1

If someone in government really wanted to do something useful they with institute 30 year terms (fixed rate for 30 years) like most of the US mortgages are. Yes, that is term not amortization. It would insure a more stable housing market and you could get rid of the stress test.

It’s very good news for sellers. The more buyers can borrow, the higher prices will be. He also talked about reducing the stress test which will have a similar effect.

From the previous thread, shout out to James Soper for the earthquake article. Really interesting research that they are doing.

We’re paying ~$480 for earthquake insurance, with a 10% deductible on TIV. That deductible is pretty steep though, it’d be nearly $90,000 if a claim was submitted. So I pay another $150 to for a buy-down on the deductible which reduces it to $2,500. So now its $630 for earthquake insurance, building only (no contents). It’s a lot considering chances of a large damaging earthquake and it increases my policy amount by nearly 50%.

Marko thinks it’s a waste, and perhaps it is. If I had very litte equity in the house, I’d probably forgo it. If a quake hit which ruined the house, I’d probably just walk away and declare bankruptcy. But since I have a lot of equity, I want to protect that investment.

We pay $440 a year for ours, and it’s a 5% deductible.

Our late-seventies house is not on bedrock and has a brick chimney, which don’t do well in earthquakes.

The purpose of insurance is to transfer risk that you can’t handle on your own. Our emergency fund can’t cover the cost to repair mega damage to our home, so we think this insurance is prudent.

This is very good news for first time home buyers if the Conservatives get elected!

https://www.cbc.ca/news/politics/scheer-housing-mortgages-1.5293794

You’re still missing it, Deb was responding to Leo who had already answered your question.

Cool visualization of municipality size since the 1800s in BC. Too bad not using metropolitan areas though.

https://twitter.com/j_mcelroy/status/1176169825573359617?s=20