Where to invest in the everything bubble?

We all know that the housing market is at record highs, and has appreciated drastically in the past couple decades. Detached prices, although down a little bit from the highs last year, have nearly quadrupled from the turn of the century.

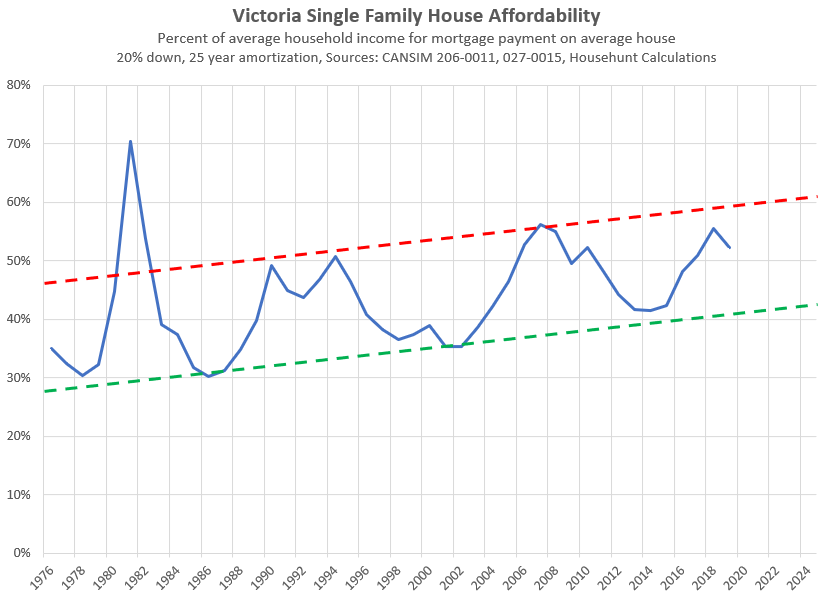

Affordability, although again improved since the recent peak, is still historically strained.

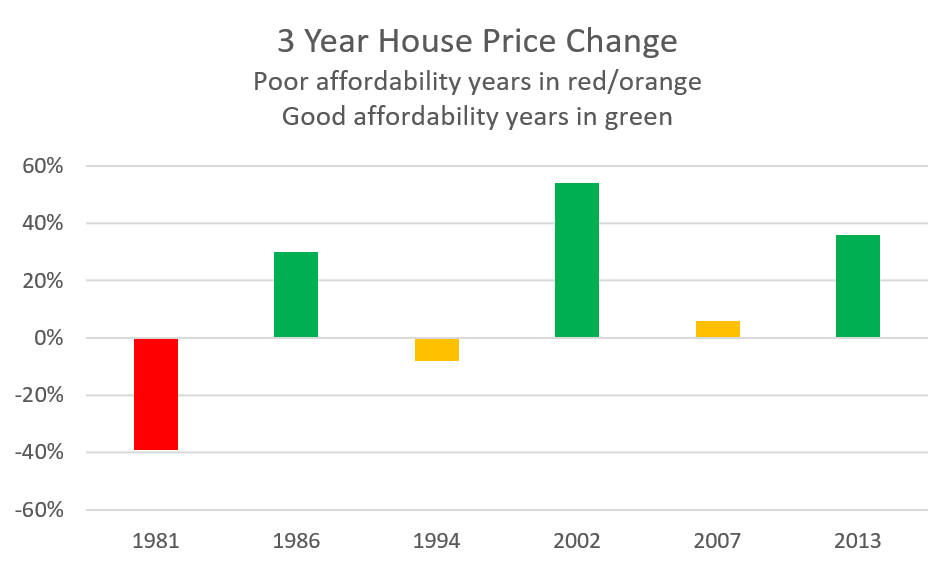

All this doesn’t necessarily portend a crash in housing prices or even a significant decline, but we know that at the very least poor affordability is correlated with sub-par gains in house prices in the medium term.

So you might think it makes sense to steer clear of housing until some more risk bleeds out of the market. But where else to invest money?

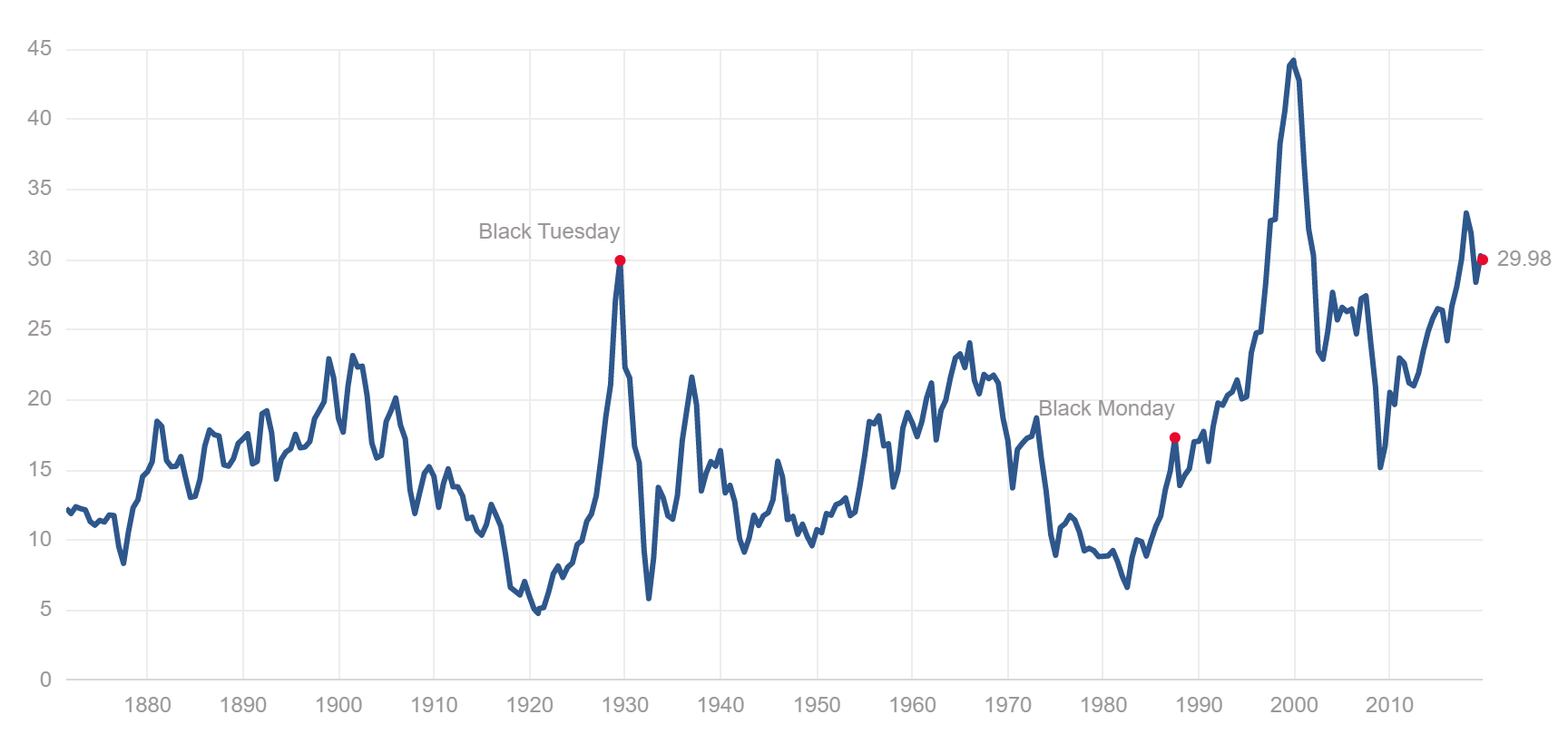

The stock market too has a 10 year bull market in the rear view mirror and there are ominous clouds on the horizon pointing to an upcoming recession. Measured by the Case Shiller Price to Earnings Ratio, valuations in the stock market are extremely stretched, second now only to the .com bubble.

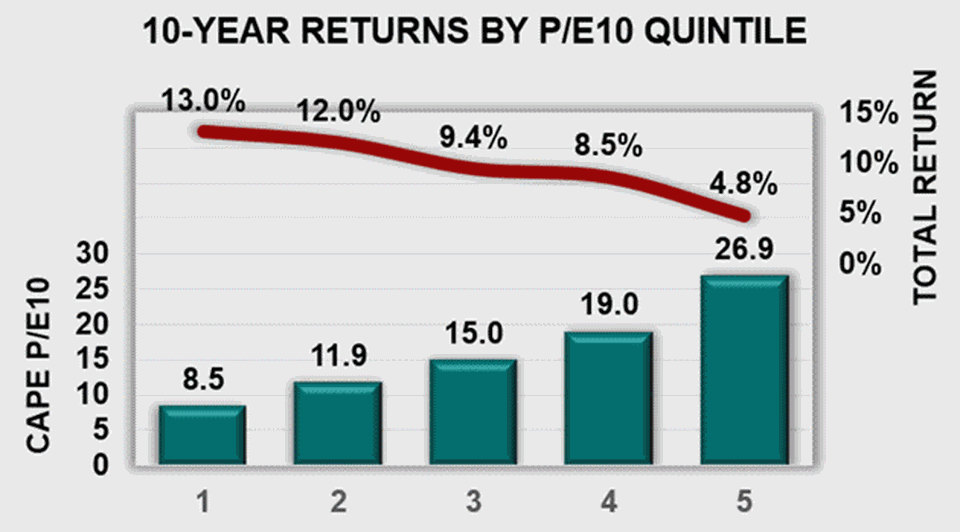

Just like with housing and affordability, we have seen that higher PE ratios are correlated with lower stock market returns. At current valuations, that would put stock returns around 4% annually going forward: much less than the long term average.

Fixed income side is no better, GICs and savings accounts pay nothing, while bond yields turn down and are increasingly turning negative. Forget returns, soon you will be paying organizations to take your money while it erodes away due to inflation.

Cannabis stocks? That’s yesterdays news. Bitcoin? Not with a ten foot pole myself. All in on black at Elements? No matter the economic conditions, investing in yourself is usually a good option if you have the opportunity.

So far I’m sticking with a diversified low cost portfolio, but I suspect we will all have to get used to lower returns in almost all areas going forward. The one advantage I do see with the world awash in capital is the potential to fund rental housing which becomes relatively more attractive. Also renewable energy and clean tech investments is an area of opportunity where returns are starting to get competitive. With the federal parties falling over each other to offer incentives to lower emissions that will only get more attractive going forward.

What do you think will do best in the next 5 years?

It is not just the plastic packaging, it is the meat used to produce the cat/dog food. A UCLA research study found that feeding pets creates the equivalent of 64 million tons of carbon dioxide a year.

@Barrister Sure, I reposted it here: https://househuntvictoria.ca/2019/10/01/foreign-buying-the-impact-on-victoria/

Leo: Great article, can you reposting the link in the next post as well, there is a lot worth discussing in it.

Gee, that’s just what I did. And then I moved to Vancouver and bought a SFH on one income.

Our very own…

https://capnews.ca/foreign-capital-money-laundering-victoria-real-estate/

Nice work Leo S

I’ve noticed Marko really doesn’t like dogs.

I like dogs as animals. I just find it interesting that people complain about the cost of living/housing but they can afford to spend $2000/year +/- on a pet. Or these environmental protests and we have 100 million dogs between the US/Canada. That’s a lot of plastic for all the dog food packaging.

“Witnessed a mid/late-20s hipster with a bunch of really original forearm tattoos and a dog complaining about the price of condos the other day. Hmmmmm….maybe buy a condo then get the dog/tattoos? Just a thought.”

I’ve noticed Marko really doesn’t like dogs.

If you are saving for a down payment the thousands matter. The latte factor is real. https://www.mrmoneymustache.com/2011/08/01/a-millionaire-is-made-ten-bucks-at-a-time/

Real talk, dogs and tattoos cost thousands, not many hundreds of thousands. Just a thought. This is a rehash of the avocado toast argument.

Marko Juras – …I guess but tax advantages

Speaking of Canadian tax advantages and investing, does any have any good resources for studying up on this?

What are peoples thoughts on BMO’s ZZZD etf run by Larry Berman?

With the markets at all time highs, I have been selling out of alot of my stocks and etfs’s and putting the money in to ZZZD.

I still own large amount of Chartwell Retirement Residences that pays a nice monthly dividend

and my one speculative stock left is ETSY.

Monday numbers:

Month Sep Sep

Year 2019 2018

Net Unconditional Sales: 596 533

New Listings: 1,128 1,165

Active Listings: 2,808 2,646

Expect perhaps another 30 sales today.

Inventory up only 6% from this time last year.

New listings unchanged.

Market indexed all in one ETFs are the way to go. Low MER (~0.22%), captures entire market, single fund for ease. Pick one of VEQT/VGRO/VBAL/VCONS, or blend to fine tune asset allocation, and call it a day.

Great post. Looking at the historical returns of countries is humbling. Who would have predicted this performance since 2004…. Denmark (+493%) leading the pack and Israel (+20%) being near the bottom?

“A $100,000 investment in Denmark’s total stock market index in 2004 would have grown to an incredible $593k. The same investment in Finland’s total stock market index would have grown to a pathetic $118k. An investment in any country’s index would have at least doubled in value, except for Finland, Italy, Israel, and Ireland.

Note to self: Don’t invest in countries that start with the letter “I”

If it makes you feel better, Washington’s getting hit hard too

…

Spokane also broke a temperature record on Sunday, with a high of only 38 degrees at the airport. This shattered the “cold maximum temperature” record of 50 degrees set in 1959.”

“According to the records, as far back as the records go, this is the earliest snowfall ever, since they’ve been keeping records in the 1880s.

Thanks for the tip!

I went all-in, and so far today alone I’m up 600% (in Bolivars 🙂 )

Over the long haul Canada has been one of the better developed markets but not the best. See for example the returns 1900-2016 – https://engineeredportfolio.com/2017/07/30/which-country-has-the-best-stock-market/.

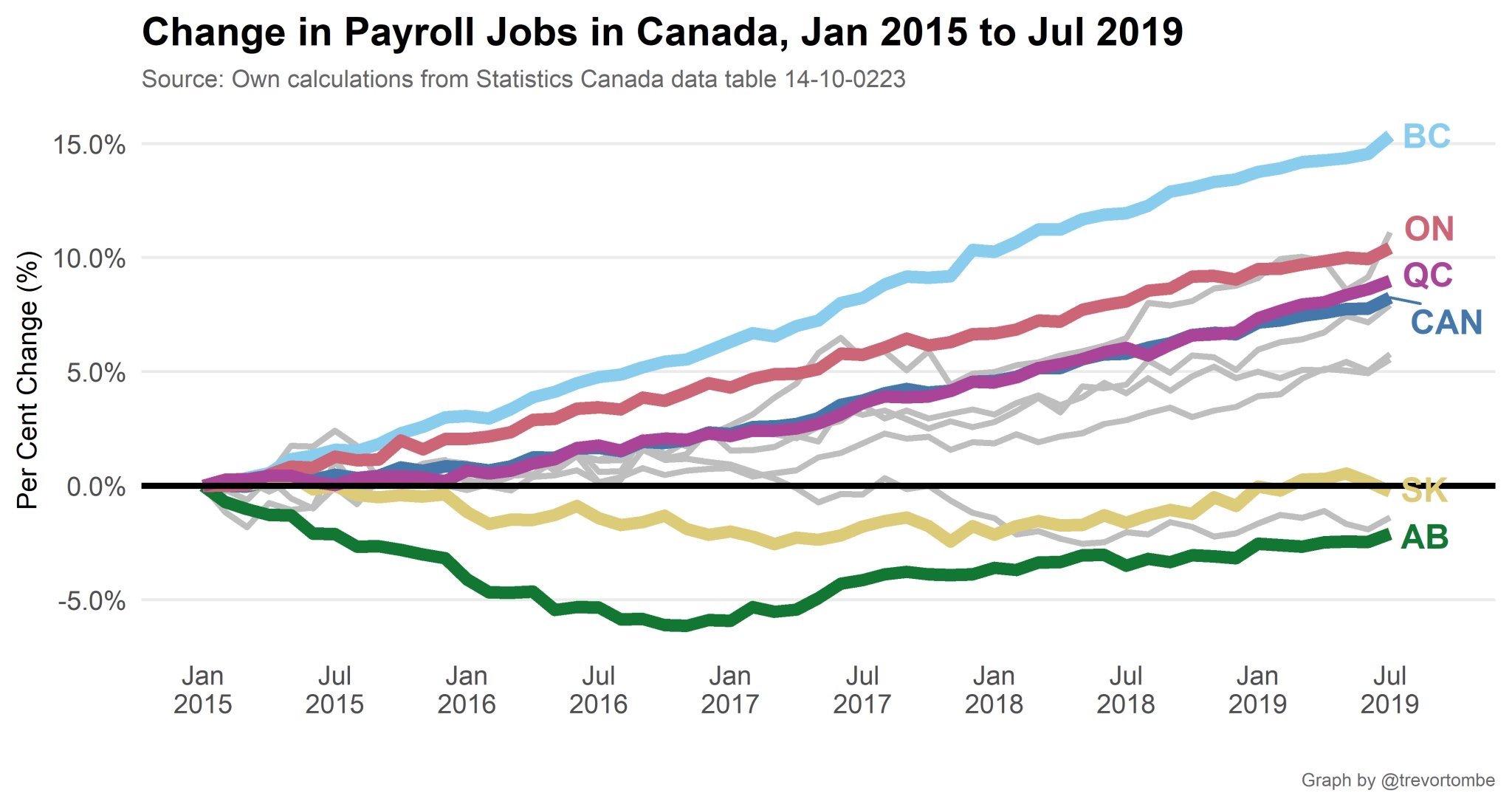

Recently Canada has been middling:

https://fourpillarfreedom.com/visualizing-stock-market-returns-in-23-different-countries/

For any unregistered (not TFSA not RRSP) investments there is a pretty good argument for Canadian dividend stocks because of the tax advantages.

The Venezuelan stock market is not in a bubble.

Canadian natural gas stocks are not at bubble valuations.

What “Warning” Introvert ? !! We’ve been dumped on! Already 12 inches!

Snowfall warning in Calgary today. That’s Calgary for you!

Dunno. Probably low but not like the world would be dragged down if we underperform. As we have been doing

“ For example, Canadian equities have “drastically” underperformed other major indexes on a risk-adjusted basis over the last decade, he explained. That’s because emerging market growth reached a pinnacle of 8.5% in 2007 and has since moderated, and commodities demand likewise decreased.”

https://www.advisor.ca/my-practice/conversations/why-home-country-bias-can-hurt-clients/

Guess an economy build on resources and lending money for housing isn’t all that competitive.

What do you mean by adjusted?

Since we are in an everything bubble and this bubble is obvious why haven’t the markets already adjusted for the bubble?

I guess only thing it’s very Canada focused. So any downturn in Canada could hit them all at once.

I guess but tax advantages, no currency to worry about, and what are the odds Canada downturns but the rest of the world including the US is just fine.

Interesting local article on the Spec tax’s impact in Oak Bay.

“Nearly half of the Oak Bay homes that have been identified for the speculation and vacancy tax are foreign owned.

The province’s Sept. 12 report on the new speculation and vacancy tax (SVT) showed that out of 9,964 declarations, Oak Bay has 85 non-exempt properties, of which 31 are foreign owned, 15 are satellite families and 23 are B.C. residents with at least one non-exempt residential home in Oak Bay.

There are 222 residential homes in Oak Bay owned by out-of-district Canadians, and 123 residential homes that are foreign owned. Among the exempt residents, 8,607 homeowners live in the home, tenants occupy 1,153 residences, while other exemptions include 112 homes under construction, 120 homes recently acquired, 105 with rental restrictions and 55 owners that are in the midst of a divorce or recently deceased.”

https://www.oakbaynews.com/news/oak-bay-homeowners-to-pay-477000-in-spec-tax/

“Downside protection” is important for some investors (including me) who primarily don’t want to lose money. Given the “everything bubble” we’re in, for investors nearing retirement preserving capital is important. Bonds and stocks are part of the bubble, and could both fall big time, at the same time. Some loss-averse investors give up, and go to cash/GICs. But that’s no fun, lousy return and what to do?

You can do-it-yourself for downside protection, using options (buying puts and selling calls) on a stock market ETF to provide downside protection at the expense of limiting upside. If that sounds too complicated, there’s a new class of ETF’s called “buffered” ETF that do just that for you, and you can trade them (liquid) just like stocks. There are a number in the US (not suitable for Canadians for tax reasons), but the first one has appeared a couple of weeks ago in Canada.

https://www.firsttrust.ca/ContentFileLoader.aspx?ContentGUID=e2866706-b80e-4a06-add6-184f61ca9254

First Trust Cboe Vest U.S. Equity Buffer ETF – August (Hedged Units), stock symbol AUGB.F

This one is Canadian, ETF based on the US S&P 500 ETF, but is “buffered” 10% with downside protection per year and a cap of 14% upside per year. So if S&P falls 0-10%, you break even, and if it falls 23%, you’re down 13% because of the 10% buffer. It resets each year. They have other ones (“deep“ buffer) coming with more downside protection (up to 30% “crash”) and a lower upside cap.

If preserving capital is a primary factor for you, it may be a good idea to look out for more of these funds with downside protection built in.

100% off topic, but I used the Telus Health app Babylon for the first time last week. Pretty cool, saw a doctor via video call within 5 min and got electronic prescription which gets sent to whatever pharmacy you choose.

Much better than walk in for the small stuff they can handle

Whatever you do, don’t Day trade!

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3423101

Yeah dividend payers are a good strategy too and have historically done well. I guess only thing it’s very Canada focused. So any downturn in Canada could hit them all at once.

I know essentially nothing about investing, but I know enough that the data shows 99% of people that say they know something don’t actually and just have varying amounts of luck. So I keep fees low and invest in everything. I bet on the human race.

Not really up to them. All based on the underlying economic performance. Raising interest rates just because of debt levels isn’t really an option

Don’t bother telling that story to millennials, they simply won’t believe it!

Anyone here think $3.7m of govt money allocated back to Victoria for 2018 (as promised) is going to move the needle?

Highly doubt admin cost was less than $3.7 million. They were paying a lot of overtime to staff the spec tax department. They had people in 90-100k positions answering phones.

This could start with rezoning density in all municipalities from SFH to Duplexes.

+1 this would be amazing, but will all the NIMBYs in Victoria likely never to happen. I think if you chopped a 50’x110′ lot in half you could still have two really happy familes. 25′ wide yard is still plenty of room for kids/dogs to play in. Each side could easily be 1,800 sq/ft finished plus single garage.

The moral of story is the “harder you work, the luckier you get” and there are significant sacrifices that are made to get ahead. It is not for everyone. But if you are willing to roll up your sleeves, life is pretty funny, you get out what you put in! Good Luck!

Thanks for the dose of reality, but I don’t think anyone wants to hear that. What people want to hear is work-life balance, flex Fridays, affordable SFH in the core preferably close to a beach, 2.2 kids, a dog, maybe a cat too, $4,000 bicycles that weight 100 grams less than the $2,000 bicycles, shop at Whole Foods and eat out all the time, Thule box on top of the car for the trips to Whistler, let’s not forget starbucks, etc.

Witnessed a mid/late-20s hipster with a bunch of really original forearm tattoos and a dog complaining about the price of condos the other day. Hmmmmm….maybe buy a condo then get the dog/tattoos? Just a thought.

I am a fraction of the intelect of Leo so I keep things simple when it comes to investing.

TD Waterhouse Self Directed – 0% management fees (biggest factor a person can control in my opinion).

RRSPs current holdings

Every year I’ll just add to a position or buy another dividend paying stock. As far as I can tell I’ve outperformed the market by a small margin overt the last 5 years, plus no management fees.

TSFA I’ll buy small caps from time to time that interest me. Rational there is if a small cap happens to skyrocket you are in a much better tax situation in the TSFA versus it skyrocketing in the RRSP.

Beyond RRSP/TSFA I would rather go pre-sale studio or one bedroom versus non-registered investing.

currency hedging, % of Canadian equity and fixed income, etc., etc. is beyond me.

I don’t have a good idea for short-term investments. I invest with a longer window and keep down payment amounts in cash or a TFSA which is invested in index funds. I agree that investing in yourself often has high ROI and investing in your primary residence can too. By this I mean that if you are planning to sell short term to rebuy you may want to put some of your cash into small fixes and staging. Over the years we have improved our places and it is satisfying to do, but has also created a place that is easier to sell and appeals to more buyers. We have also put in a legal suite which was a good investment of cash.

Not particularly. It’s a bit higher Canadian allocation than I would normally want but I’m increasingly concerned about the fiscal and social situation in the US so I’m ok with a bit more home country bias.

Yeah, everything I’ve read about currency hedging boils down to: don’t bother. So I’m curious why vanguard decided to go with it here but I’m also not particularly concerned about it as total return should be broadly similar. Especially because fixed income is only 20%.

Yeah especially when home deals like to show up in bad market times. I haven’t thought too hard about cash availability if there were some truly good real estate deals out there (I don’t see any). Refinancing the mortgage would be the best source of funds in our case.

Like you said it’s easy for me because I don’t need the investment money anytime soon. Saving down payment is much harder and there are no good options really outside cash.

Rook: I suspect the lack of great ideas as to where to put ones savings is that none of us have any great ideas to share. I dont have any either.

If you are saving for a down payment for a house, I tend to agree with Patriot that it is best to stay in cash with GIC’s and part of it in USD accounts. The world is awash with cash but worse still mired in debt. For a brief moment, when they first brought out the stress test, I was hopeful that the government would do the right thing and start to gradually increase interest rates. My crystal ball is wrong more often than right but I dont think this story is going to end well.

Why worry about the % of Canadian equity and fixed income? Aren’t these funds designed for diversification with ~30% Canadian allocation? Is that too high? Too low? Also, as far as I can tell most of these funds are not CAD hedged but the option is there if you want it.

Before I bought my first house all my money was in a GIC yielding 18.5%. Can’t get that rate today can you?

Despite today’s low rates I wouldn’t recommend putting house buying savings into anything else. Looking back into the recent and not so recent past you can see that the underlying factors that bring house prices down also bring down other asset classes. And that includes gold.

The USD does tend to rise against the CAD in such times, so it might not be a bad idea to have some savings in USD. But make sure it’s safe. Foreign currency deposits are not guaranteed by CDIC, and for example when BCCI Canada failed holders of such deposits took a hit.

Very appreciative of the HHV blog. The insights and opinions here are fact based and respectful and hence even people with busy lives come here to visit and a pulse of what is going on.

The concerns of millenials/asset poor groups/ etc…are real. There are no easy solutions to this. However the government needs to look at proactive solutions rather than knee-jerk reactions. This could start with rezoning density in all municipalities from SFH to Duplexes.

As someone who grew up in Victoria many many many moons ago; I had to go somewhere else for university with a student loan, worked my tail off during the summers to pay it back. Re-locate to some city out east to work for a number of years to gain experience (tele-commuting wasn’t offered then). Then as skills sets and industries became redundant, had to adapt and then move internationally for work. Takes further risk (again because of redundancy) by starting a number of businesses not knowing where the next pay cheque is going to come from or is coming at all.

Fast forward 25 years, after years of agonizing (16hour days being the norm) and home ownership wasn’t even on the radar when you couldn’t even put food on the table, things are a lot rosier because of sacrifice and perseverance and lots of luck. Didn’t buy my first property until my 40s. But now we have a sustainable company employing hundreds of people globally and very comfortable going to retirement.

The moral of story is the “harder you work, the luckier you get” and there are significant sacrifices that are made to get ahead. It is not for everyone. But if you are willing to roll up your sleeves, life is pretty funny, you get out what you put in! Good Luck!

I have to say I’m disappointed no one is commenting on the topic of the actual post this time around. I was really hoping to learn some things from some seasoned veterans that have made and lost some money during the past boom and bust cycles. Scrolling through the comment section I have to wade through the ever thick and tedious tide pool of Patricks rants.

Leo S – I’ve been curious about the Vangaurd ‘asset allocation’ fund that was introduced to Canada at the beginning of the year. I like the idea of a one fund solution but haven’t bitten the bullet. Do you worry at all about the % of Canadian equity and fixed income? It also seems to me the fixed income is CAD hedged. I’m also not sure that these portfolios would be wisest for someone who is hoping to buy a home when there are actually homes for sale. I know you already have a home and can go with the ebbs and flows looking long term, but when the next recession arrives, funds will take a hit leaving one with less powder to jump on their first home purchase when good opportunities arise.

Cash is an actual position to hold sometimes, and I think right now it’s not the worst place to be. Earn 2.3% from a high interest savings account with zero risk. The question is which currency does one hold it in…

I would love to hear what other people are doing when saving to buy a home at a time like this with where the risks seem to be building fast.

Canada exports over last 5 years look to be just fine, up 30% in CAD. FX comparison with USD over that period is not good, but over long term exchange rate average is fine.

Moreover…. If we want to compare head to head Canada with USA, let’s go. Comparing exports per capita Canada vs USA in 2017, is as usual, an easy win for Team Canada. 2.8X higher for Canada in 2017 (USD). Is the idea that we’ve slipped over the last 6 years due to F/X?

Exports by country, courtesy of the CIA

https://www.cia.gov/library/publications/the-world-factbook/rankorder/2078rank.html

all USD

US $1,576m export /327m population = $4,191 USD export per capita for US

Because I too love the Victoria core and don’t want to commute. Most everyone does.

When I was in my 30s in Toronto, I also loved the Toronto core and didn’t want to commute. But too bad for me, I lived where I could afford (Brampton) and had a big 1.5 hr+ each way commute. It actually wasn’t so bad (most of the time), and nothing but great memories.

As an aside, I believe many Millennials we hear from on this site are much farther ahead than I was at a similar age, for all the good reasons (education, hard work etc). I just think some of them are expecting too-much too-fast.

If you’re trying to get ahead, stop whining about NIMBYS blocking your plans, or waiting for govt to solve your problems. Instead, focus on things like starting a business, or other ways to increase your income. Good luck!

If you don’t like the core.. why not vacate your place and move out to Port Hardy?.. it not like you need a job

Good question.

I post this recent extensive official govt spec-tax data (sep 12, 2019

https://news.gov.bc.ca/files/SVT_Consultation_All.pdf) because noone else has, so its news here.

And to especially point it out to some people here that are under the mistaken belief that are there are significant numbers of “bogeyman” house owners out there, that are preventing them from buying the house of their dreams at a lower price than they can afford. And if we can get rid of these bogeymen (by taxes, wealth confiscation and prosecutions), prices will fall and all will be well. These “bogeymen” include foreigners, satellite families, speculators, vacation homeowners, tax cheats, unexplained wealth, money launderers etc. etc.

And so this latest govt release has precise data, from all households in Victoria, which was heralded by the “bogeyman believers” here last year as going to expose the true prevalence of some of these bogeymen. This was why all 160k Victorians homeowners should do their duty and fill out the online form, “just wait for the data dump that will reveal the true numbers”. And this release of data was a complete dud for Victoria. Tiny numbers of spec-tax liable foreigners (201) , satellite families (129) and spec tax homes in general (~900), with tiny tax revenue.

The implication for a young househunter like you – the “enemy” here in your house hunt is not the bogeymen, it’s friendly-fire from your Millennial and Gen X cohorts, nice people just like you looking to buy a house, in huge numbers compared to housing supply. When you put in an offer on your Gordon Head house, you’re not going to be be bidding against “bogeymen”…foreigners, speculators, satellite families etc. – this govt data indicates there’s just too few of those to worry about. You’ll be bidding against people just like the posters here on this forum.

If that’s all true, and you agree and recognize it early, you’ll buy ahead of that coming wave of core-loving Sooke-commute-averse Millennial buyers (like yourself!) , and thank me later! If I’m wrong, oops and sorry for wasting your time.

So that’s why I post about it. Just trying to help!

Wow barrister.. thought you are a respectable man.. how far you fallen ?.. to the level of Patrick.. SMH

If you think it is insignificant.. why complain about it?

Barrister,

Zing….Great line!

Putting the foreigner issue aside….

Looking at the released govt spec tax data. For BCers, we see dismally low numbers for revenue in Greater Victoria from BCers in the 2018 spec tax. Of the $3.7m total for 2018, 32% came from BCers for spec tax properties in Victoria from 329 people. That’s $1.2m total tax from BCers for Greater Victoria spec tax, from the 160,000 declarations we all filled out in Victoria, and will fill out again in 6 months. The rate for BCers won’t increase in 2019 so should be similar, and BCers also get a tax credit, and I’m not sure if that’s even included, if not these numbers are more dismally low.

Now this issue doesn’t involve foreigners at all, just a simple question, do people think like I do that most BC speculators are home-grown BCers, and do you think that this $1.2m total Victoria spec tax from BCers is effective at taxing and discouraging their house speculation?

Except, for foreigners only, it doesn’t need to be an empty house or a second house, it can be a first house and occupied full time (satellite family). And that gets you 4X higher rate than a Canadian speculator with a second (or more) empty home. And the projected revenue from this (poorly named) spec tax for 2019 is projected to come >90% from foreigners, despite their tiny ownership numbers, and entirely due to the differential rules and huge foreigner-only rates.

Hardly equal treatment for anyone.

If we did what you suggest, it wouldn’t be xenophobic, but we don’t.

You say “Anyone that owns an empty second house will pay it.“ but that’s not what happens. Foreigners aren’t treated as “anyone”, they are in a special class and are charged 4X more. That’s not just a little higher, it’s up to 8X the cost of property tax, and discussions are in place by city and feds to ratchet this up even higher.

Imagine you’re traveling through Europe and strike up a conversation about housing in Victoria. And you tell them, “yes we have a housing crisis in Victoria, and so we have a spec tax. And so we charge Canadians one rate, and we charge foreigners four times higher.” They say, “why single out foreigners, is there a problem with foreigners owning a large percent of the housing?” And you reply, “well no, it’s just 1 home in 450”. They say “did you say one in 4?”, and you say “no, one in 450”. And they say “that sounds tiny, why pick on foreigners then, why not charge the highest rate to the highest abuses – people with multiple vacant properties, house flippers, you know actual speculators?”. And you say, well we think that a lot of these foreigners are tax cheats, and have unexplained wealth and money launderers too…… “ at that point you look up and they are gone.

You’ve heard all that talk on this forum, does anyone of it strike you as xenophobic?

I too will repeat my story.

Bought my first SFH property in Victoria core with dual professionals income in 2003. Lost everything in a messy separation. After a few years of working 2 jobs to clear the debts for a fresh start. Bought a 3800sqf SFH (3735sqf finished) plus a nice large 2 cars garage on a 1/2 acre lot with only a single tradesman income in 2014 in Langford/Bear Mt.

It can be done if you want it hard enough to work for it.

Herpa Dung has being reading Karl Marx for dummies again.The government numbers have a bit of spin to them and they seem to shy away from publishing the cost of collecting the tax. But it will put a few more houses on the market. It is mostly a one time benefit which is dwarfed by the fact that we have to build a hundred thousand housing units each year just to keep up with the immigration numbers. If I was a millennial I would be screaming for a immigration moratorium until a lot more supply is created.

Still people are feeling poorer because they are actually poorer. Boring as it may seem (and it is rather boring) look at Canada’s export numbers for the last six years, then calculate exports on a per capita basis to account for increased population. Whatever you do dont convert those numbers into USD. If you are feeling a little poorer it is probablely because you actually are poorer.

“Homes” is a lot more effective in bringing out the tears than the more specific “vacation properties”, isn’t it?

I could be wrong, but it’s highly likely that the money is gone before anyone see a dime, because they spent a lot more than that just to collect. However, their clever accounting will forgo the net negative revenue in the report.

House price increases far outstripping incomes is what happened. Also saving not getting you anywhere compared to when rates were higher and prices lower.

I will repeat my story – bought SFH (my first property) in City of Vancouver in 1980’s on one income. Simply cannot be done by someone with a comparable job today.

Not just xenophobic but bolded. That’s serious.

For years people in Vancouver tried to shut down discussion about foreign buying by claiming racism. Turns out the population is sick of that and wants to have a serious discussion about the impact of outside money on real estate markets. Read this piece by Ian Young: https://www.vanmag.com/the-van-mag-qa-ian-young

It’s a money problem, not a race problem.

Especially when the spec tax applies to BC owners and Canadians as well it’s clear that there is no basis to dismiss it as xenophobic. Anyone that owns an empty second house will pay it. Simple as that.

There we have it, from official govt release of spec tax stats (sep 12, 2019

https://news.gov.bc.ca/files/SVT_Consultation_All.pdf), in a city (Greater Victoria) with 150k dwellings, a grand total of 330 (1 out of 450 dwellings) are subject to spec tax from foreigners or satellite families (source page 86 of govt release) . And from that tiny number, we have turned xenophobic and concluded that this tiny group of foreigners is a significant cause of the housing crisis and must be targeted separately with huge tax rates, higher than anyone else, namely an outrageous 2% of house value per year. All with the hope that this tiny group of foreigners will “change their behavior” and rent or move away, making the group tinier still.

Yes

How about this one, shockingly low spec tax revenue collected for of our capital region (Victoria) was only 6% of the total, with only $3.7m spec tax collected for Victoria for calendar year 2018 (Source page 7 of govt report https://news.gov.bc.ca/files/SVT_Consultation_All.pdf )

Anyone here think $3.7m of govt money allocated back to Victoria for 2018 (as promised) is going to move the needle? It will rise for 2019 as foreigners pay more, but due to the skew of foreigners towards Vancouver, I estimate it will likely rise to about $8m – still a small amount considering it gives tourist city Victoria bad publicity worldwide . Is it worth it to over tax some elderly people out of their long standing Victoria homes?

“A revealing glimpse into the mind of an entitled Millennial.”

I agree Patrick! Whatever happened to if you want something but can’t afford it then go work harder so you can afford it?? Yes, there are people that get lucky and are able to accumulate assets without having to put in much work, but that is life.

Thanks. The govt is sticking with the $115m as you can see in their official release sep 12,2018 the $115m is a projection for a 15 month period up to March 31,2019 (see page 6) and the $58m was actual money collected on calendar year 2018 (see page 7). The numbers are accurate, just confusing.

Here’s the official govt release, dated sep 12, 2019

https://news.gov.bc.ca/files/SVT_Consultation_All.pdf

(Page 6) “SVT Revenue for Fiscal Year 2018/19

• Revenue from the tax was $115 million for the

2018-19 fiscal year, higher than estimated as a

result of:

– Public Accounts 2018-19 required that the 15 months of revenue from Jan. 1, 2018, to March 31, 2019, be reported during the 12 month fiscal year.”

//—-///

The govt is still publishing this $115m, representing 15 months, including 3 months of 2019 revenue that must be a projection of what they hope to get. A cynic must point out that they are projecting near the same numbers to report, indicating the level to which they believe the tax will be effective at freeing up homes for rent or purchase.

Lots of good data in that release, not yet discussed here, including Victoria specific info. attn: LeoS!

The actual amount collected was $58 million. The $115 million figure was a previous projection which has been inaccurately reported as the actual amount. Compare these two stories from the same source:

July 11:

https://globalnews.ca/news/5486187/bc-speculation-tax-revenue/

Sept 12:

https://globalnews.ca/news/5894374/b-c-says-speculation-tax-brings-in-58-million-in-2018-as-meetings-with-mayors-on-tax-kick-off/

There were headlines splashed all over a couple of weeks ago about $115m being raised from the spec tax, here’s a sampling

“BC’s new property tax adds $115m to affordable-housing fund”

“B.C.’s speculation tax brings in $115M, mostly from owners outside province”

Now you might think that means this is what they collected for 2018 calendar year declarations so far. But when I actually run the detailed numbers published on this article, I think it adds up to $55m collected. That’s less than half of the headline. What??

https://www.timescolonist.com/b-c-speculation-and-vacancy-tax-helps-ease-housing-crunch-finance-minister-1.23944070?utm_campaign=magnet&utm_source=article_page&utm_medium=related_articles

I don’t know what the discrepancy is for sure. Likely I’ve made a mistake or an incorrect assumption. My best hunch is from this odd phrase used that it is for tax collected “for the fiscal year 2018-19”, which for the govt ends March 31, 2019. But all spec tax that I’m aware of was only paid based in declarations up to Dec 31. As we know, spec tax rates are rising big time in 2019, and projections will be higher for 2019.

Anyway, Im just curious. The TC article is full of numbers of avg. payment and numbers that paid so easy to add them up. Do people looking at the numbers published on the TC article above agree with me that they add up to $55m spec tax collected so far for 2018 calendar year, not $115m?

Correct. My error as I was looking at the tax as initially proposed which would have been 1%.

I guess we will find out as the petition has been filed.

Again, a free housesitter would solve the problem. The tax doesn’t require that rent be charged.

I think it would take a major change contrary to the intent of the present exemption.

Presently someone from, say, Campbell River, can buy a dwelling in Victoria to be close to medical treatment in the latter and not be subject to the tax.

The house in Oak Bay isn’t used to access medical treatment. The owner isn’t a Canadian resident in the first place so she’s not covered by our Medicare. It’s reasonable to assume that she’s a US permanent resident and thus eligible for US Medicare. The house in Victoria is for recreational purposes only.

First of all the tax rate for Canadian citizens, regardless of where they live, is 0.5%. That’s $6K a year. Second we don’t know, beyond the pensions that everyone gets, what the financial situation of the owner is. And ability of any particular individual to pay has nothing to do with whether a tax is legal or not.

The only real question is whether the tax is within provincial jurisdiction.Seems pretty plain to me that it is. And I will reiterate the “mobility rights” argument is ridiculous. That simply means you can move and seek employment anywhere you want. Provincial governments aren’t obligated to set up their tax systems to allow someone who has left the province to have an empty house waiting for them.

Entitled to say this statement? 😛

It seems like a minor change to this exemption would address the couples problem: https://www2.gov.bc.ca/gov/content/taxes/property-taxes/speculation-and-vacancy-tax/exemptions-speculation-and-vacancy-tax/individuals#medical-treatment

On the other hand that would make it open to abuse. Anyone could claim they need to be out of the country for medical reasons and it’s impossible to prove. No easy answers here

We actually live in OB, and for what it is worth it our little part here, most of the people moving in those big expensive homes are people pushing baby carriages are tugging 2 or 3 kids. I am not talking tear downs, but new builds. Just saying, younger people/ Millenials are moving in not so small numbers. Perhaps some your friends?

Argh.

The question is not about whether anyone needs a house in Oak Bay, they don’t. Actually, no-one needs to own a house at all, they just need minimum shelter. Our society values home ownership a lot though, so before we allow government to limit shelter choices we should consider whether the issue they are trying to address is pressing and if they are going about it in an effective manner.

The real question is whether the BC government is acting fairly and within their jurisdiction in imposing a tax that results in an extra tax of $24,000 dollars a year for someone living on a pension for a Oak Bay home worth 1.2 million (the example in the news) that has been someone’s family home since they were five, they use regularly, and that they plan to retire to when their US husband passes. There is no way they can afford the extra $24,000 a year so they have to rent or sell.

I’m not sure if this constitutes the minimal impairment of a mobility right protected by the Charter. It does seem somewhat unfair.

However, that Oak Bay home is rentable and they could certainly find a house-sitter to move in while they are away and move out when they are there and pay utilities. Of course, creating an irregular house-sitting gig is not really solving the housing issue for local folks. Most house-sitters on the sites are not locals but people from other locations in Canada and abroad looking to travel and stay for free.

A revealing glimpse into the mind of an entitled Millennial.

But there are definitely more people that wants some one else’s oak bay house .. more than those part-time Victorian owner

No coincidence this lines up with the last price boom

That’s it! If you guys can’t share I’m taking away the oak bay house and then no one can have it.

The owners don’t need it either. That’s the real point.

Yes Spock, but this doesn’t apply to the wants of the many – noone (including you) needs someone else’s Oak Bay house.

The needs of many out weights the needs of the few..damn.. democracy does not always work for your needs

All-electric over here.

On Condos vs. SFH:

Multi-family buildings have an efficiency advantage exactly like Marko points out. Heat/cool only leaking out of one or two surfaces vs 5. However, most condos buildings are insanely inefficient on the exterior surfaces. Hopefully we see more adoption of CLT builds and better detailing: https://www.buildingscience.com/documents/insights/bsi062-thermal-bridges-redux

On saving energy:

Insulate any areas that aren’t. Get a blower door test done and determine where the air leaks are. Do your best to deal with those. From there it gets more expensive: heat pump, better windows/door, adding extra insulation. It can be impractical to add insulation in some areas (under a concrete slab, for example).

A deep energy retrofit would most likely take a place down to the studs to increase the thickness of the wall, or, add an entirely new exterior with ‘outsulaion’ over the existing exterior.

We’re still using the original electric forced-air furnace as our home’s only method of heating. A few years ago, we had to replace a few heating coils on it (not expensive).

Our BC Hydro cost is $2000-$2500 annually. That’s for a 2,200 square foot late-seventies Gordon Head box with no retrofits and 5 humans living in it.

When our furnace kicks the can, we’ll probably replace it with a more efficient version of the same kind.

I assume it would be cheaper to heat with natural gas, but I’m happy to pay more in exchange for a smaller carbon footprint.

The spec tax rate is the same for B.C. and ROC… 0.5%. (We have the Greens to thank for forcing that amendment to lower ROC rate). BCers get a tax credit of up to $2,000 against B.C. prov taxes paid and ROC doesn’t unless they are filing B.C. returns (unlikelyj. That rate is livable so not so many sad stories from BCers or Albertans,

It is foreigners and satellite families where the tax becomes an unfair tax grab – a rate 4X higher at 2% per year (provincial), on top of other city (Vancouver, 1%) and promised federal taxes (1%). For Vancouver, on a $750k home, that would be $30k per year, about 7X property tax, and enough to tax-smoke many people out of their homes.

Didn’t it peaked in 2016?

The “fall out” hasn’t produce $500K SFH as the average buyer on this board is wishing for?

Prices in core Vancouver still well over over a million approaching $1.5 million for a SFH.

https://www.vancouverisawesome.com/2019/02/06/maps-how-much-home-prices-dropped-metro-vancouver/

In fact the Vancouver market peaked in July 2018 and has been falling since then. The spec tax was introduced in the February 2018 budget. In any case that doesn’t prove causality one way or another. We do know that the RE industry is blaming the BC government for the falling prices.

I believe HHV proved that Vancouver fall out as you put it was well on it way before the speculation tax. And, HHV haven’t come to the conclusion that Victoria is having a fall out or cheap housing stock coming online at anytime soon.

There is no constitutional requirement for provinces to tax non-residents the same as residents. PEI has been charging non-residents higher property taxes for years.

That is ridiculous, given that the tax is imposed on properties left empty. It’s actually an incentive for absentee owners to move to BC and occupy the property.

Section 6 protects mobility rights. It ensures Canadians can move and work in any part of the country. The argument that imposing an unfairly higher tax on Canadians from outside B.C. the government is impairing mobility, or that it is unfairly discriminating against people based provincial or extra-provincial residency.

It is like the HOG in many ways. The HOG would likely stand up to a Charter challenge. The question in this case is whether the tax is so high or onerous or unfair that it is impairing mobility rights and/or it is not logical/fair in its imposition as it does not actually accomplish its aims and/or its aims are not fair.

My conclusion also was that it was not currently worth it for economic reasons alone. My hope is that by the time our roof needs replacing, it will become more affordable. We’d be willing to put them in if the environmental benefit is significant and pay more for this. Before we make the final decision we will look at the environmental cost of the materials used, including of life recycling issues vs. the benefits of solar to the environment over the lifespan.

Best case scenario without any failure or maintenance it will take 21-35 years to break even not factoring inflation or investment lost on the money.

However, it is highly unlikely that the solar panels don’t requires maintenance in 20+ years of service. If factor in the lost of investment and inflation solar panels doesn’t make economic sense, because one will never recover the costs of installation.

I’m not trying to rain on your parade, but most “warranty” are on a sliding scale. If the solar panels failed in 10 years you will have panel/s replacement costs of 60% discount and you still have to pay full price for the labour.

What does the Charter have to do with it? The Charter prevents governments from discriminating based on one’s race, religion, etc. The spec tax is a variation of property tax based on property use. That’s been around for a long time. Like the Home Owner’s Grant, for example. If they can charge you different property tax based on whether the owner lives in the property, they can charge you different property tax based on it being unoccupied.

We have baseboards, natural gas fireplaces, natural gas stove, natural gas dryer and natural gas on demand hot water heating. We don’t use the baseboards as our place is small, the windows face south, and we are well-insulated so the gas fireplace (on a thermostat) and cooking provide enough heat in winter.

We are holding out for solar when our roof needs replacing as our roof is also south-facing. We had a company come in to do a quote on solar panels. The quote for purchase and installation was from $14,500.00 to produce 4,825 kWh per year, up to to $35,000.00 to generate 13,000 kWh per year. The solar panels come with a 25 year warranty.

There are no government subsidies for this, but BC Hydro’s net metering program allows you to bank power made in the sunny summer for use on cloudy days by giving a credit for excess power production.

I learn something today. My thought was that people like larger properties.

They do, but no many people have $2 million for a nice acreage on the peninsula.

I have to agree most newer building have electric heat, or heat pumps, but I think Dockside Green also have gas fireplaces?

No. The first building (Regatta) at the Railyards had gas fireplaces but not beyond that.

I don’t know how to argue with that, just as people who drives smart cars and corollas claims that their vehicles are more fuel efficient than people who drive Ford F-150s.

I learn something today. My thought was that people like larger properties.

I have to agree most newer building have electric heat, or heat pumps, but I think Dockside Green also have gas fireplaces?

That all being said the large windows are quickly disappearing in condo developments due to code changes. Look forward to seeing more and more spandrel 🙂

“Willing” 🙂

Sure, it’s a matter of availability and one unit condo certainly uses less energy than one unit house. But that’s not the same as a condo being more efficient.

Also you have to consider per capita. Avg. household size in a SFH is bigger than in a condo

Renters should be happy that the landlords are subsiding their housing.

I bet on a /sqft basis there is little advantage.

That is an odd argument as you can’t buy a 1,000 sq/ft home that would be equivalent in living space quality to a 1,000 sq/ft condo. It is not like you have the option of buying a half decent newer 1,000 sq/ft home in the core.

The whole article is all over the place comparing apples to oranges, but condos can also have gas fireplaces integrated into strata fees.

With exception of some buildings built 1990-2000 gas fireplaces are not that common in condos. The only larger building build in the last 10 years I can think of that has gas fireplaces is Lyra.

The saving is there as you indicated. People in condos are willing to occupied less space than people who live in SFH dwelling.

Most new buildings don’t have that large of thermal bridging footprint to be concern with at the residential level. For instant, foam insulation separation between slab and foundation only save 3% on energy at VIU building in Duncan.

There is a great amount of energy loss in building with large windows, however it save money on lighting and people mental health.

The whole article is all over the place comparing apples to oranges, but condos can also have gas fireplaces integrated into strata fees. And of course the heat you get from common areas that shows up in your strata. I bet on a /sqft basis there is little advantage.

Thanks you all so much for the feedback. 🙂

According to “High-powered high-rise,” apartment-dwellers in B.C. pay an average of $43 per month in hydro bill – less than half of the $103 paid by those living in detached homes.

This is misleading as in a condo you are unlikely to have an oil or gas bill. Realistically it is $43 vs $150 if all homes had electricity as their main source of heat.

Which without even getting into power usage of common spaces is nuts given that the average condo is less than half the size of the average SFH

Don’t you already have your 6 months of occupancy in the bag for the year?

The ultimate arbiter of price is the market. If it ain’t selling then it’s overpriced, except for one big caveat: adequate exposure. You said it’s been listed since the 17th, and no showings. One week wouldn’t really count as adequate market exposure especially in the fall market, but the fact that none of the (hundreds of) buyers that have had your listing show up as “New” on their portal have asked for a showing is not a great start.

I’d say you have until halloween before the market goes to sleep for the year. Definitely retake better pics without the mess on Oct 1, and then you have a month to sell the place. If there’s no action in a week or two after that, I wouldn’t cling to the idea that the price is right though.

I went through the UsedVic rentals section again and continue to see more and more houses going from on the sales market (and sold) to the rental market so clearly some people feel that houses will be the means of increasing wealth over the next many years. I still don’t understand the numbers given housing valuations and rent asked but perhaps that’s where the comfort level is for those investors.

I have no idea what some of these people are smoking. Some of these places I see sell and hit the rental market are in like $1-3k per month cash flow negative @ 20% down.

It is like they have money to burn.

According to “High-powered high-rise,” apartment-dwellers in B.C. pay an average of $43 per month in hydro bill – less than half of the $103 paid by those living in detached homes.

https://bc.ctvnews.ca/think-your-high-end-condo-is-energy-efficient-bc-hydro-suggests-otherwise-1.4377291

I have baseboard heating in my SFH and the average energy cost is roughly $2200 a year. And, I hope to cut $600-800 off the bills after I complete the house renovation (no heat pump).

We listed September 17 and it has had 0 showings.

I spend hours counselling clients as to why their home isn’t selling, but when I meet with a close realtor friend (we have around 1,500 career transaction between the two of us) for lunch we always joke all the time wasted counselling when 98% of the time the factor is simply price, but sellers don’t want to hear it so you kind of counsel them in circles until they adjust the price.

You have to balance time on market versus price point as sometimes you end up selling close to asking price 90 days in, although not the majority of scenarios. As the days on market roll by the odds of selling close to asking to reduce. You have to factor in that some properties like acreages or waterfront have a limited market pool and may need more time on market. However, if your Gorden Head box is not moving price is likely the factor.

There are some common-sense things you can do like re-take the photos when the tenants move out, etc., but beyond common sense items price is 98% of the equation.

There is no magic marketing potion the average Joe seems to believe exists and therefore pays insane real estate fees.

My philoshpy is pretty simple. Solid photos, correct data input, make the property as easy as possible to show, and price accordingly. The rest (marketing in Hong Kong, drone videos, glossy brochures, open houses, etc., etc.) is all fluff to make you as the seller feel better.

I think your roof orientation may not be ideal for that if I remember correctly.

I like the Saanich one. Not the most user friendly perhaps but very flexible and localized to the options available here and emissions of our grid.: https://www.saanich.ca/EN/main/community/sustainable-saanich/green-at-home/carbon-fund-calculator.html

yes my sister was able to pick up a 1 bed room unit from the fall out , a 60k discount from assessed price … if the price was never curbed .. she will still have to penny pinch to pay rent

it was almost impossible to buy a place with averaged single income salary in Vancouver .. but with the recent meltdown , she was able to get into the market

480k was not easy for first time buyer but it is good enough to get in

Sure, you have inherent advantages when it comes to just the physical layout of it. But it could be much better if they were properly designed to remove thermal bridging and have reasonable effective R values.

$500/year on hydro is really not that great if you consider that’s like 700sqft. We spent 3 times that, for 3 times the space.

We bit the bullet a couple of years ago. We wanted to do renos, lift the house, add another storey, move some walls around. So we brought in an architect, a designer, and a realtor, and they all said forget it – the 1953 bungalow (with addition put in in 1971) was not good bones and it would be just as expensive as building new but with a far worse layout at the end. There were problems with black mold and we’d had rats in the attic and crawl space, so we weren’t too sorry to get rid of the old structure, with oil heat and old windows after nearly 65 years. So we tore it down (did manage to bring in Al Hall to salvage some joists and beams). We built a beautiful house, blew our budget as always happens, and in the process went high efficiency – triple-glazed windows, electric heat pump, extra attic insulation, enough to qualify for Built Green/Gold (2 points shy of Platinum level). Not quite Passive or Net Zero, but well above code and we felt good about ditching all fossil fuel dependency. Using the electric furnace in the winter is still a bit pricey, so we still have to figure out the sweet spot for heating, getting the settings right. We’re actually fans of wood heat, so we may still put in a wood stove, even though I know that’s not a solution that everyone can use (particulates, etc.). May eventually put in solar panels, but in BC that’s a money saving measure, not really an environmental one.

Is anyone else a fan of carbon calculators? There are many out there. I find that to be the acid test – everyone will have a different pattern of housing, car use, flights, eating, etc., so if you’re driving a Toyota Tundra to Mt Washington every weekend in the winter, or flying to the Caribbean 3x /year that might actually constitute your biggest source of emissions; depends on your total lifestyle.

The market would sort it self out. Problem solved.

“Towers” actually tend to be pretty bad from a thermal envelope perspective – especially ones with lots of glass. There are some fairly famous modern glass buildings out there with huge AC and heating loads.

I hear this argument all the time, but in all the glass sky boxes I’ve lived in with my significant other we never spent more than $500/year on hydro.

Common sense tells me when you have someone below you, above you, and to both sides the section of windows you actually have would have to be ridiculously inefficient to be worse than a house that is losing heat in 5 different directions.

Did the melt down provided more affordable housing in Vancouver or Victoria?

If some Victorian junks their old gas powered car and buys an electric car, we applaud that as a good way to reduce carbon footprint, since BC Hydro is >90% hydro generation, which is clean. Agreed.

Does the same apply to a house, if you disconnect natural gas service and convert to electric heat (powered by BC Hydro), is that also “applauded by environmentalists” as you’ve reduced your carbon footprint?

I assume the answer is “yes”, just wondering if environmentalists here agree, and are they all heating by hydro or other clean sources,

Well. Many NIMBYs in Victoria want you to move out to sooke because you’re bare over crowding their space

A house is priced right when a buyer submits an offer that is then accepted. The agreed upon price becomes the market value for that property. Just because a realtor says it’s priced right doesn’t mean that it is so – it’s just a guess as to what a buyer might be willing to pay. If there are absolutely no home sales within your region then perhaps one could say it’s slow but I’d bet that there is a price that could get the property sold tomorrow. It’s up to you to decide what your tolerance level is for that particular number.

Heading back to the topic of this blog post, I’m in the diversified, low cost portfolio group as well. I look for companies who have revenue (and not a unicorn), a reasonable PE, in a stable or solid emerging market space, and management that actually owns some of the company. These same ideas apply also to the mutual funds & ETFs I review – what do they hold and how does management apply the stated philosophy of the fund to their investments. I think there is room to beat the overall average in the coming years. I remember the dot com era well and watching unicorns IPO recently reminds me of that period but the solid companies all came through and have since increased in value.

I went through the UsedVic rentals section again and continue to see more and more houses going from on the sales market (and sold) to the rental market so clearly some people feel that houses will be the means of increasing wealth over the next many years. I still don’t understand the numbers given housing valuations and rent asked but perhaps that’s where the comfort level is for those investors.

I recently test rode an e-bike and can see my future. I love my bike but as I get older, climbing any hill large or small is painful. I understand why e-bikes are becoming so popular. I can see that my carbon emitting footprint will get significantly smaller as I transition from the car to bike for many errands. An e-bike also allows one to be outside of city centre but still be able to commute to it. This expands the area where one can live. I’m looking forward to this future.

You won’t have to pay spec tax as the lower unit is rented and only one part of the house needs to be rented to qualify for the exemption. In addition, if you have had it rented Jan-Sept that is more than six months this year which is another exemption.

I hope all is well here at hhv. Sure it is. Looking for a little advice in the comments here. We decided to list our investment property (out of Victoria) when our tenants gave notice that they were moving out. We listed September 17 and it has had 0 showings. Tenants are moving out October 1. The photos are not good – it looks cluttered because they have too much furniture in there. We aren’t sure what to do. Do we wait for them to move out October 1, then stage it, and keep it on the market? But, by then it seems it will be stale and will be overlooked, so maybe the staging is a waste of money. Otoh, if we’d like to wait until Spring to re=list, what do we do in the meantime? If we leave it vacant we will have to pay a vacancy tax, plus the rent from the lower unit already won’t cover the mortgage. So it doesn’t seem financially wise. And a third option, I suppose, is to try to find a short term renter, someone who wants it for 4 months, that will move out at the end of the 4 months, which will help us cover the mortgage and avoid vacancy tax, until we can re-list in the spring. It is not overpriced, our realtor indicated there was a tour of realtors and they agreed that it is priced right. The market is apparently just really slow right now. I hope it’s ok to ask this question in the comments. Leo, please forgive me if not, and feel free to remove it. If it is ok, would love to hear some thoughts from the housing experts here at hhv. Btw…the reason we decided to sell is because i’m working full time and took on an additional pretty big “project” that is related to my career aspirations. I just don’t have time for this shit.

No, but when there is an overwhelming amount of evidence reached independently by scientists around the world that climate change is real and threatens the future of the planet then there is consensus of opinions, not opinions reached by consensus.

Given that today is the climate strike, I’d like to hear more about housing and climate change. In particular, anything someone has done to retrofit their houses to reduce their carbon emissions and if anyone has had an energuide audit.

It seems the biggest thing you can do to reduce your emissions is:

I’d like to know more about how to get to net zero Leo.

Lets leave the climate change discussion for now since it’s off topic except as it applies to housing. And yes I realize I’m guilty here, it’s an issue that’s important to me as well.

How would a mass movement start then? There’s a lot of people on bikes these days. Quite the difference from even 5 years ago.

Science isn’t done on consensus.

If we just stopped subsidizing home ownership that problem would solve itself.

In case you hadn’t noticed, there’s a melt down going on in Vancouver right now. There’s also a shit ton of supply in the pipe over there.

This was the BC NDP Platform in 2017 description of spec tax (this is still on the NDP website). Clearly this was to be targeted to speculators.

https://action.bcndp.ca/page/-/bcndp/docs/BC-NDP-Platform-2017.pdf

“We’ll close the loopholes that let speculators dodge taxes and hide their identities and we’ll require them to pay their fair share of tax on their empty houses through a yearly two per cent absentee speculators’ tax.”

Yes, although there is a Charter issue. The government can infringe on Charter rights, but it needs to be able to show that the way they have gone about it is justified.

Justified means that the government has to show the spec tax as written is the least impairing way they could have gone about things in order to meet a the objective of stopping speculation and empty homes. And they have to show that the spec tax actually works as intended. And that the objective is one which justifies infringement in the first place.

I’m not sure the government can meet the Charter test with the spec tax. The spec tax seems to catch not just those who are speculating, but those who have secondary homes. The real issue is whether the government has a right to penalize the second category, or require them to rent their homes, as it doesn’t seem to be the best way to address housing availability given that research shows that investment in affordable and subsidized housing is way more effective and there is not a shortage of shorter-term rentals as far as I can tell.

This is a talk about energy efficient buildings and location I enjoyed from 5 years ago: https://www.youtube.com/watch?v=JEUShQ7r_tE (TedX).

If done correctly. Please point me one local current condo building done correctly.

“Towers” actually tend to be pretty bad from a thermal envelope perspective – especially ones with lots of glass. There are some fairly famous modern glass buildings out there with huge AC and heating loads.

I’m almost finished my passive house, and even though it’s replacing a shitty old house and has a great walk score, there is lots of room for improvement. Lots of foam under the foundation, concrete in the foundation, and stucco ain’t exactly a green cladding.

Hopefully we see some HHVers downtown at the climate march this afternoon.

Giving an example of bycatch. By the way it was much more complicated than filing a return apparently I would have had to go to both embassies in person and the process still wasn’t guaranteed.

Love the term “tax-smoked” out of their home by the way. So far all/nearly all the stories have been of people not wanting to pay, not that they couldn’t.

The anti spec tax lawyers are loving the fear mongering though. Big bad government is coming for you!

+1

Perhaps me need some new ways for people to establish status that don’t involve ever more stupid amounts of consumption

There is no way I am ever going to be able to own a house in an expensive city and leave it empty more than half the time, and there is no way almost everyone else will be able to do it either. That’s the reality you’re glossing over.

Here is what the NDP promised in their platform:

“People who buy property in BC but don’t live or work here and leave their property empty will be charged a two per cent tax on speculation, with optional municipality participation.”

You could make the case that doesn’t include people who live here and leave a second property in a big city empty, but that’s about all. And notice people who do live here or are citizens are charged a lot less than 2%, and the original promise was province wide.

I hope you’re not suggesting that taxes withheld at source, that you didn’t bother to follow up by filing a return (to get refunded), is anything close to an equivalent situation as these spec tax cases of people getting ‘tax-smoked’ out of their houses.

I’m not a scientist nor claimed that I’m one, but through my observation and some of the conversations that I have with the scientists that funding was a large part of their concern and sensationalism papers produce grants.

The other point of note is that if you already own an (older) house, your zoning means that you can’t suddenly build a row of townhouses or a big concrete condo building on it. Your options are to do retrofits or tear down and build new, possibly adding a suite. Or you could sell, but that doesn’t benefit anyone. The nice thing is that technology does allow for pretty decent options for green living these days, even in a sfh.

Yeah, the science on climate change is not fear mongering. You doing IT at a lab doesn’t make you an expert on climate change. Climate change is real and man-made, and there is overwhelming scientific consensus that this is true. FYI scientists often volunteer their time to write climate change reports and are not paid to show up to protests.

Hard to believe that someone would advise people to ignore the issue, just put their heads down, and enjoy their lives.

Keep your head up, ask questions, do what you can, and enjoy your life. And if the mink coat is second hand and keeping the thermostat down in winter I’m in favour.

Not just heating. Heating and transportation.

Actions biggest to smallest impact.

1. Replace gas car with EV ($16k used)

2. Cut back on gas fireplace use

3. Turn off fireplaces in the summer

4. Switch to 20% renewable natural gas.

Eventually gonna rip out the gas entirely when hot water tank reaches end of life. May crank up percentage of renewable natural gas in the meantime but not quite convinced this is sensible from an emissions standpoint.

Single family home is less energy efficient than condo. If the energy comes from fossil fuels then that delta leads to a large delta in emissions. If the energy is renewable, then the increased energy does not lead to much more emissions

Probably sound advice but it doesn’t change the fact of man-made climate change leading to bad and unpredictable results down the road. There is no scientific doubt about this and it’s not fear mongering (the media does like to do that, but not science as a whole).

Back about 15 years ago as a student I got a $5000 google award for working on an open source project (KDE). Because of my citizenship (German) I was subject to a 30% withholding tax which means they took $1500 of that amount even though I was supposed to be exempt. Clearly the intent of that tax was not to punish students programming for open source, but I was bycatch. Apparently I could have gotten it back by raising a stink at the various embassies in person but instead I just grumbled and took the lump.

Guess I’m not the type to raise shit.

Putting money under the bed sounds like a good idea these days, but if your bed is not big enough to store all the loonies and toonies, then:

1/ buy assets/stocks/etc… that churn out lots of cash and are profitable!

2/ leverage 75% if you are 35 or under; 50% if under 50. and 25% if under 70

RE is always fun because you can leverage. If you $100K, and you borrow $300K and it is positive cashflow and you get an upside on CP gains, that is good strategy to consider. However if you are bearish and you think the market might turn, then buy gold/silver/precious metals.

Personally, looking at old houses on large lots on the outskirts of the CRD. This IMHO is going to appreciate faster if RE keeps going up. Good luck!

I started my IT career at the NRC Herzberg Institute of Astrophysics, and I quickly found that much of the scientists working time was devoted to fights/justify/begs for funding. And, sensationalism/fear papers produce much better results for funding than non sensational papers. Hence, it is an unfortunate outcome of economic that research scientists have to produce an environment of fear to support their career.

The moral of the story is don’t worry. Turn off the TV/social media, and live your life to the fullest.

I wonder, if sometime in the future you’re caught as “bycatch” in a different tax that’s so high you determine that you need to up-and-leave your long-time-owned house, will you be as understanding?

Leo keeps the thermostat way down and bought the family some mink coats.

How did you cut heating by 60%?

What do you mean by this?

It doesn’t target those people. Those people got caught in the net. Every tax has bycatch.

In the lawsuit against the spec tax it is no accident that they hold up the most sympathetic couple as the face of it. Doesn’t say anything about the average payer of the tax.

And you don’t have to. We have 3 beds and 2 baths in our living area. Through deliberate actions, we have cut our carbon emissions from the houshold (heating + transportation) by 60% in the last 3 years, and I expect to cut them to essentially zero in the next year or two.

Of course there is still consumption and food based emissions, but living in the house itself doesn’t add any significant emissions over living in a condo.

You’re right that condos are more environmentally friendly in many ways. Less energy use, less land use, closer to downtown cores.

However the difference is not as big when energy is clean. A SFH has likely less embodied carbon than a steel and concrete condo building per unit area. It is less energy efficient, but from an emissions point of view that hardly matters if the energy is clean. And if your SFH is within walking/cycling distance of work or you drive an EV then the proximity advantage is also gone.

So outside of more land use it’s not that big of a difference if done correctly

Introvert,

I got a quote after a call to TD Meloche Monnex to start my house insurance for November, and the basic quote for my house insurance is $82 more than my current premium with Lloyd’s/Coast Capital.

However, the earthquake portion is insane at $1,501 with $100,000 deductible.

Lots of gold bugs on housing blogs in 2007/08. Interestingly enough it peaked at the same time as Victoria real estate (2010)

Change is hard. Especially when it goes in a way that doesn’t conform with traditional measures of economic success and particularly when it is considered a lifestyle downgrade of some kind.

For me personally, I took note when the scientists showed up to protest. And then I started reading and it scared the crap out of me. And then I started to feel a sense of deep concern for the children who come after and for the future of all the living beings on this planet. It motivated some change, but there is definitely more I could do that I am not doing.

Most people aren’t going to want to change until it is a mass movement and as uncool to waste energy or live large as it is to wear a mink coat. It’ll get there, hopefully not too late.

Often these choices are easy to make when you consider they also promote health (using the car less, living in a walkable area, converting grass to garden, not eating packaged foods) and affordability (smaller house size or co-housing options, buying second-hand).

I don’t have a problem with people that make personal choices. What I have a problem with is pretentious and hypocrites who criticized everyone around them for not conforming to their ideal life style then complaints/demand to have the life styles of what others have.

The controversy is this tax grab ostracized people (mostly older people) vs younger people, and it didn’t lower housing costs or provide more housing as how it was sold to the public.

I do. I know I’m not alone in making housing and other choices that consider environmental impacts.

Often these choices are easy to make when you consider they also promote health (using the car less, living in a walkable area, converting grass to garden, not eating packaged foods) and affordability (smaller house size or co-housing options, buying second-hand).

Yes. The Spec Tax gets coverage, but this is the pressing issue.

Better get a Taycan, because it doesn’t breakdown in between.

I agree with all your points except for subsidize low-cost rentals, because subsidizing distort the market. I believe either wages have to go up and/or housing prices drop to match the market conditions if we don’t have government meddling.

Sorry I’m gonna have to round that up to 35 and deem you mid thirties. Time to buy a faster Tesla.. or maybe a Taycan

Tesla Plaid Mode next year so I can get faster from house to house 🙂

The media are pointing out cases that aren’t matching what was promised in the NDP platform. We were promised a tax on RE speculators, not something that targets people like this long-time elderly owner couple.

As a govt, you can’t promise to tax apples, and then tax oranges instead, and expect noone to complain about that.

Thankfully “most people are pleased with it” isn’t a standard used by media and others in criticizing laws. Most people were pleased with the spec tax when it first came out too, with a 2% rate for everyone, and spec tax area including Gulf Islands (which would have badly hurt the economy of Gulf Islands). It needed stories in the media to force the govt to make changes, and the media should keep at it so that govt makes more changes.

Yes, they should and do come. If they can’t afford to buy, they should rent (as 40% do), and the govt should encourage and subsidize low-cost rentals (as they are doing).

It seems people read the news because they’re looking for things to get angry about and not… you know… for the news. It bothers me that every media outlet keeps writing about the spec tax as being “highly contrivertial”. This was in the NDP platform, they were voted in, they implemented it and most people are pleased with it. Where’s the controversy? Why publish the political opinions of people who can’t even vote here?

What about single income?. Should they come to Victoria?.. what about low income .. should they stay in Victoria.. what about waiters and servers. ? What about care takers for old people . What about service people that provides service for retirees.?… If low income cant stay to provide service .. who will .. lawyers, managers,?.. unlike metro Vancouver .. we don’t have the population to service others.. evidence in all the fast food restaurant looking to hire people.. if no one can afford to live here .. then the retirees can’t have enough service .. and if housing cost too much.. who wants to retire here ? Vancouver became pretty cheap to buy in lately

Sorry I’m gonna have to round that up to 35 and deem you mid thirties. Time to buy a faster Tesla.. or maybe a Taycan

Marko, come on you are mid 30s not early 30s!!!

33, your call.

Marko, come on you are mid 30s not early 30s!!! 😉

100k loss was at 1400 Newport Ave. Perfect storm of another condo in same building selling for a low price and bringing the rest down with it.

Just looked at my database and can’t find anything close to a 100k loss in the building.

Not an expert but common sense tells me 200 units on a 20,000 sq/ft building plot downtown is a lot more environmentally friendly than 5 houses in Happy Valley on 20,000 sq/ft. If you can explain to me otherwise, I would be curious to hear. There is one tenant I have downtown where I include hydro in the rent and last year it was less than $200 for the ENTIRE year. He has walked to work the 7 years he has rented the unit, no car at any point.

I’ve noticed everyone talks about the environment, but no one actually cares when it comes to real life. All my clients still want completely useless feature sheets when everything is available online. The attitude is let’s save the environment but I want 2,200 sq/ft home on a 6,000 sq/ft lot and I’ll pass on the electric car as I can’t do the roadtrip to Alaska in an EV.

Just look at the cars on the road. Does everyone really need a F150 to roll around town?

Don’t get me started on the municipalities….I just killed two trees submitting all the paperwork for two new builds in Colwood. Spent over $500 on printing blueprints and other crap they wanted which could have easily been sumbitted electronically. With the City of Victoria would have probably killed three trees.

That also very likely means that she’s a legal permanent resident of the US, since you can’t stay more than 6 months a year as a tourist.

Your kids are fortunate to have a parent like you if you can manage to give them that life style in Victoria. However, there are many people in Canada wanted the similar life style for their families and they are crowding into a space of 4400 person/ km² instead of spreading out at an average of 4 person/km² in the vast country of Canada.

Marko, not to be rude or appearing to run your life style down, but……I take it you are in your early 40’s? From the past, while you were in your 20’s and working, you lived with your parents as I recall. But you bought an investment condo or two? You don’t seem to mention any wife/girlfriend, kids, pets?

Early 30s.

Can’t comment on kids but I have family members living in very very tight accomodation that have super bright and active kids. I know in Croatia most kids live in condos and speak 2-3 languages and are very fit and active despite living in condos. I personally had a super happy childhood and we never had much space.