Foreign buying: The impact on Victoria

As you’ve probably heard, Vancouver is in a bit of an affordability crisis, and a lot of it is due to foreign capital. Before the foreign buyers tax was introduced in 2016, foreign buyers made up around 10% of all buyers in Vancouver and up to 16% in municipalities like Richmond. Meanwhile, a massive racket to launder money through Vancouver real estate has been making everything worse, with estimates of the impact ranging from a mild $100 million to a concerning $2 billion to a headline grabbing $5 billion (even if that was a wild guess).

So as Vancouver grapples with the aftermath of one of the most explosive housing price increases in modern history, it’s worth asking whether Victoria is being hit by the same forces.

To get the background on what foreign money is doing to Victoria real estate, ready the rest of the story in The Capital.

Some thoughts on September numbers: https://househuntvictoria.ca/2019/10/01/september-trend-reverses-but-for-how-long/

Hawkling Bears on this board have dismissed the recent months’ good news, lecturing and guiding us with soothing advice to “expect upticks, but watch the trend”. Now that Leo declares “definitely a reversal of the trend now”, shall we expect capitulation from these bears, or will we be lectured again – perhaps now be told to “watch something other than the trend”?

Def. “Hawklings” : (n) Young devotees of the Hawk graph, postponing their first home purchase until after the apocalypse.

https://housepriceindex.ca/#chart_compare=bc_victoria

Repeat sale prices for Victoria have been rising since bottoming in winter. The previous high, which we’ve now exceeded, was summer of ’18.

I could be wrong, but ……..

In Sept 2018, the VREB reported the Benchmark Price for a single family house in the Victoria Core to be $883,700, (not $878,500 as they reported today).

For Sept 2019, the BM Price was reported to be $846,500.

So that’s actually a drop of $37,200 for BM Price for single family house in the Victoria Core in the last year.

It’s also a drop of $43,100 from the all time high BM figure of $889,600 in June 2018, which I think is significant.

To me (as a person possibly interested in buying a house in Victoria in the not too distant future) (for the lowest price possible), I wanna know about PRICE trends. Yet, this kind of information seems to be secondary to many. The big emphasis always appears be on the SALES figures (which I think realtors care more about than potential buyers). Frankly, I don’t care so much about SALES numbers. I want to know about PRICES and whether they are going up or down over the course of time, so I know when it’s a good time to buy.

And in fact, when SALES numbers really start to show an escalation trend, I suspect that will probably be a sign that PRICES have returned back to Earth, so people can afford to buy again.

from the VREB:

CURRENT STATISTICS

“Victoria Real Estate Market shows increased interest in condos and townhomes

October 1, 2019 A total of 616 properties sold in the Victoria Real Estate Board region this September, 15.6 per cent more than the 533 properties sold in September 2018 but a 6.8 per cent decrease from August 2019. Sales of condominiums were up 48.3 per cent from September 2018 with 221 units sold. Sales of single family homes decreased 1.1 per cent from September 2018 with 282 sold.

“September’s statistics clearly demonstrate that Victoria continues to have a stable real estate sector and is a desirable place to live,” says Victoria Real Estate Board President Cheryl Woolley. “While sales are up compared to the same month last year, our inventory remains low, which may create challenges for people trying to get into the market in certain categories.”

There were 2,823 active listings for sale on the Victoria Real Estate Board Multiple Listing Service® at the end of September 2019, a decrease of 0.5 per cent compared to the month of August but a 6.7 per cent increase from the 2,646 active listings for sale at the end of September 2018.

The Multiple Listing Service® Home Price Index benchmark value for a single family home in the Victoria Core in September 2018 was $878,500. The benchmark value for the same home in September 2019 decreased by 3.6 per cent to $846,500, slightly less than August’s value of $847,300. The MLS® HPI benchmark value for a condominium in the Victoria Core area in September 2018 was $503,600, while the benchmark value for the same condominium in September 2019 increased by 1.6 per cent to $511,600, lower than August’s value of $518,100.”

Vancouver real estate ‘could very well be at the bottom of the market’, expert says

https://www.citynews1130.com/2019/09/25/vancouver-real-estate-bottom-market-expert/

Mr. Look-At-The-Trend doesn’t like the new trend.

I guess that depends what you mean. Literally speaking, and if we call 3 months the minimum for a new trend, then sure.

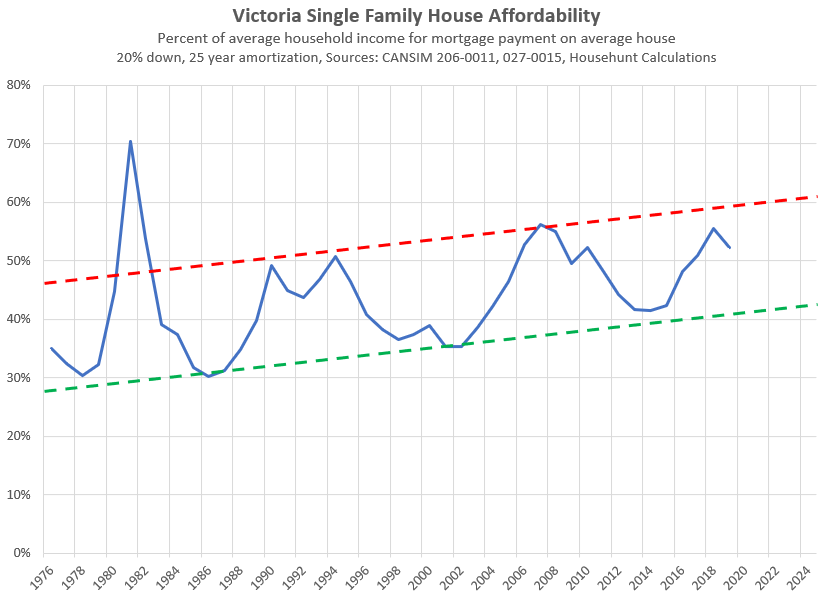

But, I still don’t think anything unforeseen is happening. The correction has definitely started, but it’s far, far too early IMO for a reversal. Have a look at your historical affordability charts.

In general terms, what has happened each time, shortly after we get to the peak and see a little drop-off? The question really goes back to your earlier contemplation you presented to the forum – will this time be different?

Creditors are still willing to dole out plenty for a mortgage, and this is the point where wait-weary buyers think this is their only chance. This could go on for months.

The real question is what happens once that pool is exhausted. Regardless, Canadians aren’t willing to give up on RE yet. The fact that people are ripping into HELOCs like tomorrow is Rapture suggests that there’s still plenty of people that feel assured nothing will be happening to the market.

Anyways, Victoria is far from alone. Vancouver just posted large sales gains just the same, but that’s coming off of horrid sales figures. Their sales are still low, developers are still bailing left, right and center. Also seeing that phenomenon in other global RE markets, as the economic backdrop continues to deteriorate.

Great post

September results are strong. Sales up, MOI down, Sales/list up, prices up. Definitely a reversal of the trend now.

Great article Leo.

Agreed, little buying impact expected from foreigners expected going forward. Of course many classed as “foreigners” transition to immigrants/citizens and I do expect ongoing buying impact in Victoria from that category.

And I also expect small amounts of foreigners selling too. Because the govt released spec tax data only found a small number (201) of foreign-owned “vacant” properties in greater Victoria (and that includes people with vacation properties). With such a small base (201) to begin with, I don’t see meaningful numbers of sales in this category per year.

The Salish Sea comprises the Strait of Georgia, Strait of Juan de Fuca, Puget Sound, and a bunch of other smaller bodies of water.

So you’re not wrong, but you’re not being as specific as I am.

Now kindly return the 3 progressive points you subtracted from me.

No that was their invention. I’ll tell them to tone it down for the next article. Same with the “created” the blog part.

Good point! The “Juan de Fuca Strait” was actually added by the editor so I can absolve myself of responsibility on that error at least.

Subtract 3 progressive points, do not pass Go(rdon Head). The correct appellation is “Salish Sea”.

I do love to see my biases regarding Victoria RE confirmed, though.

Good article, Leo. It cleanly summarizes a lot of info from this blog.

I love Leo, but he didn’t create this blog.

Leo basically slaps the face of all the bears who don’t buy the limited-land argument.

Strait of Georgia.

Congrats Leo. Wait.. did you write that part?

Really great article LeoS. The numbers from Vancouver are down but the impact will be longer lasting since so many of the buyers were in their fifties rather than the much older traditional retires. A lot of those houses will be off the market for the next twenty years.The price deferential funded early retirement.