On “Clickdata” and why I don’t cover it

Another month another rent report from the folks at Padmapper and of course the requisite spinoff articles in the media about it. “Victoria now ranks among five most expensive markets in Canada for one-bedroom rentals” exclaims Chek News. These types of articles always play well in Victoria where rents are high, and get lots of shares and comments on social media, but is there really anything to it?

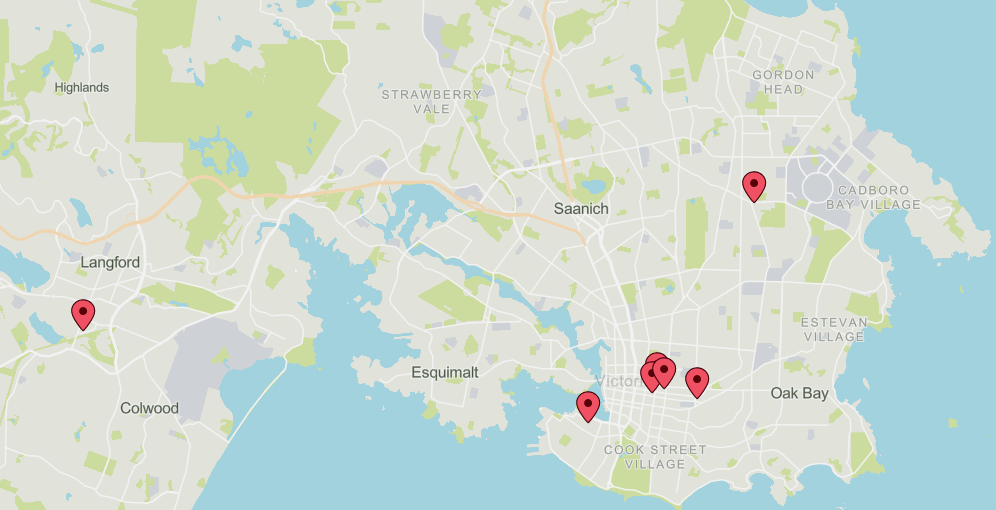

My main problem with these pseudo-data reports is the lack of detail. There is apparently no archive of these rental reports (the category only shows the most recent one) and there is no mention of how many apartment listings these reports are actually based on. Padmapper claims they have thousands of listings, but looking at the map for Victoria and filtering out vacation rentals, there is a grand total of 7 one bedroom long term rentals listed. In their methodology they say they have direct feeds from the big landlords, but why wouldn’t they list those vacancies on their map?

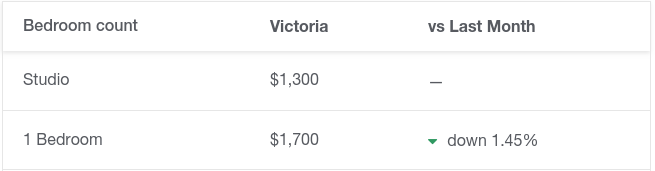

More confusing is the internal inconsistency in the data. On their summary page for Victoria they state in the table that the rent for a 1 bedroom in September is $1700, down 1.45% from last month.

A few centimetres down the page, they contradict themselves, saying that “the median rent for a 1 bedroom apartment increased by 0.71% to $1,700.” Funnily enough, on their post about the data, they say a 1 bedroom in Victoria rents for $1400, and is up 0.7% from August!

Which is it padmapper? Is the rent $1700 or $1400? Is rent up 0.7% or 0.71% or down 1.45%?

Maybe these are just simple website bugs and one of these numbers reflects reality, but given the uninspiring quality of the source listing data, my suspicion is that the “data” is heavily fudged, especially in the smaller centres where padmapper doesn’t have very many listings. That also means these reports mean almost nothing and you can’t put much if any stock in the rent movements from it. These reports are meant as advertisements and lend themselves to catchy coverage with clickable titles, but in the end have little substance. Clickbait with data, or clickdata if you will.

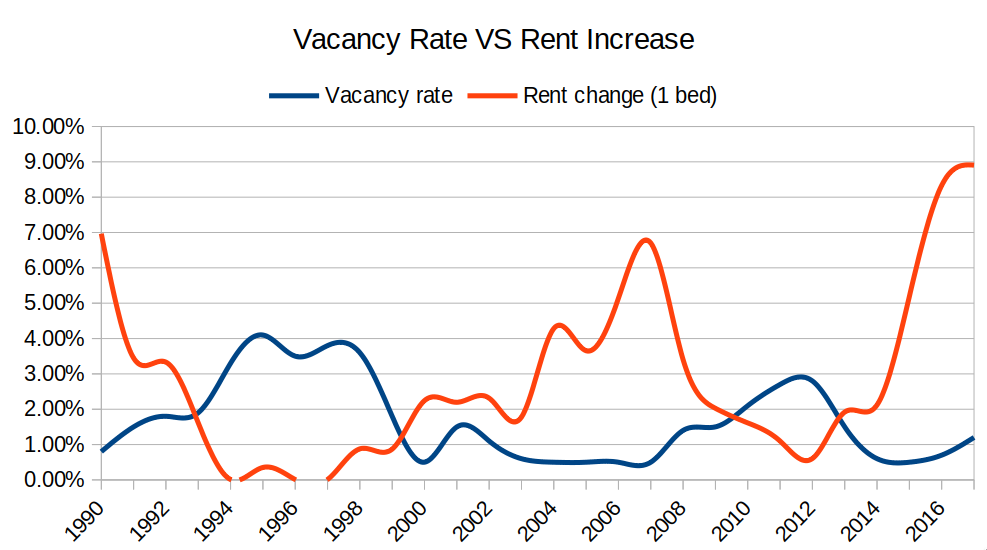

There’s a reason that CMHC only releases their rental reports once a year, and that’s because collecting this data is hard and a lot of work. Last year that report told us that while rents were up sharply, vacancies were also increasing and given all the rental construction that has been hitting the market this year, that trend will almost certainly have continued. When the new report is released in a month or two, expect an increased vacancy rate and likely an easing of the rent increase rate (although rents have still increased from last year). In the meantime, filter out the noise.

We pay $440 a year for ours, and it’s a 5% deductible.

Our late-seventies house is not on bedrock and has a brick chimney, which don’t do well in earthquakes.

The purpose of insurance is to transfer risk that you can’t handle on your own. Our emergency fund can’t cover the cost to repair mega damage to our home, so we think this insurance is prudent.

New post: https://househuntvictoria.ca/2019/09/23/sept-23-market-update/

Deb, all I asked was the sold price of a particular listing and you answered with: “more than $40k below assessment”.

That didn’t tell me the exact price, so I asked the question again which was when Leo S, told me the exact price and also referenced you had already mentioned it in your reply. That prompted me to reply: “Deb actually hadn’t and just gave me a smart ass answer” because it was pretty obvious (atleast to me) it would have sold for less than $40K under assessment since it has been listed at $40K under assessment for couple of weeks.

In my mind it is the same as If I had asked what the stock price of Microsoft is and someone replied with “current price is more than 25x P/E”

Everyone with internet access can find the BC assessment price and the listed price, not everyone has access to the actual sold price right away.

Some are off way more than that…

1940 Panorama Drive, North Vancouver

Just sold for $910,000

2018 Assessed: $1,389,900

35% difference.

@guest_63119

Me neither but just thought I would give @guest_63122 the information.

Assessments are often off by 5% one way or the other. I dont see any significance in that.

@Leo S

Thank you Leo that is exactly what I was referring so. Although I must admit it was amusing to be called “smart ass” it’s been years since I have felt so bad.

@ks112 I had posted the sales price as $690k and Deb observed it was $40k less than assessment, which is true and I think more in response to my posting the sales price, rather than your question..

Leo S. I asked how much the townhouse sold for (it was listed at $692K which was pretty much $40K less than the assessed value). Deb answered my question with the following statement: ” Over 40,000 less than the assessed value;)”

Is that not a smart ass comment?

Well, we have lots of past experience since ETFs have been around for a long time and before that the very similar index mutual funds. The difference this time is a greater percentage of equities are held in them, but there is nothing fundamentally different about the ETFs today vs 2008. We’ll see what happens. I suspect we don’t have too long to wait until something quite interesting happens in the markets.

Good article, thanks. However I’m just not easily reassured when it comes to predictions. One can come up with any number of reasons why ETFs will do just fine in the next downturn and subsequent recovery; it’s common wisdom that they will be fine. But we have no past experience to draw on – it’s unchartered territory.

Thanks for entertaining this topic – Hope I’m wrong!

Yeah I’m not worried about the long term value of stocks individually or collectively. I’m concerned with the particular ETF that’s holding Apple. It’s the eggs all in one basket problem – what if there’s a flaw in the way an ETF is designed that makes it less than desirable, yet we can’t see this flaw until a correction hits? I agree it’s unlikely to be a problem, but I’m not quite willing to go all in on that bet.

Apart from seeing how ETF products play out in a downtown, I’m also looking forward to comparing returns between my ETFs and my actively managed funds. Could be interesting and I don’t think much downside in short-medium term.

Another article on the ETF risk. https://awealthofcommonsense.com/2019/09/debunking-the-silly-passive-is-a-bubble-myth/

This is an interesting strategy. Diversify not just investments but also management approaches. One thing to keep in mind is if ETFs are distorting the market then they also distort the underlying equities. So if your active manager buys Apple directly, then you are inheriting much of the risk of ETFs given the fact that Apple will be pushed up by being in various indices.

The other way I look at it is diversification. I would not put all my money into the S&P500 as many do (lured by excellent returns in the last decade). VGRO which I primarily use owns 12,245 stocks and 15,647 bonds right now so is far more diversified than that.

The only way I really see to mitigate that problem is to buy stocks that aren’t in the major indices. Here is someone talking about that idea: https://www.equities.com/news/invest-in-stocks-that-are-not-in-major-indexes

Thanks Leo. I’ve decided to move about half of my investments to an investment manager (with a relatively low fee structure) to hedge my bets going into the next downturn. It’s funny, on the one hand with an all in one vanguard ETF (like VEQT), you are wildly diversified. And yet you own just one product. What if there’s something under the hood of that particular ETF that doesn’t jive well with a panic style correction, something that steers traders towards other products?

Yeah it was an interesting read. A few thoughts on it.

I’m not particularly concerned about who says something. Lots of people who successfully predicted something have a very poor track record afterwards. I haven’t analyzed Michael Bury’s accuracy on predictions though.

As long as there are enough active traders out there, then the market remains relatively efficient, and any inefficiencies introduced from funds should be corrected very quickly.

It’s interesting that MMM points out Catherine Wood and the ARK fund as an example of active investors finding inefficiencies in the market. ARK has a well publicized $6000 price target for Tesla. As much as I’m a huge fan of Tesla and electric cars, that is certifiably insane, so I’m not sure about that example on the “smart active investors” side of the equation.

The bigger issue is that everything is overvalued. The world is swimming in capital, so everything looks like a bubble right now.

What you want to avoid is amplification of ground movement and liquefaction. Bedrock avoids both of those so it won’t make an earthquake worse than it already is but of course your house may very well not survive just the regular unamplified earthquake

More info:

The Soil Factor

Local ground conditions can change the characteristics of earthquake motions. Have the local building authority or soil engineers check the soil conditions of your property. If your home is situated on poor soil, its foundation should be reinforced.

Poor – deep loose sand; silty clays; sand and gravel; and soft, saturated granular soils.

Earthquake forces are amplified on water-saturated soils, changing the soil from a solid to a liquid. The quicksand effect makes the ground incapable of supporting a foundation. The ground can crack or heave, causing uneven settling or building collapse.

Good – bedrock (deep and unbroken rock formations)and stiff soils.

These soil types are best since much less vibration is transferred through the foundation to the structure above

http://earthquakescanada.nrcan.gc.ca/info-gen/prepare-preparer/eqresist-en.php#The_Soil_Factor

Listed on the maps page

https://househuntvictoria.ca/maps/

That’s the exact price. I don’t understand the question. List $692k, sold $690k. Assessed $40k higher at $731.6k so I don’t understand how pointing that out is a “smart ass comment”.

There is a seismic hazard map around somewhere that will show how good or bad the soil is under your house.

For a 60’s house, having it bolted to the foundation is important.

Leo’s, I was wondering if you knew the exact price?

Deb just made a smart ass comment below because the listing price was $40k below assessment.

Replying to Marko

My house is in the core and built in the 60’s and there are a lot of big rocks on my property but not sure whats under the house. I also have a lot of tall Gary Oak tree’s that I would imagine will all come down.

So your saying houses built on rocks would be OK in a earthquake?

Seems like a slow day on here so I’ll take some liberties and go a little off topic. Has anyone seen the latest from MMM?

https://www.mrmoneymustache.com/2019/09/12/michael-burry-index-funds/

I’ve been a happy and devoted passive ETF investor for years, singing their praises. But I gotta say I’m a little rattled by some of what I’m reading. They’ve become incredibly popular since 2008. We haven’t seen how they perform in a major crash. Maybe MMM can refute Burry’s specific predictions, however I’m guessing we’ll learn some things about ETFs when the next major market correction hits and I’m not sure I want to experience that learning curve first hand ! Thoughts?

Speaking about Earthquakes. What are peoples thoughts about earthquake Insurance. I am paying an extra $450 a year for it.

I talked to one of my neighbors who has never paid for it and said I am wasting money.

I’ve never bought it and never will. If the deductible was reasonable but at 10-15% deductible when you multiply odds of a large earthquake x odds of home sustaining that much damage x odds of you surviving the earthquake the causes that much damage I agree with your neighbor, waste of money.

If you are on rock in a newer build complete waste of money. If you are in an older home in the core the lot itself is worth 80% of the value +/- so it wouldn’t be a complete loss.

I’ve never bought extended warranties, I pass on comprehensive/collision with ICBC. Where I do need insurance, such as home insurance, I’ll go massive deductibles to lower the premium. Rather deal with a 5k water leak myself than adjuster and all that BS.

At this point I’ve saved enough over the years to drive one car into a tree and still be ahead.

Seems like a great deal, assuming it is a good policy (what is/isn’t covered is significant for earthquake coverage). What’s the neighbors argument against it?

Posted it down below. $690k

Leo S, do you know what 12-60 Dallas sold for?

Speaking about Earthquakes. What are peoples thoughts about earthquake Insurance. I am paying an extra $450 a year for it.

I talked to one of my neighbors who has never paid for it and said I am wasting money.

https://www.quantamagazine.org/artificial-intelligence-takes-on-earthquake-prediction-20190919/

Interesting stuff about earthquakes in the area in this article.

Over 40,000 less than the assessed value;)

Yep, absolutely. And Padmapper tracks vacant rents aka advertised rents so I would certainly expect it to be substantially higher than the average rent for occupied units. I’m just not convinced the data is worth anything and would much rather wait for the CMHC report.

Depends entirely on vacancies. Just because advertised rents are extremely high in periods of low vacancy does not mean that the entire market needs to “catch up” until you get to that level. From the data we know that when vacancies hit about 4% rents stop increasing. So if we get there (still likely at about 1.5-2%) then asking prices for vacant units will drop towards the same level as that of occupied units.

Sold $690,000

Anyone know if 12-60 Dallas sold? If so how much?

With pricing of owned homes, there is just one average, which is what homes are selling for, because no one knows precisely what the ones that don’t sell would sell for. With rented units, there are two averages, average rents for the occupied (“rented”) homes and for the vacant (“for rent”) homes. There’s a big difference in these prices (25%), at least in Victoria and other markets with low vacancy rates.

CMHC data points out the Victoria average rent for vacant units is about 25% higher than occupied units (page 2 of https://assets.cmhc-schl.gc.ca/sf/project/cmhc/pubsandreports/rental-market-reports-major-centres/2018/rental-market-reports-victoria-64471-2018-a01-en.pdf?rev=d83a0e0e-1b9e-482f-8375-d53fee15ea6b )

So in 2018, from CMHC data, the average Victoria 2bdr occupied rent was $1,400, the average vacant unit rent was $1,800. There’s a high turnover, (18% per year in 2018), so that exposes people to market rents which are going to be closer to the vacant rent, which could be up to 25% higher. Of course people looking to rent usually end up with some discount from the offered rent, but nowhere near 25% off.

That all means that (if vacancy rates stay low) I would expect average rents for the occupied homes to track upward each year well above inflation as the 18% of Victoria renters each year turn over from lower rents to the higher vacant rents. So we shouldn’t be surprised to see 4-6% rent average increases for the next few years in Victoria.

Lief: BC Assessment is the true number, All sorts of errors on listings.

Anyone know how the assessed value is based on the real estate portals? I noticed it listing assessed at 1.15m but bc assessment shows 1.05?

Padmapper doesn’t aggregate usedvic so they’re missing the majority of local rental listings. The app is great, their data for Victoria is not.