January: Sales drop, condo prices stumble

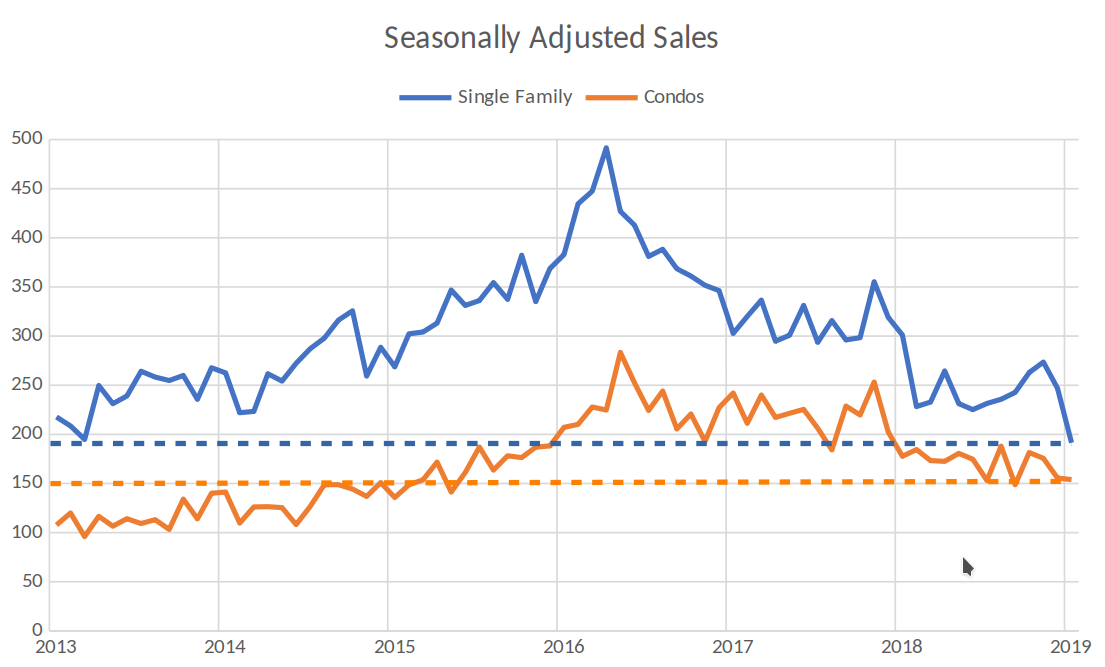

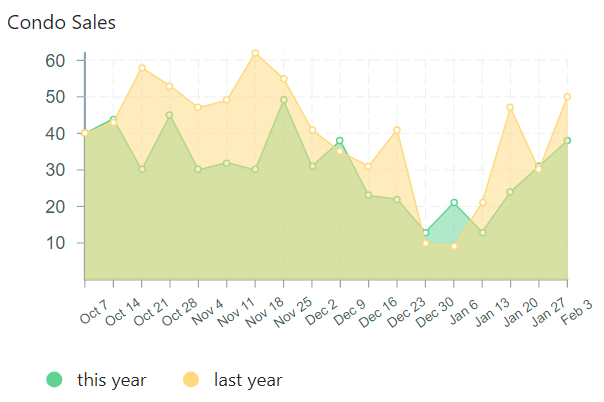

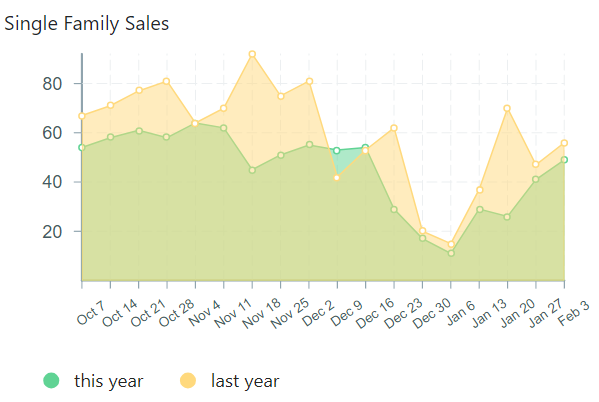

More or less final numbers are in and it definitely wasn’t a strong month for real estate in Victoria. Condo sales remained relatively steady from December but sales of single family homes took a big dip, dropping to the lowest level since 2013.

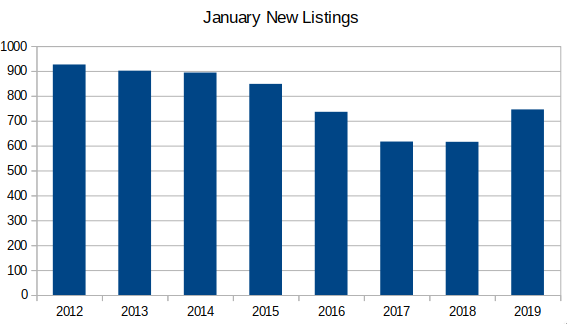

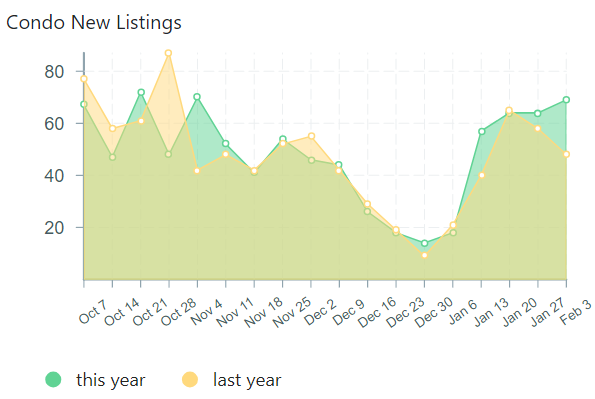

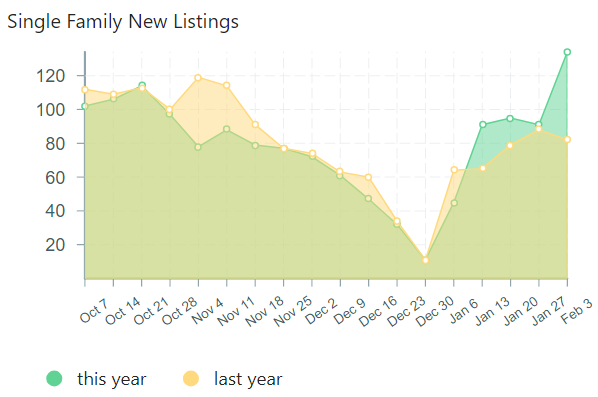

On the other side of the equation, after two years of very low levels of new listings in January, we are finally seeing some signs of life there, with new listings up 21% from last year. We are still down substantially from the level of new listings we saw in the first half of the decade, but at least the trend is looking good.

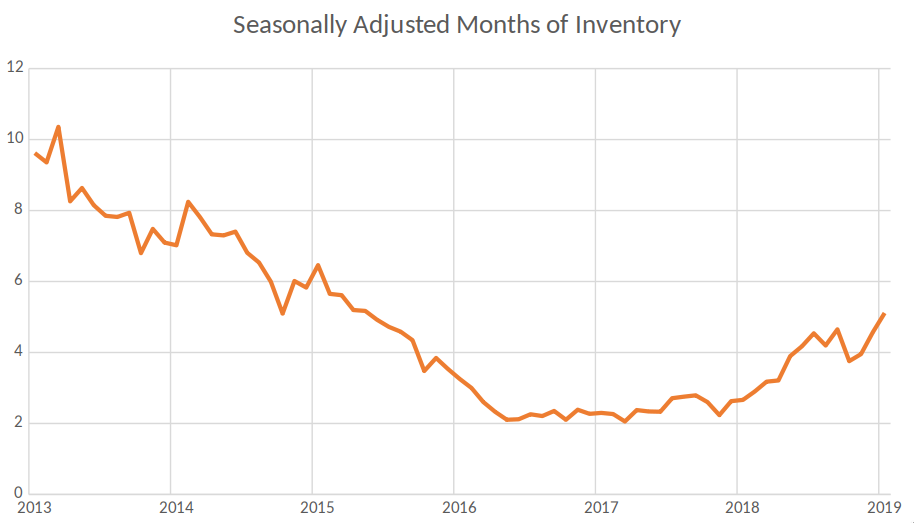

Put those two things together and the result is a continuation of the cooling trend for the entire market. Traditionally a balanced market is defined as months of inventory around 6 and means prices should be stable, but the direction of the trend is important as well when it comes to price movements in the market. With sales at very low levels, the percentage of sales that come from sellers that must sell rises, and those sellers tend to take lower prices.

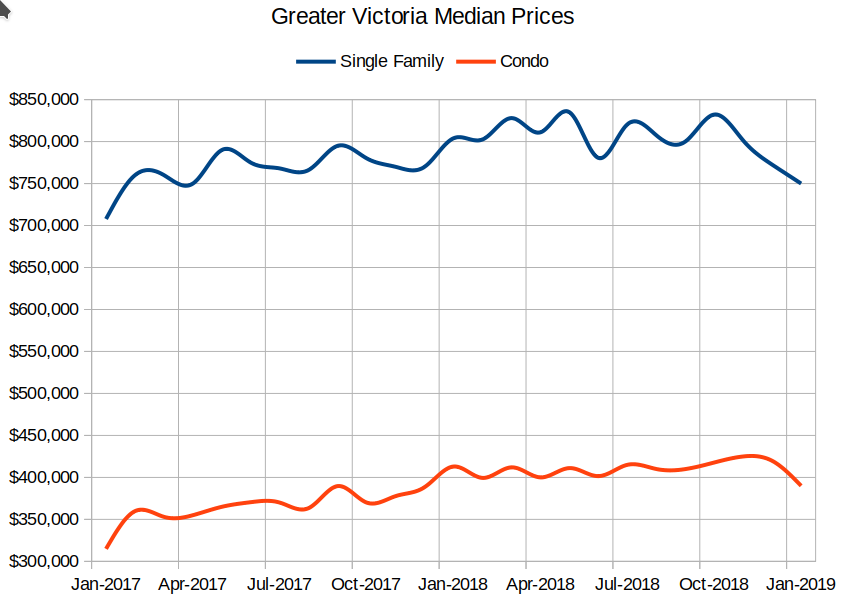

Interestingly enough, despite the single family market being much weaker than the condo side, condo prices took the more substantial dip this month coming in at $390,000.

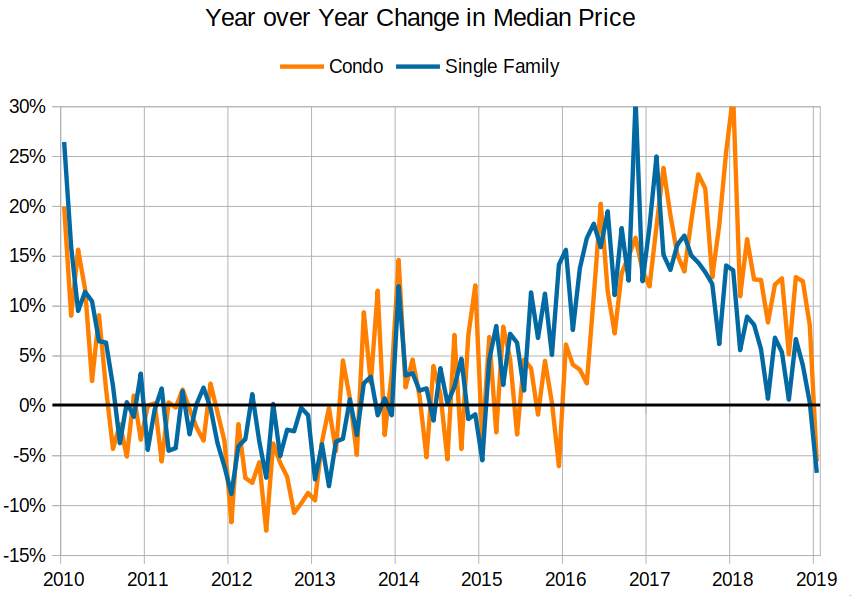

Median prices are relatively volatile, and doubly so in January when sales are low so I wouldn’t get too excited about this dip in prices. I would not be surprised at all if medians were up again in February. However the magnitude of the decline is certainly on the high end of normal. Condo prices dropped 7% from last month which only happens once every 2 years or so and single family prices were down about 3% from December. For the first time in years, both condo and single family median prices are down from a year ago.

The spring market is going to be very interesting and I believe the bellwether for the rest of the year. Usually price gains are concentrated in the spring market, so unless we see prices hold or appreciate, I believe we are going to see some substantial declines in median prices in the fall. It’s an election year and there’s a lot of speculation whether the feds will introduce some measures to help people afford houses (aka goose the market), but I doubt it will be substantial. So far the effect of their credit tightening is exactly what they intended with a moderation of the most expensive markets and any measures they introduce (such as upping the CMHC limit past $1M) would be minor at best. The biggest reason I don’t think they will take substantial steps to underpin the market is because it seems that most people support what has been done so far to curb indebtedness. Outside of the industry itself, it seems there is broad based support for putting a lid on house price appreciation and cutting down some of the out of control markets. That might change if prices decline a lot, but so far I don’t see a big political risk from them standing behind their rules.

New post: https://househuntvictoria.ca/2019/02/07/the-wealth-effect/

Really appreciated hearing the perspective from someone in your situation.

Good post Broccoli Sprouts.

The last three open houses I went to in Victoria were for houses in the $650-700k range (so cheap!) and all three of them suffered from some combination of deferred maintenance, bad renovations (nothing says “this house sucks shit” like multiple flooring types and transition strips from one end to the other), or bad location. Add $50k to the purchase price if you’re handy, $100k if you’re moderately handy and $150k if you’re not.

Your point about the east van dump vs. victoria dump is a good one. Houses in the westside and west van got run up into the $3 million range. Did it happen to Surrey, Delta, Port Moody, Poco, Coquitlam, etc. Nope, but that’s where most people who live in “Vancouver” live, and they aren’t cashing out to move to Victoria with a million bucks in the bank.

And what about the pull of family, friends, community, familiarity, etc.? Victoria might be cheaper, but how many of those lucky people living west of Ontario St are actually going to pull up roots and move?

Also if a moldy shit shack on West 29th was worth $3.2 million back in 2016 and a comparable house in Victoria was $850k, but the shit shack is now worth $2.6 million and a comparable house in Victoria is worth $1.1 million, you gonna sell, or roll the dice and wait it out?

The smart (or lucky) money got out between 2015 and 2017 when Vancouver was full on basket-case.

I have followed this blog for a few months, and I find that the quality of comments is pretty high, so thanks to all for the entertainment and information. This is my first post. I am a middle-aged Vancouver renter with some good savings hoping to move to Victoria within the next 12-18 months and buy a house. I just want to say, from my perspective, Victoria homes are far from cheap. They are looking even more expensive to me these days as home prices in Vancouver and its suburbs are falling. I have looked at at least 50 homes in Victoria over the past year in person, and I’m sorry to say, most of the homes I’ve seen in good areas under $1 million need a ton of renovations. Many people haven’t done the maintenance required to keep their homes nice, and now they want a buyer to pay a massive premium over their purchase price and also do all the deferred maintenance! I have to laugh at the comparisons of elite Vancouver neighborhood (foreign buyer dominated) prices to Victoria prices. A more realistic example would be “hey look you can (maybe) sell your East Van dump for $1.3 and buy a Victoria dump for $850k”. I am in the fortunate position of being able to retain a high Vancouver salary and move to Victoria. If I had to find a new job in Victoria, I wouldn’t even be able to consider paying Victoria prices. In my opinion, Victoria prices have a ways to fall.

Victoria benchmark $705,871

Victoria average household income $74,787

Victoria P/E = 9.4x

Vancouver benchmark $1,709,754

Vancouver average household income $99,937

Vancouver P/E = 17.2x

Quick scan I think the most balanced P/E:

Williams Lake benchmark $242,069

Williams Lake average household income $87,633

Williams Lake P/E = 2.8x

“However, Victoria suffered the biggest fall, dragged down by low average incomes, including the least for residents under age 35 of any city on the list. One silver lining: with the province’s lowest unemployment rate, it can look forward to higher incomes. The drastic change in Victoria’s fortunes also owes something to another adjustment to this year’s methodology that breaks the Capital Region into its constituent municipalities. This gave greater representation to other southern Vancouver Island municipalities while filtering out some of the region’s higher-income bedroom communities at Victoria’s expense.”

Source:

https://www.bcbusiness.ca/Best-Cities-for-work-in-BC-2019

Note… P/E I had to work out myself. They should think about including it. Just my own 3c…

https://www.cheknews.ca/victoria-housing-market-13th-least-affordable-in-the-world-according-to-report-532559/

Victoria… so cheap.

“Do we know what type of box they live in.”

The corrugated type

why would you think some one willing to part with 1 million wants to come to Victoria … chances are .. those people dont even live in Vancouver

@ Deryk

If you think someone who just lost a $1M selling a house in Vancouver will have no problem buying another house in Victoria right away then I also got some immortality pills to sell you.

@leom

I think social media will play a bigger part just like it probably did in the run up when everyone was posting about the money they were making. I saw countless sponsored ads on getting rich via housing flips. Friends that went to seminars off social media ads etc

News travels fast these days and this news is not looking good!

“The escalating cost of homeownership in Canada, and its knock-on effects to the economy and to our society, is a problem… But the answer to that problem, cannot be more debt. And particularly, it cannot be more consumer debt, fuelled by lax underwriting standards,”

Banking regulator defends mortgage stress test, open to change when warranted

https://www.vancourier.com/real-estate/banking-regulator-defends-mortgage-stress-test-open-to-change-when-warranted-1.23624367

I really do hope the ofsi sticks to the stress test as it is now and helps to reduce this debt Canadians are taking on.

The solution to excess debt just might be…make it easier to get into it.

Morneau taking close look at return to 30-year insured mortgages, homebuilders’ association says:

https://www.theglobeandmail.com/politics/article-morneau-taking-close-look-at-return-to-30-year-insured-mortgages/

Barrister give me a break

All I am saying is his example is ludicrous

So here’s a thought that just occurred to me after reading the Vancouver Sun article linked below.

What effect will social media have on the next serious real estate correction?

Victoria has experienced two periods of stagnation with slightly declining prices since 1995 and during those times social media either didn’t exist or wasn’t as pervasive.

During the RE stagnation from the late 1990’s to 2002, social media didn’t exist and during the period of stagnation prior to 2013, social media wasn’t as pervasive as it is today.

These days the under 40 crowd seem to treat social media as the grand oracle of collective consciousness and many people don’t make decisions with consulting the grand oracle and that creates groupthink.

Older folks like Barrister and me have crystal balls but unlike social media users, we know (as do our wives) our crystal balls are best ignored; conversely many social media users follow the groupthink of social media.

So what will happen during the next serious downturn when social media induced groupthink creates a downward spiral of negativity towards real estate prices and induces fear of losing an entire downpayment that took years to save? Will social media cause a long term stagnation or a serious correction downwards? The fact that this sudden reversal in RE is a simultaneous global change will be interesting to watch.

Many pundits blame the sudden global change in RE on China blocking currency from leaving China, but perhaps social media is the real culprit responsible for the sudden reversal in global RE prices.

Tomato: Do we know what type of box they live in.

Jaleek: Can you name 10 or 20 of those equally nice places that are cheaper. And why have you not moved there?

“Even with a horrific drop of one million dollars on this house in Vancouver’s west side, the people can still move to Victoria, buy a house in a nice neighbourhood within walking distance to downtown Victoria…… and put approximately one million dollars in the bank.”

Or they used leverage and had zero or negative equity and live in a box.

So….. net income 16200, expenses are opportunity cost 16000 (@4%) + 4800 strata + 3000 property tax + unspecified insurance and repairs is a net loss of at least $7600 for the first year with no hope of any improvement in that math for the entire time you will own the property.

I was the tenant, not the landlord. My point was to illustrate that even though on certain properties it made was more sense to rent in 2011-2013 the market still went up 40%.

@ks112 You asked if I thought that the people who sold their house at 4213 west 14th in Vancouver would likely take their money and Buy a house in Victoria. I Absolutely think they would….. in fact, Victoria is very likely one of the places where these people will look to buy because Victoria is so cheap. What do you think they are going to do? Put the money in the bank and pay rent for the rest of their lives. Of course….no one knows their particular circumstances. If they are reading HousehuntVictoria I’d love to hear what they plan to do next and what their circumstances are in general.

My guess is that people who are buying and selling multi million dollar homes are willing to take risks and would prefer to own rather than rent if possible.

@ Deryk

If you were the seller and lost $1M, would you be in a hurry to buy another place in Victoria given the extent on how our prices are correlated with Vancouver? If I just lost $1M on a real estate transaction, I would think long and hard before trying it again.

I don’t know how to quote but to the previous comment about how lucky we are to live in Victoria

Please don’t compare us with the 5-10most expensive places in the world – and then tell us how lucky we are

Please compare us with the 1000’s of equally nice places that cost significantly lower amounts of money and let us know how much we suck

Unless they didn’t buy it outright with cash. If they only put 20% down, they’d owe a fat wad of cash.

4213 West 14th in Vancouver’s Point Grey neighbourhood. The 1912-built cottage on a regular sized lot was bought in Feb. 2016 for $2.88 million. It was listed in Nov. 2017 for $3.07 million and just sold for $1.98 million. Its most recent assessed value, as of July 1, 2018, was $2.44 million. The year prior it was assessed at $2.86 million.

Even with a horrific drop of one million dollars on this house in Vancouver’s west side, the people can still move to Victoria, buy a house in a nice neighbourhood within walking distance to downtown Victoria…… and put approximately one million dollars in the bank.

To me…….That’s an example of how reasonable prices still are in Victoria.

There is still a spread of about a million dollars…..even “after” west side Vancouver prices have dropped one million dollars. It’s astonishing actually and says a lot about how lucky we are in Victoria.

Yes I’m with you and OSFI 100% on that. They should have done it long ago, but now and forever is good too.

“I rented a place at Bayview One 2011-2013 for $1,350 a month. Market value at the time was about $400,000, strata fees $400/month, taxes $250ish/month”

So….. net income 16200, expenses are opportunity cost 16000 (@4%) + 4800 strata + 3000 property tax + unspecified insurance and repairs is a net loss of at least $7600 for the first year with no hope of any improvement in that math for the entire time you will own the property.

If you wish to deploy this as an example of a succesful speculative ploy, I congratulate you and raise a glass in your direction without envy as I did the same thing on two Fairfield properties.

It is impossible however to suggest that the rental is in any way a viable business proposition. The number of people who look for “investment” properties is a continuing source of wonder. Condos aside for just a moment, anyone who owns and rents out a single family detached dwelling anywhere in Victoria or Vancouver is subsidising their tenants massively.

Nice find. I’m actually surprised you didn’t link to the January 2013 edition, too. 😛

Funny the quote on the front though.

No, many aren’t. But I know a lot of people who are, including some of you who lurk on this site. One of the most basic principles in a market – don’t ever participate in panic.

When most people are rushing to get in and spending huge amounts to do it, others are running away and saving/investing as much as they can in something else. No guarantee of success of course, but here, today, and between those two choices…

Hawks graph is in McLeans

Here you go – lead story in their February issue.

Dasmo

#55889

Ahhh looking forward the the burning houses back on the cover of McLeans….

Me too – that will probably mean it’s almost safe to buy again….

Full text of the recent OSFI response to critics of the stress test.

http://www.osfi-bsif.gc.ca/Eng/osfi-bsif/med/sp-ds/Pages/CR20190205.aspx

Love this piece:

“The most common criticism is that we implemented a national policy to deal with a localized problem – that of extreme price escalation in the residential property market that only exists in Toronto and Vancouver. ”

“This criticism assumes that B-20 was designed to target escalating home prices. Which it was not.”

“B-20 was designed to target mortgage underwriting standards. And sound underwritings look the same no matter what city or province you live in. Ensuring a borrower is not over-leveraged and can withstand a change in circumstances, including a change in interest rates, is sensible regardless of what city you’re in.”

Bottom line is – despite what hopefuls in the media are telling you, B20 ain’t going anywhere for now.

Perhaps this gives perspectives to those who are lobbying OSFI to scrap B20 due to escalating RE market weakness. As a few of us have kept telling you – OSFI doesn’t care that your house price is falling. They care that regardless of whatever the market is doing, that sound underwriting principles are being observed. In Canada lately, what a novel concept this is.

As far as I’m concerned, good for them.

Ahhh looking forward the the burning houses back on the cover of McLeans….

New comic for today:

The media’s sure starting to grease the slide now…right on the front page of the Vancouver Sun’s webpage:

“Five examples of Metro Vancouver homeowners losing big in a plunging market”

https://vancouversun.com/homes/buying-selling/five-examples-of-metro-vancouver-homeowners-losing-big-in-a-plunging-market

Recent immigrants using offshore funds far outnumber de jure foreign buyers. These groups are certainly important in some sectors, e.g. as noted in Wolf’s post, but I think in the broad market factors affecting local buyers, e.g. interest rates, stress test, and household debt are more significant.

I thought foreign buyers such a small amount of buyers…

Is a lack of foreign buyers to blame for plummeting home prices?

ttps://beta.ctvnews.ca/local/british-columbia/2019/2/4/1_4282140.html?__twitter_impression=true

Last time sales in Vancouver were this low was coming out of the Great Recession. It will be interesting to see how low it goes.

Also:

“The top end of the market driven largely by foreign buyers, especially Chinese, has been the hardest hit. Prices in posh West Vancouver have plunged 14 percent in a year.

“These homes in West Van were selling for $12 million, $13 million two years ago,” says Adil Dinani, a realtor with Royal LePage, a unit of Brookfield Real Estate Services Inc. “Agents are asking me to throw them off for anything — $8 million, $8.5 million, whatever it is.”

Dinani, who’s been in the business for 14 years, says there are fewer speculative investors, and foreign buyers have really pulled back. “And what local buyer has $6 million, $7 million to put towards a home?” he said.”

https://www.bnnbloomberg.ca/biggest-vancouver-home-price-fall-since-2013-is-tip-of-iceberg-1.1208867

Definitely something to think about. Going back to the old hood is safe and comforting in a way but trying somewhere new also appeals. We can always move again!

I have been to the Save On and Fol Epi. There is also a Good Life gym.

We shall see.

I lived in VicWest for years. I most enjoyed its proximity to everything. You are the center and from there you can get both into town and out easily. The SaveOn has lots of organic stuff especially if compared to others. FolEpi for coffee and treats, the goose, the E&N. Lots of good walks, a large moat to keep the zombies out. It’s a great neighbourhood. You don’t have to mow your lawn like in OB either!

Thanks gwac. Saw a great looking place for rent but it is for March. Always lived in Oak Bay, South Jubilee but it might be fun to live in another part of town for a few years. Walking, running opportunities is a high priority for us.

Yes, that seems true. Not much to be gained or lost either way renting vs buying over 4 years if the prices stay flat. Main thing is if you love the place and want to stay there long term.

Railyards

Very nice up and coming area. Close to town but far enough away to not have all the problems. Worth a look.

Any thoughts on living at the Railyards? Saw an ad for a nice looking condo for rent. Not our time but it isn’t somewhere I know much about.

@ Josh

I was pointing to the fact that half a million in this city is not going to get you very far.

Take a million dollars for instants. None of the 1 million dollar homes I see here are anywhere close to looking like they are worth that.

You have actually come to the conclusion that markets are cyclical and eventually, most of those not in the market today will buy in at more affordable prices. The market eventually recovers from there.

Over time, those buyers get a nose-ring and a backside branding, speciate into bulls and proceed to tell the next generation of poor little cubs that the market will never achieve affordability – ever again. So on and so forth. 🙂

You have become an honorary bear today. Reject the t-shirt all you want and I don’t care how loudly you puff and wail snorts of protest through your nose-ring. Congratulations!

Might watch the TSX over the next few years. While the headwinds of recession seem to be brewing atm, a lot of beavers might be moving what’s left of their money away from housing and into something that’s actually productive.

In the hypothetical, nothing explodes. Prices just stay the same.

In a world where prices here are flat for 4 years, I come out ahead by staying in my rental and leaving my money in a savings account rather than buying the place I’m currently renting.

Yes I agree. Thing is, it does happen and folks are figuring out reliable methods and getting good results. If you’re building/renovating and have the desire – they can choose someone who is keen on it. Doesn’t take someone with experience, just someone willing to be more careful in that area.

This is from Dasmo’s blog: https://blackturtleredphoenix.wordpress.com/2018/08/06/pretty-good/

I’m no expert but there are a lot of different forms of indoor pollution. Any particular one you’re interested in?

For example, CO2 in schools: https://www.nkarch.com/blog/study-air-quality-in-passive-house-schools-supports-learning

Sleep: https://www.ncbi.nlm.nih.gov/pubmed/26452168

Cooking: https://ehp.niehs.nih.gov/doi/full/10.1289/ehp.122-A27

I don’t have a list of links handy but I suspect google will find some reliable ones.

Still wouldn’t be close to 25% when I can rent for below the cost of the equivalent places cost. The place I’m renting right now would cost more in taxes and interest than I pay for rent even with 20% down. Also, when I’ve lived in places with downstairs tenants I paid less.

I rented a place at Bayview One 2011-2013 for $1,350 a month. Market value at the time was about $400,000, strata fees $400/month, taxes $250ish/month. Didn’t really make sense to buy but the market still exploded.

In Croatia you would have a hard time renting out a 300,000 Euro condo for 800 Euros a month and interest rates substantially higher there.

I don’t think owning and renting a perfect substitutes for the average person like diet coke and diet Pepsi would be.

Can someone explain to the parental basement dweller Patrick that in a place like Oakbay the households with 9 figure net worths skews the average and median is most likely a better gauge of wealth for the area than the average?

Average is more appropriate for places like Langford and also parental basement dwellers in general.

In the big picture governments are ultimately responsible for prices going down. The reason is that the root cause of falling prices is excessive prices, and government policies encouraging RE ownership have been responsible for prices getting too high.

The policies of the previous provincial and federal governments were just as responsible for the huge runup under their tenure as the present governments are for the small declines under theirs.

But you don’t hear this much, since the unspoken convention is to pretend prices go up on their own and government “intervention” only exists when you can identify policies that try to cool the market.

Did you already know that Oak Bay net worth average household is $2.3m before you read it my post today?

I’ve never seen net worth of individual cities like Oak Bay, North Saanich etc. posted on this board. Previous mentions were referring to greater Victoria. If posts about net worth upset you, just scroll the page and move on to something you like.

BINGO! I’ve got bingo…. anyone else? Haven’t seen this marched out since Dec. 24, Dec 20, Nov 26, Nov 22 Nov 7, Oct 31, Sept 10…… (google is your friend :-))

LF just not doing if for me. Finally come to the conclusion that the bears are needed to drive prices higher over the long term. 🙁 . I need you guys to get those large spikes up. I need you guys to finally give up. The Bears are great….Long live the bears.

Stocks are closed now,,, What to do, what to do…

Ingrate, I posted that silly graph twice for you already. Do you want me to tell you to “stick a fork in this bloated pig”, too? Post some slashers? Yay team orange, boo team blue?

😛

@transformer

https://www.custommade.com/blog/off-gassing/

You can’t keep a house in bankruptcy if you have a lot of equity in it at the time when you go bankrupt. … If your house has little or no equity, you can usually make an arrangement with the mortgage company to keep paying your mortgage, and keep your house after filing bankruptcy

https://www.bankruptcy-canada.ca/house-in-bankruptcy

Local while you guys speculate on the direction of the housing market. To be honest could go either way. I will stick to penny stocks…to amuse myself. 🙂 Not getting enough amusement from posting here.

@ Gawc,

In the example you listed about buying a $600k house in 2018 or renting until 2022 and then buying that $600k house. Assuming everything else is the same then you are only better off renting if the rent you pay is less than then the total cost borne by the homeowner minus principal repayments: [interest portion of the mortgage + property tax + maintenance expenses etc.. + any other additional costs that are borne to the homeowner but not the renter in question].

For simplicity I did not include the opportunity cost for 4 years on the down payment that the homeowner would have to put down if they bought in 2018. Mainly because that is a hypothetical scenario where you could have had zero or negative returns if you were shitty investor.

So if for example in 2022 the renter paid a total of $x amount in rent where as the owner paid $x+$1000 amount in costs not including principal payment then the renter in 2022 would be able to put a down down payment which would be $1000 more than the equity that the homeowner who bought in 2018 currently has. Vice versa for the opposite.

The government didn’t, but I suppose if people believe it widely enough it doesn’t make much difference. In every country that is seeing this downturn in the market, each one of them has a unique reason they think prices are falling.

It ranges from Brexit, Trump, foreign buyer ban, B20, cessation of interest only mortgages, tightening as a result of central bank inquiries into scandal, currency appreciating too rapidly etc. Yet the commonality in all of it is shrinking global liquidity and a withdrawal of inflows previously directed at those markets. Victoria was never a real target, but its market action is largely correlated with VanRE for the most part.

Excellent choice. I suspect you’ll get one.

Sidekick

Could you elaborate on both points please? Possibly share some studies? I’m most interested in the topic.

BC housing taxes and the Canadian governments new mortgage rules.

Same thing in Hong Kong, Australia, London, Seattle etc.

What Government were you talking about again?

Patrick,

Why do you even bother posting household net worth Victoria. We know you don’t have any given the genius statement below that you posted earlier:

“Also, declaring bankruptcy doesn’t make your property worthless.”

Lol, you’re right it doesn’t make the property worthless, actually it doesn’t matter what the property is worth as any equity in it doesn’t belong to you anymore. Now go take a hike after you finish the chores that you promised your parents you would do so they don’t cut off the internet in the basement.

I really do understand why prices all of sudden jump big time over a short period of time. The psychology is played out on here in what happens when prices do not fall as expected / anticipated.

The Government has create a situation where a large section of buyers now believe that prices are going down. They have the ability to buy now but are waiting

2009 was not the government but the situation in the US.

Very interesting… Problem is you need sellers who have no choice but to play the game with the buyers rules.. 2009 sellers really for the most part did not. For 5 years it was a game to see who was forced to blink. Buyers blinked.

Who will be forced to blink this time…. Only 2000 homes on the market… 5k the last time. NDP spending and hiring big time. Liberals last time not so much.

Got the popcorn for the show.

Sure, but that’s not what I was responding to.

Still wouldn’t be close to 25% when I can rent for below the cost of the equivalent places cost. The place I’m renting right now would cost more in taxes and interest than I pay for rent even with 20% down. Also, when I’ve lived in places with downstairs tenants I paid less.

Re ventilation discussion an assumption is being made that you have tradespeople in residential constructions that are truly component in their field, which is far and few between. New building code/theory/studies are great on paper, executing that to exact specs on a residential site, good luck.

You just had $120,000 tied up in a non-performing asset for 4 years.

Even if you just left it in a savings account earning 3%

Statistically speaking your home should also go up 3% per year +/- if you are in it for the long haul. Then throw in the added benefit of a basement suite option, principal repayment, tax advantages if principal residence, and not having to move on notice, etc.

Also how much of what you’re actually paying is just interest to the bank if you’re paying the same as what it would cost to rent out that place.

True, makes a bigger difference now then a year ago. I have all variable mortgages and they went from more than half going towards principal to approx. 25% going towards principal in the last year (the type of product I have the payment always stays the same….I guess until interest is more than the payment?). That being said in the years before the recent run above significant chunks of principal were paid off.

That’s a completely unrealistic assumption. If you’re going to wait 4 years, anyone with a brain would put away as much as possible and invest to avoid giving the bank more interest than they have to.

Most stats about average household net worth are based on Greater Victoria, and they show about $1.05m average net worth per household, which is very high. Some people are surprised at how high that is. So what about individual cities, not Greater Victoria. It turns out that it is much higher for some core Victoria cities. Overall about half of net worth is in RE. And of course net worth is after paying off mortgage and other debts.

Here ya go…

These are just the cities that made the top 100 in Canada (apologies to Langford, and City of Victoria…)

— Average Household Net Worth —

Oak Bay $2.3m (6th highest / 100 top cities)

North Saanich $1.9m

Central Saanich $1.1m

Saanich $1.0m

Sidney $950k

https://www.moneysense.ca/spend/real-estate/canadas-best-places-to-live-2018-richest-100/. July 31, 2018

Methodology seems to use stats Canada data, CMHC, Environics

https://www.moneysense.ca/save/canadas-best-places-to-live-2018-methodology/

You just had $120,000 tied up in a non-performing asset for 4 years.

Even if you just left it in a savings account earning 3% (https://www.coastcapitalsavings.com/promotions/term-deposit-offers)

you’re still making $15,000 on that money.

Also how much of what you’re actually paying is just interest to the bank if you’re paying the same as what it would cost to rent out that place. (ie: I’m renting a place for 1950, that is assessed at $750,000). With 20% down, I’m paying $200 more a month than just interest costs.

There really should be the availability of both nominal and real numbers. The inflation adjusted is good for long term comparison. Like comparing house prices from 1960 to now. But comparing 2000 to now I find it’s too distorting. Also comparing 1990 to 1980. In those cases I would rather see what actually happened rather than what happened through a filter.

The moldy shack models are well into the 600’s now.

LF sounds logical

OSFI: The solution…cannot be more household debt or weak mortgage underwriting standards

Speaking Tuesday at a lunch in Toronto hosted by the Economic Club of Canada, Carolyn Rogers, assistant superintendent with the Office of the Superintendent of Financial Institutions (OSFI), defended the recent adoption of tougher mortgage underwriting rules.

“Against a backdrop of record levels of consumer debt, this was a level of risk-taking that OSFI decided needed to be reined in,” Rogers said.

However, that step has been met with a number of criticisms, including that it is being driven by particularly hot housing markets in Toronto and Vancouver; that tougher rules on banks may drive borrowers to unregulated lenders; and that the policy has a host of other unintended consequences, such as freezing out young homebuyers, driving up rents and exacerbating economic inequality.

Rogers addressed these criticisms in her speech today, acknowledging that “the escalating cost of homeownership in Canada, and its knock-on effects to the economy and to society, is a problem. And it’s a problem that is proving very challenging to address.”

However, Rogers insisted that the solution to the problem is not greater household debt, enabled by weak underwriting standards. “Recent history has shown that relaxing bank underwriting standards can lead to extreme and persistent levels of financial instability that more than undo any economic gains they were intended to support,” she said.

https://www.advisor.ca/news/industry-news/osfi-defends-tougher-mortgage-rules/

I will make it real simple. Your rent and utilities is your mortgage /tax and utilities. Now how is inflation adjusted better? I also assume you have the down payment and you are not going to increase the down payment in 4 years.

Depends entirely on your rental costs vs ownership costs during that time, and what subjective value you put on renting vs owning. This is an individual calculation and cannot be answered in general. I would recommend people to use the wait vs buy spreadsheet at the bottom of this page: https://househuntvictoria.ca/resources-2/

Curious how people think this is better and you are ahead

Price in 2018 600,000 salary 100k

price in 2022 600,000 salary 110k

10% inflation 20% down and 480K mortgage both scenarios.

4 year of paying someone mortgage while renting.

Explain to me how inflation adjusted is better… I am slow…

That’s an interesting question. 2013/14 was basically coming off of the ~10% correction in Victoria. That correction was an unusual one because it was IMO, hidden by a precipitous drop of interest rates, which actually restored the affordability to more the long term trend. Regardless, prices at that time weren’t terribly bad in absolute terms, I don’t think I would have any issue with valuations being there unless of course, interest rates took a real trip upwards.

I have the annual prices, both nominal and adjusted. Probably better to use anyways, as looking at month to month for any time period won’t carry much predictive value (ie March 1990 saw this, then April 1990 saw that, and then presume March and April 2019 might be similar).

Think of it on the way up – people think it will cost more tomorrow, so buyers act in a way that ensures it is so.

Interesting that a lot of people seem to think prices are falling and are just waiting. Just assuming and that it is a given that it will get cheaper…

Maybe it will maybe it wont curious to see how it plays out..

Rather have the $50,000 and roommates personally.

From a Globe and Mail article on Vancouver sales hitting a 10 year low….

“Eric Carlson, chief executive at Anthem Properties Group Ltd., said he expects sales volume for resale properties to be slow for another one or two quarters. For buyers considering entry-level condos, the thought of losing $50,000 in market value has been a deterrent, he said. “But they will get tired of sitting in basement suites or living with their parents or having roommates,” Mr. Carlson said.”

https://www.bnnbloomberg.ca/regulator-osfi-opens-door-to-easing-canadian-mortgage-rules-1.1209507

this is bank/election pressure I think.

Now that’s funny. You switch to using inflation adjusted numbers, and then in the same post admit that even doing that doesn’t disprove Michael’s correct observation “Michael: I don’t even think the GTA dropped back to ’85 levels, and it was one of the hardest hit in the 90’s.”.

LF, It looks like you spent time making the post, and finding the nice inflation adjusted graph, and then found out that it didn’t back up your point. Damn! But no need for facts to get in the way of time spent on a nice graph, so post it anyway, hoping perhaps that a “climate change” denier analogy would save it!

@ ks112

#55834

I thought houses were over valued in 2010-2012, when we were looking. I still say we payed too much for what we got. But, as mentioned in the comment below. We look at it like rent. It was the best value we could get for the Market at that time in “Greater Victoria”

C’mon $500K and you can only get some awful moldy shack nowadays? Yes, yes. It’s the land argument here. But sheesh!

I would buy in a heartbeat. It’s specifically periods where houses and even condos made more money than people that I thought was unsustainable. I still think it was unsustainable.

Great post! I agree.

Question for the “true bears” on the forum. From what others have said, most “true bears” here feel that the prices in 2013-2014 were high and due for correction. So if prices fall from today to 2013-14 prices (inflation adjusted), would you buy or still think it is overvalued?

Also, I wonder if there is any monthly sales and price data for the last real estate correction (in the 1990s). I wonder if the speed of the price decreases then vs what what is experienced now can be compared to maybe see what is to come?

@ Local Fool

#55831

@QT

Thanks for the feedback. I don’t have a heat pump. Just a simple HRV and radiant heat. At 14k to add a heat pump I couldn’t help but say F*ck that!

I think the equation might change with an energy efficient envelope. I don’t need cooling and my heating needs are minimal. We were without power for three days in the cold and we only needed sweaters on the third day. The second day had the sun so some passive house was happening! In the heat wave we actually had to keep the windows shut to keep the hot air out.

Yeah Right,

Where’s your RE comic of the day?

This is a similar tactic that people use when they say climate change isn’t happening. You select a moment in the data series that is advantageous for your argument, select a data type which is either inaccurate, out of context, or incomplete, and bingo.

Using unadjusted RE prices that ignore inflation is usually pointless when we’re talking about prices over decades. We all know what fiat does over time, so here is the adjusted chart:

Sure, prices in the GTA didn’t go back to 1985 levels. If I select 1987 though, then it’s a different story and I’m pretty sure that still counts as the mid 80’s. Conversely, I could make it sound ridiculously dire and say that by 1996, house prices were only slightly higher than in 1974. The 90’s valuations were also affected by plummeting interest rates, but that’s a different issue and argument I suppose.

At any rate, I was talking nationally. Anyone who looks can pretty clearly see that the aftermath of the 1989-1991 national housing bust was not nice to most markets’ valuations for the proceeding decade, but it was a fantastic time to buy for anyone with the means.

I believe there is a correction in the wind, but not as big as 50% in 5 years. But if this does happen we would not sell.

We bought our primary residence to live in. It was just as much to pay the mortgage, plus extras, as it would be for us to rent back then (capable after a huge down-payment at the start).

Less than six years we now look at the extras as our rent as the mortgage is payed off. The most expensive being the annual land tax.

Our rent/expenses (tax, garbage, heat, etc) is now around $300 a month.

So Nah, we are not looking at what the market is doing and will live there for a long long time to come.

Sure, if you don’t believe inflation is meaningful.

By 1996, the real value had definitely dropped below the value in 1987, if not 1986. The 2009 value there is actually lower than the 1989 value.

I don’t even think the GTA dropped back to ’85 levels, and it was one of the hardest hit in the 90’s.

1985 was ~100k.

By 1995 it pulled back to 200k.

http://canada.lilithezine.com/images/Toronto-Real-Estate-Statistics-04.gif

While technically this is true, it looked like this was the 1 in 12 scenarios studied where it didn’t save. As you mention, air-conditioning via a heat pump on the west coast. I would guess that’s not a common setup.

That’s actually what happened in most Canadian markets. Housing prices nationally, rebounded after the ’81 crash and then blew apart again at the advent of the ’90s. It drifted downwards most of that decade, finding its footing again around 2001-2003. Some markets actually didn’t recover in real terms, until 2010.

Would also argue that we’re not in the “fear” stage yet. Plenty of folks are quite confident that things will be turning around in the spring. I know there are individuals panicking, but not the market at large if you see what I mean.

Good comparison, but don’t forget all the examples where this ‘fear’ stage turned out to be a great time to buy (early ’91, early ’97…)

Lots of people in the 90s thought prices would crash back to the mid-80s.

Haha, just reading the reddit vancouver – “Vancouver home sales fall nearly 40% in January” thread- and the top comment gave me a chuckle:

“Prices aren’t falling, they’re increasing at a negative rate.

Source: Realturd™ “

Leo, Marko, or anyone in the know – what month(s) of the year would we generally see the most listings?

Local fool…absolutely agree….. “no one should be dumping a primary residence in an attempt to buy back in later, cheaper. Not that you can’t “win”, but it’s just not what homes are for.”

If I had a monopoly on that, I would be cooling my heels in some tropical paradise far away from here. I have no idea where things will end up, which is why I loathe to give amounts, percent declines etc. The graph picture was just a curiosity. But I know what’s going on around me right now and for the moment, it doesn’t look good.

Vancouver is IMO, one of the largest housing bubbles in the world. Having said that, Victoria is not Vancouver in many ways, but the latter is a bell-weather of sorts and the correlation between the markets doesn’t engender much comfort.

Aside, no one should be dumping a primary residence in an attempt to buy back in later, cheaper. Not that you can’t “win”, but it’s just not what homes are for.

But impugning an exact, and unreasonable even to many bears, amount to LF was your point IMHO. Best known as the “straw man argument”.

You are correct that pulling air out of the house through a vent (bathroom/hood) would create negative air (lower pressure inside the house compare to outside.) There is a good indicator of an air leak if a door move open/shut when the active vent in operation. A professional range hood (800-900 CFM or greater) would require an active makeup air vent to prevent back draft and pulling open your outside door or slam your screen door shut.

Again you are correct and not missing anything here. Condensation is cause when high humidity warm air contact with cold surface at dew point. Such as, warm moist shower air fog up mirror in bathrooms, windows fog up during winter due to high humidity indoor air, morning dew/frost due to warm air and cool earth surface, or fog due to warm earth surface and cool air.

Food for thought:

HRV/ERV are good to have for getting fresh air into a building, but it will not always save on energy in certain conditions and environment such as the Westcoast.

https://commons.bcit.ca/buildingscience/research/graduate-student-research/abstract-energy-implications-of-heat-recovery-ventilators-used-in-multi-family-residential-buildings-murbs/

“A 3D model of a typical one bedroom apartment was built…

HVAC system implementing HRV does not always consume less energy when comparing with a balanced ventilation system. Installing an HRV consumes more cooling energy annually because the system does not take advantage of free cooling. The HRV does reduce the overall heating energy but uses more fan energy when compared to the supply and exhaust fans in the balanced ventilation system.

The overall energy savings when implementing an HRV with an air-to-air heat pump systems was -647 kWh, 1272 kWh, and 1225 kWh in Vancouver, Edmonton and Ottawa. More overall energy was consumed when an HRV was installed with an air-to-air heat pump system in Vancouver.”

LF – I actually agree with you that the Vic market is likely to fall. But I caution people against too much certainty – especially with respect to the future.

Smart sounding people posted here through 2007-2009 and 2011-2013 explaining why the market was going to “tank”.

If I was giving advice to prospective Victoria homeowners it would be:

1) No harm in waiting a bit. There is NO indication that we are in a market that is about to run away (again).

2) Assuming you are committed to Victoria and committed to owning don’t wait too long or get wedded to a particular percent fall in prices. Life is a time limited opportunity.

10 years of HHV has taught us that most people’s strongly held beliefs about where house prices are going have been WRONG, WRONG, WRONG.

If you like where you live, and are not overstretched it would be stupid to sell your PR on basically a strong hunch.

CE, you’re still quite the smart@$$, eh.

Actually you know, the US gov dumped trillions into the housing sector to try to backstop the losses – and prices still fell nearly 40%. Whether it would have been worse without all that effort, I suppose we’ll never know.

The bigger wild card in all this, and the uncertainty I have, is the extent to which CB’s try to “fix” things again. I don’t see the tools available to Poloz this time around but then again who ever does. Stuck in QE in perpetuity doesn’t sound like a healthy place for an economy to be. Good article in the SCMP recently about exactly that issue.

No, he didn’t say a number, so I in my question I inserted 50% fall as a reasonable example of what he’s talking about. Do you find that unreasonable? He did refer to the collapse being a “smoking hole of a crater” and we will need “mercy on our souls” and of course posted the Hawk graph which is a bigger fall than 50%. Anyway, substitute any number you like instead of 50%, as the exact amount of the price fall wasn’t the point of the question.

Doesn’t matter what government does. Once the crash starts nothing can stop it. Just like the 50% crash we had after the Global Financial Crisis. Governments tried everything but they couldn’t stop the inexorable decline in Victoria RE prices.

Yes it always runs its course, except of course for all those times it just wobbles up or down a bit and NOTHING at all dramatic happens.

Patrick,

“If I believed that you are correct, and this house bubble collapse will result in prices falling 50%”

Did LF say he thought prices will fall 50%? I must have missed that.

And it only needs to fall another 80% to match Hawk’s graph.

Patrick, you don’t own a house! What you own is a make believe 25 year $500k amortizer mortgage @ 3.5% which your somehow paying 70/30 interest/principal on…

Did you do the dishes today? Better hurry and do them upstairs if you don’t want the parents to cut off your internet.

I would not sell. Even if the market crash was guaranteed. Maybe if I was guaranteed to buy back the same house and guaranteed to be able to live in an equal or better one for that five years as I waited it out AND I got a free back massage every day. Then I would sell.

Marko, thanks for the reply. To be clear I was asking if the owner was convinced that prices were going to fall, so it wouldn’t be a guarantee, just something you thought to be very likely. (admittedly close to the same thing, just wanted to clarify)

How about other homeowners – if you are convinced that house prices will fall 50% over the next 5 years, would you sell your principal residence now and rent instead?

If it was guaranteed of course I would.

Nice post, clearly outlining the bear case. Also nice to see you end by hoping for “mercy on our souls” which is much appreciated, and much kinder than wanting our “hubris to be wiped clean”. Thanks!

Regarding the prediction of a price crash – I don’t agree, but let’s assume that I do agree.

If I believed that you are correct, and this house bubble collapse will result in prices falling 50%, I might not buy another property, but I wouldn’t sell my principle residence and rent something.

I enjoy owning a house, for reasons more than money, such as family. I’ve lived through some RE downturns (25% in Toronto in early 90s over 5 years) and wouldn’t have wanted to rent through that either. Remember, you paying off 100% of a house in 25 years, so you are paying off 4% per year on average (mainly in later years, but those years will come.)

If you buy when you are 30, and never look at house prices again, and just pay off your 25 year mortgage over 25 years, you will at age 55 own a house outright, and then you can look at prices to see how much equity you have.

Maybe there has been a terrible market for 25 years and your $800k house will only net you $600k if you sell it. So what, is that so bad and to be feared? Is this $600k cash out the situation that you fear, and warn that will have homeowners like me begging for someone to have “mercy on my soul”?

If you rent for 25 years, you may have nothing (or at least less than $600k) to show for it at the end of 25 years. That same “bubble” story can apply to stocks and inflation and taxes can eat away any gains.

Q. How about other homeowners here – if you are convinced that house prices will fall 50% over the next 5 years, would you sell your principal residence now and rent instead?

LF, nice catch on the graphs.

The important caveat here is “if properly designed and built”. Requires a lot more design and precision in building to make reality match the theory. It can be done, but I wouldn’t underestimate the complexity of acquiring that body of knowledge.

Well given that the province in their infinite wisdom has gotten rid of most owner builders (https://househuntvictoria.ca/2017/02/23/the-owner-builder-exam/) , and given that the Victoria residential builder’s association told me that the source for their claim that building inspectors were spending fully half of their time teaching owner builders how to build was a building inspector, they should now have lots of time to actually inspect buildings again.

I should really write a post on this that I can point to, but although I use VREB data, I often publish slightly different averages and medians. That is because:

In the long run this matters little, but the stats I focus on are the ones that are more relevant to most house hunters in this region. Doesn’t make too much sense to include a house on Mayne island or a sale in Duncan in the median price.

First half week of January we were up 20% from same time last year. I wouldn’t make too much of the first week of anything.

If you look at the January graphs I posted in the morning, the big difference between January 2019 and January 2018 was that in January 2018 we had a big mid-month surge in sales which we didn’t have this year. That was an anomaly that won’t be repeated in Feb. I bet we’ll still end up with fewer sales though.

For those of you who are still missing our old doom-sayer Hawk, here’s his graph.

Incidentally, the one on the left is West Van Benchmark price, up to today…

That quote from Phil Moore from the article was a real gem…

“Today’s market conditions are largely the result of the mortgage stress test that the federal government imposed at the beginning of last year,” Phil Moore, the realtor group’s president said in a statement Monday.”

That is complete nonsense, and he’s well aware of it. I know for a fact that Phil Moore personally follows news clearinghouses on this topic and he’s quite aware what’s actually happening are two things:

Global liquidity shrinkage, of which Vancouver (and by proximity, Victoria) was one of the larger recipients on Earth.

He says what he says above to provide a means of applying pressure to regulators to withdrawal market supressive policies, and to give folks a sense that this is something well within our ability to “fix”.

It’s not. What he doesn’t want to say is if you pulled the stress-test out tomorrow, the downward trajectory would continue. The correction started long before B20, it started before the NDP, it started before the FB tax, the empty homes tax or the speculation tax. It will continue regardless of whatever they do – policies may slow or hasten the hearse along the journey, but that journey is going to be happening. This is a simple math and economics equation, and it always was; there isn’t enough money being generated in the entire economy to provide the current pricing with support, let alone growth.

Another way to frame it is to remind folks of the following sentiment a little while ago – you even saw it from posters on this site:

“Geez, look at how despite all the wrenches thrown at the market, and it keeps going. Amazing!”

This is the same thing, but the other side of the mountain. Once market momentum becomes established up, or down, it has to run its course. And today, what course is that?

The ugly reality is local people made a desperate attempt to play catch up with a fleeting, global force they thought was permanent, and which economically, they couldn’t possibly hope to match. Now, and predictably, the deluge of cash pouring into the region with reckless abandon has almost entirely disappeared in an ethereal puff of smoke.

What we have developing in southwestern BC is a rapidly growing, smoking hole of a crater being blasted out by what may be one of the largest unfolding housing market corrections Canada has ever seen. In fact, it was Poloz himself that said – There’s a crater under every bubble. Every one. Can’t say there weren’t people that tried to warn you.

May Mr. Market have mercy on our souls, because bursting housing bubbles cause real harm to the people that live there.

That really sucks. 🙁

Ruh roh…

https://www.bloomberg.com/amp/news/articles/2019-02-04/biggest-vancouver-home-price-fall-since-2013-is-tip-of-iceberg?srnd=economics-vp&__twitter_impression=true

Just joking. Nothing to worry about. Can’t and won’t happen here in Victoria. No connection to Vancouver whatsoever (except when Vancouver prices are increasing, and only when increasing). Besides, stories in the msm like this dont have any impact on people.

In addition, they are not making anymore land here unlike Vancouver. Victoria will be fine. Everyone is worth $1 million plus and every grey hair is moving here to buy single family homes.

One last word…. globalization. Doesn’t matter if markets are falling all over the world…. Victoria will remain unaffected.

Always impressed by what some folks here seem to know about all things HVAC.

The extent of my knowledge on the subject is: insulation good.

Dasmo…… What you say is probably very true about our clothes 🙂

You’re taking your life in your hands walking in James Bay at this time of year. I have to go down there on occasion for meetings and when I leave the house I always quote Lawrence Oates to the wife: “I am just going outside and may be some time”.

It is a natural reaction after some of the mistakes with early sealed homes. However, as Sidekick points out, things have changed a lot. A proper HRV is much better than dragging air into your house through your (probably moldy) wall insulation and crawlspace. The main intuition you have is correct – houses need fresh air. The change is that we now want to control where that air comes from.

Well-built homes with heat recovery ventilators are almost universally more comfortable than old “leaky” houses. The air gets cleaned and exchanged the right way, not randomly.

If particle off your cloths are that toxic the dryer venting ain’t going to save you….

James Bay is in the process of changing; number of planned high rises are apparently being considered by a couple of developers. Not surprising considering the location.

400 cfm and rarely on full blast. So not a c*ck extension in the form of a hood vent. I would think this would cause air to want to suck in to the house not blow out. The condensation would be formed by warm moist interior air escaping out and contacting a cold surface outside. Or am I missing some science there? There is also no real pressure indicators like any door movement at all etc. But hey, If there is a candidate for the issue I am all ears!

Yep. Love it.

Pretty sure you are wrong. There are a lot of studies of indoor air quality out there. Generally, the biggest source of pollutants is cooking.

Some interesting (and sad) ones include studies of air quality related to sleep and learning.

On the weekend I took my first stroll through James Bay – from one end of Montreal to the other, what a bizarre mish mash, from dilapidated, to weird, to ugly, to cute. Such an odd neighborhood.

Fair advice from people on “Seal it tight, vent it right”. I’m too old fashioned to accept that though. Years ago I watched a documentary where a researcher was shocked at the rate of division in cells in their lab dishes. “Something” was causing their samples to multiply out of control. They traced it to the water supply in plastic bottles. And so at that time I phoned Canada’s consumer health watchdog and mentioned to them that we should probably be concerned about the plastic in the food containers. They said “Oh not to worry, we check to see if their are petroleum levels in the food”. The problem is that years later they discovered that they had been checking for the wrong thing. They were not checking for Phthalate at that time. (The same thing that was showing up in the cancer studies many years ago when I had phoned to say that we should be checking for this.)

So…forgive me if I don’t trust sealed homes for the same reason. I don’t like the idea of air passing through the plastic units. I don’t like the idea of plastic particles floating around a house from ventless driers. I’m not convinced it is healthy. I could be wrong of course!

If it’s a big honkin’ hood then it could be depressurizing your house and causing some of the condensation issues. That make-up air has to come from somewhere.

So true, I have been storing kids paintings for over 30 years now. Time for a recycling cleanout but I am too sentimental about some things.

Interesting the spell check picked up the word “too” and wanted to replace it with to or two. Hope this isn’t another word going out of use. I am a bit sentimental about words as well.

HRV is constantly exchanging air without much heat loss (Heat recovery ventilator). When ever anyone visits our place the first thing they comment on is the smell of fresh air inside. Mind you we also went through a reasonable effort to not have off gassing products in our build. No VOC paint, Our kitchen is all made from no VOC plywood, no synthetic flooring, Natural oil/wax finish on the wood floor upstairs true concrete polish downstairs, not epoxy, real wood joists, no OSB etc. Now we could have also specified certain Drywall and glue and joint compounds but I was getting worn down both financially as well as mentally. But… we did enough. Long story short, venting isn’t the only thing to do with inside air quality.

We have a non venting dryer. It condenses the water and drains it. It still collects all the lint etc in two collector filters. Works fine and no large hole in the wall.

We did opt for a hood vent that vents outside mind you. Did not want the smell problems without venting that. Glad I made that decision.

Sadly, that person just died.

https://vancouverisland.ctvnews.ca/woman-62-dies-after-being-struck-in-saanich-intersection-1.4282353#_gus&_gucid=&_gup=twitter&_gsc=ij3pn8g

Doubt she’s in any shape to be posting pictures…

https://www.timescolonist.com/pedestrian-struck-in-saanich-taken-to-hospital-with-significant-injuries-1.23621292

This weather is horrible.

Mind you, it’s a tad worse elsewhere. Back home in Calgary the high today is -25. Low tonight: -30.

I also have a bad cold. These are tough times, friends.

On the tight house issue I am experiencing the potential problems with that. One of the reasons I built my envelope out of ICF floor to ceiling was because I didn’t want the ability for water to enter my walls. I simply did not trust that things would be built perfectly. A sealed envelope with mechanical ventilation needs to be sealed! That is a meticulous job that will be done by people that don’t know and don’t care most likely. My house is pretty tight as evidenced by my blower test but they missed some details. My inside air has nowhere to go so it finds anywhere to escape. Lucky me it can’t hide so when it’s cold outside the warm air condensation manifest itself on the outside of my house in concentrated areas where leaks in that seal can find their way out. We managed to stop the spot above my entry door by peeling back that siding and sealing there but there are other spots to address now. Thank you Warranty….

The problem I see is that there will me many houses where you wont see that water. Either it’s going back into the walls or will start collecting in the gap between the firing strips and the outer siding and then finding it’s way into the walls where they forgot that bit of tuck tape or didn’t press it down evenly or through the nail holes in the house wrap etc. Capillary action is a nasty thing….

Anyway, Building inspectors should actually start to become building inspectors in my opinion. It’s handy they aren’t too tough but then again is that what we need? I am thankful my engineers were not letting any shortcut pass by them. It cost me money but then again I have 100% faith in the structural integrity of my house…

Wolf, one should never miss an opportunity to burn the kids art projects.

People are starting to short Canadian banks left right and center, including over 400M USD of new interest this year. So far they’re losing the bets, but it’s sure an uptick…

“I’m burning the kids art projects for heat.”

You’d be able to afford heat if you didn’t over-extend on the house.

Deryk – it doesn’t work like that. A tight house with mechanical ventilation has the best air quality of all. Better than opening all the windows and doors in your house. The best ones come with pollutant sensors built in and will spool up/down depending on the detected concentrations of CO2, VOCs, humitidy etc. Some come with built-in HEPA filtration etc.

“Seal it tight, ventilate right”

Wonder if Introvert will post any pictures depicting how wonderful Victoria winter weather is today?

I know inventory is up but there does not seem to be a lot of listings in the core.

LeoS : Thanks for the numbers It looks like it might be a bit slower this year. Too early to really draw any conclusions.

Even Malibu is a bitter cold 60F (15C) degrees today. Just spoke to one of the kids.

Deryk: I like your phrase “thinking in a silo”. It applies to a lot of ideas these days.

Monday update.

56 sales, 91 new listings, 2001 inventory.

Some newer buildings have lacked air movement, but if you look at the gold standard for energy efficiency, the passive house, part of the design is constant air flow using the heat recovery ventilator. So a properly designed passive house will have better air quality than a normal house

It’s not a bad idea, on the other hand, you could get an air purifier. Those can be quite effective and aren’t too energy intensive.

Wonder if Introvert will post any pictures depicting how wonderful Victoria winter weather is today?

Can’t help but worry about the new building codes that seal a house up to the point of being dangerous. I can’t help but believe that this will cause an unhealthy environment for people. Nylon and plastic fibres from clothes in driers that don’t vent outside, Plastic fibres in furniture and carpets floating around in the air. Heated and burned oils from cooking foods. Molds that grow and settle on foods which is in every home. Etc etc. My prediction is that years from now, when illness starts to show up……they will wonder what the hell we were thinking about.

Surely it is best to have a generous exchange of clean air even if it means a higher heating bill. (Health benefits versus energy saving building codes that are thinking in a silo)

@guest_55693

We originally had it rented at 1500+ utilities, after our tenant gave notice, we listed it at 1600 to test the market and gauge response for the first week

LOL missed this earlier.

You really are too stupid to spell my name right aren’t you,

So you disagree that you dropped the rent on your place by $100 to rent it out?

Not really though, since the hydro power you don’t use gets sold to either the US or Alberta and displaces coal generated power.

Dining room. Heck I hope no one in this favela has to make do with a walk-in closet that small. Oh the humanity!

That would be a blast Barrister. I would even reveal my real nam then! I am a woman but my name isn’t Grace.

Hopefully our house will have sold and we will be settled in a nice apartment.

Gulp.

Not super well situated for solar but after we do the roof I’ll likely put some panels up for entertainment purposes.

Lifetime emissions from solar power is slightly higher than Hydro from what i have read so it would actually add a tiny amount to emissions total. Near as makes no difference though

@ Marko, Leo S

Do you guys find it easier to talk owners into accepting offers below ask now? Given that the price decline in January is in the news.

BC’s new step code will make gas mostly a thing of the past. I believe you will still be able to use it for some appliances (HW tank) but they’ll need to be much higher-end ‘sealed’ combustion models.

Indoor cooking with gas will be out, as will giant exhaust fans. Trying to build passive right now is a bit challenging because current codes haven’t caught up with the techniques required for step 3/4/5/PH.

Leo, do you plan on adding solar to the mix? What kind of impact do you think it’ll have on your numbers?

Do sales record/occur on weekends? When I worked at a bank a few years back we didn’t fund on weekends and lawyers weren’t signing on weekends either. Things could have changed in the last few years also I’m not sure in realtor land when a sale is recorded so that could Impact it as well.

Marko how is the weekend so far. Your Friday number was shocking to me.

Doesn’t seem to be a lot of sale signs in the core but could be I am driving the wrong streets.

@ renter in paradise

I think what makes the Cordova bay house especially attractive is that the suite does not take up the entire downstairs. The homeowner still have partial usage of the downstairs area.

“Younger people dont seem to entertain as much these days. Changing times.”

Because they paid what you paid and only got 600 square feet!

@ Patrick

Just give it up, you don’t own a home. What you own is a make believe 25 year amortizer mortgage of $500k @ 3.5% which you are paying 70/30 interest/principal on ( the same one Introvert agreed to have also)……

Oh btw did you do the dishes like your parents asked you to do? You know, part of the arrangement that allows you to live rent free in their basement?

“took ya 24 hours to come up with that”

Sorry that I don’t spend every waking moment on HHV. I have a life beyond an anonymous internet forum. Not sure you do.

Grace: I probably should arrange a backyard barbecue for HHV this summer. Younger people dont seem to entertain as much these days. Changing times.

Can I come visit Barrister? Sounds lovely!

Actually we use the dining room a lot. at least four times a week and more when the kids and their people are up during the summer and Christmas. My wife likes doing dinner parties and we tend to entertain a lot. Most months we have people in from California or Europe for a week or two. Hell of a lot cheaper than going out to restaurants. At times it does feel like a small hotel but we have interesting friends from around the world and made some wonderful friends here as well. Good thing my wife adores cooking.

I definitely see the same thing on SFH rentals that I follow. Some will languish for a month or two until a price drop if initially priced too high. Westshore rentals seem to offer value for a price and seem to go quickly from the lists I follow. The other thing of course is pets – if allowed, they tend to rent faster and at higher rates.

Scotch & cigars with camera focus set on their phones on the table….. yeeeaaahhhhhh…. not sure who thought that was a good idea. Thank you for sharing – that was worth a chuckle.

Saw a few more properties in the areas I follow go pending so I’ll go along here with this statement — not that my opinion on this holds value 😉 Interesting in that 4878 Cordova Bay Rd went pending at $855k which I believe sets the high bar that 1150 Timber Ln could possibly get. No I’m not pointing out bagholders (and 4878 isn’t one) just following on a question that was asked about values of Cordova Bay/Broadmead properties sometime ago. 4878 Cordova Bay Rd went pending $50k under assessment, 57 DOM and $20k under ask and with a complete, above ground suite in place makes it a better value than the Timber Ln property

@guest_55657 hey keep making those videos – I think they are great

What type of anecdotes with snarkiness added are you speaking out against here? Here’s a post with an anecdote about a single Vancouver house sale, where the poster adds the snarky comment “what a horrible, possibly life changing, financial disaster. This shit’s getting real, folks”. LocalFool, is that a good example of an anecdote with a snarky comment, because it was your recent post. https://househuntvictoria.ca/2019/01/28/demographia-were-number-2/#comment-55456

Conclusion: People who rent glass houses, shouldn’t throw stones.

Yeah, looks like the westshore held up well thru the mid-cycle year.

.

@Barrister

How often do you use that 550sq ft dinning room ?

People are using less and less space now I think, at least in my generation, born in 84

We live in A 2500sq ft house, just the two of us and a couple dogs. We have a two bedroom suite that occupies about 1000/sq of it.

so the 1500sq/ft that we have works well for us at this point in our lives.

Having the suite at this point is optional, it will not make or break the bank. it would just be wasted space that we would be heating and not using.

We do plan on building our own house within the next two years and will probably put a suite in it also or at least set up for one.

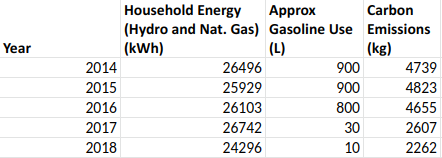

Not much more to say. Using utility records for the last 5 years I calculated household related emissions based on hydro, nat gas, and gasoline usage.

Gasoline went away with switch to EV. Nat gas is most of the remainder given BC hydros extremely low emissions factor (9 grams CO2 per kWh).

Made me realize nat gas fireplaces are shockingly inefficient so will stop using for the most part. Once the hot water tank dies I’ll replace with electric and disconnect gas.

There’s more examples, too: others are seeing themselves outbid “twice by retirees”, there have been several recent cases of condos being sold over asking after multiple offers, a condo sold downtown for multiple millions to wealthy boomers, and so on and so forth. And yes – these examples are quite real, some of them featured in media recently.

And yet despite these anecdotes, the actual market data continues to deteriorate markedly. Liquidity is shrinking both directly via a reduction in money supply, and indirectly via a growing wariness of banks to lend. Inventory is rising despite many sellers holding back hoping for a spring run up. Sales are cratering despite our much paraded “desirability” and all QT’s sightings of “Sold” signs. Auto sales and home furnishing sales are all heading south – and this is all occurring despite record low unemployment and population growth. When this data starts to change again, and it eventually will, then you’ll have a case.

For people watching this all unfold, it’s important to understand that the plurality of anecdotes is not data. Throwing a dose of snarkiness in with it doesn’t enhance the anecdote, either. Pointing out market data and its current trend isn’t a characteristic of sage, it’s a simple observation that’s abundantly obvious to anyone with 30 seconds to spare.

P.S. Almost one but Hawk has predicted an “imminent market crash” in Victoria. Use your power of observation you employed above and in much the same vein, stop overgeneralizing.

It is probably a product of my old age, but 539 sq. feet seems really small to me. I tried to visualize it and it is smaller than the dining room. I am not sure that we have done right by people.

I am not anticipating much of a slow down or price drop in the West Shore overall. Prices already reflect local incomes and of equal significance the number of jobs out there continue to grow each year.

While it is trendy on here to make fun of the West Shore my opinion is that the area is quickly developing into a really good community particularly for young families. Equally the ever increasing density of Victoria is not exactly appealing to everyone. I am not trying to reignite the debate of how wonderful it is to have a forest of condo towers downtown and how it is where it is all happening. My only point is that the West Shore is much more pleasant than five years ago and certainly much more affordable,

I tend to agree that apartment rents are much more reactive to vacancy rates and the market than SFH but I suspect that a 4% vacancy rate is really requires for rents to slide. But once that threshold is reached the slide can become rather pronounced.

It look like the average unwashed Westshore buyers didn’t get the memo of an imminent market crash as predicted by the bear sages on this board, because I found that there are ample of sold among for sale signs on my drive through Royal Bay and Southpoint today.

Re rentals….my on the street findings.

I chatted with a rental property manager (172 units) on Friday and he said February is the first time in 8 years they don’t have a single turnover. He did mention a couple of new inventory to their company SFHs did have to drop the asking price by $100 to $200. He said one of the new inventory SFHs brought to market thanks to spec tax. Previously used as vacation home by an Albertan.

Client at Encore getting lots of applications on a $1,700/month for a 530 sq/ft one bedroom at Encore. However; the two bed units aren’t moving quickly -> https://www.usedvictoria.com/classified-ad/Brand-New-Unit-in-The-Encore-Building-250000_32839771

450k one bed unit you get lots of applications at $1,700/month and 750k unit (with double the strata fees) you can’t get $2,500/month. Price point is way more important than value.

I’m wondering, does any Victoria RE agent do a regular show where they talk about specific Victoria properties available for sale. For example, a topic one week might be their “top 5 picks for someone looking to buy a SFH for around $1m in Victoria”.. next week might be an apt in Langford. Maybe there is something stopping a RE agent doing that

You can’t talk negatively about other agents’ listings and not sure if the listing agent/sellers would even like it if you only talked about their listings positively. It is an odd world out there….once I received hate mail from owners of a property because I commented on the sale price of it in a video. They said they couldn’t send their kids out to play on the street because of my breach of privacy or some BS.

Once or twice a year I make a video on what I think is a good pre-sale development purchase but the videos are poorly received in terms of viewership.

Example from 7 yrs ago….

https://www.youtube.com/watch?v=zwv4h5DId7E

Cool. Love to hear more on this.

Damn – some good numbers there. I might have to look into something like this for a future project.

Lots of shit posting lately!

@guest_55650

It’s in the fernwood/jubilee area

@ Josh