Demographia: We’re number 2!

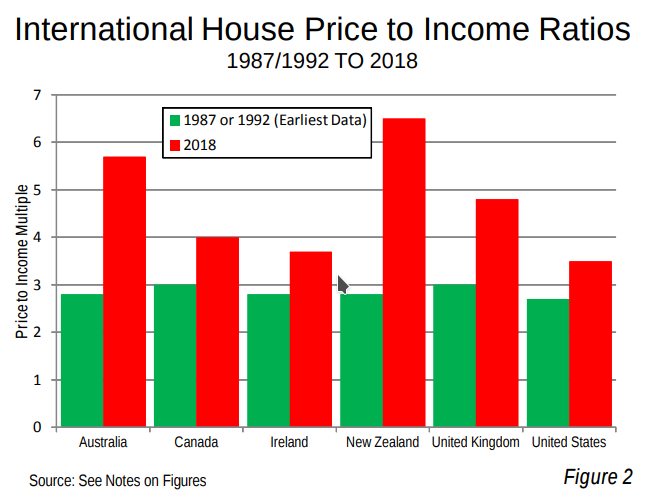

You may have heard of the Demographia Housing Affordability Survey. This comes out once a year and they compare various cities around the world based on the median multiple: the median house price divided by the median household income. A ratio of 3 or less is deemed “affordable” (only 9 out of the 91 compared major markets fell into this category: all in the United States). Cities with ratios above 5.1 were classified as “severely unaffordable”, and about a third of cities landed in that category.

If you look at Canada as a whole, it doesn’t appear there is anything to be concerned about. Compared to Australia and New Zealand our housing affordability is tame.

Of course as you may have heard, Canada is a big place, and there is no such thing as a Canadian housing market. In fact in the Demographia survey, Canadian markets are heavily represented both on the most affordable end of the scale (Cape Breton and Fort Mac are the most affordable two markets out of the 309 cities they compared) and the least affordable end (we have 6 of the 20 least affordable markets). In Victoria, we tend to end up more on the latter end of that scale (surprise!). After spending some time languishing in 3rd or 4th place in Canada (sometimes behind Abbotsford and Kelowna), in the last two years we have been a solid second behind only Vancouver. In other words outside of Vancouver, Victoria has the least affordable housing market in all of Canada.

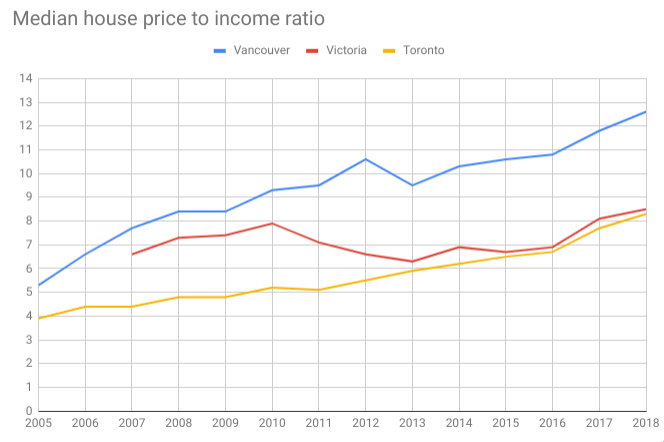

I pulled the affordability ratios out of all of their surveys for Victoria as well as the two biggest markets in the country.

My Take:

I like the Demographia Surveys. Their methodology is more or less transparent, they consistently publish their annual reports to the public, and they are up front with their biases and positions. That position is that affordable housing requires permissive zoning policies. In fact they go a step further and assert that it is impossible for a city to create affordable housing by increasing density: affordable housing requires geographic expansion.

Although the evidence so far does seem to support their stance, I’m not quite ready to give up on the hope that intelligently making a city denser and keeping it relatively compact can be done without horribly unaffordable housing. I hope the only solution is not endless sprawl. They point to Vancouver as a prime example of a city where 4 decades of urban containment policy has lead to price escalation, but if you look at the data it’s only in the last 15 years or so that Vancouver has gone from a fairly unaffordable median multiple of 5.3 to crazy town (12.6). It seems unlikely that this recent escalation is all due to the long standing policy of urban containment.

I also have a bit of a problem with the median sales price as an accurate price gauge for the entire market. The median is great if you restrict yourself to one property type because the distribution tends to be more or less a normal one, which makes the median quite stable. However for the entire market including condos and single family, the median falls right around the price range of a teardown single family or a high end condo and the relatively fewer sales in that range make the median not reflective of the price of either type of housing. However this limitation is not catastrophic and just leads to the median dwelling price being a little less stable than it would be for just one property type.

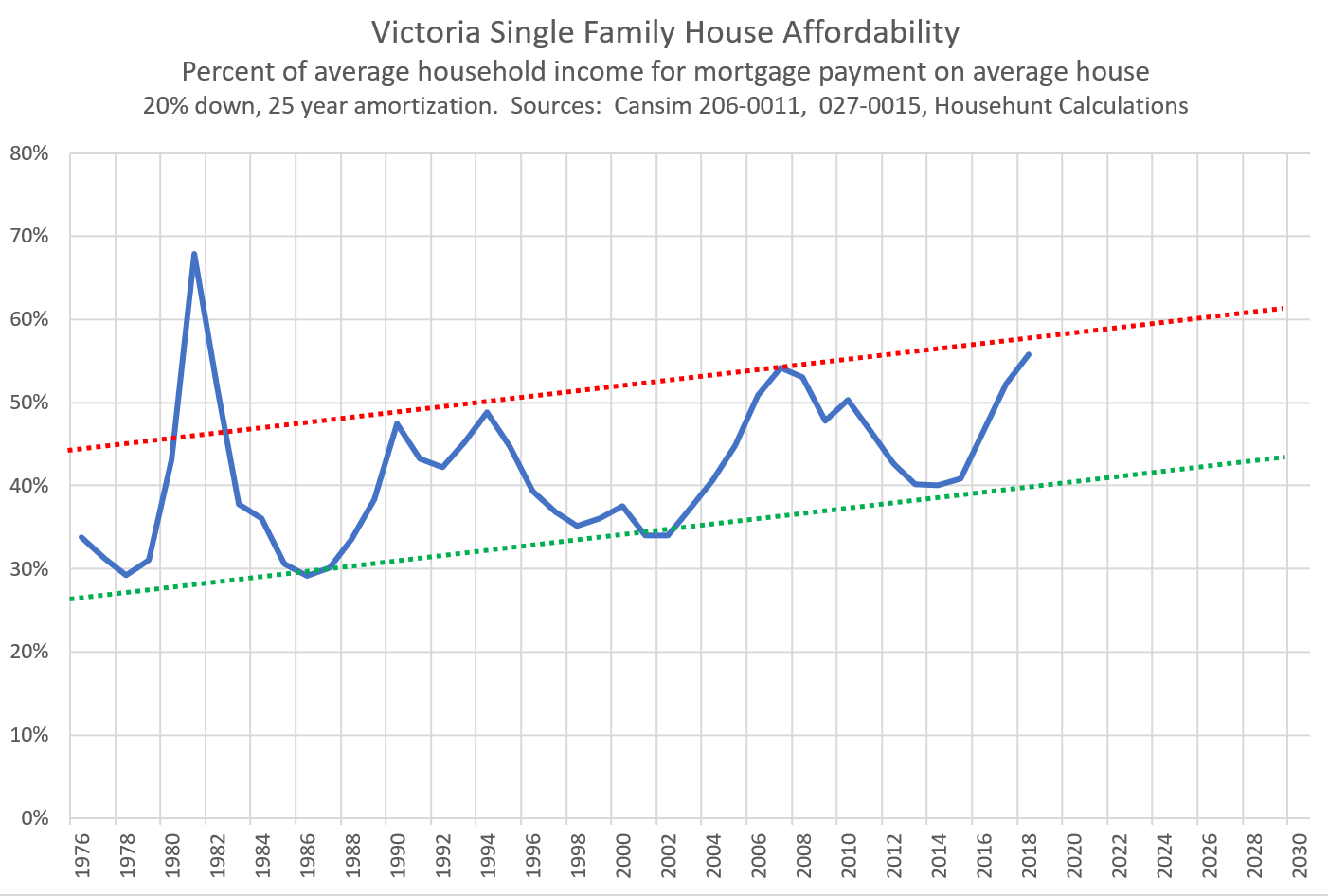

Their insistence that affordable housing requires a median multiple under 3 may also be a bit of a fantasy at this point. They state they leave out interest rates because those can change over the mortgage – and they are right about that – but in the end low interest rates are a primary factor in affordability. Expecting markets to return to such a low median multiple under today’s rates is a losing proposition and only happens when economic conditions are poor (as can be seen in their list of the most affordable markets). However this doesn’t affect the comparison within a country, where interest rates and credit conditions are equal across markets.

We are now tracking very closely to Toronto’s level of affordability which is interesting given how different the cities are. Cities generally become less affordable as they grow according to Demographia’s data, and it’s not good news for our future competitiveness if we are already matching Canada’s largest city with a tiny fraction of their population. I think if we are to make the transition from sleepy retiree town to real working city, we will need to find a way to make housing more affordable so that businesses can expand and continue to attract talent.

Also weekly sales numbers courtesy of the VREB.

| January 2019 |

Jan

2018

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 42 | 93 | 171 | 261 | 431 |

| New Listings | 92 | 274 | 501 | 711 | 772 |

| Active Listings | 1828 | 1884 | 1914 | 1980 | 1491 |

| Sales to New Listings | 46% | 34% | 34% | 37% | 56% |

| Sales Projection | — | 392 | 316 | 330 | |

| Months of Inventory | 3.5 | ||||

Sales took a slight bump last week but still down about a quarter from this time last year. Listings meanwhile continue to come on board, currently at a rate about 10% faster than last year. We’ve got four solid business days left so I suspect we will end the month with sales down just over 20% from last year. That would put us back to around 2014 levels of market activity.

You can see on this post just how Vancouver real estate prices are coming down due to the government intervention on all 3 levels of government.

https://www.strawhomes.com/blog/2019/06/19/vancouver-housing-market-correction-2019-should-i-buy/

Lol Dasmo, u decided to use $900k in cash because at the time the interest on the mortgage is higher than the rate you would have got on any suitable fixed income investment and the equity markets crashed. And your also not an entrepreneur. Have I covered all my basis yet?

January numbers: https://househuntvictoria.ca/2019/01/31/january-mediocre-sales-condo-prices-stumble/

The answer is…. If I bought the house with $900k in cash I’m an idiot…

@ local fool

I kind of enjoy pointing out the obvious fundamental flaws in the comments certain uneducated bulls make. I even think that some the educated bulls on the forum think they are clowns.

Hey Patrick, pop quiz:

If I bought a house for $1M and I financed it with $900k cash and a $100k mortgage, then one month later the market crashes and my house is worth $800k. Am I a bag holder? I still have positive equity of pretty much $700k (plus whatever tiny principal paydown I made in that month) so I am still sitting pretty right?

Ponder on that for awhile and if you can answer that correctly then you will do better in life, I promise you 😉

Noone who has ever had a mortgage would post math that bad in describing a typical mortgage. A mortgage starts out about 70:30 interest:principal , not the other way around like you think it works.

So based on that , I’m assuming you rent.

And that’s the worst of it…

@ Dasmo,

So I was assuming 70/30 as an average over 10 years to be conservative, so @ 55/45 then the owner would have need to shell out close to 300k in the first 10 years in cash to pay off 150k in mortgage debt.

Hey Patrick, hope ur taking notes 😉

One more observation I have made is that some of the bulls automatically assume that just because someone is bearish on Victoria realestate it automatically makes them poor. Like seriously how sheltered and narrow minded are you? I know tons of people with 7+ figure net worths that are bearish on BC realestate.

@ Marko, this is slightly off topic but have you ever looked at an investment condo in Edmonton or Calgary? Cap rates there are much attractive than Victoria, you can probably low ball on top right now and oil/gas is cyclical so there is appreciation opportunity in the future. I wonder if you can be cashflow positive even when u hire property management company?

In fact if the first five years were at 2.7% and the next five were at 3.7% then the pay off would be more like 55 principle 45 interest. So ya, Your math is a bit wrong.

Ks112. Just don’t bother. You’re encouraging exactly the same pointless exchange you were complaining about earlier.

@ Patrick

Are you not going to thank me for the personal finance lesson I just gave you?

Also how do u know I am not both a home owner and a renter? Maybe I rent out the entire house I own in Gordon head but also rent a condo downtown to live because I work downtown and have grandfathered cheap rent;). Maybe I am on the forum trying to gauge if I should sell the house I currently own (worth around 800k ish which is why I am so interested in that market), keep the cash in hand and then buy something nicer once the higher end prices come down.

Lol I am not even that much of a bear (I am thinking lower end may drop 15% max and hopefully the $1.5M range will come down closer to $1M) but man you and introvert sure like to talk a bunch of uneducated childish smack over and over again.

Or maybe I am 40 like introvert and live for free in my parent’s basement.

@K112 Mortgages work on a sliding scale with interest being front end loaded. So it depends on the rate over time. Over ten years at an average of 3.5% you will actually end up at a 50/50 ratio of principle to interest.

.. not every one is afraid of having neighbours close to your fences … why are people in Victoria scare of density … seriously .. travel around the world and see what real density in a good size city is about …

Also, please don’t bother replying with “oh but my tenant in my basement pays for part of the mortgage etc.” Because that just means the home owner also only gets to use a portion of the home that he/she bought.

My parents have lived in 2 beds 1 bath (upper of a bungalow in Oaklands) for 20+ yrs. Also, for 20+ yrs they have rented the basement suite. They don’t need to rent it anymore but they don’t need the space so they continue to do so. I am guessing that even after income taxes they’ve pulled more out of the suite than the purchase price of the home.

Alternatively they could have bought a 2 bed 1 bath one level for $40,000 less back in 1995, with no suite/income that would now be worth $200,000 less. The extra $200,000 capital value would offset any theoretical capital gains taxes secondary to suite but it doesn’t matter anyway as they plan to live it out in the home.

I am just a big fan of suites. You don’t need to rent it but it is always there and I have yet to make any easier money in my life. Nothing comes remotely close in terms of return/lack of effort. I have to do 3 mere postings to net what my tenant pays me per month. 3 mere postings is work involved. Meeting sellers including challenging characters like any people business, paperwork, data input, installing signs, answering phone calls/emails, etc., etc…….tenant I type in the e-transfer password.

Introvert,

I don’t actually live in Langford. I live in the City of Victoria and to be honest, density isn’t really my cup of tea either. But in a growing region, you have to put people somewhere. My opinion is that Langford is doing a good job of accommodating that growth by building a range of housing from low to high density.

Not everyone wants to or is able to live in an sfd, and not everyone wants to live in a condo. A mix of houses, duplexes, row houses, townhouses, and condos is a positive imo.

While you, the clever renter, have used your $210k rental payments over ten years to reduce your landlord’s mortgage debt.

Hi dad,

I’ve hiked in every park you mentioned many times. They’re gems.

I’m just not a fan of dense residential communities. I think density is great downtown (City of Victoria), but that’s about it. I’m not a fan of Uptown, BTW.

The older parts of Langford aren’t that dense, but most of the new subdivisions are horrible—fairly large houses on very small lots, such that your house is literally six feet from your neighbour’s house on each side and everyone’s back yard is a tiny patch of grass. With every household owning 2+ vehicles and every fifth household owning a boat that sits on the driveway, street parking is a nightmare. Being all squished in there like that isn’t my cup of tea, and I think Langford could do better. But the residents seem to like how their municipality is developing, so by that measure Langford is doing a good job.

Lol @ Patrick. First, I love how you got your panties in a knot because I simply mentioned that bears should post more actual bag holders.

Second, please let me educate you on how principal pay down of a mortgage works. How does principal paydown of a mortgage happen? Well it’s kinda simple actually, the home owner takes money from his/her bank account and gives it to the mortgage provider. What does that mean? It means you are using an asset (cash) that you have to pay down a liability (mortgage debt) that you also have. And the result is that your net worth stays the same because those are offsetting transactions.

Now i am not sure if your familiar with what an amortizing mortgage is, but in an amortizing mortgage the first years of your payment term you are paying quite abit of interest. So in your example where a home owner has payed down 150k in principal in 10 years, if we assume during that 10 years the average principal to interest ratio in the mortgage payment is 70/30 (math is prob lil off). So that means the home owner actually has spent a little over 210k in cash to reduce his or her mortgage debt by 150k.

Also, please don’t bother replying with “oh but my tenant in my basement pays for part of the mortgage etc.” Because that just means the home owner also only gets to use a portion of the home that he/she bought.

As far as parks are concerned Langford is definitely freeloading off of the regional and provincial taxpayer

100% agree with more mix housing development in core Victoria .. unfortunately … there seems to be a lot of anti development residing in James bay/fairfield area – Any one who goes down on that moss street event can see that anti development banner held up by the local properties owner… so many Nimby’s… dont see core Victoria area being redeveloped into any thing nice within the next decades .. too many property owners who bought in 2 decades ago are still alive … need to wait for another generation of people to change the atmosphere of the place

“More likely a townhome development in Langford….there aren’t a ton of examples of giant buildings on quiet streets in the middle of residential neighbourhoods.”

I am probably in the minority here, but I see a lot of positives in the way Langford is developing and the mix of housing being built.

It also has some things that Saanich does not like a core area with lots of services and medium density residential. It’s very walkable. What’s Saanich’s core? A mall designed to look like a city? Mt. Doug Market?

As for parks, maybe the city-owned ones aren’t that great, who knows. I’ve never noticed because there are so many great parks nearby (Goldstream, Gowlland Tod, Mt. Wells, Mill Hill, Thetis Lake, etc.)

Introvert seems like she doesn’t get out much.

With regard to real estate, that only happens when property taxes approach the rental value of the property. Because property owners only have two choices, pay the taxes or walk. It’s entirely different from income taxes which may affect incentive to earn, or sales taxes which may encourage underground sales. This is something that Adam Smith himself recognized.

Needless to say Victoria is not remotely near that point.

Happy to see small tax increase to buy land for parks. Can never have enough.

Marko, I absolutely agree that I dont see the costs of building a new house dropping any time soon.

I don’t believe I have the patience or knowhow at this point but I like hearing about various options. I just dump it all into WealthSimple. I got into their trade app beta, so I might have some fun with that.

Kudos to Saanich. Imagine the same scenario occurring in Langford … two giant condo buildings would be standing there in no time.

More likely a townhome development in Langford….there aren’t a ton of examples of giant buildings on quiet streets in the middle of residential neighbourhoods.

That area in Saanich doesn’t have a ton of parks so not a bad move in my opinion but as soon as the park opens, you’ll have people hanging out in the parking chatting about how unaffordable Victoria is.

Kudos to Saanich. Imagine the same scenario occurring in Langford … two giant condo buildings would be standing there in no time.

Saanich OKs $5.5M-deal for park edging Royal Jubilee Hospital

https://www.timescolonist.com/news/local/saanich-oks-5-5m-deal-for-park-edging-royal-jubilee-hospital-1.23618126

@ Josh

#55609

Yes, I do it through Questrade.

But I did a lot of comparing to settle on those versions of ETFs. If I got the equivalent from Vanguard it would have been more. But probably still lower than your 0.4 -which is really good as well.

You might want to consider TD Mutual Funds ‑ e‑Series, with MERs as low as 0.33%*

https://www.td.com/ca/en/personal-banking/products/saving-investing/mutual-funds/td-eseries-funds/

But with Questrade for me, it’s all about controlling my own funds and keeping the fees very low.

Buying ETFs are virtually free as well at Questrade.

Selling does still cost (Sell 1¢/share; min. $4.95 to max. $9.95). So I just buy to balance the portfolio and decide at year end if I want to sell bloated assets to balance it back to those numbers.

It takes me moments to contribute every payday. And around 15min at the end of the year if I need to rebalance the whole allocation (I built an excel calculator).

https://www.questrade.com/pricing/self-directed-commissions-plans-fees?refid=sjvzuniv

Marko Gov thinks the tax trough will continue indefinitely. At a point increased taxes actually bring in less revenue.

Here’s the info on that:

I don’t get Saanich’s business model. Someone buys a 500k teardown in the Swan Lake area. They replace is with a $1.2 million house. You keep the mill rate the same (owners of existing homes don’t see their taxes go up) and you just increased your tax revenue forever (minus the new home depreciating on the assessment) for infrastructure improvements.

The $1.2 million home has a modern safe suite above the garage so affordability also improves.

Discouraging building with higher fees not sure if that makes sense for maintaining infrastructure.

I thought my 0.4 was good. Is that a self-managed account?

My favorite compounding demonstration is A Penny Doubled Everyday:

If you were given a choice to receive one million dollars in one month or a penny doubled every day for 30 days which one would you choose?

Day 1: $.01

Day 2: $.02

Day 3: $.04

Day 4: $.08

Day 5: $.16

Day 6: $.32

Day 7: $.64

Day 8: $1.28

Day 9: $2.56

Day 10: $5.12

Day 11: $10.24

Day 12: $20.48

Day 13: $40.96

Day 14: $81.92

Day 15: $163.84

Day 16: $327.68

Day 17: $655.36

Day 18: $1,310.72

Day 19: $2,621.44

Day 20: $5,242.88

Day 21: $10,485.76

Day 22: $20,971.52

Day 23: $41,943.04

Day 24: $83,886.08

Day 25: $167,772.16

Day 26: $335,544.32

Day 27: $671,088.64

Day 28: $1,342,177.28

Day 29: $2,684,354.56

Day 30: $5,368,709.12

Day 31: $10737418.24

Ontario considering allowing realtors to tell prospective home buyers the prices of other offers

The government launched a consultation Thursday looking at the Real Estate and Business Brokers Act, and that’s one rule they’re looking at changing.

Currently, if there are multiple bids on a home, the seller’s broker can only disclose the number of competing offers, but not the details of them.

https://business.financialpost.com/real-estate/ontario-may-allow-disclosure-of-prices-in-real-estate-bidding-wars

Here’s the info on that:

https://www.timescolonist.com/real-estate/housing-affordability-eroding-saanich-to-boost-building-costs-1.23615217

The example given was someone with $0 in 2009, (no down payment, for simplicity) who now has $450k equity. It is more remarkable (a bigger “yay!”) to turn nothing (*) into $450k, than to turn $500k into $919k. If you want more details on how to do that, ask some of the many bulls here who have done it.

( * ) Factor in a small down payment if you like

The average Joe doesn’t really comprehend how many stakeholders are involved that have caused construction costs to balloon. You need to run like a two-page spreadsheet to add up a all the costs that have nothing to do with physical construction.

Saanich doing their best to help affordability by piling on more fees -> https://www.saanichnews.com/news/head-of-greater-victoria-builders-warns-of-changing-construction-climate/

Then add WCB, Building Code, BC Housing, etc., every year with more and more bureaucracy.

Quality is a house built now better? (laughing again)

Of course. (sarcasm) Honestly, we’ve just cut more and more things out of our houses over the years. Can’t really get the buyer to pay for TJIs/plywood and stupid crap like we use to insulate interior walls around laundry rooms. Even as a huge Tesla fan after doing 4 houses in a row with a Nema 14-50 (charging plug for electric car) decided to cut ($150) from last house as no one cared when I pointed things like that out to them. Stopped doing all the extras, houses still sell no problem.

And of course, the building code instead of making a $150 electric plug in garages mandatory, something that could be super useful in 5-10 years, is focused on all sorts of other non-sense.

The parameter was 10 years, not the “last few”. Someone buying 10 years ago has almost no chance of being a “bag holder” unless they’ve been raiding that equity all this time. Even then, that’d be tough given there are limits to how much you can raid.

People overleveraging themselves over the last 2 years on the other hand…scary.

No lets say you had $500k in 2009. Place that in the market and get a return 7% compounded. You’ll roughly get $919K by now!

Yay, compound interest.

As I’ve said over the years, I don’t think there is a strong case for a scenario where new build constructions drops substantially.

meant to say

As I’ve said over the years, I don’t think there is a strong case for a scenario where new build costs drop substantially.

Makes sense, since there weren’t a lot of purchases in the last few years.

I understand the rules and regulation changes are there to protect and makes things better (laughing right now). Markos post demonstrates some of the issues that are making homes too expensive to build. Sad really what governments say but actually do..

Quality is a house built now better? (laughing again)

Patrick

Let’s take a theoretical house that was purchased in 2009 for $600,000; $600,000 + 128 % = $1,368,000… now $1,368,000 – 50% = $684,000. Careful what you wish for!

Marko,

Yes, great SFH post.

correction on my previous post (1990 not 1981)

Drywall that was installed before 1990 has the potential to contain asbestos in the mudding compound. Drywall containing asbestos can be brought to the landfill for disposal as ACM.

In addition to the restrictions above, documentation confirming that the drywall has been tested and confirmed to contain asbestos fibres must be provided. There are a number of labs in the region that can complete this testing at a nominal fee. HAZMAT Survey, Testing and Removal Service Providers

Note: Drywall is not accepted for recycling at the Hartland facility. Clean drywall can be recycled at local private facilities; please visit MyRecyclopedia.ca for a list of drywall recyclers.

https://www.crd.bc.ca/service/waste-recycling/hartland-landfill-facility/asbestos

Marko really good post…

And it’s stuff like that that continues to kill the SFH.

My father sold his last spec home in October and it is the first time in 10+ years he is doing nothing. There is just not enough margin in anything right now once you add up all the costs (and he has no financing costs to deal with at this point in his career) nothing really makes sense. I remember in 2008 we bought a lot in Langford, it automatically met criteria to subdivided into two lots. Excavator showed up Monday morning, old house was demolished by Monday afternoon. Excavation done by Wednesday and we were working on the footings by Friday.

Now to do the same thing is like 6 months later and $50,000 extra in BS paperwork/delays you are working on the footings. Instead of the house being dumped at Hartland now it is dumped at Hartland, but the asbestos is in yellow bags. It is an improvement but it costs a fortune.

Also, looking at the subdivisions in Colwood/Langford I don’t think developers can drop lot prices much as the infrastructure costs are staggering. You are typically blasting apart a side of a hill to squeeze out a few lots, this is after you spend 2-3 years getting screwed around by local politics. Even Langford is becoming tough on re-zoning.

Then even when you finally have a registered vacant lot in Colwood in a huge cookie-cutter subdivision is still a bureaucratic nightmare to build.

In Colwood, for example, you have to pay $2,800 for a character and development permit which takes 6 to 8 weeks before they take a look at your building permit. Funny part is the houses that go through this character and development bullshit still look as cookie-cutter as the homes pre 2017 (before some genius at Colwood thought this policy would be a good idea).

As I’ve said over the years, I don’t think there is a strong case for a scenario where new build constructions drops substantially. I think the much more likely scenario is if the market prices drop constructions just crawls to a halt.

I also think small time builders like my father (1-2 houses/year) are done going forward other than the high-end of the market. It is going to be all massive developers like Royal Bay in the future. Small builders won’t be able to keep up with the bureaucracy. If you have a company of 100 people you just send some random to take all the courses as a “representative.” For the one woman or man show it is tough.

Even with a huge Victoria crash, you’ll be hard pressed to find many Victoria “bag holders.” A typical Victoria home owner who bought 10 years ago (2009), isn’t up 60%, they are up 128%. Even a 50% drop wouldn’t make them a “bag holder”.

Many bears here have never yet had a mortgage, so they may not realize the basics. One point that they miss is the equity buildup that is occurring.

For example, consider someone who has bought for $500k in 2009. Assume, for simplicity, this was no down payment at all via a $500k mortgage (3.5%, 25 year).

Typical Victoria house prices have risen 60 % since 2009, so some bears here are saying the gain is 60%, since the House is worth $800k. But after 10 years, the outstanding mortgage has fallen to $350k, because of principal repayments that occur as part of normal mortgage payments.

So we have a house worth $800k, and we owe $350k. That’s not a 60% gain, it’s a 128% gain. ((800/350)-1)=1.28.

Expressed another way, for them to become a “bag holder” , with the value of their house falling below the outstanding mortgage, this would require a fall of 450/800= 56%. So for people who’ve bought >10 years ago, let’s hold off on the “bag holder” calls until Vic prices have fallen >56%. Last I checked, teranet Victoria was 0.5% from all-time high Sep 2018. https://www.nbc.ca/content/dam/bnc/en/rates-and-analysis/economic-analysis/economic-news-teranet.pdf

I assume why no buyer would agree is if the deal fell through. They would have to divulge to any buyer that the house has asbestos

Saanich just jacked up development fees also. So Dasmo what you refer to is exactly true. Governments talk about affordable housing is BS.

And it’s stuff like that that continues to kill the SFH. At least in the core. Anything that needs redoing will have to become multi family to make economic sense. Be it fees, demolition/enviro costs or crazy code requirements. Building new SFHs will not make economic sense. So what I am saying is there are other factors that will affect that particular market. Perhaps it’s this administrative inflation that is the factor which slants the affordability chart ever upwards despite the cycle within….

Saanich has started asking for an asbestos report before they dole out a building permit it anything to be remodelled could have asbestos. So buyer beware, It is not cheap to have the men in white come in to takeout a floor or drywall. Hartland has even more Stricker rules this year…Bylaw and workplace are making a lot more surprise visits.

B.C. nurses just signed their new deal a few days ago: they got an annual 2% increase for 3 years, plus some extras.

Flat market, while not exciting, would be good outcome going forward. Over 5-10 yrs affordability would improve with inflation. Pretty much everyone wins with the exception of those who have come to use their homes as ATM machines.

Real estate market must be slow out there, lots of posts from Marko today.

On the verge of bankruptcy.

A word of advice to buyers. You buy a house pre 1981 pay the money to check for asbestos. It is a real expensive process to get rid of it.

Unless the house has been sitting on market for many months and the seller is super motivated you will be super hard pressed to get a residential seller to agree to an environmental assessment. Even back in 2011-2013 it was tough.

I remember my clients were buying a house in Fairfield in 2013 that in 10-15 yrs they wanted to add a floor to so I thought it would be a good idea to test the stucco/drywall….and nope, completely rejected by seller. Seller was willing to lose the deal over it.

It is wise to be aware of what could contain asbestos and how much it would cost to deal with but getting approval from seller in real life is a no go for the most part.

75 Regina went for $461K

Marko thank you for your insight. I thought I could find some savings as a buyer but it’s clearly not as simple as I thought considering the new rules about representation.

Bears ridicule owners who overextend on real estate and lose their shirt. But when an owner doesn’t overextend (e.g. by buying only one house at a time), they ridicule him/her for not overextending: “if you were truly smart, you would have bought two.”

Comic time:

Introvert is most definitely a woman….

Any one know what 75 Regina was sold for?

B.C. teachers are breathing a sigh of relief after last night’s byelection. The teachers’ contract expires in June, and they would much prefer to negotiate with the GreeNDP than with the BC Liberals (the governing party that illegally ripped up their contract and underfunded the education system for a generation).

B.C. nurses just signed their new deal a few days ago: they got an annual 2% increase for 3 years, plus some extras.

https://vancouversun.com/health/local-health/b-c-nurses-approve-new-collective-agreement-with-pay-increase-workload-changes

My portfolio

USA 50% XUU

CAD 20% XIC

Dev Int. 17.5% XEF

Emg Int. 7.5% XEC

Bond 5% ZDB

100%

Average MER: 0.11%

http://www.squawkfox.com/tools/portfolio_mer_calculator/

@ Bowler

Just FYI, Introvert does not actually own or have equity in a house, Introvert is also a he and not a she.

Usually its men who get a kick out of boasting fictitious facts in front other men (d*ck measuring contest). Do you actually think a woman would bother to go on an internet forum day in and day out and brag about the equity they have in their house to a group of predominately male strangers?

Lol, but keep it going Introvert. Like i said before, it is pretty entertaining. Too bad Hawk isn’t here any more 🙁

Oh you should see how low my MERs are..

I don’t think you know what “arbitrary” means.

True, I won’t sell because I need a place to live. And because I don’t jump into and out of owning a house like it’s a stock.

As for your assertion that I “will neither gain nor lose anything,” that’s just nonsense. Occasionally we hear this type of stuff from renters—that equity means nothing because you haven’t cashed it out yet. The only value of conclusions like that is they make you feel better.

Well, you get what you pay for.

I didn’t buy two properties because having two mortgages sounds scary to me. If taking out only one mortgage at a time means I’m not truly smart, then call me dumb!

Yes, I did buy when I could afford to. Not everyone buys when they can afford to, however. We all make our own decisions in life.

I’m not too concerned about my anonymous online reputation.

Net worth is probably declining a bit on the market value side, but it’s growing on the principal pay down side.

The principal only goes one direction: down. Until it’s gone. Market value will fluctuate but trends up over time.

Michael

Still holding RNX. Watching the news. Everything seems positive. Only issue too many shares.

I have no idea of course how many more houses will come on the market! 529 was about the tops we thought we could get. Not sure we are patient enough to wait.

We see the realtors again on Monday so will see what they say.

https://www.sookenewsmirror.com/news/greater-victoria-grew-by-more-than-5000-people-between-july-2017-and-june-2018/

here is an article regarding population growth recently … but i dont think the growth is from retirees — its more from the construction boom with increase labour demand …

numbers didnt add up in 2011 to 215 — market was flat and decreasing .. the market only picked up when vancouver and alberta have a crisis… the 15% intended retirees never followed though .. atleast not 15%

.. this is not facts .. only opinions…

If memory serves from 3 yrs ago, I sold at +49.3% 🙂

Joking aside, congrat’s on your RNX gwac (~500%)

Grace: I would wait for the 529 to sell and then price below the other competition. That is assuming that you are not expecting a lot more houses to come on the market. If the 529 does not sell quickly then you might consider this to be a bad year to be in the market.

House pricing! A house that is nicer than ours is listed for 529,000( 60,000 below assessment)and a house 3 houses away from us and almost identical just came on the market for 599,000 ( way way overpriced) and 70,000 over assessment). So what do we do? Still mulling it over!

Best way is for you to ignore posts that reference it. Close your eyes tight and scroll down to next post.

Prices are up 50% since that article was published in 2011. Many factors there, but if you just bought in 2011 because of the boomers coming, you’d be up 50%.

Moreover, well-heeled boomer retirees are in-fact coming…,

There are some new high-priced condos being built in Victoria. There has been speculation from some here that we have “run out of buyers”. And then we hear recently from the one of the most prominent projects (Customs House) that they are selling fast, including several record-breaking prices for any condo, and that the “typical buyer” is in fact a well-heeled boomer, and many are from outside Victoria. This is an important source of buyers that shouldn’t be ignored.

https://www.timescolonist.com/real-estate/10-79m-downtown-victoria-condo-sale-doubles-the-previous-record-1.23510734

“Project real estate agent Craig Anderson, of Vancouver’s Magnum Projects, said buyers are typically 55 to 64 years old, planning to live here full-time during retirement. At least half the buyers are from Victoria. Some Canadian buyers have been living far afield, in places such as Japan and Europe.”

I agree that the Greens have a problem but they should have seen this coming.

Me thinks the spring market is going to be one big yawn. Sellers have no reason to be in a rush (economy still ok)/Jobs ok) buyers also have no reason to be in a rush /government intervention and affordability. There will be some bargains in the high end and the few dumps people need to unload.

A word of advice to buyers. You buy a house pre 1981 pay the money to check for asbestos. It is a real expensive process to get rid of it.

So you say, head meet sand, which is then buttressed by the above. Non sequitur, IMO.

What isn’t going to ever change is that migration and their associated demographic patterns are data questions. It cannot be resolved by anecdotes and stated desires, intentions, assurances – ever. No amount of,

“I was outbid twice (or 20 times), by retirees”,

“5 of my friends had this experience”

“I saw a 15 tour buses full of Asian looking RE investors”,

“My friend works at a RE firm and all the callers are Chinese buyers looking to buy”,

“I’ve seen 12,368 surveys of people across the solar system re Victoria and they all say…”

…will ever unseat this simple reality no matter how numerous or authoritative the source.

All this stuff says is, Victoria’s popular with retirees. This is objectively supportable given the city’s demographics. Everyone has known that for the last 75 years. If the retirees are coming in greater than average numbers today, okay. That’s fine – let’s see the data and examine the effects. It’d be interesting to analyze, for sure.

No data? Then it’s conjecture and nothing more. If conjecture is being rejected as proof in lieu of data, that’s not sticking your head in the sand.

Well actually pleased with last nights election results. I new NDP was going to win. Seeing the Green results was beautiful. Mr Professor is being manipulated for NDP gain. Hopefully we will see some changes and not just keep kissing John`s ass and voting yes on everything…

The conspiracy theorist in me thinks the NDP may have helped Pro rep disappear.

Green really needs to do something to be relevant or they have seen the high in seats and aligning themselves 100% with the NDP is not it.

But if Leo “boasts” that his index funds have nearly matched the market, then I’ll believe him.

Leif – need to add two more zeroes to that. Lots of companies have wiped out 5 Billion in shareholder value, but wiping out 500 Billion makes you a special breed.

Case study in why you should ignore nearly all on line claims of stock picking prowess

Last time he posted he said he never owned it, then he did own it but forgot, then despite remembering, still couldn’t remember what he bought “last week”, and now definitely did own it but sold it (presumably near or at the peak of course). Good to see his memory has finally returned with such detail. 🙂

Yes let’s all ignore what’s actually happening and what is predicted to increase. Head, meet sand.

Source

https://www.theglobeandmail.com/globe-investor/retirement/the-boomer-shift-how-canadas-economy-is-headed-for-majorchange/article27159892/

Of course not all of these boomers are going to move to the island. If they did, we’d have a massive problem because the population would literally skyrocket. But even if they don’t ALL move, the % that do with their deep pockets have a large impact on the RE market because they are net-new buyers.

When we were looking this last spring, two houses we were interested in were snapped up within a week of listing by retired couples moving to the island. Both went $50K over list. A third house that didn’t fit us (but we have a friend who knew the owners) was sold for $35K over list the night before it was about to go on the market.

When we look at trends to see where the market is headed, you don’t get cherry pick which factors you will include and which you won’t. Just as affordability can’t be ignored, neither can retirees moving here.

But did you sell GE at +50%? Probably not….

Have have socialist health care, fire dept, police, sewage, power, and I wouldn’t want it any other way.

Board is producing new map-based reports for year over year single family price changes based on the HPI: https://www.vreb.org/pdf/HPIMap1812.pdf

Kinda interesting with Oak Bay and Saanich east roughly flat while other core areas are +~6%

Yeah that was really good timing. Good from my perspective, I think the NDP need some more time to really develop their platform and see if it will be effective.

Quick reminder if you lowballed Victoria right after any of the financial market bottoms this millenium (green arrows), you were soon smiling.

Haven’t owned GE for years Leif, but after I suggested it over 3yrs ago it quickly shot up 50%.

We really need to stop referring to that study on upcoming retirees “intending” to move to Victoria…as the saying goes, “the road to hell is paved with good intentions”. Not to mention, I intend to have six pack abs in 2019, but the beer fridge in the basement keeps calling out my name.

Not sure if anyone posted on the Chinese Bank bailout

https://www.forbes.com/sites/francescoppola/2019/01/29/the-great-chinese-bank-bailout/amp/?__twitter_impression=true

“We are here?”

For the person calling to buy GE

Since it peaked in 2000, GE has wiped out about $5,000,000,000 in shareholder value.

https://www.bloomberg.com/graphics/2019-general-electric-rise-and-downfall/?utm_source=facebook&utm_campaign=socialflow-organic&utm_content=business&utm_medium=social&cmpid=socialflow-facebook-business

I like KeePassXC. Written in C++ instead of C# and runs natively in Linux.

https://keepassxc.org/

No system is perfect, but using any password manager is a massive upgrade in general security, even the cloud-based ones. Password re-use is the biggest threat at the moment.

https://haveibeenpwned.com/

https://www.cheknews.ca/saanich-council-asks-for-community-support-to-purchase-kings-road-land-for-5-5m-529997/

Here’s your chance in Saanich. 5 acres of development land in the core:

a/ 63 SFH homes @3500 ft2 lots or

b/ 126 Duplexes or

c/ 186 townhomes or

d/ 500 apartments.

Catch is Saanich is already raising property taxes this year, and they are looking for donations to finance a big chunk of this land. Quoting George Bernard Shaw “Socialism is the same as Communism, only better English”.

I expected Nanaimo to be closer. My theory (not original) – Plecas report reminded a few people that Liberals deserved a few more years in penalty box

73 of 111 reporting; 49NDP to LIb 41. This over and my last post.

Back to housing.

Yes, that does seem plausible.

Introvert,

“Oh I’m a bag holder all right. I’m holding bags of equity from both appreciation and mortgage pay down.”

A fool and her illusionary money are… ?

Dudette… you really have nothing. Your equity is worth nothing more than an arbitrary figure that you believe you can turn into real money if you sell.

But you won’t sell because you need a place to live. And due to that fact, you will neither gain nor lose anything. So it truly means absolutely nothing.

Your opinion, for all intents and purposes, is worthless. You bought in 2009…. great. You didnt buy two. You would have if you were truly smart and knew what was coming but you didnt. So, that to me means you bought when you could afford to and did nothing more.

Cool it. Seriously. Just try to be you for the conversation rather than trying to impress. You water down your position and reputation by telling us how awesome your net worth is when its declining on a daily basis.

[Edit: Removed some insults, keep it clean folks – admin]

Local Fool: Real Coke factor.

58 of 111 still 50 to 40.

I am guessing this is over.

If you oppose the Libs strategic vote for NDP

50 of 111 boxes NDP 50% to Lib 40%.

Conjecture on why?

The question here is the fact that the Green support seems to have been cut in half.

Not enough gwacs in Nanaimo?

Local Fool: Not a surprise, it has been a safe seat for decades.

Almost half count NDP 50% to 39%

NDP are going to get the seat…

Early still, but the Greens look like the big loser at 7.2% of the vote compared to the last election.

31 of 111 ballot boxes counted NDP 48% to Lib 41%

With 15 of 111 ballot boxes counted the NDP has a commanding lead of 50% to 37%.

With less than 5% of the vote counted the NDP is in a commanding lead at 51%

Other than a fairly high net worth for my age, I don’t have that much in terms of possessions—you’re right.

I agree, it would be nice if the other homeowners here did some boasting once in a while.

Will do!

Any results yet on the by election?

@ local fool

I agree with the loss aversion post u made earlier! I think this is amplified because of the big run up we just had in the market.

Gotcha. Ya, I thought that was an uncharacteristic kind of comment for you to make. Always found you worth debating FWIW… 🙂

Maybe, I don’t know. I just wish I knew carpentry. Somehow, I can fix almost anything mechanical or technological, but I wouldn’t know how to lay floor or build a staircase to save my life. Kind of pathetic and incongruent…and jealous of your build too.

@ introvert

The more I read your posts the more I believe that the only bags your carrying are groceries bags when you’re walking down to the basement suite where you live, in a house thats owned by your parents.

Usually people who brag constantly don’t actually have much. You brag about your alleged equity and mortgage paydown in one week more than all the other homeowners on here combined since the existence of the forum. I’ve never seen Barrister brag about how he’s up probably almost 7 figures in his Rockland house (I figured he’s up close to 7 figures because he said in the current market his house is worth $2.5M and I believe he bought before the run up). I don’t see Marko brag about how much equity he has in his house and investment properties. Leo S. has a gordon head house, don’t ever see him rambling on either. You, however…. Lol but carry on its kind of entertaining 😉

I might add that I admit to being a financial idiot for building my house….

Ummmm when I said all you Bears are financial idiots. Prove me wrong. It was a parallel to the spec tax calling property owners all greedy speculators. Prove them wrong.

I think you bears are all too smart for your own good!

Real estate market must be slow out there, lots of posts from Marko today.

“…15% “intend” to retire in Victoria if/when they can afford it.”

Here we go again with “the survey.” That thing belongs in the same pile as Hawk’s graph or Michael’s crazy “we are here?” chart.

It is not hard or time consuming to find renters at a fair market price, by definition.

You’d save on the BC spec tax all right, but PEI would hit you with their non-resident property tax surcharge.

Oh I’m a bag holder all right. I’m holding bags of equity from both appreciation and mortgage pay down.

Great Twitter thread on the psychological fallacies that drive loss aversion when investment property is sinking in value – speaking in context of the Toronto and Vancouver RE markets.

“Investors hold on to their cashflow negative properties for longer than they should. A good example of the sunk cost fallacy. When the investor’s property drops in value from $1.4M to $1.1M most prefer to hold on even if they’re cashflow neg $1,500 p/m to avoid the $300K loss. Interesting, I think a lot of people mistakenly assume that once a property’s value goes negative investors will all rush to sell their cashflow neg properties asap – when history and psychology show the opposite is true. They’ll hold on as long as they can!”

https://twitter.com/JohnPasalis/status/1090620666594902017

@ Patrick

Pretty sure Victoria’s home price to income one of the highest in the world? You can’t cherry pick Canada as a whole because then you include the prices in godforsaken PEI! Nice try to sneak one in though.

Your other points about rich people in Victoria is of little relevance as there are some very wealthy people (the richest woman in Canada lives in 10 mile point) here that skews the average and they won’t drive local real estate prices. This is probably why you see all those homes over $1.5M just sitting on the market while the ones priced around $700k (which by the way probably would have sold for close to $800k last year) are sold relatively quickly.

@ Local Fool

I don’t have the time or energy to research all the “bag holders”, this is why I suggested someone else do it when they want to make a point to the bulls. Otherwise it’s just the same debate over and over again.

@Yeah Right

I was speaking to cloud based password management options, but to hack Keepass someone doesn’t need your master password. A DLL injection attack using something like KeeFarce will extract your entire Keepass database from memory into clear text. Are you 100% confident that your USB key has never been plugged into a compromised computer? No system is 100% secure. In reality you are likely fine with Keepass, I’m just very paranoid.

i would like to see that 15% intended retirees in 2011 to come here and retire now… i would love to see population growth of that 15% in Victoria ..

Not bad for a bear, but you forgot ( or have blocked out) …

No, I don’t get it. Worldwide, this isn’t necessarily a repeating cycle, with an upper bound. Canada’s affordability as measured by mortgage-as-a-%-of-income is among the lowest in the world.

Click here https://www.numbeo.com/property-investment/rankings_by_country.jsp and then click on the column “mortgage-as-a-%-of-income” to see for yourself.

Canadas is 53%. You assume that this is high as it gets – but look at other countries (Sweden 67%, UK 62%, Israel 95%, Croatia 89%, South Korea 122%, Hungary 105%, Honk Kong 320%)

Correct me if I’m wrong, it’s the bulls that are losing hundreds of thousands of dollars these days, just as the bears predicted would happen. And this is just the beginning of the decline, I seriously doubt if SFH prices will experience the Spring Rush with a bump in prices.

So if the bulls are losing hundreds of thousands in Vancouver and $50,000+++ in Victoria, then who are the financial idiots? The bears were the ones warning of unsustainable increases as I recall.

Some of the losses are hidden, for example, the young couple who listened to the bulls on this site two years ago, then bought during the 2017 spring frenzie, spent $125,000 on a beautiful kitchen and bathroom renovation, then sold recently for $50,000 over the price they paid in 2017. Total loss for this young couple was well over $100,000 because they bought the hype the bulls were pushing; but their loss doesn’t show up when comparing bought vs sold prices.

Recently the bulls have added a caveat to their bullish rants, to wit, “you can’t go wrong with Victoria real estate…PROVIDED YOU HOLD LONG TERM, for at least ten years”

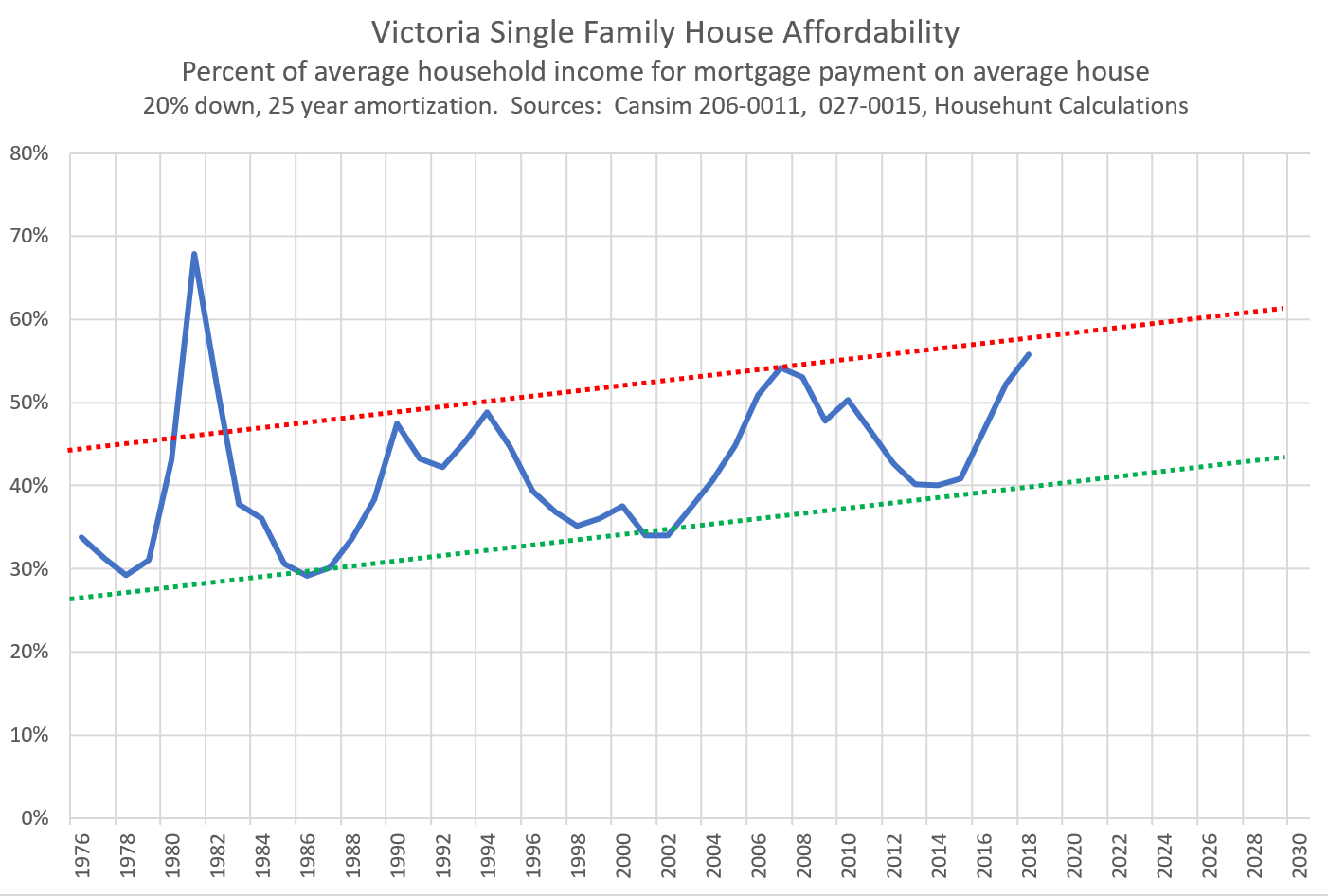

Long term I’m a bull too, but for the past few years I’ve been bearish, it’s a repeating cycle and it had to happen, it was always just a matter of time. I’ll be bearish for another 24 months, during the interim my paid-off house is comfortable and my cash is earning at least 4% per year in interest while I patiently wait for the dip in LeoS’s affordability graph on post #55348. It’s a repeating cycle!! Get it?

@ islandscott

#55499

I like KeePass https://keepass.info/download.html

https://en.wikipedia.org/wiki/KeePass

It’s totally trusted and what the experts use.

A 2017 Consumer Reports article described KeePass as one of the four most widely used password managers (alongside 1Password, Dashlane and LastPass), being “popular among tech enthusiasts” and offering the same level of security as non-free competitors but being more difficult to install.[11]

They offer a portable one that I use on a thumb/USB drive and store a copy of it inside google drive (cloud). Good luck getting my master password!

ks112,

If you’d like to see another kind of content, why don’t you just post it? There’s plenty of sources to get bag holder info. The only thing is, much of it focuses on Vancouver at the moment.

@ Josh

Exactly, so its a stupid and pointless exchange. Unless evidence is presented where Gordon Head homes are selling at late 2015 early 2016 prices, Introvert will keep saying those points you mentioned over and over again.

I bet He will shut his mouth if and when prices decrease to that level because the price he supposedly bought in 2009 isn’t far off from 2014 prices, and getting back to 2014 prices is very likely if the market has already dropped to 2015 prices.

I also wouldn’t worry about Introvert bragging about net worth, usually it’s only the wannabe’s that brag, especially the ones that brag on an anonymous internet forum. I think there are only a hand full of verified posters on this site? So for all you know Introvert could be some 40 year old living in his parent’s basement in Gordon Head.

Mortgage growth rates slowing? That’s not being debated here, because its obvious to everyone but you that mortgage growth rates slow when less houses are being sold. Total Mortgage balances up 3% YOY.

Bingo…

Bulls should keep this in their clipboard and just paste it in whenever they’re getting itchy fingers. This is exactly all of their arguments.

thank you L.F for making a logical point … self proclaimed bears or bulls here are like Democrats vs Republicans.. it is no longer about current facts .. its about being right and proofing that their choices are right … it is true that bulls have a phenomenal run in the last 3 years .. but can you claim it is the same thing for the next 3 years .. the current facts – people no longer offer 100k above asking .. the current facts – sales are slowing … the current facts credit is tightening .. why hold on to a simple branding such as bull or bear… just look at current situations

Ya that’s fair and see your point. Consider this exchange:

“Credit growth in Canada is decelerating by X percent per quarter. With mortgage originations, and the amount of mortgage being booked, falling to levels not seen since 198X, this is having X impact on the housing market, and the prospects for an immediate turnaround in sentiment is unlikely. This is in conjunction with global macro trends, which are also showing similar patterns, with China and USA following suit….(or whatever is happening).”

Here’s a typical rebuttal seen on this site of late:

“And yet here you are, missing out on the market. You’ll never buy anyways; you’ll just sit here like you always have. Want to compare net worth? And look at this chart of price growth in Victoria for the last XX years. You’ve all said the same thing all this time, and have always been wrong. You’re a socialist, a lefty, envious and poor. You think you can outsmart the market. Here’s a picture of flowers in January. Here’s current weather conditions in Manitoba. We have no land, we’re desirable, construction costs are never going to fall, and regulations ensure this is the case. We’ve turned a corner.”

Break that down, and you’ll see there’s actually no debate happening. They’re not even discussing the same thing. It’s worthless “conversation”, as you point out.

So look at it like this. Whether I am in the market or not, the first comment might be more useful if I want to learn about the market and help educate myself in making a decision, regardless of whether that means buying or not buying. It’s something to consider among other things, and if that information makes at least one person fly less blindly, that’s awesome. Conversely, as some people have said, it also cannot and should not always be about logic and data alone – because markets aren’t either.

So, I do see value in talking about data, current and former even if it isn’t connected to a meaningful debate. If the “bearish” cohort focuses mainly on bag holders hereon in, that’s more for “entertainment” or shock value than anything. Sure maybe someone with an opposing viewpoint can’t say much or they twist it into something else to try to mitigate it, but that doesn’t change the fact that no one’s learning anything.

Readers need to judge for themselves which posts represent value and skip those that they think don’t. Having said that, if I search for bag holders and find something interesting, I’ll post them from time to time as I did below. Thanks for your thoughts btw!

One group that the spec tax is going to hit hard is the operators of illegal AirBnBs in the spec tax areas. They are either going to have to pay up, sell or do some real contortions to avoid paying.

And yes the spec tax is going to make it hard to justify keeping a $5 million dollar Oak Bay waterfront home largely vacant as a vacation home. That is going to cost you $100,000 per year as an American or other foreigner and $25,000 as a Canadian.

Is this a good or a bad thing? Those vacationers do pump some money into our economy. On the other hand each home kept empty for vacationers is one less home for locals to live in.

Suppose I buy a home in lovely Summerside PEI and live there a lot of the time, but my aging parents stay in Victoria. If I decide it is absolutely necessary for me to own a condo in Victoria and maintain it vacant year round so that I can visit anytime how much would this cost me?

Assume $400,000 condo. It would cost me $2000 per year. Big deal.

There are a number of ways I could make this zero dollars per year. Simplest strategy – maintain BC residency which would also save income tax. Another strategy – buy your vacant property on First Nations land (May not be a good option in Victoria but in Vancouver there is centrally located and luxurious property located on reserve land in several spots.) Rent your condo to family or friends but maintain a vacant room for yourself. Buy just outside the spec tax area. In Victoria that would mean East Sooke, Willis Point, or areas along the Malahat. Depending on where your aging parents lived those might be convenient or inconvenient

For a given level of government spending I’d rather money be raised by things like spec tax, PT tax, carbon tax rather than income tax. Better to tax luxuries (vacant second homes) or negatives (carbon emissions) rather than taxing positive things (working).

Overall I support the spec tax. The problem I do have with it is that adding the spec tax without removing or reducing anything else increased our overall level of taxation (albeit fairly slightly)

There are so many exemptions in the spec tax that actual tales of hardship are going to be few and far between.

Off topic, but as an information security professional I disagree with the use of cloud based password managers. Using one is putting way too much trust and eggs in one basket. There is no way to verify their back end security and ALL your passwords are at risk if your PC or their service is compromised.

Use 4 word passphrases (which are easier to remember than random characters) and multi-factor authentication where possible. I keep cryptic personal password hints in an email draft for easy access. Email account is protected with 2FA. IMO if you need to record your full passwords it’s better to write them down at home in a hidden location. If you’re really paranoid you can salt the written down passwords. Bad actors are not breaking into your house. This also has the advantage of a significant other having easy access should something happen to you.

On prem enterprise level password management solutions are available for business uses that have nice features like auditing, alerting, change management, AD integration, etc.

@ Local Fool

I wasn’t pointing to you directly but I have noticed that every couple days someone posts the same theory or graph related to house prices, income or debt or the asset bubble chart and point to the impending housing crash in Victoria. And then like clock work, the bulls will post actual evidence of whats happened to the market in the past 4 years and how great of a place Victoria is compared to the rest of Canada and blah blah. This is pointless as the bears are posting theory while the bulls are posting actual historical evidence.

So if the bears are trying to make an argument about the housing crash in Victoria then they need to demonstrate verifiable concrete evidence. This is why I am suggesting the bears to post more content on actual “bag holders”. I noticed that when actual “bag holders” are posted, the bulls have much of a less rebuttal to go on, it’s usually Introvert saying how he bought in 2009 so he’s not a bag holder, yet.

Not a heroic position, since you are also fundamentally exempt from paying any spec tax.

It’s easy to be in favour of taxes that apply to others.

Expensive, luxury properties typically take up to two years to sell and this is expected and not because the price needed to be lowered repeatedly so they could be sold within six months.

Charging people who are BC residents and bona fide sellers spec tax merely because it took them more than six months to sell their property seems pointless, punitive and ridiculous to me. I find it surprising that you are defending it in this hypothetical circumstance.

We already make those in the top income bracket pay 51% tax in BC so what’s the difference between that and someone paying the spec tax because their $5 million vacant property doesn’t move in 6 months?

I am all pro business, low taxes, small government but not a huge fan of properties sitting vacant. Fundamentally I don’t mind the tax.

Plus, even years before the notion of the spec tax I was always pro renting recreational properties versus buying so the cottage spec tax sob story isn’t really something that grasps me either.

There’s a type of mob mentality going on with bears, too.

I disagree. If support drops for the Greens in the byelection it could very well be because a chunk of would-be Green supporters strategically voted for the NDP so that the GreeNDP government stays in power. In fact, the Greens don’t have a hope of winning that particular seat, so I question their decision to even run a candidate given what’s at stake.

Theory and graphs is generally all the bears have to go on. The real world has provided nothing but butt-kickings to them since 1981, basically. Sure, there have been downturns over the years but prices never dropped dramatically, whereas the run-ups have been dramatic.

Obligatory disclaimer: this downturn could be different. (But I doubt it.)

Marko, you’re a beauty. Your frankness is always a breath of fresh air.

How long did it take you, Marko? 🙂

Expensive, luxury properties typically take up to two years to sell and this is expected and not because the price needed to be lowered repeatedly so they could be sold within six months.

Charging people who are BC residents and bona fide sellers spec tax merely because it took them more than six months to sell their property seems pointless, punitive and ridiculous to me. I find it surprising that you are defending it in this hypothetical circumstance.

But you didn’t answer my question which was “did you ever have a real estate listing that took more than six months to sell?”

I think the spec tax might be working…

A few months back I was over in Van (in an area not included in Van’s Empty Home Tax) and walking through a very small neighborhood I know well – there were 3 houses with for rent signs – I can’t remember ever seeing this.

Last weekend I was back over in Van and took a walk through the same neighborhood – all the places were occupied and rented. Coincidence? Perhaps. But due to the timing, I think it was likely due to the spec tax.

Marko: I read your article on buying investment condos and I was impressed both by the content and the clarity of thought. I am not an expert or anywhere close when it comes to condo investments but you seem to be giving very clear and sensible advise and I commend you on that.

My question for you, considering the run up of condo prices in the last couple of years, do any condos in the core still fall into your categories of sensible investments?

Marko, have you ever had a RE listing that took more than 6 months to sell? If that isn’t a primary residence for your seller, and it’s empty, they may pay spec tax on it. Are you OK with that too, as anyone should be able to sell a house within 6 months.

Yes, I am, if you are taking longer than 6 months to sell a vacant home under normal circumstances your price is too high.

Any if the circumstance aren’t normal, like death, plenty of expentions for that etc. ->

https://www2.gov.bc.ca/gov/content/taxes/property-taxes/speculation-and-vacancy-tax/exemptions-speculation-and-vacancy-tax/individuals

How many renters in Victoria have seen what their net worth could have been—and what location they could have afforded to buy into—get obliterated, go up in smoke, by the previous couple of run-ups? It’s probably because they thought gravity always applied here, or that they could time it just right. What a horrible, possibly life-changing, financial disaster.

some one is mad … why so emotional? .. that statement alone proves something in your personality

Marko, have you ever had a RE listing that took more than 6 months to sell? If that isn’t a primary residence for your seller, and it’s empty, they may pay spec tax on it. Are you OK with that too, as anyone should be able to sell a house within 6 months.

Since I’m basically the one doing it, I’ll presume you’re talking to me. 🙂 I don’t really agree. Personal experience and anecdotes have their place and carry high emotional weight, but actual market data is far more powerful than anecdotes of tour buses filled with Chinese RE investors, or people asserting their home values doing this or that. This is why I’ve been able to tell you over the last year that the decline is not merely a “bump”, because the meta financial data in RE and other durable goods clearly shows it isn’t – despite your home’s value potentially going up in that time. And it’s not hard to look at this data, either. Anyone who has, knows exactly what I mean.

The theory is just about education, and the demonstration that time honored principles of markets and human behavior don’t merely disappear simply because people can’t imagine they apply anymore. And I know, it sure felt like that here for some time. For those that don’t like that kind of info or think it shouldn’t be on HHV – don’t read it, and/or throw it out like yesterday’s garbage.

That information is intended as a demonstration of a principle, i.e. what happens when a market turns. It’s not meant to show what the general market is doing per se, which is why I don’t post that stuff often. I’ve called it “chewing gum” in the past, and at least some people are interested in it. But sure, some will take it as a good market gauge on its own (it’s not), others will use it to feel a sense of hope in seeing those examples, still others will feel a sense of schadenfreude watching “those greedy bastards” get their faces ripped off in the market. To each his own, but identifying Hawk’s “bag holders” shouldn’t be the primary focus if your goal is analytics. But…I will post more as time goes on.

I really think Marko is giving great advise, find a hungry young realtor who will spend hours with you.

Just curious. If vacancy rates rise, and it is harder and takes longer to find renters at a fair market price… if one of your units is empty for 6 months in a year, despite your best efforts, you’ll need to pay spec tax on it (on top of you getting no rent). Would you be OK with that happening to you and other landlords?

lol…..how would you not have a unit rented in 6 months despite best efforts? If I can’t rent for $1,500 a week later I am at $1,400, a week after that at $1,300…..etc,, I can’t picture a scenario where I haven’t rented one of my units in 4 to 6 weeks. It isn’t rocket science, lower the price until it is rented.

This is my personal strategy -> http://victoria.citified.ca/news/stay-small-a-guide-to-buying-an-investment-condo-in-victoria/

The mortgages are small so it is hard to run into trouble. Even a 50% drop in rents would easily be managed.

As for landlords who bought into places where the numbers don’t make sense, they are cash flow negative and they need crazy rents to sustain…….not my problem. Should have thought about that when they purchased. With the market going flat a lot of stupid purchases from the last few years will be exposed.

Here, a New Cartoon that I though was Victoria appropriate.

Use a password manager.

It isn’t just the passwords, all the interfaces are different so you have to navigate around this crap once a year. Just creates inefficiency.

Rather than another BS department why not hire more nurses/train more GPs. The way they’ve set up administering the spec tax just seems like a massive waste of money. It literally has zero common sense, kind of like when the foreign buyer tax was applied in Vancouver to unconditional contracts.

Just curious. If vacancy rates rise, and it is harder and takes longer to find renters at a fair market price… if one of your units is empty for 6 months in a year, despite your best efforts, you’ll need to pay spec tax on it (on top of you getting no rent). Would you be OK with that happening to you and other landlords?

Has anyone on here sought out a realtor licence just to buy and sell their own home?

You could get up an running for about $6ish so numbers wise it would work. Just a matter of how much your time is worth. If you are smart you can blow through the course in about 3-4 weeks. If you are average it will take you about 3 months.

If there’s 0 incentive to buy without a realtor then why do I hear of some people doing it? Sorry to sound naieve but if I can find the house on the internet myself, view it at an open house and compare other sales and my own finances to base on and make an offer, then why would a listing agent keep 100% of the commission when a portion of that would have otherwise been paid to my realtor if I had one? If you’re listing a house and a buyer walks up without a realtor wouldn’t there be some positive gain from offering them a % of that commission to make the sale? Deal for them / deal for me. Or does this just not happen? When I Google it there’s a lot more scare tactic articles making it seem like I’m going to buy a secret grow-op if I don’t have a buyer’s realtor.

With the new rules there is just so much paperwork to go over with unrepresented parties that it is a huge pain. The listing agent could just email it for review but the Real Estate Council is just waiting to roast agents getting involved in double-ending (different from dual agency) that if you don’t sit down with people to explain everything and dot every i you will get roasted sooner or later.

Essentially the Real Estate Council wants to eliminate double-ending, their goal is that everyone have their own representation.

So as a listing agent you spend all this time with an unrepresented party for them to write a lowball.

Now you have to go to your client, the seller, and before your present the offer to them you have to present the commission disclosure. So you are showing up to your clients’ house with a massive commission disclosure (double what you would normally make) and a lowball offer, I am sure that will go over super well.

Your alternative as an agent is to decrease the gross commission to 50% but then you are taking on a much large amount of risk and you are making the same amount as if someone was to come with their own agent (a lot less work for the listing agent) so why just not encourage everyone to get their own agent?

With the new rules you are just going to run into one roadblock after another trying to make lowballs directly through the listing agent.

My suggestion would be get a newbie agent who is broke and willing to write up one lowball after another until your are successful.

Marko: My typo, where is that second cup of coffee, it is 2060 Beach Drive and the Realtor .com has the original listing price as 1595. Did they drop it some point in between?

I think bears needs to post less theory and graphs on bubble busts etc in general. This is because the bulls will just come with the rebuttal of “my home prices increased 50% in the last 4 years” and “Victoria is different from the rest of the world”. And right now those two latter points carry more weight than all those theory and graphs.

Bears needs to identify more local “bag holders” which are increasing in number and also bag holders in Vancouver in the lower end of the market (someone selling their house for $3 million what they paid for instead of $4 million is more or less irrelevant to Victoria compared to someone selling their house in Richmond for $750k when they bought for $1M 2 years ago.)

Use a password manager. In fact, everyone should use a secure password manager to help reduce the possibility of an account being taken over. Password managers are also very good at helping to spot phishing attempts by not providing login information to a bogus website. LastPass and DashLane are some of the popular ones.

https://www.pcmag.com/article2/0,2817,2407168,00.asp

In terms of the spec tax I don’t have a fundamental problem with it. I live in my house and I rent out my condos long-term, but the paperwork is going to be super annoying. Between all the crap I already must do; corporate taxes, personal taxes, WCB, payroll for my employee, etc., etc. it makes just logging into all the different municipality websites to pay municipal taxes annoying. Victoria has “MyCity Online,” others have some other crap. I always forget the passwords.

Now add more paperwork, another useless bloated inefficient government department to oversee.

In my opinion in terms of unnecessary bureaucracy this is stupider than the Liberal $37,500 interest-free loan program. Who knows how many people are sitting around downtown Victoria doing nothing still maintaining the program even though it has been cancelled? At least that program was optional.

This seemed timely:

https://www.smbc-comics.com/comic/the-real-villain

Not usually housing-related, but SMBC has lots of clever humour…

Speaking of low ball offers, 260 Beach drive sold. Asking 1,595; sold for 1,175.

I guess they were not that offended. Assessment 1,455

Unless I am missing something the asking price was $1,195,000 so $ 1,175,000 is not really a low ball.

In terms of the Nanaimo election, I will be surprised if the NDP dont win. But equally important will be how the Greens fare. If there is a marked drop for the Greens support then they will have to rethink whether supporting the NDP is hurting more than helping.

On the contrary, that statement doesn’t go far enough. Stupidity, especially in financial matters, is a beautifully universal trait of our species. Welcome to the club.

Of course, your friendly cohort of “bears” are therefore in good company with the rapidly growing population of “financial idiots” who overleveraged on housing and are now losing hundreds of thousands of dollars, and in some cases millions of dollars.

I’ll also add that someone’s perspective on the short to medium term future of the housing market vis-à-vis their perspective on various tax policies, aren’t necessarily synonymous.

West coast cities in general, fared the worst in terms of declines, and recovered the strongest. Many cities in that region have since exceeded the heights of HB1.

Speaking of low ball offers, 260 Beach drive sold. Asking 1,595; sold for 1,175.

I guess they were not that offended. Assessment 1,455

I found it interesting that the number of millennials exceed the number of boomers (actually there was a note of sadness there.as I thought of lost friends). But that lead me to a second thought regarding housing in Victoria.

There has been a lot of speculation here that one of the reasons for the increase of house prices is that there has been a wave of asset rich boomers who are retiring here in Victoria. Personally I think there is a lot of truth in that position.

Still on my first cup of coffee but what struck me is that (assuming boomers were born between 46 and 55)is that the vast majority of boomers have already reached retirement age. That flood of retiring boomers should be turning into a trickle over the next couple of years. Put another way, within two years every boomer will be at least 65. The significance of the fact that there is more millennials is simply put that the boomers are dying out.

I think we are going to see a noticeable impact in the next five years on the SFH market.

Obviously death frees up the house but equally significant and what moves the time chart forward a lot of years is downsizing or entering nursing homes. The fact of the matter is that only a small portion of people remain in their SFH after age 75 and that number really decreases by age 80. To paraphrase Will Rogers famous comment about land, the thing about boomers is that they dont make them anymore.

I understand the frustration of millennials but the fact of the matter is that your day has finally come. Over the next five years you will be the ones buying SFH because we have simply run out of retired boomers. The houses will have to be affordable for you because because you are the market. Having waited and worked hard you will also enjoy having the next generation snapping at your heels and complaining how you are hogging all the housing and how unfair that is because you inherited all your wealth from the boomers. Have fun with that.