The Owner Builder Exam

This post is based on the information gathered and work done in this area by Marko Juras.

Each year Rich Coleman – our Minister Responsible for Housing – pens a letter to BC Housing laying out their mandate for the year. Last year he reminded them that as a public sector organization, they were bound to the Taxpayer Accountability Principles which state that their actions should be consistent with government priorities and be executed efficiently to respect the taxpayer’s dollar. Unfortunately it seems like that letter fell on deaf ears.

You see, BC Housing has a department called Licensing and Consumer Services (formerly the Homeowner Protection Office) that amongst other things administers residential builder licensing. For a builder to get licensed they have to show experience in building and continue to receive training (such as on this arduous Caribbean cruise) to maintain their licenses. An exception to this has always been individuals building for themselves – the owner builder – who merely had to pay BC Housing for an Owner Builder Authorization. In the last 15 years, some 45,000 people went that route in BC.

Clearly the idea that that many people could build their own home relatively unmolested by the government could not stand, so last July BC Housing introduced the Owner Builder Exam. This 100 question exam requires 70% to pass, and you only get one attempt for your application (you get a partial refund if you fail but then you have to re-apply). BC Housing justifies this test saying it protects the consumer, helps owner builders expand their knowledge base, and creates a more level playing field. This sounds great, other than the fact that it is complete and utter nonsense. Let’s examine these justifications in detail.

Protect the consumer. For the consumer to be protected, the consumer must have been harmed to start with. The Homeowner Protection Act already makes the owner builder responsible for construction defects in the home for a period of 10 years, similar to third party home warranties. This means buyers of owner built homes are already protected as well as any buyer of a new home. In addition, BC Housing does not cite a single instance of any harm that has befallen the consumer from owner built homes.

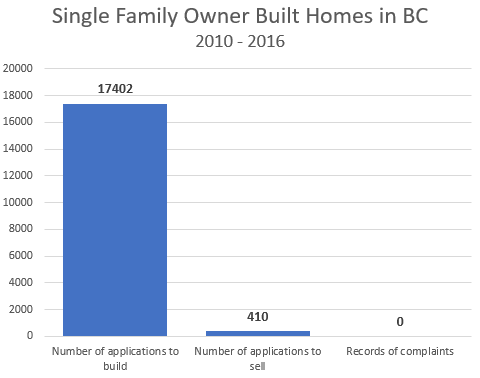

To dig further into this, a freedom of information act was submitted on December 6, 2016 requesting the number of owner built houses constructed and sold, as well as the number of consumer complaints received about owner built houses from January 1, 2010 to June 30, 2016. Here is the response and the results.

Several things are clear from this data.

- Compared to the applications to build, there are only very few applications to sell owner built homes. So either there are massive number of illegal sales (extremely unlikely as that is trivial to detect through the land title office and fines for sellers and realtors are huge) or owner builders tend to build their dream homes to live in long term.

- BC Housing has no record of complaints so it has no basis to surmise there is any problem at all with owner built homes. Given they aren’t doing their jobs to justify new regulation, let’s see if we can find any evidence of widespread problems with owner built houses. According to this recent article, there were only 2 court cases related to owner builders in the last two years, and the first case where a buyer successfully sued an owner builder based on the statutory warranty was in early 2016. Meanwhile according to BC Housing, 0.2% of homes built by licensed builders result in complaints (that would have been about 23 complaints in 2016).

If people are building homes to live in long term they are unlikely to cut corners and compromise quality during construction to start with. Even if they wanted to, building a house already entails layers upon layers of checks and balances to ensure that they are built properly. All the drawings have to be drawn by a designer or architect and engineered by a structural engineer and then double checked by city inspectors. Structural engineers also typically make 4 to 5 site visits to conduct onsite inspections and building inspectors check every stage of construction to verify it is being built to the plans and to code. Even if they had motivation, it would be extremely difficult for any owner builder to build a defective or sub-par house.

Help owner builders expand their knowledge base. Owner builders may not have a construction background so on the surface of it, this seems like a worthwhile goal. Unfortunately the exam does absolutely nothing to help the owner builder. Here’s why:

- BC Housing has not provided a study guide, only vague topics that the exam covers. Clearly the purpose is not to educate since they are making no effort to do so.

- Questions are often either completely irrelevant (“What is the second law of thermodynamics?”) irrelevant to the type of house that is being built (“When are furring strips required for vinyl siding?”), have answers that depend on the municipality you live in (“When should you apply for an occupancy permit?“), or reference technical minutiae of the 966 page BC Building Code (“What is the moisture permeability of 6mil poly?”) that any sane person would look up and not memorize.

- Exam results are not released to the owner builder. How can you possibly learn if you don’t know what you didn’t know?

Even if some genius home owner could memorize every single nailing pattern and framing bracket how would that help them build a better home? Will they be going around arguing with the structural engineer on design, or with the professional framer on which type of nails to use, or will the city inspector waive his or her framing concerns because the home owner has passed an exam and knows nailing patterns?

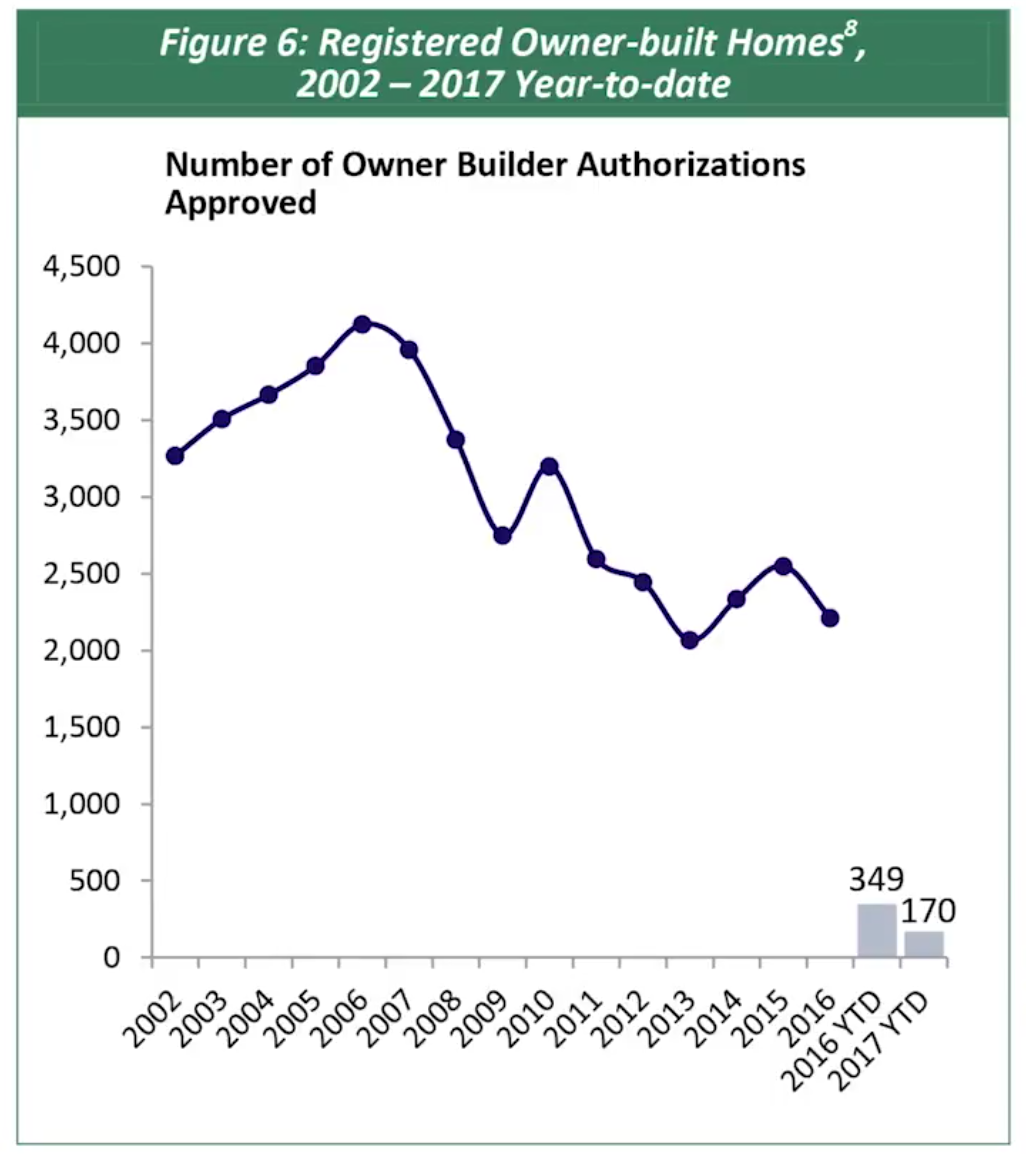

Create a more level playing field. Even though the exam was introduced July 4th, 2016, 2016 was the second lowest year for Owner Builder Authorizations ever. 2017 will certainly be the lowest, while builder homes increased substantially. You put up enough inane hoops for people to jump through and many people will just give up and hire a builder instead. So instead of creating a level playing field, it seems this exam has heavily tilted the playing field towards commercial builders and has made it unnecessarily difficult for someone that just wants to build their own dwelling.

In summary, the owner builder exam:

- was introduced to solve a problem that doesn’t exist,

- will do nothing to improve the quality of owner built homes,

- will cost people thousands of dollars in lost time and money, and

- creates a costly new program and red tape that must be administered by BC Housing.

Why would they introduce a program that increases the cost and time to build homes when the government is loudly touting their efforts to improve housing affordability? Why would they introduce a useless exam and tons of additional bureaucratic hoops while they plaster the Internet with ads proclaiming to be looking for ideas to cut red tape?

Normally I hold to the idea that most policy is introduced out of a desire to improve the system, but the situation around this exam is suspicious. It gets more so when we consider that 8 of the top 10 donors to the BC Liberals are in the development or construction industry. Cutting down on the few thousand homes built by owners in BC every year would be greatly in their favour, and considering there is no logical reason for the exam, it makes you wonder what other motivation there may have been.

The quotes interspersed in this article are just a tiny sample from the over 500 emails from British Columbians that Marko Juras has received on this issue including some truly heartbreaking stories from people that have had their plans for building their home jeopardized.

This may seem like an obscure issue to many people, but I feel like it impinges on our basic freedom to pursue our passions and dreams without undue interference. Constructing your own shelter seems like a fundamental right and a way for people with the right skills to afford a house they otherwise never could. Especially in rural BC where land is cheap, construction skills are common, and testing centres are a day’s travel away, this exam is having a real negative impact on British Columbians. I don’t think that can be allowed to stand.

I am currently homeless and have a plot of land. I couldnèt even get a contractor if I could afford it anyway. I am going to study for this test but man what am I to do if I don’t pass? And I’m reading it takes 3 months to take exam? My family has built several homes and I need a home to live in!!! Has anyone challenged this? I can’t even get a building loan if I don’t have a owner builder permit or a contractor. I donèt know what Ièm going to do if I don’t pass.

This is implemented to discourage owner-builders and manipulate the housing market. This was implemented to assist medium- to large-sized construction companies, financial institutions, and housing market control. Now the government and financial institutions are controlling the housing market through developers and builders. They reduced inventory in order to raise housing prices and then created a false perception of foreign buyers in order to impose taxes and fees. It also aided them in creating false inflation in order to promote a false recession, giving the Bank of Canada the opportunity to raise interest rates.

There was no need to increase the interest rates. The interest rate was increased to help cover the screw-ups of the government and the Bank of Canada by giving the money to everyone, including large enterprises during COVID, which wasn’t necessary. The COVID free money should have been distributed to the affected households on the basis of their last year’s household income, not to everyone.

Now, by inducing false inflation and raising interest rates, we are contributing to the recession in order to assist financial institutions, large investors, large enterprises, and multinational corporations in repaying debts and financial aid from the COVID that they did not require.

The Bank of Canada should bring the interest rate down to mid-2022 levels. They should ask for audits of the money given to people and businesses during COVID. Some people never make between $1500 and $2000 per month. But they still got around $2000 per month from the government for doing nothing. Some people purposely didn’t work or didn’t go back to work after the pandemic was over just because they were getting free money. Some were working on cash and still receiving money from the government. I think the government should start doing audits and get the money back that was given to people and small and large businesses instead of increasing interest rates and imposing false inflation and recession.

I plan to fail and then sue the BC government over this stupid test. wish me luck.

Hi Lawren. I haven’t approached the BCREA about it, but I can’t see why they would be interested in going to bat for it. Doesn’t really affect their members.

Has the BCREA tried to have the policy altered? Has anyone approached them about this?

BC Building Code. One can view it at any library. Most have 2 copies on hand in the reference section.

I recently took the exam in Castlegar. I studied the flash cards that were available online (thank you Mark) and studied part 9, section 20-24 of the BC building code, as was suggested by BC Housing. I know that there are 2 day courses offered in towns like Vernon, Prince George, Surrey, etc. but the closest is I have taken many multiple answer exams over 40 years in the oil patch. The companies I worked for made us do these exams because they wanted to educate their workers so that we would have a good understanding of what we needed to be aware of

Problem is with this real estate boom, so much shoddy work was getting overlooked and innocent people are spending way too much of their credit for possibly poorly built homes.

You are making the false assumption that shoddy work has been done by owner-builders when in fact it is for the vast majority licenced builders.

I don’t like the man telling me what to do as much as the next guy. Problem is with this real estate boom, so much shoddy work was getting overlooked and innocent people are spending way too much of their credit for possibly poorly built homes.

I went through the process of the new owner/builder system successfully and will say this: “The application, test, and requirements of the owner builder permit are minimal compared to the challenges of actually building a proper house.” It’s just another step in the process and hardly the most difficult one.

Totally agree ,and surprised there has not been more opposition to the whole warranty thing even before the exam.

So hey the new housing minister is Selina Robinson… Maybe some emails, phone calls as well as your local mla might see some results..hopefully..

Dc

This is very honest and logical analysis and assessment of the owner builder authorization examination. I agree with every word of the article. there is no justification for making this law and I strongly support abrogating it altogether . I think the criteria of passing the exam is also undemocratic. Why not making the pass is just any mark above fifty percent like the pass in elections for presidency or for ruling the country which is way more important than building a house.

I feel this new test system is Bulls hit in2010 I was an owner builder not one problem and now I am selling to downsize only to run in to this we can not allow this to keep happening

Has anyone received a response from an MLA on this? What was it?

I just thought of something else fishy about the exam results.

Who does the audit of the exam results? If one is not allowed to take away a copy of their completed exam when completed, or get it back following marking, not only do they not know which questions they may have gotten wrong, they also can’t be sure they got any wrong at all.

If BC Housing are responsible for their own audit of the completed exams, this opens it up to the potential for fraud – no evidence?

I stand by my own conclusion, the requirement to write an exam such as this must be dropped. If the cost has increased to potential owner builders who have taken the exam, over what they would have paid to receive the authorization before this exam was instituted, I believe all excess funds paid must be refunded to those who paid. This has been a failed exercise.

Again I urge all to phone their MLAs and follow up with email or written letter NOW.

In response to a comment posted earlier:

“We are wanting to fight the hpo it is against our rights and causing huge delays in our build!! How do we get around this?

Thank you

Thomas Leddy”

To everyone who has posted to this article, please do the following as quickly as possible:

Phone, don’t just write, your MLA’s office, especially if your MLA is not a Liberal. Tell them you wish to have them make themselves aware of this issue and then work together to strike down the requirement to have the exam written. Get the name of who you speak with and ask them to follow up with a phone call or an email as early as possible.

Write your MLA’s office to follow up the phone call if you don’t hear back within a week. Do this on paper or by email. Follow this up with a phone call in a few days.

It’s now October 19th, 2017. PLEASE DO THIS NOW. There is great strength in approaching as many MLAs at one time to have this requirement overturned. One issue not mentioned in the article is that the program is incredibly poorly funded and managed. There are not enough people working to even accomplish simple title searches to confirm ownership of the intended building site. Another requirement is that the person writing the test for authorization must have their name on title, which forces people with spouses (of any form) to have the most likely candidate for passing the test on title – something that every couple may not want to be the case.

LET’S GET THE NDP/GREEN GOVERNMENT TO TOSS THIS EXAM REQUIREMENT IMMEDIATELY!!! PHONE AND WRITE NOW. Tell any friends or acquaintances about this. Post this article to your Facebook page and ask that it be widely shared.

Fabulous and relevant article, I applaud you in writing and publishing it! I will be pushing it “out there” as much as I can, as my partner is facing the delays of this absurd requirement, along with all of the subtrades who could be working on the new home NOW!

This requirement should be scrapped, as their current manpower can’t even check a property owner’s legal ownership of the land title when given a month to do so, hence one of the exam writing dates is missed, pushing the entire building process a further month back.

@Dave. Maybe there is a chance the new gov’t will take a second look and realize it’s a broken system. Keep talking to the MLAs…

So this is crap! I have built three homes over a 35 yr span.. Now you have to own the land before u can even apply and they can say no to,allowing u to build at,that stage, and if u get through that hoop then the test so if u dont pass u are now stuck with a lot… Or,have to,hire a builder .. So who is the winner here ? Builders! Realtors. Hmm wonder which one lines politicians pockets the most.

And dont we live in Canada isnt it my right to build a house? Yes i have to follow building codes etc. In my homes i hired the same sub contractors the “builders” use had them inspected by municipal inspectors. Are they trying to,eliminate the local inspectors?

Building a home should be my right as long as i follow the codes.

Having a stupid test as some of the ? Examples on cabinets? Flooring paint.. These are not even nessasary to,have … Let alone anything to do,with struture or intergrity

And if i build a house it is usually over built… And yes i warranty it if i were to,sell it before the 10yrs.

How many stories out there stating that warranty on homes isnt worth the paper its written on just another money grab.

And yes courses are available at $800 ish money grab again

Congrats Angryob on passing. Figures that it just stinks all the way down.

A little bit of related information. I took the only course on the education registry at https://lims.bchousing.org/LIMSPortal/registry/Education/Default.aspx?searchBy=offering&offName=Owner+builder&offProvider=CPD&offTf=Any&offArea=Any&offPoint=0

This course is 800 dollars, two days and the guy who taught it is the consultant used in the exam questions. He even has screenshots of the start and end of the exam and told us he wrote some of the questions. This seems to me to be a conflict of interest. A firearms licensing course is also 2 days, but doesn’t include the horrible hotel lunch and is only a couple hundred dollars. What a scam this whole thing is.

Felt bad for the lady at Douglas college exam, she said people had yelled at her until she told them that she didn’t work for bc housing. I passed so there is hope.

Thanks Leo.

I noticed an earlier post of yours that said 1/3 of the folks who take this test fail. After looking through those questions, is it any wonder?

I feel sorry for those poor souls who failed this exam; They are probably shrouded in shame, when in reality the ones who should be truly ashamed is the electorate that gives power to these senseless, foolish and power hungry clowns who have the audacity to force us to take an exam that is not required for our role and then hide the results from us. Worse still, they do it under the pretext that it is for our good.

Reminds me of Reagan’s view of the role of government… If it moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it. In this particular case, it might be even more sinister.

It used to be that people in leadership were those who actually previously worked in the Industry that they lead. But now a days position is more a reflection of desire and connections than aptitude. Here we entrust a lawyer with telling us what we need to know to build a house. Shame on you BC Housing! Shame on you Minister of Housing for letting this atrocity continue under your watch!

The options for some of the questions can be so close that even a seasoned builder will struggle. In some cases, more than one answer is technically correct. Take the question on the Perimeter drain – should it be below the bottom or top of the floor slab or bottom of the footing? Well if it is below the bottom of footing, most likely it is technically below the bottom of floor slab as well and it may actually be even better that way. But since the code says below the bottom of the slab, that is gospel for these clowns who don’t understand the theory behind it. When we give power to these people, we end up with cases like this one…

http://www2.gov.bc.ca/gov/content/industry/construction-industry/building-codes-standards/building-code-appeal-board/building-code-appeal-board-decisions/bcab-1345

This is exactly why they hide our results. They don’t want us to challenge the results on an exam that we shouldn’t be forced to take in the first place.

In all honesty, explain to me how I can have any respect for this kind of leadership? I am not trying to be rude. I am simply telling you this is a ridiculous mandate! One that makes absolutely no sense.

I hope those with the power to change this are listening!

Cheers!

Thanks for posting Imur. Truly ridiculous. Good thing you know what kind of gas they put into windows though! Can you imagine what a disaster your house had been if you thought it was nitrogen?

After waiting for almost 3 months, I finally got an invitation to write the exam. I will give a sampling of the questions asked and you can decide for yourself what kind of people we have as our leaders in government…

1) What is a design that aids Rainwater deflection?

2) What is required to work in a site with chemical hazards?

3) When is it NOT acceptable to inspect a waterline?

4) Top of the Perimeter drain tile should be below the bottom or top of the floor slab?

5) Does Radon gas have a color or smell?

6) When a foundation wall thickness is reduced to accommodate a beam what bearing length is needed?

7) What is the best way to prevent a joists from twisting?

8) Are horizontal security blocking on an outside door needed on both sides?

9) What the fastener spacing required for Sheating? 12in on edge and 16in elsewhere?

10) What product can be used together to eliminate differential shrikage?

11) Disadvantage of using Clay roof?

12) Maximum allowed vapor permeability? 80ng/p.a? 60ng/p.a?

13) What is the gas b/t double pane windows? Argon? Nitrogen? Oxygen?

14) Sash hinged windows are called what?

15) Requirements to work on gas as owner builder is covered in what Act? Standard Safety Act?

16) Most efficient form of insulation? Batt?

17) Expanded or Extruded Polystyrene absorbs less moisture?

18) Shoring requirement of Worksafe BC is for excavation deeper that 1.5m?

19) Is Principle Exhaust optional?

20) Sanded grout over non-sanded grout – when to use?

21) Pallet stoves are more efficient than traditional wood stoves?

22) 2nd owner builder authorization 18 months after first issuance or occupancy?

23) Chimney lining sticks up on top by how much?

24) What happens if a plumbing inspection fails?

25) What happens if a electrical inspection fails?

Trust me, you don’t need to know all this off the top to build a house. If you ever need to know any of this, you can look it up. Besides, they don’t tell you what you got wrong. So how are you supposed to learn anything anyway. It is quite obvious that they want to reduce the number of owner builders competing with contractors. Begs the question… how is the government benefiting.

We Canadians must be really stupid to allow BS like this to go unchallenged. The person at BC housing who started this program should be fired in my opinion and we need to investigate why they started this.

Cheers!

I’ve been put in the “Queue” waiting on acceptance of my application.

Whey put this process in place when you don’t have the resources to run

it adequately? It’s postponing our build and costing me thousands of

dollars every week I wait. A complete failed program.

The author articulates his case clearly. Seems obvious to me that the government is violating the fundamental freedom to build a shelter for oneself. If the concern is that an owner builder would sell a bad product, they can enforce the disclosure rules they already have. Can we fight this in court? We should make bc-housing repay the time spent waiting for their approval to write their exam and also the time spent studying for this exam.

So even though I m a red seal carpenter for 30 years i still have to do this HPO exam if i want to build my families home ? So why even waste money and time going to school to be ticketed. Some ones fot their hands in the cookie jar

No way to get around it Thomas. They designed it so there wouldn’t be one. Just write to your MLA.

We are wanting to fight the hpo it is against our rights and causing huge delays in our build!! How do we get around this?

Thank you

Thomas Leddy

@Jonny67 – my understanding is that if you are doing anything that requires a building permit you need a license to apply for the permit. Guess who I didn’t vote for last week. .

This article has hit it right on the head of the nail. I live in rural BC and have already built a shop/suite and now need to expand my business and to find more b….sh…t red tape to build my wife a home where we can sell our business and retire and live our life out in peace. Honestly even my local building inspector thinks its stupid. Since he is the one to make sure this house is built properly and to code. But hey I guess we need more government people around doing nothing but bogging down the system and getting every second Friday off with pay because there job is so hard. I thought our government was here to help people not just try to get more tax dollars from them. It would be interesting to see if any of them could pass this test or even know how to pound a nail. It’s sad and I fear for my kids speaking of which one just had a certified builder do a addition and it was the most ridicules and expensive addition I have ever seen.

Update on the owner builders:

https://youtu.be/LbeSz7l2xTQ?t=8m30s

Some facts:

Only 1/3 of the applicants have passed the exam so far of the 1211 applicants. 1/3 are waiting to take the exam, and 1/3 were denied or withdrew their applications.

2017 Jan/Feb compared to 2016 Jan/Feb, owner builder approvals are down 50%

Clearly the policy is having the intended effect of decimating owner builders. In fact Wendy admits this: “Of course what we want to see happening is more licensed builders being approved”.

Well, this Owner Builder exam is clearly corruption at work, and means I won’t be moving to BC.

I’d just like to point out that PEI requires no building inspections at all outside the 2 cities, owner building is common, it’s both the windiest and snowiest Province, and owner-built houses don’t fall down.

@jonny67 – good question. It would need to come from an approved facility…but not idea on the HPO requirement.

How do these rules apply to getting a pre-fab home dropped onto the site. e.g., if I were to pour footings and install a septic system myself (or GC those jobs), could I drop a pre-fab house on site without having to go through this hassle?

New post: https://househuntvictoria.ca/2017/02/27/feb-27-market-update/

Haha….

Sounds more like you’re a non-survivalist

I admit to entertaining some apocalypse readiness. I am a sucker for the genre. Power independence would be a big part of that puzzle. Remember we have our own little apocalypse hanging over our heads all the time. Before you start to think I’m a survivalist, I have no stored water or food at my house right now. I have a first aid kit in the car though….

Nah, throw in a wood burner for when the apocalypse comes.

My plan is a 200 amp main and then a 100 amp for the garage. Garage and outdoor would be on that. I might put the charger in my plans as a rough in. So when the electrician who knows what he is doing sees the plan they can quote and plan accordingly. I might do conduit instead of cat5e etc to every room. It’s the question of propane or not to propane that’s driving me nuts. I hate hydro and it’s cost but all electric is so simple and I can generate my own, if I can afford the equipment…

I wouldn’t discourage anyone from predicting how/when the next downturn happens – speculating is fun and I may partake myself. However it’s worth acknowledging how terrible just about everyone on here (including myself) has been at foreseeing future housing moves. Keep in mind that no one on this blog predicted or even suggested the current rapid rise in prices could happen (okay maybe Michael’s one exception). That being said a thread on future scenarios would be interesting, but respectfully I just wouldn’t recommend people act today on what anyone on here (including myself) thinks will happen tomorrow 🙂

Personally I find it more fun (and easy) to predict what we won’t know in the future. I made such a prediction mid last year when I said that by spring 2017 we wouldn’t know if Vancouver prices are near the peak or near the bottom (still stand by that one!)

Is there anything between 200 and 400 amp service?

Yes, with overhead power you can pull 200 amps for the main home and 100 amps for the suite off the grid versus having a subpanel for the suite coming off the 200 amp main.

400 amp becomes expensive as you need mechanical room, etc.

Will write a new post on this with some simulations.

Is there anything between 200 and 400 amp service?

I believe it is if you sell the house within 10 years. Which makes sense.

You can build just have to register and if you sell the house you have to purchase a home warranty.

Hmmmm….makes sense.

Alberta: Apply to owner build, pay $750 and if you intend to live in the house for 10 years you don’t have to buy a new home warranty.

Saskatchewan: No regulation I can find.

Manitoba: You can build just have to register and if you sell the house you have to purchase a home warranty.

Ontario: You have to apply for a letter of confirmation in certain municipalities to exempt yourself from needing to purchase a home warranty.

Quebec: Need to be registered as a construction employer. As far as I can tell that is just $350 fee and standards you have to follow when hiring contractors.

New Brunswick: No regulation I can see beyond normal building inspections.

Etc. etc. I don’t think an exam like this exists anywhere else in Canada.

I’d put conduit in. Cheaper and more flexible when you actually decide on what to get.

I disagree. I would wire your garage with a Nema 14-50 right of the bat. Your panel will be clean and you won’t have to muck around later with someone throwing in a 50 amp breaker and also your electrician will need to calculate max load right off the bat factoring in the 50 amp breaker. You’ll also have it all inspected depends on the municpality you live in……where BC Safety Authority is responsible it is hit and miss. A lot of the time the BC Safety Authority inspectors don’t even show up.

Doing if afterwards becomes a huge pain especially if you get another electrician to come in. They have to go around and figure out heating, all your appliances, etc., to determine max load.

Marko or others – any idea how BC compares to other jurisdictions when it comes to regulation of owner builders? Are we now an outlier with this exam?

First province to introduce an owner-builder exam.

I thought the tesla wall charger pulls 80A

Pulls whatever you want it to pull (based on the size of breaker you install). For me at 50 amps it put my max load 199 amps and I didn’t want to go over 200 amps max load, have the house burn down and not get insurance. Problem with electric car charging is the calculation for max load is very high (80%). If you have a 50 amp breaker you go 50 x .8 and it takes up 40 amps of max load. Other things you multiple by a smaller ratio factor.

Marko or others – any idea how BC compares to other jurisdictions when it comes to regulation of owner builders? Are we now an outlier with this exam?

I just use the Carlon PVC. It’s not super cheap – but I wouldn’t build a new home without at least one home run to every room.

Thanks Marko, no gas to the line. I am thinking some propane for some things but want to be all electric able because solar is going to be the way and I might not have it now but will eventually. Anyway, food for though…

@Sidekick, what did you use as conduit? Smurf tube looks expensive.

+1 on hawk capitulation this year

Prediction 1: House prices take another 15-20% jump this year. Then prices slide 2-3% per year for the next few years, as interest rates start edging up.

Prediction 2: Hawk finally capitulates. He cashes in his famous portfolio, gets a big mortgage, and buys a run-down 1950s house for $1.5m later this year. This marks the top of the market.

I think this spring the demand level stays the same but listings continue at their slugish pace. The average shitbox in gordon head reaches 1 million. That’s when the market takes a sudden dive. Everyone panics over this crazy 1 million price tag for a 1970s split level with no en suite, tiny rooms and that stupid long hallway that wastes all that space. Don’t forget the oil furnace! Anyway then the bears swoop in and buy a GH shitbox for like 50k. At this point I also buy in and rent a couple of bulldozers to take care of those crapboxes.

“Leo, how do you personally see a correction playing out?”

This is what I’d like to see people on this blog predict. What are the top ~5 scenarios likely to play out in Victoria? I always find myself flip/flopping between Hawk (coupled with disbelief every time a new high is reached) and the Bulls (low inventory of decent quality, my neighbours x 3 waiting to buy).

I throw some speculation out there when I have a few minutes.

I’d put conduit in. Cheaper and more flexible when you actually decide on what to get.

And conduit between you mech room and all the other rooms. Saved me a couple of times…

I thought the tesla wall charger pulls 80A

Hey Marko, can you remind me of your recommendation for being electric car ready again?

Unless you have 400 amp power do as many gas appliances as possible…..I even did gas dryer to take load off the panel. Then if you don’t have a make of electric car in mind have a Nema 14-50 installed in your garage on a 50 amp breaker. Electricians will tell you “the code already requires a car charging plug,” but it’s only a Nema 5-20 which is essentially useless. Charges a Tesla at 8 km/h instead of 6 km/h Nema 5-15 (regular household plug).

I have a friend building a house right now and he is doing three Nema 14-50s in his garage.

If you have no gas at property line but no suite you’ll probably be okay too with 200 amps too.

Hey Marko, can you remind me of your recommendation for being electric car ready again?

I bought my building lot in 2013 and starting building in in 2014 before the exam. I don’t think I could pass the exam, but my house turned out really well and I haven’t had one problem with it. Even being a 2014 build I put in contigencies for electric car charging, two cat 5e wires to every single room in the house, etc….that is my problem with the exam. Building a house is about common sense not memorizing the code book.

I can get over seeing a house for sale, sold the. seeing it listed for rent on used Victoria or Craigslist. (Over and over again). Astonishes me that people would pay $3,000 plus to rent a house and owners are coming out profitable. I could see a suite or floor of house but buy a house to rent the whole place out in this market….I guess as long as low vacancy and low mortgage rates it’s an attractive investment??

…with the capital gain increase dividends and stocks and the use of TFSA seem more attractive to me?

http://www.usedvictoria.com/classified-ad/1912-Character-Home-in-Fairfield_28952697.lite

Marko, did you pass the test ?

VicRenter, it’s one of the few times I left out “average” prices dropped 20%. As per Ross Kay HPI is a trailing number and misses the important early indicator of large money leaving or entering the market that average prices show as HPI is 6 months or more behind.

Sales high of last spring of 1200 range and now 500 range shows Victoria is close to entering the same Vancouver decline phase as peak FOMO passes.

Open houses were blocking driveways with 40 cards on the table a few weeks ago according to Marko. Looks like a change is in motion if Oak Bay is dead.

Leo, how do you personally see a correction playing out? Prices go up to the point where the market finally stalls somewhere in 2018/2019, inventory starts to build as a result, demand drops off as people realize prices aren’t going to keep going up and prices start falling until affordability goes back to historical norms?

I wonder how many serious house hunters go to open houses in a market like this and I therefore also wonder how reliable an indicator of interest the number of people at any given open house might be. Since good places are selling so quickly, anyone who might actually buy a house would surely see a place they’re interested in with their realtor as soon as it comes on the market, no? Waiting to go through the open house on a Saturday when offers are due Sunday or Monday seems stupid/unlikely.

“Vancouver’s 20% drop”

Hawk, you’ve often sited this number for Vancouver. But this weekend’s Globe says that Vancouver SFHs are only down 6% since July 2016. I’m not denying that things have slowed down in Vancouver but it doesn’t seem to be nearly as desperate as a 20% decline.

Went to a couple of open houses in Oak Bay, not a lot of people there. Might be too early in the season or perhaps a slow down in buyers.

Another email I received last night re owner-builder exam….

“As for the program, I have long suspected that the insurers (New Home Warranty/ Travellers/etc) have always had an incestuous relationship with the former HPO. If you look at the history of the HPO you will find former private home warranty insurer employees in important positions at HPO. This would be acceptable to gain experienced help to a new department. What has happened is that the HPO has appeared to adopt “carte blanche” most of the insurers home warranty criteria. (practically verbatim) This would be of course in the best interests of the insurance company. I would say if you were investigating corruption the best place to start would be with be insurers.(National Home Warranty and others) They have the most input to the program and also the most to gain because of their clients (licensed builders) have to insure”

The crash meter is relevant to Bearkilla’s increase in posts the last month as his Langford slum dumps lose value faster than all the piles of price reductions on the nice places out there no one wants. Might as well torch’em Bearkilla, might get more on insurance. 😉

I don’t think we will see a correction this year. I just can’t imagine what combination of factors could turn the market around that quickly outside of global recession.

The correction could be as early as next year but I suspect 2019 is more likely based on previous run ups.

I also think that the next correction will be very unlike our previous two plateaus, Without massive drops in interest rates, prices will drop significantly to get affordability back in line.

I agree with Hawk here. The number one sign that a market is imploding is low listings, high demand and rising prices.

I don’t deny it’s insane but the insanity is happening. The POS we are renting sold for way too much, instantly, with no inspection at all. Poor quality reno throughout. Fridge leaks, stove top broken, sink leaks, dishwasher sucks, washing machine stinks (we bought our own). It’s just not worth slightly south of a million. Yet…. that’s what it sold for.

Saanich East listings are the highest in months Dasmo, as well as Oak Bay. It’s still technically winter and March/April will only bring more listings which can easily shift the market south. As we’ve seen sales in Oak Bay getting price slashed in order to get sold in a thin market.

When I see new one bedroom condos with front row views of crack central on Pandora going for over $500K you know this market is about to blow bigtime. But there is a McDonalds across the street for when things get tight paying the $2000 plus a month mortgage plus strata.

Thing is Hawk, at these inventory levels there doesn’t need to be many fools. With the flames stoked high from last years action I expect there to be more than enough this spring.

When every bank and financial entity in Canada who lends the mortgage money and international entities that lend the bond money to Canada warns of extreme danger, I’d say it’s pretty obvious what has happened in Vancouver’s 20% drop is coming here anytime now. There can only be so many stupid people left in the fool pool like any other market top.

You can be a pompous know it all who got lucky as you said, or you can look at the over valuation warnings and use financial intelligence. Luck is always fleeting, like FOMO and easy credit.

Fitch warns Canada’s housing markets are ‘unsustainable’

http://www.bnn.ca/fitch-warns-canada-s-housing-markets-are-unsustainable-1.673597

There is some truth to the saying that nothing is inevitable but death and taxes.

Bubble? Maybe. Maybe not. Crash? Maybe. Maybe not.

Prices going up forever in a straight line – extremely unlikely. Prices recovering over time – extremely likely.

What house prices will do in Victoria has been incorrectly predicted by you for what – 10 years? 20 years? Your own firm belief that you know the future takes away from your analysis imo. Even more, you don’t need these imminent doom predictions to make a credible point about risk.

I do agree that a strategy of living frugally by saving on shelter costs and investing in the stock market is a fine one though. Would suit many more than being a homeowner even if the overall ROI is lower in the long-term.

“Disagree that a bubble will pop in Canada just because it did in the US. A crash could occur, but it did not happen here in 2008 and it is, imo, unlikely to occur in the near future here without other precipitating factors. ”

It was propped up by Harper by $114 Billion in shit mortgages passed onto CMHC and taxpayers, you continue to ignore that major point.

Foreclosure is as good as bankruptcy, they walked away and went off to live in their cars, and the banks chose not to chase them down due their being swamped. Ignoring debt levels far exceeding the US and buyers over extending themselves believing this will never end is evident all over this blog.

FOMO is running on fumes and to ignore that shows you can’t accept the inevitable conclusion to the largest Canadian housing debt bubble in history. The markets have been on an 9 year roll, just because Victoria didn’t participate til the last few doesn’t mean there is some law that prevents a crash because we missed out trying to imitate Vancouver gains based on money laundering and mass speculation, the latter being what is happening here now.

Ignoring new US policies coming in and the global turmoil this is causing is another major catalyst you ignore. Trump is on a psychotic mission and it’s going to send markets into the most volatility in history. He hasn’t even started to blow this thing up.

What do all these appreciation markets (including ours) have in common? They are all places to which a statistically significant number of people with means relocate irrespective of how the economy is doing.

Hawk that article is from 2011 and foreclosure is not bankruptcy especially in a non-recourse lending environment like much of the US.

In a non-recourse mortgage if the borrower fails to make payments, the lender can seize the house but has no recourse to any other of the borrower’s assets so a homeowner who is underwater can walk away from the house and many did ergo the high foreclosure rate. In some parts of the US this was a smart decision imo.

Although this can be a logical choice, it is one not available in Canada except in Alberta and Saskatchewan and even then it is only available to uninsured borrowers. Prices would have to drop more than 20% for it to make financial sense to do this in some situations.

Agreed as to the relation between job loss, health issues and divorce. Disagree that a bubble will pop in Canada just because it did in the US. A crash could occur, but it did not happen here in 2008 and it is, imo, unlikely to occur in the near future here without other precipitating factors. The best defence to this is risk management on your investment decision.

I’m not downplaying the effects. I’m telling you that RE in appreciation markets has recovered from the 2008 crash. If you held you’d have made back all your gains. I’m suggesting that if you can do the same here there is a strong likelihood that you will make money on your house long-term.

I also note that in other markets in the US this is still not the case. There are still underwater homeowners and these markets are less desirable overall for a number of varied reasons. I would not, in a downturn, count on some markets in Canada to return to peak in seven years or so if there was a drop.

My money is, however, invested based on an analysis that we are in an appreciation market and likely to recover within this time frame. I could be wrong, things are unpredictable but this is my best guess without a crystal ball. You can make a different assessment and different investment decisions as a result.

Readers, you can believe in totoro’s reasoned and measured view of (local real estate) investing, or you can believe Mister-I-Sold-My-House-Thinking-There-Would-Be-A-Crash-And-Prices-Increased-40%-Since-Then-But-My-Stocks-Are-Up-500%.

Marko, have you ever had a client who took out an 800k mortgage, or even close? What are the ranges of borrowing of the clients you’ve worked with?

Mike Grace, you’re the other person who interacts with buyers on a constant basis, what proportions of buyers borrow what amount?

” but there were not extra millions who went bankrupt just because they invested in housing.”

“The use of misleading comparisons on this board that go on for years and years while never coming true are annoying.”

Yes, your BS assumptions are getting annoying as usual. I like the facts myself. Over a trillion dollars went to bail out homeowners while approx. 8 million plus went into foreclosure/bankruptcy and just walked away. Losing your home due to a job loss is part of the bubble popping ICYMI. Many health problems and divorce etc can be related.

Downplaying the real effect of the US crash is the most asinine thing I’ve read on here.

“Already some 5 million homes have been lost to foreclosure; estimates of future foreclosures range widely. Zandi, who has followed the mortgage mess since the housing market began to crack in 2006, figures foreclosures will strike another three million homes in the next three or four years.”

“Prices decline, that pushes people underwater,” he said. “There’s 14 million people now underwater. Half of those are underwater by more than 30 percent. That’s the fodder for (more) default.”

http://www.nbcnews.com/id/42881365/ns/business-personal_finance/t/no-end-sight-foreclosure-quagmire/#.WLL8zvkrKUk

I see. I stand by the statement that these markets tend to recover rather quickly.

For me in the context of a long-term investment in housing, and as I’ve stated here many times, the window for this is around seven years and this is what I view to be rather quickly when compared to less desirable markets that can drop and stay down longer or never recover fully to peak.

I believed this when I bought in 2009 and 2012 at a time when most believed there would be a crash and that interest rates would rise. I also thought interest rates would rise and prices might fall but I still bought. Why? Because there is only the deal of the day, your life is time limited and you don’t have a crystal ball.

For the house we bought in 2009 we had to wait seven years to see any gains at all and at many points during these years after transaction costs the house would have been a net loss if sold. A real problem if we had to sell. And then suddenly we gained 40% of the purchase price on the sale last year and overall ROI far exceeding the stock market returns during the same period due to leverage.

For the house we bought in 2012 we only had to wait four years, but that was chance not skill. The market changed and we did not predict this. We were prepared to hold through a crash. I would still buy today at today’s prices provided we identified a home that worked for us and were able to afford it without undesirable lifestyle impacts.

As I’ve said before, looking at past performance, seven years is the minimum I would look to hold right now if buying a home in Victoria – or any appreciation market. I would not invest in a cash flow market with a view to experiencing any appreciation at all. It can happen but depreciation can also happen where rents provide positive cash flow. Rare to get both cash flow and stable appreciation.

It is now nine years since the 2008 melt-down. Some markets in the US are still well below peak. In some areas there are sub-markets that are well above peak and other areas nearby that are below. Desirability/demand appears correlated with those areas that are above peak.

https://www.washingtonpost.com/graphics/business/wonk/housing/overview/

http://www.globalpropertyguide.com/North-America/United-States/Price-History

You did. “Such markets tend to recover rather quickly from down periods. Similar markets include TO, Vancouver, Seattle, San Francisco, New York, most of Hawaii, Los Angeles”

Who said Seattle wasn’t affected much?

I wouldn’t say Seattle wasn’t affected much. Prices dropped some 30% and it took 7 years for prices to recover their peak nominal values..

There were a million consumer bankruptcies total in the US in 2008, about 260,000 more than in 2007. Two out of three bankrupts had lost a job and half experienced a serious health problem. Medical expenses are the reason 62% of Americans file for bankruptcy . The housing market crash was bad for the economy and highly leveraged people who had other life issues, but there were not extra millions who went bankrupt just because they invested in housing.

And just like we are not Toronto or Australia or Japan, we are not the US and the US market is not the same across the US. Markets are local with some national influences like lending rules and interest rates. Many people held and in appreciation markets they are now doing very well. Some are still underwater in other areas of the US and this has resulted in even more divergence between appreciation and cash flow markets as consumer confidence is a big factor.

The use of misleading comparisons on this board that go on for years and years while never coming true are annoying. One day prices will stop rising or decline. You can see the effects of economic downturns in some areas of Alberta and there would be impacts here if prices dropped and the employment rates took a nosedive. It could happen but the main thing is to make sure you manage your risk. Get life insurance. Don’t buy if you are in a shaky relationship.

Just like no one here predicted that the rise would happen when and how it did, I don’t believe anyone here has a crystal ball on its end.

Even further I believe it is largely irrelevant to an investing decision for most people, just like trying to time the stock market has been proven a losing strategy. Buy when you are ready and can afford it or invest your money otherwise in something with acceptable ROI.

There are all sorts of ways to live and buying a house right now is not the be all and end all unless this is what you really want.

A fool is one who thinks a house is an investment. 1981 was a peak year for over-valuation like Vancouver was last year and Victoria is now as per CMHC.

How many in the US in 2005 went into it for an investment at far less levels of debt and went bankrupt thinking the same babble bullshit? Millions.

Bearkilla you’re so full of shit. A high priced niche store does not increase rents.

Yes and in my opinion this reflects reality and is the valid comparison and we were talking about ten years – wait to 2019 and do your comparison or compare any other ten-year period but don’t pick the year that gives you the best results.

And leverage is the key reason, along with the tax exemption, that primary residences outperform the market – well that plus the fact that you get a shelter benefit with an economic component on top of the return unlike with stocks.

70% of Canadians do not use a mortgage worth of leverage to buy into the market due to risk of a call and financing rates/availability. Some more advanced investors might do this with a HELOC Smith Manoeuver and this might change things a bit, but you’d need the home equity to start with otherwise you are taking a big risk, even bigger after a long uptick in the market.

I wouldn’t do this myself, but if you have access to 400k without being a homeowner at the same rate as a mortgage and you aren’t worried about a call it could work – just in practice there is not a widespread use of this due to perception/reality of risk and you can’t live in or rent out a stock in hard times. Also just not a strategy recommended by any prudent investor I know.

People do commonly borrow at low insured rates to buy a family home. They also have to live somewhere and the cost of shelter is built in to the payment and a benefit not available with stocks which also adds to the return.

Here is 56 years of data for Victoria house prices: https://househuntvictoria.ca/2016/03/17/a-brief-history-of-prices/

I regard housing as an investment just like the other types of investments we have. I don’t buy a house unless I believe it will an acceptable return on capital. Why would I? That is the key to financial independence and the money is representative of life energy. I have no desire to pay for a shelter that will be cash flow negative or less than the market would return.

I would recommend starting out with a primary residence, not stocks, if you know you want to stay in a place for long enough to wait out a downturn and you have enough for a down payment. You can’t beat access to capital that a mortgage provides.

This is not the only way to go, you could also live in a cheap apartment to save and invest in the market if you have higher incomes and you aren’t sure you want to own a home. Nothing wrong with that and it only takes a million invested to create a safe indefinite withdrawal rate of 40k per year which enables a good lifestyle if you are into travelling in lower cost places part of the year.

Even better, start your own business if you are so inclined. Or try to get a job with a good pension if you are not.

I own a few properties near red barn markets and their rents increased dramatically once the red barns opened.

No, I hadn’t. I looked up some charts for Hong Kong and San Francisco briefly and they appeared to underperform the S&P in the long run.

Do you have data going back the last half century or more for Victoria?

I couldn’t find anything long-term, but here’s Van from 1977 to last September, with what appears to be about a nominal 8%/yr increase in detached prices:

http://i.huffpost.com/gen/4762680/original.jpg

In comparison, portfoliovisualizer.com says US large caps returned about 10.5%/yr in the same timeframe. The difference between 8% and 10.5% compounded over forty years is more than 2.5x.

You’ve only demonstrated that then was a good time to buy and now is a good time to sell. You’re also comparing a leveraged investment to a non-levered one. Things look very different if we compare 2009 to now and throw in some leveraged investment in stocks.

I’m concerned with the long view and don’t regard housing as an investment. It’s not clear to me if we disagree on this or not. Would (or do) you invest only in your primary residence?

2016-1981 is 35 years. A whole start to finish life cycle for home buying for many. Waiting for 1981 to come back is a fools game. Like trying to time the stock market and holding cash.

The Vancouver average is down due to low high-end sales which seems to be a direct result of the foreign buyer tax. Try the median – down what – 3% from peak for SFHs and up for condos? Not to say prices won’t drop in Vancouver or Victoria, they seem poised to drop in Vancouver and boy did they have a crazy run up far exceeding ours in duration and scope, but we did not move up with them in tandem and we are a different city with different factors at play. One day the ascent will stop here, just not sure when.

Weren’t the new and much increased assessments just released in January? How many SFH sales have there been on Monterey or in Oak Bay since then?

John,

Chamberlin had a big price slash a month or so ago as well. Goes to show that with The Red Barn a few houses away it did not effect the price like the Barn pumpers like to spin.

A house at 1423 Fairfield also sold under assessed value at $800,000. Looks like a nice little house on a 6,000 square foot lot. House is assessed at $155,000. That makes the lot worth $645K

The same for another place at 1041 Chamberlain that sold for $850,000 with the house assessed at $189,000. That’s a 64 x 120 feet lot for $661,000.

Barrister it has been quite awhile since I’ve seen a property on Monterey or Oak Bay sell for under assessed value.

“I have no idea when this will occur, just that a crash cannot still be called “imminent” when prices keep going up or flat for decades.”

More weak assumptions when Vancouver average prices just droppped 20% and sales drop 40% ? In 1981 prices were rising to all time highs regardless of high rates, then the bottom fell out.

Inflation numbers yesterday showed that Canadian rates have a chance to go up here, not just via the US bond market.

ICYMI via Stats Can,

Canada’s inflation rate spikes to two-year high as gas prices soar 20%, the biggest hike in six years

http://business.financialpost.com/news/economy/canadas-inflation-rate-spikes-to-two-year-high-as-gas-prices-soar-20-the-biggest-hike-in-six-years

Maybe. A rise to 6% would have some dire impacts on the Canadian economy and I really doubt that government policy will move in that direction. If rates stay low a plateau could occur – prices definitely cannot keep going up forever like this – it will have to moderate/stop imo. I have no idea when this will occur, just that a crash cannot still be called “imminent” when prices keep going up or flat for decades. Given inflation a plateau is actually a drop in any event.

Have you done the math for a primary residence vs. stocks based on past performance?

Leo has for houses in Victoria and without inflation adjustment the return has been 7% per year on average over the long term. Now add in leverage and some accounting for the economic value of the shelter benefit you are gaining (rental equivalent cost) less expenses of ownership and the capital gains tax exemption.

Ex. house bought in 2006 for $500,000 with $110,000 investment – current value $983,576, plus principal pay-down of 70k. If you sold through Marko on a mere listing today you would walk away with approx. $550,000 tax free on your $110,000 investment. Now do the math with putting only 5% down and paying the CMHC fees!

If you bought $110,000 worth of stocks in 2006 this becomes $216, 387 at a 7% return, you would walk away $106,387 on your $110,00o investment that may or may not be taxable.

This is without adjusting for other rent v. buy factors like a suite or renting a cheaper place than the costs of ownership and investing the difference. You can use the rent v. buy calculator for that.

In my view a primary residence is the clear winner. A second home not so much.

Yes. In general though if you don’t have to sell this is a significant mitigator of risk. Of course divorce and illness can not always be controlled for.

An appreciation market is my term and this is my theory – you don’t have to agree with it.

It is a market that has a long track record of appreciating at a rate higher than inflation. This does not mean prices will never go down, just that this is what has occurred to date.

In such a market there is significant retained home equity that buoys the system and housing is looked at favourably as an investment separated from income. Such markets tend to recover rather quickly from down periods. Similar markets include TO, Vancouver, Seattle, San Francisco, New York, most of Hawaii, Los Angeles… I am not predicting the future will always continue this way, just that this is what has occurred and appears a likely possibility long-term because past long-term performance is the best indicator we have.

And then there are other markets that are not as desirable where you can actually get a good return from rents but the houses appreciate at or below inflation. Most of the Nova Scotia (except Halifax), PEI and Newfoundland are like this.

Smaller towns in the north are often like this. Almost all of the rust belt in the US has been like this. Some of these properties are good investments for cash flow as they can bring in 1-2% of the value of the home per month – not something that happens in appreciation markets.

The taxing of capital gains on suites rather than the entire residence is another example of Canadian policy makers treating the symptoms rather than the disease, as they are all terrified of losing that boomer vote.

Why can’t they tax capital gains on principal residence? They could index it to inflation and scale the tax based on years living at that residence (i.e. 50% full marginal rate for < 1 yr down to no capital gains if you lived in your house for 5+ years). Add in a few exceptional cases for selling early such as relocation due to work, death of spouse, etc., and you’ll have a reasonable tax that doesn’t punish good homeowners, won’t take away the boomers nest eggs, and will give house prices a more reasonable projection.

1050 & 1033 Monterey Ave were in better condition and had details that 1587 didn’t, eg., more woodwork, coffered ceilings, better cabinets, etc. (and maybe larger lots?) Also, from what I’m seeing, proximity to Oak Bay Ave isn’t a huge selling factor for some. For example, when I host out of town friends, they like all our villages in all different parts of Victoria including as far out as Cadboro Bay or Cordova Bay – to them, an extra 5 or 10 minute drive is nothing. When I grew up, these seemed like the boonies but not anymore. Times are a-changin.

Barrister the sale on Monterey is a bit of a shock. I would have guessed that that property would have sold for a lot more than 1.15 million. Just the house on this lot is assessed at over $400,000!

1050 Monterey sold a year ago for $1,400,000

1033 Monterey sold two years ago for $1,444,000

In many ways the GTA is worse. Much worse.

Take a look at King City, ON. I have family there. It used to just be Anytown, ON with lots of humble, middle class folks in modest homes. Now cookie-cutter McMansions are popping out of the old farmland on the outskirts.

One can be yours, too, for a cool $3M:

https://www.realtor.ca/Residential/Single-Family/17572777/82-CHUCK-ORMSBY-Crescent-King-Ontario-L7B0A9-King-City

Fifth of an acre? Check.

No trees or privacy? Check.

Every other house looks the same? Check.

Two-hour round-trip commute to downtown? Check.

Small town excitement? You bet.

What kind of brain parasite does one need to think these are rational purchases? These are houses for the 0.1%. We’re talking Palo Alto or Greenwich prices, or before the GTA and Vancouver lot their minds, Forest Hill or Shaughnessy prices. I like King, for what it is, but I cannot fathom the appeal at that price range.

This doesn’t make a lick of sense to me. What happened to medical specialists and Bay Street bigwigs having fancy houses in fancy places, not way out in the middle of nowhere?

An historic plunge of 5-year fixed rates from ca. 6% to 2% probably had more than a little to do with this. From here on out, either the rates stay low, in which case this was a one-off boost, or they rise and that component of gains is undone.

I would agree only under the assumption that other investments aren’t being sacrificed. But comparing with stock markets sounds like you’re drawing some kind of equivalence, and that worries me.

I think HHVers are a much savvier lot than the general population, so maybe the buyer’s circumstances you envision are different, but the anecdotes I’ve heard of the house rich / cash poor pumping everything they have into RE and neglecting their RRSPs/TFSAs/etc. is terrifying. It seems especially foolhardy given that only the very hottest real estate markets compare to broad stock market returns over the long run.

To me, Victoria RE carries a fair bit of risk: you’re likely taking a heavily leveraged position with no diversification at a time of high valuations and very low interest rates.

What’s this “appreciation market” term? It sounds like you’ve given the Victoria market a special label to justify some assumption of future price gains. This sounds like circular reasoning.

John Dollar – I never had a problem w/ CRA taxing people’s second, third, fourth properties w/ Capital Gains.

What I do have a problem w/ is the CRA now appearing to give people less incentive to ever supply a suite for a permanent tenant to the rental market in their Primary Residence. So, in cities w/ a shortage of rentals like Victoria, they are making the problem worse w/ the new declaration on the income tax form. Myself, I know now that I will never ever supply a suite to a permanent tenant because of this change to the income tax form. (and I might have otherwise – esp. if Oak Bay ever did legalize it)

Now I have to wonder – what is the appeal of a house w/ a suite now? How many other people will now also make the decision to not supply a suite to a permanent tenant? How much harder is this going to make life for tenants seeking non-existent rentals?

The Owner Builder Exam is also making supply and affordability of housing worse – so the Province works in concert w/ the Fed’s to make the housing situation worse.

“Guarantee you that less than 25% of builders in B.C. would pass the owner-builder closed book exam if you put it in front of them right now.”

Just curious Marko, did you pass the test ? Or did you fail and is why you are so upset ?

“All sorts of people saying the same words on this board in 2008 and then prices did plateau for years instead of dropping as most thought.”

No one expected Harper to take $114 Billion of bad mortgages off the so called “conservative lending” banks hands and dump them into taxpayers hands and cover it up for years either. If the laws of economics were allowed to react without being in a rigged market there would have been a major correction/crash like the US.

That won’t be happening next time when JT can’t even rustle up his $150 billion infrastructure plan for over a year and half now. He’ll be selling off Canadian infrastructure like Trump is planning.

Trump and Trudeau plan to sell out our public infrastructure

http://vancouversun.com/opinion/opinion-trump-and-trudeau-plan-to-sell-our-our-public-infrastructure

My profession is unregulated. Need to work on that….

I hear you Local Fool. You can add; “People have talked about a crash for years and it’s only gone up.” To that list of justifications….

Going back to the home front, some indications that there might be less buyers but not exactly a swarm of listings either.

Heard that the house on Monterey sold about 50k under asking at 1.15 with only two offers. Smaller lot, older house, no garage but a very short walk to the Penny Farthing Pub and the heart of Oak Bay. On the other hand I am still surprised (although I should not be) at how little a million dollars buys you these days.

– Home building is a profession.

I can change my own car brakes, I can sell my home privately, I can represent myself in court, etc.

-To become a licenced professional you need to pass an exam to prove your competence (This should include demonstrating prior experience and education prerequisites).

I don’t recall having to write an exam to become a licenced builder/developer? There are ton of “licenced builders,” in Victoria that in my opinion have very poor prior experience. Guarantee you that less than 25% of builders in B.C. would pass the owner-builder closed book exam if you put it in front of them right now.

-To maintain professional standing you need to commit to continued learning and development.

Such as going on a curise once a year? http://www.buildingitright.com/cpd-at-sea.html

As Leo said….we need proof that owner-builder homes are problematic, or significantly more problematic than licenced builder homes. In Victoria, for example, I doubt your typical spec Happy Valley home is better constructed compared to your owner-builder Oak Bay or North Saanich home.

A 800k mortgage may indeed be a rational choice based on the performance of RE in Victoria over the past 35 years – depending on your income and other assets.

All sorts of people saying the same words on this board in 2008 and then prices did plateau for years instead of dropping as most thought.

I’d say rhetoric based on a set viewpoint not backed up by objective evidence is depressing. Good information and an understanding of your own comfort with risk and risk mitigation based on the best available information is not.

It, like stock market drops, is inconsequential if you are invested for the long-term and don’t have to sell. Could be devastating if you do. Buying in an appreciation market is a long-term play. You just get lucky if you make money short-term.

@ Hawk,

It’s been incredible to see what’s been going on in Toronto, ie Vancouver 2.o. And amazingly, some people think that it will plateau at these obscene prices or even at a higher price point. All kinds of justifications or ham-handed arguments are being put forth as such.

Foreign money. Boomers. Lots of new jobs being made. Inflate the debt away. World class (there’s even an article out now calling Victoria a global city). No new land. It’s different here, and different this time. The rhetoric is depressingly similar every time a RE market goes out of control.

A few people I have talked to locally and that have bought (and some that haven’t) seem to like to say, “Well, the market may drop here and there, but it will just come back”.

It’s as if by half-way acknowledging and admitting the market may go down (but then they effectively make the drop inconsequential), renders an 800k mortgage a rational choice.

AG, that’s why you make 2%, only an idiot would come to that conclusion but John Dollar already explained that.

“How lenders are sidestepping Canada’s mortgage rules with ‘bundles’ of debt”

In the short term, that sounds like very bullish news. I didn’t realize you were so positive on the market, Hawk. Thanks for the update.

When the banks keep warning and the pumpers keep cheering you know the end is near. Wasn’t the TSX down over 240 points yesterday ? No comment from Mikey of course.

Canada’s inflation rate spikes to two-year high as gas prices soar 20%, the biggest hike in six years

http://business.financialpost.com/news/economy/canadas-inflation-rate-spikes-to-two-year-high-as-gas-prices-soar-20-the-biggest-hike-in-six-years

RBC CEO says Toronto real estate market ‘not sustainable,’

The CEO of Canada’s largest bank says it is time to consider bringing measures that cooled Vancouver’s sizzling housing market to Toronto.

“You’re seeing 20 per cent house price growth in a market where you shouldn’t see that much,” McKay said in an interview. “That’s concerning. That’s not sustainable. Therefore, I do believe we are now at a point where we need to consider similar types of measures that we saw in Vancouver.”

http://business.financialpost.com/news/fp-street/rbc-boost-dividend-after-24-profit-growth-to-3-billion-beats-expectations

Pretty soon the bubble will pop and the builder exam will be the last thing on anyone’s mind as the mortgage lending gets shadier by the day.

How lenders are sidestepping Canada’s mortgage rules with ‘bundles’ of debt

“This is what happens at the late stage of a housing bubble – the quality of lending goes down,” he said.

http://business.financialpost.com/personal-finance/mortgages-real-estate/how-lenders-are-sidestepping-canadas-mortgage-rules-with-bundles-of-debt

‘They are rules. They are not guidelines’: Canada’s financial watchdog warns lenders against bundled loans

http://business.financialpost.com/news/energy/exclusive-canadas-financial-watchdog-warns-lenders-against-bundled-loans

@Jim Dandy

I’m absolutely for increased regulation and education of owner builders if anyone can show there is a serious problem with them.

I also completely agree that we can’t allow any idiot to build a house of their own design just because they want to. But the thing is, there are already tons of checks and balances to ensure that doesn’t happen. We have engineers that have to approve designs, we have inspectors that check.

So if you can provide evidence (or even just several anecdotes) that show that despite these checks and balances, owner builders are building inferior buildings to professional builders, then you have a point.

By the way, I am fine with restrictions on owner builds if they are being abused. It is perfectly reasonable to crack down on people abusing the owner build to run a business. But as far as I can tell this really isn’t happening (otherwise there would be far more requests to sell on file).

Regulation is fine if it’s based on evidence. The argument that “it’s a profession so it should be automatically heavily regulated” doesn’t hold water.

I can change the brakes and transmission in my own car then go for a drive on Hwy 99 at 110Km/h at rush-hour without breaking a single regulation, potentially endangering thousands of people.

But, I need to pass a non-sensical exam to schedule the carpenter and the plumber to do work laid-out by a licensed architect (or house designer) to meet code and approved by the authority that issued the building permit? Really??

No hate, but common-sense indicates there is overreach here, clearly to the benefit of licensed builder’s.

As a custom home builder I can’t help but weigh in on this topic yet again, even if I am significantly outnumbered.

Ok I’ll outline my opinion now (gulp).

-Home building is a profession.

-Professions need regulation and oversight.

-To become a licenced professional you need to pass an exam to prove your competence (This should include demonstrating prior experience and education prerequisites).

-To maintain professional standing you need to commit to continued learning and development.

-Professions need a code of conduct and a method to penalize those who break it.

What I believe is wrong with the current HPO owner/builder system:

-No study guide for owner/builders.

-Not enough transparency with information flowing to the public.

-Those who have proven their ability to build homes previously are given no chance to avoid the exam.

-Sounds like some pretty far out and silly questions are being asked on the exam.

There is certainly significant room for improvement on this issue. But I really don’t think that allowing the general public build homes and sell them without demonstrated knowledge/skills is the answer. I meet many people who are frustrated about not being able to build their own home. When I ask questions about how they would go about building, and where their experience level is, I often think that the HPO has saved these people from themselves. It’s very easy to underestimate the complexity of the building process, and how quickly things can go south on you.

There you have it my friends. The bastard builder has spoken 🙂

Cue the hate mail?

In housing news, still not enough listings coming on. 217 new in the last 7 days while 180 have sold, and 27 others off market. So net gain of about 10 listings in one week. Hardly what we should be seeing at this point.

Agreed on all your points, so much so that I’ve setup a website and a FB group so that wannabe owner-builders in BC like me can discuss, lobby, share tips & tricks, help each-other prepare for the exam, etc.

Visit http://www.bcownerbuilder.ca

On Facebook: https://www.facebook.com/groups/bcownerbuilder

Let’s help each-other build!

They are actually not allowed to sell that house without living in it for 12 months first.

Yes, owner build issue. The owner builder is responsible and can be held liable. When the owner builder sells a house he/she is mandated by the Homeowner Protection Act to provide the equivalent of a new home warranty to purchasers of the house for the period 10 years after construction (2 years materials and labour, 5 years building envelope, 10 years structural).

http://www.bclaws.ca/civix/document/id/consol20/consol20/00_98031_01#section23