Housing affordability is a top priority for Canadians, but you wouldn’t know it looking at the platforms

You may have heard that we have an election coming up in less than 2 weeks. In a poll conducted by the CBC, the top three concerns voiced by Canadians were health care, climate change, and the cost of living (a huge part of which is housing affordability). Given we live in a very expensive city, you can be sure that housing affordability is an even higher priority for Victorians than that. So you would think each party would be falling over themselves to propose ambitious plans to make houses more affordable, right? Well I kept hoping that would still materialize, but after Monday’s debate contained exactly zero references to housing affordability it seems we’ll be stuck with nothing of consequence.

Starting with the Liberals, their platform page makes no mention of housing policy at all. You’d have to dig into the full platform to find any indication of policy plans, and then there are precious few. In fact there are only 2 concrete changes mentioned.

- Increase the purchase price cap on the First Time Home Buyer Incentive program to $800,000 in high priced cities like Victoria. They describe this in a very misleading way by saying the program “gives people up to 10 per cent of the purchase price of their first home”. In reality the government buys a 10% stake in your house, so you’re not getting 10% off, you’re just getting 90% ownership of a house.

- Implement a National Vacancy Tax on foreign-owned empty homes. Given we already have a vacancy tax (and Vancouver has two), this will almost certainly be a nothingburger for Victoria.

Really, that’s it other than a vague promise to “work with” provinces on a beneficial ownership registry (which we’re already doing). We have to give the Liberals some credit for creating the National Housing Strategy in 2017, but that’s been off to a slow start and it’s disappointing that they seem to be out of new ideas on housing.

Here’s the point where the Conservatives could pounce on the Liberals and embarrass them with a well thought out housing plan that will take steps to address the housing crisis by bringing new supply, constraining toxic demand, and addressing some of the structural issues that make it hard and expensive to build in this country. But as I said, here we are 2 weeks out from the election and the Conservatives haven’t even released a platform yet. So all we have is a press release promising to:

- Remove the mortgage stress test for renewals. A very minor tweak to the stress test at best to allow borrowers who cannot pass the stress test to switch lenders. Potentially a sensible move, but certainly won’t make a lick of difference to the vast majority. There is also a vague and worrying promise to “fix” the stress test for first time homebuyers but no clue as to what that might entail.

- Allow 30 year amortizations for first time homebuyers. Aka goose demand to encourage more debt

- Launch an inquiry into money laundering in real estate. Good idea, but we’ve already got one, and it’s very nice.

- Make surplus federal real estate available for development. Good news for the developers that will get a deal on some land, but it’s not like there is tons of idle federal owned land that will appear for development. Federal crown land makes up 1% of BC land.

It’s a sad state of affairs that more ambitious and well thought out ideas are only found in the Green and NDP platforms. I’d go through them in detail, but given they have almost no chance of forming government, there isn’t much point. To be clear I don’t mean to dismiss the efforts of the two smaller parties, but we have to be realistic and accept they are unlikely to turn into policy. The Greens get the most points here by focusing directly on addressing affordable housing for those with core housing need, instead of taking the easy path by charging the market with cheap credit. The NDP also have bigger plans than the big two to fast track 500,000 more rental housing units in addition to some goosing of the resale market by bringing back 30 year amortizations.

Housing policy makers can fundamentally enact change in three ways:

- Loosen credit to drive demand

- Build housing to increase supply

- Tackle structural issues behind housing affordability

Right now the unimaginative big parties have been focusing on boosting demand by throwing some money at home buyers in the hope that we won’t notice the mountain of debt as long as it’s cheap. That’s unequivocally bad policy. It kicks the can down the road but in the end the party has to end and the bills come due. In the long run, it makes housing less affordable, not more.

Building more housing seems sensible and should be done, but the scale of the problem is so large that it’s hard to make a dent. The Liberals’ $55B National Housing Strategy aims to build 125,000 homes over 10 years. Given our population, that works out to about 125 new homes per year in Victoria. We’ll hardly notice.

That leaves structural issues in housing. The provincial government has gone to some lengths to tackle toxic demand in housing and it seems the feds are taking a page out of that playbook to promise similar initiatives. Beyond that we’ve seen a complete lack of imagination to tackle issues in land availability and construction costs that are driving up prices. What else could they do? Well to start they could offer incentives to relax restrictive local zoning and red tape, mandate density around transit projects, conduct research and investments into modern pre-fab housing, launch a review of the building code to cut complexity, and make a big push to expand expertise and construction of mass-timber structures made from carbon-sequestering BC wood. There are lots of ideas out there that have the potential to make a difference.

Throwing more fuel on the fire won’t solve our housing crisis and neither will tinkering around the edges of policies. We’re going to have to become a lot more creative and bold to make a dent in this problem, and demand our leaders do the same.

I missed this discussion. Leo – very passionate discourse. I echo it. Well done. The plans, as they stand, from the 2-bigs raises demand and encourages more debt. It solves nothing. Supply increases plus tackling toxic demand are the pillars of the solution, or a road to that destination. One new report out today says 20% of all current sales are to new arrivals in to Canada. We need immigration to continue growth and replace retiring baby-boomer workers; however, immigration also raises housing demand and we need to know that and address it as part of the supply picture.

Just be thankful the gulf island potheads are the only ones delusional enough to vote for them. Pot-induced psychosis can lead people to believe all sorts of strange things.

Monday numbers (preliminary as they seem to be delayed).

https://househuntvictoria.ca/latest

Right, Saanich/GI won’t be close.

The Victoria riding should be thisclose (between Greens, NDP and Libs).

vote because you can .. who knows,,polls are funny .. look how U.S ends up with trump

i personally dont believe in Polls by tele.. tends to bias toward certain demographic

on the other hand – NDP seems to gain grounds after the debate – minority gov is not bad at all … just no work done

So as someone in the Saanich-Gulf Islands riding, where E.May is polling at about 60%, what is the point of voting in the riding at all?

Affordability was pretty ugly when I moved here in 2008. However I was too young/optimistic/naive to care or pay any attention. People in their 30s and 40s already in the market would laugh at us saying “good luck ever affording a home here” but again it just didn’t concern me then. We found work here, started renting a cheap apartment, slowly saving, eventually buying when we were ready and affordability had improved.

We sold our Ottawa SFH for $585K in 2008, moved back and bought our current SFH in Victoria in 2009 for $650K. Fast-forward to 2019, the same Ottawa SFH is valued just under $900K, Victoria SFH is valued at around $1.05M. So if we had been working all these time, we would still be able to buy the same or more; Otherwise we would still move back and just buy something smaller.

BTW, we have voted on this beautiful Thanksgiving Sunday!

Oh sure, I would take a 60s apartment over a low ceiling basement. The units I sought (and typically got) when I was a renter would be the main or upper floor of a character house, or part of a floor depending on the size of the house + unit.

60s apartments don’t have the same charm (wood floors, high ceilings, etc).

I like it when you put numbers out .. makes more factual sense

personal observations/opinions.

4 years ago when i came back to Victoria for work , I am thinking of staying since housing is relatively cheap- now not so sure. Kinda disheartening to see more and more of my friends my age (mellenials) going back greater Vancouver because the cost is almost equivalent.

population growth is directly connected to cost of living – otherwise, every one will be in Hawaii

Hypothetical Question for the Millennials , working class and Retirees who move here 4-6 years ago:

Would you move to Victoria now with today’s housing cost (with wage growth/inflation adjusted ) ?

In my experience, they tend to be substandard – low ceiling height, inadequate windows (which can be dangerous)

This part of the rental market is relatively fixed in terms of absolute supply going forward. Maybe a few crappy suites get created every year in old houses but I feel like that has been played out. The vast majority of old homes with decent suite potential have suites now.

New supply is pretty much new apartment buildings (concrete ones too) and new suites in new houses on the Westshore which are built to code 95% of the time.

“Actually average rent is higher in the secondary market indicating in general higher quality units. Mostly because much of the purpose built stock is 60s low rises.”

That isn’t surprising since most of the secondary market is condos. Basement suites are a small, but significant part of the secondary market.

In my experience, they tend to be substandard – low ceiling height, inadequate windows (which can be dangerous), and other deficiencies like being able to communicate to your landlord through the register in the ceiling. At least you can tell him to turn the heat up, which you have no control over.

Could be my bias coming through as I’ve lived in both purpose-built rental housing and basement suites, and 100 times out of 100 I would take the suite in the purpose-built building. Doesn’t feel like you’re occupying someone else’s house, way less risk of getting a psycho landlord, and you pay about the same (not sure if that’s still true but it was when I was renting).

The current build rate, with 3,200 completions in last 12 months should have already raised the rental vacancy rate by about 0.4-1.0% (YOY to Sept).

Because….G. Vic. Population rose 1.75% over last 12 months (stats can estimate https://www150.statcan.gc.ca/n1/daily-quotidien/191011/t007a-eng.htm). Since there are 146k dwellings, they would require about 146k * 1.75% = 2550 homes. So the 3200-2550= 650 as “excess over population growth”, and represents 0.4% of all 146k dwellings. Since 40% of dwellings are rentals (60k rentals) if those 650 all showed up in rental units, that would be a 1% increase in rental vacancy rate. For-sale inventory has risen 250 so that would imply 650-250=400 rental units vacant (0.7% vacancy rate change).

Of course there are many other factors like changing household size, tear downs, suite creations, dark sales etc and the stats can numbers are just estimates from labour surveys. But given the above there should be an increase (0.4%-1.0%) in rental vacancy rate right now (sept 2019) or something else is going on.

The point is, we are definitely starting to complete more homes (3200) in excess of need based in population growth (2550), and that 2550 number was only passed in early 2019 (see LeoS chart). Next year, the projections of completions increases to 4K per year, so unless population growth rises, this rental vacancy rate should increase by 1-2% by sep 2020, resulting in a big improvement in rental availability.

Always like this as the lead. Month to month figures for starts are so extremely variable that it makes no sense to even quote them. You want at least a 12 month sum or running avg to make any sense of the data.

Construction has eased a bit for sure but not that dramatically yet. We had a similar dip last year. Could still bounce back.

As for the cause, it’s mostly flatlined prices. Yes there should be less red tape absolutely but mostly builders are being more cautious because prices are not accelerating and they want to avoid oversupply if the market slows further

Of course these do not obstruct the building process at all. So why are these named in relation to falling starts – because builders are afraid they will lead to falling prices, and they reduce starts when they anticipate falling prices.

Have a great Thanksgiving everyone.

(Oct 9) https://www.timescolonist.com/business/greater-victoria-s-hot-homebuilding-sector-cooled-by-regulations-says-critic-1.23971577

Greater Victoria’s hot homebuilding sector cooled by regulations, says critic

“ Through the first nine months of this year, [Victoria] builders have started 2,569 new homes, down from the 3,028 started in the same period last year.

He claims the federally imposed mortgage stress test, the provincial speculation tax and municipalities hiking up development cost charges and dragging out approval processes. have all combined to choke the pace of building at a time when all regions claim there is a lack of housing.

“They all throw up challenges to the housing market,” Edge said, noting the region is still dealing with low unemployment and a growing population that put increased demand on housing.“

hey marko, your comments and data seems pretty unbiased .. when did we peaked out on constructions boom before 2008?

Leo would probably know where the data is but 2006 +/- would have been the peak.

I think downtown construction will slow down. I can’t think of a single project downtown/Vic West that is currently being excavated? Everyone is stuck at the same BS at city hall and market for pre-sales isn’t great. Once the current crop of projects is finished might be a bit of a lull in terms of cranes downtown.

We lived in 2 60s apartments and they were good. Biggest downside is lack of in-suite laundry.

When buyers come to me to help them find a condo in-suite laundry is the number one criteria, by far. Second is usually rentals allowed (most of my clients are younger).

I imagine in-suite laundry is a big thing for those renting as well.

We lived in 2 60s apartments and they were good. Biggest downside is lack of in-suite laundry.

Anecdata, but myself and most of my friends vastly prefer(ed) suites in houses to 60s low rise apartments.

Happy Thanksgiving to everyone. Up island at the moment. Beautiful fall colours up here!

They also include secondary market although the data quality isn’t that great I believe..

October 2018

Primary vacancy rate: 1.2%

Secondary vacancy rate: 0.4%

Methodology: https://www03.cmhc-schl.gc.ca/hmip-pimh/en/TableMapChart/SrmsMethodology

Actually average rent is higher in the secondary market indicating in general higher quality units. Mostly because much of the purpose built stock is 60s low rises. That is changing now with new rental construction hitting the market that is commanding rents as high as the rented condos.

“The metric I use to measure availability’s isn’t construction starts, it is vacancy rate. While we await official vacancy numbers from CMHC, I haven’t seen media reports (or posts here) claiming improvements.”

I suspect things have improved. Lots of purpose-built out in Langford that has hit or is about to hit the market.

Problem I have with the CMHC’s vacancy rate (the one everybody quotes) is that it’s a snap-shot in time of the vacancy rate of purpose-built rentals, which is about 40% of the rental market. Purpose-built rentals will always be more desirable than shitty secondary market units like basement suites, which is where you would expect to see the rental market soften first.

Aren’t you part of the group that gets really pissy when people talk about other countries or even Vancouver?

hey marko, your comments and data seems pretty unbiased .. when did we peaked out on constructions boom before 2008?

The metric I use to measure availability’s isn’t construction starts, it is vacancy rate. While we await official vacancy numbers from CMHC, I haven’t seen media reports (or posts here) claiming improvements. It would be great to see substantial improvement with more vacancies, as that would put an end to much of the “housing crisis” argument, and it would just become “I would prefer to own, not rent” argument.

how much tax should we reduce to be consider Okay?

Greater Victoria’s construction boom remained red-hot in 2018 with the highest number of housing starts in more than four decades, according to a new report.

The region saw 4,273 housing starts in the region as construction began on a number of projects like Langford’s Belmont Residences, new data from the Canadian Mortgage and Housing Corporation shows.

That eclipsed the number of housing starts in 2017 by 411, and was the most since 1976.

https://vancouverisland.ctvnews.ca/greater-victoria-saw-most-housing-starts-last-year-since-1976-report-1.4247479

totally agree wit you on this one but then we have lots of people like the story posted earlier

Summary of Canadian Social housing programs

Source: https://twitter.com/nicholas_falvo/status/1183005080087355392?s=21

Canada’s most affordable RE markets are in the provinces with the highest taxes.

If you want to just stick to BC, the BC Liberals brought in an income tax cut after taking office in 2001. Compare before to after.

And tax them less. 🙂

How can we find new dwellings for people (at any price) if we don’t build enough new dwellings? Vacancy rate is still low. Building more units (inc. SFH in core) will solve availability, and also lower rents and prices.

Simpler solution to affordability, stop offering sellers ridiculous amounts of money for shelter.

Simple solution to affordability, pay people more.

Just want to bring a different perspective to low in employment rates in Victoria.. it is not that we have an unemployment issue. We just have no one to hire.

Back to the lack of services we go

That was the case in the early 80’s and is the case in every crash. Crashes happen simply because buyers dry up at current prices. There is always someone who has to sell and they have to take whatever is offered.

Also you appear to be underestimating the influence of investors. They have no emotional considerations and will stop buying, or sell if they already own, if they think price appreciation may reverse.

Happy Thanksgiving everyone. Hope you are able to spend time surrounded by your loved ones.

Patrick I am on my phone and can’t really see the graph. But did local fool just use real wages and nominal mortgage payments to justify why affordability is poor?

QT, I think local fool has seen the writing on the wall and will offer atleast $650k on that $850k house.

Patriotz, that is exactly why a large correction is not likely. People will keep paying their mortgage until they can’t anymore instead of selling at a loss.

After the early 80’s crash, 90% of the workforce was still employed. Like me.

Affordability in BC has been helped in the last year by 4.5% wage growth. Your posted graph shows an impressive nominal wage growth in BC of 4.5% YOY September. But you have highlited inflation adjusted wage growth. Affordability calculations use nominal household income, and there’d be no reason to use inflation adjusted wage growth as a proxy for that. The reason is that the other variables in affordability (mortgage payment, house price) are not inflation adjusted. Of course if one used inflation adjusted mortgage payments, you’d see mortgage payments falling each year by inflation, because it gets easier each year to pay a mortgage, especially with wage growth of 4.5%. Assuming wage growth translates to a similar household income gain, the househunters you are competing against will qualify for higher mortgages.

I guess I would say, keep being mindful of basic principles. A lot of people get confused (or conveniently forget) about the notion of “correction”, thinking it means nothing but lower prices. That’s rarely the case – as you know it involves changes to consumer spending power, real prices and the cost of carrying debt, some of which Marko alluded to.

But the basic principle here is that a correction restores affordability, which is a pattern that has continued unabated in Victoria as far back as reliable records are kept.

Affordability hasn’t really been improving via wage growth in BC, at least not in real terms. In fact up until July, we’ve had declining real wages since October 2018 and were among the worst performing in the country.

http://www.bcstats.gov.bc.ca/Files/9bf727e9-f34c-407c-b0a4-07720ddfbb1a/EarningsandEmploymentTrendsData.pdf

A mild move downward in price has made affordability somewhat better, but the bigger factor to date is, IMO, the falling costs of debt. Despite both, affordability hasn’t changed too much. Ergo, I have two problems with his conclusion.

1) One concept that I have mentioned many times, is that RE affordability is stagnant at two points in the cycle – the peak, and the trough. That can vary cycle to cycle, but from point “A” in one cycle to point “A” in the next is about 11 to 14 years. Most times we come off the peak, we actually see a brief resurgence (and perhaps even a new peak) until affordability then improves to the point which allows the cycle to renew. So far, that dynamic does not appear to be playing out differently than in previous cycles. As affordability hasn’t appreciably changed yet, I do not believe we’re about to begin a new up-cycle.

2) The second problem IMO, is where he points out that flat prices plus rising wages could cover off the correction, leading to an extended flat market. While technically he is correct (as I pointed out above), the problem is the time it would take for wage growth alone to restore that affordability. We’re a bit past the peak right now, which suggests that the trough is perhaps 3 to 5 years away. In other words, at current valuations a correction via wage growth alone would exceed the historical pattern for changes in affordability in this market, and by a pretty wide margin. Affordability across the entire market cannot remain so poor for that long, for the simple reason that credit cannot grow to the sky. This is where incomes eventually provide that gravity.

So what then?

My layman’s view is that I do expect that this particular correction will probably be buoyed by a falling cost of money, but unlike the last cycle, I don’t think that will be the dominant actor. I believe changes in pricing will be the principle mode by which affordability will improve. But we’ll see!

Hey. Just because you buy or not the house does not mean you are a bear or bull. It just mean lots of factors that goes into this .. don’t brand those who are not buying into a blind bear. it’s the same we don’t brand all home owners into bulls… Life situation are different for every one

I always find those who use the bear bull word here laughable.. only here to boost their ego

And, insulting the seller and RE agents with a lowball bid of $500K on a $850K house.

Rook, local fool is probably at an open house currently trying to pull the trigger on purchasing

Oxymoron: Young renters couldn’t save enought money to buyin in good time, but think that they will be swimming in money to buy luxury SFH in the core when they are unemployed in a market crash.

BC has lowest unemployment in Canada (tied with Quebec)

That is quite low and could be bullish for housing, although I imagine many of those employed are in the housing sector in some way. But we don’t know what it will be a year from now. The unemployment rate doubled in B.C. from ‘81-‘82.

I think we’ve been flat too long for a major correction.

Local Fool can you take this one on? It kind of makes sense but I have a feeling that is not a sign that a correction is staved off.

Exactly why we need to test wealth and not just income. A lottery winner can structure their finances to draw a minimal income while sitting on their riches. They won the lottery, they should pay their property taxes.

Man.. wish I can “smoked”out of my house and sell the place take the money to some more affordable place..on the other hand avacado toast .. talk about entitled mellenials right ?.. .. *

Just renter, I don’t consider having much wealth. In fact my net worth is less than the average home owner networth someone quoted.

They can get a reverse mortgage just like seniors everywhere else in the country. Are you reading about seniors being “smoked” out of their houses in the other 9 provinces?

If you want to read about a provincial deferral program that isn’t completely bonkers, here’s Ontario’s. Notice it applies to school tax only and you must be 65+ and receiving GIS.

https://www.fin.gov.on.ca/en/refund/plt/seniors.html

Here’s Toronto’s program. Both this and the provincial program defer increases in property tax only.

https://www.toronto.ca/services-payments/property-taxes-utilities/property-tax/property-tax-rebates-and-relief-programs/property-tax-and-utility-relief-program/

Marko: Boring is actually a pretty good place to be; enough in life is unpredictable.

I think we’ve been flat too long for a major correction. 2017 average SFH for Greater Victoria was $859,871 and this year so far we are at $865,977 so 24 months under the belt of affordability improving (prices flat plus wage growth). I personally do think the economy will slow down but by then will be at 3-5 years of flat and interest rates won’t go anywhere. It is going to be a flat boring market for the next 2-3 years if I had to guess.

Basing it on wealth could mean that seniors with low income, that have had high house appreciation may still get “smoked” out of their house, because they would have so much wealth built up in their house. Wealth testing is hard, because especially the truely wealthy will be able to put their money in trusts and other vehicles that would reduce their “wealth” on paper. While seniors that have their “wealth” tied up in their residence would get caught up in it.

@Ks112

Go and enjoy life and all the wealth you have! Why are you wasting so much time?

bulls on this board: I bought a house and through dumb luck it appreciated 40% so I am smart and if you rent and think prices are going down u are stupid and a loser. Goes and finds some supporting data to prove their point (terenet index)

Bears on this board: I didn’t buy a house and now prices are unaffordable to me and people like me, but I am entitled to a house so something needs to give and prices will come down . Goes and finds cherry picked data (west van house prices, asset bubble graph)

The above doesn’t include all bulls or bears but represents the attitude of the majority.

Semantics. Wealth testing is better, income testing is more practical. They would both have similar effect of likely cutting 90% of the people who use tax deferral off.

Doesn’t matter though neither will happen.

Conservatives (finally) released their platform.

Housing is discussed on page 5

https://cpc-platform.s3.ca-central-1.amazonaws.com/CPC_Platform_8.5x11_FINAL_EN_OCT11_web.pdf

Nothing new for housing (aside from mentioned above) other than this Green Reno credit, which applies to existing homeowners and not purchases. It does seem like a good idea, but not going to move the needle on house affordability. I suppose someone buying a house who plans to green reno it could benefit a little.

“Introduce the Green Home Renovation Tax Credit

To encourage Canadians to lower emissions from their homes, we will introduce a two-year, 20 per cent refundable tax credit to help cover the cost of green home renovations between $1,000 and $20,000.

This would apply to things like solar panels, insulation, or energy efficient windows and doors that improve your home’s energy efficiency. These green home improvements will save you money in the long term by lowering your monthly energy bill. These renovations also have the potential to increase the value of your home. This two-year tax credit will be available in the 2020 and 2021

calendar years.”

Oh, so now they should be income tested and not wealth tested. Great, that’s what I’ve been saying all along,

You were the one who introduced the idea that they should be wealth tested, which got the whole discussion going.

Here’s what you said (63727)

> LeoS : [Tax deferral] Both should be scrapped or wealth tested to only make them available to those who actually need it.

For the record, I have no problem with income testing any govt handouts. So we agree on that.

Australia does have wealth testing for some social assistance programs, but it excludes personal residences from the calculation.

Your homework assignment is to examine the implications for the housing market.

Wealth testing is obv better for government handouts but also difficult to implement in real life. Income testing is a good enough proxy and will catch 98% of the same people.

The vast majority of people using tax deferral are not multi-millionaires that are financially engineering themselves into zero income. Most have regular OAS, CPP, pensions, or RRIF income streams and income tests would be just fine to determine who legitimately needs to to defer taxes and who doesn’t.

That’s quite correct, but someone doing that will pay more income taxes in the long run than someone who realizes about the same taxable income year to year, due to progressive tax brackets.

Of course there are many business people who really do have fluctuating incomes from year to year that aren’t the result of financial engineering.

Of course, but their personal income is zero in any year that they don’t choose to sell shares or declare dividends. They can fund their lifestyle through bank loans, using stock or property as collateral. Or from prior savings. If you inherit money from a relative, or win the lottery, you may quit your job, live off that capital and have very little income too – yet you’re wealthy.

My only point here is that wealthy people don’t necessarily have high incomes.

Lowest national unemployment in decades.

Maybe a recession is coming but the numbers are good so far. Absolutely not just driven by public sector hiring.

Come on off it, that’s just the nominal salary they’re paid. Their actual income is from things like stock options, dividends and capital gains which are taxed at a lower rate than salaries.

since this is a real estate blog lets use VREB’s definition of victoria core

“VREB region we call the Core, which is comprised of 7 VREB Districts: Victoria; Victoria West; Oak Bay; Esquimalt; View Royal; Saanich East; and Saanich West.”

https://www.vreb.org/buying-selling/about-victoria-bc/the-vreb-core-region

and since lots of the data gathered displayed here is from vreb – we should use that definition –

I notice some people on this blog tends to fudge the boundary lines to fit certain data points when presenting a biased argument

Yup, care is needed. Not all wealth is equal for these purposes. You can (usually) easily borrow from an owned home at good rates. AFAIK, not as easy to do so from a DB pension.

And our royal highny declares” let them have cake”

I considered sannich areas South of Mackenzie and and east of view royal as core Victoria , pretty much a 10km diameter area that holds majority of greater Victoria s population

Article from South China Post (oct 10)

https://www.scmp.com/news/hong-kong/hong-kong-economy/article/3032390/more-40-cent-hongkongers-want-emigrate-amid

“More than 40 per cent of Hongkongers want to emigrate amid ongoing protests, survey finds

=======

Given Honk Kong’s 7.4m population, (and the 300k Hong Kong residents that are Canadian citizens already), 40% wanting to leave, 17% to Canada and 23% already planning emigration implies about 125k people who’ve started planning emigration to Canada (many as citizens with Canadian passports would just need to get on a one-way flight to Vancouver). If any significant fraction of this does actually occur, it would be a huge influx of new residents to Canada (mainly Vancouver and Toronto ).

Noticed you left out Vic West & Esquimalt, as well as Oaklands and Fairfield.

When private sector jobs are disappearing, but the public sector is going on a hiring spree before the election, doesn’t really seem like a positive personally.

And what about the 3 months prior?

Yes, maybe they’ll get an english degree like Introvert and easily be able to get into the market.

Would you like to wealth test other govt programs?. Be careful because someone like a govt worker (renting a home) with a good defined benefit pension plan could be considered to have a big asset that might make them considered to be wealthy. Would you like them to be unable to receive govt subsidized programs because of that deemed “wealth”?

While people with high incomes are likely wealthy, the reverse is not true.

Ie) Wealthy people don’t necessarily have high incomes. (Inheritance, immigrated with wealth, retirement, house appreciation etc.). Many business owners and some billionaires work for $1 per year. As you know, Victoria has $1.1m av. Household wealth (amongst the highest in Canada, despite average household income).

Ignoring that, I have no problem with income testing the tax deferral. But if someone fails the low-income test, IMO they should still be offered the tax deferral at a higher interest rate that matches the govt cost. Because then there is no subsidy.

The facts do make all the fear mongering in the election cycle quite laughable.

Not really necessary because income is highly correlated to wealth.

But sure, I’m in favour of income testing the property tax deferral program mostly because it’s much easier than wealth testing. Anyone who earns more than GIS/OAS shouldn’t get it.

It’s not about getting them to leave, it’s about them paying their fair share of property taxes that anyone has to pay, regardless of age. I support hardship deferrals of property tax but it should be based on income and wealth and not on age.

Well talk about shooting your self in the foot.. some type of tax are good way to discourage uncontrollable price increase.. but some are just going to make affordability worst.. I can see people with raising rent or some house not renting out at all.. just personal observation Lots of neighbors around my parents places are not renting out their paid off vancouver house with suites. Makes no tax benefits. All empty nesters sitting on 2000+sqf houses. Now more random taxes.. soon water taxes for renters

If politicians want to make affordability housing solutions.. they should give landlords insensitive to rent out their suites.. in this case, taxation discouragement is not the right way to make things better.. as much as I hate the idea of giving already wealthy people more benefits, I still think taxation insensitive is the way to make a dent in housing affordability

I am sure some of you have seen this house for sale earlier this year. Now the upstairs is for rent, do you think the owner will be cash-flow positive?

https://victoria.craigslist.org/apa/d/victoria-lovely-3-bed-1-bath-house-for/6994234108.html

Don’t know what this one was bought for but most likely cash-flow negative unless massive downpayment

https://victoria.craigslist.org/apa/d/victoria-bright-cozy-whole-house-for/6978534643.html

James, the job loss in September is largely due to losses in the service sector where students have gone back to school. Hopefully they will choose their career carefully so they can afford a SFH once they graduate.

Gain of 33K jobs for BC YOY, I don’t know what the % unemployed was.

Victoria unemployment near best in the country isn’t a blip, it’s been seen before in the last year.

what was last year’s numbers ?

**cricket noise **

I guess the bears are looking at “seniors sitting on a $1.2m asset” as the next house-occupying boogeyman to focus on. Knock yourself out, but these aren’t the non-voting, silent “boogeymen” like the foreigners and money launderers. Won’t be so easy to smoke ‘em out of their houses. Seniors are a big demographic, vote, speak up, and the govt listens to them.

September unemployment (august in brackets) by Province

Newfoundland and Labrador 11.5 per cent (13.1)

Prince Edward Island 8.8 (8.9)

Nova Scotia 7.2 (7.9)

New Brunswick 8.3 (8.6)

Quebec 4.8 (4.7)

Ontario 5.3 (5.6)

Manitoba 5.0 (5.6)

Saskatchewan 5.3 (5.1)

Alberta 6.6 (7.2)

British Columbia 4.8 (5.0)

https://www.ctvnews.ca/business/unemployment-down-after-54k-jobs-added-in-sept-1.4634245

Local Fool, the core i refer to is not limited to downtown (I consider it to be gordon head, broadmead, oakbay, fairfield, cook street, james bay) Maybe decent neighborhood in greater victoria is what i should have referred to

So what is that, 4 months straight that BC has lost jobs?

≠

Local Fool, if a decent livable SFH in the core is your goal then I wouldn’t wait in the hopes that prices will come down significantly from ~$800k, you have seen first hand how resilient prices are for those homes.

I think downtown condos will have a higher chance of experiencing a decline in prices just given the huge boost in inventory recently.

Translated: Because one person can’t buy in, the entire market is off kilter and in a bubble? Haha. I’m your Local Fool, not your Local Sophist.

I simply don’t believe in participating in panic, and I don’t believe in a static, perpetually unaffordable market. I’m not talking about unaffordable for any one person, I am talking generally. I don’t expect to buy at the bottom of the market but by the same token, I’m less inclined to buy when most of the fluff is still there.

No, I don’t think I’m saying that. I’m not resolutely opposed to buying even without that 100k raise. I wouldn’t go get a pre-approval if that was the case and I wouldn’t be surprised if I had something by the end of 2020. But, we are picky and that makes it more difficult. Worse, I find the much of the scantly available housing is overvalued for my tastes. We’re still keeping an eye out though – something will eventually show up.

Fine. Middle ground would be me saying, “VicRE is a delightful, transitionally luxury asset class, as long as it isn’t downtown…because Local Sophist hates downtown”. 🙂

Let’s leave this topic for now as I don’t think most folks are that interested in this exchange.

Victoria BC unemployment fell to 3.2% in Sept. (down from 3.3%). That puts us second best out of 35 cities in Canada (after Quebec City 3.0%).

https://www.ctvnews.ca/business/unemployment-down-after-54k-jobs-added-in-sept-1.4634245

Thank you Patrick, local fool so what you are saying is that even if you suddenly got an $100k raise at your job you still wouldn’t buy because you think prices are going down correct?

As I recall, the poster has consistently stated that he can afford a home. And he’s detailed meeting two bank/mortgage ladies that can vouch for that.

So for him it’s instead an issue that prices are too high and likely headed down. It’s an entirely valid position, and he may be right, I just happen to disagree as I think prices are staying high.

Nonetheless, I predict he’ll buy within a year, and live happily ever after. 🙂

Introvert, I don’t see the issue with my post as i had done it on purpose (I am sorry it went over your head though ). I noticed something Patrick is good at, so I asked him to do that something on my behalf.

It looks like you’re pretty good at it too, so do you mind helping out if Patrick doesn’t have the time?

BC job numbers are growing YOY, but at half the rate of Ontario. To be expected given the priorities of the govts (BC-NDP vs Ontario-PC)

https://betterdwelling.com/canadas-job-market-improves-with-4-out-5-jobs-coming-from-self-employment/#_

“British Columbia is seeing gains to employment, but they’re lagging the rest of the general economy. The province shed 8,400 jobs in September, bringing the total net gain over the past 12-months to 33,400. That’s a 1.3% increase in jobs, less than half the rate of job growth in Ontario. Things are still improving, but at a much lower clip than they should be.”

ks112, three days ago:

ks112, today:

We don’t have to treat all govt programs equally, nor should we. Programs designed to help families with child care are different than ones designed to help seniors sitting on a $1.2MM asset that they own free and clear and could leverage to pay property taxes.

But if a young family is like one of those senior homeowners who are sitting on a $1.2MM asset that they own outright, then sure they can be denied childcare subsidies so we can better improve the lives of other families without that wealth.

We need to test on both income and wealth.

“Exactly. Two of the many definitions I found for luxury are “An inessential, desirable item which is expensive or difficult to obtain” or “Something adding to pleasure or comfort but not absolutely necessary”

Owning a SFH is not a necessity, and to a lot of people having the space of one would be a genuine luxury, adding comfort or pleasure to their lives”

Thank you Garden Suitor, that reinforces my statement that currently here in Victoria owning a decent SFH in the core without basement tenants is considered a luxury. If people knew that about you, chances are they will perceive you as having above average income and or wealth, just like they would if you owned a porsche or a rolex.

This is a classic case of “the devil is in the details”.

Canada as a whole did, but the majority of those gains were from public sector growth, not private sector growth. In fact, the latter has been declining. I’ll leave it to others to determine which constitutes a better indicator for the economy in general.

But looking at BC particularly, by contrast we’ve seen several months of consecutive decline in the labor market. In fact, BC had some of the worst performing numbers in the country, west of Quebec.

https://www150.statcan.gc.ca/n1/daily-quotidien/191011/t005a-eng.htm

local fool i am confused, so what you are saying is that you can afford the SFH you want without issue given your current financial situation but choose to not do so because you think prices will drop hence you don’t want to be the one holding the bag?

See this whole time I thought you could not afford the home you want currently and hence think affordability is out of wack so prices need to come down (Patrick can you go back and check his prior posts please?).

Sweet. How did BC do?

Glad you asked!

Yes, there were blowout good news numbers. It wasn’t just the big numbers for job gains and falling unemployment. The best news was wage gains, which are best-in-a-decade 4.3% per year. If that also happens to household incomes (and interest rates stay low), it bodes well for another improvement in housing affordability, accomplished without a drop in house prices. You gotta love that!

https://business.financialpost.com/news/economy/newsalert-national-unemployment-rate-down-after-country-adds-54000-jobs-in-september

“Canada’s job market on track for one of its best years on record

The economy gains 53,700 job, blowing past forecasts

The economy added 53,700 jobs last month, Statistics Canada said Friday in Ottawa, following a gain of 81,100 in August. Canada has now added 358,100 since December, the most in the first nine months of a year since 2002.

On the plus side, not only is employment growing, but so are wages. Hourly pay was up 4.3 per cent in September from a year earlier, accelerating from a 3.7 per cent pace in August. The last few months have seen the strongest year-over-year increases in a decade.”

tic toc!

Public education is not a handout to families with children. Its original and continued purpose is to maintain an economically productive workforce – that can pay taxes to support stuff like medicare and old age pensions.

False accusation! I didn’t change any words in quotations. I just referred (post 63699) to young families and seniors, and you don’t own that phrase.

You may like to shoot the messenger, but comments from bulls here have absolutely no effect on prices. And you may not like it, but so far the people who have been arguing that high prices are going to stay high have been correct.

You’ll notice that I refer to income testing and you refer to wealth testing. Do you want all govt programs, like the Child/daycare subsidies for example, to be wealth tested (not just income tested),so they are not available to someone you call “wealthy” (ie with on-paper equity in a home)?

Sure the local yoga centre can create a “seniors” rate for 55+ without my questioning their motivations. Or what have you.

But someone who has a track record of changing words in “quotations”, and who makes every argument imaginable to justify continued high prices and the policies that support them, no.

I’m pretty sure 55+ homeowners are giving handouts to hipster families by paying school tax through their property tax.

In practice there will be little difference.

Given average home value of $1.2M and 73% of senior owned homes have no mortgage, what percentage of users of the tax deferral program (for 55+) would you guess actually need the program vs are just taking advantage (as they are smart to do)?

I thought an upper bound of 10% below, but after looking at the stats I’ll revise my guess down to a max of 5%. If we want a program to support seniors living in poverty (which I support by all means) then this is fantastically missing the mark.

I’m not opposed to tax deferral being income tested, (assuming the 2% interest deferral loan actually costs the govt much money). I was replying to you saying that it should be scrapped.

There are lots of low-income homeowners (senior, disabled, family w/children) that benefit from the deferral.

No we become Venezuela.. your paper asset house will be worthless by than in global values

Patrick, I’m sure you realize yourself that your argument is internally inconsistent.

On the one hand you are saying we can only allow homeowners to get the benefit of this super-prime interest rate because there is no risk of them defaulting.

On the other hand you are trying to paint the beneficiaries of the property tax deferral as near-destitute and only the tax deferral program is keeping them from losing their home (I wonder how they pay their 85% mortgaged house?). Not that I really need to point it out but this is clearly not true. Average home value for those deferring taxes is $1.2M (https://vancouversun.com/health/seniors/property-tax-deferrals-by-seniors-grows-53-per-cent-in-four-years)

The 55+ property tax deferral program is a handout to the wealthy. Simple as that. It is available to older home owners with substantial equity. You don’t have to look hard to find the stats to show those two factors are highly correlated to wealth.

It’s a bit of a moot point since taking the program away would be political suicide so it won’t happen. Just like the home owner grant.

Both should be scrapped or wealth tested to only make them available to those who actually need it.

#raisemypropertytaxes

Exactly. Two of the many definitions I found for luxury are “An inessential, desirable item which is expensive or difficult to obtain” or “Something adding to pleasure or comfort but not absolutely necessary”

Owning a SFH is not a necessity, and to a lot of people having the space of one would be a genuine luxury, adding comfort or pleasure to their lives.

A disabled person, (or young family with a child) with 15% equity in a home qualifies for the deferral. Are you now saying that anyone with 15% equity in a home is “wealthy”? We are told here that because of unaffordable housing the homeowners are struggling to pay mortgages, living paycheck to paycheck… not wealthy.

Also, you haven’t stated why you think that the loan is subsidized, as I estimate that 2% interest paid is about what it costs the govt.. if so it’s a wash and not a subsidy.

So what then? Are you calling for a market where affordability is forever unchanging or forever deteriorating?

It’s almost like a debate of semantics, too. To me, luxury implies a product displaying superior craftsmanship, presentation, sophistication, durability and timelessness. Generally, that comes at a high price. In other words, the high price emerges from those properties inherent to that asset.

Conversely, what you’re saying is, “After a major earthquake with all the water lines broken, a hot shower whenever you want it is now a luxury”. Kind of a hollow definition in this context. You could slap almost any price on anything if the buyer thinks no matter the price, it will cost more tomorrow. That’s exactly what happened to southwestern BC…rather obviously, IMO.

None of those situations apply to me and neither of us can stand downtown or the immediately surrounding areas. Personal preference, but I do wonder why anyone would want to live downtown at all regardless of the type of accommodation it was.

If you fancy Twinkies and they normally sell for $1.25, but suddenly everyone goes ballistic over them and now they’re selling for $50.00, could you buy one of these newfound “luxury” confections? Sure you could. What’s 50 bucks these days? But would you?

The 4th choice is not to buy at valuations you do not have faith in. Meanwhile, your stash grows everyday. Yes, it’s a gamble. But getting in or staying out, always is.

That’s the rub isn’t it. A subsidized low interest loan by definition only works if you only give it out to those who are already wealthy.

And that’s why it should be scrapped.

I’d be in favor of that. As long as the renters are (like the seniors) able to provide securable collateral such as deed to a property with 15% equity (perhaps a family member’s property), or other securable assets (stocks etc). If there’s no collateral, the loan can’t be 2% (and would be closer to >10% loan rates charged by Visa/MasterCard). Limiting it to homeowners insures that there are very few losses or problems collecting. That’s why the govt does it, and it costs them very little.

Killing the seniors/disabled tax deferral would be a good way for the govt to lose the seniors/disabled vote.

Don’t worry, we’re starting to leave this cold cagw socialist backwater. 🙂 Hawaii of the country my ass.

at the University of Victoria, the temperature was 0.4 C, beating an old record set 129 years ago in 1890.

https://www.cheknews.ca/cold-temperature-records-broken-on-vancouver-island-612145/

Fairy tales of eternal economic—and population—growth.

Great. Extend it to everyone then. Homeowners get to borrow say $5000/year at 2% to pay their property taxes. Renters get to borrow $5000/year to pay their rent.

If you’re concerned about hurting or helping people, then I absolutely guarantee you that there are more renters that would be greatly helped by the ability to borrow money at low rates than owners.

The deferral program doesn’t cost much to the govt. They’re lending money out at 2% interest to seniors/disabled and 4% for young families. It’s likely just an accounting entry for them (as it is for banks), but if it really causes them to borrow more money, they’d be paying similar interest in bonds, so a wash.

Canceling the program would hurt some seniors, disabled and young families with children. For what benefit, other than making some unaffected people feel good?

Local fool. If the market price of a Kia becomes $125k then it absolutely becomes a luxury car, the government even says so even with the extra luxury tax you will pay ;). I also did not say VicRe as a whole is luxury, I said a owning decent SFH in the core without basement dwelling tenants is now considered a luxury, and such are not accessible to the average local wage earner anymore.

There are only three choices for you and anyone else that wants to own a SFH in the core:

A) You think prices are going to come down with rates staying pretty much where they are and as such you don’t have to do extra work to improve your income/wealth situation and can afford that SFH in the future.

B) You improve your income/wealth situation so you can afford to buy a SFH on the assumption that the current market stands.

C) Give up on the SFH in the core and get a townhouse/condo or a SFH in the outskirts.

Agreed. I’ll leave, but you first.

Ya .. time to actively euthanize old people

There’s a reason I said “up to 40%” and not “40% cart blanche”.

In fact some properties are showing falls even more than 40%, but that’s too few at this point to really consider. Right now, prices in West Van are more or less where they were 4 to 5 years ago, but bearing in mind it’s also segment dependent.

You’re really digging your heels into this “VicRE is now luxury” theme, aren’t you. Expensive does not inherently equate to luxury. If buyers want to pay $100,000 for a 10 year old Kia Sportage, that doesn’t turn it into a luxury car.

But if we go by your apparent reasoning, we have examples from arguably the most “luxury” RE markets in the country, right across the Georgia Strait, that appear to contradict your premise. Having done at least a bit of traveling around North America…I can tell you, VicRE isn’t generally luxury. It’s charming for sure, but it’s no Monaco or Palm Springs. And it’s no West Van, either.

Touché. This election, vote for the Euthanasia party!

How much does the deferment program cost the province annually?

Maybe lack of housing isn’t the problem, but too many people.

I’ve already said I’m in favor of equalizing the interest rate, and that would include the compounding method.

I think people can innocently refer to age 55+ as “seniors” without you questioning their motivations.

Anyway, the big part of the deferment is the deferment, not the interest charged or the compounding method. And I think that it’s great that property tax deferment is also available to families with children. Most cash flow analysis I’ve seen here don’t consider PT deferment as an option for young people (with children) who say they can’t afford the mortgage and property tax. Affordability calculations might look different if they defer the tax until eventual sale.

The property tax deferral program should definitely be scrapped. Reverse mortgages are the market solution to the problem of low income elderly home owners.

By the way what percentage of elderly homeowners who use property tax deferral actually need it vs just using it because it’s a no-brainer financially?

I’d be shocked if it was as high as 10%.

Patrioz, so you can’t buy an older townhouse instead of a SFH and live your life? Why do people think they are all entitled to be able afford a SFH house in the core to live?

The limited supply and increased demand has driven the prices up from 2013-2019, how is that different from the price of a 1990 porsche 911? The underpinning economic fundamentals of the prices increases are exactly the same.

That’s part of it yes. The other part is that the prefab tech isn’t quite up to scale yet where the costs are much lower. Most CLT panels come from StructureLAM in Penticton. Not exactly a big operation. We need much bigger scale and scope to bring costs down.

I do think municipalities will come in line by offering fast-track approvals when more standardized housing types become available.

Hey Patrick, isn’t it your time to mention that Canada had another month of massive job creation and how that bodes well for BC Housing?

But I can buy a much cheaper car that gets me to the same places just as fast and has more space.

Something is really bringing out the absurd posts these days.

@guest_63616

I read QT as speaking to the fact that current West Van prices still show good gains compared to their 2012-2014 values, and that West Van prices are only down 28% off their 2016 peak and not 40% (assuming we can trust that HPI).

That’s not cherry picking, that’s using HPI data on an entire segment, and speaking to a specific range in time.

You’re not counting the difference between simple and compound interest, which can build up to a substantial amount over the years. That is a major part of the taxpayer subsidy.

You just pointed out that it’s not level in interest rate between young Families and 55+ (note you changed my wording to “seniors” to make it sound more defensible), never mind everyone else.

As well, there is a requirement that the owner have 15% equity based on assessed value. Obviously young families are more likely to fail this than 55+.

James, in 2013 owning a livable SFH in the core without tenants was still in reach of most people, as such it wasn’t considered a luxury item. It isn’t anymore and only available to those with two “professional incomes” or more hence it is a luxury item now. Not sure what your point is.

In 2013, an early 90’s porsche 911 was around $20k usd, that same car is now over $65K usd. before it wasn’t a luxury item, now it is and as a result you have a completely different set of buyers now compared to before. Same principle as a SFH in the core, for a plethora of reasons, it is just more desirable now compared to 2013 hence the price increase. And yes I can compare the two because neither are necessities in life (you don’t need to buy a 964 porsche 911 to live your life just like you don’t need to buy a SFH to live your life)

And yet those 1000 sqf SFH w/ the luxuries you detail still sell for $700-$800k. It’s almost as if it’s not the house at all.

It’s kinda weird that they tripled the rates for West Vancouver only, but hey, I don’t know much.

The “playing field” is already level at least until the property is sold. The BC Property Tax deferral is also available to any age family with at least one child under 18. The only price difference with the seniors (or disabled) deferral is a higher interest rate (4% for young family, 2% for seniors or disabled). On a $5000 property tax bill that is $100/year interest difference per year. Of course no interest is paid until the property is sold, so until that time the “playing field” is level with both young Families and seniors getting a full deferment of taxes. I’d be in favor of equalizing the interest rate, but the programs are a good idea overall.

Well, right now the government is taxing young people to subsidize property tax deferral for 55+ owners, some of whom might be retired while some might be earning high incomes. Perhaps a simple level playing field would be the fairest.

Ah.. why would you tell people not to cherry pick prices.. then you proceed to cherry pick price range in the years that fits your argument?

Could it possibly be that there are more elderly single/couple people that are living in SFH?

Perhaps, the government could make more affordable SFH in the core for younger hipsters that need the space for their growing family by taxing elderly people with unused rooms into retirement housing.

Thanks for the correction.

Can’t explain how I always thought that Greater Victoria population was something along the line of 72,000-73,000 people. Perhaps, for years I got mixed up/remember only Victoria and Oak Bay as Greater Victoria.

The REBGV SFH benchmark for West Van is down 25% from the apparent peak in July 2016. I myself have claimed that lot value properties have seen 50% losses. RE price declines for SFH are almost all in the lot value.

https://www.rebgv.org/market-watch/monthly-market-report/september-2019.html

That is nonsense. BC Stats says that Victoria CMA had a population of around 250K in the early 1980’s. It still hasn’t hit 500K. Another example of someone making up explosive growth to try to justify excessive prices.

http://www.llbc.leg.bc.ca/public/PubDocs/bcdocs/270917/2001/VV762001.htm

In any case, what matters is not whether SFH has been keeping up with the whole population, but whether it’s been keeping up with the number of households which reasonably need one. The latest census shows that there are more SFH than there are households with >= 3 people.

Because automobile complexity only have to pass simple federal and provincial regulations that is too advance and intricate to be dealt with at the local level. Mean while housing construction is simple enough that not only federal and provincial, and the local 13 municipalities (bylaws are different in every municipality) have to make their present felt. Hence, it take time and money to build something.

I don’t think a 1000 sqf SFH with arborite countertop and linoleum/parquet flooring back in the 80s or now considered as luxury. However, 2000 sqf houses with granite countertop possibly can be considered as a luxury item, and there are enough demands dictating the price that we are seeing currently.

https://www.darrinqualman.com/house-size/

And please provide a link to statistic that shown West Van houses lost up to 40% (please don’t cherry pick a few overprice houses that flippers lost their shirt). And, $2.5 millions still is a far cry from the 2014 average of $2 million, or $1.7/1.8 millions in 2012/2013

https://vallarino.ca/stats/west-vancouver-real-estate-prices

The CRD population is now 5 times greater than what it was in the 80s, and I don’t think the number of SFH has keep up in the last 4 decades.

Good luck to you James, hope you can get that nice SFH for 40% off current prices, that would probably involve rates being atleast triple compared to what they are currently. I personally see a higher likelihood of large money outflows from hong kong and finding their way to the Vancouver/Victoria real estate market.

Has it even hit 10 year averages the last 3 months? I don’t think so.

Still on pace for the worst year of sales since before the year 2000.

That was also the case 5 years ago. And is also the case in Vancouver

I understand now. West Vancouver has lost all appeal, and that’s why it’s dropping like a stone. Thank you, Thank you.

Local fool, the truth is 5 years ago a SFH in the core was not considered a luxury item and it was obtainable for the median household (more inventory lower prices and no B20). Now that has changed, the thing to realize is that there are only a finite number of SFH homes in core on a 6000+ sq lot, the income someone makes over time typically is always on a positive slope. So as long as Victoria is a desirable place to live then there is catalyst for home prices here to keep increasing.

No, maybe not. The comparison for some reason just seemed to jump out at me.

my post was to convey the message of how many can afford a house at current pricing ..

i am not sure what is KS insisting about when i agree with him

i am out of examples so i will just let some one else here to explain it

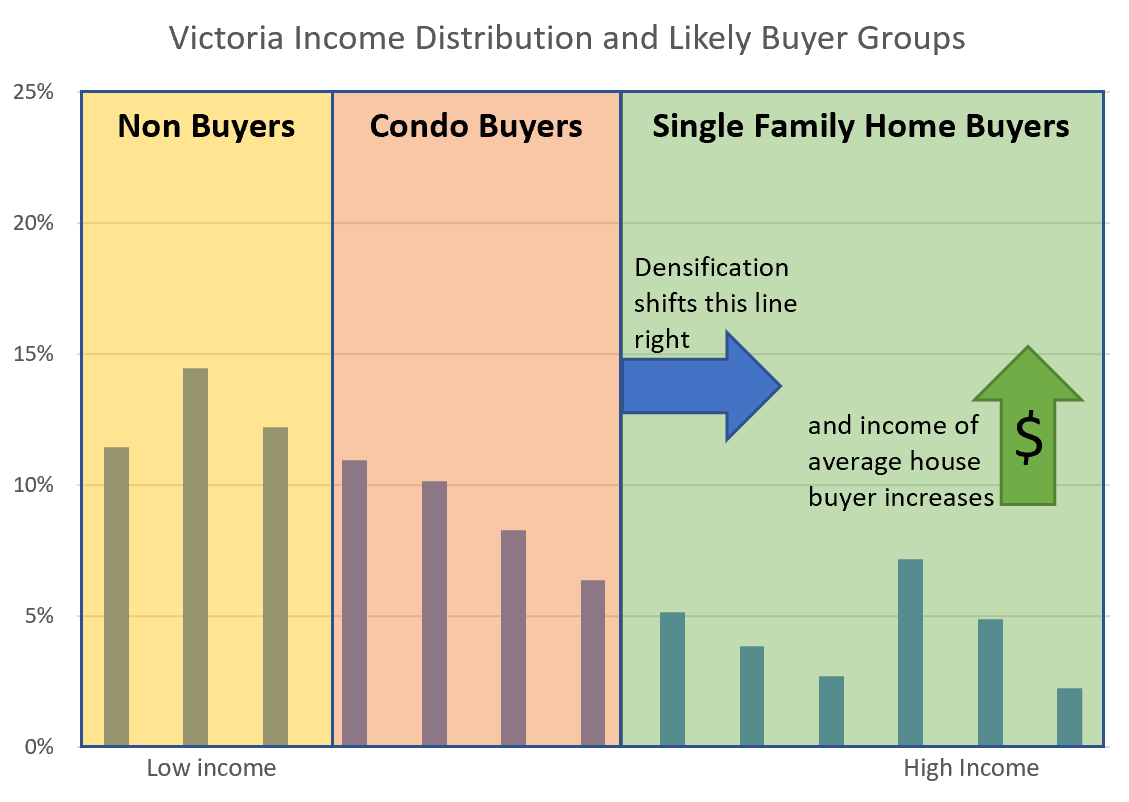

Sure. Although I’m not sure those things can be sensibly compared in a mature market. I can certainly make sense of the trends (more and more condos as a percentage) and estimate what that does, and I can imagine that if no one owned any property and we put the whole city up for sale the top 40% of income earners would snap up the single family housing.

What I like about the simple ratios is that it puts a lower bound on what income we should expect to be able to buy a detached house.

Depends entirely on the industry. Job vacancy rates are actually quite high at the moment.

Yup. Aaaaaand what proportion of the housing stock is SFH? About 40%…

I was wondering if someone was going to take that comment on.

Ya. That activity surge in the first 1/3 or so of the correction has happened to varying degrees in different markets in Canada going back at least the last 30 years. The pattern is pretty repetitive. Affordability stops deteriorating, goes sideways, improves, then deteriorates once more as the remaining enthusiasts jump in.

Finally, it begins improving again as the market resumes its downward trend. I’m pretty sure your own data shows this occurring for this city, over and over and over again. In the last large-scale national housing correction in ’90, the same suppositions were made when the activity in ’91 increased against a backdrop of poor performance.

Pretty sure I’ve even posted articles from that time period, especially from Toronto, all talking about “stabalizing”, “recovering” – everything we’re contemplating now. It’s why I keep saying, folks, there’s (so far) nothing new under the sun here.

Corrections restore affordability – and we’re not there at this point. Will it be different this time? Couldn’t say, but history seems suggestive. The country certainly doesn’t seem to be poised for a large scale RE boom from here.

Not sure why we need to guess at what people are making. Stats are available…..

Census: https://www12.statcan.gc.ca/census-recensement/2016/as-sa/fogs-spg/Facts-cma-eng.cfm?LANG=Eng&GK=CMA&GC=935&TOPIC=6

Add a few percent to scale from 2016 to 2019 incomes.

13.6% of Victoria households earn more than $150k/year

About a third of Victoria households earn more than $100k/year. Those are the SFH buyers.

I’m not so sure about that. Look around the province at housing. Is it really cheap anywhere? I’ve mentioned before that in 1991 my parents bought a quarter section (160 acres) with outbuildings and house outside Salmon Arm for $75,000. Now it’s worth perhaps $1-$1.5M. A decent house in town there is about $500,000. Cheaper than here but we’re talking about a town of 20,000 people.

@guest_63626

. Man. No one is measuring Dicks in a lesbian party. People only want to know how many are there. This is the bizzilian time that I have to explain it using different examples

The analogy I like to use is cars. For a car it takes a lot of engineering time to produce one but then it takes almost zero engineering time to build one. It’s 90% automated production.

Houses are totally different. Every project is a largely custom thing with hundreds or thousands of engineering hours invested and specialty approvals. Most of it is built by on site.

Mass timber housing is one step towards pre-fab where wall and floor panels are produced (almost fully automated) in a factory and then just assembled on site. I talked to the framers at Hockley corners and they said it cut framing time by half and everything fit exact to the millimetre. Expand that concept to design (90% of design of a house or apartment should be stock and automated) and approvals (much easier to approve things when they aren’t custom) and you have the potential to save massive time and cost.

Back to cars. How shitty and expensive were cars when they were hand built and only designed for very small production runs? The answer is very. Somehow the industrial revolution never reached the construction sector.

So then, 4 years ago, it wasn’t a luxury item? That fast? What about in other peaks in previous cycles? Was it a luxury item in 1980, 1990, and 2007, until they weren’t? Do you know that the “no land” in BC cities argument has been going on since the late 1970’s?

How is it that west van homes have lost up to 40% of their value so far? Wouldn’t that market be more considered luxury or at least more desirable than anything here? Is there another force at work, rather than homes just magically turning into “luxury” items almost overnight?

It’s not an argument that holds water IMO. You appear to be confusing luxury with desirability, and secondly, the essence of why the item suddenly became so desirable in the first place. There’s no shortage of SFH’s in Greater Victoria relative to the needs of the population, at all. It’s not hard to deduce something so basic when you see that SFH’s have generally always been easily available here, yet, that availability shrank to almost nothing just as the market went into full mania-mode. Coincidence? It isn’t. Because RE moves slowly, that phase in the cycle is perceived by some people to be permanent. Likewise, it isn’t.

Affordability deterioration through density changes happens to cities over a great deal of time (many decades), not in a few short years – if it happens at all. Just because the cost of an item has been driven to the moon via excitement, that’s not an expression of its luxury as much as it is an indication of the prevailing sentiment towards that asset in that moment.

As an aside, the “core” that everyone refers to here is so small it’s kind of meaningless. Living in somewhere like Gordon Head is a 15 minute drive from downtown. Suburbia in a real urban region is more like 45 minutes away, on the freeway. You could easily call GH a core part of the city. Sidney now, not so much. Eh, whatever.

Is it? It certainly has corrected, but the surge in activity in the last couple months has possibly arrested the fall in prices. Not in all categories for sure, but it certainly firmed up quite a bit. Not sure what will happen there going forward.

Hmm. I would say most homes get built during hot markets yes. At the beginning it’s relatively affordable and at the end it’s not.

I think it’s two things. Yes the market will push around prices and eventually in a downturn whatever inventory is available will get sold off at fire sale prices. But if construction costs are higher than potential sale prices then there’s a lull in building which tightens up the market (eventually). It leads to these boom and bust cycles.

Herpa, just go on MLS right now and see how many SFH in the 800k range you like and then ponder if there are more people with greater financial means than you also looking at those same houses. The point is that a decent SFH in the core is now considered a luxury item, as such it is no longer affordable by the average person. You either need to have above average household income (2 professional incomes) or a huge downpayment.

@ ks – it doesnt matter what two 80k income can buy – but in reality – the 2 two 80k+ (160+ house hold income ) only makes up less then 12% of victoria Core population or sanich or sook area

and of the 12% people – most of of them already bought

Issue I see with your argument is at 12% we are adding hundreds of families every year at 160k+/year income; however, we are adding a fraction of that in terms of SFHs in the core.

isnt that sample size kinda irrelevant .. i never heard bill gates talk about how many home less friends he have

Simply pointing out that I’ve seen mass immigration numbers play out on the ground with my business in terms of real estate demand.

isnt that sample size kinda irrelevant .. i never heard bill gates talk about how many home less friends he have

Thank you LF. I am not sure why KS keep mentioning about professional income .

Note some of these measures would simply drive prices up and come right out of the BC Liberal and federal Conservative playbooks. Other measures are quite good (hint: the ones that don’t involve “helping” people to buy). Contrast with the BC NDP whose housing policies have been much more consistent.

Sounds like they are just telling various groups what they want to hear without too much analysis. But that’s characteristic of 3rd parties who won’t be called upon to deliver.

“So many delusional people in Victoria with way too much time on their hands.”

YES, and several can be seen posting all day on this forum:)

No. Target gross immigration in 2018 was 310K (final number apparently not available right now, 2017 was 286K). That includes everyone granted PR status including people already living in Canada.

https://www.canada.ca/en/immigration-refugees-citizenship/corporate/publications-manuals/annual-report-parliament-immigration-2018/report.html

You don’t need to keep repeating yourself. Your argument is perfectly clear.

And, I think it makes sense. It’s of little interest, at least to me, to say that high income cohorts exist, or to claim that there are lots of them, or they know lots of people that fall into this category.

When we’re talking about the market writ large, the question you pose in my view is the right one – what proportion of people fall into the various categories? This is a data question, full stop.

The fact is, we’re not a high earning city with a large economy. It doesn’t mean there’s no room for exclusive, high priced neighbourhoods, but it does mean that if you have too much of the housing stock being priced in the upper tier ranges, you’re eventually going to have a rollback.

@ ks – it doesnt matter what two 80k income can buy – but in reality – the 2 two 80k+ (160+ house hold income ) only makes up less then 12% of victoria Core population or sanich or sook area

and of the 12% people – most of of them already bought

so yes, I am competing with 160k, 250k , 400k .. but HOW MANY..

I am saying i agree with you – there will always be people who have higher earning than me, But my argument is not WHO has higher income than me.

http://338canada.com/districts/59026e.htm

So a resident is taking the city to supreme court to fight an approved development because at 2.5 stories it is 0.5 stories higher than the community plan limit of 2 stories.

Funny thing is this guy doesn’t even live on the block…..hilarious. So many delusional people in Victoria with way too much time on their hands. Rundown old inefficient houses are being replaced by brand new energy efficent townhomes……….the travesty.

If I own a SFH and the person next to me is going for a skyscraper I would be super pro. Let them build the skyscraper, cash out on my house to the next developer and buy in the Uplands. I find it hilarious how people think that brand new density next to them will somehow devalue their property when in the vast majority of cases it does the opposite.

Not to mention people in Canada don’t live in family homes for 200 yrs like they do back home. You sell your 2”x4” crappy box and buy a 2”x4” crappy box elsewhere.

Same is true today in Venezuela.

Given the savings habits of some of those immigrants, even if they don’t make a higher income than the locals here or didn’t come here with bags of $, it is not inconceivable to think that they will be able to afford a home in due time where locals in similar employment situations won’t be able to (gotta have starbucks, gotta go out for dinner, gotta go on vacation, gotta buy a new truck etc..).

I’ve helped five Croatian families in Canada less than 3 yrs in Canada buy property in Greater Victoria in the last two years.

Not sure what the income numbers look like but I’ve had friends from Croatia land in Victoria right into 80k/year IT jobs to start and within 2-3 years they are up six figures on the one income, but for the most part everyone has a partner that also works.

Canada is not importanting immigrants to work at starbucks. The way the immigration admission criteria work is you have to be young, educated, solid english, etc.

I personally think this should be relaxed and we should get more immigration to fill jobs in construction and retail, etc., but I am not an expert in this field.

If the government really wanted to deal with the housing issue put a moratorium or at least reduce immigration to the point where the population is stable.

I don’t agree with a moratorium, but I really respect this argument as it makes perfect sense in my small brian. The arguments I can’t stand are “no skyscrapers, no clearcutting for subdivisions, no development, etc.” but somehow let’s affordability and comfortably accommodate 400,000 additional people per year.

Well Patrick, looks I stand to be corrected this time until Barrister further elaborates.

Ad from 1930:

The post we are both referring to (63651, Barrister) has no mention of “housing bubble cities”. The poster is proposing to decrease immigration Canada-wide “until the housing crisis can be addressed” , and also refers to low/falling Canada GDP/exports/manufacturing – all Canada-wide metrics.

Since you are “pretty sure” (without evidence), kindly point to a single part of that post that refers to only the “housing bubble cities”.

Patrick, I think you are trying to cherry pick data again. I am pretty sure the housing crises referenced in the quote you posted is directed at those “housing bubble” cities. The price/income ratio you listed is an average for the whole country and includes places like PEI.

By what measurable metric do we have a nationwide housing crisis? Compared to Canada in the 1970s?

Let’s instead compare Canada with other developed countries today.

Canada House prices/income and other metrics compare favourably with those countries above

https://www.numbeo.com/property-investment/rankings_by_country.jsp

So what is the yardstick you are using to measure “housing crisis”?

We should never be slaves to the letter rather than the spirit. We should never throw out reasonableness. We should never throw up our hands and accept rules that aren’t sensible.