Province Passes Legislation for Beneficial Ownership Registry

On Friday the Ministry of Finance announced the legislation to support the Beneficial Ownership Registry in BC. This means that starting May 1, 2020, businesses will need to maintain records of which individuals have control of the business, which will in turn lead to transparency around who owns the property held by the business.

What does it mean for Victoria real estate valuations? Don’t hold your breath for a noticable change in the market. For individual owners there is no change, and it doesn’t change anything fundamental for a company owning property either. Obscured property ownership via numbered companies or blind trusts is most common in the higher price ranges but a quick survey of 20 high priced ($2M+) houses turned up only one numbered company on title. The owners of those will be revealed via this beneficial ownership registry, and some that are not keen to be discovered have certainly been making plans to dispose of property or otherwise restructure ownership before the tax comes into effect. In more normal price ranges, obscured ownership just isn’t a factor. The registry may very well have a bigger impact in the ultra high end market in Vancouver, where apparently the ownership of nearly half of the highest end properties is unknown. It will also remove a loophole in the foreign buyers tax that allowed individuals to hide purchases behind complex corporate structures. Thus it will further knock down Vancouver’s high end market and may have some secondary effect in limiting overflow to Victoria but it won’t be a big enough factor to really observe in the numbers.

The biggest impact of the tax (as with the speculation tax) is the increased transparency of information. As the province says, “Ministry of Finance compliance and auditing officers, as well as law enforcement officials, will have access to the registry. Information may also be shared with the Canada Revenue Agency in efforts to stop tax evasion.” This is a tool for the CRA and provincial authorities to more effectively work tax and criminal cases so that they can go after the money. That critically levels the playing field some more and reduces the perception that the market is unfair and stacked against normal buyers. I think that is a critical benefit of these kinds of regulatory changes, and not to be overlooked.

Weekly numbers courtesy of the VREB.

| October 2019 |

Oct

2018

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 101 | 237 | 373 | 513 | 598 |

| New Listings | 210 | 414 | 604 | 815 | 958 |

| Active Listings | 2768 | 2756 | 2729 | 2703 | 2510 |

| Sales to New Listings | 48% | 57% | 62% | 63% | 62% |

| Sales Projection | — | 514 | 598 | 600 | |

| Months of Inventory | 4.2 | ||||

No change from last week, with sales still exactly the same as last year. Expect that final tally within 5% depending on how many agents decide to upload their deals before the end of the month. Listings too are roughly on par (just a bit under) with inventory 6% higher than this time last year.

October update: https://househuntvictoria.ca/2019/11/01/october-steady-as-she-goes

How is raising property taxes by more than inflation helping housing affordability? Council is talking out of the side of their mouths.

But how will the CRD pay for the 50 new positions?

second lowest new listing count in last 15 years for November.

How is raising property taxes by more than inflation helping housing affordability? Council is talking out of the side of their mouths.

Probably due to all the global warming 🙂

3312 WESTMOUNT ROAD, West Vancouver

Bought 2015 $3,618,000

Just sold for $2,900,000

13345 55a Avenue, Surrey

Bought 2011 $1,880,000

Just sold for $1,478,000

Sure looks balanced to me.

Shut up!

still obsessed with earning hierarchy ?

Haha always hard to predict turnout. I’ve switched to handing out handfuls.

Meanwhile Andrew Weaver around the corner from us tweeted out an hour ago that they had 195 kids already

Light turnout by the trick-or-treaters this halloween. I gave the last kid two, full size, chocolate bars.

Cynic, Introvert will crack the $60k a year mark in his/her highest earning years so you better watch out.

Plan is to pay off the mortgage by our early forties (possibly sooner), which will give us the next ~20 years (our highest-earning years) to bank a great deal of income before we retire. We also have a defined-benefit public sector pension.

I agree with totoro about the riskiness of the Victoria market. This isn’t Winnipeg; people want to live here. Unless your hold period is short, owning a SFH in the core of Victoria is pretty darn low risk, IMO.

I think there are lots of ways to do well financially and everyone’s gotta do what works best for them.

Sure let’s look at various 10 year returns:

2009-2019: 9.1%

1999-2009: 5.45%

1989-1999: 9.1%

30 year return is 8%

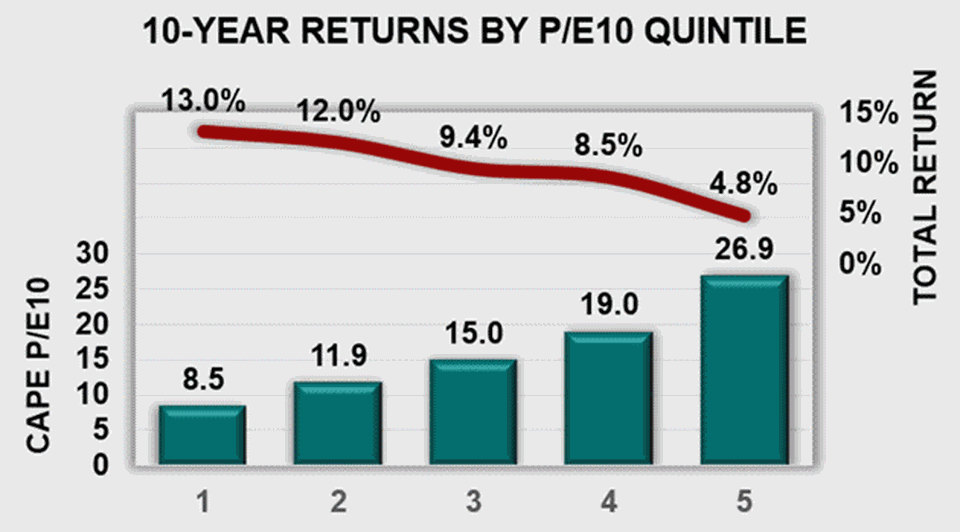

Now let’s look at market valuations from Case shiller price/earnings:

1989: 15

1999: 40

2009: 15

2019: 30

What will the return be in the next decade? No one knows, but I am quite certain it will be substantially lower than 9%.

Then of course you subtract MER (0.9% on that fund) and taxes because mortgage paydown is after tax.

To be clear I expect investment returns to still be higher than mortgage paydown and that’s why I pay the mortgage only after all tax advantaged accounts are full, but it isn’t likely to be nearly the spread you are saying in the next decade.

You are comparing total return of the fund against price appreciation only for RE. But don’t get the impression I think it’s a good idea to buy RE now.

Paying off debt is an investment strategy because it uses savings to generate a future return. And in general, any investment strategy incorporates a risk strategy.

“Paying off the mortgage and lowering debt:asset ratio is the best investment strategy to be prepared for whatever lies ahead.”

That’s not an investment strategy, that’s a risk strategy

“You are an investment adviser (a profession that needs and depends on other peoples money to making living), right?”

Nope, retired in my mid 40’s after working for around 15 years.

“Until then, please stop suggesting (and criticizing) what we do with our own money. Thank you.”

I am not criticizing people, just trying to help them by taking an alternative view. In today’s society it seems whenever someone says something that someone doesn’t agree with they tell them to shut up, people should be more open, I believe that everyone should own a house if they can but also have a portfolio, the same reason that your confident that your house will be a good investment is the same reason that the stock market will be a good place in the long term, it’s called economic growth. If everyone stops using banks or oil or electricity or computers or buying food etc…then yes the stock market will drop long term.

Leo, here you go I just picked off the top of my head a balanced fund with a 30 year track record in the 9% range, its up over 1,100% in 30 years vs less than 300% vs real estate

https://www.morningstar.ca/ca/report/fund/performance.aspx?t=0P0000714C

Kind of like realtors always saying now is the best time to buy.

I didn’t read Kenny G soliciting for anyone’s business. I read it as someone presenting an alternate option to invest and perhaps diversify one’s portfolio.

A little crabby today there freedom. Go out trick or treating tonight and hope some snickers make their way into your bag.

Awhile back, we’d see several posts per day here of price drops and other collapsing metrics in the Vancouver market, with added commentary pointing out how relevant this data is for our own Victoria market. Those posts have largely dried up, and (to me) the Vancouver market seems to have recovered to the “balanced” stage based on recent sales and MOI metrics. Is that the general consensus, or is there another reason for the “Silence of the Bears”?

No not just like stocks. Most stock market investors put in no more than 10% of their income every year, not 800% of their income once.

Everyone talks about US stock market performance as if it were the norm:

“We collect a database of capital appreciation indexes for 39 markets with histories going back into the 1920s. Over 1921 to 1996, US equities had the highest real return of all countries, at 4.3 per cent, versus a median of 0.8 per cent for other countries. The high equity premium obtained for US equities therefore appears to be the exception rather than the rule.”

https://ftalphaville.ft.com/2018/02/13/2198717/everyone-is-wrong-on-the-internet-stock-market-returns-edition/

Maybe you are looking at different portfolios (US only perhaps?), but that is not the case for a diversified global low cost portfolio such as this one:

10 year return: 9.57%

20 year return: 5.25%

https://cdn.canadiancouchpotato.com/wp-content/uploads/2019/03/CCP-Model-Portfolios-ETFs-2018.pdf

Future returns are negatively correlated with stock market valuations, and stock market valuations are currently very high (rightmost bin on this graph)

IMO in our market it is only a significant risk if your hold window is short, just like with stocks. If you are in a shaky relationship, do not buy a house together if you cannot afford to buy the other party out.

Hi Kenny G,

You are an investment adviser (a profession that needs and depends on other peoples money to making living), right?

If so, of course we should all break out of our “little conservative comfort zone” in your professional opinion, but I have yet to meet one adviser (except Francis Chou) who would take ZERO fee when their clients investments make zero or negative gain in the market.

Until then, please stop suggesting (and criticizing) what we do with our own money. Thank you.

Good plan. Paying off the mortgage and lowering debt:asset ratio is the best investment strategy to be prepared for whatever lies ahead.

Same can be said with the housing market. Yet you spout off about your house appreciation all the time while ignoring the fact you are banking on a one asset strategy. That is a huge risk imo.

You ignored risk and came out ahead, but that doesn’t mean there was no risk.

I’m so lucky I found a new spouse after Hawk died.

“10 years of bull market is not a good way to judge long term returns.”

oh, btw the numbers look very similar for 20 and 30 years

10 years of bull market is not a good way to judge long term returns.

“also some growing consensus that market returns will be lower going forward so there may not be much real world difference.”

I have been hearing this for over 10 years, meanwhile a simple moderate risk balanced portfolio has averaged almost 10% during that time. The fact is when you payoff a mortgage at 2.50% you get an after tax return of 2.50%, it may give you peace of mind but people need to break out of their little conservative comfort zone. Since moving here almost 20 years ago I noticed that on the whole Victorians are very conservative with money, which isn’t surprising given the number of public service workers, who tend to be on a whole more risk adverse. It may help you sleep at night, but your missing a lot of low hanging fruit. I certainly don’t consider myself a high risk taker by any means just a person who is well educated in how money and financial markets work.

Bingo…

Almost certainly good advice. Personally I just fill up tax advantaged accounts then use any remainder to pay down mortgage. RESP->RRSP->TFSA->Mortgage.

Likely better returns by leaving out the accelerated mortgage paydown, but I like the non-financial return of peace of mind as well. Also some growing consensus that market returns will be lower going forward so there may not be much real world difference.

Or if we are going to sell citizenship it should be for a meaningful amount of money (maybe 5 or 10 million minimum) paid directly to the government. I could support that if it were combined with strong background checks on the applicants.

James and Introvert if I didn’t know better, I’d say you were married.

I’m not sure you get my point. I don’t need to show anyone – I’m sure your right. I’m just not resonating with what you’re saying. I know I might be able to, “get it to work” for me. And I don’t care in the slightest – I’m comfortable and content with what I have. There are plenty of people that aren’t interested in taking risk on in the way you elucidate. I’d be one of them. I’m sure you’re wealthier than I as a result.

You know what? That’s completely fine with me. There’s nothing wrong with a good play, nor is it to be someone who simply has a different tolerance of risk, or type of risk, from you.

Go on…

It isn’t for sale. There are other requirements, such as recent business management experience (Working in finance or HR management of at least two people for two years of last 5 years). And then you are scored against other investment applications based on languages (French a big +, education, age etc.) They have a backlog of applicants, so pausing the program just allows them to work through that, and refine the criteria. Main item they should work on is choosing people that will stay in Quebec, currently you just need to have an “intention to stay in Quebec”. So it ends up to be a “Toronto/Vancouver investment immigrant program”.

Soper, we all know you’re in deep shit, no matter what.

“Far too rich for my blood. I agree the potential for that to be truly advantageous is there, but the downside risk I would find to be completely unacceptable.

I’d rather skip that opportunity for some peace of mind. It’s just the price you pay either way, I guess.”

Show me one 5 year period over the last 80 years where a diversified portfolio was negative. I assume most people have saving invested in stocks or mutual funds, not leveraging when you have a secure profession is like waiting up to pay cash before you buy a house. I’m not talking leveraging the full amount of your house but lets say you borrow 300K against 1MM house and you pay that off over 5 -10 years, why not get the money working now and pay it off over time, the same as you do with a house. People wont borrow to invest in a diversified portfolio but they will leverage into a rental with low or negative cash flow and no liquidity.

You’re an idiot.

No one said it was impossible, they said we’re in deep shit if that’s what they’re doing.

Far too rich for my blood. I agree the potential for that to be truly advantageous is there, but the downside risk I would find to be completely unacceptable.

I’d rather skip that opportunity for some peace of mind. It’s just the price you pay either way, I guess.

If you ask most people with a paid-for house if they plan to borrow money against their home to invest in the stock market, the answer would be no.

Also, the invest-more, pay-off-the-mortgage-less plan ignores risk, IMO.

Steve Saretsky chatting with Ian Young. The first bit is on foreign buyers and the rest is on the Quebec Investor Program and the impact of foreign capital on the Vancouver market.

https://www.youtube.com/watch?v=758TrgsF05Q

Article by Ian Young form a few years ago on the Quebec Immigrant Investor Program

“The QIIP is still on track to send about 1,400 new millionaire households to Vancouver annually for the next few years. (Historically about two-thirds of all millionaire migrants end up in Vancouver, and one third in Toronto).

This is the point where supply hawks point out that 1,400 households only represent a small fraction of Metro Vancouver transactions: about 5 per cent of residential sales in a typical year. But a basic understanding of the home-buying behaviour of the Chinese multi-millionaires who dominate IIP/QIIP arrivals reveals their folly. Pretty much all data and market observers – from condo king Bob Rennie, to industry-friendly economists, to academics like David Ley and Andy Yan – agree that such buyers are concentrated in expensive detached housing, in areas like Vancouver’s Westside and Richmond.

So let’s apply conservative assumptions. Let’s assume the typical QIIP household buys a home worth C$2.5 million, the bog-standard average detached price in the City of Vancouver.According to the REBGV, the all-sales average for Greater Vancouver last month was C$1.06million. This means that if our QIIP households represent 5 per cent of sales, they actually represent about 12 per cent of the entire dollar value of the market.

Yet this, too, seriously undervalues their likely share. It assumes QIIP households make a single lifetime purchase, and this is known to be untrue. IIP migrants LOVE buying real estate. According to federal data, real estate ownership is by far their most popular business activity in Canada. Real estate ownership made up 63.1 per cent of all unincorporated business activity by IIP migrants, according to the official Canadian Employer-Employee Dynamics Database. For all IIP businesses, both incorporated and unincorporated, real estate ownership was easily the biggest category, at 48.8 per cent.

Modest adjustments to our assumptions boost the QIIP’s dollar share of the Greater Vancouver market. If their average purchase is C$3.5 million, closer to the Westside detached average, their dollar share leaps to more than 16 per cent. If only one in three such millionaire households buys a second property based on the same assumptions, then it’s 22 per cent of the entire Greater Van market. And so on.

These calculations represent the dollar proportion of all sales of all housing types, in all areas from Pemberton to the deepest Fraser Valley. Yet, the QIIP’s impact is not so dilute: it is focussed to an extreme degree on detached housing in areas like Richmond and the Westside, the epicentres of the unaffordability boom in the past decade. The QIIP is thus a vital strut that supports these sectors, and these sectors arguably support the whole market, as other buyers look further afield, and cashed-up boomers hand off the same money to their kids to buy condos.

https://www.scmp.com/news/world/united-states-canada/article/1983336/one-point-plan-tackle-vancouvers-housing

“Yeah I think the hope/indication is they will revise or cancel it before that time. Doesn’t seem like the citizenship should be for sale.”

Good news. Not only is selling citizenship terrible policy but studies have shown that these investor programs have provided little economic benefit to the country. The Federal Immigrant Investor Program was axed for this exact reason. Most of those coming through QIIP want nothing to do with Quebec in the first place and around 90% leave the province and the majority eventually end up in Vancouver which has helped fuel speculation and the rapid acceleration in home prices there. The number of those who come through the investor programs may not seem like much until you consider their accumulated impact on the real estate market through decades of these programs running and the fact the most end up in just a couple of cities. They are the marginal buyers and those buyers set the price. We don’t have to guess what type of businesses they are involved in as well since data shows real estate is by far their most popular business activity here.

“From 2005-2012, about 45,000 millionaire migrants arrived in Vancouver under just two wealth-determined schemes, the now-defunct Immigrant Investor Programme and the still-running Quebec Immigrant Investor Programme. Let’s put that in perspective. The entire United States only accepted 9,450 wealth migration applications in the same period under its famous EB-5 scheme, likely representing fewer than 30,000 individuals. So, Vancouver has recently received more wealth-determined migration than any other city in the world, by a long stretch. This, in a city with some of the lowest incomes in Canada.”

https://www.scmp.com/comment/blogs/article/1804916/something-grotesquely-wrong-vancouvers-housing-market-and-time?page=all

“I’ve yet to meet anyone who regretted paying off their mortgage

Well, I for one sort of do. We bought our first house in 2001, I remember back then that 400K seemed like a fortune to pay for a house. We paid it off by 2007, before we had children, mind you interest rates were higher at 5%. In hind sight it didn’t work out badly as once the house was paid of we leveraged it into the stock market in 2009/2010 and have done quite well, but if I was doing it again especially at these interest rates and I had a secure profession I would encourage clients to pay the minimum and invest your savings, if you have the means pay it off quickly and borrow back a large amount to leverage in stock market at an after tax interest rate of around 1.50%. I also encourage clients over 55 to defer paying property taxes and keep the money invested.

But this is not uncommon. The US has the EB-5 which allows “purchase” of a green card (and eventual citizenship) if there is an investment of $500,000-$1M and creation of 10 US jobs.

Yeah I think the hope/indication is they will revise or cancel it before that time. Doesn’t seem like the citizenship should be for sale.

The suspension is for new applications. Any applications submitted before Nov 1 will be processed as usual. Applications will resume July 1, 2020. Given the normal backlog this will likely not in itself affect immigrant numbers.

https://www.immigration.ca/applications-suspended-for-popular-quebec-immigrant-investor-program-until-2020

Great news. Always thought that program was effectively a fraud.

Quebec is suspending it’s immigrant investor program until 2020.

https://twitter.com/RadioCanadaInfo/status/1189553060160274437?s=20

“The Legault government has decided to suspend, until July 1, 2020, its controversial immigrant investor program, which ultimately results in permanent residence in Canada.

This program was reserved for foreign millionaires or billionaires, who, depending on their financial means, could receive a Quebec selection certificate (CSQ). A total of 1900 places was awarded by Quebec.”

“Numerous anomalies have been identified in recent years and “the government’s desire” is to “revise” this investor program.”

It’s also not unreasonable to presume rates will be similar to today. Both scenarios are equally reasonable, to my mind.

Paying off your mortgage ASAP is always a good idea, IMO, and it’s my philosophy too.

I’ve yet to meet anyone who regretted paying off their mortgage.

We’re doing ABW payments and are going to be looking at doing lump sum payments along with it.

In the near term rates may well be going down, but in 5 years it’s not unreasonable to presume rates being notably higher.

In any case, doubling down on the principle to mitigate the risks at the first renewal seems prudent. And if the rates haven’t moved, so much the better, and you’ll have payed it off that much faster. We’re hoping less than 20 years, in our case.

Yes, this makes sense. The likely explanation for the govt referring to this as the “business keeping the records”, is that the business does keep the records, but it needs to be stored in a new online gove maintained site. The company would create its own account, and enter the share information once. If it never changes, that’s it, otherwise the company would self-update as needed. So no annual fees/filings with the govt. And nothing is public, as only the company has access to its account (other than govt auditors, who likely notify the company anyway that they are doing an audit).

Doesn’t seem onerous. But not sure if it will catch money launderers, as how likely would it be that they maintain an accurate registry?

Car has been towed and all 4 tires replaced. I was hit with 50% depreciation on the tires and after paying my deductible, am only getting $150 back from ICBC on an $800 bill. Not even enough for a nest cam. Slasher wins, but I’m pointing the baby monitor at the car now.

This is why I have all my deductibles at highest possible amount for everything from ICBC to home insurance. You save a lot on the annual premiums going high deductible but you don’t really lose much….on the smaller stuff I rather just deal with it on my own.

To me it is obvious that companies will have to submit the names of beneficial owners otherwise it is virtually pointless. They are not going to send officials to examine the books at all the head office locations. (Well maybe they are sending senior staff in February to companies headquartered in the Caymans).

Bank of Canada holds interest rate at 1.75%, wary of global slowdown

https://www.cbc.ca/news/business/bank-of-canada-interest-rate-oct-30-1.5340613

Looks like rates will stay steady or perhaps drop in the near future (which many bears think is IMPOSSIBLE!).

Inflation is at 1.9%, right at the Bank’s target of 2%.

Any broad economic slowdown will tend to lower inflation, clearing a safe(r) path for interest rate cuts.

That’s brutal. I’d be peeved, too.

Not sure video of the perp would even help. All you’d have is grainy footage of a guy wearing a hoodie. Police would have nothing else to go on.

Unfortunately, incidents like this almost always go unsolved, even with video evidence.

We have a camera and have even had the police out to look at footage after a minor vandalism. Almost impossible to get enough quality at night to identify someone.

Slasher of Oakland’s update

Car has been towed and all 4 tires replaced. I was hit with 50% depreciation on the tires and after paying my deductible, am only getting $150 back from ICBC on an $800 bill. Not even enough for a nest cam. Slasher wins, but I’m pointing the baby monitor at the car now.

I don’t know if CCTV throughout Victoria is really necessary but I am still quite surprised that not a single person in my neighborhood had a recording of this loser’s tire slashing adventure.

As I recall, you made the same argument for the beneficial ownership registry. Where are the articles from the investigative journalists on important discoveries from that?

Family owned businesses might not want other family members to know how many shares everyone owns, let alone the public in general. They are called “private” corporations, and they shouldn’t need to disclose publicly like the publicly-traded ones do.

From the working in that article, It appears ambiguous as to whether this information actually gets filed and sent to the govt, or is just “kept” by the business and available to govt. as you likely know, businesses need to keep a minute book with documents in it.

It may that you’re correct and it actually gets sent to the govt, it if that’s the case it’s a poorly worded description in the article.

What brings you to that conclusion? They say that companies are required to collect and maintain these records which would be within the company but they also say “Information collected includes…”. The collected could refer to what the company is collecting, but it could also refer to the government collecting it for a registry once gathered by the company.

Personally I have little to no faith in the government doing anything useful with this information. Needs to be open to investigative journalists. Much of the action so far was prompted by work from the press, not government.

Actually it seems this corporate beneficial owner info won’t be public at all, which is ideal. That’s different than the property beneficial owner one, which as you say is public. The corporate one is just information to be stored by the company at the company HQ, not in a govt database. Only available to govt officials who want to examine it during an audit. Hard to see how it will have much effect on anything. Seems odd to call it a registry when there isn’t a central registry at all. https://news.gov.bc.ca/releases/2019FIN0113-002038

I think we talked about this a couple months ago. Property Ownership data for individuals is already public. This changes nothing. The existing system is not free but it is public.

I don’t see any indication that the new system will be any different.

I do.

One leads to power being constrained in the hands of the very few.

The power will be abused regardless.

Well you missed the point. As well as CCTV cameras on some streets, I’m also in favour of the corporate beneficial registry, and the property beneficial owner registry. But all of those are under the important condition that the information be only available to govt, not the public, as clearly stated in my post today (64168). I wouldn’t be in favour of CCTV cameras being broadcast to the public.

We already tell the govt lots of things, like how much we make (tax returns), but that’s very different than it being publicly available, and I hope you see the difference.

“Yes, that’s to counter the house rule that every new tax, red tape or loss of privacy rights must be unconditionally accepted…”

Lol, coming from the guy who only a few days ago mentioned that it might be time to go all Nineteen Eighty-Four in response to the great Oaklands tire massacre of 2019.

Yes, that’s to counter the house rule that every new tax, red tape or loss of privacy rights must be unconditionally accepted on the premise that it may help us catch money launderers or lower the buy-in price for a home.

I’ll have you know my grandma’s house is owned by a series of shell companies in the Grand Caymans. She is not going to be happy about this.

Don’t you know that it’s a house rule that the “granny defense” be raised against any attempt to limit fraud and tax evasion? 🙂

Agreed. That’s why I don’t see much affect for the market here. A small percentage of properties are held by companies, a minority of those have unclear ownership via numbered or other opaque structures and no public info, and an unknown but likely small percentage of those are hiding ownership for nefarious reasons. I support the transparency 100% but it’s just not going to move the needle here.

Right, but people with lots of companies see no point in naming them, and just use numbers instead of a name. Some RE developers do that. That doesn’t imply anything sinister, and the same information requirements exist for both named and numbered companies. Yet the public sees a “numbered company” owning something and assumes the worst.

IMO, both this new corporate and the existing property beneficial owner registry shouldn’t be available to the general public, just for authorized govt use. Some people like privacy and don’t want to advertise to the world … “look how rich I am, I own 5 office buildings and 10 Tim Hortons!”

I think we agree. The solution is reducing the work done, not shifting the fees from builders to general taxpayer.

Baseboard heating in a big rancher can be very expensive in the winter but that does sound excessive.

Our house (~2200sqft) used an avg of $138/month of hydro. Heat pump + basement baseboards + electric car.

Nothing fundamentally. But depends on what information is available on that company. Named companies often have publicly discoverable information about their ownership while numbered companies rarely do.

Why single out numbered companies? What’s the difference between 123 Inc. and ABC Inc.?

Beneficial ownership registry changes nothing for individuals as far as I know

haha lets not have cops because hey might catch the wrong bad guy

Beneficial Ownership Registry = Stupid. I can’t believe they have made it public.

Be prepared to experience a huge increase in scams and property fraud aimed at the elderly. It seems that massive loss of privacy is worth it just to catch 50 “bad” Chinese dudes in Vancouver.

Gas, Honda, and see link for Wattage Estimation Guide (we had 5000 Watts Honda generators for our 2600 sqf rancher out in Sooke. Wood for heating, fridge and hot water used propane).

https://powerequipment.honda.com/generators/generator-wattage-estimation-guide

How many sqf is the house?

It could be the tenant/s are wasting energy by open windows with the heat on, and running the washer dryers several times per day if the house have a rented suite.

Another possibility is that the attic may have inadequate insulation and perhaps there are leaks around the doors and windows as well as poor humidity sensor.

Check out the link: http://forums.redflagdeals.com/baseboard-heating-only-whats-your-cost-hydro-1368171/

$4,176 per year is a lot.

We’re electric-only at our house, and we pay $2,000 to $2,500 a year.

@ Barrister

Depends on the duty cycle and the needed capacity. Leo can give you my husbands number if you are really interested in more details.

I disagree. There is a lot of common sense items that come up during a build. I’d wager thousands, if not tens of thousands of dollars are often wasted on unnecessary work. I’d be happy to clog up the HHV comments with some examples…

Hey I’m a big proponent of prefab (which I did). Coupled with a catalog of designs there is most definitely room for cost savings and better buildings. You could probably cut engineering fees in half (P.Eng still has to inspect the place and sign off), you can cut your energy modeling costs in half (remember siting/geography plays a big part). You cannot eliminate the blower door test (now required as we’re in ‘Step Code 1’).

Generally I’ve been happy with the city and inspectors, but there is most definitely room for the city to be more accommodating and reduce the cost burden on builders/owners.

Set up a Hydro account for the place we bought. Get this:

They offered to do an averaging agreement for the previous 12 months of energy use, which equalled $348.00 a month. Running the math at current rates, that works out to the current owners using about 2850 kw/h a month!

I have no idea what the current owners do, but that’s an extraordinary amount of energy considering the square footage. The house is well insulated with all double pane glass. Electric everything, but still…

I think we’ll just start fresh and go from there.

Someone has to prepare architectural drawings for large residential/commercial buildings as they are a critical component to communicate details, identify building issues, make records and facilitate change management. On a residential house there is little to no formal change management documentation process and the carpenters are much more hands on in the construction decision making process. Without a formal processes and documentation it creates legal issues and slows down the construction process on large scale buildings. With that being said the quality of architectural drawings are have substantially dropped off in the last 5-7 years, less attention to detail, less review, less qualified staff, and incomplete drawings.

Exactly who is it that is going to pay to maintain this registry? Hopefully it is the numbered companies and trusts and not another bureaucracy that is being put on the general taxpayer.

I have a question that is sort of only indirectly involved with housing. My neighbours who are somewhat eldery are thinking about getting some type of home generator for emergencies. Any advise regarding this would really be appreciated. gas or diesal? brands, size and what about fuel capacity and storage.

Personally, I would very much prefer to live in a building designed by an architect.

Really? Some of the worst single-family homes I’ve ever seen have been designed by architects. Architects-owners especially are bad for crappy designs in my opinion.

Buildings pretty much have to be designed by architects so can’t compare to a designer building.

Personally, I would very much prefer to live in a building designed by an architect.

I am thinking we will beat last year by just a tad.