Flat market continues to be flat

July numbers were released on Thursday in the middle of my vacation, so here is my lukewarm take on the month’s results.

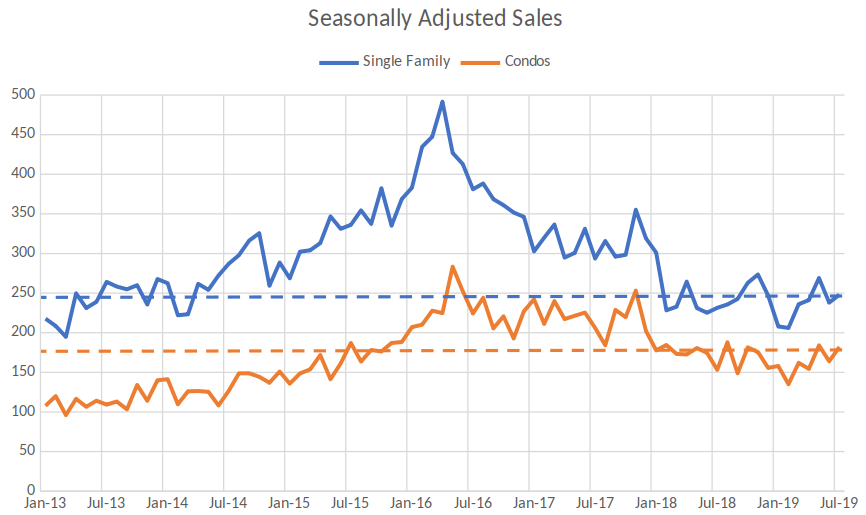

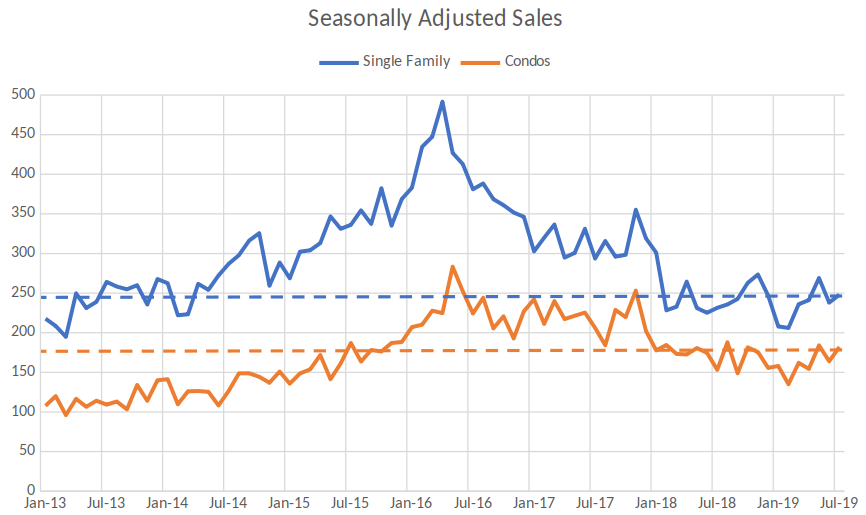

While Vancouver and Toronto sales in July were up 23% and 24% from a year ago, we had a much more modest gain of 8%. It’s clear that the days of decreasing year over year sales are over, but at this point I believe that is more because sales don’t have much more room to drop as opposed to a sustained recovery in the making. Or at least single family sales don’t have a lot more room to drop, the condo market remains near long term average sales levels and could certainly slow further. The mortgage stress test has certainly thrown a wrench into the predictability of the market, as it becomes difficult to distinguish ripple effects from the introduction of the credit-constricting measure from the overall real estate cycle.

Sales remain roughly flat post stress test as I see it with the usual monthly noise. The other way you could look at that chart is an increasing trend from the very low levels of Jan/Feb, but I would want to see sales break out of their post-stress test range before calling this any kind of sustained increase.

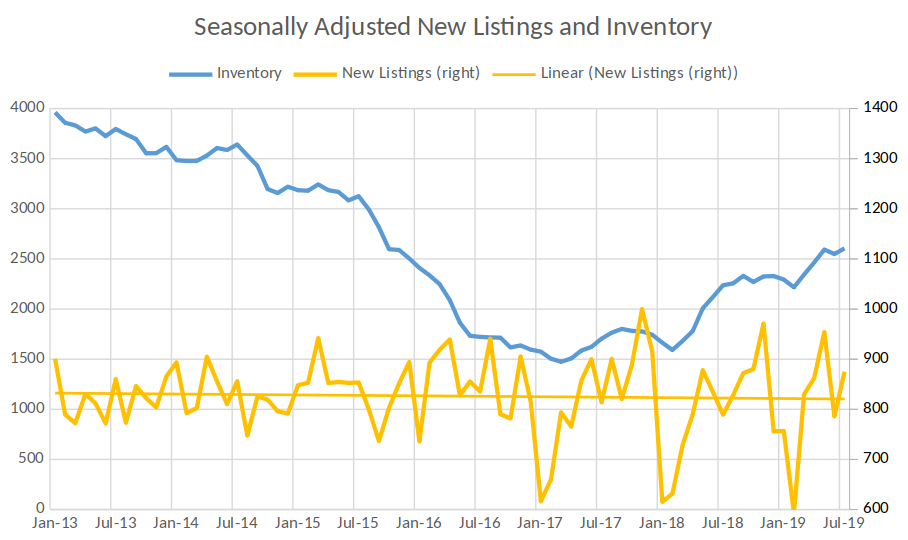

Inventory, although down slightly in July, is actually up when seasonally adjusted (in other words, it usually drops more in July from June) and this is due to an increased rate of new listings (up some 10% from last July). New listings have been trending upwards a bit this year which is good news, but if you look past the increased volatility in the last 3 years, the longer run rate of new listings is still dead flat (see yellow trend line).

The market as a whole continues to cool, although significantly more slowly than we saw for much of the last 18 months and some market segments have stalled out (single family in the core is the same as last July in roughly balanced conditions). Single family house prices are drifting downward at a slow pace, partially due to the current slowdown and partially due to irrational market behaviour when the market was overheated in 2016/2017. If we extrapolated the current rate of decline (usually a bad idea) of the 12 month running average it is declining at a rate of $25,000/year or 3%. Condo and townhouse prices are approximately flat.

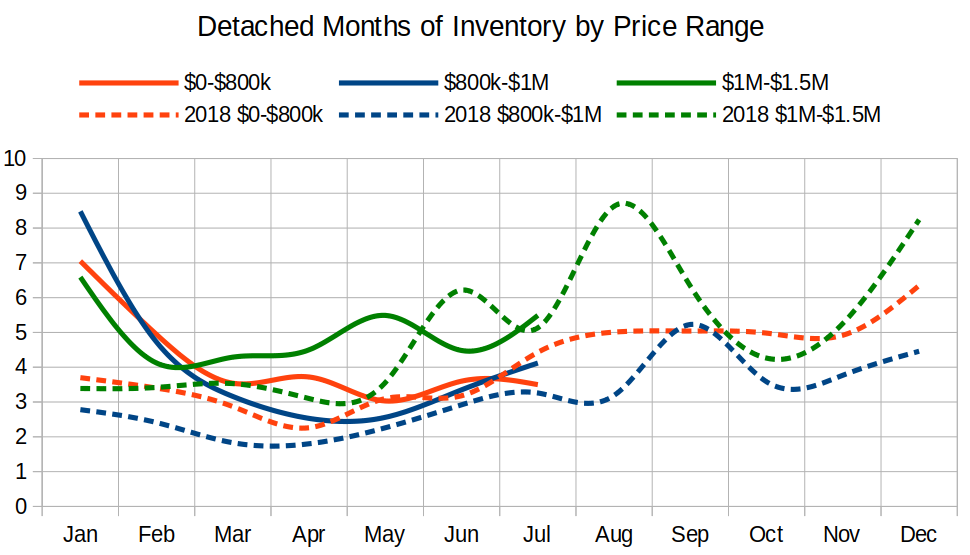

So what of the assertion by the real estate board that the under $1.5M properties are more active and entry level is seeing strong demand? Well the mainstream inventory is always more active than the luxury market no matter the market conditions, so the first part is a bit of an empty statement. However, is there “strong demand” in the entry level? There are two parts to this:

- The entry level single family segment is indeed the strongest of the bunch, and months of inventory in that segment are lower than last year (red lines in chart below) as opposed to the mid range (blue) and higher end (green) that are all slower than last year.

- Sales overall are at multi-year lows so demand is not that strong no matter how it is distributed. Perhaps more accurately demand at the lower end is reasonable in the face of tight inventory.

So although the overall market is slower than it was at this time last year and sellers are accepting more off asking price, if you’re looking in that entry level range don’t expect any deals.

In other news, I came across this article in the TC making the case against the spec tax in a haphazard way. The argument makes little sense and conflates the effect of the foreign buyers tax with the speculation tax as well as trying to argue simultaneously that the speculation tax won’t have any effect but somehow it is vitally important that we get rid of it. Also amusing when the claim comes out that the speculation tax will hurt construction (no decrease in starts yet). Apparently there is no speculation in Victoria but the entire construction industry depends on speculators to stay afloat?

More interesting is that for the first time I’ve seen reference to the buyer motivation and origin data from the up island real estate board. We’ve discussed the Victoria data out of this survey many times here, but I haven’t seen the same data for the rest of the island. I’d love to see the actual source data, because the TC article has nearly unbelievable figures like “59 per cent of all buyers were purchasing for retirement purposes” which given the market includes Nanaimo I can’t believe are accurate. If anyone has access to these data please get in touch.

Overall I don’t believe July figures represent a substantial change in the market. Some more sales in the face of more inventory means the situation is roughly unchanged. The bounce in Vancouver is worth watching for sure as I don’t think it is what anyone expected at this point but it’s too early to tell what it will turn into. By no means is that market significantly closer to being supported by fundamentals, but stranger things have happened across the pond.

Have a good rest of your long weekend everyone.

New post: no analysis just some musings on space

https://househuntvictoria.ca/2019/08/14/space/

You shouldn’t assume that visible minorities that you see aren’t Canadian, and are tourists. You can’t tell nationality by looking at someone, unless you’re also checking passports. An ethnic Chinese that you see at Butchart may well be a Canadian citizen, not Chinese citizen, and as Canadian as you.

Haha.

I guarantee you, that never stopped them before. Last few years at Butchart was just full of them end to end, regardless of whenever in the day we went.

Maybe that’s it – all of them have now seen everything here and are now going elsewhere? 😛

That article makes no sense to me.

Ian says “Chinese applications for Canadian immigration and visitor visas both fell to their lowest levels in recent years” and “potential losses of hundreds of millions of dollars in visitor spending.”

That implies a drop in visitors. But visitors are up 3%. Sure it’s not up double digits like previous years, but up is up, and certainly not leading to losses of hundreds of millions of dollars in visitor spending.

I am originally from hong-couver and talking to friends , family and others , they all mentioned, cost of ferry, overnight housing, cost of expenses , food is too price… Chinese people are cheap even if we have money ..

Ya that’s a decent read. Not surprising to me given the change I’ve seen. I do wonder whether the arrest of that woman really was it. China’s been ramping up the restrictions on a lot of its citizens travelling, their economy has been faltering and they’re disappearing from foreign RE markets. Don’t think that’s a plus for international tourism.

I wonder what the other tourist sources are to Victoria? I suspect a lot of Americans, Indians and possibly Indonesians. Haven’t noticed the numbers of those guys really changing though, not that I’ve paid careful attention. The loss of Chinese though, was just impossible not to notice.

Chinese tourism is definitely down, Ian Young @ SCMP just wrote an article on it…

https://www.scmp.com/news/china/diplomacy/article/3022670/chinese-immigration-and-visitor-visa-applications-canada

Bc building codes now available free online https://news.gov.bc.ca/releases/2019CITZ0051-001602

Recent official comments from govt (Destination BC https://www.destinationbc.ca) reporting record international BC tourism this year (2019). This isn’t an estimate, they count the exact numbers as long as point of entry to Canada is BC.

(August 12,2019) https://www.cbc.ca/news/canada/british-columbia/tourism-bc-record-numbers-1.5241120 Tourism in B.C. expected to reach record levels again in 2019 | CBC News – CBC.ca

“The number of tourists visiting B.C. in 2019 is expected to set a new record and will likely increase in the years to come, said Maya Lange, vice president of global marketing at Destination B.C. Many of these tourists come from the United States, United Kingdom, China and Mexico.”

Btw, visitors to BC from Asia Pacific up 0.7% over last year. https://www.destinationbc.ca/content/uploads/2019/06/Tourism-Indicators_June-2019.pdf

Quite the pounding on the markets today and a potentially critical inversion of the US 2/10 yield curve. Worse, China’s metrics are flashing red everywhere and the 80 billion bucks they recently threw into the lending space doesn’t appear to be helping. In 2019, where they go, the world goes.

They’ve been quietly nationalizing some pretty major banks over there that are starting to buckle under the stress of non-performing cross collaterized (euphemism for defacto-unsecured) loans, while auto sales, energy, and factory outputs are all sinking.

What a time to be alive. We’ve seen inversions before, but never at these debt levels with the central bank ammo chest so low. For Canada, we’ve so blown out our collective brains on debt, that we may find ourselves among the least able to cope with the transitions that are happening.

PS, speaking of China, Chinese buyers in Victoria, etc

For the few (or no one) people who care, a little update on my own personal anecdote regarding Chinese tourism in Victoria and what I perceived to be a visible reduction in the amount of them in previous hot-spots. I went to the Butchart Gardens this last weekend as I often do, and again, compared to previous years – way, way less of them.

When I went to guest services to renew my annual, I got into a conversation with one of the staff at the front counter. Well, it’s not my imagination. They apparently have a system where they coordinate visitation with several tourism agencies (basically the companies that own and operate those big tour buses you always see), and according to this fellow, the activity they are facilitating has fallen way back this year. He had no idea why, but I wouldn’t expect him to know that. While I’ve noticed it most there, it’s in several other areas as well that for years, had been wall-to-wall, and now, are not.

Just an anecdote, but it’s interesting against the backdrop of everything else we’re seeing.

Cynic, if Introvert loses his job during a recession he can always rent the upstairs of his house and live in the basement to save money. Maybe one of the bears here will be the one renting the upstairs, lol that would be funny.

Introvert, you are an idiot. And if you are truly hoping for a recession and the hurt it will bring to so many people for some personal gain in real estate you are a despicable human being.

troll statement or not. You’re an idiot.

Agreed – the money printing is not good long run, likely even sooner than that. I’m just calling a spade a spade in terms oh how (as it continues unchecked) it will impact asset prices.

In terms of actually fixing things, there is a brilliant idea which covers more than just these economic issues but also tackles what is the issue of our time, climate change. Enter the Green New Deal which would

1) help seriously start addressing climate change by transitioning (much, much more quickly) away from carbon fuels

2) be a turbo boost to the economy because more renewable (or non carbon energy) will require new infrastructure, loads of new jobs, new industries in fact a new economy.

Of course there is a not insignificant part of the public which remains horribly misinformed, uneducated and stubborn about climate change. And those with vested interests are like vipers defending their dens. Plus, even if such a transition is put into action, the amount of job losses that will have to be dealt with will be staggering. So there are huge hurdles to a Green New Deal but it’s by far the best solution I’ve heard so far – hopefully we’ll get to this sooner than later.

Very limited precedent – sure, it could mean an increase in nominal prices, but what precedent there is doesn’t really bear that out. There’s been a lot of interesting discussion out there recently about the “Japanification” of monetary policy, or more specifically, the idea of CB’s getting trapped into a perpetually low rate, interventionist regime.

When the RE (and basically everything else) bubble over there went bust, they committed to similar actions we’re seeing today across a greater expanse of the globe. The net effect of Japan’s policies on house prices isn’t entirely clear, but what is clear is that prices there continued to decline all the while they were keeping rates to the floor, buying their own bonds and even their own equities in a desperate attempt to stave off what are long term cultural and demographic trends.

Japan may have demographic trends that Canada doesn’t face, but I think the issue is bigger and more systemic than mere population decline. You have to consider why all this unconventional and upside-down monetary policy is occurring. I don’t think it signals strength.

A globally aging population, devaluation of global labor both in terms of hourly cost as well as outright replacement by automation are deflationary dynamics. Money printing is not going to be able to ultimately pave over that, but I don’t know that anyone sees a better alternative right now. A massive war might do the trick, but at a probably appalling cost.

Negative interest rates create an environment to buy or find a place to store your money where you are not charged. So gold/ crypto crappy shit/ real-estate and so on. While the beginning will look ok. Long term it just makes people spend and take on debt that they should not. Will not end well. Just more risk people add to their portfolio.

The whole yield curve is around 1.25%. Not a great sign for the health of the economy.

Trump will start talking about further tax cuts…While a good idea. US cannot afford it long-term.

https://www.bankofcanada.ca/rates/interest-rates/canadian-bonds/

There’s a tremendous amount of discussion happening in financial circles about yield inversions, current interest rates, a savings glut, devaluation of currencies and extrapolating out what can be expected. We have the unprecedented reaction to 2008 (QE and the more than quintupling of debt held by the US FED with 10 year lows in interest rates). Also at play are demographic changes and technology advancements that mean we may be in an entirely new ballgame where old predictions and expectations just aren’t relevant going forward.

25 HHV points to those who can predict what devaluing currencies, negative yields and rock bottom interest rates will mean for asset prices like real estate in the short term. (Look up)

Yes, because the entire economy benefits from higher house prices. And higher unemployment. And higher inflation. And higher deficits… oh, wait a sec

The last downturn which caused us to go from surpluses to deficits. Next time it will go from deficits to bigger deficits and low interest rates to even lower and lower rates. Its not something that is sustainable or good in anyway.

The aftermath of the last recession did wonders for house prices here. Here’s hoping for another good recession!

I want one of those negative 10 year mortgage rates they have in Norway but I don’t want the economic conditions to go with it

When you do not let economies go through natural cycles things get out of wack. Negative interest rates are one of the results. We again will see central banks try to manage and smooth things. May work for a while but one day the ugliness will happen and happen quickly. Lot of people on this earth which is another variable in all of this. China and Russia and the US all have different agendas which is also very concerning.

Maybe, maybe not. From the posted chart, there was a bigger and longer yield curve inversion from 2001-2002, and there was no recession in Canada, and Victoria house prices rose each year during and after the inversion, (Vic avg house prices doubled from 2001 to 2006) https://www.vreb.org/media/attachments/view/doc/ye782018/pdf/Annual%20Summary%20of%20Single%20Family%20Sales%20from%201978

Leo,

I would have thought the graph I posted below would have been more visible.

😛

“Just astonishing. This number keeps rising!

87% of the Canadian yield curve is now inverted.

Completely dwarfs the levels prior to GFC and only 2 pct pts away from the peak of the housing bubble.

This won’t end well.”

https://pbs.twimg.com/media/EB432JPUwAAUG7Z?format=png&name=large

https://twitter.com/TaviCosta/status/1161427159992266753?s=20

Canada’s GDP only fell slightly in one quarter in 2001, so no dot-com recession here. https://www.bdc.ca/en/articles-tools/entrepreneur-toolkit/publications/monthly-economic-letter/pages/1902.aspx

It did, though not a major one. The response was lower interest rates which led to the first phase of the housing bubble. You know what happened when it collapsed. We now appear to be near to top of the second phase.

Wonder if Victoria condo buildings will be halted in Victoria.. seems like there are lots of inventory that is still trying to sell in the pre sale stage.. but some of these buildings are almost near completion date in downtown

https://www.vancourier.com/real-estate/metro-vancouver-developers-delay-projects-in-sluggish-condo-market-1.23914513

I don’t think the dot com bubble caused a recession though. It just caused all those programmers that couldn’t get a job in tech to switch to creating algorithms for financial companies, which helped lead in the financial crisis.

Of course it is. It doesn’t mean the observation is invalid, and I’m not even disagreeing with you. But I’m not going to stray from the suggestion to watch what happens. Let’s see us beavers keep up our million dollar crap-shacks when the housing led recession really gets going.

What recession, you say?

Andy7:

“In regards to sales, SFH sales were the 2nd HIGHEST going back through 2010. Only 2016 had higher sales.”

What you say is correct, on a monthly basis.

In my summary I was using sales to the end of July this year and then using that figure to estimate what the annual sales will be, with the big “if” that monthly sales do not increase markedly from where they have been to date in 2019. July was a marked increase compared to January through June. I should have made that clearer in the summary.

Cheers

No need to rely on someone else telling you what the trend has been for Vancouver Island prices. Look at them yourself. http://creastats.crea.ca/vani/

Up 55% from $325k (Jan 2016) to $500k (now,July 2019).

Having a lot of the boomers moving into the Comox valley is a good thing since it takes pressure off of Victoria.

@ Local Fool

Next time you’re up island, drive through downtown Comox. One thing I’ve noticed over the last 2 years is the difference in the vehicles – the amount of Audis, BMWs, Porsche SUVs etc has skyrocketed – it reminds me of West Van.

In theory, yes we’d expect all of Van Island to follow Van in time. I expect that, so when I’m not seeing it up island, despite a reasonable time frame having passed, and housing prices are still rising, to me that’s a red flag.

There’s no way a house in the Comox Valley should be closing in on the $1M mark – waterfront sure, but not regular homes. And that’s what is being seen in part of town that really shouldn’t be getting that price tag.

What I’m pointing out is there is more going on in the Comox Valley in terms of money flow into housing than is being acknowledged and it too needs regulations like have been put into Victoria, Nanaimo etc.

P.S. Is it an anecdote when people are pointing out the empty homes?

I don’t doubt some of the anecdotes are true. That kind of extreme escalation you’ve seen there over the last 3 years almost by definition means there’ll be empty homes. But at the end of the day, both aspects are data questions (ie how many foreign, how many empty).

The latest sales info from the VIREB doesn’t really show anything that is markedly outside what we saw for July 2019 generally for other regions. Even though they recorded a notable 40% increase in sales, it needs to be considered against the small volume of transactions occurring in that area. Port Alberni is the same story with its 40% jump – and once again, I don’t think anything nefarious is going on in that town either. In both cases, I would wonder if the market is feeling uncertain which is contributing to whipsawing volumes against generally tepid price growth. I’d ignore it, as at this juncture, it’s noise.

Also keep in mind, those markets have also historically followed ours, which in turn follows Vancouver. Again, perhaps wait and see. Volumes lead prices, but the former has to persist for long enough. It’s far too early to call a new trend IMO, and most of the indicators in the province continue to show a deteriorating trend.

@ Local Fool

I disagree. If you spend time in the area, and you speak to people in different neighborhoods, you’ll be surprised how many people from outside of BC own property in the Comox Valley; there are a lot of empty homes. Not West Van empty, but enough to make your head turn.

I doubt the Comox Valley is being flooded with foreign buyers. Seems like a lousy place and point in time to speculate, too. Would you buy a house there now and expect big capital gains over the next few years?

I’d say let’s see what happens as more air comes out of Vancouver and Victoria. If it does, the valley will eventually follow.

@ Ford Prefect

In regards to sales, SFH sales were the 2nd HIGHEST going back through 2010. Only 2016 had higher sales.

I think something fishy is going on in the Comox Valley – it’s an area that’s exempt from both the foreign buyer and spec taxes and I think people are taking advantage of that. There’s a LOT of empty homes and homes that are used for a week here or there and otherwise sit empty the rest of the year as they’re owned by people out of province etc. Why the government doesn’t acknowledge this or look into, I have no idea.

Barrister, I would say the neighborhood is probably comparable to the Sea Ridge Park area of Broadmead and less prestigious than the ones around Gonzales (Denison Road Area), this one is much closer to the core though compared to Broadmead.

It’s on a hill with ocean glimpses from certain rooms. The lot is massive and mostly useable, I have seen quite a few where the lot is big but most of it is useless as it goes off a cliff or backs into a hill. I don’t need or want a house that big though, I would rather this be a smaller house with a pool or a guesthouse in the backyard.

ks112: Hard for me to say because I am not very familiar with that area. I would question whether that location would be a great choice. But others who are familiar might have a better idea. What are your thoughts.

That video is amazing. The 20minute mark gets into why Vancouver and Toronto do not have the same issue. This is really worth watching.

Video is from 2013 and not much has changed. Cities have almost zero say in Ontario. Very different in BC. Cities control most aspects of a development as seen by years of delays in some cities in BC and no delay in others.

Seen this house drop its price by $400K now since last fall:

https://www.realtor.ca/real-estate/21014447/7-bedroom-single-family-house-3460-bonair-pl-victoria-mt-tolmie

Barrister, what do you think of the value proposition? Still need another 400k cut to be in my price range though.

very insightful – definitely applies to constructions in Victoria -I hear lots of horror stories from constructions worker when sitting at the sauna at swimming pool.

“Many Countries (including Canada & USA) use coal fired plants to generate Electricity.”

According to NR Can, 82% of Canada’s Electricity is non GHG emitting. in BC, it’s close to 98% (depending on the year). Across Canada, only 8.6% comes from coal-mostly from Alberta and Saskatchewan. Alberta’s Coal plants were supposed to be shut down by 2030 under the Notley government- the Kenney government is now “studying” it..

And much (90-90%) of the coal BC exports is metallurgical coal, not thermal coal. Still bad, but slightly less bad.

Our experience with a heat pump has been great- we live in a renovated 1910s home, and our total electricity costs are $1500/yr, including heat, hot water and power for our Nissan Leaf (well, that’s just 6 months old, but the impact is negligible. ) we have two young kids, and a much higher percentage of that goes to hot water for baths etc. than a typical family.

Our incremental cost on the heat pump was about $5500 ($6500 quote for a high efficiency NG furnace vs $12,000 for our high efficiency heat pump, this was before incentives, which have significantly increased since we did our install) Noise is negligible, and far far less than the cars driving by on our street when standing right next to the heat pump (and it’s in our backyard.)

One thing I did do was change the settings to prevent the backup furnace from kicking in: it was initially set up to be able to accomodate “instant heat” like a NG or our old oil furnace. The backup heater is just an electric coil, and costs a lot more to run. I don’t think our backup heater has ever turned on in ~18 months.

A heat pump is designed to deliver smaller amounts of heat constantly, so you have to keep the house temperature constant (doesn’t matter what temperature, just not adjusting it every few hours and expecting it to change instantly.) We use a programmable thermostat to adjust it and give it lots of time to come up to temperature.

As for BC Hydro capacity- according to BC Hydro (and they have grid engineers working on this), they’re not worried. Plus, in a few years when we replace our roof, we are going to consider solar (depending on hydro rates, etc- right now it makes little sense)- hard to imagine how you can get zero carbon fuel into a NG furnace (backyard composting? Septic tank gas capture?) There is no way Fortis can produce enough renewable Natural Gas for current demand, let alone for BC to reach its carbon targets.

All in all, I feel better that we’ve significantly reduced our carbon emissions (depending on how you measure it, by about 98% from 2 years ago) for a pretty insignificant overall cost (I figure incremental cost for heat pump, insulating the house and electric car are about $15k, which would be amortized over 10-20 years) and minimal changes to our lifestyle. Totally get that not all families can afford that $15k, but for many families it’s absolutely affordable.

Has anyone else watched this CBC documentary on the Condo Craze in Toronto?

Just another commodity? Slapped together to make the developers a big profit?

Most of what they talk about could be applied to Vancouver and Victoria too.

https://youtu.be/QIWimSN_cGk

In a few short years, friends, our family will have in-home A/C: it’s called the basement 🙂

I believe Natural Gas will be with us a long time, and it is definitely the best way currently for for most people to heat their homes in Canada. (Prairies – 40 in the winter)

When I changed my furnace I was quoted close to 20K for a heat pump. How many people can afford that?

Off housing topic:

Many Countries (including Canada & USA) use coal fired plants to generate Electricity.

Also, BC is a huge exporter of coal, so we are definitely not helping the environment!

As someone who had to spend $15K on a new heat pump and air exchanger I thought 3 and 4 times about ripping it out and going with a NG furnace. Since NG is already at my house the costs of a new NG furnace would have only been ~$5K, or less than half the cost (I could have gotten the bottom of the line heat pump and air exchanger for about $11K installed, but went with a quieter, more efficient unit with a longer warranty)

The reason I swallowed the extra costs for another heat pump is I do get A/C in the summer with it, it’ll likely help house resale value in the future, this last winter when the NG pipeline explosion happened NG availability was seriously crimped within BC and…. well, I told myself I’m doing my part on the environment. But NG is the cleanest (lowest carbon intensity) fuel out there.

However, when my NG water tank needed replacing, I put another one right back in its place. Electric water tanks are frig’n expensive to operate, plus the more appliances in your house that are electric powered, the quicker you get bumped up into that second tier BC Hydro pricing.

I have no clue if Canada will actually stick to climate targets. The environmental imperative is clear, but when push comes to shove with people’s wallets they tend to vote for whoever will tell them what they want to hear. It’s going to be an interesting next couple decades.

PS

QT – for BC not all electricity needs to come from dams. I think decentralization of power production will slowly become a bigger part of our energy mix. We need that baseline power but locally produced power can play a part.

Natural gas is where it’s at for heating old homes. I replaced baseboards with a combo gas furnace- water heater and my heating bill dropped from over $350 for a cold house to maybe $60 in the coldest months for toasty toasty goodness 24-7. Night and day for me both financially and comfort wise.

The more electric cars on the road there are the higher electricity prices will go. Gas will just get cheaper and cheaper.

There’s some pollution but that’s reality for inefficient old homes that people can’t afford to replace. Want better environmental decisions that cost more? Ban all sorts of foreign, multi home whatever buyers from the demand side of the equation and make those rules digestible by the current tax base. Incentivize environmentally sound choices. For now though, house prices are high, fortis pays you to use gas and gas is cheap and awesome.

No one wants to pollute but in many cases the environment is a casualty of high house prices as well.

Modern heat pumps aren’t too bad with noise, many have insulation features that keeps noise down, and you always have the option to add a noise insulation (thicker) jacket over top of the compressor.

All the power to people who buy into the electrification mode, but please don’t mislead the public with uneducated guesses.

In order for BC to go with 100% EV cars the hydro requirement would be at least an additional 3.2X more site C size dams at the present and even more in the future, and even greater if BC convert to 100% heating by electricity. More site C size dams are not going to happen anytime soon, because of the costs and environment destruction. Therefore we will continue to suck on the old hydro carbon for energy for many years to some.

Most people that have heat pumps are not saving the environment or energy, because it seems as if it is a license to waste more energy, just because they can with AC (cooling required more energy than heating).

Natural gas price in the last 10 years has been quite consistence (lower than electricity) and has some what come down in price, and likely to stay low for the foreseeable future (environment requirement to capture natural gas from wells instead of flaring is one among many reasons). And, and out right ban of fossil fuel is not going to happen because we don’t have enough electricity to do so. Also, where will the government get their money that they are getting now from exercise tax, fuel tax, carbon tax, municipality levy, etc…?

https://www.fortisbc.com/news-events/stories-and-news-from-fortisbc/stories-news-from-fortisbc/2019/07/16/the-best-whole-home-cooling-options

https://www.nrcan.gc.ca/energy/publications/efficiency/heating-heat-pump/6831

“You may be able to reduce your heating costs by up to 50 percent if you convert from an electric furnace to an all-electric air-source heat pump. Your actual savings will vary, depending on factors such as local climate, the efficiency of your current heating system, the cost of fuel and electricity, and the size and HSPF of the heat pump installed.”

https://www.cbc.ca/news/canada/british-columbia/homeowners-hot-under-collar-at-high-cost-of-electric-heat-1.3934542

“At first, making the switch seemed like an economic win as well as an environmental one.”

“”I live in a modern home with an Energy Rating of 81,” Pamela Day wrote. “We have a heat pump with a back up electric furnace. BC Hydro’s green incentive second level pricing would only be an incentive for me to change my back up furnace to gas. That would certainly make financial sense but I cannot see that as a “green” solution.””

Enjoying our newer (2017) 98% efficient gas furnace. We like it warm (22-23) and the most expensive month last year was February at $65.

Pretty sure our house still uses the original electric forced-air furnace. Had a few burnt-out heating coils replaced on it a few years ago, but other than that it’s been working just fine for us.

When it dies, we’re probably going to replace it with a brand new unit of the same kind. Not a huge fan of heat-pumps (due to cost and noise outside) but would never install a natural gas furnace; we’re trying to lower our emissions, not increase them.

I do anticipate that electricity costs will continue to increase (for example, just wait for the full picture on the Site C cost-overruns in the next 10 years), but electricity is still the way to go, IMO.

The Queen Mary kitchen could use some updating for the 18 mil price tag… I know the value is in the land, but yuck.

Interested in anyone’s take on 2879 Acacia Dr in Langford. I’ve been watching it for a while, usually places with suites sell is there something wrong with it? I’ll probably go check it out soon, still not near the price I’d like for out west though.

Will do. Back Tuesday

Absolutely. Putting in fossil fuel heating at this point is like buying a brand new gas car. The technology will be obsolete before the end of life of the product.

I should have taken the opportunity to ditch natural gas when my hot water tank needed replacing a couple years ago but wasn’t thinking ahead.

Vancouver’s building code essentially prevents gas in new builds as well even if doesn’t do so explicitly.

LeoS Enjoy the vacation but when you get back could you give us a breakdown of SFH v Condos?

Skip the natural gas, and go directly to a heat-pump. I did the numbers last year, and while there’s a higher up-front capital investment, it should be cheaper over the long term (a bit hard to estimate given that natural gas prices fluctuate wildly, but it appears hydro will only go up.)

Plus, with every municipality declaring a climate emergency, there’s likely either to be a) significant increases in carbon tax or b) an outright ban on fossil fuel furnaces sometime in the lifespan of your furnace (15-25years). Given the bigger incentives now being offered to switch to heat pumps, might be a good idea to get ahead of the curve.

San Fransisco is going this way:

https://www.bloomberg.com/news/articles/2019-07-17/california-s-berkeley-bans-natural-gas-in-new-buildings

While no one is talking about banning gas furnaces at this point, it’s going to be coming eventually, or else there’s no way the Province/Canada can meet its climate targets.

Plus you get air conditioning for free. Given you plan to live in the house for a long time, I’d avoid having to replace your furnace again prematurely in 10 years or so.

7% ahead of last August sales rate

14% increase in inventory

Still on vacation, seems like everyone else is too. Monday numbers:

Month Aug Aug

Year 2019 2018

Net Unconditional Sales: 205 594

New Listings: 371 972

Active Listings: 2,914 2,519

Went to a couple of open houses on our way back from the library and we were the only ones there.But that should not be a surprise for this time of year.

I switched out a oil furnace for natural gas about 4 years ago in my Victoria house and it cost me around $5,500 at that time for the complete job including removal of old furnace and oil tank. I had to get FortisBC to run a gas line to my house. But, I was lucky as it was already running down my street so the cost was minimal, but it did take a long time for them to show up and do it. So you need to arrange this first if you don’t have gas running to your house already. I also received a $1,000 rebate from FortisBC after the furnace install.

As previously mentioned, for ease of service and parts it would be best to go with a Carrier or Lennox furnace.

I received three quotes from large company’s and they were all about the same and I ended up going with West Bay Mechanical and they did a good job and I have no complaints. I did not call any small one man band companies for a quotes, but, i would guess they may be cheaper.

PS. I tried to put a natural gas furnace in another house I own in East Saanich and there was no gas line on the street and it would have been quite a few thousand dollars to get a gas line installed so I was not able to do it.

5-6k sounds about right for licensed/insured job.

No, it is not worth the couple of hundred bucks of saving to deal with the hassle and dirty furnace removal.

Most modern furnace quality are pretty much similar to each others. However, the simpler furnace tend to required lower maintenance than fancy multi features furnace. What important is the availability of furnace parts and service over that of fancy brand names.

Don’t get too wound up in the AFUE efficiency jargon, because gas price is so low that you will never recover the $500 different in the lifetime of the furnace.

Do get a multi or variable speed blower for comfort and low noise.

It is also important to get correct furnace sizing.

Eye-opening Doz Zone episode on the poor construction quality of many of those condo towers that are quickly being thrown up in Toronto and the impact of the condo boom on the city

https://www.youtube.com/watch?v=QIWimSN_cGk

Comox Valley, July update.

Despite a sharp rise in sales in July, compared to last July, sales are still on track to be the lowest since the year 2000.

However prices continue to rise with some rather mundane single family properties selling for in excess of $1m. The 12 most recent sales went for 99% of asking price and were 7% and 20% higher than the 2018 and 2017 assessments, respectively.

One example will suffice to show what is happening. The house was owned by a young couple. The realtor suggested the selling price which they thought was ridiculous – “nobody in their right mind would pay this much for our house. ” Details: date built, 1993, 4 bed, 2 bath, .618 acre, 2,500 sq. ft. , located in Comox. Ask, $880k, $870k offered and accepted within days, 2018 assessed $712k, 2017 assessed $647k. When new, in 1993, this house would have sold for around $200k.

Hey,

I’ve been watching HHV for nearly a year now without posting, and it’s been a fun ride so far.

I’m seeking some advice as I am getting increasingly closer to making an offer on a home – and because the blog is really quiet these days I figured this would be a good time to keep some of you busy. Can anyone recommend a good, even excellent, name to conduct a house inspection?

Good discussion. Thanks, Leo.

I think “flat” is a good phrase. But the Victoria Real Estate Board’s numbers point to a 3.4% HPI drop YOY, and over 10%, the data suggests, in recent months. In following sales, I see more and more sales below the property tax assessment values [very rarely do I see a sale above, but it does happen, don’t get me wrong]. I am not in the bear or bull camp – I am in the data camp. 5-year mortgage rates are falling due to the bond market. A BMO economist and our friend Phil Sopher are suggesting that we have hit a soft landing and now prices will resume the rising path, though at a slower pace due to B20. Here is the clip on BNN:

https://www.bnnbloomberg.ca/canada-s-housing-market-sticks-its-soft-landing-bmo-1.1299783

Interesting times. History in this RE market tells us that the “hot” season for RE here is over. July was decent, but below the 10 year average. My guess is that, with the last 12 months playing out as expected [slow to down], we have 6 to 12 months to go; however, all of this does not allow for a recession. Given what is going on globally, a recession is a strong probability within those 12 months. RE is not a bad place to be during an economic recession as long as your job is safe.

Thanks, again, Leo.

The market seems to have gone into the summer sleep mode.

Hello HHV!

I posted a while back when I was still house hunting, but I am happy to report that I have bought my first home and have been happily settled in it for the last 6 months.

Question for anyone who has done this:

I worked out the cost-benefit of switching my oil furnace to natural gas and it makes sense to do it now since we plan to be in the house for a while.

1) Any recommendations on installers? (I’ve got soft quotes of ~5-6k…is this in the ballpark?)

2) Any recommended brands of furnaces?

3) Has anyone asked for an itemized quote? …what I am getting at is that I am confident to do the removal myself, and only really require the install. I don’t want to pay for a standard removal+install if I can do part of the work myself.

Thanks in advance

-Happy happy homeowner 🙂

Haha i hope so too!

Rush: I would hope that you would quote both accurately and in context.

Queen Mary Estate on the market for $18M

https://luxuryresidence.ca/2019/08/01/queen-mary-bay-estate

use the > sign

since its a bit slow – how do you do you quote a previous person?

I don’t have direct data for mortgage rates in 1960, but I do know that the prime rate was 5.75%. I would expect mortgage rates to have been no lower than that. In addition, mortgage qualification was more strict back then, e.g. larger down payment requirements. Also relevant to mortgage qualification, the norm for households was one income.

As was well demonstrated post-1981, the effect of higher interest rates is delayed. So picking a high-price high-rate endpoint obscures the real story.

https://www150.statcan.gc.ca/n1/pub/11-210-x/2010000/t098-eng.htm

Only if real rates were to jump of course (..highly unlikely at this point). Here’s a quick nominal roadmap for what I see right around the corner.

Recall how prices went up about 17000% early 1900s, and well over 1000% from ’60-’81 as nominal rates went from 2 to 20%. Also note how much prices went up in the 1890’s and 1950’s before inflation took off eh. All the signals and drivers are currently aligning for a riveting 2020s.

Here’s a link to what prices did early 1900s (pg 30).

https://issuu.com/sadmagazine/docs/12.13_mad_mad_world

Leo

Good luck with those ventures

Hard to predict anything right now with Trump. How far will he take his trade wars…A global recession is not out of question and it could be a dozy but than you have central banks wiling to lower rates to zero and below and flood markets with cash.

I will stick with gold…

Leo, can you please remind me briefly how it is that you became the administrator of HHV? All I can recall is that HHV (the founder) passed the reins on to someone else, who then passed them on to you. Is that right?

You have to hand it to VanRE. Bullish sentiment put up an incredible fight leading to, so far, over six (arguably seven) tops – each getting slammed back down by resistance. We’ve all heard of bull traps and dead cat bounces, but this is really something to behold.

Looking at the whole chart, and what’s been going on since 2016, it’s becoming increasingly clear that something is happening in Vancouver that Vancouver hasn’t seen in a long time. With the failure of the price floor becoming clearly evident, if this picture doesn’t scream “party’s over”, then nothing does.

It’s starting to get a bit late to say, “tick tock”…

So now that rates are plummeting I wonder if Michael thinks that housing will decline. After all the big theory was that rising rates boost housing.

Am doing some writing for a new news platform coming out. Also working on an eBook to summarize what I’ve learned about the housing market in Victoria over the last decade. Maybe it’s premature but I consider the local market something of a solved problem as far as the bigger factors and cycles go.

Mostly just enjoying life though 🙂

You need to take your fine work to whatever the next step is.

Rates at two year low: https://www.ratespy.com/canadian-rates-plunge-to-two-year-low-080610287

@gwac

I had a chat with the guy that prepares the reports for Victoria. Nice guy who knows what’s going on but the framework they chose is mandated for the entire country so there is very little he can do except run the prescribed models.

Doesn’t sound like fun to me.

Currently back on vacation. Only intermittent internet access

bond yields collapsing around the world. Mortgage rates should slowly come down.

https://www.bankofcanada.ca/rates/interest-rates/canadian-bonds/

Leo

Well let me think who would be good to run their research department. You are wasting your talent here. 🙂

I wasn’t a big fan of those CMHC market assessments to start with as I wrote here a couple times. It got briefly better but now I don’t put much stock in them at all.

I don’t think they’re measuring the right things. Overheating and price acceleration in particular happen early/mid cycle not at peaks. Bad predictors of downturns.

If they’re going to publish these then they need to publish a full back test results

At risk of what? A normal market cycle?

https://biv.com/article/2019/08/metro-vancouver-housing-market-no-longer-vulnerable-victoria-still-risk-cmhc

Interesting perspective I thought.

“Metro Vancouver housing market no longer ‘vulnerable’ but Victoria still at risk: CMHC

CMHC’s HMA examines urban real estate markets across Canada, assessing a combination of four key risk factors: overvaluation of house prices in comparison with levels that can be supported by economic fundamentals; overheating, when demand for homes in the region outpaces supply; sustained acceleration in house prices; and overbuilding, when the inventory of available homes exceeds demand.

Eric Bond, senior specialist, Market Analysis at CMHC, said of the Vancouver market, “While home price growth over the past few years significantly outpaced levels supported by fundamentals, these imbalances have narrowed through growth in fundamentals and lower home prices in different segments of the resale market.”

However, Greater Victoria – along with Toronto and Hamilton, Ontario – remained at high risk, according to the CMHC. Victoria’s market still showed moderate risk of overvaluation, price acceleration and overheating, said the agency, but these are showing signs of easing. “The decline in price and growth in fundamentals have helped to narrow the average estimate of overvaluation in Victoria,” wrote the report authors.

Yeah we’re probably arguing semantics here. For sure you can aggregate all the data nationally and the result won’t be just noise due to factors that affect the entire country. You can do the same thing for the entire planet and say “earth’s housing market” which also moves with some commonality but it won’t help you very much if you’re interested in Belgium.

Vancouver could well crash (and pull down the national figures) while Montreal does just fine. Or vice versa. National crashes happen, but localized ones do too.

OK, that seems to be a different point than “There is no such thing as a national housing market.” IMO, the national housing market in Canada exists and has a huge influence on sales and prices. Just like the Ireland, Australia or any housing market exists. And when (for example) Ireland’s market crashed, it affected all houses regardless if they were “substitutable” in the same local area. The whole country got pounded at once. Same could happen to Canada. While there are regional differences, there are common factors across the country affecting sales and prices too.

For example, look at the sales ups/downs for Victoria housing 2013-2019 (charts are below), and notice how the same ups/downs happened in the Canadian market, at the same time, even though the houses aren’t substitutable across Canada. That correlation might not be as strong throughout history, but I was surprised at how well it does seem to correlate for the last 6 years.

Anyway, thanks for the discussion.

It’s a matter of degree. The economics term that applies here is substitutability. Is a Sooke house a substitute for an Oak Bay house? To a large degree it is. You can work in Victoria by buying either house and have access to much the same services. The economy of both is essentially non-existent and relies on being proximate to the same core. Of course a Langford house is an even closer substitute to an Oak Bay house and a Victoria house even stronger. That is entirely different than a Halifax house and an Oak Bay house.

So can markets with strong substitutability move in opposite directions? Not really. Yes Sooke can be weaker or stronger than Oak Bay at a given point, or Sooke can decline before Oak Bay declines, but you won’t find those markets going in opposite direction for any substantial period of time.

One of my favourite markets is the Victoria market, where, for the past 38 years, prices have basically only gone up. May that continue—within Leo’s observed affordability band—forever!

OK. I would assume that this would then also apply to the Greater Victoria market as well, where Oak Bay and Sooke might go in opposite directions (just as Canada and Victoria might). But we can still talk about a “Greater Victoria” market, just as (I hope) we can talk about a “Canada market” (or an “Australia market”). These national markets are just the average of all the regional markets, just as Greater Victoria is an average of the various cities. This may seem obvious, but you were the one who said “There is no such thing as a national housing market. There are common factors for sure but regional markets commonly go in different directions”

That’s not exactly what I’m saying. I’m saying that different regional markets can go in opposite directions at the same time. That is not the same as comparing Victoria to Canada which can certainly have similar behaviour at any given point. Things like stress test affects country wide, but local conditions are different.

Compare two markets like Vancouver and Calgary for example. Wildly different performance over the last decade. Compare Montreal right now to Victoria. Montreal very hot, Victoria sluggish. So many examples of markets around the country in different parts of their cycles. It isn’t synchronized, though of course things like national immigration and credit availability affect all markets (though not equally)

Month Aug Aug

Year 2019 2018

Net Unconditional Sales: 75 594

New Listings: 153 972

Active Listings: 2,921 2,519

For all intents and purposes there certainly is.

Perhaps you are meaning that different regional markets have different degrees of volatility and achieve their peaks at somewhat different times, (for instance, the West has historically peaked before eastern markets do) but that’s not unique to Canada. True, some small, resource dependent markets for instance may be completely different (Atlantic fishing and oil communities are a perfect example), but nationally the power to buy homes comes from credit. In Canada, credit doesn’t come from too many places.

You could more credibly say that of the USA, where the avenues for credit are much more than here, but nevertheless all it takes is a few minutes on Trading Economics and I could pull up most of its largest metro regions and presto…

It would be interesting if you could prove that assertion by data overlaying Canada house sales vs Victoria house sales and point out how they are commonly going in different directions. From the chart I posted, Canada house sales had a big run and peaked in Q2-2016 and then dropped and levelled of for the last year. To a layman like me that sounds similar to the Victoria picture, and sound similar not so different.

Here’s a graph of Victoria sales and Canada sales. Do these look like they are going in different directions to you? (They look look highly correlated to me in direction, differing only in magnitude, not direction)

Victoria sales …,

Canada sales ….

I’m speaking about Victoria of course.

Condo sales can certainly fall more, but single family has been puttering along at 2013 levels which is close to as low as they tend to go.

There is no such thing as a national housing market. There are common factors for sure but regional markets commonly go in different directions

As noted on the chart, these are annualized sales values and seasonally adjusted.

Canada housing sales are still high, 470k sales in 2019Q2 is only 15% down from the all-time peak 555k in 2016Q2. And stable over the last 6 quarters. Not alarming or forecasting a price crash IMO. And they do have lots farther that they could fall, US sales fell 65%, (not 15% like Canada).

exactly .. if you rich .. does it matters about rising inequality ? will you pull your money out from a place where you are making lots of money and settle in a country that is culturally different and speaks different language?

Ya not a good scene. Xi can afford to wait it out and see who’s in the Oval Office next year. US system means a potential administration change.

Love him or hate him, I don’t see a subsequent POTUS sticking it to China as hard as he is. Don’t buy our soybeans? Okay, here’s a 300 billion dollar tariff. Right away.

Serious balls. Brilliant, or insane. But, he is the president.

I think the protests were set off by the extradition bill, but from my understanding this is being fed from a latent and longstanding expression of the rising inequality that has been occurring in HK over the last 20 years. If so, I do wonder if it has any parallels with some of the yellow vest populist movements in Europe.

It’s interesting that right now there is a ton of global uncertainty with HK, Brexit, big trade wars with China, while on the ground things seem solid wrt work, hiring plans, building, technology etc (from talking to businesses). I guess that’s a better description of the dichotomy that I feel.

Personally I think the biggest risk for Canada is the US. Completely disfunctional political system and an economy at the tail end of a long boom that is fueled by massive deficit spending. In comparison Canada looks much better but of course we would be hit badly by any wobble down there.

i watch chinese news too but when i see the violent protesters on the news , i see young and dumb high school / university kids making a scene and causing insane amount of negative coverage. you would understand the cultral difference divide between mainland china and hong kong if you are chinese. The working class does not cared that much. the extradition law does not affect them .. they just want to have a job and roof over their heads.

its like how the Stanley cup riot in vancouver .. most people are regular peaceful mob, but there will always be radicals

their extradition law was deemed a necessity when a rich mainland chinese boy murdered and butchered her girl in taiwan but fled to hong kong. he pratically got away free because hongkong law does not allow him to be brought to justice ..

the legit rich people does not care .. they make money either way either as hong kong or china… only poor people protested because fear of losing identity .. similar to the states … most of the poorly educated people cared about mexican taking jobs.. rich people see that as cheap labour

atleast that is how i remembered how it happened … i could be wrong

but hey look we have something similar .. howdy HAUWEI

Bingo. Great comment.

I would gently suggest to curious folks to take a look at the housing busts in other advanced economies over the last 20 years. The story is basically the same wherever you look.

As volumes decline, price momentum keeps the prices rising…for a while. Then the volumes bottom out, but prices continue falling (to everyone’s amazement and bewilderment).

To pull up the closest and best known example, here are home sales volumes versus prices in the US housing bust a decade ago. Home prices there dropped for several years after their sales volumes bottomed out.

https://househuntvictoria.ca/2018/05/04/musings-on-future-affordability/#comment-43223

Not by themselves, no. But like I say, they form part of a story. Yield curve inversions are another and perhaps more compelling indicator of trouble.

I don’t know if there’s really anything directly causal. The only thing you could really say causes busts, are the booms themselves. Not too helpful though. Anyways.

Have you been watching developments in Asia? I do wonder if China’s going to have a tougher time holding things together. I mean that metaphorically with respect to its financial system (what little we know of, anyways) and literally, with respect to HK.

Some people in BC think that both dynamics represent the next leg up for RE here. Personally, I think that’s owing to a remaining bubble mentality that says “it’s inevitable that prices are going to skyrocket again, we just need to look around to find the next catal…oh hey look, Chinese will be more desperate than ever to get their money out, and, 300,000 HK expats are angry and going to march over and buy VanRE homes!”

Well yes but those aren’t causal at all. It’s not like low unemployment leads to a recession, it’s just a symptom of a long boom. Eventually all booms end but that doesn’t really help predicting when.

I agree.

Leo, you may recall from your previous historical research that indicators like unemployment and wage growth have been seen to be strongest before a recession. Ditto for housing starts, especially condos.

Not a dichotomy at all. Every recession has been presaged by a nadir in unemployment. Once unemployment increases, the recession will already have begun.

Interesting dichotomy right now between record low unemployment and strong wage growth paired with recession indicators like inverted yield curve.

Haha yeah me neither. Nice part about getting older is you run out of things you need to buy.

That’s too bad. You’re right, not worth the hassle. As for that rate cut, I’m doing my part by not stimulating the economy (much).

My renewal is not for a few more months, but I could hypothetically renew today and lock in a 5-year fixed lower than my current 5-year fixed, which is just crazy.

I investigated switching the bad variable over to fixed but after fees it would only save about $1200. Not worth the hassle. Maybe we’ll get a rate cut

If the parents are the defacto owners of the property and there is an adult child with exclusive possession then it is NOT a principle residence. My suspicion is that the adult child was put down as the legal title owner so that a principle residence claim could be put in at the time of sale. Whereas the parents are now claiming that they were the exclusive beneficial owners. It would appear that the parents were claiming the total proceeds of the condo and not just the initial money advanced. If they are now claiming that they were always the beneficial owners of the property the only reason to put title in the daughters name was to fraudulently claim the PR exemption and I would have awarded them nothing. if they were only claiming the initial amounts advanced then it was fair to have considered this an interest free loan.

Of course not. With my vast intellect I usually find that just looking at the URL is enough to give me a thorough understanding of the material 🙂

Many lenders’ fixed rates are lower than their variables right now, which is crazy. Here I was getting all amped-up to renew with a variable for the first time ever. Won’t be doing that if this keeps up.

I’ve only ever done variable but when the fixed is cheaper as it is now only makes sense to go fixed. Personally I look for a 0.75%-1% discount on the variable vs fixed.

It wasn’t beyond their means to help in this manner. The daughter was studying at Royal Roads and it was intended to provide her with free accommodation short-term to help her out and, at the same time, for her to manage the property and the suite for the parents. With an agreement in place to sell this would not have been an issue.

Totally makes sense. Free rent in nice place for daughter, in house manager of house with suite for parents. When sold profits are split and parents use theirs for retirement and the daughter for her next home purchase. The house had to have appreciated 200k during that time period plus it was cash flow positive and paying down the mortgage. This is why parents buy their children condos during university. It can be a win:win depending on the market.

Profit sharing in a PR for a child? Doesn’t really make sense. How does that help the parents retire if the place never gets sold?

KISS. If the parents have the means to help, then help in a simple and direct way. If they don’t have the means to help like your example above, they probably shouldn’t be helping. Part of the reason this case fell apart was because the parents were (apparently) helping beyond their means. Even with an agreement that would have gone sideways when they needed the money back.

More specifically putting it on the title for anything but an outright gift.

There are way more options than this, including profit sharing, that can be a win:win and may be the only way parents of more limited means can help their children in this manner and still retire. The key is setting it out in an agreement so everyone is clear.

Debt repayment is investment. You are buying the debt back from the creditor. Not different in net from using the money to buy debt from someone else, except the returns are tax free in the case of personal debts being repaid.

If you read the article you can see a bias on the part of the source (Manulife) which makes money on selling and managing investment products. So they make more money if you don’t pay down your mortgage and instead use your savings to buy products in TSFA’s or RRSP’s.

I’ve been doing debt repayment since before it was cool 🙂

Many lenders’ fixed rates are lower than their variables right now, which is crazy. Here I was getting all amped-up to renew with a variable for the first time ever. Won’t be doing that if this keeps up.

This isn’t a comment on this situation since I don’t know the details but a lack of boundaries between parents and adult kids is not really good intentions and ends in disaster often.

Caveat is right, either give it as a gift and absolve yourself of the right to direct the use of it, or make a proper mortgage loan that will be beneficial to the kids. Vague “helping” by sprinkling money around with uncertain strings attached is not good for anyone.

Neither the parents nor the daughter claimed that the payment was a loan. The daughter claimed that the money was a gift and the parents claimed that the payment made them the beneficial owners.

If the money had been documented as a loan conventional remedies (e.g. foreclosure) would have sufficed to get the money back. Or the daughter could likely have refinanced or sold, assuming appreciation.

One of the ways high indebtedness puts a drag on the economy, people choosing to put their money to debt repayment instead of investment

https://www.ratespy.com/mortgage-paydown-overtakes-investing-080310262

It seems as though you might not have read the judgement? And, from my perspective, it was set up with the best of intentions on the part of the parents as a win:win and they’d already done it with their son who had repaid the loan and decided to stay in the house.

Daughter lived rent free (at the age of 36) while she attended school, parents had someone on site to manage the suite, and their intention was to give her with part of the proceeds. The property was significantly cash flow positive when the daughter rented it when she moved to Nanaimo and she kept this money.

The issue is more than that. If you are “helping” your offspring you don’t give them a loan that you can call on demand at a time that is convenient for you and inconvenient for them.

If you ARE going to help your kids I’d suggest:

1) a gift you can afford

2) a clearly documented loan on terms better than they could get from the bank.

Way down on the “helpful” list is using your kids as a vehicle to speculate on RE and avoid capital gains tax under the guise of helping them.

Two interesting economic events this past Friday.

Central banks seem determined to lower the value of their fiat currencies.

As Patriotz said, the issue is that it was not clearly documented.

f you read the full judgment you’ll see that the daughter was not a credible witness and the judge found it was never intended to be a gift. I don’t think it helped that the daughter, at 36, complained to the judge that her parents went on a vacation after her mother was treated for cancer instead of helping her more, although they were still providing her significant support at 36. The parents were, however, going to give her part of the proceeds to buy her own home when this one sold. Unlikely to happen now. They haven’t spoken in two years.