Are regulators pulling off the soft landing?

When housing prices ratchet up and become overvalued, the industry and regulators love to talk about a soft landing when the market cools down. There is a lot of rhetoric on both sides of the debate, and as usual, the truth lies somewhere in the middle. Back in 2006 the president of the US National Association of Realtors famously predicted that market had landed softly (it hadn’t), while housing bears like to proclaim that there has never been a soft landing in real estate (there has).

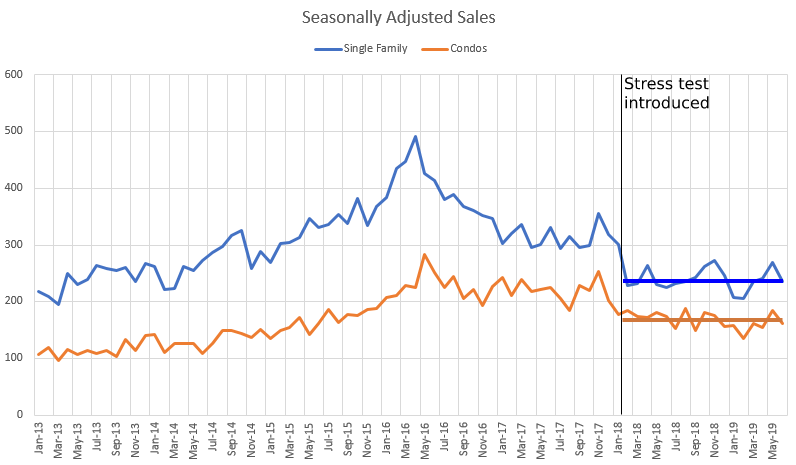

So what is happening now? Well we know that regulators have been fiddling with credit availability for 10 years, gradually restricting it to keep a lid on house price appreciation and counteract the effect of extremely low interest rates. However none of these interventions were really felt by the market until the introduction of the mortgage stress test, which immediately cut sales by some 20% and has kept them there so far.

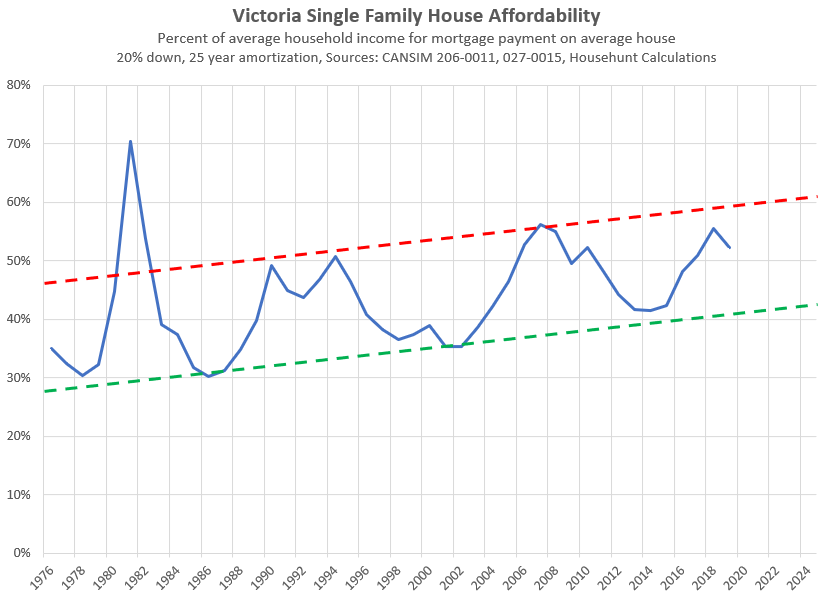

There is no doubt that the market was backing off from the peak long before then, but without the stress test the hot market would have persisted for longer. How long? Well the last time we had a hot market in Victoria, it lasted 5 – 6 years before cooling off, while this hot market was only 2 years old when regulators intervened (see green line going into red area in the graph below).

And there’s more evidence that the runup was cut short by regulators. Looking at affordability, we can see that the stress test cut short the rise in prices, dropping down before we would have normally expected them to. While this is no exact science, normally I would expect single family houses to become increasingly unaffordable over time (each peak higher than the last in the chart below) and this time it didn’t happen. No doubt that’s because the stress test radically reduced buying power and halted the increase in prices.

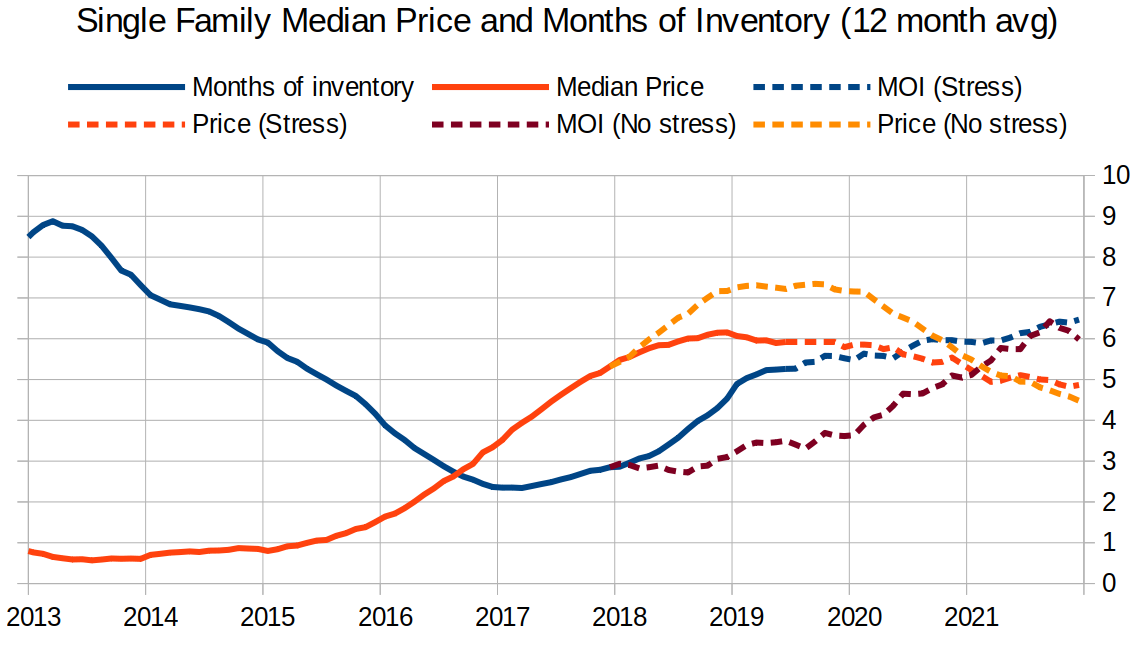

What does this mean for the current correction? Well if you will excuse the WAG, here is what I think would have happend to prices if the stress test wouldn’t have been introduced 18 months ago. Solid lines are actual data to now, same colored dashed lines are what might happen going forward with the stress test in place and the orange dashed line is what might have happened to prices if there was no regulatory intervention.

I’ve deliberately left the vertical axis labels out for prices because the point here is not to make predictions about exactly where prices would have or will end up, but rather illustrate that without intervention, prices would have surely gone higher than they have, and the resulting correction would have likely been steeper to restore affordability. Right now, it seems that regulators may have cut the top off the price mountain and saved us both from some of the trip up, as well as some of the trip down. Arguably smoothing out the boom/bust cycle is exactly the intended effect of these kind of regulatory interventions.

What do you think? Is this going to be a hard landing, soft landing, or something else entirely?

My take on the month: https://househuntvictoria.ca/latest

If you don’t want to ever live in the GH house, why not sell it now? Because it is an obstacle to you buying a home that you do want. It can take a long time to sell a house, especially in a slow market, complicated by the issues of existing tenants. You could get similar returns on the cash as you look for a house that you do want to live in.

The article says that the FTB exemption was not applied for. But…

The issue is that the money was not documented as a loan. If it had been I don’t think the case would have gone to court.

That could be the intent. But now there is a court decision finding that the parents were the beneficial owners and CRA can go after them for the tax on the proceeds.

You could argue my house belongs to CIBC all along. But that’s no tax scam

I am not going to pile on. Instead I suggest that you everyone take a moment to contemplate the true awfulness of a boatless, economy class-flying existence.

If the place was actually the parents place all along then PRE should not apply.

Agree with Barrister. Sounds like a tax scam.

Patrick, I can’t afford the new house without selling the old one first

I don’t think they were. The daughter bought the place under her name. I don’t think there is an issue with getting a loan to buy the place.

LeoS: Basically, from a fast reading, the parents were either lying or trying to scam the government by having her claim the first time buyer exemption.

This is relevant to a discussion we’ve had here in the past.

Dispute over $110,000 given by parents to daughter to help purchase a house.

https://www.timescolonist.com/news/local/judge-sides-with-parents-in-110-000-dispute-with-daughter-over-colwood-home-1.23901270

I’d say if you’re going to give money, give it as a gift. This kind of half gift half leveraged investment idea is a bad one.

Selling first is a good idea as long as you follow through and buy a new place. If you hold on to your old place, and then see your dream house at a good price, you might end up owning two homes. And then of course, fate will be cruel and the crash will come!

$500 cashlow positive pre income tax. Barrister, I am not marrying anyone at this point. And if I really want to marry for money then I would be looking at someone with alot more money.

The lawyer is a breath of fresh air though compared to the typical stuck up nurse here thinking they are God’s gift.

In closing I would like to advise that if one wants something but can’t afford it currently, work hard to make more money instead of waiting for that thing to go on sale.

Is that pre or post income tax? At your income level you’ll be highly taxed on the principal paydown portion of the rent going to cover the mortgage and any additional positive cash flow. If it is post-tax and all expenses than this is better than average rental return for a house purchased in 2013, assuming you didn’t put more than 20% down.

Plus 16 years of living with your mortgage more than covered while the principal was paid down by 350k for a total after tax gain of 870k is not too shabby.

ks112

In closing, I would point out that in your tax bracket, rental and employment income would be taxed at around 39%. I’m guessing that the cash positive scenario is due to not declaring the rental income. I hope I’m wrong.

KS112: Might want to hold off on buying if you are serious about marrying the lawyer. She will want you to move to Van for obvious reasons (if she pulls out a prenupt, run).

I forget his name, but early this year there was a handsome young lad who tried to warn people that the ‘perfect storm’ mid-cycle correction was over.

Great quote. Always something new to learn…

Just thought it was presented in poor taste. Wasn’t irate or anything. Not trying to be the HH police, so say as you will.

Sold Out, i bought the house in 2013 for ~$540K, I am getting 2700 a month in rent right now. If you read my post before, I am cash-flow positive on the house currently and always have been or close to even. Obviously with the price increase on the house recently the cap rate is now shit, which partly brings me to my dilemma of selling and cashing out or not. But basically the rent is financing the mortgage and then some, in other words, the renters will have paid for the house if I choose to see the mortgage through.

I have rented a condo downtown since 2011, my landlord didn’t increase my rent until 2016. I did not move in the house because I work downtown and I go downtown lots on weekends for dinners and drinks, when factoring time, parking, gas, cabs it didn’t make any sense for me to live in the house. The house is 3 bedrooms up stairs with a suite down stairs and not reno’d, I don’t need the extra space, feel like mowing the lawn and would much rather live in a new modern condo than a 1970’s house. The house was bought with the thought of either upgrading later on or doing an extensive reno once I have a family.

I am definitely not going to get into the middle of this debate. Everyone has their own values and I appreciate that I am not particularly virtuous but rather with too much of a tendency to being sociopathic to care what others think and genetically frugal as a Scotsman. What I do know is that when it comes to money rationality is rarely on anyones list unless they are talking about other peoples money.

Time to move back to the housing market.

Wow the nastiness just got turned up to 11.

People should live their lives however the hell they want (obviously without harming others, the definition of “harming” being a tricky one to set). Anyways, if ks112 earns well and wants to spend accordingly, hey go for it! Last I checked it’s their life to live. They may regret the lifestyle choices later, but then again they may not. As I keep telling my 16 year old “life is about choices, dealing with the consequences of those choices, and hopefully learning from it.”

And even if someone is posturing and acting like what some would classify as being a pompous ass, ask yourself: why does it matter to YOU? Ultimately that’s just your ego strutting its stuff to make itself feel better. BTW, I say all these things knowing full well sometimes my ego gets caught up as well – if I’m lucky I will remind myself of one of the quotes/teachings of my favorite author and speaker, Eckhart Tolle:

“Non reaction to the ego in others is one of the most effective ways not only of going beyond the ego in yourself, but also of dissolving the collective human ego.”

And now for your moment of Zen…

Vancouver July sales up 25%….yeah. Check out sales for the last 28 days for White Rock on Zolo. Detached…0. Then check out the sales numbers for Richmond, West Van, North Van, Burnaby, Surrey…..

$600K gain from purchase price in 2010. This looks like a purpose built triplex (in 2003) and I doubt the sellers are going to get away with claiming PR for the whole property. Say it gets split 50/50. If their marginal tax rate is 40% the income tax haul is $600K * 0.5 * 0.5 * 0.4 = $60K.

https://www.theglobeandmail.com/real-estate/vancouver/article-vancouver-home-prime-for-redevelopment-sells-for-136-million/

True. And in the same vein, it could also once again show what seems like recovery is often not in real estate. Expect upticks, watch the trend.

If we roll into October and things continue to incline, then it could be something worth pondering. But today the trend hasn’t changed…so far.

GTA condo sales in Q2 second highest ever and Vancouver July sales up more than 25%. Very interesting to see the bounce in Toronto and lesser extent Vancouver. Once again showing what seems like certainty is often not in real estate.

You’re a bit of a creep.

ks112

If you’re financing a house that you don’t live in, a new car, as well as paying rent on a separate residence, I would argue that you’re definitely living beyond your means. What’s the cap rate on the rental house? If you’re paying more in rent than the house is paying you, how is that a prudent financial plan? Car payments are the biggest waste of money I can think of. $50,000 represents 2.5 cars, or 25 years worth of driving for me, and I only pay cash for cars. If you just want to look wealthy, carry on with your plan. If you want to actually be wealthy, you’ll probably have to marry the lawyer.

Perhaps the definition of “striving” is different between people with HH income of $100-150K/yr and $700K/yr? If so, there is no point debating.

….

Local fool,

The car reference is a response to Sold Out saying I make poor financial decisions and drowning in debt. Which my response is saying I make mostly prudent financial decisions with the exception of the car.

You do realize that an entry level Toyota 4 runner approaches $50k right? Would it have sounded better if I said an entry level Toyota 4 runner instead? I think you are over-reacting.

We’re learning a lot about ks112 today.

Ks112,

Sorry. But I’m going to.

Despite your complaint about the quality of others’ posts on here, you’re doing a great job of pulling it down several more notches. Your self described “stupid” 50k dollar car is worth far more than what many people drive or could. And you know it.

Nothing looks worse on a person than posturing with random strangers over how much assets they have, while trying to appear like they’re not bragging by denigrating those assets like they’re nothing. Just, yuck.

If you finally find a way to make ends meet with your apparently humble income, perhaps consider donating to a charity of your choice. While your “stupid” 50k dollar car is nothing to you, a small donation might end up meaning the world to a needy family struggling to make a life for their kids. Maybe also consider getting your partner to donate some of that functionally worthless, gaudy designer clothing to someone who actually can’t afford to clothe their family.

Sold Out,

So having a nice house in nice neighborhood is considered having an ostentatious lifestyle now. I don’t think i am blowing my brains, On my $~200k income I am living in a rented condo with grandfathered rent of $1400 a month, my house in gh is rented out and I have about $500 a month of positive cash-flow from that. Zero debt, couple hundred grand in investments (tax free/RRSP and Margin), I do have a stupid $50k car though.

I don’t know her financial situation too well, but she lives in a coal harbour condo probably worth $1M that she bought (only 680 sq ft though….), has another condo downtown she rents out, has a 2012 C class Mercedes, but a very very bad shopping habit when it comes to designer clothes/shoes/purses (her closet is worth more than my car).

Also keep in mind our income includes bonuses which makes up a significant portion (>30%) and varies every year.

So true Sold Out. Mind set is everything. My daughter and husband have one car and a bike. The car which they bought 2nd hand around 8 years ago is a Subaru Forester. They still have it. She drives the car to work …. he rides his bike. I gave them my turn of the century solid oak dining room set 15 years ago. They still use it every day. I went with them when they first got together to estate sales etc. Bought them a gorgeous couch and chair for around $500.00 cash. It is top quality and probably would have sold in the $7,000 range. The set also came with custom slip covers in a spring like pattern that are washable. This way you get two different looks. They still have these as well and they look brand new. Also at the same place bought many many kitchen items and gadgets for next to nothing. Picked up a mid 50s dinette set for the kitchen for $150. Arborite top, chrome legs, vinyl seats. Still like new. Again, excellent quality. And you know whatÉ All their friends rave about their stuff. Many of them have the grey or brown couch with the separate chaise lounge. From the Brick no doubt, on credit and will last up to the day it is paid off….boring, boring, boring.

Engagement ringÉ How about a used 18K gold ring with a centre ruby having sparkling diamond accents. $500 instead of $5000!

Wedding. In my back yard with close friends and family. About 35 people in attendance. All family members brought something tasty to eat and was well organized. I paid for the wedding dress, flowers, & the wedding cake.. Also all alcoholic and non alcoholic beverages. It was a beautiful August wedding. Cost to the bride and groom………..nothing.

I am lucky that my daughter had faith in me and was wise enough to listen to me, her grand parents, aunts and uncles etc and put what was sensible to her in action. It has paid off.

ks 112

If a couple who have a net income of ~$350k can’t finance a comfortable lifestyle, including home ownership in YVR, the problem is not property valuation. People who earn big salaries tend to advertise it with ostentatious lifestyles, trying to impress the other high-income earners they live amongst. If your self-worth is predicated on keeping up appearances, your net-worth will never amount to much. I can only presume that you have both blown your brains out on debt, relying on cash flow to keep it together, and have no savings for a DP.

If this isn’t a troll, you two are a delusional, debt-ridden, sorry excuse for high-income earners.

Sold Out, how can one be “striving” in Vancouver if one cannot even afford a decent house in a nice neighborhood? Median income means crap all in Vancouver, Why? Because there is such a gap between the average joes and the ones “striving”. Maybe in % terms the ones striving are very small relative to the population, but in notional terms there are many of them, enough of them that nice SFH in nice neighborhoods are close to 50 times the average hh income.

Victoria hh income is comparable to Vancouver and I would definitely feel like I am “striving” here (will definitely have a nice house with water views and a boat in the harbour). House prices aside, Just take dinner’s for example, a nice steak dinner for two with a glass of wine in Vancouver at Hy’s, Elisa, Victor will run me $250 easy. In Victoria, I am good at the brasserie for $150.

I will have to say though, the drinks at the Q bar at the Empress in Victoria is the same price as the Pac Rim and more expensive than the Fairmont Hotel Vancouver and Fairmont Waterfront.

How does a pregnant woman know she’s carrying a future lawyer?

She starts having uncontrollable cravings for bolonga.

ks112

Well, buying an over-valued, west-side house would certainly qualify as “doing it wrong”.

https://www.zumper.com/apartments-for-rent/37332910/4-bedroom-kitsilano-vancouver-bc

Plenty of rentals on the west-side, and some of the best public school catchment areas in the country.

$700k is almost 7x the median household income in YVR; as you can imagine, we’re all playing the world’s tiniest violins right now. If you honestly think that $700k is “comfortably upper middle class”, and not 0.01%er territory, you’re seriously wealthorexic.

*Correction – $700k is nearly 10x the median hh income. Math was never my best subject;)

Sold out, I haven’t done the actual math but $700K a year in gross income will probably get you this house:

https://www.realtor.ca/real-estate/20898498/5-bedroom-single-family-house-3278-w-15th-avenue-vancouver

2 kids in private schools, no real restrictions on meals (eat what you feel like), nice clothes (within reason), 2 cars (each in the $80k range), couple nice vacations a year, maybe a cabin/vacation home somewhere and savings for retirement/kid’s post secondary school.

I would definitely call it a comfortable upper middle class, but wouldn’t call it thriving (no boat in the Marina, probably still fly economy on vacations etc.).

Barrister, I just texted her and she said this:

Question: What is the difference between a lawyer and a liar?

Answer: the pronunciation

ks112: I am a new blogger here today but have been watching this site since Prairie Boy.

I could not hold my tongue any longer at reading ks112 comments on not being able to thrive in Vancouver on $700K annually!!

My daughter is a nurse and works 20 hrs per week. My son-in-law works full time and earns approximately $68K per year. They have one child. They were able to buy a 1912 home in East Van in the Grandview area 2 blocks off of commercial drive. My grand daughter went to an elite private school from the age of 2 to 13 yrs. Granted, they bought their home 12 years ago having a large down payment and will have it paid off in 2 more years. They live well. But they manage their money wisely. And that is what it is all about.

Ks: Ask her what her favourite lawyer joke is; I will add it to my collection. Personally I dont find Vancouver an appealing place to live, perhaps if you are younger. But obviously millions disagree. Different strokes.

Anyone who can’t thrive in Vancouver on $700k/yr is doing it wrong.

Well Barrister, I need a very rich wife that I am attracted to. Or else what is the point of having all the money in the world if you are with a woman you are not attracted to. Sure I can hope to get money out of a divorce but that is a slime ball move.

I am actually currently dating a lawyer in Vancouver, she makes a lot more than I do (general counsel of a multi billion $ company). But even when we add our incomes together (around $700K), it still doesn’t feel well off in Vancouver, in Victoria absolutely but Vancouver is a different beast.

KS112: Your other alternative is to marry a very rich wife. Even if the marriage is not happy you are still guaranteed a very happy divorce.

Thanks barrister, I will take u up on that one of these days. And I agree, as a single guy after taking income taxes in to account I am competing directly with the two professional couples that Marko references. Only exception is I most likely have a bigger downpayment.

I don’t see the point of paying more if I don’t get the views. My current house is on a quiet side street in Gordon head (standard 1970’s home on a 6800 sqft lot), I can simply spend 200k and renovate the crap out of it and be done.

KS112 At 1.3 million you are still in a pretty competitive bracket. Wish I had a crystal ball but your guess is as good as mine.Water views are nice but I am not sure that they are really worth the premium price. You tend not to notice them after a while, or at least I dont. I do take weekly walks on Willows beach which I do enjoy. But these are all very personal choices. You get more house for your money in Cordoba Bay but Oak Bay is likely to be the better investment in the long run.

At this point I would say that finding the right house might be more important than trying to time the market.

Happy to buy you lunch one day since I would like your take on the market..

No Barrister, l mentioned this before, I have a gordon head house that bought I 2013 which I rent out. I in turn rent a condo downtown (I have grand fathered rent from 2011). I want to get into a nicer house and i think I can get around 800k for my current house so with that money I am in the market for something $1.3M, but for $1.3M I want something nice with water views in Oak Bay or Cordova bay. I can’t find any I like in that price range currently.

So my dilemma is whether or not I should sell the gh house now, pocket the money and wait for the correction. Or if I should keep the GH house and hope that the correction only happens in the high end. Hence I regularly keep an eye out for gh home prices.

Ugh that cedar close house is a dump. Not even a real kitchen. Cant wait to see what it goes for. 699k is very optimistic. There are some pretty nice places listed in the low 700s around Victoria/Saanich. I live in Gordon Head and basically anything around me has been listed, reduced, then unlisted. I think the longer people wait to lower their prices the more disappointed they will be.

ks112: Are you in the middle of house hunting at the moment?

ks112: Did not think people set up for bidding wars much these days.

Reading the VREB report I was struck by the increase this year of the number of condos for sale.

is this one set up for a bidding war?

https://www.realtor.ca/real-estate/20985011/3-bedroom-single-family-house-1677-cedarwood-close-victoria-gordon-head

She got an english degree, and then contracted has with an ‘s.

https://www.vreb.org/pdf/VREBNewsReleaseFull.pdf

I think page 3 gives a more representative look at what is happening. When sales of plus 1.5m dollar homes are doing crap. It skews the average home statistics that people are looking for but hey if you believe the average SFH is down 10% over last year and 4% from last month great (so the house last year priced at 900k is 810k this year don’t think so).

I think introvert did everything right and should be commended. Some people take the bull by the horn and do what it takes. Others pick flowers and blame others as time passes.

JULY 2019 NUMBERS: Media reporting:

Greater Victoria Prices Sharply Down.

July stats now in from Victoria. Single family, Greater Victoria, down significantly from last July: 10 percent drop in average prices, 6.5 percent in median price. Reality setting in. Total inventory up more than 13 percent from last year. So many people I know said Victoria can never drop. The reality is that Victoria is directly linked to the Lower Mainland market.

Last month, Soper flew back to 2009 to buy. Ha ha. Now’s he bought for real? OK then…

Soper hasn’t actually bought and is being driven insane by each successive year of no price crash.

i suppose if times get really rough introvert can move to the basement and rent out the upstairs.

James,

Congrats! May it bring you and your family lots of happiness, and be a great long term investment.

KS112

Ya I am not going to play the what if game. I am going to assume that in 99% of the case, a 2009 purchase works better than a 2019 purchase because of leverage and tax consequences.

Introvert has a border to, so that just adds to his purchase and paying off the mortgage.

well gawc, I am gona play devi’s advocate. Suppose that Soper not anchoring himself down to a mortgage early on has allowed him to be very aggressive with his career choices/investment decisions and now has ended up in much higher earning position than if he had bought a house earlier and remained conservative wit his career/investment options.

So now in 2019 instead of making $80K and carrying a $500k mortgage living in a $800K house, he is now making $350k and carrying a $1.2M mortgage and living in a $1.6M house. So is he better off in the latter example? I would say so.

I thinks Introvert did a tad better buying in 2009 than someone who bought in 2019. Just saying….

Well if I am reading this thread correctly the so called “basher” now has a better house than the “promoter” who bought 10 years ago. So maybe in the “basher’s” case it was better to wait?

I love seeing the bashers buy and disappear. It is very funny.

Congrats Soper…Now you can support the other side. LOL

Yes congrats Introvert! I know you’ve been waiting a long time. Always knew you wouldn’t be a bear forever.

Still jealous I see.

Interesting I guess affordability is moving people into Condos. 524k is a lot for a condo. Near all time high, Add in condo fees and Condos are getting mighty expensive. Close to a sfh.

The Multiple Listing Service® Home Price Index benchmark value for a single family home in the Victoria Core in July 2018 was $889,200. The benchmark value for the same home in July 2019 decreased by 3.4 per cent to $858,800, slightly less than June’s value of $859,600. The MLS® HPI benchmark value for a condominium in the Victoria Core area in July 2018 was $508,300, while the benchmark value for the same condominium in July 2019 increased by 3 per cent to $523,400, lower than June’s value of $524,100.

Introvert: Congratulations, what part of town did you buy in? Old or new? Rather exciting for you.

Helpful B.C. energy efficiency rebate search tool:

https://betterhomesbc.ca/

Soper travelled back in time to buy a house. He’s a very stable genius. It’s a really nice house, too:

I also agree on the grammar. Intro- apostrophes are not to be trifled with.

Well, congrats James, you grouch!

I guess we’re all waiting to see Leo’s final monthly summary.

You can easily afford a house now? Last month you said you couldn’t:

Notable jump in VanRE sales for July.

Start of something, or nothing goes to blazes in a straight line? 😛

Marko,

I should have clarified that these numbeo.com comparisons were for a 1,100sq ft condo (actually 100sq meters) in the city core. Not a SFH. As you point out, a SFH comparison is even worse (even more expensive in Zagreb than Victoria)

I graduated from University in December 2008.

Can you guess why I couldn’t afford a place in 2009? I can easily afford one now though, which is why I bought one. It’s why you don’t see me on here much.

Also, using a ‘s as a contraction of has in that fashion is sinful.

End of the day there has been significant wage growth in the last 3 years compare to 2013. From 2013 – 2016, the going rate of a newly minted chartered accountant was around $70K-75K in this town, now days the going rate is $80k-$85K.

If you have a household income of around $100k, you will be priced out of a SFH in the core. It is much better to think of ways to make more money than waiting for a housing correction. Why? Because there is no downside, if you make more money and there is a housing correction well then that’s even better for you.

I just had a former colleague switch jobs in Victoria (finance/accounting related) from one public entity to another, she went from $86k to pretty much $100k and it was pretty much a lateral move.

What would you say, at least in your experience, the mixture is at the moment between FTB and trade up buyers? How about foreign buyers?

There are no foreign buyers. This year I’ve had a few first time buyers buy in the 700k-1 million range. Always the same story, 2x professionals that are good at saving and by the time they are late 20s/early 30s they’ve paid off the student loans and saved 100-200k for a downpayment. Often parents chip in to clear them of CMHC fees.

I am guessing the young professionals on average have wealthier parents than young non-professionals based on cycle of poverty.

On this Victoria BC to Zagreb, Croatia comparison, Victoria price/income (7.55) is 50% cheaper than Zagreb (12.18).

I am familiar with real estate in Zagreb and there is no way those numbers are close. Zagreb is far more unaffordable in relation to Victoria. My cousin is an oncologist (and a good one at that, he worked in Toronto in oncology for a few years and got a pHD on top), his wife is also a medical doctor and all the can afford is a 1,100 sq/ft condo. In Toronto he turned down a $340,000 CND/year position now he makes around $40,000 CND/year, but a decent house in Zagreb is not much cheaper than Victoria. Certainly not half the price.

Unless you have family money or some crazy business there is no way you are getting into a SFH so when these young couples show up here and they can get into a townhome or SFH they go for it knowing it would never happen back home.

Right. Likely they recognize value. As Marko has pointed out, housing in Croatia as measured by price/income ratio is much higher priced than Canada.

On this Victoria BC to Zagreb, Croatia comparison, Victoria home price/income (7.55) is 40% cheaper than Zagreb (12.18). Same with mortgage as a % of income.(Victoria 53%, Zagreb 90%) https://www.numbeo.com/property-investment/compare_cities.jsp?country1=Croatia&city1=Zagreb&country2=Canada&city2=Victoria&displayCurrency=CAD

Thanks for all that.

What would you say, at least in your experience, the mixture is at the moment between FTB and trade up buyers? How about foreign buyers?

I wonder why they’re not dithering or bearish.

KS: I suspect those same couples ten years from now will be moving up to the 1.2 to 1.4 homes if interest rates stay low. I am beginning to suspect that the local market does indeed support a lot of the price structure that we are seeing now.

Marko: I suspect that same category of buyers (teachers, IT workers, government that you mention), perhaps who bought ten years ago, are now moving up the ladder into 1.2 to 1.4 homes in the core.

Marco’s sentiment echos mine regarding the amount of couple with family incomes in the 150k range that puts pressure on the 800k homes. Local fool, do you have any contradictory evidence or theories?

Hey Marko. Been a while since you popped in. Do you have any recent market perceptions you can share? Do you find it slower, faster, different type of buyer than this time in previous years, etc? Or, no difference you can tell?

Busier than last year for sure. Sellers are pricing a bit more reasonably and buyers appreciate having 5-8 buisness days for conditions. I kind of like, my listings are moving and my buyers can do some due diligence.

Below 800k is still super competitive. Lots of multiple offer situations but rarely is anyone going over asking. This week I wrote offers for three different buyers in multiple situations.

Condo, 2 offers, 15k below asking winning offer.

Home in Langford, 2 offers, 15k below asking winning offer.

Home in Cedar Hill, 3 offers, my clients went 12k over asking and didn’t get it but I doubt the winning offer is much higher (still waiting for conditions to be removed).

I’ve helped five young Croatian couples buy a property in the last 24 months. Sixth young couple shows up at my office last week. Husband arrived in Victoria 8 months ago and landed a government job 60k/year. Wife arrives 4 months ago also lands a $60k/year government job. They have some savings for a down payment. Qualified for about to 650k factoring in downpayment.

Immigration policy has to be playing into the housing problem imo. The only friend that couldn’t get PR (permanent residency) was a drywaller working 70 hours a week. His second work holiday visa expired, and he had to go back to Croatia after two years despite his drywall company making all efforts with immigration. So instead of keeping someone around that can help alleviate the construction labour shortage but would have a hard time buying a place himself we send him back and keep all the smart ITers and similar that are only straining the demand side of the equation.

All in all while the economy is holding steady and the NDP are spending I can’t see much price pressure under 800k. Just too may stereotypical government/teacher/firefighter/military/health professionals/uvic/IT/etc making 100-175k family income that are in this price range.

Rob Carrick says spend spend spend!

Actually he doesn’t. He says pay down your debt, you got lucky. Interest rates aren’t going anywhere on the upside.

https://www.theglobeandmail.com/investing/personal-finance/article-the-us-federal-reserve-just-saved-canadians-who-borrowed-too-much/

You probably haven’t been paying attention. Soper’s mentioned on occasion that he can’t afford a house at today’s prices. I also asked him once, out of curiosity, whether he could have afforded a house in 2009; his answer was no.

So my earlier comment in this thread—to which I think you’re alluding—about Soper not being able to afford a house is factual as far as one can tell. I didn’t need to—and didn’t—imply anything.

Always funny when the self-appointed lunchroom supervisor/vigilante of this blog gives me one of his awesome reality checks.

Hey Marko. Been a while since you popped in. Do you have any recent market perceptions you can share? Do you find it slower, faster, different type of buyer than this time in previous years, etc? Or, no difference you can tell?

Rush life, not at all. I don’t insult people for no reason, only started giving introvert the reality check because he/she kept up the personal insults to others for no reason other than because they had a different view on home prices.

Assessed for $11,241,000 and remember that’s a July 1, 2018 valuation. Note that the other 2019 sales on the waterfront side of that block were also under assessment.

https://www.bcassessment.ca//Property/Info/QTAwMDAwMDVDVw==

I don’t follow the Vancouver market closely but a sale popped up on our board today (Victoria realtor had it co-listed).

3533 Point Grey for $10 million on the dot…..78 yr built on a 4,900 sq/ft lot. What da?

KS112: Did not like Beach Drive when I was looking for a house (different strokes for different folks). Originally I did put in an accepted offer on an old manor house in Oak Bay that was rather unique but, sadly, the foundation was giving away and it was built right on the side of a cliff.

Victoria has been a lot of fun and it is pleasant in a nice way still but less to my taste with each passing year. I am looking forward to a small town of about 50k and sitting on my dock on the lake. The house might take a bit of getting used to though.

The short answer is no I cannot see myself moving back and for me it has nothing to do with house prices.

“you don’t attempt to peacock and insult” two posts earlier “even though he/she prob makes like $60k a year tops and needs both basement tenants and parental help to allegedly get in the market in 2009”. Seems a bit hypocritical don’t you think?

Local fool, you left out the Chinese money in your description of Vancouver ;), I expect another turn of that write up.

LOL, Barrister I feel that your comments are reasonable and reflect reality so I left you out. You base your comments on actual facts instead of pure theory or cherry picking data points. You also don’t attempt to peacock and insult those whom you are debating against on an anonymous internet forum.

If prices do crash after you have cashed out, would you consider returning Barrister? Maybe have a beach drive address instead of a Rockland one 😉

Sure.

Price collapses can be caused by several different mechanisms, but the main catalyst is when the core of a RE bubble develops a sugary, sweet filled center and is no longer able to support itself by intellectual degeneracy pressure.

What happens:

With intellectual degeneracy thoroughly expended, the bubble is then held up only by a substance best described as “transient marshmallow fluff”. The result is a cascading series of events, starting with the craniums of maniacal market participants. It forces each of their craniums to collapse forthwith into to a rotating neutron star or black hole, which in turn consume everything in their debt laden bodies from the neck down. If there are enough participants, electroweak interaction may actually force all of them to merge together into a giant, vacuous element commonly known as Trumpinium. Trumpinium is a highly dangerous, unstable, carrot-colored element that should be buried only at specially constructed underground facilities in Nevada.

Chemical and visual properties of a housing bubble collapse:

The visual nature of the resulting bubble explosion is dependent on the region in question. Victoria types tend to be rich in elements such as eccentrium and snootyum, which produces an unpleasant orange explosion which instantly sickens those not previously and repeatedly exposed to those elements.

Vancouver types contain snootyium, but also lululemonese, sushion, and propertese. Explosions of this nature are characterized by a fowl, fish like smell, but the lululemonese gives the rancid cloud a very pleasing shape (wink) provided your down payment is large enough.

A sufficiently large bubble explosion may generate KS112-rays energetic enough to initiate photodisintegration directly, annihilating the Trumpium at the quantum level, which will inevitably cause a complete collapse of the bubble.

Let me know if that helps.

KS112: I feel left out. Mind you that is fair since I am moving to a small town soon. I dont know if prices will drop in the core but I was amazed to see the number of homes in Fernwood with an asking price near or above a million.

Can someone post some new theories or catalyst for home prices to drop instead of the same old price-income and price-rent ratios please. Because I know Patrick will follow up with some Terenet numbers and then Introvert will make some type of comment implying that the bears can’t afford a home in Victoria etc. (even though he/she prob makes like $60k a year tops and needs both basement tenants and parental help to allegedly get in the market in 2009.)

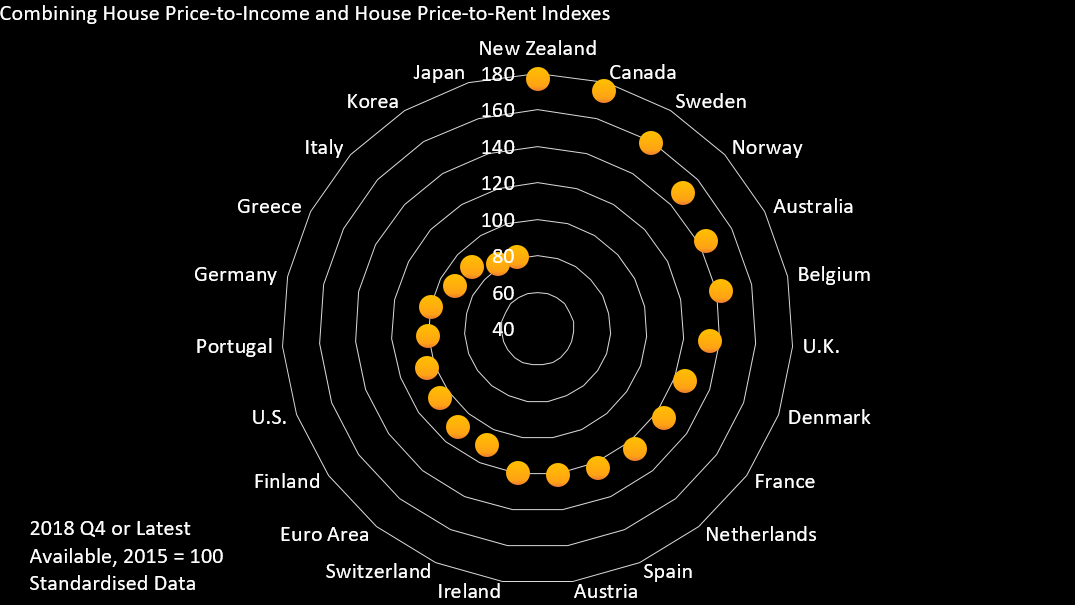

“Canada and New Zealand are the most vulnerable to a house price correction given both the price-income ratio and the price-rent ratio are well above their long-run averages, according to Bloomberg Economics.”

https://www.bnnbloomberg.ca/so-where-is-the-next-house-price-bubble-brewing-1.1294261

Rush: Not totally surprising that crime stats are up.

haha that’s where your wrong Patrick, haven’t you been reading what we have been writing – when the economy is doing well we see the potential increase for interest rates (bad for new buyers and thus house prices) and when the economy is doing poorly that means less jobs and less buyers – so you see our world is always rosey duh.

PS Victoria crime stats up – maybe not a deterrent for people moving here but certainly surprising to me:

https://vicpd.ca/node/2264

“Victoria BC – Crime Severity Index (CSI) numbers, released by Statistics Canada last week, show that crime severity is up in VicPD’s policing jurisdiction inclusive of Victoria and Esquimalt.

The CSI or Crime Severity Index, is a Statistics Canada tool for measuring police-reported crime that tracks changes in both the severity and volume of crime (learn more about the CSI here). It is updated annually. A rise in CSI often indicates that the public are reporting more crimes to police and that these crimes are more severe.

Statistics Canada CSI analysis mostly focuses on larger urban centres. Victoria and Esquimalt are part of the Greater Victoria Census Metropolitan Area or CMA, and much of Statistics Canada’s analysis is made at this level. However, the extended CSI data allows for understanding of trends within VicPD’s primary service areas of Victoria and Esquimalt*.

Key preliminary 2018 findings in the Victoria and Esquimalt CSI data are:

· Victoria & Esquimalt saw a crime severity index increase of 5.15%.

· Canada’s overall CSI is 1.9% higher nationally. The CSI for B.C. is 0%. Victoria and Esquimalt’s 5.15% crime severity increase is above the national and provincial trends – nearly 3 times the national average and over 10 times the provincial average.

· Victoria & Esquimalt’s violent crime CSI increased 2.49%.

· The national violent crime CSI increased by 1.4% but decreased for B.C. by 1.59%.

· Victoria & Esquimalt’s non-violent crime CSI increased by 6.18%.

· The national non-violent crime CSI increased by 2.4%, and increased for B.C. by 1.06%.

· The 2008-2018 ten-year CSI trend shows an overall drop in crime severity.

· The 2013-2018 CSI trends shows a steady increase over the last five years.”

Interesting article where parents lent money to daughter for a house but did no paperwork. Daughter said house was hers and parents wanted to sell to pay down some obligations. Judge sided with parents and forcing a sale. Not so sure I agree with the decision but an insight into parents, adult children & houses.

https://www.timescolonist.com/news/local/judge-sides-with-parents-in-110-000-dispute-with-daughter-over-colwood-home-1.239

///=== warning: good Canadian economic news ahead, may be upsetting to some “bad-news-bears” here. If so, please skip ahead. ===

Canada’s economy has some good news today …

July 31 https://www.fxstreet.com/news/canada-another-upside-surprise-in-gdp-rbc-201907311315

“ Canada: Another upside surprise in GDP – RBC

Josh Nye, senior economist at the Royal Bank of Canada, notes that the Canada’s GDP rose 0.2% in May, 0.1 ppt above consensus as goods production saw another solid increase.

Key Quotes

“Canadian GDP surprised to the upside for a third consecutive month in May. Growth was once again broadly-based with most services industries recording gains (retail and wholesale being key exceptions) and goods production posting another solid increase.”

“Today’s solid reading for May leaves us tracking annualized growth of nearly 3% in Q2—above our earlier estimate and the Bank of Canada’s latest forecast**. Strong growth in the last several months underscores why the BoC has maintained a neutral policy bias even as the Fed is set to lower rates, starting this afternoon.”

==== end of warning: bears may safely resume reading now

No. Mortgage credit growth rates in Canada have been falling since 2009 (10% growth YOY), until today (3.7% growth YOY), and over that time Canada house prices have risen 75% (teranet).

https://betterdwelling.com/canadian-mortgage-growth-rises-from-lows-but-still-not-quite-back-to-normal/

Typo, I meant negative growth (below zero), not declining yet still in positive territory.

Your negativity towards high prices and mortgage growth is trolling and trying to get a reaction.

In response to that, I was tempted to call you stupid, Soper, but then I realized you’ve been priced-out of the Victoria market your entire adult life, which is probably more of a bad-luck story than one of stupidity.

Mortgage credit growth is one part of a complete picture. MCG is useful though in implying the trajectory of consumer’s ability/willingness to dabble in the housing market.

It can be tricky to understand this one. Here’s my understanding FWIW.

Mortgage credit growth should always be positive. A certain level of growth is always required in order for Canadians to continue to trade amongst the existing housing inventory, resale or new.

When the rate of growth rises for a sustained period, it means that ability for the housing inventory (new or resale) to be absorbed at current prices grows. That will generally, but not always, lead to price growth.

When the rate of growth declines, the inverse is implied. It means that the ability for that same housing inventory to be absorbed at current prices is lower. That will imply a slower market which if persistent and large enough, means that prices will have to fall to a level in which that absorption resumes.

A zero rate of MCG would imply that the existing stock of homes on the market are not being absorbed at all. That would imply a pretty serious economic situation was underway and is very rare to see in Canada. A declining rate of growth is even worse. That would imply, at least to me, a quickly shrinking population amidst a serious economic calamity. It is interesting to note, that this did occur very briefly in the early 1980’s, but that quickly snapped back.

So what’s MCG doing now? At the moment, it’s trending down. On its own, that metric implies continuing weakness in home absorption (and by extension, price growth) which is exactly what we continue to see overall, nationally. Is that bad news or good news? I guess it depends on who’s answering. But again, it’s not the only thing to watch.

“Never attribute to malice that which is adequately explained by stupidity.”

We’ve been lectured by bears here how important mortgage credit growth is for the housing market, and the Canadian economy in general. Treated to endless posts about how weak the mortgage credit growth is, with the dire consequences for the Canadian economy and unemployment etc. So a single post to report some good news should be received as good news for everyone, unless you want to see unemployment, bankruptcies and the B.C. or Canadian economy collapse, and are bugged by anyone who says differently.

Well let’s start with the fact, which is I have absolutely no affiliation to the RE industry and am just a Victoria homeowner. If that sounds so weird to you, why not also pick on a typical bear, (or even the king of the bears here) who is a renter and has never owned a home or never even had a mortgage. Ask them the same questions about why are they here when they have no skin in the game? I’ve stated before, I’m interested in economic issues in general, and the Victoria house market in particular, because I am (like 61% of households) a homeowner.

As an aside, IMO, nothing anyone says here is going to move the needle, so it would be pointless for anyone, including an industry professional to be “pumping” here anyway.

Agreed. Gotta be industry, skin in the RE game, or an… interesting opinion on what is good for Canada’s economy.

If interest rates ever head upward there is going to be some serious hurt out there. Hopefully the stress test might contain some of the worst of it.

Patrick,

How is the all time high and increase in mortgage growth good news? Besides just trying to troll and get a reaction, please explain what makes you believe this is good news?

For someone who repeatedly states they have no affiliation to the industry, you sure seem to cheerlead pretty hard for it. A little too hard to just be some random dude that spends a lot of time pumping things on a random blog.

Give us the goods buddy… are you heavily leveraged? Are family members in the business? It has to be something. No one is so fixated on something without some kind of personal interest in it.

It sure is, but just not for me (never owned nor lived in a RV) 😉

Latest figures for mortgage growth in Canada are released today and have good news…

This is data for June. Another all-time-high and growth of 3.7% YOY. Still a low rate of growth, but above inflation and nowhere near the point of “shrinking” that some here have mis-stated. The good news is that the trend is improving with the last 3 months growing at 4.3% annualized which would move it to close to the normal range (ie we are not far from 5% – the long term average growth).

https://betterdwelling.com/canadian-mortgage-growth-rises-from-lows-but-still-not-quite-back-to-normal/

“Mortgage Growth Expected To Continue Short-Term Acceleration

The annualized pace of growth is pointing more potential growth, at least near-term. The 3-month annualized growth reached 4.3% in June, an increase of 38.70% from the same period last year. This represents a 16.21% increase compared to the current 12 month rate of growth. “

Hope everyone had a great weekend and are enjoying the weather. I am not seeing any real price declines, at least not in the core. Suspect that we will need to see a lot more inventory buildup before there is any impact. Unaffordable or not there still seems to be a lot of people buying.

Thanks, freedom. It’s a cool idea and a great way to get a depreciating asset earning some money for you.

https://www.usedvictoria.com/classified-ad/Starcraft-Travel-Trailer-for-Rent_33347618

https://www.usedvictoria.com/classified-ad/27-travel-trailer-renting-RV-camping-rental_27125451

https://www.usedvictoria.com/classified-ad/5th-Wheel-Trailer-For-Rent—WE-DELIVER-TO-YOU_23929572

That’s a great idea! What company does this?

🙂

By the way, getting a camper trailer delivered to a campsite, highly recommended. Better than having to drive the beasts around.

7% increase in sales rate compared to last year

12% more inventory on the market

10% higher new listings rate

I don’t recall reading a single post here saying you could do that.

Month Jul Jul

Year 2019 2018

Net Unconditional Sales: 629 651

New Listings: 1,051 1,048

Active Listings: 2,963 2,60

Off on vacation at the moment so likely won’t get to a new post until Friday.

Are u waiting til the 1st to post numbers Leo?

I see National Post writer Tristin Hopper is visiting again:

I find this editorial choice quite fascinating.

I agree with caveat emptor…so, I went to Canadian and bought an axe, then to the garden centre for some sharpened stakes to line the perimeter of my property.

With a basement full of beer and beef jerky, I’ll be able to ride this one out.

“What would cause prices to start increasing again?”

Apart from what Patrick outlined… which IMHO will not create any rapid price increase.

We need the world to start thinking of Canada as a safe haven again. Maybe a world event? Political unrest ? Something happening in Asia/China?

Maybe a large currency differential that is significant enough along with the recent large slump in prices to override any 20% spec tax.

https://business.financialpost.com/real-estate/hong-kongers-scout-properties-in-canada-and-u-k-to-escape-protests

If Vancouver homeowners get a second chance to sell, they likely will. And then they will be looking to buy somewhere on the West Coast where they can still buy under USD $1M million.

Nope.

Toronto is the second least affordable market in the country. Which just goes to show you that surveys about what people “would” do aren’t worth much.

Nothing is impossible, but I doubt it unless sales keep increasing. I think current sales levels are sufficient to keep prices stable, but not to increase prices. June reading was strong, although there is a fair amount of seasonality there.

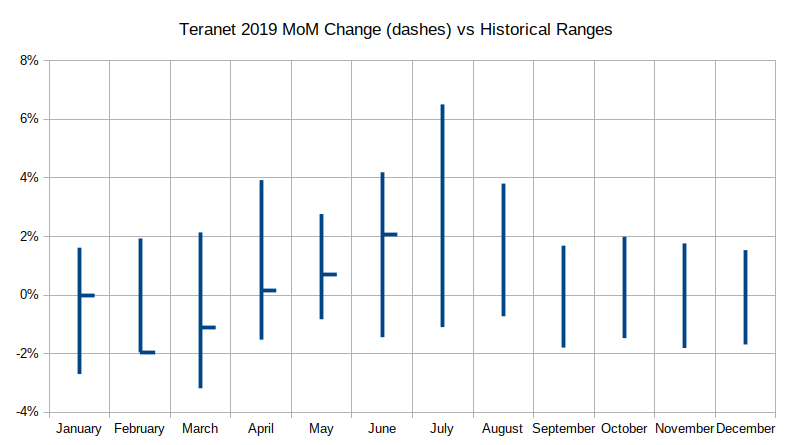

Here is are the 2019 readings compared to historical ranges:

Last May was +1.79% followed by +1.31% in June but the rest of the year averaged to flat anyway.

I think we’ve been in a steady state since the stress test was brought in wrt sales. I could definitely see a slow increase in sales as people have had 18 months to beg/borrow/steal/save additional down payment to pass the stress test. Should be a gradual process though and increased sales coming into increased inventory levels. We’ll see what happens. Sometimes you get several months of strengthening in a weakening market, and vice versa. It’s not a smooth ride for sure.

“Prices may have already started increasing”

You must be a realtor, lol

Prices may have already started increasing. Victoria Teranet (june 208.39) is up 2.9% from March 2019 (202.44) https://housepriceindex.ca/category/reports/

Factors that could keep it going….

Probably not even that. So Victoria is dirt amongst 18-24 year olds, then 6th most popular 25-34 then dirt again in the next 10 years and suddenly 4th most popular. The survey is just there to justify the articles that will be written about it.

Bears surrendering.

I’m very curious to see how the net migration pans out for retirees. Victoria is a destination for sure but affordable only to wealthy retirees and our already old population means we have more turnover (people become net sellers sometime in their 70s)

What would cause prices to start increasing again?

Those polls are like those “how good a job is your political leader doing?”.

It’s not bullish or bearish, it’s a snapshot in time among the participants in that poll. It’s not really meaningful IMO. Juwai is the worst offender I know of, but there are others. Usually tourist and investment rags.

Just sayin’.

https://www.vicnews.com/news/victoria-outside-the-top-10-most-desirable-canadian-cities-to-relocate/

I know this goes against the very religion of many of the bulls on this forum, but Victoria is not in the top 10 most desirable cities to relocate within Canada anymore. I hope you can find peace after reading this 😉

“While Toronto might be one of the most expensive place to buy real estate in Canada, it is also the most popular destination in Canada to buy real estate, with Victoria falling outside the Top 10.

According to a new survey, 10 per cent of respondents, the equivalent of about 3 million Canadian adults, said they’d move to Toronto in order to be able to buy a place.

Halifax is the second-most popular destination, followed by St. Catharine’s, and Ottawa. Kelowna, London, and Kitchener tied for fifth, followed by Montreal (8th), Calgary (9th) and Vancouver (10th). Victoria finished in 11th place, ahead of St. John’s and Hamilton.

The list of least popular cities starts with Canmore, Winnipeg, Quebec, Edmonton, Oshawa, Saskatoon, Windsor, Whistler, and Regina.

Younger Canadians are the most willing to move for homeownership, with 85 per cent of Gen Z adults and 70 per cent of Millennials saying they would move for real estate. Fifty-seven per cent of Gen Xers (45-54) and 26 per cent of those over 65 say they are willing to move.

Looking at specific age groups, Victoria did among individuals aged 25-34 in sixth place (tied with Hamilton and Kelowna), and among individuals aged 45-54 in fourth place tied with Toronto and Kitchener. Victoria also tied for fourth place with Kelowna and St. Catharines among individuals 65 years and older.

Victoria, however, falls outside the Top 10 for individuals aged 18-24 and individuals aged 35-44. In other words, individuals just entering the workforce, and those still entering their prime earning years, are staying away from Victoria, likely for reasons of housing affordability, but also other opportunities. Notably, Toronto is the preferred destination for individuals aged 18 to 44, suggesting that the city is attractive to a wide variety of individuals at different stages of their personal and professional lives.

Victoria is also a popular destination for individuals who live in British Columbia, ahead of Vancouver, but behind Kelowna. Almost 20 per cent of British Columbians said they would move to Kelowna, while almost 13 per cent identified Victoria, with Vancouver coming in at 12 per cent.”

Another day, another July windstorm.

Smoothing the boom/bust cycle does have merit, though not for smart investors looking to buy in a down market.

Is anyone following Deutsche Bank, hopefully the German Government rides to the rescue before we have another meltdown.

Zombie apocalypse.

My WAG: Barring an economic shock, it’s a soft landing. There’s still a massive hangover in the US from their monetary policies for the last 10 years, so their (and our) interest rates aren’t looking to be heading up much anytime soon, the Canadian and BC economy is still chugging along and retirees are continuing to increase in numbers (17.74% of population in 2019, increasing by 0.5% per year, or 1.85M, through 2030 to 23% of population). Note that on Vancouver Island, those 65 and older already make up 23% of the population.

This could be one of the things that push prices up but without an external force like this i disagree with Patrick and don’ think we will be hitting all time high prices – at least not in terms of median or average. here are the details:

https://business.financialpost.com/real-estate/hong-kongers-scout-properties-in-canada-and-u-k-to-escape-protests

“Vancouver, where housing prices have been in a slump for the past year, may be the first city to benefit from the upheaval in Hong Kong.

Changes in Vancouver tax laws have pushed property prices lower since 2018, Knight Frank LLP said in a report, adding that investors will also benefit from currency-adjusted discounts of 17 per cent over the last year. Luxury homes were hit hardest by property tax changes causing the price of mansions to fall in the last few months leading to more incentives for buyers. With the city being home to a large Asian population, Vancouver is an appealing choice for many Hong Kong buyers.

“The tsunami tide of capital coming overseas in the last 10 years displaced a lot of old Hong Kong money,” CBRE’s Ho said. “Now, Hong Kong capital is looking at the price correction in Vancouver as an opportunity to get back in the market.””

Great post Leo. The sales graph in particular shows the effect of the stress test.

I think we’ll be going to all-time-high in prices within a few months, and that’s a takeoff more than a landing, so I’ll go with “something else entirely”