July 22 Market Update

Weekly numbers courtesy of the VREB.

| July 2019 |

July

2018

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 136 | 298 | 479 | 651 | |

| New Listings | 284 | 564 | 807 | 1048 | |

| Active Listings | 2995 | 3008 | 2970 | 2607 | |

| Sales to New Listings | 48% | 53% | 59% | 62% | |

| Sales Projection | — | 690 | 710 | ||

| Months of Inventory | 4.0 | ||||

Another relatively busy last week with 181 sales, up from 165 the week before and only 136 in the first week of the month. That puts us at 8% ahead of the sales pace of last year, and if sales continue like this we might make almost 750 sales for the month which would be over the long run average of 720 for July. A little surprising to see this amount of activity in July when sales usually back off from June. Easing of the stress test rate combined with the lower fixed rates bringing some more buyers on board?

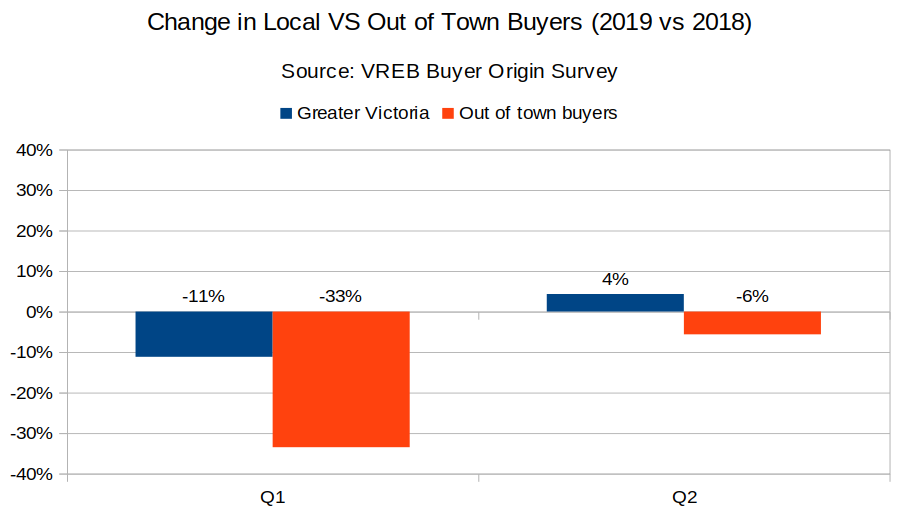

Last week I talked about the spec tax and possible impact on Victoria, which I concluded to be minimal at present. Another data point is the buyer origin data which was just released for the second quarter. Remember this data comes in response to the question “Where is the buyer currently residing?” so it is by no means a perfect measure of where buyers are coming from, but it is one that has been consistently applied over the years so we can get a sense of trends.

In the second quarter as in the first, out of town buyer numbers were down substantially (in Q2 down from the already lower Q2 2018), while local Victoria buyers picked up the buying slack, increasing their numbers over the same time last year.

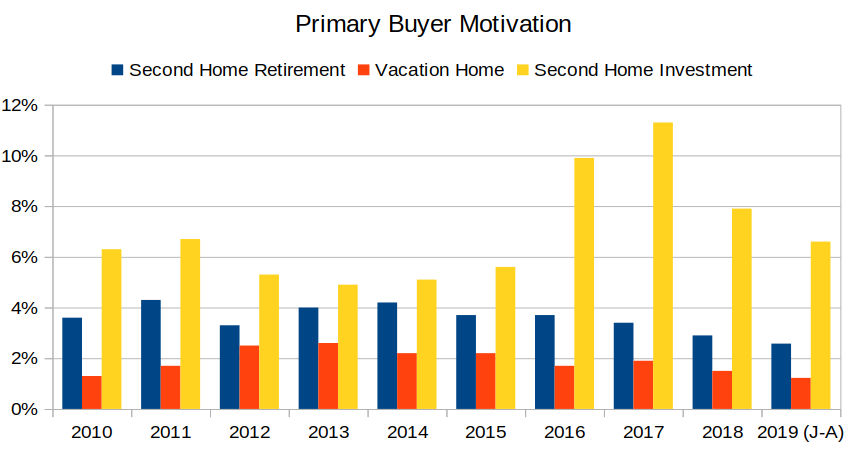

We can also look at the survey of primary buyer motivations for some clues. Here are those results as they pertain to buyers interested in purchasing second (or third, fourth, etc) properties:

A couple things to take away from those numbers:

- Investor interest continues to decline. The doubling in the percentage of buyers that were purchasing investment properties indicates a level of speculation in the market that is brought out by rapid price appreciation. Remember sales were up substantially in 2016/17 as well so the number of investor buyers actually quadrupled in those years compared to the sleepy market of 2013 (despite rentals yields that had substantially deteriorated). What was the most effective curb to speculators? Not the spec tax, it was simply the fact that prices stopped increasing.

- Second home purchasing for vacation or future retirement continues to decline. The proportion of buyers motivated by purchasing a vacation home (1.23%) or future retirement home (2.58%) is now at the lowest point since data begins in 2010. While it seems natural to attribute that to the speculation tax which would hit some of those purchases, that proportion has actually been decreasing for a few years. I suspect price escalation again has more to do with it (fewer people able to afford it) than the speculation tax.

If there’s a small sales recovery underway, it seems it’s mostly driven by locals right now.

New post: https://househuntvictoria.ca/2019/07/25/are-regulators-pulling-off-the-soft-landing/

@Barrister

Be very careful what you say about Sicilians….

https://www.youtube.com/watch?v=S3yon2GyoiM

If it is too much of a pain for developers (with all the resources they have) to deal with the city, it would be near impossible for a home owner to do it, doesn’t matter how much pain one could take.

Note 1322 Rockland did also have some neighbours’ support back in late 2004 and early 2005 when they first started. After they failed one or two times, one of the neighbours (who is also a small developer) even took conditional possession of the property and tried again (with different plans) and failed again. There has been multiple attempts since including one last year (or 2017?) by the owner, all failed.

Freedom: I checked with a couple of developers, including Abstract, not interested, too much of a pain dealing with the city when it comes to a heritage house.

GWAC: if it proves too much of pain or if I start getting the mantra of affordable housing only, I will sell it to the highest bidder who right now is the Scilian Lighting Company by a far mark.

Barrister seems like a lot of stress for what…

Moving a house is a pain in the ass whether it is 2 feet or 200 miles, The house will never be the same. There will be damage. Retirement is not about that stress. Very few heritage homes burn and when they do the city does not make it easy on any rebuild they usually encompass the old style house.

Just my 2 sense, you have to do what you feel you have to do… best of luck on your path.

Barrister,

If you don’t need to do it for profit, but just want to make things right, you could also check out some reputable developers, say Abstract, to see if any of them is interested in taking on the project. I am sure they would pay a reasonable price (if they think the rezoning is feasible) and wouldn’t burn the house down. This project would be much easier and with likely better results for them to do it than for a non-professional-developer/home owner.

Freedom: Actually my rezoning is not going to make a profit. It would be much simpler to sell it to a rather notorious non-developer who has made me an offer. Strong probability that the house would suffer an unfortunate fire since the land without the heritage home is worth a lot more. What i am trying to do is sever off some of the land so the house is no longer a target for the unscrupulous. The value of the two extra lots will be just about the cost of moving the house forward on the present lot. I would make fast easy money by selling it to the Sicilian Lighting Company guy.

Can a development start before receiving a permit?

Sure, the purpose of most (if not all) developers is, of course, to make max profits.

Freedom_2008,

It doesn’t matter if you think it’s trivial to keep a place fully rented during development until a building permit is issued, and then evict the tenant. It is what the developer thinks. I’m not a developer, but am assuming this would be a significant deterrent for some, especially “foreigners” (like Barrister might be deemed to be if living in CH during the process)

Barrister’s house is probably in good shape so should have no issue to rent it out while waiting for city’s approval (normally takes much longer than 6 months). It is probably to owner’s benefits to have people living in to avoid squatting, especially in Rockland area, if the owner is not in the city.

Once/if the approval is obtained, the house wouldn’t be considered as livable during the move, thus should has no spec tax, right?

I don’t work for BC government (or anyone else), thus don’t know any details of how spec tax revenue is used, so your guess is as good as mine 😉

In this example, the spec tax is applied for the mere attempt to make a profit ( in the period after buying/starting to develop the property but prior to a building permit ), rather than being applied to a final profit (or loss). Apparently that makes no difference to you however to me it’s a significant difference that will discourage developers ( including Barrister). It would be easy for the government to exempt spec tax throughout the entire development process, and hopefully they will rectify this or cancel the spec text altogether.

And how will taxes improve housing volume or lower price?

Nope. My point is that this subdivision/rezoning (either by Barrister or other non-charity based owners) is to make profit, any applicable taxes are just part of the business cost, not really as you said that “govt is intent on punishing people” for this instance.

If your point is that the spec tax costs are tax deductible, that is not an example of no pain no gain. It is an example of “pain, less gain”. Instead you should provide a rationale of why you think spec tax should be applied during the development process prior to a building permit being issued. Otherwise it seems like you are in favour of targeting taxes to people who are trying to solve the housing crisis.

If the subdividing/rezoning is possible/doable, not just the current owner, anyone who buys the property can do it, too. Since whoever does it would get the most $$$$$, any tax related in the process is just part of the development cost (no pain no gain). But I would feel sorry if it is done for a charity purpose and gets taxed unfairly.

He may want to avoid 2%/year spec tax while living (happily) in Switzerland as it’s being sorted out. Out govt is intent on punishing people who don’t have someone living in (or actively building) the home at all times, regardless if they are trying to make things better, by improving density, which takes time.

I don’t think Barrister has schedule restrictions. The beauty of having financial independence.

What’s your time estimate for getting this all sorted out, approved and sold?

Barrister that is very ambitious. Good luck

Didn’t somebody turn their yard into a chicken farm over there when their development got shot down.

Freedom: I am aware of 1322 but a very different situation. The immediate neighbours are okay with the plan and actually one of them suggested it. They are worried about a repeat of the Foul Bay “fire” after we leave.

But your suggestions are much appreciated and very much on point. We will be informally asking for more input; height restrictions seem to be the main concern but covenants on the land with the neighbours might add reassurance.

Barrister, you should talk to your neighbours and Rockland Neighbourhood Association first, before hiring people doing any draft for talking with city, as there is not much chance if the neighbours and the association oppose it.

You can also google “1322 Rockland Ave” to see the history of similar failed development attempts in past 15 years of that heritage house. e.g.

http://www.rockland.bc.ca/1322Rockland.html,

http://www.rockland.bc.ca/1322.html

https://goyodelarosa.wordpress.com/2008/02/01/plans-for-schu-um-1322-rockland-historic-mansion-still-concern-rockland-neighbourhood-association/

Caveat : 35C (about 95F) is a pretty typical summer day in LA. Did hear back from Nickel Bros. who basically dont think the house can be moved. Even partially disassembled there are too many trees blocking the way which the city would not allow to be trimmed back.

We are now looking at the possibility of moving the house on the existing lot in order to facilitate the creation of three building lots or townhouses on the existing lot. If we can manage that then at least it would remove the temptation for some developer to have an accidental fire to get rid of the heritage house. Will report back to see if this is practical.

Well no, mortgage debt is not shrinking . Someone who tells others here to keep a close eye on mortgage debt should in fact keep a closer eye on it himself.

https://betterdwelling.com/canadian-mortgage-debt-prints-the-second-slowest-may-in-at-least-3-decades/

July 2,2019 Canadian mortgage debt reached a new all-time record high

“The outstanding debt stood at $1.56 trillion in May, up 0.68% from the month before. The balance was also 3.64% higher than the same month last year.”

Interesting how industry related publications start asking the tough questions….years after the fact.

“Is it time to call Canadian real estate “a bubble?””

“…the dam could be on the verge of bursting. Canadian household debt continues to jangle nerves, and while mortgage debt is shrinking, insolvencies aren’t.

“We’re seeing historic insolvencies across the country,” said Butler. “To me, these things are worrying, to say the least.”

https://www.mortgagebrokernews.ca/people/is-it-time-to-call-canadian-real-estate-a-bubble-277418.aspx

https://www.bnnbloomberg.ca/hong-kongers-scout-properties-in-canada-and-u-k-to-escape-protests-1.1292120

Not sure what to make of this but this Country is seen as a safe haven…. More than happy to see them pay as much tax as possible if they buy here.

“Will Josh find a house to buy in James Bay or move back to Ottawa?”

And the closely watched sequel – “Will Barrister pull the plug on Victoria and move to Ticino?”. 35 degrees in Lugano today.

“Will Josh find a house to buy in James Bay or move back to Ottawa?” is one of many HHV cliffhangers that keeps readers coming back….

Josh: Actually, was mostly wondering if you think Victoria has become more affordable for you. Obviously it is since you are planning to buy so perhaps it is not all as gloomy as you have sounded in the past.

I can appreciate that you might not want total strangers on the internet commenting on your life plans. The simple solution would be to not write about it repeatedly on the internet, But I am glad to year that the housing market appears more manageable.

It could be considered more practical than superficial depending on what plans you have. If you want a family, it’s not greed or lifestyle vanity to choose a partner that has a hope of getting out of their student debt before they’re 35. Remember, we’re talking about millennials here. Our version of “wealthy” means able to pay all the bills and go out for dinner a few times a month.

I think the 4 or 5 years I mentioned would be this year or next. I’m able to buy now so no move necessary. Good to know strangers on the internet are holding my life plans accountable over the years.

https://business.financialpost.com/real-estate/how-to-get-a-5000-amazon-credit-buy-a-house-through-realogy

Great, so as soon as you get your new house you can fill it full of “smart home” stuff direct from Amazon that will send any and all data about you to their servers. No thanks.

I prefer Redfin’s model there. Automate the process and cash back.

Former Landlord, please read what I wrote again and let it sink in for a minute. I was referring to women using money as the ultimate equalizer in the mating game.

But since we are on the subject, I wouldn’t mind seeing some net worths surveys of single men vs single women. If i had to guess, I would imagine they would be much skewed towards men as you get above the mid 7 figure range.

@ Cynic, Thanks for all the Good Wishes! Although, I would not suggest buying 3 houses … unless that is all you do. Why do you call yourself Cynic when all you have is good wishes?

I would like to hear a real discussion on QE and its effect on everything. If you have enough $ to have 3 houses; My call would not be real estate… start a local service business that does not rely on currency exchange. Maybe window washing? You can hire me as I just bought an extension pole to get to the high windows.

Did you really just say, women don’t typically have money?

Money is the great equalizer in the mating game which women don’t typically have. I don’t mean it that women can’t make money, but it is much more common to see a wealthy man with a trophy wife than vice versa.

P.S. I am not talking about you Barrister!!

Tomato: In fairness I was not talking about myself. In point of fact, my wife is worth substantially more than me. I will admit that she is far too young and far too good looking for me and treats me much better than I deserve. Her only flaw seems to be really bad taste in men.

Barrister is 8 feet tall?? Holy cow, the NBA is calling!

@guest_62020

I’m sure @Barrister will just wipe away his tears with $100 bills. Could be worse!

@josh

So dating choices based on earning ability isn’t superficial?

Barrister, what is the single 8 club? 8 figure net worth and nothing else? That club works also, however it depends on if your ego can accept the rest of society viewing you as nothing more than a sugar daddy.

Josh: Is this the year you were planning on moving if prices did not drop in Victoria. I remember you were talking about Ottawa?

ks112: Being in the single 8 club works as well but in which case are you not better off on your own? The years may have made me a bit cynical.

Women are attracted to men with Money?!?! Mind blown…….

These days men needs to be in the 6/6/6 club, or at least have two out of the three:

– 6 feet height minimum

– 6 pack abs minimum

– 6 figure income minimum

Could also have been written that Millenials are less superficial and more financially practical in their dating habits, but that wouldn’t have been quite so clickable.

LeoS: A fun little survey but not sure that it really reflects reality. What would be more interesting is to see if men are starting to value financial worth more than looks. Gramma’s maxim of making sure that he is a “good provider” has been around a long time.

The problem with this type of survey is that people are not particularly honest in setting out their actual priorities. Humor might be at the top of your list but someone who is destined to be making minimum wage somehow never seems that funny.

Is it likely that the cost of housing has created a shift in thinking; more than likely yes. How much of a shift and to what degree in each gender is the more interesting question and one very hard to measure.

More millennials base dating decisions on property-buying prospects than looks, survey suggests

https://www.cbc.ca/news/business/millennials-property-over-looks-dating-1.5221772

Not that it hasn’t always been that way

@guest_61977

True. Even during the peak of the decline in the US following 2008 prices only dropped 1% per month. Obviously a catastrophic decline but happened very slowly.

Buck 2,

I’m going right now to buy another house as you’re right, the QE and money supply is ensuring prices will continue to rise. As a matter of fact, just look at what is happening in Vancouver and other places around the world. Prices are still rising everywhere owing to the worldwide money supply and QE and i see no end in sight.

I truly hope you are putting your new found $200 K over assessed equity to work and buying another home here in Vic so you can survive. You will probably get really rich. The stats Leo has been putting on this site demonstrate nothing but continued growth for the real estate market.

As well, you can simply rent out your leveraged purchase and build massive amounts of equity with little to no work at all. Just speak to landlords on here. Easiest side gig in the world. All renters are great and you never have to put any money into the place. Its practically free money with no risk.

Darn it, now you have me so convinced that i’m going to buy not only a second house, but a third to boot! Thanks Buck 2, you should be a financial planner and really share with the world your knowledge and insight.

Not only am i going to survive, i’m going to be rich… rich i say.

Yo Fool, can you please explain how 4 X money supply is going to decrease the price of real estate? Barring a gold standard or a severe increase in the fractional reserve requirements inflation is evident. When I asked my father who is a now diseased Harvard MBA graduate why things always go up? He had no answer . He said the only reason is because things have always gone up. (Weak response) .

Then there came Ben Bernanke……. That is where we are.

@ Renter.. You have no idea what you are saying. The house beside my house is actually significant for a house owner that is deciding how they are going to survive. You need to worry about Canadian Money supply and QE programs world wide. There is not much difference here than anywhere else. 4 X More $ supply = What? Please grab something, if not housing, buy something tangible.

Vancouver prices are currently up 32% since the “beginning of 2016”, and are -5.2% below all time high.

Victoria up 38% since start of 2016 and -0.8% from all time high.

Hardly something for a bear to “crow” about.

(Teranet https://www.nbc.ca/content/dam/bnc/en/rates-and-analysis/economic-analysis/economic-news-teranet.pdf )

What data? That was just an unverifiable comment. To be fair, so was your reply.

Ahhhh….. I just love the smell of cherry-picked data in the evening, don’t you? 2 houses just down the road from me recently went pending for well below assessed – $170k below and $235k below.

I don’t think what I would say, would change. I would simply expect to lose a portion of my down payment, at least in the interim. I would definitely have less interest in the market though. Heck, I might even go away.

Hmm. I think it’s pretty clear the cycle has been turning for a while. I started crowing about it in the beginning of 2016, when the first signs of trouble in Vancouver began. It’s important to understand that RE by definition moves slowly. At first it’s almost imperceptible, then when you look back a year, you go wow – what a different market. Compare today to 1.5 years ago. Go back and read the comments on how it would never stop. Huge difference, and it shows no sign of turning around.

@ Local , You seem very intelligent and we have read your bear arguments for 3 years or more. Just for laughs can you pretend you just bought a house? Everyone has heard you and Hawk present statistic after statistic … anyone can create a bias. Just pretend for one week that you already own a house. The house beside me just sold for $200 K above assessed value ? Why is that ? I just do not see anything you have talked about become reality. Give it a try…Play devils advocate to your own writing.

It’s an excellent question. But why do you put the onus on me? 😛

Haha. Of course I’m guessing, but it’s fun to guess. Let’s presume no black swans (China imploding, hyperinflation, Great Depression 2.0 etc) and nothing manifestly bizarre coming from central banks.

I think Victoria has a few years of decline to go. In the context of our housing market right now, I don’t care what the US Fed does, or Poloz for that matter. IMO its effect on our market’s trajectory will be negligible. What’s happening now is IMO, a coupling of normal cyclical dynamics, consumer debt saturation as well as shifting global capital. Keep in mind that falling interest rates paradoxically is often a prelude to falling house prices, something that has been alluded to here before. More pointedly, there comes a point in time where continuing to lower the cost of money is akin to pushing on a string. If the consumer can’t afford it and/or is not excited about borrowing, it won’t matter.

I think continuing weakness emanating from the bubble bursting in Vancouver is going to drag the provincial economy down, and it will be enough to effect the data nationally. I also believe the Province’s very sudden and dramatic shift to RE will force a housing led recession as that unsustainable phenomenon continues to recede. If that occurs, that raises the specter of further price declines, in some regions and market segments, of greater than 40% IMO, all in.

In absolute terms, I don’t think Victoria will (or could) see the kind of losses Vancouver will and already is, but I suspect that people on both sides of the fence are going to be surprised by what they see. As you know, I do not believe there is a robust economic argument that can make a rational case for the present prices in this city. Conversely, I do not believe a correction will see us going to P/I ratios of 30% while interest rates remain at or near where they are. Housing affordability (% of gross income) is another matter and I think Leo’s data on this is instructive, if not suggestive. Hence, I’m currently of the mind that the decline here will be more of a bleed-out that will gain momentum as sentiment sours, as opposed to rampant blood gushing you may see in Vancouver.

More broadly, Canada’s competitiveness globally has declined to at least some degree, both due to shifting commodity demands as well domestic policies some perceive as onerous, restrictive, or even chaotic. This phenomenon has the potential to make our coming RE woes more acute, as that sector recedes with other sectors having a weakened ability to absorb the slack.

The good news is in the local context, Victoria is comparatively well positioned geographically and climatologically (by Canadian standards anyways), and has high quality infrastructure and workforce talent, something that will assist with a market recovery once it materializes.

Potentially, yes. Presuming central banks continue their meddling and as you suppose, rates go unconventional, I think there is a possibility that the additional capital could accelerate to hard assets including RE. That flow might even be frantic, but whether or not it winds up in Canadian RE is anyone’s guess. Right now, Canadian RE probably isn’t as attractive as it was a few years ago. It may be even less attractive a year or two from now.

While no amount of “stimulus” will allow home prices to go to the sky, I’d be concerned that excessive money printing and low rates may contribute to violent boom and bust cycles in RE, which we haven’t historically seen. So it’s entirely possible that the next run up here locally might be effected by this, perhaps significantly. Where inflation fits into this, I don’t know. That could be a threat too, but I’d argue the falling cost of globalized labor, automation and global debt being what it is, seems to be more of a deflationary dynamic. Long story short, unconventional monetary policy is the wild card that could seriously rock the apple cart. I don’t buy their air of confidence for one moment.

Local Fool.

I’m curious what you think will likely happen in Victoria in the coming year, and further down the road when interest rates follow US Feds lead and lowers further. If the economy stagnates rates could even go negative. With such “free money” floating around, wouldn’t we see another run up in prices, maybe until shit really really hits the fan?

You know what I think that’s the answer. I was wondering why the percentage was so low, and that would explain it. Thanks

Do land title records register first time buyers even if they don’t qualify for the First Time Buyers Program?

The survey isn’t great. I suspect a socioeconomic researcher would do a facepalm at the design of it (ambiguous questions and such), so I would take results with a grain of salt. Really the only useful information in there is buyer motivation (first time buyers percentage comes from there) and financing method. The one advantage it has is that it has been applied over a relatively long time period so is useful for trends. Ideally it would be good to cross reference the data against other sources. Interestingly enough the first-time buyer data does not match the first-time buyer percentages from land title records. I’m not sure why.

Perhaps confusingly worded. I meant it has declined very strongly from the big surge in 2016. That’s a little different than retirement/vacation home purchases that peaked in 2014 and have been just slowly drifting downwards. The big swing is definitely in investor interest.

This is my sense. Prices can surely drift downwards, but bigger drops require economic weakness. Perhaps that is coming but this bull run has already outlasted calls for its end by several years. When it will truly end we don’t know.

For example on the construction side there is weakness in Vancouver, but trades are not worried yet because there is so much infrastructure work going on right now that it has soaked up the slack. Talking to builders around here, they are still shipping skilled trades in from the prairies because of a shortage (carpenters for example).

US Census.gov data has Seattle nominal rents (median and average) rising each and every year from 2006-2017.

For example, Over the 2007-2011 crash Seattle nominal rents rose 14% (even Seattle real rents rose 5% above inflation during the 2007-2011 crash).

To view the US Census.gov data https://www.deptofnumbers.com/rent/washington/seattle/ (click on nominal to switch from real)

In Seattle, rents continued to go up in 2007 and 2008 (their house price peak was in 2007), and then went down in 2009 and 2010.

Rents didn’t go down in nominal terms in Vancouver in the 1980’s, but remember inflation was still fairly high, and I can tell you the rental market was very weak as I was a landlord.

It’s well known that rents in Calgary have come down in the last few years, but of course the oil industry has been hard hit. But the RE industry is as big in BC as oil is in Alberta.

https://seattlebubble.com/blog/2010/09/22/big-picture-week-price-to-rent-ratio/

This is not an exemption under the legislation establishing the spec tax, or Vancouver’s vacancy tax. The exemptions are spelled out clearly.

As I’ve said before, someone holding out for a rent that is above market is not trying to rent the property.

Post #61993 correction: should read [20% cheaper]

Rent either stayed the same or went up during the US market crashed of 2008. If I recalled correctly, during the market crashed of the 80s rent in Victoria stayed the same or went up similar to the US market, however for a short time landlords did offered first month free rent to attract renters.

Bellingham with population of less than 90,000 people and Whatcom County is 200,000 which is far below the CRD, and it 143 km from Seattle. And, their housing is about 30% cheaper to buy while rent is at the same price as Victoria.

At the end of the day, renters in Victoria should be grateful that their rents are being financed by their landlords.

https://www.numbeo.com/cost-of-living/in/Victoria?displayCurrency=USD

https://www.numbeo.com/cost-of-living/in/Bellingham

Nice lecture professor. But you don’t need to impressively “postulate within academic theory” to find rising rents as prices fall.

US nominal median gross rent has risen every year from 2006 to present. This of course includes the big US housing crash from 2007 (rent $789/month) -2011(rent $871/month). Same with average nominal rents. Not a single year with a fall in rent during the crash. Even real (inflation adjusted) median and average rents rose 2% during the crash) . https://www.deptofnumbers.com/rent/us/ (Make sure to click on “nominal” as it defaults to real.

So now you know of one instance! Now back to your theory books.

You don’t get rising rents when home prices are declining. In the early stages when it’s just a volume drop-off you can (i.e. when the market appears to enter a deceptively “stable” phase), but that’s not where the lion’s share of the increase is typically seen.

There is academic theory out there that postulates rents rising as home prices fall, if prospective buyers refuse to buy and/or sell their home to prevent locking in greater losses. In theory, that puts greater pressure on the rental stock, ergo rent prices rise. But, I don’t know of any instances where that’s actually occurred in practice.

A declining housing market is an inevitable result of overpricing against growing supply, and participants not seeing any upside potential in a speculative purchase. As both real and speculative demand is met, vacancy rates rise, and rent/purchase price pressures across the board abate.

This is pretty basic stuff, folks. All I’m outlining is a simple and time honoured RE cycle which is exactly what’s unfolding. It’s happened here many, many times before, and it will happen yet again. There’s never going to be a situation where, “demand can never be satiated ever again”. This is especially true given the declining interest in RE juxtaposed with the avalanche of new supply coming online both this year and next.

Perhaps those high advertised rents are simply a tax dodge; the owner advertises a rental with a price high enough to ensure that it stays empty, but can then claim that they shouldn’t be subject to vacancy tax because they’re trying to find tenants.

Well we all know what Jimmy McMillan has to say about this subject!

I did say that some of the rents being asked were high but I didn’t say they were actually getting that. I see some of the same properties time and again reposted and with asking coming down. I don’t see the same trend of increasing rents that you seem to see — at least not in the space I follow.

Rental yield is much higher in USA (10.45%) than Canada (4.23%), more than double. So rents are much higher (relative to price) in USA than Canada. To equalize that, Canada house prices would need to fall and/or rents would need to rise. I happen to believe that rents will rise.

https://www.numbeo.com/property-investment/rankings_by_country.jsp (Gross rental yield city Centre)

They don’t occur in tandem. This is a pretty linear process.

Volumes always lead prices, prices effects are leading in their wider effects in the economy. At that point you can get a feedback loop to the bottom. We’re not generally talking months – Vancouver’s decline began in March 2016. It’s taken three years for it to get to where it is now.

The effect is already being seen both in terms of luxury car sales, the fact that most realtors in Vancouver this year haven’t made a sale etc. The economy in BC is now very over-weighted in RE, so we can expect to see the effects of this in a continuing correction.

Maybe typical of Seattle – the metro which is 10x the size of Victoria, and HQ of Microsoft, Amazon, etc. – but not of the US, and particularly not typical of metros of 1/3 million.

I seem to recall people saying that about core areas of Vancouver. The drops have arrived, without a contracting economy or jobs.

Depends what you call a big drop, but house prices started falling in the US in 2006 while the economy and employment were still growing.

Both sales and prices seem to remain reasonably solid. Inventory is up a little but some small portion is probably due to the spec tax but not enough to really nudge prices.

I agree that some rents asked for are very high. But if you visit the USA (eg Seattle) you’d see that they are typical rents. So time will tell what happens to our rental rates here – I believe they are headed up.

I’d be interested to see an analysis of current home pricing and viability of investing in rental properties. I’ve seen a small but definite uptick in homes that I recognize having recently sold and now on the rental market. Some of the rents asked are pretty outrageous and I suspect due to trying to cover expenses.

Great post Leo. The buyer survey data is in very helpful. More charts from that would be appreciated, for example the primary buyer motivation for first house would be good too, assuming they record metrics about that (age groups, mortgage size, long term vs recent resident – whatever they give you)

Freedom_2008

Uh huh. There’s always investor presence in a RE market. Don’t really think it’d function well without, actually. As the correction continues, don’t expect that to go to zero or something. That’s not the point, either.

A sudden spike like the one you pointed out, is when the “horde” comes in with the hope of making a quick profit. Generally signals a market top. They come in quick, and tend to leave just as quickly.

By looking at the second home buyer motivation chart for all 9.5 years, it seems to me that investor interest is the top reason and have been holding steady (not declining) except the spikes between 2016-2018.

It’s interesting looking at the “Primary Buyer Motivation” chart. A pretty decent demonstration that by the time the public at large attempts to jump on the bandwagon, much of the profit taking has already occurred.

Doesn’t last long.

So, it would appear that locals are perceiving that there is less competition in the market, and that pricing may be more in tune with current market conditions. Whether it was the rush to pile on taxes, the stress test, or the global trend of falling foreign ownership, we are seeing a return to sales being driven by locals.

WRT pricing, I don’t think we’ll see big drops until the economy starts to contract and jobs become more scarce. The latest housing start numbers are surprisingly robust –

https://thetyee.ca/Analysis/2019/07/19/BC-Housing-Starts-Blow-Past-Forecasts/

so significant numbers of jobs aren’t being shed by the construction industry, yet. I’m not holding my breath for rising interest rates to dampen pricing in the near future. Looks like a decade of free money has created a perpetual SNAFU in the real estate market.

I believe Mary-Ann G hit a nerve…