About all those new listings

New listings have been on a tear in April, and it’s worth looking at what might be behind the increase. Ever since rates jumped two years ago and people started facing huge increases in their monthly mortgage payments, I’ve been on the lookout for evidence that owners could be under stress. While mortgage arrears are an extremely lagging indictor, a big jump in mortgage payments could pressure investors to sell their properties, or force owner-occupiers out of homes. While there have been some previous times with higher listings (last fall was pretty healthy), in general new listings have been well within normal ranges. Whether it’s by extending amortizations or tightening their belts in other areas, owners have generally managed increasing rates well.

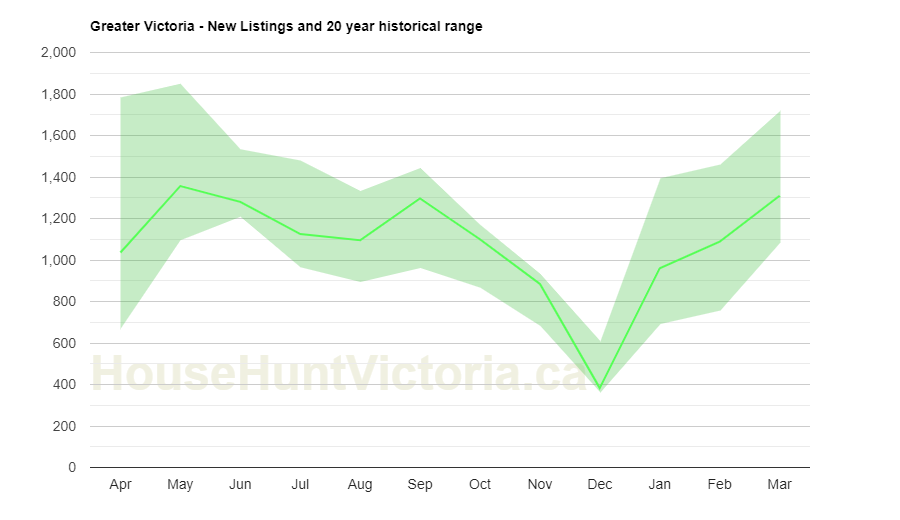

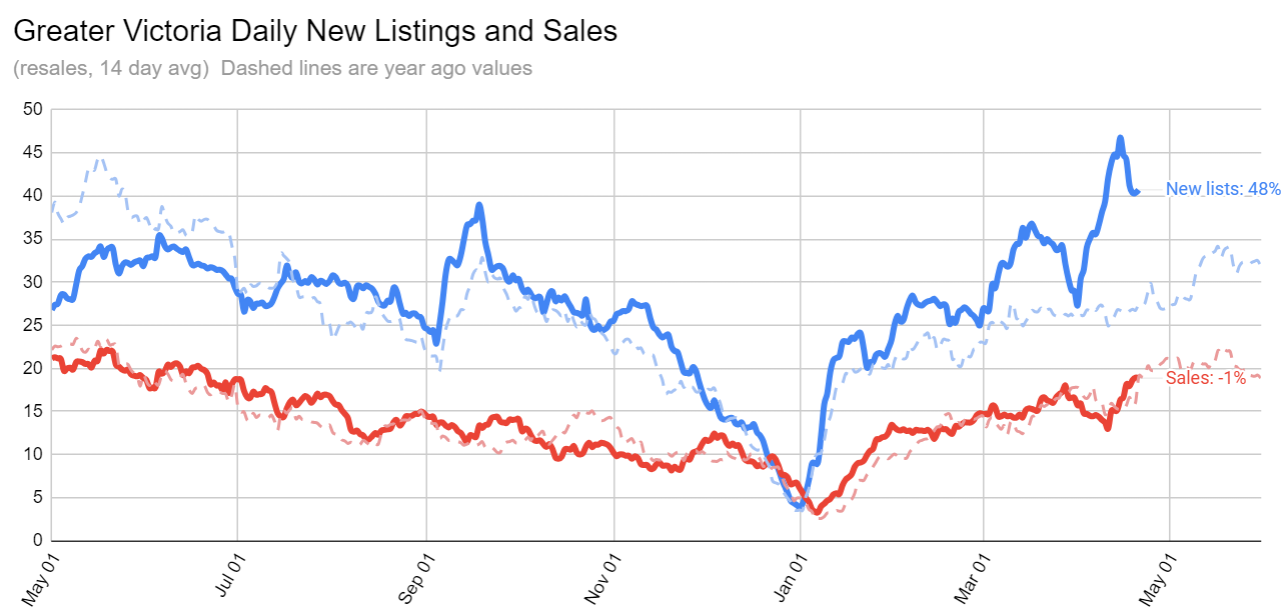

However so far in April, new listings are running at 62% higher than a year ago, putting us on track to go from the lower end of the historical range to the top end. Where are all these new listings coming from, and what part of the market is seeing the most inventory? Lets take a look.

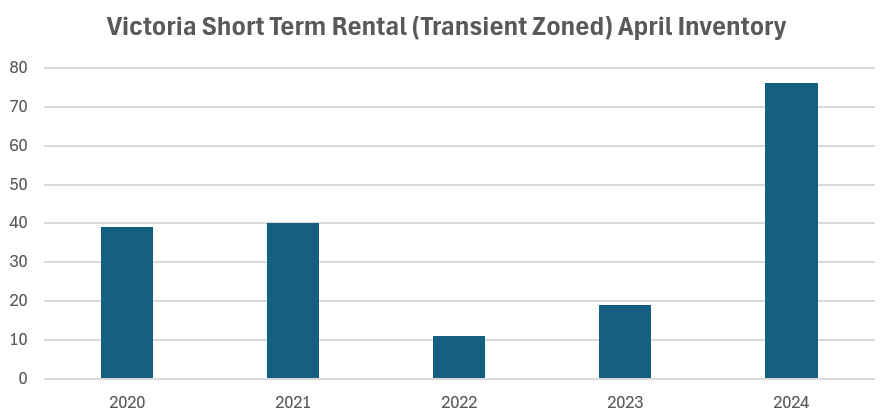

Many people believe that the provincial (effective) ban on short term rentals is to blame for the boom, and it’s certainly true that it has motivated a lot more listings in buildings that previously allowed short term rentals than normal. However with the short term rental premium evaporating (at least for the small units), most sellers have been loathe to sell, so the market has not been flooded with inventory. Yes inventory of these units nearly quadrupled from last April, but that’s only an additional 57 listings, and we were around half that just 3 years ago.

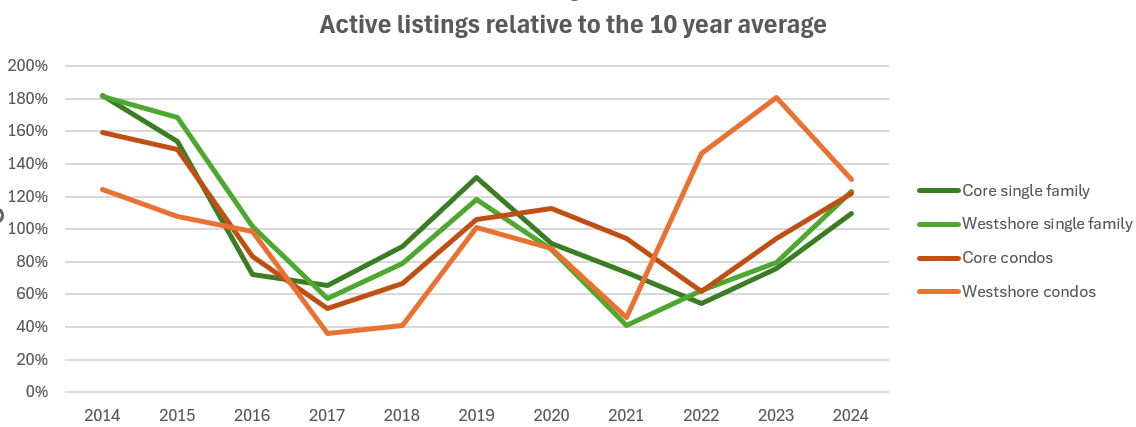

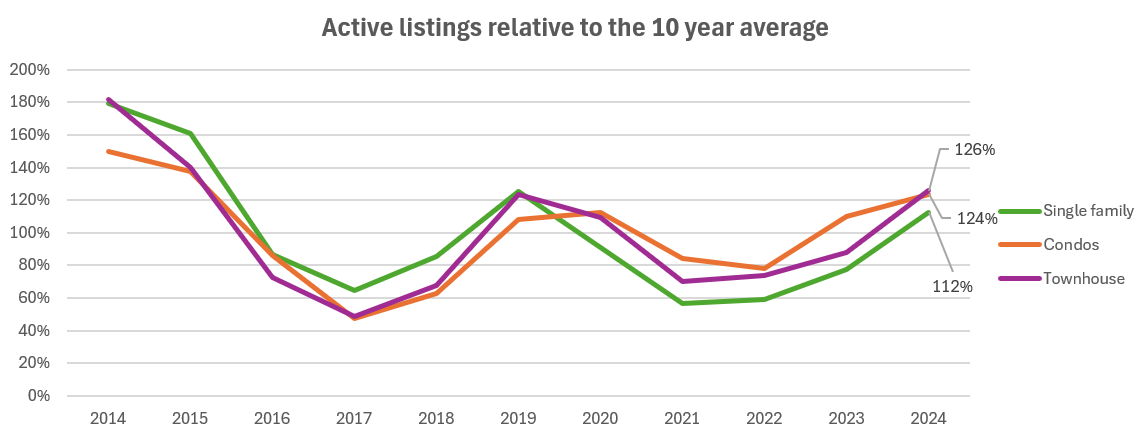

When we’ve gained 910 listings in a year, the increase in short term rental listings only explains 6% of the bump. Where have the real gains been? It’s really not in any particular category. Looking at inventory relative to long run averages, all the property types have followed similar paths, with houses and condos/townhouses a little higher than the average for this time of year, with single family up a little less than multifamily.

Breaking those down further by region, we also don’t see a wild divergence, with the westshore showing somewhat more inventory relative to the average right now than the core. If you’re wondering what’s happening with westshore condos, a ton of presales were de-listed from MLS this year given the new construction market is dead slow right now.

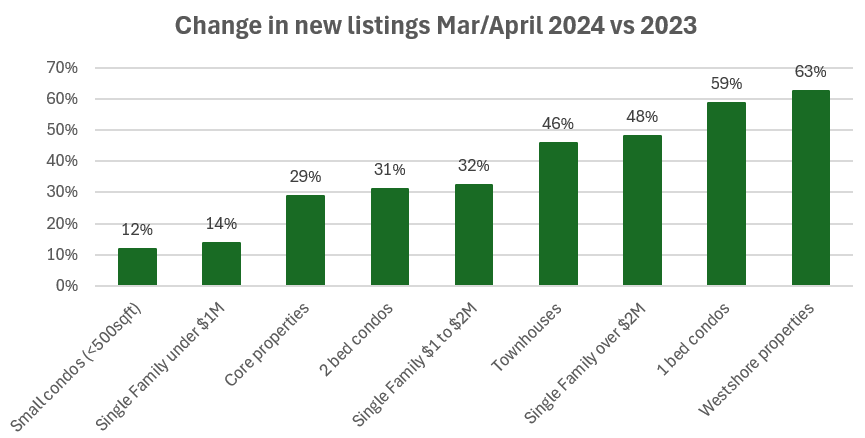

In terms of new listings to date in March and April, here’s what the picture looks like.

In terms of new listings to date in March and April, here’s what the picture looks like.

Again, if you think this listings surge is driven by short term rental microcondos hitting the market, that’s not the case. New listings of small condos were up only 12% from last year, despite the looming short term rental deadline. Owners of those condos generally made alternate plans well before this point.

Also if you’re hoping the new listings surge will relieve the competitive conditions in detached properties under a million, that’s also not happening yet. New listings there are up less than most categories. The core is also seeing a substantially smaller increase in listings than the westshore. As I’ve mentioned a few times, mortgage debt loads are highest in the westshore, so this would be consistent with rate pressure being behind some of the increased inventory. So far the increased new listings are essentially counteracting the normal increase in buyer activity for the spring and keeping the market pretty stable, but we’ll have to see how far this listings run goes. If we continue to see a lot of motivated sellers listing into the summer and fall we could shift back into a buyer’s market quickly.

The question going forward is whether the controversial change to capital gains inclusion rates incentivize even more owners of investment properties to sell before the June 25th deadline. It’s possible, but I suspect the impact on the market won’t be huge, and potentially even difficult or impossible to pick out of the noise. If that’s you and you’re contemplating a quick sale before the deadline, consult your accountant or play with this useful tool by PWL to help model whether it’s worth selling now or holding.

Also the weekly numbers

| April 2024 |

Apr

2023

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 131 | 282 | 465 | 637 | |

| New Listings | 466 | 823 | 1187 | 1036 | |

| Active Listings | 2801 | 2896 | 2964 | 2043 | |

| Sales to New Listings | 28% | 34% | 39% | 62% | |

| Sales YoY Change | — | +12% | +9% | -23% | |

| New Lists YoY Change | — | +74% | +62% | -24% | |

| Inventory YoY Change | +39% | +42% | +44% | +50% | |

| Months of Inventory | |||||

New lists dipped a little compared to the first two weeks, but it’s still an impressive jump from last April. We’re no longer on track to beat the all time record for new listings, but it should be on the high end of the historical range. Meanwhile sales are identical to this time last year. We are on track for a year over year increase in sales activity mostly because we have two extra business days this April.

It should also be known that the West Hills Development Is a 30 year build out. They will pause the builds when sales slow down. They will accelerate the builds when sales pickup. They are In no hurry. You have to have a very sharp pencil. The margins are very tight with these guys. For example, a plumber Is lucky to make a grand profit per house…That Is ridiculously cheap. 100 houses Is a hundred grand profit.

The same thing goes for framers, electricians, roofers, Insulators, drywallers, painters, cabinets, tile guys.

Even realtors…You think the In house realtors at West Hills are making 6 and 3…Think again.

You can make a decent living with these guys…But you won’t be making any money.

Now you can’t exactly blame the developers. At the end of the day, they have to sell their shit at a price that people can afford to buy.

☮

I knew you worked for the CRA. Are you packing a glock?

Lol my line of work requires that unfortunately.

Honestly I don’t know how the young contractors do it . I guess when you’re in it , then it’s just the new normal . I would be pulling my hair out if I was a GC today

If I wasn’t spending other peoples money…I would seriously lose my shit.

I am 100% transparent with everyone I deal with. Its go…or don’t go.

You can’t even destroy a rock wall for a garden bed without getting It tested. Even when Its tested you have to make an appointment to dispose the mortar (with a certificate).

And of course Marco’s squirrel habitat report

Max , good stuff , man 100 grand just to do asbestos abatement and I’m guessing before deconstruct

You have an amazing memory…You are correct. That was In the West Hills development. My Son graduated Belmont at 17 and has been framing houses ever since. He Is now 19 and has over 34 houses under his belt. His boss along with his 5 man crew frame a house every 10 days off the foundation. Right now they are super busy up on Skirt Mountain…That’s right beside Bear Mountain. Not to be confused with Triangle Mountain.

Yah Covid with all its lost income, productivity, sense of impending doom and uncertainty was a real great backdrop for love making.

Weren’t you the one that said your son got laid off awhile ago in the westshore building SFH?

Had a price on Dufferin In Oak Bay 4400 sq/ft build. Dead level lot, 10′ hole for an 8′ basement, 3 stories, 12/12 roof. $75 grand foundation and framing…Three separate framing quotes. That’s $17 per sq/ft to crib the foundation and frame the house. The asbestos removal and demolition of the existing house Is a $100 grand. Trades In the SFH market are not slow IMO.

Ya the sfh and condo towers are very different animals . Trades in the the sfh market seem to be getting slower so I wouldn’t be suprised if quotes coming in are more competitive. Condo projects are were u hang out if u have a drug habit , never my shtick

I know a fairly well known custom-home builder in town, couple months ago he didn’t see prices coming down for his projects but now he’s starting to see that too. Definitely seems to be lagging the larger developments where some are seeing close to a double digit decrease for some trades now compared to peak.

Only a small bump

That Is too funny dude. Everyone was on the CERB and deferred their mortgage payments for 6 months…There was no time for hate. It was a great big party smashing pots and pans together. It was love more than anything. Probably a lot of pregnancies.

Vicreanalyst, ya I have no finger on the pulse with condos, all my experience is with sfh and townhouses . I know I just stayed away from them

Not on bigger pojects.

Whatever , bang on there’s very skinny margin on building materials , no real cost savings between building a house and a half dozen units . Labour has gone through the roof , and sub trades get so little done in a day . Real productivity in construction has fallen off a cliff .

Yes. A healthy dose of the principle of charity is in order.

I’ll try to explain it to you without using a crayon.

Economies of scale comes about when ordering materials and appliances. The suppliers are willing to lower their prices when you buy in bulk amounts.

Here is another example if you are buying flooring for 30 condominiums you would then be able to buy directly from the manufacturer in say Atlanta and have it delivered rather than buying from a local retail outfit.

I’m not sure what you mean but it sounds like jibber jabber.

If a SFH lot of 10,000 square feet vacant lot is a million and you build one house the land is a million per house. Build a fourplex on the site and the land value is ex. 250k per home. That is a 750k/unit difference.

Building plus land costs are currently very high for both multifamily or single family new builds vs. existing housing stock which probably affects marketability in a higher interest rate environment. Bringing down land value through taxation is probably not the answer. As Leo has pointed out, increasing density to bring down the land value per unit probably is a solution over time.

We talk about the bonus windfall of going missing middle. But that’s not the reality.

There are three building sites that are zoned for multi-family being promoted as missing middle in Victoria

2345 Howard at $1,200,000 or $209 per square foot of land

956 Heywood at $1,475,000 or $241 /sq. ft.

931 McClure Street at $1,775,000 or $235/ sq. ft.

But a single family zoned lot at Wootton is asking $1,600,000 or $224 per sq. ft.

There is no bonus windfall for multi plex land over that of a single family. Our problem is that the demand for single family land is greater than development land. Developers are having problems buying land at a price where it is economically feasible to build multi-family in Victoria City. Instead they are looking at land in less desirable areas along residential collector roads in areas such as Vic West and Esquimalt where the land is cheaper. Or they have to buy the property today and wait half a dozen years for prices to increase to make the project viable.

The cost to build multi-family housing doesn’t have any economies of scale to bring costs down if there are less than 12 units. We don’t have any lots big enough for 12 or more units without having to assemble adjoining properties. And since a lot of these properties have undergone renovation from the past gentrification craze in the neighborhoods, there are very few building sites that are economically feasible to develop in the city.

We have to get the price of land down in Victoria and Oak Bay. We are going to have to lay the boots to those old pre-1960’s small houses on large lots by taxing them differently.

That is good information re development slow down Leo and I agree with your proposed solution – seems sensible.

Except that’s precisely what it did with missing middle. They were worried about land values, so they tried to do land value capture based on an economic analysis of what lift there might be. Costs went up, rates went up, and the projects which may have barely penciled no longer did and the policy was a lame duck.

Now land lift should be much higher going from low density to perhaps 10 floors so there’s more lift to capture, and because there is still a rezoning process here, municipalities with CAC policies can apply them at that point. But generally all land lift capture will slow down building. The idea there is some free money that governments can simply scoop off without any downstream impacts is just not true. Governments have been chasing this idea of free social housing by various schemes for decades and it doesn’t work, just transfers the cost to other new housing instead of just properly funding social housing construction through taxes.

The simple solution is to have a lifetime cap on the PRE. Problem of untaxed excess gains solved without any complex new policy or penalizing redevelopment. But that will never happen.

Thanks whatever. Could be a little late for me to move back in with my parents :-).

Westerly that isn’t the way the real estate market works. There will always be buyers and sellers even in the worst real estate markets. In down markets it just takes longer to find a buyer. In severe downturns property values have to fall to the point that investors will once again start to buy. That sets a price floor where the rental income provides a positive cash flow to an investor with a return on their down payment that is at a rate close to what they could achieve from other investments with the same level of risk.

However that can get tricky as prices and rents could both be falling as people leave the city. Most often the market over corrects before rebounding and stabilizing.

For first time buyers they have the option of selling and moving back into their parents home or moving to a province that has better opportunities and waiting for the market to rebound. But that brings a lot of new inventory onto the market with the seller following the market down as prices fall.

There are some that can’t or won’t move back home and then the lender will start foreclosure proceedings for missed payments. If you think you might be in this situation then speak with a lawyer about bankruptcy early. For a lot of those caught in this predicament they will know a year or more out that they have a problem. Start now.

So prices kept going up but the market dropped. People stopped buying and selling? This helped supply how?

There was no price collapse from the 1974 Ontario land speculation tax.

You can see the numbers here for Toronto, (source: Toronto RE board). http://www.mysearchforahome.com/2013/07/home-prices-in-toronto-history.html

Just another HHV “oops” post 🙂

Thanks Patriots. Other than collapsing prices, how many more residences were created as a result of that tax? Assuming for the moment that supply is the issue.

https://financialpost.com/personal-finance/mortgages-real-estate/ontario-tried-a-speculation-tax-on-property-and-the-market-collapsed-overnight

You might ask, why don’t governments try this today? Because it worked – too well.

Wow there’s some tripe on here the last day or so. Prices dropping 20-40% would primarily be from interest rates going up or serious recession. The people most hurt by that would be young low to middle income families. Retirees in Oak Bay would not even blink – although they could do some renos cheaper to allow themselves to stay in their homes longer.

Those that would benefit the most are investor / developers. They have cash in their pockets, can afford to sit out a recession, land-banking all the way. The best time to buy property is when interest is high and prices are low.

Want to increase land availability? Lower capital gains, get rid of all these ridiculous property taxes / penalties scams etc that do way more harm than good. You cannot tax your way out of this housing problem.

Two great elections coming up this year and next.

Just a false dichotomy imo. A tax that applies to windfall profits due to upzoning above a certain amount and is used for ex. affordable housing on a 4 million dollar profit is not going to stop redevelopment. I’m not opposed to a capital gains windfall from rezoning to create more density, but to apply the primary residence exemption to the entire gain does not seem to promote overall tax fairness.

Assuming they collect that would give you an idea of how incredibly restrictive zoning was on that land.

Doesn’t bother me at all though. A few people getting a windfall in exchange for a ton of housing is a lot better than every single family home owner getting a windfall for absolutely nothing.

Of course they’ve negotiated. Insane not to.

Sounds like a great opportunity to negotiate the realtor fees down with them if they really want the listing.

It is not a scam. Will they get 3x? Not sure but the parties are sophisticated.

How is a 4 million dollar unearned tax free windfall as a result of government policies fair? The primary residence exemption is creating significant tax unfairness in this case imo. There should be some contribution to a housing affordability fund required for short term above market gains in this scenario.

How is that unfair? In what school of real estate investment is buying a 300sqft condo a good idea? Buy land around a major transportation hub on the other hand is a more savvy move, speaking of which some Saanich owners will also be able to cash in on the new OCP.

Well, they just should of asked the realtors for the cheque and really no need to sign to try a sale if its that much of guarantee. If those realtors are that confident they should be willing to offer to buy on the spot. It’s really just the old door knock sign up trick that usually doesn’t pan out for the quoted price. The key thing to remember, if the person comes to you, it’s most likely a scam and if you can’t spot the mark or stooge in the room, it’s you.

The soil in many areas is not easy to compact. You don’t want settlement under a road, so it is often better to backfill with gravel.

There is a distinct meanness lately.

Know someone with a primary residence in Vancouver near a sky train station. They and their neighbours have been approached by and signed on with real estate agents. They’ve been told they can get about 3x market value as a group sale with the new up-zoning. Current market values are around 2 million.

So, this means that these homeowners win an extra 4 million dollar tax free lottery due to government changes. Meanwhile the Janion owner lost their legal zoning and $100,000.

Seems just sightly unfair. Especially the tax exemption on an unearned over market windfall.

Ok, so confirmed that the policy is as written in the SSMU technical briefing I just didn’t read it carefully enough:

1. the TOA areas will not be force-upzoned for various reasons, some mentioned in my previous comment

2. By end of 2025 munis will need to produce housing needs reports using a standard methodology, update their OCPs to accommodate housing needs, and make sure zoned capacity is there to match housing needs

So no requirement to up zone TOA per se, but hitting the zoned capacity without it would be very difficult

Bond trend for the last month.

Josh, I’ve mentioned this before but several public sites have recent sale prices as well as sale price history such as house sigma. 210 Montreal St sold @ 1.365 after being listed at 1.4

Sale price for 210 Montreal St please and thank you?

Maybe it’s just me , but househunt is becoming more radicalized lol .

So like in this scenario there’s some factor that causes house prices to drop while other costs remain stable? Like food, gas costs etc remain stable? And employment and wages remain stable? It’s just the housing that dives? And then only people who get divorced or become disabled abd can’t work – a relatively small percentage- would truly suffer from the rapid decline , everyone else only losing a grin? Hmmm … that seems like magical thinking to me. I mean, I don’t think it’s likely (or possible?) for house prices to decline that much without it causing suffering.

Whatever just think harder and come up with a better solution.

I am not going to shed a tear for any home owner that thinks a 20 percent drop in their home price would devastate them. You’ll still have a home and still be making the same mortgage payments. All what will happen is you’ll lose the grin on your face.

And for those that don’t have a mortgage nothing in your life will change if prices dropped 40 percent.

What would change is that more people would be able to afford to buy a home.

A drop in prices would benefit more people than would be hurt. So boo hoo to you.

Yes for most people, no for the lowest income folks. No amount of regulatory reform will make the private market build homes that rent for $500/month shelter rate. I don’t think anyone is arguing that it will. Yes to more social housing. Not sure what percent of the market can’t be served by market housing, maybe 10 or 20%? That’s still 2x to 4x more social housing than we have now.

I like the policy because it recognizes that there’s nothing inherently wrong with short term rentals if there’s enough housing. Perhaps it will incentivize some municipalities to permit a ton of housing to ensure their vacancy rate stays up and they can continue to allow short term rentals. West Kelowna has opted out of the short term rental restrictions.

Totally agree that it may not be a workable model for investors to buy up units for short term rental if it can be banned again later. Also a little unclear what the timeline is here. CMHC stats are released in January or February. If West Kelowna gets the CMHC report next year that its vacancy is under 3% are short term rentals banned again immediately? Does it have to be 2 years? Is there a grace period? All unknown but we’ll find out next year I guess.

Great!

Also, a question for you on the str regulations. I saw a post from you praising the government for allowing munis to opt out if their vacancy rate goes above 3%. My question is, if a city drops the str regs because vacancy >3%, and allows str, then if vacancy rate drops in future below threshold (? 2%) are they forced back to banning them? If so, I wouldn’t praise that, it sounds absurd. There’s a reasonable chance that cities see vacancy rates >3% in the next few years, especially with a recession.

I am constantly puzzled by the “affordable” housing discussion that happens in Canada’s most expensive and desirable cities. Why is it the job of any level of government to make SFHs an affordable commodity? Yes, we need to ensure that there is appropriate density to allow all income levels access to housing as well as find solutions for the unhoused. However, this idea that owing a SFH in one of the most desirable places to live is some sort of entitlement for our kids is ridiculous. There are plenty of places to buy a SFH in Canada for much less. Let the market determine prices – if they get too high, people will move to other places and demand (with prices) will fall.

If we fixed the bureaucracy that stifles building – would that alone result in enough supply? I still don’t see how. For example, who will supply social housing for the most difficult to house? I could be wrong but I can’t imagine the private market doing a good job at that.

You know what’s stupid? I have a huge empty backyard that I never use, with an apartment building behind that. Would be nice to build something there. But basically impossible.

If you bought a property as a place to live, a drop in potential sale price should be irrelevant. You thought the purchase price was worth it, right?

I’m not missing it, no doubt permitting is part of the challenge. I spoke to the lead planner in Kelowna, they said part of their success if because they can turn around a building permit for a quadplex within a few weeks if it’s a design that’s been built before, a couple months if new.

Zoning is one big part of the problem being addressed. The only thing worse than spending tens of thousands on dumb consultant reports is spending all that money, waiting years, then finding out your project is rejected. One the approvals are by right then permitting becomes the biggest barrier.

The government strictly limiting what can be built where and putting every request to change that through years of process is not hands off capitalism. We have a centrally planned housing production system and it’s not working.

The BC government can change the LGA tomorrow. They already changed it a couple times. Municipalities have zero power except what is given to them by the province. That’s why there’s no court challenge about the province stepping in and forcing all of them to update their single family zoning. Their is no dispute about who holds land use powers.

As for the TOAs, the reason they didn’t force upzoning immediately is because many cities have policies like tenant assistance that kicks in on rezoning, and they didn’t want to kill those policies by unilaterally upping zoning near transit until there was a legal framework to apply them outside of that. That change just went in, so it’s no longer a barrier. TOAs will be incorporated into the updated OCPs, and then by end of 2025 zoning is supposed to be updated to “better match” the OCPs, so zoning in TOAs may need to be updated by that point. The wording is a little vague though, so I’ve reached out to the province to clarify.

Wow, whateveriwanttocallmyself.

Force everyone in Oak Bay to move by applying confiscatory taxes, because they only care about money. Light a stick of dynamite to force them off their asses. 40% drop in house prices would be great, and if people go bankrupt, so what.

You’re a man of the people.

But time is the great leveller – hope you remember all your comments here years down the road when you’re feeling perhaps a little more vulnerable and someone comes hard after what’s yours.

But wasn’t they when the govt was more hands on in building housing for poorer folks and coops and such? I mean, I thought we got to this place because of decades of hands off capitalism – this being the inevitable result (the freight train we all should have seen coming but somehow didn’t).

It did for a long time actually, low income people just lived in accommodation that middle income people didn’t want, such as basement suites, old apartments and mobile homes. Problem is that middle income people are now competing for these properties because affordability has declined so much.

There were also “projects” built for lower income people but that’s not where most of them lived.

BC Cities still effectively control their own land use through their broad powers to write and regulate their zoning bylaws. These are outlined in law here and you can see how wide the cities powers still are: http://www.bclaws.gov.bc.ca/civix/document/id/complete/statreg/r15001_14#division_d0e44295

For example, when writing new city land use bylaws, the new law only states that the cities need to “consider” the “guidelines” for the new transit-oriented-areas. Yes, the BC government could change these laws in the future and give the cities less power, but they didn’t do that in 2024 and they would be in for a big fight if they did in the future.

California state government enacted similar “upzoning” legislation to BC in 2021. But like BC, the California cities also have control over the bylaws for land use, and the upzoning flopped because the cities found ways to block it when they wanted to. Same thing will happen in BC in NIMBY areas.

There are some people with truly mind blowing amounts of wealth, even here in Canada. Someone who decided they weren’t “that rich” because they went to another richer friends house and that house turns with the sun but theirs doesn’t – so not that rich. Those people can def afford to pay more and given the total shit show of a housing market and sad state of affairs for so so so many (an increasing number actually) – they should pay more. But because they are so rich they don’t even bother to be landlords and they’re pretty invisible and under the radar when there’s talk of solutions.

I think you’re right that there’s no chance that we can fix the unaffordability problem if we just continue as we always have. An intervening factor that could help a lot, imo, is government investment in low income housing. Lots of it too. I mean, whoever thought that the private market could ever accommodate housing needs of the poorest was delusional or doesn’t understand basic economics (or both). In this case we need the money to acquire that housing / land (however expensive it will be) probably from taxes – right? Then, we can tax those with more and do more to protect the middle, rather than creating massive opportunities for the already rich by gutting the middle to “save the poor” (still have my doubts that it would do down like that).

I’m upper middle btw so yeah I’m biased here.

Not really, the chances would be good that most of the developers would be bankrupt and couldn’t buy up the land.

But there is no chance that we will be able to keep house prices high and create more affordable housing. The two are mutually exclusive.

But I doubt we have any choice in the matter at all. The market is going to do what it does. And here we are today with high immigration and yet Toronto is facing a possible glut of condominiums for sale. As unsold condos have increased 41 percent from last year.

So WTF is going on!

I think we are experiencing once again the Boomerang generation as kids sell their condo or house and move back in with their parents or move to other provinces for better opportunities. Just like what happened in the 1980’s bust.

Bill Bennett’s (and later Vander Zalm’s) Socreds were in office all through the 1980’s. They weren’t blamed for the recession and RE bust and to be fair it was beyond any provincial government’s control.

Interesting that Glenn Clark’s government was blamed for the much milder decline in RE prices in the late 1990’s. By those who liked high prices anyway, i.e. the RE industry.

So in your scenario this would fix things because developers could snap up land dirt cheap qnw have time to build more dense housing while the people who lost their shirts work their way out of bankruptcy so that they can buy back from the developers in 20-40 years? So the solution is to concentrate the ownership of land into an even smaller group and wait for the benefits of that to trickle down to the masses? Just trying to see how that would work.

You aren’t backfilling, the COV is backfilling. They are forcing home owners to test the city side of the property to make sure it isn’t contaminated, if it is then they give you a higher estimate to upgrade the services so you as the home owner can pay for the city to deal with their contaminated soil.

Before: You call COV to upgrade services to your lot line. They come and upgrade services and cost is fixed amount.

Now: Before COV comes to upgrade they want the home owner to send them a report of soil samples where the city trench needs to be dug to install service. If no contamination, you are an extra 10k out + cost to put in services and yes they can backfill using same soil BUT you still had to pay for the test/road permit/traffic control to carry out testing. If contamination then you are completely screwed as they city will want home owner to pay for it.

It’s not sure the $10k +/- of non-sense testing but also I imagine the company drilling the holes in the road has to coordinate with city staff as to where the city would be digging trenches for new services, etc. It is all a painful process.

I bet by next year you have to get a traffic engineering report that will note what the impact on the neighbourhood/street will be as a result of having to close to road to drill the holes for the samples.

But why? It’s kind of awesome having a base here. It’s part of the local culture. I say keep the base where it is and transition away from current housing to mix of townhouses and apartments on base still owned by feds.

I don’t want to get into a debate but I was under the impression that rents in the pmq are below market and I’d say they should be.

Whatever , I don’t think a Hail Mary recession like the 80s is coming or the 90s blah . Homeowners today are getting lots of support , probably why theres very little in the way of distressed sales . It’s up from here

Yes Dee, a 20 to 40 percent drop in home prices would be good for housing in the long run. Some people will lose everything they own – but they have to take the hit for the good of the team.

After a couple of years in bankruptcy they will be fine.

If you are one of the unfortunate that lose it all, think on the bright side as at least your kids will now be able to afford a home.

The Feds, as usual, are not being clear on what they plan to do with the married quarters at Esquimalt or Belmont Park.

That housing was never for long term occupancy. It was only for temporary housing for the military. An entire generation has now grown up in that shitty housing. And they don’t get a deal on rent. They have to pay the same rent as those off the base.

The Feds idea is if they have more housing for the military then that will take the pressure off of Esquimalt and Victoria that have military renting off base. They are not being very clear if they would allow non military to buy or rent on the Married Quarters land.

I say the hell with it. Decommission the entire fu*&ing base and move it and the military families to Prince Rupert.

They wouldn’t make you sample if you are backfilling with the same soil would they? That wouldn’t make any sense. I thought it was meant for soil that is being trucked away and dumped.

“What we need for long term stability is a 1980’s style recession with property values falling by 20 to 40 percent. The NDP did it before – they can do it again.”

Are you joking? Like, do you really want this to happen? Sounds painful.

Problem is lot of BS applying to SFHs as well such as this new soil sample testing bullshit. Even if you have an old house and need a new sewer/storm/water you are screwed now.

Or if you want to add a suite which requires upgrading the water line to the house you are going to be out 10k for soil sample testing on a suite, lol.

If the cost to service multi-family land goes up – then you would just have to buy the land for less. That’s the simple answer.

However, you are not likely to be able to do so as someone wants that same lot to build a single family home.

What we need for long term stability is a 1980’s style recession with property values falling by 20 to 40 percent. The NDP did it before – they can do it again.

I’ve heard rumblings about building more (military?) housing on the military lands in Esquimalt. Is that what you’re talking about Whatever? I think it’s a great idea since so many military people have to wait on long waitlists to get into the military housing. My understanding is that there is a fair bit of empty land on the base there. Why not build a couple of towers for the military folks? Similar to building student housing on university lands. Or even assisted living on hospital lands. Why not build housing in underutilized lands for people who use those spaces most anyway.

Might be more money in building a single family home as opposed to 4 small units . A lot less hassle and probably quicker turn over .

When you increase the density of a parcel of land, that increases the cost of the land. Development property is not purchased on a price per square foot of land but on a price per buildable square foot of land.

Increase the density from 1.5 to 2.5 and a developer can now pay more for the land as they can build more smaller units to maximize profit. The problem with most cities is that single family land is worth the equivalent or more than development land especially in the areas that the province wants to see more development.

We have to bring the cost of residential land down and we can do that by encouraging more home owners to list their homes for sale. Not by encouraging more people to stay in their houses when they retire with deferred property tax programs or by keeping property taxes low on under utilized properties.

Another way is for the government to increase the competition among contractors. If the Feds did open up Esquimalt to development then the land should NEVER be sold to one developer. Instead it should be sold on a lottery system to many builders that would then compete on price and speed to build these homes. Sell the land to one contractor and they will spend the next 20 years parsing out the land.

What we need to do is break the cycle of increasing prices. And we could do that by flooding the market with cheaper land.

Or we could just do nothing. Because a prolonged recession will accomplish all of the above. Land prices tank in a recession.

You are missing the permitting insanity thought. I’ve seen the city staff comments on the first missing middle project in Victoria after developer submitted for BP and good chance it doesn’t move forward the comments/requirements are so insane.

This is one of a long laundry list of items. If you build a 4,000 sq/ft SFH you don’t require electrical and plumbing drawings; however, the COV building department at THEIR DISCRETION can request electrical/plumbing drawings for anything 4 units or more even thought code doesn’t require it. That’s a 10k expense. I mentioned the 10k soil sampling expenses last week, add like another 20 things.

They want things on a missing middle project that are normally for high-rises. Not to mention they are requiring 400′, yes 400′ of brand new sidewalks for this particular project. They want the applicant to have the civil engineer re-draw the sidewalks after city staff previously agreed on a design, etc. The re-drawing impacts trees on the property which the parks department likely won’t approve so you have the engineering department requesting something parks department won’t approve.

I spent $80k on 100′ feet of sidewalk/roadworks on a SFH two years ago, can’t even imagine what 400′ is going to cost. Had same issue, what city engineering wanted parks didn’t approve, it was insane, like 6 months of delays because the two departments couldn’t agree on how to deal with a tree. I made a video about it -> https://www.youtube.com/watch?v=s6aSPG47AQo&t=2s

I’ll continue to be a broken record, but I don’t think people have to worry about multi-plexes lining their streets anytime soon.

Janion 296 sq.ft. condo sold today for $340,000 and here is the sales history on the unit

2022-03-31 $445,000

2018-08-15 $315,000

2016-12-14 $148,900+GST (brand new)

My minor quibble here is we need to bring down the cost of land per home. That’s easy to do by permitting more density. Kind of impossible to bring down the cost of land unless you’re proposing to blight it.

Most new housing built in the city are contracts between the owner and a builder. While most new housing in the Westshore is builders buying land and selling on speculation of finding a buyer later on.

Why so little speculation builders in the Victoria Core? Because the land is just too frigging expensive. They can buy one lot in the city for the cost of two or three vacant lots in the Westshore. If the contractor builds three houses at a time then the contractor has economies of scale that will help keep costs down.

You will pay upwards of 30 percent more to build the identical house (excluding land) in the core than you will to buy one in the Westshore.

Want to solve the housing problem? Bring the cost of land down in the city.

Interest rates don’t have to come down to build housing.

The land prices have to come down.

And that is accomplished by having more existing properties listed. Start by getting rid of the property tax deferral in BC. Raise the property taxes on under utilized properties so that more retirees have to sell their homes and move into condominiums.

In other words, light a stick of dynamite under their arses to get them to move on. As it is now, there are one or two people living in a house that would house half the people of a Croatian village.

We have had a large increase in the number of people living in Greater Victoria. Yet the population of Oak Bay hasn’t really changed much.

Definitely. Most owners do not have the risk tolerance for that.

But by-right approvals is a game changer for small builders that currently are basically only building new single family because they have neither the capital nor the risk-tolerance for the rezoning process. That’s what happened in Kelowna anyway.

The tax rate in Oak Bay is lower because the property values are higher than most of the adjoining neighborhoods. You can’t just look at the tax rate, you have to consider the tax rate and the property value as a whole.

Some one living in a home that is mostly land value will change their minds about continuing to do so when they are paying a base property tax that is higher than more expensive homes. They will sell to a developer that will redevelop the site sooner rather than paying a high base for the next several years.

I’m not a person that likes the idea of using taxes to solve social problems. But Oak Bay is different. Money is what is dearest to most that live there. So you hit them where it hurts. Make it so it is less desirable for retirees to move there by draining their bank accounts.

The Feds are looking at public lands to develop economical housing on prepaid leased lots. That would probably work but the lease has to be less than 99 years. A 60 year prepaid lease would guarantee that the price of the properties would be less than a home on a freehold lot. If the housing to be built is for rental purposes then the lease would not be prepaid. There would be a monthly ground rent paid to CMHC which can be adjusted depending on the income level of the renters.

A scenario would be that a young couple buys the home with a 60 year lease and raise a family. At around the 30 year mark the kids are gone and the now older couple rents out the property for the remaining 30 or so years . At the end of the lease the house is demolished and a modern home of the standards of what will be in 60 years from now is built.

The government is making home ownership homes, that will transition into rentals and then redeveloped with new homes in 60 years. A constant renewal of housing in the city.

That is not why owner occupiers are not “redeveloping”. The tax rate in Oak Bay is less than many other municipalities.

First of all, there has to be some motivation to do this in that it has to make economic and personal sense. Most people are not in the redevelopment game and the bar is that it is unreasonably expensive and troublesome for an owner who is not themselves a developer to tear down and rebuild and costs can spiral. Why would they take on such a project? Only if they are experienced developers or motivated to build for a family member imo.

Even when the new fourplex rules come into play I don’t think owners will be “redeveloping”. Places will get sold to developers when the numbers work and then changes will happen. Interest rates probably need to come down first.

I don’t think you understand how land use works. Province controls all of it. Municipalities have no power other than what is delegated to them.

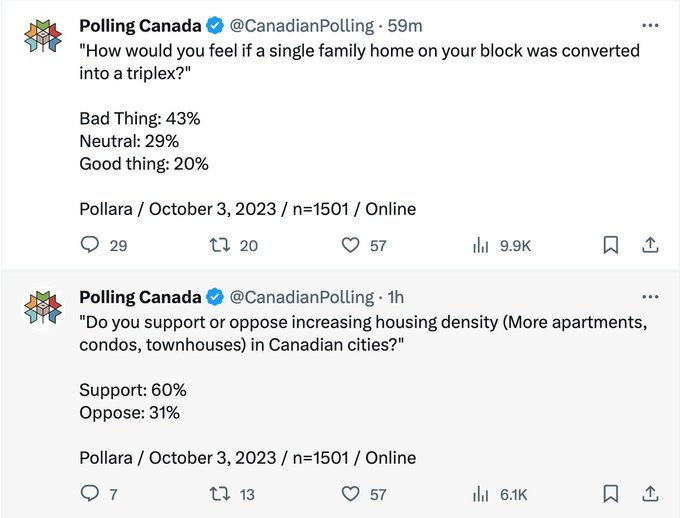

As far as housing goes, doing something about it is very popular. Polls show people support housing in general, just not next to them. Hence why the best place for reforms is at the provincial level, not the municipal one where all the complaints are from neighbours of specific projects.

That would be nearly impossible to administer Westerly. Just do it using the BC Assessments ratio of land to improvements.

What if there’s 3 bedrooms but only 2 people? Under-usage. You should write to Trudeau.

Oak Bay is a bit different than most districts. There are many small houses on large lots that are not being re-developed as the owners don’t want to pay higher taxes. This is the fault of our current property tax system. The more one improves the property the more property taxes are paid.

What we need is a tax system that recognizes the current tax system but also penalizes those that have not been improving their properties. If you live in a small pre 1960’s home that under utilizes the land then your property taxes should be increased. Those properties should have to pay a base tax that is higher than the current tax rate they pay.

If the owner redevelops the land then perhaps in some cases they could pay lower property taxes than the older housing? If the house value is say less than 50 percent of the land value then they should be paying 50 percent more property taxes than they are currently paying.

I doubt that one can get housing to change in Oak Bay unless you motivate Oak Bay residents where they think most – in their pocket book.

Sidewalks and curbs just get in the way of parking on the front lawn. Part of Saanich’s rural charm.

Municipalities are a creation of the provincial government. A point Danielle Smith is making in Alberta currently.

Frank, Eastdowne has sidewalks on both sides as does pretty much every street in North Oak Bay, are you sure your property is in North OB?

Compare this to many parts of Saanich that have no sidewalks on either side of the street which I find very odd.

Do you know how beautiful it is here right now?

Eastdowne area.

I imagine Ravi will fix housing in the same way that this government has done such a great job with both the medical system and with the drug addicts on our streets.

Still cannot comprehend why Frank chooses to live in Winnipeg but owns properties in North Oak Bay and Ladysmith. SMDH.

Frank, what street in North OB has no sidewalk?

It is naive (or at least unrealistic) to think that the province can strong arm municipalities to upzone in areas that the municipality doesn’t consider suitable for upzoning. The “naive” part is the statement that “Ravi better slap down this nonsense”. Because “Ravi” can’t… politics doesn’t work like that, because the local politicians answer to the local voters, not to a higher level of government. .

The local politicians that defy the province rules will be popular, and re-elected. California found that out with their failed upzoning that was ignored by the cities, because the city politicians listened to their voters, so they would be re-elected. Same thing will happen in BC.

Without sidewalks, pedestrians are at risk of injury, especially at night. My North Oak Bay property has no sidewalks, how can people living in four plexes with no parking get to the bus safely. There’ll be bodies strewn all over the streets.

I’m all for open data, but also I don’t see it as a huge deal. You either like the place at the price it’s listed or you don’t. Knowing that it’s been listed at the same price for 100 days is somewhat useful but you will get that info if you’re even remotely interested in making an offer.

Also

Ravi better slap down this nonsense. The exemption is there for munis who literally can’t accomodate new housing because of hard infrastructure constraints, not lacking nice-to-haves.

well well….look what we have on a council meeting agenda tonight in View Royal 🙂 I can’t wait to see what BS Oak Bay will try going forward.

As far as I understand they are considering 80% of View Royal as “underserved by sidewalks.”

https://viewroyalbc.civicweb.net/filepro/documents/?preview=70967

Coastal Flood Risk Areas Map – Technical Memo

THAT the Committee recommend to Council that staff be directed to prepare an application for a four-year extension from the Small Scale Multi-Unit Housing Legislation for the lands identified on the Coastal Flood Risk Areas map until the Coastal Adaptation Plan and Official Community Plan update are completed. (SCOHL-01-24)

SSMUH Housing and Infrastructure

THAT the Committee recommend to Council that a request for a four-year extension from the Small Scale Multi-Unit Housing Legislation be considered for those areas that are underserved by sidewalks to allow for the Transportation Master Plan, Drainage Master Plan, and Development Cost Charges Bylaw updates, and amendments to be completed. (SCOHL-02-24)

Draft Transit Oriented Area (TOA) Amendment Bylaw No. 1134, Small Scale Multi-Unit Housing (SSMUH) Amendment Bylaw No. 1135, 2024 and Garden Suite Regulations

THAT the Committee recommend to Council that any additional properties not required to be included on the Transit-Oriented Areas Designation Map be removed. (SCOHL-03-24)

2024 04 19 Standing Committee on Housing Legislation Minutes

And rushed last summer when they thought it was peak (rates)…. I guess the question is: how many market timers are now left? Is there a big number of people sitting on cash waiting to ride the next anticipated upswing or those that figure they just need to buy what they can or forever be left behind on the next lift?

Lots of people were rushing to buy in Feb trying to front run the spring market.

Also, it seems odd how much faith some folks are putting on a quarter point drop in the BoC rate to ignite the market. Maybe after about four or five drops you will see something. A quarter will probably result in a quick flutter of activity with the market soon realizing it was just a quarter.

I believe in Calgary the re-listing practice is banned (unless you get a new agent).

I personally believe that all the data should be opened up to the consumer and I know it can be frustrating to see re-lists, but when you start looking at beyond Canada/US the availability and fluidity to real estate sales information we have is just insane compared to the rest of the world.

This is a listing in my building in Zagreb listed by the biggest and most well known real estate brokerage in Zagreb – https://eurovilla.hr/en/property/855335/

And beyond the horrible listing with no photos or address good luck ever getting your hands on any sales data in the building.

(The reason a lot of listings don’t have an address is the agent doesn’t want people trying to go directly to seller to cut out the agent). Try that for transparency 🙂 No address, no photos, no sales data to gauge listing price.

People complain about organized real estate but it has its benefits. It’s insane we can pull up listing details/photos for a house that sold 20 years ago including the photos from that sale 20 years ago and send it to our clients with on click.

+1, that’s a reasonable theory for sure.

The realtor view on the portal gives a listing history for a property whether sold or not sold, with all the times it has been listed on MLS, for how long and the prices. These data points really should be more available to the consumer.

New housing targets out. That means local municipalities with housing targets include:

Victoria

North Saanich

Central Saanich

Saanich

Oak Bay

Colwood

Esquimalt

Sidney

View Royal

The only local ones not on the list are:

Langford

Sooke

Highlands & Metchosin

https://news.gov.bc.ca/releases/2024HOUS0062-000620

I think it is just the realization that rates are not falling and spring is the time to list. People have probably been holding on for a better selling time and realizing next year may not be better rates so now is the time. Lots of people have mortgage renewals coming up.

Im betting divorce rates have something to do with this. Tons of people started really hating their spouses during covid but it takes a long time for people to go through the throes of divorce and getting their places listed. Probably wouldn’t be very easy to get that kind of data though. The listing surge could also be read as a symptom of market sentiment.

Many sellers would beg to differ.

Prices are significantly down from peak in spring 2022.

A drop in rates would stimulate sales. I do wonder if the investment demand is drastically reduced for years? A good thing to slow appreciation and I guess if we get a lot of purpose built rentals along with lower immigration/study/work permits then this could keep rental rates in check. If we don’t get more rental housing then this will result in worsening conditions for renters.

I do agree that the str listings are a small percent, but not as small as identified based on legal units.

Marko, yes interest rate cuts will get the ball rolling again . Everyone is rooting for them as it’s the only way to get more housing . We are 2 years into this and really nothing has changed , if we were to get lower prices it should have happened by now . This year might be the high for inventory, cause I don’t think low inventory has gone away imo

And no deterioration in the labour market. 5,000 listings will be tough given how many more people live in Victoria now compared to 12 years ago, but the big difference is that in 2012 people were not renewing into mortgage rates significantly higher than what they had, this is completely different now.

I think we need interest rate cuts for prices to push up across the board.

Going forward , even with more listings I’m guessing prices will start to push up , I think this is the bottom . Last 2 big recessions , prices where flat for a long time , but this time I’m thinking it’s different imo

Thank you Marko for the interesting reply.

Problem is things slow down in the fall seasonally and it is also always surprising how long sellers are willing to sit on market even with vacant properties. If there was to be substantial downward pressure on prices in my opinion it would occur next spring. We need to get to 5,000+ listings on current sales volume and this isn’t happening by the fall.

I think we are topping out at 3,400 listings for the year which is high compared to last 8 years but we were at 5000+ 10-12 years ago.

Not distress….right now I have on the roster of new listings in May; moving into retirement home, moving into kids SFH basement, estate sale, upgrading to larger home, kids finished uvic selling property that was purchased for kids to stay at while at uvic, moving back to Croatia.

I haven’t dealt with a lot of divorces in terms of a sale. More commonly I am seeing a buyout (I know sounds crazy at these interest rates but often parents of the one party staying help out) and then you help the bought out side purchase something.

https://www.businessinsider.com/meteoric-rise-spectacular-fall-airbnb-queen-vacation-rentals-real-estate2024-4?utm_source=pocket-newtab-en-us

End of Summer will tell the tale of our housing market IMO. I gather the next few months inventory will continue to grow, by Sept/Oct/Nov is when we’ll begin to see price reductions. With increased inventory it’ll cause downward pressure on prices. Even tho price reductions are happening, on most every listing, it’s hard to track as most have expired/cancelled then re-listed under a new MLS at a reduced price. This drives me crazy as it brings no transparency to what’s really happening regarding price drops on specific properties.

Marko, any idea why most people are listing right now? Other than death, divorce and relocation.

I am going to have to side with Leo on this one, I think STRs are a very small % of the increase in new listings. New listings are surging in most places across Canada, even in markets that weren’t large on STRs.

(Doesn’t change my opinion from previous thread that banning STRs does have a consequence of less housing being built).

Also, I’ve received quite a few phone calls in the last couple of days from people wanting to list in the next couple of weeks. The vast majority of these, even when repeat clients, are completely out of the blue which goes back to my theory that it is impossible for “insiders” to predict new listings coming to market months in advance.

Where I have noticed an increase is in the number of listings of properties that were purchased during Covid. The turn over rate for properties bought in the last few years has increased.

The majority of strs were never legal. Ex Saanich had loads and it is not a permitted use even in a primary residence. I think strs are more than 6% of the bump and more to come next month.

End of this summer might be interesting.

1.86% until December 2025.

A lot of us are on the downward trajectory of mortgage obligations…Like almost done.

I don’t have or want an str In my principle residence.

If I want to make money, I drag my ass out of bed and go to work, just like everyone else.