The new federal housing plan

Ever since polling numbers collapsed last summer, the federal government has been on a speedrun to reverse the (arguably well justified) perception that they have done a disastrous job on housing. Though I would argue that most of the housing blame should be placed on municipal and provincial governments, there’s no doubt that the federal government’s failure to plan out non-permanent resident numbers have contributed to the problem, and most importantly Canadians put a lot more blame on the feds than any other level of government.

Last year the federal government made a key move to exempt purpose built rental from GST; important to ensure the boom in rental construction continues. In my view, broad availability of rental with secure tenure is an important factor in solving the housing crisis. Then they announced they were reigning in non-permanent resident growth which resolves much of the excess demand side. On Friday, the federal government released their new comprehensive housing plan jam-packed with existing and new policy. Is it any good? Keep reading for my summary and review.

First of all, I appreciate the plan introduction drawing parallels between past housing shortages and today. While I realize it’s just politicians appealing to patriotism to sell the plan, it resonates with me because I feel the national mood has become negative and cynical in the face of big challenges. We can’t build housing because the infrastructure isn’t there, we can’t build infrastructure to any reasonable timeline or budget, we can’t decarbonize because the grid capacity isn’t there, there’s no point in reforming permitting because we don’t have the trades, we can’t have immigration because there’s a shortage of doctors, etc etc.

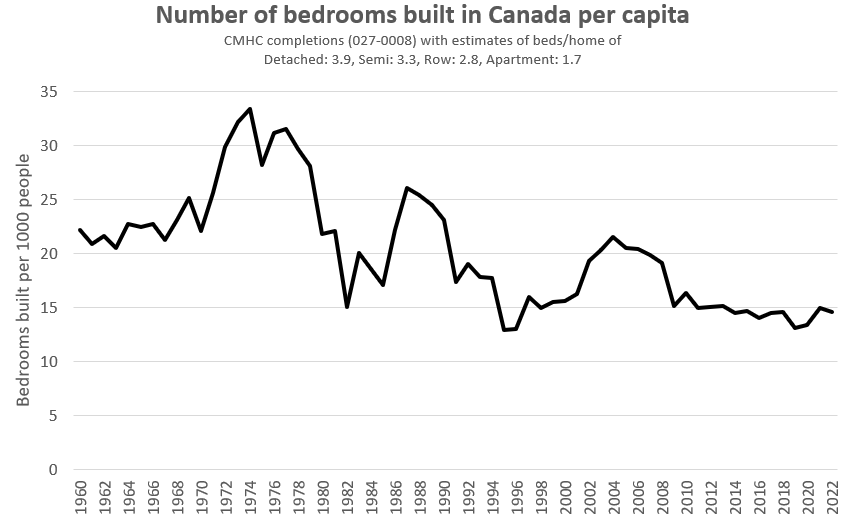

In my view, the answer to all of them is to tackle the problem like every previous generation has, and I hope we can get back to that approach on housing. Post-war we built out thousands of strawberry box homes. In the 70s for the boomers we built out hundreds of thousands of apartments, reaching levels of construction we have never since matched.

But enough of the problem and rousing calls, there’s absolutely no denying that the Liberals housing record has been very poor. Though they deserve credit for restarting affordable housing construction after decades of neglect, until last year they ignored the structural barriers to building housing while ramping up population growth in unplanned ways. While very little of Victoria’s recent house price growth could be attributed back to federal policy, it’s very likely that price explosions in small town Ontario as well as escalating rent prices across the country are direct results of those policies.

Now they hope to reverse course to save themselves from a wipeout at the next election with a strong focus on housing. Here’s the clearly good parts of the plan, the things that have some promise but I’m skeptical about, and the announcements that will do essentially nothing.

The good

Increasing Capital Cost Allowance to 10% for apartment construction. An important reform which paired with the GST exemption and low cost financing should keep rental construction viable and high while high rates depress condo demand and starts. Developers will be redoing the math on a lot of sites as the case to build rentals has significantly improved.

The new provincial housing accelerator money for provinces that adopt upzoning similar to what BC has done is also unequivocally good. A lack of infrastructure for density is a real challenge in some areas and this announcement opens the door for that money to flow to get it built. My one quibble here is that the federal government should allow provinces to access the money if they demonstrate an increase in building using other means. Currently some provinces are balking at the requirements to adopt new building code requirements and buyer/renter protections, saying they will add costs. There’s an argument to be made that if those provinces can hit the building targets in other ways they should also get access to the money.

Remove GST from student residence construction. The big impact here is the previous announcement to remove GST from rental construction, but I’ve long argued that building more student housing is an underappreciated way to tackle the housing crisis. There’s generally little opposition to student housing on campus, it reduces pressure on local rental markets, allows students to avoid commuting (low carbon), the land is generally already owned, and it should be possible to make it a cost-neutral endeavour other than adding the cost of construction to balance sheets. The biggest challenge is getting schools to put up basic housing that can be economically built instead of trying to make each new project a showcase. Removing GST is positive, but I’d like to see the federal government directly stepping up with funding to build these dorms.

Financing reforms for market housing, including expanding Canada Mortgage Bonds and the federal Apartment Construction Loan Program. There’s also reference to relaxing requirements and streamlining the applications for the ACLP, which I’ve heard from builders was a big impediment to accessing those programs in the past. These countercyclical investments make sense when private lenders are demanding higher returns.

Continuing and expanding non-market housing funding – There’s a myriad of announcements for non-market housing, both buying up existing apartments to preserve affordability, and building new housing. It’s clear that even if we fix our market system, we will need to expand non-market housing for the 10-20% of lowest income earners for whom the market simply can’t build for because the rents they are able to pay don’t cover costs. The fantasy that we can get affordable housing for free through inclusionary zoning has been smashed in recent years as program after program failed to yield results while driving up the cost of market housing. My one concern is that it’s a myriad of different programs, each with a slightly different goal and different administrative overhead (AHF, RHS, CRPF, CHDP, CHI, ACLP, it’s enough to make your head spin). I can’t help but wonder if it’s not more cost effective to have one program to buy new homes at market prices, subsidize them down to below-market levels, and distribute them according to need.

Updating the building code to allow point access blocks (single stair) – Though it sounds like an obscure change, a big part of the reason we aren’t building family-sized apartments is because of the dual-stair requirement in buildings over two floors, which is one of the strictest requirements in the world. Single stair buildings allow small infill apartments on single lots that contain 3 bed apartments with windows, while also reducing construction costs and efficiency. BC already announced this process will get underway in the province, but it’s good to see it expand nationwide.

Modernizing Housing Data – While this won’t impact housing affordability directly, I was glad to see money allocated to improving the state of housing data. The state of housing data in Canada is an absolute disgrace. Data on new house prices is hilariously inaccurate, data on resale prices is locked up by CREA and not publicly available, and data on rents only comes out once a year. As a result, housing reports at every level are routinely based on old or incomplete data, causing municipalities to badly misjudge demand while the CMHC releases forecasts that are out of date the minute they go public.

More funding for Indigenous housing. I’m no expert on this so can’t evaluate the impact of the two announced programs. While not mentioned in the plan, I am extremely impressed with the scale of Indigenous-led housing projects in Vancouver. Senakw will add 6000 units while the Jericho project targets 13,000. These projects show:

1. The actual unmet demand for housing in our major cities and

2. what can be done without endless municipal meddling and compromise.

I don’t know the barriers to replicating similar projects nationwide but it could really make a dent in the housing shortage.

Prioritizing construction trades in immigration. While labour economists may disagree with me here, I believe it’s a good move to use the immigration system to address shortages in the skilled trades. In the past, only 3% of immigrants were in the construction sector, and while that may be optimal from a GDP/capita basis (the lawyer will make more than a carpenter), it’s sure creating problems for housing.

Things I’m skeptical of

Canada Builds to “build homes for the middle class”. The feds have taken much of what BC has done, and this is an expansion of the BC Builds program that was announced but not really put into action yet. While all new housing is helpful, I’ve long been deeply skeptical of claims to build homes for the middle class. If we can’t even come close to building homes for lower income folks, it’s even less likely that we can make a dent in homes for the much larger middle class. The real reason behind these programs is that subsidizing deeply affordable homes is very expensive. Even with free land, it takes heavy subsidies to bring cost recovery rents ($1900/month on a non-profit project in Langford) down to shelter rate ($500/month) levels. With the flak that governments have taken by promising affordable homes that then rent for just a little below market, I get the temptation to just change the marketing and say the homes aren’t “affordable”, they’re for the middle class. New homes help regardless, and if they’re non-market they will generally get more affordable over time. Just don’t expect to get one of these middle class homes anytime soon.

Actions to do with reducing homelesses. Most of these are a continuation of the funding for the existing Reaching Home program that has been in place since 2019. While I’m sure many have been helped through the program, it’s also clear that it hasn’t been nearly enough, with homelessness numbers expanding in Canada since then. I suspect this will be a chronic struggle until we drastically improve housing affordability as a whole.

Low cost loans for adding suites. While not necessarily bad and they haven’t released the details, I suspect it will again be copied from the BC program, where applicants need to commit to offering suites at below-market rates. While I haven’t heard of an update on this program, I suspect uptake will be very low and it will be canned.

Incentivizing density to existing homes – Details are lacking here, but the government is promising various reforms for owners to add density, including upping the CMHC limit in certain cases. I’m skeptical because in general existing owners are not going to be the ones turning houses into duplexes or triplexes, that will be developers and builders. Financing reforms do not turn owners into competent builders.

Changes to how homes are built – A good chunk of the plan is about new construction methods and procedures, including standardized plans for infill housing types, innovation funding for new building techniques, support for modular housing, prefab, and automation. Why am I skeptical of this? It’s not that we don’t need to improve construction productivity, which has been flatlined for decades. It’s that I don’t believe this is a market failure, but rather a result of strangling the market with overly complex and site-specific regulation. I’ve spoken to builders of garden suites, and they say they could source low-cost modular homes for a fraction of the cost of current builds if the regulations allowed standard designs to be placed on hundreds of lots. Instead we have prescriptive standards that require a lot of site-specific customization. Tossing a few million in grants around will not solve this problem, and the money is far better spent on producing clear and permissive regulations that allow the market to innovate.

Renters Bill of Rights – I’m generally in favour of evening the playing field between owners and renters. Currently renting is precarious in Canada for too many, and even with strong progress on resale affordability many people will be renters for their entire life. However the idea that requiring landlords to disclose rental price history will empower tenants to bargain on rentals is astoundingly naive. What an apartment used to rent for has no bearing on the current market price. The idea that a history of paying rent on time should be used to build your credit score is good, but it’s unclear how this would work. Would landlords be required to track and report this to credit rating agencies? That seems unlikely to happen for all but the biggest corporate landlords, and may further disadvantage renters without that history.

The nothingburgers

Building homes on top of shops and businesses. Most existing businesses are not built to support anything on top of them, and it’s not going to be feasible to build there despite access to a low cost loan.

Identifying underused public land for housing – I’ve been hearing every level of government talking about this for years with precious little to show for it. Shouldn’t we have identified this magical underused land by now if it was out there?

Tenant protection fund – While important, a $15M national fund for legal services will last all of four seconds.

30 year amortizations for first time buyers on new homes – There has been a wild overreaction to this policy online, with many slamming it as pushing up prices and doing nothing for affordability. While it’s true that any incremental new demand measure will put positive pressure on home prices, the number of first time buyers buying new homes who access insured mortgages is vanishingly small. This will have essentially zero impact on pricing, and the little bit of demand it may add is limited to new builds which is good for incentivizing instruction.

Increasing the RRSP Home Buyer’s Plan Withdrawal limit to $60,000. While this may have a bigger demand-boosting effect than the amortization change, it’s fundamentally just allowing people to use their own money for a different purpose. While one could argue it’s encouraging first time buyers to raid their retirement savings, I’m also entirely confident that people who have managed to amass that much in their RRSPs can be trusted to make that decision themselves.

Other nothingburgers include some money to help municipalities enforce short term rental restrictions (keep squeezing that stone), extending the ban on foreign buyers to January 1, 2027, and increasing the enforcement of real estate fraud by the CRA. Some commenters have been excited about the promise to implement direct income verification for mortgages with the CRA. While I fully support this move (fraud is bad, mkay) I believe the accounts of mortgage fraud have been generally exaggerated. I don’t believe there’s enough of it that a crackdown will substantially reduce mortgage volumes.

I debated adding an “actively bad” section just for the policy to “confront financialization of housing” proposal, where the government intends to “restrict the purchase of existing single family homes by very large, corporate investors”. While this is a common bogeyman online, it’s not a significant real-world factor, and the reality is that corporate investors are exactly the actors with capacity to turn single family lots into a ton more housing by redeveloping it. If implemented carefully this has the potential to do nothing, and if implemented badly it has the potential to seriously backfire and impede housing supply. Because it’s just an intention to consult, I’ll reserve judgement.

Overall, I think the plan is positive, even if the shotgun approach means that many of the smaller actions are inconsequential. The big ones are very strong supports for rental housing which should mean that our rental housing boom continues despite the challenges of higher rates, and pressuring other provinces to adopt zoning reforms similar to what BC has done. Overall however, because much of it is copy of the existing BC plan, it means that the marginal impact on the BC market is marginal. The zoning reforms are already underway so this won’t change anything, and the rest of the reforms will have little immediate impact. For other provinces it depends entirely on whether they want to play ball which is far from certain.

So will tackling the biggest issue for Canadians (housing and cost of living, which are intimately linked) reverse the fate of the Liberals? I doubt it. Last year I said the Liberals could release a plan straight out of the fever dream of YIMBYs and it wouldn’t make a difference. Elections are about outcomes and vibes, not plans, and the supply side reforms will not happen quickly enough to impact rents or prices by 2025. While I believe these are generally useful actions, the reality is there are no quick fixes to the housing shortage. When New Zealand announced their sweeping zoning reforms, an economic analysis predicted that the impacts would be “small at first, noticeable within a decade, and enormous for the next generation”. Unfortunately for the Liberals, it won’t be the next generation voting in 2025, it’ll be the current one.

What do you think of the plan?

Also the weekly numbers

| April 2024 |

Apr

2023

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 131 | 282 | 637 | ||

| New Listings | 466 | 823 | 1036 | ||

| Active Listings | 2801 | 2896 | 2043 | ||

| Sales to New Listings | 28% | 34% | 62% | ||

| Sales YoY Change | — | +12% | -23% | ||

| New Lists YoY Change | — | +74% | -24% | ||

| Inventory YoY Change | +39% | +42% | +50% | ||

| Months of Inventory | |||||

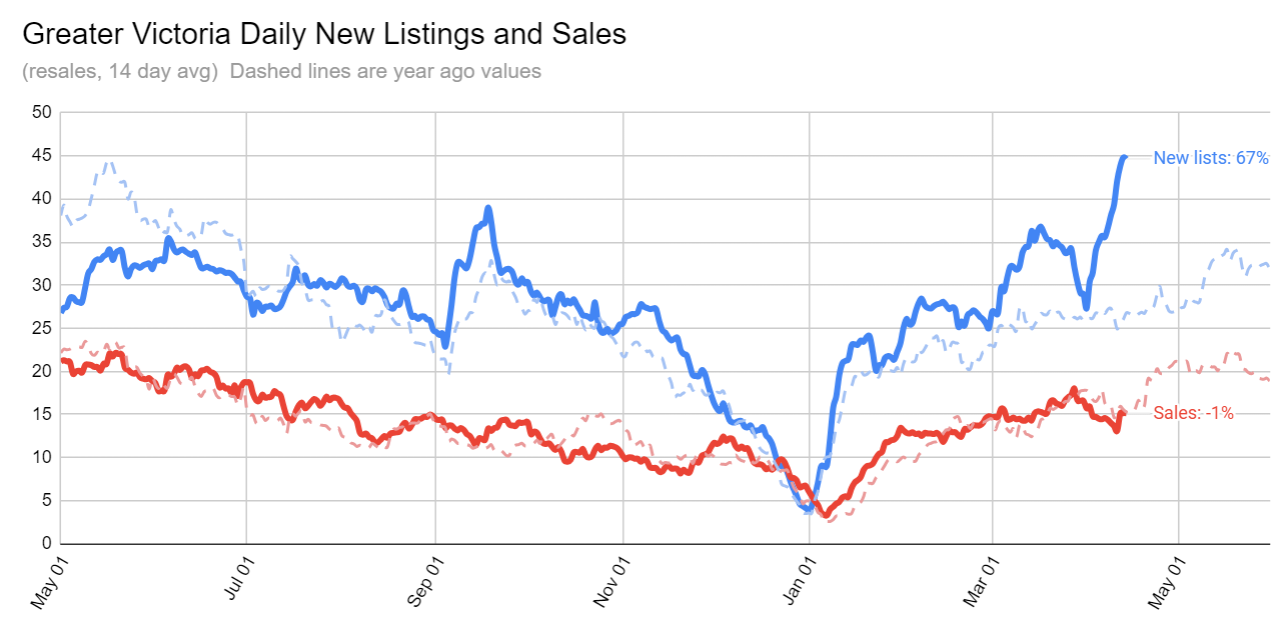

Note that on a calendar day basis we are up 12% on sales, but on a business day basis we are down 1%. The daily data also confirms that we are pacing the year ago sales levels while new listings are continuing to come in at drastically higher rates.

As usual, new list numbers are volatile and could well drop off again like they did near the end of March. So far we are on track for the most new listings ever in April, but not by much (it would take a +72% increase in new lists to beat April 2010). Stay tuned for a deeper dive into those new listings and what might be driving them closer to the end of the month.

If supply is the problem, why is the inventory ~ 45% higher than last year?

New post: https://househuntvictoria.ca/2024/04/22/about-all-those-new-listings

My overall assessment is that interest rates and associated poor affordability which means low sales is 90% of the reason some developers are pulling back. Some policies have gotten worse for supply, some have gotten better, so it’s basically a wash. No GST, CCA changes, other tax reforms has made rentals a lot more attractive. Labour market not so tight anymore either. Lots of projects still going ahead.

Bosa twiddling their thumbs with Dockside after they twiddled their thumbs for the last 15 years is not really saying a lot. Maybe they should pivot.

I highly doubt it. Market impacts happen when changes are announced, not 6 months later. The surge in listings was last fall. Some people took a haircut and sold, some moved to the long term rental market. Who owns a short term rental and is just now waking up to the fact they won’t be able to rent it in a week? I mean maybe some people are out to lunch like that, but most have already made alternate plans.

~76 active listings of STR condos right now, compared to 19 last April. Big percentage increase, but 57 additional listings is just 6% of the increase in inventory from last year

Is it a minor factor? I’m not sure about that in terms of current conditions. The May 31 deadline probably results in a statistically significant increase in listings PLUS a statistically significant decrease in demand for str (legally zoned or not) properties since last years’ announcement.

Plenty of super dumb policies that need to be reversed, but adding a few small condos to inventory (6% of the increase from last April), many of which aren’t even competing with new builds because they’re very small just isn’t even on the top 20 list.

This is really yesterday’s story though. If the NPR reforms are implemented as planned we will have a pretty substantial outflow of temporary residents and population growth entirely unremarkable (just under 1% by my estimate)

and a bunch of factors make projects not feasible. It’s like the soil testing BS the COV has introduced. Will it and the associated increased costs on its own sideline multiplexes from being built? No, but you multiple BS x 10 and yes it will.

You also don’t know how close a developer is in making a let’s go/let’s not go decision; therefore, that minor factor may be the tipping point.

I guess my point is policy needs to focus on supply to get out of this mess, but it seems like there is an infinite amount of policy possible to try and subdue demand while we bring in a record number of immigrants.

Sure it’s a minor factor, but very little of the increased inventory is from STR buildings. Listings are just up across the board.

I argued that some of the lost SRT premium was a function of the overall market being down.

Oh good, now we are having car jackings happening downtown.

The government will take up the slack and they can afford to pay 1600 a ft for low cost housing. Cannot see the developers complaining about that. Maybe if the Feds put up a lot of building lots at a dollar a lot than things might move ahead.

I think you or someone else actually argued this point on hhv, just pointing to the fact that the impact will just be STR losing it’s premium.

They are going to discover when you declare war on investment, nothing gets built.

How would a bunch of inventory not lower prices in general?

For example, the 834 is a non SRT building previously. However, 10 units listed at Juilet that were previous SRTs directly impact market value of the 834 units as they are comparables.

I thought it was just the STR premium disappearing.

STR ban = lower condo prices downtown. Bosa pre-sales would have to compete against those lower prices; however, it is not like the construction costs/regulation comes down; therefore, project isn’t feasible and we are looking at dirt instead of two new towers going up.

Obviously a lot of other factors at play such as interest rates, the market in general being slow, etc., but the STR ban did put downward price pressure on the downtown market in itself and it is difficult to sell a pre-sale at $1,000 a foot when newer re-sales are $800 a foot, for example.

and then what happens is the STR inventory clears out in a year or two but we haven’t had as much supply come to market and prices go back up.

Isn’t “poor remand” to be expected as a result of all the government actions to specifically reduce demand. That were supposed to help the housing crisis, but may actually worsen it by reducing demand for new construction housing. The government actions to reduce demand include foreigners tax, vacancy tax, foreigner ban, satellite family tax, airbnb/STR ban, flipper tax and now capital gains tax increases for investment properties.

Many people here on HHV pointed out at the time thst these bogeymen taxes have a negative effect on the economy, and that includes reducing demand for housing. Which leads to reduced new home construction. .

More the culmulative impact of a slow down activity from interest, investment, building and over regulation dragging it all down at once. Bosa tends to do well idling or slowing projects when things turn down and rev up again on the other side. The result of the measures to address a housing shortage will result in fewer homes being built and what is there being more expensive. The irony is they have the AirBnB problem wrong, it’s actually they don’t have enough of them and they need more.

Huh? The new towers would not have allowed STRs anyway. Banning it makes no difference to Bosa. Projects being delayed is just high rates and poor demand.

Maybe there’s an argument to be made on the capital gains changes putting a damper on pre-sales though.

Ahhh i see!

I don’t believe there is much signal here, just noise. Especially when you are talking about the reported sales numbers from the VREB which don’t even reflect actual sales, just when they were reported. The chart below is the 14 day running average of actual pending sales which reflects when deals are actually made.

This April: Week 2 is 15% higher than Week 1 and Week 3 is 21% higher than Week 2. How does this compare to last year?

Not sure what you mean by acceleration of sales but it’s near as makes no difference identical to last year.

It’s going to be more of a function of how the properties are priced. Leo, can you check to see the acceleration of sales through the month this year compared to last year is higher?

Yeah I think pretty much what I expected early in the spring. Decent inventory.

Maybe, but only because we have more business days this month than last April. Sales rate / business day is identical so far this month.

Don’t do it? Inferior location means it will correct faster and more severe in a downturn. Also wfh is ending so the commute is also detriment. This is playing out as we speak, and the westshore pumpers on hhv are no longer posting.

Care to elaborate, @VicRE?

I’ve been thinking about the short term rental ban where they have left it open specifically to owners of principle residences. I’ve asked myself, “why would they do that? Would that not just trade a unit for a unit?” No more condo BNBs, tourists now stay in suites in peoples PRs. It’s a net zero (give or take).

Long term rentals are a PITA, much riskier than they were previously. BNB are lucrative. With BNB, as a homeowner, you rent when you want to and you can choose to occasionally your unit for friends etc – I’ve been contemplating it for our next house.

However, if you have a rented suite that is incidental to your occupation of the property you still get full PR. If you operate a full commercial business in the suite it may muddy the waters enough or open it to new legislation to tax that portion of the property without question.

Just a thought, no other basis.

REIT’s rarely report dividends because they’re not corporations. They do report “other” (which is net rental) income which is taxable as such by the unit holder. You are correct about return of capital, which results from applying CCA to rental income.

My guess is that we get even more listings next week and next month given the change in sentiment, tax changes, and STR ban.

An increase of 68 over last week…..we peak at 3,300-3,400 this year?

Looks like it will be an ok sales month. 465+183ish+70ish = 718 sales

Month to date market activity:

Sales: 465 (up 9% compared to same week last year)

New listings: 1187 (up 62%)

Inventory: 2964 (up 44%)

You can already see it on the ground…..Bosa has put the next two Dockside towers on hold for now. Government bans STRs, prices drop, Bosa can’t secure pre-sales at a price point to make the project work as a result, we don’t get new housing inventory.

Having difficultly keeping up with all the new regulations hitting my inbox every day…..a lot of this is just complete non-sense…force small stratas of 5 to 10 units into depreciation report? If townhomes they will need to pay thousands of dollars for someone to tell them they need to paint their trim. Also, the 18 months for new stratas…..let’s waste money getting a depreciation report while the building is under a 5 year building envelope warranty.

Literally every day I am getting hit with news of new non-sense, imo, regulations.

Some of the changes…..

On April 22, 2024 Order in Council OIC 204-2024 brought into force changes to the Strata Property Act about depreciation reports. Stratas can no longer waive or defer obtaining or updating their depreciation report and must obtain a new report at least once every 5 years.

Certain small stratas are still exempt. While renumbered, the wording is essentially the same. Regulation 6.22 says that SPA s. 94(2) doesn’t apply “in relation to a strata corporation if and for so long as there are fewer than 5 strata lots in the strata plan.” There are no other exemptions.

Stratas established between July 1, 2024 and June 30, 2027 must get their first depreciation report within 2 years after the date of its first AGM.

A strata established on or after July 1, 2027 must get their first depreciation report within 18 months after their first AGM. Previously the deadline was within 6 months of the date of the strata corporation’s second AGM.

I thought for REITs it is only dividends that are treated as income and the return of capital when the share is sold is subject to capital gains?

However, if you can control when you sell and realize less than 250k of gains per year you should be able to avoid the higher rate for personally held stocks? I guess unless you die. RE is much more difficult as you dispose of the whole asset at once usually.

https://www.canadianrealestatemagazine.ca/expert-advice/real-estate-investment-trust-taxation/

Well presales should be based on an expectation of a higher market price than presale price at closing, because that’s the tradeoff for the buyer taking on risk from the developer. Now if buyers don’t have faith that the market price will go up in the interval, the developer will have to sell presales for under current market price. But that’s the way it’s supposed to work.

Assignments are what they are – sometimes business sometimes capital gains (new rate). In addition, there are the anti-flipping rules on this.

My point was that the decision invest in a presale is often based on an expectation of appreciation because you commit to a price and have to wait years to move in. I think there will be less interest with the new capital gains tax and without the expectation of appreciation plus high interest rates.

I just wonder if some projects might have a harder time selling enough units to proceed no matter the buyer motivation which might slow down supply. I’ve never bought a presale but I’d be hesitant to right now.

Presale assignments are taxed as business income so for those intending to flip a presale, who are a lot of purchasers I think, there are no changes. Nor are there any changes for those intending to live in the unit when completed.

It has occurred to me that the capital gains changes do not apply to REIT’s. As unit trusts they distribute all their income to unitholders to be taxed at their own personal rates (none if in RRSP or TSFA). This is also the case for any mutual fund or ETF.

Lyall listing cancelled.

is 303 916 Lyall St sold? How much is it sold for? Thanks

you would be surprised on what people believe in.

Investment capital goes where it will get the best returns.

Interest rates are high and probably not coming down that much, rental rates are static/dropping, prices static/dropping… I don’t think the power of leverage and time overcomes these factors for most currently but if conditions change then the cap gains rules might make a difference. A better approach for some might be to have more people on title so co-ownership/joint ventures might be more attractive.

However, it is clear that government is moving to disincentivize investment in Canadian real estate. At the same time they have to be careful not to collapse the market as there would be blood on the streets for your average Canadian homeowner/voter and the overall economy. So far they’ve made some sensible moves and some head scratching ones, but they sure are spending a lot of money and creating a debt snowball.

Going forward long-term appreciation rates may well drop – which is a good thing overall but will not encourage investment capital in any type of real estate, including purpose built rentals unless they are heavily subsidized by government. I don’t know who is going to buy presales now either which, if I understand matters correctly, are required to finance ex. condo developments.

On the “Under utilized Land” piece I learned that even in the small community I live in there are several Lots (60 ft wide) that are designated as road right of way. As subdivision occurs there are several of these placed around the perimeter to give future access options to a development. When the development occurs there are some of these access options that basically become orphaned properties under the control of the ministry of transport. I made an inquiry and was told a town can apply to have these returned to the town as lots. Now that zoning is allowing for multi units on Single Family lots it makes sense to round up these orphaned parcels and apply to have them transferred or sold off to fund affordable housing in the community. I am working on getting that done in my community. It’s not much but it’s something.

~40bps lower currently. Insurance premium lowers as the dowpayment approaches 20%.

Don’t insured mortgages typically have a slightly lower interest rate, offsetting some of the insurance premium?

Ok, good to know thanks. I thought it was 4% p.a. but that seemed way too high.

Toss in the possibility (if not probability) of vacancy controls and the returns on owning a rental may not outweigh the risk.

With totoro’s thread from yesterday, you have to wonder when the person is at the point of the juice being worth the squeeze? That monthly bleed on cash on a depreciated asset that’s underwater in actual value to carrying costs, when does a person consider just tearing the bandaid off with bankruptcy? Every situation is different, but if the person has limited assets, they might consider tossing whatever liquidity they have into a coffee can along with whatever they can sell easily for cash and start the process. Then look at giving up half their net for the next two years and start buying back their credit with a clean slate afterwards.

Real estate is not a good investment (for new money) nowadays. IMO. Still not a bad idea to hold properties bought years ago, with little or no mortgages.

If you hold the RE estate within a corporation it doesn’t matter (condo vs SFH) , as the higher inclusion rate (66.7%) applies to all the cap gain, with no $250k threshold. .(at least for sales after June 24, 2024)

Would it not make more sense to buy condos now as you can offload them in varying years versus SFH you have to offload in one year so you are more exposed to the >250k.

I doubt many condos have appreciated more than $250,000. Maybe some high end 7 figure condos, but not the average condo.

I dont think that the new capital gains rules makes investing in a condo any more appealing.

Downtown condo sales may be soft or bearish, but not in the remainder of the Victoria Core. The condo market outside of the downtown area in the Victoria Core still favors sellers with 3 months of inventory and an average days-on-market at 34.

A prospective purchaser for home occupation outside of downtown gets more value for their money in that for nearly the same price ($570,000) they can have a decade older but larger two-bedroom condo of around 950 square feet rather than a downtown condo of around 750 square feet which could be a one-bedroom or a junior two-bedroom suite.

An investor is looking towards maximizing rent per square foot which is almost always a downtown location. While a home occupier is looking more towards a trade-off of location and square footage.

For those reasons I would put the current market for home occupation as being stronger than the investor market.

But it isn’t a massive difference. There are still investors that are betting on the long game of market appreciation and higher future rents.

Also keep in mind investors are a big part of that market and they’re not buying .

With condos having ample listings and slow sales, it would be seller price expectations are too high. I know someone who made a few offers on condos downtown and they were shocked on how sellers were refusing to move off what seemed to high asking prices on unoccupied units.

I find it interesting that downtown condo sales seem to have slowed down. There is a lot of inventory so it is not for a lack of choice. Sales of everything else, almost everywhere else is doing well so it is not the general market or interest rates.

Marko, your thoughts or anyone else? Has there been a shift in how downtown is perceived? Or some other factor?

Absolutely right, which makes it even more of a sore point.

The insurance isn’t for your protection, it’s for the lender’s protection. We’ve had periods in major cities where prices have been lower than 5 years earlier. Sometimes a lot lower.

I see the cmhc premium added to your mortgage as the equivalent of rolling your car loan in. Want to pay for that car for 25-30 years? Just as the car is worthless after 5 years, so is the insurance. Do what you can to get to a 10-20% down and the premium drops considerably.

Agreed on the amortization of the cmhc premium as it is usually treated. However, people pay it because they don’t have a large enough down payment. In reality it should be amortized over the standard 5 year mortgage term, in fact I think that’s how it is treated for tax purposes (have to look this up). The premium is / was pretty close to a typical down-payment on a starter home. Maybe not so much at the moment. Using the $36k in the example, 5% of $700k is $35,000. Bye-bye down payment. Courtesy Federal Gov.

Premium is a lump sum paid to CMHC (or others) at time of purchase. For your example the premium is 4%, i.e. $36K. If the premium is added to the amount borrowed as usual, amortized that’s an extra $233 a month or so at current rates.

Something your 285 a year does not include

Any amount would help.

If you maintain the house, you mitigate everything you just said.

It seems like new build townhouses in Langford often have extremely limited parking and you need a car. This makes renting a four-bed to four roommates problematic, which I guess will be an issue in the core as well eventually.

Not an option in this case and hard to imagine that many parents could give ex. a 900k mortgage to their children.

If you get to ex. a 150k loss selling in a down market and have no other assets that is a hard recovery point based on earned income.

Depends on if you are an investor or not. If you have a budget of x and you need a home for a family a Royal Bay or Westhill townhome close to schools is a reasonable option. Your alternative is an old townhome in the core with two bathrooms less and one has to weight those pros and cons.

Marko-I think you meant $285 per month. Friends of mine budget $8000-12,000 a year for potential maintenance for their homes, and they are both retired.

Many of the peak buyers already tapped out mom and dad’s HELOCs for the downpayments. I know a few that had the plan to pay it back once they gained enough equity for their own HELOCs to cover. I think I made a comment on it around 2022 saying it had the potential to be a multigenerational wealth drag or wipeout once interest rates went up and prices flattened resulting in mom and dad having to work late into their retirement years as a result.

I forgot mortgage insurance — how much would that be on a $900k mortgage at 5% down? Another $2k per month?

Thanks Marko. Hard lesson but will pass this info along.

I been trying to warn about buying in the westshore, dont do it!!

Landscaping, fence, deck/patio repairs, driveway, windows. This is not counting all the other random issues i have encountered on my houses. Your 285 a year is very very bare bones

In the core I would try to re-finance and just hold in there; however, the problem with the Westshore is he will be battling new inventory from Westhills/Royal Bay/etc., for the next 20 years. I’ve had two sets of clients shopping for a townhomes on the Westshore recently so I’ve seen it all and there are a lot of options including well price new builds undercutting used (even with GST applied) -> https://www.realtor.ca/real-estate/26720518/3216-happy-valley-rd-langford-happy-valley

Also, new builds no PTT versus used you have to pay PTT above 500k, etc.

So not sure. Core, hold for sure. Westshore, not sure.

Also, know a number of developers/builders pivoting on the Westshore and getting CHMC loans and building rental townhomes so you can’t really depend on much upward rental rates. $4k for a townhome is already at the top, does your friend even re-rent for $4k if tenant leaves? Certainly not getting more at this point and time.

I don’t think changing the terms is an option at the moment due to a change in employment.

Why not go fixed and then wait it out? There is no other choice if its a first time buyer with limited financial means. Or get family loan to pay down the mortgage, better paying interest to mom and dad than the bank.

It was a 2022 purchase – not sure what month – with minimum down. I’m not going to ask for more information.

The thought right now is to hold through to a better market. What do you think about this approach Marko?

Townhome story close to believable actually if they bought during March or April 2022. I currently have clients with an accepted offer on a townhome in Langford that is $155,500 less than an IDENTICAL townhome (same orientation, everything) that sold in early 2022.

Health care is a lot better in most European countries. If I had top notch health care in Canada, or at least access to decent health care even if it was out of my own pocket then the equation totally changes.

$7k per month doesn’t sound that far-fetched, depending on the details. A $950k townhouse (eg. https://www.realtor.ca/real-estate/26736030/1210-solstice-cres-langford-westhills) at 5% down and 5% interest rate, is $5.5k in mortgage alone. Add on property tax and strata fees and you’re probably well over $6k per month.

The comments about pushing the rich out / scaring away precious investment dollars are BS. There will always be rich people that opt to stay here for the same/similar reasons that others stay – proximity to family and familiarity (those being the two biggest ones i can think of – surely there are others). Traveling in Europe is the same. There are countries where the middle is far larger than ours, the government is more inflated, and still people choose to stay (including the rich and very rich).

Well then you had better put that piggy bank Into a GIC.

This Is my daily maintenance cost for a 2600 sq/ft SFH on 10,000 sq/ft of dirt…

Roof replacement (every 25 years) $1.45 per day.

Hot water tank replacement (every 7 years) $0.28 per day.

Roof d-moss and gutter cleaning (every year) $0.70 per day.

Lawn and garden service (four months per year) $4.40 per day.

Pressure washing and window cleaning (every year) $1.10 per day.

-$7.93 per day.

-$237.90 per month.

-$2854.80 per year.

To me… $2854.80 per year for a very solid and Thorough maintenance regiment for a SFH Is very reasonable.

Everyone seems to have this stigma that house maintenance Is a huge expense. As long as you heat It and live In It, maintaining a SFH Is IMO very cheap.

Yeah, that number is high. Maybe it is including those expenses. I didn’t ask for more details so I probably should not have posted it. Moved in with family so no rent.

Uhhh, 7k a month for a langford townhouse?? Stories like these makes zero sense in real life. He could and can stop the pain at anytime switching to fixed…. thats their own fault, but instead he is running a 3k month loss while renting another place to live?

I’ll start a roof piggy bank for the next one. What if it’s $40,000?

Frank, roof shingles last 25 years. $13k every 25 years Is pretty cheap maintenance. Its $1.45 per day. You can’t even buy a banana for that.

Marko:

Delaying selling does keep the original investment intact though as you stated, but the gain when triggered will result in less cash flow to your corporation as that is where you are invested.

Real estate capital gains in your corporation will be subject to the 66% rate in June, regardless of when you purchased them or when you sell them. The low tax rate in the corporation is very helpful in amassing investment capital, but as you know is less efficient when you are getting it out.

MOD stocks in the US have been doing really well with good future prospects.

I don’t know. I hope not.

Another good example in favour of a broad-based land-value tax. Hoarding developable land would become prohibitively expensive.

Cue up the virtue signalling “smallest violin” comments.

totoro- I guess one could say he’s subsidizing his tenant and made a bad investment. Have they lost their entire down payment yet?

No sure about CND, if you are in the S&P500 sure but other than railways “quality” Canadian stocks haven’t been so hot…take a look at Telus, down 23% in last 12 months, for example.

Emphasis on has. Not for a couple of years now. The tenant with ex 200k invested in quality Canadian dividend stocks has been way better off renting than buying for a couple of years now.

An acquaintance who bought a Langford townhouse at peak on variable has moved out and is renting the place for 4k/month while paying a 7k mortgage plus insurance, water/garbage/repairs, and property taxes. He’ll lose significantly if he has to sell and is, of course, cash flow negative every month.

It may be like this for a while.

The rich just adapt and then the country just loses out even more. I remember meeting a person in the hotel gym in Tenerife a few years ago and we got chatting about real estate. He was noting how he made a large return on a real estate investment sale in a foreign country and I was like you are going to get hammered on capital gains in your home country where you file taxes and he pulled a credit card out of wallet and was like do you know what this is? It works everywhere and then he said “that’s low level stuff.”

(He kept the gains in the country where he sold the property and was extracting it using other means including setting up a VISA in that country and then using the VISA elsewhere which is drawing off an account in a foreign country so he wouldn’t have to transfer the money back to his country of origin).

All sorts of other crap going that is very high level and we rolling out enforcement units at multiple levels of government against single unit landlord owners at the Janion, lol. Yea, that is going to solve our problems.

If you are a high functioning professional working 60 hrs/week and spending your remaining few hours a day jogging/cycling/working out what you get in return is continually higher taxes, no doctor, and the worse part is in Canada you can’t even take your after tax dollars to pay for a doctor.

I too would re-consider Canada at this point and time. Also, with the world being so global you have a lot more buying power with US dollars.

As some on this forum have taken pains to point out, the leveraged RE investor has done much better with the same available capital (i.e. a down payment) than just about anyone in the stock market.

And that’s the direct result of government policies that have skewed investment returns toward leveraged RE investors.

Easter was April last week, so I wonder if that skews things.

So the renter has 500k invested in Enbridge earning 40k a year while the landlord has a 500k condo that is paid off and cash flowing like 22k a year?

What if the renter has invested their capital in Enbridge and makes a greater return than the landlord?

Too much of our economy is related to real estate. If we can’t increase supply with new construction, then we have to increase supply by prying existing real estate out of the hands of passive real estate investors.

“I’ll give you my (real estate) when you pry (or take) it from my cold, dead hands”

– bloggers on HHV

Aside of the comedic relief, it isn’t going to be as if you have a choice. There is a cycle to real estate and we are now into the stage of investors divesting themselves of surplus existing rental properties. That will bring more supply onto the market and bring home prices down. Or at least condo prices down and to a lesser degree detached house prices.

Ground zero – is the downtown condo market. The Months of Inventory, average days-on-market (DoM), and the Sales to New Listings Ratio (SNLR) indicate this as our weakest market. One can see this happening as there has been an increase in listings for downtown pre-owned condos of less than five years in age on the market. Condos that have been in the past attractive to investors. If we are going to have a glut of housing this is where it will manifest itself first.

Marko, good to c house sales pushing up , maybe the worst is behind us , and we can c start to c prices move higher too . This could be the bottom and a good time to buy

Thats why the marginal bracket gets adjusted.

Why would a diehard EV owner even consider buying Enbridge stock?

He is not asking for sympathy. He is explaining the practical result on his decision-making.

The thing with “eat the rich” philosophy is that you are eating the source of your tax dollars and productivity if you get the tax policy wrong and scapegoating deflects from getting to reasonable solutions

Canada has a nice natural environment, good banking system, and a stronger social safety net than the US and thankfully fewer gun violence problems.

However, when you can’t get a doctor or preventative medical care and you are walking past homeless drug addicted people and paying more taxes while the problems that matter to you get worse and not better you start wondering about where you want to put your life energy. If government decision making was less political and more pragmatic I think this would be different.

If I was just starting and did not own a home yet I would be looking at getting a job or starting a business outside of Canada. Information on how to do this is so accessible these days.

To be fair there should be an adjustment for inflation on the capital gain amount. If an item has doubled in the last twenty years then there is really no gain (and probably a loss) because of inflation. To tax inflation which is primarily caused by government is bordering on the obscene.

Like every investment.

Marko, think how stupid the average Canadian is and then spend five minutes thinking what the word average actually means. People wont connect the increased taxes with doctors leaving Canada.

Me moving all my assets out of Canada ten years ago is not all that important. Two of my brothers and one of my sisters moving their businesses actually represents over a hundred high paying jobs on products that were mostly high value exports. A drop in the bucket but how many drops before you have a river?

OK so I’ll say speculative investment. You find out at some future date if it’s good or bad.

The capital gains inclusion rate went up to 75% across the board under Mulroney and we survived. But people forget.

I don’t think the current capital gains policies are optimal however, I think different rates should be applied to different assets depending on whether they involve increased production. Existing residential RE does not.

People are dumb. They will start to get it when their childrens’ pediatrician moves to the US.

This can’t continue too much longer without consequences imo.

I’ve brought this point up many times over the last 10 years on HHV. For me personally, selling rental properties doesn’t make sense because if I have a rental condo worth $500,000 returning x%/year it’s not like I can sell it and re-invest $500,000 into I don’t know, Enbridge paying a 8%/year dividend.

Due to fees and capital gains tax I have a lot less than $500,000 to re-invest; therefore, the return has to be much higher. The higher the capital gains tax inclusion/taxes go the less incentive there is to sell imo.

Also when I retire the capital gain will be in a lower tax bracket so if I do sell one day it will be when I retire and I’ll sell those with the least appreciation first.

It’s not a bad investment if it goes up in value. Some investors by stocks on margin which means they are paying interest on part of the investment in hopes of higher returns.

Very popular politically to add extra taxes to people with higher incomes/assets.

However, tax changes have consequences that are well known and people that are business minded, strategic and productive in ways that build wealth or garner higher incomes are already paying disproportionately higher taxes. By increasing the cap gains tax Canada becomes a less attractive place for business, incorporated professionals or high earners.

You might not feel sorry for top performers paying disproportionately more tax, but the Canadian economy will not grow in the same way if those with the aptitude for business are disincentivized by this. The Canadian quality of life will eventually be impacted. More capital and high performing professionals will leave Canada. Businesses will not be started here at the same rate. It is already happening.

Canada just doesn’t produce very much. We have bought and sold a lot of real estate amongst ourselves with prices propped up by temporary resident and immigration numbers which are about to plummet. We will still have a supply issue so there will be demand, but the volume of RE transactions has/will drop and I don’t see that prices will rise much near term. Without oil the general economy would fall into a tailspin. We should be creating conditions to reduce this reliance by supporting new tech or other businesses, but we are doing the opposite.

I think things are about to get worse. Government debt appears irrational, as is government spending. Looking more likely that the Canadian dollar will drop further and we enter a period of recession.

Confirmed

A subsidy means someone is paying below market. Now a sitting tenant under rent controls can be paying below market and that’s a subsidy.

However if a property is being rented out at market but the rent doesn’t cover expenses (and I mean actual expenses not principal repayment) that’s not a subsidy. It’s just a bad investment.

Yes Westerly delaying selling your investment might work for you. But I am of the opinion that this is just the start of increases in Capital Gains.

A bird in the hand is worth two in the bush

At today’s prices and interest rates, most renters of sfhs are being subsidized by the owner. A single home can house 3 generations, far more economical than each generation living in separate apartments.

As mentioned, not looking for sympathy, but like other investors we’ll consider delaying our sales. 3-5 years from now our income and taxes will drop considerably. It makes a difference.

So $150K less after tax proceeds given a $2 Million gain (note that’s just the gain, it means the sale proceeds are more than that) are going to derail your life plans?

Put away the violins.

The outcome of the shortage is not the same. If the property is owned by an investor rather than an owner-occupier there is an increase in economic inequality. The investor captures the gains in both the investment property and their own residence, and the renter loses ground.

If the senior vacancy rate is 20%, (I don’t know where) it’s because it is far more expensive than staying in your own home until you’re in your nineties. Usually alone. Once the house is paid for, food is $500 per month, taxes and utilities $700, lawn care $300, well under $2000 a month. I heard that fire departments (in Winnipeg I think) were going to start charging $2700 to go on a call to help someone off the floor in a personal care home. The staff were not required (or didn’t have the equipment) to lift them up. Also, there are no rent controls on senior housing if food and other care is included in the monthly fee. Not many seniors can afford $4000-5000 a month. It sucks getting old.

And, before you light your torches, yes do the math backwards and see I’m talking about capital gains of aprox $2 million and our marginal tax rate is aprox 50%. I’m not asking anyone to feel sorry for me, but the gain was going into our forever home. Instead we’ll stay in what may have become a rental for another couple years – denying more housing. Trudeau does not understand that you cannot tax your way out of the housing problem. Quite the opposite.

I agree that the increased capital gains will cause some investors to pause. We’re in that boat and reconsidering selling developable property in the near future, I know someone else also reconsidering. For us it’s a tax difference of aprox $150-$170K. We may only sell a lot or two a year to reduce the pain, or maybe we’ll sell one property and not the other. Regardless, I am doing the tax calculation. At the very least we will wait for the fed election and see what happens. And, we are not one of the .01%’ers that Freeland is lying about- not even close. This tax will affect many families.

Senior housing vacancy rate is like over 20%. Think we’re okay there.

Our government’s failure to provide adequate spaces for seniors in personal care homes and encourage them to stay in their homes as long as possible is contributing more to the housing crisis than many of the other factors discussed. No mention in the budget about building more facilities for seniors. The new capital gains tax rates will also discourage investors, like myself, to liquidate their properties. Individuals who invested decades ago did not anticipate millions of immigrants coming to Canada, or maybe they did.

Gentrification was one of the causes of our current affordability problem. If you could swing a hammer then you could renovate an old pre 1960’s home and flip it for a profit.

But most of the houses remained the same size and underutilized the size of the lot. That drove land prices up and made it increasingly difficult to assemble lots for multi-family town homes. So builders needed more units to make a profit and that meant the condos had to get smaller and smaller.

The downtown condo market is a somewhat unique market in that the downtown area has a higher percentile of investors than the surrounding districts. The average monthly rent for a downtown condo is $2,255, according to Craigslist, calculated over 110 listings. That’s a Gross Rent Multiplier *of 20 for the downtown core.

At the moment we are at the highest number of active downtown condo listings since January. The median asking price is $624,900 calculated over 187 listings.

The downtown core has a three month average of 26 sales per month. The median sale price is $545,000 calculated over 77 sales over the last 90 days. That’s about 7.25 months of inventory. Average Days-on-Market is 48 and the Sales to New Listings Ratio (SNLR) for last month was 25% which means that for every condo that sold – four were listed.

Most properties sell within a 91% to 103% of asking price with the average at 97% . Yet the agents have the median list to median sale price spread on downtown condos at close to 13%

*The GRM is a simplified inverse calculation of the Capitalization Rate. A GRM of 20 is roughly equivalent to a Cap Rate of 3%

Looking at these numbers my opinion is that the market for downtown condos is soft / bearish, being in favor of buyers.

If a renter is evicted, and an owner-occupier buys the home, the process that takes place is called gentrification. With a winner (owner occupier) and a loser (evicted tenant). Where the higher income people are able to buy the homes and lower incomes find it harder to even rent homes, leading them to options like moving away, living in their car, homelessness etc. The housing market isn’t a closed system in Victoria – people move here and others are forced out through gentrification. Rental units slow down this gentrification.

The renter gets more victim points than an owner-occupier.

But landlords are evil, so I don’t know what the final woke score is.

Maybe the house should be converted to a safe injection site?

It isn’t simple like that. Because tenants that rent the investor’s homes are not the same group as the owner occupiers that would own the homes if there was no investor. Someone may move here from Prince George, with a good job offer, but no savings to buy a home. And he’s able to rent a home in Victoria because of landlords providing the service.

Rentals provide an opportunity for lower incomes to rent homes, and these are often people that could never afford a home. Investors provide the opportunity for lower income people to rent homes.

A tenant moves out of a rental and the owner puts the property up for sale and sells it.

What has happened to the home occupancy rate?

And if the new owner rents it. What has happened to the vacancy rate?

Solid sales pace this week, April sales should exceed last year at this point.

The would-be owner-occupier is displaced with a renter.

Is that good or bad? Are owners better than renters?

The housing supply, and shortage, is the same either way.

I think that was Nan’s point really. An investor is simply displacing someone who wants to be an owner-occupier. Because of this the investor is receiving the windfall from the runup in prices due to wrongheaded policies, not an owner-occupier. I don’t mean investors in purpose built rentals of course.

I used to be a landlord by the way.

“However, the last decade or so has been anything but normal. The low interest rates and ease of financing has caused a lot of people to become heavily weighted in real estate. They have all of their eggs in one basket.”

I’m not sure if this was supposed to argue my point. Once again, the housing stock has not changed. Investors purchase housing and rent it. Rental prices must be low then?

“We will never meet the 70s construction rate , gone and never come back . In the 80s we could get a house done in 6 months . Today I’m watching workers on the same house 2/3 years . So no , even if u can easily get rezoning , construction is an industry bogged down in regulation and that’s never going to change”

I’m saying there is a lack of supply given the total demand for all types of housing. We can adjust the demand through immigration etc, but investors are not the enemy. Yes, the construction industry is bogged down in regulation. I think its worthwhile to try and reduce government bureaucracy to try and reduce the time and costs for projects.

People struggle with the concept that “good ideas” can be in conflict with each other. Why can’t you discourage energy use and increase the costs and have cheap building supplies and labour? Why can’t you protect the trees, the environment, discourage cars, have super safe and environmental building codes and have cheap houses?

Investors are important to the marketplace. As they cause housing to be built and thereby increase the stock of housing.

They also moderate the highs and lows of the real estate market. When prices get too high and it no longer makes economic sense to buy they become net sellers and thereby increase inventory which leads to lower prices.

When prices are too low, then investors will once again buy rental homes as they will once again be making a good return and prices will rise.

However, the last decade or so has been anything but normal. The low interest rates and ease of financing has caused a lot of people to become heavily weighted in real estate. They have all of their eggs in one basket.

We will never meet the 70s construction rate , gone and never come back . In the 80s we could get a house done in 6 months . Today I’m watching workers on the same house 2/3 years . So no , even if u can easily get rezoning , construction is an industry bogged down in regulation and that’s never going to change .

Couldn’t agree more. Adding more regulations and “enforcements units” and departments to enforce these regulations does not help supply whatsoever. Record housing starts occurred 50 years ago!

Just think about the SRT non-sense. The person I phoned in licensing @ COV said he couldn’t help me as they have a department for SRTs so he transferred me there. Now the province will have their own enforcement. Resources are being waste left right and center on things that have nothing to do with adding supply.

Or governments could focus on revising immigration to allow construction workers into the country, open/invest in trade schools/programs to train more people in trades, decrease bureaucracy when it comes to construction/housing or at least try to maintain is status quo which they can’t seem to do, etc.

Nan, I think it pretty sad that your comment has any thumbs up and it makes it pretty clear to me that you have never been a landlord. The market isn’t expensive because because investors are morally bankrupt. It’s expensive because we have a housing supply issue. The total housing stock doesn’t change when an investor purchases a unit. I wish people would get off their high horse and start focusing on how we can actually fix the issue, which is to try to fix the bureaucracy around housing.

Be true eco warriors and make Vancouver Island energy independent by going on the 100 mile energy diet. We have all the coal right here and the ability to liquify it to make it usable. No need for pipelines or shipping solar panels through cumbersome and energy intensive supply chains.

https://science.howstuffworks.com/environmental/energy/coal-liquid-efficient-gasoline1.htm

Luckily we receive 4 million exajoules per year of free fusion energy or we’d literally be freezing in the dark.

(exa = 10^18)

When I roll coal with my modified F-250 there’s an indescribable feeling of joy that you saps driving compact EVs will never experience.

First link I googled for Switzerland co2 per capita – Switzerland’s large footprint is partly driven by all the goods it imports. If emissions generated via imports are counted, the footprint of each resident of Switzerland is 14 tonnes of CO2 per year. In comparison, the global average is six tonnes.

There are zero examples of places with high quality of life that use very little energy. Canada also has extremely cold temperatures and vast distances. Energy is the single most important commodity on the planet.

Wow!. This is a remarkable and good news story all around. It shows how one person’s dream to help the homeless can come true, and 99 homes are built and sited on a 65 acre patch of undeveloped forest . Located outside the city (Fredericton NB), but on a transit line and near to big box and other stores.

From the tech entrepreneur who funds $4m (and works full time on the project throughout), to the locals building the homes from scratch, the landowner who sold him the land at a discount, the helpful (yes, helpful!) government officials, to the descriptions of the formerly homeless residents that have found homes.

A real feel-good story! Worth a read if you’re frustrated and jaded about reading about housing solutions wasting money and going nowhere. Here’s a story about someone who actually got things done.

Here’s a Maclean’s article with the details. https://macleans.ca/longforms/tiny-homes-fredericton

A nice anecdote in the story. The developer finds the 65 acre of forest for sale for $550k, and offers the seller $500k. The seller hears about the homeless project he’d be building, and counters at $450k !

A pic of a formerly homeless resident in their new tiny home …

https://www.theglobeandmail.com/real-estate/calgary-and-edmonton/article-calgary-tenants-shocked-by-heavy-rent-increases/

N.B. tiny home village complete after ‘cranking out’ a house a week for 2 years

https://www.cbc.ca/player/play/video/9.4205532

So aggregate the numbers for Switzerland with the EU and Canada with the US, taking into account domestic demand and import/export balance, and get back to us.

Did someone say the government announced an enforcement unit today? lol……..how bloated can the government get before everything crumbles. Introduce something like spec tax, create new department to administer, then create department to enforce by crown liening people’s titles, then another department for removing those liens….rinse and repeat with new regulations.

The rules are so convoluted the enforcement team(s) will have trouble understanding. I posted my question about whether I needed a license for stays over 30 days in a principal residence in a short term rental group on FB and everyone gave a different answer/understanding 🙂

All the EV Ready plans coming back really positive in the buildings I own in, this is for a 2014 build in Vic West

“Your house system is capable of sustaining 226.304kW of power that this plan would require.

This is equal to thirty-four, 40 amp (6.656kW), 208 volt, 2 pole breaker systems that would

share potentially up to seven EVSEs per circuit for a total of 204 potential EVSEs but with the

expectations of only 202 potential EVSEs. Your two, two stall private garages will be allowed

to connect one EVSE each.”

Infrastructure Costs:

– Coordination with City of Victoria and BC Hydro

– One 400-amp, 347/600V 3 phase EVSE sub-service from common property system to

dedicated EVSE panel to distribute branch circuits. This includes a new breaker,

transformer, and 800-amp 120/208 volt ‘EV Panel A’ (c/w 1 X 400-amp 3P breaker, 18

X 40 amp 2P breakers and 1 X 15 amp 1P breaker for local LV system). EV Panel A to

feed ‘EV Panel B’ (c/w 16 X 40 amp 2P breakers and 1 X 15 amp 1P breaker for local LV

system).

– Sub-Contracting: Electrical engineer determination letter and single line diagram

alteration

– Sub-Contracting: Coring/scanning as required

– WAP installed throughout connected back to strata supplied internet connection for

EVSE vendor cloud-based billing or energy monitoring

– All pipework, wiring, fittings, and hangers throughout to junction boxes within 5

meters of all parking stalls

– All labour required for infrastructure installation

– Permit for all work

– DOES NOT INCLUDE Electrical Operating Permit

– DOES NOT INCLUDE Strata lawyer costs for bylaw and rule changes

– Coverage of 204 parking stalls

– 1 year parts and labour warranty

Total Infrastructure Budget – $345,139.81 plus GST

REBATE @ $600 per stall X 204 stalls – $120,000.00

Balance infrastructure cost = $242,396.80 (with GST on $345,139.81)

LMAO. Yes if only they had listened to anonymous blog guy.

Why would they relax, when the retroactive fines could be $5000-$10,000 per day?

If STR rules are as well enforced as environmental or forestry regulations in BC then STR operators can probably relax until they get their first warning letter 2 years from now.

C’mon Patrick, don’t play dumb. The concept of larger fines for corporations than for “individuals” is incredibly widespread through all kinds of law as I am sure you know. And it has nothing to do with corporations being evil. It’s all about the potential size and scale of violations as well as the fine needed to be an actual deterrent.

Nan> Perhaps your prelaw should have focused on getting your facts straight. And precisely what is prelaw in the first place? I never practiced in the United States (surely your extensive prelaw taught you that the United States does not have Barristers and at the very least that should have been a hint) and making unfounded allegations as to a persons ethics must have been covered in your so called pre-law classes. Out of curiosity did you actually graduate with a Bachelors degree and from what University.

Gave everyone on hhv plenty of warning lmao.

Do those numbers factor in the energy embodied in imported and exported goods?

The numbers are meaningless if not.

Well if quality of life means cruising in your F150 perhaps.

Here is some food for thought. Annual per capita energy use (all sources, kWH equivalent):

Canada 102,160

Switzerland 33,351

https://ourworldindata.org/grapher/per-capita-energy-use

Nan- That’s quite an accomplishment for someone in their forties who would have graduated just prior to the great financial crisis. Then had 10 years to build 6 businesses with 330 employees only to be hit with the pandemic. Congratulations, you’re one incredible person.

The government airbnb announcement turned out to be “worse than a wet fart”.

Including absurd high financial penalties for violating their poorly defined guidelines and overlapping rules. $10,000 per day in fines possible for str hosts violating their rules. To illustrate how arbitrary and punitive the fines are, the fines are up to $5,000 PER DAY for individuals and up to $10,000 for corporations. Why should “corporations” face up to double fines for the same “offense”. Oh right, corporations are “evil”, so they pay double.

This is just an example of the government taking completely legal and productive behavior (str rental) and treating it like a serious criminal offense. And they’re proud to announce the “investigations” to catch the str “crooks” that will begin after May 1, by an impressive sounding “provincial enforcement unit”. Meanwhile, plenty of legitimate crimes go un-investigated. Like money laundering- whatever happened to that?

https://bc.ctvnews.ca/b-c-premier-to-make-announcement-on-short-term-rental-rules-1.6852275

“ Short-term rental platforms that violate B.C.’s pending regulations can face administrative penalties of up to $10,000 per day, officials announced Thursday.

Investigations into non-compliant companies and individual hosts will be conducted by a provincial enforcement unit, which will launch once the new rules take effect on May 1.

The Ministry of Housing said daily penalties will range from $500 to $5,000 for hosts, depending on the infraction, and reach as high as $10,000 for corporations.”

https://www.theglobeandmail.com/business/article-gen-x-millennials-net-worth-wealth/

@ Frank – I have 330 employees across 6 businesses. The only real estate I hold is personal real estate I live in and commercial property I use for the businesses.

@ Barrister – As a retired lawyer who practiced successfully in the US, I am sure ethics wasn’t high on your list of priorities. That being said, my philosophy class was part of pre-law in the early 2000’s. Perhaps consider some PD for fun and learn about it! Maybe you’ll see things differently.

“The public is getting played well.”

“Never ascribe to malice what can adequately be explained by incompetence.”

From a couple of days ago. I wouldn’t say the public is getting played or our levels of government are incompetent.

I would say our current issues are related on inability of society to think critically and prioritize important goals. The leaders just reflect that inability.

It could be said that we are reaping the rewards of all our “well intentioned” ideas and failing to think about how that impacts the most important goals.

I would submit that what we should care about is:

1. Fertility rate (demographic time bomb)

2. Cost of energy (high quality of life=high energy use, low energy use=low quality of life)

3. Cost of living including housing (young people leaving BC for Alberta – women have less children as the cost of living increases)

None of the following items helps the above items.

1. ALR (we already get 90%+ of our food off island)

2. Pushing for density and not prioritizing SFH (women choose to have more children in houses than apartments)

3. Making energy more expensive (gas taxes, fossil fuel bans, blocking pipelines, carbon taxes, blocking dams & over regulating nuclear)

4. Amazing building codes and green ideals (so safe!, but not what we were doing when we previously successfully built houses quickly)

5. Prioritizing bike/bus lanes over building a decent highway so that commute times to places that build houses are short.

6. Climate change coordinators and tree protection officers (not cheap or helpful for our primary objectives)

7. Vastly increasing regulation of all kinds

8. Increasing taxation levels to spend money on non priority issues (eg. EV vehicle and heat pump rebates)

Blows my mind that they are only just “considering” it now. It’s been obvious for decades that there is so much underutilized land there. Also some seriously substandard military housing

The STR announcement was truly a nothingburger. Basically trying to remind folks that “the province is on it”

david eby speaking live: https://bc.ctvnews.ca/b-c-premier-to-make-announcement-on-short-term-rental-rules-1.6852275

Feds consider turning some CFB Esquimalt land into housing

https://www.cheknews.ca/feds-consider-turning-some-cfb-esquimalt-land-into-housing-1200015/

While I hope they’re “buckling”, it’s more like to be a “wet fart”.

https://bc.ctvnews.ca/b-c-premier-to-make-announcement-on-short-term-rental-rules-1.6852275

Are they buckling or doubling down? Or the standard government wet fart announcement where they just keep re-announcing everything…

Reality is in this market there are very few inventors in the market; therefore, your buyers for the most part will be owner-occupiers and no owner occupier is going to want to complete on a property and take on the tenants until the move out. The majority of the time the completion/possession date is a few days after the tenants have to move, in accordance with legal notice.

You don’t have to give tenants notice to sell the property. You have to give them notice to get them to move out.

Aren’t taxes were based on nominal value? In times of high inflation, you’ll be paying taxes even without change in actual value.

If you can get taxed at the old rate (50%), compared to the newest blended rate…