The non-permanent residents

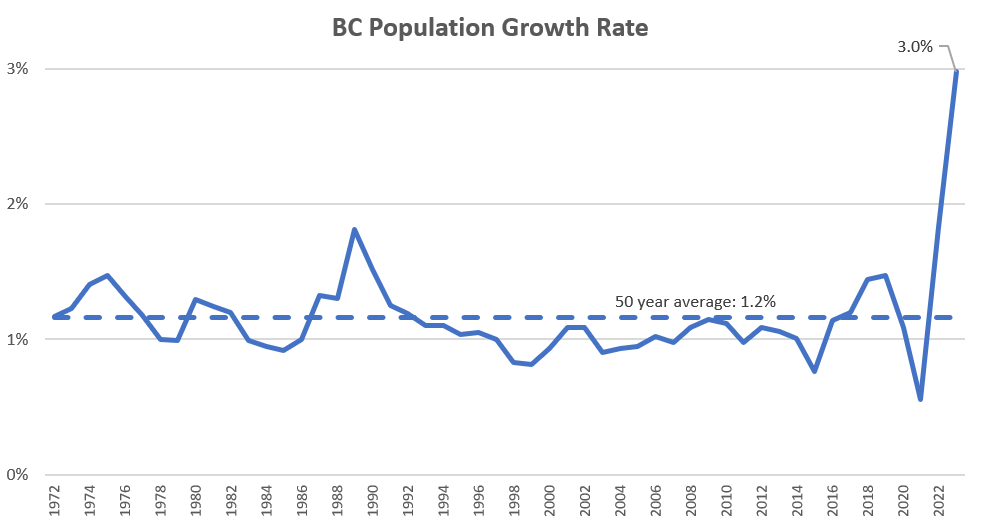

Much has been written about the surge in population growth in recent years, and indeed year over year growth in B.C. has spiked to levels that we have not seen in many decades.

Many have blamed the national spike in prices on this, and of course it’s true that more people represent more demand which requires more housing to be built. It’s also true that even in a YIMBY utopia, it’s not possible for housing construction to respond to changes in demand that quickly. It takes time to build capacity in the labour market, and to physically build housing (average construction time for apartment buildings in Victoria is just shy of 2 years). But the recent surge in population growth is not a primary factor behind the post-pandemic price spike. As I’ve mentioned before, non-permanent residents only directly impact the rental market because they generally can’t easily buy (foreign buyers tax and bans). Rising rents do drive more people to buy as the gap between buying and renting shrinks, but this is a secondary effect. A surge in the temporary resident population takes a while to filter through to higher prices, and the post-pandemic jump in prices was primarily a reflection of low rates and changes in living preferences that spiked some markets. The weak connection between population growth and prices is also evident in the drop in prices since 2022 despite ever-increasing population growth rates. There’s no doubt though that without a commensurate increase in the supply of homes, more demand from people needing a place to live will eventually drive up house prices as well as rents.

Equally important as the headline number though is how population is growing. The 500,000 a year target for permanent immigration sounds high but is mostly just compensating for a drop in the natural growth rate. If we only had natural growth and permanent immigration, the population growth rate would be entirely unremarkable. What’s really different in recent years is the large jump in non-permanent residents, generally composed of international students, temporary foreign workers, and refugees or special programs (people fleeing Ukraine, Hong Kong, Iran, etc).

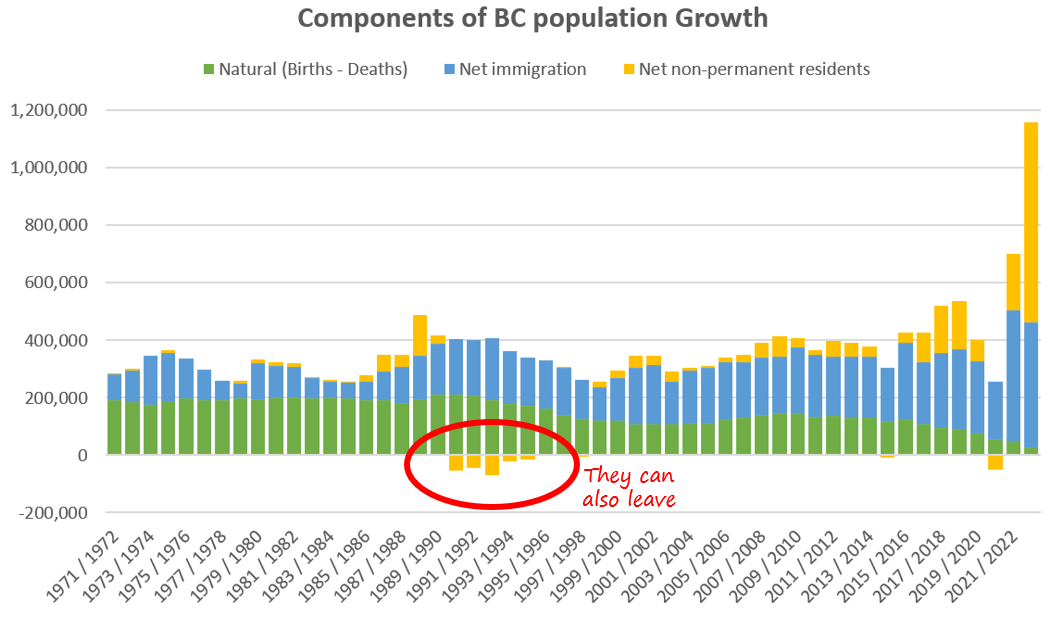

But the thing about non-permanent residents is, well, that they’re not here permanently. They can come quickly, but they can also leave quickly. That’s what happened in the late 90s when the economy soured and there was a net outflow of temporary residents. The same could happen again, but this time the numbers are far larger, and with it the impact on the housing market.

If you’re a rental investor I would make sure your investment still works at vacancy rates higher than we’ve seen in Victoria for the last couple decades. Especially with a large-scale switch to rental construction in recent years bringing in more (desperately needed) secure rental housing, it’s a scenario that should be taken seriously. Worth remembering that 3% is the minimum healthy vacancy rate where rents generally start pacing inflation rather than spiraling upwards. Just because Victoria has the worst chronic rental vacancy rate in Canada and has been seemingly stuck at very low vacancy rates for decades doesn’t mean it must stay that way. With a larger percentage of our population composed of non-permanent residents, it increases volatility in both directions.

All that is true before two substantial announcements about reforms coming on this file from the federal government:

- International students cap to reduce admissions to 35% below 2023 levels and

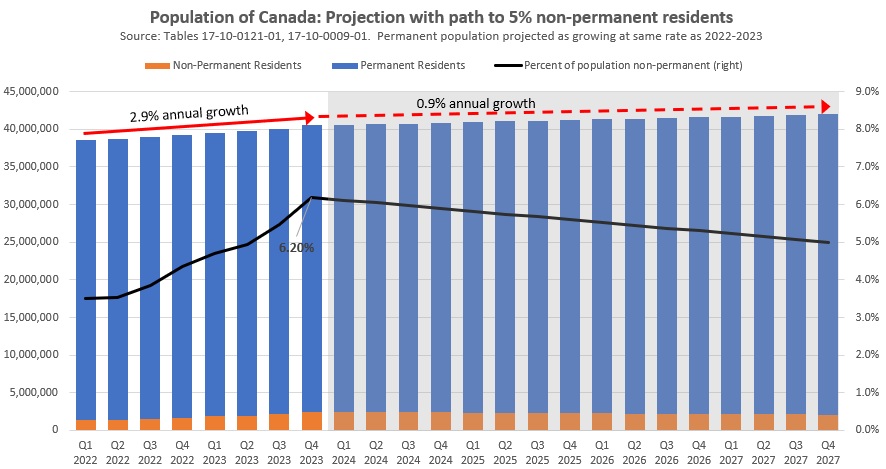

- Limiting the total number of non-permanent residents to 5% of the population by 2027

The first is in many ways less interesting than the second, because it’s merely one of the mechanisms by which they will achieve the overall target. International student caps will mostly hit Ontario where international enrollments went stratospheric in recent years, and to a lesser extent the lower mainland. I don’t expect a big hit in absolute numbers in Victoria, but expect some pain at the various institutions on the island as budgets are crimped.

For the second, the government is promising to reduce the proportion of non-permanent residents from 6.2% of the population in the last quarter of 2023, to 5% of the population in 2027. That means about half a million fewer non-permanent residents will be in Canada in 4 years from now. Is that a big deal? Yes and no. Yes, in that after years of large increases in that population, we are flipping over to decreases, and they could be front-loaded. No, in that it’s unlikely to actually drop the population if phased in gradually, and we will basically be returning to a level of growth we had before this recent spike. The below chart shows a scenario where non-permanent residents are reduced to 5% of the population over the projected period, while the population of permanent residents continues to grow at the previous rate. While the growth rate drops dramatically, the population of Canada would continue to grow at a modest rate.

It’s been obvious that the policy error of unchecked growth would have to be reigned in, and it seems that job is being done. As job vacancies decline, it makes sense that the number of non-permanent workers would also decline. Overall, likely one of the few demand-side interventions that actually have a sizeable effect, giving supply-side reforms a chance to catch up. Given some of the impacts of the reforms will be front-loaded, I expect the national rental vacancy rate to start to rebound from last year’s lows.

Also the weekly numbers

| March 2024 |

Mar

2023

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 44 | 162 | 299 | 446 | 590 |

| New Listings | 114 | 427 | 784 | 1084 | 1118 |

| Active Listings | 2354 | 2470 | 2588 | 2655 | 1970 |

| Sales to New Listings | 39% | 38% | 38% | 41% | 53% |

| Sales YoY Change | — | +8% | +5% | +4% | -29% |

| New Lists YoY Change | — | +26% | +35% | +31% | -8% |

| Inventory YoY Change | +27% | +31% | +35% | +38% | +85% |

| Months of Inventory | |||||

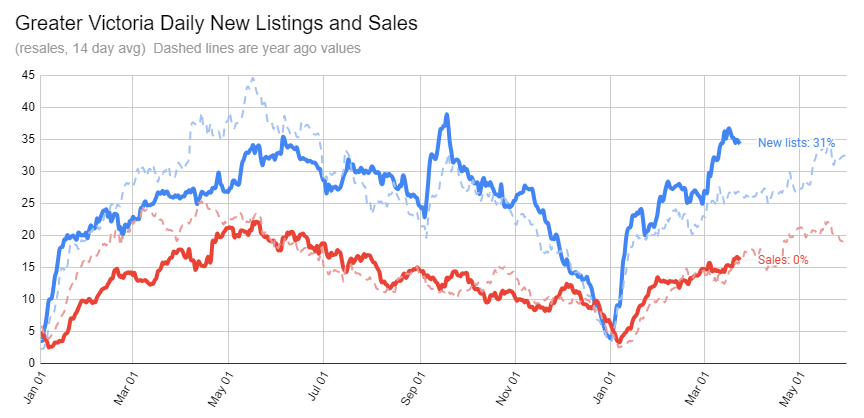

No great change last week, with sales still tracking the year ago level pretty closely while new lists have held up at about a third higher than last year.

It’s worth remembering that April and May are generally the highest months for new listings, so we are likely to see another leg up in new listings levels in the coming weeks. That should bring inventory a good bit above 3000 as the peak for the year, which we haven’t seen since 2015.

In other good house-hunting news. Zealty is now showing sold prices on the island (sign-up required, I have no affiliation with Zealty).

New post: https://househuntvictoria.ca/2024/04/02/march-market-update-2/

Earthquake hit Taiwan today. That’s when density really sucks, along with no insurance.

You need to remember that the news was full of Modern Monetary Theorists assuring us that printing money does not cause inflation.

A lot of people are not able to recognize crackpot nonsense and believe whatever the media tells them.

looks like Abby road made the right choice by waiting, pending at 1.225.

People whining about 5%…Too funny.

Good times.

I would have only been 8 years old at that time, but the misery was everywhere. This Is a hay ride!

Anything real estate was toxic. Bankers, realtors, all the trades, suppliers. It was logging and commercial fishing that pulled us out of that one.

https://www.forbes.com/advisor/ca/mortgages/mortgage-rates-history/

This is a condo or a suite in a house?

Just slightly under market, as usual. Not less than it would have rented for pre-Airbnb ban.

This conflict is actually quite minimal compared to some other instances (a company s banked by the bank and the analysts employed by the bank are also provide their analysis of the said company’s stock to investors.)

I wasn’t talking about rentals, but feel free to go back in threads here in 2021/22 where rates, debt and price escalation were being discussed to see what perspectives were being thrown around by folks.

You’re the one adding the term “idiot” into the discussion and not me. The point is that belief is the enemy of reason and people decided to put themselves at risk on a belief that what was going on was what was going to always be, mostly to justify their actions to satisfy getting what they wanted. They worked hard to convince themselves that it was the new normal and were antagonist (to put it mildly) against any counter narrative at the time. Hence, it being a belief instead of reason. People like simple things over complex reasoning. I know many seemingly intelligent people that refused to take 1.6% 5 year fixed on their renewals because during the pandemic because they were getting a 1% on a variable because they programmed themselves to believe that variable always beats fixed and no amount of reason could shake them from that belief.

Come on, their business is to sell mortgages and how hard would they look to push narratives that would dissuade their costumers from buying their primary products like variable mortgages when there is money to be made. Nothing nefarious or a conspiracy, but how hard would they look for something that would have a negative bottom line impact and then decide to advance it? I believe the term is “the rational self actor”. People didn’t want to know it, so they choose not to see it, as a result those swimming in debt complaining about high rates have no one to blame but themselves.

BNS kept it real

It is nice to see more inventory as we enter the spring market. Now if it were only the right kind of inventory. More one-bedroom condos are not going to help with stabilizing or lowering prices in the middle income house market.

Having said that, I have noticed more 1970’s basement homes for sale in Langford and Colwood than in the past. I wonder if we might see a shift in buyer’s preferences away from newer homes on small lots to the larger older basement homes on large lots.

Developments like West Hills and Royal Bay are nice – but they tend to be boring repetitive housing.

In my opinion mortgage money is still cheap at the current rate. It’s just you need more of it than ever before.

One may have thought this would have brought prices down similar to what happened in 1994 and 1995. It hasn’t. Or maybe I should say it hasn’t yet. It takes awhile for interest rate increases to percolate through the market.

I mean literally none of the big banks saw the magnitude of the increases coming. They were all dead wrong in their forecasts made in fall 2021.

Basically you have to go back to 94-95 to find a time that interest rates increased as much as 2022-2023 in a two year time frame. So I don’t think it is quite right to characterize anyone who didn’t anticipate the recent round of increases as idiots who “think buying lotto tickets is a prudent retirement planning”

Umm…really. Would you say the same for rental rates? Is it unrealistic for landlords to expect these rates to remain at the current levels with the clamp down on vacation rentals and new rental projects?

Ask me in a year from now and I will tell you how obvious it should have been to landlords.

The “experts” were warning of rate increases, but very few called the pace or magnitude of the increase. Most people don’t follow monetary policy. Therefore to most people the size or speed of this interest rate increase was not “obvious”.

The experience of the last 15 years might have lulled people into a false sense of security, i.e. when rates go up they only go up a bit and quickly come back down. Even in the longer historical perspective the 2022-2023 increase is large and sudden (admittedly from insanely low levels back to more normal levels).

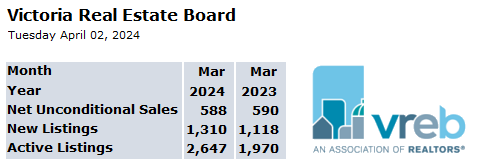

Final March numbers

Sales: 588 (unchanged from last year’s 590)

New lists: 1310 (up 17%)

Inventory: 2647 (up 34%)

How could they have not? It was obvious at the time that low interest rates were a one time crisis measure and massive sovereign debt spending was going to result in inflation that was going to need to be corrected by an escalation in interest rates. These people convinced themselves that rates would stay low to justify themselves in mismanaging their personal finances. Likely the same people that think buying lotto tickets is a prudent retirement planning. In the end hope is not a plan.

I don’t anticipate any increase in the number of forced sales to show up on the market. The market is still stable and orderly. Drop the price by 5 percent under market value and you may get multiple bids. No anticipation of an increase in forced sales on my part.

However, my insiders are telling me that real estate agents are having problems pricing properties in this market. This is one of the more difficult markets to estimate market value. One needs more to rely on than a few sales and a property’s assessed value.

Early Easter likely skewed both sales and listings IMO. I think the next two weeks should set the tone for the rest of the spring market.

How did you price it?

Sure but very few will actually forced to sell.

VicREanalyst, those that bought at the pandemic low interest rate are going to have a significant increase in their monthly payments. Whether they qualified at the stress test or not. I highly doubt that anyone at that time was anticipating nine rate increases from BoC. That’s something that most people would not have budgeted for.

Just rented a unit out and had as many applicants as pre-Airbnb changes. I think there is more for tenants to choose from, but obviously still a very low vacancy rate.

Is cable still a thing? I think we cancelled ours in 2015.

Patrick, if your getting your OAS fully clawed back and you applied at 65 you should have deferred it until 70 where you would qualify for a larger OAS payment and it would take longer to claw it all back. Your net income would need to be 140K at 65 to be fully clawed back or 280K for a couple, perhaps you could use some tax planning help? You seem to enjoy “back door bragging “ about your pension retirement income and your children’s house shopping for 2MM dollar houses.

very few were paying the posted rate at execution.

This you too?

Lower sales than last year, wasn’t expecting that.

The historical 5 year fixed interest rate cratered at 3.21% in 2021. In 2019 it was 4.25%. In 2023 it was 6.49%.

Those that could not meet the federal 2% stress test could get around the stress test by using non federally regulated lenders. A federally regulated lender would be the Chartered Banks such as RBC, Scotia, BMO, etc. Non federal regulated would be provincially regulated or most of what is left such as trust companies, credit unions, Bob’s Bank, etc.

The default rate for “A” lenders is around 0.15%. The default rate for “B” lenders is six times higher at 1%

BC is second to Ontario in defaults which sounds bad but most home owners that are coming up for renewal that anticipate difficulty making their monthly payments are able to sell. Some might even make a bit of a profit.

Couple more suited sfh went for under 1M. 981 Kenneth and 3541 Doncaster

Doubted given the types of deals currently available.

Your point does not make any sense: have you changed your position and are now asserting OAS is no longer a pension and is some sort of life end tax rebate or a tax credit starting at the age of 65? Or are you just trying to draw a false analogy?

If it is just a pension, why be concerned if you are thought to be getting it?

I doubt if many have to sell but I suspect that some cable subscriptions are being cancelled.

That’s fine, my comment was directed at whoever said lots of people are going broke and havd to sell as soon as they have to renew so I pointed out the current 5 year fixed is less than the stress test rate in 2020/2021/2022

I wonder if the credit card debt is the outstanding monthly balance amount or is it the past 30 day due amount? Is this what people are carrying after the minimum payment amount?

To be clear, so far they’ve never sent me a penny of OAS to begin with, they just “claw” 100% of it back before they send it. Presumably if income falls below a threshold they start sending it the following year, but clawbacks could still occur when taxes are filed.

Does this remind you of Garth Turner and his squirrel recipes? The 2008 GFC was supposed to happen. They kicked the can, now here we are again. Only this time? I don’t know. Avoid debt at all costs, I know that much. That was a wake up call.

I don’t like It at all. That Is why I posted It multiple times.

This Is about a quarter cow. The more quarters you buy the better the deal.

https://glenwoodmeats.ca/shop/frozen-products/freezer-packs/55lb-variety-pack/

Which is why you posted about it multiple times I guess.

I don’t like the carbon tax for selfish reasons, mainly that I don’t get any money back.

Relax. My OAS pension is 100% clawed back, which is fine with me. I suppose I have some interest from temporary use of that money for 12 months prior to clawback that’s “only“ taxed at 54%, so maybe I’ll feel good about that with my next latte.

Btw, when you do buy your first home, you will likely get a $1,500 federal tax buyer credit (HBTC) on your taxes, which isn’t clawed back. I hope you also use that to buy yourself lattes at cafes, so you don’t feel left out of government handouts.

Well, good for them. I could give a shit, I write off all my vehicle fuel expenses anyway. My Wife works from home and I heat the house with a woodstove. They do have me on grocery expenses. If you have a deep freeze, you can go to glen wood meats and they will butcher you an entire cow.

BC has carbon tax rebates, but only for lower income families. I’m gonna guess there will be some tweaks to that in the future, once the federal carbon tax is done away with.

In other words. PST just jumped to 10% today? Since BC gets no rebates.

It’s a team effort. BC has tied it’s increases to the federal schedule, but BC doesn’t send the cheques out that other jurisdictions get. It use to be “so called” revenue neutral and would come with a tax decrease elsewhere, but that was tossed and it is all just general revenue windfall now. Falcon will likely try to split hairs on the original revenue neutral concept, but Rustad will eat his lunch on that Falcon was a part of the team that brought it in. The funny thing is that Eby is probably counting on that Rustad will devour a good number BCLib/Uni voters and assume that Rustad will top out because the general public think Rustad and his team are too nutty on social issues. However, people tend to forget that the BC voter likes to unleash surprises on election and the pocket book will likely be the only thing that matters on election day this year. So, being nutty on social issues may not be a factor where many might just say well, that social issue (SOGI, DEI, addiction, overdose and etc..) is not a “me problem”, and just vote on who they think will take money from their pocket and who won’t. Of course, the Greens will be irrelevant.

I know BC started It In 2008, but this Is not the time for carbon tax Increases.

Except Trudeau isn’t responsible for B.C.’s carbon tax.

These are popping up at fuel pumps all over town right next to the price button.

https://www.etsy.com/ca/market/i_did_that_trudeau_stickers

Too funny, please, no one tell Trudeau that all he has to do is to convince people that the carbon pricing scheme is a part of being “on the dole”. Seems like he would just need to rename the carbon rebate to carbon pension and he would be set for a landslide.

No, not wrong at all. Social pension for the benefit of “social welfare” is a welfare cheque. I hope you enjoy it as it subsidizes lattes and mimosas for you at cafes in either France or Australia while looking to help your children acquire million dollar properties in Victoria.

Exactly, thanks for the supporting point. Disabled was only one example of a person that may have been economically disadvantaged, as you point out, others that may not have had the opportunity to participate in the economy during their lives in which OAS is in place to support. It’s tough to argue that people earning between 90k and 120k annually in retirement and are also likely sitting on millions in assets were economically disadvantaged and are in need of a social welfare benefit.

In summary, if you pay an accountant that works hard to ensure that you can maximize your OAS benefit, you are likely taking a benefit that was designed for someone in need. Where your pension is just a pension and is paid out to you and the accountant only works on tax implications for it.

I took a one year (1 point higher than 3 year) and was told I can renew in 6 months with no penalty. Then take another one year and renew in another 6 months. Variable was 9% at RBC.

Not sure I would personally go five year fixed right now as you might regret the last two years. I would probably go three year fixed at the moment. The discount on the variable is so poor it is a gamble right now. Things might change later in the year where varaible starts to make more sense (closer timeframe to rates being cut).

-$3,929 on their credit cards. (notices the cards) meaning not one.

-$20,165 in student loans.

-$21,717 in car loans.

-$13,986 in personal loans.

=$59,797k.

That Is a rather difficult amount of consumer debt to carry each month on top of the mortgage, considering they are all high Interest.

https://www.sunlife.ca/en/tools-and-resources/money-and-finances/managing-your-money/what-s-the-average-debt-in-canada-and-how-do-you-compare-/

Then there Is:

-Starbucks.

-Gym membership.

-Childcare.

-Cell phone.

-Groceries.

-Hydro.

-Property Tax.

-Strata fee (If applicable).

-Parking for work.

-vehicle fuel/ vehicle maintenance.

Even a couple each clearing $120k (after taxes) for a $240k combined Income (after taxes). There’s not much left.

Loans officers will review your bank statements for the past five years. They know what’s coming In and what’s going out.

Yes, that’s the downside.

Young people did get $2000/month to stay home and play video games during covid, so there was an upside too.

Overall, it was not a good deal.

Was it a good lesson?

Not sure what that means, if one’s mortgage is up then ya they will take the best deal they can get to renew.

No one thought they would stay there forever. I would be thrilled for a 5% five year fixed renewal In Dec 2025. If rates come down, well that’s great too. Renewing Is still borrowing. I see these Uber Eats drivers In their middle ages driving cars that cost who knows how many 10’s of thousands of dollars, add on credit card debt. I’m sure driving for Uber Eats Is not their day job, Its their second or third job. Its consumer debt, not mortgage debt. Those will be the ones you could possibly vulch.

Sure, but is that happening? (I honestly don’t know). My impression was that the prevailing mantra / advice has been “go / stay variable, rates will drop soon”.

5% still isn’t much relief to those who borrowed at 200 points lower than that, and were convinced rates would stay there forever.

…Or they can just afford to not do anything at all, other than occupy the house and live happily ever after… Just like Its supposed to be.

Funny one can renew a 5 year at lower rates currently 😉

We haven’t seen a big rise in defaults. But why should we? Most home owners have lots of equity. They can sell before they default on three mortgage payments. The effect of the interest rate increases over the last two years hasn’t been felt by most home owners as they have been able to sell at high prices, extend their mortgages and cut other expenses.

If you are banking on rate cuts, you shouldn’t be In the game. The rates are cheap even at 8%. The problem Is, what was once a $200k house Is now $1m or more. That all comes down to the price of the dirt and the replacement cost of the house. That Is not going to change…Ever.

For debt maturity profiles one would look back over the last five years to when peak sales occurred in Greater Victoria.

May to July 2023

February to June 2022

February to September 2021

July to November 2020

April to September 2019

2021 was a really big sale volume year and that corresponds to mortgages with three year terms to renew this year. It isn’t just sales either. There were a lot of home owners taking advantage of the low interest rate at that time as well.

When I looked at just one neighborhood in Victoria, 30 percent of the homes listed for sale were bought during Covid and some had their mortgages through “B” lenders.

I think there will be a snow ball effect over the next several months. But, at this time, I doubt it will become an avalanche. A little culling of the herd. Perhaps a reoccurrence of the boomerang generation effect of the 1980’s as a generation of home owners return to live with their parents or leave for better opportunities in Alberta.

What was the stress test at interest rate lows? 5.25%?

And what are variable rate borrowers paying now? 6.5%?

I don’t think any deception was required.

We haven’t seen a big rise in defaults yet, but rate cut hopes have been pervasive. Those hopes seem to be fading again today…

The disscussion I was replying to was about International travel when we retire.

There are alot of people In the CRD that have owned their house for a considerable amount of time. I wasn’t discussing a new buyer today.

I renewed at pandemic low rates. I had to, my 5 year term was up. So I renewed for another 5 year fixed at 1.86%. Is that a crime? Would you have done differently?

So am I. You think I don’t eat? Blame the 15% or so Inflation on all levels of the Government.

Many also do, it comes back to simple demand and supply.

And do you have any idea of their maturity profile?

The main issue is not whether msp accesses your travel history directly, they don’t, or whether you can get away with coverage by not reporting absences as required, but making sure that you are covered by msp when out of country if something goes wrong.

If you are seriously injured abroad and need to use travel insurance the form for msp coverage of out of country care will be submitted by most travel insurers to get back some of their costs. It requires disclosure of date of exit and entry. If you are not covered by msp this voids most travel insurance coverage and you will need to pay personally.

If you get ex. hit by a car in Dubai and it is cheaper for the insurer to medevac you (50k plus) to hospital in Canada they will. Msp will get notification of your absence through the same form and if you are ineligible for msp you will be responsible for your Canadian hospital bills.

You can apply in advance for permission from msp for coverage for absences longer than six months when you travel: https://www2.gov.bc.ca/gov/content/health/health-drug-coverage/msp/bc-residents/managing-your-msp-account/leaving-bc-temporarily

https://www2.gov.bc.ca/assets/gov/health/forms/2814fil.pdf

I think bc ferries union signed a shit deal at the last bargaining agreement in hindsight and never got all the inflation bumps government employees got. So this is a interim catch-up

The way to get around the Stress Test from the big banks, that are federally regulated, is to obtain financing from lenders which are overseen by provincial governments. These lenders face fewer regulations and unlike the major banks, do not require their applicants take federally mandated mortgage tests that ensure the applicants can make payments even if rates go up.

One subset of this group of lenders – Mortgage Investment Companies (MICs) – has mushroomed in the past three years, taking on riskier deals, when record low borrowing costs pushed up mortgage demand at the peak of a housing market boom in 2022.

Data from the Canada Mortgage and Housing Corp showed that nearly 1 per cent of mortgages from private lenders were delinquent in the third quarter of 2023 compared with the industry-wide rate of 0.15 per cent.

The market share of newly-extended mortgages by private lenders in the first quarter of 2023 jumped to 8 per cent from 5.3 per cent in 2021, while the share of those lent by big banks fell to 53.8 per cent from 62 per cent, the data showed.

Data from the Canada Mortgage and Housing Corp showed that nearly 1 per cent of mortgages from private lenders were delinquent in the third quarter of 2023 compared with the industry-wide rate of 0.15 per cent.

The market share of newly-extended mortgages by private lenders in the first quarter of 2023 jumped to 8 per cent from 5.3 per cent in 2021, while the share of those lent by big banks fell to 53.8 per cent from 62 per cent, the data showed.

BC Ferries 7.75% wage increase over the weekend, BC Gov employees is it 3% as of this morning?

I understand that, but CBSA is not going to care if you leave for 10 years and come back, as a CND citizen (which is that situation I am talking about).

I’ve also done a bit of research on Reddit and plenty of people on there along the lines of “I left Toronto for two years, came back, broke my leg, went to emerg and OHIP didn’t know I was gone, I only found out about the 153 day rule years later” so if OHIP isn’t talking to CBSA doubt MSP is.

I understand it is recorded, but how would they link two passports for John Smith leaving under a foreign passport and entering with his or her CND passport. I think they simply don’t care as John is a CND resident and can come back whenever he or she wants (so when he or she left isn’t important) and CBSA probably doesn’t have a mandate with CRA/provincial health care.

If this was important I think they would have outgoing/exit immigration. As I said we are realtors are required to fintrac every client and I bet the government calls that data collection even thought as I said no one has come to Fair Realty in 14 years to look at the data.

The example was an $1m home. Every buyer for homes $1m or more needs minimum 20% ($200k+) down payment.

Since June 2020 all airlines exiting Canada are legally required to provide the passenger manifest to cbsa including passport numbers. If you are travelling on a foreign or Canadian passport this will be recorded and given to cbsa.

It’s not IRC – it is CBSA. They care for national security reasons.

The record is required when applying for permanent residency, for example.

Msp will require it if your eligibility is challenged. This can arise if you are injured out of country and your insurer seeks partial payment from msp. Not being covered by msp invalidates many travel insurance policies which is why most don’t offer more than six months of coverage.

It can also be required if cra challenges your residency. Normally only in the case of multi year absences.

Patrick, what new buyer would have $200k for a down payment? Many don’t.

I don’t buy that unless they got around the stress test, which then is their own fault.

Since it would be for a new buyer , they should settle for a below median price SFH.

For example, $1 million SFH would be an $800k mortgage ($200k down) and that’s a mortgage payment of $4,653/month (5% rate, ratehub.ca , 5/25 term).

Assuming rates stay around 5%, over the 25 year life of the mortgage, only $1,986 per month of that is interest (average over 25 years), the rest ($2,667 per month) goes to forced savings.

Enjoy the Provincial and Federal Carbon tax hikes tomorrow, will not add to inflation at all or to your grocery bill.

You’re right Zack, and the worst has yet to come. Those that bought at pandemic low rates are going to feel a world of hurt in the next several months unless they sell in a market with increasing inventory.

Sometimes I read the chat here just for entertainment. Some people are just clueless.

Everyone with a lick of sense knows that the BOC created a government subsidized handout to homeowners who bought prior to Feb 2022.

Great job, you refinanced at pandemic low rates. Brilliant.

The rest of us are paying for it through the 15% or so inflation that we just experienced over the past 2 years.

The median SFH mortgage payment for a new buyer today? $7000 per month.

But yeah, it’s awesome for you that it only costs $800 for your family.

Mortgage costs, see: https://www.nbc.ca/content/dam/bnc/taux-analyses/analyse-eco/logement/housing-affordability.pdf

I’ll order it for sure, I am curious. My KLM account definitely doesn’t have any CND info. I don’t check in at airport, Canada doesn’t have outgoing immigration like other countries, security doesn’t scan my passport and when boarding the flight my passport isn’t scanned.

And why would Canada even care? I doubt immigration Canada even communicates with BC MSP. My guess is BC MSP ties it to what you declare on taxes at best.

You can check. It is free to order a copy of your travel history report. If you travel on two passports you provide both numbers. Those who have gotten the report have found it to have a high degree of accuracy including for US/Canada borders by car or boat.

This is crap news for consumers and we are taking a step back. I am guessing Victoria agents started doing too much business up island so the VIREB stepped in to protect their agents’ business. Now if you want to look up island your Victoria realtor won’t be able to set you up on an automated search, for example.

On the whole I don’t think people realize what an amazing system realtor.ca/mls is Canada is.

In most other countries you need to visit 20 websites to view 80% of available inventory versus in Canada one website, realtor.ca, probably has >98% of available residential inventory listed. I would say as a consuner that’s pretty convenient.

Every buyer and seller in Canada is Fintraced, for example, but in 14 years of me collecting 4 to 6 pages of Fintrac data information on every client we’ve never had a request for that information from the feds once in those 14 years and it’s not like we upload it anywhere.

I often fly to Europe with KLM and my online profile with KLM has non-Cnd passport info and then I re-enter with Cnd and no one questions how long I was gone for….seems odd.

I would be very impressed if every manifest from COHO/Seattle Clipper/flight/etc. was actually cross referenced with arrival information given how inept government is at everything else.

Its better to burn out, than fade away. Perhaps they should try beer.

To answer your question. My oldest Son went to Costa Rica and stayed with my friends for a month. Vaccinations were part of the deal. There Is alot of poverty down there…But they have giraffes.

It’s also the reason male life expectancy in Russia is 58.

Not In Kamchatka. In Russia, vodka Is their vaccine.

https://www.quora.com/Why-arent-Chukotka-Kamchatka-and-some-other-regions-in-Russia-connected-by-road-or-railroad-with-the-rest-of-the-country

What worries me about these exotic, equatorial countries are the exotic creatures and diseases that exist. Don’t you need a multitude of vaccinations to travel to these destinations?

Probably the only legal way you can leave without being noted is aboard a private watercraft.

Back in the day I used to hike into Washington. Probably not advisable post 9/11

I’ll choose Kamchatka over Dubai for retirement, thanks.

I have friends that sold out here and moved to Costa Rica. They get kicked out every now and again and have to fly to Panama for a week or two, then they return with no Issues. I haven’t talked to them In awhile, they still come back to Canada to visit family, but not for 6 months…Maybe 6 days.

Now that Is a very sensitive subject. I’m pretty sure you could just tell them to f#ck off with no repercussions.

Okay, Money Power It Is.

Max, I think the “M” stands for money.

Totoro, how do they know my gender since it can change daily with my mood?

Makes sense if you don’t have the status to stay in one country the whole time or perhaps for weather reasons. Digital nomad visas area really good in some of these countries for those that don’t have status and meet the criteria.

I’m attached to Canada and my people here and I can’t see giving up residency even though we could save a lot on taxes and live an extravagant lifestyle. However, if you have a home here and rent it out while you are gone pt, the after tax rents can pay for all or most of your living expenses abroad in many countries.

For us, one of the reasons to go to SEA is the quality and affordability of preventative health care. You can show up at a hospital without an appointment and order from a menu and have your results in the afternoon or next day. The medical doctors, who speak English, have often been trained in the US or Canada. Treatment is similarly affordable. Dental work is also much more affordable.

The government pulled the legislation for changes to trust funds on Thursday. The changes were an effort to catch foreign straw buyers of real estate but inadvertently included those with legitimate reasons for estate planning.

They have had spinners on the dashes of squad cars for over a decade. If you are a high risk driver they can spot you a 1/2 mile away.

And they pack Glocks.

Your travel history is tracked by the Canada Border Services Agency. For air travel this started June 2020 and for the US/Canada border Canadians have been tracked since June 2019.

Exit data is collected directly from airline passenger manifests. Entries are through CBSA and include not just passport information but a photo of your entry is taken at all airports and matched to your passport and this is kept for 15 years as well.

The travel history report contains your records for both Entries and Exits and includes:

name

date of birth

citizenship

gender

date of entry

location of the port of entry, and

any document numbers associated with that travel, such as a passport number

https://www.cbsa-asfc.gc.ca/agency-agence/reports-rapports/pia-efvp/atip-aiprp/thr-rav-eng.html

I assume MPower means Man Power. Is that politically correct these days?

Sounds like a payday loan. There Is a documentary on Netfix on how the payday loan king was brought to his knees.

It’s not “we”. It’s a lending institution in Washington DC, MPower Financing, that gives high interest loans (fixed rates, starting from 12.99%) to international and domestic students studying in the U.S. and Canada. Though if you are a U.S. citizen or have a U.S. co-signor, then it looks like you can get a loan with Sallie Mae as well for a better rate (Variable Rates: 1.87% APR – 11.97% APR. Fixed Rates: 3.75% APR – 12.85% APR)

I might be mistaken, but like with Nexus cards, they only have to touch the passport next to the scanner tower and not actually have to swipe it.

They scan my boarding pass and look at my passport for ID purposes as far as I can tell (I don’t check in, I get my boarding passes online)

A lot of things aren’t right.

https://www.cbsa-asfc.gc.ca/btb-pdf/eedcu-cudes-eng.html

It’s been a while since I flew out of the country, but I’m pretty sure I had to scan my passport at one of those kiosks and answer a bunch of questions.

Why are we providing loans to foreign students? This cannot be right? Are these government of Canada loans or loans guaranteed by the government of Canada? How do you enforce these loans when the foreign student goes back home? I really like to believe that this is not the case but knowing how screwed up things are this might not surprise me.

Marko, how do you get on a flight without having your passport scanned?

Yes.

https://www.internationalstudentloan.com/loan_information/international_students_canada

Can foreign students get student loans here?

Hmmm interesting. I’ve been in Dubai a couple of times and the hotel prices have been more than reasonable. Love the weather in the winter but wouldn’t want to live there. It’s basically next level Las Vegas.

Just curious how BC knows if someone is gone for more than 6 months? I don’t see anyone scanning my passport into a database when I board a international flight to leave Canada?

Can they hone a cylinder wall?

https://www.robertsoncollege.com/blog/studying-at-robertson/average-student-loan-debt-canada/

My Brother lives In New Zealand and My Sister lives In Australia. Maybe Its SEA, but there Is somewhere cheap they travel to each year. Kind of like our Mexico.

Someone mentioned Dubai. As an example of costs there, I could show you my my August 2013 home electricity bill. $2300. For one month.

The gifted students get scholarships.

That takes money. My Wife and I did not come from money. My Wife attended Sprott Shaw straight out of high school and the Provincial Government was hiring students out the back door, She has been there for 30 years. I didn’t know where I was going, so I went to work for my Father who was a builder at that time. I attended Camosun College and got my red seal certification In carpentry. EI paid for both of our training, we were paid to go to school. Once I hit 30 I got bored with carpentry and moved on. Yeah the first 10 years was a bumpy road, but what doesn’t kill you only makes you stronger.

Looking back…Everything worked out just fine.

Approximately 4 million Canadian citizens have emigrated to other countries, primarily the U.S. Approximately 2 million are children born outside of Canada and have dual citizenship. I would guess that the majority of emigrants are well educated and represent some of our brightest and talented people. This is also known as the “brain drain “. The lure of high paying jobs in healthcare, technology, engineering, etc… far exceeds what they could earn in Canada. They are usually provided health insurance and have access to better healthcare. These Canadians can return any time they wish, with U.S. dollars in their pockets. As world turmoil increases and they have amassed a substantial amount of savings and assets, returning to Canada becomes more appealing. I know of one woman who went to medical school in the U.S., then moved to Israel to practice. I wouldn’t doubt she is considering moving back.

So approximately 10% of our population live permanently outside of Canada and can return whenever they want. Canada is still viewed as a safe haven compared to most of the world.

It is fairly common for Canadians to live abroad these days for 3-6 months if they are retired or work online. It will, imo, become even more common going forward – just makes economic sense and you skip the winters.

As for full time relocation and becoming non resident for tax purposes- that’s less common. It means selling property and closing bank accounts and it is a hassle to reverse. Makes more sense if you have a second citizenship or permanent residency. It can lead to significant income tax savings as many countries have far lower income tax rates.

Anyone want to riddle me how the seller of 1744 Triest Cres and their realtor would ever think the house is worth 1.6 in this market?

Okay, sorry If I pissed you off. Even In Victoria with two kids and a SFH with as little as $3000 per month Is doable.

My mortgage Is only $840 per month. Obviously we make more than 3k per month, but It can be done.

At any rate, there goes my plans of moving to SEA.

-$840 mortgage (accelerated bi-weekly $420 payments) .

-$500 property tax.

-$196 house Insurance.

-$1000 groceries.

-$160 vehicle Insurance (2 vehicles).

-$250 hydro.

-$150 vehicle fuel.

-$100 cell phone/Netflix.

$3196.00 per month.

This would be a super frugal budget. I actually pay $1010 per month towards my mortgage, but I’m allowed to make principle only payments and at 1.86% until Dec 2025, It only makes sense.

I’m also not allowing for Birthdays, Easter, and Christmas (that’s expensive).

And of course there is vehicle maintenance and life surprises.

My Wife works for the Provincial Government. We have a family practitioner with extended health and dental benefits.

In closing, I think I’ll just stick to Victoria BC.

No

What about Dubai? Have you been there?

Sorry to bother you.

Spending 9 days on the big island in Hawaii, walking by the real estate office I see the prices of SFH were off 10% last year

Panama will cost a bit more to live than SEAs.

I have culture tie with SEA and like the food, hence I prefer SEA to other destinations.

If you eat out every meal and drive a car then it would be $1500 or more per person per month, however $1000 is doable if you eat in and drive a scooter.

I’m aware that yearly income tax filling is a requirement, and I have an accountant that take care of it in Victoria.

I prefer a diversify portfolio, and stock pays out that give me the option of early retirement.

I’m sorry if hear a bit of jealousy here.

BC MSP required 6 months per year of resident in BC to qualify,

or a one time of 24 consecutive months once in 60 months (5 year) period,

or pay private medical insurance for 3 months wait period before BC MSP kick in, if I decide to move back.

By the way, top-notch medical insurance in Vietnam is dirt cheap, between $125 and $275 a month pending your age.

https://www2.gov.bc.ca/gov/content/health/health-drug-coverage/msp/bc-residents/managing-your-msp-account/leaving-bc-temporarily

About 2.8 million Canadians are doing it.

I didn’t think It would be that easy. If It was easy, everyone would be doing It.

I’m a knuckle dragger…However, I do have an abacus.

Has to come back to Canada for six months? For what reason? Canadian tax liability is judged not on days “in country” but by a totally subjective judgement as to where one’s true residency is. The first question that CRA will be ask is “where does your family reside?” If the wife and family are in West Van, his worldwide income is fully taxable at standard CRA rates without exception, even if he personally spends five years or a decade outside of Canada. There is a small dodge – his capital gains from sales of Canadian securities are not taxed but if you think this advantage is worth the international-man-of-mystery persona you would be required to construct may I suggest you learn to use the calculator on your phone.

MSRP IS judged on days “in province”.If he thinks he can drift around the SEA beaches yet retain access to MSRP let him make a substantial claim and they will immediately ask if he can substantiate a minimum of 180 nights in BC in the last calendar year

You can live well as a couple in Vietnam or Malaysia for $3000 a month total at current exchange rates. Locals do it for far less.

Panama is more expensive and less safe, but closer.

You can compare costs here: https://www.numbeo.com/cost-of-living/comparison.jsp

What are your thoughts on Panama?

Also how much cash do you need to live In SEA? 1 million, 2 million, 3 million?

For now, but I’m planing to relocate to SEA countries permanently in the next 2-3 years.

I’m thinking of renting condos in 2 SEA countries and fly between them, because the airfares are often below $200 round trip.

So you still have to come back to Canada 5 months per year?

Yes, it’s Vietnam, however Thailand, Malaysia, and Indonesia price are similar and same as top-notch health care as long as you have money (still much cheaper than here for glasses, dental, drugs, etc…)

I’m not sure what Philippines is like because I haven’t been there.

Add: dispensing fees in Victoria are often cost more than the price of the drugs in SEA countries.

https://househuntvictoria.ca/2020/10/15/does-a-suite-risk-capital-gains-tax-a-professional-perspective/

https://www.canada.ca/en/revenue-agency/programs/about-canada-revenue-agency-cra/compliance/combat-tax-crimes.html

Roll the dice, maybe you win, maybe you lose.

I’m not sure whom to believe: an anonymous poster who thinks, among other things, that CRA agents pack heat, or my accountant 🙂

Leo had a good discussion on this topic in 2020: https://househuntvictoria.ca/2020/10/15/does-a-suite-risk-capital-gains-tax-a-professional-perspective/

Leo, what does this mean to you? Will you still be able to access data?

Try to sell…They have until 2031 to make that decision for you. You don’t decide. You were operating a business out of your primary residence, as If you get 100% capital gains exemption. You should really have a business licence. If CRA was reading this they would chew you up and spit you out!

https://www.victoria.ca/media/file/long-term-rental-property-business-licence-application

https://fariscpa.com/how-long-can-the-cra-audit-you-how-far-back-can-the-cra-audit-your-taxes/

Lesson: realtor’s verbal assurance not legally binding!

Judge rules ‘buyer beware’ after couple skipped home inspection and then found faulty windows

https://www.timescolonist.com/local-news/judge-rules-buyer-beware-after-couple-skipped-home-inspection-and-then-found-faulty-windows-8530545

Confirmed. We stopped renting our basement suite in 2022. Always declared rental income, with suite as 50% of the house. Zero capital gain owing.

Lmao, so what is actuall incorrect about the statement?

Yeah, that’s nuts!

“people who had worked very little during their adult lives despite not being disabled. They were called housewives”

Grab your popcorn, we haven’t seen a person flayed alive since the Ottoman empire.

If you wish to keep your silky skin attached to your body, you may wish to insert “outside the home” between “little” and “during”.

When OAS was introduced there was a very large cohort of people who had worked very little during their adult lives despite not being disabled. They were called housewives.

That’s just the starting point of the clawback. I think you still get something all the way up to $120K income. And note that’s individual income.

There are many types of pensions, and the old age pension is one called a social pension. So your lecture about the old age pension not being correctly considered a pension is wrong.

https://en.m.wikipedia.org/wiki/Social_pension

Oh, okay, what was your employee percentage contribution and how much did the employer contribute? What are the investment funds where the assets held? Would be classified as defined contribution or define benefit? Oh ya, none of that because it’s a 100% tax payer funded entitlement. It merely gets called a pension to appease folk’s sensibilities because they don’t like the thought of collecting welfare. However, in the end, it is just old person welfare that’s mostly maintained as a vote buy. Accept it, and enjoy the benefit of the hard work of your fellow charitable citizens.

Happy Valley assessments are mostly a work of fiction, it would seem. eg. 109-3439 Ambrosia:

2023 Assessment $861,000

2024 Assessment $977,000

Pending at $825,000

OAS is available to all seniors whose income is under $90,000. This is the vast majority of seniors. Like it or not it is a retirement pension. I’ve worked my entire life, not lazy or entitled, and will be receiving it in retirement. Regardless of where it started it’s not welfare.

Well, OAS faces clawback based on income because it’s a welfare benefit and not a real pension. It’s meant for people that were disabled and were unable to work during their life. However, the lazy and moochie types believe it’s something they should get too. Ideally, it should be asset tested as well as income tested, unfortunately, it is only tested against income.

and OAS can (should?) be similarly delayed for a higher payment….

No. You have the wrong information.

You can collect CPP at 60 or above not 67 even if you are currently 50. For every year you delay taking cpp up to 70 you get paid more per month when you take it. I have no plans to take it until 70.

OAS starts at 65.

https://www.canada.ca/en/services/benefits/publicpensions/cpp/cpp-benefit/when-start.html

1). I’m 50, for me I can not collect CPP until I am 67.

2). There Is no CPP claw back YET. Wait until the boomers are done.

3). My suite Is 1150 sq/ft, my house Is 2600 sq/ft, CRA WILL look at all the other factors.

4). Having a tenant is a hassle, I would rather ditch the (2k – 1/3 for taxes) rental Income and collect my 100% capital gains exemption. Especially after the huge price acceleration I have experienced over the past decades!

5). I have had the same accountant since I was 20 years old.

6). I am not banking on CPP, OAS, or GIS.

There appears to be more confusion on this board than usual. Maybe everyone getting ready for the long weekend?

1. CPP does not start at 67, minimum age is 60. A person may choose to delay CPP to get a higher amount later – this decision assumes there is a later. Age of death of males above me in my family: 62, 64, 72. Not planning to follow them, but I’ll be taking CPP at the earliest time – and I’ll likely still be working at something I like. You can collect and still work.

2. There is no CPP claw-back, that’s OAS. One could argue that you can lose it through marginal tax rates but that’s a different topic. If you have OAS claw-backs then good for you, you’re well above average income! If you’ve been advised to delay your CPP then presumably the advisor doesn’t see an OAS claw-back issue. Sorry, then you’re average or lower.

3. Having a suite in your home does not automatically eliminate the personal residence exemption. Here are the basic criteria: A. If you have not claimed CCA (no-one would with any amount of research). B. YOU (it does not say anyone before you) did not make a structural change to add a suite, and c. The suite is relatively small (ancillary use) as compared to your personal use. Accountants have used under 50% for years – CRA may look at other factors. Even if you had to make an allocation to the suite the rental income over the years would more than offset any difference.

What’s wrong girl? odour and Itchiness got you down?

Excellent description of the federal government.

Maggie, you have the power to make it look like this

Leo, you really deserve much better than this sandbox for sub-literate knuckle dragging.

Well, WTF…Where do I sign up? I don’t want to be part of the federation.

No one pays taxes in Saskatchewan. They’ve succeeded from the federation and joined Alberta.

Its tax time and I’m just really pissed off. I pay my accountant $500 to tell me how much I owe the govt. At least I can write off the accountant. At least we live In the best part of Canada, could you Imagine living In Regina and paying all these taxes.

I think they want 100 cents.

I would settle for 50 cents on the dollar If they paid me on Tuesday and I wasn’t forced to pay Into It anymore.

They’re going to claw it back anyway.

I have been paying Into cpp since I was 17 years old and now I have to wait until I’m 67 to collect a dime…That really pisses me off. I want a buy out!

…Or forced to sell.

From the world of it’s morally wrong to let a sucker keep their money. Here’s a new legal scam to exploit some idiots..

From: https://financialpost.com/real-estate/mortgages/reverse-mortgage-card-plastic-twist-tapping-home-equity

Canada, New Zealand, and Australia have all changed…And Its not looking good!

Vietnam?

We like SE Asia for all sorts of reasons, including excellent affordable health care even if you pay out of pocket.

Canada is failing on this front. And on housing and addiction issues. Some areas of SE Asia are very safe, have a housing oversupply, and very little visible addiction or homeless issues. Places like Japan and Malaysia, for example. Not to mention the food.

The world has changed. I love many things about Canada, but you can have a better quality of life elsewhere (particularly in winter) at an affordable price as a retired Canadian or a remote worker.

Its a really nice Inlaw suite….They are perfectly legal. No money Is exchanged.

The Inlaw suite was In place as per the drawings submitted to Langford In 1981. I bought the house In 2001. My Father actually bought It In 1998. I bought It off him. He charged me 8% Interest until I could buy him out. The banks wouldn’t touch me…I was young, I carried that 8% “demand loan” until I had enough equity to buy him out…working 7 days per week.

$225k In y2k was a lot of money. My Wife thought I was nuts. That was a lot of mortgage debt for that time.

All I did was update the suite. No plumbing alterations…It was all In place with copper water lines and abs drains.

I borrowed 100k from the bank using my not rented suite back In 2010. I had to sign an “assignment of rents agreement” even though the suite wasn’t rented and was completely vacant …They still gave me the 100k.

Max if you “theoretically” have a permitted suite the municipality already knows and BC assessment raised your assessment to include a suite in the property value calculation. If not? I don’t think government or public service agencies actually talk and get on the same page in a sense. If someone were renting, a person would be stupid to not tell their insurer part of the home is rented. Could really bite if you had a claim and they wouldn’t pay.

It’s complicated but from what I understand it’s based on when you change use to partly rented, what the value was then of the home and then if you sell the time and increase in value is factored into the capital gains tax. So if you’ve owned your home for 20 years but only rented it for two the capital gains is based on the rental’s percentage of your home and the difference in value from two years prior to when you sell. There’s operating expenses and capital expenses on your rental. Some people claim if you don’t claim capital expenses you don’t get hit with capital gains? I’m not an expert for sure. Your income is rental income minus ordinary expenses to upkeep the rental or rent it or manage it, etc. maybe utilities if you include them in rent, but also a portion of interest paid on the portion of the mortgage pertaining to the rental, can include property transfer tax if done from the beginning of a purchase. It should definitely be all factored in if someone is thinking about renting a suite in their home.

My mortgage Is $840 per month, I’ve been here awhile. My suite Is 1150 sq/ft that hasn’t been rented since 2006 because I’m a shitty landlord and really don’t like tenants. So 2k per month I would be surrendering 50% of my capital gains exemption. The house Is valued at 1.2m, Lets say I list for 995k to keep It below 1m (In today’s market). I really don’t think Its worth It.

Don’t you only lose the capital gains exemption on the percentage of the house that was rented?

Agreed about the feds wanting a shakedown, though.

If you rent a suite In your primary residence and play by the rules and pay your taxes on the rental Income…You lose your 100% capital gains exemption on the sale of the house, correct? You were operating a business.

So 2k per month equals 24k per year added to your annual Income, lets say the govt takes 1/3 bringing your total annual rental Income down to 16k. Plus you lose your 100% capital gains exemption on the sale of the house, Is this correct?

Is It really worth It?

Seems to me the feds want to shake the tree on people not declaring the rental Income.

I could also see municipalities wanting a piece of that action with higher property taxes.

Insurance companies will also want to join the party with higher premiums.

Again, Is It really worth It?

I’m in the U60 category and top-notch travel insurance is less than $125/mo.

Have you seen the traffic out In Sooke these days? I went to go renew my DL out there because I thought It would be faster. It Is absolutely Insane In both directions at all times of the day. You would have to be a complete nutjob to buy In Sooke.

It Is literally like trying to head up Island on a long weekend x 2…Every single day, even Sundays.

They have one grocery store and a home hardware for 13,000 people, everyone comes to Langford to buy their shit.

They have only one way In and out…Single lane each direction (as you enter the sooke area). One bridge single lane each direction. Crawling at best. No priority lanes for buses, so their stuck just like everyone else, and certainly no bike lanes.

They should really warn people about moving out there.

Good for you bro. There was a time when I would have said that we have much better health care…That ship has long since sailed.

I took early retirement and has been travelling back and forth between South East Asia and Victoria every 3 months or so for over a year now, and it is much cheaper to live in nice warm coastal cities in SEA than here.

Fuel is $0.35 cheaper per litter for a country that import oil, and gas. Electricity cost is higher over there than here, but you only need AC when you are indoor. Grocery is much cheaper including import fruits, local fruits and vegetable are 1/5 to 1/6 of the price.

Below is the view from my 2 bedroom beachfront fully furnished condo that I rented for $450/mo.

I know a few folks that spent around a mil in Sooke that are hating their lives right now and are looking to sell, but they were informed (by Realtors they talked to) if they wanted their properties to move they would need to be listing in the 8’s.

People that bought In happy valley, west hills, and kettle creek are all going to take a bath.

Not so Happy Valley price expectation change: asking 799k and assessed at 907k.. 3422 Turnstone

As a renter it could be a great way to game the system and falsify your credit score . The feds would be gathering good credit info from any ol putz

As a gen-x, I could really give a shit.

Federal: Justin Trudeau Is not getting my vote.

Provincial: David Eby Is not getting my vote.

Municipal: Scott Goodmanson Is not getting my vote.

They are all failures.

If you drive a vehicle with a combustion engine, you had better fill up today.

Heat your house with natural gas…Well bend over. Even hydro Is going up, beer Is going up.

It Is the government that Is causing Inflation.

21 cent per litre added to the truckers that stock our grocery stores! The price of food Is going to do a moon shot.

Getting off the Island to bounce around Vancouver for a good time…Will be a luxury.

https://vancouversun.com/news/local-news/five-things-whats-going-to-cost-you-more-starting-on-april-1#:~:text=B.C.%20is%20raising%20the%20carbon,emission%20targets%20have%20to%20pay.

I suggest getting your FAC and a deep freeze, and bagging as many deer as your licence allows.

I also suggest getting a fishing licence and bagging as many salmon, crab, and prawns as your licence allows.

Get a green house and grow whatever you possibly can.

What if the renters have tons of credit card debt, this new measure won’t do them any good.

What if the credit reporting agencies don’t care about keeping track of rental payments? Will Trudeau create a new Federal agency to handle this and assign rental credit scores?

I suspect that co-ownerships will be the second leading cause of divorce.

Divorces regularly deals with a division of property and results in lots of happy people (most often us matrimonial lawyers). Remember that research has shown that marriage is the leading cause of divorce.

Yeah, I’m not sure how it is supposed to work. Maybe the Prime Minister was just blithering?

Mt. Tolmie, landlords can already get credit reports and scores for renters so there’s not much difference there. I don’t know how Mom & Pop landlords could be compelled to report on rent payments to credit agencies? Maybe managed rental buildings would. My mortgage company doesn’t even report my 9 years of mortgage payments.

How will the credit agencies get the information pertaining to rent payments, through their financial institution?

Standard terms for co ownership agreements include a shotgun clause. One party pulls the trigger and the other party either buys them out using the prescribed method for valuation within a set timeframe or the whole property is listed.

By the way, owning a property with your spouse is co ownership. Same issues arise upon breakdown of relationship if you don’t have a written agreement.

A co-ownership gets messy when neither side is willing to buy out the other. Both parties may stop co-operating with each other on maintenance and financial obligations and the entire property may fall into bank foreclosure. That’s one way to force a sale.

Or one party could try to sell their interest in the marketplace but it would likely sell at a large discount. The new buyer would buy into the property at a lower price but still own half interest in the entire property.

There was a property on Wilkinson Road where one side tried to sell their interest in the marketplace but the listing eventually expired. So I don’t know what eventually happened. I believe the agent had problems obtaining access to show the property to buyers.

Trudeau announced today that on-time rent payments will count toward your credit score.

I see this as a win for landlords. When considering rental applications, they can check with Equifax or TransUnion and exclude applicants with a score below 700 (or so). If there are multiple satisfactory applicants, then just choose the one with the highest score.

I somehow doubt the young people cheering the announcement were thinking about that, however.

Reprieve for Parksville: https://nanaimonewsnow.com/2024/03/27/taken-care-of-all-of-our-concerns-legislation-changes-keep-parksvilles-resort-row-in-tact/

I presume you did not have a comprehensive written and legally binding co-ownership agreement.

Co-ownership without this is lunacy. Co-ownership with this is like having strata rules for everything, including maintenance. A difference is that in a co-ownership agreement either party can compel a sale and the other party can buy the share using a preset valuation method.

Co-ownership… Grandma at 932 didn’t want to sell, the kids at 930 did. Now 924 Is almost built out, With 936 under construction. 919, 915, 911, and 907 directly behind 932 and 930 are grouped as a land assembly. Co-ownership Is a very bad Idea.

Try getting a structural engineer, geotech, or house lifter.

I don’t see it in day to day life. Trying to get a septic inspector/contractor for a buyer of mine right now and the guy I like to use is booked two months out.

I could see It being a complete nightmare. There Is a house on Jenkins In Langford that Is co-owned. One of the co-owners didn’t want to sell. Now they have two Five story condo buildings going up on both sides and one directly behind them. It looks hilarious.

I have had the same business partner for decades, set boundaries, leave each other alone, the two of us have our own tasks…And our own office space. We are still very good friends.

” We are in a terrible co-ownership situation”

Don’t tell Totoro

I could see one issue of co-ownership would be agreeing on maintenance and repairs. If the problem exists on your part of the property, do you pay the entire amount or share the expense since the improvement would add value to the entire property. Sharing yard work, gutter cleaning, etc.. would probably fall on one owner’s shoulders as a lot of people are lazy. Your life will improve greatly once it’s behind you. Having a business partner can also be a nightmare, you’re not alone.

I think your thinking of skilled labour…Not certified tradesmen.

Sahtlam Seeker, I’m sorry to hear that your co-ownership has not worked out well. Co-ownerships are very tricky when it comes to sell. I’m guessing you have a 50 percent ownership in the property. So you may be dealing with the issue of share value versus market value for the property. I would certainly appreciate if you would keep us updated as your circumstances are a rarity but will most likely become more common in the future.

Best to you and your family for the future.

Frank, yes living on the same property. Marko, thanks a million for the kind words. I do everything I can do educate people about the pitfalls of co-ownership. I think the most basic principal is that if there are ANY cracks in a relationship, co-ownership will often make them much more pronounced. In my case, it was a bad idea from the start, but one often looks past red flags to secure housing especially if you have young kids to think of.

Seeker- Were you living on the same property?

Totoro and I disagree on this topic 🙂 but as I’ve said personally I would rather buy a 300 sq/ft unit at Janion then getting into a co-ownership situation with someone. Best of luck, hope you can sell quickly and move on.

Hearing of further weakening in the local trades market.

Well as a long time lurker and three time (worthless) commenter, I would like to announce that my house is finally going on the market after the long weekend. As you might be able to guess from my username the house is up island, not in Victoria. We are in a terrible co-ownership situation that is finally coming to an end. I’ll keep the forum up to date on how the selling process goes, in case it could provide a window into things as they currently are.

Frank , gotta agree just more gibberish coming out of left field .

Well, see if it’s a housing strategy pivot, they might be going with: “you’ll never own, so here’s some rental cookies”. As long as demand side inducements stay out of trying to buy votes from all parties we are on the right track, but unfortunately, those are probably on the way soon.

If you’re a Hobbit.

I see Trudeau is on his knees begging for votes by bringing in ineffective measures to help renters. Another pile of B.S. and bureaucracy. Justin, just reduce demand.

2023 Canadian population increased 3.2% (1.2 million), the largest increase since 1957 3.3% (500,000). Only difference, the 1957 increase was mostly from a robust birth rate, now it’s primarily immigration. It’s a lot easier to house an infant.

What a buyer may be concerned about in these older homes is Vermiculite attic insulation. Not all vermiculite products contain asbestos, but some do. An EPA study showed some vermiculite products contain low levels of asbestos.

Vermiculite attic insulation is a pebble-like, pour-in product and is usually light-brown, gray, or gold in color. It may have shiny flakes, and/or small accordion-like pieces. You can also check for markings on the material or its packaging. One common brand was called Zonolite.

What should I do if I have vermiculite attic insulation?

Leave it alone. If vermiculite insulation is disturbed, it may release asbestos fibers into the air. At this point the safest and easiest option for intact insulation is to leave it alone. If the insulation is exposed or spilling into living areas, immediate steps should be taken to seal the cracks. Or have it professionally removed.

Prior to the formation of BC Assessment, each municipality determined the assessed value and property taxes. Each municipality set its own rules on what would be taxable. In Victoria and Saanich, a basement under 6.5 feet was not taxable. But in other areas such as the Fraser Valley there was no such rule.

To escape the tax man, people in Victoria built homes with low basement ceilings while in the Fraser Valley and Vancouver they built homes of the same vintage with full height basements. Another odd thing about Victoria’s old stock of housing is the number of homes with only two-bedrooms on the main floor. Victoria was a retirement town and retirees only had a need for two-bedrooms. While on the mainland almost all of the old stock of housing has three bedrooms on the main floor.

Banks too had their own sets of rules way back then. At one time, banks would not lend on houses of less than 850 square feet and it was difficult to get a mortgage for a house in Langford. As more bank regulations were being initiated from Ontario headquarters of the big banks the lack of a third bedroom and livable floor area of less than 850 square feet was considered a detriment.

That’s changed and banks will now lend on almost anything these days. And I suppose that’s a good thing as a number of the older stock of housing would not meet the old lending regulations.

6’5″ is typical minimum requirement for living space and 6’1″ under beam and ducting.

Looks like the Mortimer sold to another Vancouver buyer, so we may see a rezoning sign on the property very soon.

I’ve understood that any area under 7 feet in height can’t be counted as square footage. Ceilings should be a certain height for air quality reasons.

Maybe people don’t want to live in huge towers. If that’s what someone wants, move to Taiwan, South (or North) Korea, China, etc…, all the places people are trying to escape.

Mortimer sold for 89 percent of its assessed value. The land is assessed at $950,000. All of the drop has been in land values as lot prices have been declining in the city.

Land values are trending back to 2021 price levels as investors and developers are not as active in the market anymore. Looks like we may have a price correction this Spring in housing as lot values are typically the first to decline.

Lol didn’t see that.

I wouldn’t pay that much for a basement ceiling height is only 6’2”.

1670 mortimer, 950k pending suited up and down with some updates. Seems like a good price for mt tolmie unless there is something wrong with the house.

The solution is much simpler than social engineering , reducing temporary residents, and inflating unskilled workers wages. Just build more homes. Starting with huge towers (with parking). Then we can keep the foreign students, foreign workers and even allow/encourage Airbnbs, second homes, foreigners, satellite families, vacant homes and flippers.

Increased .wages would be passed on to the consumer, increasing inflation. Paying someone more doesn’t mean they will work efficiently, ie. bust their ass. Rewarding productivity, instead of being paid an hourly wage, is a great incentive. My summer job in the 70’s was delivering soft drinks, we were paid a minimal base salary and a commission for every case we delivered, I bust my ass. I can’t believe that the inspectors don’t inspect the work that is permitted, but then they have no incentive to do their job.

You cannot have a shortage of unskilled labour, because of the elasticity of the unskilled labour market. In plain language, that means that if you want more workers, all you have to do is pay them more. Canada’s labour participation rate is only 65%.

When business lobbies such as the Canadian Chamber of Commerce claim they “need” more temporary workers what they are really saying is that they are unwilling to pay more than subsistence wages, and as well are unwilling to make capital improvements. Meanwhile the costs of supporting this subsistence wage work force are externalized into the rental market and social services.

Most of the non-permanent residents – including international students – are in fact housed in the the same housing that Canadians want, just at much higher density. For example

None of these views are original on my part, there’s been plenty in the media lately on just this topic.

I’ve also seen permitted work that wasn’t done to code, and the two times I’ve had permitted work done by pros, there were no inspections. Case closed, they just trust the contractor did it to properly. So there are no guarantees in any case.

In a lot of cases, I don’t think it’s worth the hassle to get permits because it can trigger a bunch of stupid code requirements. But obviously if you are doing a major renovation, that is a different story.

About 30 percent of the current listings in Oaklands were bought during Covid when the interest rate was low.

Permit and the quality of interior finishing work are two completely separate things. Small renos without permit are ok, but major renos without permit are 100% shit. The one in Gordon Head and the one in Oak Bay are perfect examples that none of them have proper flashing and sill on new cut windows, no passive air and s/a in downstairs bds, no fire separation drywalls; and the list goes on. I doubt insurance company would pay for fire or water damages on these two properties in future.

Back to prices.. Anyone see 1700 Albert? Sold in March 2022 for 1.225. listed now after a few price drops for 1.098…

Government won’t end up hitting these targets to reduce temporary residents IMO. This is just empty rhetoric and flawed “we will help housing by redistribution” promises ahead of a coming election.

For starters, the foreign workers (a big % of the temporary residents) are great for the economy, because we have a labour shortage (as everyone who interacts with businesses knows well).

Second, they are mostly housed where Canadians don’t want to live anyway – in employer provided housing (trailers etc.), or a single room in a lousy part of town or a rural setting etc.

Leo, your analysis is faulty.

The government can reduce the number of temporary residents to 5% by simply granting more of them permanent residency.

It’s just the sort of thing Justin would do.

Not sure if it’s true, but heard of a buyer in Victoria that thought they had new drainage on the property they purchased, but apparently the seller just dug down enough to drop in what look to be new PVC clean outs around the property, but they were just faux.

Gifts from your realtor after you just made them a boat load of money and put yourself majorly in debt? Thanks, but no.

I’d try to fire the realtor who gives me a gift.