The rates tailwind

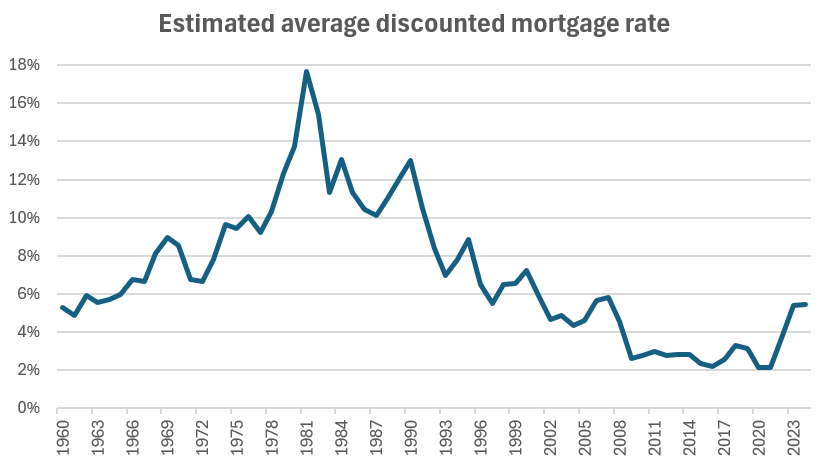

From 1981 to 1991, interest rates dropped by 43%.

From 1991 to 2001, interest rates dropped by 42%.

From 2001 to 2011, interest rates dropped by 54%.

From 2011 to 2021, interest rates dropped by 32%.

During that 40 year period, a house in Victoria rose by 5.8% per year, a figure less than the long run average only because 1981 marked the peak of arguably the only true housing bubble in the city’s modern history. But while there’s been a lot said about the 40 year drop in rates, it’s also true that rates now are at essentially the same level as we had over 60 years ago.

2021 marked the bottom for interest rates, with going rates today up around 150% (+3.2 percentage points) from that low point. Meanwhile the average house price in 2024 at $1.2M is essentially unchanged from 3 years ago.

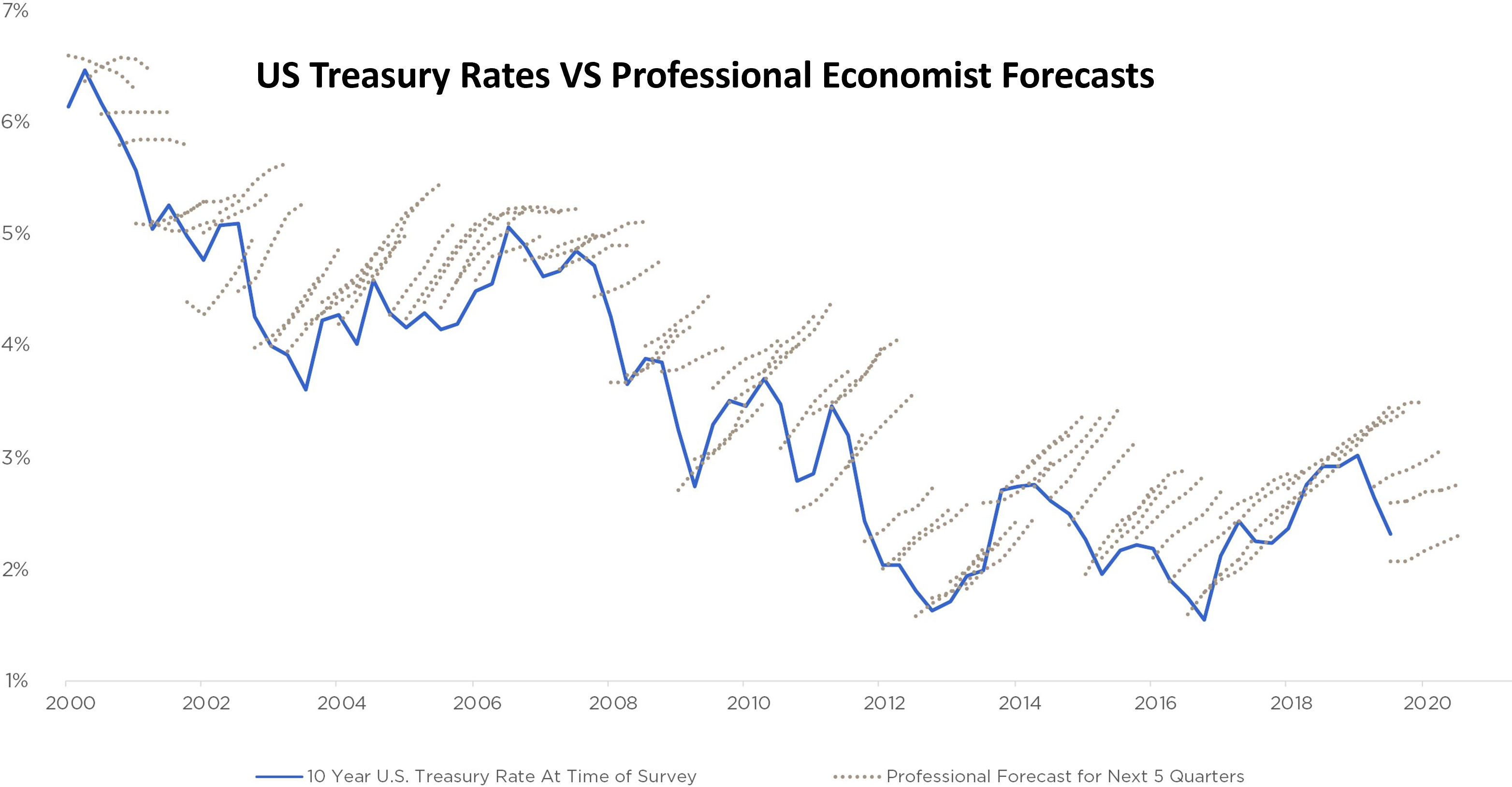

Now no one knows what rates will do in the future. Sure the Bank of Canada is warning that they won’t come down to those ultra-low levels we saw during the pandemic, and the markets expect them to be higher for longer, but let’s be honest: everyone is just guessing.

In 2031 we might end up with rates about where they are today. Or rates could be at the start of a multi-decade climb and end up higher (like we had from 1960 to 1981). Or perhaps they’ll be back down at ~2% where they were in 2021. The only thing that we can be pretty sure about is that they won’t be down 30-50% from 2021 levels like the pattern we saw in the past 40 years. What does that mean for housing?

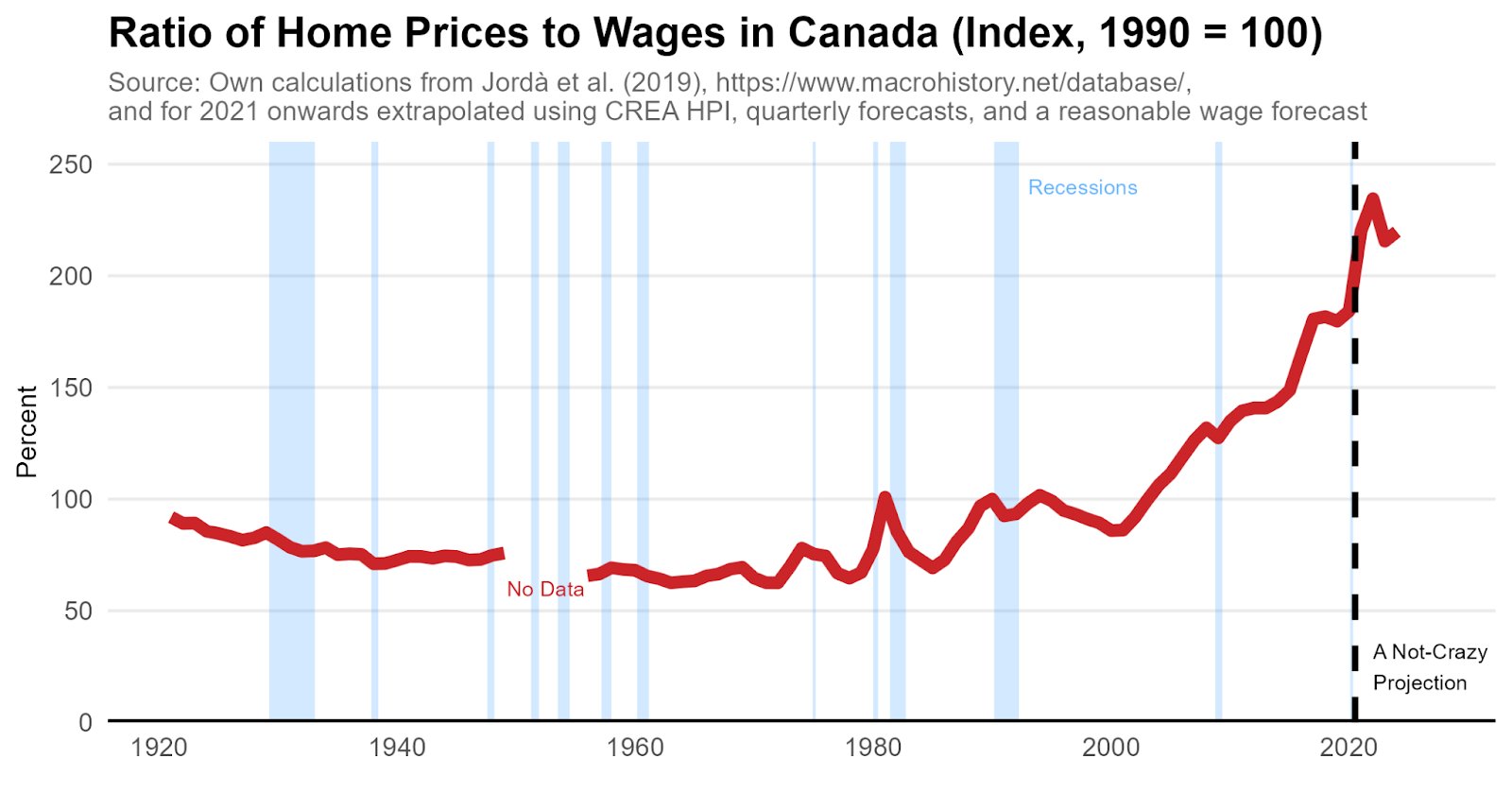

First, we have to acknowledge that interest rates aren’t everything. We have price data from 1960 in Victoria, and prices were increasing at pretty similar rates before 1980 as after, so it’s clear that rates aren’t some magical lever that control prices. Ability to pay would only be the prime driver of prices if housing was always in chronic shortage and prices always represented the maximum that buyers were able to pay for that entire period.

If you look back at newspaper archives around the turn of the century though, house prices were not so wildly different than 50 years later, so it does seem like 1960 was about the turning point when they started rising quickly. While I don’t have reliable data for Victoria, it is interesting that the 1960s was around the time when prices in Canada started rising faster than incomes after decades of the opposite trend.

Rates are only one factor of many. For example cash buyers aren’t affected (other than opportunity cost) and we seem to have more of those than most cities. And more importantly, increased demand only pushes prices up in the face of a shortage. Prices in Edmonton for example are hardly different today than 15 years ago despite strong population growth. However with some of the lowest chronic rental vacancy rates in the country, there’s little debate that there is a shortage in Victoria. With that shortage, rising buying power from decreasing rates has gone to pushing up prices.

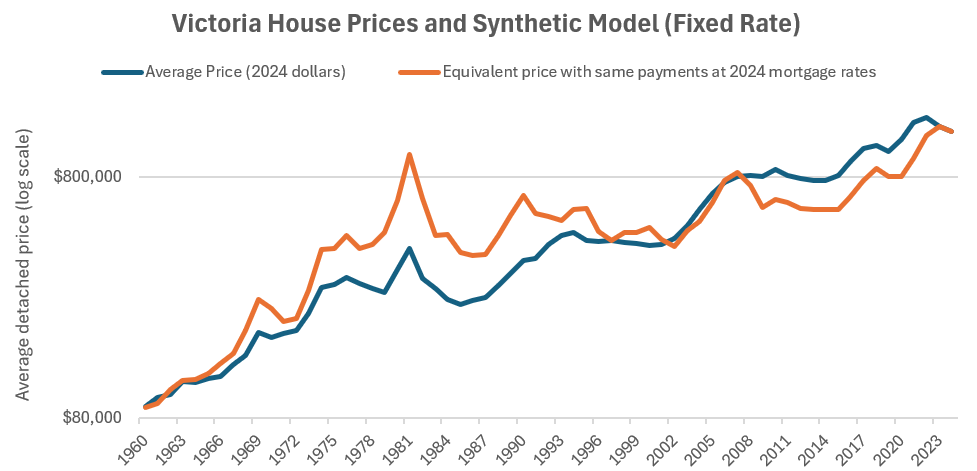

So what would have happened if rates had not been on such a wild ride over the decades? One way to look at it is to examine people’s willingness to pay. For people buying with a mortgage, what they paid is the monthly mortgage amount which we can calculate from prevailing rates and prices (that’s a consistent 80% mortgage on the average price, not actual mortgage balances). If we take those payments as what buyers were willing to pay (because they paid them), then we can run the calculation backwards and determine the house prices for a given payment and constant rates. The below chart is actual detached prices, and prices with rate changes factored out.

While the start and end points are roughly the same, the path of buyers’ willingness to pay is quite different when factoring out rates. The big increases were from 1960 to about 1975 (possibly connected to steep rise in dual-earner households), with willingness to pay growing far more slowly after that. For 25 years after the mid 70s, buyers essentially weren’t willing to pay any more for a house on a monthly basis, but prices increased from dropping rates. It also shows how crazy the 1981 bubble really was, with house buyers willing to pay nearly the equivalent of payments on today’s houses despite the fact that they were more common back then.

Overall willingness to pay for detached houses should continue to increase as they become more rare in the coming decades. However since we can’t rely on a repeat of the rate drops of the last 40 years, and it’s unlikely we’ll see a big jump in ability to pay like in the 60s, expect a structurally slower rate of price appreciation in the coming decades. The charts above are for single family because we have data going further back, but that should be even more significant in the multifamily housing space which is less fundamentally supply constrained.

Also the weekly numbers

| March 2024 |

Mar

2023

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 44 | 162 | 299 | 590 | |

| New Listings | 114 | 427 | 784 | 1118 | |

| Active Listings | 2354 | 2470 | 2588 | 1970 | |

| Sales to New Listings | 39% | 38% | 38% | 53% | |

| Sales YoY Change | — | +8% | +5% | -29% | |

| New Lists YoY Change | — | +26% | +35% | -8% | |

| Inventory YoY Change | +27% | +31% | +35% | +85% | |

| Months of Inventory | |||||

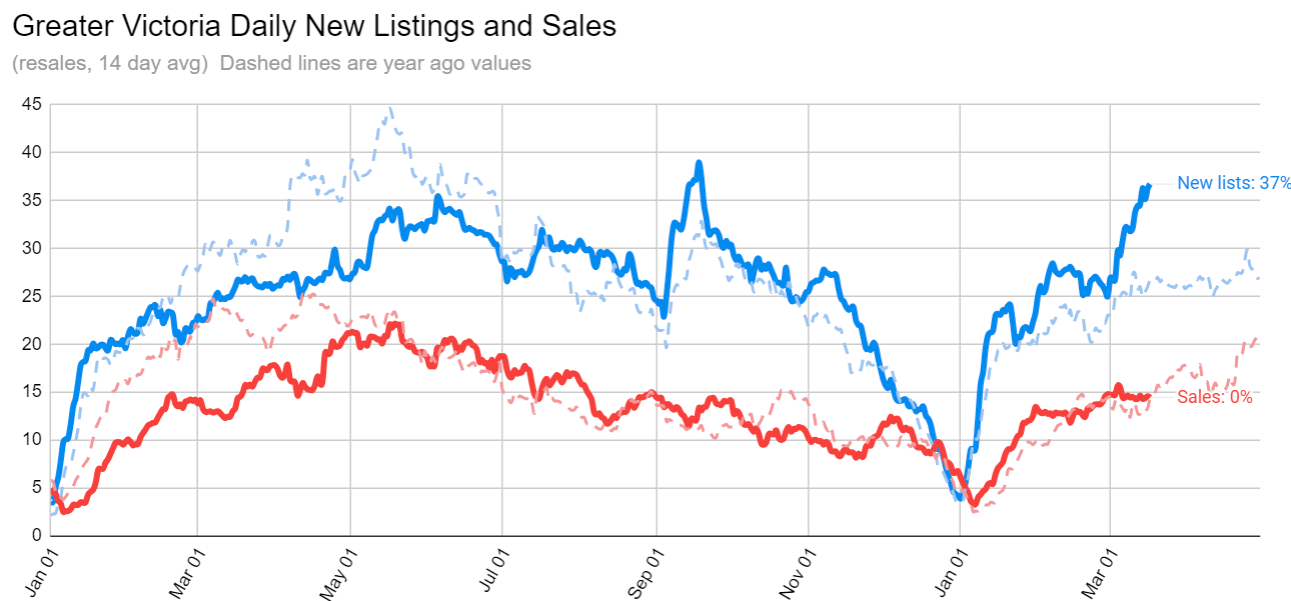

While sales are similar to last year, new listings are really surging now and that’s also driving inventory gains.

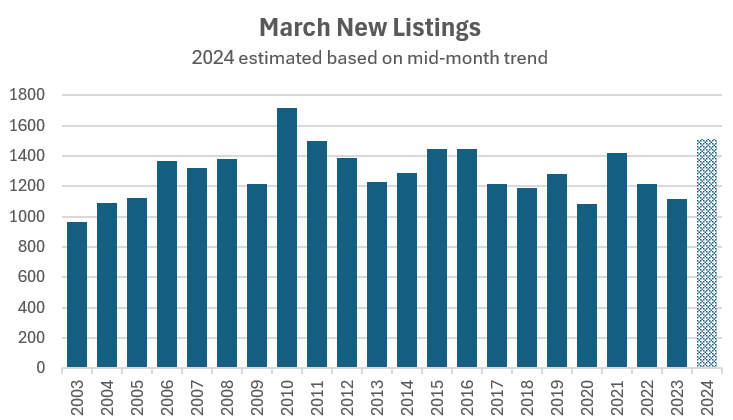

At 35% above last March, we’re beyond making up for a weak showing from a year ago, and starting to approach the upper end of the historical range. If the increase holds to the end of the month we’ll end up at the second or third highest number of new listings in March in the past 20 years.

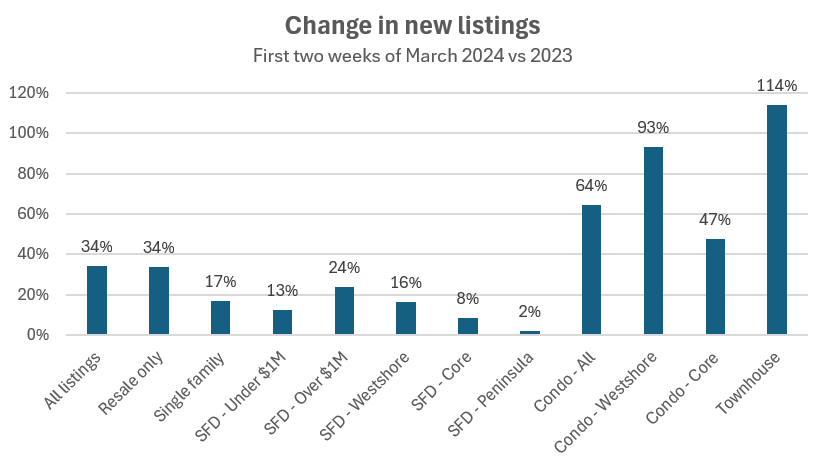

But where are those new listings actually landing? If you’re looking in the hottest part of the market (single family under a million), you’d be forgiven if you haven’t noticed a flood of new listings. In that category, new lists are only up 13% from a year ago. The big jumps are in condos (with the biggest increase in the westshore) and townhouses. Townhouses are a small part of the market, but new listings more than doubled from 29 a year ago to 62 in the last two weeks.

Too early to say exactly what’s behind the listings surge or whether it will hold, but just like the westshore market is weaker, it’s likely because the owners and buyers in that segment are younger and more credit dependent. If purchases are more leveraged, there’s a higher likelihood that owners are under stress (more supply) and greater reduction in buying power for buyers (less demand). That’s going to put a drag on prices of those entry-level housing types.

New post: https://househuntvictoria.ca/2024/03/25/the-non-permanent-residents/

Umm, thanks for the update. Good to hear that there’s some value out there.

I interpret clients saying ” I want to delay my listing until after BOC cuts interest rates in June” as trying to time the market. This is something that didn’t happen before covid, average person had zero clue on what the BOC even do.

Recall that the period of 2000 to 2010 was mostly a lost decade for US stocks and then real estate after the crash while Canadian stocks and real estate soared, while our dollar was worth more then the greenback, everything is cyclical.

Barrister,

Thanks. Yes, US markets have outpaced Canada for sure in the last 10 years, especially when measured in CAD.

VicREanalyst it depends on how you are interpreting “timing”. Real estate markets go through cycles. The Spring market is generally the strongest followed by the Autumn. If you were planning to sell, would you consider this as timing the market? Rarely do markets shift direction rapidly unless there is a black swan event.

Real estate markets follow a calendar – not a stop watch.

Maybe not time the market, but certainly plan for the market. The average exposure for a downtown condo is 54 days-on-market. Unless you want to carry mortgages on two properties for a couple of months waiting for the condo to sell.

I already posted about this months ago, ever since realtors took over tik toc everyone is now a macro economic expert and believes they can time the market. Who knows what will actually happen, I am just posting the anecdotes I’ve heard from my “insider contacts” on what their clients are telling them.

What is it that folks always say about trying to time market? Or does that only apply to buyers? lol… They might risk run into the real estate dog days of July and August unless they hope a single cut really spurs buyers. Isn’t the typical next flurry of sales activity after the spring is the September/October window? We did have the odd summer surge a year ago when folks thought rates peaked, but I am not sure that’s there after the last round of rate increases (people waiting on peak that is).

“ Tell them to get in touch with Marko”

But confirm that Marko has at least a 20 point marketing plan for the home. 30 is better.

Actually, the better advice is to use a real estate agent that already has a listing in the complex. They will have recent knowledge of anything that is going on with the strata and will likely have shown units in the complex to a list of their clients. When I did this, the agent already had a client that wanted to buy in the building and the property was sold in a couple of days.

Tell them to get in touch with Marko.

Hey Leo, do you know how long it take Zealty to update the sold properties on the map?

Thanks, whatever, that is a lot of good information that I will pass on. My only advise is perhaps to price a little on the low side rather than to miss the spring market since they really want to move sooner rather than later.

Barrister, there are 165 downtown condos for sale ranging from $348,000 to $7,559,000. About 28 sale per month so that is close to six months of inventory. Without any other information on your friend’s condo as to size, view, etc, I am just left to commenting using a Sales to Assessment Ratio which needs to be explained as most people don’t understand it.

In the last 30 days the downtown condos have sold as low at 0.72 times their assessed value to as high as 1.25 times their assessed value. That’s quite a range. But, if your friend has an average condo for the area then its SAR would be centered around the median or 0.95 times its assessed value. Which is a big assumption.

The typical downtown condos is a non view suite circa 2011 with around 745 finished square feet and sells for around $725 per square foot. A downtown condo on average takes 54 days to sell and rents for around $3.00 per square foot.

If your friend needs more accuracy then at the very least an address is necessary.

Or at the very least as someone on the internet once claimed Lisa Helps said. Pretty much the same thing.

This just in. Developers are going to build a fourplex on a 21,000 sq foot lot and have no room left over to provide parking

Heard some sellers trying to time a June rate cut for listings now.

Does anyone have a feel for what is going on with condos at the moment. A friend of ours is thinking of selling their condo downtown with a view to moving to Sidney but is worried about pricing it.

Lighten up Patrick, I wasn’t talking about you. Sheesh, go back and read the exchange again.

Zealty now has sold data for Vancouver Island

https://www.zealty.ca/imap.html

I am finding value now, last offer about 3 weeks ago and it came down to my unconditional v. some extra money. They took the extra money, but it’s the fewest competitors I have had in the last several years and with most selection I have had to choose to offer on. I passed on two in the last couple of weeks (still available) because I want to see the selection April brings (maybe others are doing this?). As for buyers returning, it’s just guess work. I think it really depends on where in the market you are looking. I think the market between 1 and 1.5 is seeing limited buyer demand because of rates and the need for 20% down. I think if the move up buyers start selling places, they will have the downpayment cash (maybe that 1 to 1.5 will start moving), but they have to sell for that to happen. So, I expect SFD under a mil will be busy now with the CMHC warriors. I have a few acquaintances that sold their places between 2-3 mil (a different market all together) seems to be moving. From people I am talking to right now in where I am buying, they need the rate on the 5 year fixed rate to get the mortgage because the variable, or the 2, and 3 years fixed rates knock them out of contention on price, but they don’t want to be locked in on the 5 if rates are dropping soon (so, they feel stuck). For me, I don’t mind eating the 5 year against dropping rates to get what I want since it’s a 20 to 25 year purchase for me (for some reason people look at owning homes now like having a car on a 4 or 5 year timeline), and the rates will balance over term, so paying a higher for a couple years doesn’t really matter.

On a public forum like this, you’ve spent the last 15+ years publicly claiming the housing bubble is about to burst, which hasn’t happened. So you think you’re debating on forums with a bunch of bullish homeowner fools (you’ve called them “wannabees and poseurs, who are going to be the nouveau poor.”) because they don’t agree with you.

One explanation for your dour assessment above is simply because it turns out that they’ve been right and you’ve been wrong!

UmmReally, you’re up to bat, swinging at pitches. Do you see the market like that article you posted (buyers won’t return until fall), or do you think buyers have returned now?

Just busy doing what he loves: hosting open houses….

Judging by the absence of Marko commenting all weekend, I’d say the market is very active. We could call it the Marko Factor.

Have to confess, I’ve spent just about all my working life surrounded by smart, well informed, motivated people. One benefit of reading a public forum like this is that I get to see that not everyone is like that. 🙂

https://financialpost.com/real-estate/housing-market-staggered-return-buyers-rbc

Inventory is on the way, but the debate seems over when the buyers might return.

Some free advice, don’t “conflate” on purpose, as it’s misleading.

Anyway, yes it’s good for housing that temporary residents may be falling. Almost none of them own homes, but it might help with rentals. This doesn’t help right away though, it’s a gradual effect over the next three years, and we will have added 1.5 million more permanent immigrants by then. Overall, this doesn’t add up to cheaper home prices IMO.

Frank, it dos not matter what you want. As Lisa Helps once said, single family homes are a white settler idea and so your opinion or desires dont count. Since Lisa Helps is now a direct advisor to Ebby for housing why are some people surprised that this is what you get.

I’m afraid getting anyone to put in an honest days work in our socialist society is next to impossible. Why work when the government will provide your every need? At least that’s what they want you to believe. I hear the same story from all sectors of employment, no one is capable of or wants to do strenuous work except for new immigrants. I’ve dealt with some young people and am not impressed with their basic skills. Our education system has fail miserably.

As for 4 plexes being rentals, that’s the last thing neighborhoods that were primarily single family residences want.

Typical answer arrived via pure google searches and not much overall thought. Fails to consider that the rate of nonpermanent resident will need to be negative 100k+ per year instead of positive 700k plus a year of what is currently experienced (2022/2023). The total delta is likely closer to 1M less people per year coming into the country compared to the status quo…..

If a new build 2 bedroom rental In Langford Is 2k per month, I would Imagine a new build 2 bedroom In Oak Bay would be 4k per month…48k per year.

Frank, so how have most new builds, especially for rentals, impressed you lately? Most of these four plexs are likely to be rentals.

What’s worse Is you need them. My buddy owns an asbestos abatement company…The guys quit every other day. He has bulletins posted at Wilkinson Road Corrections for guys getting released. “A positive attitude Is key” Is his spin. Same thing with a cement finisher I know, bulletins at Wilky “If you cant finish school, finish cement”… Work today!

patriotz- You’ve obviously never hired a full time employee. I have, dealing with employees is sometimes the most difficult part of being in business.

Barrister- Developers might not care how ugly their product is, but buyers might. Have you ever heard of street appeal. I hear it is important when selecting a house, to the buyer. Ever buy an ugly car, or ugly clothes, people are sensitive to the impression they make. “My, what an ugly home you have”.

Nothing to do with living in Toronto himself, of course. NIDBY. That’s Etobicoke to be precise, in the “old” Toronto (pre-amalgamation) you have a similar level of density already.

Looks like the carrot on a stick approach isn’t working in Ontario. Doug Ford stated that he doesn’t think 4 plexes will go over well in Toronto neighborhoods. He’s right, and the feds might take the carrot away because they aren’t even close to meeting the affordable housing levels that have been set. They have only built 6% of their expected 20,000 units.

Well then I guess we’re moving downstairs. Its not really a basement rather the lower level.

You want the brothel to be upstairs and not in the basement.

I was totally kidding totoro…Like my Wife Is going to let me run a brothel In the basement, or grow cannabis. Even though they do make for very beautiful house plants.

No. Whatever your position on the matter, It is currently completely illegal to do this.

The license issued by the City of Victoria is for escort services only which are limited to introducing parties and which cannot include sex work.

The following are criminal offences:

https://www2.gov.bc.ca/assets/gov/law-crime-and-justice/criminal-justice/prosecution-service/crown-counsel-policy-manual/sex-3.pdf

I agree that I conflated immigration and temporary residency in that last post, but for good reason.

From the perspective of housing demand there’s functionally very little difference between “temporary residents” and “immigrants” as everyone who comes here needs a home and each additional resident in this country contributes to rising rental demand.

The rental market here has been persistently hot because of outsized population growth, and you can bet that if our population growth rate starts to fall precipitously that this slows down soon in line with the falling rental rates the US is seeing.

Moreover, most of the recent rise in the Canadian population (2/3 of the population rise last year) has been from temporary residents who, as a group have been growing in proportion to population over the last 8 years. Effectively, the temporary resident population seems not so temporary.

What is more after covid the feds simply converted large swaths of temporary residents over to the immigration stream by offering PR.

Finally, I didn’t refer to temporary workers, but temporary residents, which is a broader category that includes student permits.

Regardless of the semantics, it looks like Canada’s population rise is going to start cratering soon. You can imagine that as the next election cycle comes along there will be heavy pressure on all sides to set hard caps in line with infrastructure demand on total population growth through immigration and temporary resident permits.

Frank, the developers dont care how ugly the fourplexs are but building a fourplex on a Uplands lot that cost 2.2 million is pretty profitable. Thats about 500k per door for a premium lot. Most of the lots are a half acre. I suspect that under the new regulation they will not have to provide much if any parking. (you should be using an electrical bicycle anyway so learn to live with less) Eventually it will make Oak Bay less desirable but there is a lot of money to be made before that happens.

Water and sewer will need to be upgraded but your property tax increases will pay for it and mostly not the developers.

Agricultural workers are excluded from the recently announced cuts.

More generally, there’s a difference between “can’t get” and “won’t get if you don’t offer a living wage”. Most jobs currently performed by TFWs could be filled by Canadians simply if the employers offered higher wages. The potential workers are there – we are a long way from 100% labour market participation. Or employers could invest capital to reduce labour requirements. Bringing in temporary residents (and that includes students) to perform low wage jobs is one factor in our stagnant labour productivity and per capital GDP.

Also appears you missed the announcement of student visa cuts, which will primarily hit BC and Ontario.

https://www.canada.ca/en/employment-social-development/news/2024/03/government-of-canada-to-adjust-temporary-measures-under-the-temporary-foreign-worker-program-workforce-solutions-road-map.html

My house in North Oak Bay is assessed at $169,000 with a total value of $1.35 million. It is not what is currently desired by new buyers who want an open concept interior. Being built in 1954 it is still rock solid and might outlast some of the new houses that are being built today. To replace it at $400 a sq. ft., plus demolition costs, would result in a property valued at $2+ million. I can’t see many 4 plexus being built in the area as they would look completely out of place. Downright ugly in my opinion. I’m also confident that one would not be approved due to insufficient water/sewer supply. Especially if 10 were to be built on one block. Not to mention accommodating parking for 4 families. If you’re so intent on densification, you should move to Taiwan, it’s similar in size to the Island with a population of 20+ million crammed on it. Enjoy!

Aren’t temporary workers needed to do work you can’t get Canadians to do? Many of them are essential for the agricultural industry. Are we shooting ourself in the foot? Have they addressed the over abundance of foreign students yet? They were looking into it.

Temporary foreign workers aren’t immigrants and don’t count towards immigration numbers.

There are no changes to planned immigration levels. The Fed announcement confirmed the exact same totals as before… namely 500k new immigrants per year.

https://www.linkedin.com/pulse/canada-immigration-levels-plan-2024-2026-goals-revisited-pm5mc/

“immigration odyssey maintains a trajectory already set in motion. The plan sets forth a target of 485,000 new immigrants in 2024, with an aspirational goal of 500,000 for 2025 and 2026.“

Hang on tight folks, feds are finally going to act on immigration. 500k decline in temporary resident population over 3 years.

Sounds like we don’t even need to wait for Pollieve to win the election for immigration rates to crash by 75%. Already starting this year: https://www.cbc.ca/news/politics/canada-targets-decrease-temporary-residents-population-1.7151107

Who said the Liberals can’t admit their mistakes? That would be a relief, as I really don’t want to vote for the cons.

That said, I still can’t stomach voting for the current government, and I suspect a lot of committed centrists feel the same. You can’t wait this long to fix your terrible mistakes. 1.2 million people coming into Canada in a single year when we’re dealing with a housing crisis, I mean come on… If that’s not a reason to fire the PM, I don’t know what else is.

The value is primarily in the land for older homes. These homes in Oak Bay are already devalued to 200-300k for the structure while the land is still worth 1.5 million. This is why a new home in Oak Bay is not 1.8 – its 2.8 right next to the 1.8 million 1930s home because of the different structure value.

That’s the cognitive dissonance Frank. That’s how you justify the price in your mind. Sure Bob’s house is nicer than ours – but we’re five minutes closer to the beach. When we die we will be richer than Bob.

I was talking with a woman in her fifties that owns a house in South Oak Bay. Her spouse died last year and the kids have all grown up. Now she can do what she wants and not be tied down to moving the kids back and forth through out the city to school events. She wants to sell and move to Prospect Lake away from the city and live along a country road with a view of the lake. She doesn’t want location she wants a life style.

You only live once.

What you’re really buying is land, not the shack on it. Houses are money pits, they don’t last forever.

Ever since this blog started people have complained about the crap listed for sale. Victoria is an old city, there will always be crap houses for sale. You’ll just pay more for them and then with cognitive dissonance convince yourself that they are great homes. Most of the pre 1970 homes were built for retirees that moved here with limited funds and built economy housing. Two bedrooms on the main floor with one bathroom which was less than a thousand square feet and an unfinished basement with a low ceiling. They were crap houses then and they are crap houses today just dressed up with granite counter tops and Ikea cabinets. There are hundreds if not thousands of these homes in Greater Victoria. And the agents keep telling you so, every time they say you’re buying the location because who the hell would pay this much for the house.

Ya should be lots more coming on after the long weekend. Very curious on how much sales pick up.

Since It was a refinance and not a simple renewal I had a lawyer Involved. He showed me the appraisal. He also explained why the banks only look at 40% of the rental Income. The banks assume you are paying taxes on the Income, they also assume you are Insured to have a tenant living In your basement, and they allow for downtime when the suite may be unoccupied…Like In between tenants.

Dad, I give out copies of my appraisal reports if I can obtain a Letter of Release from the client. It’s up to the authorized user to say yes or no. An applicant called up two or three months back and asked for a copy. I CC’d his request to the broker and the broker replied “NO”. No other explanation just – no.

The appraisal still remains the property of the lender until I am released from my legal obligations to that lender. Which means I can not do an appraisal on your property for another lender until I get a release or the intended use of the appraisal is completed.

You are considered an unintended user or third party. In the past when letter of releases were not obtained, home owners would get a copy of a report and use it for another purpose such as a divorce. That can get very messy if your spouse’s lawyer wants me to appear in court. Now the appraisal reports specifically deny you to use the report for any other use than that identified in the report and the name of the authorized user which would be the name of the bank. Your name only appears as the applicant, home owner or mortgagee.

I’ll admit that as an error to Max, the lender can use other means of income verification. They just can’t get an appraiser to do a rental report as I said there are exceptions and that’s why I posted such a large comment.

In Max’s case his suite was vacant, so he doesn’t have a T1, T4 or T776 that a broker or lender is able to support the rental income by a lease or notice of assessment.

Since when? My lender gave me a copy in 2020.

I am not trying to cherry pick anything, just admit that your statement in question was poorly written and that some lenders will take into account rental income from a illegal suite when providing a mortgage, that’s it.

It has been awhile.

DisInformation.

https://www.apa.org/topics/journalism-facts/misinformation-disinformation

Actually Max, you pay the bank. The bank pays the management company and the management company pays the appraiser. I never get a e-transfer from you or from the bank. It’s done this way because at no time are you my client or the authorized user of the report. Which is another big change that has happened in the last decade. The mortgage appraisal business has completely changed since you bought your home as new regulations were brought in after the 2008 financial crisis. Back when you bought your property it was common for the bank to give you a copy of the report. That doesn’t happen anymore as the appraisal report remains the property of the bank. The bank can not release a copy of the report without obtaining a Letter of Release.

That is not true, this is what you wrote below, just admit your error and move on.

https://househuntvictoria.ca/2024/03/18/the-rates-tailwind/#comment-113054

Yes they will. Even If the Illegal suite Is not rented. 40% of fair rental value. Suite could be rented for 2k per month…banks see $800 per month In rental Income. This Is with the banks appraiser (that you pay for) who physically comes and checks It out and takes pictures.

VicREanalyst, what I am not implying is that no lender will take into account rental income from an illegal suite. I can’t speak for all lenders.

What I did say is that an appraiser will not knowingly provide the documentation on an illegal suite. There are exceptions and that’s why I posted such a long reply. Because I know you will try to cherry pick what you want to hear. But why would an appraiser knowingly mislead a lender and chance a law suite that will cost them thousands in legal fees to defend and much more in damages for a $125 fee? This is an easy thing for you to verify – just call up a couple of appraisal companies and ask them to provide a rental report on an illegal suite for financing. Then you can report back here with the names of the appraisal companies. Then I will copy your comment and email the appraisal company and CC the email to the Appraisal Institute. And I will get a reply from them.

Actually, I already have a letter from the AIC regarding this. It’s another long one.

I totally agree. I’m 6′ 175lbs. I’m not a super runner or anything. My Wife’s phone tells me the two of us do 10,000 steps per day. With that said at 50 you are still going to feel a little bit tired. After 438,000 hours on the planet with gravity at 9.81 m/s2…Just saying.

I think retired Is short for really tired.

Some crap in South Jubilee and some in the Maplewood through the high Quadra areas. Maybe Oaklands as well, minus the Avenbury one that sold (different from the rest for sale there).

Which ones?

Yes, basically he was implying that no lender will take into account rental income from an illegal suite which is factually false. I think he knew it was false which is why he posted that long post about the AIC.

That’s what is was about? I didn’t read it.

Misinformation is what it is. The truth is that you will be able to find multiple lenders right now that will take into account rental income from an illegal suite.

Circling back to health over 50. This is the most important issue everyone over 40 should be concerned with, this is more important then house prices. Watch the first 4 mins.

https://www.youtube.com/watch?v=JU4Bzos1hTA&t=320s

Ya, no one is reading a post that long.

Do you have anything else you would like to add to this discussion?

FYI VicREanalyst. Appraising in Canada has changed significantly over the last decade. Real estate appraisals have become highly regulated, as they should be, as they release billions of dollars in financing every year in Canada.

Providing a Market Rent for Secondary Suites April 2022

Given the current conditions in Canadian housing markets, many mortgage applicants are turning to additional sources of income to assist in financing their home or investment property.

AIC Professional Appraisers (P.App.) continue to play a major role in safeguarding the real estate market by providing objective and independent opinions on value.

AIC Professional Appraisers can provide three types of professional services for Market Rent assignments:

(This is the most rigorous Professional Service that an AIC Professional Appraiser can provide.)

As part of their professional services, an AIC Professional Appraiser :

AIC Professional Appraisers can provide Market Rent Valuations on:

• legal secondary suites

• new homes

• suites under construction

• accessory dwellings

• single family dwellings

• townhouses

• strata/condos

AIC Members are insured to provide market rent valuations for legal secondary suites.

UPDATED JUNE 21, 2023 (“I” refers to the person doing the rental study in this case it means Appraiser)

No, providing an estimate of market rent for an identified secondary suite that is illegal/unauthorized does not comply with CUSPAP and will invalidate a member’s insurance coverage.

Yes, a Member can complete a Market Rent Consulting Report but only for a general or generic type of property.

A Market Rent Consulting Report provides an overview or survey of market rents for secondary suites in a general area/neighbourhood. There is no requirement for inspection or permits as there is no specific property.

Members who provide a Consulting Report on Market Rents on secondary suites in a general area/neighbourhood must:

comply with the Consulting Standard in CUSPAP

not identify any specific property in the Consulting Report

not link the Consulting Report to any specific identifiable property

provide the Consulting Report as a separate report that is not contained within, or attached to, an appraisal report for an identifiable property.

4. What is required for a Market Rent (Standalone or Addenda) for a secondary suite in an identifiable property?

In addition to the requirement to comply with the Reporting and Real Property Appraisal Standards in CUSPAP, the three main steps include:

confirm zoning and/or legislation that allows the secondary suite

confirm permits or if unable to confirm a permit exists, that the suite has the characteristics of a legal secondary suite, and

inspect the secondary suite (please refer to question #10)

ZONING AND PERMITS

5. If Zoning does not allow a secondary suite, can I still complete a Market Rent?

No, Zoning must allow secondary suites. Remember that checking zoning is only the first step – the Member must also research rental data, inspect the property, and confirm whether the secondary suite is legal by checking with the municipality to confirm whether a building permit exists or, if unable to confirm a permit exists, confirm that the suite has the characteristics of a legal secondary suite.

Members should also research whether a property’s zoning is changing or a variance or exception is granted to allow a secondary suite. A property owner may, or the municipality will have proof of this change.

In some Provinces, local zoning may be overridden by regional or provincial authorities, however, any legislation or regulation on that matter must have been passed and imminent or in effect.

“Permitted under zoning” means: the existence of the secondary suite is allowed under a Zoning Bylaw for that location and property type.

Having a “permit” typically means: an owner has applied for and received authorization from the municipality in the form of a development or building permit to build/alter a property to include a secondary suite.

Normally a municipality or fire department will inspect the property to ensure the secondary suite complies with building and safety codes such room sizes, window sizes, exits, plumbing, heating, fire safety, and smoke/carbon monoxide alarms as part of the permit process.

An occupancy permit is normally provided to an owner after a suite meets all municipal or building code requirements.

A Member must research both zoning and permits, for secondary suites.

It is sufficient only if the owner can provide a copy of the approved building or final occupancy permit to show the secondary suite is authorized.

Members must indicate how this information was obtained and include assumptions and limiting conditions relating to reliance on this information in the report.

If the owner does not have a copy, the Member should contact the municipality for permit information. If unable to confirm a permit exists, the Member should confirm that the suite has the characteristics of a legal secondary suite.

The Member must still make a reasonable effort to confirm the legality of a secondary suite and include the efforts they made to verify the secondary suite’s legality within the report.

A Member should notify the client/AMC that checking with a municipality takes time. After endeavouring to confirm the legal permit status of a secondary suite with the municipality, a Member may include an extraordinary assumption but only when the permit status is unknown.

In most instances – NO.

There are some exceptions:

A home is under construction and includes a secondary suite.

For estimating the impact on the value of a property due to an illegal status like a cost-to-cure assignment. This is typically NOT related to mortgage financing.

For any Hypothetical Condition, a Member must have information about the improvement such as the cost to remedy, construction plans, estimated time of completion, and other pertinent items.

INSPECTION

10. Do I have to inspect the secondary suite?

Yes, a property inspection is required unless:

there is recent reliable data (less than 3-year-old MLS) identifying the characteristics of the suite

or

you have performed a recent prior inspection.

If a complete personal interior inspection is not possible, a Member should:

discuss this with the Client,

modify the Scope of the assignment,

provide an explanation in the report, and

invoke a limiting condition.

Any reason not to inspect must meet the Reasonable Appraiser test. Reasons not to inspect are typically limited to new construction, denied access on-site, or safety/health concerns.

No, a Desktop or Drive-By for Market Rent for a secondary suite is not normally acceptable.

Desktop and Drive-by report forms were designed to provide a market value for a home in limited cases and with limited liability and are not intended for estimating the market rent of a secondary suite within a property (e.g., a basement suite). A house is more easily verified through more than one third-party source (MLS, Google Street view, aerials, assessment, and other public records) and by the appraiser’s own eyes.

Reliable third-party data on a house is generally available to appraisers but reliable data on a secondary suite in the house is typically not. Often an MLS listing does not include detailed information on a secondary suite and will note only that “agent/seller does not warrant retrofit status” which can often mean it is not in compliance with zoning, fire, health, safety, or other municipal standards.

There has been a significant increase in fraud in Canada – including mortgage fraud. Equifax Canada flags 15,000 to 24,000 of mortgage applications each month for lenders as fraudulent or suspicious. Members should rely on a personal inspection rather than private information or, information that may be outdated, biased, or fraudulent.

Members should always be careful not to disclose personal information and follow provincial privacy laws and PIPEDA. Members should consider whether consent is implied or if informed consent is required and must not provide personal or confidential information to a municipality unless required by law.

A Member is required to research a property, including legality and will contact a municipality to verify publicly available property information as part of the normal scope of work. The member is requesting – not providing- information about a property.

No, market rents for “illegal” secondary suites should not be valued. It is also not acceptable practice to ignore legal characteristics of suites in order to compare “apples” (illegal secondary suites) to “oranges” (legal secondary suites).

If the Zoning By-Law does not allow secondary suites, but the property has a zoning variance or exemption can I complete a market rent?

Yes, if a secondary suite is a legal non-conforming use, market rent can be completed provided all other steps are followed (e.g., inspection, permit).

Do I have to list all features to show that the secondary suite conforms to building and safety requirements?

No, normally an approved building or occupancy permit is sufficient to show that the secondary suite conforms to building and safety requirements. You must still describe the secondary suite and should identify commonly expected items in a secondary suite such as: a separate entrance, kitchen, bathroom, windows, and normal safety features found in secondary suites.

Do I need to add a Hypothetical Condition, Extraordinary Assumption or Extraordinary Limiting Condition for secondary suites?

A Hypothetical Condition should not be added since Members should not be completing market rents based on untrue information. In exceptional cases where the Scope of Work requires Hypothetical Conditions that are necessary to complete the assignment (e.g., damaged properties or estimating damages), this must be clearly disclosed and explained in the report. (See CUPAP 7.10.7.)

An Extraordinary Assumption IS added when a Member is uncertain about some information. (See CUSPAP 7.9)

An Extraordinary Limiting Condition IS added when a Member is unable to complete an interior inspection. An explanation and justification must be included in the report. (See FAQ #10)

A Member should complete most of the steps, but it is NOT necessary to contact the municipality for permits and legality.

It is reasonable to assume that a house is permitted but it is not reasonable to make an assumption that a secondary suite is permitted.

Normally two suites require two separate market rent analyses in two separate reports since there will normally be differences in at least location (e.g., upper level, ground level, basement).

Many zoning bylaws will not allow two suites – if only one suite is allowed under zoning, only one market rent valuation for the allowed suite can be provided. If only one suite is allowed in an owner-occupied home, a Member should confirm occupancy, already a normal part of the appraisal process that is required in the history section of a report obtained from prior rental history or a current lease (similar to the requirements under CUSPAP 8.2.14., 9.13 and Practice Note 4.18.)

If a property has two dwellings – both a primary residence and an ancillary dwelling or carriage or laneway house, Members should confirm if a client requires one or two market rent valuations. When valuations for multiple residences or rents are requested, two reports are recommended as two sets of analysis may be required.

One market rent may be provided for an entire property provided it is reasonable, supported by the market evidence, and not misleading. The report must discuss how basement finishes are treated in the Direct Comparison Approach and other sections of the report (see Practice Note 4.13). A Member must be cautious not to do indirectly what they cannot do directly under CUSPAP Ethics 5.1.

A Member may include information about the actual current rent for illegal suites in a report. A Member must be cautious as it may be misleading to describe this as “market rent” in the report.

Do I need to obtain a copy of the rental agreement?

The practice of requesting the rental agreement is similar to the practice of requesting an agreement for sale.

If a rental agreement is not provided, a Member should contact their client and request that production of the information be arranged.

If the information is unobtainable, a Member must explain the efforts they made to obtain the information in the report. (See PN 4.18)

A market rent assignment is an estimation of market rent value, which is predicated on the Highest and Best Use of a property which is determined to a significant extent by the legally permissible uses allowed by local municipal land use controls. As such, land use controls must be noted and analysed in a report.

Identifying land use controls has always been a requirement under CUSPAP. While zoning is the most recognized land control, a Member must consider other land controls such as community plans, environment/flood, rental housing rules, or even parking. It is common to find additional controls about rooming houses or student rentals that may be relevant to the assignment.

Appraisers have an important role in maintaining the integrity of a sound financial system in Canada. B20, the Residential Mortgage Underwriting Practices and Procedures Guideline has principles around a borrower’s capacity to service their debt obligations on a timely basis and the underlying collateral. Members must exercise due diligence in both the market value (OSFI Principle 4) and the market rent (OSFI Principle 3) because lenders rely on appraisers for two of the three critical OSFI principles in the underwriting process. In declining markets, the appraiser’s role in market rent may be even more important because the underlying property value may become less sound collateral. If rental income cannot be verified by reliable well-documented sources, both the Member and the lender must exercise caution.

Here are examples of clear and concise messages and guidance from OSFI in several of their publications:

From B20:

Misrepresentation

FRFIs should maintain adequate mechanisms for the detection, prevention and reporting of all forms of fraud or misrepresentation (e.g., falsified income documents) in the mortgage underwriting process. For insured mortgage loan applications, FRFIs are expected to report suspected or confirmed fraud or misrepresentation to the relevant mortgage insurer.

Income Verification

Lenders should also exercise rigorous due diligence in underwriting loans that are materially dependent on income derived from the property to repay the loan (e.g., rental income derived from an investment property).

From the OSFI Annual Risk Report:

Recent supervisory reviews identified several common issues around underwriting, specifically income verification in areas that have been raised as being problematic in the past including business for self, rentals, exceptions to income sustainability as well as collateral management.

https://www.osfi-bsif.gc.ca/Documents/WET5/ARO/eng/2022/aro.html#housing

From OSFI letter to FRFIs regarding “Reinforcing Prudent Residential Mortgage Risk Management”:

OSFI expects all financial institutions to exhibit rigour in the verification of a borrower’s income as it is a critical element in the residential mortgage underwriting process. Inadequate income verification can adversely affect the assessment of credit risk, anti-money laundering and counter terrorist-financing (AML/CTF) compliance, capital requirements, and mortgage insurability. OSFI is aware of incidents where financial institutions have encountered misrepresentation of income and/or employment.

If “tourist commercial”, which one would think includes hotels and motels, is a zoned use why then the issue with the provincial changes? Hotels and motels aren’t being shut down around the province are they?

Could you fill us in?

It Is perfectly legal to have a brothel In your basement In the COV. It Is also perfectly legal to grow 4 cannabis plants Indoors under both metal halide and high pressure sodium lighting conditions In your basement In the COV.

https://vancouverisland.ctvnews.ca/behind-closed-doors-brothels-thrive-as-licensed-escort-agencies-in-victoria-1.3472536

https://www2.gov.bc.ca/gov/content/safety/public-safety/cannabis/growing-at-home

My Wife won’t let me do either, however I’m sure there are some divorced men out there that might find this Information to be useful.

Could be that, but both seem to be about 250k over where they need to be in each of their respective locations to get some action. It will be interesting to see what happens in April when even more inventory comes on. I have seen in some neighbourhoods where multiple similar houses have already started some downward price adjustments as similar inventory competes for buyers.

Sorry but when did you say this came into effect? That you cannot use income from a none permitted suite for rental income when applying for a mortgage?

I don’t need a loan anymore. It was 2012 when I needed the loan…The loan has been repaid.

Escorts actually file taxes, I see no reason you can’t have a brothel In your basement.

That was a joke…I was just kidding.

Max, no one has said that you can’t have an in-law suite in your home. Just that lenders can’t use the income from an illegal suite for you to qualify for a loan. Just like the income from an illegal grow operation or a brothel in your basement can’t be used.

I bet the one on Wycliffe and the one on Monterey not moving because entire renovation without permit. Sometimes, flippers are just too lazy not applying permit.

The last time I rented the space was In 2001. I don’t need rental Income. I never really did.

The suite Is vacant. In law suites are still perfectly legal, so I just keep It empty and clean.

2012 was when I wanted to borrow the 100k. The suite was vacant, but It was there…And that’s all they really cared about.

Max, since 2012 then there have been changes. The one that may effect you today is that the suite must now have a permit from the City otherwise the appraiser is no longer able to complete a rental study without voiding their insurance. The insurance policy is there to protect the lender from a loss if the lender has to seize your property because you can’t make the payments if the suite is shut down by the city for fire, health or safety reasons, or that a disgruntled renter or neighbor lodges a written complaint to the city that closes down your illegal suite.

If the suite is not on permit, that voids the insurance policy and the appraiser has to pay legal fees and damages out of their own pocket. The court case follows along the line that the lender would have never given Max the $100,000 if they had known that the suite was illegal. This is a court case that is impossible for an appraiser to defend as it goes against OSFI regulations and that an appraiser may only appraise legally permissible uses. Appraisers have been sued by lenders for doing this and they have lost in court. It was becoming so prevalent to have rental reports done on illegal suites in the mortgage industry that the insurance provider stepped in and a special event was scheduled for appraisers to attend across Canada to immediately end this business practice of providing rental studies on illegal suites as the insurance provider would no longer defend these cases.

Insurance companies are tightening up regulations on a lot of things so that they don’t have to pay out damages.

Even back In 2012…I had way more skin In the game then the bank. So I wanted to refinance $100k for bath/kitchen upgrades and other shit. I had to pay for an appraiser to come check It out. Just to make sure there was actually a suite that could be rented for $1k per month (1100 sq/ft). he took a bunch of pictures. I had to sign an “assignments of rents” Then they released the funds. Even though It wasn’t even rented out…It was vacant. And It still Is.

https://bcrealestatelawyers.com/knowledge-centre/legal-issues-faqs/terminology/

When I was 26 years old (2001) I rented the suite out. I found It was far better for me to just work more. I kicked them out and the suite has been vacant ever since. Being a landlord Is not for everyone. It actually really sucks.

It is important to remember that OFSI is not concerned with the housing market at all or people having the ability to buy. It’s only concern is the stability of the financial institutions it regulates and that is a good thing.

I think you’re right REAddict, the OSFI changes will likely make it more difficult for people to buy houses in the Victoria market. OSFI has been tightening up the rules on suites without permits as well as the percentage of income that may be used to qualify an applicant.

These rules are a reversal of what have been a main cause of the hyper inflation in house prices for the last two decades.

Brokers have been trying to get around these rules to qualify their clients for larger mortgages, so I suspect OSFI will be doing more tightening up on third party verification. One such rule is that an onsite inspection of the premises has to be performed by the third party doing the income verification if there is no listing on the property that is less than three years old or the person doing the verification has not inspected the premises. The lender or broker can not do their own income verification and neither can someone that has an interest in the property such as a real estate agent. The person doing the income verification must also carry insurance of not less than $2,000,000 to provide this service and have no interest in the property. That insurance policy costs $3,500 a year. Essentially that just leaves Property Managers and Appraisers than can do these reports.

Yes OSFI is making it more difficult for home buyers in order to curb housing inflation. Although, It is a bit like closing the barn doors after the horse has left but the changes will most likely work going forward.

For me, I am contemplating not to provide third party verification as a stand alone service for lenders or brokers as the requirements to complete the seven page mandatory report is time consuming while the lenders have not increased the fee they pay for this service in 15 years. You end up working for less than minimum wage to provide a report that meets all of their regulations. The lenders can hire a property manager like Brown Brothers or Devon Properties instead that will likely charge the person getting the loan between $300 to $500.

My Wife’s BC Service’s Card and BC Drivers License already have my last name on It. Both my kids have my middle name and my last name on their Birth Certificates. All the bills that come Into the household have my last name on It. Does that make It easier?

Even the mortgage has my last name on It…It’s just the title has my Wife’s maiden name on It.

To save you from yourself when rates come down.

4506 chatterton way, 17000 sqft lot 3000 sqft house with some renos and separate finished auxiliary building with washroom. 1.45 pending

I think the OSFI tightening sucks honestly! I’m a single homeowner and wouldn’t have been able to buy this house at just under $500,000 if that rule had been in place at the time and I had $100,000 down. 4.5x income is so little in this market. Will put even greater pressure on homes with suites in my opinion as rental income will be even more desperately needed to offset that. What is the point when there’s already TDS and GDS caps at most lenders.

Exactly, the two of us are just thinking of our two kids.

NP – I would just call up a local notary and see how much it is to be added to title. This is well worth doing asap so that there are no admin/legal issues to deal with should something happen to your wife. Best to remove all the stress you can for loved ones.

Thanks so much totoro!

You can be added to title with no issues as the spouse and no payment of PTT. The name change for your wife can also be done but is not necessary for any legal reason. You can DIY the name change but you need a lawyer/notary to electronically file to add a spouse to title.

See: https://ltsa.ca/property-owners/make-changes-to-title/change-name/

And for the property transfer tax exemption: https://www2.gov.bc.ca/gov/content/taxes/property-taxes/property-transfer-tax/exemptions/transfer-principal-residence

Patrick, these are my wife’s holdings and most of the kids and grandkids are in either the US or Europe. Nobody, except the two of us are in Canada. Her assets are in both the US and Europe. Her family holdings are fairly diversified and truthfully I dont spend time actually following the details. The kids are all very involved. My point was simply, especially viewing the drop in the value of the Canadian dollar, that one might consider returns elsewhere. There is always good and bad in that.

Thanks for making the Rockland house sound very grand (in spite of the fact it is too small to even qualify to be a mansion much less a castle).

Can’t we just take our marriage certificate down to the land titles office?

Max. phone your real estate lawyer, unless there are tax implications, it should be relatively cheap. Do you want title to be held with survivor rights? Talk to the lawyer about tenants in common or right of survivorship and other issues. It can make a big difference if one of you dies.

According to this, at the peak (2 years ago), 38% of mortgages to first time buyers were 4.5x or greater.

Clearly the stress test is not an effective tool by itself, without increasing the 2% buffer, when interest rates are ultra-low.

I don’t want to poke the bear here…I’ll just leave It be. I’m sure I’ll die first anyway.

Hopefully they won’t make you pay the land transfer tax. Again.

I have been with my Wife since I was 17. We borrowed 70k (@7% Interest) from my Fathers rrsp for a down payment on the house we still live In today. In order for my Father to lend this money from his rrsp It had to be at arms length. I was 26 she was 24 and she was my girlfriend at that time so It worked. The bank gave us the $165k mortgage no problem, the house was $235k. This would have been 2001. In 2006 with price acceleration we had the equity to pay my Father back, so now we just had a mortgage with the bank.

I married my Wife In 2007. Since the down payment loan had to be at arms length meant It had to be her name on the title and It was her maiden name. Now both my Wife and I want to correct that to have both of our married names on the title…How do we do that? And how much does It cost?

https://wkzo.com/2024/03/22/canada-regulator-to-cap-mortgages-for-highly-indebted-borrowers-newspaper-says/

It’s also important to remember, it’s only for the mortgages that banks take the risk on. Lenders have already been doing much more diligence on their own on the uninsured side of things the last 2 years. So, if there is an impact, it’s will mostly be on that market over a million. Mostly, the stress test has brought it to that 4.5X mark anyways… So, maybe they will bow to pressure and drop the stress test for Libs in the upcoming budget, but the new 4.5 rule basically does the same function. (The timing for budget messaging and appearing to take action is a little too coincidental)

Not that I’ve seen. People are making a big deal about it but I don’t think it will have a big impact. They’re just putting some brakes on future acceleration. Doubt they’ll be interested in cutting it from current levels much

What exactly are you criticizing here?

Barrister’s approach seems practical and tax efficient. A family trust can be a very good way to reduce tax and probate fees if you have significant assets. And part of his family is in the us. reit returns are in no way comparable to owning rental properties in Austin over the last 15 years.

Austin Texas is the capital of one of the wealthiest states not only in the U.S., but any region in the entire world. Lots of government bureaucrats to rent to. Probably a wise business decision. Still would like to know property taxes and insurance.

Have they specified what the cap will be? Hopefully much lower than 12%. It is frankly criminal it was allowed to get to >25% at the height of the pandemic frenzy.

4.5x income — household income, presumably — is still too high IMO. I guess there’s little chance they’ll ratchet that ratio lower? OSFI seems like another agency that is belatedly reactive, when it should be more proactive.

Are you kidding? You really own multiple properties in Austin TX and rent them out, from your Rockland Castle, all for the benefit of your kids? I love my kids too, but not like that 🙂 Why not just get a REIT?

Yes, that’s primarily based on anecdotes in the forum though. I’ll wait to see it confirmed by Leo’s (fabulous) sales-to-assessment chart.

So OSFI is going to restrict mortgages over 4.5x loan to income. Those already died down due to higher rates, but they want to ensure it stays that way when rates drop https://www.theglobeandmail.com/business/article-osfi-mortgages-banks-borrowers/

The market seems to be getting some good prices this spring. Better than some people feared.

Looks like 4706 crofton in Sunnymead finally sold (1.5). Renoed 3,000 sqft house with 2 bedroom suite and own laundry on ~10,000 sqft lot. IMO that is better value than 784 Walema for 1.55 that sold a week ago with similar lot size but no renos and a 1 bed suite.

I’ve heard property taxes are very high in the U.S. Also insurance. Lots of violent weather.

Yes VicREanalyst but we have not had the surge in renewals yet. Those that took out mortgages 3 and 5 years ago when mortgage activity was high and interest rates low. That won’t show up till late Spring / Summer.

This possibly is one of the reasons why there has been a recent significant increase in listings. We might surpass the ten year high in active listings by summer.

Most of the rate hikes have already been in place for over a year now.

Residential mortgage portfolios have ballooned alongside rising prices to make Canadian borrowers among the most highly indebted in the world. Canada’s mortgage market is facing a surge in renewals in the coming years with RBC Economics estimating that $900 billion worth of mortgages – almost 60% of all outstanding mortgages at chartered banks- are due to renew between 2024 and 2026.

The delinquency rates remain near historical lows, but the economy has yet to feel the full impact of the rate hikes given that monetary policy typically acts with a lag of 12 to 18 months. Interest rates have not increased since July 2023 so I would guess we have 6 months to a year before we see the impact of the rate hikes.

Might this be the beginning of a perfect storm in the housing market?

Kate Middleton just announced that she has cancer. Sometimes the world just is not right.

Roger, go back fifteen years and calculate gains in Austin, including rental rates. properties are in trusts for kids and grandkids, they will continue to do fine.

Yes.

It’s just physics. https://www.astronomynotes.com/gravappl/s10.htm

https://www.newsweek.com/austin-housing-market-sinking-1843057

Depending on the house you may need a big HELOC, plus the foreign income is also a headache every tax season. I suppose if you bought during 2010 era, you would also enjoyed the CAD devaluation on top.

Many people buying in the US use a HELOC on their primary residence. HELOCs are an expensive way to borrow now given interest rate hikes.

He would have needed cash on hand then, so after accounting for leverage I am still not sure if he would actually be better off.

He probably bought in Austin after the GFC wen everything down there was near $0. Phoenix was also a super popular place for Canadians to buy at that time. Fire sale. Buying now though…

How? I’ve looked into this before and the financing rates are much higher than what I can get to buy a investment property in Canada. Unless you have some other ways of obtaining cheap capital?

Our real estate investments in Austin have done a lot better than anything in Victoria could have done over the last ten years..

Exactly. If you are in long enough to pay down the mortgage your roi on capital invested decreases due to reduced leverage. Gains in appreciation early on result in huge roi far exceeding the stock market.

It may be a while before we see appreciation like this or declines in interest rates and leverage also magnifies losses. We can see this for homes bought peak in 2022 which are selling today at a loss.

Marko-What’s the average daily sales you expect to see? This time of year.

Less condos, more SFH

Which was the Oak Bay property?

34 sales today with 20 over one million, can’t say I’ve seen that before. Including a sale in Oak Bay for $11 million.

I’ve done well in stocks; however, pales in comparison to real estate gains. The difference is leverage.

The first three condos I bought around 200k/each….I didn’t have 600k to invest in stocks, I had 120k.

It is already legally zoned tourist commercial and they are paying different rates.

Parksville approved this zoning specifically to attract investors to this specific area because of the benefits these units bring and have brought to the town. The zoning, which is 20 years old, applies to a small area and states: “This zone is intended to provide accommodation and other services to visitors to the community.”

Based on this representation people invested in a specific type of property and they are now collateral damage. Seems unfair.

And no, I don’t own one of these units.

20-30 years is a long time to stay in. By the time you can afford to buy a rental property most people are at least 40 these days. Heck – lots are 40 before they can buy a place to live.

In terms of cash flow, a rental condo won’t make cash flow sense even if rates come down 2% imo. Even if it does you’ll be paying top marginal tax rate on any net rental income but probably not seeing a cent of it because it is going to principal.

Of course the longer you own the more the appreciation, equity pay down, and rental increases make cash flow more likely – but then you have more equity in that could be invested in passive things like stocks and GICs instead.

Where the overall ROI changes a lot for real estate is if prices start to rise quickly.

Marko, a lot of us dont have a twenty to thirty year horizon.

Much more of a Jubilee/Oaklands area, I would give it OB border if it was the other side of Dean.. so, ish might work, but an interesting selling price since it started close to 1.3 for asking. The lower sale price is even more surprising because it has 3 bdrms up that makes it much more appealing for families. It’s funny how many places try to sell at a premium with 2 bdrms up and try to claim it’s has a 3rd bdrm because they slapped up some walls in the basement and plopped some carpet over the concrete.

I agree, but real estate is a 20-30 year horizon in my opinion. Right now it doesn’t make sense to buy a rental condo, but if interest rates were to come down 2% the cashflow numbers can quickly change.

It all depends on when you got in and how much you put down. If you got in 10 years ago you benefited from extremely low mortgage rates and you paid down the mortgage quick because a lot went to principle – plus rents up way faster than was expected over this period of time.

Interest rates are now so high that if you were paying 2k for principle and 1k for interest before you are now paying 2k for interest and 1k for principle. Easy to be in the red just with this shift alone, never mind other expenses.

There is no shortage of high cost housing that someone in the top 10% can afford to buy. Ludicrous interpretation of “affordable” having no reference to the real life economic position of people in Canada. It is basically saying let them eat cake.

There is a severe shortage of housing that middle income and below individuals can afford to buy or rent and those that can only afford to rent are in a more precarious position as they have far fewer options. A shortage of private market landlords – should current conditions lead to this – will not be good for renters unless the government gets on board with building significant quantities of purpose-built rent geared to income units.

interesting sales… 1839 Townley (oak bay border ish and suited with some updates) goes for 1.16, 4320 Glanford which is not suited and went for 1.23. And then 734 newberry which has a suite goes for 1.4? I guess people are paying for lot size but townley is not small at over 8000 sqft while the other ones are both at 13000. Then there is the Avebury one Marko mentioned that went for 1.4 old suited on a 6450 sqft lot….

Haven’t seen any of them in person so maybe there’s more reasons behind the sales.

I am a little confused when landlords complain about strata fees, insurance, taxes, etc.

Every unit I own strata fee increases have exceeded increases in rent on a % basis, but when you look at real life numbers my cash flow has improved over the years. For example, in one unit my strata fees over the last 10 years have increase 66% so they went from approx. $150 to $250 and my rent went up 61%; however, that 61% equates to $1,150 to $1,850 per month. So in real life strata fees went up $100 and rent $700.

Even the only cash flow negative property I’ve ever completed on last year things are stablizing. I was able to just re-finance that unit from 6% to 5.24% three year fixed and then if interest rates continue to drop I’ll just get a mortgage on another property and use those funds to pay down 15%/year of the 5.24% mortgage to bring the effective rate even lower. Tenants will move out in a couple of years I’ll probably re-rent at that time close to cashflow neutral and then it is downhill form there.

I and four other people in my circle exited rental “investment” properties decades ago but all of us agreed it was primarily about stories like the one below. I like a little virtue-signalling, leftie steet-cred strutting, confiscatory and intrusive government as much as the next guy, but it does reduce your appetite for putting a property out into the market. I remember these letters – definitive rulings with NO name attached as a sender. Big brother and his green-eyed horde have spoken.

‘Peter works from home in Vancouver and has a rental in Nanaimo. Makes sense if you want to own some dirt yet happen to be in a city where real estate is now the domain of the wealthy and the uber-indebted. being a LL ain’t easy. “I had a flood in the rental property,” he tells me. “Repairs have left me in the hole financially, so I brought forward my retirement plan to move to the place, as it will save me money versus Vancouver.”

Well, that didn’t work.

Pete filled out his RTB-32 form, “Two Month Notice to End Tenancy For Landlord’s Use of Property” and delivered it to his tenant. And so the troubles began.

“The tenant filed an action with the RTB. The RTB said I was lying. A phone call and a faceless bureaucrat with unknown qualifications. There’s no appeal process. They said I didn’t provide enough ‘evidence’ that I would in fact move in. How do you provide evidence of something that hasn’t happened yet? No matter, they are here to protect ‘working families’. My tenants make more than I do.”’

from Garth yesterday

Parksville is free to rezone this area for hotels and then the properties can legally be operated as such. Of course that means the owners would have to pay commercial property tax rates and meet provincial standards for operating a hotel, which I have a feeling they don’t want to do.

My upstairs tenants are moving out. They gave notice at the end of last month. It’s a beautiful loft unit that we fully updated before they moved in (summer 2022). They’re excellent tenants – pay the rent on time every time. Our long term plan is to maybe move into that unit when the kids are grown and move out. Then we could rent out the main unit. I used to panic when a tenant gave notice – until i realized that it’s not bad since i can then increase the rent to market. I also used to be firmly against rental control measures (where increases between tenants are capped by government). At this point with the crazy price of rentals I feel so bad for renters that I think we should try some form of rent control – but only for a set/limited period of time. It is a bit concerning that i can increase the rent by any amount – particularly in this scenario.

Totoro – I agree that more coops would be great. Obviously we also need far more purpose built rental buildings.

Have to be affordable to someone if they’re going to sell. Either an owner-occupier or another investor.

BNN- Ottawa targeting 20% reduction in temporary residents over 3 years. Another insignificant tweak.

https://www2.gov.bc.ca/gov/content/taxes/income-taxes/personal/credits/renters-tax-credit

When a tax credit is really a tool to see who is declaring rental income? If you haven’t been claiming rental income, I would start for the 2023 tax year as you may get an audit if you tenants apply for the tax credit.

Nah, I am good.

Yes.

When government takes away legal zoning that someone paid a premium to obtain I think everyone should be concerned – and many will be. By trying to shift blame unfairly the government will ultimately accomplish nothing but a throw up a smoke screen that will discourage investment in BC/Canada and not be worth it.

As an aside, it is not only the Janion that is affected by this, there are many places that were built for short term stays that are not hotels that are impacted and which are needed for tourism-based economies and unsuitable for long term occupancy. Places like resort drive in Parksville: https://nanaimonewsnow.com/2024/02/07/how-practical-is-this-parksville-council-balks-at-exemption-requirement-for-short-term-rentals/#:~:text=It%E2%80%99s%20a%20caveat%20Parksville%20took%20exception%20to%20and,double%20the%20provincial%20average%20for%20two%20straight%20years

If it is not illegal and a substantial benefit then I suggest just stating it. No need for some blanket of secrecy.

You can borrow against the equity in your rental and invest it in stocks and the interest will be tax deductible it that is what you are referring to. However you had better be making more than the current rate of interest which is not a risk I would take.

There is no free lunch.

Well it is good to have something and a big decision to sell. No-one really knows what is next.

Totoro- You missed tenant’s ability to pay the high rents and utilities. One of my tenants pays the rent but ran up a $2000 water bill which they have paid. Now the bill is close to $500, maybe they’re washing cars to make extra money. It might be a good time to liquidate property in favor of other investments, but those are sky high. Even gold and bitcoin are crazy. Having a minimal mortgage and a healthy line of credit on the property keeps me in the game. A great property manager is also a huge plus.

It has nothing to do with appreciation or capital gains and everything to do with annual income and expenses. I wont’ get into it anymore, but you need to think outside the box, and no it isn’t anything illegal.

The tax benefits to owning a rental property only make sense if the investment ultimately makes sense from a ROI perspective during your window of ownership.

The fact that you can claim your mortgage interest and expenses from your personal income might reduce the cost of these expenses in after tax dollars up to 50%, but a loss is a loss and principal paydown will be done in after tax dollars leaving you with significant negative cash flow at today’s numbers.

When prices were appreciating this was a plus for high income earners as you were not taxed on these gains until you sold. A competent accountant cannot turn a cash flow negative property into a plus for you if prices are not appreciating, and particularly if they are depreciating even if you end up claiming a capital cost allowance.

If you have a really long window of ownership you might end up okay. A lot of people don’t want to be in for a minimum 10 years imo when they are looking a market like we are in now.

There are substantial tax benefits available through rentals for folks in high income tax brackets if you have some creativity in the types of rentals you do and a competent accountant, I’ll leave it at that.

There have been a lot of changes over the past couple years that do impact the case for owning residential real estate outside of a primary residence, not saying reforms were not needed, but these include:

Also, yes, we have a housing crisis but, no, it was not caused by “greedy landlords” imo. We don’t have enough rentals or affordable properties suitable for owners. Landlords leaving the market or not entering it means fewer rentals overall creates more difficulties for renters but it doesn’t meant that former rentals that are put for sale are going to be affordable.

Personally, I’m a fan of coops. I would like to see a major move towards public/private partnerships using public lands for this. They create stable housing with some sense of ownership.

I’m concerned about the weird patchwork response that Canada has to major social issues making solutions difficult to achieve. The federal and provincial governments can’t seem to get it together on things like housing and health care despite the realities of Pandora Avenue or overcrowded ERs and family doctor shortages repeated across the country.

Do you mean the current rent is 2K/month below market, which is the correct definition of a subsidy, or just that you’re losing 2K/month on current expenses? Or part of each?

Half way through the comment and the phone rang. Not sure that it is any one thing but rather his costs are way up both through strata fees and insurance, mortgage renewal looks a bit worse but mostly his tenants look like they have decided to never move. For whatever reason he thinks that condo prices at best going to be either flat or actually decrease over the next five years. I think his bottom line is that each year he has been losing more and more money and if prices are flat then he is better getting out now.