Vancouver premium fades, but it’s still a lot of money

After 6+ years of price stagnation following the Great Financial Crisis, two things turned the market around in 2014/15: the improvement of affordability from years of dropping rates and rising incomes, and the start of a surge of Vancouver buyers.

Since then, Vancouver buyers have remained a substantial factor in the market, but the rate seems to be influenced at least partially by the Vancouver premium: in other words how much more expensive Vancouver is compared to Victoria. It’s logical that if you live in Vancouver and can cash out big by moving here, you’ll be more likely to be tempted to do so. On a relative basis, that factor hit its peak in 2015, when the average Vancouver detached house was over twice as expensive as the average house in Victoria.

In recent years the ratio has been falling again. With Vancouver houses around 80% more expensive than Victoria today, it’s probably a little higher than the historical norm but not by that much.

However while the Vancouver premium is back to where we were a decade ago in percentage terms, the rate of Vancouver buyers is not. In 2013, VREB agents reported that only 5.4% of buyers moved from Vancouver, while in 2023 that was still 9.6%. A drop from the 2022 level of nearly 12%, but still quite elevated. I believe part of the reason is that the Vancouver premium for detached properties in absolute terms also remains very high at just under a million.

While the correlation is far from perfect, cashing out of Vancouver and getting a Victoria house plus nearly a million today is undeniably more attractive than doing the same thing a decade ago and being left with half that amount. The fact that both represent 80% premiums is likely less meaningful to real life buyers.

For that reason, while the rate of Vancouver buyers may drop further in 2024 (few want to sell in a weak market), I don’t think we’re getting back to that 5% level anytime soon. I don’t have data on this, but anecdotally most of those Vancouver buyers would be buying into the detached market.

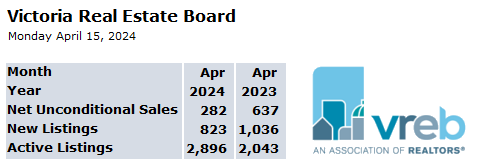

Also the weekly numbers

| April 2024 |

Apr

2023

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 131 | 637 | |||

| New Listings | 466 | 1036 | |||

| Active Listings | 2801 | 2043 | |||

| Sales to New Listings | 28% | 62% | |||

| Sales YoY Change | — | -23% | |||

| New Lists YoY Change | — | -24% | |||

| Inventory YoY Change | +39% | +50% | |||

| Months of Inventory | |||||

I usually don’t show the percent change of new listings and sales to the same week a year ago because small differences in dates (remember we are comparing to the closest Monday) swing the comparison a lot early in the month and with the timing of Easter we have several confounds. That said, it’s a strong start to the month, with the first 7 days bringing in 65% more new listings than the first 7 days of April 2023. Sales meanwhile are at at best keeping up with the year ago pace.

Sure many listings at the start of the month will be re-lists, but that’s true every month. It’s pretty clear that we have much healthier new listings activity than a year ago. One thing to note is that last April was a weak month for new listings (-24% from April 2022) so part of this is base effect. Inventory now up 39% is also the strongest we’ve seen since last May. The listings side has created a markedly cooler market than a year ago, and that gap has been growing.

The same is evident in the prevalence of over-ask sales (happening in 11% of sales today VS 16% a year ago), and months of inventory which remains solidly above the trend from last year. As has been the case for some months, the most competitive segments are the detached properties under a million in the core, along with townhouse substitutes in the same areas.

On the new supply side, the BC government has mandated that municipalities allow Small Scale Multiunit Housing (3-6 homes) on all urban lots, with a deadline of June 30th, 2024 for municipalities to update their zoning. If done correctly, it could be a game-changer for infill housing, turning the construction of tri to sixplexes from a multi-year rezoning ordeal with uncertain outcomes to a simple building permit. However there’s plenty of opportunity for municipalities to legalize these forms on paper only, with enough other restrictions to make adoption very slow or non-existent.

For example Delta is making only minor changes to expand legal duplex and suite areas, while leaving setback and height regulations unchanged. As we learned from Vancouver’s ineffective duplex upzoning or Victoria’s initial missing middle policy, it’s likely too restrictive to yield a lot of housing. Meanwhile Burnaby is seemingly intent to make the new forms buildable, legalizing a diversity of infill options including multiplexes and fee-simple rowhouses in various configurations, while relaxing lot coverage rules for the new forms. Watch for each local municipality to release their proposed zoning reforms in the coming weeks. The success or failure of this initiative rests with the municipalities for now.

On the demand side, Trudeau has mentioned that some mortgage changes are coming on or before the budget on April 16th. I’m thinking it will be either extended amortizations for first-time buyers or (as was an election promise) an increase in the CMHC insurance limit to $1.25M. The former would have no discernable market impact, but the latter would really break the current dam that exists at the $1M mark (and likely push prices up somewhat for properties above that barrier). Housing is the focus of the budget this year, and they’ll try to pull out all the stops to reverse course on an issue that they’ve lost voter confidence on.

Thanks for the chart.

Sorry Marko – your parking study failed to account for the parking needs of the squirrels.

New post: https://househuntvictoria.ca/2024/04/15/the-new-federal-housing-plan/

Outrageously high!

Yeah, we’re screwed.

Too many people want this, or at least keep voting for this.

Just came across the new city soil testing procedures for a COV SFH….home owner told me her builder is budgeting $14k (an expenses that didn’t exist last year when building a home).

“Due to recent changes to Provincial Legislation related to soil relocation and soil

receiving sites that came into effect on March 1, 2023, the applicant is required to

retain the services of a Qualified Professional for any project requiring excavation

and disposal of any volume of soil for the purpose of characterizing the soil and

determining a suitable disposal facility. The soil assessment must include samples

from proposed service trench locations, with a report to be provided to the City. This

is required to allow the City to provide the most accurate estimate and to install the

new services most efficiently. Additionally, soil from a property with a current or

former BC CSR Schedule 2 Activity must comply with provincial soil relocation

requirements, including the one week notification period prior to soil relocation.

o A Street Occupancy Permit from Transportation Engineering will be required for

work in the roadway.

This is required to complete cost estimates for new City services.”

How much government owned land is there inside the urban containment boundary?

Not enough, and expanding cities is very difficult politically. Eby isn’t even willing to entertain that idea.

Rents were up 8% across NZ in 2023. A little higher in Auckland (9.1%). Doesn’t look to be a rent miracle anywhere in NZ in 2023.

The provincial actions aren’t as impactful as the B.C. government would like you to believe. For example, Ravi keeps going around to talks (I went to one in Oak Bay) and saying “we’ve removed public hearings from OCP compliant projects.”

What do you think when you hear that? You think, okay if OCP says four story building on XYZ street a developer can build a four-story building. That isn’t the complete picture thought, municipality can still roadblock the project at committee of the whole or land use committee or some other non-sense. A developer proposed an OCP complaint project in View Royal and it was shot down.

I texted the builder I ran into Slegg Lumber this morning to send me COV comments on his multiplex and wow….insane. I don’t think Barrister has to worry about streets being stuffed with multiplexes anytime soon.

and my bookkeeper sent me a breakdown of my consultants so far for a rezoning application in Colwood (still not rezoned). One of these is for a biologist to put together a report that squirrels were spotted on the property 🙂 (I don’t blame the biologist, I blame the municipality).

The worst part is after spending 16k on a traffic/parking study the counsellors at one of council meetings kept saying “all these traffic reports are the same, I don’t put any value or trust in them.” Well, why is the muncipality forcing me into a parking study? (even thought the building meets at parking bylaws with two spots to spare).

$15,981.17

$18,684.17

$3,960.12

$2,491.12

$136,973.59

$13,210.53

$2,968.87

$2,541.00

$546.00

$4,856.25

$4,550.98

TOTAL $206,763.80

Actually Caveat that’s not a bad idea. I would tweak it a bit. The government should develop land subdivisions and sell off lots by a lottery to contractors under the condition that construction has to be started in the next two years.

We need to open up more land to small scale contractors rather than have the big land developers sit on the land.

“Relaxed” zoning was extended to all major cities in NZ in 2021.

A critique from the fellow who wants the Australian government to expropriate land, build houses and distribute them at below cost via a lottery.

Meanwhile back in the real world removing barriers to building housing will result in more housing getting built.

The real question in B.C. is whether the provincial actions will actually result in lower barriers to building housing or whether municipal governments will just layer on enough costs, obstacles, and bureaucracy to effectively cancel out the provincial changes.

Whatever,

I pointed that out to Leo back in December. https://househuntvictoria.ca/2023/12/11/summary-of-housing-policy-actions/#comment-109148

Not surprisingly, Leo is sticking with support of the Auckland upzoning study. He replied here https://househuntvictoria.ca/2023/12/11/summary-of-housing-policy-actions/#comment-109158

Many of these urban planning studies are pseudo-science anyway, so it’s hard to know what to make of them. Even the believers in the “Auckland miracle” tell us it will take years to see significant results here.

Meanwhile, Auckland rents are up 9.1% YOY in 2023, rising more than any NZ city, so the “miracle” may be fading.

Maybe they should ban str/airbnb 🙂 https://www.newshub.co.nz/home/money/2024/02/median-weekly-rent-continues-to-rise-auckland-regains-status-as-most-expensive-place.html

@ Marko the difference bw Airbnb long stay vs short might also be the purpose of the stay. So if it’s 100 days but not the person principal residence. Not sure but I think I’ve heard of some Airbnb hosts vetting on that criteria. Also would be interesting to read RTB decisions and see if they recognize that distinction.

@Barrister

“In November 2023, the Province introduced legislation requiring local governments to allow 3, 4 or 6 units per lot in all single-detached zones, depending on lot size and location. This will be done through changes to the zoning bylaw. The District of Saanich has until June 30th, 2024 to complete the changes to the zoning bylaw. ”

Guess they’ve gotta wait a couple months before they do anything.

Guess they would have to subdivide it to get more. Could easily fit 6 big places though.

Douglas Todd: Famous New Zealand study may not actually show mass upzoning works

Opinion: Other scholars have concluded any increase in housing builds was minimal and probably a normal part of a cyclical business

It’s the study heard around the world, often cited as the answer to the housing-affordability crisis in big cities.

The research purported to show that blanket property upzoning in pricey Auckland, New Zealand, led to a dramatic increase in new housing units. Studies led by Ryan Greenaway-McGrevy, an economist at the University of Auckland who has long advocated increased density, have been reported on in newspapers of the left, right and centre, including The Economist, The New York Times and The Spectator. But is Greenaway-McGrevy’s conclusion — that mass upzoning caused strong new housing supply — an urban myth, as a number of scholars suggest?

The toughest critique of Greenaway-McGrevy’s studies — which said Auckland ended up with about 21,000 more housing approvals, or four per cent more housing units, over a five-year period after New Zealand passed countrywide upzoning in 2016 — is from Australian scholars Cameron Murray and Tim Helm, which they spell out in a series titled The Auckland Myth.

Their analysis maintains Greenaway-McGrevy’s May study of Auckland doesn’t prove upzoning increased net housing supply. Importantly, it doesn’t even suggest upzoning lowers prices.

The critical scholars maintain that handing blanket upzoning to developers, by allowing them to build higher towers or squeeze more units onto a lot, hands existing owners startling new property rights and profit, which raises prices.

In addition to pointing to methodological problems in the Auckland study, the scholars say the modest increase it found in housing activity can largely be attributed to normal “boom and bust” building cycles.

Significantly, they say, Auckland’s upzoning mostly led to the city giving mere “consent” to more houses. But when demolitions were taken into account, significant net new housing units didn’t necessarily materialize.

Not sure if that makes sense, Airbnb (the platform) has something called “Long Stay.” If you set the minimum at 90 days, aren’t you clearing every single STR regulation (provincial and municipal)?

Is there a law/regulation that prevents you from using Airbnb as a platform to rent to someone for one year, for example? Does the government force the guest/host into a RTA tenancy agreement beyond a certain lenght of stay? Curious, I am not sure.

Rentals longer than 30 days aren’t considered STR by the COV bylaw so you don’t need a COV license.

So airbnb is wrong saying you need a license for 30+ long stays.

You can show airbnb the COV application and the bylaw that defines a STR as <30 days. And ask airbnb to show you something saying you need a license. You’re likely speaking to an inexperienced airbnb support person.

I vaguely remember talk that all AirBnB rentals in BC will need to carry a license number or maybe that was for the city of Victoria.

Have to love public administration….received an email this morning from AirBnb

“Hi Marko,

As you may know, Hosts in Victoria are required to display a business licence by May 1, 2024 to continue hosting. If you haven’t started the process to apply for a licence for your listing(s), we recommend starting as soon as possible to protect your ability to host.”

so I head over to https://www.victoria.ca/media/file/2024-short-term-rental-business-application-form

which notes

“All related documentation and information are available at victoria.ca/str. For information or assistance completing this form, please contact

Bylaw and Licensing Services at 250.361.0215 or email str@victoria.ca.”

and I have a question so I phone the number on the application….nice person, but he doesn’t deal with STR licensing….transfer to different department that doesn’t answer, phone multiple times and so on. Like how do you have a number for questions on a form and that individual has to transfer you to a different department.

I am really curious as to how this will go down as one of the signatures required on the form is from the strata and my strata is 30 day minimum (which I do only 30 day minimum), but for principal residence under COV you can do 4 times a year under 30 days so COV is asking my strata to sign a document that I can do rentals under 30 days which they won’t go for.

***Update, got in touch with the STR department and according to COV if I am doing minimum 30 day rentals I don’t need a licence (but Airbnb wants one?) If I am renting two or more rooms I need a long term rental licence so I guess if I have a one bedroom condo (principal residence) I don’t need either but if its a two bedroom condo you need the long term one………..fak this is confusing.

Does anyone know for a principal residence Airbnb rental of >30 days do you need a licence in the COV?

***Further update, Airbnb support telling me I do need a licence even for 30+ day long stays, opposite of what COV is telling me.

and we wonder why productivity in this country is poor 🙂

I have no problem with people putting stuff out for others to take/use. But if it’s not gone in 48 hours then take it back and deal with your own garbage. And obviously no one wants your crappy couch, stained mattress or CRT monitor from the 1980’s

6 stabbings in Winnipeg is a slow weekend.

In other news, couch and mattress season appears to have come early this year in Victoria where lazy POS abandon their garbage on the curbs for their once neighbours to stare at and deal with….

You’re just stigmatizing vulnerable people making it your fault that it’s happening… Being facetious (unfortunately needs to be said because some would actually seriously say that).

another stabbing in downtown Victoria, is that like close to half a dozen in a month?

More precisely:

If you want to be close to Asian markets and don’t want to deal with corruption Singapore doesn’t have much competition. HK used to be in the game but China has scotched that. For those of you who think there are too many non-permanent residents (e.g. TFW) in Canada:

That’s out of a total population of 5.637 million.

Of my transactions under $1 million a large portion involve one of my clients, or both, being employed by public service. Out of control spending/hiring in terms of public service not only isn’t placing boots on the ground in terms of building housing it also further increases housing demand in certain price segments such as Langford townhomes. In my view Langford townhomes, for example, only have so far to fall despite that increased inventory as they will also have support floor of 2x public service incomes.

Max tax rate on personal income in Singapore is 20%. You earn 20k tax-free. Corporate tax rate is 17%. Health care is excellent although there is a cost-sharing so not entirely free but affordable unlike the states. It costs Singapore 1/3 of what Canada spends per person. Public service functions well. Banks are stable.

Of course there are downsides including a big population in a small area, summer weather, high cost of living, fewer civil liberties, and long working hours. I’m sure many others. The point being that there are public service lessons to learn.

Companies and individuals have an increasingly global view re. residency and corporate headquarters. Proctor & Gamble moved to Singapore. Who is choosing to come to Canada? Largely people who cannot afford other options and not international businesses.

https://countryeconomy.com/countries/compare/canada/singapore?sc=XE74

The Bank of Canada’s opinion on this:

https://www.nbc.ca/content/dam/bnc/taux-analyses/analyse-eco/etude-speciale/special-report_240311.pdf

Gosig, it would be better if you only got to keep 10% of the bonus and the rest would be used to build social housing for people more deserving than you.

After 3 years of my company making no profit… we just closed a quite profitable 2023. And we were rewarded with a good bonus. 47% of which I got to keep. Not bitter. I’m sure the deducted money will be used prudently. I would probably have just blown it saving for my retirement anyway. (No pension)

Totoro, they are not about to change how things work, and adding another massive government program just means increasing more of everything. Be careful of what you wish for because they wont deliver it the way you want. Why would you expect otherwise.

Getting status in other countries can be a bit of a challenge in many cases. By the way the solution may be to just make sure that you never get sick.

Except you’ll pay a very large departure tax bill on your Canadian assets to become a non-resident. It probably does not make sense for anyone but a very high income earner who can work online from anywhere to do this. You’ll need a second passport or permanent residency in a low tax jurisdiction to make it viable.

I’m not doing this, but for the first time I was motivated to look into it just because I am not happy with my government’s performance on health care in particular.

Fixable by electing the CPC with PP as prime minister

That’s why people are flocking to Alberta, their premier gives J.T. the finger every chance she gets. And the people support her.

Totoro , Ya the writing is on the wall , Canada is a very inept and dysfunctional country . Keep what u like about it and shop around for the rest .

I have no problem contributing to social housing via additional taxation. I have a problem when I’m taxed disproportionately and on an increasing scale and I don’t see results.

Health care and housing have been left to deteriorate for years. The public service has expanded while our economic productivity declines. The drug crisis is insane.

I have an overall problem with waste and political posturing about solutions that are not real and never materialize. Or miss the mark completely because they are essentially vote-buying moves. Math does not lie and good policy is based on good data.

It is like patriotism. Good to be patriotic? Yes – but. Germans were patriotic to the point of endorsing genocide as a solution. At some point you need to assert individual control over what you will and will not participate in and endorse.

James, dont know the zoning for that lot but if it is regular lot I dont think so or is it prezoned?

Totoro, I am assuming that you are okay paying an extra 20 or 25% in taxes on your business to pay for all the social housing that you want built. You are the target taxpayer as a small business owner so stop complaining when you want the government to spend even more on massive projects.

Although, it sounds like maybe it is more a matter of keep taxing other people while I leave the country with all my goodies.

Sorry, but your side by side posts triggered that.

Sure, but that would have to have a zoning change approved. Could you not build 28 townhouses on that land right now?

How do you do that with the unions involved?

We’ve been giving some consideration to becoming a non-residents.

I love Canada for many reasons, but I resent paying for an ineffective public service and living with the result in ex. poor access to health care combined with disproportionate taxation. If I felt the taxes I pay were put to good use I’d be okay to pay even more. Heck, I donate to social causes for this reason.

Balance still favours remaining here, but for the first time in my life, Canada is giving me a reason to look abroad for retirement.

Attitudes will change if the rents are cheap. In Vienna and Singapore these are culturally acceptable options and in Vienna you’ll find those with and without means in public housing.

I think that’s the reason Harper cut it.

In Singapore the typical low cost property for the masses is a leasehold, and not owned. They have a special term for properties that are owned as fee simple – a “landed property”. And those landed properties in Singapore are uncommon and incredibly expensive, higher than Vancouver prices for example.

By making them leasehold properties, Singapore (or any other country) is able to subsidize the construction without giving anything to the tenants – since the government owns the home. That actually makes sense, because the government can’t subsidize fee-simple homes and just hand them over as a windfall profit to the lucky homebuyer at subsidized prices.

I mention that because leasehold properties are available in Victoria, Vancouver and elsewhere at very affordable prices. For example, you can get a 50 year leasehold for $300k in Vancouver west end. But few people want them. So if we build thousands more leasehold properties, maybe nobody wants them.

My opinion is that Canadians want to own their homes, and not be leaseholding shoebox sized apartments as they are in Singapore.

It’s not the same people every year though. Consider the university educated professional who pays no taxes while at school, is then employed at a high salary, then takes time off to have a child or two, then goes back to work, then retires.

Or the bank president’s wife who doesn’t need to have a paying job. Remember Canadians file individual returns and tax statistics are based on that.

40% of Canadians pay no net tax as they receive more in benefits than they contributed. 20% of Canadians pay 70% of all tax revenue.

You’re welcome.

If you think the country is at present an unproductive, unambitious basket case, stand by for a change for the worse when Atlas makes a disaffected shoulder movement.

My favorite real estate podcast had Ravi on the show – https://m.youtube.com/watch?v=ryvRk-0B_2E&pp=ygUOUmF2aSB0b20gc3Rvcnk%3D

I think raising GST is probably political suicide for the liberals.

If government employees had skin in the game like the private sector there would be way more efficiency. Not saying there is not a very good reason to have government be non-profit, but would be great to have hard-nosed practical common sense solutions based on realistic projections for benefit rather than re-election.

There is a role for a strong elected leader with business sense to change things, but these people are few and far between and very few are attracted to public service given the social media circus you expose yourself to. I’ve been reading up on the pragmatic leadership of the late Lee Kuan Yew which led to Singapore’s success. Effective business-minded public bureaucracy was and is a big part of it.

Not sure what you mean? He is building in the COV (City of Victoria). You are going to get the same comments South Fairfield or Doncaster as same staff.

Big picture is it a positive for society if more and more people rent public housing? I view renting whether it be public or market as a hamster spinning on a wheel, how are you suppose to get ahead? I think we need more rentals but the way numbers are going purpose built rental construction will shortly overtake SFH/strata essentially guiding people into renting for life versus trying to get established into the market and build equity over 10-20-30 years.

I would think someone paying their home off over 30 years is also beneficial to the government?

Marko, which part of town is he building in and does that maybe make a difference.

This morning I was at Slegg Lumber and ran into a builder I know who is working on a missing middle building permit application in the COV. He showed me 7 pages of comments from City Staff in response to him submitting his plans…..and wow, the public is getting played hard by politicians. In my estimation the comments will costs him 10s of thousands to resolve and delay him another 12 months from getting a BP. The worse part is its all complete non-sense.

It’s getting boring agreeing with Totoro.

Public/Private joint ventures seem to be the better solution for long term housing. False Creek leasehold condominiums and rental buildings being an example that allows a city to rejuvenate its stock of low income housing every 60 to 90 years depending on the terms of the lease.

However, I am a bit disappointed with how the First Nation’s lands in Vancouver will be developed with prepaid leases.

Depends on the tax. If the feds want to raise taxes, best way would be to raise the GST, which was introduced because it doesn’t impact productivity or competitiveness. Remember it was originally 7%.

+1, great observation put into words. I think long term we are really really screwed in Canada.

Inventory not in the right places. I was in Langford again this weekend and there are a number of pockets where you have four townhomes (used re-sale) for sale, within a few hundred feet.

Then you have condo buildings specifically downtown with 12+ units for sale in one building.

The SFH core under a million inventory isn’t budging.

Exactly. Only sensible solution is probably going to be public housing built on government owned lands subject to long-term leases.

Higher taxes are definitely going to be an issue for productivity and retaining high performing workers. Much more common to see high income Canadians pursuing employment abroad or simply working abroad and becoming non-residents for tax purposes.

Higher taxes affect businesses too. As a business owner I find that government policy is already not that supportive. It seems like policy makers don’t get the basics of what makes and motivates successful small business in Canada. They probably don’t because policy makers don’t know what they don’t know unless they have been business owners which is very rare. They don’t know what it is like to be highly strategic and attentive because your survival is on the line, the stress of making a payroll and taking care of employees, or the pressing need to fund your own pension.

This is despite the fact that small businesses (1 to 99 employees) are 98% of all employer businesses and employ 2/3 of Canadians. They essentially fund most of the economy because government taxes these revenues to pay for its own employees and administration. Hit this sector too hard and entrepreneurs will move elsewhere or potential small business owners will look for government jobs instead.

should show the data by product type.

Read up on common sense and broaden your real world experience before posting links from the internet 🙂

President Donald Trump awarded the Presidential Medal of Freedom to economist Arthur Laffer, whose disputed theories on tax cuts have guided Republican policy since the 1980s.

Laffer was credited with helping to spur income tax reductions around the world and boosting national economies as a result. Critics say the tax cuts he has espoused over the years have not produced the promised results and have instead contributed to growing income inequality and soaring budget deficits.

Looks like sales pace is picking up a tad, inventory build slowed down a tad.

You can have the best policies in the world but fee simple ownership will still go to the highest bidder. Notable that places with progressive policies like Vienna or Singapore don’t focus on fee simple ownership for the masses.

James: instead of the townhouses, maybe a 12 story building would get even more units.

Wouldn’t that be just the cities with the worst housing development policies?

2084 Ferndale Rd – $2.1 million in Gordon head for 4/5s of an acre of land. You could get how many new townhouses on there? 28?

No one said that. There is more avoidance of realizing income as tax rates rise. So raising rates may result in less income. If tax rates were 99%, almost everyone would try to reduce their realized income. And if rates were 1%, almost noone would do it. Read up on the Laffer curve if you have more questions.

LMAO, so people aren’t actively trying to do that now but will only do so if the tax brackets increase? Jesus christ…..

Patrick, we just continue the present policy of just increasing the number of government jobs which has accounted for almost all of the job growth in the last few years. Problem solved.

Yes, part of the “burn the furniture for heat” approach to solving the housing crisis. First we smoke out the foreigners, satellite families and stvr renters. So we can move into their homes.

So sure, why not send the rich packing as well with high taxes? All for a one-time gain of housing units. All these actions have a cost, which is reduced economic growth necessary to maintain jobs and prosperity.

Higher taxes here, on the other hand, would help with the housing crisis. It would encourage even more businesses and professions to move south of the border or elsewhere. Not going to effect me so I am fine with it.

Likely to be a “tax-the-rich” federal budget coming, with highest marginal tax rate to be raised. Current highest marginal rate (combined) is 53.5% in BC. Dumb idea, since rates are high already. Raising high taxes to “even higher” taxes often backfires, with less revenue realized, as people use legal strategies to realize less income (as per Laffer curve) It also doesn’t just tax the rich, it likely raises taxes for anyone selling an investment property with a large gain for example.

Best cities in the world as voted by capitalism

SELECT name FROM cities ORDER BY price DESC

Now we don’t have to argue.

The commercial lot in Rupert probably needs a couple million to decontaminate.

Lol wtf is Conde Nast? Forbes seems to think different.

Yes, in that Karen Carpenter died 13 years after the song (we’ve only just begun) was released. The song’s history is more interesting than that though.

Things worked out very well for the song and the composer.

The carpenters wrote a lot of their songs (eg Top of the World), but “we’ve only just begun wasn’t one of them”. That song was written as a bank commercial by Paul Williams. The song was a big hit for Paul Williams as well as the carpenters and the Paul Williams version made it into the Grammy Hall of Fame.

Chillin in Rupert. 20,000 sqft commercial lot right downtown by the water for $720k

“The measure of a society is how well they treat the most unfortunate people in their cities”

it is? i didnt realize how societies were measured. thank you.

As I recall, that really didn’t work out for the best for Karen Carpenter.

.

The measure of a society is how well they treat the most unfortunate people in their cities . So on a per capita basis what cities in Canada would the homeless consider the best to live in?

For most of the same reasons why we have chosen to live in Victoria, so would the homeless chose to live here. According to a 2020 Homeless Point in Time study on the homeless only 42% of the homeless have lived in Victoria for more than five years. 28% were first-year new comers, 18.5% moved to Victoria to follow family. Sounds a lot like the rest of us.

That might be a better gauge of the desirability of a city than a fluff piece in a tourism magazine.

Frank – you are making sense!

Why would that be relevant? Of course tourism Victoria reported that news, as did many other news sites.

e.g. National Post

https://nationalpost.com/news/canada/victoria-conde-nast-worlds-best-city

520,000 readers of conde nast voted in the “ best of” awards and Victoria came out at the top.

Lol, did you expect tourism victoria to post something else? This place has gone down hill so much in because it is in a transition phase.

Views from an ivory tower are always better than the streets.

I don’t agree there. Over last 10 years…

Victoria SFH prices more than doubled (+115%) https://www.vreb.org/historical-statistics#gsc.tab=0

.. And as for our beloved city of Victoria in 2023, how great are all these high or “best city in the world” ratings!! (See pic) https://www.tourismvictoria.com/conde#:~:text=Cond%C3%A9%2520Nast%2520Readers%2520Vote%2520Victoria,premier%2520travel%2520magazine's%2520globetrotting%2520readers.

I compare Canada with other countries and I see things going in the wrong direction. Germany is a small country with limited resources yet is an industrial powerhouse. Canada, on the other hand, has unlimited resources but is an industrial weakling. Venezuela was once one of the wealthiest countries per capita and now is in complete collapse thanks to a corrupt socialist government. It also has unlimited resources but has severely mismanaged them while government authorities line their pockets. I see Canada becoming more like a Venezuela than a Germany.

Talking to a friend this morning and his niece went to Scotland to get her PHD in mathematics. She’s not coming back. A large number of our brightest individuals end up in other countries, it’s a huge brain drain. Why do you think we have a shortage of doctors? They don’t want to work in our flawed system, and can simply make more money in other countries. I usually agree with Patrick’s comments, not this one.

Patrick, glad to hear that you have finally begun, because the last ten years have not been great.

I don’t think so.

Canada’s future is bright, like the title of the Carpenters’ song… “We’ve Only Just Begun’’

Maybe that’s true, but it’s also really harsh, for the people who bought into specifically grandfathered units just trying their first leg on the property ladder in an environment where nothing else worked with the numbers. Anyways, for those of you thinking well, they had it coming, let’s hope you guys keep your big-boy britches on when the gov’t comes in hot with vacancy control and some of you end up holding the bag beholden to tenants & being forced to rent at increasingly below-market rates.

Oblio, that’s incredible and terrible! What craziness to put that tax burden on the tenant.

Yes even the ghost towns are getting pricey.

https://www.facebook.com/groups/goldtrailsandghosttowns/posts/10159235124392044/

Fascinating but I am starting to suspect that there are serious problems in this country

@max lay off the insults please and I don’t think the random pictures add to the discussion either thx

Can’t be the Woss I remember. Those seem to be rather optimistic prices….

Can someone tell me exactly what this young person was doing wrong being creative to get ahead -> https://www.timescolonist.com/local-news/attack-on-property-rights-why-bcs-new-rental-rules-leave-some-owners-on-edge-7716966

Are we better as a society now that he has to leave his unit vacant 180 days a year?

Depends on the government. In Croatia the government encourages Airbnb and short-term rentals so people can make money and depend less on the government. No Airbnb restrictions, no Aribnb income tax (yes that is correct, on tax paid on Airbnb income you earn), no vacancy tax, etc.

I think the thought is if an airbnb operator can make money off tourists then they aren’t asking the government for handouts.

I can tell you not one person in the line up at the Janion pre-sale knew it was STR zoned. The sales team didn’t even pitch it to anyone.

Original Janion purchasers bought into the building by pure luck. You think the developer would have been selling pre-sales for $110,000 when a few years later they were worth $350,000?

But Leo, the government is forcing everyone to live in urban centers, that is why prices in Victoria/Vancouver/Toronto are so expensive 🙂

The comments section of HHV was a gem for 10+ years, unfotunately it all started going to s*** approximately two years ago and has just become worse and worse.

And you need Marko to teach you this? Its the chain link off to right.

Snowflake! Do you even know how to light a fire or cook?

I really hope that mute button works both ways…Because you are a whiner!

Thanks to Marko, now I know about the mute button. Very helpful for ignoring childish internet trolls.

This had better not be another false flag.

Should I bring my tomato plants In and head down to the bunker?

Iran has started it’s attack on Israel……

Just chilling in Woss, about an hour north of Campbell River

You do a lot of that. It doesn’t seem like It takes very much to amuse you.

Ya like those who bought STR in Victoria during the early days of 2012/13/14.

LMAO

I said, when you were young with balls of steel. Failure would be easily absorbed…You could rebound unscathed and try again.

You sound like a pussy!

Where did you read that? I think now might be the time to go back to Econ 101.

Risk and reward are two entirely separate concepts and don’t have to be correlated at all — see the Darwin awards as an example.

I think what you’re referring to is that in an efficient market, higher risk assets tend to offer a premium return because the market recognizes that you need to pay more for risk.

That doesn’t mean that every high risk action automatically comes with a high reward.

The people who know how to identify rewarding opportunities, without taking on excess risk, tend to have better outcomes.

OK. Fair enough. As I’ve previously said, it was a dumb move by government to shut down STR, and doubly so to not grandfather the existing properties.

I know you are uber wealthy. I have done very well myself. However If an Individual has to go BK…That will effect them for the rest of their life. This 7 year bullshit Is a myth. The first question a loans officer asks you Is “have you ever declared bankruptcy”?

Hard to see that (worst case) losing 100-150k adds up to “ They may never recover from such a blow…For the rest of their lives”.

Obviously if they bought multiple units it could add up. Hopefully there aren’t many in that situation. But it is investment RE, and that’s always risky as others have pointed out.

maybe 100k to 150k if someone bought at the absolute peak, $ amount wise it is not that much different than other products bought at the peak, but % wise it is more.

Here’s a trick question for renters, non-resident landlords, and others in the know:

Is a Canadian resident paying rent to a non-resident landlord required to withhold and remit 25 per cent of the rent to the CRA?

Yes! (The judge acknowledged “the harsh consequences,” in her decision [6 years rent x 25%, plus compounding interest, plus penalties]…Not knowing a landlord is a non-resident is not considered a valid excuse).

https://www.castanet.net/news/Canada/481749/Foreign-landlord-fails-to-pay-taxes-CRA-goes-after-tenant

I don’t know, I’m not In the game. High rates, strata fees, commission, no future coming Into peak STR season. Not a good place to be. I could see the down payment being evaporated.

There Is an article In the TC about It.

https://www.timescolonist.com/local-news/short-term-rental-owners-fighting-against-province-and-city-of-victoria-8596130

How much did these str condos fall in value? Depending on when they bought, haven’t many of them still made a profit if they sell?

Risk equals reward. Do It when you are young. As you age, lower the risk.

Key word risks

If I hadn’t taken some very significant risks In my early twenties, I wouldn’t be as happy as I am right now.

Absolutely, RE investment has numerous risks. Want something more.certain? Try a GIC next time.

If someone actually paid attention to what was happening they would realize the clamp down on STR was only to get worse, not just in BC but globally. What you actually have is unsophisticated people putting alot of money in a asset at the top of the cycle thinking it was a fool proof way to make $.

So instead of doing that, one goes out and pays a premium and buys an STR. So basically tried to take a short cut and it didn’t end up working out.

For some people It only takes one financial blow like that. They may never recover from such a blow…For the rest of their lives.

Agreed, but the mob wanted blood and Eby complied.

In other words…They had It coming. Did the leaky condo Investors purchasing their unit(s) In the 1990’s have It coming too?

Should that also have been taken Into consideration?

Econ 101 also teaches you that the rule of law contributes to the creation of a stable financial environment where property rights are protected and investors feel trust in the transactional environment. A necessary prerequisite to a well-functioning economy.

The rule of law requires government to be conducted according to law and answerable for their acts in the ordinary courts. One element of the rule of law is that the law should be reasonably stable, in order to facilitate planning and coordinated action over time.

Regarding STR. ECON101 teaches you that political risk is the risk an investment’s returns could suffer as a result of political changes. Recall investment trusts way back in the early 2000s.

Those who invested into STRs should have taken this into consideration when purchasing their unit(s).

I’m all for being resourceful and agree with do what it takes to have what you want, but there are real limits in imposed by current affordability vs. income stats which present some significant financial barriers that did not exist in the past. Heck, it hard for a doctor to afford a house here.

A significant proportion of our population cannot and will not be able to overcome this economic mountain even with a life partner and it will cause compounding and cascading social issues – as it already is. Some of them will move away, which is probably smart, but this will leave fewer people to do median and below jobs. These jobs include the important services offered by child care workers, care aides, mental health workers, lpns, education assistants, and home support workers.

Everyone needs a secure place to live but not everyone can or will earn well above median incomes even if they try as hard as they can. These reasons include health conditions, aptitudes, language issues, and a background of poverty. 27% of Canadians have a diagnosed disability and this is a low estimate as many people do not know they have a disability or live with ex. undiagnosed depression for fear of stigma. These affect earning capacity and housing insecurity worsens health outcomes.

The answer is not always go get a well over median income job. I think at this point we need to look to our income stats and recognize that full time employees or employed families in the median band or below can no longer afford to buy a secure place to live and rental rates make it hard to get ahead. Ultimately, without family assistance or government investment in secure rental housing a greater % of our population will live in precarious and unaffordable housing no matter how hard they work.

Polygamy, marriage to more than one spouse at a time. Now you have six Incomes.

https://www.britannica.com/topic/polygamy-marriage

Yes, that would have been good.

Not really, being single is the ultimate privelage to get ahead. Unless things have changed, it allowed me to take risks to gain experience and earn higher wages by taking on risks with less stable jobs, that were more rewarding; having the ability to relocate on short notice; ability to take education opportunities; and don’t forget the ability to work extras and overtime to jump ahead of the whiny and lazy people that think it’s wrong for you to be promoted ahead of them…

Re. go get another job or a better job…

sure, of course, that’s a given option and part of the action often employed by the resourceful…it’s what gets you the down payment.

Hook up with a chick…Now you have two Incomes.

How about doing it the old fashioned way and go get another job or a better job?

That would have been the right thing to do, for sure 100%. This Is a devastating blow for a lot of people. Feel sorry for them.

I wouldn’t expect someone to be an expert in iPhones if they’d never tried an iPhone.

Similarily, I advise you to try out latest Tesla FSD before announcing what it can and cannot do. I’ve driven 5 times now from uplands to various spots downtown without a single intervention (other than some speed adjustments to suit my taste).

Anyway, if you don’t want to get a Tesla with FSD, then don’t! I’m just telling you, as a former curmudgeon, that I’m a convert and the new FSD is working great for me. No, not ready for level 3 (unsupervised), but huge improvements.

To beat on a dead horse, I had to weigh in on the STR zoning and echo Totoro in sentiment.

I continue to be dismayed, but no longer surprised, how housing assistance/incentives are so subtly skewed to help those from privilege (whether they see it or not) and hinder efforts of those without advantage (e.g. family assistance in the form of secure shelter, education, down payments, etc.).

People without privilege, especially singles, need to get really creative if they want to get ahead. And, while hard to image for some people on this forum, this may mean living in a small micro apartment with an aim to eventually sell to move up in the world, or perhaps save for another home and keep the micro unit as an investment vehicle for retirement – a retirement which may involve no inheritance, no work pension, and no assumption of government assistance. Choosing to opt into an apartment with a legally zoned business option is not fool hardy, it’s resourceful. If it were me under these circumstances, I’d feel extremely deflated and angry, especially when government is incentivizing and helping the purchase of new and/or bigger homes for first time buyers, and providing tax breaks, etc for people with a lot more advantage.

For example, why is society/government helping first time buyers to purchase new homes? If a first-time buyer can even consider buying a new home (versus an older home) they are already a member of a privileged class and should not be subsidized. Why does someone get a GST rebate if they purchase a new home for a relative to inhabit? They can afford to buy a second home, but we still provide a tax break to the family? I know those are federal examples, but think how frustrating it would feel. It boggles my mind.

I’m o.k. for policy and zoning changes to help the greater good, but those areas zoned specifically for STR should have been grandfathered – once sold, STR option ends, but not before. It’s also a bit of an arbitrary, inconsistent thing when they allow an exemption for the strip in Parksville, but don’t allow an exemption for others who purchased in other designated STR zones.

Had to get that off my chest

I think we have a different understanding about how technology advances. Stops and starts is the norm, not continuous improvement. This isn’t a simple process of miniaturizing transistors and increasing the processing capacity of computer chips (so-called “Moore’s law”).

Self driving vehicles need new technological breakthroughs to be viable. The current pattern recognition based systems simply aren’t up to the task.

I can’t believe how many idiots Tesla has taken money from over the years on AP & FSD. They’ve now tried it five times on me. Gave me 30-day trail on AP1 in 2016 then asked for $3k, no thanks. Then they gave me two 30-day trials twice in Europe, no thanks. Then they gave FSD to me when I bought my new Model Y here recently and now I am in a 30 day free FSD trail again. I’ve been using it the last three weeks and it simply sucks. My prediction is 2016 was we were 25 years out and fast forward to 2024 my prediction is we are 20 years out.

I do think Tesla is running out of people to con thought. FSD at one point was $12k then they ran out of all those idiots, then subscription was $199 and now it is $99…..if they offered it for $9/month I wouldn’t buy it. The only useful feature is the standard autopilot (which now comes included with car) in Europe on proper highways, but we don’t have such highways in the island.

(I love Teslas, but the FSD is a joke/scam in its current state, maybe in 15-20 years).

Good point.

Interesting, thanks. I’m looking forward to self-park, as that might be something very useful in tight squeezes in mall parking lots etc. The YouTube videos of it are impressive, where it always backs in so you can start out going forward which is much safer.

Keeping in mind that they can’t have two PRs at the same time.

Deryk, there is an election (subsection 45(2)) available to continue to claim the property as their PR for up to 4 years. CRA will accept a late election with some exceptions. Search “CRA 4 year principal residence election”.

If this is for future planning they would want to consider which way they think the market may go. You can’t undo the election AFAIK. They can get an appraisal done now (safest, but not cheap) but I think the BCAA percent change over a couple years would work as well and is free.

Good to know. Seems like the self park is currently not permitted by icbc.

Derek get a fair market appraisal if you are significantly above assessment and file the change of use.

Tesla FSD isn’t level 3, it’s level 2.

The difference is that level 2 requires constant supervision, which Tesla FSD is vigilant at monitoring. If you take your eyes off the road or hands off the wheel the FSD will warn you, and then disable the FSD if you dont comply. Whereas “ At Level 3, the driver can take their attention off the road for extended periods of time while the software takes over all of the vehicle’s longitudinal and lateral controls.”

There’s no requirement that you get appraisal. You self-declare the values based on your good faith estimate of “fair market value”. Of course if you’re audited, any supporting information like an appraisal would be very helpful to support your position. Especially if it’s different from the assessment,

You also need to file tax forms like schedule 3 and form T2091 as described here https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/personal-income/line-12700-capital-gains/principal-residence-other-real-estate/changes-use.html

Great invention, until it kills you. Apple gave up on the entire EV autonomous driving experiment for a reason. After spending billions of dollars that could have been put to better use. Like housing.

Patrick my understanding is that engaging the supervised autonomous driving feature voids your insurance coverage currently. Any use of level 3 vehicles on roadways is subject to 368 dollar ticket as of this month. Seems like level 2 is covered so maybe this is where you fit.

https://www2.gov.bc.ca/gov/content/transportation/driving-and-cycling/road-safety-rules-and-consequences/self-drive

Hey Zach,

I agree with much of what you say. Especially for the robotaxi (no driver), which is years away.

However, like most technology, it’s constantly improving, and it’s not going to stay at the “student driver” level for long. For example, years from now cars may be sending/receiving data to other cars and a self-driving car could be far superior to a human. (Since they could know where cars are around corners etc.). I don’t mind being an early adaptor as it may help that happen.

Anyway, if you get a chance, you should check it out you might be blown away like I was with the latest FSD version. It’s a “ChatGPT” moment that might change your view of how good self-driving is now and where it may be headed.

If someone decides to rent out their principle residence for a year or two and then sell it, what is the standard way, or best way to establish the value of the home at the time of renting out the entire home and then selling it a year or two later?

If the Property went up in the one or two years I realize that they would have to pay capital gains on any gain. But how do you establish the actual value at the time of it no longer being one’ principle residence?

Especially if the house is worth more than the property assessment because of improvements etc.

Does Revenue Canada go by a real estate appraisal done at the time of the switch?

Do they need more than one independent appraisal done at the switch to revenue property?

Any thoughts?

You couldn’t pay me to supervise a student driver, so why would I want to buy the privilege to supervise a bad computer driver?

Several years ago a self-important billionaire assured people “self driving will be ready… next year”. He made that promise every year for a while until people stopped listening.

That promise is becoming increasingly unrealistic. Most observers in this area now doubt that self driving cars will ever be a reality with the current technology. Even in San Francisco they’re taking the robo taxis off the road.

I think I’ll save my money for something else.

Quick q for the community here, Zealty seemed to work for a few weeks to review Victoria sold data… but no longer works? Any insight? Big fan of this blog!

Tesla announced a huge price change on the latest option for Supervised Full Service Driving (FSD) in USA/Canada. It was $12,000 USD, but is now $99 /month in USA and Canada.

Available now as a one month free trial for people with existing teslas. I’ve added if to my Tesla for the last few weeks. While I wouldn’t pay $12,000 usd, I will pay $99/month when the free trial is over.

It drives well all over Victoria (supervised by the driver with hands on/near the wheel and eyes on the road of course). Still has problems (not reading some speed limits, stop/slow handheld sign at road work sites not followed, doesn’t fully yield to buses). Also drives should be smoother – excessive acceleration from stop for example. Also auto-park not enabled yet in Canada (just USA) for some reason. But overall is amazing and I’d expect them to solve those last few issues as well within the next year.

It’s like driving with a good student driver, who is not quite ready for the road test 🙂

Definitely not ready for “robotaxi” (no driver) yet – that could be years away imo. But this should make Tesla owners happy, and lead to more new Tesla sales too.

https://www.ctvnews.ca/autos/tesla-cuts-full-self-driving-subscription-prices-in-u-s-canada-1.6845413

Pump and dump…Sucks to be them.

Same shit happened with wall street bets and game stop.

Kids made tens of millions!

Slow and steady…Just like The Hare & the Tortoise.

The kids that made the tens of millions…Are dead, or In rehab. Look It up.

The ones that knew It was to good to be true…Got out.

https://www.cnbc.com/2021/01/30/gamestop-reddit-and-robinhood-a-full-recap-of-the-historic-retail-trading-mania-on-wall-street.html

I’ve sold 10 units at the Janion as the listing agent over the years and I wouldn’t classify any of the 10 sellers as wealthy investors.

In certain scenarios it made sense to pay the premium such as this tugboat operator ->

https://www.timescolonist.com/local-news/attack-on-property-rights-why-bcs-new-rental-rules-leave-some-owners-on-edge-7716966

That’s exactly what It Is. At the same time Its the tax on tax on tax on levels of the Government, the fees, the applications, the high Interest rates, the stress test.

Why are houses so unaffordable? Because the Government made them unaffordable…That’s why.

Cut the Government spending In half…Houses would be affordable!

I’m not saying cut health care…Or any of the shit that really matters.

I’m saying cut the fat off these upper echelon Government contract workers raking In $325k per year.

limited means so then you pay a premium and buy STR condo?

Even local governments were caught off guard. Why would the City of Victoria have voted to increase the licensing fee from $1,500 to $2,500 for STRs two weeks earlier if they knew this was coming.

Even @ $2,500 this ban vipes $2 million out of the COV budget and guaranteed they didn’t reduce any expenditures as a result.

Some people might say legal STR zoning attracted people who wanted to comply with the law.

But you are probably right.

the people who bought legal str units were young and foolish, old enough to know better, too desperate, too naive, too greedy, rich enough to handle a loss, so poor they should never have taken a risk, and basically just deserve what they got.

Absolutely nothing to do with reasonable reliance on legal zoning at a price point attractive to someone with more limited means and that would have been grandfathered under the Local Government Act if zoning changed, except for provincial intervention.

Have they actually specified what that “specified threshold” will be? And what are the levels at the moment?

This is interesting, everyone knew the rule coming in about 4.5x, but it’s interesting the cap that OFSI is putting on banks on how many highly leveraged borrower’s they are allowed to have on the books.

https://financialpost.com/fp-finance/banking/osfi-limits-banks-mortgages-highly-indebted-borrowers

It will be interesting to see how banks ensure they don’t have too many borrowers at the threshold or over.

So old enough to know better, and wealthy enough to absorb the loss. Even better!

You may want to reread my comment.

Don’t see it as a reckless decision myself and many of the people who bought legal STR units are of retirement age. In at least one case a retired couple who visit grandchildren here frequently and rent out when they go back home.

And what seems reckless now did not seem reckless then following a long period of appreciation pricing out renters. The person I am aware of who bought at 5% down was a first time buyer and had insecure rental housing before.

I guess the courts will answer this question in any event if the province does not offer to settle before it is heard. Be a couple of years before we get an answer and it will be what it will be.

LOL, lets not pretend the reality doesn’t go something like this:

– A few first movers realized the STR opportunity and made lots of money

– more people joined in and bid those properties up

– then everyone and their dog thinks they will be a genius doing this

– there is a housing shortage and STRs are in the cross hairs

– human nature is greed and ignores this and keeps bidding up STRs

– sound “insider contact” advice on HHV was ignored.

– shoe drops

– late comers holding the bag and crying.

LMAO too funny

Presumably “someone” was very young to have made such a reckless financial decision (at a time of huge uncertainty in the world)? So they will learn from their mistake, and will have time to recover financially?

What I find concerning is the amount of interference by this government in matters that are usually done at the municipal level.

Uhhh no, you are making an assumption that the legal-non conforming zoning use cannot be changed. I will bet no reputable lawyer would write a legal opinion saying that.

I believe that municipalities are required to grandfather existing zoning. Perhaps Marko can provide more detail on this. Nevertheless, this is a very unusual case of the provine being responcible for changing the zoning (at the request of the City of Victoria) which is almost unheard of in terms of this same scale operation.

They more than likely have the power to do this but but it is not anything foreseeable by the owners of these units when they purchased them.

Yes. It is called legal non-conforming uses when zoning changes and you are grandfathered. When you are grandfathered you can continue but you cannot change or expand your use and if you discontinue the use for a period of time you can lose it. However zoning is municipally controlled and in the STR case the province stepped in to override this with legislation.

https://www.bclaws.gov.bc.ca/civix/document/id/complete/statreg/r15001_14#division_d0e50260

What happened when the City of Victoria backdated a heritage designation on Rogers Chocolates with a new bylaw?

https://www.douglasmagazine.com/business-meets-heritage/

There was some legal recourse in the case under some acts, but when in doubt, it’s always best to file a lawsuit and see what happens.

But you are making an assumption that the zoning won’t change. Is there a legal basis you are making that assumption on?

I don’t know. I view it along the lines of you buy a property zoned for a bakery. You run a bakery for 10 years and on your business licence every year you pay $1,500 and it says “bakery” and then all of a sudden, the government decides that a bakery isn’t the flavour of the day and you can only operate a deli.

“Liberals say their plan to ‘solve the housing crisis’ will build 3.9M homes by 2031”

https://ca.finance.yahoo.com/news/liberals-release-plan-solve-housing-152030186.html

it’s a gamble, not a sure thing. Just like all the missing middle lot buyers currently

How is that financial security when you pay a premium to do STR in a unit that is likely too small for long term living? Also, you could have pointed them to my “insider contact” info and they would have had like 3 months to unload 😉

They could have bought another place that was bigger for the same price. Shit happens when you yolo, may this be a good lesson for the future. If this played out the opposit way then they would likely be bragging about how much of a genius they were.

Oops didn’t read Leo already made my point…

STR regulation arrives and we are about to drown in froth and phlegm about government over reach.

Do any of you recall the spec tax? Government getting out their revolvers and aiming them at any filthy bourgeois rabble who deigned to leave their home empty?

Crickets then, apoplexy now. What’s the difference?

So, it is a mistake to buy real estate on the premise of zoning, size of lot, or other attributes you think may influence market value down the road, unless you actually needs those attributes? Not sure I agree with that. Buyers, for example, buy SFHs for principal residence on big lots they don’t actually need but feel that it may be better re-sale down the road for redevelopment purposes to a developer, etc.

Although the Canadian Charter of Rights and Freedoms does not expressly protect property rights, such rights are created and are therefore protected by both common law and by statute law — although both can be changed by legislation.

“Why Property Rights Were Excluded from the Canadian Charter of Rights and Freedoms” (1991) 24 Canadian Journal of Political Science 309.

Special Joint Committee on the Constitution and during Parliamentary debate on Bill C-60, Progressive Conservative MPs proposed that a right to “the enjoyment of property” be included under section 7 of the Charter. This amendment was rejected largely due to provincial government concerns, shared by federal New Democratic Party MPs, that entrenching property rights in the Charter of Rights and Freedoms could interfere with environmental, zoning and other land use regulation; public ownership, expropriation and regulation of resource-based and other industries; and with legislative restrictions on foreign ownership of land.

This is my exact concern, what’s next if this is demeed to be ok.

Did they?

I wouldn’t have expected a legal use to be removed. Back when I had nothing and no family help and was looking to find a way to get ahead I would have viewed this purchase as an opportunity to create some financial security as it came with STR options as backup to life circumstances and was an affordable way into the market.

We considered assisting one of our kids to buy in the Janion. We rejected it eventually for a number of reasons, but zoning risk was not one of them.

Really? Because life never changes and not using it this way now means they had no plan to ever use it this way and did not have a right to rely on the legal use they paid for?

Disagree. Every property owner should be concerned about a precedent that permits government to remove vested rights without compensation or grandfathering. If it applies in the case of this legal use then it becomes a precedent if upheld by a court.

We have a long line of court decisions affirming vested property rights and grandfathering, or, in the case of expropriation, requiring a compelling purpose and the payment of fair market compensation.

I would go further and say everyone should be concerned about holding the actions of government to the standard of what would be considered fair and just in a democratic society. I do not agree that this government action meets this standard.

Hence my point that every owner should be worried is an exaggeration. Tend to agree that for STR they overstepped on legal non-conforming, but i don’t buy the slippery slope argument at all for regular owners.

I also know of someone like that. If they had no intention of using it as a STR then the mistake was buying it in the first place when they could have gotten a condo without the STR premium instead.

Trans Canada (of which I’m a shareholder) took a hit when Biden cancelled Keystone XL. However they have more assets than that and I have many more assets other than TC. This is called regulatory risk. If you choose to put all your money in one asset that is subject to a lot of government regulation you are taking on a very high degree of regulatory risk.

And per your example, why would anyone buy a property that was priced for commercial use as their principal residence? Nobody should be taking on commercial risks on their own residence. Unless they had plans for future commercial use.

It’s none of my bee’s wax, but were they planning on living there or planning on the STR income to afford it? Buying property has risks but starting a business is much riskier. Especially if you require the business income to afford the property. I’m not saying I don’t feel for them but they did just about the riskiest thing they could have done with their financial future.

That would not have made the properties more available to long term renters or owner-occupiers, indeed it would have made them less available.

The reforms changing what can be built on a lot are separate measures from the STR legal use removal and cannot be conflated.

Someone who owns a Janion unit has lost a vested legal right they paid for and has zero benefit from the new multiplex possibilities. Someone who owns a lot has a new right but did not lose an existing one.

Every property owner should be concerned with the removal of vested property rights causing unexpected losses that could not be reasonably mitigated. Owning property is a very large investment for most people – the biggest one they will make.

I know a case of someone who bought a unit in Janion in 2021 with 5% down as a first-time homeowner at the top of their affordability level and could only resell at a loss right now that would set them back ten years and possibly push them into bankruptcy – which would not even remove the debt. There is always a risk of a drop in the market, but the drop in the Janion value is way beyond that.

No doubt STRs needed regulation, but people need security respecting existing legal uses of property so they can plan their lives.

I think if you cracked down on illegal ones the increase in demand for the legal ones would offset the increase to 5k.

And I question your court challenge assertion given the financial non-sense muncipalities already impose on development and business.

I guess the other option would have been to classify STVR as commericial properties and charge them commercial property tax rates that are almost 4x higher then residential, this would make sense as they are essentially the same as hotels.

I mean not really. I would argue most owners in BC are seeing a net expansion of property rights from the province’s reforms, not a restriction.

But someone operating in a legal non-conforming way on their property perhaps should be, especially if the use is something that is disliked by neighbours (any use with negative externalities)

Nothing, and quite possibly would have happened.

You effectively are, it’s just a loophole. If you have a legal non-conforming use but the city says you need to pay $1M/year to continue using it, then it’s a practical ban. So then it’s just a question of degree of reasonableness of the licensing fee.

$1500/year was already high but probably didn’t kill the business case for too many units. I suspect upping it to $5000/year would also have attracted a court challenge.

Agree with this approach. I hope those property owners win. Province was way too heavy handed in their approach creating large losses. Every property owner or potential property owner should be concerned.

Prior to the province legislation the City of Victoria had increased the licensing fee from $1,500 to $2,500. What would have prevented them from increasing it to $5,000?

The difference is you aren’t talking property rights away. For example, capital gains inclusion changes so more tax is payable that doesn’t infringe on property right.

I don’t see any functional difference between what they did and an effective ban using punitive licensing fees.

This was also feasible as they would have had a database of the licenced ones.

Or a million other better ideas than the stupid one they come up. Although, I will admit super popular. Politically extremely well executed.

Certainly will be interesting to see how this plays out in court. In my opinion, it is an attack on property rights which everyone should be concerned about.

There were a million different ways to tackle this problem. For example, go after illegal AirBnbs making the legal ones more lucrative due to less competition. Then increase licensing fees on the legal ones from $1,500 per year to $5,000 per year at municipal level. In Victoria that means 700 × $5,000 = $3.5 million. Let’s say a million to employ a few staff to do nothing at City Hall you have $2.5 million left over per year. Go to CMHC/BC Housing to borrow money at lower rates and build subsidized housing in Rock Bay/Burnside/George areas.

Instead we have a law suit, microsuits being offered for $1,800/month long term rent and the value of the units at Janion has dropped from 400k to 350k for 300 sq.ft., who is this actually helping (other than hotels).

Airbnb has also been banned in new construction for a long time it isn’t like new inventory was ever going to be added going forward. Existing legal inventory would have just become a small non-relevant % of housing units. A couple of larger projects approved is 700 units.

Agree that it’s a good one for the courts to test. While I support restricting STVRs in general in favour of longer term uses, undermining the expectation of legal non-conforming use doesn’t seem like a great move.

I think a better idea would have been to ban new STVR in those buildings but grandfather existing owners. It would kill the resale just the same but allow existing owners to keep operating if they like. The numbers would naturally dwindle over time

I think removing STR rights for legal units, instead of focusing on the many more illegal units, was harsh & also dumb, and so I understand the sentiment of suing the gov’t, but all that said, I don’t think this lawsuit has much of a chance. It’s not a realistic answer in my view.

Great analysis Barrister. Yes, US property rights are much stronger than Canada, but I hope that the BC STVR owners prevail with their case.

I believe that they are arguing that their properties were downzoned in that a permitted use (and indeed a permitted use that was actually being employed) was removed and that this has actually caused economic damage. In essence, this is analogous to expropriation occurring without any compensation being offered.

Ownership of property has traditionally been viewed in English Common law as a “bundle” of rights”. The one example that many people are familiar with is mineral rights which can be separate from the other rights on a parcel of property. Easements are another common set of divisible property rights.

At issue will be whether the province, which certainly has the legal right to change zoning can do so without any compensation to the landowner. It should be an interesting challenge for the courts. Unlike the US constitution there are no property rights protections.

Hawaii (and specifically Maui) very likely won’t be banning airbnb. They only plan to further crack down on illegal airbnb (to make them register and pay taxes), which is their current position as well. This position is confirmed clearly by the governor of Hawaii. Anyone interested can watch the governor explain (April 2024) that they aren’t cracking down on airbnb. (Hawaii governor https://youtu.be/EWqdNNUnoA4?si=SNH2IZ84rE5WueAg at 5:15 “if you are a short term rental, and pay your taxes you are fine”

BC could learn from places like Maui in how to tax vacant/stvr and other types of homes. Maui has an incredibly simple system, where they tax non-owner-occupied homes at higher tax rates than owner occupied. Very simple, and fully described in a few lines. They have different rates for owner occupied/ stvr/long term rent/part time owner/ https://www.mauicounty.gov/DocumentCenter/View/141482/2023-Tax-Rate they also have progressive rates that rise with home value.

They don’t add a complicated layer like BC of

——taxing foreigners or “satellite families” at higher rates

—— make payment be a separate process than property tax

——require everyone to make annual declarations online to restate their circumstances.

Lmao

It most definitely does. The question will be whether the public policy purpose justifies the infringement.

I’m not sure how this is in any way comparable.

Back in 1975 a new act was brought into force and specifically stated that “land shall be deemed not to be taken or injuriously affected by reason of the ALR designation”. Lands subject to the ALC were over two acres, had already been designated agricultural or with agr 1-4 potential, and were already being assessed as farmland. No previous subdivisions of farmland for, example, residential subdivisions, were rendered inoperable as a result. AKA vested rights were not impacted.