Checking on the AirBnB situation

A few months ago I looked at the potential impact of the province’s AirBnB restrictions, especially the removal of grandfathering that previously allowed owners in a couple dozen buildings downtown to legally operate short term rentals with a city license. Few expected the province to take that step, but it did mean that the short term rental regulations would be more impactful in Victoria than most other cities in the province.

At the time I expected the impact from the regulations to be threefold:

- The rental market would cool a little, as some units on the short term rental market would end up rented long term

- The condo market would cool a little, as some units are sold

- The value of short term rental units would take a serious hit as the short term rental premium evaporated.

Three months later, it’s time to check in to see how things have unfolded.

There’s not much to say about the rental market because we lack reliable data. Anecdotally the market has definitely cooled, and advertised rents have not really moved in about a year. We are due to receive updated CMHC vacancy data any day now and it will definitely be a higher vacancy rate than the 1% we had in 2022, but that will be as of October 2023, and will not reflect any impact of the short term rental regulations.

Certainly there are quite a number of fully furnished rentals advertised for long term tenants, with some using MLS photos from earlier sales attempts that didn’t succeed. Smaller units seem to be posted around $1800/month with larger 1 beds in the low $2000s, however leased rents may be lower given the current glut.

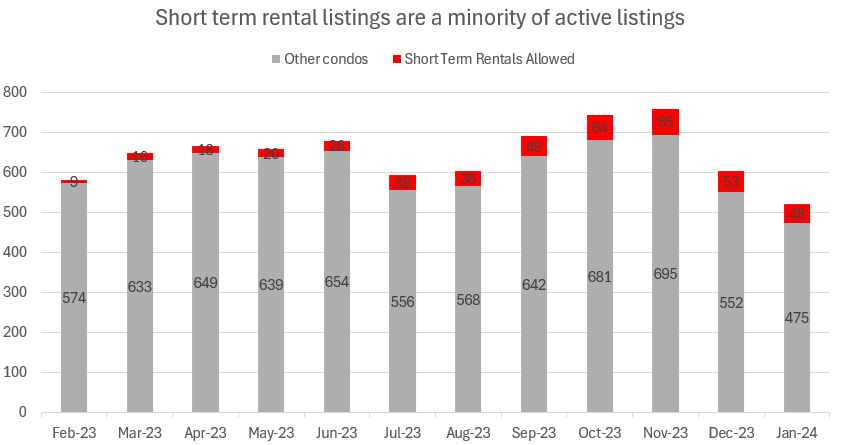

On the resale market, additional condo listings have cooled the condo market as a whole, but it’s not a huge factor. The listings that came onto the market from short term rental buildings are still only about 10% of active listings, cooling the market a little, but not that you’d really notice. It is interesting that listings from short term rental buildings were increasing all year, well before the regulations were announced in October. Fluke or did some owners guess what was coming down the pike?

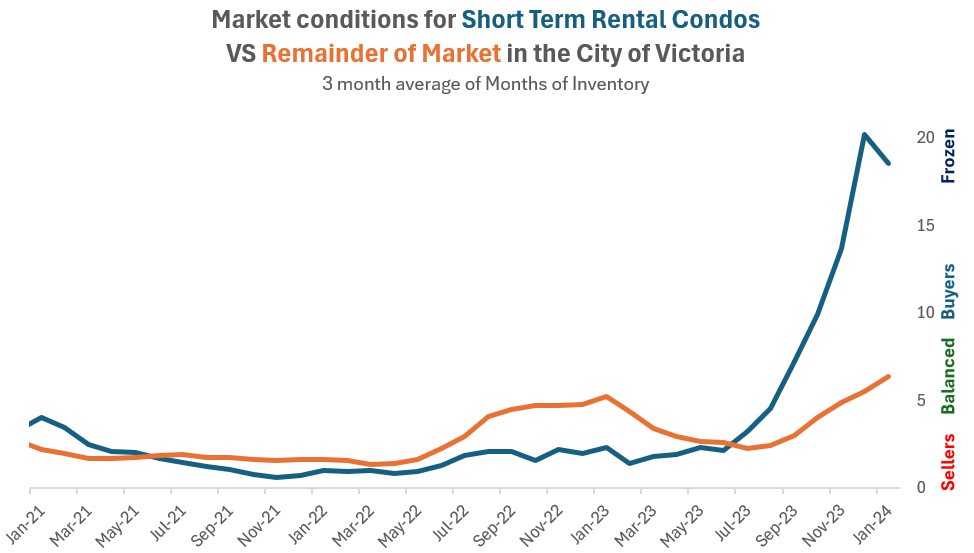

Looking at market conditions, it’s a big gap right now, with short term rental condos in a deep freeze well beyond any normal buyers market, while the rest of the condos in the City of Victoria remain in buyers market territory. While prices in the condo market slid a little into the fall, it’s only a few percent.

In October I estimated that short term rental condos were selling at a premium of around 13%, and may have gotten as high as 20% higher per square foot than similarly sized condos that didn’t allow short term rentals in 2023. That premium should have evaporated immediately when the regulations were passed, but did it?

There haven’t been many sales of those units since October, but price weakness is evident. The first few sales immediately after the announcement were seemingly unaffected, selling for prices quite similar to what they were worth before the change. After that, valuations seemed to take more of a hit, with a unit in Mermaid Wharf going for around 15% below pre-regulation value, and a unit in the Falls going for 10% under assessment when other units in the same building averaged 10% over earlier in the year. A larger unit in the Astoria did comparatively better, coming in at what I would judge as close to pre-regulation value. Overall, units that are a similar size to regular condos are holding their value better than small ones, which have notably barely sold (zero sales in the Janion for example). Clearly market values remain below seller expectations, and more sellers are cancelling listings, or trying their luck in the rental market.

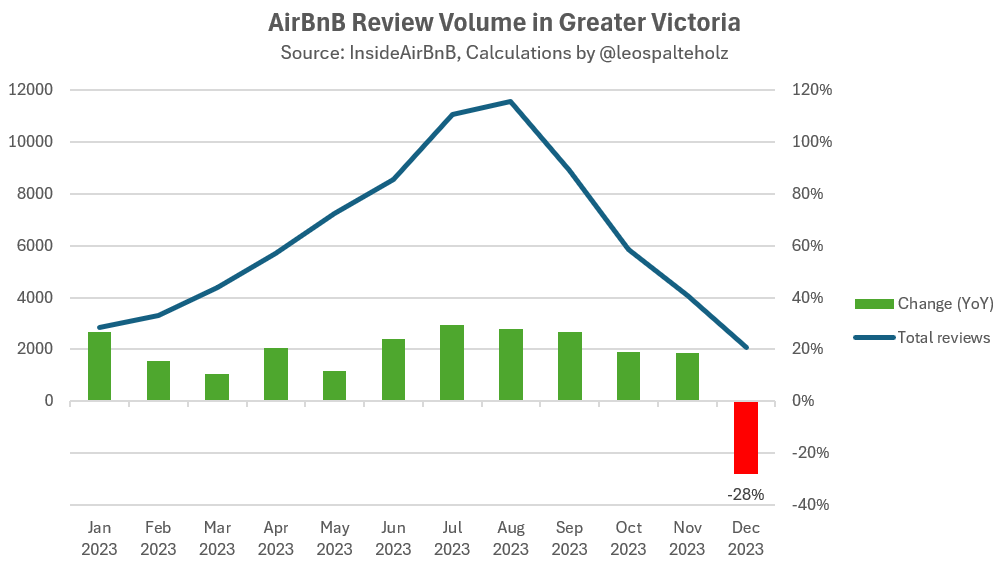

With owners casting about for what to do with their units and taking some off the short term rental market, has this been reflected in AirBnB activity? Seemingly yes. After growing at a pace of about 15% last year, activity took a dive in December, with review activity falling 28%.

Looking just at unique reviews, the story is similar, with a 6% drop in unique listings in December set against gains of 25% during the rest of the year. This is likely to accelerate to the provincial short term rental deadline of May 1st. Once the ban is fully in place, it would be interesting to look at the impact on hotel and remaining short term rental rates. With less supply, prices should go up for short term stays.

Also the weekly numbers

| January 2024 |

Jan

2023

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 32 | 95 | 181 | 278 | |

| New Listings | 187 | 443 | 640 | 805 | |

| Active Listings | 2008 | 2087 | 2108 | 1739 | |

| Sales to New Listings | 17% | 21% | 28% | 35% | |

| Sales YoY Change | — | +37% | +22% | -41% | |

| New Lists YoY Change | — | +25% | +17% | +16% | |

| Inventory YoY Change | +25% | +25% | +23% | +134% | |

| Months of Inventory | 6.3 | ||||

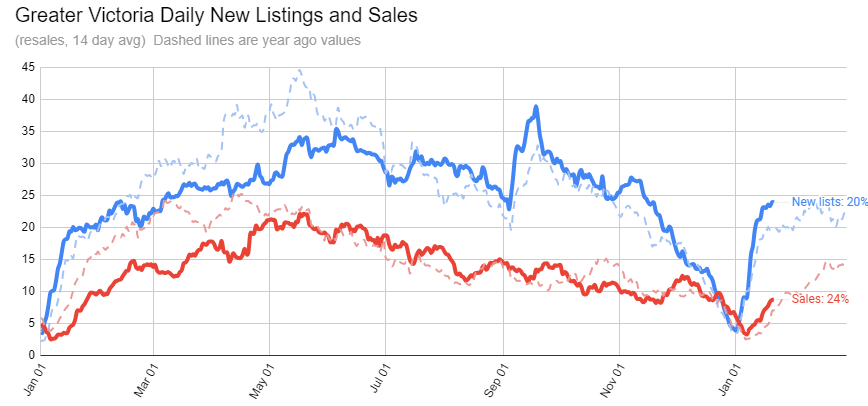

Now that we are out of the winter sales trough, we are starting to get a better idea of how January will shape up. Sales and inventory are both up by about a fifth, coming off an extremely slow year ago comparator. With inventory also up by a similar amount, market conditions are nearly identical to where we were last January.

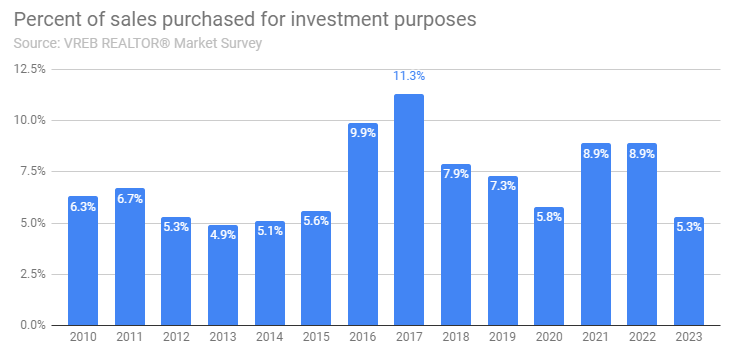

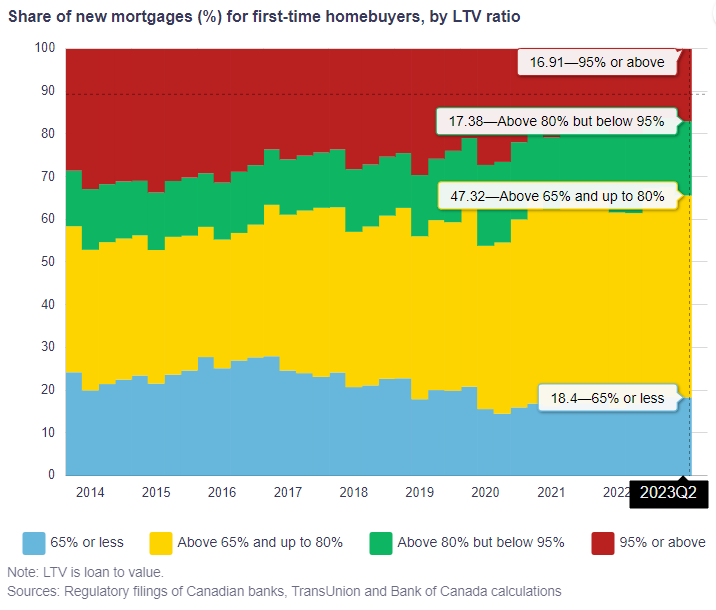

Meanwhile the feds have acted on runaway non-permanent resident numbers, cutting the total number of study permits they will issue in 2024 by 35% from 2023 values. We don’t have the details yet, but permits will be assigned to each province by population, which means BC and Ontario will likely face steeper cuts. The best summary of the changes so far is here. Once the province has their quote they decide how to allocate it amongst their institutions, and it sounds like BC is intending to cut most deeply in private colleges which are primarily in the lower mainland. However the big schools are also likely to face budget crunches again this year. In the short term that will primarily reduce demand pressures in the rental market, and further sour the case for investors to buy condos to rent out. Investment buying activity has already dropped substantially according to the most recent VREB survey data. In 2023 it was lower than we’ve seen it in nearly a decade.

An illegal suite is one that has not received a permit from the city. Most of the homes in Greater Victoria have illegal suites. I think most people just don’t like the term illegal. It is more accurate to call suites that are rented to non family members as a non permitted or unauthorized use. A non permitted use may be shut down by a written complaint made to the city from a neighbor.

That’s not likely to happen as the neighbor probably has a “not legal” suite as well. But that’s a gamble that you take on yourself. That’s not a gamble that most lenders will take on.

New post: https://househuntvictoria.ca/2024/01/29/how-often-do-owners-move/

those people shouldn’t be investing in real estate.

Please define “illegal”? If it means not registered with the city, then the illegal ones are everywhere, and much more than the legal ones. And it would be another matter (and number), if it means the rental income is not reported (to CRA).

I suspect most owners could still sell for more than their purchase price, but people are stubborn and anchor to peak prices, not to what they bought for.

It is important that an owner, potential owner and lender know the permitted uses within the zone and that the construction meets municipal requirements. If the property has been bought and is being used as security based on it being revenue property with one or more possibly illegal suites, the lender could be at risk if the municipality discovers this improper use and requires the tenants to vacate.

Source: Professional Legal Training Course 2023

The Law Society of British Columbia

September 2023

Can anyone please tell me their experiences with getting a mortgage for a place with a basement or detached suite? How much of the potential suite income were you allowed to use to qualify etc.? My wife and I are going back and fourth, my gut tells me I’m not super stoked to be a landlord or share part of my space, but on the other hand we are in a time of pretty heavy COL increases across the board and a suite could provide some relief that way. Anyway, does anyone have a semi-recent experience with this? Thanks!

How am I trolling?

That depends on when the STRs were purchased. recent buyers will have to wait longer than longer term owners of those units. All I know is that there is a group exploring legal options. Whether they succeed or not I have no opinion on that. I dont think peak values are as important to the owners as recovering what each of them paid. There were only a handful of units available at the peak as I was actively pursuing one (thankfully unsuccessfully) so I dont know how many people are really going to be in trouble.

#332).

I feel the most comfortable transporting my family in one of these…

Ah, so you’re just trolling then.

I don’t and there is no problem to solve go look back at the posts.

Feel free to mute me 😉

So don’t do it. Problem solved.

The Janion would turn into an actual hotel before a legal challenge would succeed. The only people who would be motivated to undertake a legal challenge are likely limited to those who are actually in the hole and those are far and few in between.

I got no problem with gas powered cars but I am not comfortable transporting my family on the highway in those cars that I can buy for 5k.

I think it’s going to be a long time before small STRs recover peak values, and I have zero confidence that a legal challenge will suceed.

Everyone hates a gas powered sedan. I’d look for something like a 1st gen Mazda 3 or Mazda 6 for cheap, reliable transportation. If you want something newer, you’ll obviously have to spend more.

I should also say I haven’t bought a car since 2018, so no idea whether it’s still possible to get something decent in the sub $5k range. Maybe you need to go up to ~$8,000 now to filter out the absolute junk.

It is quite possibly a good number of those long term rental conversions are temporary until market conditions are more favourable for sellers. That and a potential legal challenge in the works.

#322).

🙂

Case in point.

Introvert the ball is in your court, please enlighten the group with your automotive knowledge.

IMO, there is the same percentage of dicks here as elsewhere…just fewer of them (3 or 4) with such a small group of players.

We got rid of the last of the Canadian investments over ten years ago. While you might not be able to fix stupid, you certainly can elect stupid.

what we really need here is a laugh react emoji so we can join Facebook in the passive aggressive use of said emoji to make people feel small when they say something others don’t agree with rather than have a meaningful debate. For this comment you can substitute the thumbs up for a laugh react and I will take it as a sign to punish myself. 🙂

#316).

The tidal wave of unfunded liabilities.

Scared of what exactly? The government bonds are a core pillar of any diversified investment portfolio, you have them too if you have any type of balanced mutual funds/etfs etc.

#313).

Are they scared yet?

again interest rate parity

I have not personally bought the 5 year but I have bought other terms before. My work (and all others like it) has holdings across the curve and we are not the federal government.

Well, there is no “have to” but you’ll have a hard time moving those bonds when others are paying higher yields and then liquidity becomes a problem. That liquidity problem is creeping in, making lower rates a fantasy unless there’s QE.

The BoC snuck their buy into it’s report last week when there was a surprise liquidity issue…

https://www.reuters.com/world/americas/bank-canada-may-end-quantitative-tightening-sooner-after-money-market-strains-2024-01-24/

#309).

Do you buy CDN bonds? I think Its pretty clear the only one who does buy CDN bonds Is the CDN Government Itself.

No you are forgetting interest parity and the CAD could depreciate as a result. There is no circumstance where CDN yields HAVE TO increase if US yields do.

Sounds like a Frank comment.

2 year is still over 4%, depends on how that inversion corrects itself. It’s less than 50 points off.

#305).

We have a Federal election coming up. What else drives the country? We sell houses to each other. What else Is there? The fundamentals of our economy depend on the sale of real estate?

☮

Not that big of an assumption. BoC had to step in with a small buy already because of pressure on their repo rate. If US yields rise, CDN yields will need to follow to continue be able sell bonds. It is likely a short to near term scenario playing out over the next three to six months. As well, this will be occuring seperate the BoC overnight rate.

That is a big assumption. I don’t see 5 year yields breaching 4% again and I also think the long term equilibrium for the BOC overnight rate to be 4% going forward.

#303).

👎

re 5k cars: as someone who is currently looking, there is absolutely nothing to be had for 5k that won’t cost double that in repairs or run reliably as is. And this is coming from someone currently drives a 2006 ford escape with 280,000km, purchased for $2400 6 years ago. If anyone thinks there is a 5k deal to be had, please send me the link..

The quick and simple lunch version: US bond sales have lagged in the couple of auctions and it looks like demand for them is really falling off in advance of the next round of auctions. The result, yields will will go up unless the FED starts bond buys (new QE), but since QE puts upward pressure on inflation, the FED will be hesitant to intervene and will likely allow yields to grow. The CDN bonds will have to pace the US bonds resulting in higher borrowing costs in mortgages here. The big thing is the market isn’t liking sovereign debt right and it will drive yeilds up across the board…

Marko, ya I could go for a chinwag over a pint . Alcohol and housing should be a good recipe for a fist fight lol

#300).

Okay, could a firm, like a tech firm for example. Buy one of these previous Air BnB’s…Then use them for temporary stay’s for their many executives or even out of town employees that just need a couple of nights…And do this over and over the coarse of a year or years? I would imagine the executives or employees wouldn’t be paying anything for the use. It would be cheaper than a hotel and It would always be there.

Kind of like an Air BnB…But not really. Wouldn’t this be a complete write off for the firm that they could sell years down the road? They wouldn’t be a short term rental, they would be a short term stay. Buy this car from me today…And receive a three night stay In beautiful Victoria BC absolutely free.

Month to date numbers:

Sales: 286 (up 19% compared to the same time last year)

New lists: 840 (up 16%)

Inventory: 2114 (up 21%)

Interesting. So seems like most will turn into long term rentals. Makes sense given the limited success with sales of those small units so far.

We have a pole going on our victoria realtor fb page right now I thought was interesting

“Im curious what your airbnb clients are doing with their condos?”

35 votes so far

Already listed and sold – 0

Currently listed – 7

Coming later this spring – 1

Keeping and renting long term – 22

Keeping it for themselves – 3

Keeping it for executive rental – 2

Oh I recall getting a lot of pushback etc. on here with people showing hockey stick graphs of used car prices. Very similar to Barrister’s experience when he shared his mortgage rate forecast from his bay street friends.

That is the whole problem I have with a general forum concept, people with zero clue of anything outside of google posting random b.s. I guess that is why you use the mute function.

Max , if your doing a hon and re ring then on a newer car your probaly going to over bore the cylinder . I’m involved in the old British car clubs and older cars with su carbs or webers , removing the head and cleaning up the cylinders is not a big deal. I have a twin cam mga and I can get the pistons out replaced and cylinders honed is a days work for me . I have my engine out every spring . Sorry about this rubbish as it’s a real estate site and I’m a member of other old car sites for kind of gibberish cheers

I don’t think you needed industry knowledge to see what was coming. Prices on cars skyrocketed and then we got hit with huge interest rate increases on top of the crazy prices. It was only a matter of time before demand for cars dropped. Even after the first round of Tesla price cuts I kept commenting online that further cuts were necessary to induce demand. I predicted the Model S back at 99k a year in advance 🙂 It couldn’t have been more obvious, to me anyway, that people were going to stop buying the Model S @ $120k @ 7-8% interest rates.

In management roles at two of the big chains in town. They tell me the kind of cars they keep on the lot and the kind they don’t bother with which they either auction them off or send them off to the smaller independent dealerships. You can guess the price point of each.

The issues you mentioned are typically progressive in nature and won’t leave you stranded all of a sudden without notice. Bad back and busted hands 🙂

#292).

You only need one licensed mechanic to oversee the shop, most of what you see are just skilled labour.

If you have to get your cylinder walls honed…They would more than likely suggest you get a new ride 😉

Vicreanalyst, so I’m guessing u know some car salesman . Have u yourself done , valve stem guides or crankshaft bearing replacement or a hon and piston rings . Like I was saying lots of older cars have fallen behind on maintenance the are on the road . Lots of folks do not want to spend money on their cars as they see it as a big bill . For what it’s worth we have a huge shortage of mechanics at all the shops and a big reason why u can’t get your car repaired . Well paying job but u are guaranteed a bad back lol

I got a few friends in the industry, they were the ones telling boots on the ground observations back at the start of the decline in late 2022 which I posted on here.

#289).

And MAID.

I don’t see “many issues”. That particular link states 50 years but we have used 30 and done the math.

IMO 4% is a fairly safe bet for not running out of money if you have invested in something like the Canadian Couch Potato portfolio in a DIY style at with low transaction fees.

If you have rentals, you have to be able to maintain those as you and they age, but they can provide a hedge against stock market ups/downs and inflation – which you pay for through need for active management even with a property manager if you are prepared to pay for one.

https://www.morningstar.com/retirement/morningstars-retirement-income-research-reevaluating-4-withdrawal-rule

We should not miss an opportunity for a shout out to CPP for their efforts to totally reform in the late ’90s. Prior to those reforms the plan was going to run out of money leaving contributors bereft, post-reform there is little to no chance of this happening.

So there IS precedent for a government to take responsbility for its’ promises. Roll on health care liberalization and reform which seems at this stage to promise only waste, agony, worry, and early death for you and your loved ones.

Vicreanalyst , I’m guessing u know squat about cars .

Again, many issues with this back on the envelope guide, if you look at the bottom of the article link it is designed to last at least 50 years.

What about a private message feature?

The math is based on the 4% safe withdrawal rate which allows you to take 4% out of your investment portfolio every year and this should last for a full retirement without running out of money. https://www.forbes.com/advisor/retirement/four-percent-rule-retirement/

Getting 80k in retirement from your investments still carries tax consequences apart from the TFSA withdrawals. 80k is realistically 60k after tax. That is 5k a month. The median retiree gets 15k a year from OAS and CPP. This brings you to about 6k a month.

Do you need 6k a month in retirement? Maybe not, but this is what many people with government-style pensions receive and IMO you will need something more than CPP/OAS and a paid off home to be comfortable in retirement without an employer pension.

In terms of why create a pension for yourself, for us it is a very important aspect of independence and the mental freedom to stop work. Once your earning capacity is reduced/eliminated you have what you have. Trips, helping family in significant ways, charity, hobbies, fitness, home maintenance and upgrades, top quality preventative and enhanced health care, vehicle purchases, and the most expensive potential cost for us imo may be long term care that allows for very comfortable aging in place at home including the option of private pay live in care.

Yep. Poverty/frugality sticks even when you’ve saved and invested your way out. Plus who doesn’t like a deal 🙂

This is just an example of stupid pointless debates certain individuals start here, someone with zero knowledge on a subject making a random statement just for the purpose of engagement.

Yeah…we had a car once that we bought for $150 (ok yes, this was “back in the day” as they say), worked fine, we drove it for a year then sold it. A week later the buyer phones me & says “you know that car you sold me, it broke”, so I’m like “sorry, what broke” – and the answer was that the car literally ‘broke’ in the sense that the frame of the car (not unibody then) cracked in half when he drove over some bump. Good times!

New cars do have better safety . Older cars are usually pretty worn out and probably unreliable . I don’t think folks driving older cars are really aware how many problems they have underneath them as nobody really does any maintenance on them

How do you figure? I see it staying around the current mark

Depends a lot on what kind of person you are. Speaking only for myself, if you had a very linear career with endless work, lots of family obligations and little free time, maybe you have a lot of pent-up demand to knock the lights out in your first 10-15 years of retirement while you can, and travel & toys alone could eat up a bunch. Of course, if you managed to live a more balanced life throughout your career, maybe you don’t care. I do, though. There are studies showing that many or most retired people who have saved all their lives have trouble switching to any spending mode, but luckily that’s one problem I haven’t encountered personally! Giving also becomes more fun if you have time and funds to focus on it.

LMAO, please show me $5k cars with working traction control, current generation airbags with all service and maintenance up to date and has enough power to comfortably and safely drive on the malahat? I am talking basics here, not asking for back up cameras, lane departure and other driver assist gadgets.

Yeah, you guys are right on this – assuming one has the discipline to invest that money and then use it for paydown later. But anyone who already has the discipline to double up mortgage payments probably has that.

Good thing my retirement is going well despite my many mistakes over the years!

The notion that only a new or nearly-new vehicle is safe (enough) for a family is probably partly why it’s commonplace to see people financing $50K vehicles.

Tell me you don’t know much about cars without telling me you don’t know much about cars.

No changes to HHV, please.

Also, mark me down as being opposed to the thumbs-up counter and the mute button.

Spring buyers should get their pre-approved mortgages locked in now. The bond market is set to to go on a 2-3 month rip that will drag fixed rates up with it.

Don’t go changing anything.

Yes, there’s a few snippy exchanges, some unrefuted b.s., and the occasional lengthy digression, but relative to most comment fora HHV is an island of civility and good sense.

I am fine with electric cars but we had to import about twenty per cent of our hydro last year and just maybe we should not be mandating all new housing to be electric. I know that it has been a particularly bad drought year in 23 but this might be more of the norm in coming years. Doing both cars and houses might not be prudent.

I think housing and transportation go hand in hand. Proximity to public transit, parking, charging stations, bicycle paths, commuting distance, etc… All considerations when deciding on a place to live. Other factors such as schools, health care availability, services such as first responders are also worthy of discussion. Purely discussing the frustrations of the housing market can be tedious.

I think it is fine the way it is. The off topic discussions really aren’t that bad, and they seem to peter out quickly.

I think downvoting can stifle discussion, as it does on Reddit. People just drop out or self-censor.

Scrolling past comments or using the mute button seems to work well enough imo.

If I had time I wouldn’t spend a lot on a car either. My specialty back in the day was hunting for lease take-overs where the owner gives me “cashback” to take over a lease. My best was deal was I took over a 2008 Honda Civic Si lease that was $362 per month taxes included and the owner gave me $3,600 cash plus paid the $400 Honda lease transfer fee. At the end of the lease I bought the car out for $13,xxx. Drove it for another year and sold it for $15,xxx. Simply don’t have time to do that anymore.

In my defense I was posting good content from my VIHA nightshifts even 16 years ago. 20th year anniversary of HHV is coming up, should organize another pub night.

Mute button works well enough imo.

Probably not because I’m not really interested in creating a more complex forum. However if people generally feel that there’s too much off-topic chatter, I could look at other ways to handle this. For example, if a comment gets too many downvotes, it gets hidden.

My concern there (and the reason I disabled the down-votes button entirely) is that I prefer voting to be positive, rather than people downvoting instead of responding. However we could make the downvote button an “offtopic” button or something and then hide if a comment gets a bunch of offtopic votes.

Thoughts?

As I recall Marko had an alt account cosplaying as a local nurse when he first started commenting on HHV 🙂

As always, any individual sales/assessed value ratio is nearly meaningless, but once you look at a group it becomes useful.

Just like forecasts. Any given forecast is useless, but there is value in consensus forecasts in certain areas.

Nah, watch for the middle-east conflict and resulting oil price increases that will be inflationary.

Six to eight thousand a month is not unusual for a couple with a paid off house and who run a car assuming some prescriptions and some travel. Heat, hydro, utilities and insurance along with a reasonable clothing and food budget adds up pretty fast these days.

“Of course I have. I just haven’t paid more than $5k

Please don’t take this personally but I would never put my family in a $5k vehicle and drive it on the highway. Maybe you are a mechanic and knows exactly what is going on with the car, in which case that is fine.

https://www.bbc.co.uk/news/business-67562522

Should make for a sporting week ahead…….

? Of course I have. I just haven’t paid more than $5k. I’ve put over 50k on my current vehicle which is both safe and extremely reliable.

instead of 4 weeks of vacation you now have 52 weeks so ya I would expect expenses to stay the same at best.

So you have never purchased a reliable and safe vehicle for your family?

There are many issues with this common back-of-the-envelope calc. which I won’t get into. But please show me the calculation where your typical viha nurse can pocket 80k a year in pension during retirement?

Ok, I’ll take back the status symbol comment. I’ve personally never spent more than $5k to purchase a vehicle, so everything looks like a status symbol to me.

If one has a paid off principal residence, what on earth would they do with $80K/year in retirement?

Do people really expect to have or need the same expenses to live comfortably in retirement, as in the years building up to retirement?

Please google “origin of the Canada pension plan”.

Not so, CPP benefits are entirely based on contributions, which means the working poor receive the least benefits. OAS originally had no means test at all, and still pays full benefits up to $86K income.

It’s GIS which is the safety net from complete impoverishment, and one third of OAS recipients also receive GIS. That’s evidence that voluntary retirement saving hasn’t been working for too many people.

They were never intended to. They were introduced at a time when far more people had employer pensions than today.

$2 million * 4% withdrawal rate = $80k per year withdrawal rate.

This is a standard retirement drawdown calculation.

CPP and OAS were designed to backstop the working poor from complete impoverishment after they are no longer able to work.

Absolutely no one who has the ability to save any money for retirement should ever kid themselves that the CPP and OAS will (on their own) ensure they maintain the quality of life they had during employment.

Consider the CPP a small, forced fixed income investment holding that will vastly underperform the market, but roughly track inflation.

Please show the math on that. I highly doubt you need $2M to replicate the pension income of a VIHA nurse or whatever Marko was.

Yes. I don’t recall hearing that any of the foreign students were homeless in 2023. There was the W5 segment that showed big problems in Cape Breton, but they are now building student accomodations there. Cape Breton just got overwhelmed with numbers. It’s not as bad as Cape Breton for foreign students elsewhere.

Is this across all homes or just the pos ones? Could be builders trying to speculate on future 4plex builds.

You could drive a semi through the wiggle room on that one. There’s always something for rent, isn’t there?

I am not a fan of assessment analysis, but I do get to see hundreds of homes on a regular basis. I do my own analysis what did a Gordon Head box in XYZ shape cost last year and what does it cost now in absolute terms.

Hardwood is a strong sale when you factor in the condition of the home, but as you point that it would in terms of numbers it shows weakness in the market.

I showed a number of SFH properties requiring substantial repairs/updates over the weekend and I thought some were well over-priced and now receiving messages after showings “offer received” then an hour later “second offer received.” Truly surprised what people are willing to pay for SFHs that need a ton of work given current construction costs. I would have thought these interest rates would have put a serious dent in the market, but things have really turned in the last two weeks. You would think there would be more people out there in this situation -> https://www.reddit.com/r/PersonalFinanceCanada/comments/1acu38x/made_a_financial_mistake_house_poor_would/

If interest rates drop 1% to lower 4s it is going to be crazy out there. The way things are going the last two weeks, based on what I am seeing the ground, unless we get a flood of new listings in February/March there might be upward pressure prices on SFHs again.

I worry that almost all of on campus housing will be turned over to foreign students instead of being provided to Canadian students from out of town.

#239).

Stay put and be happy with what you have. If you sell…You are probably making a very big mistake. Rash decisions often fail…leading to living in a one bedroom condo or apartment paying $1625 per month with no parking.

“ Ontario colleges and universities will be required to guarantee housing for incoming international students,”

That seems to be all the government knows how to do. Pass the buck and pass a law that says someone else needs to guarantee housing. How about the government passes the same law for themselves (the government) to guarantee housing for homeless Canadians?

Well at least someone in Canada will have guaranteed housing – foreign students!

Such an odd comment comparing rent in a one bedroom condo or apartment to living in a nearly fully paid / mortgage-free older SFH in Langford.

#236).

I assume that Includes utilities? That’s not bad for a couple. It always comes back to the same thing…People with an SFH just won’t sell.

Generation X will just stay put, They are for the most part 20 years or more In. They read this blog. I am damn sure I would be absolutely shell shocked of where I could be living If I didn’t have what I have today. And I’m humble, I’m a simple man, I’m In Langford of all places.

I know you guys hate Langford, But I will say this. I pay less than $1200 per month Including Mortgage, Property Tax, House Insurance, Life Insurance, CRD water, sewer, and garbage pickup. 2600 sq/ft SFH 10,000 sq/ft lot In the cities core…And I don’t have a care In the f#cking world.

https://nationalpost.com/pmn/news-pmn/canada-news-pmn/post-secondary-schools-must-guarantee-housing-for-international-students-ontario

Possibly, in the spring more people will move to Victoria for jobs and the supply of rentals will be drawn down. But at the moment the supply is meeting the demand for rentals.

Today, you will find one-bedroom suites in purpose built apartment blocks near downtown (845 Burdett) asking $1,625 a month without parking for a 725 square feet suite. That’s a big one-bedroom apartment which is about the size of a two-bedroom downtown condo today.

A two-bedroom apartment at 1760 Fort for $2,095 excluding parking has been available since December 7.

Generally speaking these older 1970’s apartment buildings tend to be the least expensive rentals. But for the last few years there has been almost none available. Now I see more vacancies advertised in what were fully occupied apartment buildings just a year ago.

The rental market is a pillar that supports the real estate market. If the rental market weakens then we just won’t get people investing in new housing. And that could lead to a glut of condos on the market as investors switch from net buyers to net sellers. And that would, in time, cause house prices to slide as condo owners will not be able to move up to a house.

Personally, I’m not as overly concerned about the interest rate as most people on this blog. For the most part, mortgage renewals are evenly spaced over the year so the impact is spread out. However, higher vacancy rates coupled with weaker rental rates have an immediate effect on a much larger number of home owners.

I have had the opportunity to speak with home owners that owned rentals in the early 1980’s downturn. Just as many people do today. And while the interest rate was a factor for many home owners it was the investors that got crushed as their rentals went vacant and they could not lease them up at the previous rents. They were caught between a rock and a hard place. If they lowered the rent then they would not be able to make their mortgage obligations and they would face going bankrupt. So they held out for months to find a new tenant and spent their savings to pay for a vacant suite – until they just could not do it anymore.

They couldn’t sell as the mortgage was more than market value. And they couldn’t rent at a lower rate.

This isn’t the 1980’s, this time we have high immigration and that has been supporting the rental market. As long as we have more young people (20 to 40 age) that are more likely to be renters, moving here than leaving market prices should remain stable.

I don’t put much faith in those that are retiring here with cash purchases to save the market from a downturn. There have always been retirees moving to Victoria to live out their years. As the legend goes, retirees and old elephants instinctively direct themselves to go when they reach a certain age. It is the younger buyers and renters that are the foundation of the real estate pyramid.

#233).

Don’t get me wrong. Both my Wife and I will be collecting CCP/OAS at age 67… We paid for It. We know Its not enough. We never thought It was going to be enough…They told you this. Back In the late 80’s there was a 60 minuets episode of an old guy eating Alpo dog food…That really resonated with me.

I’ve read a lot of good advice, much of which is ignored by most. Discipline is the key.

#231).

I couldn’t agree with you anymore. I honestly couldn’t handle actually having a boss. There are much better ways out there to carve out a good solid living. Make hay when the sun Is shining, don’t spend money like a drunken sailor.

Agreed. However, a lot of business owners have very low salaries when they start and CPP is not going to be enough for almost anyone to live unless they have low subsidized housing and even then it is going to be very difficult as this amounts to living on 20k a year if you qualify for the max.

It was okay when middle income Canadian could afford to buy and pay off a house and had that to fall back on in retirement – provided they did not get divorced. Doesn’t work so well now when a room rental is 900 plus utilities, many people have been priced out, and all they’ll have is the CPP/OAS.

There is nothing as satisfying as being a (successful) independent business owner; I’m not a Protestant, but do know about having a work ethic, and the pleasure of being self reliant.

#228).

First, It was meant to be a supplement anyway. Second, If you have a mortgage In retirement you did something very wrong. Third, You can’t park at Walmart overnight anymore…That ship has sailed.

Plenty of higher paid employees not saving for retirement either. That’s another reason why CPP is being beefed up.

But hardly anyone in the private sector gets a pension these days anyway. That’s one reason why they’re beefing up CPP. And of course self-employed people pay for and get CPP, and if you have a corporation you can get it to pay you a salary to get you in CPP. Likewise RRSP.

#226).

Lol 🙂

If you own a rental car business personally you are incredibly foolish.

#221).

If you own a rental car business personally, Any expenses associated with It are deductible.

What you are suggesting would be highly scrutinized and would certainly not be 100% deductible.

For the YOLO types that think their retirement is looked after by government programs. Guess what! CPP and OAS just don’t cut it and when your body can’t work anymore because of illness or age. Oh, that mortgage in retirement years isn’t a good plan either……

https://bc.ctvnews.ca/in-an-rv-outside-walmart-a-senior-dreams-of-housing-as-dramatic-reversal-plays-out-1.6744940

Managing a small business is something I know.

Telling Marko how good he has it as a small business owner with his six figures with a holdco that has rental property because he got an EV rebate vs. someone who is an employee driving a minivan is RIDICULOUS.

Every tax advantage has its disadvantage. Every opportunity has risks. In my experience, most people talk without really understanding the math or assessing and understanding the risks.

I’m not saying that Marko is not doing well, but he is out there hustling for a living without being subsidized by the taxpayer re. a pension and it is a risk – most small businesses do not make it. Right now there are a whole lot of realtors and not many listings. He is also operating rentals which are not subsidized by the government and we have a huge shortage of rental housing. It is not free money – none of it.

And yes, there are employees out there without pensions who are also not saving for retirement because they are in low-paid jobs. These are the people who should have access to subsidized housing. But that is another discussion.

Marko, if you are looking for a status symbol get a G3 for your Holdco. For travel expenses, business conferences are always an option. The LSUC had some great conferences in the Caribbean and also in parts of Europe. Holdco might be looking for possible condo investments in Croatia?

RAVs have insanely low depreciation. Buy one, drive it for 10 years (no battery replacement to worry about) and sell it for $10,000 less than you paid for it. Cost $1000 a year to own ($80 a month-less than a bus pass). If gas goes over $2 a liter for an extended period of time, more people will consider EVs,

The same expenses are deductible for a proprietorship. The proviso in both cases being they have to be actual business expenses. For example if you own a rental personally your car expenses associated with it are deductible.

#218).

I get It with the commuters. We live on a recreational Island…Towing boilers, fifth wheels, boats, hauling campers, driving motor homes. Making their way out Into the deep, beautiful wilderness areas this Island has to offer…And all the other Islands off this Island. I really don’t think the vehicles with this kind of towing capacity and range are going away anytime soon…And they were here first. And I think the kids of tomorrow would enjoy that very same experience. Its gotta be a 50/50 thing.

With a family income of below ~$95k he will very likely get more back in rebates than he spends on carbon tax.

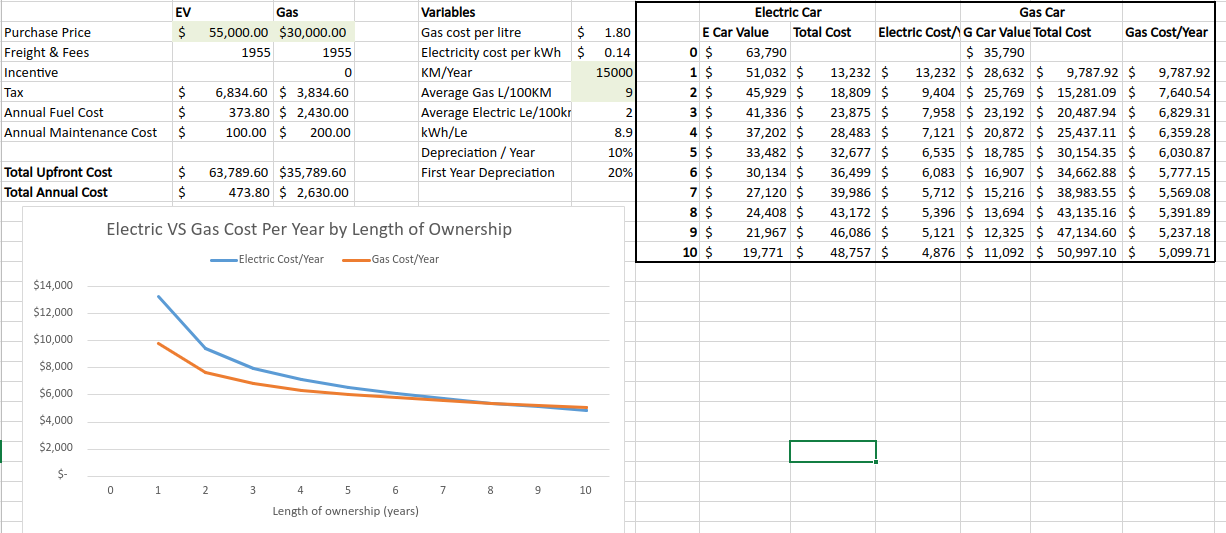

With zero incentives and over an 8 year ownership period, a $55k EV costs the same as a $30k gas car, but no one would blink an eye at a family buying the most basic RAV you can get. With incentives the breakeven is at 3.5 years

I don’t know about travel, how am I suppose to expense tickets to Europe? I haven’t been totally happy with the corp direction I took. Very expensive on a yearly basis to maintain, the interest rates on mortgages are now higher/more complicated (as my properties are in a Holdco), difficult to pull money out of the corp without getting dinged, etc.

I think incentives for EVs are dumb policy but I qualified ($5k federal and $3k provincial) so it is what it is. I would have bought the same car without the incentives. In Croatia I received a 10k Euro (approximately $14,500 CND) rebate on a 43k Model Y, ended up being 33k Euros out the door including VAT (taxes). Just to put things into perspective a Mazda CX-5 is >40k euros depending on options and gas is more expensive then here.

As far as status symbol, I had 2008 Civic Si and then a 2012 Honda Civic Si I drove for 155,000 km and when I look at my accounting numbers even with the Honda Civic I was spending $6k/year just on gas. Not to mention maintenance.

2023 Civic Si – 38k

2023 Tesla Y – 45k (after rebates) and I save >$6k/year on gas plus maintenance plus time (I don’t have to take it in for oil changes, etc.)

I view the 3/Y more as a logical appliances rather than “status symbols.” Every day you see a ton of Ford Broncos and Jeep Wranglers that are pushing $70k + horrid on gas consumption. I would think that would be a “status symbol.”

#213).

That’s the shady part. They have been trying to knock the rungs out from this ladder for a very long time…Especially the small corps.

Just get a very sharp accountant and a really strong prescription of sleeping pills.

How else would small business owners get paid? Either take a salary or a dividend or both. There is also the benefit of running some costs associated with your everyday life as a business expense (e.g. dining, car, travel, equipment, furniture, trades work, etc.)

#211).

Well said…And good for you!

#209).

Pay myself dividends from my corporation In Canada? I don’t know how much longer this Is going to stick…Its shady at best.

Against all “professional” advice, I rapidly paid down my first mortgage with double & 20% principal only payments. Being mortgage-free freed-up cash-flow and gave me piece of mind -both invaluable for an independent business operator with uncertainty around every corner.

(90% of people are wrong 90% of the time, so by doing something different there is a pretty good chance of being right.)

You do what works for you. Tonnes of shit advice out there, and paying off debt is never a terrible idea.

Isn’t this available to everyone that buys the tesla? Isn’t there also a income test for the rebates not withstanding marko probably has a corp.?

Lastly, are people who put their kids in hockey actually poor schmucks?

#206).

I have to pay It down, Its a mortgage obligation. I can’t just not pay It. All I am doing Is paying a little bit more than I have to…And they are Principle Only Payments. I did leverage up, re-fi…New main bath, new 500 sq/ft accessory building In the back yard. Otherwise I would be sub 100k on the mortgage.

#202).

I understand that If you take care of your pennies your dollars take care of themselves… But were not talking a lot of money here, like $600 bux that would be taxable Income. Remember, those guys pack glocks.

Max , shite no don’t pay it down , leverage up on the next cycle . Anyone who has been paying off they’re mortgage in the last 10 years are out 100s of thousands

It’s the reverse Robinhood tax…not to mention the folks that are in rentals stuck with either oil or natural gas heat paying the tax and people with a million plus dollar asset get thousands in rebates to add value to those assets by installing heat pumps or windows…

https://www2.gov.bc.ca/gov/content/taxes/income-taxes/personal/credits/climate-action#annual-benefit-amount

Called the peak over a year ago here via insider contact info. Patrick can check for the receipts and compare against the actual charts. Same with rents

I beat both of yall to it, come on now

So a realtor earning well into the 6 figures gets $8k back to purchase a status symbol, while some poor schmuck driving his kids to hockey in a 10 year old minivan gets to pay more carbon tax.

And then people wonder why there is a backlash against “progressive” governments.

Beat me to the “pay it down” punch. Actually aggressively paying down a low-interest loan is precisely the wrong thing to do. Ill-considered moves like that are one reason why many Canadians reach retirement with nothing to show for it.

Well the greatest way to take advantage of such a situation is to put the same money in a tax free investment at a higher rate (i.e. TFSA) and then use the proceeds to pay down the mortgage at renewal time.

Nothing wrong with paying down any debt at any time though.

Disagree. Better off putting that extra $ in a 5%+ gic and make lumpsum payment at end of the term.

Max. I enjoy reading your posts. I would however caution you to be careful with how much personal information you share here.

Good for you, that’s a great way to take advantage of your super-low rate & is the right thing to do. Probably 9 out of 10 would just spend more on other stuff.

From the GTCA: “This site has undergone changes in developers, and while a proposed redevelopment exists, it has not yet gone before the council for approval. Nevertheless, the site, comprising 14 houses, most of which were vacant, has become a target for squatting, graffiti, and vandalism. In response, the GTCA has advocated for the developer and Saanich to address these issues, leading to plans for the demolition of the vacant homes and site clearance…”

The excavators have finally started digging at the old Il Greco lot last week, and site clearing is happening at 630 Gorge Rd W, the site of the old Gorge View Apts. This is going to be 25 townhomes, Abstract overseeing construction.

Marko are you referring to model Y’s single motor? this was only available within the last year in Canada and is 10k cheaper than the usual dual motor

Different times though, I bought a car at beginning of covid, drove it for 7,000 km and sold it 16 months later for $14,000 more to the dealership. Could have sold it for $20,000 more privately but didn’t want to deal with people.

A large factor in the drop of used EV prices is the huge price cuts Tesla had on their brand new EVs which took down the re-sale market. For example, the Model Y I purchased in December was discounted to 53k plus 8k in federal/provincial incentives which took it down to 45k. Obviously if you bought a Model Y for 80k during covid you are kind of screwed.

This is where Hertz got screwed.

Occurred to me that what the dealer might really be trying to do is sell OP another new car.

Ask a dealership what they’ll give you for a used EV.

You should see what you can get a pandemic purchased ebike for now with less than 500 km…. Not to mention RVs and boats.

must have timed the used car market well. Last summer VW gave m $25k for a 2020 Jetta I paid 21k for only had 10,000km on it though

https://www.realtor.ca/real-estate/26451307/m04-456-pandora-ave-victoria-downtown

I was the listing agent on the unit back in 2017 when it sold for $321,000 so at this point the appreciation is tight

~~~~~~

I knew a few guys/gals (bankers , lawyers, realtors and their cute assistants) have brought into air bnb rentals.. now they are dumping and trying to cut their loss early…-> it was quite/a good run…..

also i knew some realtors owns multi-family rental heres in town.

==

so to get ahead, you have to have certain access(mls)or buddy up with realtor friends… now it’s time to unload and maybe harvest some nice profits before it’s drying up shortly.

That’s odd as the used car market is taking a beating right now.

I didn’t get a letter Max, and I have more time left, 32 months, but in doing my annual check of my credit report from Equifax (I have access through RBC to Transunion anytime) I saw there was an inquiry or whatever it is when a company pulls your credit in January from my mortgage company. I found that odd. They never have done so before and I’ve been with them in two different mortgage over almost 8 years. I do have a variable rate mortgage whose interest rate has gone from 1.35-6.1%.

Max, we have a mortgage due in 2 years with a rate of 1.5%. I have not received a letter. We would just pay it out when it comes due if rates above 4%.

On another note we got a killer deal on a new car 3 years ago, the dealer keeps sending me notices that they want to buy it back.

Your principal outstanding is small enough that you can call their bluff.

#180).

That’s the thing, I think they want me to “blend and extend” or the more popular term “blend and pretend”…But I’m not biting. I will tell you one thing that Is for sure…. I will not dot an “i” or cross a “t” Until the very last minute of that 5 year fixed term Interest Rate at 1.89% has expired.

Those were emergency level Interest Rates…Once In a lifetime.

Max: rather strange that they would send this letter at this point when you still have two years to go. Mind you they are blending the two rates together and maybe if you thought interest rates were on the way up then this might make sense.

#178).

I got a letter from the bank…

Mortgage type: 5 year fixed.

Principle outstanding: $184,468.67.

Term remaining: 22 Months.

Mortgage Interest Rate: 1.89%.

Replacement Rate: 7.53%.

Interest Rate Discount: 2.9%.

Interest Rate Differential calculation: 4.63%.

Discharge Fee: $75.

Transfer Fee: $75.

I don’t know why they are sending me this letter 22 months prior to my renewal. I make Bi-weekly accelerated Mortgage payments…Plus Bi-weekly 20% extra payments (Principle Only Payments). BC Assessment says the SFH Is valued at $1,092,000. Anyone else getting this letter?

Agreed.

“MIT researchers have now designed a battery material that could offer a more sustainable way to power electric cars. The new lithium-ion battery includes a cathode based on organic materials, instead of cobalt or nickel…

the researchers showed that this material, which could be produced at much lower cost than cobalt-containing batteries, can conduct electricity at similar rates as cobalt batteries. The new battery also has comparable storage capacity and can be charged up faster than cobalt batteries”

https://mishtalk.com/economics/mit-develops-lower-cost-fast-charging-organic-batteries-to-power-evs/

I see that the roundhouse proposal has finally passed. Might be interesting to see how the Victoria Housing part of the proposal will be developed. It appears that it will be in part both subsidized housing units as well as supportive housing units. The mix is not finalized at this point and will be in part determined by funding negotiations. At the moment it looks like a eighteen story tower of public housing. This is I believe to be in addition to 180 subsidized below market rental units in the other buildings. This should counterbalance the elite nature of the the existing condos.

So hartwood sold at 10% below assessed when on average houses were selling for 6% lesd than assessed last month. So this sale would actually drag down the sale to assessed metric for January. Am I missing something here?

I guess I don’t know the technical terms. An example of what I was referring to is on tillicum where there were 4-5 houses that are being torn down. They’re not being replaced with sf. That’s what I’m referring to – I’ve seen a few of those. I was away for a few months and was surprised to see a bunch of houses gone across from Esquimalt Rec (another example).

Patrick, perhaps buyers’ agents will just morph into office assistants and be paid an hourly wage to write up contracts. I don’t know how, but the agencies would adapt.

GoC 5Y yield up 5 bps today, not 58.

https://www.marketwatch.com/investing/bond/tmbmkca-05y?countrycode=bx

Buyers don’t have a problem paying for their own lawyer, they could get used to paying the buyer agent themselves. A fee per hour model would make sense, just like a lawyer charges. What doesn’t make sense is the seller paying for the buyer’s agent.

All of these options likely would mean less revenue for the buyer agent, which is why they’re opposed to it.

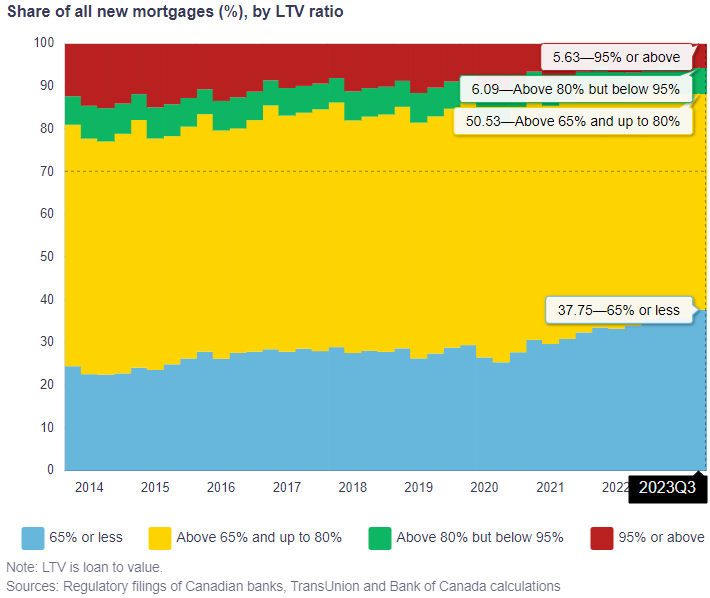

Dee, I have yet to have a set of plans and construction costs submitted for a multi-plex on a single family lot. Houses with basement suites or Accessory Dwelling Units (ADU) but not multiplexes yet. I’m sure there will be some submitted and it will be interesting to determine if they are economically feasible. I haven’t had any new lender’s guidelines regarding multiplexes either. Without those guidelines multiplexes will fall under the existing lending regulations. Four units or less then it’s a residential mortgage. Five units and more then it’s a commercial mortgage. Commercial mortgages are more expensive.

No signs of SFH “frenzy” yet, but you’re right a few rate cuts could bring it back.

Leo’s December 2023 sales to assessment for SFH is still at 94%, about unchanged from previous month (93%) and 7% below June 2023.

There are plenty of recent anecdotes on HHV about SFH market heating up, but not yet confirmed by those sales:assessment numbers.

I think it would be strange for most purchasers to have to pay a flat fee to a buyer’s agent every time they make an offer on a property as they are use to getting this service for free.

Or they could have their attorney write up a conditional purchase agreement. Then their attorney might hire an appraiser and home inspector if the offer is subject to a satisfactory appraisal and home inspection. This would likely slow down the process of buying a home. Which could be a disadvantage to some buyers in a hot market.

I see quite a bit of torn down sfh being prepped for multi family. It sure will be a thing to own sf in the future. Imagine the frenzy on sf if rates come down. I hope rates hold steady or even go up another .25 to prevent it. Scary that there’s barely a lid on it. Or perhaps Im totally wrong.

We don’t know the agent’s marketing plan. The listing agent could have intentionally under listed the property to create an auction environment or the agent’s lack of experience may have had the agent to under estimate the property’s market value as most homes that have sold are remodeled before being listed. This was a property in need of a lot of updating with few to no recent sales of similar properties for comparison.

I am expecting that we will see an increase in listings of homes in this condition as there has been a shift in Estate Sales as more inheritors are choosing to sell rather than rent the properties. The problem for prospective purchasers is that they more often than not significantly underestimate the cost of renovating. That may get the buyer into trouble as they may not be able to get enough funding to complete the project and have to sell a home in partially finished condition.

Yes, this is the “sunderland” case named after the first plaintiff in the RE commission class action case.

Note that a main issue in the case is ”steering”, where buyer clients would get steered away from buying a property offering lower buyer commissions.

An easy way to see if this happening as a seller would be to tell your realtor that you are offering only $1 for the buyer’s commission, and hear what they say to that. If they tell you that buyer agents won’t show the property to their clients, and if in fact this does occur, this sound like the “steering” they are talking about. Whether this “steering” violates Canada Competition laws is a matter for the courts to decide.

Here’s a G&M article talking about it…

https://www.theglobeandmail.com/real-estate/article-lawsuit-alleges-price-fixing-of-realtor-commissions/

“On behalf of Toronto resident Mark Sunderland, Kalloghlian Myers has alleged practically every major brokerage brand in organized real estate – from Re/Max and Royal LePage to Sutton Group and IPro Realty – is part of the conspiracy. At issue is a common practice where an agent representing a home seller must list the commission they will offer to co-operating buyers’ agents. Mr. Myers and the experts his firm has hired allege this a form anti-competitive business practice called “steering.”

What they claim is that from the moment you list a property for sale in Ontario, there are anti-competitive rules of the key real estate bodies that keep commission rates artificially high, and there are also more subtle but measurable pressures on sellers to accept these high commissions or face lower buyer interest and potentially longer timelines to sell.”

-========

I am seeing some strong sales in the SFH market to start the year and that is reflected with Hartood at 100k+ over asking. I find it crazy that there is so much demand at these interest rates combined with these prices.

https://financialpost.com/pmn/business-wire-news-releases-pmn/real-estate-commission-price-fixing-class-action-expanded-to-cover-all-of-canada

I am not sure where you got the “better than expected growth” for Canada.

Today’s jump of 58 bps in GoC 5Y yield is probably due to the deterioration in the fiscal balance. A lot of bonds will be issued in the next 1-3 years to support this fiscal recklessness. JT is determined to spend as much as possible and try to win the next elections.

https://www.reuters.com/world/americas/canada-records-c191-bln-budget-deficit-over-first-eight-months-202324-2024-01-26/

Can anyone shed light on this townhouse? It is re-sold every 2 or 3 years. Is there a problem with that house? What is included in the $521 maintenance fee that is not cheap.

https://www.realtor.ca/real-estate/26451282/4-2622-shelbourne-st-victoria-oaklands

Josh, solid state batteries are already here . Making them in scale is the problem but I’m sure we will being seeing them in cars in the next five years . Some real cool stuff is being done with making batteries out of pretty much anything organic too

Hillview actually sold back in late November or early December, but had an extended probate that needed to be dealt with and that’s why it went pending on the new year. As well, location wise, Hartwood is a more desirable location for some because it is still walking distance to shopping and the added benefit if it’s suited, a close walk to Uvic for your potential tenant pool.

Can anyone explain why the Hartwood pending on 1.011, but the Hillview only 1.02, that doesn’t make sense.

Cash. But we don’t know the price yet…

I also like the GMC Canyon, but it’s just ICE.

Canada and US 5 year bonds up over 50bps in the last month on better then expected growth, this trend doesn’t bode well for a substantial drop in mortgage rates this spring.

I was speaking with the manager of large mortgage group at one of the big banks and estimated 2 and 5 year discounted mortgage rate is around 5.6 to 5.7% at the moment.

Out of curiosity, are you financing it, leasing, or paying cash?

yeah, there seems to be a lot of stuff out there when you google whether it’s hype or real…

I’m on the list for a new Tacoma hybrid (non-plug-in), which seems to be where their actual manufacturing is going in the meantime. Don’t know about the longer-term longevity of that approach vs. ICE, but it is Toyota. Guess we’ll see.

back of the envelope of ~$1500 NOI ($1800 rent less $300 in strata and property tax) and 5% cap rate indicates no more than 300k in an optimistic scenario.

Yeah, Josh beat me to it. It’s a running joke in EV circles that Toyota announces a huge new development in battery technology every single year with nothing to show for it.

They’ve been saying they have solid state batteries figured out for many years. They keep saying they’re ready to figure out mass production then in another year they make basically the same press release. It’s an attempt to placate shareholders after they made fewer EV investments than basically everyone except Honda. I hope it’s true and I hope it makes it’s way to a real model soon, but I’ve seen that press release many times.

Toyota keeps hinting/talking about what could be really a game-changer on EV batteries? That could be a big deal, in & of itself plus given their market share, plus for me personally (I just like Toyota).

https://finance.yahoo.com/news/toyota-boasts-battery-technology-745-190000672.html

So at what price point does the Janion makes sense , for return on investment for month to month rent

The “cash for keys” examples are all from Ontario. There are “government types” and there are, well, “types”. Ironic that in this case it’s the landlords getting the short end of the stick.

Janion unit below 350k just hit the market -> https://www.realtor.ca/real-estate/26451307/m04-456-pandora-ave-victoria-downtown

I was the listing agent on the unit back in 2017 when it sold for $321,000 so at this point the appreciation is tight.

I totally agree with Marko on the EV discussion.

One thing I feel is that when I have a discussion on EV’s…. people tend to fall into the two categories.

Kind of like whether one looks at the glass as half full or half empty. No amount of discussion will shift the view.

It’s also kind of like when we are looking at buying a house that is priced near the property assessment, we tend to convince ourselves that the property assessment is likely way too high.

But when we buy the place we immediately shift our view and think that it must be good value because it is close to the property assessment:)

By the way, I think EV discussions have value on a real estate forum because it helps keep the topic on people’s mind when they are considering buying that condo or house.

Ev is just getting started , manufactures are throwing billions at it . Solid state batteries will be the next break through and will be a game changer

https://househuntvictoria.ca/2024/01/22/checking-on-the-airbnb-situation/#comment-110862

No, there is only one interest free 40k for green stuff, but you will certainly spend more than 40k, so it’s the first 40k!

+1, you think someone at the tenancy branch with flex fridays, vacation, pension, etc. cares that it’s taking a 1 year to process the dispute?

That’s what you get with government on all levels. Net result ends up being less available housing.

That’s not what the CEO of Hertz is saying whatsoever, see interview below

https://m.youtube.com/watch?v=EOG5zr_KroE&pp=ygUJSGVydHogY2Vv

After driving an EV almost 300,000 km with nearly zero maintenance I wouldn’t touch a PHEV with a 10-foot pole. Two systems to potentially go wrong and the fact they are interconnected just complicates the matter. I don’t know what the service intervals are on PHEVs but I imagine you still need oil changes and all that non-sense. I would get a regular gas car any day before a PHEV.

As for roadtrips over 8 years took my Model S down to California, Kelowna, Whistler, many trips to Tofino and never had any issues with charging. I don’t like sitting for 3+ hrs in a stretch so the charging doesn’t bother me and many of these places (Tofino, Whistler) you can easily now do without charging.

I also have a Tesla in Europe and charging while traveling is a better experience there. Same superchargers but usually right next to excellent food/coffee options. My model Y there hits 900 km/h on superchargers. That’s a lot of range in just 20 min which is barely enough time to go to bathroom and buy a snack. If we are eating I literally have to go move the car to avoid idle charges. Imagine the technology in 5 or 10 years.

EV sales have slowed because it’s 8% to finance a new EV, not because people are shifting to ICEs.

Hertz got screwed because they bought Teslas and then Tesla dropped the price $20k and it whipped millions off Hertz books.

https://www.ctvnews.ca/canada/landlord-and-tenant-board-backlogs-resulting-in-cash-for-keys-deals-1.6743484

Well, of course it’s broken, it’s government types running it.

If you ask the president of Toyota or Hertz I think you will find your grid is quite safe – we’re pretty much at peak pure EV. PHEV on the other hand has legs. I think I’ll get the new Prius to toddle around the Peninsula in an electric state of grace for 363 days a year yet be able to push out to Whistler or the Okanagan from time to time without once considering where I might go to charge up. Those two gas-burning trips will of course place me among the unibrow damned but I can live with that.

Barrister- The power will (and currently is) come from plants run on natural gas, or in some places, plants run on coal. Ironic. Phoenix receives 42% of its electricity from natural gas. That’s why they didn’t have massive outages last summer when temperatures reached 115F. Even with the largest nuclear plant in North America 55 miles west of the city, huge solar installations in one of the sunniest places in the world, and extensive wind farms. Without the plants run on natural gas, which are capable of increasing energy production when needed (you can’t make the wind blow faster or the sun burn brighter) they would have had blackouts and thousands would have died.

I believe in 2023 that BC imported about 20% of its electrical needs. If we are going to convert most of the cars and have all new houses be electrical where is all the power going to come from and at what cost?

#136).

When I was just 17 years old It was Centra Gas that came to the South Vancouver Island…The latest and greatest shit going Into every house that was being built at that time. Huge selling feature. Plumbers were lining up for their Gas fitters apprenticeship. 33 years later and now Its end of line…Wow.

I think if your home is heated by gas, you have to remove the furnace to get the full rebate. You don’t have to get rid of everything.

#134).

Is that really the deal? You have to ditch your gas appliances to qualify?

Not as far as I know, but I want to keep my gas furnace and hot water anyway, so wouldn’t qualify in any case.

Maybe things have changed, but the last time I got quotes on a heat pump, the installer basically just pocketed the grants anyway.

#132.

Do these DIY qualify for the grant? My Mother In Law only paid $900 In the end for her ductless heat pump…But had to drop 10 grand on the plumber first. She didn’t need a permit for the electrical. she had a crawl space…It was easy, The plumber came with the electrician, and the Insurance, and what ever else It took to make the grant work.

It was a reimbursement thing.

Dad , I don’t think the installation is too tough but will require a permit for the electrical

#129).

So you can get a 40k Interest free loan from the Government for 10 years? When you say first 40k Is there a second?

On the subject of heat pumps, does anyone have experience with any of the DIY units that are currently on the market?

RE: Harrison’s question about the Oak Bay renovation, I would suggest finishing the basement is the best bang for the buck. Use the square feet you have, as long as there is enough ceiling height. You can always use flush mount beams in the basement to gain height if needed (probably about $10-15k each). Some people are opposed to a master in the basement, but I’ve lived in one and didn’t mind it all. Basements are darker and quieter, which is good for sleeping. The other thing to consider is moisture. I suggest installing a central dehumidifier and make sure perimeter drains are working. Also add as many windows as possible to make it feel less like a basement.

#128). Like this one from Amazon…

Description

“Cool down with this 14,000 BTU (10,000 SACC) portable air conditioner by Danby, perfect for cooling spaces up to 550 square feet. To help maximize your comfort, the 4-in-1 design: air conditioner, fan, dehumidifier, and heater helps ensure you feel comfortable no matter the weather out! Designed for year-round use, enjoy the heater function in the winter months. Enjoy three powerful fan speeds to personalize your cooling experience, and the single-hose design efficiently exhausts warm and humid air outside. The LED display makes adjusting settings effortlessly. The 24-hour programmable timer allows for better control of when the unit operates, which helps you save on your monthly hydro bill. Its four castors make this unit easy to move from room to room. Plus, the R32 Refrigerant used in this model is environmentally friendly, and its Global Warming Potential is 3x lower than R410a. SACC is short for Seasonally Adjusted Cooling Capacity”.

$668.98 CAD

https://www.amazon.ca/Danby-DPA100HB1BDB-6-13000-10000-Portable/dp/B0912L4PRW

#126).

I have a Square D 200 AMP Electric Heating House Power Panel…Its meant to run electric heat. Every room has base board heat. I don’t use any of them. The only electricity we use Is from the lights, what ever Is plugged Into the wall, and the electric water heater.

I just can’t bear to witness the compressor or that ugly shit they use to conceal the lines.

You can get really good Danby Premiere Indoor heat pumps that are just as good as the shit they are spinning.

I wouldn’t. That would mean spending money to have cellulose blown in, not to mention the ugly holes that are left behind on stucco that is impossible to match.

#124).

Correct, you would need armoured cable. The attic Is your friend for sure, It would be the lower level that would be problematic. I understand wiring Is done In home runs from the panel…which Is good. I also agree with you In cutting out swaths of drywall where necessary, then replacing them with the cut out piece. A multi master tool Is a great tool for fast cutting of drywall.

Armoured cable could look good I guess, Kind of that studio vibe…

Dang. I’d prefer to have empty cavities because at least you could blow in cellulose.

Agreed, but still lots of aluminum wire used today for feeders/sub-panels etc.

1000%. Program ends in March of this year, so chop-chop if you can make use of it.

I would definitely get the aluminum wire out of there , was a cheap stupid idea right from the get go

Max , u can surface mount in proper conduit but that pic won’t fly . If you’re pulling wire best to go basement up or attic down . Having said that cutting a 10 inch strip of horizontal drywall from stud to stud is not a big deal , mostly when u just put the drywall back in

I’m not sure if this is a semantics thing, but that also doesn’t require tearing out drywall. It requires cutting a section of the drywall out large enough to drill a hole, and then replacing the section of drywall and patching it.

#120).

Of coarse you can, you have to pig tail every box with copper…Your house Insurance requires this.

Not the entire house. Blocking, top plates, wire staples…It would be impossible.

You could do what this dude did and just surface mount everything to your existing drywall…

I think renovating, especially when it is “green” stuff makes a ton of sense at the moment. The zero interest factor on the first 40k you can get interest free from the government reduces the cost of the loan by half over the 10 years you pay it off. Plus grants and energy savings. Win Win Win.

I’ve found trades pricing a bit softer since the holidays but generally the faster those guys are out of my life the better. Taking that risk on for a year or more seems crazy to me. I’d rather let someone else do that. I mean what has the developer spent upgrading all those pipes on Hampshire over the last year? I bet that’s millions by itself. Land + city costs, + build, I bet those houses end up costing 3.5MM each. My house isn’t as ostentatious, but my location is the exact same give or take a block and my house cost less than 1/3rd of that and has similar sq ft I bet.

If you have money to burn that’s one thing but most people don’t, even in Oak Bay. If you bet wrong and don’t have the cushion, you can get stuck with a hole in the ground and no money. I wouldn’t count on banks for anything these days.

My suggestion would be to not rewire a house unless you need to. Not my idea of a good time, and there are ways to deal with aluminum wiring other than replacing it.

You can rip out drywall if that’s your thing, but even I (not a pro) can pull in new wire without tearing out drywall. If I can do it, I’m pretty sure an electrician can.

#116).

You will be hard pressed to find a sparky to do what you are suggesting. counter plugs require 20amp gfci. And you will be ripping out drywall.

In an existing build? Yes, I’d say it’s more than adequate. I’ve got R7 insulation in my walls, and it seems just fine for this climate.

You don’t need to rip out drywall to rewire a house.

Typical spray foam is (by far) my least favourite of all insulation types.

It is? I guess if you have 50 year old single pane windows, then it isn’t the weakest link.

#113).

Then you expose all the aluminum wiring that will need to be replaced. It can be done, and I’m sure there are guys out there that would just love to do It for you. I think It would be best to either rent It or rip It down.

https://househuntvictoria.ca/2024/01/22/checking-on-the-airbnb-situation/#comment-110840

It’s probably cheaper than any other form of insulation once you factor in building out walls & lost square footage

I think they were talking about for new construction. Obviously it wouldn’t be worth it to tear out the drywall on a 70s build to replace the insulation. The existing insulation is more than adequate.

#110).

Spray foam Is huge expensive. I don’t think anyone doubts that It can’t be done. Is It worth It? For a house that you probably don’t even really like anyway.

https://househuntvictoria.ca/2024/01/22/checking-on-the-airbnb-situation/#comment-110831

Just FYI, 2×4 is r20 with closed cell spray foam.

You can get heat-pump water heaters which plug into a 15a socket: https://www.youtube.com/watch?v=YT0zTRD7N2s

You can get load sharing devices which will share a single circuit across multiple high-load draws. For example: https://splitvolt.com/

What’s that old proverb from 1573 ? A fool and his money…

US economy still on fire , Canada flat as a pancake . Sooner maybe than later people in charge have got to get back to blowing up the real estate bubble , our economy badly needs it

Yes – you can’t stop people who actually WANT to buy the Brooklyn bridge…

I don’t know, I’ve spent hours going over the court documents and honestly you would need to be a greedy imbecile to fall for something like this. Even the “offers” he sent out look like a kid in grade 8 put them together in terms of presenation, not too mention the returns are beyond stupidity. When I see a public traded company paying more than 7-8% dividend I start the research let alone what he was offering. Just based on the returns I would immediately conclude it is a scam and wouldn’t bother with research, but people fall for the get rich quick over and over and over again.

With that in mind, would I rather the locating firm pockets the money or I have to pay taxes for a government agency to do an investigation for a bunch of people with hundreds of thousands of dollars that got greedy and have zero common sense? I think I would prefer to save my tax money.

That’s going to be rough on the Gas Water Heater for us. It’s the only remaining appliance we have on gas, but after installing a heat pump our 100 amp panel is full. That’ll be a costly upgrade as we’ll need to upgrade to a 200 amp panel. I suppose if electric cars are going to become more of thing, that’s inevitable anyways.

Not really. 2 x 6 was brought in to meet insulation needs, not structural. Nothing wrong with 2 x 4 if you meet insulation requirements in another fashion.

I’d rip it down though.