Failure to launch?

More young adults have been living with their parents in recent decades. In Canada, the number of young adults living with parents doubled in 20 years, and has continued to expand since then. Its not just a Canadian phenomenon either, with “living with parents” being the most common arrangement for young adults aged 18-34 in the UK and US while the percentage forming a family plummets.

There are many potential reasons for this shift, with students increasingly likely to pursue post-secondary education and staying at home longer during their studies. Part of it is also cultural, with an increasing percentage of Canadians from cultures where living with a parent into adulthood is more common. Affordability of rents and home ownership is also a factor, given it’s more difficult to leave the house when homes cost more to rent or own. At least that’s the argument that was made in a recent FT article that argued the housing crisis was behind the UK’s drop in young adults forming their own households. It sounds plausible and the chart showing affordability there is the worst in 150 years certainly underlines the point, but is that the whole story? What does the data actually look like in Canada?

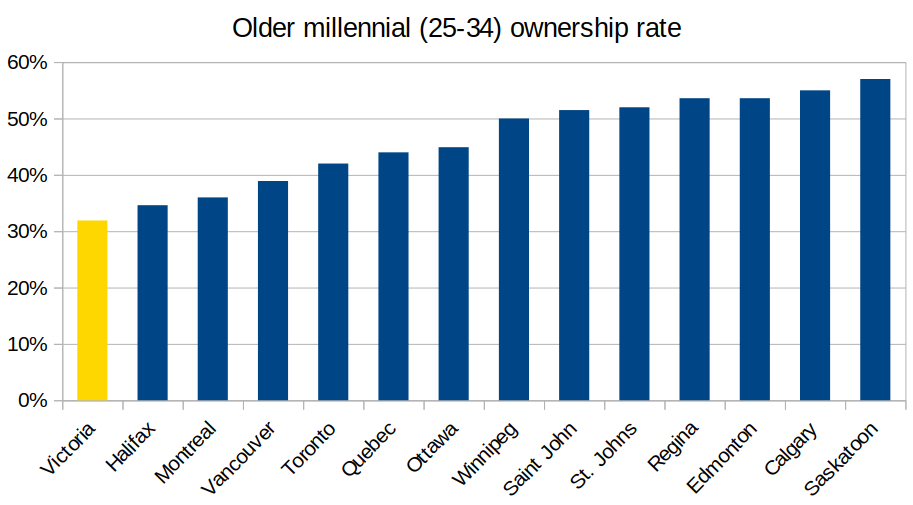

I previously wrote about millennial home ownership rates, where Victoria is solidly (and somewhat puzzlingly) in dead last place, despite not being the most expensive market in the country.

Note: Chart from 2016 census data

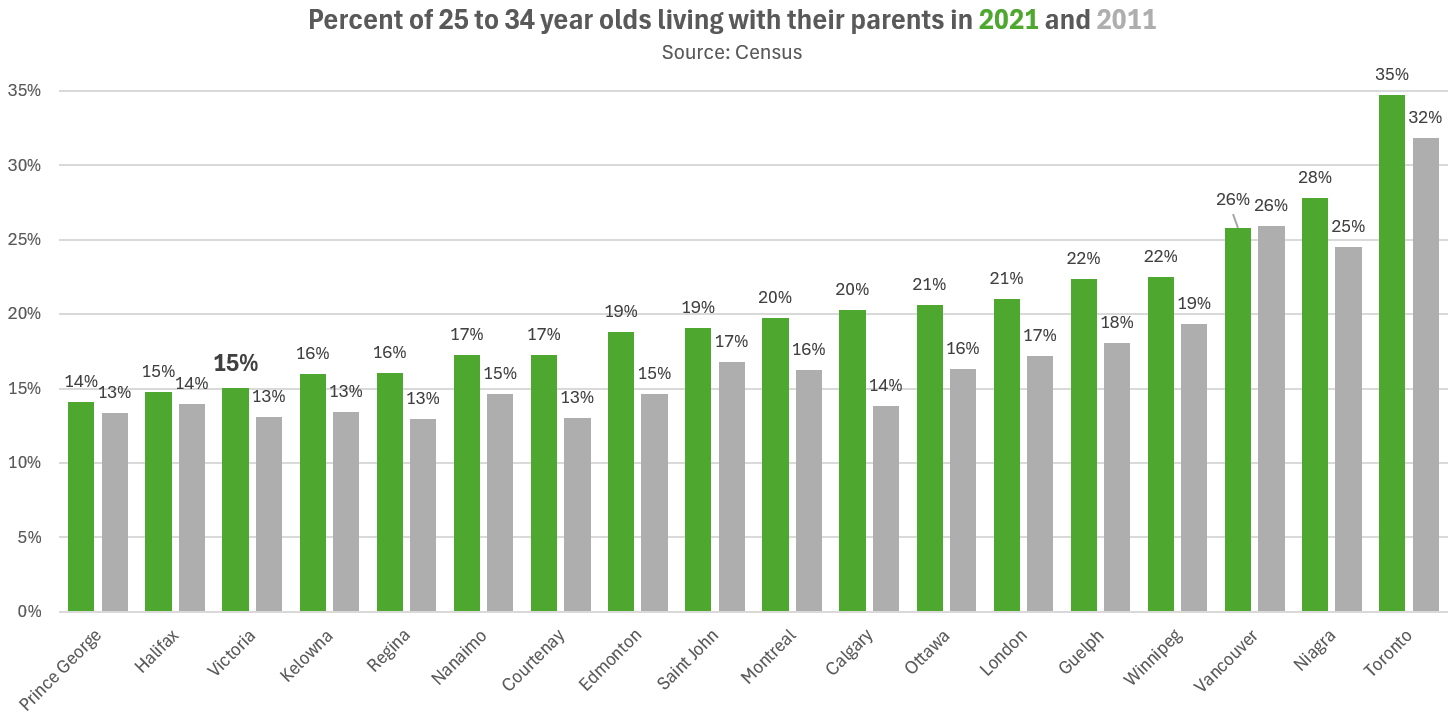

Given our relatively high rents, are Victoria’s young adults also likely to remain living with parents? The Census has this answer, and the answer is: surprisingly not. Note I’ve used only young adults from the ages of 25 to 34 in order to minimize the impact of the student population in younger cohorts.

As with ownership rates, some of these data points make intuitive sense. Our two highest priced cities, Toronto and Vancouver have a very high rate of young adults living with their parents. But beyond that there doesn’t seem to be a lot of relationship between housing costs and whether young adults are living independently. Some cheap cities like Halifax and Regina have highly independent young adults, while others (Winnipeg) have plenty of offspring at home. Very affordable Edmonton is middle of the pack. The Niagra region, with a benchmark price of $617,000 is near the top, while Victoria with prices a third higher has some of the lowest percentage of young adults still in the home. If they’re not in the family home, and not buying houses, then they must either be renting or leaving town altogether.

Cultural mix is definitely a factor, but even if we look at change from 2011 to 2021, there is no clear pattern by housing costs. Vancouver’s rate didn’t change at all in 10 years while Toronto increased by 3 percentage points. The relatively affordable Calgary saw the largest increase in young adults living at home, while Victoria was on the low end of the increases and substantially cheaper Courtenay’s rate increased by four percentage points.

As with the ownership data, Victoria is a bit of a puzzler here, but overall there is more to the trend of hanger-on kids than just housing costs. What are your theories what is driving it?

Also the weekly numbers

| January 2024 |

Jan

2023

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 32 | 95 | 278 | ||

| New Listings | 187 | 443 | 805 | ||

| Active Listings | 2008 | 2087 | 1739 | ||

| Sales to New Listings | 17% | 21% | 35% | ||

| Sales YoY Change | — | +37% | -41% | ||

| New Lists YoY Change | — | +25% | +16% | ||

| Inventory YoY Change | +25% | +25% | +134% | ||

| Months of Inventory | 6.3 | ||||

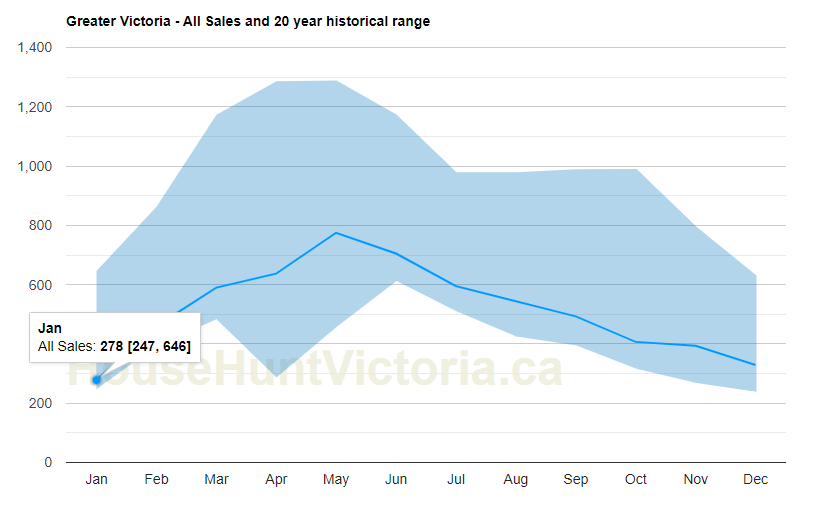

A decent start for activity in the first half of January, with sales and new lists both solidly outperforming last January. However it’s worth keeping in mind that:

- The first weeks of January always have low sales numbers so it doesn’t take a lot of sales or new listings to shift the percentages in big ways. The next two weeks will have a lot more influence on the month’s performance

- Last January was a pretty terrible month for sales. At 278 it was the 3rd worst on record going back to 1985 which doesn’t make it a great trick to outperform this year. Even if the 37% more sales holds for the entire month, we would end up at lower than the average for January.

Either way, expect activity to pick up as we move into spring and year over year improvements in activity for the first few months at least. Last year the market improved substantially, hitting a low of 2.3 residential months of inventory in May, which is a pretty active sellers market. With a quarter more inventory I doubt we will get that low this year, but that depends on how tempting those dropping rates are to buyers that have been sidelined. With 5 year fixed rates once again dropping under the 5% mark, we’re roughly back to where we were a year ago on the rate picture. Prices are roughly similar which means affordability is slightly better due to rising incomes in that time.

New post: https://househuntvictoria.ca/2024/01/22/checking-on-the-airbnb-situation/

Smart sellers price sharply IMO. Sell or don’t sell. Never understood the sellers who overprice then keep their places up for months and years. Why put up with that grief?

My favourite was when Marko edited a post that was the subject of a heated argument I was having with him. That was fun.

I guess open houses do work!

Depends if you are viewing middle age as the middle third of your life. But you are right about the oxford definition.

Could the lower % of insured mortgages in Victoria just be a function of the more houses purchased greater than one million? i.e., you can’t buy a house over a million without 20% minimum down

Curious Cat,

I’d echo Totors’s advice and cut the 26 year old some slack. There’s worse things than a guest who dresses nicely and has champagne taste. Such as a guest who is a slob and is disrespectful in general. Maybe with alcohol/drug problems too.

If you want to do something you could increase his rent. But maybe he’s serious about NZ and that might help him make a move one way or the other.

In the meantime, the Bible tells us that we are our brothers’ keeper. Of course that applies to helping all human beings, but it especially applies to close family like this. And it sounds like this young man needs and appreciates your help. And kudos to you for helping him.

45-65 is middle-aged last time I checked the dictionary.

I can cut a 26-year-old some slack (he’s 26 not 27). I may be biased as I didn’t really get it together until I was 30, and made most of my financially important decisions and professional progress in a period of 10 years.

I think it is good to give younger people some leeway. They are no different from older people except for their access to information and options plus time.

Which one? Price point?

10 offers on a SFH I showed over the weekend.

At 27 he is already middle age.

From my experience with nieces and nephews and friends kids in their 20’s I find that many just take longer to get setted in “adulting” vs previous generations, but most of them get there. It seems like one year they seem to be floating and then things click and the next thing you know their moving in with partner and house hold income is 150 – 200k+.

#324).

Hes 27 years old, he should be In his prime earning years. Being a male he less than two thirds of his life left to go. Make It count. I’m a gen X’er. You sound like a very nice person. Perhaps too nice.

This is all great advice everyone. Thanks, it’s hard to find someone to talk to about this, and sometimes random internet people know best and tell you things straight up.

If you are feeling like this it is time for a change.

Your nephew probably just doesn’t know any better because he is viewing you as a parent substitute and he can’t place himself in your shoes easily. However, you should know better as it really is not a kindness to stick with a situation that is not working for you and which is colouring your opinion of him unfairly and will possibly impact family feelings long term. The question should be not what will moving out will cost him each month, but what will create the happiest and closest relationship you can have as extended family.

In your shoes I would just give an earlier timeline because he is not in a crisis situation. There are lots of rooms for rent, and it is a much better time to find apartments that it has been for a long time. Your inaction is keeping him stuck in a dependent situation which is not good for him as he can afford to move out and saving some money each month is really not the issue – inertia is. Let him know that if he is really stuck in future he can stay for a shorter time as needed, and that you love him and want him to visit as much as possible. Reach out to his parents and let them know everything kindly as well.

I lived with extended family when I was 19. Looking back, I think I stayed a bit too long and would have benefited from my own adult space earlier. I ended up greatly enjoying having my own friends over and have lifelong friends from that period of time.

Also, as an adult I remain grateful to the family members that helped me and I now have the resources to help their extended family members. It is satisfying and it is always worth it to think long term and not allow resentment to colour anything.

Percent changes doesn’t mean much during the low sales weeks of the year.

You better clarify when summer begins, Out by May1st or June1st. Do it Now.

#318)

Tell him, due to the rising cost of inflation the rent goes up $100 per month from here on out. You wouldn’t be kicking him out, rather putting a fire under his ass. Find a room to rent elsewhere for him.

In reference to the Post of Nov 27/28 2023 about Land Lift and Community Amenity Contribution (CAC) fees. I’ve just started the book ‘Progress and Poverty’ by Henry George originally published in 1879 and quite popular at the time and an influence at least to some degree apparently to economists after that. I haven’t read enough to form an opinion one way or the other about his ideas but I am interested in reading it all. Not 100% sure how it all fits together but thought that I would mention it here. The book is available (free) through Project Gutenberg as a epub/ Kindle. Also, there is a Substack (blog?) available at progressandpoverty@substack.com which sends out somewhat regular posts – not my Substack.

Yes it’s causing resentment on my part for sure. I want my space back and we are just enabling him now, but I recognize there’s a housing crisis and feel guilty for even considering kicking him out. I would be viewed/vilified as the out-of-touch Gen X’er who doesn’t understand how hard it is for this generation. At least, that’s the sense I get from Reddit.

I guess I’m trying to peel the band-aid off gently instead of ripping it off? I feel like because I said “summer” that it’s my own fault for giving such a long timeline and now I have to just live with that. I hope I don’t have to be the ‘mean Auntie’ and tell him to leave, but I am working up the courage to do that.

agreed, your boots on the ground observations would be a better indicator.

#315). This one has a two car garage above the hydraulic ramp as well…

Too small of a sample size to draw an conclusions at this point.

I myself like the higher density changes , but it will produce few results as there’s much more than zoning going on in housing . I do think there are spots where the numbers will work , but few people really can afford the missing middle . We probably only have rich and poor buyers , and we are already have homes for them to buy

#312).

So a house without a driveway doesn’t have to pay this “exclusive use” fee? I thought we were doing the city a favour by having two on site parking slots? What about a two car garage bringing the total number of on site parking slots to four…Is there an “exclusive use” fee there as well? Are they going to start charging us by the car?

This would be the homeowner paying the city for exclusive use of the street frontage taken up by the driveway. A bit different.

The reality is that there is no silver bullet to fix housing. The NDP is firing a whole lot of silver buckshot at the housing issue and hoping to score some hits.

With the zoning changes in particular I feel it’s likely to produce some additional housing at least. Some municipalities will work hard to sabotage it but other communities will embrace it and more multi-unit construction will happen there. And if it totally fails then at least by the standards of government initiatives it won’t have been a particularly costly failure.

I’m also not worried about the death of the SFH. There is still lots of demand for that product and it is obviously still allowed.

#309).

People In James Bay rent parking spaces In driveways all the time…My Sister pays $350 per month. Its a stones throw to her work. She splits It with her job share partner. It costs more but Its always there.

Yes, and make sure to add that to homes with driveway access that would otherwise be parking frontage value that someone paying the $200 for street parking could use. Even call it a “car access convenience fee”… Since it reserves space just for someone with a driveway. Can we bring back pay toilets as well? Lots of ways to run up costs….

#307). I don’t think Its a few minuets they are editable, rather your last post only can be edited.

Curious Cat,

Interesting, well written post. Thanks

#305).

I do, you can’t really view It until Its posted.

Everyone (including Leo) sometimes edits a post in the few minutes they are editable.

If this upsets you, wait a few minutes before replying, or if you do reply immediately, realize that recent posts get edited and they might change.

Making an issue about that is silly.

That spot is worth more than that. Average car is 15′ by 6′. At 90 sq.ft, the price should be set at at least a 1/4 of what people pay to rent a unit at the Janion. These are basically single family car parking spots, so they should command a premium.

That’s been clear for a while.

Don’t know what the point of doing it in bad faith is. Changing their posts after the fact to misrepresent what they’re arguing is bizarre behaviour.

#301).

And a few more of these…

In order to help the developer to figure out the economics of underground parking the city should start charging a $200 a month fee for overnight street parking. There is no reason for the city to provide a free parking lot to snyone.

Technically (i.e. according to the census) you’re not, but you are in practical terms. 🙂

Great, this is being done. Parking minimums should be abolished, and the developer is best positioned to figure out how much parking is needed to sell the units. Province has stepped in to ensure that cities can’t do single family zoning around skytrain and transit anymore.

Impossible to build rapid transit to effectively service SFHs unless you want to triple your taxes. I don’t really like sprawl (would prefer us not to pave everything) but given I live in yesteryear’s sprawl, I’m also not particularly opposed to greenfield development.

Land value tax does this. Unfortunately not something that is likely to be politically feasible. Existing owners (especially elderly) would be crushed in the transition so no party will bring this in.

I’m in favour of most of them because I know that solving the problem requires an all of the above approach. I think I’ve been pretty consistent on that front.

At 40, technically my wife and I live with parents. Mother in law moved into the suite when we bought the house a decade ago.

Great setup. She’s got an affordable place to live in retirement (we don’t charge rent). Kids have their grandma, we have someone to watch the house, help with the kids and garden. We enjoy each others company and neither side interferes with the lives of the others.

I know this doesn’t work with many parent/child relationships, but when it works it’s great.

Cheap shot. I’ve also stated what I want to see done that would solve the housing problem, that’s not “just here for arguing”.

And for the record, here’s what I would like to see done to help housing:

—— build more mega towers, all with sufficient underground parking

——-build more SFH (using greenfield development and some unproductive ALR land). Build rapid transit to service them.

——- increase density of existing homes by lower taxes based on higher occupancy, higher taxes of low occupancy. That incentivizes suites and larger household sizes (ie families) in larger dwellings(SFH).

You’ve argued with most or all of those . Yet I don’t accuse you of “not wanting to solve the problem and just being here to argue”. You just have different opinions than me, and I think it’s valuable to hear all sides.

And here’s some of the ideas that I argued with you about where I think I was right.

– “affordability is cyclical” you told us , with upper and lower bounds drawn onto the charts, controlled by “consumer sentiment”.

– “money laundering investigations” by BC government are worthwhile and important to help the housing crisis .

-“homes are affordable”. I started saying that in 2018 and they were a lot more affordable than today. . But I still got arguments from lots of HHVers back then for daring to call them “affordable”. And about $800K SFH being unaffordable because they’d need to pay more than their $1,900 rent, and “affordability is cyclical” as shown on your affordability chart, so let’s just wait for lower prices.

yup, you guys spoiled him. Better to rip the band-aid off now and let him explore the real world on his own

So for sales it’s +37% for the first 2 weeks and now +22% for first 3 weeks., that means increase in sales in the 3rd week of Jan the YoY is roughly 9%. For new lists its +25% for the first 2 weeks and now +17% for the first 3 weeks, translates into 3rd week of Jan YoY increase of 2%. Looks like things are normalizing after a spike to start the year.

Curious cat , the lot of them sound immature and are just spinning their tires , sorry it sounds mean . I don’t think they are unusual today and that’s where it’s at . Having said that i do know some 30 ish young folk that are already very successful

#292).

Perhaps Its the sellers knowing Its the buyers looking at the listing agent?

Oops good catch, “prospective” buyer. Oh btw and it’s “Sir Daddy” to you 😉

#290).

We are prepared to gift each of our boys 100k…But we want to know where its going. They are going to have to wait for the rest, I don’t know how long we are going to live. I do however know that only the good die young…So that could be quite some time.

Month to date numbers:

Sales: 181 (up 22% compared to same time last year)

New lists: 640 (up 17%)

Inventory: 2108 (up 23%)

Getting in quick with a final comment before Leo puts up a new post…

I know 3 younger Millenials or older Gen Z (96/97/98) that are still living with family. The 27-yo has a Comp Sci degree from UVic, a job with the provincial govt making 60k+ and still lives with his parents. He does want to move out, however his parents are Boomers (75+) and have significant health issues so he’s living there to provide assistance. He told me he’s been looking at 2bed condos downtown to purchase, as he thinks those would be easiest to sell, though his budget is 400k max and realistically, he thinks he can’t afford the mortgage PLUS the strata fees, so he feels stuck. His parents want him to stay at home forever and tell him he can have the house when they die, meanwhile, it would make more sense to sell their GH house and just buy 2 condos with the proceeds, one for the son, one for them, and then they no longer have to deal with the stairs and their son can start adulting.

The 25-yo is a young mother in Wpg, she moved out a couple years ago living in the same complex as her mom (who’s a lifelong renter), but then didn’t like her job/chosen career path so she quit and she and her son moved back in with Mom last summer and looks like this will be a pretty permanent situation. It’s been 6+ months of no job/schooling, but Mom has no problem with this and has basically taken over parenting the young son.

The 26-yo (turning 27 this year) is living with me, has been for over 2 years now, but we are charging what I guess is cheap rent ($500) so there’s been little motivation for him to launch. At first the goal was to help a family member move here from another province while they went to school. At the time the rent seemed like a lot because he was paying less than that living at home and is not a big bedroom. Well he got his certificate, did not get a job in that field, and has been working in the restaurant industry (less than F/T) and travelling all over. My spouse feels like we are subsidizing his lifestyle. (He’s been to Edmonton, Toronto, Montreal, Calgary, Vancouver, Europe last summer, just came back from 2 weeks in NZ and going to Wpg to see a concert in March.) I had a talk with him last fall about figuring out his life, what does he want to do, and told him I expected him to move out by summer if he’s not going to school. He has looked at a few apartments in town, but he has champagne taste (won’t take a bus, only ubers or taxis, doesn’t have a license so won’t look at anything outside of the core, wears name-brand clothes and buys all the latest gadgets) and has only been looking at brand new which of course, is very expensive. Studios are 1700/mth min, One bedrooms 1850+. I feel like he will struggle a lot on his own (based on observation) so I’ve been trying to encourage him to team up with a roommate so he did go view a 2bed at the new apartment being built, The Gorge, but the unit he likes is $2800. Still, $1400 is less than a 1 bed and I said he could split the cost of utilities, but this is still triple what he’s used to paying. But now after his NZ trip, he’s telling me he doesn’t want to sign a one year lease because he ‘might’ move to NZ.

100%

Sir Goof, what is a “perspective” buyer?

Which is a perfectly legitimate reason for being here, let’s acknowledge.

That article is from February 2022 when interest rates were near bottom. If many young buyers needed help with payments then, what about today?

“Approximately 40 per cent of the parents of younger homeowners in Ontario say that they helped their children financially with their purchase, with the average gift exceeding $70,000.” ( i wonder if couples needed help from both parents, 70K x 2 = 140K +?)

“Meanwhile, 38 per cent of parents who helped financially with a house purchase said that they help their children pay their mortgage payments, suggesting that a not insignificant number of younger homeowners would struggle to pay their bills without assistance.”

https://www.cp24.com/news/poll-finds-more-than-40-per-cent-of-young-homeowners-received-financial-help-from-parents-average-gift-surpassed-70k-1.5791105?cache=yes%3Fot%3DAjaxLayout%3FautoPlay%3Dtrue%3Fot%3DAjaxLayout%3FautoPlay%3Dtrue%2F7.449716%3FclipId%3D1691853

I went to an open house in Oak bay on the weekend, attending realtor said it had been quiet. House was origianlly listed at 2.3, 6 months ago now down to 1.9.

I would take a bet that parent’s lines of credit (or possibly savings), have seen an offsetting increased amount to go with that reduction. Can’t insure over a million currently so as prices rise people will find other ways around it.

High ratio share has gotten absolutely crushed in recent years (note chart to 2022)

That means Ontario (which has well over 1/2 the foreign students in all of Canada) and BC will be hit the hardest, while some provinces will be hit very little or not at all.

However I don’t think BC approaches the farce that is the status quo in Ontario, where private sector McColleges affiliated with regular colleges operate from strip malls.

Lol that is my target rental demographic!

35% (in reality it’s north of 40%) cut in study permits in 2024. Gonna be a mad scramble in the education sector this year. PPP students no longer eligible for work permits so that is going to crush a lot of schools in Ontario (many of them likely deserve to be).

What would you call it when California says you must allow 4 units and cities say ok but you get less floor space if you want to build a duplex than it you want to build a house?

I’ve been saying this from the start.

It’s a big positive step to have a provincial backstop but I’m not kidding myself that it’s going to solve all the problems. We know cities are working to undermine it already.

By the way when we discussed a city that upzoning actually is working in, you were complaining about parking. So when it works it’s bad, when it doesn’t work it’s bad. Pretty clear you have no interest in solving anything and are just here to argue.

if all the other numbers work with the 5 year rate then ya, no point in introducing more variables outside your control into any investment.

So you would go with a 5-year fixed right now?

There are uninsured in the low 5’s last time I checked. If it’s an investment property then I don’t know why you want to gamble on rates, if you need to gamble on rates to make the investment work then the economics are likely too risky to begin with.

I don’t know about 1%. There are 5 year fixed mortgages as low as 4.94% but that is insured. Un-insured on an investment property is more like 5.69ish on a 5-year fixed, I would think?

My thought is I would probably pay even a bit higher and gamble with a 1-year fixed or variable. Two years isn’t a ton of time to make up a higher rate for three years.

Some stats from our 2023 VREB survey

How did the buyer finance the purchase?

Conventional mortgage (20% or more down payment) 1,516 51.6%

High ratio mortgage (less than 20% down payment) 233 7.9%

All cash 861 29.3%

Don’t know 326 11.1%

Total Responses 2,936 100.0%

^Is it just me or is the high ratio mortgage number @ 7.9% incredibly low? (that being said it is what I see in my personal business give or take, rarely do I have high ratio clients).

How did your buyer first learn about this property?

The buyer located the property on a REALTOR®’s automated listing search service 1,518 51.63%

A REALTOR® (you or another) located the property and informed the buyer 791 26.90%

REALTOR.ca 317 10.78%

Your personal website 72 2.45%

OpenHousesVictoria.ca 16 0.54%

Other website 29 0.99%

Real estate sign 36 1.22%

Relative or friend 44 1.50%

Real estate tabloid (Real Estate Victoria, The Real Estate Book, etc.) 2 0.07%

Classified ad 1 0.03%

Other 69 2.35%

Don’t know 45 1.53%

Total Responses 2,940 100.00%

^What does this tell me? By just being on MLS (even via mere posting) and offering a reasonable cooperating commission you cover off >90% of how buyers locate a property. Everything else including neighbourhood expert is non-sense, but sellers eat it up.

+1.

And clients have only themselves to blame for picking a higher priced agent providing the same service.

Leo: “BC likely has a couple years of back and forth of a similar nature [dismal upzoning result, like California] “.

And so the dampening of upzoning-increasing-supply expectations in BC already begins… So if it flops here, it’s the cities fault… got it. When do the BC University professors who come up with these ideas become accountable, at least to the extent that the government stops listening to them.

Pass bad policy that municipalities can torpedo, get bad results. Pass good policy, get good results. Problem in California was they legalized 4 units on paper but cities just restricted FSR or pulled other tricks to make those 4 units not buildable in reality. BC likely has a couple years of back and forth of a similar nature ahead of it as cities try to pass policy to neutralize the intent of the provincial backstop

I doubt the average house hunter has any understanding of that. I think bottom line is people need to qualify at 7%+ for houses in those areas and most of those perspective buyers will also need to unload their current house.

Upzoning has recently flopped in California.

California has a housing crisis too, and upzoned the entire state two years ago (Jan 1, 2022) , by a bill called SB9, allowing anyone to build up to 4 homes on their existing lot. Results so far have been a dismal failure – in a state with 17 million existing dwellings (about same number as Canada, and 100X Victoria), uptake of this idea has by applications has been close to zero in the first 12 months. People expecting BC’s upzoning to significantly increase supply should be prepared for similar dismal results.

Here’s an article about it https://twitter.com/DrCameronMurray/status/1748930411953275387

Max , Nelson is a nice lil town , everything is alittle bit cheaper there , and the weather is nicer up around Russell beach . Could see myself having longer stays there as im not married to Canada

#264).

Can you live in Panama permanently?

U.S. and Canadian citizens can move to the Central American country if they meet the requirements for immigration and take the steps needed to obtain a visa.

Pensioner: Retirees who earn at least $500 per month can qualify for permanent residence status. If you’re moving with your spouse, you must earn at least $600 per month between the two of you. You will be asked to provide bank statements and proof of continued payments from the government agency or company that pays your pension, such as a notarized letter.

https://blog.remitly.com/immigration/moving-to-panama/

#263).

I want this one.

Max I would but I don’t any more competing offers for a seaside villa

New lists looking pretty healthy

#260).

Please enlighten me on New Zealand…I have family there. Climates pretty much Identical.

Vicreanalyst , the opens in oak bay Fairfield’s where pretty quiet, not sure if the uptick in inflation was a downer or still early in the year. I guess all bets off with a real possibility of trump back in for 4 more years . New Zealand here I come

Jason Binab and his Agency has done well in Oak Bay. Re/Max and Newport list more and sell more in Oak Bay. But his firm is up there among the top three or four.

As for a buyer’s agent? Pick anyone as they are all generally competent and fairly incorruptible.

I think for those that are not familiar with the area they might consider hiring an appraiser to assist them in formulating an offer to purchase. It’s only a couple hundred bucks and they do all the research and analysis for you. They can do a desk top analysis on most properties in 2 or 3 hours which may give you more confidence in presenting an offer knowing that the offer lays within a reliable and reasonable range of market value. Then you can decide how much you really want the property. if you can’t live without the home then you may still want to pay over market but at least you will know the range that is or is not reasonable.

#257).

Did you happen to catch the big fight at the Scotiabank Arena in Toronto, Ontario, Canada last night? This Is Canada on the world stage…

https://twitter.com/kalebra07/status/1748887086797578543

Turn up the volume…The message Is very clear.

This is where the US economy and Canadian economy are diverging. The US economy is robust (3-5% GDP growth) while Canadian economy is anemic. On “per capita” basis, the Canadian GDP has been shrinking for a while. Unemployment in US is still at record lows whereas it has been rising in Canada for a while. Due to the slow drops in inflation, rates won’t go down as fast as people want. It’s truly a reflection of the drop in Canadian productivity relative to US productivity.

#255).

Especially on the high end market such as Oak Bay. Jason Binab has done very well over the years.

What about all the years we’ve had in the last 10 years where you list on Thursday and take the best unconditional offer Monday night? Sellers still lean towards the “neighborhood expert” or established realtor.

Either way nothing will change. Everyone will continue to complain about real estate fees to no end, but as I said last week no one will ever take action. Presented with the option of a 2% not well known agent and the 3% neighborhood expert they will go with the neighborhood expert, only to complain about fees. Out of the 52 comments on FB not one person suggested someone with lower fees.

So he paid around 1% more to be able to get out 2 years earlier (compared to 5 year fixed)? So then that becomes a math question, he has to make up that extra 1% he paid over the 3 years with lower rates in the last two to break even. Back of the envelope math indicates the rate in the last 2 years need to be 3.9% or lower to make this worthwhile.

how were the open houses yesterday?

Isn’t this people perceive the realtors with more sales as more knowledgeable about the market so when those realtors tell the sellers they need to drop the price then they tend to listen, this then becomes a feedback loop.

#250).

I still have 22 months to wait It out.

I have it covered with variable and fixed mortgages lol

#248).

“If I Were the Devil, I’d have a third of its real estate and four-fifths of its population, but I would not be happy until I had seized the ripest apple on the tree”.

https://www.snopes.com/fact-check/if-i-were-the-devil/

if we knew what his quote was on the variable or 1yr fxd , just do the math on break-even estimates after a year

Varaible would be higher but if rates start dropping later this year the variable does too plus you can easily get out and into a fixed (that may end up being substantially lower than 6.39%), or a 1 year fixed so you can refinance this time next year?

If the client was only approved for a 6.39% 3yr fixed, sounds like his alternative approvals like variable would be a much higher than equivalent going rates too. Best to do a break-even analysis to see where comfort is on deciding one versus the other. e.g., using your variable rate, could assume the market expectations for cut over next twelve months and do the math where you’d stand over remaining term all else equal etc

I had a client recently complete on a pre-sale condo and he went with a 6.39% 3-year fixed. Not sure what everyone’s thoughts are? Does one go variable right now and then wait to switch into a 5-year fixed later this year? Or do you go 1 or 2 year fixed? 3 seems like an odd number to pick given the current situation, but maybe it is the correct play?

+1, common sense.

Recent post on the Oak Bay Local FB Page

“Hello OBL

Can someone recommend a site or link where realtors are rated ?

Basically looking to see who has more sells in the oakbay area ? Is there a way to find out ?

Many thanks”

and then 53 comments with recommendations on great Oak Bay realtors. This is why the fees will never come down, people are asking and looking for the wrong things. Someone selling the most in a certain area just means they obtain the most listings in that area, but the consumer thinks they are more effective; therefore, paying the fees when they have a lot of cheaper options, and then complaining about the fees they paid when the opted not to go with cheaper options.

Pardon me Dad for not understanding the meaning/definition of the word “restrictive” when used in a cost-of-borrowing sense.

My main ask for a real estate agent is to be available as needed, find out unique info on the properties we should know about or intel from sellers that could be helpful, and be good at negotiating the small details when it comes to the final offer process.

I’ve never based decisions around their suggestions for pricing as they are naturally self interested and ideally just want the transaction to go thru to get their piece of the payment.

And agree Leo on interest rate predictions. it’s fair that track records for banks and “experts” are terrible, market expectations are the best predictor we can rely on but even that take it with a grain of salt. Never an easy decision to figure out what mortgage rate to take when buying a property. Back when mortgage rates were at rock bottom, it was “so obvious” to lock in five year fixed but of course majority went variable to save the extra bit of interest since everybody was predicting interest rates to stay low for much longer. It seems like an easy choice looking back but most rely on what banks or mortgage brokers suggest, which is often the wrong outcome. but we don’t have 30yr mortgages like most americans so it’s a bit less impactful in comparison. Some in US locked in at crazy low rates for 30yrs so will never need to worry if they ended up in their what was planned as their forever home.

An old one but a good one:

Einstein dies and goes to heaven only to be informed that his room is not yet ready.

“I hope you will not mind waiting in a dormitory.

We are very sorry, but it’s the best we can do and you will have to share the room with others” he is told by the doorman.

Einstein says that this is no problem at all and that there is no need to make such a great fuss.

So the doorman leads him to the dorm.

They enter and Albert is introduced to all of the present inhabitants.

“See, Here is your first room mate. He has an IQ of 180!”

“That’s wonderful!” says Albert.

“We can discuss mathematics!”

“And here is your second room mate.

His IQ is 150!”

“That’s wonderful!” says Albert.

“We can discuss physics!”

“And here is your third room mate.

His IQ is 100!”

“That’s wonderful!

We can discuss the latest plays at the theater!”

Just then another man moves out to capture Albert’s hand and shake it.

“I’m your last room mate and I’m sorry, but my IQ is only 80.”

Albert smiles back at him and says, “So, where do you think interest rates are headed?”

Realistically no one has a clue where rates are going, including the central banks. All the big bank forecasters failed to see the jump in rates, and they keep guessing because that’s what they’re being paid to do. If anyone could reliably predict rates they’re cashing cheques not writing about it.

Market expectations are likely your best bet as far as a projection since they are a reflection of best available information, but even that has a poor track record. Right now some more people are banking on cuts, including in the mortgage market, with a few more folks going variable hoping that it will pay off, despite the rates being substantially higher than fixed right now (under 5% for fixed, vs over 6% for variable)

re: Leaseholds

England has a long history of residential leaseholds, but are going to prohibit leaseholds on new houses.

Residential leaseholds are seen as “an outdated feudal system that needs to go”.

Were realtors interest rate and CPI experts before covid?

True, but numbers like the inflation rate and unemployment – and dare we say the RE market – do say something, and they aren’t saying restrictive to me.

the market is pricing in and expecting several cuts this year. It would be a big shock if we don’t see lower rates within the next 6 months. But yes no point in this debate, but do think real estate agents at least a have fair point when talking about lower rates being a reason to buy nowadays. It was everyone’s worry last year when rates were going up and up and up

The average rate over some arbitrary period of time says nothing about whether rates are currently restrictive or not.

Anyhow, I’ll leave it at that, so as not to start another one of these pointless debates about where rates might end up.

I think that interest rates are actually low at the moment all things considered.

Today’s BoC’s benchmark interest rate of 5.0% is below average.

Date Range: 1990 – 2023 Average: 5.78%

Highest: 16%, Feb 1991 Lowest: 0.25%, Apr 2009

https://www.fxempire.com/macro/canada/interest-rate

Rates are restrictive right now. I think it would be reasonable to expect that at some point in the future, they will be lower.

#230).

Are there people out there that are actually banking on lower Interest rates though? I think people have adjusted and this Is just the new normal moving forward.

Some have better credentials than others:

“Derek Holt is Vice President and Head of Capital Markets Economics at Scotiabank in Toronto. He is responsible for leading the team in the application of economic and financial market forecasts and research to the needs of Scotiabank’s global institutional investor clients and major bank clients…”

That’s the good thing about the modern world. There’s an analyst to match any priors

I want to thank whoever it was here that introduced me (us) to Derek Holt of Scotia Bank Economics Publications.

https://www.scotiabank.com/ca/en/about/economics/economics-publications.html

It is so refreshing to read learned reports from someone in the FIRE industry who does not peddle the wishful-thinking mantra that CB rates will soon be dropping:

“Next Week’s Risk Dashboard

-Global inflation risk is rising again

-Soaring shipping costs to pass through to higher inflation

– Global wage pressures maintain upside risk to inflation

-Bank of Canada to hold, push back on cuts…

In light of this recent reacceleration of underlying inflation, the rise in global shipping costs, and the already present idiosyncratic drivers of Canadian inflation risk, I would be surprised to hear Macklem sounding incrementally more dovish. I think he’ll sound more cautious if anything and continue to intimate that markets are overly aggressive in pricing near-term rate cuts…”

#225). This ones a bit more realistic for today.

https://www.proskypanels.com/fake-window/

You should offer your services at open houses to answer questions on renos etc, charge a fee to the listing agent and also get potential clients.

#224). “Fake window light product EDGEWIN is a user-friendly product with LED lighting. When the installation is done, the image you selected from the image gallery will appear as a realistic window view. Offering ease of installation thanks to its modular structure, EDGEWIN allows you to achieve your goal in about 10 minutes”.

#223).

What’s an Inside window? An LED screen with drapes?

Vicreanalyst , ya pretty much , I am always in awe of real estate economist . I wonder why they are wasting they’re talent standing around open houses

Lol looks the car salesman that sold a Toyota highlander to my mom took his at the union down unless it sold. I remember he was telling me how easy the money is and was showing me the ad on the app. The last list price was like 50k less than his purchase price and I think it was still priced $50k too much (I think the ask was 640k or something for a 600 sqft 1 bedroom with inside window, it was top floor though).

Rates are coming down blah blah blah.

Yep back to the other crises, that’s real estate . I will be hitting some opens today in oak bay and Fairfield and listen to some wisdom the used house salesman will be spewing

Super interesting listen from a guy that orchestrated massive mortgage fraud in the US https://podcasts.apple.com/ca/podcast/lex-fridman-podcast/id1434243584?i=1000641998244

Sat. morning and time to get back to housing. Not seeing a whole lot of new listings in the Janion. I assumed that there would be more by now.

Doctors can incorporate.

Family doctors? Not buying that. Friday golf would be as wild as it gets for that crowd.

Whether it’s real or a head fake remains to be seen, but there definitely is an “upbeat” feel to the economy and housing prospects so far in 2024. Consumer sentiment stateside up big time…

[jan 19, 2024] “Americans Are Suddenly a Lot More Upbeat About the Economy

Consumer sentiment gauge posted the largest two-month gain since 1991

https://www.wsj.com/economy/consumers/americans-are-finally-feeling-better-about-the-economy-e964804f

#213).

If I told you they love heli skiing and night time sky diving the most…what would your thoughts on that be?

Not quite as many people in that bracket have child and/or spousal support to pay and in lot of cases multiple ones. But yes the concept is correct, adding to your networth especially liquid networth is a very attractive proposition.

I can buy that

#210).

Okay, well lets just say that they absolutely love working and doing a good job…But they love golf more.

Yes, very true.

The amazing thing is that there were previous times and places that taxes were up to 98% of income. In that case, sure, why work more to only get 2%. The Beatle song tax Man was written for that since the Beatles were getting taxed 95% in the 1960’s Britain “that’s one for me, 19 for you… tax Man!”

You’re right.

If you’re at the highest marginal tax rates, your income is $200k+. In that case, you have very likely paid all of your living expenses and whatever you earn after-tax is likely directly adding to your net worth. Compared to say the first $100k of income which was all expenses. So why wouldn’t people want extra income? The “all goes to to government” is an excuse as you say.

#206).

To a certain level. A level that makes no sense for the effort.

It’s just an excuse for not wanting to work or get a job that pays more. At my work lots of people’s bonuses have the 54% deduction taken right off by payroll, do people complain about taxes? absolutely! Is anyone saying they want to do a shittier job and get a smaller bonus? nope!

Does anyone actually believe that? If they really did they would never ask for a raise or want a better paying job – or envy someone with one.

Seems to me it’s another one of those things in the political sphere that people know isn’t true, but they think it sounds cool or something.

If you are making say 200k gross a year instead of 300k gross a year…your after-tax income will always be lower as we have a marginal tax system (all else equal). Yes, you won’t net the same proportion when grossing 300k but you will still walk away with more.

So odd how people assume it just all goes to the government when you make a higher salary

#203).

Well yeah!

#200).

I get It…your accountant had better have a very sharp pencil though.

https://www.wealthsimple.com/en-ca/learn/average-marginal-tax-rates#how_marginal_tax_rates_vary_by_province_territory

LMAO, what family doctor doesn’t set up his practice as a business? And what kind of dumb ass accountant does that doctor have to advise on paying themselves in a manner that they end up at the 54% bracket?

These stories are just bs. More likely the doctor just doesn’t feel like working that much and uses the tax argument as an excuse.

They may need to address the idea of “the doctor isn’t accepting new patients” . What good is a medical system full of closed-to-new-patients family doctors offices? Maybe encourage all doctors to accept new patients. Yes, that will worsen the wait times for existing patients. But it’s better than a “two-tier” system where there are lucky people-with-doctors and unlucky people-with no doctors.

Maybe a simple idea, pay doctors 25% more across the board if they are family doctors in offices and they are accepting new patients you call one up, and you get an appointment, maybe in 2 months, but you have a family doctor.

Note to Leo: thanks for being “patient”… we will soon get back to housing.

#199).

I understand that…If It was 100% they wouldn’t be able to eat. If you want to work like dog I guess your right…YOLO.

if more money to incentivize doctors isn’t going to cut it because they’d rather be golfing, well that’s a nice problem to have, isn’t it? So maybe, we do a version of this where we say force them by law (with no more pay – so they’d be happy!) to have walk-in clinic hours say half the day – they can opt out of this, but if they do, they’re forced to wear a giant button that says “I’m a Doctor – ask me what I get paid”…

More income is more after-tax income too. The top tax rate isn’t 100%, it is 54%. There’s no scenario where “it all goes to the government”

marginal tax system, it’s worth learning more on it

#195).

It would just go to the taxman…That wouldn’t solve their “can’t afford nice enough houses here” Problem.

When I was young, I used to pound In lots of overtime…10 hour days, weekends, whatever. My accountant made It very clear by actually showing me a chart. I never worked overtime again.

There are doctors that want to make more money. We are told that some can’t afford nice enough houses here, that would be one reason for them to make more money.

#193).

Like some kind of side hustle? To make extra money? He doesn’t want to make any extra money…That’s why he takes Fridays off.

Right, this idea would incentivize the doc by making extra money to see patients-without-doctors and seeing them after hours. So maybe your doc works 1-9pm on Thursday instead, and for four hours (5-9pm) he accepts walkins (anyone) if they pay $30. So he sees some patients-without-doctors and makes more money. The key part of this idea is the doc office can;’t say “the doctor isn’t accepting new patients” during that after hours clinic – all are welcome.

#191).

My Doctor takes Fridays off to play golf…He tells me It all goes to the Government If he doesn’t. Same for my Dentist. They both open their doors at 9am then close them at 5pm Mon-Thur… There Is no “seen outside of regular office hours”.

Here’s an idea to improve family doctor access:

“$30 User fees, only after hours and if walkins (ie anyone) accepted”

There should be a $30 user fee for any visit to ANY family doctor for a patient seen outside of regular office hours (9-5 mon-Friday), as long as the doctor also accepts walkins during the after hours clinic

That would:

– pay ALL family doctors more (if they work outside office hours and accept walk-ins). By “walkins” I mean anyone can go, don’t need to be an existing patient

– user fee only applies to an after hours visit . The “walkin” visit might be an appointment after hours, but it’s open to anyone, not just existing patients.

– walkins must be accepted so people without doctors can also go

– user fee is paid by patient to doctor on top of MSP fees to doctor

– preserve “free, unlimited” access as anyone can still go within business hours for free

– improve access after hours, which is especially needed in short notice.

– user fee discourages frivolous use of scarce after hours medical resources with trivial problems

– improve chances of someone without a doctor to get seen after hours (since the “free” crowd wouldn’t be going then).

– a doctor doing this is typically going to see 5 patients/hour, so that’s $150 per hour bonus on top of Medicare, a good incentive for the family docs with full practices to start seeing some new patients-without-doctors after hours

This would cost the government nothing.

#189).

Perhaps they don’t like the mandates…I know a lot of nurses don’t.

Thanks for the info, Patrick.

OK, why don’t you folks just make me king for a day, I can fix this doctor-access issue. Any clinic that is willing to go back to the full walk-in-all day model, the doctors there each get paid an extra $50k or so a year. Offset or partially offset by a minimum user-fee (means-tested) of say $30 per person per visit, which also would keep out a large proportion of people who go to a doctor & gum up the works when they have the sniffles because it’s “free”.

Yes yes, I’m sure an MD on this site can tell me why this is nuts, or unfair, or going to the dark side.

😉

#186).

I think the system Is good…But my family has a family practitioner. I can’t even begin to think why this would not be normal for anyone. We certainly pay enough In taxes.

There are many many countries which offer advanced preventative health screening for relatively reasonable prices. For example:

https://hosp.ncgm.go.jp/en/mec/menu.html

https://www.clinicandturkey.com/full-check-up/

And you can get whole body cancer screening in Vancouver:

https://aimmedicalimaging.com/appointments/rates/

Canadian’s antipathy to private medicine is seemingly sustained by the “equation”:

private medicine = US style system = bad.

It’s true that on many measures the US system is bad (while recognizing they also have some of the best doctors, technology and medical research in the world). They pay a lot more than us as percentage of GDP, have some of the worst health outcomes in the developed world, have highly inequitable access, and the job-based insurance decreases labour mobility.

So by comparing our system to one of the worst systems in the world at least some Canadians can still feel good about our system!

“an 80 minute visit with a Doctor at Mayo Clinic – Phoenix is $825”

And IF you could get such a thing in BC in the “system” the internal costs to support that “free” visit for you would be five times as much, contorted by an inefficient, voracious, and unaccountable government department. So, free to you but the thousands will be paid for. By your grandchildren’s taxes.

#183).

The Peninsula Is very nice…In fact I think the entire Greater Victoria Region Is very nice. I prefer the West Shore since I grew up out here and frequent the up Island and like to head out to Sooke from time to time. As a kid I used to love hopping on the bus and heading to the downtown core…It was so vibrant and big with so much to explore. We would just wonder around all day. The experience Itself was probably rather small, but when your young everything is big, being a kid your like a sponge and just absorb everything. To each Is own…The West Shore Is my stomping ground.

You just have to know the best ways to navigate the entire Greater Victoria Region. For example I prefer to take the Duke Point ferry terminal to head to Vancouver Since I have some necessary stops I would like to make along the path anyway.

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/tax-return/completing-a-tax-return/personal-income/line-12700-capital-gains/principal-residence-other-real-estate/changes-use/changing-your-principal-residence-a-rental-business-property.html

Ya your cost of borrowing is 3.3% and you can get 5.3% risk free in a GIC. Young or not, whenever you have the chance to risk free arbitrage you should. Regardless I would not pay off a 3.3% mortgage, I would ride that like a rented mule and invest the rest.

Peter, If you want to start at the top, there is the Mayo Clinic, rated # 1 in North America in many categories. You can phone them and find out costs ($). They welcome new patients. Phoenix is likely nearest.

https://www.mayoclinic.org/departments-centers/mayo-clinic-executive-health-program/sections/overview/ovc-20253196

They have an online cost estimator https://estimator.mayoclinic.org/mychartguestpay/GuestEstimates/GetEstimateServices?svcArea=WP-248LIY6F86KM6ag5byC0Z3jg-3D-3D-24L6JEW2DBc04vJLXatZTCiFWT-2BzpNJ9QiIl2ejLsLBHM-3D&isMultiSA=false&location=WP-24NYja3WUW-2BJ6YCYEzTHSGvA-3D-3D-24SRvFZlgPV5wxUBNh9ki6swwr6tF9-2FaQk0Zc-2BjtMn8Io-3D

an 80 minute visit with a Doctor at Mayo Clinic – Phoenix is $825 USD (lab would be additional). If you need referrals, these can be done in Mayo within 24 hours in many cases. They are world famous for this type of care., accepting new patients worldwide for complete assessment.

https://estimator.mayoclinic.org/mychartguestpay/GuestEstimates/GetEstimateDetails?&token=49Sh7FiF0BuMmO3ZvaU2HN2ioB8GjK4blacqcDV4IMA%3D&svcArea=WP-248LIY6F86KM6ag5byC0Z3jg-3D-3D-24L6JEW2DBc04vJLXatZTCiFWT-2BzpNJ9QiIl2ejLsLBHM-3D&location=WP-24NYja3WUW-2BJ6YCYEzTHSGvA-3D-3D-24SRvFZlgPV5wxUBNh9ki6swwr6tF9-2FaQk0Zc-2BjtMn8Io-3D&template=WP-24uLmSrazVENoEu0BDYMg3Eg-3D-3D-24ein7V8-2BxuK-2FyEeZx24fx30fhMNpomXMTW6eDF4dDGw8-3D

Peter, no idea what it costs since we are covered by Medicare.

@ VicRE – yes we ported our mortgage, refinanced the rental with option to have as either a full HELOC so we don’t pay a penalty when we sell or a regular mortgage if we decide to rent.

Arbitrage the 500K? We are young so I definitely would not be leaving all 500 K in a GIC. Would be putting 200 K in an index fund like XEQT or XGRO wihtin our TFSAs. rest possibly @ 4.5% with TDs GIC fund

So you ported your existing mortgage to your new house and refinanced the rental? I would cash out, leave the mortgage and arbtriage the 500k with a GIC and make the 2% spread (10k a year pre tax).

Barrister, would you mind sharing a ballpark $ figure for what something like that costs? Thanks

for what it’s worth, if it were me, I’d sell & get out from under that, but I’m heavily influenced by my fervent desire to never, ever deal with tenants again in my life.

either way, sell or keep, I think you’ll end up doing fine, as I do think Victoria RE prices will maintain their inexorable upwards march with some hiccups along the way

If you turn your principal residence into a rental, it gets an adjusted cost base equal to the market value at the time this happens. If you sell it at some future date, the capital gain is based on the sale price. If you move back in, the capital gain is based on the market value at that time.

It is possible in some scenarios to avoid the capital gain if you move back in, but simply moving to another residence in the same city isn’t one of them.

Private medicine clinics – Agreed. The CMAJ has said that the only two countries with similar restrictions on private medicine besides Canada are Cuba and North Korea.

OK, so the rate on the new property we will move into is 3.3% until June 2026. about $3900/mo. We are comfortable with this for sure as we used to be paying $2200 accelerated bi-weekly. We bring in 300K gross per year my husband and I. No other payments besides normal stuff like insurance etc. And childcare.

The rate on the home we are debating whether to sell or rent will be 5.6% approx $4350/mo 30 yr amort. And yes if it was turned into a rental we would have to pay capital gains on the difference in selling price from the appraised value (1.265) at change in use. We bought it for 660K in 2017 and did everything you can do to a house (drains, roof, windows, doors, interiors, furnace, landscaping etc etc)

Millenial I would keep in mind if you don’t sell and rent it you lose the capital gains exemption because it is no longer your home but an investment property, and will pay it I believe at the time it is turned into a rental at its appraised value, or maybe that only applies when you turn it back to your home if you move back in. I forget exactly but it bears looking into, as you’ll pay it somewhere along the line. If you want to sell why wait? Do you just hope its value is more at that time?

What?? Marko you don’t know what it sells for in a year! What kind of realtor are you!!?!?!

Wait, What is the rate on your new mortgage? Depending on your mortgage prepayment penalty I would pay off as much as you can on the mortgage Unless you can arbitrage it with a GIC or confident of getting a risk adjusted return higher than your mortgage via other investment opportunities. Or if you are running some type of business on the side and want to use the mortgage interest as a write off, but you need to do an assessment to see if its worth it from an after tax perspective.

Readdict, after having lived in both a 1950’s solid home built using Douglas Fir and a modern luxury home I choose the renovated 50’s home.

Marko, preventive medicine has pretty much been dropped , we are really just doing emergency . I myself had a stress test done and that was a favour , but i had the impression that it was really not being performed as much anymore and every human should have one after 50 . If you want preventative medicine , gotta go to private clinics . Otherwise just wait to do a face plant and get emergency care

Marko, that sounds much like the standard checkup I get with the family doctors clinic when I am down here in LA for the winter break. Couple of extra things because of my age and history. Very extensive blood work and breakdown which helps in adjusting some vitamin supplements.

This is the sort of testing everyone deserves to get every year. I am sure that someone here will not agree but I really believe that there is a lot of things they can fix if they only catch things early.

Smart move getting the heart checked as well as getting a full workup.

Max, I do live in the core, and the house I’m currently in is a 1956 build with a 1979 addition. I don’t think your house qualifies as an old house. I did all due diligence including sewer lines and perimeter drains and home inspection when I bought it. Has given me no trouble, I’ve been here 7+ years . Did a minor reno involving removing some drywall (gasp- with asbestos testing first which was negative) in an outside corner bedroom closet to re-insulate it and put a better vapour barrier, etc. on as it was a cold zone. Some cosmetic/decorating upgrades, newer flooring, but it had already had a full renovation of the kitchen and bathroom. It’ll last for a long time yet, and not all houses in the core are old, nor is that the only area I’ve been looking in although I prefer to head the direction of the peninsula rather than to the west shore if not.

What does it sell for in a year?

Just for context of how badly our government has screwed up health care. I was in Croatia (1/3 GDP per capita versus Canada) for Christmas/New Year and my friend mentioned she had surgery so I asked her what her symptoms were and she said “no symptoms, picked up on ultrasound as part of my yearly physical.” So I am like hmmm interesting, I haven’t had a family doctor in Victoria in over 8 years let alone a physical or ultrasound, ever.

Same friend recommends a private clinic (since I don’t have public health care in Croatia) that offers physicals I call and get an appointment two days later at 8:30 am. I left the clinic at 10:15 am and managed to have full bloodwork/urine sample, spirometry, EKG, abdominal ultrasound/prostate ultrasound performed by a radiologist, physical exam by urologist, physical exam by internist + 15 min consult + email review by internist of all the bloodwork, etc for 200 euros. Here you can see all the packages and costs (scroll down) – https://www.croatiapoliklinika.hr/usluge/sistematski-pregledi/

I was super impressed with how the private clinic functioned it was literally from one room to another like a factory assembly line but I think that is simply a function of private efficiency. All my questions/concerned answered.

My cholesterol was a bit high and the internist gave her opinion that meds weren’t required, but I wanted a second opinion from a cardiologist so I managed to get an appointment for a consult at a different cardiology clinic for 100 euros, within 24 hours at 7 pm at night. Once again, private business, why wouldn’t the cardiologist stay late for an extra 100 eurso. Suggested some dietary changes and then I’ll go back again in the summer.

In Canada on the other hand I can’t even get hold of penicillin for strep throat without going to emerg. How would I even get to a cardiologist without a family doctor for something preventative and non-urgent like cholesterol?

Thanks everyone for the input. Another WWYD question.

Say you could either sell for 1.25 and walk away with 500 k tax free. Use that money to refill TFSAs, pay down mortgage on new home, and about 200K into non registered accounts (other accounts are maxed, TFSAs and non registered used for downpayment on new family house).

Or don’t sell immediately and rent it out min 1 year lease @ 4-5K per month, mortgage approx $4500/mo.

Harrison and Telus are great , but they too have a long wait now just to throw your money at them . Canada’s healthcare doesn’t work and will never work

How does it compare to other developed nations? An absolute comparison for this is meaningless.

I live in Ontario and I can tell you a lot of people don’t think this is any kind of solution. The money going to these private clinics is coming out of the public health care budget and it appears that in many cases the private clinics will receive more funding than hospitals for the same procedure. That means fewer services in total.

I think that much of the increase in life expectancy is due to this, not to any improvements in health care itself:

https://uwaterloo.ca/tobacco-use-canada/adult-tobacco-use/smoking-canada/historical-trends-smoking-prevalence

The only answer. No matter how much one enjoys flaunting one’s socialist pretensions it does not balance the pain of one single family waiting months to get their toddler’s hearing tested.

https://ottawa.citynews.ca/2024/01/17/private-clinics-expansion-ontario/

Good point. Victoria (along with North Vancouver) has the worst waiting times in Canada for walk-ins. https://vancouversun.com/news/local-news/victoria-north-vancouver-highest-wait-times-walk-in-clinics

And the “walk-ins” that do exist are some hybrid of telemedicine and appointments based system. Or they have just closed period.

I agree that for huge numbers of people, access to family doctors is atrocious in Victoria, and that includes walkins which are disappearing fast anyway.

I do stick with my main point that, despite this significant problem, overall health outcomes in Canada (longevity + 4 years) have improved since previous generation. And no, this doesn’t mean that it’s easy to find or see a family doctor in Victoria – it isn’t!

That one was a puzzler. Beginning to wonder if Patrick lives in Victoria, Texas or maybe Vitoria, Brazil.

Here in Victoria, B.C., Canada true walk in clinics don’t really exist anymore.

As an anecdote: My recent medical care has either been at emerg (slow, but not terrible at 3 AM on a Monday morning) or through an extended family member that is a doctor (against their rules but thankfully willing to bend the rules).

Patrick, I’m wondering where you see this? Genuine question. Where I live, the nearest clinics (Sidney) all have signs by appointment only – I really don’t see a true walk-in clinic anywhere in my community. Then when you try to phone for appointment at the time the phone lines open, they have a message that says full up for the day, or at least that’s been my experience. I haven’t seen a true walk-in clinic open for business since the pandemic started.

#153).

That Is very true. The work around for that was to peel the big yellow onion down layer by layer until you had a white onion In hand…Tie that to your belt and then you were truly the man. No problem with ferry costs…Even the Brentwood Bay ferry.

Only returned to the core in the last year and a bit as prices adjusted down. Through the pandemic I had offers beat out in Sooke (really happy that person came in at 150k over my offer there), Sidney, Brentwood Bay and a couple in between. I am in a better spot now since am passing on places that I would of just bought a year or 2 ago.

Like the time I caught the ferry to Shelbyville? I needed a new heel for m’shoe. So I decided to go to Morganville, which is what they called Shelbyville in those days. So I tied an onion to my belt, which was the style at the time. Now, to take the ferry cost a nickel, and in those days, nickels had pictures of bumblebees on ’em. “Gimme five bees for a quarter,” you’d say. Now where were we? Oh, yeah. The important thing was that I had an onion on my belt, which was the style at the time. They didn’t have any white onions, because of the war. The only thing you could get was those big yellow ones…

#151).

I understand and appreciate what you guys are doing. You two seem fixated on the core. How old would this SFH be? My house was built In 1981, That’s 43 years old now. 200 amp panel, all copper plumbing, copper wiring, solid bones, new sewer connection that I paid for…I own an old house and I’m fine with that. How old are these SFH that you guys are looking at? 63 – 73 years old now? Have you sent a camera down from the toilet to the street? Perimeter drains? knob and tube in areas? Panel size? on site parking or street parking only? lead pipe waterlines? Hazardous materials In house?

I guarantee Umm Really is not alone in trying to buy for about the last three to four years. I have been also. Distinctly recall the offer that I lost out on a house in multiples over for $60 to an investor who rented it right after, right as the Pandemic was being declared. I think it was March 8, three days before. Then trying quite a few offers throughout the summer and fall and spring and next summer and even into the following spring, then the heydey of the craziness, and pausing as most sane people do or did, then trying different angles, types of properties, with suites, without suites, different locations. I think the sidelines are pretty crowded with folks waiting to buy “finally” if they can qualify and finally get an accepted offer on a house they want, or at least will settle for. Some of us have homes to keep and want to buy another, some want to sell and buy another, some want to buy the first, and some are reassessing what a home is really and dropped out from the single-family realm down to townhomes or condos. Maybe 2024 will be the year? Who knows, I guess it has kept me busy, and probably a few others!

#149).

You can also deep fry donuts using motor oil.

That’s good to hear. Here’s hoping that 2024 is the year.

I have been pulling the trigger over that time (except the 6 months of pure COVID housing madness peak), just see if it finds the target in 2024. What’s the saying: “luck is merely when preparation meets opportunity”.

Agreed. Nothing against people who can pack up their belongings to a storage area and let a stranger live in their home. There’s lots of ways to make money, but I’ll pass on that one. I guess it could work for a single person, I can’t imagine it for a family.

#145). ,

I don’t want hospital medical care costs to Incur. I’ll just go to life labs and get It over with.

My Wife would demand a brand new bed, bedding, and pillows.

“Spend less”… That sounds more like a frivolous New Year’s resolution, akin to “lose weight” and “exercise more.” Best to see what people actually do.

On a side note, umm..really you’ve been close to pulling the “buy house” trigger for 4+ years, is 2024 going to be the year for you?

https://bc.ctvnews.ca/half-of-british-columbians-plan-to-cut-spending-in-2024-td-poll-finds-1.6732923

I guess from what’s being pumped as the upward swing in real estate this year, they all must be cutting back to buy homes….lol

No I didn’t say that, as I believe that access to family doctors in offices is much worse. Access to doctors by walk-in clinics (episodic care) is much better. Access to doctors by tele-medicine is much better, for most it was completely unavailable. Obviously walkins and telemedicine aren’t a substitute for a good family doctor providing longitude care. Just like McDonald’s isn’t a substitute for a home cooked meal, but that doesn’t stop people eating out fast food

“Health care” is bigger than access to family doctors in offices . What I did say is that life expectancy has improved by four years, and there are many other metrics of health overall that have improved along with that.

One thing people forget is about 30% of people don’t seek out medical care, whether it is available or not. They get it when they need it, typically in the last 6 months of life where most hospital medical care costs are incurred. That’s always been the case.

#139).

Our family Is very lucky to have a family practitioner, and he’s young…38 years old. He operates his practice out of his house In the West Shore. My Wife works for the Provincial Government and has extended health care coverage. She has to pay for this extended coverage…Its not free. We have our prescriptions dispensed at Walmart. What was once $2 for 100 generic antibiotics Is now $85 for the same 100 generic antibiotics with the same dispensing fee. She has 100% prescription coverage through her plan. I don’t think healthcare Is Improving at all. Just saying.

Since I am now 50 he has been nagging me to get blood work done. I am one of those that would rather just die than know I’m dying. I feel fine anyway.

I am just not a big fan of strangers living in my residence, I don’t know why. It is odd as I am in hotels on average once a month and have no issues with that.

The dangers of relying strictly on the internet for all information.

Patrick must be the only person in Victoria that thinks ACCESS to health care has improved in 25 years.

What has improved is healthcare itself if you can access it. Numerous diseases are curable or manageable that were much more deadly only 35 years ago. Multiple types of cancer, hepatitis C, Aids to name just a few

#137).

What more could a Man possibly ask for? Solar panel with battery storage for an LED bulb and Cell phone charger Included…Good to go!

#136).

Those Ice fishing tents are by far the best quality…You can even Install a woodstove that you can actually cook on.

Dee, you are conflating two different issues, affordability and equality.

Consider, when the Canadian economy collapses and we are all reduced to living in tents as no one can afford to own or rent, we will have solved the inequality problem. hooray?

Lived experience.

Middle class people today have far more wealth than those of 50 years ago.

Not really – 4 years tacked on at the end doesn’t do much for me, I’m more focused on whether the enjoyable/productive part of my life has increased, and navigating it without a doctor doesn’t help that part. I think it’s a failure of the system, and I think it’s time as a society that we are willing to discuss blank-slate alternatives looking at what has worked in other countries, whether it’s a dual system or some co-pay or whatever.

The better part is better drugs, better medical procedures once intervention is required, better outcomes there, no question. That’s progress. That picture of progress doesn’t measure the parts that are clearly being left behind, like family medicine, which is pretty important to a large segment of the population.

I agree that when picking through stats , today is not the same as yesterday . Lots of folks cannot get a Gp , it’s pretty fuked up . I myself am happy to pay the 800 bucks a month

You ignored the 4 year increase in life expectancy. That should cure your “cold comfort”

Not doubting the stats per se, but do they tell us all is well with the world? I mean, just with the doctors thing, ok we have more doctors, are they in family medicine? can you even go down the road to your local clinic and it’s actually just open for 8 hours for walk-ins? Because I don’t have a doctor & I can’t do that. 2 years on wait list now.

And on the housing, ok what type of housing, I mean someone owning a 600 sq. ft. condo today doesn’t somehow ‘count’ the same way as wanting to own a SFH for a growing family? And I guess I’m thinking more locally, ie. Victoria – are you really saying you don’t see a housing issue here?

I take pretty cold comfort from these stats, personally.

Insured doesn’t mean fixed in time when they want to sell and show the house. Clogged the sink/toilet and there is some flooding, now you have to repair floor/carpet. Just doesn’t sound like a worthwhile endeavor given the risk and stress for what maybe a $5k after tax profit?

Possibly, but if both parties are in agreement prior to the signing and there is no duress or coercion I suspect that the RTB will decline to hear a complaint. I agree that Airbnb is probably a safer route though.

No. It is only acceptable if you or a close family member move back into the home and occupy it for six months. The OP in this case is putting his home up for sale and will not move back in and this will and has attracted liability for a penalty of 12 months’ rent in BC.

Housing, 2023 compared to 1998

Home ownership rate is up.

– 2023 home ownership rate 66.5%

-1998 home ownership rate 64%

https://www12.statcan.gc.ca/nhs-enm/2011/as-sa/99-014-x/2011002/c-g/c-g01-eng.cfm

Healthcare, 2023 compared to 1998

In 2023, 38% more practicing Physicians per capita and life expectancy up 4 years

Canada has 38% more practicing doctors per capita in 2023 https://www.theglobaleconomy.com/Canada/doctors_per_1000_people/#:~:text=The%20latest%20value%20from%202021,3.93%20doctors%20per%201%2C000%20people.

Life expectancy has improved from 79 to 83 years https://www.macrotrends.net/countries/CAN/canada/life-expectancy#:~:text=The%20current%20life%20expectancy%20for,a%200.18%25%20increase%20from%202021.

Clothes down to storage locker. Everything else such as family photos fit into exactly one bin which also goes down to storage locker. Nothing of any value in the unit otherwise. Don’t own any watches or anything of that nature. If it was a couple of thousand I probably would not do it.

And you pretty much leave everything else?

That is for certain. I find it astounding it’s still up for debate. And the whole thing about well, now you have parents helping with downpayments – uh yes, but (i) they do it mostly because the situation is that desparate, ie it’s a bad sign not a great thing, and (ii) it means we’re sort of perpetuating a two-class society, the haves & have-nots, increasingly defined by housing and parental wealth.

None of that is good for society, in my view.