The (Garbage) New Home Price Index

It’s nothing but puzzles on the blog lately, and here’s the latest one:

The New House Price Index (NHPI) is an economic indicator developed and maintained by Statistics Canada that measures the changes in the selling prices of new houses over time. It is the only index of house prices that StatsCan maintains, and is thus often used in other measures, by policymakers, economists, and researchers to evaluate the performance of the real estate sector.

The NHPI is based on a monthly survey of builders and contractors, who provide data on the selling prices of their new houses (detached, semi-detached, and row houses). Custom homes are not included, and data is only taken from the larger builders. The survey takes into account a range of quality factors and adjusts for them to determine the pure change in price between periods. More detail on the methodology is available here.

That all sounds reasonable, but unfortunately the index itself seems to be entirely disconnected with the reality of prices, and it’s especially bad in Victoria. According to Statistics Canada, a new house costs the same now as it did in 30 years ago. Not sure what everyone’s whining about!

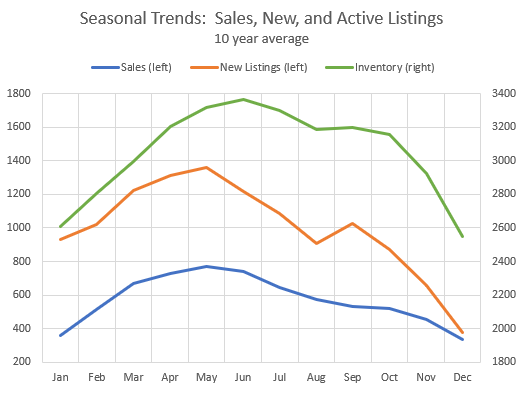

What’s interesting is that the NHPI is not catastrophically bad in every city, and in fact it varies wildly relative to the Teranet HPI depending on where you look. For the following chart I compared house price growth from January 2000 to March 2023 as measured by the NHPI and the Teranet HPI (inflation adjusted).

As you can see, in some cities like Quebec City, Montreal, Ottawa, Winnipeg, and Edmonton the two indices are at least roughly in the same ballpark. Calgary stands out where the NHPI actually grew a lot more than the Teranet index. And then there’s cities like Halifax, Toronto, Hamilton, Vancouver, and Victoria where the NHPI wildly understates the actual increase in house prices. The situation in Victoria is particularly bad, with prices up 217% since the turn of the century while the NHPI claims they are up only 45%.

Uses of the NHPI

According to Statistics Canada, the NHPI is used by “building contractors, market analysts interested in housing policy, suppliers and manufacturers of building products, insurance companies, federal government agencies such as the Canada Mortgage and Housing Corporation (CMHC), and provincial and municipal housing agencies responsible for housing policy.”

Given the apparent flaws in the index, that’s concerning, but perhaps more importantly, the NHPI is used in the calculation of the housing component of the CPI. The housing component of the CPI is one of the most significant expenditure classes, as housing costs are usually the largest expense for households. The housing component can be further broken down into subcategories, such as rent, homeowners’ replacement cost, interest costs, property taxes, and more.

The NHPI contributes to the homeowners’ replacement cost, interest costs, and other costs components, which make up 6.44%, 2.94%, and 4.43% of the CPI respectively. Up until 2021, the NHPI was the sole index used in the calculation of mortgage interest costs, however since then they’ve also folded in a measure of resale prices which reduces the impact the NHPI has in that category (resale price indexes are also now used for calculating commissions as part of other costs). However as far as I can tell, only the NHPI is used for homeowners replacement costs to this day. In fact, they use the “House-only” part of the NHPI, which is particularly hilarious in Victoria. Did you know that new houses are wildly cheaper today than they were 40 years ago?

Given the importance of the NHPI to calculating the CPI, and the importance of the CPI to setting interest rates, and the importance of interest rates to housing, one would think they would get this index right. But unless I’m missing something, it seems they haven’t. It’s not that they’re not aware of the discrepancy, in fact it’s listed as one of their frequently asked questions. They explain away differences as being due to quality adjustment, but this explanation is not plausible for several reasons. Firstly, Victoria houses certainly did not get 5 times nicer in 40 years, which is what would have been required to keep the NHPI constant while prices quintupled. Secondly we would expect similar changes in quality between different cities and a roughly similar discount of the NHPI relative to an index like Teranet. However in reality we see both huge discounts and premiums depending on the city. I’ve reached out to statscan for comment to see if they can shed some light on the situation.

Also the weekly sales

| April 2023 |

Apr

2022

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 159 | 286 | 466 | 824 | |

| New Listings | 304 | 539 | 799 | 1368 | |

| Active Listings | 2013 | 2046 | 2054 | 1365 | |

| Sales to New Listings | 52% | 53% | 58% | 60% | |

| Sales YoY Change | -36% | -33% | -24% | -26% | |

| New Lists YoY Change | -30% | -17% | -22% | -10% | |

| Inventory YoY Change | +71% | +71% | +57% | -6% | |

| Months of Inventory | 1.7 | ||||

The chronic and puzzling new listings shortage discussed last week is getting even worse in April. No sign of the nice jump in listings we had this time last year, and combined with a relatively strong week of sales it’s really slowing down inventory growth.

Next week I’ll look in detail at whether prices are moving due to the sellers strike, but for now on request here is how sales prices are looking relative to list price so far this month. Properties on average are going a percent or two under list, with more dispersion on the detached side (which is normal).

As a late New Year’s resolution, perhaps some of us could restrict themselves to one post per day? In that way the blog can remain identifiably Leo’s, we reduce prolix repetitive froth, and my 20-year-old MacBook’s pixels can have a little breather.

https://www.bcrea.bc.ca/legally-speaking/prohibition-on-rental-and-age-restrictions-in-strata-buildings-556/

Stratas have always had the power to restrict short-term rentals as distinct from long term.

What am I missing? I believe the seniors condos restricted to those over 55 still can rent out their units but the tenants must be of that age. All stratas must now allow rentals.

Maybe the primary reason condo owners don’t want renters in their complex is to keep out Airbnb transients. Long term renters have signed contracts, security deposits, etc… and are known to the neighbors. They can be excellent tenants. Strangers from who knows where are less predictable.

We could have $27k lots here too, if we wanted, but voters have chosen otherwise.

Well Barrister the turn over rate using the number of homes in Victoria City today and the number of sales last year is 41 years.

The turn over rate is an effective metric to estimate how “hot” or how “cold” the market is in a given area. Of course 41 years doesn’t mean much unless you relate it to past real estate cycles.

Really, hundreds of BC condominium complexes chose to raise their age restrictions to 55 rather than have rentals in the building. If someone on this blog, had suggested that this would have happened back then, they would have been raked over the coals.

https://www.theglobeandmail.com/canada/british-columbia/article-bc-introduces-exemptions-for-children-spouses-living-in-55-plus/

Formally no. But they do have a rose by another name:

https://www.houstontx.gov/legal/deed.html

Why a year? What relevance is it to use one year. why not five years, or six months?

In contrast using active listings illustrates what is happening in that particular market at that time. Not what buyers and sellers were experiencing 6 months or a year ago. If I were to illustrate what is happening in Victoria, It would go something like…

“The City of Victoria has a population of 91,867 and some 53,070 single family and strata homes (latest census). As per VREB there are currently 55 single family homes for sale in all of Victoria City ranging in price from $625,000 to $4,100,000.”

I think that gives the reader a really good snap shot of the Victoria market place and why our prices are so high. Most Victorians think the real estate market is a lot bigger than what it is and tend to compare Victoria to Vancouver or Seattle. We are a small market. All of our 13 municipalities combined are less in population and housing count than Surrey alone.

Ever hear the story of the ant laying on its back floating down a river on a leaf with a hard-on screaming “raise the bridge, raise the bridge” That’s Victoria.

If your roof is fairly simple, snap-lock can be ordered to size and goes down quite quickly. No warranty though…

Typically 5-7% of the houses sell in a given year. Using an average Sales-New Listings (SNL) ratio of 50%, I would assume 10-14% houses go on MLS every year. The recent increase in listing-delisting-new listing cycle means the “true” SNL is higher and it probably means less than 10% of the houses will go on MLS this year.

Before we get too panicked over the numbers it might be more helpful to look at what percentage of houses come up for sale over the period of a year.

Another way of looking at it would be how long does the average person live in a house before selling it? Some may be passed down to children but that is likely to be a small percentage. A first look would be to add up the total sales in a year and then calculate it as a percentage of all houses.

Speaking about Texas. Did you know that Houston does not have zoning.

It’s worthy of a google to see what happens in a city when you get what you wish for.

I think there are four dates now to consider

The meeting of minds when the offer was accepted

The pending date as determined by both parties when the subject clauses are removed.

The rescission date set by legislation

The closing date when the Title is transferred.

In most cases, these date are quite close together. But in some rare cases the date the offer was accepted and the closing date can be months or years apart if it is pre-construction offer on a condo. My recollection is the real estate board uses the pending date as the date of sale. As I recollect they did “F” up a year ago and used the closing date. That could have caused problems if one was relying on a small sample size in an analysis.

Thanks Leo and Marko!

Pending Date

“Enter the date the last subject was removed.”

Not sure what happens with unconditional rescission period offers. I enter in the date the rescission period expired (instead of accepted date), not sure what other agents do.

Saanich has some 50,000 private dwellings but only 235 are listed for sale. That’s less than half of one percent of the stock of housing up for sale. Or to put it another way 99.5 percent of the housing in Saanich is not for sale.

Victoria City is a little over half of one percent.

Oak Bay is around 0.9 percent

Langford has about 1.25 percent and has been building homes like crazy.

These percentages would have to double before we would see any change.

There is no frigging way we can build enough homes to bring down prices. If we could get more existing homes to be listed as we have had in years past then we could.

Any government legislation that is concerned only with new construction without addressing existing housing is doomed to failure. We can not build our way out of this problem. To meet the demand with just new housing we would need to import thousands and thousand of workers and their families. And they are all going to need a place to live.

I believe the former (when the contract is accepted with no conditions)

No one answered my question so I’ll try again …

Is the sale pending date (in mls) based on when offer was accepted OR when rescission and subject removal period has ended?

Ahh yes, good point.

That’s USD, which is closer to $180 per foot. Still cheaper than here, but my impression from Matt Risinger videos is a lot of Texas housing isn’t great.

New listings at a 20 year low.

Sales at a 10 year low.

It isn’t a bad market for sellers. For example, if we go back 10 years that is a bad market for sellers (where prices still barely budged).

2013 Sales/Active Inventory 615/4,585

2023 Sales/Active Inventory 637/2,043

The one thing I will note is SFHs and condo activity seems to be diverging at the moment. SFHs moving briskly, condos slow.

I mean you answered your own question. Sales are higher in April than they were in March, which is normal seasonal pattern. Meanwhile new lists dropped from March when they are supposed to be increasing.

All things equal, lower MOI is good for sellers. No doubt that there are still delusional sellers clinging to peak pricing. Market has tightened up a lot since the fall, but we’re still quite a distance from 2022 conditions or pricing. The difference then is we had IMO a large percentage of irrational sales due to 75% of properties going over ask. Today we have a tight but rational market.

“Sales picking up more or less normally while listings just get worse and worse. Bad news for buyers.”

Are sales picking up? And how much worse is inventory getting? Sales are stuck in the low 3 digits, the average weekly sales is only about 10 sales higher in April compared to March, and there are still more new listings than sales. The main driver of lower inventory seem to be “delistings,” with almost double the number of “failed” sales in April than actual sales. I’m not sure I understand, and if I am missing something please let me know, but overall this seems to be much worse news for sellers than buyers.

People pay $2 million for a townhome on Oak Street (6 lanes) in Vancouver when I am sure they could buy a better townhome on a quiet cul-de-sac in Langley for 1/2 the price.

Location is a function of density or proximity to density in a lot of cases. Exceptions do apply like waterfront on a lake outside of town, etc.

Oh well, it looks like we are passed that bank scare that made central banks hesitant, so we should get the overnight rate bump in the next meeting that we should of had last time. However, the 7th of June is a fair ways off, but hopefully sellers will look to get ahead of the next bump and look to get some listings out there…

It’s the location they’re paying for, not the density. Think a SFH in the same spot would be cheaper?

April sales: 637 (-23% from last April)

New lists: 1036 (-24%)

Inventory: 2043 (+50%)

Sales picking up more or less normally while listings just get worse and worse. Bad news for buyers.

New post tonight.

Time to DIY install a metal roof? 🙂

Hot damn I myself am waiting out the hot spring market so we shall see looking for prices to still turn down

Agreed, in the case where they are looking for a family home and able to buy now, then “now” is the best time to buy. For a bunch of reasons put together. Especially over the long term.

There are some HHVers unable to buy the family home “now”, so I just wanted to point out that for them there is always hope that buyer conditions could improve. I think it would take a combination of recession/unemployment/ out migration from BC. But that has happened many times in the past. I definitely don’t advise waiting around for that to happen though.

I see affordability similar to CAPE ratios in the stock market.

Does it correlate with future performance? Yes.

Can it be used to time the market? Not really.

Since someone brought up high taxation, perhaps this has something to do with the low price of the lot:

—- Affordability improved by 12% in 2009 (57% to 50%)

—- Affordability improved by 20% in 2013 (52 to 42)

—- Affordability improved by 9% in 2019 (57 to 52 )

I’ve never really understood the “affordability improvement” or “inflation adjusted,” or the seller “lost a bunch of money, after transacation fees” even thought purchase price stayed the same.

These metrics are great for Leo putting together an analysis but for the individual person did it really help if affordability improved in 2019 if they were in a position to buy in 2017/2018, etc. Unless the purchase price drops, which it rarely has to any substantial degree, tough to beat owning a SFH with a suite versus renting when you factor in principal re-payment, housing security, etc.

People also find high density very attractive and pay an arm and a leg for it. I’ve recent sold a few condos in Vic West to retirees from Alberta. They certainly aren’t coming to Vic West from Calgary/Edmonton for jobs or the poor health care. Sure, you could buy 1 hr from Victoria in Crofton for 1/2 the prices but you just don’t have the stuff density can afford in Vic West (spectacular walkways along the water, restaurants, cafes, shopping, etc.).

I love density. I have a place in Zagreb in a super dense location and it’s pretty cool having a gym in the basement, three top notch resturants with 500 feet, two cafes within 500 feet, three grocery stores within 8 minute walk, bakeries, dentisty, doctor, massage, etc., all less than 10 minute walk. I only use the car when I leave the city.

Even thought it is dense you aren’t bumping into people on the sidewalk. When I was in Taiwan I found the same thing, incredibly dense areas but you still walk freely outside. If you can avoid commuting density is pretty cool imo.

So $133 per foot to build. I imagine GableCraft/Verity/Westhills is building at $200 per foot but the land is the big difference.

Metal roof quote:

2017: $10,500

2023: $19,125

We have a combination of high taxation and a government policy that strongly favours cramming everything into a handful of high density cities. It is not a coincidence that high density cities usually produce very expensive housing.

Cost breakdown of building a house in Texas. $226,000 all in. Of course the $27k lot helps

https://www.tiktok.com/@caselucasrobinson/video/7227720866178764078

Rents, together with incomes of owner-occupiers, support RE prices. An investor has only two reasons to hold a property – it’s putting money in his pocket now, or it isn’t but he expects to come ahead on appreciation. Negative cash flow and flat or falling prices will motivate investors to stay our or get out. Conversely rents that produce positive cash flow will motivate investors to stay in or get in.

High rents are not the cause, they are the effect. The effect of excess demand (across North America) and pathetic supply. Blaming high real estate prices on high rents is another example of twisted logic.

You got me Barrister it seems your a hell of a lawyer as yes I missed some context in my post.

When I was talking about this blog comment section relating to food, kids, life annd sometimes interest rates I meant it all in relation to real estate and the value that tying real life experiences to real estate has. For example I’m far more likely to pay attention to the comments about a life experience someone had buying or seeking a home, a current struggle their kids are having in the market or the fact that someone was at a restaurant and it was full of people ordering drinks and dinner and so in their opinion there isn’t a recession ahead.

To me that’s more valuable to the current Victoria market situation than people posting articles about how many immigrants Canada is getting or housing predictions for 2025 in Sudbury because your right, look at the title of the blog 🙂

Hope that’s now clear and have a good night and I’ll call you if I need lawyer to cross examine a someone (jk)

Anyone got recommendations for an installer of heat pump hot water tanks?

Yes Frank, condos have become the poor person’s apartment buildings. If you are looking for an investment property most people look towards a condo. And most don’t want to be surprised with a special assessment so they look at new or near new condo complexes.

Or they can keep their current home as a rental and build a new one with a legal basement suite. Thereby increasing the inventory of houses and the number of rentals.

With buying a condo, a couple of hundred bucks of that monthly strata fee goes to a reserve for future repairs. You don’t get that money back when you sell. When you buy a purpose built apartment building you don’t have to have a depreciation report done every few years and you don’t have to have a reserve for replacements. You just re-finance the building for a new roof or elevator and amortize it over 25 years.

On a per unit basis the monthly expenses for a condo are significantly higher than buying a purpose built apartment building.

And the cost to purchase is lower too. A renovated 16 unit apartment building on Carrie Street is listed at $335,000 per unit. A one bedroom condo alone is closer to $500,000. So you’re further ahead buying a purpose built apartment building than buying condos.

And that’s why condos are the poor person’s apartment building. Most can afford a condo but a lot fewer can afford to pay several million for an apartment building.

Question for Realtors & Leo – Is the sale pending date (in mls) based on when offer was accepted OR when rescission and subject removal period has ended?

In my opinion, what’s keeping our house prices from a significant decline is high rents. In this market those looking to buy a home and are fortunate to have a paid off or small mortgage on their current home don’t have to sell if they are willing to become a landlord. They can have their cake and eat it too.

But the rental market is a fragile market. It relies heavily on the 20 to 40 year old age group that are most often renters. They are typically the first to get laid off in a recession or have their hours cut back. A change in their fortunes would result in an increase in the vacancy rate and dropping rents. And that could cause a flood of new listings coming onto the market.

Here it is the last day of the month and craigslist has 131 one-bedroom listings with a 6 kilometer radius of the downtown area with the average one-bedroom asking $1,765 per month with most one bedroom rentals falling in a narrow range between $1,620 to $1,940. If you’re sharing a bed that’s affordable. If someone starting out in the job force finds themselves single or relying on one income, not so good as rent will gobble up 50 or 60 percent of their income.

The rental market for two-bedrooms isn’t any better. The average two-bedroom rents at $2,446 with about 128 listings and a range for most from $2,200 to $2,700.

Of course you could always rent one of the newer “affordable” units say in Hudson Walk. A 517 square feet one-bedroom is $1,950 per month plus another $250 for a storage locker and parking. An 861 square foot two-bedroom starts from $2,580 plus parking and storage. 517 square feet is about the size of a double garage.

The average one-bedroom is around 650 square feet and includes parking for a rental rate around $2.75 per square foot. One of the “affordable” rentals start around $4.25 per square foot. We do have a rental problem, but building “affordable rentals” isn’t going to help much in the foreseeable future because you can’t build affordable housing. New housing is expensive to build so you need to get a high rent to make a profit.

What will change the market is how that important 20 to 40 age group reacts. They can come to Victoria and not get ahead in life as a huge chunk of their paycheck goes to rent or they can chose Alberta where they can build a bank account. And then Victoria can go back to what it was known as before. A place for the newlyweds and nearly deads.

And there are going to be more large investors coming into the residential markets from the commercial markets as demand for office space decreases. Also, at these multimillion dollar levels, I don’t know how many small investors can afford to fund projects that take years to complete. I believe that individuals have been priced out of investing in real estate with the exception of buying a condo and listing it on Airbnb which helps nobody. Anything involving buying a million dollar+ property and redeveloping it takes deep pockets.

Again, as my property manager told me a few weeks ago, many of his clients have sold their rental properties leaving him with an all time low in inventory for people who are looking for a place to rent. He gets inquiries every day and has nothing to offer. The same is true in Ladysmith.

Except for three periods where “Something around the corner” did appear in 2009, 2013, 2019 to improve affordability. That’s about once every five years.

—- Affordability improved by 12% in 2009 (57% to 50%)

—- Affordability improved by 20% in 2013 (52 to 42)

—- Affordability improved by 9% in 2019 (57 to 52 )

Frank, you can’t have to have it both ways. If you want more housing in cities then somethings have to go.

Investors play an important part in real estate. As they build more housing as prices increase which increases supply and moderate prices increases as demand is being met. Investors also moderate price declines, as they buy up housing for their cash flow when prices fall too low.

At least that has been the generally accepted theory of the past. But never before has real estate had so many investors. The low interest rates made a lot of people that would have never bought multiple properties before by directly purchasing properties or investing in syndicated mortgages that with their massive pooled money can buy up properties.

We are living in a new paradigm of real estate investors. A shortage of housing but at the same time there has never before have so many people invested in multiple properties either directly or indirectly.

Syndicated mortgages were once the preserve of sophisticated investors, but are now being pitched to ordinary consumers with promises of low risk and high returns. With the astronomical rise in rents they are becoming more prevalent in the rental market place. The concern is that people may be investing in these believing they’re more in the nature of a conventional mortgage, where they have a very sound and secure investment backed by the property itself, when in fact that may not be the case.

On CTV News- Toronto is reviewing 70 apartment complexes (currently providing affordable rent for thousands of people) for demolition and construction of new condos. This is just pure greed.

I was told buy what you can as soon as you can. I personally have never tried to “wait out” a market – then again I have only bought 3x and every time with the intention of keeping it for a while. Also, I have never ever regretted having a suite.

Why not a bridge from Esquimalt to Colwood before a metro?

Only an Emperor would get a high speed train built. A Tsar would probably invade the Aleutian Islands.

Build a high speed train from Victoria to Campbell River.

From Victoria:

– 10 minutes to Duncan

– 20 minutes to Ladysmith

– 30 minutes to Nanaimo

– 40 minutes to Parksville/Qualicum

– 50 minutes to Comox Valley

– 60 minutes to Campbell River

And build that bridge from Vancouver to Nanaimo also with high speed train tracks next to the highway.

Victoria, Nanaimo and Comox Valley are already over 60k, so we are already over halfway there.

Westshore is also over 60k and should also have better mass transit to it. However, I am sure most would argue it is not a seperate population centre.

We bought our first house in Sooke in 2010 and our second home in Colwood in 2014. 2014 seemed like a buyer’s market and we got a much better deal. Only 35k more for a house that was 25% larger and much closer to Victoria.

That was less than 10 years ago. However, that was in the Westshore. Not sure what the core was like at the time.

Are you implying that he should buy now because a year from now he might lose his job?

There are some important dates to consider when looking at older homes. There have been many BC Building Codes adopted since 1973. Each one adopted new changes from plumbing to ventilation. Some of the changes did have a significant effect on the cost to build a home such as when BC went from 2×4 construction to the superior 2 x 6 construction, increased insulation, vapor barriers and vinyl break thermal pane windows. Knowing when a house was built and the codes at that time can take some of the guess work out of what’s hidden or unapparent in the home’s walls.

There were some codes adopted that did lead to problems such as UFFI insulation, water infiltration (leaky condo) and aluminum wiring in multi-family and some single family houses but these have subsequently been amended.

Homes built before the BC codes were a hodge podge of standards that each municipality set themselves. When a contractor was someone with a phone and a telephone book. And the builders and sub trades were just Bob and his Boys, and it took four months to build a Gordon Head home with the buyer finishing the basement at a later date themselves. Most of the housing built in this era fell under the category of “economy”. Economy being another word for crap. Ironically during the 1970’s, BC was having a housing shortage at that time too. The shortage ended in the mid 1980’s when BC went from a shortage to a glut of housing on the market.

This is a pretty funny statement. Are you sure that the full effect of the current rates won’t impact your own financial situation (i.e. job or other income?) but only that of others?

Maybe. And maybe not. Personally what I’ve found over the years is that any real estate decision, at any price point, always involves a lot of compromises and it’s very hard to find something – anything – that fits budget, needs, and some wants. Seems to be that “the right property” only comes along pretty rarely. And so if I were looking, and that unicorn actually comes along now, I’d be jumping on it and not waiting. Market drops are not likely to be long-term here anyways even if they do happen.

AirBnB: You seem to maybe have missed the title of this blog which may explain why it is about housing and not about what everyone is generally talking about.

Who is going to make this change? We need solid honest people with brave words to create an understanding. The solution is right in front of us; albeit, changing density locations, creating a home for everyone. The world is changing too quickly for anyone to grasp. “own nothing and be happy” But .. have a home given to you. It is so possible, its actually easy. Give the drugs free and clean, stop crime. Give accommodation free and clear , stop crime!. ( this is easy just need the right people in government) 2% inflation is a figure pulled out of thin air before money printing was invented. 4% inflation target, stop the pain. ( why not? do you like pain?) 40 year amortizations allow many more people to own houses. The ONLY reason people complain about longer amortizations is they want a Housing Crash. Otherwise its a great idea if they want to buy.. Its simple we just need to get rid of the male ego and countries.

You mean the picture of my fan club waiting for my next post? Or maybe they were getting directions to a PETA convention (I’ve never seen so many fur collars/hoods).

As you typed that into your phone Alexandra( no judgement) 🙂

This website is sad and funny at times. There’s very little conversation about what actual people out in the real world are actually talking about (food, experiences, kids and yes sometimes interest rates) and instead on here there’s immigration debates, density debates, municipal council results, doom and gloom, interest rate speculation and articles posted that fit peoples own thoughts.

PS. I’m not trying to be negative as There are a small number of people that share their very own life experiences that actually provide some knowledge and those peoples real life posts are 10 times better than the frequent opinions IMO

Introvert’s post @10:41 am…click on financial post article: Wow….look at that picture. The still is what grabs me and not the article. I wish I could have had this photo in my hand to show it to someone 30 years ago. Then try to explain it.

The subway has come to a total stop. People are just about to disembark while a horde of people are ready to board. Yet, all is calm. The woman in the foreground just about to step off, oblivious to all around, head down staring at her mobile phone. And the crowd waiting to get on? 90% (?) of them also quietly staring at their phones. .. unaware of anything, as their entire world in that screen somewhere. This is our society now.

There were two outright failures so far this year, Silicon Valley Bank and Signature Bank. Failure means the bank is liquidated.

https://www.fdic.gov/resources/resolutions/bank-failures/failed-bank-list/

Introvert- Any clue as to the address of this property? I’d like to know the value of this tear down and its age. What would be the final price of the 2 mansions? $20,000,000? Each.

LMAO

Hey Patrick, Totoro:

Thanks for the encouragement! I really appreciate it, especially the kind words Patrick. And all the best Totoro for your son too.. I will say it’s an uphill battle to return to BC but it isn’t impossible. A colleague of mine at UBC went to high school at Gordon Head, and another here is from Duncan. Not the norm, but it happens!

The collapse of commercial real estate, primarily due to covid and remote work policies, could make residential real estate more expensive. The commercial investors could turn their attention to residential properties and start to buy up more real estate in that sector. Our own government workers who are on strike are pushing for working at home instead of commuting to an office every day. They will also require more space in which to work and some peace and quiet, necessitating a sfh instead of a cramped apartment/condo with noisy neighbors.

The first domino to fall due to the “high” interests rates was the smaller US banks. The government and Fed quickly responded and backstopped the banks from failing. The next domino to fall is CRE, and it will be much bigger. All banks will be affected by the write down of these CRE loans. While the governments may extend the backstop to protect bigger banks (by rewriting the rules of solvency), lending in all sectors will freeze when this happens.

https://financialpost.com/real-estate/property-post/canada-office-real-estate-sector-heading-for-reckoning

It‘s always been like that. As it stands now, Canada homeownership increases with age, and is about 75% at age 65. That’s “excellent” , compared to other countries and previous Canadian generations. Of course “perfect” would be 100% homeownership. But don’t miss the point by confusing “excellent” with “perfect”

Agreed.

In a year when house prices rise 20%, the housing component of the CPI shouldn’t necessarily be anywhere near that, since the CPI housing component isn’t a measure of house prices, but rather a measure of renters expenses (ie rent) and existing homeowner’s expenses (mortgage interest, maintenance, taxes). Yes, new mortgages are influenced by mls-resale prices, and statCan was correct in including them in mortgage interest calculation ( and reducing nhpi ) starting in 2021. Of course the mortgage interest cost in the cpi is for all mortgages, not just the new ones, so it’s only a portion of mortgages that are “new”. Homeowner “renovation” (maintenance) costs would be ideally captured by a pure “home depot inflation” measurement, but statCan doesn’t do that. NHPI is not that good, but statCan relies more on the SHS (survey of household spending) for the housing CPI.

It would be a big mistake to increase weighting of MLS-median or teranet house price changes in the CPI. Just look at 2022, when rents and homeowner’s mortgage interest had big rises. Yet MLS-medians fell for the year. Who would accept the idea that there should be deflation in the 2022 CPI housing component because MLS-resale prices fell?

Most, but not all. We are living in a two class society at this point with what benefits one group coming at the expense of the other.

I wish we had politicians that would do the right thing, even if it meant not being reelected in the short term.

CPI reflects all ongoing costs of home ownership, i.e. what homeowners are collectively paying at any given time. Oh and it includes rents too.

Consider the problem with including sale prices in CPI. One, changes in house prices aren’t uniform across the country. During the Toronto bust of the early 90’s, house prices went up in BC. Two, changes in house prices only affect households who are buying or selling, and in opposite directions.. Three, pensions are indexed to CPI. Do we cut people’s pension payments when there’s a housing bust, or increase them when there’s a bubble? Most pensioners are home owners and their net worth increases with house prices.

Giving the government more of our hard earned money hoping they will use it to solve societal problems they created is absolute lunacy.

More influential is the fact that the majority of those who vote are homeowners. However, a majority of those homeowners also have children and affordability is an election issue imo. It seems like everyone knows this is an issue and governments at the Federal and provincial levels are taking steps to address this but it is very slow.

Secondary home ownership provides very significant tax revenues to government (income and capital gains), whereas primary residence ownership is capital gains exempt with huge windfalls accruing to some. Removing part of the CG exemption for a primary residence would be effective and raise a whole lot of tax revenue that could be used to subsidize affordable housing. But this would probably be a move that would lose an election.

@Kristan

Don’t let the RE agents scare you into buying too soon. The full effect of the current rates will be visible in the next 6-12 months. At a minimum, I would wait until October-November. In my opinion, we should look at the Canadian macro environment with the 80s-90s stagflation lens than the 2007-2009 disinflationary environment.

This is a policy choice that ensures CPI numbers don’t reflect the true cost of housing. Also, the opposite argument is made in the policy to not tax profits on primary residences (because homes aren’t considered investments/assets).

https://financialpost.com/news/economy/bank-of-canada-population-boom-rate-decision

I agree that politicians are also catering to homeowners self-interest. The number of politicians that are multiple home owners is higher than the general population (something like 38%) so I think this is an additional motivation. In other words, they are motivated by both.

A clean, ready to build lot at this location would cost you anywhere from 1.2-1.5+mil, the landscaping, garage and cabinets through the house would cost you more than $300k, so you only valued the entire 3800 sq ft building + landscaping + garage + fence just worth somewhere in between $500-800k or $130-210/sq ft?

13% over three years. Let’s hope interest rates stay at current levels because if they come back down the combination of wage growth and low inventory we could be testing those record high March/April 2022 prices.

Home purchased in James Bay in November for for $900k just re-sold today for $983,500. Pretty much what I am seeing in the marketplace. Prices bottomed out in November and have trickled back up.

I think it may be more important to find a house that suits especially if it works in the long run. I dont have a crystal ball but it is far too easy to be priced out of the RE market by waiting.

I have been on this blog for the last 13 years (Marko even longer), so I know that the above is absolutely true.

B.C. nurses ratify new three-year collective agreement

https://bc.ctvnews.ca/b-c-nurses-ratify-new-three-year-collective-agreement-1.6374985#:~:text=Nurses%20in%20British%20Columbia%20have,practical%20nurses%20in%20the%20province.

There has always been something around the corner that was going to improve conditions for buyers for the last 16 years on HHV but unfortunately it never really seems to materalize.

Reality is long term trend on SFHs in the core will be further deterioation in affordability with an occiasion blip here and there which is pretty much impossible to predict and even if you do hit a down blip the long term trend probably still has prices higher than they were few years ago before the blip.

https://www.theglobeandmail.com/business/commentary/article-canada-housing-crisis-singapore-real-estate/

While we’re applying twisted logic to solve the housing crisis, here’s a few suggestions: Outlaw golf and develop all the land wasted pursuing a small white ball. Ban coffee, tear down all the outlets and build apartments that are property constructed. That will also reduce emissions from all the vehicles lined up in the drive throughs. My life wouldn’t change but some people might put up a fuss.

I was reading in the paper about those that are living in vans as the cost of rentals are overly expensive in the city.

Yet shopping malls are open from 9 to 9 during the day which leaves the parking lots empty over night. If the mall charged $25 a night to park their vans and supplied security for the over night users that might help those in need.

Let’s do the math. 125 stalls at $25 a night over 365 nights that’s $1,140, 625 in additional revenue for the mall owner while the over night users are paying $750 a month for a secured living space.

A small fraction of the total inventory is only listed for sale. Perhaps only one to three percent of the entire stock of housing at any one time is listed. In other words some 97 percent of the housing stock is not listed for sale. If we could reduce demand for existing homes but at the same time encourage demand for new construction that might be the win win situation that we’re trying to achieve. That could be done by increasing the down payment requirement for those buying the older less expensive homes as an investment to say a 50 percent down payment. Fewer investors competing against those wanting to buy their first home should reduce prices for existing homes as investors shift from buying older homes to purchasing new construction where they only have to come up with a much smaller down payment.

Patrick: you need to correct that graph for population. Higher population cities will be more expensive than lower population ones, and density is correlated to population. High density low population cities should be cheaper than low density high population cities.

For what it’s worth, here’s CMHC’s market outlook released today.

Video breakdown:

https://youtu.be/Ej2kbr9baMk

Pdf report:

https://www.cmhc-schl.gc.ca/en/professionals/housing-markets-data-and-research/market-reports/housing-market/housing-market-outlook

Kristan

Don’t give up hope, Spring/Summer market is not when you want to buy. Just wait a bit longer for Sept/Oct onwards will be better. It generally takes 6-8 months per rate hike to be felt in the market (plus BOC might not be finished raising yet).

A house with a suite is a good idea.

If you’re thinking about going this route, it’s a good idea to speak with lenders to see what documentation you’ll need to provide in order for the rental income to be included in the debt service ratios. Some lenders will require you to have a signed lease. This can be tough since it’s next to impossible to show the home you’re buying to prospective tenants before you’re the legal owner. Each lender is different, so get the facts and don’t forget to get pre-approved for a mortgage before house hunting.

When the space is a self-contained suite, fully compliant with municipal zoning (i.e. the suite is legal/permitted), the borrower can use the (projected) rental income added to their own to help qualify for the mortgage. For example, a client could buy a legal 4-plex, occupy one unit and use the rent from the other three added to his own to make the mortgage qualifying debt-to-income ratio work.

However, when the space is a room in your house, or income from a non-permitted (illegal) suite (basement, garage, etc.) that income is generally not allowed to be factored into qualifying as the municipality could force you to shut down your suite (or you don’t/can’t keep a roommate for whatever reason), and there goes the income you were relying on to help pay the mortgage. Doesn’t mean you can’t rent out a space in your property; just means you can’t use the projected income to help you qualify for the mortgage because the income is unreliable from a mortgage lender’s point of view.

To prove the amount of rental income a legal space could generate, lenders often require an independent assessment from a property appraiser. Your mortgage professional would help you coordinate this. If leases are already in place, then those can be used to prove income instead.

Kristan, you think there is less competition for houses with suites? I’m surprised, as I think that is a big factor in terms of some people’s affordability. It is still a hot market, as the one on Vincent that went pending yesterday for 1.3 something 110K or so over asking will attest. I don’t know that I agree conditions have improved in terms of risk either? I do agree most days however that it is depressing!

Kristan,

It’s disappointing to hear that you haven’t found a place yet. I agree that it is a sorry state of affairs when someone in your position finds it hard to secure housing here. For comparison, a family member of mine who is a professor in the mid west US is changing universities and selling/buying a house in the new city, and that process is a piece-of-cake that will be done in a few weeks. Then again, the Midwest isn’t everyone’s first choice of where to live.

Hang in there, we need you in Victoria! it sounds like you’re close and I hope you find something soon.

Kristan, you may want to think of a career change then from government to corporate. If there are only 4 positions a year available in North America it sounds like you are in a very narrow academic field. What would you do if UVIC closed that academic field. Do you have skills that are transferable to private enterprise?

I have a son on the STEM PhD track. Not sure he’ll ever get back to BC. Getting tenure is a major accomplishment so congrats on that!

Hey Totoro:

Thanks! Yeah, we would have gone with fixed, so in terms of effective price things are unchanged for us. Those affordability plots Leo generates really describe our experience well. Things have been basically flat in terms of our reach since March 2022. But absolutely you’re right that conditions have improved in terms of risk, trajectory for future interest rate changes, and especially competition for properties with suites.

The real estate board has yet to update its data system to the current assessments. That may happen in the next month or so when BC Assessment completes it’s final revision after the appeals are completed.

Whatever:

I’m a faculty member at UVic, and therefore employment is basically fixed. There are ~ 4 jobs/year for people like me in North America, with several hundred very competitive and qualified people applying..

Kristan, You are still holding on as are a lot of people. Prices won’t come down until people like yourself say it is worth it to live in Victoria and start to look elsewhere.

The pay may be higher in Victoria, but it’s not what you earn that counts, it’s what you don’t spend. You can earn a high income in Victoria and just tread water or you can move to a different community at a lower pay and build a bank account.

I’m not sure, but we do know that prices are down from last time this year by 10% so you have better entry conditions than previously. Interest rates are higher but maybe you would’ve chosen variable before or maybe when the term of this mortgage comes up you’ll be at a lower rate. In any event the 10% is a real number.

The anecdotes seem to point to a little rebound, but the US economic data is flashing” recession”.

We need Leo’s “sales price to assessment” chart to let us know where things stand in Victoria.

I would be more in favor of a bridge crossing from Vancouver to Nanaimo which would open up the central area of the island, than a metro for Victoria.

I have to admit, it has been depressing watching the market these days. We’ve been waiting on the sidelines on account of low affordability and waiting for pay increases to come into effect (July 2022 increase is supposed to be finally implemented later this month; July 2023 increase will include tenure (!) bump). Even with bad market conditions we were positioned to jump in (with those pay increases) but is it going to get even worse now?

The act of building stimulates demand as more people move to the cities for better paying jobs. When you build housing it is necessary to import more workers and those workers need to find a rental or a home to buy. Greater Victoria is not a large populated area so what would be an insignificant increase in the top ten most populated cities in Canada, will have an effect on prices. Relative to the ten most populated cities we live in a small fish bowl.

Conversely, if or when the positive migration to the area slows or reverses due to say an economic recession, then that would bring prices down. We would experience a reverse trend as the most important age group (20 to 40) are less likely to move here because of the high costs of living, renting or buying. This is the age group that are the biggest consumers of goods and services. As opposed to retirees moving here that survive on a piece of toast a day and don’t add greatly to the local gross domestic product.

The economic pendulum, that brought high prices, swings both ways. The cure for high prices are high prices themselves.

Are you avoiding the question, which was for you to “ name a city that has ceased to have a “functional metro” because of high housing costs”?

Your statement was “ you cannot have a functional metro when people who perform necessary jobs can’t afford to live there, or are unwilling to pay the price to live there.”

Many examples of cities with high prices (and functioning metros) contradict your statement (NYC, London, Sydney, Vancouver) so hopefully you can find at least one with a “non-functioning metro” to support your statement. Or are we supposed to believe that Victoria will be the first one, because of a $3m house on Transit/Oak Bay?

Almost half the population of Hong Kong lives in public housing. Take a good look at that picture.

https://en.wikipedia.org/wiki/Public_housing_in_Hong_Kong

Patrick- Exactly what I’ve thought all along, there are no examples of high density cities having affordable housing, the exact opposite is true. No matter how much land is consumed or how high you build, there will never be enough development to satisfy the endless demand. The only limiting factor is: how much can you afford. I believe the locals want to keep it that way.

Right, but Barrister’s example has said to assume that you’re a Tsar who can all but throw people out of windows to make things happen.

A decision to cut down one tree in the COV cannot be made easily these days let alone buulding a small city. Just the beauracy of the infrastructure such as BC Hydro, sewage, environmental etc., would take a solid 20 to 30 years.

The standard HHV narrative is that the way to improve affordability is to increase density.

There is “inconvenient data” that contradicts that narrative

Namely that… “ There is a strong association between urban density and housing affordability, such that affordability is better where urban densities are lower. There is a positive correlation of +0.858 (1.000 would be perfect correlation).

As you can see, US cities with higher density (LA, SF, SD) are less affordable than lower density cities like (NY, LV, Miami)

And if you look worldwide at least affordable cities (price/rent), we see that the least affordable cities in the world (price/income) are also the cities with very high density. (China, India, Asian cities https://www.numbeo.com/property-investment/rankings.jsp )

A co-relation of 0.82 is very high between higher density and WORSE affordability.

Of course co-relation isn’t causation. But at least we can see that for these cities with high prices, having high density hasn’t stopped them from having the worst affordability in the world. And as their density has increased, their affordability has WORSENED

The point being: Sure, let’s increase density so more people can live here. But let’s not expect that it will make homes more affordable. We just may become more like SF, LA with higher density and even higher prices.

https://www.newgeography.com/content/007221-higher-urban-densities-associated-with-worst-housing-affordability

What are the barriers to a provincial government policy decision to sell off some crown land for development?

I can think of First Nations land claims (a significant barrier, to be sure). Are there others? Could the province otherwise just decide to build infrastructure and sell off unincorporated crown land for development?

This is your theory, and not accepted fact. Can you provide an example of what you’re referring to. By naming a city that has ceased to have a “functional metro” because of high housing costs? Hong Kong has about the highest house prices of any city – yet somehow it has a “functional metro”.

Let me put out a challenge to the smart and creative people here. You are made Tsar of Vancouver island with the mandate to develop at least five small cities of around 60k people that are extremely livable and family friendly for people. As the government what steps would you take to make this happen. (you might be Tsar but you cannot throw people out windows but short of that what is possible)

Looking for blood: Condos nearing completion with mortgage appraisals less than investors paid

Yes it’s a Toronto story, but after all it’s a metro with over 10 times metro Victoria’s population, and Canada’s #1 immigrant destination.

The problem, as has been previously discussed here, is that you cannot have a functional metro when people who perform necessary jobs can’t afford to live there, or are unwilling to pay the price to live there. Every metro requires a diverse workforce, and telling people to live somewhere else if they think it’s too expensive is not going to achieve that.

Agreed.

I like HHVer Warren Blacking’s comment on this point.

https://househuntvictoria.ca/2023/04/11/will-income-gains-fix-affordability/#comment-100532

I agree Marko and the reason people do not move up island more is that we have not built the infrastructure or move jobs to those areas.

In this giant merry-go-round of chaotic information, it seems we need to agree to a common target and then weigh all choices against that.

I would argue that given that the majority of Canadians wish to own their own home, and the majority of those desire a single family home we should start there.

What things make SFH’s cheaper and faster to build? Which things make them more expensive and slower?

Sometimes there is clear sufficient value to pick the more expensive choice(copper vs aluminum wiring). However there are many choices that should be looked at closely because they value does not seem to be present. Is the amount of agriculture produced on the ALR worth protecting in all cases?

Electric car chargers, tree permits, etc

Is there something that prevents immigrants from going to Edmonton (where they are probably more jobs and easier to find a GP)? I know 3x young Croatian couples that came through Saskatchewan’s Immigrant Nominee Program and the minute they obtained their landed immigrant status they quit their jobs and moved to Victoria.

Moose Jaw is less than half the price for real estate, but they opted to move here. There is a reason people pay $3.3 million to be on a small lot in Transit in Oak Bay when they could have 50 acres up island for the same price. There is a reason people pay $800,000 for a studio downtown Toronto when they could have a mansion elsewhere.

If CPI was over-relying on the NHPI (new house price) data in 2022 to “cook” the numbers, they would have OVER-estimated inflation in 2022. Because NHPI rose +3% in 2022 and resale housing prices fell (-7%). Do you really think that the “true” CPI inflation was lower than the reported 6.8% in 2022?

In reality, NHPI is one of the smaller of many inputs into the housing component of the CPI, with the SHS (Survey of Household Spending), OFSI and banks data being much bigger inputs. And the 2021 revision to CPI methodology for weighting of NHPI in mortgage interest (MICI) reduced the NHPI weighting in inputs by more than half. So for years starting with 2021, I would consider this a “small-to-nothing” issue for moving the needle of CPI measurement.

Remember, CPI doesn’t include the purchase of a house, because it is considered an asset, not a consumer good. Once you realize that, you can see why it would be a mistake to include house prices in the CPI. Instead, they include the expenses of owning a house, like mortgage interest, taxes, maintenance etc. That’s why in a year where house prices rise by 25%, inflation might be 2%, because the only component that has risen is the higher mortgage interest being paid by the small % of mortgage payers that have bought in that year. Overall, the average mortgage payer isn’t paying that much more interest, and the mortgage interest component is only 4% weighting of inflation calculation anyway.

I will go against the current wisdom and simply state that you are not going to make housing affordable as long as you have a policy of cramming an ever increasing population (mostly due to immigration) into the same handful of cities. Of coarse all the developers with their tracts of land banks would have a fit along with the owners of rental units as prices fell if new population centers were created. .

Have the province and the Feds move ten thousand jobs out of Victoria and you will see prices a lot more affordable here.

On the other hand, I guess you cam argue that Vancouver with its high density is a model of affordability.

I really think that we have failed the younger generations.

Something is seriously wrong if we can’t build an 11 storey apartment block properly. Add to that $3-4 million homes replacing modest homes in what was a middle class neighbourhood. I don’t foresee affordability returning to several markets in Canada, ever.

I think this is ignoring the elephant in the room, namely that a large majority of voters are property owners and are at best indifferent to housing prices, or worse think that higher prices benefit them. Plus many jobs depend on our outsized RE sector which ironically is not producing enough shelter.

Politicians will cater to whomever they think will get them votes. That many politicians are landlords themselves is just a reflection of the electorate at large, not a problem in itself.

Back when everyone knew who Tim Horton actually was.

A couple more interest rate hikes would not surprise me in the least. Maybe as much as another point before the end of the year. This is not a prediction. Remember I think the Leafs will win the cup every year. (I am old enough to remember when they actual did win)

https://www.ctvnews.ca/business/bank-of-canada-considered-raising-interest-rates-at-its-last-meeting-1.6372371?fbclid=IwAR0EEbSSOqc8HDotpMoo0EjaHqhR3oKlJJZwrpaqjDjpMwBLolDMlXVNOpc&mibextid=Zxz2cZ

Oh oh

Yes, at renewal (for now) is when mortgage holders need to get their amortizations in line. OFSI can change this at any time if they deem risk. IMO these mortgage holders are defaulting on their mortgages and they should have to get the amortizations back in line immediately.

From: https://www.thestar.com/amp/business/2023/04/25/one-third-of-canadian-homeowners-now-have-mortgage-periods-of-more-than-30-years.html

So, in the Federal budget they passed a rule for banks not to trigger these mortgages to renegotiation or higher payments when they hit the limit on the mortgage agreement, this resulting in the debt being added to the back end as an extended amortization to maintain their current monthly payments. The one thing that doesn’t seem clear, which I figure must happen: when the mortgages come due for renewal, they need to be brought into regulatory compliance, right? Meaning the renewed mortgage amortization can’t be greater than 30 years and no more than 80% of the value of the property can actually be mortgaged. Is this being missed? Or was there another rule change I missed? This should still result in a number of renewals with higher payments, needing to bring additional funds for a lump sum payment to get back to 80%, or having to list a property for sale.

Thanks Leo for more confirmation CPI numbers are cooked. No wonder politicians happily pump housing to as high as possible, knowing there will be no need to reflect those costs in wage and pension hikes. Not like they have a conflict of interest or anything.

https://vancouversun.com/opinion/columnists/douglas-todd-many-canadian-politicians-belong-to-the-landlord-class-we-should-question-their-motivations

Thurston:You are right about the 4.7, but again on a really small lot considering the price point. I guess I am not moving to Transit anytime soon.

There’s another new build being finished up on transit listed for 4.7 so 3.3 and 2.9 are not looking too bad

I hear you Barrister…. this is starting to remind me of West Vancouver 4 years ago : Nothing special about this $2.9M asking??

http://www.realtor.ca/real-estate/25456040/1141-oxford-st-victoria-fairfield-west

A new build on Transit in Oak Bay just sold for 3.3 million. 3800 sq feet on a small 6,600 sq ft. lot. The house looks nice but my brain is having trouble at pricing it much more than two million. Comments about me being old and out of touch are not required at this time. It is a nice house but not exactly a luxury mansion on an acre lot.

Vicreanalyst, what am I reconciling the cost data with?

Lenders demand a Cost Approach for proposed construction. But they also want the loan to be set up for draws at different stages of construction.

A plumber or electrician will rough in their work in one stage and then come back and install toilets and light fixtures in the last stage of construction. When you get the builders costs they just have Plumber $75,000. Electrician $50,000. Not a break down for roughed in versus finishing. It’s necessary to review the contractors quote and then redo all of their numbers to set out a schedule for mortgage draws. When you do that, then some costs may look out of place relative to costs you have seen from other builders. Then you call the builder or home owner to ask for an explanation. Home owners building their own home without a contractor tend to not include builder’s profit, so you will have to add builder’s profit into the costs and schedules.

The lender could hire a Quantity Surveyor to estimate detailed costs, but they’ll be charging upwards of $3,000 to do the research into the costs of installing windows, tiles, heat pumps, etc. Lenders are cheap, they pay for nothing.

There are two ways to estimate costs. One is with a detailed break down of materials and labor that’s a quantity survey. The other is the unit in place method. I can look at the builder’s total cost and divide it by the square footage and see if the price per square foot is in line with other projects. If similar houses are being built at $275 a square foot but the supplied costs come in at $175 or $375 then there is a problem.

So when you say reconcile, what you really mean is verifying the supplied costs against the appraiser’s experience. That’s already being done.

Speaking of hedonic NHPI improvements, Rogers just announced that their mobile (cellphone) customers’ smart phones will work anywhere in Canada (for text and 911 messages) starting in 2024, via a partnership with Starlink and Lynk satellites. No upgrade needed, your regular iPhone/android will work. They expect to improve this year by year to add voice/data/internet. When that happens, that’ll probably make places with lousy cell service like a cabin in the wilderness (and many parts of Gordon Head 🙂 ) worth a little more $$, without inflation causing it. https://ca.finance.yahoo.com/news/rogers-records-511-million-profit-133324119.html

Right. And UPS sees the same thing. Volumes down 7% for March . UPS moves an amount equivalent to 6% of the US GDP in its trucks. https://www.cnn.com/2023/04/25/business/ups-earnings-us-economy-slowdown/index.html

Huh.

Re: Average size of new homes in the 2000’s Vs say the 1940’s and 1970-1978. A good percentage of the homes built in the 1930’s and 40’s were around 900 square feet having 2 beds, LR/DR/Kit & one bath. Usually they were built with a full partial underground basement and they were considered a “bungalow”. Even though realtors will now advertise this house as a 1800 square foot home because the mostly low ceiling lower level is now finished. The BC assessment will still say 900 square ft home with a 900 square ft finished basement.

Most of the newly built 1970’s homes such as the ones in the Gordon Head area were around 1150-1250 square feet having 3 beds/LR/DRj/Kit and 1-1/2 baths. They were termed as bi-level homes. The assessments for these homes are still reported as 1200 square foot home with mostly now a finished “basement”. So those homes historically will be reported as being 1150 square foot homes. Realtors will be selling them as 2000 square foot homes. The thing is, those “basements” aren’t really that as the homes were built on a cement slab above the ground and so in turn, a ground level entry.

Most of the 2000 to 2023 newly built homes have the same ground entry or near ground entry but are no longer considered having a basement by the builder, the realtor or BC assessment. So now, because everything is finished by usually having the ground level as the main floor and the upper level(s) having the bedroom quarters.

So historically those newly built homes will be reported as having 2400 sq. ft. vs the 1974 newly built as 1150 sq ft.

There are more houses that are 40 years old than ones that aren’t.

This is the main problem I see. As Patrick pointed out, houses certainly have gotten much nicer in 40 years, in terms of all measures we could quantify: square footage, number of electric outlets, number (and quality) of windows and doors, bathrooms and plumbing fixtures, energy efficiency, telecom connections, and things that are harder to quantify like safety and sound-proofness, etc. I don’t know if it’s 5 times, but it’s probably 2-3 times at least. This has to account for a significant amount of the cost; but probably not all.

Including the GST is a problem as it isn’t the same for all housing. Depending on the price or if the sale is for home occupation or investment the GST can be either net GST or full GST. For consistency in the data the better way is not to include the GST.

The local chapter of the Appraisal Institute used to put on a dinner seminar called the “Guinea Pig House”. A sample of three building styles with building specifications were sent to three contractors and they would provide their cost estimates on those three homes. The cost estimates that they provided on the same home were not that close to each other. A lot of the problem was how each contractor interpreted the questionnaire, plans, and specifications.

I have seen the questionnaire that the NPI provided years ago. One of the issues that I remember from the questionnaire was they wanted the cost of brick construction. We don’t build homes with brick construction on the west coast. If you want a brick house built then you should be buying a home 3,000 kilometers east of here. The examples that they gave, just didn’t apply to the west coast. A builder filling out the questionnaire would have trouble interpreting what the NPI was asking.

There are companies that do provide this information for a fee. The one that comes to mind is Marshal Swift. They provide construction costs for insurance purposes. But the user still has to apply an economic conditions factor to the data. A factor that the user has to determine for their geographical area, and various builder’s profit.

When I’m doing new construction, I get the plans and an itemized construction costs to build. The problem is how they are itemized and what the builder has included. Sometimes they include the cost to demolish a home, blasting, tree removal and other site preparation. Those costs have to be taken out as the assumption is that the lot is vacant and ready to build on with site services at the lot line. It sounds really simple to determine construction costs, but in reality it is difficult as most infill homes are site specific and cost plus jobs while homes in new subdivisions are usually built on speculation to sell later and there is an economy of scale as the contractor is building several homes at the same time in the same subdivision.

Stuff like that happens all the time in the private sector, you just don’t hear about it until it gets bad enough to warrant news coverage.

The US doesn’t use sale prices at all. They use owner equivalent rent, i.e. what the household would have to pay if they rented the same dwelling. The rationale is that CPI is supposed to measure the cost of consumption, i.e. use of the dwelling, and that’s rental value. Ownership expenses are considered to be carrying costs of an investment, not consumption.

Keep in mind there there is no “true” value of inflation, just individual costs incorporated into an index based on some methodology.

Also Canada does not include land costs in CPI because land is not consumed. Nor are sale prices per se included. However ongoing ownership costs, including structure replacement which is a measure of depreciation, are included.

https://www.bls.gov/cpi/factsheets/owners-equivalent-rent-and-rent.htm

Introvert a good read , shipping has in the past been a great indicator of where an economy is going I didn’t mind the last 2 recessions myself

Some dark clouds starting to form in the distance?

CN says rail traffic shows recession has already started

https://financialpost.com/transportation/rail/cn-rail-traffic-drop-signals-canada-in-recession

I wonder why they don’t use the GST amount reported to Canada on new home sales to accurately calculate the selling prices of new homes as part of their data set?

A good (not ”great”) article. I don’t agree with your headline assessment of the NHPI as “garbage”. For the following reasons:

— It is not advertised as a measure of house prices as seen by MLS median sale prices. Yet you put it on a chart labelled “measures of Victoria house prices”

— it is specifically understood to be measuring contractor sale prices of new houses by large developers in new subdivisions. These are typically on the outskirts of cities. As you’ve pointed out, in some cities that has been close to average mls price changes, in others (Victoria) it hasn’t.

—- hedonic price adjustments. Most countries in the world use a hedonic house price index for use in measures of inflation. NHPI has this too. This means to adjust prices for “ square footage, land area, age, bedrooms, bathrooms, garage, swimming pool, fireplace, and air conditioning”

Let’s just use one of those, square footage of new SFH homes. They have risen by 2.5X in USA and 2X in Canada. Many countries in the world list house prices by price per square meter.

The index itself isn’t “garbage”. Using it as a comparative measure of overall house prices (as you did in your chart) could be described as an “unfair” comparison, because they are measuring different things.

====———-

Here is square footage of new houses in USA and Canada. That’s just one hedonic measurement, there are lots of others (appliances, fireplace, air conditioning, better energy usage etc.)

‘Tear it down’: Langford building empties, but questions about safety, permits remain

https://www.timescolonist.com/local-news/tear-it-down-langford-building-empties-but-questions-about-safety-permits-remain-6908838

Great work, Leo.

I know a lot of people have complained that Canada’s official inflation numbers are invalid due to inaccurate assessments of how housing prices affect inflation, but I haven’t seen anyone dig into the flaws in this way before.

It’s particularly remarkable how the differentials between the nHPI and Teranet are largest in the markets with the largest effect of land price appreciation (some would call them the biggest housing bubbles) and the worst affordability in the country.

It strikes me as a major problem if Stats Can is creating national data that ignores or smoothed out the problems in the places most affected by Canada’s housing crisis, particularly if it’s possible that policy makers and the BOC are using this data to guide their actions.

Honestly, if you don’t get a valid response from Stats Canada, have you thought about republishing this analysis more widely? Definitely we need to see more coverage in the broader media of the questionable metrics being used by our official government agencies if they really aren’t acting to address flaws like this one.