The new listings puzzle

Ever since the peak of the market one year ago I’ve been tracking new listings levels very closely. At first it was to see if the rapid rise in rates and drop in prices would motivate a flood of new listings like what happened in 1981, then in the fall to monitor whether there was any sign of owner distress from trigger rates. Neither of those came to pass, with new listings coming in at only moderately higher than the year ago rate in the second half of 2022. Despite all time high prices, affordability did not match the catastrophic levels of 1981, and owners were able to keep their cool during the decline. At the same time banks didn’t force higher payments on most of their variable mortgage holders, instead opting to kick the can down the road with longer amortizations.

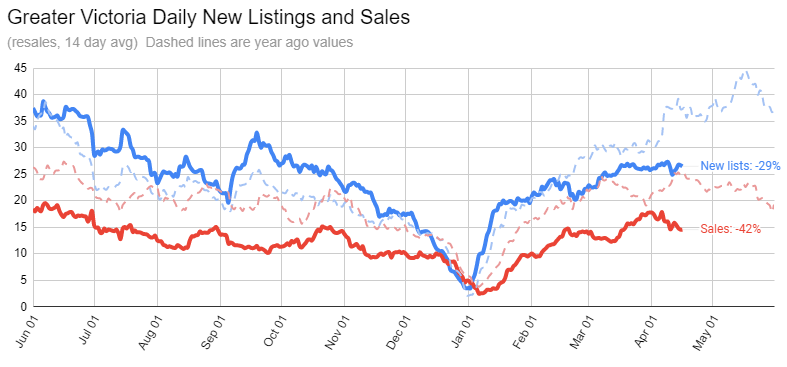

Instead of increasing, new listings started to falter late last year, first falling to roughly the year ago level, and then further in February, landing around 15-20% lower. That continued last week, with a distinct failure of new listings to match the jump this week last year, while sales also remained suppressed.

| April 2023 |

Apr

2022

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 159 | 286 | 824 | ||

| New Listings | 304 | 539 | 1368 | ||

| Active Listings | 2013 | 2046 | 1365 | ||

| Sales to New Listings | 52% | 53% | 60% | ||

| Sales YoY Change | -36% | -33% | -26% | ||

| New Lists YoY Change | -30% | -17% | -10% | ||

| Inventory YoY Change | +71% | +71% | -6% | ||

| Months of Inventory | 1.7 | ||||

There’s no shortage of explanations for this if you ask people about why new listings are down.

- Prices are down from peak and sellers are reluctant to sell for less than they could have gotten a year ago.

- Seller have been conditioned to only sell in extreme sellers market, an active or balanced market is not enough.

- Affordability is bad and people can’t afford to upgrade and take on higher payments.

- Inventory is low and sellers are waiting for something to buy before they sell

- Investors bailed out earlier and now there’s fewer left, so less listings from investors

- The rental market is strong so people are choosing to rent out properties instead of selling them.

At first glance, those all sound very reasonable. Loss aversion and anchoring are powerful biases, even if not entirely logical. If you are selling to upgrade, it’s a lot better to do that now than in the frantic low-rate, low inventory mania we had before, and you’ll pay less on the differential as well. And though rents are up, when set against an increase in carrying costs it’s a tossup whether that has improved or worsened rental returns.

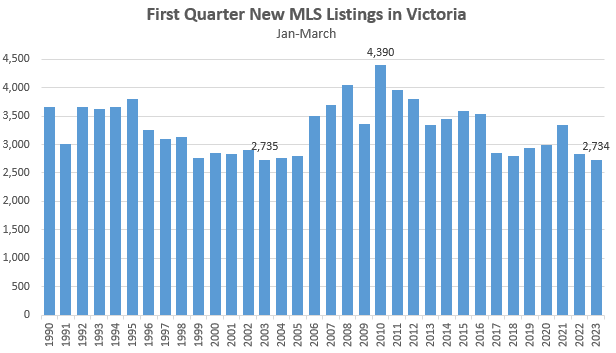

The fundamental problem is that none of those reasons hold up to a lot of scrutiny. New listings were higher in the fall despite a weaker market, which throws a wrench into the idea that sellers are holding out for higher prices, or more affordability, or better selection. And if we look back further, it falls apart even more. There were fewer new listings in the first quarter of 2023 than in any year since 1990.

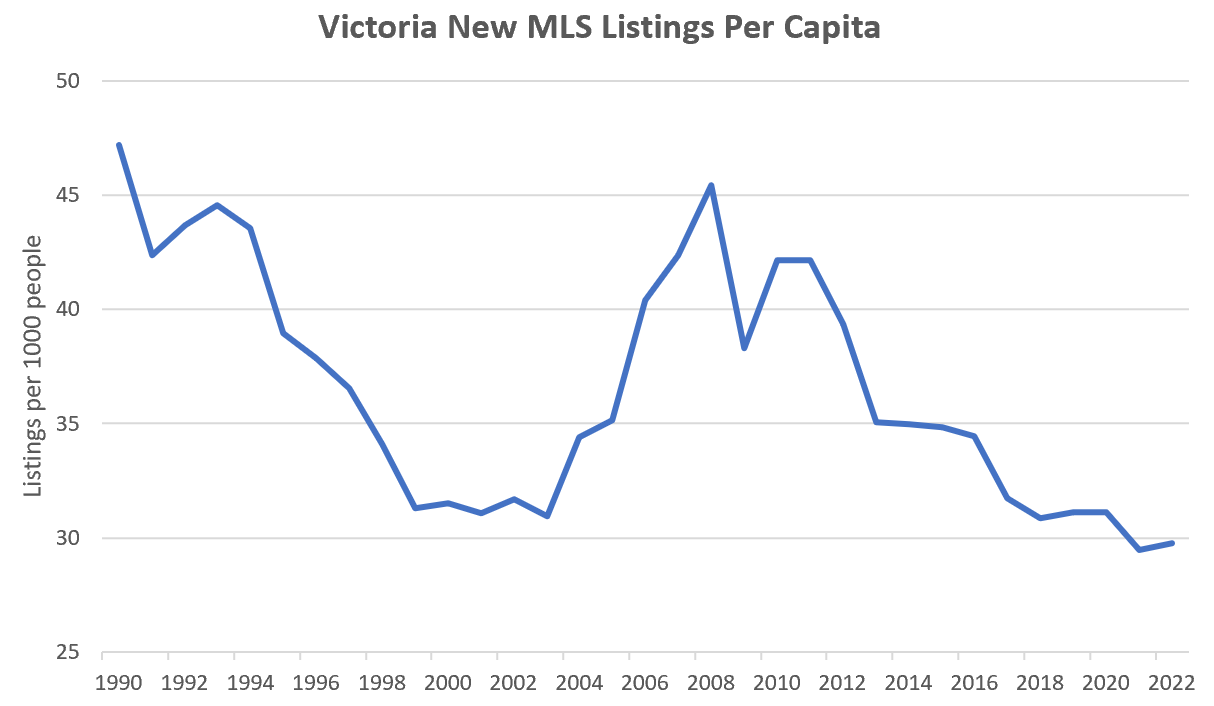

We should expect new listings to increase as both the housing stock and the population grows over time. After all the number of dwellings in Victoria grew by 50,000 from 1991 to 2021, surely we should expect more of them to hit the market every year given the ownership rate is up since then, and about 83% of property transfers happen on MLS.

But new listings are not increasing, and in fact adjusting the full year of new listings for population, 2021 and 2022 were the slowest two years on record.

It doesn’t seem like new listings are random, but it also doesn’t match with any aspect of the market. In 2021 the market was red hot, affordability was poor, and listings were at all time lows. In 2022 the market turned over, but affordability was worse, and listings were still very low. The last time new listings were this low the market was the exact opposite. At the turn of the century affordability was excellent and the market was slow, just starting to heat up in the early 2000s. Also no rate shock or COVID back then, but new listings were similarly sluggish. Meanwhile in 2007, affordability was poor like it is now and we were at the tail end of a large runup in prices, but new listings were very healthy. In 2013 the market was in a slow buyers market with plenty of inventory, and yet new listings were middle of the road. The market in the early 90s swung wildly, but new listings were on a pretty steady downward slide from the start to the end of the decade. If there’s a connection to the market, I’m not seeing it.

So what’s the theory of new listings? Is it actually random and I’m just finding patterns in the noise, or is there some reason why new listings seem to be on a 20 year cycle? Perhaps something to do with demographics?

What are your thoughts? A case of beer to anyone with a workable theory.

New post: https://househuntvictoria.ca/2023/04/25/the-garbage-new-home-price-index/

The homes under duress circumstances will be spread out. However, if the number of listings remains low then the percentage of homes under duress, relative to total listings, will be greater.

Low listings make the marketplace less predictable and riskier.

One could look back over the last five years to see when the volume of sales were highest. Typically that is the Spring market, that’s when a lot of mortgages will come up for renewal. We are now one year out from the peak market.

When the mortgage term comes up for renewal then people have to renew at the new rate. It spreads out the number of forced sales over a longer period of time.

I suspect it is mostly a matter of stabilizing the market. This is going to take a few years to play out and may involve a couple more rate hikes.

Assuming that they were accredited professional engineers in good standing with their professional body and have insurance.

Definitely. And it doesn’t look like rates are coming down this year at least to unwind that. Gonna be interesting

As Leo said, the engineers are responsible. The building inspectors are not permitted to do inspections (see the building bylaw under “complex buildings”). They do however collect documents (Letters of Assurance) from the engineers that state the engineers are responsible and further, that they are fully insured in case something like this happens. This is part of the building permit process. The engineer’s insurers should be the ones stepping up and helping the displaced tenants, not the City of Langford taxpayers.

Is it just me or does everyone feel that banks/government are introducing a lot of moral hazard by kicking the can down the road and allowing these ridiculous amortization periods. This is very frustrating for those of us who wanted to see the free market (not social engineering and market control) dictate prices

The engineers are responsible, simple as that

Who do the engineers report to? What are they signing off on? Why is this building so poorly constructed? How many more buildings are going to be uninhabitable? Who is responsible to find the answers to these questions? In other words, where does the buck stop. Who issued the permits, aren’t they ultimately responsible?

The “inspectors”. If you mean the City, then you have jumped to a conclusion that the City inspects multi-family properties. Why would the city have to hire qualified inspectors for multi-family housing when there are professional engineers that do this already?

How many times have I heard, on this blog, how government workers get in the way of building and slow down the process of approvals? To the best of my knowledge, city inspectors stopped inspecting multi-family when the “leaky condo” syndrome occurred and now the cities rely on professional engineers to do their job.

Are you now advocating for more government workers that will slow down the process?

What about the inspectors? Do they not have a certain amount of responsibility?

I think it cost two structural engineers on the project their accreditation.

Regarding the apartment complex in Langford, where was all the inspections and quality control measures while it was being built? With all the red tape involved, shouldn’t new construction projects be properly built. Has the developer built other apartments in the area and are those garbage also? Sounds like a lot of shady business to me. I’d expect this in other parts of the world, not here.

Nothing wrong with saving 81%!

Impressive. Not a project I’d be keen to tackle myself.

Leo u also could have also ordered small batch concrete But if u don’t have enough bodies they don’t like to wait

The Centurion Apartment Real Estate Investment Trust (“REIT”) invests in a diversified portfolio of rental apartments and student housing properties, as well as mortgage and equity investments in property developments, across Canada and the United States and participates in the profits derived from them. With that mandate, the REIT always looks for opportunities using strict due diligence to ensure investments are responsible and beneficial for its investors. We concentrate on communities with historically low vacancy rates, growing population demographics, and opportunities to improve rent levels.

Spent about $1300 (rented excavator + concrete + forms) compared to two quotes both at $7k.

The 90 unit apartment high rise was built in 2018/2019

How old is the building? Looked it up- 2018. Not good.

Langford has revoked the occupancy permit for a troubled apartment building – formerly known as Danbrook One – over safety concerns, the city announced, adding that residents were to vacate their homes immediately.

The rental building located at 2770 Claude Rd. – renamed as RidgeView Place – is owned by Centurion Apartment Properties Inc. and had the permit revoked “due to ongoing life safety concerns related to the structural design and performance of the building,” the city said in a news release.

Tesla raises and drops prices at a whim, but this is exciting nonetheless:

Love this reply: “The NIMBYs still won even when they YIMBY’d.”

Thread:

https://twitter.com/j_mcelroy/status/1650667882366509056

Oh geez. How much money did you save by DIY?

Will do, new post tonight, was just busy over the weekend with other things.

Having mixed and poured 75 bags of concrete for a new walkway I’m really glad to have a desk job.

@LeoS Could I trouble you for an updated sale / list price chart for detached? Please and thank you.

Hmm seems to me banks are partly too blame for low inventory Pretty sure banks didn’t throw homeowners a life line in the 80s or the 90s

https://www.theglobeandmail.com/business/article-canada-mortgage-insurers-homeowners/

Yes, fine now.

fwiw, I thought the typo’d handle “Bar Rester” was good too 🙂

See how this works

Thanks lets see if this works. Fantastic, thanks for the help.

The new lists are disappointing, but the monthly sales drop levelling off seems to be coming as expected as the declining months from last year become the comparison point for this year’s data. It will be interesting to see if the market just stagnates along with people just jumping on the few desirable listings that pop on the market. Curious to see where this goes, will the escalated interest rates start having a bigger affect now that it’s at the one year out point (that is said to be where the actual impact will happen) or will it be what is being reported in the news that the rate pause was the cue to kick off the next escalation frenzy? A further market decline or a big take off will be tough with nothing to buy.

Barrister…when you go on to make a comment, just below that box you will see a “person” icon. Your name will probably be “Barrester” . Click on that to erase and then change the name to “Barrister”.

I had some computer issues and had to change the handle. I messed something up no doubt. Still a nice Monday outside.

Listings drought really starting to hit.

Sales; 466 (down 24%)

New lists: 799 (down 22%)

Inventory: 2054 (up 57%)

You spelled your name wrong, Barrister.

Canada has a housing problem and it’s not the one people think.

From: https://financialpost.com/news/economy/canadian-home-prices-dragging-economic-growth

Does the car battery thing have anything to do with housing in Victoria?

Nowhere as much as spending needless money to prop up a dying auto industry, because many believe that the car culture is going away.

Currently, we are having a shortage of workers instead of a shortage of jobs.

Thank you for your mindless diatribe, but why shouldn’t we let the free market determine the direction of an industry/company instead of wasting money?

Take the TMX pipeline, Site C dam, Bombardier C Series, Canada telcos, automobile industry, and lumber industry that hasn’t produced positive results or survived after endless amount of bailouts.

What happened to a dying industry after a decade of meeting targets for incentives?

Do we shell out more cash to prop it up again and again?

Yes, it’s a big positive for Canada and the auto-industry in general. As pointed out, the subsidies only happen if targets are met. Two thumbs up from me for Trudeau on this one.

Leo, I don’t understand why you have to rain on the parade of mindless, knee-jerk outrage with your details and nuance. People don’t need nuance. They need more reasons to stand in their driveways wearing a soiled bathrobe and screaming at golden retrievers about the deep state.

Getting back to actual housing, there seems to be a small pickup in sales in the 2mil to 4mil mark in the last couple of days. What are you seeing on the ground?

There’s way more to it than that. Reality is the US IRA structured incentives in such a way that if Canada doesn’t essentially match them we can kiss our auto industry goodbye. Wonder how much flak the government would get (by the same folks) when those jobs disappear? The deal is structured in a way that the incentives are contingent on the US continuing to offer incentives. If they stop, we stop. Subsidies are paid out only if milestones are hit.

.

Even with subsidies it’s a big net positive, the interview with Flavio here is pretty good and explains how it’s structured

https://www.ctvnews.ca/video?clipId=2664516&playlistId=1.6366571&binId=1.810401&playlistPageNum=1

Seems to be given the units already exist, but I’m not sure who would enforce it exactly

QT- Won’t the government be surprised when they see 1000 robots instead of 3000 people working in the plant. I can see a multitude of potential health hazards working with toxic chemicals, even with strict precautions. Kiss more farmland goodbye and say hello to another toxic waste site.

Marko- My point exactly, why waste years of paying interest or loss of interest income to build when an investor can buy existing units and receive instant revenue. I had a .4 acre lot in Langford with a shack on it that I dreamt of developing. Paid $130,000 for it in 2002 so the land was basically free. Didn’t want to deal with contractors, time delays, unexpected costs, etc… Sold it in 2017 and bought a prime commercial building in Winnipeg for almost half what I sold it for. Waiting 4 years to finish a project is insanity, that’s how people lose a lot of money, too many variables over that length of time.

I don’t hate electric cars, but I hate ecoquacks that rip off the taxpayers and the poor.

If 13.7 billion to buy 3000 jobs in Ontario is true, then we must throw the crooks and the mouthpiece leaders behind bars because we are paying $4,566,666 to buy a direct BEV job. Even if we added indirect jobs, a possibility of 30,000, then it still works out to be $415,151 per job for 33,000 people.

https://globalnews.ca/news/9641259/volkswagen-ev-plant-canada-ontario/

There would be no requirement to have sole ownership in any event, but unless there is legal separate title it would be coownership with a right to say, Unit 1 which is harder to sell.

I don’t see how separate legal title is registered for missing middle houeplex units, but there is a reference to separately titled affordable home ownership units which are apparently permitted in a houseplex and must be sold for less than 10% of market. Hard to know what is what.

Prohibited, but is it enforceable?

Yeah worked great, they are now working on phase 2 which when we talked to one of their planners about a year ago he said it would apply to about 6000 lots. Haven’t gotten an update on where that stands, but I will ask.

Good question. There are strata titled rentals available that can be sold off individually.

No, this would be prohibited. I recently posted a building that is rentals only despite being strata titled.

Is there a requirement that all dwelling units be owned by one person or corporation? That is, could the units be strata titled and sold separately to different investors?

If so, could an owner just move in to their unit when it happens to be vacant?

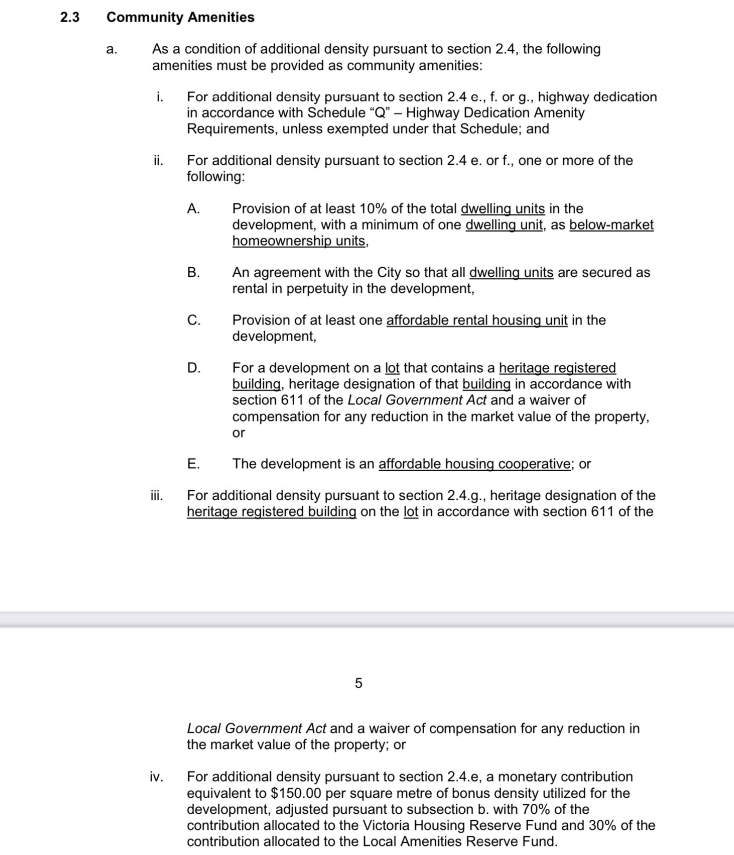

My understanding is that the zoning has been changed as set out in the Zoning Regulation Bylaw and section 2.3.a.II.A of Schedule P seems to contemplate a requirement for additional affordable home ownership units in houseplexes in some situations. It is not at all clear.

anyone know what 2331 pacific sold for? thanks

It’s an important to understand the difference between a house with four permitted suites and what may look like the identical home but with four separately titled units.

Both may look identical, but they won’t be in price.

My understanding so far. is that Victoria is allowing the former and not the later. The zoning for the land is not going to change just the permitted uses.

Wow, that is actually a really good idea. Slap five exterior design options to the same pre-approved plans so you have a bit of variety in terms of curb appeal and let them build.

We aren’t, but the current policy is too restrictive.

Kelowna upzoned for missing middle quadplexes. 800 lots and there were a couple template quadplex designs that were preapproved and people could just go straight to building permit. Total revolution for small builders that previously could only build single family. 300 building permits in 5 years.

Agreed, but I look at super weird things as I’ve brought up before on HHV. I have a section for the make and model of car they drive. Mazda3 hatchback, automatically renting it to them. Dodge Ram 1500, automatically shredding it. 2500 diesel I’ll take a closer look 🙂

I do some business in Croatia as well and you have to really know your market. Peugeot 207 automatic rent. BMW 3/4/5 series M or M-sport package automatic shred (what the stereotypical Dodge Ram 1500 driver drives in Croatia believe it or not).

I actually think the opposite. You’ll need some prime locations like Fairfield and James Bay to pencil out a profitable spec build. When it comes to selling it has some major drawbacks (number of units won’t have parking, no elevator to third floor, etc.)

I am looking to do a sixplex personally (will do a YouTube series on it) but I missed the boat on the land aquisition back in November when there were some deals to be had. Prices are back up again so waiting for the right opportunity. Rough numbers would be 800k to 1000k for the land and then 1.5 to 1.7 million to build so let’s say $2.5 million all in. Timewise I am being realistic, two years for building permit (yes two years) and then another 18 months to build so 4 years give or take.

Not rushing into it whatsoever. For example, right now I have a pre-sale contract to complete later this year on a 600 sq.ft. one bedroom at Dockside by Bosa for $559,900. That means I can buy almost 5 luxury condos for the projected cost of the sixplex with a stroke of a pen and zero aggregation and risk.

My primary motivation is design as I would like a very very specific approach minimizing maintenance and headaches with tenants. No elevator, built on slab with surface parking, no common areas (6 exterior entrances for the 6 units), bulletproof exterior envelope with large overhangs, slide in appliances (hate the built in crap condos are doing), EV charging so I can take all of Frank’s tenants, etc. I’ve pencilled out a long list.

Frank to build 5 units and rent really doesn’t make a whole lot of sense But to build 5 strata units to sell would work

Still a commercial loan where the market value has to be in excess of the loan. Additional bank charges, legal, and appraisal fees apply that are in excess of a residential mortgage.

The current rents are a lot higher than the rent restrictions allow, so you are not going to find a legal five plex in Greater Victoria that cheap unless it is in need of extensive and expensive renovations. If you can find one at all. There are very few of them that come up for sale. There is one at 1157 Princess listed at $2,300,000 but its over 100 years old. The average rent for a one-bedroom in Victoria is around $1,750 per month so I would guestimate this 5 suiter is bringing in over $7,500 a month (including the illegal studio) as it is. Which is above the median income qualification for Victoria.

The other option is to build a new five plex, but that is going to be more expensive than buying a 100 year old conversion, which means you will need to get even higher rents than the average to service the debt, taxes, and other costs attributable to the operation. The cost of acquiring a lot and demolishing the old improvements is going to be close to a million itself. Then another 1.5 to 2.0 million in construction costs to build five suites. But now you have a limitation on the rents you can charge!

How fast do you want to go broke?

> Bank of Canada interest rate pause could force landlords to sell properties: experts

From: https://www.ctvnews.ca/business/bank-of-canada-interest-rate-pause-could-force-landlords-to-sell-properties-experts-1.6366788

I guess there’s a lobby already hunting for rate cuts, but I keep seeing news reports about all the activity and the market about to take off (that was a Global BC report that compared March 2023 numbers to December 2022…lol..)

https://globalnews.ca/video/rd/9028b12e-df1b-11ed-af15-0242ac110006/?jwsource=cl

Who would of guessed that sales are better in March than in December?

Has anyone crunched the numbers on acquiring the land, building costs of a 4 or 6 plex, legal and permit fees, financing, and length of time to completion? What is your return on investment? It will take years to complete and who can predict the market? What type of individual is capable of such a project? Not many, other than a large developer who probably has crunched the numbers and realized that it isn’t worth their time. They are focused on larger projects. Are there any in the works? Or are we chasing unicorns.

The new CMHC MLI select program for multi-family five and above removes, imo, all barriers in the difference between res and comm CMHC insurance and probably mortgage rates too given that you can get a 50 year amortization and up to 95% loans if you meet the eligibility criteria.

Something that no one on this blog has been considering on these house complexes is their resale value. When it comes to building four self contained suites versus five self contained suites you should contact your lender to verify if the project will fall under a residential mortgage. Generally four self-contained suites is the maximum under a residential mortgage. After that then the project is a commercial loan.

That makes qualifying for a mortgage more difficult and expensive for a future buyer and consequently limits the pool of prospective buyers.

On a price per unit basis, a rental unit will receive significantly less in the market place than the the equivalent size strata unit which can be sold separately. Since rental units are bought on their income producing potential, If there are restrictions on the amount of rent that can be charged that’s likely to be a deal killer for most projects as the capitalized net income, in most cases, will likely fall short of the cost to build plus land value.

The re-sale market for multi-plex rental houses is a lot smaller than for a single family unit as there are fewer prospective buyers. In my opinion, these house plexes would likely be a boutique market. Build too many and that may saturate that segment of the market place. The market value of these rental house plexes are not going to be in the range of first time buyers as they will be priced in the area of 2.5 million dollars and not that attractive to a middle income household that have a restriction to live in one of them as the home owner’s unit will likely be small in order to squeeze the other 3 or 4 units into the building envelope given the height, floor space ratio and site coverage restrictions. The majority of lots that fall under the middle middle initiative will be on lots in the 5,000 to 6,000 square foot range. When I try to envision the house that would be built under these regulations in order maximize the floor area while minimizing costs, I come up with an elongated cube shaped building which brings back the memories of the Vancouver Special. These plexes will likely be easily recognized and probably not vary much in style and have little in ornamentation. Basically the most cost effective optimum floor plan repeated over and over again by builders.

No one has a crystal ball. This is just my opinion based on a cursory reading of the restrictions imposed. I have no idea how the province or city will be able to enforce any of these restrictions or if they would try. As some of the restrictions sound as enforceable as the helmut, anti-idling, and illegal suite laws that we have now.

Curious to see what the first one will look like as it may set the standard of dozens or hundreds of others to come. Obviously, I am not a fan of this type of infill housing. I would prefer a comprehensive neighborhood re-development plan to assemble lots into town house complexes. But there is only so much private enterprise can do without direct government intervention such as eminent domain or large subsidies. So we are left with this band-aid type of solution.

Yeah I feel like there’s a ton of theories about how the pandemic reduced listings, but at least in Victoria it’s hardly a blip. New listings have changed a lot more in non pandemic years

So smart!

We did this too, for our first tenancy. I think it does what it’s supposed to do.

Perks of being in the 1%!

Agreed.

When you think about it, it’s wild that an important business decision such as this can rely so heavily on instinct/intuition.

Yes. And that’s why, back when we were in this ‘business’ of renting, our rental application always asked for the current landlord contact AND the one before the current one. Always talk to the one before, they tell you more of the real deal I think.

Actually, we found our rental application form was one of the most useful components of the process, it went into quite a bit of detail. Maybe a bit over-the-top, but it did let people know that we were going to be paying attention and helped weed people out who weren’t prepared for that.

Interesting perspective, not sure what to make of it. I feel like new listings have been trending down for a long time including before covid especially when you adjust for population growth.

Everything is incredibly complicated with the COV and then they claim to be understaffed as a result of bringing in their own non-sense. A lot of the time the staff don’t understand their own policies.

I am still trying to get back a compliance deposit on a SFH build a year after occupancy has been obtained. They take literally months to answer emails, forget to do what they say they will, etc.

If you saw what goes on first hand you would understand why I am so bullish on real estate long term. Politics (rezoning) is one thing, but red tape beuracracy is a totally different animal. I just don’t see good historical examples of red tape ever being substantially reduced.

Even though some companies are cutting down on remote work compared to during Covid, remote work is still way up over what it was 5 years ago.

I think increase in remote work opportunities could be contributing to new listings reduction and ability to stay in current dwelling longer. If there is less pressure to move for work, people may be staying put longer.

I have been working remote since before Covid and in the past I would have had to move outside of Victoria to have more opportunity to work in the position I currently have. Also, lots of companies are now offering hybrid remote work opportunities (3 days in the office seems to be the compromise a lot of companies are settling on). This might also be reducing pressure on people feeling the need to move to reduce their commute times.

Definitely. I would also say when you have a bunch of people reading this and coming to different conclusions (I talked to some builders and a couple councillors and everyone had a slightly different interpretation), the bylaw is way too complicated

Leo, it could be and would make more sense.

Reading the zoning bylaw regulation now I also think that if a houseplex falls under the s.3 siting/floor space requirements then section 2.3 may not apply at all, and no contribution or affordable housing might be necessary. I initially read this as a requirement for all additional density without seeing that 2.4 that might permit even greater density for a houseplex than contemplated in section 3 (mostly because I don’t understand floor space calculation significance I think) and therefore be subject to 2.3 only in this case.

If it is generally easy to meet the section 3 requirements without asking for additional density then maybe section 2 will not be used very often and owners who are interested can simply comply with section 3 and all of the following:

i. at least one adaptable dwelling unit that is not a secondary dwelling unit;

ii. at least one secondary dwelling unit, except where all dwelling units are secured as rental in perpetuity; and

iii. the greater of two dwelling units or 30% of the total dwelling units are three-bedroom dwelling units, at a minimum.

I would say both the bylaw and the application form could be much clearer.

I try to do as much as I can when there is a few days in-between tenants in terms of fixing up/freshening up the unit. I made a video about it recently and how it relates to the broken windows theory I learned @ UVIC – https://www.youtube.com/watch?v=h8t0eNvhP3o&t=26s

I’ve definitively had tenants damage things beyond normal wear and tear, but nothing too too crazy (chipped junks of flooring, etc). I’ve also always given back the damage deposit and given the best references to the worst tenants I’ve had just so they would leave in peace 🙂 If you have a bad tenant that is looking for a new place, as the landlord, what is your incentive to give a bad reference?

That is why I don’t trust references.

“’ve spent tens of thousands of dollars on my properties: 2 new roofs in 2 years- +$20,000, new 3 piece second bathroom- $15,000 this year, in 2008 I put $30,000 of improvements in one place, new natural gas furnace- $5000, a multitude of appliances and on and on. I have never had willful damage done to any property just necessary upgrades. A pittance compared to the appreciation over the years.

Not sure if your complaining about your tenants using the roof over their heads to stay dry and warm as a nuisance to you but I was talking about deliberate damage and I have just as many receipts but also recognize the appreciation. Although you won’t realize that until you sell and based on the years you just quoted sounds like you should sell and enjoy the windfall Frank 🙂

“It’s just a deposit. You can go through the tenancy branch for more if it’s required. It’s not like you can just take the deposit anyway without permission from the tenant.”

Spoken like someone that thinks the system currently works.I would welcome general wear and tear and have laughed at the amateur repairs in drywall that’s clearly damaged beyond a Home Depot patch kit and fixed it myself with no follow up with previous tenants. Also The RTB process is broken . And fyi There’s a Facebook group for tenants and they share ways to f%#k over landlords. I have a screenshot on an old phone and one was recently shared in the landlord bc page, some here may have seen it. I’m not trying to demonize rentals or tenants I’m just saying there’s a lot of animosity out there

Had a landlord try to claim the damage deposit for their need to replace a 14 year old hot water tank and for the sun damage on the 30 year old drapes. Sent a very courteous letter to them referenceing the appropriate sections of the tenancy act to which they responded with a screaming and swearing phone call. On the move out day, they showed up with big frowns and the entire deposit (they didn’t care for the reference about what they are required to do if they didn’t return the deposit in it’s entirety). From that point on, I have only dealt with professional property managers and have avoided private landlords and Scots.

Totoro, Reading the missing middle info again, I think it is an OR item, but only for houseplexes. Note the OR at the end of 2.3.a.ii, and 2.3.a.iii.

So if you are building a houseplex you can choose to pay the fee instead of doing the onsite affordability/rental. if you are doing a townhouse, you need one of the items under 2.3.a.ii

Ughhh I am pretty sure you can’t claim on normal wear and tear, it’s a very grey area and not worth the effort in my experience.

This made me laugh so hard, Leo. 🙂

Over the years, our tenant did us many favours and we were friends, so we didn’t pursue it beyond the full damage deposit.

All parties agreed on the damage; and I bet, had we asked our tenant for more, our tenant would have graciously complied, but in the end we decided to just eat it.

Tenants do cause wear and tear and occasional damage. Just like owners do. There are quite a few landlords who experience significant negligent and sometimes deliberate damage. You can control for a lot of that with vetting applicants well, having a well–maintained place and inspecting annually or so informally while carrying out repairs.

The different anecdotal stories or “anecdata” are such small sample sizes they are not representative, but serious damage can be high impact. Good to put a lot of effort into prevention and maintenance.

From dust we came, and to dust our rental properties shall return.

So your property manager during regular inspection noticed that the rental property had normal wear and tear damage and then he/she threatened the tenants with eviction if they didn’t fix it out of pocket? Is that the story you’re trying to convey?

I’ve spent tens of thousands of dollars on my properties: 2 new roofs in 2 years- +$20,000, new 3 piece second bathroom- $15,000 this year, in 2008 I put $30,000 of improvements in one place, new natural gas furnace- $5000, a multitude of appliances and on and on. I have never had willful damage done to any property just necessary upgrades. A pittance compared to the appreciation over the years.

They do regular inspections. As any professional should.

Damage (holes in the wall) and normal wear and tear are different ( scratches on the floor, tiles)

Frank, why did your property manager inspect the property in the first place? Alot of your stories here don’t add up.

It’s just a deposit. You can go through the tenancy branch for more if it’s required. It’s not like you can just take the deposit anyway without permission from the tenant.

100%. When my tenant of 10 years left, there was damage far in excess of the damage deposit. Even the sweetest, caring tenant (which mine was) will damage your property, over time.

I think the damage deposit can’t be more than half of the first month’s rent — which is a joke, because it costs a fortune to fix and replace things these days.

I know the discussion has moved on from the new listings puzzle, but I wonder if 1) there is any use in discussing delisting in understanding active listings, 2) if clarity property use could help sort out some of the hypotheses listed in the post and 3) if it is worth breaking the statistics out a bit more to see where activity is (or isn’t)? Caveat all of this with I do not know if my calculations or assumptions are correct, and always happy to have advice and corrections!

1) In the attached chart, active listings (AL) have trended up slowly and steadily since January, and expected Active Listings (eAL; previous weekly AL+Weekly New Listings-Weekly Sales) has been higher (because delists pull down AL without a sale happening) but parallel (because the rate of delists has been stable). Starting March Week 4, delists (eAL-AL) started trending up erratically, and while AL has stayed flat and steady.

It seems like delisting is a relevant factor to describe to what is happening in the market. I’m not sure what it says though, since I don’t know enough to say what drives and describes delist behaviour. Do sellers choose to delist because a property isn’t selling? Or for some other factor (too much work, timing the market)? Or are they advised to delist for some reason by their realtor? Or is there a typical delist scenario where a factor or convergence of factors (one/more offers fell through maybe?) naturally result in a delist?

Regardless, if one could know why delists are happening that would help understand this part of the market and maybe shed light on hypothesis 1-6. If you could look at delists over time and compare them to some of the other data (sales to delists ratio?) maybe another pattern would emerge too.

2) For hypothesis 1-6, is there any way to tell if the listing is owner-occupied? Maybe this data isn’t collected, but if it were you might be able to see whether folks are selling (or listing or delisting) the home they live in vs one they rent out. If most listings are owner-occupied, and more of the sales last year were not owner-occupied, then 5 or 6 looks more plausible. If most delists are owner-occupied, maybe 4 is a better fit?.

3) Would it be useful/possible to break out the stats (sales, lists, active lists) by housing type, by price range, or by municipality? If activity is concentrated to a specific type of property, or area, or dollar value that could show that there are other specific factors moving things (e.g. more desirable municipal conditions?), overriding or weakening some of the 6 hypothesis as global explanations?

I appreciate all the data and discussion here!

lol, what are the stipulations for the types of investment allowed?

Since “affordability” is the mantra, here’s a terse FHSA summary from Garth:

“… all the funds you invest are deductible from taxable income, unlike the tax-free savings account. And yet upon withdrawal (to buy a house) the money is tax-free. So the taxpayers of Canada are footing the cost of tax-deductible down payments on houses which can be sold for a tax-free profit.

If you want to know why real estate is unaffordable, just read that last sentence again. This is yet another example of soft-brained policy which ends up having an outcome exactly opposite to that which was intended.”

I call b.s. on that and so would everyone else with landlord experience.

LMAO, references…….

B.C.’s new housing policies are draconian. And they need to be

The huge CMHC hike of insurance rates may have been the final nail in the coffin of feasibility, but it was pretty marginal to start. Fixes coming

This is literally the reason I drive an EV.

Uranium or Plutonium?

I don’t hate electric cars, I hate sitting on 100 lbs. of the primary component of thermonuclear weapons. See below.

It’s correct. I didn’t say only Canadian residents living here more than 6 months a year. There are a number of other criteria which can result in someone being deemed a resident for taxation purposes, as you pointed out.

Zero MMHI applications https://twitter.com/DaveThompsonVIC/status/1649204967687987203

As I’ve been saying for the last year, it will take years and year before you actually see MMHI product secondary to bureaucracy.

“Any Canadian resident (living here more than 6 months a year) is taxable on worldwide income”

Totally incorrect and possibly tremendously expensive for someone who thought the statement to be true. CRA judges whether any particular Canadian citizen needs to pay income tax by judging whether they are or are not a resident of Canada. Many factors enter into the judgement but the primary question would be “where does your family reside?” If a Canadian is working in Europe or the Middle East he would be responsible for full, normal taxes on his income even if he never returned to Canada for years IF his wife lived in Canada.

https://www.reuters.com/business/autos-transportation/canada-offering-more-than-c13-bln-over-decade-volkswagen-battery-plant-govt-2023-04-20/

EV advocates must be really happy now, because the government is solving the imminent BEV crisis by throwing $13 billion plus $700 million corporate welfare at VW during this difficult time, instead of paying PSAC workers, and solving the healthcare and housing crisis.

Already said I have a property management company for my four airbnbs and recommend it for those that can afford it as there are obviously costs associated with them taking a percentage off the top and I manage the tenants in my garage suite myself, which is honestly more work, but I’m not going to hire a company for people I see a couple times a week. I also do get to know some of the Airbnb guests staying even though I don’t manage it as there are some construction companies that use them for workers doing contract work but don’t live here. You don’t seem to like new things like Airbnb and electric cars Frank, but I kinda get it I hate most new music.

Since 1989 I have not spent one cent on tenant damage. In fact my management company inspected one property and found it to be in disrepair. He was going to evict them but in less than one month they completely repaired all the damage out of their own pocket. You see, if you get evicted and have no references you’re SOL to find another place to live. The management companies also screen tenants thoroughly, avoiding potential future problems. You should try it.

I have multiple and have never had one trashed. Have had guest parties that needed to be reigned in and stopped by the management company, but never trashed. Some damage too but if you think your place isn’t getting damaged by long term tenants you’re out to lunch. I’ve spent 10s of thousands repairing long term tenant damage and the RTB process is a circus. At least with Airbnb you have their credit card on file and can instantly make claims, well your reputable management company can on your behalf anyways.

Any stats on what percentage of AirBnBs get trashed? Great way to throw a wild party. There is no shortage of idiots out there.

I’ve been told they’re illegal in Saanich as well, just no enforcement.

It depends what the municipal bylaws say. You need to check and see if short term rentals are prohibited or not. For example, Esquimalt has no licensing system, but they are not permitted in the zoning bylaw so are illegal unless the home is specifically zoned as a bed and breakfast. https://www.todayinbc.com/news/more-than-100-illegal-short-term-rental-suites-listed-in-esquimalt/

This is a double edged sword, less people selling in Vancouver and moving here also

“If the current one are operating illegally, then the issue is enforcement against illegal operators, which has been complaint-based only in many places.”

So are current airbnbs operating in municipalities that don’t have a system for licensing them like Victoria does illegal?

Great post Leo!

Maybe a few factors involved here.

1) Less opportunity for remote work, and a back to the workplace trend means less people can sell out of Vic and move somewhere cheaper.

2) Less demand for ‘sell and buy up’ with people not wanting to tamper with their existing mortgages OR incur the associated transactional costs, or face housing insecurity.

3)I personally see housing (in)security as the biggest factor. You’re not going to list in this market until you’ve found an appropriate alternate living arrangement. It’s a feedback loop to less and less listings. Transactional complexity to safely purchase/ list/sell in this market is a massive barrier.

I think the teranet +0.51% (not seasonally adjusted) for Canada-wide prices is reflecting recent (early 2023) trends, as CREA has reported the same thing, notice the uptick in Canada-wide SFH prices in 2023. Looks like Canada-wide SFH prices ($800k benchmark) are at the same level as mid 2021. And still up +40% from pre-Covid (2019)

This price chart looks like “froth” being blown off, after a spectacular rise.

https://wolfstreet.com/2023/04/14/the-most-splendid-housing-bubbles-in-canada-spring-selling-season-in-a-housing-bust/

next msg

This is definitely true. The acrobatics they did to claim they are on track to meet their 114,000 new affordable home target is embarrassing. I’d be a lot more interested in a deep dive as to why they aren’t on track, instead of nonsense like counting 20,000 homes supposedly returned to the market from spec tax, which is highly questionable.

Keep in mind this is reflecting pending sales around January and I believe the headline figure is a 3 month average, so mostly fall data here. Doesn’t actually reflect current conditions, but seems like they caught up with where reality was some time back.

If the current one are operating illegally, then the issue is enforcement against illegal operators, which has been complaint-based only in many places. Municipalities will be able to enforce much more easily if they have a monthly report from Airbnb identifying exact locations of active listings and names of operators. In this case, a municipality can just issue cease and desist notices where the use cannot be permitted under bylaw, and give a timeline to get a license where this is an option. If the Airbnb is already licensed by a municipality (like Victoria) it seems unlikely that much will change.

This is shameful. There is no practical pathway for them to get more education/training in Canada to satisfy licensure. Almost all the residency (and other post-grad) spots go to Canadian med school graduates. The US is much more welcoming, about 1/3 of their residency positions go to foreign trained doctors.

This all means that out of 500,000 immigrants to Canada, very few will be working as medical doctors here. Only fully trained MD’s from USA, UK/Ireland, South Africa, and Australia can routinely get licensed here.

Teranet house index posts some wild data for March.

Teranet house price index for Victoria down -4.71% for the month (MOM). Down -8.70% YOY. And -12.78% from May 2022 peak.

Their Canada wide numbers are Canada composite UP +0.51% for the month and down -6.94% YOY. -10.71% from peak.

A strange, volatile data set. I’m wondering if the low sales numbers isn’t providing them enough data for Victoria (and other small cities). For example, they have another small city Sherbrooke PQ up +10.56% this month. And the Thunder Bay index explodes up +19.71% for the single month!

https://housepriceindex.ca/2023/04/march2023/

It doesn’t look like the system wanted more skilled workers or honest tax paying citizens.

https://globalnews.ca/news/8369003/foreign-doctors-ready-to-help-sidelined-by-regulations-expert-says/

Currently there are more than 13,000 internationally trained doctors in Canada who are not working as doctors, according to the Internationally Trained Physicians’ Access Coalition. Of those doctors, 47 per cent are not in the healthcare field at all.

I wouldn’t be surprised if millions of immigrants living in Canada do not report their world wide income. Who wants to pay income tax twice?

If someone living in Canada is still working for an Eastern European employer – at Eastern European wages I presume – that tells me that Canadian employers have no use for him. By the way, I can tell you that the “desperate” need for software developers has deflated considerably over the past year.

Any Canadian resident (living here more than 6 months a year) is taxable on worldwide income. As discussed previously, being a Canadian citizen has nothing to do with it. Back in the 70’s Howard Hughes famously stayed at Vancouver’s Bayshore Inn for just under 6 months, and then returned to the US, for just this reason.

“ use Airbnbs but I think there are significant legislative changes coming for them this fall in BC – at the very least there will be mandated information sharing from Airbnb to all municipalities. If you have an Airbnb that is not in a unit or area or condition that can be legally licensed I’d be thinking about a transition plan right now.

That’s fine I have no problem with them being regulated and i actually welcome that as all of my airbnbs are deliberately purchased and not an afterthought like so many I see online., but the current ones should not be punished and should be phased out.

This government is so desperate on creating new housing that they’re fudging numbers and using deregulation of airbnbs as a plus In their housing deliverables and it’s a joke.

Met a recent immigrant from Eastern Europe (not Ukraine), a 36 year old software developer with a wife and child. They have been here for around one year and had settled in a rural community in eastern Manitoba. I asked if he had a hard time finding work and his reply was he still works remotely for his employer back in his homeland. Good for him, but how does that help the shortage of workers Canada desperately needs? I wonder how many other immigrants live here yet work in a different country, remotely. Could help explain why fewer are becoming Canadian citizens. Not sure the tax implications of such an arrangement, I suspect they are obligated to file and pay taxes here, but how would the government know? Doesn’t seem to be a solution to our worker shortage and definitely contributes to the housing shortage.

I use Airbnbs but I think there are significant legislative changes coming for them this fall in BC – at the very least there will be mandated information sharing from Airbnb to all municipalities. If you have an Airbnb that is not in a unit or area or condition that can be legally licensed I’d be thinking about a transition plan right now.

Yes, but it would be taxable at that point just like a RSP withdrawal. When you use it to buy a home it is a non-taxable withdrawal.

Also someone was talking about airbnbs and hotels and they are really filling a need right now. I know people hate them but I don’t blame anyone for doing it as I have several myself in multiple locations but also have a tenant. They have issues but not the same as renting long term as I’ve done that to. I think the property should fit a certain type of Airbnb so not a basement suite in view Royal but a certain type of place should be able to be a Stvb

“Perhaps they think it’s better to densify Vic city and the inner suburbs? That’s not hypocritical. In any case, they have no say on development in the westshore, unlike those who live there.

Yeah perhaps they think that, but again like the anti developers others refer to on this blog they sure don’t say that. And I should have been more clear that I agree that people in Langford with 10 year old houses also shouldn’t be hypocrites. That work for you? Also Langford is densifying but all the elite types love to point to the houses being built and not the condos and townhomes. It’s really just convenient for them. Lastly saying “perhaps they are thinking” and then saying what your thinking is pretty obvious

Perhaps they think it’s better to densify Vic city and the inner suburbs? That’s not hypocritical. In any case, they have no say on development in the westshore, unlike those who live there.

@totoro can they just cash out and use the money for something else? If I read correctly, it would be in the adult child’s name?

Totoro, really good food for thought. Thanks for the info/links.

This is not what I said. FWIW if you wanted to sell a share of a home to an adult child who is a FTB they could use the new TFHSA for this.

Totoro, didn’t you say some time ago that you had purchased a triplex for your kids, in their names? Would this not make them ineligible for the first home savings account? Or perhaps I’m confusing you with someone else?

Leo u forgot coffee It’s condos and coffee

Makes sense to gift your kids that amount to fund their TFHSA

Hooray for another vehicle to funnel money into real estate. It is our economy after all

In terms of helping adult children 18 plus in our expensive market, I’ve reviewed the new Tax-Free First Home Savings Account (TFHSA). It seems like a very good deal. I will be working to open a questrade account with each of our children and making an annual contribution on their behalf because:

$8000/year max for 5 years (40k total max) AND acts as a tax deduction from their income (like a RSP);

accrues interest/gains tax-free and non-taxable when/if withdrawn to buy a home (like a TFSA);

if child never buys a home it can be transferred to an RSP tax-free and without needing RSP room (and then subject to RSP withdrawal rules), or withdrawn (taxable); and,

doesn’t affect child’s RSP or TFSA contribution room.

Seems like a no lose proposition and, as a parent (or young adult), you can just contribute what/when/if you can. For a young adult FTHB it is probably better to fund this account first before an RSP as you get the same benefits without the requirement to repay contributions under the RSP First Time Homebuyer’s plan. You can also transfer RSPs to the TFHSA prior to withdrawal if you have room.

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/first-home-savings-account/withdrawing-money-from-your-fhsa.html

“When I see people living in 10 yr old houses in Langford complaining about pace of development that’s just plain dumb. Do people have zero self reflection to understand that trees had to be cut for their subdivision to be built?”

This same hypocrisy exists for the people living in downtown Victoria criticizing the pace of development in the westshore. Their street trees in Fernwood or James Bay are a little bigger so they now occupy some moral high ground on housing.

I don’t think you can blame one past Council member for legislation and policies passed by 6 out of 9 of a completely different Council. Hard to believe they didn’t know what they were passing when the requirements are clearly listed, but maybe it was better to get something passed.

Most on council are keen to make MM work. I’m disappointed to discover that Isitt’s poison pill was left in (I think people didn’t even realize the impact of that amendment), but no one was under the impression that MMHI was anything but a flawed policy in its current form. It was still better to pass it, end single family zoning, and fix it later with an amendment that will be much less controversial.

Council will only need to make these changes if they are legislatively required to and there may indeed be exceptions for “affordable housing mandates”. As a taxpayer, I’m disappointed that so much time and energy aka taxpayer money was spent on this issue – years of it – with this ineffective result. I hope that they NDP legislation in the fall address this. Maybe, maybe not.

You don’t know what you don’t know 🙂 I always use the past as the best predictor when I have to make a decision, but there are wild cards. Victoria is due for an earthquake, for example.

And who knows how climate and technological change will reshape human behaviour in the decades to come. I would certainly be looking to relocate now from many areas of the world for the sake of my children’s children. Victoria looks like one of the better spots to remain in from this perspective.

The market in the prairies where I’m from was nuts when ours was nuts but now it is more back to normal. I could go back “home” (haven’t lived there in 2+ decades) and buy a beautiful detached home in a great neighborhood – nothing to be done – for 450K (no suite and none needed). My cousin who is a single parent (single income) with 2 kids bought her own house in a very nice neighborhood on her own for 405K (needs some work). When my family visits and they see my house, how much of it is rented, how much our mortgage is, how much the house is worth, they are shocked. Just mentioning this because I recall someone saying this past week that all across Canada prices are skyrocketing – not true. Where I’m from they march ever upward but always so slowly (minus some periods of decreases that are always corrected in the medium term). Also, it’s the prairies, can build out and out and out (which happens).

Long term, for Victoria, I am curious to see if there are any wild card factors that come in to throw things off. But, short and medium term, given the supply issue, it seems clear to me that real estate (especial SF) will hold its value at least (and probably march up).

Anti-development views just make me wealthier as I already have the real estate. My rents go up, the market value of my properties goes up. I literally posted the other day that I plan to start buying up pre-sale condos in future phases of Dockside as I don’t expect the government to solve the housing issues (aka your anti-development stance will prevail long term in my opinion). If I thought the government would do something tangible I wouldn’t buy up units I didn’t think I could rent easily down the road due to excess supply.

Even thought anti-developmemt benefits me financially I am still of the opinion that it is a stupid stance, but I plan on taking full advantage of it for my benefit.

And it has zero impact on my real estate sales business.

I am SUPER pro the massive rental projects going forward downtown Victoria. How does a REIT renting 1,800 apartments benefit me? I can’t buy the units, I can’t sell the units as an agent, and it creates competition for my personal rentals.

Medicare Will Bring A Socialist Dictatorship, 1961:

https://www.youtube.com/watch?v=Bejdhs3jGyw

Obama, 2009:

Frank in the early 60s:

So the solution to our health care crisis is communism?

Curious to see what you find! I’ve heard anecdotally about a dearth in new listings in Canada, the States, and elsewhere, but the plural of anecdote is not data..

I’m more looking for a 30 year explanation, not just post-pandemic. But I suspect that 30 year single explanation may not exist. I am looking at other cities to see if this same thing is happening everywhere in Canada.

Great, thanks!

As for the subject of this post, I have no meaningful contribution to add other than to note that whatever the right answer is, and it probably has more than one cause, it may be “macro,” in the same way that the run-up during COVID was “macro.” I have heard about similar dips in listings across developed countries just as there was similar fiscal policy during the pandemic, similar run-ups, etc. That is maybe the right explanation applies to Holland as well as here?

The new asessments took effect January and have been mostly reflected in sales since then (older listings from 2022 still have the old assessments so I leave those out). The March summary has a chart of the sales/assessment to date.

Hey Barrister:

” not only harsh but strikes me that it is more accurate of Marko being either stupid or just plain lying in order to push his agenda”

I don’t know. Harsh, ok, but he’s struck me as “Eastern European” not lying and conniving. That is blunt not mean. Definitely less harsh than many former Soviet physicists I’ve worked with.. 😉

—

By the way, what’s happened with sell prices vs. assessment now that July 2022 assessments have rolled out?

I think Markos comment about people either being stupid or just plain lying seems to be not only harsh but strikes me that it is more accurate of Marko being either stupid or just plain lying in order to push his agenda. I guess he must think a lot of his clients are stupid or are just lying. Just because some people hold views that are inconvenient to you and your family business does not make them either stupid or liars.

We seem to have reached a new low of name calling on here.

The inverse of Singers shallow pond, they care about housing, just not the kind they can see

Saanich homeowners face 7.19 per cent tax increase with 2023 budget

https://www.timescolonist.com/local-news/saanich-homeowners-face-719-per-cent-tax-increase-with-2023-budget-6874851

The insanity is even worse in Vietnam. Out in the middle of nowhere with no service on a tinny dirt trail may cost a few hundred dollars per square meter, and a new development that is 5km from downtown HCMC cost $150,000 USD for a square meter of land.

When I see people living in 10 yr old houses in Langford complaining about pace of development that’s just plain dumb. Do people have zero self reflection to understand that trees had to be cut for their subdivision to be built?

Sorry, I should have said hand deconstuct all the houses.

So the solution to our housing crisis is communism. Plow down all the houses and build huge apartment complexes. It would be easier just to move to North Korea.

An “average home owner” who says they want more housing built, just not in their neighbourhood, isn’t lying IMHO. People can honestly want all sorts of things that aren’t practical. In fact that’s the central problem of democracy IMHO.

I think the average home owner claims to be in support of more housing so either they are dumb or just straight up plain lying.

Yup, that sums it up. Condo in the city 500,000 euros. House on an acre 1.5 hrs from city 50,000 euros and we are talking 1.5 hrs from city but in a place big enough that you would be close to a doctor, elementary school, etc.

Even with more people working from home the appetite to be close to city center here is insane.

There is a development right now 3 km from the main square at 4,000 euros per square meter and a development 1.5 km from main square jumps to 7,000 euros per square meter.

Here is the new and active listings together.

I think it is more about choices. Real Estate became a more attractive investment in the late 1990’s after…

The dotcom bubble was a rapid rise in U.S. technology stock equity valuations fueled by investments in Internet-based companies in the late 1990s. The value of equity markets grew exponentially during the dotcom bubble, with the Nasdaq rising from under 1,000 to more than 5,000 between 1995 and 2000.

Maybe the next boom will be AI? which may draw people away from Real Estate

It sounds like as of 12:01 am, our government is going on strike. Finally, maybe sanity will prevail in our country.

lol! Just when I thought things could not get stupider!

Ok, did some more digging, and that change was due to Ben Isitt’s poison pill amendment he put in on the way out. I thought that his stupid amendments were reversed before the policy was adopted by the new council, but apparently not. That fee combined with CMHC’s increase in multifamily insurance means MM is probably not viable until the new council makes a number of changes.

What’s interesting is that Eby said the intent of the provincial upzoning is that multifamily becomes just as easy to build as single family. Victoria’s MM policy fails that in a big way, so they will need to make changes if they want to comply with the spirit of the provincial direction.

What’s the problem with people owning multiple properties? Is it different than corporate ownership?

Without investor-owned properties, there wouldn’t be any rental housing.

Sounds like Japan. Prices in the cities still expensive because that’s where people are moving to so population is still increasing, while there’s lots of abandoned homes in the more remote places. Canada doesn’t seem to have a lot of cities/areas with dropping populations.

It makes sense, but it’s something of a tautology. Fewer new listings by definition means people are staying longer, but why are they staying longer? And why did they suddenly stay shorter from 2000 to 2010?

I don’t think the problem is that the average voter is dumb – even if they are – but rather that the average voter is already an owner.

The late 90s are hard to explain though. Very few new listings like now, but after nearly a decade of complete stagnation in the market, and losses in condos.

Looking for one unifying theory of new listings is probably asking too much though. But it is puzzling, when the market was going up the theory was that people didn’t want to sell because market is going up, now market is down and theory is people don’t want to sell because market is down. Would all be fine if it hadn’t have been opposite in the past.

If banks can drag this out long enough and most unions are getting somewhere along the lines for 10% over 3 years they may drag it out long enough where wage growth start to dampen the blow of people actually having to pay off principal.

The crazy thing is even thought the population has dropped from 5 million to 4 million people in the last 30 years and continues to drop, real estate prices in attractive places have more than doubled in the last 6 years.

Who knows what the situation would be like if we had immigration like Canada.

.

I see it first hand personally every day. The majority of my real estate business in Victoria stems from clients that are employed by tax payer dollars whether it be BC Government, BCI, Feds, BC ferries, military, etc., and keep in mind all of these just received large wage increases. Just look at what PSAC is seeking right now…13.5% over 3 years – https://ottawa.ctvnews.ca/ottawa-residents-preparing-for-the-possibility-of-a-major-strike-1.6361138

Same on the rental front….last two places I’ve rented out have been to military officers. I don’t know what the stats are but I am guessing the number of people stationed and working at the base grows every year.

Then combine it with lack of supply and a government unwilling to address the supply problem it makes for real estate being fairly bulletproof long term. I am of the opinion that despite the upzoning, etc., there is too much red tape in place for the supply to keep up with demand (immigration) let alone flood the market with inventory.

When I see an obvious supply problem that the government is not willing to actually address and at the same time they fuel demand (see top two quotes from posters) of course I am going to buy more property long term. Everyone is going to do what it in the best interest for themselves and their family.

Is it my fault the average voter is dumb and doesn’t elect officials that are actually willing to address the supply problem? Actually addressing the problem would mean not only passing missing middle but having a policy in place that a sixplex permit needs to be turned around in 10 business days which will never happen, not two years (which is my prediction).

No wonder so many people are leaving.

If you thought new listings and inventory were bad in Victoria, in my condo building in Zagreb, Croatia there hasn’t been one change of ownership in 3.5 yrs across 62 condo units. New listings of quality property are simply non-existent. As I am spending quite a bit of time studying the market in Croatia here are some observations that apply and don’t apply to Victoria.

i. Real estate accordingly to all metrics is far less affordable than Canada and dual income young professional struggle to to purchase anything. When a family has a property in a quality desirable location it is almost exclusively passed down within the family. Classic example, one of my cousins is an anesthesiologist-intensivist and his brother is an architect. The parents owned a 1,200 sq.ft. condo close to town center neither brother could afford to ever purchase so they gifted it to the doctor son and helped the architect son financially buy a different condo. The parents moved to their weekend home outside the city. This isn’t the situation in Canada quite yet, but it may be coming as more and more people are priced out.

It may manifest in a number of different ways such as parents build a garden suite in the backyard and let the child plus his or her family move into the main part of the home. Either way, the home doesn’t hit the market.

ii. In Croatia it is expensive, difficult and complicated to buy and sell; therefore, people simply don’t move very often. In Victoria we don’t have the difficulty problem (MLS system is amazing, land title system is top notch, easy and simple to secure financing, etc); however, it is becoming very expensive when you factor in real estate fees, PTT, legal fees are now $2k each side, etc. When you are trying to move-up market and affordability is already stretched this may be having an small impact.

iii. In Croatia people become attached to their property emotionally. I don’t see this in Victoria as much as how does one become emotionally attached to a box in the Westhills or Royal Bay but it could become a bit of a factor going forward as people stay longer in their properties. I know my parents bought their Oaklands home almost 30 years ago and when they pack it in I have no intention of selling it. I grew up in the house, my home office currently is in the garage of the property, I am familiar with all the renos my parents have carried out over the last 30 years. It has a suite so it would make a great rental property, etc. Now it has missing middle potential as well. Definitively keeping it essentially forever with no intention of ever selling.

iv. No annual property tax in Croatia doesn’t put pressure on anyone to sell anything, especially inherited properties. We don’t have this problem in Victoria as we do have annual property taxes plus spec tax if vacant.

Yes, and this is what the regulation states – you need to provide affordable housing in an uneconomic way, plus pay the housing reserve fee (about 40k on a 3000 square foot conversion to 3 suites).

If this is true, I would not do this if I had a large house as the math doesn’t work and the government red tape requirements are too onerous with the affordable housing covenants, restrictions and payments.

My read of it is that an owner of a large home who wants to stay in a suite and create and rent out or sell two suites is actually better off only having one secondary suite,, or downsizing. Too bad as my recollection of the studies was that the people for whom a house conversion made the most economic sense were owner occupants looking to add a couple of suites for retirement income or family members.

Even for most developers this is not going to make sense vs. other options.

A fully charged Tesla, for example (smallest battery) gives a distance of 422 km. The vic-sooke person is short 24 km a day on the trickle charge. This means they will only need to go to a fast charge at a public charger once every 17 days and that is only if they do not charge for longer on ex. weekends. Most people don’t drive 80km a day, the average is 50 km. It is not insurmountable for a tenant. As an owner, I will be installing a Level 2 though.

Looking into it. This is a seriously problematic change that flew under the radar if it is intended. The old version looked like this:

Is that for 98 kwh or 131 kwh battery pack?

If it take 96 hours for the 98 kwh pack, then it would give 3.9 km/h charge time or a range of 54.6 km for 14 hour of charge time. That mean one Sidney or Sooke to Victoria to and fro commute is a no-go with a regular 110V outlet.

https://www.caranddriver.com/ford/f-150-lightning

The other concern is how much infrastructure need to be upgrade to boost cyclists safety due to much heavier BEV on the road?

Starting from zero. If a tenant is driving to and from work daily trickle charging is adequate. If they are going on a long trip they’ll use a public fast charge.

Not based on my read of the rules unless I am missing something:

https://www.victoria.ca/assets/Departments/Planning~Development/Development~Services/Zoning/Bylaws/Schedule%20P.pdf

It is all set out in the application:

https://www.victoria.ca/assets/Departments/Planning~Development/Development~Services/Applications/MM%20Permit%20Application.pdf

For a houseplex or corner townhouse, one or more of the following:

- Provision of at least 10% of the total dwelling units in the development, with a minimum of one dwelling unit, as below-market

homeownership units

- An agreement with the City so that all dwelling units are secured as rental in perpetuity in the development

Provision of at least one affordable rental housing unit in the development

For a development on a lot that contains a heritage registered building, heritage designation of that building in accordance with

section 611 of the Local Government Act and a waiver of compensation for any reduction in the market value of the property

The development is an affordable housing cooperative

AND

For houseplexes, a monetary contribution equivalent to $150 per square metre of bonus density utilized for the development, with 70%

of the contribution allocated to the Victoria Housing Reserve Fund and 30% of the contribution allocated to the Local Amenities Reserve

Fund.

Really unworkable for your average homeowner imo.

I think sales are much less mysterious. They often behave about how you would expect them to behave in response to various events. Not to the point of being fully predictable but at least they tend to make sense more often than not.

If you have unlimited cash you can buy as much property as you want. Bill Gates is the largest owner of farmland in the U.S. If you need financing, the banks have limits on how many properties they want you to own, even if some are fully paid for.

toroto- From what I’ve read, it only takes 96 hours to fully charge the F-150 lightning off a regular outlet.

How about the banks extending amortizations for variable mortgages to up to 70 years (I got this from Garth’s blog and haven’t fact checked)? It sounds like the banks have released the pressure on a lot of homeowners who would otherwise be in a distressed financial situation, preventing a forced increase in listings.

Some other reasons I’ve heard from friends and family on why they’re not selling, even though they currently want to:

1. One is on year 3 of a 5 year mortgage, which is fixed rate at below 2%. They don’t want to move and have to remortgage at a significantly higher rate, even though they can afford to upgrade based on their salaries.

2. One person who owns multiple rentals bought a presale (in Kelowna) and intended to sell it immediately upon completion. They decided not to when the prices came down from the peak, and the rental income is so high that they don’t need to accept a lower value than peak.

Some other ideas:

– Government positions have accounted for a huge proportion of the job gains in the last two years. They’ve basically debt financed a floor under the jobs market which allows many people to keep paying their mortgage and buy houses, who may otherwise struggle to find work.

– The massive immigration has supported the rental market and demand for housing in general, meaning there is no urgency to sell.

Arthur’s point should win the case of beer. Buying and holding, and then buying more, has been ingrained in Canadian culture. I am betting the people who own more than one property are taking a larger and larger share of the market. This is the game of Monopoly that we all played as children, playing out in real life. The Land Owner Transparency Registry “LOTR” could shed some light on this. I believe many properties are increasingly in the hands of a smaller share of owners who continue to increase their property portfolios. As there is no cap on how many properties a person can own, I would expect this problem to get far worse.

Harcourt, 1987 at second reading: “ I’ve said also that it is unfair — this legislation — to a number of people, particularly first-time home-buyers, who are seeing part of their initial down payment now having to be applied to this tax. You know, that could be taken away from young people who were hoping to have those funds not just for the down payment, but to have for their appliances, for their carpeting, for the drapes, for the expenditures that you have to have when you get into your first house.”

So the original bill did not include a first time home buyer exemption at least

I don’t have data from pre-1990, but new lists trended up quite a bit in the 2000s despite PTT. But when was the first time home buyer exemption put in place?

Leo, perhaps new listings have trended down ever since 1987, when B.C. introduced the Property Transfer Tax?

Note that (I’m pretty sure) there is no on site affordability requirements for the missing middle policy in Victoria. However if you don’t do on site affordability you need to pay into the affordable housing fund in lieu ($150/m^2)

You could deny them but why would you? You don’t need a charger installed, they just need an outdoor extension cord to do Level 1 trickle charging from a regular outlet at home. If they don’t pay utilities, charge a small fee equivalent to cost for this – likely going to be in the 10-20 dollar a month range. If you want to install a faster charger you can and there are rebates:

https://electricvehicles.bchydro.com/incentives/charger-rebates/home