March: Continued strong stats hide turning market

If you look at the headline stats for the month of March, you’d have to conclude that the market remains as hot as ever. Inventory was the lowest ever for a March, sales remained 9% above the 20 year average for March, and single family prices were the highest on record. By any reasonable measure, the market remains very hot, so don’t expect any deals out there quite yet. However there are increasing signs that the trend has turned around and some cooling is finally happening.

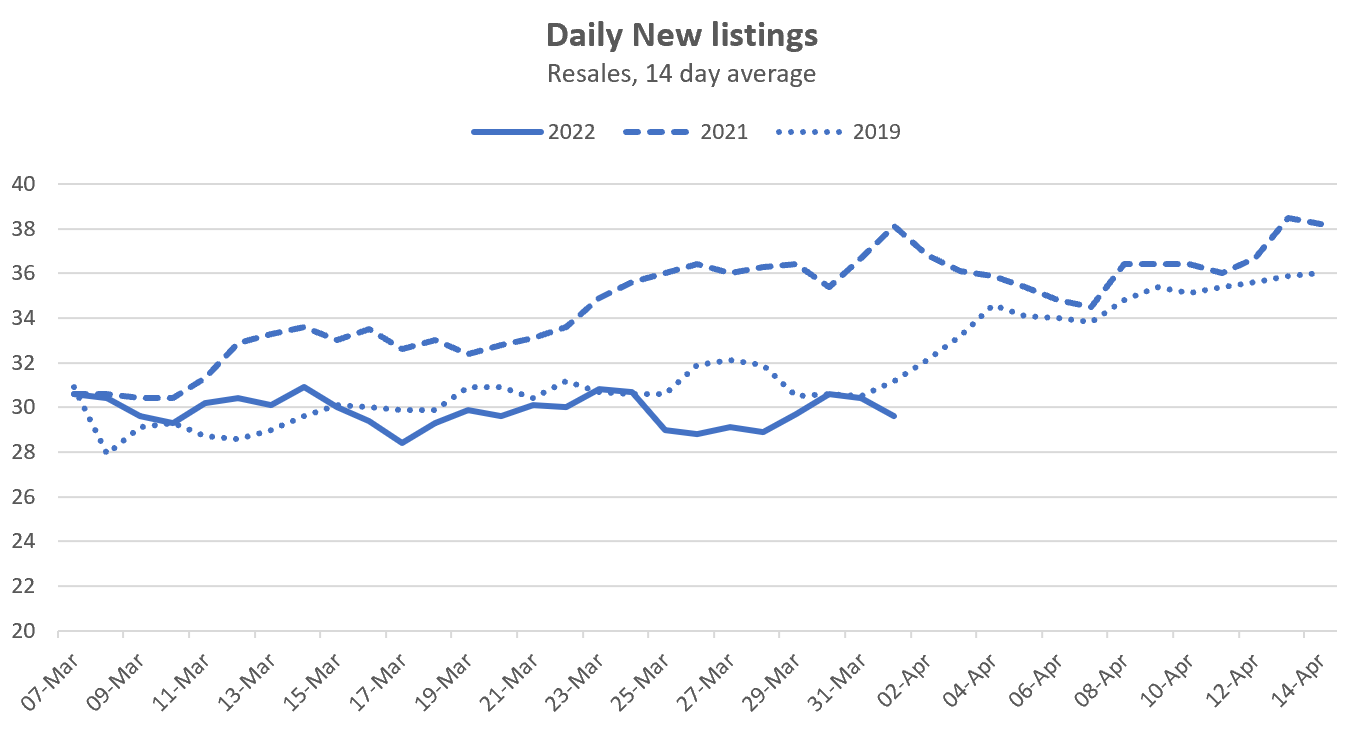

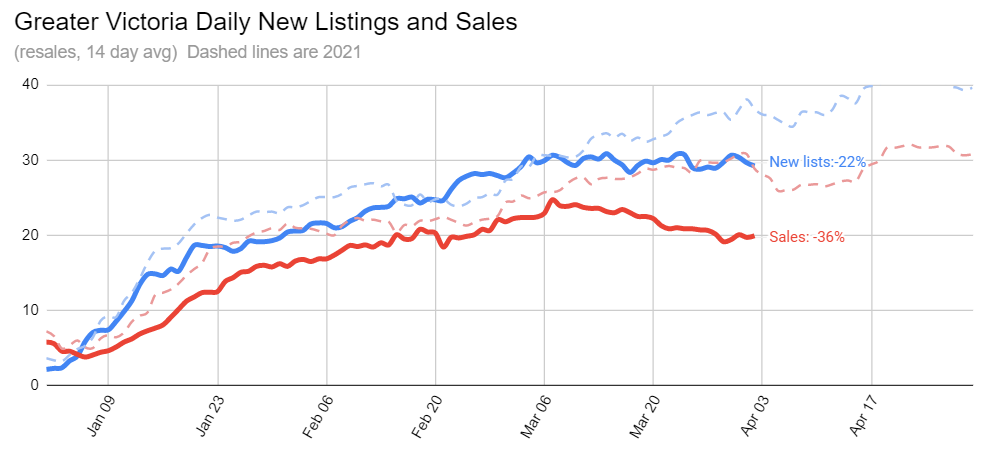

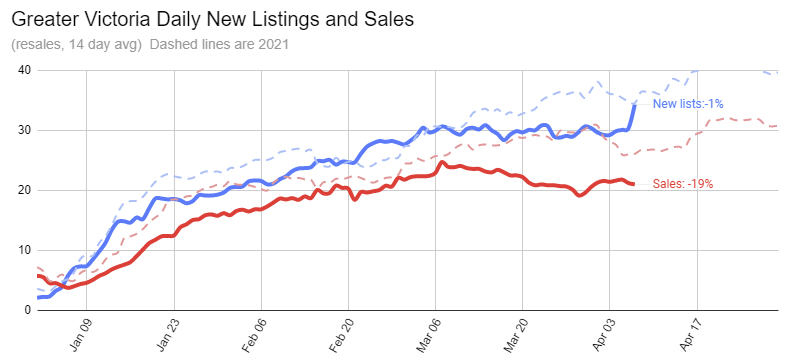

About halfway through the month, new lists started lagging the pace from a year ago. One explanation for the pullback in new listings is that it’s been spring break, and with restrictions gone it’s very likely that more people took the time to travel when they didn’t last year. This theory is backed up if we compare the rate of new listings this year to 2019. Before we had heard of COVID, new lists behaved similarly, with a flat spot in March before continuing upward in April. In that case we should expect more new listings to arrive this week and next.

The drop in sales is less easily explained by the break. While of course buyers could have gone travelling as well, when we are coming from a time with nearly 10 buyers for every seller, we wouldn’t expect that to translate into fewer sales even if half the buyers are gone. It’s only a small gap that has opened up between new listings and sales, but the decrease in over-asks and the similar reports of slowdowns from across the country make it more likely to be a real reversal and not just a temporary glitch.

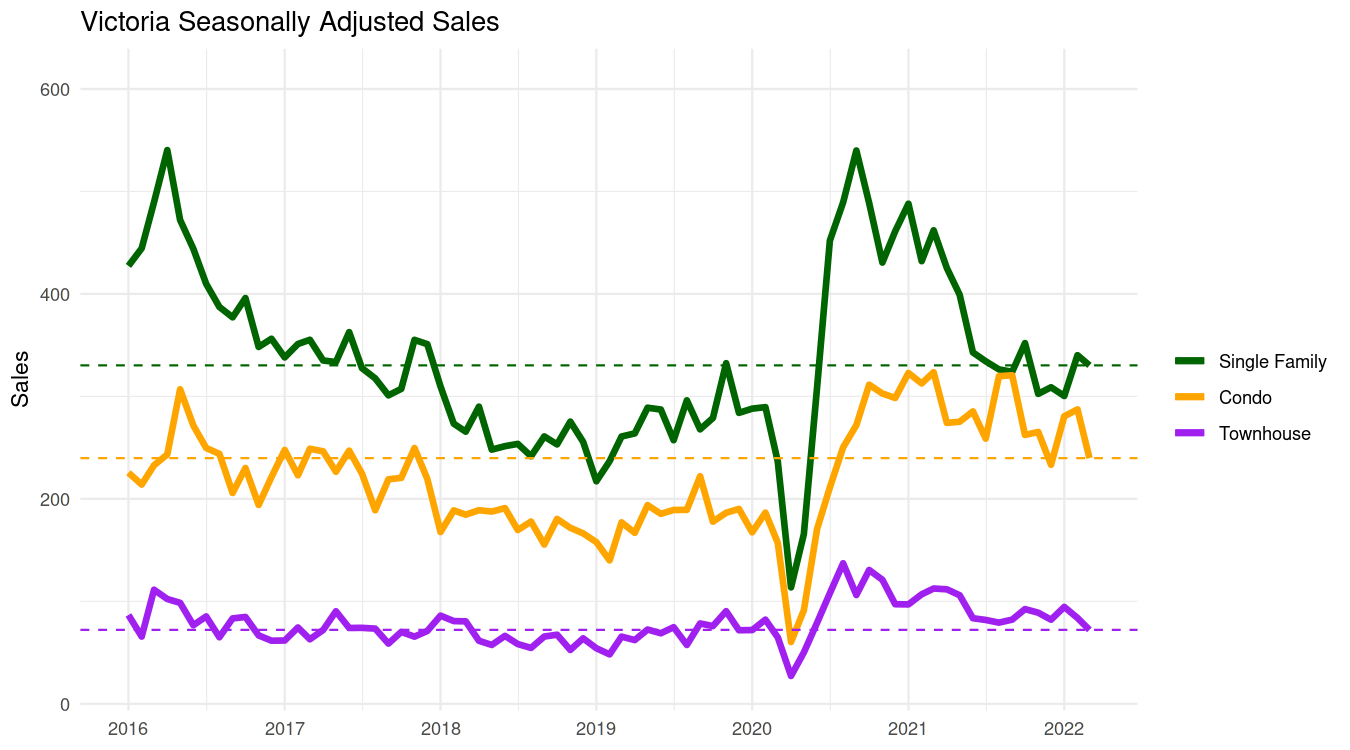

Full month sales don’t show the slowdown yet, with both single family and condo sales still at above pre-pandemic levels despite much less inventory available.

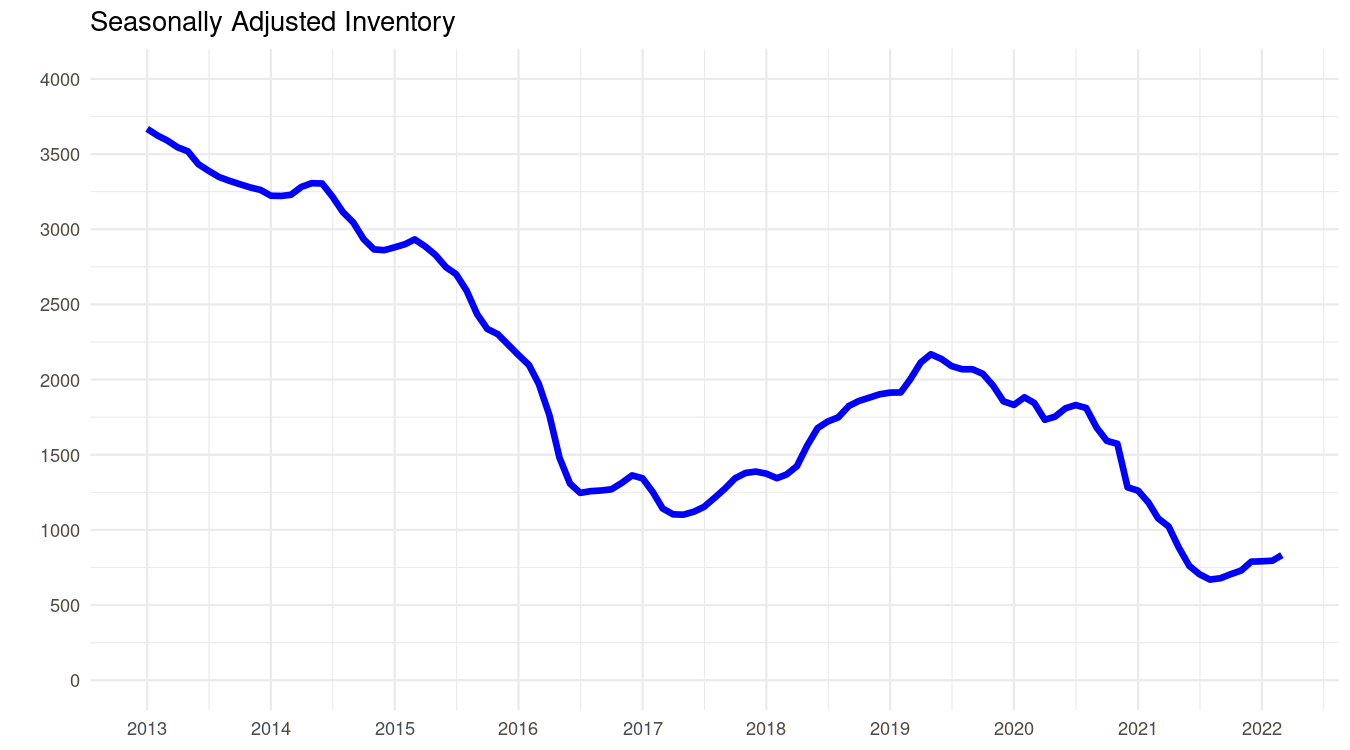

Sales still remain constrained by inventory, with March coming in at record lows for the time of year. However on a seasonally adjusted basis we are continuing our very slow, very gradual increase in selection.

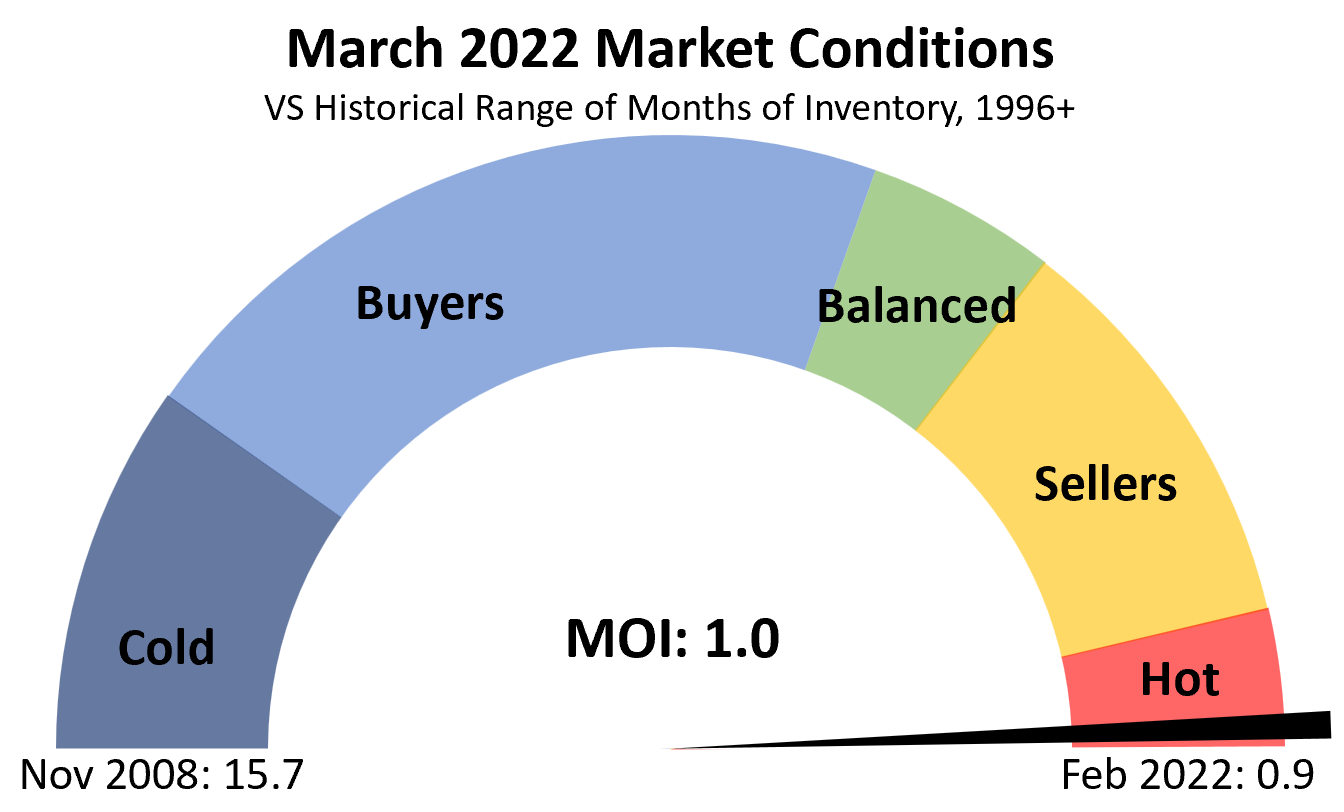

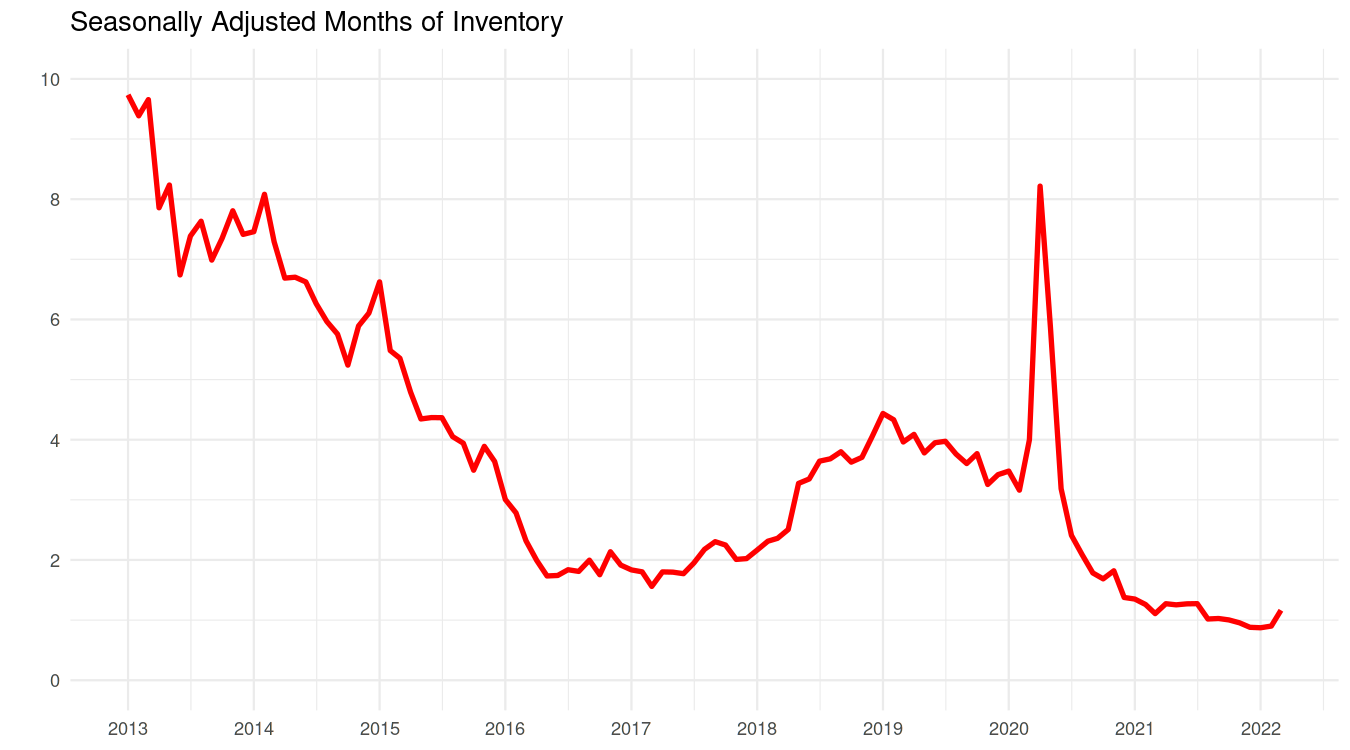

A similar slight improvement in conditions is seen in the measures of months of inventory, which has taken a small but seemingly significant step up for the first time in a long time.

On to prices then, and here’s where it gets a bit more complicated. On the one hand, with around 1 month of inventory, the pressure for prices to increase remains nearly as strong as ever. And that’s what’s happening as the upward pace seems uninterrupted.

However if the pullback holds and bidding wars continue to subside, you may start to see more individual examples where sale prices are coming in substantially lower than comparables just a few weeks ago. Rather than evidence of big price slides in the market, those will likely be more indicative of a return to rational bidding. In superheated markets, we see more irrational and over-market bids. Once we get back to a normal active market (5-20% over-asks rather than over 50%) then sales prices will more accurately reflect market value, exposing some truly questionable sales that happened during peak frenzy.

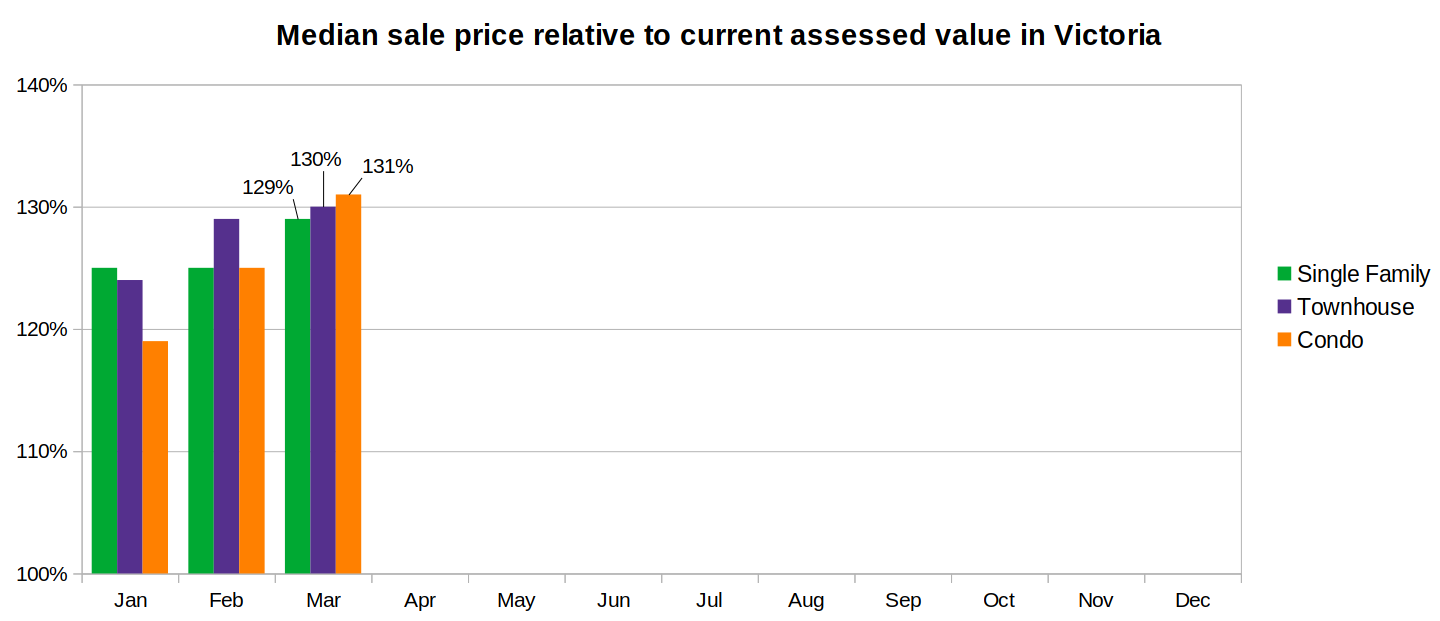

Any change to overall pricing we will see in the sales to assessed value stats once we get more inventory on the market. Unsurprisingly valuations have continued to increase there, with all property types posting increases from February, and the median place now selling at around 30% higher than its valuation from last July.

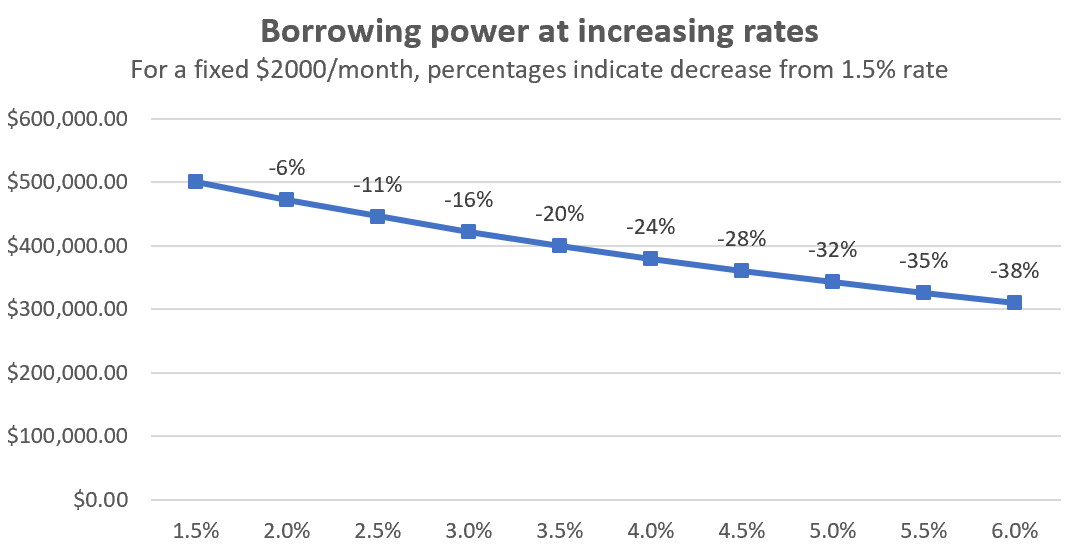

The next Bank of Canada rate announcement is next Wednesday, and there’s no doubt that rates will be going up again. The only question is whether it will be a 0.25% increase or if they will back up their increasingly hawkish messaging with a 0.5% increase. Remember that Bank of Canada rate hikes affect borrowers of variable mortgages immediately, while the large increases in fixed rates generally hit the market on a 2 to 3 month delay as rate holds expire. With fixed rates above 4% and an associated stress test at over 6% that will certainly take some demand out of the market.

How much? Impossible to say, but with affordability as strained as it is, there aren’t that many scenarios don’t involve at least a minor price pullback.

4512 Emily Carr. Can someone tell me how much it sold for.

Leo please delete the happychucky one. Never remember what my username is. Thanks

4512 Emily Carr. Can someone tell me how much it sold for. Thanks

New post: https://househuntvictoria.ca/2022/04/11/consumer-sentiment-revisited/

Interesting article. This stood out:

Arrgghh…

Paxlovid is the wonder drug pill available for Covid that reduces hospitalizations by 78% and deaths by 100% (when treatment started within 5 days for mild/moderate Covid )

– Most adults over 50 with Covid will benefit greatly from this drug, because it also reduces symptoms, including progression to long Covid etc.

– the problem, we have been told, is that there isn’t enough supply available. So our public health departments introduced very strict criteria, so that it’s only available to immune compromised and un-vaccinated people (exact criteria here http://www.bccdc.ca/health-professionals/clinical-resources/covid-19-care/treatments)

OK, I can accept this, and am supposed to trust that the government knows what it’s doing. A bit of a head shaker thinking that anti-vaxxers should be front of line for this wonder pill, and also that they would seek out medical care and take it if they were offered it.

And it turns out that BC has received a BIG supply for 15,000 patients for Paxlovid, but has only distributed 5% (781) of the Paxlovid pills. The globe and mail found this out. And they found that government red tape and complicated indications have caused this fiasco. Instead of the usual idea where drugs are sent to pharmacies and prescribed by your doctor, we have a inefficient centralized government bureaucracy setup that is not succeeding in distributing the Paxlovid they have received, and are sitting on 14,500 unused Paxlovid treatment courses.

They should open up Paxlovid availability to anyone over 50 with Covid, with a Doctor’s prescription. And distribute it to pharmacies so that treatment courses can be started as soon as possible. (Keep some in stock in case the anti-vaxxers ever show up needing it, but the fact they’ve only distributed 5% (781 doses) in two months out of 15,000 means they only need to keep a small amount on hand)

Ask yourself this question… if your parent, age 80 got Covid today, wouldn’t you want them to start on Paxlovid right away, so they don’t get hospitalized or die on a ventilator? And would you consider it acceptable for BC Health to be sitting on 14,500 unused doses?

Here’s a good CBC video describing the Paxlovid problem in Canada https://www.youtube.com/watch?v=cvvaVyUrCn8

https://www.theglobeandmail.com/canada/article-covid-19-antiviral-drug-paxlovid-being-dispensed-at-low-rates-across/

Doctors fees are laughably low these days. Make more $ in the trades and don’t have all the overhead. And we wonder why nobody can find a doctor…

My friend went to the dentist a couple of weeks ago. He had a small chip in each of two teeth. The dentist charged $527.00 for filling those chips with whatever. No anaesthetic, in and out in less than 15 minutes. Doctor: $30.00 per visit per patient.

Rockland isn’t a huge area. When I grew up it was just an area of Fairfield. Our family home was Linden and McClure area. Many of those homes are certainly equivalent to the realtors designation of “Rockland”. It is beautiful granted but people do tend to speed down Rockland Ave towards Cook. 1325 Rockland is asking $1,597,500. 2300 Sq Ft.

We all know Victoria has a family physician shortage, but how come dentists seem to be doing just fine here? We never hear them complaining about the high cost of living, and they don’t seem to be leaving their dental practices in droves. I guess dentists just earn way more money than GPs?

There are only two houses for sale in the whole Rockland area and one of those is listed at six million which is not much help for the average buyer. I just dont see a lot of new listing for a number of areas. I wonder how much of the inventory is death and divorce driven?

I’m impressed with the sale price of 2545 Asquith… listed at 900k and sold for 1.3. Clearly underpriced at 900, but 1.3 is a solid figure for an un-updated place with no suite. Looks like there’s some life left in the Oaklands market.

After reading about the mass of new listings mentioned in this thread I went to check realtor.ca to see what was available in Oaklands (my area of interest) and I don’t see a single house listing with 3+ beds in that neighbourhood presently except for a pretty unique one right on Finlayson with eight (!) bedrooms. I’d say we need significantly more new listings in this area for buyers to feel any relief.

Marko you had a new build going on in that area with the gold-plated sidewalk right? Things turn out okay for you there?

Rates from:

1981 to 1991 decreased by 39%

1991 to 2001 decreased by 36%

2001 to 2011 decreased by 36%

2011 to 2021 decreased by 29%

Not saying real estate won’t be a good investment in the future, but the impact of rates on long run appreciation is still wildly underappreciated. The 40 year trend means only few owners have experience in an environment where you can’t essentially count on your mortgage rate going down every renewal (and value up as a result).

I’m not counting out the possibility of one more dropping cycle though.

Monday numbers:

Sales: 247 (-12% over same week last year)

New listings: 439 (down 3%)

Inventory: 1175 (down 17%)

New post tonight.

Since you’re talking about effects from the 1980’s and early 1990’s, let’s look at Toronto prices during that period.

1980:$70K Toronto house price.

1989:$280k

1996:$210K

Toronto prices gained 4X in the 1980’s ($70k to $280k)

With the recession in the 90’s, prices fell to $210K.

Overall that’s still a 3X price change (70->210) when measured from 1980 to 1996 (the bottom of the downturn).

And of course another 6X change since then (210k->$1.3m+), leaving house prices 18X now what they were in 1980.

The point being, buy/hold a house and forget about prices. Measure home prices over decades, and the price gains will take care of themselves, while you and your family enjoy the house.

Looking back, don’t we all wish that we had followed that simple advice?

Here’s more evidence that immigration will not prevent RE busts. Look at the chart below, and note the huge increase in immigration between the early 1980’s and late 1980’s – early 1990’s. And then what did we get? The Toronto bust, the largest post-WWII bust in terms of market cap.

https://www150.statcan.gc.ca/n1/pub/11-630-x/11-630-x2016006-eng.htm

Immigration were cut in half during COVID and the shortage of workers were exacerbated by an ageing population, plus early retirement due to the pandemic. And, the cruncher is that many millennials feels that manual labour positions are below them.

What doesn’t quite make sense to me is how we can have 100,000 new British Columbians and still have an intense labour shortage in most industries. Are all the new residents working remotely for companies elsewhere, or did they bring new businesses that employed more than actually came?

They’re not foreign, they’re new Canadians. Foreign buyer ban doesn’t impact them.

So, if 100,000 people came to BC last year and 63,000 were considered to be foreign; how will the 2 year foreign buyer ban impact a tight rental market? Seems like a policy to satisfy xenophobes and jingoists will just have a real negative impact on locals that are in the rental category.

Patrick- Yes the men are staying to fight but will be able to reunite with their families when the time comes. Unfortunately, the elderly are being left behind and are being sacrificed. What we are witnessing is instinctual human behaviour to preserve the species, by protecting the children.

There are 1.3 million Ukrainians in Canada that, along with non- Ukrainians, will be opening their homes to these desperate young people. It’s happening as we speak.

My understanding is that the Ukrainian refugees have virtually no males of “fighting war” age (age 18 to 60). Those males cannot legally leave Ukraine as they are needed in the war effort. The Ukrainian refugees to Canada would likely be women, children and elderly males. A study from Poland found that 93% of adult Ukrainian refugees are women. https://www.rescue.org/press-release/poland-welcomes-over-2-million-refugees-ukraine-irc-assessment-finds-people-need-work

That obviously complicates the immigration process as they would want to bring over the husband to join them in Canada when possible.

Too early to tell imo.

totoro- When my grandparents fled Eastern Europe over a hundred years ago, they had no intention of going back. There’s nothing to go back to. They’re here to stay. If you look at the bombed out Soviet- era apartment blocks they are leaving, Canada looks a helluva lot better. Lots of Europeans want to come to Canada to escape the congestion in countries like France, Germany, Portugal, UK, etc… Plus, no one knows when this madness will end.

Pretty sure a lot of Ukrainian families will want to return. I have no issue with those who qualify through the regular programs and want to stay and become Canadians doing so even if they do so as a result of working and studying here on an emergency refugee visa. Given the lack of vetting and id in the emergency stream, having close attention to who we are letting in permanently would be my concern.

Many people in Toronto are moving to Moncton.

https://globalnews.ca/news/7680006/n-b-housing-boom-sees-house-prices-climb-30-in-2021/

It looks like there are programs for individuals or organizations (churches etc) to sponsor Ukrainian refugees coming to Canada.

Does anyone have information on best way (organizations etc) to help/sponsor Ukrainian refugees, for the Victoria area?

I read articles like this where BC people are complaining about the process https://globalnews.ca/news/8677917/ukraine-refugee-concerns/

In these woke times, it is ludicrous to suggest Canada would ever return refugees.

https://househuntvictoria.ca/2022/04/04/march-continued-strong-stats-hide-turning-market/#comment-86968

Patrick,

It give the Ukrainians ample amount of time to save and buy their homes here in Canada without falling into the foreign home buyers category.

Great!

Do you see what the government did there?

They are allowing Ukrainian refugees to work/study in Canada and using the preexisting outline to give Ukrainians Permanent Status and a path to become Canadian citizens.

Government of Canada — https://www.cic.gc.ca/english/helpcentre/answer.asp?qnum=664

How much work experience do I need to be eligible for the Canadian Experience Class?

To be eligible for permanent residence under the Canadian Experience Class you must have completed, within the three years before you apply, at least:

12 months of full-time work:

30 hours/week for 12 months = 1 year full time (1,560 hours), OR

equal amount in part-time hours, such as:

15 hours/week for 24 months = 1 year full time (1,560 hours)

30 hours/week for 12 months at more than 1 job = 1 year full time (1,560 hours)

Yes, that’s a fabulous program. Three years entry and work permit for the whole family. https://www.canada.ca/en/immigration-refugees-citizenship/services/immigrate-canada/ukraine-measures/portal-application-ukraine-cuaet.html

As mentioned, most would return when it’s safe to do so. But I hope by then there is also a pathway for those that want to stay here to remain in Canada permanently.Many of us here are immigrants or children of immigrants, and realize what a huge upheaval it would be to move the whole family back to the “old country”.

I think many immigrants still “love their homeland” – nothing wrong with that. It’s another thing insisitjng that Ukrainian refugees en masse will need to “go back when the war is over”. It may be safe, but their house, village and careers are destroyed. Being a refugee of a terrible war like this should be a one-way to ticket to Canada – no one asked Canadian immigrants to return to Europe in 1946 when WWII ended

Immigration has always been fabulous and supportive to Canada, including the economy and the housing market.

The “biggest RE bust since the 1930s” certainly didn’t happen in Toronto during the 1980s, because of the huge population increases That’s relevant since Toronto is by far the largest destination for immigrants. 51% of Toronto population is “ visible minority”, (an ironic title since they are now the majority), so it is a good case study for the effect of immigration in house prices and affordability.

There wasn’t a single year where nominal house prices fell in Toronto from 1964 to 1989. And this occured despite the incredibly high mortgages (10-20%) seen in part of that period. The reason is likely that the population doubled ( 2 mill to 4 mill) during that 25 year period. Visible minorities were 13% in 1981 and are now 52% – a rise due to immigration.

Toronto RE prices doubled during the 1980s (inflation adjusted), and nominal rose much more than that.

We can see from Toronto house prices that the immigrants, many who arrive “with no money” have always supported the market, which is now at all time highs.

“The demographics of Toronto, Ontario, Canada make Toronto one of the most multicultural and multiracial cities in the world. In 2016, 51.5 percent of the residents of the city proper belonged to a visible minority group, compared with 49.1% in 2011,[1][2] and 13.6% in 1981.[“ https://en.wikipedia.org/wiki/Demographics_of_Toronto

Toronto yearly house prices changes % (showing nominal price increases every year from 1964-89) https://www.livabl.com/2017/01/history-of-toronto-real-estate-peaks-and-crashes.html

Ukrainians are coming as part of the ‘Canada-Ukraine Authorization for Emergency Travel’ program. The status granted in Canada is for three years only (allowing them to work or study) with the expectation that they will go back when it is safe to do so.

Absolutely. I saw the same thing out east in the 1979-80 period and had university friends that were Vietnamese immigrants. They all did great, and bought homes within 5-10 years. I also would expect a big success from the Ukrainian immigration.

Over 40 million Ukrainians would translate into 400,000 in the top 1%. That’s a lot of wealthy people with assets outside of the country. If 10% come to Canada, that’s 40,000 wealthy buyers. Their instant refugee status enables them to purchase whatever they want. They will have an effect across the country, especially central and western Canada. Indirectly, the Island will be impacted. A war in Europe is far more significant than wars in under developed countries. This is definitely not 1980, and there is no correlation between Vietnamese refugees and high interest rates. Other Europeans are also spooked and will be sending their wives and children to the security Canada has to offer. The bottom line is there is more money looking for real estate than there is real estate.

I disagree.

As a Vietnamese refugee that came to Victoria in late 1980, and we all were renters (that put pressure on the rental market). However, by early 1983 my family were the first Vietnamese family that bought a home in Victoria/Vancouver Island, and soon after many of my Vietnamese friends also bought their own homes (refugees/immigrants often live a modest lifestyle, work hard/multiple jobs, and pool family money together).

So, I would expect the Ukrainians are going to buys their own homes within the next 3-4 years, and surpass local born economically.

We are in a condition that have high demand for resources, high commodities price, population growth, economic growth, and shortage of workers, that suggests we will see exponential cost of housing going forward.

A side note, OPEC just announced that they are incapable of increase oil production, because the production is maxed out.

Weather.

living expense in Victoria is not that much difference than UK or Germany but less job opportunities. And the average Canadians can’t afford to live in here. It’s just hard to find a reason why thousands refugees will land here.

If you want to look at a historical parallel, there’s the Vietnamese boat people migration of the late 1970’s and early 1980’s. In 1979 and 1980 alone, over 60,000 refugees were admitted to Canada. About 200,000 in total.

And then what happened? The biggest RE bust since the 1930’s. As always, what matters is affordability. Bringing in people with no money will not support the market.

I am willing to bet the victoria market sees zero impact from the crisis in Ukraine.

This site should have a survey for what blog readers feel the median in our market will be in 8 – 12 months time.

Some people are getting nervous and thinking that increasing interest rates and other pending restrictions are going to slow down the real estate market. I don’t think so and any investor selling today will probably be sorry a year from now. Some places in Ontario are going for $500,000- 1 mil over ask. Hamilton average home price is 1 mil. 30 thousand Ukrainians have already come to Canada since the war began, expect hundreds of thousands more. Canadians are opening up their homes to them but they will eventually need a place of their own. This housing crisis is only going to get worse.

Or unless they’re investors.

YYC- Good point, more sellers means more buyers, unless they’re moving to Moncton.

Buying a multi-unit rental doesn’t keep anyone from being an owner-occupier.

I am hearing rumors of 35% down requirement coming on investment properties. A change could be coming that would limit all that equity people are pulling out of there homes to buy second residences. While at the same time a corporation can now easily get 95% financing on apartment buildings.

Where will all the occupants of those 109 listings go? I would guess some will become buyers in the Victoria area. Thoughts anyone?

“These are incredible prices.” No kidding… for a non descript 1950’s box in the middle of nowhere! Rather move all the way out to Saanich.

Two properties came up for sale on Walker St. in Ladysmith recently. 1950’s era, 1/4 acre-1/2 acre lots, both completely renovated. Assessed values $650,000-700,000. One was listed for 1.2 and sold for 1.375m. The other, listed for 1.385m hasn’t sold. Fantastic views. The assessed values were up 35% last year. These are incredible prices.

BCGEU contract expired: March 31

BC nurses contract expired: March 31

BC teachers contract expires: June 30

I wonder if more expensive properties are the ones that will not lag.

Right. With SFH sales down 30% YOY in March 2022, (and listings down much less at down 5% https://www.macrealty.com/greater-victoria-saanich-peninsula-parksville-and-nanaimo-real-estate-market-statistics-march-2022/),

….it doesn’t look like the buyers would be there to support those 109 listings at current prices (at least for the SFH).

Between failed offer nights, and the BofC expected 1/2 point rise in rates this Wednesday , it should be an “interesting” week. As your charts show, a 1/2 point price rise reduces borrowing power by 4%, which is $40K on $1 million borrowed to buy a SFH.

What matters is who is making offers. Otherwise you’re just a bystander.

Leo- Isn’t this the time of year that listings are supposed to explode? There must be hundreds of prospective buyers out there. Most realtors probably have a few clients they are dealing with. Depending on the price distribution of the listings, I’m sure there will be sufficient interest to absorb properties in the average price range. More expensive properties may lag.

Cancelled

With 109 listings on Thursday, many are set up for bidding wars with offers Tuesday or Wednesday. Could be an opportunity there as the decreasing number of buyers are spread too thin for 2x the normal number of listings. I suspect we’ll see a good number of failed offer nights next week.

There can’t be as many big union strikes though if there are less union members.

That’s US data, and Reagan was elected in 1980. Breaking the power of unions was a big part of his agenda.

I do agree that inflation in the 1970’s played a big role in labour disputes.

OK, i was referring to what I think caused the strikes, not what factors are co-related. Thanks for the discussion.

Your graph doesn’t show that at all.

Looks pretty steady from 1950 until the late 70s, then dips considerably after 1980.

Also I said it correlates, not that that was the cause, and it clearly does.

No, the number of strikes doesn’t correlate with union membership. As you can see, union membership has been falling steadily since 1950. Yet the strikes rose from 1964 to 1981 (during inflation) , as union membership continued to fall. And strikes fell to almost nothing in the 2000’s, and there are still plenty of unions around.

It’s hard to go on strike if there’s 2% inflation per year, since you’d be asking for so little to catch up to inflation.

What happened back then is something like the teachers union would sign a 4 year deal at 3% increase per year, so 12% total. But inflation would be 25% during that 4 year period. So at the end, the teachers were behind 13% and also wanted increases of 6% per year for the next 4 years – so the headline would be that the teachers wanted a 37% increase, and that seemed outrageous and would end up in a strike.

Got an error message and no connection to the page. Could just be my phone, but had to point out the irony for the many here that love to talk about government inadequacies

Link works for me…

If their audit division is as responsive as that link no one has anything to worry about

There is an audit division for the speculation and vacancy tax and audits are routinely carried out on a sample of filings. I would suggest that it is extremely foolhardy to make a false declaration.

https://www2.gov.bc.ca/gov/content/taxes/speculation-vacancy-tax/audit

Could anyone tell me what 2860 Graham St. went for? Thank you 🙂

No, very much on topic. I shared my experience with this same thing several weeks back and asked the same question. My experience is that I receive declarations in property mailboxes, I call or go online to say yes, they’re rented, and I never hear anything else about it. If they are using CRA income tax data to compare I’d be very nervous to be someone claiming it’s rented and not claiming that rental income, but I’m sure some out there haven’t put the two together yet and will land in audit hell at some point.

I think that probably also correlates to number of workers who are unionized. Going to be less strikes when way less people are unionized than in the 70s.

Off topic – I recently submitted my self declaration for the speculation and vacancy tax. Does anyone know, is this essentially an honour system or are they verifying/corroborating with other data sources like CRA income tax etc. to confirm someone is actually renting their property out?

Thought about pulling the trigger on 2647 Anscomb Pl , but scared by the millions of listings yesterday.

You’d have to assume interest rates have gone flat too.

Tons of listings yesterday, but overall not seeing anything too unusual. In 2019 after spring break we saw a bump in listings, would expect something similar this year into april. In one day we spiked back up to last year’s listings levels.

Let’s say negotiations end at 3% over 3 years. Assuming market goes flat wouldn’t that improve affordability 10% over 3 years and 20% over 6 years?

interesting chart. And yes, most of the government employees in the thread are talking about striking. I would too.

With big inflation, we should expect not only more wage negotiations, but more labour strikes and work disruptions.

In the last period of big inflation (1970s-80s), there were a lot of labour strikes. Various groups would find that they had lost ground to inflation for a few years, and were then asking for 10-30% increases to catch up. If the employer says “no”, a likely outcome is a strike. When there’s no inflation, it’s not as common to see employees suddenly ask for 10-30% raise, because they haven’t lost that much to inflation.

Big Strikes per year in the USA

(See next msg)

I take it you weren’t around in the 1970’s. But good of you to bring this up, such wage demands to meet inflation are the sort of thing the central banks are worried about. Appears that the government is worried too, since inflation-fed labour strife was one of the issues that led to the defeat of BC’s first NDP government.

According to a Reddit thread this is the how the bcgeu negotiation is going:

“What the union is asking for:

2 year agreement

This year, a COLA adjustment or 5%, whichever is greater

In April 2023 a COLA adjustment or 5%, whichever is higher, plus an unspecified flat rate increase

What the government is offering:

3 year agreement

For this year, 1.75% increase plus $0.25/hr, plus a one time $1000 taxable bonus

2% raise in April 2023 and April 2024”

I realize the first year offer isn’t terrible especially if your wage is low ($23 an hour for example) but 2% raises in the face of unprecedented inflation – government should be ashamed on that offer. They should at least link to inflation somewhat. I was thinking they would do 3.5% this year. (CPI less 1.5% or something like that).

Is it just me, or did the market just get flooded over night with houses in the 1.3-2M range?

I can’t speak for Patrick, but my concern comes from studies like this.

https://www.nejm.org/doi/full/10.1056/NEJMoa2201570

There really is no “recommended interval” yet for a fourth dose. They’re still figuring it out, and this study would suggest four months rather than six. Since there’s no longer a supply issue, I’d prefer they be less stingy and allow people and their doctors to start making the call for themselves, particularly if they’re more than 50 years old.

My understanding was that the 4th dose will end up being about 6 months after the 3rd dose.

They started rolling out dose 3 last October to 70+ which is 6 months ago. I got mine this January, so I expect I will be eligible around July.

It does not sound like they are denying anyone a 4th dose, they are just rolling it out at the recommended interval.

Not sure where your concern is coming from.

Felt like winning a lottery? That was how we felt when we got our current GP.

Happy to announce we have a new family doctor. Miracles happen.

“The Canadian Real Estate Association (CREA) is proud to announce a pilot project that will display real-time tracking of offers on REALTOR.ca listings, a first for Canada…The pilot, scheduled to begin this summer in select markets across Canada, will support REALTORS® in reinforcing consumer confidence in the current home buying and selling process via REALTOR.ca.

“This opportunity is well-timed and well-suited for our market,” said Jeff King, CEO of the Real Estate Board of Greater Vancouver. “We are excited to participate in a by REALTORS® for REALTORS® solution that provides equality of access to information and facilitates increased transparency for the consumer.”

Sounds like CREA has decided on ‘their own’ to test open bidding with the help of an Aussie company – https://twitter.com/CREA_ACI/status/1511803231910957069?t=xnY_p3XNGYozJvDF4lvZLA&s=19

Ok, but what about our favourite nemesis province, you know, the one that fired their health services CEO this week. What does their science say?

Unfortunately the long-standing doctor-patient relationship and the foundational ethical concept of informed consent was radically altered when the government removed the ability of physicians to provide exemptions to the thousands of people who had severe and potentially life-long reactions to the vaccine (speaking from personal experience here) or other medical conditions which ruled out the vaccine. There is no exemption process here, only a deferral process. With the fear driven support of most of the public, the horrendous precedent has now been set that the government knows better than your personal physician as to what’s best for you.

It’s like the free speech argument – seems like a great idea to limit the spread of ideas you don’t agree with, until such time that you’re banned from saying something you personally want to say.

The Budget is pretty much a non event I would say other than it is predicated on a continuing hot economy churning out tax revenue given the level of new spending on things like defence. A recession would result in a dreadful financial situation for Canada. Then too much awaited new homeowners savings plan won’t start until 2023 and even then you can only put in $8,000 a year up to $40,000. Confirms that the Federal Liberals (the other parties, too) are dependent on the good will of real estate owners and investors.

Absolutely. A 69 year old with multiple medical conditions is at high risk if they get Covid.

In Ontario or USA, they’d be eligible for a 4th vaccination. In BC, they wouldn’t be eligible (unless they were immunocompromised e.g. by chemotherapy or transplant therapy).

Allowing a person’s doctor to override this situation would make sense., since the vaccine is safe and is in good supply.

Agreed, many people don’t have family doctors, which is a terrible problem, but is a separate issue. And that shouldn’t prevent people from getting treatments recommended by their doctors. To be clear, this would be in addition to the eligibility provided by public health rules, not replacing it.

I like suburban roofing.

Snap-lock is really easy to put down if you’re up for it. You can get it at Ken’s or Protec.

The foreign ban won’t apply to many purchases. The two year foreign ban only applies to “non-recreational properties”. Not sure how they’ll define that, but there aren’t many foreigners buying in Victoria or Vancouver already because of the 2% spec tax. And most of the homes bought by foreigners are likely recreational (such as whistler, tofino, gulf islands or Sidney) so foreigners would still be allowed to buy (although subject to existing provincial foreign buyer tax)

https://budget.gc.ca/2022/report-rapport/chap1-en.html#2022-4

“ To make sure that housing is owned by Canadians instead of foreign investors, Budget 2022 announces the government’s intention to propose restrictions that would prohibit foreign commercial enterprises and people who are not Canadian citizens or permanent residents from acquiring non- recreational, residential property in Canada for a period of two years.”

Flipper rule introduced in Budget not new per se. Just needs to be better enforced by CRA. I would suggest that CRA would assess as business income even if held longer than a year if pattern exits. What is new is that the one year rule applies, even if claimed as principal residence.

With the rollout of the 4th Covid vaccine, we see different age cutoffs in different regions. Why is BC lagging other areas in the rollout?

USA: age 50+ eligible for 4th dose of Covid vaccine

Ontario: age 60+ eligible for 4th dose of Covid vaccine

BC: age 70+ eligible for 4th dose of Covid vaccine

There doesn’t seem to any science behind these recommendations for different age groups. There is also plenty of supply of the Covid vaccines, with BC currently having on-hand supply of 700,000 vaccines. BC gets as much vaccine as Ontario if they ask for it. Pfizer and Moderna have plenty of supply available. (e.g. Africa are cancelling Moderna orders because they have more than they can handle. https://www.reuters.com/business/healthcare-pharmaceuticals/covax-african-union-decline-buy-more-doses-modernas-covid-shots-2022-04-05/).

So why is BC slower than other areas on uptake of the new vaccines? We needed to get “surprised” by the last Covid wave, and it sounds like we will need to get surprised by the next Covid wave, before they’ll lower the age for the 4th vaccine to Ontario levels (age 60) or USA (age 50).

Why can’t the BC government let your doctor decide if you need a Covid vaccine, and this would over-ride these arbitrary age limits?

Right. To me, this is where the NDP policies shine. It seems like it took the NDP/Liberal partnership to make this happen, and the NDP were pushing for it. That said, it was “baby steps”, with only $300 million per year, and only helping kids under 12. Hopefully they’ll keep increasing it to cover all ages (for low incomes).

Great!

Right. At least the new rules will end the “games”, as it applies to everyone flipping.

I’m certainly for the dental care for kids. Children’s health in this country should not have to suffer because their parents NEED to buy that extra six pack of beer or a carton cigarettes extra every week.

Legal right to a home inspection on acceptance of offer to purchase….Fantastic!! Disappointed in the flipper tax. Should be at least 3 years.

Apparently business income, rather than capital gains. This is CRA policy already except for principal residences, and they will even go after those if it appears the owners are in the reno-and-sell business.

“Among other things, the Home Buyers Bill of Rights could also include ensuring a legal right to a home inspection and ensuring transparency on the history of sales prices on title searches”

Federal budget is out.. overall I give it a B+

(great!) FINALLY!An actual tax on speculators, a flipper tax added, where ANYONE selling a house within one year of purchase pays full income tax on profit(even for a personal residence); this is the exact tax I was suggesting, although I wanted a five year limit not just one year.

——

The good news in this budget isn’t housing.

Dental care for kids (if family income less than $70k)

Increased military spending (90 new jets) , help for Ukraine

Does anyone have any roofing contractor recommendations? Looking at installing metal. Thanks!

What matters is inflation going forward. Which we don’t know.

No one saying they aren’t laughable. But is 6% interest on your mortgage laughable?

GIC rates are still laughable when inflation greatly outpaces them.

The market value of the bond component dropped immediately in response to the higher interest rates, but will receive the higher yield going forward.

The question is what will happen to the stock component.

Wow, that was fast. It’s been so long since a GIC rate was anything but laughable, but it’s nice to see some rates with some decent returns. And likely more to come.

fwiw, VBAL – HHV’s favorite balanced fund is down 1.23% YOY (before 2% div). So a risk-free 1 yr GIC of 3.08% would have beat it. I wonder how long that will last?

GIC interest rates are increasing. Right now highest 1yr rate @3.08%, 2yr@3.3%,3yr@3.75%,4yr@3.8% &5yr@3.85%. So now it seems very possible if BOC increases by .25% this month, that we’ll be seeing 4% on a rate that is totally safe as an investment. 5-6% on residential mortgages by the end of the year are getting more and more likely.

Totally agree, for decades now I’ve been saying that Gordon Head will never get built, but no one listens any more.

That happened with Tuscany village as well. The house was where the CIBC is now, behind the Petro-Can.

There is another example of a developer encircling a house when the owner failed to sell. This one is a bit closer to home. The developer was the Town of Sidney and the building was their firehall. While Sidney has completed a new firehall now (in a different location), the previous firehall was constructed at the SE corner of Third Street and Sidney Avenue in the 1980’s. Google maps still shows the old building although the property was recently sold and a new building constructed (oddly though, if you use google street mapping it shows the old building off Sidney Avenue but the new building off Third Street). The owner was an elderly lady by the name of Mrs. Menzies (her son used to own and run Menzies Marine at the time). Everyone (including her son) tried to convince her to move but to no avail and the firehall was built around her cutting off sunlight to her house and garden. After she passed away some years later the property was bought by the city and became a parking area for the fire department. All this for a new firehall that lasted less than 40 years.

omg Frank that pic is so funny!

There is only one way to find out. List the property for sale and then get them to top the high bid. Short of that you’re just taking their word for it.

I looked it up. It was in Seattle, in 2006. They offered her $1,000,000. Probably worth a lot more now.

Kimo-Sorry I can’t provide the details, but I’ve seen one example where an elderly lady refused to sell her small house for a large development. They offered her ridiculous money but ended up building this huge building around her. It was hilarious. Maybe someone out there knows the specifics.

Recently got a letter notifying me of a possible land assembly that could involve my property. Letter says developer would offer significantly more than if I were to sell. Thing is, in this market, finding another home could be quite tricky so the incentive would have to be huge. Impossible question I suspect but what is typically ‘significantly more’ in Victoria? I imagine it varies quite a bit. I live in Oaklands and they apparently have 3 houses lined up for the assembly and are looking for additional land including possibly mine.

I would like to know the demographics of the 100,000 net new residents. Especially their net worth and age bracket distribution.

More than 100k people moved to B.C. in 2021, setting a 60-year record

https://bc.ctvnews.ca/more-than-100k-people-moved-to-b-c-in-2021-setting-a-60-year-record-1.5851154

Like we haven’t been doing just that for over 150 years? Kinda thought that’s what Canada is all about.

Yes, and if an exemption can’t be found, the foreigner can just rent instead of buying/owning a home here. For that matter, anyone with an interest/need in renting a second home (or multiple extra homes) is also able to do so, despite the apparent obsession with “preserving homes for Canadians to live in”

These taxes are a waste of time, and having a foreign ownership ban lasting two years is inane. In two years time, there will be 800K more immigrants in the country looking for homes to live in. The foreign ban would be a drop in the bucket.

re: Taxing Americans who own property in Canada, and banning buying for two years

Well here’s one NY congressman that already “gives a hoot’”, and says the same thing that I’ve been saying here for years. Namely that Canada would be violating USMCA (formerly NAFTA) by introducing 1% foreign property tax on Americans. The objections from the USA will be much stronger if/when this two-year ban is announced in the budget.

https://higgins.house.gov/media-center/press-releases/congressman-higgins-objects-to-proposed-canadian-tax-on-american

NY Congressman: “ We believe this tax is not just an unfair fine on good neighbors but a violation of the United States-Mexico-Canadian Agreement and international tax law. We are working with the Biden Administration to advocate on behalf of Americans and urge Canada to reject this proposal on Americans. Its adoption could lead to a race to the bottom for both of our countries.”

I think I fall into this category you’re trying to create and I can tell you that a) I don’t claim to be a genius b) my rental homes are not invaluable c) in my mind, the value that they do hold does not come from rich foreigner boogeyman wanting to buy our land d) the sentiment you claim exists in the message “the party is over” is not there because it’s a two year ban, and e) Leo is absolutely correct that this is 100% political theatre.

You can’t just drop houses on any piece of land. Sewer systems, water supply, gas and hydro lines need to be run. Then there’s roads, garbage removal, snow removal (in most of the country), fire, ambulance, police, schools, hospitals, etc… Then good luck finding the workers to provide the services to support a new area. City resources are stretched as it is. You can’t snap your fingers and create housing.

Where’s the limited land in Edmonton, Calgary, Montreal, Toronto, Ottawa, Saskatoon, Regina, Winnipeg?

As if anyone south of the border gave a hoot. Americans buying properties abroad costs American jobs, right? And the last thing states like Florida or Arizona would want is a ban on Canadians buying winter properties.

Canadians own more foreign property than foreigners own in Canada. And that includes real estate and financial assets. (Stocks, bonds).

This will pointlessly anger the Americans, who will likely respond in kind.

In the past, legal experts have said this type of thing (banning foreigners buying) isn’t legal under trade treaties like USMCA – it will be interesting to hear what they think of this new idea. I suspect the reason they plan to limit this foreign ban to two years is because they know it’s illegal under existing trade agreements but it would take more than two years to challenge it.

cant live in a reit.

Foreign $ in Reits justs helps build supply.

Rich

Sorry the party in not over. I have mentioned this for years on here and everyone ignored and kept calling for a crash. Nothing is going to change.

We are going to allow a huge amount of people in Canada over the next 10 years. I predict 6 million. They are all going to the same places.

Interest rates will be the only thing that delays the party. Every major city has limited land. We need to go up and that will always make houses in demand in those areas.

There’s nothing stopping a foreign entity from buying out a REIT that owns a huge amount of Canadian real estate. I believe when the Fairmount Hotel chain was sold to the Saudis, the portfolio included the Banff Springs hotel, an iconic Canadian landmark. We’ve already been sold out to foreign entities. Canada may just be an illusion.

“Won’t make a difference here.” It will make a difference. Think beyond the stats, about the impact this policy will have on consumer sentiment. The seemingly wealthy average Joe housing investor genius thinks that their house is invaluable because of an unlimited supply of rich foreigners wanting to buy all our Canadian land. The message is that the party is over, folks.

Leo

wont disagree but we need to keep going after foreign ownership and get those already owning like NS did country wide. We need to stop having foreign ownership period while Canadians are facing this market. One step at a time, If I was a foreigner owning i would be selling with what could be on the horizon.

Every bit helps.

Need to increase supply now with appropriate measures. Lots of land out there just need to access it and approve quickly. Victoria and Saanich are a joke at timely approval.

Won’t make any difference here. FBT already reduced sales to foreign owners to a trickle (less than 5 a month in Victoria) and the exemptions are big enough to drive a truck through. 100% political theatre.

The most interesting thing here is the $4B for munis to accelerate supply. Victoria is positioning to make a strong case for this money right now.

This is a good plan

Need to build supply and take powers away from municipalities.

The federal government is planning to unveil a significant crackdown on foreign homebuyers as part of Thursday’s federal budget, CTV National News Ottawa Bureau Chief Joyce Napier reported Wednesday afternoon.

According to her reporting, the feds will make it illegal for all foreign nationals to purchase any residential properties in Canada for the next two years, including condos, apartments and single-family homes.

Permanent residents, foreign workers and students will reportedly be exempt from the measure, as are foreign nationals purchasing a primary residence in Canada rather than a vacation home or investment property. No cost was yet attached to this measure.

The new law would bring greater clarity to the Liberal campaign promise that pledged to bar foreign nationals from purchasing non-recreational, residential property in Canada for two years.

It remains unclear how prevalent foreign homebuyers are in influencing the Canadian residential market, as data remains scarce.

However, a crackdown on foreign homebuyers has gained political traction at the federal and provincial levels, with the federal government introducing a national one-per-cent tax on the value of non-resident, non-Canadian owned properties considered vacant or underused. That measure came into effect at the start of the year.

Provincially, Ontario recently announced it was increasing its foreign homebuyers tax to 20 per cent from 15 per cent and expanding its scope to the entire province. And the Nova Scotia government unveiled new taxes on non-resident homebuyers in its budget last month.

Further to the foreign homebuyer ban, CTV News reported the feds are setting aside $4 billion to help municipalities update their zoning and permitting systems to allow for accelerated construction of residential units. Ottawa is also reportedly announcing $1.5 billion in loans and funding for cooperative housing and a further billion dollars for the construction of affordable housing units.

The expected measures expand on some of the pledges made by the Liberal Party when it struck a support deal with the New Democrats, in particular a push for addressing housing affordability and tackling what the government describes as the “financialization” of housing as prices soar.

Affordability has become a hot pocket-book issue throughout the pandemic, as prices skyrocketed not only in Canada’s largest urban centres, but in outlying communities as well. The average non-seasonally adjusted home price hit a record of $816,720 in February, up 20.6 per cent from a year ago; and the average home price in Toronto is now hovering just shy of $1.3 million.

Related

We own some rural vacant land no where near any Town’s in Nova Scotia, so now we will have to pay a 2% tax!

LOL, what a joke!

But, as proven by the BC NDP, these type of taxes are winners at election time!

Communism was a failure but the threat of communism was hugely beneficial to the lower and middle classes across the Western world. It’s no coincidence that the period when communism appeared to many as a viable alternative coincided with worker friendly policies, lower inequality and strong income gains across all percentiles. Better to throw a few crumbs to the workers than risk social unrest or revolution.

Now that communism has visibly and obviously failed the gains of the welfare state are being rolled back and the income once again concentrating at the top of the food chain

Yes, the Nova Scotia ”spec” tax plan is even more bizarre than our BC spec tax, in that

the Nova Scotia spec tax:

—-Nova Scotia acknowledges that only 4% of homes are owned by non-residents anyway, so this can’t make much of a difference..

Nova Scotia explains this tax by saying “ We want to make sure people can afford a place to call home.”

If that’s true, how can they justify exempting Nova Scotia residents from this tax entirely?

These links are to the Nova Scotia government website explaining the tax…

https://novascotia.ca/budget/docs/Tax-measures-Non-Resident-Property-Tax.pdf

https://novascotia.ca/finance/en/home/taxation/tax101/non-resident-deed-transfer-tax-and-property-tax.html

What Patriotz said.

You can look up the rules yourself on the CRA website – they have bulletins that explain everything. https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/rental-income/completing-form-t776-statement-real-estate-rentals/rental-expenses-you-deduct.html

I believe the spec tax does not apply to the entire province, I know property in Ladysmith is exempt. I also believe that a property only needs to be rented for a minimum of 6 months.

CRA doesn’t care whether a business activity conforms to local zoning or licensing. What’s deductible depends on the nature of the business. You are supposed to pro-rate expenses for items which are also used personally. That’s true whether you are running a short term or long term rental.

If you have a rented suite in your home in Vancouver, the owner is required to have a license for that. Same thing may happen in Victoria area one day.

Not true of course, there’s BC’s spec tax. However this appears to be much broader in scope, it applies to the whole province and the exemption for renting out applies only if for a full year.

Really? I know people that say they are writing off cell phone bills and car payments based on using them to run their AirBnB business and I don’t believe those count as write offs for just renting to tenants.

You could claim the fee that you spend for the business licence as an expense, but that is still an extra expense. Everything else would be the same.

The idea of running an AirBnB has always been appealing as I know several people that do and make a heck of a lot more than just renting. I haven’t talked to an accountant about it, but does anyone know if licensing them as Victoria has done actually allows owners to claim greater write offs than if they were just receiving the income and having to claim it? This is obviously based off the assumption they’re claiming the AirBnB income with no license, but just wondering if forcing owners to register as a business has actually benefited these owners and left them with more profit after business write offs, which I assume is the opposite of city councils plans when this all started.

It’s a factor but perhaps not that large. I wrote an article about it last year https://www.capitaldaily.ca/news/victoria-airbnbs-disappearing-covid-rentals

City of Victoria has had some wins in court since that story so they do seem to be actively enforcing it, even if they couldn’t get AirBnB to comply to add the license numbers to the listings. Would make sense if the other munis adopted similar restrictions.

Licensed Airbnbs are legal in Victoria but you need to meet the eligibility criteria and if in a condo your strata has to permit it to get licensed. Any home owner who meets the eligibility criteria can get a short term stay business licence and become an Airbnb host. The fine is $500 per day for non compliant listings which seems high enough to prohibit a free for all.

Unfortunately – like everything – these airbnb restrictions are only as good as the enforcement. Apparently Victoria has 2 full time staff dedicated to cracking down on Airbnb but this scraper shows plenty of people happy to risk whatever fee the city is levying – http://insideairbnb.com/victoria/

Zach De Vries (council member) had mentioned they are also illegal in Saanich but unless people complain they aren’t enforcing anything.

Only a handful of buildings in Victoria have AirBnB zoning, listed below. This list remains fixed as they do not approve such zoning on new builds; therefore, every year the % of air BnBs makes up a smaller and smaller % of the market. It is already small to start with. A few of these buildings such as Legato don’t have many AirBnBs to start with.

1) Janion- 1610 Store st/456 Pandora

2) Era- 787 Yates st

3) Union- 517 Fisgard st/528 pandora

4) Falls- 707 Courtney st

5) the Oriental- 562 yate

6) Leiser- 534 Yates

7) Astoria – 751 Fairfield

8) Mermaid wharf- 409 swift

9) 595 Pandora-595 Pandora

10) Leiser- 524 Yates st

11) Vogue -599 Pandora

12) Cityzen- 613 herald

13) Legato-960 Yates

14) Palladian- 1602 quadra

15) Monacco- 610 johnson

16) SoHo- 848 Mason

17) Juliet – 760 Johnson

Marko, exactly when was the last time the real estate market was actually rational?

I rarely hear anything about the impact air BnB’s are having on the real estate market. How many are there? Aren’t they one of the main reasons there is a housing shortage? How many “homes” have been converted to hotels?

The variability between individual sales right now is off the charts. Incredibly irrational market.

Place I think will have 5 offers end up with 15 and place I think will pull in 8 end up with 2. Almost no rhyme or reason.

This is somewhat misleading, because Canadian tax statistics are for individuals. So take the family of some bank exec making $2mil a year, with a non-working wife and 2 kids in university. Only one out of four of them pays income taxes, but they are all living off his income. You get a similar situation for the middle class when a spouse isn’t working to take care of young kids or for some other situation. Or for retirees.

More generally, it needs to be recognized that someone who pays no little or tax this year may be in a different situation next year, or was in a previous year. That is, the bottom 40% are not all the same people every year.

Becareful of what you wished for.

Throughout history, wealth inequality has only been rectified by warfare, revolution, state collapse and plague. — The Great Leveler: Walter Scheidel.

Not sure this quite works as a Canadian example. The bottom 40% pull more in services and subsidies then what they put into the pot, functionally they do not really pay tax in the end. Whereas the top 20% of income earners in this country pay 70% of the freight for government operations and services. The wealth inequality argument just really doesn’t come across very well because it feels like a class warfare approach…”the reason why have so little is because that other person has so much!” Redistribution schemes typically end in crashing productivity across the economy, but I guess if the goal is to make everyone equally poor, that is the way to go.

Wouldn’t the middle class also have a morally indefensible position as they too “exploit the status quo” while others are in poverty? What should we do about that?

I hope you realize that the average household in Victoria has over $1 million in net assets, and most of those households would be considered middle class.

Your moral high ground position would be better received if you outlined what extra amounts you are willing to contribute to help those in poverty.

Good article. Yes, that Ontario 1974 spec tax sure did work, obviously a collapse overnight was a little harsh, but the right idea.

I’ve been advocating for a real speculator tax here in BC too (speculator tax would be : Tax net profit at full income tax rate if property sold within 5 years, for any reason, including personal residence). The current spec tax we have doesn’t hit actual speculators that are buying and flipping multiple properties.

I think our provincial government is happy with the current BC spec tax, which is only paid by 1% of BCers, and mostly paid by a few foreigners. And the government also benefits from some of our RE experts telling people that the spec tax is working/helping, so most people think that we actually tax speculators in BC, when our spec tax mostly taxes foreigners.

Yes, rising in US too. The US 30 year mortgage rate crossed the 5% threshold today – considered an important level and it made headlines.

https://www.cnbc.com/2022/04/05/30-year-fixed-mortgage-crosses-5percent-for-the-first-time-since-2013.html

30-year fixed mortgage crosses 5%

“The average rate on the popular 30-year fixed mortgage just crossed 5%, now standing at 5.02%, according to Mortgage News Daily. This is the first time it has crossed that threshold since 2011, save two days in 2018. It stood at 3.38% one year ago today. “

You’re not going to find a government that supports this as many politicians, while not rich, have high salaries. Case in point, the NDP government not only voted to remove a policy that holds back 10% of their executive cabinet pay for not delivering balanced budgets (essentially giving themselves a big pay raise) they also made it retroactive to last April. In dollars that means the Premier just voted himself a $40,000 raise and with the retroactive part, another $10,000 on top of that. It’s no wonder the NDP don’t seem to think there’s an affordability problem in BC while they fatten their own pockets.

A few years back I read a story in the NP titled something like “Why don’t governments really do something about high house prices? They’re afraid it might work.” The reason governments tip-toe with half measures is that they know a great many homeowners will be upset if prices go down significantly. Leo has suggested a real strategy, namely raising property tax and and lowering income tax, which would both bring house prices down and encourage productive activity. Here’s something which actually was tried and did work:

Ontario tried a speculation tax on property, and the market ‘collapsed overnight’

The province announced a 50 per cent land speculation tax on April 9, 1974, a date the Ontario real estate industry will always remember

A truly effective strategy to bring prices down has to make RE less attractive as a place to store wealth.

Agreed, we do need better unilateral global wealth taxation so people don’t just move assets around out of individual countries.

Bottom line is that wealth inequality is worsening and it’s morally indefensible that so many are in poverty while the rich continue to exploit the status quo to fatten their pockets. We need to do something about it. I don’t have the answers but we have to try something.

I don’t really expect it to tank, but the introduction of stress test in 2018 and rising rates knocked the market from appreciating to flat within months.

Meanwhile Q1 2018 avg detached price was $900k or $3800/month for 80% financed at 4%. Q1 2022 avg price at $1.4M turns into $5900/month. Or $1750 vs $2550/month for condos. Incomes and rents up in the meantime of course as well.

Marko, Leo or other agents/brokers – Any thoughts on what you’re seeing with respect to buyer/seller sentiment in the market right now?

Steve S shared this:

Hmmm doesn’t seem super crazy, unless it keeps going up. Market didn’t tank in 2018-2019.

Back above 2.5% today. Pointing to average 5 yr fixed rates of close to 4%.

Thanks for the info. Though it doesn’t sound good when the politicians can’t even do an “elevator pitch” description of how the cooling off is supposed to work. Doesn’t sound like they have figured it out yet.

Don’t live there myself but from what I have seen visiting I agree with your observations about both communities being super family friendly.

“Right. This “cooling off” bill looks to be a train wreck. It would seem that unless/until they get this sorted out, they’d be better to do nothing, than something stupid.”

It’s not that uncommon to put the authority to do a thing in the Act, and bury nearly all of the substantive policy details in Regulation, which is how the proposed amendment is structured. There are pros and cons to doing it this way.

Right. This “cooling off” bill looks to be a train wreck. It would seem that unless/until they get this sorted out, they’d be better to do nothing, than something stupid.

https://www.timescolonist.com/opinion/les-leyne-house-buyers-cooling-off-bill-is-a-chiller-5232761

“They are debating a bill that has measures that haven’t been written yet, because they will flow from a report that hasn’t yet been received.

Even Robinson has conceded the bill is not aimed directly at affordability issues. Faced with the need to do something … anything, she focused on consumer protection instead, which is a different topic. Anyone who thinks the cooling-off period is about the real estate market is in for some disappointment.

Apart from the fact the opposition MLAs are flying blind on the details, there are also misgivings about the principles.

Liberal critic Rene Merrifield, whose career is in residential construction, said a cooling-off period could increase prices.

“I don’t know why the NDP is choosing an option that is going to raise prices rather than lower them.

“The wrong tool, the wrong way, creating uncertainty, creating chaos and unknowns. As a result, I’m sure we’re going to have a really long debate on this one.”

B.C. Green Leader Sonia Furstenau said: “This piece of legislation is, actually, spectacular in that it consists of nothing but gaps.”

After a similar “pass-this, details-to-come-later” approach to freedom of information law earlier, and the shutdown of debate on assorted bills last fall, it’s another example of how the NDP will use its majority however it suits them.“

Royal Bay is pretty awesome imo, just not at a higher price than a livable home in South Oak Bay.

Re: West Hills and Royal Bay overvalued and not appealing

Maybe not appealing to you, but with a young family I love both communities. We tried for both but couldn’t swing a 3 bedroom house at their prices, it was more economical to get a suite below 3 bedrooms in an older house as our first home.

The tradeoff is maintenance on an older house, yardwork and managing a suite (knock on wood though, this part has been easy) vs. walk in and do nothing in RB / West Hills. Those neighbourhoods are awesome for families: well lit sidewalks, tons of kids to play with, great playgrounds, nice Xmas lights, no one has 2 mouldy RVs in their driveway and 2 freedom trucks on the lawn, it’s a nice vibe. I like my neighborhood too but it’s older Colwood and we have to wear reflector vests if my kids go for a bike ride in the evening, there’s no sidewalks and few lights.

You zip strap plywood or similar. Inspector passes it, you remove plywood.

So much this. In fact, there have been times where I’m unsure who is ultimately responsible for something.

It’s funny because I always see cable railings (horizontal wire for stair/landing barriers) in the local magazine-showcased houses and I have to scratch my head. How on earth are they able to get illegal railings past the inspector and then be so brazen as to show them off in a magazine?

I also ‘laugh’ because safety is a driver for so many code rules, but we have the droopy chain ‘fence’ in the inner harbour walkway – arguably the most packed/busy area of Victoria.

Or there being no requirement for the city to have concrete sidewalks engineer-tested when city workers do it (but the rest of us have to)…

Les Leyne: House buyers cooling-off bill is a chiller

https://www.timescolonist.com/opinion/les-leyne-house-buyers-cooling-off-bill-is-a-chiller-5232761

Reading all this about ridiculous restrictions on development is disconcerting. Does anyone have any idea what is involved in getting an occupancy permit to start a business? Is it just as ridiculous? Government officials don’t realize that ordinary people don’t have the resources to meet the wildly impossible criteria they impose. Only the government has unlimited funds. I guess we live in different worlds.

Design review panels are a massive waste of time. You’ve got a group of people and Saanich staff talking about whether the panels on a new building are too blue, or where the tenant in the garden suite will store their garbage cans (both actual examples from Saanich)

Problem with kit homes is bureaucracy once again. For example, City of Colwood has a bylaw that on lots less than <550 sq/m (aka 6000 sqft) you have to sumbit a character and form development permit along with the building permit at an additional cost of $2,800. Then city staff critique your design, etc. Kit home would never fly as the staff come back and say "I think you should do this with the roof lines over the front entrance, etc."

Risk aversion.

No one wants to be on the hook for making a mistake, so standards get made that add checks and requirements and third party review. And none of the new rules on their own are particularly onerous and most have a reasonable rationale for them, so no one opposes them. The sum of all of them add tremendous friction to any project though.

Some awesome designers out there for a fraction of the cost of architects. You may want to line up surveying asap as it can be a long long wait right now. Whether you go with architect or designer they will need a survey to go by.

I mean at the required scale. You see a lot of kit cars and planes around?

It creates more jobs at those government institutions whether it be municipal, provincial or federal, which creates more team leaders more team managers and so on.

Read up on the BC Owner Housing exam which employees a bunch of BC government bureaucrats and find me ONE document ever released by BC Housing on how this exam has improved quality of owner builder homes. It doesn’t exist but who cares, employs people who then go out there and try to outbid eachother for housing on the basis of their 100% useless job and then proceed to complain that housing is too expensive.

I’ve now sent out over 6,000 study guides for the exam and honestly not one person has had one positive thing to say even after they email me to say they’ve passed.

Great! Was the transition area close to what was shown on the Olympic shadow map? http://www.olympicrainshadow.com/

There are companies offering ‘panelized’ kits (what most people think is ‘pre-fab’). They’re not significantly cheaper, but they are significantly better than site-built.

Why is it not possible, when there are cars and airplane kits available?

Generally I’d start with architect/designer first. They will most likely have a list of builders they like to work with. If you happen to see a place you like and the builders have a sign up, you could contact them and find out which architects/designers they like to work with.

Which municipality you in?

The symptom is caused by too many over/useless educated people that preferred to push a pencil all day instead of swinging a hammer.

YYC-YYJ: Really depends what you’re looking for. It varies a lot, but in general, a reputable builder will probably do a good job, and likely to be better at getting your price per sq/ft down. An architect would likely get you a more attractive/custom home, but will probably cost more per sq. ft. But they might be better at convincing you to have smaller building, so overall price might be similar.

If your aesthetics run to the typical (e.g. if you’re looking for something very similar to other new homes you’ve seen), a good builder is probably your best bet.

But in both categories, there’s wide variation.

Excellent idea, because millenials would get to ripoff pensioners on fixed income that couldn’t afford to pay taxes on their house.

Question on building a new home.

We own a old timer house on a high bank waterfront lot and would like to tear it down and build new home.

Is it best to find a builder to handle everything or hire an architect to draw up the plans and shop to different builders and oversee the project?

Or any other suggestions from anyone who has build a new home lately!

Love to see a good Vogon reference.

Regarding sidewalks and the cumbersome approval/consulting/delays/review/etc, perhaps I can ask a hopefully less controversial question.. is there an agreed upon (non finger pointing) answer for how those standards came to be here? I imagine it wasn’t that way twenty years ago. (Or perhaps it was?) What changed exactly? Not that it’s a unique phenomenon to Victoria.

Btw Patrick, I compared the Doppler yesterday afternoon during the rain with the page you linked to about the rain shadow. Guess where the transition was from rain to less rain? Always nice to see how science works.

Good to see this page is as left as ever. Lol

Tax the rich will solve everything. Naive and stupid policy. Taxes are already too high here. Marginal tax is above 50% already. Raising tax to the so call Rick does not bring in more tax it just creates more avoidance in either moving assets or just moving. Ask a doctor or vet or engineer or someone else if it’s really worth living here if they could save a ton in taxes.

Notice we have a doctor shortage.

All the stupid policies to bring down house prices have been an ndp failure. Only way to fix the problem is build more homes. Open up more land. Get rid of stupid policies that restrict building.

Hey keep dreaming if you thing raising taxes on the rich will solve anything. Just a socialist fantasy.

Doubling or tripling municipal taxes. Wtf that so far out there no even the NDP would touch that. Lol

Canada manages to construct approximately 250,000 homes each year. Unfortunately, 200,000-300,000 are demolished every year for little to no net gain. This problem will never be solved.

All these HHV’er ideas end up to be variations of “tax the rich”.

For example, this increase property tax idea is introduced as a way to tax speculators. But then we introduce means testing, so the middle and lower classes won’t pay, and the single example mentioned that should be taxed more isn’t a speculator, but an “old person in a $4mm waterfront home”…… of course because they’re rich.

Lowering income taxes only makes sense to me if progressively applied to the lowest end first. There’s no way that the upper brackets should have their taxes lowered (and I say that as one of them).

And maybe we should be raising property taxes progressively based on value against region median.

Old person in a median or sub-median SFH? Taxes stay the same.

Old person in a $4MM waterfront? Tax them more.

Probably not possible with today’s building standards to have DIY kits, but I do think we should be able to get pre-approved modular, mostly prefab in-fill building options that are allowed by right under zoning and can be put up with minimum fuss.

– increase (triple) property taxes to USA levels

– eliminate property tax deferrals for old and disabled people

– eliminate the homeowner grant.

All of these ideas would, at a minimum need to get means tested so only the rich are affected.

But then there is an income tax cut, which isn’t means tested, and hands back money to the rich.

I don’t see the point in doing any of them, means tested or not.’

Ends up to be just another “tax the rich” idea.

Hey Siri, what is a straw man argument?

An overall increase in taxes? No thanks. But a revenue neutral shift from taxing work to taxing land I could absolutely support.

And keep the property tax deferral by all means. It’s mostly unnecessary, but it also doesn’t cost government that much and there is a definite benefit to letting people age in place.

Homeowner grant is ridiculous. Why have a government program to hand tax dollars back to citizens (minus administration costs). If the public policy goal is for citizens to have more money then just tax them less in the first place for God’s sake. Or as a counter factual – if the homeowner grant is so great then how about the government increases income tax and the PST so the can GIVE US MORE FREE MONEY? Clearly if you don’t support that you must be mean to old people or whatever Patrick said.

What do you make of Royal Bay then? 200-300k more for a house in Royal Bay over Westhills.

I was thinking about this today when I was reading about the 70,000 Sears house kits that were sold by mail order and constructed between 1908 and 1940 – many going strong today.

Ah yes. The 3 point housing tax plan – advocated by many HHV’ers

– increase (triple) property taxes to USA levels

– eliminate property tax deferrals for old and disabled people

– eliminate the homeowner grant.

So that an elderly or disabled homeowner with a low and fixed income, currently “just getting by” by deferring $5K property tax annually, would now have to:

– pay $15,000 property tax annually (rates tripled), with no deferral

– not get a homeowner grant.

Sounds like a plan that would “smoke” old and disabled people out of their homes, so they go “somewhere else” so some young HHV’er can move in!

And the “icing on this regressive tax cake!”…. an income tax cut benefitting the wealthiest high income earners the most!

Count me out!

If I were to point at one market segment that is overly exuberant it would be the small lot homes in Westhills. That would be the market that I would expect to crack first as its pricing is not inline with the surrounding areas. Relative to other neighbourhoods I would peg the prices at being $100,000 to $150,000 over the surrounding areas. I don’t see the “value” in that overly crowded area.

Finally got my pre-retrofit inspection report. Anyone got a recommended heat pump installer?

Yeah, California property taxes are something. (I was a postdoc in New York, and can testify that those were also something to behold. Pensions for public sector unions don’t fund themselves, I guess.)

I guess it’s a bit of an unanswerable counterfactual, but I’d worry about the Law of Unintended Consequences rearing its head if property taxes went up here. (Maybe I’m being overly cynical though!) To coarse-grain, in California you have the ever escalating problems with very high cost of ownership, high property taxes, barriers to development, and all of those taxes go into supporting a recalcitrant and self-important bureaucracy that got to justify its existence. That is, somehow all of the bad things can coexist at once, rather than destructively interfering with each other.

Leo

You have sum up the problem with Canada in a paragraph. Only positive note is most western countries are the same.