Market seems to ease ahead of rates and government action

I’m out of town this week, but wanted to write a quick update on the slowing market which has continued in the last week. Make no mistake the market is still extremely active compared to normal, but there’s been a distinct shift in the last couple weeks that’s showing up in the number as well. There were 700 sales as of this morning, down 29% from the same week last year, but with 26% less inventory on the market that’s not overly surprising. The only hint of a slowdown in the weekly numbers table is a slight pullback in the sales to list ratio when it usually increases as the month progresses.

| Mar 2022 |

Mar

2021

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 143 | 356 | 527 | 700 | 1173 |

| New Listings | 230 | 509 | 763 | 1010 | 1419 |

| Active Listings | 902 | 935 | 985 | 1019 | 1310 |

| Sales to New Listings | 62% | 70% | 69% | 69% | 83% |

| Sales YoY Change | -30% | -22% | -27% | -29% | |

| Months of Inventory | 1.1 | ||||

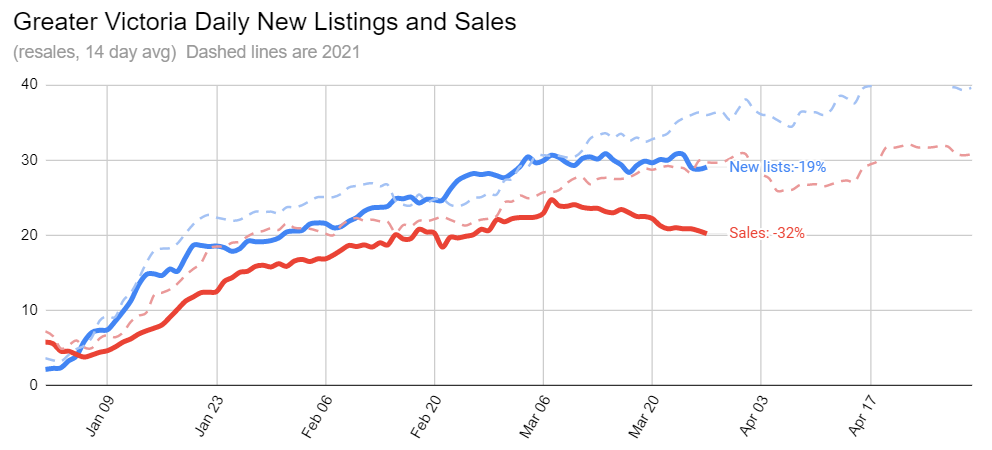

The shift is more visible in the daily numbers. While new listings have also lagged compared to last year, sales are dropping somewhat faster, widening the gap between new lists and sales after they have tracked closely all year.

The only thing other than a pullback in buyer sentiment that could explain the sales lull this early in the selling season is that it’s spring break. Last spring almost no one was vaccinated and no one was travelling, so sales could continue. This year there are more people heading out of town or out of the country, which could explain the reduction in market activity. However given the market started to shift before spring break started, I suspect it’s not the whole explanation.

The rate of over-ask sales has also has been on a downward trend, at 55% of properties going over the asking price in the last two weeks compared to a high of over 70% a couple weeks back. Month to date, we’ve still had 65% of single family properties go for over the asking price, while 60% of condos did the same. Remember we need at least 2 months of inventory for bidding wars to subside to normal levels, and we certainly won’t reach that in March.

I suspect that with rising fixed rates, affordability is biting buyers and some are pulling back. With the bond market now higher than it has been for over a decade, fixed rates are also set to keep on rising. Remember that rising fixed rates take effect on a delay since most buyers will be shopping with pre-approved rates. Every rise in fixed rates (which about half of borrowers are going with), means not only higher payments but also a higher stress test rate that buyers must pass. At the same time the Bank of Canada messaging is increasingly hawkish, with recent remarks emphasizing that their focus is fighting inflation, not worrying about the impact of rising rates on house prices. “So, while we will watch developments with respect to households closely as we proceed, it’s important to be clear that returning inflation to the 2% target is our primary focus and unwavering commitment. We have taken action and will continue to do so to return inflation to target, and we are prepared to act forcefully.”

Meanwhile the province has reiterated that the cooling off period is coming but that’s nothing we didn’t already know. That will officially kill the no condition bidding wars as it guarantees that buyers have time to do their due diligence or back out, similar to the recision period when buying new construction. There’s no details yet on how exactly this will work, however the changes are coming this summer. I suspect the rules will be largely irrelevant as most of the bidding wars they are concerned about will have died down naturally by that point.

What are you seeing in the market? Any better luck house hunting out there or are you putting your plans on hold to see what the market does?

New post: https://househuntvictoria.ca/2022/04/04/march-continued-strong-stats-hide-turning-market

Have you even seen a housing advocacy group (representing prospective homeowners) recommending relaxing environmental or climate-change policies so that more housing can be built? If renters are for this, they should speak up, I haven’t heard anything.

For example: One of the reasons that oak bay council cited for killing the proposed quest condo building was that a single Garry oak tree “… belonging to a neighbouring property could be potentially at risk from excavation for underground parking; the 2021 heat dome is a stark reminder to protect tree canopy.” https://www.timescolonist.com/opinion/comment-oak-bay-aiming-for-best-answers-to-housing-crisis-5212815

Did any renters or housing advocacy groups speak up to complain about that “possibility of loss of one tree is too many” point?

Tenants are too preoccupied calling landlords and developers greedy and are easily swayed into thinking airbnb, foreign investors, and speculators are the root cause of the housing problem and hence they elect the same government officials.

The barriers are driven by the majority who already own. Middle class yes, but they feel they are getting richer as the cost of housing rises. Why complain?

You honestly think that renters wouldn’t be willing to trade some trees for lower prices? Don’t blame the victim.

This did some numbers on twitter. Apparently other regions have similarly illogical arguments made so it struck a nerve.

Excellent reply to a thread on Reddit, worth a read-> https://www.reddit.com/r/VictoriaBC/comments/tti8ey/the_greed_of_landlords_is_disgusting_in_this_city/i2zsdsj/

I put up a 10×10 bedroom in a suite for my mom on FB marketplace for $800 (previously rented for $650) and had over 100 inquiries had to shut down the ad. Rented it to a UVIC Phd student my mom felt so bad for him told him if he stayed for 12 months the last month would be free. Shitty housing situation out there.

Let’s continue to save the trees and block development. #savethetree(s).

I also don’t think the hand deconstruction bylaws are enough, we need toothpick deconstruction.

Barriers to housing driven by the middle class who complain about the cost of housing.

I think what is happening sucks and people are in the right to be annoyed, but I don’t agree that we will see some great divide between those that own SFHs and those that don’t. If you are living in a condo or apartment in Victoria, you still have it better than 98% of the global population.

I love walking so if I had a downtown desk job, I would strongly consider not having a car and just buying a Modo membership. That would not be the end of the world for me or impact my happiness.

Thank you very much Leo!

These are slightly lower prices than I expected. I’m surprised that 8 Seagirt sold for below asking price, though I’m a novice and maybe this was predictable to more trained eyes.

Cancelled listing

Squamish has come along way. It used to be a horrible place when the pulp mill was located across the bay.

I’m not sure if the LNG plant is still going ahead on the old pulp mill site. Does anyone know?

I’m guessing that it should not effect Squamish much…… as nothing could be as bad as the pulp mill stink.

There is some great hiking in the area as well and some wonderful first nations history. It was always a long way from Vancouver…but it’s a good highway and some people don’t seem to mind the commute.

Does anyone know how much 2860 Graham st sold for?

8 Seagirt Rd: $938,000

540 Treanor: $966,000

Basically yes. BCassessment.ca will show the sales price after the title is transferred (usually 1-3 months after sale). There used to be some sites that showed the immediate sale prices but I think they got shut down by the board.

Right now you’d have to ask an agent, or sign up for a portal that can show you sale prices (but only for small subsection of the market because the system limits the number of results to 350): https://househuntvictoria.ca/matrix/

It’s pretty dumb and this info should be public but that’s the current situation.

Hey guys longtime reader, first time writer/questioner.

I’m wondering does anybody know how much either 8 Seagirt Rd or 540 Treanor Ave sold for?

Am I correct in assuming this isn’t public information that can be looked up, that I would need to be a realtor to get this information directly?

Thanks in advance!

Right. Dry and sunny is good.

We are spoiled here in southern part of Victoria – sunny and dry under the Olympic shadow. At least in the southern half of the Saanich peninsula. (South of royal oak drive)

Recent HH arrivals to Victoria, who like things dry and sunny, should make sure they’re aware of the Olympic shadow and where it is and isn’t in Victoria.

Here’s a map and description of the Olympic shadow.

http://www.olympicrainshadow.com/olympicrainshadowmap.html

Yes, good points.

On balance, I think Victoria is my ideal place to live. But I do sometimes like to daydream what it would be like to live in other nice spots and, because of the nature of daydreams, I tend to under-weigh the negatives and over-weigh the positives.

If it makes a difference to you, Squamish gets more than double the rain than Victoria, a lot more snow, and is about 3 degrees colder on average in winter. Victoria gets 2200 hours of sunshine a year vs. 1940 in Squamish.

Good example of Gell-Mann Amnesia:

“Briefly stated, the Gell-Mann Amnesia effect is as follows. You open the newspaper to an article on some subject you know well. In Murray’s case, physics. In mine, show business. You read the article and see the journalist has absolutely no understanding of either the facts or the issues. Often, the article is so wrong it actually presents the story backward—reversing cause and effect. I call these the “wet streets cause rain” stories. Paper’s full of them.

In any case, you read with exasperation or amusement the multiple errors in a story, and then turn the page to national or international affairs, and read as if the rest of the newspaper was somehow more accurate about Palestine than the baloney you just read. You turn the page, and forget what you know.”

Yes, Squamish is gorgeous, and is a destination city on its own, without the proximity to Vancouver.

If they build “N” more homes and “more than N” households want to move there and buy, prices are unlikely to fall, regardless of what “N” is.

It’s still a great thing to build the homes, because more people get to live and enjoy a great lifestyle in Squamish. Can’t go wrong putting shovels in the ground. The same likely applies here in Victoria.

Fair.

I bet it would be pretty sweet living in Squamish. I’ve only visited once or twice, but whenever I see photos I’m always impressed.

The quality of being in or near the mountains but still within an hour’s drive of a big city is appealing to me. In this respect, Squamish is similar to Canmore, Alberta, which I also love.

The point, as Leo alluded to, is that Squamish is increasingly drawn into the metro Vancouver RE market and whatever new supply it has added is just going to be a drop in the bucket. Thus its RE prices are going to be determined by metro wide factors.

The same sort of price increases have been seen in cities outside Toronto such as Peterborough and even farther out such as in the Niagara region.

The only sensible thing in that article is calling for the spec tax to be expanded to Squamish. The rest is a mess. They mix up approvals vs actual built homes, mix up building something VS building enough.

“Yesterday 6 people came over for dinner and I made 6 hot dogs. Today 10 people came over and I made 8 hot dogs. I made more food so I don’t understand why people are hungry”

Supply increasing in Squamish, B.C., but home prices are, too

https://docdro.id/jByp4IA

https://www.theglobeandmail.com/real-estate/vancouver/article-housing-supply-affordability-squamish-bc/

What metric are you using for “primary” here? Headcount? Aggregate compensation? Revenue? Economic impact?

Tech outpaced tourism as an industry a while back, with a revenue of $4B and just under 17,000 people employed. But I’m not sure what tourism touts.

I’ve been “accused” (correctly) of saying that Victoria homes are affordable. So let me back that up with examples that show how an average home in Victoria is affordable to an average family

As I see it, the “Victoria homes are unaffordable” crowd are missing a major point.

They are never looking at average homes for average incomes. They expect average incomes to afford above average homes.

—-An average home is a condo (especially near downtown).

—-Average household income is $100K (that’s what is used on the HHV affordability charts). This is a 2 income household. This excludes unlikely homebuyers like pensioners, students etc.

——-Average home size is 3 people (requiring 2bdr).

—— Average homebuyer could afford $450-550k. This would result in a mortgage equivalent to rent. (note: the average BC first time homebuyer paid (afforded) $560K in 2019)

Here’s an “affordable” sample of what this average family could buy, as there are MANY options to choose from now, all over core Victoria and beyond. (Note: these are listed prices, and HHV reports that average selling price for condo is currently 5% above ask.

—-$550K James.Bay. 2bdr with garden patio “ Pets Allowed, Family Oriented “ https://www.realtor.ca/real-estate/24210208/103-305-michigan-st-victoria-james-bay

——$499K Cook st village 2bdr, corner unit, 2 balconies “bright and extremely spacious, amazing location” 302 1101 Hilda St https://www.realtor.ca/real-estate/24220237/302-1101-hilda-st-victoria-fairfield-west

—-$450K Fernwood 206 1500 Elford St “ modern, completely updated, steps from downtown” https://www.realtor.ca/real-estate/24208060/206-1500-elford-st-victoria-fernwood

To me, these homes pass the test of being affordable and suitable for an average family (3 people+pets). They are modern, nice looking, walking distance to parks and downtown Victoria. If we define affordable as average family income affording an average home, then Victoria passes the test as affordable

Above average homes (SFH, 3+ bedrooms) aren’t affordable to average incomes.

But as shown above, average homes are affordable to average incomes.

If I’m wrong, please tell me how low the price would need to get for nice 2 bdr condos in core Victoria to be considered “affordable”, if $450K is too much

Blues man- You hit the nail on the head. Other than tourism, the primary employer in Victoria, and across Canada, would be government- Provincial, Federal, city, and all the health care workers, teachers, military, etc.. All supported by government revenue. All with good salaries, job security, pensions and benefits. No wonder real estate is expensive.

Add to that all the retired government employees across the country looking for a place to relocate, I doubt prices will ever fall. I don’t anticipate any reduction in government positions, in fact it will probably increase, along with our taxes.

Many independent businesses that do exist probably rely on lucrative government contracts.

This is all fine and dandy if only government entities weren’t so inefficient and bogged down by endless bureaucracy.

In terms of moving to the island for job opportunities when I came here 4 yrs ago I was told be the recruiting agencies that there was a so called “beauty tax” or island tax here. Effectively, and it proved to be true, at least before the WFH phenomenon due to the pandemic, jobs here paid quite a lot less than equivalent to other markets in Canada. Wife and I are finance professionals and on top of the cut in salary were far less interesting job opportunities. For every 1 job opp here there were 10 on the mainland. However, the competition here was far less. Still a good move for us, but not so much for interesting work on big opportunities for advancement. Really a govt town.

I’m not convinced there are rich people sitting around either as it seems like more of an ongoing thing where they’ve either already arrived and bought up a home or they’re not here yet and will buy up a home when they get here. I only assume they’re buying up homes, not sitting around.

No. But they do seem like they might fall into that category of last to arrive and the first to leave.

Patrick, you too! Again, all the best..

Kristan,

Yes, in terms of bargains in the market, there does seem to be “nothing “. But whatever you get is a start, and maybe it turns out like this nice Yiddish Folk Tale that my kids loved… “Something from Nothing” https://www.amazon.ca/Something-Nothing-Phoebe-Gilman/dp/1443119466

Thanks for the discussion!

Hey Patrick:

I think I’m understanding better what you’re saying, and agree, actually. Although I’d push back a bit and say that there’s not a conflict between rising affordability indices and FTBs slanting upwardly mobile and less picky (in particular buying below the mean). People have finite resources after all. So it isn’t clear to me that the affordability measures are misleading per se. But that may be a semantic distinction.

I think part of the tricky thing with the thread is that there are a few competing questions being discussed in parallel. One is, to exaggerate for effect a bit, whether the current market is normal and young people are just whining. Another is what to do in the face of it all. But those separate questions are being conflated a bit.. I’d argue it’s 100% clear that the market is bad in historical terms. “Nothing is new under the sun,” yes, but the current state of affairs is objectively bad, and not only here. When Marko chimes in about identical listings in Royal Bay selling at ~ 2x price from 2019 to 2022, that’s bad no matter how you slice it. Bad for FTBs, bad for young people, bad for the economy actually, since that is money that goes from investing in new things to not new things. “What is to be done?” is a separate question. We’ve introduced our kids to the lovely Eastern European Yiddish folk take “It could always be worse” (https://www.amazon.com/Could-Always-Be-Worse-Yiddish/dp/0374436363) and certainly take try to take that attitude..

Yes, a general term for that is gentrification. And it’s a big factor in Victoria. I’m guilty as anyone – arrived about 30 years ago from out East and bought a nice house here in Core Victoria. Probably outbid some locals. (Then the Victoria market stayed totally flat for about 7 years and everyone forgot about RE- but that’s another story).

It’s relevant in that these new arrivals to Victoria are an ongoing supply of people that can afford the prices. And they aren’t typically FTB, so they arrive with equity and higher than average incomes. So the metrics about “average incomes affording average homes” don’t apply when the few available homes are bid on by new arrivals to the city. Every projection I’ve seen is for population rising faster than dwellings, and definitely faster than desirable core SFH.

Rates could rise, and prices could definitely fall back. We would not be immune.

I don’t think that this will approve affordability much if at all though – because of the higher mortgage payments. Because historically, affordability has always worsened during a period of rate rises, and then only improved as rates fell . But if a higher mortgage interest payment doesn’t scare you, then yes you would likely see more inventory and lower prices with higher rates.

Great! In terms of bears – you’re the real deal!

I am not this but i’ll take that title over ‘perma affordability guy’

Nope, haven’t the checked the MLS in months. likely over a year now.

Mostly i can tell you can’t see anything wrong with the logic in my post so you don’t actually address what i said. So let me ask you Patrick – do you think if interest rates go up and we see a pull back in prices in Canada that Victoria will be immune to this? Are we some kind of special?

The reason that more don’t come, at least until they’re older (hence the retiring boomers with cash-only sales who are driving this boom) is because the career opportunities for these young professionals are much more in toronto, vancouver, calgary, etc.

Choosing to buy a ‘bargain’ home within walking distance comes with less career advancement, less income, less of the rock-star 9-5 lifestyle that these people also value.

Yes, I’m measuring the affordability for the FTB that buy the homes.

This is to answer the following questions:

—- Q. are FTB able to handle the payments, so they won’t get “hammered” if interest rates rise and be unable to pay the mortgage ?

—- Q. Are current prices sustainable, meaning will we find about the same number of FTB with as much cash and income as the prior year?

The statscan data answers both of those questions for me as YES, which is reassuring that the market is sustainable when it comes to available FTB.

When we see how modest/prudent the FTB in BC are (560K average home price, with 150% of median income), this indicates to me that THEY can afford the home that they bought, and won’t default on the mortgage. And it answers another question “who can afford to buy these homes”, when we realize that the FTB are buying lower priced homes, and yes they can afford them. The funny thing is that the people asking the question “who can afford these homes” could themselves afford the average home that a FTB is buying. They just think they should skip the first couple of rungs on the housing ladder, and enter with a SFH on their first buy. Which may be a mistake, time will tell.

You seem firmly set on your Plan B which is to wait for lower prices. And so you seem a long way from pulling the trigger on buying, which is unfortunate since that’s obviously the goal.

HHV has seen a few people posting in similar circumstances as you over the years. They were dubbed “perma-bears”. One of them proudly accepted the title “King of the bears”. Making detailed, rational reasonable posts about how houses were overvalued, and various economic indicators and YouTube influencers had convinced them to wait for falling prices.

Now the funny thing is most of them ending up “surprising” the HHVer board by suddenly and unexpectedly announcing “We bought a house!”. So I’m curious, as you type these long bearish posts, do you also have another browser tab open to mls.ca which you refresh a few times as you make your HHV post?

btw) if it helps… the justification that the perma-bears typically make to explain their sudden purchase was that they found a house that seemed underpriced and perfect for them. So they threw caution (and their charts of inverted bond yields) to the wind, and bought a house. And never looked back!

It is not communal ownership. It is essentially a strata except with a co-ownership agreement. Saves a lot of money to do this with a non strata duplex home over buying a single side under strata and you have binding rules. Only issue is it is uncommon and harder to sell part of.

I’m not from here and found this whole city is sale. I know 10 people from Vancouver and five people who moved from Toronto in the past couple of years who sold their homes between 2.5 and 6.4 million and were blown away that they could get a house walking distance to work. For educated professionals all of them thought it was a deal. Maybe it is a good thing that more people do not think this way as of yet, but there are some of us out there.

These numbers are only looking at FTB that were actually able to close on a house. To measure affordability you would need to take into account all potential FTB, which would also include renters that have never owned before. I expect the median income for this group could be even lower than 30% below median.

My affordability position might be more believable to some than “affordability is a cycle” charts implying that “affordability for average incomes affording a Victoria SFH” is cyclical, and the “affordability fairy” may make Victoria SFH affordable again to average incomes if we wait long enough.

Rather than joining the “pity party”, it seems to me to be more helpful to show (2019 StatCan data) how BCers are in fact affording homes, and how they’re doing it prudently by buying below average cost homes as their first home. Where they start building up equity. In the hopes that a HHVer will read that and say, “I could do that too”, instead of sitting around on the sidelines asking “who can possibly afford these homes’? In practical terms, that means buying what you can afford now, and may mean settling for a Westshore townhouse instead of a SFH.

Ahh yes, the ominous, (and never fact backed) Victoria is special due to X (rich people in this case) and prices will continue upwards and can’t come down. Unfortunately what is happening now is not exclusive to Victoria, as i’ve mentioned in previous posts. Look at the Teranet – https://housepriceindex.ca/2022/03/february2022/ – Victoria up 22% yoy meanwhile Kelowna is up 28% (even with the fires), Abbotsford up 35%, then we move over to Ontario (we all know how desirable it is there) and we see 16 cities and 13 of them have gained MORE than Victoria in the last year. And these aren’t cheap east coast cities. Are Barrie and Guelph and Brantford and Windsor special cities like Victoria? If Victoria was full of rich people willing to pay whatever for homes and it was more special then these other cities shouldn’t we see prices rising much faster then other cities?

I don’t think anyone doubts that BC has many objectively beautiful cities including Victoria. I do think however, many of us our bias as we live here and underappreciate how many people don’t want to be stuck on a rock or pay Victoria prices. I think we also look for reasons to justify current prices when the fact is the main reasons for these prices are we have historically low inventory, coming off rock bottom rates, with increased speculation (like many parts of BC and Canada). If rates stay high and we suddenly got a whack of inventory (not possible overnight but lets assume it was) then prices would drop. Just like anywhere in Canada. you could argue prices would drop less in Victoria then other places – and i believe that would be the case – but this idea that there are rich people just sitting around waiting to buy up all the homes in Victoria is nonsense IMO.

That’s what I meant too.

Nope.

“Seek out the houses that need work and you may be surprised.”

This is what we did in 2020. The market was hot, but not white hot. In most cases, the house was priced below market value, resulting in multiple offers and a winning unconditional bid. A couple of the houses have subsequently been flipped, so that’s who we were competing with.

What worked was finding a house priced above market value for the condition it was in, which we purchased below ask without having to compete, and with conditions. I felt that we paid a little bit over market (~$20k), but there wasn’t anything too wrong with the house other than being cosmetically tired and not having any shiny new things in the kitchen and bathroom. I still find it odd that there wasn’t more interest in it. A little cash and some sweat and toil and it’s a pretty nice house now.

And by shiny new place I didn’t mean new build. I meant updated (a 50s house can be very nice completely renovated). But everyone goes for these types of properties. I am saying go for the dregs and see what you can drum up. It takes risk and imagination no doubt.

While I agree that the floor for homes has jumped. Rental prices you can generate from income suites are also substantially higher. I am guessing it’s the down payment and stress test that will become or is the limiting factor for entry level places which to me can be resolved by co ownership. Our friends in Vancouver did exactly this in 2015 with a Vancouver special version of a duplex. I think that things haven’t been extreme enough for long enough in Victoria for people yet, but I think people will start seriously considering alternate ownership scenarios to get in the market. Additional legal documents can be drawn up how you need them for co ownership (what happens if one party wants to sell or move etc). No challenge is insurmountable.

Also regarding Dunkirk, it has not sold yet so I would not assume it will go for that much over ask if any.

You mean you sold it? Even if you did it’s hard to figure out whether you actually got the money back from the renos themselves.

Nope, not by a long shot. Never bought a house less than 30 years old myself.

I’m no fan of stratas but I’d take one over communal ownership any day.

Hey Millenialx2:

Yes, that is basically the plan for us too once summer comes. The problem of late has been that the floor for those properties has jumped substantially since you bought, and especially the past two years (remember: listing and selling prices are not the same right now, especially for anything that has potential income generation meaning suites, so you may be misled somewhat as to where the market currently stands), and inventory is at historical lows.

Re Dunkirk:

Listing prices are meaningless when selling prices for properties with suites are going for >= 200k over ask. Let’s see what the selling price is. I’d guess 1.4-1.5m minimum. In which case you’re talking about something ~ coincident with the floor of the 3 bed townhome market, with the added complication that now you need two families willing to go in on it together, both of which are coming from the upper 40% of the distribution. (750k at 20% down means 125k household income at current rates no stress test.)

FWIW, one got to do what one got to do. For us, when the time comes, we may very well go in on a property with a suite with a dear friend of ours if that’s what it takes.

Wonder if spring break is responsible for the lull in listings and those listings will hit in April, while the larger drop in sales is the market cooling.

When we bought in 2017 (a very hot market) we literally would seek out places that had been sitting on the market for a bit and go view them. Most were dumps. We ended up buying one for close to the ask price (I felt we overpaid by 30K still) and got a purchase + improvements mortgage to renovate it. We ended up spending lots on renovations but the house is essentially brand new now. Hubby believed we would never get our money back for all the renovations we did. And now look where we are. Everyone wants a shiny new place. The reality is that those will go for top dollar. Seek out the houses that need work and you may be surprised.

$710,000

Not sure what is less believable: Patrick arguing affordability is actually fine, or the UBCM arguing there is no housing shortage.

Sales: 833 (down 29%)

New list: 1217 (down 14%)

Inventory: 1063 (down 19%)

Back in town, so new post coming on the month soonish.

Check out 1006 Dunkirk Lane. This is basically 650K per family to have a non conforming up/down duplex. I would not think this is unaffordable… Yes it’s not perfect and the upstairs needs cosmetic updates, but lots of yard for each unit and a large lot. That is cheaper than a 1500 sq ft 3 bedroom townhouse in the area by far and no strata fees. There are deals and places out there for those who truly want to get in the market.

Hey Patrick:

This is a funny case where I think that the conclusion you’re drawing is correct, but the lesson is wrong. Let me explain. Basically, I claim that you’re falling victim to a sampling error.

Here’s an extreme example, from the Bay Area. If you look at the demographic distribution of first time buyers there, it has a large bump in the 25-35 range, larger than average nationwide. Similar to what you describe in your comment actually, where those buyers have larger than average income, and are buying below the median.

Problem is, when conditioning on first time buyers there, you’re isolated a highly non-representative demographic. Largely young techies, or double-income professional couples without kids, making in excess of 250k/year US.

Here’s another way of phrasing a punchline from the data you quote: first time buyers were (emphasis on the “were;” remember the data you quote is from 2019, before home prices nearly doubled) skewing from the upper end of the distribution, and are getting by with less.

Certainly the conclusion — that first time buyers are doing better than the affordability chart suggests — is correct. But how is that actually happening? By buyers a standard deviation above the mean buying properties that, under normal conditions, would be bought by people at the mean. Which in the absence of supply prices the latter into worse outcomes.

So yes, conclusion is correct. But I don’t think you can reliably extrapolate to a wider picture for prospective FTBs, because you’re conditioning on a narrow subset of the distribution.

Incidentally, for all the talk about how young people need to learn to stop being entitled and live with less, well, one thing your data shows is that exactly this is happening.

As for the question about retirees shifting the median income downward, that’s a great question.

“Data data data! I cannot make bricks without clay!”

Looking around, median household retiree income in Canada appears to be ~ 65k, higher than the median income in the region. Given that Victoria is a good retirement destination, I’d actually expect retiree income to be higher here than the national average.

It’d be great to have fine-grained statistical information about all this. Like, the distribution of incomes according to age, # of adults, # of kids. That would allow for a better estimate for the distribution of prospective buyers.

But all that being said, as to whether one should be interested in the ability of people at the median to afford ownership. Well, look. Suppose you want to keep historical norms of ownership across all sectors of the market, i.e. about 65% of the population. If so, then yes!, you’d better want people at the median to be able to get into the lower third of the distribution of housing options, in particular townhomes for families.

As the city densifies and more densely packed but high quality options become available for families, sure, that will change. But those options largely don’t exist yet.

What he’s saying is that you have to have a higher than median income to afford even a below median price property.

Isn’t that exactly the problem?

Patrick is absolutely right about first time buyers but what amazes me is that this might be a surprise for anyone.

This right here is what people really don’t seem to understand. I see so many posts or hear people saying “who can afford these homes?” It’s strange that people can’t seem to comprehend that there is a lot of money in Victoria just because they may not have it themselves.

Good points.

Data shows that First time buyers in BC have higher than median income, and buy below median price homes. So measuring affordability using both median income and median home price grossly overestimates unaffordability of homes for first time buyers.

StatCan data (2019) shows us that homes in BC purchased by first time buyers are twice as affordable to them as the typical values we see on affordability charts (that use average incomes buying average homes). Because what actually happens is first time buyers have 50% above-average incomes and are buying 30% below average price homes (as described below). Combine those two factors and the homes are twice (150/70=2.1) as affordable>

For example, buying a $800k average home with an $80k average income would be equal to 10 years income. But buying a $560k home (30% below average) with $120K household income (50% above average) is 4.5 years income – more than double the affordability.StatCan data tells us that this is what is actually happening in the BC housing market, and it explains why FTB are affording to buy homes and pay for them.

Details:

StatCan came out with an interesting study on first time buyers (FTB) in BC in 2019

https://www150.statcan.gc.ca/n1/pub/46-28-0001/2019001/article/00002-eng.htm

They captured FTB data by identifying a FTB as a household where the filer or spouse claimed the homeBuyerAmount (HBA) on tax return (which is available to any FTB). (That might miss a few FTB that didn’t bother claiming the $5k amount, but should get >90% of them).

Some interesting StatCan stats for BC FTB in 2018

First Time Buyers (FTB ) in BC:

– have incomes 150% of median. (63k per person vs $40k)

– buy cheaper homes (70% of median home price).

– Only 25% buy SFH. The rest condos or townhouses .

– Only a small % of housing stock is sold to FTB per year (<2%).

So when we think of FTB, we shouldn’t imagine an average income buying an average price home. What is occurring is a 50% above average income buying a 30% below average price home. Both of those factors (50% above average incomes buying 30% below average price home) make homes much more affordable to FTB

When we do this, and combine those two factors, we see that homes in BC purchased by FTB are much more affordable. Homes are twice as affordable (150/70=2.1) compared to measuring affordability of an average income buying an average home.

As Leo has pointed out what matters in charting changes in affordability over time is median family income (better than household which includes singles) versus cost of buying. People looking to enter the market are a small fraction of family units, but that’s always been the case.

This is the first time in a long time that it has been an employees market, wages are significantly up, especially in the construction sector where increases are outpacing inflation. From project mangers to on-site employees, the latest carpenters union agreement had a material increase in the hourly rate and overall compensation package. This is not going to make housing costs any cheaper, but it is a great time to be an employee in high demand industries.

It is also a great time to move somewhere else, I know many people earning Toronto wages in Victoria and working remotely. While others are working north island or on the gulf island for companies all across Canada. Victoria wages have lagged behind other cities, but if you are an individual with several skills in the top 25% you will always be in high demand.

Victoria is still on sale for a lot of people not from this town and most people still do not realize it.

Is the median household income a valid representation of what house hunters are earning? Does the median include, for example, older cohorts living on modest pensions who bought their houses in the 60s for under 100k?

Growing wealth inequality:

https://www.youtube.com/watch?v=PVNdvkXTe1E&t=2495s

Two things you can take to the bank on the internet:

1) People underestimate their average commute time.

2) People exaggerate their investment returns.

The joy of commuting – https://www.vox.com/2015/5/20/8629881/commuting-health-happiness

I have had the joy of driving from near legislature to center of Sooke several times during afternoon rush. One hour is a good ballpark number. None of my trips were much faster than that and one was much slower (accident). Never done the morning rush hour commute the other way so can’t comment on that.

Not strictly a BC problem either.

https://twitter.com/clairlemon/status/1509616243631788034?cxt=HHwWhMCozbX-nfMpAAAA

I lived in Sooke and worked downtown for 5 years. We purposely bought near a bus stop so I could commute by bus, so definitely did not live in my car. It was 1 hr each way and sometimes longer on the way back due to traffic backed up at Mackenzie. That should be less now with overpass, but don’t know how much that has improved things, since I no longer commute. Got lots of reading done on the bus and was even able to get work done by tethering my laptop to my phone.

For a lot of that time we only had one vehicle that my wife needed for her work in Sooke.

Only moved closer after having our first kid to shorten the commute to be with the kids more.

This is not strictly a Victoria problem and the ‘move somewhere else’ worked once upon a time but now the majority of the Province is like this, as is Ontario and quickly fracturing out to many areas of the country.

But David Eby Might.

People can always move somewhere else, nice places are always desirable and Victoria had limited land. If you want a home some tough choices will have to made. Increase income or decrease home ownership expectations. Construction costs are not going down and council isn’t going to remove any red tape or fees for development.

Be good if prices stopped escalating for a start.

This shouldn’t be a battle between existing and future owners here and that dialogue goes nowhere. The people who bought before I could made way more money on housing and had it way easier than me to buy in, but then they will likely die earlier too (or already have) – so there is that.

After that I would like to see co-ops make a comeback. Rent to income units built on municipal or provincial lands with no fee for the land or a fee paid from capital gains taxes on the sales of primary residences and not co-op purchasers.

At this point I’m looking for densification and new affordable housing options and not seeing too much happening.

A friend was hoping to put a suite in in their home in Oak Bay but read the new policy – three off street parking spots – one covered – required for a legal suite or to have a boarder. For most older homes in Oak Bay that is impossible without tearing down and building new – maybe not even then because driveways are a limited width under the bylaw.

No, just support policies that make housing more affordable, instead of telling people who aren’t in their position to stop being “entitled”.

Yes that means lower prices. But nobody’s asking you to give up your house, right?

I’m not sure which way some people go to get to Sooke. I always stay on the highway and take the west shore parkway.

If you follow the highway signs it is more zig zaggy and I find it takes longer.

I’m not a crazy fast driver. Never had a ticket for years. I do fly a bit on the straight stretches but nothing crazy.

Hampton court to the welcome to Sooke sign is 35 minutes. (Edge of town to edge of town.

My main point is that a commute from Sooke is much easier than a commute in Vancouver. (Oak street bridge, lions gate bridge, dease Island tunnel etc etc.)

I have been very lucky to travel and see the world and I love Sooke.

I certainly wouldn’t want to commute to work…… anywhere.

For myself …I feel it would be lot of time wasted out of ones life.

But “millions” do commute for a number of reasons and I wouldn’t want to judge them. ( For example: I’ve heard some say that they like the time alone to unwind after work.)

Many people would think Sooke is too rural with not enough things to do. (Vancouver people often say that about Victoria. New York people say that about Vancouver. And so on. And so on:)

I’m never bored. I never have enough time to do all the things I love to do.

“Yes, the inner city is limited and will become more expensive but if we (as a city, society) had some consideration for future generations and densified rather than restricting growth and commoditized housing only to deliver ever increasing riches in the present there would be much less of an issue.”

I’m sorry, but a part of densification is reducing the sizing the yard or not getting a yard… You can’t have it both ways.

I don’t get it. A young couple in their mid 30’s 8 years ago (2015), scrimped and saved, didn’t get any family financial support and finally had enough to put down on a modest SFD. So they bought one. They didn’t know at the time their house was going to go from $500K to well over twice that come 2022. Quite the opposite because loads of people were telling them houses were priced too high….and they were biting their fingernails hoping they didn’t make the biggest mistake in their lives. So now they should feel guilty? What would some have them do? Sell their home at a greatly reduced price so that a similar aged couple can buy it? Where are they going to live? Life happens. We do not know what the future holds. None of us. Hopefully, the entire economy won’t go to r.. sh.t, and instead will cool down moderately and then level off.

Found this interesting. Not sure about the probability of it actually happening though..

https://financialpost.com/opinion/opinion-let-a-thousand-four-plexes-bloom-how-private-property-rights-can-fix-canadas-housing-crisis

Well if you bought a house, that actually does make you entitled to owning it. You get that in writing. And I don’t think you’ll offend a homeowner by calling them “entitled” to own something they bought.

Improving prosperity is a reasonable goal in a capitalist environment and has been the case for western societies during the past few generations, but now it’s viewed as entitled? Not surprising when our system has exploited future generations for today’s gains and if your own interests are at stake, it’s easy to proclaim entitlement.

Just because some people are satisfied with less due to their lived experiences does not mean we all should lower our expectations. By that measure any expectation beyond starvation is entitled. Certainly we are extremely fortunate for the way we live in Canada but let’s be reasonable. Marko, you claim you can deal with a Mazda 3 just fine but isn’t it rather entitled to expect to own a car at all? Many people use the bus or walk and do just fine! Can’t you make due with less?

A house with a yard is a reasonable aspiration in Canada and has been quite attainable until the recent decade. Yes, the inner city is limited and will become more expensive but if we (as a city, society) had some consideration for future generations and densified rather than restricting growth and commoditized housing only to deliver ever increasing riches in the present there would be much less of an issue.

It’s possible if you drive to Thetis and bike the rest of the way.

Entitled =_? struggling into one’s 40’s in the hope of attaining < 2/3 of what was readily attainable for people in the same income bracket < 2 years ago

(When I was posting about townhome numbers, I was thinking of some friends we have. Below average household income for two parents, but well above median. Three kids. Living in 900 ft^2 2 bed 1 bath suite in elderly grandmother's basement, with an unsure situation when said grandmother passes away. Grew up on the edge of town, with family ties here. They're closer to the representative family in the region than the family dealing with the tremendous pain of not having a formal dining room. But, sure, they're the entitled ones.)

I rarely go downtown for stores, as I’m not much of a consumer of new goods. What matters to me is having the best options for food, coffee, pubs, and culture (such as it is here). Downtown blows the westshore out of the water for those.

May I suggest that the people who should properly be called entitled are those who were able to buy at much lower prices and don’t see the need to correct the policies that have led to the current housing crisis. It didn’t just happen.

Markos worldly perspective is one that is missing in Victoria and a lot of cities in Canada. There is a sense of entitlement with most people in Victoria around having a house with a yard, two bathrooms and a single room for each kid.

I said “If you live in Sooke and work downtown you pretty much do.”

There is no way on earth you are not spending 2 hrs in your car if such is the case. Have better things to do with 2 hrs of my time every day. You are defintively not averaging 45 minutes each way in commuting times, to downtown.

Good for you Deryk. Why does everyone here think that everything is measured by the distance to downtown Victoria. Unless you happen to work in downtown Victoria which is less and less people as a percentage there are not a lot of reasons to venture downtown for most people. For many things you have a better selection of stores in the Westshore.

I have to step in and say a few things about Sooke and living here.

Sooke is an amazing place to live. Small communities are not for everyone of course but many people love the sense of scale and sanity while they make a living and raise their families.

The traffic can be an issue for sure but honestly, when it is put into a world perspective it just isn’t that bad.

A lot of people complain that they want the highway upgraded …and then complain when the work is being done.

(Try getting across the oak street bridge and then the through the dease island tunnel at rush hour.)

Sooke is nothing like that.

As I’ve said…I can get to Hampton field in Vicoria in 35 minutes. (45 -minutes at rush hour.)

Of course the road needs work also ……but that is happening and more will be done.

Making smug comments that “people in Sooke live in their cars” sounds very parochial to me.

Just for the record……. It’s also not even true.

Unlike people on this blog the average person doesn’t pay attention to what central bankers say. We had a decade of jawboning on inflation and more than that – wage and price controls – back in the 1970’s and it didn’t work. What worked was higher interest rates.

I do agree the central bankers don’t want a recession but they will do what it takes to defeat a wage-price spiral which is what they are really worried about.

An OpEd by two unnamed Oak Bay councilors…..

From: https://www.timescolonist.com/opinion/comment-oak-bay-aiming-for-best-answers-to-housing-crisis-5212815

One of the funniest things I have read all year. Basically says stop criticizing and making fun of us…lol.. Accept it Oak Bay city council, you’re a joke; just a different kind of joke than the Victoria city council, but a joke all the same.

Luxury is a very flexible term, but I agree that Marko;s description is a very nice place to live.

I don’t see mention of a wine fridge in the amenities. It is not luxury if there is no wine fridge.

The (almost panicky) jawboning, after letting themselves get so far behind the curve, seems to be working… won’t take much at this rate to produce a good enough impact. Despite what they say they’re not going to decimate the economy just to prove a point because inflation will fall fast if everyone loses, or worries about losing their jobs and significantly reduces spending. If most don’t take any notice of their comments and keep spending like maniacs then yes , rates will rise higher until spending is impacted. Isn’t this the regular routine?

Central bankers and economists are practically screaming a warning of much higher rates on mortgages and HELOCs

If you live in Sooke and work downtown you pretty much do.

I don’t live in my car though. 🙂

In Victoria I drive a Model S which is arguably one of the best cars in the world when it comes to performance/safety/technology/etc. In Croatia I bought and drive a Mazda3 hatchback base model with a 6 spd manual. The Mazda cost is 1/5 of the Tesla and honestly other than lack of blistering acceleration and having to go to a gas station the Mazda is pretty much the same thing. Both have A/C, both have nice interiors (in my opinion), both have power windows, both have power mirrors, both have ok sound systems, both have comfortable seats (Mazda is manual, Tesla is power, but who cares one less thing to break), both cruise comfortably at 150 km/h, both are reliable. Like what is the difference between a Mazda CX-5 and a Porsche Macan? You pay 3x the cost for the Porsche so you have alcantara to touch on the headliner? Is that really going to change the quality of your trip to Mount Washington and back? If someone told me I had to drive a Mazda3 or Civic Sport for the rest of my life I wouldn’t lose a minute sleep over it. Corolla…..yikes, that is a soul sucking car.

Similar applies to real estate, to me anyway. If you can’t accept that your parent’s house had a formal dining room you need settle on something without a formal dining room you would use 2x per year when the parent’s visit then I don’t know, move to Edmonton?

My grandfather’s house had no bathroom or washroom inside, just an outhouse 100 feet away. I had to bike 5 km to my cousins to shower when I spent summers with my grandfather. No bathroom to a house or condo with a full bathroom is a serious delta difference. 2 bathroom vs 4 bathroom home isn’t a big delta difference, imo.

Re townhouse statistics, well I can do a little number crunching from the MLS data.

This is a histogram of recent selling prices for >= 3 bed 2 bath townhouses and half-duplexes originally listed below 1m in the greater area excluding Sooke. The two below 750k were both sold for 745k, and are ~1200 square feet. Strata fees averaged 300/month for townhouses.

So, small statistics, but the floor in that market is ~750k.

For reference, a family with say 100k in savings, no help from parents, above median household income at 100k/year, at current interest rates (ignoring stress test) falls short of that by 200k.

We’ve gone over this before. That’s a Canada-wide figure. Census data shows the ownership rate in Victoria CMA fell from in 65.1% 2011 to 62.6% in 2016. 2021 numbers will be out soon.

https://www150.statcan.gc.ca/n1/daily-quotidien/171025/t001c-eng.htm

The census indicates whether a household is the owner of their dwelling or not. Your case is a single household. So yes, if you have adult children living with their parents the homeownership rate will include adults who aren’t owners. But note the rate is for households not individuals, i.e. it’s owning households out of total households, not owning adults out of total adults. This is also the case for shared houses where one or more residents is the owner.

Hey Marko: I see what you’re saying about 2x street sweeper! But surely you also understand that even so you’re talking about life a standard deviation above the mean, and 2-3 above the median.

And sure, point taken that the condo is a luxury property. (I actually agree there.) But a basic 3 bed townhome 30+ minutes out of downtown for a young family is not, and those two things are in spitting distance of each other. And that’s a serious (and recent! remember where things stood two years ago) problem if one wants a broad and durable middle class, which I think all of us here do. (And, if one wants to keep global perspective, then I’d say it’s fair to compare the housing market here relative to salary with that of other developed nations.)

Probably we don’t disagree as much as it sounds. I certainly agree with what you said about printing money, and other things too.. Anyway, thanks, and back to writing..

Hey Patrick: Regarding the stress test, ha! No kidding.

Thanks for the discussion too. All the best..

Yes, that seems to be a type of “stress test” that noone talks about.

Fair enough. It’s good that you’re open to the suburbs. I hope you find a great home for your family. Thanks for the discussion.

Hey Patrick: I think you misread what I wrote or perhaps I didn’t write clearly.

For us, we’re on two MLS email lists. One for townhouses 3 bed 2bath plus, and one for SFDs, both spanning from Sooke to up the Peninsula. I haven’t run a statistical analysis on either set, so I won’t claim high resolution here, but what I’ve noticed is that the set of townhouses has been north of 800k plus Strata in Westshore/Peninsula, with Victoria of course running higher. By the back of the envelope calculation I suggested earlier, that rules out ~60%+ of families under 40, barring significant family help or prior investment in housing.

We’re actually not interested in a SFD in the core. That would be nice, but if wishes were horses, we’d all have a lot of horses. Our case is a little unusual, in that we moved here from elsewhere and already have young kids. A townhouse would be a hard sell for the wife, after we’ve lived very cheaply for the last 13 years in the hope of someday buying a house. We have to wait until summer anyway for permanent residency goes through, so for now we wait and save and take our kids to parks and hikes and count our blessings.

I was surprised when you mentioned a benchmark of a 3bdr townhouse within 40 minutes of downtown. Most house hunters here wouldn’t even consider that, as they are looking for a SFH in the core.

So that’s illuminating that you don’t even know the prices of townhouses, I guess you too are looking for a SFH in the core like everyone else?

Nothing wrong with that. Though it does indicate and reassure me that things aren’t as bad as they sound, when most people here are in fact like you – they could afford that benchmark townhouse you described – they just want something better.

is the fact that I don’t have 2,000 sq/ft to have a dedicated room for setting up my PS5 dream gaming setup?“

‘

‘

Marco, I think your quote is really what it’s all about. Most people growing up in Canada probably lived in a nice sized house with a large yard so that is a they also strive for, if you grew up in a small house or condo then that seems normal to a lot of people in other parts of the world. We had a athlete stay with is from Vienna last year and he was blown away by the size of our fridge and house, he was used to an apartment in the city. Once you get used to a large house with a yard or an expensive car it’s hard to accept a 800 so foot condo or drove a Corolla. We moved to nearly new house over a year ago and it’s quite nice but I can already see downsizing from almost 4K square feet once kids leave as it’s far too much house.

Just saying, In how many countries can two mini street sweeping incomes buy a luxury condo in a prime location in a desirable city?

The condo I mentioned is a luxurious property (by my standards, I know everyone else will including Barrister will disagree). You can’t expect the average income to be able to afford a luxury property.

Hey Patrick: Well, for us, we’ll see what happens. But I threw out the 3 bed townhome as an attempt to put down a reasonable benchmark. The professionals could better address the actual number, but from the MLS emails I get I’d estimate those prices have climbed to north of 800k plus Strata fees (selecting for >= 3 bed 2 bath).

Hey Marko: I’m extremely sympathetic to the fact that one got to keep perspective. Especially historical perspective.

But, to be fair, the example you picked is unrepresentative. Average household income in Victoria is ~90k not 150k; median is ~55k. Those numbers are a little distorted though since they lump single and married people together though. A better estimate for household income for married families would be an average of ~130k, median of ~80k. But then, if we’re talking about younger families with kids, scale both of those numbers down.

If we’re talking about medians not averages, i.e. the lower half of society (not just the lowest 35%), then the two bed two bath condo you mention is comically far out of reach.

More than 200k of that 700k is non-sense bureaucracy and taxes.

That sounds like a reasonable expectation. Assuming that this 3bdr townhouse within 40 minutes of downtown is what you’re looking for, what is your price max? Back in July 2021, those could be had for $700k (with $110k family income). How bad is it now?

100% agree, another run up seems insane. At the same time market metrics not even close to a drop in prices.

Just the other day, as I happen to be walking to tennis courts, I ran into a nice younger guy operating one of those mini street sweeping machines. We got to chatting and he volunteered information that he makes $74k/year. I don’t want to offend anyone operating a mini street sweeping machine but it doesn’t seem to be rocket science. $74/year x 2 = $148k family income = you can buy a 2 bed 2 bath (starting at 809k+GST) in this development https://docksidebybosa.com. One of the best developers in all of BC, in on of the better locations in Victoria imo, in one of the best cities in Canada, in one of the best countries in the world, on a mini street sweeping income x2.

Yes, it sucks as the same person would have been able to buy a SFH in the Oaklands area 22 years ago, but to say we are facing some social division……I think people need to get out of Canada and travel a bit more to see what real social division is. The only social division is our government which pretends to be middle class orientated printing money making the rich even richer.

I live in a condo assessed in the mid 800s so nothing super crazy. Let me see, I have heat, hot water, fully stocked grocery store short walk away, three well maintained city parks within 5 minutes walk. One of the parks the city is dumping a few million into to make it nicer, even thought it was already nice. One of my favorite past times is playing tennis which entails walking along the Songhees Walkway to free tennis courts overlooking the ocean, that the city nicely resurfaces so I can serve up my aces.

What exactly is the social division? I don’t commute an hour each day so I can have 10 feet of backyard to my spec build on the Westshore or I don’t have to worry about the crappy old basement in South Oak Bay flooding? Or is the fact that I don’t have 2,000 sq/ft to have a dedicated room for setting up my PS5 dream gaming setup?

Fair enough – my point is realtors use bidding wars to obtain higher prices for their clients and – according to Leos post (https://househuntvictoria.ca/2021/04/19/do-bidding-wars-work/) it works. With reduction in bidding wars and over asks then its fair to say the market is turning and we will see prices either rise less or stop rising (or eventually drop) – cant’ say that it wont’ stop here and go back up but with all the other factors it just seems unlikely to me.

Looks like will be about 270 sales down YOY and 200 new listings down YOY….it isn’t a massive divergence imo. People forget what a balance market actually looks like 2012-2014.

I mentioned a week ago expect a huge drop in over ask % reason being more and more sellers are pricing at market and even with a slight cool-off will lead even more sellers to price at market. I wouldn’t be surprised if this number dropped to 20-30% and we were still hitting peak prices.

A house I listed in Royal Bay two years ago that sold for $855k just re-sold for $1.575 million with an asking price of $1.575 million. The final sales price is what matters not whether it sold for 100k, 200k, or 300k over ask.

Since the Reddit comment was referring to the census, that wouldn’t necessarily apply to the Canada housing survey, which isn’t the census. You’d need to review the methodology used for that, which was in the links I provided. If both of them (census and survey) use that same methodology, it would support being able to compare the values.

As it stands, I’m assuming (for example) that a married couple with 3 adult kids living at home would be counted as one household owning a home. I don’t see any problem with that, as long as it is used consistently. Because it is not people we are counting in homeownership, it is homes, and what percent are owned out of the total number of homes.

The comment I saw was on reddit and did reference statscan definition: “Yes, the figure includes adult children living with their parents. The reason for this is because the census uses the term “economic family’, which is defined as “two or more people living in the same dwelling who are related by blood, marriage or adoption, or who are living common law, as well as single people who are living either alone or with others to whom they are unrelated.”

https://www150.statcan.gc.ca/n1/pub/75-006-x/2019001/article/00012-eng.htm#a9

My point is that an increase of young adults living at home (due to affordability or culture) will skew that homeownership stat upwards and make it seem like things are more affordable when in fact the opposite may be true.

Hey Patrick: Well, I’m not sure what sort of evidence you’re looking for, and I suspect we have different priors. The market is obviously worse now than even two years ago, let alone twenty, by nearly every statistical metric available. Indexed value as a function of time; inflation-adjusted salary as a function of time, especially broken down into not just the average but the variance; etc. (Incomes have grown more for the upper quintile, while the rest has remained approximately constant.)

When it comes to being locked out, here’s a simple back of the envelope computation. Given the distribution of incomes and what listings are going for right now, what fraction of families under forty could purchase a three bedroom townhome within 40 minutes of downtown? Without help from parents, and without prior equity to draw upon, and relying on standard historical norms for financing (where five times annual salary is getting risky). I’ll tell you this: it ain’t close to 65%. And it won’t be even if they saved 20% of income for 5-10 years. Then compare with the number for even two years ago, or 5/10/20.

But this is all sort of obvious. When salaries are relatively stable in inflation-adjusted terms, and housing prices double, well..

(I’d emphasize that, like the plots our host has generated, these problems have been lit on fire in the last two years. Turn the clock back to March 2020, and you have a difficult landscape, but much better than now.)

Yes, there are options other than moaning and complaining. One can try to climb the ladder, provided that you start early enough or put off having kids. Live cheaply, simply. Maybe if you wait long enough it will work out for you. For us, it will, eventually. But the question is about society writ large. (There’s also long-term economic problems that arise; money in the housing market is not generating any goods or economy per se.)

What I was alluding to with social instability is the following (having seen it first hand in the Bay Area). Do you want society to be ordered so as to support the formation of a broad and durable middle class? Historically speaking, its existence is a recent development, not to be taken for granted, and it’s not an accident that with it has come relative peace and social unity. The easing of social tensions. Etc. When the cost of basic housing grows this much, you run the risk of severely reducing social mobility and generating a rather rigid hierarchy in society, shrinking the middle class to a subset with generational wealth built up by the housing bubble and very wealthy people that don’t like to think of themselves as rich.

There, you have essentially four people groups. Super-duper wealthy people; upper middle class, usually two high paying incomes; middle class, but only have a house because of generational ties; and everyone else. That last group is the majority of the population, and there’s relatively little mobility between the groups precisely because of the potential barrier posed by the enormous cost of living. That potential barrier has led to class resentment and a host of other problems.

Hey Marko: Somewhat agreed, although unless you want your young families to not procreate, better to have three or four bedroom condos/townhomes. Sure, elsewhere in the world people get by just fine without them. But historical expectations in the new world are different, and part of the boundary conditions one got to solve.

As for climate, well, to put on the physicist hat, all of that is really deck chair rearranging. If you want serious O(1) changes in carbon emissions without O(1) changes in human behavior, you need to revisit power generation. Switching to nuclear/hydro gives an O(50%) reduction; all of the other things don’t even come close.

Yes, that 68.55% homeownership was measured by statcan as part of their Canada Housing Survey (2018). You’ll find all the details for the Canada housing survey here (including statcan links and detailed methodology) https://househuntvictoria.ca/2021/07/02/june-market-eases-slightly-but-remains-hot/#comment-80966

I hadn’t heard about the “living at home” thing. Statcan designed the study, so one would hope that they would use similar methodology to the census. Then again, they sometimes change methodologies between censuses too.

The 2021 census data was collected in may 2021, at the peak of the third wave of Covid. This will make it harder for apples to apples comparisons between census 2021 and 2016, because there will always be people saying things like “yes, but this was during Covid and there were more people living at home so blah blah blah and we cannot compare the values” with prior census.

As an illustration of how Covid might skew home ownership measurements, look at the gyrations in USA homeownership that have occurred during Covid, (homeownership rate went way up, then down, probably noise). This seems to point to problems with measurements during Covid instead of actual changes in homeownership. I don’t know how this would affect the Canada census in may 2021, but we know that many stats have been skewed during Covid.

Is it possible to see sales and new listings for sub 1.5 mil prices? And again for above?

Patrick I tried to find some info on this once but could not. I saw a comment in a thread once that said this number includes people living with their parents. IE if you can’t afford a home so are living with your parents at age 30 then you would be included as a ‘homeowner’ in that stat. Can you confirm or deny that? I assumed their would be an age where that was true (25 years as a cutoff for example) but I could see anything on the stats can page I was looking at. Any ideas?

There’s no evidence that they have been locked out of the housing market, as ownership levels always rise with age, and they are rising quickly for millennials. We will know more when the 2021 census data is released, but preliminary estimates from statcan (2018) showed overall homeownership levels rising (to 68.55%), not falling. That would mean fewer people “locked out” of homeownership, not more.

Moreover, about 35% of people have always rented, and this will likely remain, especially for the young people. Previous generations haven’t responded to this with “social instability,” as owning (vs renting) is a “want, not a need”.

They aren’t in sync – thats the point. As per Leos post “sales are dropping somewhat faster, widening the gap between new lists and sales” and to top it off “the rate of over-ask sales has also has been on a downward trend, at 55% of properties going over the asking price in the last two weeks compared to a high of over 70% a couple weeks back”. The chart shows clearly listings are basically flat the last two weeks and sales are trending down.

This all wouldn’t be explained away by spring break (especially the over asks). Now you could say a lot of garbage properties have come to market recently that are sitting or just not getting asking price which could explain it but without that, and just looking at the data (along with realtors like Steve Saretsky in Vancouver saying homes that were getting 150K over ask are getting picked up for 50-100K over ask now, or Toronto increasing supply at record levels) it seems like we may be in for a slow down. Still a sellers market no question – but could be turning. Its only been two weeks so could just be a blip but as you say April will be telling.

That’s the same social division, just with a generous helping of debt. I’ve said before that if the majority can’t aspire to more than that, those with SFH had better watch out.

We can still solve a few problems and get young people into the housing market via condos, just not SFHs. This should also align with the social responsibility we have for the “environmental crisis” that is at hand.

Regarding affluent millennials and generational wealth transfer:

We moved here from the Bay Area, and so are well familiar with the effect that a small number of highly affluent people can have on a large housing market. (Tech comprises only O(10%) of the labor market there. Yet, precisely because of a lack of available housing, young wealthy tech folks are able to set the cost of housing the region.) So that could well be the case.

But, at some point, these homes got to be paid for with actual dollars. What fraction of families under 40 will be able to afford say SFDs if they do not correct and fall below 1.3m? One got to compare that reservoir of potential buyers with the resources in hand with the available supply.

FWIW, you’d better hope things correct. There will be long-term social instabilities that come with locking a supermajority of young people out of the housing market.

Absolutely, however there also a possibility of a larger portion of affluent families when the cohort is larger, and free money from the bank of mom and dad make appreciation and value of money meaningless.

2016 Census indicated that Victoria single detached house are 39.5% (44.1% in BC, and 53.6% in Canada) of total housing stock. So it is likely that SFH buyers would be competing with affluent families offspring presently or in the immediate near future.

There are roughly 10 million people between the age of 25-44 in Canada that will see a share of $1200 billion, and if half of that cohort are from affluent families then their share of the wealth transfer translate to an average of $240K each or $480K free money per couple.

‘Bank of Mom and Dad’: https://tinyurl.com/bczvkrd8

Serious question: will millennials, as a group, have have the down payments and incomes to bid up prices and maintain carrying costs? Seems prices might be tied to the wealth and incomes of the cohort, and not necessarily the size of the cohort. I’ve seen mixed research on the overall wealth of millennials, and where they rank on the income scales, so it’s not clear to me.

But perhaps I am missing something.

Here’s a population projection pyramid for 2030, and we can see the largest demographic groups are the age 35-44 which is exactly what I have posted. For example, the male 35-39 population will be the largest in Canada (3.7%) representing 1.51 million people, compared to 1.2m shown on your chart. That’s a 26% increase expected by 2030. Same for the other cohorts in the 35-44 homebuying group. That’s likely 26% more people looking to buy from the same (or fewer) stock of SFH in Core Victoria.

https://www.populationpyramid.net/canada/2030/

Any one knows how much 1403-1020 View St sold for ?

The largest age group of home buyers are 30-39 year old in Canada. And, as Patrick point out we are at the beginning of this buying trend, and it is highly likely that we will see ascending of house price for the next decade or more that exacerbates by restrictive construction policies.

https://www.statista.com/statistics/444868/canada-resident-population-by-age-group/

Immigration (average immigrant age is 30). And you’re using a 4 year old chart to start off with (possibly extrapolated from the 2016 census).

Don’t know what I’m missing there Patrick, but every thing I’ve seen w/r to demographics in Canada, numbers drop off before 35.

Here’s a graph showing the coming wave of age 35-44 (millennial, genY) group, considered the biggest house buying cohort . It’s a USA graph from census, projecting to 2030. Canada’s population rise is higher, so Canada numbers would be proportionately more than this. Adjusting for canadas projected growth, this means about 3% more people in this age group per year during the 2020-2030 decade. This is the start of the “millennial wave” of housebuyers. You can see from the graph that we are in the early years of this wave, and the numbers easily exceed prior peaks.

People buying in 2020 have caught the start of this wave.

Be fearful when others are greedy, and greedy when others are fearful. — Warren Buffett

I’ve had clients make unsubstantiated claims that their building is leaky (when it isn’t) then call me to sell and then only when I explain to them that the buyers will be reading minutes that they clue in that they just tanked their re-sale. Unfortunately, a lot of people can’t think a few steps ahead.

Just look at heard mentality in real estate. Great time to buy, no one buys. Crap time to buy everyone piles in.

You are less likely to put your home up on the market or purchase heading into spring break if you have plans and people weren’t travelling much last few years. I find it odd that both new listings and sales down substantially in sync.

Year over year sales will be down huge this year but won’t change market much if new listings are down too. We need to see lower sales and higher new listings.

Spring break didn’t start until last week (unless you’re counting private school kids — i don’t know how much of the market they make up).

Fair enough and that’s been my experience in purchasing over the years too, so maybe I’m just being too cynical. Interesting about the average seller not being that sophisticated or able to think that far ahead though.

Yes conditional offers were the most common situation. But during this period, unconditional offers were also allowed, with no cooling off period possible. The only thing that’s changed is unconditional offers have become more common due to demand.

The new law is likely a good idea. There should be a substantial penalty for someone withdrawing from an unconditional offer. As mentioned, losing some/all of the deposit is planned.

Average seller is not this sophisticated or able to think that far ahead, re implications cool off period. Also, based on my experience very few sellers are hiding major issues IN THE CONTEXT of prices. Let’s say you have vermiculite in the attic ~ 15k issue you may to try squeak by someone. Does that even change a buyers 100k over ask offer to 85k over ask?