Exploring scenarios for future affordability

We know that rising prices have led to severely deteriorated affordability, with especially detached properties breaking out of the historical ranges for that measure, while condo affordability is at the level where prices usually turned around.

Given that, let’s look at a few scenarios of what might happen to affordability going forward. In the past two cycles, affordability dropped roughly 15 percentage points over a period of about 7 to 8 years from the peak.

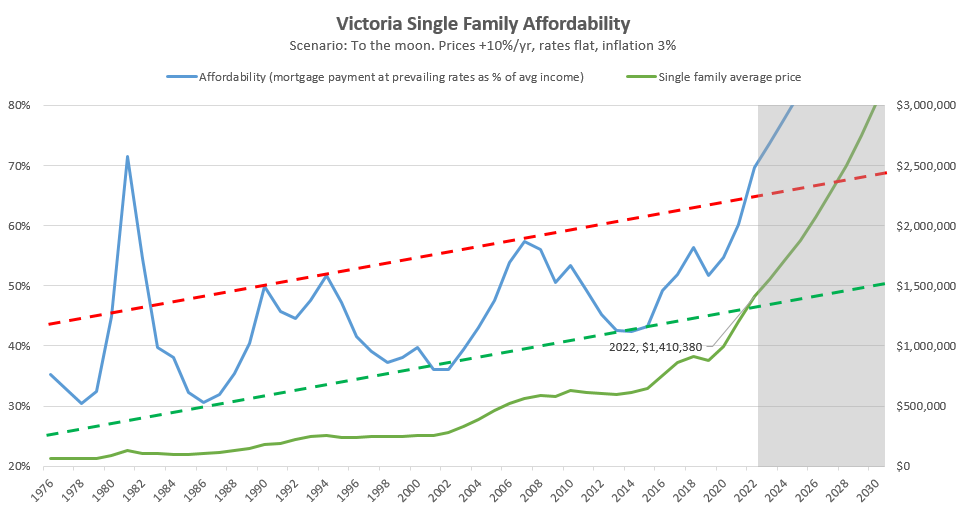

- To the moon, it’s different this time. In this scenario, affordability and prices don’t matter anymore, everyone is just going to keep bidding up prices forever. Needless to say I doubt this is a possibility, but I’m including it for completeness sake and to satisfy the permanent bulls. At a pedestrian 10% annual price gains, the average single family home would hit 3 million in 2030.

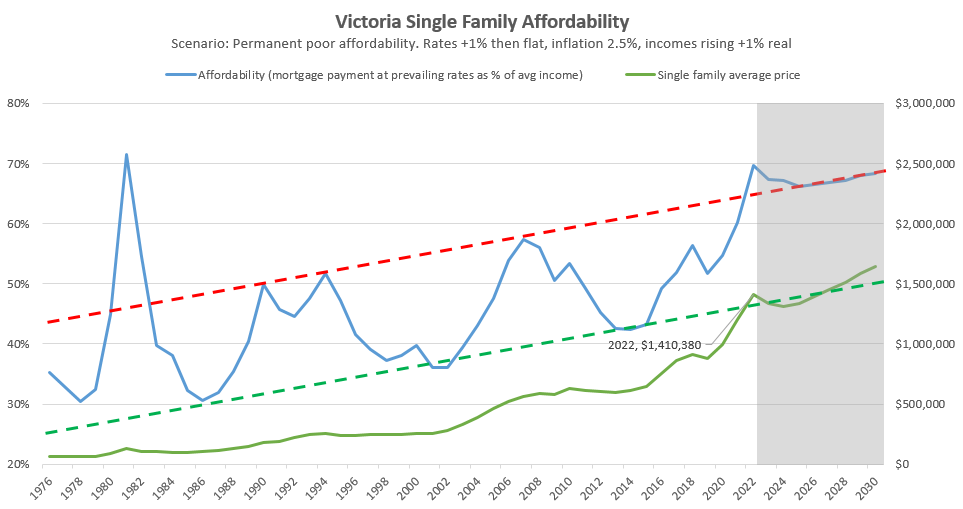

- Long term poor affordability. The second most bullish, in this scenario affordability stays very poor, but remains roughly within ranges of historical norms. The affordability cycle is broken and no longer improves like it did in the past, with prices rising as incomes increase (assumed rising at inflation + 1%). Rates go up by 1% from current levels causing a small price pullback followed by 4%/year gains. I don’t think this is an especially likely scenario, as the next recession will inevitably hit consumer confidence and enthusiasm for housing with it.

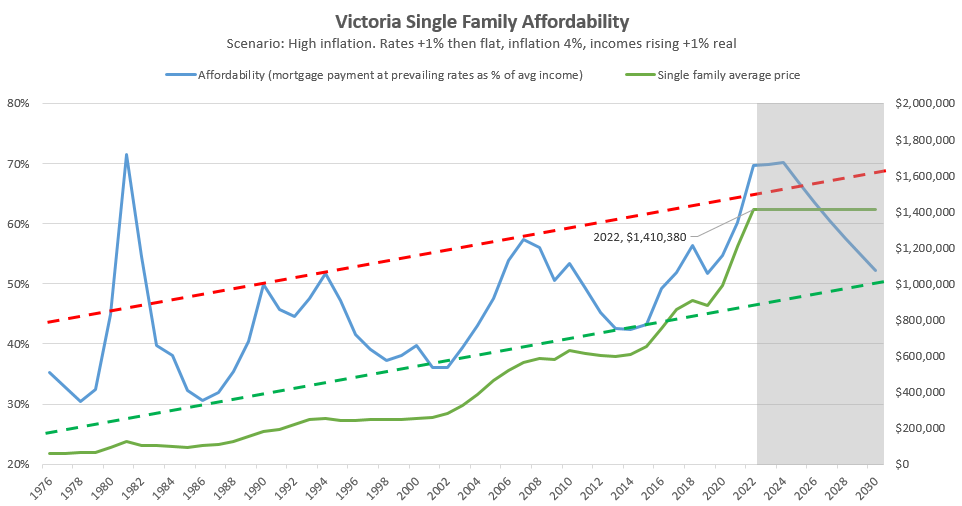

- High inflation – We’re in a time of unprecedented high inflation, and real estate is generally seen as an inflation hedge. One could imagine a case where incomes rise ahead of inflation (average has been inflation + 1% in past years), real estate prices stay roughly flat in nominal terms, while rates are manipulated to stay relatively low to devalue our COVID debts. This to me is an unlikely combination of factors, but again I’m including it because of Victoria real estate’s tendency to surprise to the upside and this is one scenario that I could see as at least plausible that would still bring affordability back down without a nominal price correction.

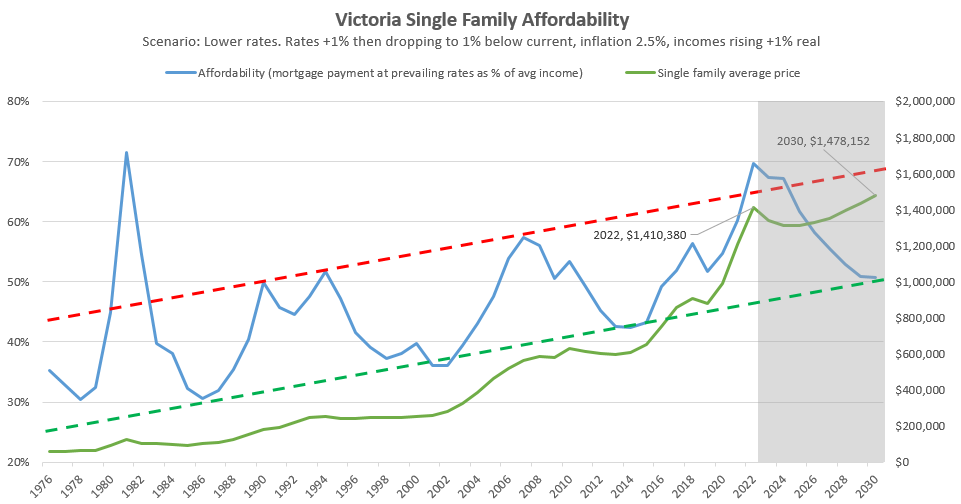

- Affordability returns, through lower rates – In the past, affordability primarily returned due to dropping interest rates, secondarily due to rising incomes, and lastly due to slightly dropping prices. Though everyone is now talking about rising rates, dropping rates aren’t entirely out of the question. That scenario is charted below, with rates rising first by 1% from current levels, then dropping down again to 1% below current levels when the next recession hits. In that scenario (assuming incomes stayed ahead of inflation), affordability would return while prices could remain roughly at the same level as they are now in 2030.

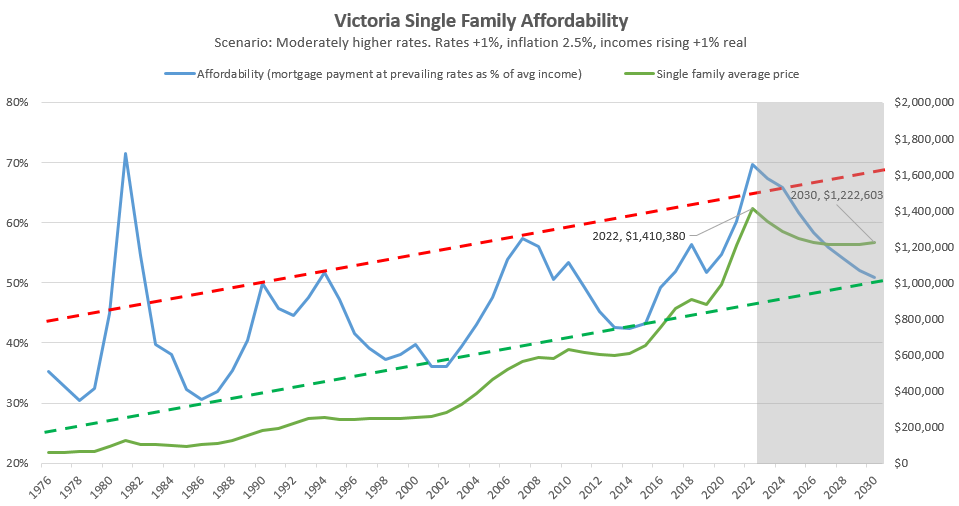

- Affordability returns, moderately higher rates – Rates are rising now, but we may hit a wall pretty quickly as interest costs on higher debt loads start dragging on the economy. In this scenario, rates rise 1% then stay flat. If incomes cooperate, prices in 2030 would have to be about 15% lower to bring affordability back.

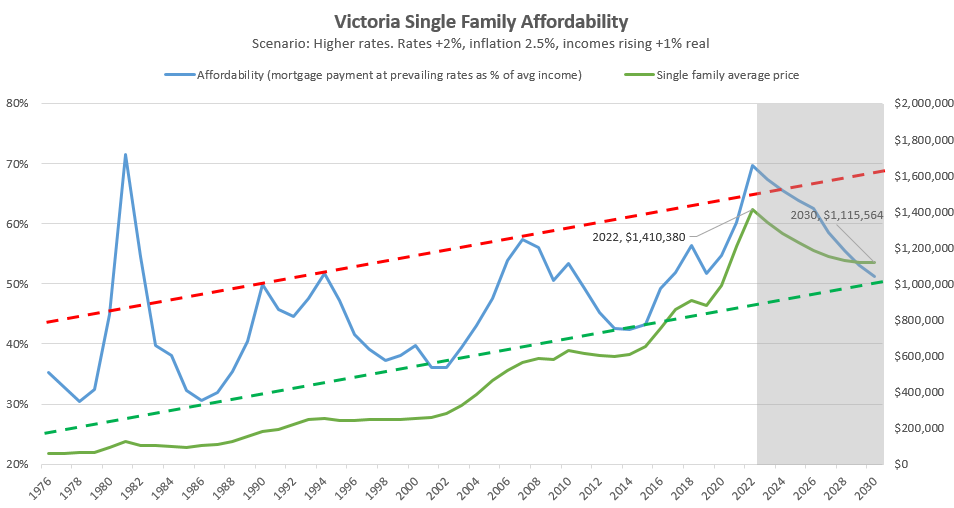

- Affordability returns, higher rates. What if rates rise to 2% above current levels? Prices would have to drop 20% by 2030 to bring back affordability.

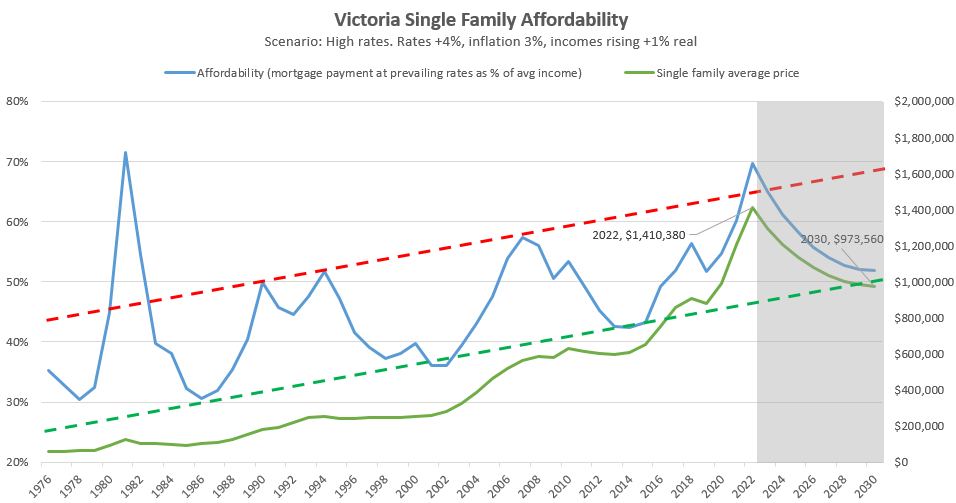

- Affordability returns, high rates. If rates rose a lot (likely because inflation was stubbornly high), then prices would have to drop a lot to restore affordability. A 4% increase in rates even with very solid income gains would require prices to drop 30% to bring affordability back in line. I suspect our economy would not withstand rates anywhere near this high, but no one thought we’d be teetering at the edge of global conflict this year either.

Of course there are infinite variations on those outcomes. Perhaps affordability returns partially but not down to levels we’ve seen in the past. Or there’s a longer stagnation in prices. Or incomes no longer keep pace with inflation. However this gives you a sense of the magnitude of price movements that could result if affordability either stays poor or continues the historical cycle.

What is your guess for the most likely outcome for our market? Will affordability return like it has in the past or are things different now? And will prices in 2030 be up, down, or sideways?

Also weekly numbers courtesy of the VREB.

| Mar 2022 |

Mar

2021

|

||||

|---|---|---|---|---|---|

| Wk 1 | Wk 2 | Wk 3 | Wk 4 | ||

| Sales | 143 | 356 | 527 | 1173 | |

| New Listings | 230 | 509 | 763 | 1419 | |

| Active Listings | 902 | 935 | 985 | 1310 | |

| Sales to New Listings | 62% | 70% | 69% | 83% | |

| Sales YoY Change | -30% | -22% | -27% | ||

| Months of Inventory | 1.1 | ||||

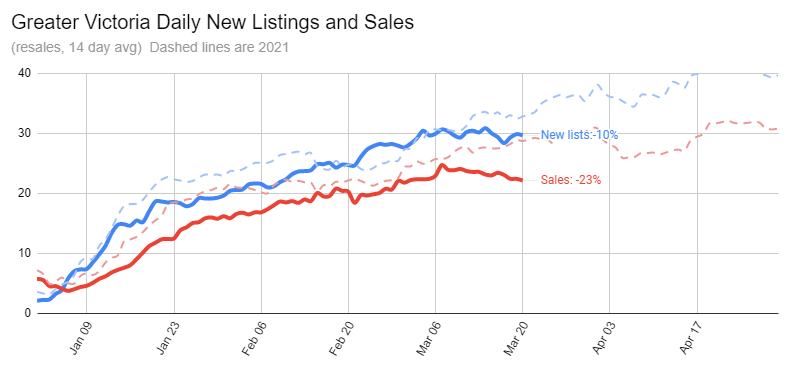

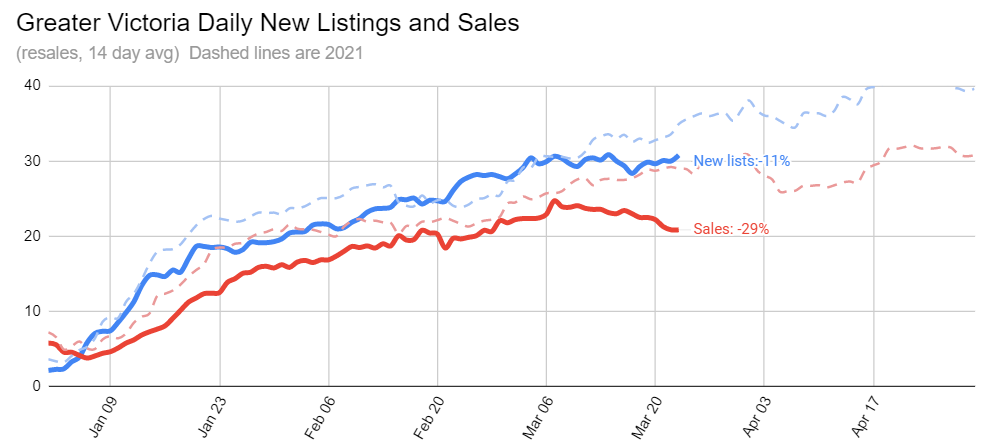

There’s a bit of a curious lull in new listings which is unusual for this time of year. That has also depressed sales for the past week and we’ve even seen them drop a bit rather than staying on an increasing trend as we would expect in March. Even the sales to list ratio pulled back a bit which again we wouldn’t expect halfway through the month. Still plenty of bidding wars, but I’m hearing more about less ambitious bids, fewer offers, and the return of the odd conditional offer. To early to call a slowdown, but this is worth watching carefully. Have the rate hikes already started taking steam out of the market?

New post: https://househuntvictoria.ca/2022/03/28/market-seems-to-ease-ahead-of-rates-and-government-action/

That’s what happens every time a house sells with multiple bids, isn’t it?

Just wanted to post this beauty again from Paul Krugman.

This is literally Introvert’s only reason for being on this site.

Rates SHOULD go up over 5% to get people off the addicition of cheap debt, but in reality they most likely won’t hit 5%. You would be betting against the entire system. Higher rates mean higher costs to service public debt we are drunk on, less revenues all around (just on the provincal level a $5 mill sale in Vancouver is $168,000 in PTT to government coffers).

It would be like shorting the S&P500 when it has returned on average over 10%/year for the last 65 years. You might get lucky, but you are betting against the system. My prediction is BoC will raise the rates a bit, but mostly talk tough, and then slash them again when another headwind appears.

As for real estate does a 10%-20% pullback even mean anything? Spec house in Royal Bay will fall from $1.5 to $1.3? or still more than double it was a few years ago.

Don’t think rates will get as far as some on this blog believe. With far higher debt levels than ever before and a housing dependant economy the slow down will come quickly.

The best was when people on HHV use to post loses due to transactional costs 10 years ago. Like someone bought and sold for 650k and then people would comment on how they lost 40k between real estate fees, PTT, etc., even thought there was no benefit to them or buyers. Price was still 650k but the loss made doomers feel good.

Not sure what the obsession is about losing/not losing money on real estate. Every day people drive new cars off the lot and they take a beating, but if you have to sell a house for a loss it is the end of the world.

That is why prices are sticky on the way down. People will hold on just not to take a loss.

Seeing less offers on SFHs, condos still very competitive.

Right. The same applies to homeowners who would naturally hope that prices rise, and be thrilled when they do rise. This is normal and reasonable. What wouldn’t be OK is for a homeowner to be happy that someone else lost out on homeownership.

There was a downturn in Vancouver around 2017-18, and HHV started getting filled with gleeful posts documenting spectacular losses on resales of Vancouver area houses. They didn’t stop there, they needed to also identify the owners (by posting the address) and then speculating as to the financial devastation that must be occurring for that person. e.g. “1234 ABC street in Richmond, purchased for $3m and sold for $1.8m 3 years later – likely a horrible, life-changing event for that owner…” Hopefully we won’t see that posts like that here again. It’s easy enough to comment on house prices in general without identifying and speculating on the misfortunes of individuals.

To be honest, as a homeowner I’m hoping prices stop rising (maybe fall back closer to July 2021 assessments) and the market supply returns to normal . But I’m not looking for anyone to get “hammered” along the way.

Weekly numbers:

Sales: 700 (down 29%)

New lists: 1010 (down 20%)

Inventory 1019 (down 26%, first time over 1000 since October)

I’m out of town but will try for a brief update tonight.

I think it is one thing to hope that prices fall, and another to hope that others who have bought now suffer because of a downturn/rate increase. I think the reactions that are posted here are more in response to a sense that the latter is being wished for.

In my opinion, it is high time prices ceased this crazy pace of escalation, but I don’t wish foreclosure, bankruptcy or forced sale on anyone.

And, in fact, while it is possible that there will be a widespread market disruption, the more probable outcome is that new buyers who can least afford it and are on variable rates will be the ones who experience the most hardship as rates rise.

Crazy to try to guilt anyone for hoping for house prices to fall. Everyone is an adult here and makes their own choices. Buying a house means taking into account a possible price decline. Or should we scold investors hoping for a pullback in a stock so they can buy in? Too much time of ever increasing prices has warped people’s thinking about housing.

I find myself agreeing again with Patriotz (unusual week) that very few people will lose their houses unless this becomes much more severe than anyone is imagining. It is too early to tell but it is likely that house prices will mostly just remain flat and perhaps an initial small decline of ten percent.

If you are holding on to a rental condo with negative cash flow this might be a good time to consider selling and taking your appreciation profits. But my crystal ball has not worked in a long time so it will be interesting to see how it plays out.

Frank: When you say that “they” will not let it happen, exactly which they are you referring to?

In a downturn, I expect more net investor buying, not less. So that homeownership rate falls.

If the homeownership rate falls, it means less homes are owned by owner occupiers, and more by investors (of various types). In a typical price decline/bust , the homeownership rate falls.

For example, Ireland bust – homeownership rate fell from 78 to 70 https://tradingeconomics.com/ireland/home-ownership-rate

USA bust, homeownership fell from 69 to 64 https://www.statista.com/statistics/184902/homeownership-rate-in-the-us-since-2003/

That means ireland’s bust saw net investor ownership rise from 22 to 30, and USA’s bust investors rise from 31 to 36 during the bust.

Banks tighten lending standards, and many househunters are unable to qualify, despite the lower house prices. Someone has to end up owning the houses, and that leaves investors.

The point being, a price decline/bust from rising rates is bad for would-be homeowners (as a group). Since homeownership rate falls, it means more fewer homeowners achieving their dream of homeownership.

If interest rates rise enough to lower house prices, stock markets will be devastated. I don’t think they’ll let that happen.

As I’ve said before, I don’t expect an increase in interest rates to result in forced sales or foreclosures for more than a very small number of people, and many of them are likely to be investors, not owner-occupiers.

If we do see a price decline or even a bust, almost all properties on the market will continue to be sold for the usual reasons, just at a lower price than could be obtained before. Except an added reason being investors wanting to get out while they’re still ahead.

And last but by no means least, it’s buyers who are responsible for the market price at any given time, and thus are ultimately responsible for falling prices if conditions don’t go their way. Not non buyers.

Bluesman asked a question.

You stated what you thought you saw.

You’re hysterical. As in, characterized by or arising from psychoneurotic hysteria.

I’m sorry, but this is vailed joy just like Bluesman eluded to. The rates should hammer people. It looks like people are experiencing further strain which would be a good time to acquire distressed assets. Those who bought all they could won’t like their next mortgage renewal.

This is pent up joy whether you acknowledge it or not.

Seems like the only reason the raise rates a bit is so they can drop them during the next “crisis.”

You may be right.

Fwiw, i think the increases will be more moderate, and max out at under 5% for the 5 year mortgage discount rate.

The BOC talks tough, but always manages to find an “excuse variant” to keep rates low.

Thanks for the discussion.

You might be right but when I googled the five year rate for 2006 in Canada it showed a low of 6.6 for what little that is worth. You might be referring to the discounted rate. In fairness discounted rates are not the usual metric used for comparison.

Regardless, I suspect we will be seeing much higher rates in the future.

5 year fixed mortgage rate was below 5% in 2006, so that also didn’t make its first appearance in 2008 crisis. And in 1969, posted 5 year mortgage rate was also below 5 ( 4.79% ).

https://www.ratehub.ca/5-year-fixed-mortgage-rate-history

Patrick : He was referring to mortgage rates not bond rates. But it is Sunday night and you may have not been reading with care.

5 year bond with less than 5% yields have been around continuously since June 2002, and weren’t first seen in 2008 crisis. https://wowa.ca/canada-5-year-bond-yield

YOY total CPI has been above 3% four times since 2002 (and has been briefly above 4%) and none of those has resulted in yields higher than 5%

https://www.bankofcanada.ca/rates/price-indexes/cpi/

Meaning… I think BoC will take a slow approach to raising BOC interest rates unless the economy (GDP, employment) seems to be overheating.

I would dare say 5% or under still is cheap money.

My parents paid 18.75% interest rate for their first home, and I thought that 6.5% was cheap money when I paid 6.5% for my first home.

Patriotz and I do not always agree but his analysis on rates is spot on. Amongst other joys you are likely going to have to pay more taxes to pay the interest on the various levels of government debt.

New builds are going to cost more as the carrying cost of projects increase and as inflation increases material and labour costs. There is a very good chance that the days of cheap money are coming to an end. Personally I would not even consider putting out mortgage money at less than 7% and I would want to be paid back in USD. So if you can get a five year under four it is still cheap money.

You have it backwards actually. Higher spending would tend to result in higher interest rates for a given inflation target. The government does not set interest rates, the BoC does, and the latter has made it pretty clear that they are going to follow the Fed, as there is no workable alternative.

5 year rates under 5% are a historical aberration which have only been around since the 2008 financial crisis. For a little over a decade we’ve been able to get away with rock bottom rates without rising consumer price inflation and incipient wage-price spiral, but global events have now ended that.

I think he was intending to say that there are winners and losers in all market movements.

Rate could reach 5-6%, but IMO it is unlikely because the Liberals + NDP coalitions are spending like drunken sailors, so they have to keep rates low and/or print more money to pay for all of their projects.

Builders are not impervious from increase rates, because it increase their borrowing costs that give little incentive to build when the profit margin is slim or negative. And, all government level depends greatly on housing for their budget.

Inflation is here to stay and it is no going to go away at anytime soon. Generational disconnect of millennials with manual labour will continue on till generation Z and hopefully immigrants step in to increase construction quicker than the demand.

My sentiment on housing is the same as Barrister is that it is highly unlikely that housing will drop significantly in the near term, but more than likely will increase due to greater demand, influx of population, shortage of labour, and materials from the incoming cold/trade war.

Can anyone tell me the fate of duplex at 116 simcoe in James bay? MLS 896789

Was on the market twice in the last month or so. Removed again or sold? Thanks.

Builders are facing three headwinds -inflated costs, labour supply shortages and rising rates. These lead to longer development cycles and higher costs.

If we add lower house sale prices to the mix this will slow down construction completion of new homes. Builders will wait for their completed homes to sell at a reasonable price rather than starting to build new homes.

Most people here agree that the only way out of this housing crisis is to quickly and substantially increase home construction. This is unlikely to happen in the current environment.

I’ve been reading this blog for so long, and before then there was the other Victoria housing blog, forget the name, and then also there was the Ozzie Jurock one. This one provides excellent analysis and interesting insights. But stepping back from the spirited debate in all the blogs over the years about the basic question of whether RE will go up or go down and why, and the myriad factors of why it might do one or the other, then at the risk of oversimplification, I believe if you had to focus on a single predominant factor, I’d focus on monthly servicing costs. And another broad-brush thing I’ve internalized is that when the government is absolutely determined to raise rates, you’d better take that seriously and step out of the way. Whether just due to rising rates increasing servicing costs, or fear thereof, or central banks overshooting and tripping into recession, all in all the odds favour a bad outcome in my view, or at least a measure of reversion to the mean/retrenchment – call it what you will, but I would not be buying in this environment. In my view, this is a time to batten down the hatches if you haven’t already.

But, like someone else just said, I’m mostly just an observer at this stage of my life. Though the rising GIC rates are starting to be of interest…

Totoro: So would you lend me 100k at one percent? with inflation running at 5%. If not, why not? People seem to forget that with our banking system there is an enormous expansion of the money supply that has rather serious consequences when money is being lent below inflation. Basically it is the underlying generator behind inflation. Inflation certainly undercuts the value of most peoples savings.

For those of you who are watching GIC’s, the rates are gradually increasing. Right now the best 2yr is @3.03%, 3yr @ 3.4% & 5yr @3.41%. Probably next week many more banks/credit unions will be following suit. Certainly a good chance by the end of the year we will be seeing at least 4% on some terms. With most financial institutions one can get paid out interest each year if desired.

My search shows it sold for over asking at $2,050,000. The house looks beautifully renovated in the pictures, so the sold price seems like what I would expect.

Anyone know the current status of 1499 Edgemont? Was listed for an absurd amount and for sale sign is now gone – no sold sign up?

Intelligent post as always Totoro. Couldn’t agree with you more.

Well said. Great post Totoro!

Bluesman made the comment, I simply agreed with them

Totally disagree. We are not living in a communist country. Our system is most certainly better for individuals than communism was and I do have enough the experience with the effects of communism to state this opinion firmly.

Our system does not involve theft when you qualify for a mortgage at a posted rate, nor is it theft from those with savings accounts – which are often the same people.

The system is one which has institutional controls and we all live with these rules. When something is not working well, as can be seen with the housing shortage, particularly for rentals, then our institutions need to address this. It is a very very slow process but my best guess is that it, in addition to the rule changes put in to date, more will be coming.

And as far as interest rates go, if they go up people will pay more for their mortgages and people will shift in their investment choices. Its a cycle as far as I can tell and your time is best put into analyzing your options rather than complaining about them.

The only thing with the cycle is you only live so long. Instead of wishing for something to happen to others so you can benefit, determine what you can do now and take steps. When you take hold of the locus of control it is remarkable what can be accomplished in any market conditions – in our society.

My guess at this point is that 5 yr rates will be well north of 5% and very likely 6% by this time next year. SFH prices will most likely only see a minor decline or remain flat. What might take a bit of a beating is condo prices. What will support the housing market particularly for SFH is an influx of well over 450k immigrants many with significant capital.

For me at least is how crippling the inflation might actually be as disposable incomes become really stretched. But my crystal ball is really not to be trusted.

But you might well see some construction slow downs at least in the private sector.

It has to be recognized that those who borrow at negative real rates are benefiting from the taxation of, or theft from if you want to be less polite, savers who are receiving negative real rates.

Restoring positive real rates is not punishment, it’s just fairness. Those who bet their future on continuing negative real rates are not innocent bystanders.

Transactions are almost always mutually beneficial.

Dude, I’m an edible green plant in the cabbage family whose large flowering head, stalk and small associated leaves are eaten as a vegetable, and I’m covered in cheese whiz.

And you’re suggesting I read between the lines?

B&C read btw the lines.

How reasonable is it to think a normalized rate environment may also provide other investment opportunities for people looking for secure, low risk ROI?

For example, instead of chasing yield or hoping for capital appreciation, wealthy investors, seniors, or those with reduced risk tolerance may be more likely to diversify their portfolios and potentially reduce real estate exposure in an uncertain environment.

My in-laws are approaching 70, and would like to buy an investment property. My parents, when they were approaching 70 just before the GFC, basically were all in on savings and bonds.

I wonder how much the calculus for investment allocation changes in a normalized rate environment?

I read Umm’s post and I didn’t get that from his/her tone. Seems to me he/she was just commenting on potential fall out of rising rates and consequences on households who are stretched…

Housing is now viewed as an investment.

Markets don’t care about tears on the way up or the way down. There are winners and losers in all transactions in all markets. Low rates and inflated house prices have benefited one segment of the population and been disastrous for another segment. Rising rates and depreciating house prices may benefit one segment of the population and be disastrous for another segment.

Framed as an investment, it seems disingenuous to be sympathetic to one group’s losses over the other. The market (and invested capital) definitely doesn’t care. Nor should it.

It depends if it’s use is as an adjective or an adverb…

adjective

extremely impressive or daunting; inspiring great admiration, apprehension, or fear.

“the awesome power of the atomic bomb”

adverb

extremely well; excellently.

“my yearly review went awesome”

So, I will let you pick…

Again, up and coming, you like to read things that are not stated with interpreting and assigning motivations and casting aspersions based on some different way knowing you must have. No burst was mentioned, and no joy in others misfortune. But hey, structure things in whatever way makes the world and the people in it make sense to you. I’m sure your retort will be as amusing as always with buzzwords, jargon, and playing the victim while attempting a few more obviously trolling insults while you go.

I agree Barrister, rates should be expected by everyone to go up and normalize. And the asset appreciation caused by those artificially low rates must come down to balance. Economics matter. I guess I don’t know how “awesome” is used to describe the scenario. As respects residential real estate, we all know its an emotional asset. The events on the national and global scale are really concerning and I don’t know who would be giddy to be taking on an enormous amount of leverage for an asset purchase. CBs starting their rate hike cycles (its about time), bond yields rising, inflation insanity and a war which is devastating and heartbreaking to watch.

Agreed Bluesman, there is pleasure at others loss in Umm’s tone for sure.

It’s also not uncommon right now as I’ve overheard a few conversations recently about this same thing. I can sympathize with the current situation for first-time homebuyers right now, but the wishing and hoping for a massive burst just so those currently without a home can swoop in and obtain a property from someone that’s now bankrupt, in arrears, etc. is not only unrealistic, but sad.

It’s unrealistic because there are many wealthy investors waiting for the exact same thing that will beat out the average homebuyer with a good down payment and it’s sad because they’re literally hoping friends and/or family of theirs will lose their home just so they can have one.

Blueman: No joy in this for me, but a realistic appraisal at this point might mitigate some grief for a lot of people. None of us have a crystal ball, but increased rates was fairly predictable. If we are lucky interest rates will revert to just historical norms. At this point in my life I am just an observer.

Umm is there a bit of schadenfreude in your tone here?

I am even more convinced now with the numbers discussed here (the costs are huge) that the increasing interest rates will be awesome. The rates should also hammer those folks that borrowed against their equity to buy in the stock market too, believing growth there would always out pace any borrowing cost increase. It looks as people are coming under further strain from over purchasing, over borrowing, inflation costs and now the interest rate growth environment; it will be tough not to see asset devaluation occuring. Folks initially will be looking to actualize gains, then mitigate losses and the last out of the party de-leveraging all they can to stay afloat. It should be a good time for some to acquire distressed assets in the coming year or two. What COVID brought in disruption for the increase of assets values, it will probably bring just as much disruption on the way out. Those who bought all they could with all they had the last two years probably aren’t looking to forward to their fixed term mortgage renewals or the BoC rate announcements.

Bluesman: Maybe time to stop worrying about money for recreation. Your recreation is likely to be a second job just like it was for my dad. The new mantra is going to be your work, work balance.

The Teranet index for Victoria peaked in Jun 2008 and for Vancouver in Jul 2008. Teranet has a built in delay of 2-3 months compared to sale date based indexes, e.g. from real estate boards.

It took about 6 months for prices to drop in Victoria in response to the global economy collapsing in 2008.

I am getting that suspicion that you will not only see increasing mortgage rates but that there may not be much if any of a price drop for houses, particularly SFH

$8900 mortgage pymt per month eh. If you can pony up that or even $7000 per month and still have money left for living and recreation (and kids???) Then you must be in the top 2.5% of income earners. That’s a monthly that would choke a horse as we used to say.

A 1% rise in rates (from 3 to 4% on 5yr mortgage) would mean mortgage payment up 11%. That worsens affordability calculation by about 9%, so house prices would need to fall more than that.

A 4% rise in rates (from 3 to 7% on 5yr mortgage) would mean mortgage payment up 52%. That worsens affordability calculation by about 30%, so house prices would need to fall more than that.

Do you think house prices falls are going to exceed numbers like that so that affordability calculation actually improves?

So people on HHV will be saying things like “hey, we just bought a SFH with a 7% mortgage. Affordability is so much better now than it used to be!”

If you borrow $1m.

—— at 3% for 25 years, you pay $4,700 per month for 25 years. Total payments $1.4m so you paid $400K interest.

——- if rates are instead 7%, and you attempt your plan of “easily mitigating the higher rates”, and pay it off in 15 years, you’d need to pay $8,900 per month ($106k per year), and you end up paying $1.6m total payments. That’s $600K interest which is more than the original example, so you haven’t mitigated it fully.

Moreover, what kind of lifestyle are you going to have as you’re paying $106K per year on your mortgage for 15 years? You didn’t want to spend $4,700/ month ($58k/year) on a $1m mortgage @3%, and insisted on diversifying your portfolio. Why would you then be happy taking on a 7% mortgage, and pouring everything into paying off a mortgage for 15 years?

I don’t see the benefits in your plan to wait until you can start off with a mortgage at high interest high rates (and pay it off sooner). IMO, a better move would have been to buy when you were first able to (a few years ago), and lock in 10 year term rates. If the house price insanity cools off, and you can buy something <10% above July 2021 assessment, I think you’d still be better off pulling the trigger now, while you can still get a 10 year rate @ 4%. Then just make the monthly fixed payments, and forget about house prices and interest rates for ten years.

Assuming, of course, that the fairies keep prices from going down.

And interesting enough, immediately after each one there was a period of falling prices or an outright bust (in Vancouver or Toronto anyway, perhaps flat in Victoria).

Any buyer with a larger than average DP will be better off, since they’ll have less competition.

Yes, after the heavily indepted that predicated everything on borrowing get hammered by the higher rates. If people have big down payments, cash reserves and strong monthly cash flows; the increasing rates can be easily mitigated by shortening the borrowing term, more money upfront and increasing the monthly payment. Thus reducing the amount money paid out on interest. In the end you can still equal out to what you would have committed in debt servicing when interest rates were lower. As long as people weren’t basing everything on monthly payments and maxing everything they can to get all they can, there are opportunities to be had in an increasing rate environment beyond just a 100% cash purchase. The ones that should be worried are the folks that couldn’t manage to save to begin with that were gifted funds from family HELOCs for a down payment and maxed out what they can afford on monthly payments.

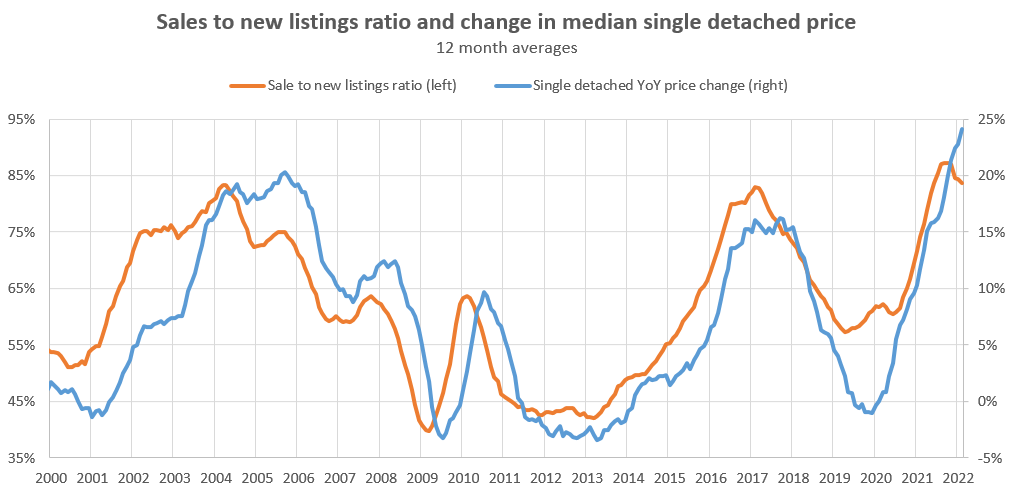

You seem happy to see rising rates. Higher rates mean worse affordability (mortgage payment as % of income), and from historical data we won’t see improving affordability until rates start falling, which is a few years away. Rising rates mean higher mortgage payments for FTB, that historically are more than the savings from lower house prices.

You can see this in the charts of affordability and mortgage rates. Note that every period of rising rates has seen worsening affordability. Affordability has only started to improve when rates started falling.

Here are historical periods of rising rates and the worsening effect on affordability

—- 1979-81 +40% worse affordability

—- 87-90 , 15% worse affordability

—- 93-94 , 5% worse affordability

—-2005-07 , 10% worse affordability

The only buyers that should be happy to see rising rates are cash buyers, since they’ll have less competition.

They’re not, because they lend at a higher rate than they borrow. It’s savers who are the ultimate lenders (banks are just intermediaries) and who lose from interest rates lower than inflation.

So bring on those higher rates.

At some point interest rates have to be above real inflation. The banks are leveraged well over ten fold and losing money from inflation for every loaned dollar is eventual a path we dont want to go down.

Talk is cheap but some of the guys are talking about 6% mortgages by the end of 2023. Strangely, house prices might not drop all that much. Condos in my view are going to get hit a lot harder.

I’ve driven for 50 years and never hit a pedestrian or cyclist. I’ve had 100’s of opportunities and, no thanks to them, managed to avoid injuring anyone. Everyday I see pedestrians and cyclists ignore traffic lights, stop signs, etc… They’re all in a rush to get to the hospital. An older woman that lived across the lane from me was seriously injured by a motorist while riding her bike. She was issued a ticket for a traffic violation, it was her fault.

“ I blame most pedestrian fatalities on the fact that they are oblivious to their surroundings”

‘

‘

The facts, and common sense would state otherwise, I believe it’s actually the drivers who who are oblivious and much more likely to be driving a pick up truck or suv.

https://www.medicinenet.com/script/main/art.asp?articlekey=273503

I blame most pedestrian fatalities on the fact that they are oblivious to their surroundings. They usually have headphones on and their heads buried in their phones. They simply are not paying attention and often walk into oncoming traffic. There should be a fine for distracted walking. In my experience, I’m not aware of many drivers who weren’t cyclists and pedestrians prior to getting their drivers license. I also don’t agree with the statement that most pedestrians and cyclists are drivers. Lots of people don’t drive.

There are a couple of imbalances though. First most adult cyclists and pedestrians also drive, or have been drivers, but a great many drivers don’t cycle and seldom walk anywhere. Thus they don’t appreciate the safety issues of non-drivers. Second a driver is a lot, lot more likely to kill a cyclist or pedestrian than the other way around. Pedestrian and cyclist fatalities are a much bigger % of traffic fatalities than they used to be.

https://www.cbc.ca/radio/sunday/the-sunday-edition-for-february-3-2019-1.4997146/drivers-are-killing-more-pedestrians-in-canada-every-year-here-s-why-michael-s-essay-1.4998615

Hey Leo, I was looking at the statscan stuff again (still don’t understand where all of the new builds actually go?), but it’s interesting that we have the largest number of semi-detached on record being built, and aside from 81/82, largest number of row units as well. Still a shit load of apartments and sfhs, but seems like the mix is shifting slightly.

No $400 renters credit, and $10/day daycare announced this week, but for only 4 Victoria centres? Another molasses slow drag out on an election promise that could have helped us huge.

I can’t actually imagine that there isn’t a pullback on Monday, but holy crow!! Crazy week.

There are definitely whiny cyclists out there, just like there are whiny drivers and whiny pedestrians. I think it has more to do with personality than mode of transportation.

It’s literally all I can take from it, since the rest seems directed at some mythical cycling crowd that whinges about everything.

Good for you for taking whatever you need from this exchange on the internet to feel as though you’ve won something today. Have a good day and ride safe.

It’s a total political stunt. I will say though, it’s pretty impressive how quickly they pulled together a gas relief rebate, but are going on half a decade of promising the $400 in relief for renters and they claim to still be working on it.

Apology accepted.

You’re right. 2.509. What a rally.

I know you think you’re clever, but if you read any of my comments you’d know I’m pro-cycling and pro-cycling infrastructure. I ride a bike too, you just won’t hear me whining about roads and inadequate infrastructure like the entitled cyclist crowd. Sorry to bust your desperate narrative even further, but I think there should be incentives for E-bikes too.

This thread is fun: https://www.reddit.com/r/VictoriaBC/comments/tnn6f8/i_just_watched_maid_and_i_want_to_talk_to_you/

Granted the funds are from ICBC and come from people paying into it for insturance. They earlier announced that another rebate was probably coming, so really this is mostly a stunt, delivering the rebate early that they would have delivered anyway and calling it a gas relief rebate.

https://www.theglobeandmail.com/business/article-bank-of-canada-deputy-signals-scale-and-speed-of-rate-increases-up-for/

Where do I apply for my $110 for biking?

*this post was made purely for up-and-coming

Hey Introvert, your favourite inflation metric finally fell (barely) below $1000 USD/1000 board feet today.

You mean they should have done something that actually makes sense. Giving $110 to Tesla owners and Dodge Ram freedom fighters so they can convoy from Campbell River to James Bay is pure genius.

Once again, individual working retail taking the bus to work screwed again.

Lol yeah I guess I’ll pay my hydro bill with it. $110 let’s me drive about 5000km.

They should have dropped transit fees instead. But reality is they’re buying votes like Alberta did. Could be worse, California just announced $400 per car.

What are all the EV drivers going to do with their $110 ICBC gas rebate? Just when you think this government couldn’t make things worse they try to fight inflation with inflation. Can’t wait to see how they’re going to return housing affordability to BC. Maybe they’ll finally get around to that 2017 and 2020 election promise of a $400 renter rebate, that should fix things.

Completely agree, with the proviso that we’ve been in a very weird situation right now with almost no inventory. So sales are constrained due to lack of base inventory to sell into, which could drive this ratio down while not indicating an actual drop in demand.

Seems like now we may actually be seeing a real demand pullback starting though.

Hey Leo, at the beginning of the month I wrote:

Based on this graph

I was wondering what your thoughts on that were?

I’ve had a number of emails about that too recently

Already at 2.46 now, at this rate will break through 2.5 by EOD.

It wasn’t how many jobs, it was how many high paying jobs.

4000 cleaners getting paid $20 an hour isn’t exactly what I had in mind when I said high paying jobs, no judgement from me though.

Anyone looking to go with a 5 year fixed has already seen interest rate hikes.

I was talking with a RE agent yesterday who was saying he is suddenly getting people who are wanting to sell their rental housing units. Is he just a one off?

I’m still expecting a rise in new listings to show up in Victoria. It is showing up in some markets in Canada already, but not Victoria.

There have been big rises in new listings (February) in Calgary (+69% YOY) and small (10-20%) rises in Vancouver/Fraser valley and Edmonton.

Vancouver saw a rise in listings and fall in sales which helps inventory.

And this was February data. The 5 year Canada bond was 1.48% at end of February and is up 1% now at 2.43%. That should raise mortgage rates 1% and cool sales/prices down..

I think we will soon see rises in Victoria listings too. Leading to more choice, end of multiple bidding insanity, and lower prices

https://thoughtleadership.rbc.com/a-turning-point-more-sellers-enter-canadas-housing-market-in-february/

“More sellers enter Canada’s housing market in February

if February is any indication, more sellers may be (finally) making their way into Canada’s housing market. Early results from local real estate boards showed notable month-to-month increases in new listings across major markets. This was especially the case in Calgary and Edmonton where a wave of properties put up for sale set the stage for the strongest number of transactions ever recorded in a February. Elsewhere, the impact on activity was generally positive albeit more muted.”

That is actually pretty good, but I see nothing has changed since that video 7 years ago. People still horny over SFHs in the middle of no where just for the sake of having a small back yard.

Wow

In the stats or just anecdotal?

Only residential data there. The monthly figures from the board include commercial other others

Is the increase in listings the result of an increase in residential listings or commercial listings? After two years of pandemic restrictions, those businesses that survived are now getting hammered by increasing expenses, supply shortages, labor shortages, etc… A lot of businesses are no longer viable in this environment.

Something seems to be happening.

I’ll assume that’s for me…in which case I’ll re-iterate my complete agreement that density and ‘commutability’ are of equal or higher importance. Here is a short TEDx by a local: https://www.youtube.com/watch?v=JEUShQ7r_tE

Seeing big time slow down up island . Indicator of what’s to come perhaps ?

Sort of – we had to confirm funds in a bank for 1-3 months to approve a mortgage (1 for uninsured and 3 for insured). Basically to confirm the funds weren’t recently dropped in or we had to confirm where they came from. If regulators confirm funds in an account for a year if would be more than an inconvenience. Not perfect obviously but IF this comes out it will be interesting to see how they mandate it.

Some market segments basically no difference between core and Westshore right now. I think if you could put Royal Bay style homes in Saanich they would be less than Royal Bay.

Building step code level 5 passive SFHs will solve all these problems.

That rumour has been going around for weeks. Haven’t seen any reputable source confirm it but could happen. Ironically they might bring it in just as the market is cooling anyway. Hard to say what the effect would be. Investors could just go to credit unions. Big hit if that didn’t work. HELOC restrictions are basically unenforceable

Sooke traffic is exploding because WFH is tailing off. I think core properties will see higher price growth going forward than the Western Communities.

The only “lol” is someone pointed out how many government jobs have recently been created, you claimed there were none and there were actually 10,000.

Both RE agents and mortgage brokers have shared something resembling this to me. I wouldn’t say they described a complete slowdown, but it almost sounded like some sort of weird standoff between buyers and sellers as they both wait to see what happens in the coming weeks in regards to how people are pricing their properties, possible interest rate hikes and and inventory. I imagine those still not afraid to act right now are having more success or less competition than they’ve faced the past several months.

Agree that corporations, investor partnerships, etc. should not be allowed to buy single unit homes except in some special circumstances, however that’s something the provinces have jurisdiction over (property rights). It’s not a banking regulation issue.

That would seriously piss off a whole generation of millennials who where depending on the bank of Mom and Dad. It might not work out really well for the guys in Ottawa.

Restricting the individual investors buying power (good) while continuing to allow corp’s to buy up single unit homes (bad)… easy to see where this is going plebs!

The use of HELOC funds as a source of that down payment will be banned (as this blog told you would be the case a few months ago). Also verboten will be cash that comes from any kind of borrowing, from a gift or a loan against another investment property.“

any truth to this from Garths blog?

“The feds are (apparently) about to mandate a minimum down payment of 35% – a significant increase. More consequently, you’ll have to use actual money. The use of HELOC funds as a source of that down payment will be banned (as this blog told you would be the case a few months ago). Also verboten will be cash that comes from any kind of borrowing, from a gift or a loan against another investment property.“

https://www.greaterfool.ca/2022/03/24/rattle-your-walls/

Back on the actual house hunt issue and is anyone out there noticing the first trace of a slowdown?

If only we had started to move government jobs out of the core but the top bureaucrats want them to be in Victoria so the whole staff has to be as well. Seems like so of the smart private sector jobs are moving to the West Shore.

If only we had built sufficient homes for those people in the core instead of pushing them out to the fringes where they are car dependent and have high GHG emissions.

Ohwell, at least the core municipalities all declared climate emergencies, that’s probably enough.

I welcome contrarian opinions that are fact based and not insulting. On either side of the spectrum. Isn’t that what the blog section is supposed to be for?

Want unitary opinions? Join a religious cult, Chinese communist party or a truck convoy

Lol. 4000 of those jobs are just hiring back cleaners instead of outsourcing them. Lots of high paid jobs there.

Majority of the jobs seem to be exactly that, hiring people instead of outsourcing to contractors.

From: https://www.goldstreamgazette.com/news/gridlock-sookes-traffic-problems-far-beyond-what-anyone-could-have-anticipated/

The return to work downtown folks must be enjoying this especially if they bought out there during the pandemic. Think this is bad now, just wait for full commuter traffic to return to that road when the regular winter storms cause closers from tree blow downs and washouts. Can a new hwy ever be built to connect Sooke or to bypass the Malahat? Probably not in the world of not allowed to build anything anywhere anymore.

Gosh, Frank, I so look forward to your thoughtful and nuanced political views on a forum intended for a discussion of Victoria real estate. If only the woke crowd could see the beacon of light you have graced us with, so that they too might question the efficacy of vaccines, reject any concern for their fellow man, and embrace a political party whose members pose for selfies with seditionists in front of the Parliament building. God bless you, Frank, and thank you for bestowing upon us your seemingly endless and precious reserve of truth and wisdom.

I have been following sales in the two to four million mark because friends of mine from Toronto are looking. Might be imagining it but there seems to be a bit of slowdown this week in sales and a few more listings than earlier weeks.

For the agents with their feet on the ground, are you seeing any changes? I am probably imaging it or a simple weekly fluke. (I always liked that shipping company called Fluke Transport, whose corporate motto was : If it is on time it is a Fluke))

Thanks up-and-coming. The NDP are notorious for bloating government spending on themselves to “help” the little guy. That’s their primary agenda. Our newly created government alliance ( that nobody voted for) is scary. Free drugs! Free dental! Take proper care of yourself and you can easily afford any medication and dental care because you won’t require as much as someone who neglects their health. I blame this on an inadequate education system.

I never used an accountant. CRA website is an excellent resource and there are also plenty of good articles online. Even if you missed something initially you can always go back and adjust your returns.

Big thing I missed initially was using CMHC loan insurance as an expense, so if you needed that for your mortgage watch out for that.

Also important to do your homework on Capital Cost Allowance.

They’re right here: https://biv.com/article/2022/02/horgan-government-rapidly-inflating-government-spending-payroll

Here are some fun, but uncomfortable highlights:

“Premier John Horgan government’s own projections forecast a 93% increase in government debt by the end of the 2025 fiscal year since it assumed power in 2018. And by this time next year, the public service will have added 10,000 full-time equivalent jobs, an expansion of nearly 25%.”

“In 2017-18, the government employed 32,865 full-time equivalents at ministries, special offices and service delivery agencies. Over the next 12 months, the government will have boosted that number to an estimated total 42,508.”

“Horgan created the new B.C. Infrastructure Benefits Crown corporation in 2018 to prioritize union hiring for major infrastructure projects, like the Pattullo Bridge and Broadway subway. BCIB is expected to triple annual spending to $244.4 million in 2022-23 and increase further to $318.4 million a year later.”

Hmm. Might be hard to visualize with a 3D chart. Would be interesting to create a combined metric that incorporates affordability and MOI though. Good idea, thanks.

https://househuntvictoria.ca/2021/04/06/dusting-off-the-crystal-ball/

“What is really needed is the construction of massive apartment complexes. ” – nonsense! Do something like applying automatically approved minimum 1.2 FSR to all residential lots within 3 – 5 km of downtown Victoria. Density should have increased slowly for the past few decades instead of depending on the lack of it to drive the economy (applies to multiple cities). Marko, agree with lack of trades (due to lack of effort to address by multiple govts) & common sense and ineffective bureaucracy. All reasons why prices will be resilient for a long time to come.

Higher Local Salaries do not necessarily mean higher housing prices. On average salaries are higher in Prince George and Fort St. John than in Victoria.

I don’t think we will ever have enough supply. Not enough common sense out there for that to actually happen. I think the province will come down hard sooner or later but while they might fix the politics of zoning, they won’t fix the bureaucracy. That will only become worse.

A part of the problem is as a society, in my opinion, we have too many professionals and not enough tradespeople so you have this insane demand for housing from endless professional positions, but not enough people to build it.

None?

Where did all these new positions come from? Which ministries are new?

What is really needed is the construction of massive apartment complexes. They require large areas of land, are generally unsightly, and greatly increase traffic in the area. This will never happen in Victoria, the powers that be simply won’t allow it. If our government had any insight, they would institute such a plan to accommodate the hundreds of thousands of new immigrants. I estimate at least 500,000 Ukrainians coming to Canada in the near future. Where they’re going to stay, god only knows. The ultimate number may be even higher.

But Victoria isn’t big enough for people moving out to have an impact on prices elsewhere, except on the Island. Note I was replying to someone claiming the housing crisis was caused by government creating high paying jobs. Vancouver isn’t a capital city, Toronto is but provincial government employment is small relative to metro size. Plus Ontario has a conservative government.

And the NDP regime of the 1990s created a lot of high paying jobs but I don’t recall a housing crisis back then.

Here’s my 100 home analogy, build a hundred homes and bring in 120 families every year. You could cut down immigration to about 15% of current goals and still have a very healthy economy except for the housing sector that would scream blue murder. Some developers would be forced to do with only one or two private jets.

How pathetic… two professionals with high salaries getting help from parents to buy a home – this is Canada today.

“Research analyst salary + partner professional salary + help from parents”

Multiple ownership of single unit homes should be discouraged until there is plenty of available supply. All “investors” do now is further restrict the supply for those that want to own while benefiting from inflated rents caused by limited supply. Inflated rents drive higher prices and subsequent access to excess equity for further investment keeps the cycle going. If there was lots of supply multi home owners would dwindle as the economics wouldn’t work as easily. This game (restricted supply) has been the primary driver of the Canadian economy for the past 30 years, diverting capital & indebting the population.

There are many people that can move from let us say Victoria to Calgary, Toronto, Halifax or Duncan, Port Alberni, Nelson, etc., so if the cost of living is too high in one place, they move to another place which impacts that market there. Victoria can’t be 5x in a vacuum. For example, I had a client that was outbid on 6 condos in Victoria packed his bags and moved to Halifax and bought a SFH. He was able to do a direct job transfer for the exact same salary, etc.

If we are going to use 100 home analogies here is mine. You have 105 families; you have 100 homes. Does it really matter who rents/who owns? 5 families don’t have a home. Build more, or cut off immigration and accept a lower standard of living long term.

But the housing crisis is Canada wide. From the biggest cites to small towns.

I don’t know what the actual numbers are but my day-to-day job the majority of my clients are large institution employed including government. Just in the last 6 months I’ve represented more than 5 research analysts from various ministries.

Research analyst salary + partner professional salary + help from parents = decent chunk of demand, at least from what I can see on the ground.

The middle class is making the rich families even richer. Too many things to list big picture but small picture on a local level the middle class has added so much bureaucracy and red tape to development, for example, that good luck becoming a builder/developer going forward if you come from a working-class family. You simply can’t afford to get past the red tape in the first place. Versus if your family is already a massive developer you are good to go and you have limited competition as the barrier to entry is so high due to bureaucracy, created by middle class.

Companies like Aryze and Abstract have 30 development properties on the books and then you hope 3-4 get rezoned each year. Try starting out being able to afford one development property. You simple can’t due to uncertainty/red tape.

Actually the opposite is true. Since the move to telework during COVID, all the government positions that used to be located in victoria exclusively are available to people all over BC. My boss lives in tsawassen. While the high-paying positions in vancouver are all now available via telework to the highly skilled victoria labour market.

And the person living in a $5.2 million SFH dollar home in Oak Bay lobbying their local politicians to vote down a 14-unit rental is a saint?

One has to consider how many high paying government positions have been created in the last few years. That alone could explain the housing crisis. Being the capital of a wealthy province, and being a modest size, Victoria will never be affordable, too many high paying jobs.

The rich families buying multiple homes aren’t adding net rentals, because the temporary rentals they’re adding are matched by the ones they take away when their kids take over the home. All they are adding is evictions down the road. And BC leads the country in forced evictions.

“Also, why do mom & pop investors (aside from those that treat their tenants poorly) take so much negative heat? A SFH home was purchase 18 months ago in Oak Bay for $4 million. It re-sold last week for $5.2 million. How much tax free cash is that for living in a luxury SFH home for 18 months?”

Patrick. you missed the scenario where the person never buys the house for the kid, someone else buys it and it never is a rental in the first place. Ten years later the kid buys a house which had been a rental before.

Last time someone mention that over half the housing units in the CoV are already rental units so is there really a shortage of rentals or just the usual preference for everybody to live here if only it was cheap enough. Is the problem any different than Malibu?

Yes, I see the person buying an extra home for his kid to live in when they grow up as the “bad person in the equation” They are being great parents and it’s a great thing for their family, but I believe we are talking about the housing crisis, and I think this worsens the housing crisis. So they are nice people but doing something bad for the housing crisis. The bad thing is leading to more evictions (when the kid moves in, evicting the tenant), higher rents (loss of rent control for evicted tenants), and less available homes (if their kid moves in from out of town just for the free home). All of those worsen the housing crisis as described below.

Let’s assume we are at a “steady state”, where this year we had equal numbers of people buying homes for the kids future use and same number of instances where kids are grown up and moving in to these homes. For example….

– —-100 second homes purchased for future occupancy by family members (kids), and fully rented out to a nice family in need in the meantime.

– —-And 100 homes who were previously rented out like that, but it’s now time for grown up kid to move in. So we have 100 evictions of the “nice families” that need to find a place to live. Those families have been working and paying rent. And what do we get in return, 100 kids getting a free home to live in. So here are the scenarios, and both are bad:

– ———1. Maybe a kid vacates an existing Victoria rental to move in – and that’s not so bad, but we still have an eviction, and the home he vacates will lose rent control, which raises rents and worsens the housing crisis.

– ——-2. Even worse, maybe the kid only moves to Victoria for the free home, so we get extra population and that worsens the housing crisis for sure.

This is “rich family gentrification” which pushes hard working regular folks out of neighbourhoods . Rich families buying/hoarding multiple homes is very common in many countries, and they have worse housing situation than we have . It’s ultimately just removing homes from the market, which also worsens the housing crisis. Because this activity ends up with 1. More evictions 2. Higher rents from less rent control as people have to find new rentals 3. Less available homes in the market as they are gobbled up by rich families.

From the old anecdote “newly wed and nearly dead”, all the “nearly dead” have died off and the “newly weds” aren’t ready to die/retire and provide new listings.

This is demographic in nature.

Theories?

Couldn’t agree more. You also get what you pay for and while income from one suite isn’t that hard to manage, starting out on the right foot with a good accountant is worth the money. A CPA, especially senior one or one that has jumped ship from the CRA that really knows the ins and outs is going to cost you, but it will set you up long-term for success that H&R Block cannot provide you with.

Thanks for the tips! I have used studiotax before didn’t realize they and wealthsimple had rental sections. Have never done ufile but it looks easy, but minor cost. Up until now we have had pretty simple t4 returns, now I have a box of receipts and a 50 pager from CRA about rentals for bedtime reading zzzzz

Accountant sounds nice but a fence is looking like it’s going to be pretty pricy so I’ll see what i can budget for vs DIY

You are right Patriotz. It probably will cost Caddy more than that. And yes, you have to organize your paperwork before going to an accountant. You organize it as well when you do your own. Also, one should read up on some of their concerns before going to the accountant, and write their questions down. But for the first year, with this new experience of being a landlord having a suite in their home, this is not the time to go cheap. It is far better to know from a professional all your options. Who knows, maybe the accountant will give them some good advice on their employment income as well. Peace of mind is everything.

If my child, grandkids or friends asked me this question, I would give them the same advice. Caddy is educated and once she/he/they understand all their options and what they can deduct, then they can do their own tax later.

Anyway, it is my opinion. They will make up their own minds.

Leo, when I guessed the winning 2021 average housing price, all I did was to take your plot of housing inventory vs. market returns and pick a number that put us within the plotted range for our inventory levels, but taking into account other external factors such as affordability, increase in out of town buyers, prevalence of bidding wars, cash bids, etc.

Is there a way to take the same graph (market returns vs MOI), and plot your other favorite metric (housing affordability) on the z-axis?

That would make it very easy to predict where this market is headed.

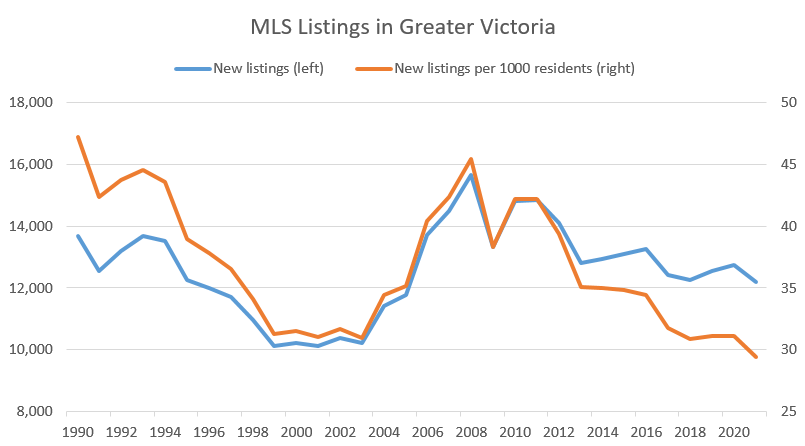

I said new listings were trending down for a decade, not inventory. You can have a large amount of new listings and still low inventory.

You’re going to have to do a lot of data organizing beforehand for that price. Might be worth it first time out to get some advice.

In my landlord days I used an old PC-based accounting program to enter all the data and perform tallies, and then did my income tax by hand. But it looks like you can just enter direct into the tax software now.

Then it makes no difference to inventory whether they sell or not.

Even if you eliminate investors and bring a bit of re-sale inventory to market you still haven’t done much to solve the “housing crisis.” Rentals still impossible to find and rents skyrocketing.

Also, why do mom & pop investors (aside from those that treat their tenants poorly) take so much negative heat? A SFH home was purchase 18 months ago in Oak Bay for $4 million. It re-sold last week for $5.2 million. How much tax free cash is that for living in a luxury SFH home for 18 months?

However, someone who lives in a $1.2 million home with a basement suite and buys a 500k cash flow negative condo to rent out so they can stuff their kid somewhere when they grow up is the bad person in this equation?

I’ve seen a few backfire, but the homes were not the most desirable plus priced at market value + delay. There is also a serious lack of quality inventory.

A greater % of sellers are starting to list close to market + the market will slow a bit and the combination of the two will lead to a large drop off in multiple bids (not to be confused with lower prices). For example, a house I may have suggested to a seller we list today for $1.5 and go for a delay in a month I’ll probably suggest we list for $1.7 and do no delay and work backwards.

Hey Marko, is it just me or were delayed offer nights something of a failure this week?

Sellers are usually looking to buy after they sell and friction costs in BC are so large that often it just makes more sense to stay put and carry out renovations or similar. For example, if you want to move for a $1 million home to another $1 million home (maybe you want to go from two level to one level) between PTT, real estate fees, legal fees, and moving costs you are looking at minimum 50k. Alternatively you can install a lift into your home, renovate a bathroom to a walk-in shower, etc., and stay put.

Caddy, for the first year, I would go to a CPA. It will probably cost you around $250, maybe more. That amount can be written off at 100% as a suite expense. There are a couple of options for you having the rental suite. I would do this so that you understand fully the entire process, especially as what you can and cannot write off, then do your own going forward.

3165 Donald Street just sold for $1.1 million. If this isn’t peak lunacy, I’m not sure what could be.

https://sothebysrealty.ca/en/property/british-columbia/greater-victoria-real-estate/saanich/834827

You’re going to pay more for a realtor than you’ve ever spent on repairs.

It’s paid by the buyer, so why should it discourage someone from selling?

Once we started having rental income, we got an accountant. Good news is, the accounting fee is tax-deductible.

How much is the Land Transfer Tax in Alberta by the way? If anyone knows? Is BC the norm?

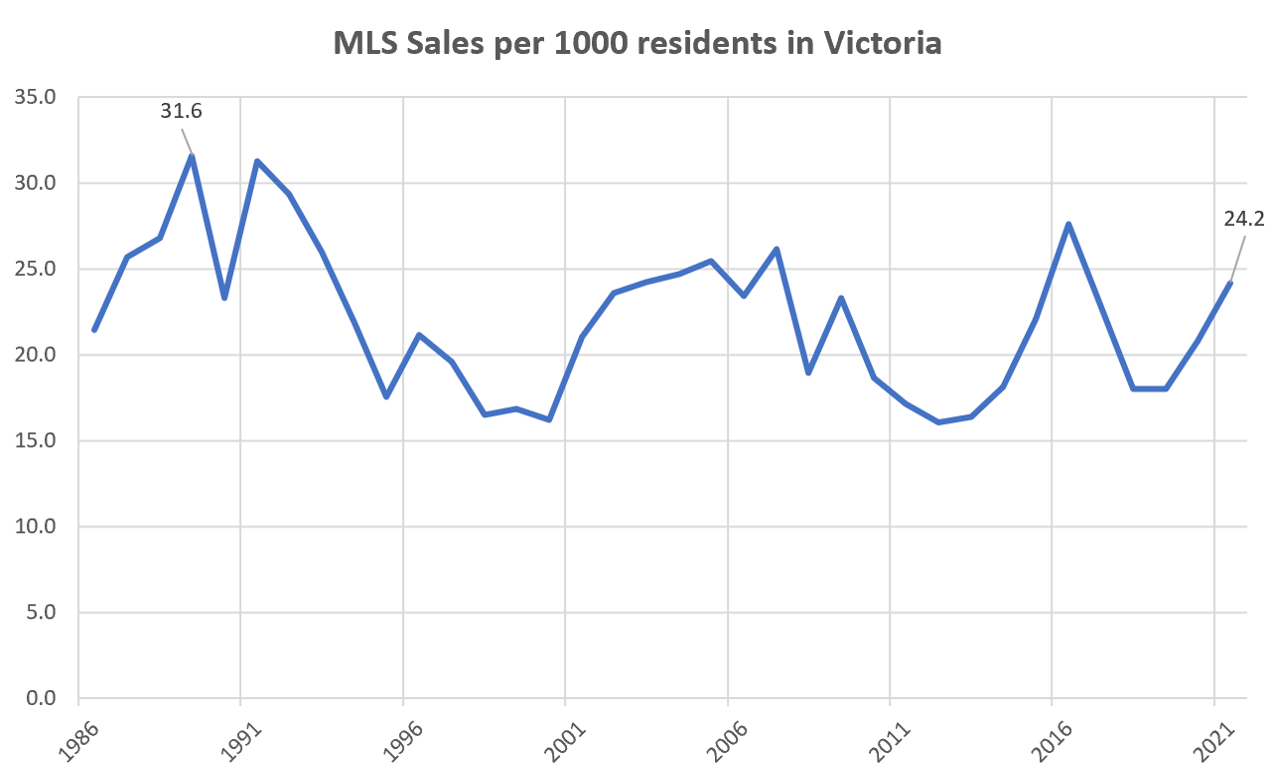

Sales per hundred thousand chart looks roughly flat to me also.

I can only imagine what sales would be without the property transfer tax. It’s like a ball and chain on the ankle of home owners.

You can keep using WealthSimple. There is a section to claim rental income and expenses.

I like ufile

Frank, two of my neighbours have recently sold all of their rental houses exactly for the reasons that you set out. One was very frank and stated that she was worried that they might change the law so that even a new owner could never remove the renters. One of her renters had been there nine years and being their late thirties was likely to never move.

I suspect that you are right and that this may be either the peak or close to the peak of the market. I would not wait in case the market takes a turn downward at which point a house with a tenant in it might not be at the top of the list for a buyer.

This might be the peak of the market. Time to cash in. My greatest deterrent is turfing my tenants onto the street. I’ve spent $13,000 on repairs so far this year and it’s only March. I can’t imagine how much insurance rates are going up, I have no control or any other option but to swallow that expense. My 12 year tenants in one property are practically living for free, given the expenses and repairs they don’t have to pay. Landlords have no control over expenses, we also have no control over what is going on in the market. In fact, by keeping local renters housed, I’m making it more difficult for out of town buyers to enter the market. From my perspective, if all rental properties were put on the market, it would probably create a far greater problem. Not everyone can afford to buy a house.

I have used StudioTax for over a decade. They started out as a developer offering their services by donation, and only recently started charging. I have not encountered a scenario they could not handle including rental income. I think if you have substantial foreign holdings you may have to look elsewhere.

LeoS: You are right about the fact that housing is a problem if it cannot keep up with population increases. Now if there was only a way to control population growth that would go a long way to ensuring a bright housing future for the young people in Canada.

Sales per hundred thousand, while far from peak, are pretty close to average when I look at your chart. Am I miss reading it.

Any recommendations on tax filing software when you have rental income? I used wealthsimple last year but now we have a suite and I assume some additional math to do on expenses etc. Thanks!

I think there’s a case to be made that affordability may have a bigger impact on condos than detached in the future. We’ll find out I guess.

But the people still need to be housed. If supply truly chronically cannot keep up, eventually you end up with massive homelessness, and then eventually fewer people simply coming to Canada if there’s no housing. Could make any declines in prices very very sticky though.

Yeah this is my biggest concern. Houses are priced for perfection. Everything is fine if nothing goes wrong. And what are the chances of nothing going wrong in the next 25 years, whether in your own life or the Canadian economy?

Will be very interesting to see the new ownership rates. They dropped in 2016 from 2011, but will they drop again? Really hard to say.

It’s a mystery all right. Also sales. Substantially lower now relative to population compared to history despite the nutty market. Long term chronic supply constraints?

Chaotic evil: Put a lowball offer with conditions on every place set up for a bidding war. Drive the bubble so you can cash in when it bursts.

More seriously, this is why we need transparent bidding.

More inventory is absolutely required. If inventory stays this low prices will keep increasing. But demand always swings faster than supply.

Fair point. Though we don’t need rates to go nearly that high because they’re so low right now. I’ve added a scenario with a +4% in rates, which even with solid income gains require a 30% price drop to restore affordability.

Yup. If we had 1981 interest rates right now, affordability would be at 214% at current prices.

Hahahahahahha!

What these scenarios suggest is that 2022 will be a good time to sell. If we’re not at a peak, there may not be much steam left in the market for a few years. We may finally have hit a lull not seen in 6-7 years.

Not much worry of significant downturn in prices after decades of successive govt.s (at all levels) ensuring limited supply & subsequent high rental rates. Add in various incentives for home ownership and easy financing for small investors and it pretty much guarantees we can keep this going. Future generations be damned! If housing supply kept pace with population growth & govts hadn’t become so dependant on housing for growth & revenue prices would be far lower. Easy $ for current homeowners at the expense of those not in the market & without parental help. Not a great reflection on society in general. Attitude seems to be “who cares, I got mine, screw the rest of you & give me more!”.

I agree with rush4life that one can’t expect house increases to go on forever, at least in the short term.

I’ve witnessed ups and downs all my life but for the past 100 years or more the trend is up. (probably due to inflation but it doesn’t matter why)

There are a few things I have tried to teach my kids.

* Never gamble or risk your principle residence. (Many people have no problem doing that…but it’s not for me and I think my kids understand that idea.)

*Take the long term view on real estate.

* Make sure you have the ability to hang on if rates go up or someone loses their job etc. (Would renting a room fill the shorfall?)

There is no such thing as ….risk free……. and no one knows the future.

My advice is don’t wait for house prices to come down to buy a house. Victoria is still not over priced in my opinion. (I would not buy a place in Vancouver though.)

Probably? Unless they’re openly bragging about doing this in your landlord group (very stupid) this seems like a bit of a leap and why landlords with multiple properties get a bad reputation. If they are actively deceiving the CRA I wish them luck as when that situation catches up to them they’re going to wish they were using write offs and offsetting that rental income in other ways each year rather than being dinged for multiple years of unpaid rental revenue.

Any sign of the beginning of a slowdown out there?

I’m not sure that this metric of affordability for SFHs is as relevant as it once would have been. We know that SFH in Victoria aren’t being purchased by average income earners without some significant financial assistance.

Perhaps based on average income of the top 10 or 20% earners? The other factor not considered is how much mortgage payments are being decreased by down payment gifts and suite rentals. I bring this up because factors like inflation and rising rates impact those with a smaller mortgage and more disposable income significantly less.

Prices are unlikely to go up forever. What happens when the children of those parents face their first adversity in a housing downturn? Imagine buying an investment property and being cash flow negative a few hundred dollars a month or more under the assumption that housing is guaranteed equity every year and then imagine a scenario where prices don’t change for a decade. Pretty disheartening I would guess when all you have ever known is increasing house prices but forgot the fact that all you have ever known is dropping interest rates as well.

If you believe things change then you must be open the possibility of a change in the direction of housing and a possible price crash. Oddly enough it may be the parents engraining housing is the perfect investment that can never lose being the reason it loses at some point (over exuberance by their children).

Interesting discussion regarding inflation and interest rates. At what point will rates have to rise? I am thankful to have purchased a house in 2019 but if I was to have to purchase now I don’t think I would have jumped in. The cost and risk scares me regarding interest increases. Does no one else worry about this?Many people I know think the government will never raise rates because too many will be in trouble. But at what point does the govt not care?

Most people I know who own a house in Victoria have just kept buying and holding. Why would they ever give that up when their investment has skyrocketed? Others have moved away and rented out their house. And now it’s worth double, lucky them!

In my opinion new buyers have fomo and are getting the max house they can afford and therefore just pushing prices up. It’s not real money because the price always goes up right? Zero risk 😮

For the most part, most homes go for more if they have a income producing suite in place over ones that do not. Many would look at this scenario as having “two residences”. One you are living in, the other you are renting out. Some are even classified as legal suites, having their own hydro meter and by meeting the municipal standards. I fail to understand why this is so acceptable, but owning a small two bedroom one bath home and purchasing a studio or one bedroom condo to be used as a rental is looked down upon? People look towards the future. They say to themselves: “When we get older the kids, can live in the main house and we can move down to the suite”. The other is saying: “We’ll live here with our ONE child (avg family being 2.5 people….so many couples with the one kid), and when we get older, we’ll move into the one bedroom condo and our son can live in the house.” I know, I am rambling on here, but, all of us tend to look at our own wants and needs at any given time, but don’t seem to appreciate or want to understand the wants, needs or the logic of others.

5. But minimal price drops due to low inventory, affordability will be impaired by poor wage growth due to continuing “stagflation”.

One thing I have always stuck to is to never try to con the tax man.

They have so many resources available that could bring up a red flag for them and it just isn’t worth it. You will get caught eventually.

Follow your acountant’s advice.

Pay the taxes. Enjoy the peace of mind. (It’s not like you get nothing from taxes. You get health care, roads, bridges, schools etc etc)

So, you mean the landlord is putting down he lives with the people he rents to? Is he (she) declaring the rental income? Hopefully he will be reported by the renters and then have the CRA on his back by paying a fine and being audited for many years to come.

I have heard of say a single woman with kids collecting social assistance saying she is separated from her husband, him saying he lives with a couple of other guys, his parents or whatever, but really living with his wife/common law spouse and the kids.

There are so many situations and scenarios in life where people are cheating in one way or another. Either not paying their fair share or not living up to their moral, legal or financial responsibilities.

I

A couple can have only one principal residence between them. Now I suppose there are a lot of people trying to defraud this in various ways but with the feds hungry for money this is a risky proposition IMHO.

https://www.canada.ca/en/revenue-agency/services/tax/technical-information/income-tax/income-tax-folios-index/series-1-individuals/folio-3-family-unit-issues/income-tax-folio-s1-f3-c2-principal-residence.html#toc3

Are people keeping the 1st house as a rental?

I think this is the #1 issue affecting inventory. Of the "haves" I know with one home, a slight majority have 2. Kept the condo they bought in their 20's and rented it out when they bought the next house to start a family in. Kept the house in Alberta and rented it out when they bought here. Bought a house to live in and then a duplex to rent. Every previous landlord I have had owned multiple homes, one owned 6.

I do not think current stats even reflect accurate secondary property ownership rates, there are so many stories in groups I'm in of landlord having mail sent to the rental so probably declaring it as a personal residence and living with a spouse in the spouse's personal residence. I know a family with kids who never married on paper for this specific reason. I am assuming a mass amount of income tax & capital gains tax dodging in these setups.