Affordability cracks long term trends

I’ve been checking in on affordability regularly as prices continue to escalate, as it’s been correlated with future price movements in the past. The affordability chart uses yearly averages, and the last time we checked in on it in December the yearly average for 2021 wasn’t yet concerning, even if recent prices were. Well we’ve got 2 months of data for 2022, so it’s time for an update.

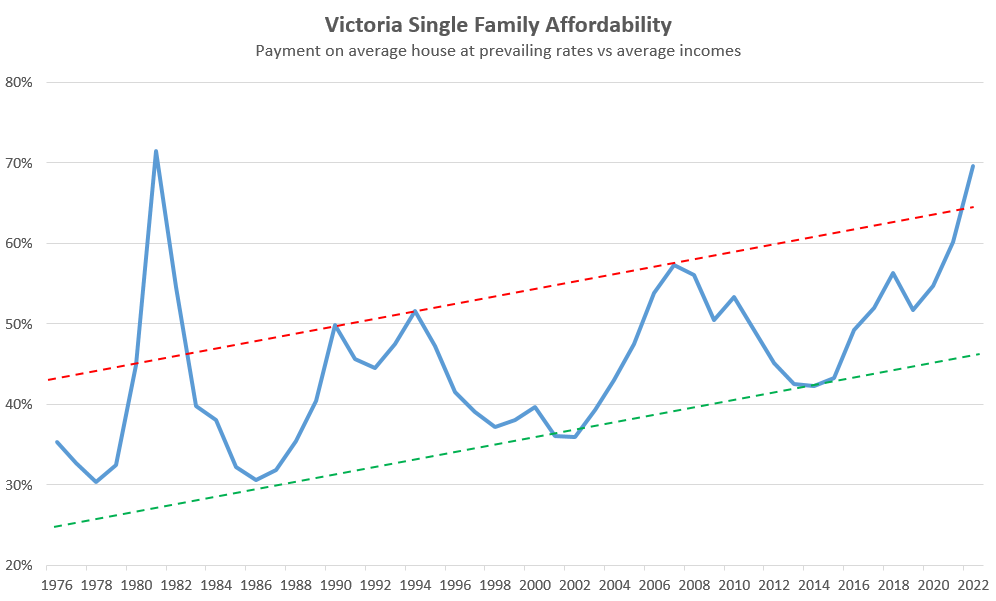

The year to date single family average price is $1.4M, which pushes affordability measures well above the long term trend for detached properties. As you know, we would expect single family homes to get less and less affordable over time in a growing and densifying city, no matter what happens to the market or interest rates in the short or medium term. We’re not exactly sure at what rate detached homes should be getting less affordable, but if we try to eyeball the trend from the last three cycles we seem to have moved above it.

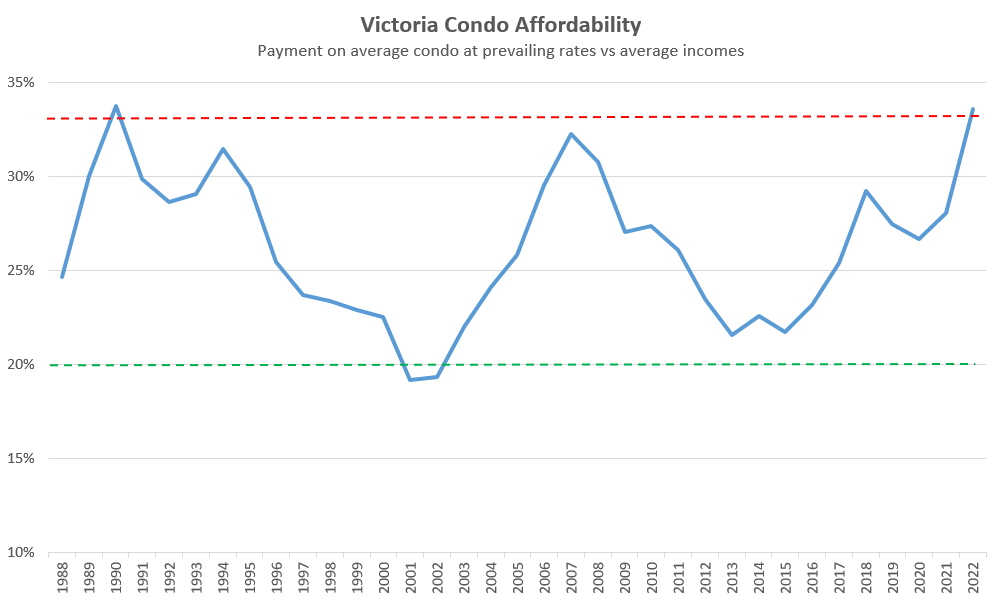

Condo affordability looks much the same, perhaps slightly less strained depending on how you draw the lines. However this level of (un)affordability is certainly at comparable levels to when the market turned around in 1991 and 2007.

As usual there’s several caveats to keep in mind with this kind of data:

- The trends are eyeballed on to past data and do not represent some kind of rule. For example as our region runs low on greenfield land the rate of affordability degradation could accelerate as single family homes can effectively no longer be built. We’re not quite there yet though.

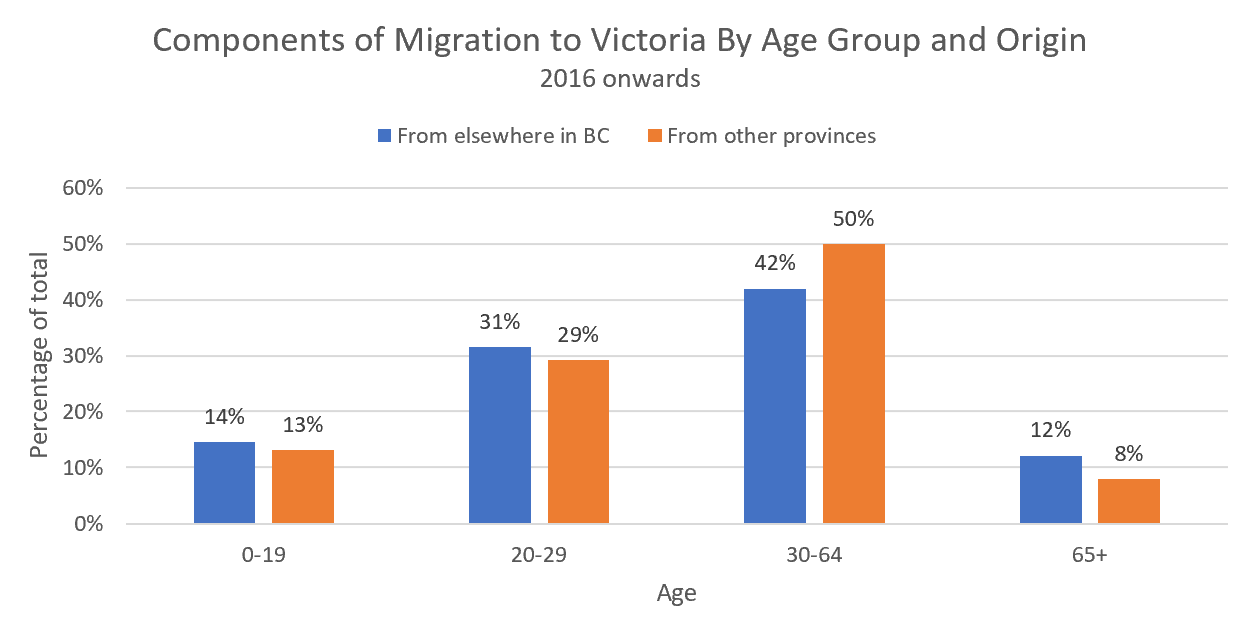

- Income data after 2019 is estimated. If there were stronger income gains in 2020, 2021, and 2022 (I’m assuming inflation + 1), then affordability may not be as poor as illustrated. With record in-migration to BC in the last couple years, it’s possible that we have seen faster than normal wage growth.

- Rates are taken from the StatCan table 027-0015 for 5 year terms, which wouldn’t reflect ultra-low variable rates that people have taken advantage of these last couple years. On the other hand the rates also don’t reflect the stress test, which seems to have entirely stopped working after 2019.

The market has surprised several times to the upside in the last two years and it may do so again, but if we see additional price gains on top of these levels then our only precedent would be 1980, and that didn’t end well. With the idea that inflation might be transitory now banished for the forseeable future, it seems Canadian consumers will be in for a painful squeeze this year as rapidly rising cost of living meets increased debt servicing costs as rates increase. On the upside many have built a cushion of savings, but it seems those extra funds will go to gas and bread rather than something a little more entertaining as restrictions are lifted.

Will affordability ever recover in our market or will it just get worse and worse? I think it will turn around this year, but what would the path back look like when rates can hardly be dropped further? I’ll take a look at that next week.

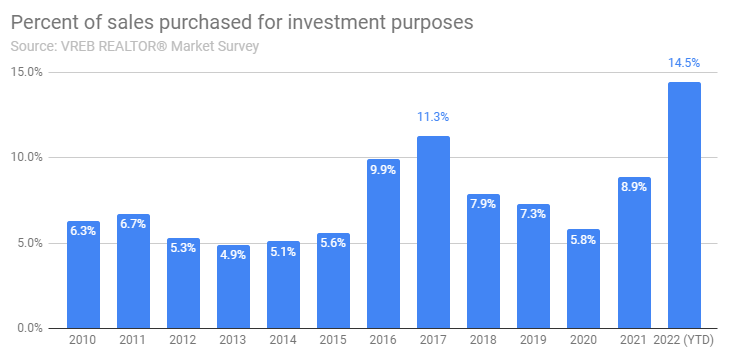

Meanwhile, investors are throwing caution to the wind and betting on another ripping market this year. Bouyed by rising prices and rents, investors snapped up a record 14.5% of properties so far this year. The figure for 2022 is only based on about 500 sales in January and February so interpret this with some caution, but it’s a continuation of the upward trend in investor participation we saw last year already. Investors are fickle property holders though, apt to dive in when prices are rising and bail when they drop. That introduces volatility and can exacerbate price swings both on the upside and on the downside. On the plus side, when the market turns it could help replentish resale inventory more quickly than we would otherwise expect.

New post: https://househuntvictoria.ca/2022/03/15/tracking-the-coming-market-slowdown/

It’s always a tough call between going to sleep or continuing to refresh househuntvic on new post nights.

Totally anecdotal, but I have recently met a couple families that moved from Toronto during Covid through our kids sports. Late 30s/early 40s professionals with kids under 10. Owned in Toronto area so can easily afford our prices here.

A big motivation for them seemed to be the lifestyle here where there kids can spend more time outside during the winters.

I wonder if it is mostly Real Estate agents moving here from places like Toronto after making a killing in the markets?

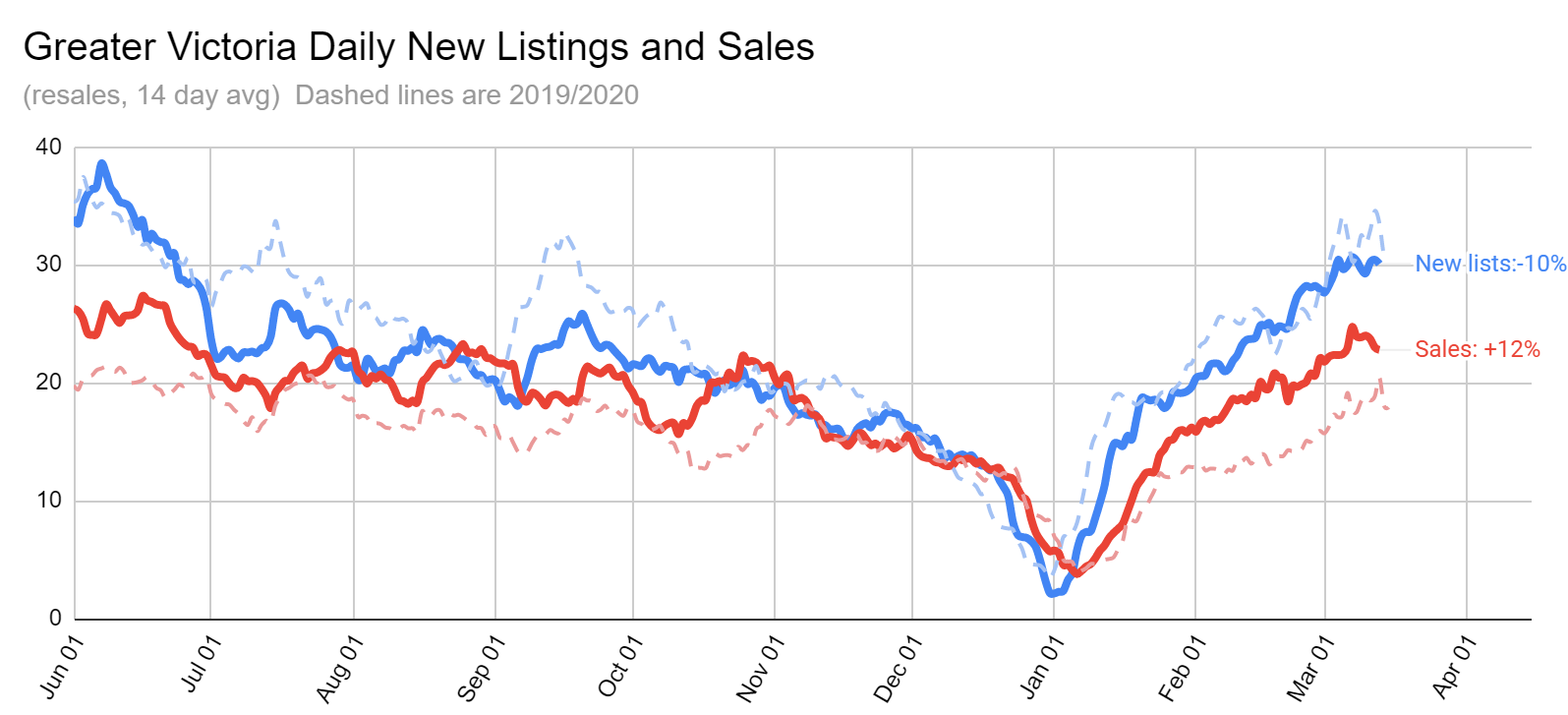

Listings were totally normally up until last July when restrictions were lifted and they were low for a few months. Then back to normal levels in the last few months.

Wrote about it here: https://househuntvictoria.ca/2022/01/17/more-on-victoria-comings-and-goings/

And here: https://househuntvictoria.ca/2022/01/10/where-buyers-came-from-in-2021/

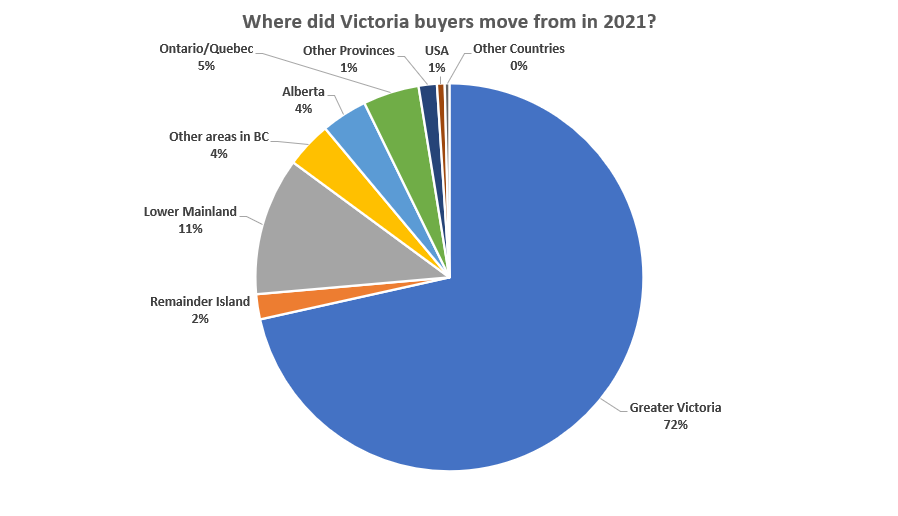

Leo- Any breakdown of out of towners origin? Ontario, Prairies, U.S., recent immigrants, lower mainland? Are they predominantly retirees? My guess would be retirees from Toronto and Vancouver.

I’ve been suspecting that a big factor keeping listings low is covid. If that’s the case, the rise in listings above expected should happen now.

Out of towners are a big part. It’s not like Victorians suddenly decided they had an extra $2M lying around right when the pandemic hit.

Marko- Any indication of who these people are with 2+ million dollar budgets? It wasn’t that long ago when that was serious money for any property and only the top 1% could afford.

It’s understandable that listings are going to increase with the lifting of pandemic restrictions. I would expect Island listings to follow but will be absorbed by an increase in people’s mobility and desire to relocate. Many Canadians have put such plans on hold the last 2 years. Maybe all these new listings in Toronto will result in more people moving west. The Prairies have experienced the worst winter in years and it’s far from over. Lots of motivated movers will be showing up soon. However, many of them will experience sticker shock.

Unfortunately, no sign of a slowdown here, yet. I showed a lot of properties over the weekend and I get updates on each property in regards to offers and some crazy # of offers. 10 offers on a house price well into the 2 million dollar range, etc. Which means that there are 9 buyers left just from that that have a budget of 2.5ish.

Something to soak up that 7 unit/day excess demand:

https://www.nationalobserver.com/2022/03/12/news/canada-province-prepares-take-potentially-thousands-ukrainian-refugees

hmm maybe the increased stock is the start of something. here is Toronto:

[img [/img]

[/img]

At around minute 23 this professor says: “[Russia] will not invade Ukraine… Putin is too smart for that. Remember what happened when Russia invaded Afghanistan…”

He has an interesting perspective, but he does seem to be a bit of a Putin apologist.

That’s a big jump today.

Last time yields were this high was 2018.

Fixed rates and variable rates going up.

Yeah I’ll probably switch back to 2020/2021 next week. AFter this week the 2020 comparison becomes useless due to COVID. Hard to say what is more “normal”. Probably the 2019 year.

They don’t have any choice in the matter.

https://www.washingtonpost.com/world/2022/03/09/ukraine-men-leave/

Leo can you also post the same chart in your comment but with 2020/2021 dashed lines? Wasn’t March 2021 pretty interesting?

About the war:

https://www.youtube.com/watch?v=JrMiSQAGOS4

Maybe a slight gap opening up between new listings and sales recently.

New post tonight

Everything take time and the climate “emergency” pundits seems to think that we are going to die tomorrow from climate change, but they forget that it is more than likely we will die from killing ourselves through greed long before climate catastrophe, if we don’t work with concrete science, industry, and the economy to move in the right direction.

There is no such thing as free lunch or free green energy. They all come at a cost, both on the economic and environment.

The West unwilling to pay for the dirty oil/gas & nuclear in our backyard, or mineral extraction/processing for solar and batteries hence the NIMBY attitude of out of sight out of mind (leave it to the developing and third world countries to destroy their environment). By going green we are promoting dictators to crack the whips on the back of over seas untermensch to extract, process and produce our “green” products, and then dump our toxic waste on their fertile land, river, and ocean under the label of recycling.

I never understood the “gotcha! decarbonizing the economy is hard actually” take.

Indeed, it is one of the hardest things humanity will ever need to do. But that doesn’t change the fact that we need to do it.

$2.2M

$2.8M

I’m trying to understand why you’re vilifying green energy and making it sound like it’s causing wars/conflict. Maybe I was reading your comment wrong, but as you point out, oil and gas is/was one of the major triggers for conflict. Wouldn’t local green energy reduce both conflict and environmental impact?

I don’t understand this statement: “supporting the green fad and destroy the energy sector”. Why does supporting the ‘green fad’ destroy the energy sector? If you’re suggesting that oil and gas will end up like coal power plants (eventually), then I agree with you.

I’m sorry but it seem that you are not very update with world events.

2008 Russia & Georgian War was over oil & gas.

2005-2006 Russia & Ukraine had a conflict, because the Ukraine siphoned Russian gas (and didn’t pay for it) over the winter for domestic use that transit through Ukraine/Poland for the EU, that lead to a gas shortage in the EU through out winter and spring (oil shot up to over $100 then drop to $81, and shot up to over $180 by 2008).

That lead to the 2014 Crimea invasion and annexation which Russia took over 80% of Ukraine Black Sea gas fields.

That lead Ukraine to dam the Dniper river that feed the Crimean water reservoir.

Russia/German Nordstream II gas line development started in 2019 was the result of the Ukraine trying to use the gas pipe between Russia and the EU as a leverage against Russia.

All of which lead to day current conflict that no one want be involved in, and the problem compounded by the EU dismantling of their fossil fuel & nuclear energy infrastructure because as of now the bulk of the EU energy supply come from Russia.

Absolutely correct, and energy development in the free world such as nuclear and oil & gas will lessen the control of dictators in third world countries or developing countries.

+1, Langford is the only muncipality you can count on getting a permit in less than 60 days. City of Victoria or Saanich, for example, expect 6 month to a year at this point and time. I know someone in James Bay that is now over a year into the process without a permit. No rezoning, no variance, SFH within all bylaws but there is a city tree that is preventing access to the property that has been a long negotiation with owner and city. Expect the city to take 2 to 3 months to get back with comments on the initial application and then 2 months for each revision. I talk about it in this video and it has become worse since then -> https://www.youtube.com/watch?v=MocTwO-Kk24

If a private company was running the show I think it would take 5 to 10 business days.

Not sure how the City of Victoria hand deconstruction bylaw is going? Anyone have any experience hand deconstructiong a SFH yet?

@Kristan – even for simple SFD projects you’re probably looking at about a year of delay prior to approval. Lots of people in the mix (architect/designer, engineers, energy consultants, etc.) and there are often 2 to 4 revisions for each.

Permits (in the CoV at least) are pretty steep at 25k to 40k depending on what the city is requiring (such as services upgrades). No idea on what consultants are charging these days, but I’m sure it would be significant. Rates on construction mortgages are higher and they’re stingy about releasing funds.

QT – What are you talking about? It doesn’t appear that Russia vs. Ukraine is oil-related, and I’m pretty sure oil & gas is propping up a lot more dictators than green energy.

I do have to agree that all those wars over green energy have been a real shame.

Does anyone know what 1584 Rockland sold for? Also 680 Richmond?

Just like rest of Vic, Homes in the area seem to be moving fast and many are 2+ million

I’m more concern with almost immediate WWIII and world poverty than the drastic climate change that will eventually happen in the distance future.

Climate is constantly changing and so far humanity manage to adapt, but war and poverty can be prevented with sound policies and the willingness to share over that of greedy green NIMBYs.

Hey Marko (as well as the couple other folks that chimed in), thanks for your thoughts. That’s good to know. (Albeit depressing that local governance erects needless barriers to sensible development even for younger families. Seems like a good thing for the province to forcibly fast track along the lines of the announcement from the Housing Ministry last month about local municipalities dragging their feet in a housing crisis.) When it comes to multi-family projects, several months/years to await approval is a complete nonstarter for ordinary folk like us.

Out of curiosity how much of the numbers you quoted for a single owner build comes from regulatory considerations? Not just building permits, but all of the other studies required to get local approval?

As for going in on something with non family members, well, that certainly isn’t at the top of our list of options, but unless things calm down we will be forced to consider it. Anyway thanks again..

I’m way more concerned about climate change wars than the switch to renewable energy.

Keep on supporting the green fad and destroy the energy sector then you won’t have to see this in your lifetime, but live in the mids of it.

I’ve been saying that energy/resources insecurity will lead to wars for years, but everyone burried their heads in the sand and dismissed my claim that wind mills, solar panels, batteries will not solve our energergy need because we don’t produce most if not all in the free world. Even if we produce all wind mills/solar panels/batteries in the free world we still need oil, gas, and coal for heavy transport, planes, shipping, industries, farming, and medicines.

Patrick, the cost isn’t the entire thing for me. It’s more what I am getting and what I have to choose from at that cost. A monthly payment is usually the last thing I look at. I am more on what the carrying cost is over term and what it cost to have that taken against gains. I see interest rates increasing as one of the only few potentials to add inventory to the market. If the cost of borrowing goes up, I mitigate that by increasing a down payment and shortening an amortization period to take down the cost of borrowing (yes, increasing a monthly payment to some extent, but taking down the borrowing cost on term). If at the same time an interest rate increase brings down the overall market price of housing when I buy, I just view it as a bonus. I have a range in my monthly cost structure that willing to commit to things such as housing, investments, retirement, entertainment, services, debt servicing (if I had any) and etc… That is broken down by percentage of capital or income committed. I am not saying that it is right for anyone else, but it gives me a great view of what my affordability level is at any time. If a housing opportunity comes up. I can evening combine some of those commitment items to make it happen. However, I keep in mind what I am sacficing to get it and that is what I weigh against the lifestyle choice of home ownership. Back to the numbers, it’s hard to give anything exact because it’s different in almost every scenario and how I would adapt to it. I made 3 offers last year, all of which me and my realtor believed we’re strong, but there was no way we could of figured what the actual insane sale price ended up being. I don’t believe I am asking for much from the market: a lessening of the insane over bids and a little more inventory. Hopefully, an increasing rate environment brings that and a price decline would just be a nice bonus.

I agree most will want to stay in Europe if possible unless they have family in Canada. I saw that the UK government has a program whereby citizens can offer accommodation in their homes for Ukrainian refugees and receive 350 pounds per month from the government as a gift. I think this is a good program for all and I would like to see this done in Canada as well. Such a small thing we can do for those experiencing the terror of war. I never thought I would see this event in Europe in my lifetime.

I guess this depends on the progress of the war. If Ukraine falls, then this might come to pass. But as long as Ukraine is still fighting most men will stay and fight The women women and children are leaving. I doubt many of them would want to be this far away from their husbands/sons. I would expect most of the refugees would stay in Europe at least for the near future.

I agree the risk is too high for flippers at the moment, but no one can predict the market, hence buyers still are buying. However, for primary resident homeowners it still make sense for many to get in because at the end of the day they still have to live somewhere, and do not want to pay their landlord rents (specially $5K/mo).

Good luck at holding on cash and time the market if that what you are doing while inflation is rising.

As for me, I sold most of my stocks in December and much of my energy stocks as well, and converted them over to index ETFs. I’m currently down roughly 10% on my index ETFs holding but the little oil and gas stocks that I held on is up, therefore it balanced out my portfolio (at no loss over all).

Life is a struggle, and I wonder what the average person in Ukraine think about life at the moment, beside trying not to be a victim and protect their family?

Every gambler knows

That the secret to survivin’

Is knowin’ what to throw away

And knowin’ what to keep

‘Cause every hand’s a winner

And every hand’s a loser

And the best that you can hope for

Is to die in your sleep”

QT- That begs the question: How many homeowners are willing to fork out over $5000+ a month for a house? Apparently quite a few, it boggles the mind. I was referring to investors that have been in the market for several years. Other than flippers playing the greater fool game, I can’t conceive that real estate is a good investment today, in most parts of Canada. Now is the time to divest some property. It was a good time to sell a lot of stocks last year. I’m not buying anything in any market, haven’t for years. Just holding on to what I have. Everything seems to be a gigantic pyramid scheme.

How many renters are willing to fork out $5300 a month for a house?

A house is going cost the landlord $1,400,000, or 25% down @ 3% interest rate 5 years fixed is $4990 a months.

Would someone be able to share what 359 Osprey sold for?

Patrick- Exactly correct, in fact it was Canadian investors that came in and bought distressed U.S. real estate when the market was down. Now the few I know have sold at a much higher level. Savvy investors buy when markets are down, that’s how they make money. The novice investors try to ride a hot market higher but get burned when things don’t go as planned. Like I said, there are different types of investors, same goes for the stock market, experienced investors know when to buy and when to sell.

Investors can reduce volatility, not adding to it For example, we have data from the US housing crash (2007), which saw homeownership falling, and investor ownership rising from 31% to 37% (over 2007 to 2015), providing a source of buyers and reduction volatility . In some markets, most of the buyers during the crash were investors, getting great bargains. The US has seen a runup in prices of 50% (2015-20) which has seen a RISING homeownership rate, and therefore LESS investor participation. This tells us that US investors reduce volatility, by buying when prices fall, and selling when prices rise (relative to homeowners, who buy in the way up, and sell in the way down). We haven’t seen a crash like this in Canada, so the US data is the best source to see investor behavior during a crash. Of course every house price crash is going to be different, but we have at least one example of the US housing crash that saw rising investor participation, reducing volatility. If rates in Victoria rise to 10+%, and there is a “bloodbath” of selling , I predict the homeownership rate will fall, meaning that “well-heeled” investor buyers will have stepped up to buy, reducing volatility here.

Hardly the case in Victoria or Vancouver, even in 2008-9 or the early 1980’s for that matter.

The primary reason for investors to put a property on the market is high vacancy rates with little prospects of finding a renter. I ran into that in 2008-2009 during the “Great Recession”. The property managers at this particular company were completely inept. I went 10 months without a renter, it was painful. The property was in Ladysmith which was not a hot market at the best of times. I took the loss, held on and now it’s paying huge dividends. There are different types of investors, some can absorb a loss and hang on, others are forced to bail. That was also a great buying opportunity, so why sell into weakness, just hold on and have confidence in your investment.

Exactly. We don’t have data on sales by investors in Victoria but it’s well established that investors add volatility to the market by jumping in when prices are rising and out when they’re falling. More so than owner occupiers.

Not saying that this will cause a crash, but it could get us back more inventory more quickly than we would otherwise expect when price gains stop

Your example is also a scenario where everything went smoothly. Imagine you buy a corner lot with another family and there is an unforseen issue that holds you up for years. As I said it is complicated but there is also RISK involved.

Also, if you are having trouble getting into the market in a traditional sense where you are looking at buying property to rezone with another family odds are you won’t be in a great position to be paying consultants during the rezoning process. Remember you are also forking out a lot of money to consultants with no guarantee as to the end results.

Maybe with an immediate family member, but with a friend not a fan of this idea personally.

Given the current conditions out there, I don’t see many reasons to expect the Canadian real estate market to correct at all. In fact, I see more reasons that will send the market even higher. Canada has committed to accepting an unlimited amount of refugees from the war in Europe. I foresee one million or more Ukrainian immigrants being fast tracked to gain the asylum they desperately need. Many will be taken in by Canadian families with the room to accommodate them. They will eventually need a place of their own.

Didn’t say compelled. It’s simply that investors are more motivated to buy when prices are rising and more motivated to sell, or just stay out, when prices are flat or falling. You can see it right in Leo’s last graph.

Why would investors be compelled to dump their properties when they are getting ridiculous rents in a market that has almost no vacancies? Most long term investors lock in 3-5 year mortgages and are fully protected against rate hikes in the meantime. The homeowners that stretched themselves to the limit, took a variable mortgage because the rate was slightly lower, and are 100% responsible to earn enough money to pay their bills, are far more exposed to risk. Any loss of employment would be devastating. Most investors, especially at these levels, have other sources of income and financial resources. If anything, investors would benefit from a temporary downturn, using the opportunity to purchase more properties. Remember, there is no shortage of renters.

Agree that the great majority of owner-occupiers will hang in through higher interest rates.

If there’s a downturn it will come from investors (who have been a historically high % of buyers lately) unloading their properties, and prospective owner-occupiers and investors unable or unwilling to buy at current prices and rates. But that’s really what’s been behind every downturn.

No I didn’t, and I have no idea where you got that impression from.

I was pretty explicit about “if the market stays flat”, which I believe you actually said it would. Either way, there wasn’t much of a choice on my end, but I’m happy where I am.

Trust that was your case. The owner of 1821 Midgard didn’t have lot development experience, but did hire a preson/company to handle/represent the rezoning application process and all meetings, maybe that helped it speeding up (about 2.5 years from start rezoning application to finish build). The new “smart density climate” in Saanich also helps.

And maybe that is the writing on the wall…..when the active realtors with real business sense (not merely sales people) and with several years experience in the market can’t figure out pricing. When there is no parity anymore. Are we at the tipping point. I think so, but I’ve felt this way many times over the last 10 years and have been wrong every time. I just don’t know anymore. Logic tells us one thing and yet the reality of what happens tells us another. I thought the stress test would be the game changer and it looked for a while it would be, shit slowed down, sentiments changed, the market took notice and stumbled, but only briefly it seemed.

The one I would do with a co-owner is a larger SFH that can be divide/suited or has a suite.

Market extremely irrational is many segments beyond my Royal Bay vs South Oak Bay comparison.

Another example from this week.

Wood-framed, Quadra area, middle of the road one bedroom condo looking into the adjacent building at short proximity sells for $1,059 per foot.

Steel and Concrete, Songhees/Vic West, one of the best buildings in all of Victoria, imo, one bedroom with some Gorge views sells for $862 per foot.

Having a hard time figuring out a lot of sales.

The only advantage to doing an alternative like an owner-build (assuming there were building lots available) is you get exactly what you want, but I doubt you will come in cheaper than comparable brand new product for sale by developer/builder. As far as other alternatives they just don’t really exist. Where can you even park a tiny home or something like that?

A 4,200 sq/ft lot in Langford/Colwood that isn’t a blasting or excavating disaster will set you back 620k+GST so that is 650k. If you aren’t a tradesperson you aren’t building anything for under 600k. Realistically, your minimum entry point at this point and time is 700k+$700k = $1.4 million.

Without writing a super long reply odds of something like this working out from financing to subdividing to construction with multiple families involved zero to none. Professional developers/builders struggle from start to finished product, let alone if you have no experience.

I remember when interest rates were 20%. People hoarded their money, there was no incentive to invest in anything when you were guaranteed to double your money in 3.5 years. This depleted the availability of money for other productive investments, and the economy suffered. I graduated in 1982 and people were lined up to work for $5 an hour. It was dismal. I don’t think any government wants to grind the economy to a halt, since their revenue depends on an active economy. Interest rates may go up 2-3%, very manageable for most. Given the way things are going in the world, don’t be surprised if they go lower.

+1, I love people referencing the 1982 housing crash. That is 40 years ago and realistically you aren’t buying a house at 18 years or enjoying it to its full potential at 90. You could literally wait your entire life waiting for the next crash.

Unless you have significant building and or development experience I would strongly advise against this idea. It appears very simple on the surface but is actually very complicated and risky. Just finished a small in-fill house in the Oaklands area is it took 5 years from start of rezoning to finished product. The amount of non-sense and bureaucracy is insane.

The other component is building lots or teardowns are a small fortune now and everyone is aware of corner lots and every other potential possibility. You aren’t going to find a sleeper where five other buyers with cash aren’t aware of the best possible use for that plot.

Most of my buyers are large institution employed (Island Health, UVIC, Military, Government, etc.); therefore, unless piss poor money management (buying boats and other stupid crap) or bad luck (serious health problems, etc.) they should be able to hang in there. The rates are so incredibly low right now that you can really dent the principal just with regular payments. Even if you stay in the same position your salary should go up with inflation +/- (while your mortgage principal decreases every month). If you have a suite the odds are you’ll be renting it for substantially more in 10 years than you are now. Then you have so many things to fall back on, let’s say in 5 years rates are up, well your mortgage principal has been seriously dented. Just re-finance at the same amort you had on the original mortgage, but with a lower principal to offset the higher rate.

I think if you are under 40 with a stable job I wouldn’t worry about rates too much. Even if absolutely, everything goes against you and you go under you still have 25-30 years to recover. My parents came to Canada with literally nothing in their late 30s and started with housekeeping/construction and with 25 years of hard work they have way more than enough for retirement. If you are 60 yrs old taking on a large mortgage….yikes.

Even better deals in Russian real estate. Their currency lost 95% of its value. That 10 million ruble property that would have cost 2 million Canadian dollars is now $100,000. Currency devaluation is a bitch.

Yes, that’s true.

In terms of preparing for it, who is to say it would peak at 10%, and not be 20% or higher like it was in 1981-82.

Anyone with debt that isn’t locked in for a long term could be affected. I’ve been advocating 10 year terms for mortgages for years here. So has CMHC head Evan Siddall. It’s not too late to look into locking a rate of 3.75% for 10 years. Then you could survive any rates for at least ten years.

Regardless what else is going on – 10% interest rates would indeed be a bloodbath. Think of all those millions borrowed at 0.9 and 1.2 %, how much interest people would need to pay at even 5%. It would precipitate an incredible recession or depression – which would stop rate increases in their tracks. So 10% isn’t very realistic, but for those who borrowed for 5 years at 1-2 %, the prospect of refinancing at 3-5 % will be daunting enough that we would expect inventory to increase sharply. Just thinking of those people Marko sees borrowing $1M ‘every day’.

Before Marko chips in, another possible alternative is to buy a corner lot, with an older house on it, to rezone and build a duplex (IMO Sooke is too far away for commuting to UVic).

A very recent example is 1821 Midgard Ave, located in Saanich next to UVic. It took a bit over a year from sending rezoning application to public hearing in Dec 2019. As it is a corner lot with reasonable size, even with very strong opposition from lots of the neighbours, the application passed fine (Saanich is very amenable now to rezoning corner lots for duplex). The building permit came 5 months later in May 2020 and the owner hired a builder from Vancouver and finished the build in June 2021. Total cost is under $2M (house pruchase price ~$880k in 2018, the total duplex size is just under 5000 sqft with finished basement in each side). Note the owner also gave away the old house to someone up island via Nickel Bros, as it was in good shape.

There are lots old houses in areas surrounding UVic. When/if market is not this crazy, it may be possible to buy one similar like this one on Midgard, more expensive now of course, but may still be doable.

Anyone following the real estate market in the Ukraine? Prices and sales are tanking. Great time to buy. Firesale prices. Affordable waterfront houses on the Black sea have never been cheaper. But act now while you still can! Buy low – sell high. And no speculation tax. I’m expecting this to fund my early retirement.

I don’t buy lottery tickets or gamble for the similar reasons I don’t participate in the annual HHV predictions – I have no crystal ball and I get no thrill from being a chance winner.

All I know is that housing has appreciated long term in our market, our family needs to live somewhere, and my window of opportunity is relatively short to become a homeowner – we don’t live forever. That means I look at what happens in ten years or more from decisions I make today and how I can control any foreseeable risks.

Luckily this worked out and continues to work. I don’t take this for granted and I just pass this on in case it helps someone else make a decision.

“Always nice to see landlords who won’t rent to themselves.”

Implying I’m being arrogant? Just arrogant? Funny, given your previous quick to anger, small-man-esque comments I would have expected you to jump straight to calling me a POS as you so eloquently posted further down. You know, comments like that make you seem like the type of guy that drives a Dodge Ram and tailgates Marko in Langford 😉

” As well, it is not a loss if it allows you to maximize your financial strength elsewhere. Buying a home really comes down to what you are willing to commit to a lifestyle choice. I am not sacrificing a retirement plan, the kids college funds, emergency funds (for illness or job loss) to own a single illiquid asset.”

You know it doesn’t have to be one or the other, right? Most homeowners are also planning for retirement and their kids futures and have other financial investments in addition to their home. You make it sound like there’s a choice between the two.

“I have a few acquaintances that have bought, pulled out of their HELOCs and bought another, they tell me about their net worth at the same time they are telling me they worried about inflation and interest rates.”

Just because you have friends playing speculator that have overleveraged themselves doesn’t mean everyone is doing it. If they have in fact overextended themselves and need to sell for a loss if interest rates go up, they’ll get to do business with an actual investor that’s currently waiting on the sidelines for that very scenario to play out.

I do care, and maybe I’ll learn something.

For example, I discussed the issue of buying vs renting with you extensively on HHV about three years ago. I tried to convince you that buying was a better deal than renting, but you held firm to the idea that your $1,900 house rental was the best way to go. You had various other reasons, like potentially moving to other countries etc. and it was an interesting discussion.

Always nice to see landlords who won’t rent to themselves.

Why do you ask these questions when you consistently show that you don’t actually care?

Didn’t you also sell in a high rate environment? (Vancouver in the 1980s). And have you ever underestimated the disadvantage you got from doing that?

fatigued, umm really (and anyone else in the “waiting for higher rates” camp)

How about showing some numbers illustrating how your idea of waiting could work?

For example, if prices fall 30%, and rates rise 3%, you’d be signing up for less of a mortgage, but it would be at higher rates so you might be paying about the same mortgage payments, and be no better off.

So have you run the numbers on this, to the point that you know when you would buy?

For example, would you buy when prices fall 30% and rates rise 3%, or would you keep waiting.

So I guess I’m asking…. What is the end point of waiting, and how much do you hope to save?

I have parked my money and I am sitting back from this market. If it goes up, so be it. Renting is not a loss if you view it as simply paying for a service. As well, it is not a loss if it allows you to maximize your financial strength elsewhere. Buying a home really comes down to what you are willing to commit to a lifestyle choice. I am not sacrificing a retirement plan, the kids college funds, emergency funds (for illness or job loss) to own a single illiquid asset. Some people may be comfortable with being single asset committed (all the power to them), but that lack of diversification does make them vulnerable. Borrowing from that single asset to invest elsewhere does not add diversification, it adds liability and furthers vulnerability. It’s funny, I have a few acquaintances that have bought, pulled out of their HELOCs and bought another, they tell me about their net worth at the same time they are telling me they worried about inflation and interest rates. They mention they are trying to spend less on food, commuting and activities for their kids. Which really surprises me because of how wealthy they keep saying they are….. I have no interest in paying someone else out of their problem with my financial flexibility. Bring on the the increasing interest rate environment. I will take an opportunity that works for me only on my terms in what I am willing to sacrifice financially for that lifestyle choice.

“Well at least I know where your bias lies as a landlord. Curse those entitled millennials. They should just take whatever they can get.”

I didn’t say any of this and these are your words, not mine. My bias as a landlord is against arrogant people and you can feel free to try to criticize me for that view, but don’t try to twist what I’m saying again as it just makes you look desperate to be right.

“The fact other millennials continue to to rationalize this market makes me embarrassed to be one some days.”

This comment will probably age about as well as selling a townhouse and renting while waiting for the market to magically provide everything ones family needs for ~850k, that currently is not provided in homes priced at $1.3m.

Basically, I’m trying to explore whether non-standard alternatives to the resale market are feasible or not. Our hope is of course that there is some correction with inventory opening up and interest rates going up, so that we could buy something this summer or next, but in case it doesn’t, we’re certainly open to unconventional options to get the job done.

Hey Marko, actually, we haven’t met, but I just realized you may know the answers to a couple questions we’ve been mulling over when considering potential alternatives for housing in the area. We’ve been mulling over the possibility of ultimately buying land and building on it, as a potentially better value than the resale market, and I just noticed that you’ve put out some videos on Youtube about what to expect for costs there. Small world! The first question is what are the realistic costs/timeline when it comes to construction in say Sooke, Westshore, or Central Saanich-ish, to give a distribution of locations? (In particular, how much cost comes from getting approved to build?)

(After all, if construction cost is ~500-600k and land is ~500-600k, then you come in at or below the market right now.)

The other question concerns construction and zoning when two families are involved. We know a couple other families who are in a similar position as us, and one theoretical prospect that would make sense elsewhere in the world would be to go in on something together. Say a piece of land, and either put a duplex on it or say put two smaller houses on it and perhaps also subdivide. Is that a realistic option in certain areas? My impression is that on the Peninsula it is basically verboten by zoning rules, but if it is a possibility in say Westshore, then that would be good to know.

Thanks in advance.

I would love to know what Fatigued Buyer feels that $1.3M should give his family in the way of housing in our market place and whether he feels that will ever be obtained?

To his sentiments i certainly can relate. It took me a long time to reconcile what we were able to get for $1.1M versus what I felt our family should be living in. But in the end I conceded it was pride screwing with my head and what i felt my family deserved, comparing ourselves to some of my peers and what they have etc. Well, now we live in a spacious house, good sized yard in a safe area with neighbors who clearly take care of their homes and properties. Ours is the one that needs work and really is a bit of an eyesore, very little curb appeal as of now. We’re chipping away at upgrades etc and will be for probably 10 yrs i reckon.

Sometimes I hate the place. Every weekend it seems is work/projects. But most of the time I am content and just thankful we are not fatigued buyers anymore.

Sure we put a ton of savings into the place and I do miss the dividend income and asset appreciation. We’ve got good jobs and we live within our means and while more discretionary cash flow goes into the house its forced us to look at our monthly budgets and cut out things like the $500/month beer and wine fund. That’s a big win right there and that goes into the house. It’s a win win.

As for Rogers. There are more active listings in Saanich now. Last count 69 active single family listings. Two weeks ago it was around 40. And we are just a few days away from the start of the Spring market that historically has seen the number of listings increase along with more buyers entering into the market.

It’s all about the price elasticity of demand and supply. If prices stay the same while supply increases? We’re likely looking at a possible correction. If we get a glut of listings – well you can guess what’s coming.

Real estate prices are quick to go up, but slow to come down. Usually.

Would someone be able to share what 359 Osprey sold for? Thanks so much!

The four decade party of falling interest rates is already over. Want to bet that the housing market will keep going in the same direction notwithstanding a reversal in the bond market? That’s essentially what you’re doing if you buy now. And yes that’s easy for me to say as an owner, mortgage free.

I have never underestimated the advantage I got from buying in a high rate environment. Sure I had to make an effort to save a down payment, but that really got you somewhere back then.

I’m trying to put myself in your shoes. I’ve always had the approach that I needed to be prepared to do what it took to have what I wanted within my value system. This mentality probably came from growing up poor though, and I realize that most Canadians don’t have this background so they may feel a lot more stressed by what they may perceive as lack of comfort.

When we bought for the first time we had good job prospects, but only a minimum down payment. Prices were rising rapidly and there were multiple offers for “nice” places. We qualified for the mortgage based on a professional exception, not income alone. Our interest rate was above 5%, but of course prices were much lower. We were worried about interest rate increases so we took a fixed rate.

At the time, my priority was buying the best house I could in the best location – as it has continued to be. It turned out that wasn’t the ideal house in the ideal location. It was a fixer upper and I didn’t really like the style. We didn’t have money to fix it, so we lived with a lot of things the way they were (like aluminum frame windows I had to wipe down every day in winter) and had two homestay students to make ends meet and make small improvements because we didn’t have the money to put in a suite.

For many, this would not have been worth it. For us and our our children it was fun and we were so grateful to be able to own. The end result of making decisions like this was that I was able to retire approx. 20 years early. Not for everyone of course, but it gave us security and a leg up for the next move and, ultimately, for financial independence.

I’m not trying to say that it is the same now, prices are higher vs. income, although interest rates are lower. I do, however, believe that the best predictor of the future is past performance.

I would not bank on investing the difference between renting and owning to make you a millionaire in ten years. That to me is a much higher risk equation than buying a house. But I’m way more comfortable with tangible things I manage individually than the stock market and the stability of owning is something that tips the scale that way even further.

I guess the bottom line is that I respect your decision, but my opinion is that for those that are considering matters strategically, buy the best house you can afford right now based on the current posted mortgage rates and have a back-up plan for what you are prepared to do if you need money for ex. repairs in the first five years of ownership. Do not buy if you are having serious relationship or unaddressed addiction issues in the family that may compromise your financial stability.

If this plan is not for you that is okay, but it has worked and will continue to work in my opinion if financial security via the housing ladder in Victoria or other appreciating markets is a focus.

Well at least I know where your bias lies as a landlord. Curse those entitled millennials. They should just take whatever they can get. The fact other millennials continue to to rationalize this market makes me embarrassed to be one some days.

200 ft from the highway and dealing with tenants. Some would consider those sacrifices. Agree that financially that seems like a good deal in this market. I’m surprised it’s been up that long. Maybe there’s more to that story. Curious if any realtors here have shown that one?

“But it doesn’t, historically speaking. Even looking back 2 years. Not sure how the simple fact that others are worse off makes me entitled for wanting to be comfortable with what $1.3M buys. If you’re willing to buy one of those places, and it feels like a good way to spend $1.3M, then power to you.”

Didn’t expect to change your mind, but also didn’t expect that you’ve reached peak millennial arrogance. Wish I knew your name so I could avoid accidentally renting to you one day.

But it doesn’t, historically speaking. Even looking back 2 years. Not sure how the simple fact that others are worse off makes me entitled for wanting to be comfortable with what $1.3M buys. If you’re willing to buy one of those places, and it feels like a good way to spend $1.3M, then power to you. But for every bidder on those homes there will be hundreds of others like me who aren’t interested. If that makes us all entitled I don’t know what to tell you.

What about 734 Rogers? It’s been for sale for a while in this market, you could certainly low ball it. Plus a 2br suite, monthly’s wouldn’t be that much & would give you a buffer incase interest rates go up as much as you think.

Has anyone run #’s on how far interest rates could go up before the fed’s would be unable to service their debt?

Re: 3912 Ascot Dr. Given the location and size of the house, that one will most likely sell for well over asking, probably $1.4-$1.5 M.

“I’m not opposed to fixing something up”

“And keep in mind, and I can’t stress this point enough, this is all being paid to live in a property I wouldn’t even like because even $1.3M these days comes with a lot of sacrifices.”

So what is it, are you willing to put in some sweat equity or are there too many sacrifices? Look at the list below and explain how any of these homes require a massive fixup. All of these properties are good enough for my family, but I’m interested in why they’re not good enough for yours, so please do layout the long list of sacrifices your family would need to endure living in these homes. I get that bidding wars suck and you don’t want to participate, but stop saying $1.3m doesn’t get you much these days as there are people currently doing all they can to buy a condo with the dream of one day getting into a $1.3m home and whiny comments like this do nothing but expose your privilege.

It’s being lumped in with this victim attitude and such high entitlement that makes me embarrassed to be a millennial some days

https://www.realtor.ca/real-estate/24130674/2913-shaylee-pl-langford-goldstream

https://www.realtor.ca/real-estate/24001728/734-rogers-ave-saanich-high-quadra

https://www.realtor.ca/real-estate/24120724/3912-ascot-dr-saanich-cedar-hill

https://www.realtor.ca/real-estate/24130496/584-kingsview-ridge-langford-mill-hill

https://www.realtor.ca/real-estate/24095042/3456-auburn-crt-langford-walfred

Independent of the discovery in the chat that millennials that made it into the housing market before 2020 are alright, and those that didn’t aren’t, it seems that the plot at the top of Leo’s post has been forgotten in the discussion. Affordability has made a generational jump over a mere 18 months. Rewind the clock even six months, and many of us younger people would be in a vastly better position. Yes, one got to figure out what to do and plan accordingly, but one got to remember that salaries have just decoupled from the cost of housing, and that is a recipe for long-term instability. (We’re another data point. We moved in Fall 2020 from the Bay Area to take up a position at UVic; we were completely shut out of the housing market there, and in relative terms the Island was a much better financial prospect. We had no equity, no help from family, but some significant cash we had saved up. We’ve been waiting for PR to go through, to avoid the foreign buyer’s tax, and so are unable to jump in until the summer anyway. Had we moved here a year earlier, we would be sitting just fine in a house. Now, we’re staring at the prospect of maybe getting a house within 45 minutes of UVic by the time our oldest graduates high school. Turns out that when the same properties jump in cost by a near factor of 2 in 18 months that this causes problems for people that were not fortunate enough to already be in the market. To say nothing about young families with less upward mobility or wealthy parents.)

Even when wages rise in step with inflation it doesn’t work. Inflation front-loads real interest payments. To see what that means, consider a jump in inflation of 2% matched by a one time rise in rates of 2%, and an annual increase in wages of 2%. Both real wages and real interest rates remain the same.

But what does that do to how much mortgage you can quality for today?

Absolutely. But the BoC doesn’t care about over leveraged homeowners. They care about maintaining the value of the national currency. People should prepare for the possibility of significantly higher rates in the next 10 years. The 5.25% qualifying rate is grossly out of date and was introduced before the global pandemic and a record amount of stimulus spending.

Rental inventory is awful, and many family suitable rentals are not stable, but I would argue the rent vs buy argument has shifted significantly toward rent this past year. Keep in mind in your example of a $1M mortgage at 3.5%, you’re dumping over $2500 a month in interest alone. Not to mention that $1.3M house is probably going to need some work in that 10 year time period (have you looked at what 1.3 gets you these days?). With insurance, property taxes, etc… you’re getting awfully close to what I’m currently paying in rent.

By far our biggest issue is stability of the rental, but like I said I’ve made peace with that and have some backup options should we lose it. Weighing the pros and cons of renting vs buying right now, for our particular situation and risk tolerance, we’re sticking with renting.

Nah, my spouse thinks you’re a condescending prick too.

10%?

I think the word ‘bloodbath’ would be commonplace if rates get anywhere close to that (without in-step salary inflation).

Parting with money in brutal bidding wars wouldn’t be to the liking of many people.

One can give suggestions, but there is no need keeping throwing “salt/insult” on an open wound at personal level. It is not a good/effective way to offer help, even to one’s own children, never mind strangers you have never met.

$1,275,000

A mere $385k over asking, and 45% over assessed

You’ve got kids and pets. You gotta secure a family home, and you’ve told us that you are wanting a certain neighborhood too.

Getting jerked around in rentals is no plan for a family with kids, and shouldn’t be touted by you for its financial cleverness and “flexibility”. I doubt that you even believe what you are typing when you describe the benefits of renting vs buying. You strike me as someone who doesn’t like to part with money, and i can’t imagine that you’re happy paying rent down the drain each month, while you watch your landlord and homeowners all around you getting rich quick.

A stock/bond portfolio is no substitute for what you want, namely a stable family home in your desired Victoria neighborhood. You know that, so no point telling us how great it is renting., unless you actually believe that.

I’m curious, does your spouse buy into all this “we could buy, but choose not to” malarkey. And what do they say about your ideas when they see home prices rising farther out of reach?

Have to refute some of your assumptions, Patrick:

1) $100k after tax income isn’t going to qualify you for a $1M mortgage. Maybe closer to $750k, which combined with a $300k down payment will sit you around $1M max purchase price with closing costs. The argument ends there because there’s nothing at that purchase price that I would feel comfortable being stuck in if the markets shift. You can’t even buy in Royal Bay at that price anymore. My criteria isn’t super unreasonable either. I’m not opposed to fixing something up, but in this market anything with potential typically goes well over asking and beyond our pre-qualified amount.

2) I definitely wouldn’t expect my income to be up “at least 60%” in a decade. I’m already in a fairly senior role in my field, and further growth is limited. My wife may see an increased income in that time but I think we’d be lucky to see 20-30% family income growth in that time period.

https://www150.statcan.gc.ca/n1/en/pub/11-626-x/11-626-x2012008-eng.pdf?st=IOjHtYpJ

So let me get this straight. The right move is to buy anything, even if I don’t like it, put 60% of my after tax income to living there, at a time when cost of living is on the rise and wages are not keeping up. Then at 10 years, perhaps refinance at $6,300 a month, which will very likely be even a higher percentage of my take home pay. And keep in mind, and I can’t stress this point enough, this is all being paid to live in a property I wouldn’t even like because even $1.3M these days comes with a lot of sacrifices.

If you stayed liquid with that $300k downpayment, saved the difference between that mortgage and current rent at a 6% rate of return (standard for a B&D portfolio), you’d have over $1M in 10 years, and a lot more flexibility over that period as well.

We both make a lot of fairly bold assumptions to support our arguments. Mine come with potential opportunity costs, but yours come with greater risk, which is simply beyond my individual risk tolerance. Same reason I don’t invest 100% in equities. But all of this is moot anyway because there simply isn’t any housing available in Victoria that meets our needs and is within our budget today. If we could stretch into a home we’d be happy with for the next 10-25 years, then I would agree with you that what happens with inflation and house prices doesn’t matter as much. But if you buy something that isn’t a good fit (and can’t be made into a good fit over time), then you’re potentially setting yourself up for a lot of misery down the road.

This is a lot more than a numbers game, and I think what frustrates me the most is how you continually trivialize the problem. If prices continue to rise at 4.7% over the next decade, a benchmark condo in Victoria will be a million bucks. If that happens, I think we’re all going to be dealing with much bigger problems.

Well no, it isn’t “me saying so”. StatCan says so. https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1110023901&pickMembers%5B0%5D=1.1&pickMembers%5B1%5D=2.4&pickMembers%5B2%5D=3.1&pickMembers%5B3%5D=4.1&cubeTimeFrame.startYear=2019&cubeTimeFrame.endYear=2019&referencePeriods=20190101%2C20190101

30 year old average income $47K

40 year old average income $60K

That’s up 30% in 10 years just from getting older. (More experienced workers get paid more)

The other 30% rise is from 2.5% inflation X 10 years and compounding

So yes, 60% rise in income for a 30 year old over ten years should be expected.

If you say so.

I don’t have a crystal ball myself, but I can remember back when rates were around 10% for a decade after high inflation had been beaten.

—-

You don’t need a life coach. You need a “number cruncher” to show you why your “wait and see” plan is foolish, using the criteria you provided.

If you do this, and houses appreciate 4% per year, you may be a millionaire in 10 years, instead of a “fatigued renter”. And you will welcome and ignore interest rate increases, as you’re immune to them for the first ten years, and easily able to pay 10% interest after that

Here are criteria I’m using based on the comments you made:

——borrow $1 million

—- I’m assuming $100k after tax income and $300K down payment (You’ve said you have above average income and substantial assets)

——Must be able to afford the payments if rates hit 10%

You have self-imposed a mortgage limit on yourself based on your ability to payback the mortgage at a rate of 10% interest. You’re attempting to be prudent, but instead I think you’re being foolish. And let me explain why.

On a $1 million mortgage,

– A 10% mortgage is going to be $9K per month

– A 3.5% mortgage is going to be $5k per month

Now you’re worried that you might be able to afford $5k per month, but you couldn’t afford $9k per month. So you don’t borrow the million. Here’s where you’re wrong!

If the $1.3m house you purchased ($300k down, $1m mortgage) is worth $2 million after 10 years (4.4% appreciation/year), you would then have $1.3 million equity ($300k down payment, $300k mortgage equity pay down, + $700k house appreciation.

This “foolish buyers” that are outbidding you aren’t so foolish after all. They realize this… do you?

There is a name for someone who does this, and it isn’t the “foolish buyer” name you call them.

The correct term for someone with $1.3m equity in their house is “millionaire”, and that could be you!

Can anyone tell me what 3018 Jackson st recently sold for?

You’re conflating what’s best for me and my family with finances, Patrick. And despite prices we did make a few offers and were outbid because anything remotely nice has 20 other buyers chomping at the bit. “Buy what you can afford now” is poor advice without further context. People should only buy right now if they actually like the house, it’s suitable for their family, and they can afford the payments if rates hit 10% (yes, it can happen and has certainly happened before). I suspect a lot of buyers right now aren’t meeting that criteria and to me that’s incredibly foolish. There is monumental risk taking on a million dollar mortgage in a rising rate environment that is really starting to resemble the early 90s. Wages are not keeping up. And as Leo has pointed out there is growing risk of knee jerk reactions from multiple layers of government to cool the froth.

I’ve made peace with my situation and have made backup plans if we lose our rental.

Was it a financial mistake to sell the townhouse? Sure. Easy to point out in hindsight. Do I regret it? No, because riding out this pandemic with a big yard close to the beach has been pretty damn nice.

Once again, you have only a superficial understanding of my situation. Telling strangers to hold their nose and leverage themselves to the tits to buy something they don’t love is wreckless and dangerous advice. I sincerely hope you’re not a life coach.

Sure. Happy to be of help.

In July 2021, I “gave it my all” with you to “buy what you can afford now”, but you confidentially turned that down. Now it appears prices are up 20%+ from there.

Here’s how you described your situation in July 2021. Perhaps the best person to help you out is not me. But instead, listen to your own comments from awhile back, and see if you still agree with them…

Here’s what you said in July 2021: [fatigued buyer] “I actually had a townhome in Langford before I moved into my rental. We sold because it wasn’t a great fit for us with our new child. Busy road, no sidewalks, no walkable parks or playgrounds. We have substantial assets and a well-above medium family income. We could probably stretch today and buy something move in ready in Gordon Head or Tanner Ridge. Why don’t we? For the reasons I opened with. Comfortable price max for us would be ~$850k and I’m happy to wait for something that meets most our needs without significantly overpaying or feeling pressured due to FOMO.” https://househuntvictoria.ca/2021/07/02/june-market-eases-slightly-but-remains-hot/#comment-80974

To me, you made a mistake selling a townhouse and opting to rent. And another mistake to pass up “ something move in ready in Gordon Head or Tanner Ridge”. And you’re in the process of another mistake “ wait for something that meets most our needs without significantly overpaying or feeling pressured due to FOMO”.

You’ve got a young family, and “substantial assets”. It’s time for you to step up and buy what you can afford. This means “draining your savings” which you’ve declined to do in the past. Hold your nose, buy a home, stretch as much as you can, then after you’ve bought forget about house prices, and live happily ever after.. youre going to be one of the 99.9% of people that makes their mortgage payments, because your income is going to increase each year with inflation and seniority, while your mortgage stays the same.

In 25 years, when your mortgage is paid off, that Gordon head house you bought for $1.5m (which you considered you overpaid, as it was “worth”$1.2 million) is probably going to be worth about $5 million. If it isn’t, so what? Your family grew up in it, and the kids are all grown and gone. That’s a problem for the 55 year old version of yourself to solve. Your job is to solve your family problem now, which is finding a stable home to live in.

Dumb millennial checking in. Please continue to guide us to the light Patrick!

Good news indeed! Too bad many millennials are not interested in that.

It’s interesting that roughly 1.2-1.3 million of those have died over the last 5 years, and about half between the ages of 75-90. So Boomers are just entering this period. Also crazy that the number of people over 100 has gone up 42% over the past 5 years.

Sorry, I meant to say there are 7.08 Million people aged 65 and older. So Baby Boomers are between the age of 58 and 76 this year. Born between 1946 and 1964.

If I’m lucky, I’ll live long enough to do another 7000 Wordles. BTW, Putin is not an answer.

Mortality rate is higher for people born before 1946, but most of them are not dead (yet):

https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1310071001

There aren’t. There are fewer than 3 million people 75 or over.

https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1710000501

If there are 7 million people in Canada born before 1946, there’s got to be a helluva lot more boomers. Most people born before 1946 are dead.

I suspect the biggest “workout” a lot of people get with this heavy equipment is the original purchase/setup and then dismantling/putting it away 🙂

Alexandra,

Yes, good points.

Thanks for that chart Patrick. “the average worth of millennial households is $491K CAD.” The Millennial classification is for age group from 26-41yrs old. That being the case, in all probability, the ones age say 26-32 are going to be a lot poorer than those aged 33-41. There are only 7.08 Million people in Canada born before 1946. So “baby boomers” were born between 1946 – 1964; the youngest being 58 this year and the oldest 76. So maybe 5 million boomers?……compared to 10.5 Million aged 25-44 & 10.12 Million aged 45-64. There is also quite a difference in their way of thinking of baby boomers born before 1956 and those born in the late 50’s to mid 60’s. Anyway, too bad the break downs are in the classifications below. There would be a much better understanding of data if the wealth breakdowns were in smaller groups…..i.e. say ages 25-32 (kids finished uni/post 2nd training ) and before they have “arrived”, then 33 – 43 (grand parents inheritances); 44 – 54 (grandparents and parents inheritances; 55-65 (many in early retirement and parent’s inheritances); 65-75 ( usually have “downsized” by now to rancher or condo, 76-82 (staying put and enjoying as much as they can in life; then finally 83 and older (good chance you are in a retirement home and have given lots of your money to your kids, grandkids and great grandkids.

Yes, but there are all sorts of other factors at play – interest rates, employment rates, immigration and demographics, pandemics, geography, climate… some of the factors are national and others are local. Cycles are explained in part by income limitations, but it is not the whole story. It is complicated and so I’ve never been interested in trying to predict our market cycle. I just stick with the buy the best place you can when you are ready and can afford it.

One, rising prices create the expectation of even more rising prices, which results in more interest from investors and schemes for them, and more prospective owner-occupiers resorting to parental help or schemes such as partner ownership.

Two, rising prices increase ability to borrow against equity for existing owners to fund the above.

But both of these borrow demand from the future and are time limited. That’s basically why there are cycles.

Would anyone be able to share what 711 Miller sold for? Thank you.

Good news! Millennials are half-millionaires already!

We are told here how unaffordable homes are for millennials. Meanwhile it turns out that the average net worth of millennial households is $491,000 CAD. (This consists of $370k home equity and $120k other assets). That means that many of them own homes already, and are well off and don’t need to rely on their parents (or income alone) for their next home purchase. And their net worth is much higher than boomers or Gen X were at similar age. Of course most (80%) of millennial net worth is home equity, which is normal at this stage of life. These smart millennials bought homes that they could afford, and are seeing the benefits of homeownership in equity growth through mortgage payments and price appreciation.

It’s clear that this clever group of millennials hasn’t been sitting around waiting for government policies (or a predicted real estate “downturn cycle”) to lower home prices, they’re buying what they can afford now.

Here is the chart showing $1 million net worth of Canadians and $491K millennial net worth

https://betterdwelling.com/canadian-average-net-worth-nears-1-million-as-growth-rises-3x-faster-than-normal/

(See Next message)

A guy was telling me “the US is broke”, which is nonsense.

The reality is that US finances are in great shape, just like Canada. People seem unaware of the basics, which is that the average US household has $1 million USD in net assets (that’s assets-debts-government debt). And the same applies to Canada (average household has close to $1 million net worth)

The US headlines focus on US government debt, currently at $30 trillion.

What gets much less press is US household assets. US households have $200 trillion in assets and $50 trillion of debts, so $150 trillion of net assets. That puts the $30 trillion of government debt in perspective. For example, If we count the government debts against the US household net worth, that leaves them with $120 trillion in net worth – which is $1 million USD per household in the USA (or $400,000 usd per person). https://www.cnbc.com/2022/03/10/household-wealth-tops-150-trillion-for-the-first-time-despite-surge-in-debt.html

By the way, the same numbers exist for Canada ($16 trillion net assets, $1 trillion debt, average net worth of $1 million per household in Canada (that’s after paying back all government debts) https://betterdwelling.com/canadian-average-net-worth-nears-1-million-as-growth-rises-3x-faster-than-normal/

I understand the preference but you can have a great workout at home with a small set of dumbbells and a rowing machine (new rowing machines fold up into a 3 by 2 foot space.). Actually a lot cheaper than a gym membership. But I do understand that it was not everyone’s first choice. Not sure I would use the word tough to describe this, it is not like my dad landing in Normandy or my mothers joy of being in London during the blitz.

I’m not sure how much price appreciation creates more appreciation. It seems like the long-term rate of appreciation is evened out by stagnation and dips.

Increasing mortgages do need to be paid back. This is why banks have lending criteria to determine what can be paid back over an ex. 25-year term. You need to show that you have the personal income to do this or fit within a high net worth exception (which means you can pay it back anyway because your assets more than cover the debt).

Where this becomes more relevant is if you have a co-signer, rather than down payment help. In this case your cosigner needs to be able to help you pay back if you cannot because you are not qualifying based on your owns means to pay and you may not have the resources in the first five years to handle home repairs or temporary job losses. But most people are pretty determined when it comes to keeping their home and would probably ex. get a roommate or put in a suite to create more breathing room.

Barrister- Look at the shares of Peloton, down over 80%. These fads only last so long. Having your favourite gym closed is tough on people who prefer working out at a fully equipped facility.. It’s also a big part their social life as well. At least that’s my experience.

We’re basically saying the same thing, but I’m talking long run vs short/medium run. No doubt price appreciation feeds price appreciation. Both psychologically and because of credit access. But the increasing mortgages all have to be paid back eventually, and right now it seems most people are expecting never to have to actually earn the money to do so.

I wonder why so many people are feeling their overall physical health is worse? There seems to have been a lot of people that started healthy physical hobbies during this.

https://www.cbc.ca/news/canada/pandemic-canadians-poll-attitude-1.6378018

One would think this would still be classified as ‘borrowing’ and not be eligible. Have to wait to see if this even happens and then what the details are to be sure though. All speculation for now.

Couldn’t someone refi their mortgage and extract the down payment that way? Not sure if it coming from a heloc makes a material difference.

Dalhousie is an expensive street but not on the Henderson Oak Bay side and soon it will be replaced by a $2.5M+ new build. I wouldn’t call 1429 Mitchel is a typical Oak Bay house due to the location and it’s sold more than $400k to its neighbor property who sold in 2020. I think the fair comparison to Curlew will be the upcoming sold price on 1091 St. David and 2486 McNeil, especially if the St. David sold for less than Curlew, than it’s really interesting market.

That is a misstatement. What I said was that home equity does support some demand and “new” demand is not all income-based and taking equity from a home to loan to a child to buy an appreciating asset is not a zero sum equation. I’m unsure of the contribution of retained equity to new demand, but I would guess it is growing as prices grow.

I showed Dalhousie and I thought it was serviceable. For a couple of hundred thousand you could make it comfortable. Let’s say it is lot value. $350 a foot to build so around $2 million if you did an owner build for a new home on a near 6,000 sqft south facing lot in Oak Bay. That’s still seems like excellent value compared to a very spec built Colwood home on a 3,400 sq/ft lot for 1.6.

The homes I am showing in Oak Bay around 1.5ish while they might be economical teardowns they are also most often very livable.

These are lot value properties. What does a million dollar lot indicate for the price of a new house?

Your position essentially appears to be that high RE prices support themselves. I will take Leo’s side that prices need to be supported by incomes. Various forms of borrowing from the future just put off this reckoning.

Dalhousie and Mitchell are both over 100 years old in old neighbourhoods. Probably sold for land value only.

lol. I see you’re still taking it personally that I told you that no one cares to have their spelling corrected.

Similar homes in Westhills 250k cheaper; whereas, Royal Bay use to be cheaper by a smidge.

Then you have 2225 Dalhousie in Oak Bay for $1.1 on a 5,940 sq/ft south facing lot and 1429 Mitchell in South Oak Bay for $1.275. Doesn’t seem like the core is the place to be anymore.

Interesting market.

The image doesn’t affect it, but you only have 3 hours to edit the comment (deleting not possible, not sure why that’s not a feature of the comments plugin I’m using)

3408 Sparrowhawk – $1.35M

3367 Curlew – $1.6M

Both of those ideas sound reasonable to me.

They should add a flipper tax (full tax on profit if sold within 5 years), that would apply to any homeowner.

Could someone kindly share what 3408 Sparrowhawk Ave and 3367 Curlew St sold for? Thanks so much!

Leo once i’ve embedded a picture is there a way to delete the post? or does it only give you a minute or so to delete?

just a rumor but could be pretty impactful:

[img [/img]

[/img]

updating pic size….

50% of Canadians assets are non-RE, and those have appreciated as well. Which isn’t a zero sum game if they use them to buy (or help their kids) to buy a home. Inheritance transfers non-RE assets to the kids which is another non-zero sum game. For example, inheriting $1m stock portfolio (or life insurance payout) and the kid uses that to buy a home. These factors are expected to transfer $trillions of non-RE assets from parents to their kids, allowing the kids to buy homes despite modest incomes.

When you lend to buy an appreciating asset you expand the borrower’s asset base beyond their income-based capacity. This increases leverage and return on capital. This is where there is a real gain. The principal, whether a loan or a gift, enables this gain.

I think we’ve been having this difference of opinion for a longish time. The use of home equity in the market to assist new homebuyers or those buying another home does fuel demand.

This might make sense in terms of zero sum if the kids were not leveraging the down payment. Because they are, it is not an equal transaction. Ie. if you lend 100% of the purchase price from equity it might be a wash, but lending 10% of the purchase price to enable 90% leverage is a mismatch.

And don’t forget co-signing. This is not a zero sum game and a lot of parents do it because they have credit room as a result of home appreciation.

Net exports minus imports from Canada to USA of oil are UP since 2013 (when $ was par).

Canada’s trade surplus with the US is BIGGER now ($85 billion surplus) than it was in 2013 ($50 billion surplus, when dollar was par, and oil was >$100).

This should lead to a stronger CAD vs USD. But other factors than trade such as “flight-to-safety” and “investment flows” (Canadians buying up US stocks) are at play.

Here is a chart of trade in goods

Note: services trade balance are much smaller amounts, lowering the overall trade balance from $85b to $75b and are found here https://novascotia.ca/finance/statistics//news.asp?id=17526)

“How is parents lending their children a down payment make it zero sum?”

That, and the fact that with changing consumer sentiment due to COVID, changing demographics leading to increased demand in areas perceived as retirement-friendly (ie. the island), and an asia-heavy breakdown of immigration that will tend to increase demand in western provinces vs eastern, you have to look at the economics at a local scale. Seeing this as zero-sum ignores most of the pertinent issues driving this boom.

How is it not?

Lending a down payment is just an advance on an inheritance. No gain there.

The parents may be in a position to lend a down payment because their house appreciated. But the only reason they need to lend that down payment is because houses appreciated and kids can’t afford it on their own.

The major other factor is that just a decade ago, the US supplied less than 10% of Canada’s oil imports, but today it supplies 75%. This has greatly reduced net exports of oil from Canada to the US and thus the effect of oil prices on the CAD versus USD.

https://househuntvictoria.ca/2022/03/07/affordability-cracks-long-term-trends/#comment-86045

How is parents lending their children a down payment make it zero sum?