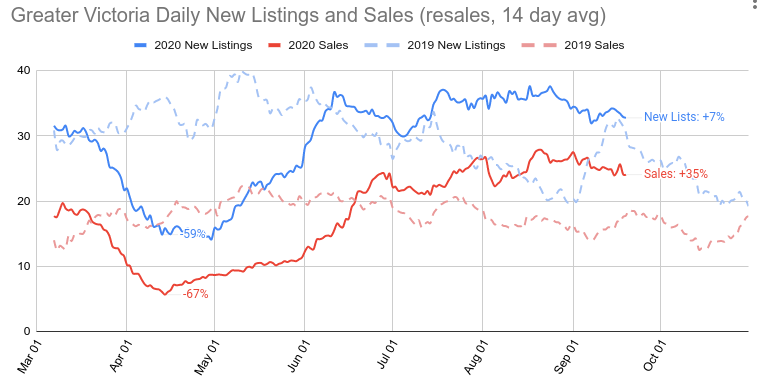

Pent up spring demand should be nearing the end, but out of towners may keep it up

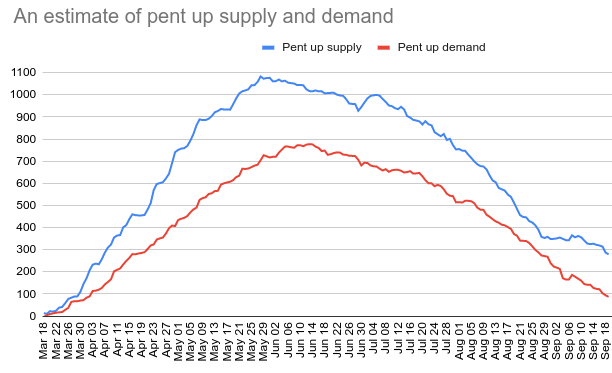

We know that the market for anything detached or semi-detached is red hot out there. In the past couple months that has been largely due to pent up demand from the spring. We don’t know exactly when that will be exhausted, but back in June I created an estimate of pent up market activity based on how many sales and listings we would have seen this year if sales rates were the same as in 2019.

By that measure we are rapidly approaching the end of pent up demand, trailing less than 100 sales since the pandemic started from last year. Supply is not that far behind, despite new listings this year not exhibiting the usual September surge. It’s clear now that we are past the sales peak for the year and the market seems to have started on the downslope for the year.

However sales are not decreasing that quickly, only down about 15% from the peak in mid August. That makes me think my previous estimate of pent up demand was an underestimate, and we are going to blow right through it in a week or so. Why is that? Well as stated previously, demand was running some 25% higher than the year ago values pre-pandemic, so comparing to 2019 may have been too conservative of a baseline.

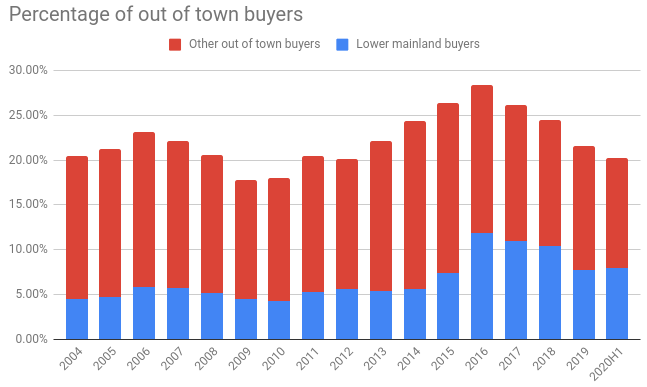

However another reason behind this strength in the market might be due to a resurgence of out of town buyers. To be clear, we don’t have any actual data that out of town buyers are on the upswing, and up to the first half of 2020 the percentage of out of town buyers had continued their multi-year downward slide. Certainly up until June we were a long way down from the highs of 2016 when we saw a surge of Vancouver buyers hit our shores.

However these data are nearly 3 months old now, and there’s a few things that indicate demand from out of towners may have picked up.

- Anecdotes. I’ve seen an uptick in people reaching out from out of town, and also heard chatter about it within the industry. However in 2016 I saw a matching surge in website traffic from the lower mainland, and this summer although traffic is up 18% from last year, the proportion of Victoria and out of town visitors is unchanged. The plural of anecdotes is not data, however as Jeff Bezos said: “The thing I have noticed is that when the anecdotes and the data disagree, the anecdotes are usually right. There is something wrong with the way that you are measuring it”

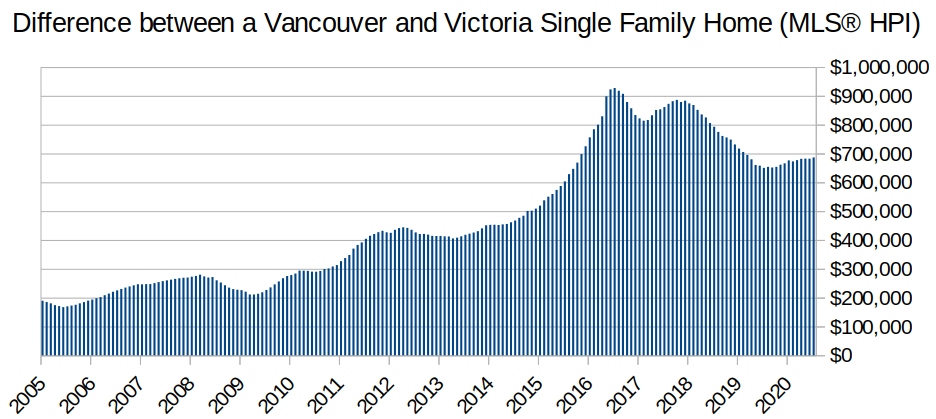

- The Vancouver Delta remains high and their market has picked up. While off from the insane peak in 2016, the benchmark Greater Vancouver detached home is still nearly $700,000 more than one here. And like ours, their market has picked up substantially in recent months, which may be allowing more Vancouver buyers to cash out again. I also wouldn’t be surprised if there’s been a surge in early retirements from folks that simply have little interest in completely changing how they work.

- Luxury real estate is completely bananas. We know the detached market is active, but year to date, single family sales as a whole are up only some 5% from last year. But in the luxury segment over $2M, sales are up nearly 90%. I’m going to go out on a limb and say it’s not because Victorians suddenly decided to upgrade their ambitions all at once.

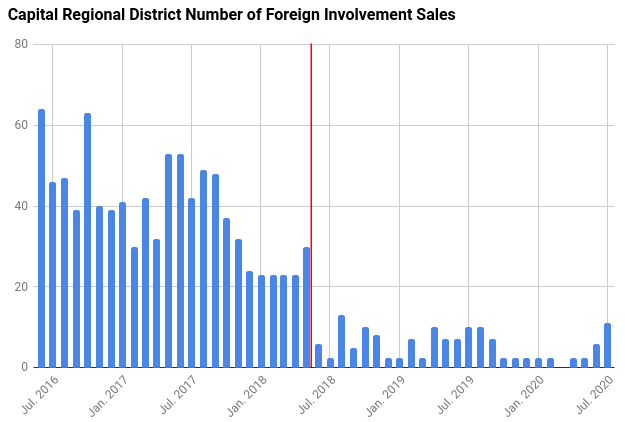

- Foreign buyers may be picking up. Direct foreign buying was decimated in Victoria after the foreign buyers tax, and in general that is still true. However for the first time in nearly a year we’ve got more than 5 buyers a month, with 6 in June buying $11M in Victoria real estate, and 11 in July buying $7M (and paying a combined $2.5M in foreign buyers tax). To be clear, these are still very low numbers and two months do not make a trend, but this is something to watch going forward.

The number of out of town buyers, first timers, and investors are key, since they represent pure demand in the market. Any uptick there will have a lot more of an impact than locals buying and selling to each other.

“Revisiting the one that was near the start of the threads the was posted by someone else asking the question about it’s status.. 2022 Carrick St. Oak Bay, Sale price 790k just posted almost 100k under assessment and after couple of price drops. Older home with a good sized lot in a preferred neighborhood… Are there any insights on the low sale price (in a world where a low sale price is still over 3/4 million)…? Any specific problems with the property or just a probate sale that wanted to be done?”

It’s very challenge to get tree removal permission in Oak Bay. New landscaping plus reasonable reno would be easily cost $100K+ and the basement size is less attractive to young family or investor.

Monthly numbers: https://househuntvictoria.ca/2020/10/01/sales-hit-yearly-high-and-continue-to-break-records

The regulators have some hand in this, since when CMHC reduced the max amortizations to 25 years, most banks followed suit. They can still do 30 years and some do, but the insurers won’t back it (and I believe won’t bulk-insure it either) so they have fewer ways to fund the loans. Don’t see any 40 year amortizations being offered, so perhaps there is an upper cap.

Interest rates dropped drastically in 2008/09. Much more than they did now. But I’m not really sure why it petered out shortly afterwards, other than the fact that affordability simply got stretched and buyers evaporated. Market sentiment seemed to just change: https://househuntvictoria.ca/2018/08/15/market-sentiment/

“After all, if people were willing to pay $2865 a month for a house in 2008, why would there be 20% fewer people willing to buy 5 years later despite the fact that they are paying 25% less per month for the same house? Victoria did not get less desirable in those 5 years. Cherry blossoms were still blooming in the spring, incomes were up, and the local economy provided more opportunities. The only thing that changed was people’s feelings about the market.”

Leo I was looking at your price history graph and noted prices peaked a year after the stock market collapse started to come back – then it dropped over the next few years – any reason why it would increase during the 2008-2009 crisis into 2010 and then drop? Not drawing parallels just more curious than anything.

Now that interest rates have pretty well bottomed and Canada needs its nest egg I was wondering what the next stimulator for house prices could be. I read a rumor on twitter that some banks were looking at amortization increases – has anyone heard anything like this – do the banks choose that or is it regulated by another entity?

Who wouldn’t pay premium not to be under the Victoria city council not to mention not having every side street clogged with the cars of the basement dwellers.

However, things might have changed in the many years since my college days when 4 people could rent a house in Oak Bay splitting $1600 per month, but because of the Oak Bay rules two had to pretend they were related to meet the Oak Bay bylaw of how many unrelated people could live in one house. The epic keggers did get a few frowns from the neighbours.

Oak Bay has cachet. But what I like the most about the place is its commitment to, and success in maintaining, low density. For example, no one has to worry about frat houses behind the Tweed Curtain.

I’ve completely adjusted to the $850K valuations, so it’ll take a million dollars for it to feel wacky again. It’ll happen sooner than everyone thinks.

No sale registered, listing cancelled.

Revisiting the one that was near the start of the threads the was posted by someone else asking the question about it’s status.. 2022 Carrick St. Oak Bay, Sale price 790k just posted almost 100k under assessment and after couple of price drops. Older home with a good sized lot in a preferred neighborhood… Are there any insights on the low sale price (in a world where a low sale price is still over 3/4 million)…? Any specific problems with the property or just a probate sale that wanted to be done?

You can also add in additional numbers to factor in risk, like a standard deviation, which will give you a range of outcomes with a probability for each.

Can anyone tell me what 2129 Sandowne sold for. Thanks

Having grown up in the Oaklands I still don’t get paying 200k-300k more for the same house in Oak Bay. It is like a 5 minute drive 🙂

Maybe here? Introvert and Leo S. live in Gordon Head so they could perhaps comment on that.

Oak Bay is nice but expensive and some people find it too conservative and old. The other place you could ask questions are the local subarea facebook pages like Oak Bay Local, Fairfield/Gonzales, Jubilee, Gordon Head Residents Association etc.. or use a realtor.

Seems ludicrous no doubt.

But $115k for a Victoria condo seemed ludicrous to my parents in the late 90s (after paying $75k for 160 acres in the early 90s)

Then $280k seemed high when my brother bought in the early 2000s

Then $380k seemed crazy when my sister bought in Gordon Head some years later.

Then $550k seemed sketchy when we bought in Gordon Head.

Now $850k is wacky for a very ordinary house

Not to say prices won’t drop or flatline, but to borrow a term from politics, it’s pretty remarkable how the Overton window has moved on price, and for how long.

That would be fine too but I’m not starting at today’s date so anyone who owns will be averaging based on the gains made to date plus the next ten years. If you buy today and use the online inflation calculator the default for 2020-2030 is 2.5%. A house worth 1 million today will be 1.280 in ten years (28% cumulative) if it keeps up with inflation and 1.48 if you use 4% (48.2%) cumulative. Guess we’ll find out.

https://smartasset.com/investing/inflation-calculator#lbVbF5jTV6

Totora…. I’m afraid we will just have to disagree on most subjects related to real estate and life. But that is what makes life interesting. Different viewpoints.

All the power to you.

I don’t think the absolute numbers can be ignored, unless we see true inflation.

10% on a 100k house is 10k and 100k on $1 million.

My wife and I are watching the Victoria market and hoping to make a move in. We’ve been told by friends to look at Oak Bay and East Saanich but it seems like there are much better deals pretty much everywhere else. I don’t understand some of the pricing. For example, what is the appeal behind the Mt. Tolmie area? It looks like a bunch of old run down houses from the 1950s and yet I see frat houses like 3909 Ansell Rd sell for $905k? In Gordon Head, it looks like I can get much better value or even Oak Bay for $150k more I have a very nice house near the water. Why is there such a value disparities around the UVic area? Henderson area seems considerably better value for not that much more…?

Are there any resources that explain the local neighborhood markets and the appeal for each?

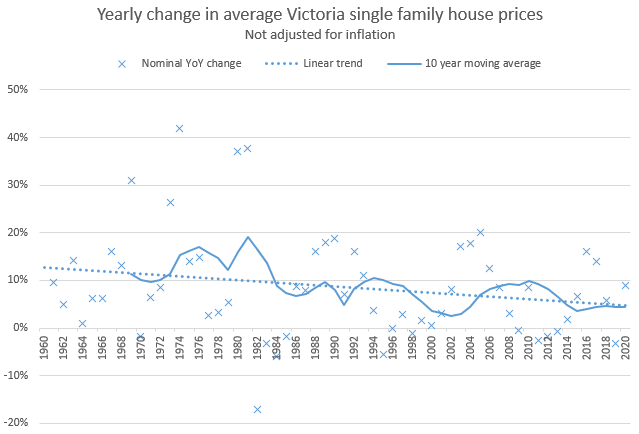

Looking at the 10 year average line, the last upswing peaked at 10% annual increase and dropped to about 4% in the lull . Right now we are 5%, perhaps it will creep up to 6% if the market continues to go nuts. Will it then drop to 0% in the next lull or are going into a more steady appreciation phase with less boom bust? Who knows.

Meaning a statement that “4% is reasonable or even conservative” while adding that it’s a single asset class in a single market, it’s spiky in the short term, vulnerable to x,y,z, etc. Don’t need an exact number to quantify that context/risk etc for purposes of conversation, imo.

That would make a box in Gordon Head $1.5 million in 10 years….I don’t know about that.

My gut feel is 2% on the high side for next 10 years.

What does that even mean? I’m not comfortable dealing with unquantified statements of risk when making financial decisions because you are not actually capturing anything unless you assign a number to it.

If you want to use a 3% figure instead, go for it. Want to use negative numbers, go for it. I’m stating that, for my purposes and knowing the factors that have affected our local market well, 4% is what I view as a reasonably conservative number capturing reasonable risk factors to use for further “nominal” appreciation estimation purposes.

So far this has actually proven conservative in my personal real estate decisions despite the plethora of opinions to the contrary on this site over the years, many of which have faded away to be replaced by new voices…. except for patriotz who has only become slightly less negative since he bought 🙂

This doesn’t mean that our local real estate will always be what it is now. There are many government measures that could be brought in to curb appreciation rates, or there could be an earthquake. Interest rates could also stay low for another decade. Make your best estimate and adjust it later if you need to. Otherwise you’ll likely get caught in some sort of analysis paralysis state and your capital will be eroded by inflation. Your life is time limited, also a pretty big factor.

“The joy of providing low cost housing to people who need a place to call home etc.”

‘

‘

‘

I have often wondered about what effect the rise of the amature landlord has had on crowding out potential low income home buyers making it hard or impossible for them to purchase a home. and forcing them to rent. I know quite a few examples of friends of mine who instead of selling their lower priced first home kept it as a rental when they upgraded to a more expensive home. It would be interesting to see the percentage of homes in Victoria that are owner occupied vs rental units.

Not of anything detached or semi detached is my bet.

damn sorry my bad…..

somehow I logged in this morning and it went to “3 day”

I take back the numbers but it is still nuts out there 🙂

Crazy thing is I have listing that people were planning on selling in the spring but have moved up their timeline to “take advantage of the market.”

Which begs the questions will we even have a decent supply in the spring.

Wut? Is my portal broken or is yours? I assume you have restricted it to VREB areas only?

I don’t know about steady….84 pending sales in last 24 hours. Unless my memory is bad that is the highest I’ve ever seen in my career. I don’t remember even seeing >84 within 24 hours in 2016.

I am going to stop even recommending pre-inspections going forward….last two I’ve been involved places ended up with 5+ unconditional offers so you might as well be burning money doing the pre-inspection, unless you are willing to bid above market.

I would say if you isolate for SFHs it is crazier than 2016 right now imo. Obviously condos slower.

My number is 4.8%. I’ve used 4% as a working estimate since I became an owner and in Victoria this has worked. Doesn’t work everywhere.

Who is claiming that? Depends on factors like use of leverage and expected rate of return and what your age/stage is.

Most people hope to do both, but you only have so much money, especially when you are starting out. Saving for a down payment is tough.

Because most people are not motivated to forgo gains to joyfully provide low cost housing to strangers, nor can they afford to do so. Most people would rather donate their time or money in a different manner. If you are at the stage where you can give back and owning low cost housing does it for you that is just fine, although probably not the best way to make a difference given the already widespread availability of low cost rentals in Moncton. I’d rather maximize my returns and provide assistance directly to people in my sphere of influence and to causes I am most interested in in a tax efficient manner.

Sure. This is why I love math. It makes the nonsensical into something understandable.

Deryk: Looking at it from a financial investments perspective, if you only have the capital for the stock market or a house/condo, then many people argue that it’s better to be in the former due to diversification. If you have the means to invest in both, then great! As you touched on, personal finance is personal. We had ~70% of our net worth in our house as equity when we bought it in 2016, because we wanted stability in a SFH. It wasn’t prudent from the numbers, but it fit our life.

Totoro: That gap between median wage and median condo/SFH pushes Victoria RE a further away from fundamentals and more into a speculative asset class. And that tends to add more uncertainty and volatility. Personally I’m bullish on our RE and think it’ll beat inflation, but am compelled to capture that risk/uncertainty when talking about it.

It’s interesting to hear peoples comments on this and that when it comes to real estate. It’s why I keep coming back to House Hunt Victoria!

I’m interested in why people make claims about the stock market being “better” than buying real estate?

Why do they assume that one is always better…. and that you might not be doing both?

I’m also interested in why people will claim that one city is better than another for investing in real estate….. when it might be interesting and possibly more profitable to invest in both.

Why do they assume that it all comes down to a spread sheet and profit when perhaps one might be motivated for other reasons.

The joy of providing low cost housing to people who need a place to call home etc.

Life is complicated and everyone has a different story.

Both linear trendline and moving 10 year average has been decreasing over the decades. Current 10 year avg at about 5% nominal.

Yes.

Sure. Just saying expecting the 7% nominal average derived from a time of partially very high inflation to continue in a world of 2% inflation is likely a misstep. Since you’re using 4% for future we don’t actually disagree. I’d estimate something similar.

Average nominal increases… do you mean unadjusted for the effects of inflation?

Most people don’t apply inflation adjustment to their gains because it is a complex calculation and people already think in today’s dollars anyway regarding actual buying power. I think if you adjust your final gain this way it is valuable for academic discussion and may remove some skew factors for some analysis, but not for comparing investment returns. I do think it is good to know both numbers, but the average nominal increase is the one that is important to me because I look at rate of return on capital as a comparison, not how much is my gain vs. the cost of goods in general.

I’ve already applied a factor of 4% instead of the actual average nominal 60-year return rate of 7% to compensate for any adjustment I would foresee occurring in the market during my hold period. If we adjust this for inflation 7% becomes 3.74% and 4% – well we’ll see what inflation does to that but it is much lower than 7% as an estimation tool.

And, yes, we went from one income to two in the 1980s, but how is an $850k median for a house in the core affordable for the median two-income family earning $80,810 when they only qualify for a mortgage of $425,000 with this income even at today’s very low interest rates?

Again, this is about reasonable estimates. No-one can predict the future of housing accurately as we’ve seen on this blog. If you want to apply a different factor go ahead, but this one seems reasonable to me. We’ll check in again in a decade maybe and see. I think I’ve already been saying this on this blog for 10 years now so during this period it has proven to be a reasonable estimate with gains exceeding 4% by a percent or so only – not hitting 7% for me anyway.

Well this isn’t going in a good direction. New listings very slow, sales steady.

Hasn’t changed much but sure. Will write a month end post first but I’ll redo that one as well.

Yeah makes very little sense to look at average nominal increases in a time period spanning decades of double digit inflation.

Shift from single to dual income households from circa 1960 to 1980.

Rising real wages until about 1980. High inflation circa 1970 to 1980 giving additional boost to nominal wages.

All time greatest fall in interest rates since 1980.

All of the above either impossible or very unlikely to happen again.

Leo, I think it’s time to re-crunch the numbers for real annual appreciation of Victoria SFHs!

https://househuntvictoria.ca/2016/03/17/a-brief-history-of-prices/

Please put it on your to-do list.

It has been 7% over the past 60 years. Things could change, but this seems like a reasonable estimate to me. No-one has a crystal ball so you just need to do the best you can by taking past performance and building in a risk factor and not counting on this return but using it to make a market entry decision.

I wouldn’t be so quick to say that 4% appreciation going forward in Victoria is reasonable, let alone conservative.

Leveraged appreciation here vs. unleveraged appreciation in Moncton is what the scenarios presented below are. And 4% is reasonable and perhaps conservative to apply here, but unreasonable to apply to Moncton imo.

I spent a long time looking at east coast RE about ten years ago as I did a lot of business out there and prices were so low. I’m very happy we bought here.

I’m too young to have gone through the 80s crash and super high rates and I can understand that this may have permanently altered your views.

Yeah RESP is so flexible I don’t see any real risk to using them. Even if your kids don’t end up going to university any trade school they can withdraw it and use it for whatever. Almost no chance to lose the grant in my view

Late 30 RESPs have a risk if your child doesn’t go to school at all but really all that is lost is the grant money. You still were able to accumulate funds in a tax free vehicle. At the end you get your initial investment back tax-free and then you have the option of getting the additional earned amount back taxed or transferred into your RRSP provided you have room. Also if you don’t max it out and you have multiple kids under the plan you can give all the grants to one child (provided they don’t exceed the $7,200) who goes to school.

Limit IS 50K but you only get grants of $7,200 so it stops making sense to contribute after $36,000 (provided you have only put in the matched amount each year).

re: RESP

if your kids end up going to out side of Canada for schooling( U.S.), some of the RESPs cannot be used towards their U.S. Educaiton. JFYI. I did read the fine lines…. what a risky and tricky world we live in 😉

Don’t forget that Federally that the RESP is a tax recovery vehicle as well. When you hit that $2500 contribution the feds toss in $500. As well, as long as you you have an RESP set up and you apply for while the child is between the ages of 6 and 9 there is $1200 of your tax money to get back provincially without even making a contribution of your own. Getting your money back from the government is always one of the investments you make.

I’m reading that there’s a lifetime contribution limit of $50,000 per beneficiary. So I guess Leo’s kids will be studying on terra firma after all.

Yeah, we contribute $210 a month for each kid’s RESP to take full advantage of the free government kick-ins. I guess I just never think of my RESP contributions as being “first” in the hierarchy, although I suppose they are. For me, RESPs and mortgage pay-down are 1a and 1b.

Plus, it feels good.

People often forget the word “personal” in “personal finance.” It’s not only about the math.

You get a gift from the feds for RESP contributions, in addition to the tax shelter. That’s what should make it the first choice for those who qualify. But you can only put in $2500/year, so it’s not like you’re starving other investment vehicles.

versus

Could you keep your foot off the scales please?

Leo, that champagne picture implies that you’re putting most of your disposable income into your kids’ RESPs relative to all other places. Is that what you’re doing? How many hundreds of thousands of dollars does each of your kids need? Are you planning on sending them to university on the moon? 🙂

Purposely go further into debt to invest and enjoy a slight tax advantage? Gosh, no thanks! There’s a couple of levels of risk there that you’re not accounting for, or that you’re comfortable with but I am not.

Fascinating post by Jens on how to properly measure affordability challenges.

https://doodles.mountainmath.ca/blog/2020/09/28/first-time-buyer-lorenz-curves/

No matter how you slice it though, Victoria is the third worst market in the country for affordability

totoro- very good advice, when investing always buy quality, it won’t let you down. Crap is crap, you’ll lose your shirt buying in poorer areas and have sleepless nights. Buying in B.C. 30 years ago was the smartest thing I’ve done in my life, also the easiest money I’ve made. Would I buy now at these prices? No.

The property taxes would be 7k/year on a 250k rental in Moncton. Paying cash and factoring in property management and all expenses you are likely to net somewhere around 10k/year pre-tax with no guarantee of appreciation. Plus good tenants can be hard to find in there because prices are low enough that people with stable lives and jobs buy and the vacancy rate is higher than here.

Here if you have 250k down on a 750k rental home with suite you’ll likely have -500/year and plus 10k after you factor principal paydown pre-tax, but the home will likely appreciate 4%/year reliably which adds $30k pre capital gains to your annual return. This means you are positive on paper only in unrealized gains and equity paydown, but adding 5k each to your taxable income that is going to cost you probably 2k/year each out of pocket until you have owned long enough that rents cover this.

If you need cash flow now ie. you are retired with a short window to invest and looking to supplement income, Moncton might be better but it is not really a great option overall, which is why you don’t see more investment there. I’d be much happier putting the capital in the stock market and withdrawing 4% per year for lower effort and a similar result.

The OP and her husband who are in their 30s and working are going to be way better off staying invested in Victoria. In 20 years the rental homes will likely net about 40k/year each in today’s dollars, or the sale of one rental home will provide a windfall of at least 1 million in today’s dollars for a very comfortable retirement with a government pension. The Moncton property will still be bringing in 10k inflation adjusted and my guess is that it might be worth $300k in today’s dollars.

Wasn’t his proposition that interest rates going up was going to dramatically increase house prices?

Paying off the mortgage on your principal residence also earns you tax free compound interest. You’re always going to come out ahead paying off money you owe to someone rather than lending money to someone.

That’s apples versus apples, mortgage payments versus stocks can work out differently either way.

Annie, If you do end up considering selling, I am happy to look at it/them. With or without a realtor, it is your call. If you decided not to use a realtor by placing ad on classifieds (craigslist / usedvictoria /bc gov Yammer etc) I keep watching on them

.

Thank you everyone for the advice- you’ve given me a lot to think about. We’ll definitely get a spreadsheet going this weekend as we weigh the options. I’ll let you know how it goes if we do end up selling! Much appreciated!

Basically should always be better returns in the market, but interest rates being low in mortgages is signalling the returns will be lower in other investments as well. 3-5% is likely safe, but are likely off the 7-10% returns we’ve been enjoying. Fixed income portion is basically zero these days.

After taking advantage of the COVID downturn very briefly we are back to our old strategy.

?

It is unfortunately. No way to compare active listings over time right now by unit type.

I guess the active listings function is still “broken” lol

Hi Annie, it’s very hard to say what is best for your situation without knowing your story. I like the advice given so far. Things for you to ponder for sure.

Having a number of properties in one of Canada’s best places to live is never a bad idea.

You are young and have different priorities than say someone older. I don’t know if you have or were planning a family but that might make a difference too. Long term thinking is always good.

On the other hand you might want to give some thought to thinking outside the box a bit… if you were not planning to expand your family).

For example: You could sell your two rental units this spring and pay cash for a duplex or two in Moncton NB where you can buy a beautiful older complete duplex in a nice neighbourhood for $250,000.00 (You would get both units for that price.) You can still buy a complete duplex in Moncton for under $170,000.00 but those ones are a bit tired, in a less than perfect neighbourhood and generally need work.

The nice thing about Moncton is that you get fairly good rents. ($1,350.00 plus utilities for each two bedroom unit. )

Sign it over to a property management company and they look after everything. You can keep track of everything through a portal. Everything is recorded and managed. We use Greenlight property management in Moncton.

Moncton is a growing city. It is a crossroads and is changing fast. Arts and culture and building some wonderful amenities like an art center, Hospitals, universities, convention centre etc etc.

Houses there are cheap. Rents are fairly good. City taxes are high. But the costs in general are much lower. Moncton is one of the least expensive cities in Canada which means that it has a lot of room to go up in price. That is starting to happen as incoming immigrants look for places to stay outside of Toronto and Quebec.

Obviously it depends on what you want out of life.

In my opinion, you can’t go wrong in Victoria long term and if you were planning a family then think about the benefits long term for them if you have been able to secure housing for them.

Good luck. You have done so well already…. you don’t need advice:)

Compound interest dudette.

https://www.investopedia.com/terms/c/compoundinterest.asp

Perhaps take 1 or 200k equity out, invest it and then you interest you pay on that is tax deductible.

Use time to your advantage.

Introvert I know you are a very conservative investor but in general – especially with mortgage rates as low as they are – you are better to invest in the market – even a balanced mutual fund would do – for the next 10 years and get you 3-5% return. At that point if you wanted to you could pay it towards your mortgage and be even further ahead.

We use one of our TFSAs as our emergency fund. Instead of maxing out our TFSAs, we’re choosing to max out mortgage pay-down. Once the house is paid off, our income will be greatly freed up allowing us to better take advantage of TFSAs and RRSPs. There’s no rush: if you don’t contribute for a while, your contribution room just continues to grow.

I suppose one could make the argument that by not contributing to TFSAs early and often we’re losing out on the benefits of tax-free compound interest. True, but by paying off our mortgage quickly we’re saving ourselves hundreds of thousands in mortgage interest — and that’s the play that we’re personally most comfortable with.

I hope people don’t use their TFSA’s as an emergency fund to keep cash. It’s such a flexible tool and it being tax free gains it should be maximized before any other asset (especially if it is eliminated in the upcoming budget for future contributions). Too many people have under performing TFSAs or none at all. It can be structured for almost any investment or combination of investments from bonds, mutual funds, ETFs, etc… or you can even day trade out of it if you are so inclined. Did I mention it is tax free gains!!! It should be the investment and savings vehicle people use before any other and max it out every year and then look to put money somewhere else after. If it is just used as a savings account and money is taken in and out of it, it is such a waste and just allows the bank to earn off your money while paying an extremely low interest rate for many years to come.

Yes. With 70% equity get a line of credit. You never need to use it if you don’t need it. Never ever sell during a downturn whether it is stocks or RE. Keep another emergency fund in your TFSA to back up the line of credit if you are stressed by the idea of using a line of credit.

I’m super old-fashioned — I have cash set aside in a bank account as my emergency fund.

Yes there is but the point is that different assets have different risks and by diversifying your assets you reduce your overall risk. Put it all into one heavily leveraged asset class and you can lose it all if things don’t go your way.

Put it all into RE and you might not get anything out of selling during a downturn. You shouldn’t depend on volatile assets such as stocks or RE for emergency funds.

Wilkinson promises to eliminate the PST for one year

https://vancouversun.com/news/politics/bc-election/wilkinson-promises-to-eliminate-the-pst-for-one-year

This proposal will go over big at the yacht club.

30 $2M+ house sales so far. All time record. Median price down a bit from August, but avg at all time record due to high end explosion. $1.12M for Greater Victoria.

Yeah, some 60% higher than the long term average for September. I think it will be the last record month though, October 1992 was 836 sales. Might be close.

Just like with any investment there is a risk. There is also a risk in putting your money in the bank and having inflation erode the value or putting it in the stock market and having to sell during a downturn or not making the gains you think you will as many investors can attest to over the years.

I have considered all sorts of investments and, in my view, real estate in Victoria is a good one if you are in the position you are – with your costs almost covered and with presumably a fairly good family income to have qualified for those mortgages in the first place. It is not a good investment for those who need rental income for their own cash flow needs because the buy in price here is too high vs rents. The more money you have to put down to generate cash flow the lower your overall ROI and the less the additional stress cost of being a landlord is likely to be worthwhile.

The things that are going to get in your way in my experience are:

863 sales as of this morning….will easily clear the previous record of 902 set in 1992. Third record setting month in a row.

+1….you could buy a couple of emergency years with this approach, not just 6 months you have saved.

Great suggestion by totoro to make use of that RRSP contribution room to cover the capital gains from selling one of the rental properties.

As things stand you are currently betting your future on continued RE appreciation and low interest rates. That might happen but it might not. By the time I was 40 I was a debt free homeowner and current on my RRSP. You could be too.

If your husband is feeling really stressed that may be enough reason to sell, but financially it is likely to be much better to hold longer-term given you are still in your 30s and working. I agree covid is causing and will cause some hardship, but housing is a core need.

I’d do the math with your husband. Consider the amount each of these properties has appreciated since purchase and the amount you annually pay down in equity on the mortgages that is paid for via rents. If your rents are almost covering your costs you are likely not paying that much in tax each year on the equity paydown amount so they are not a big tax burden.

Once you determine your rate of return you will find that you have likely made $50k/year or more in unrealized gains on each property you own. Hard to match that on your initial down payment amount anywhere else. No guarantee prices will continue to go up short term so you’d need to feel comfortable with holding through a possible downturn if you don’t sell in the spring. I would project forward ten years using a conservative 4% return in appreciation plus the equity paydown amount to determine what holding vs. selling looks like for your financial position – factor in what you would otherwise invest in if you sell as well.

If the math doesn’t persuade your husband, calculate the capital gain you will need to claim if you sell so you know what your top marginal tax rate will be and determine if you have RSP room available to cover this increase. If you don’t maybe defer the sale and plan for this if you can.

I’d also get a line of credit attached to your primary residence home equity to deal with repairs and vacancies/issues on the rentals – the interest will be tax deductible if you need to use it and with 70% equity this may work well and alleviate some fears of weathering the unknown like interest rate increases and economic downturns.

I don’t know whether it’s my luck or what but I would say 80% of the transactions I’ve done this year would not come together if buyer and seller attempted to do so off market without realtors. The majority of deals have been so incredibly challenging that I am spending more time counseling clients and talking them off a cliff than anything else. Buyers can’t see themselves and in the sellers shoes whatsoever and visca versa.

I would say 10 years ago 50% of my transactions would come together without realtors involved, but people have become more entitled and crazier in the last 10 yrs imo.

I would say only 1/3 of my clients are easy going, logical and non-emotional and I feel like to put a private deal together the buyer and seller in the same boat and 1/3 x 1/3 is only 1/9.

I do think realtors are overpaid imo but there is some need for middle people too.

Annie, if I were in your shoes, I’d sell one of the two rentals and be mortgage-free on my principal residence.

Thanks Leo yeah not a whole lot of other savings except for RESPs for kids. We do have emergency savings to cover 6 months living costs…

Hey Annie. Without giving advice, some thoughts:

What would you do? My husband and I own two rental properties in the core (SFDs in Fernwood & Esquimalt). We’ve owned them since 2014 & 2016. Both are fully rented and just about cover costs (though large items like roofs, etc. will need to be financed over the years). We have probably about 40% equity in each / 60% debt. We also own our own house with about 70% equity/ 30% debt. We are in our late 30s. My husband wants to sell the rental property in Esquimalt next spring – he feels over leveraged and worried about the economy re: COVID, etc. I’m thinking we should just hang on as the rentals were always meant to be long term investments. We have no other debt and I’m a long term government employee. Without knowing our complete scenario- which way would you go?

I am a bit surprised that people generally don’t buy a house from a sale by owner. I’ve done it several times and it is so easy and straight forward. We simply have our lawyers do everything. Saves a ton of money. We have also used a realtor and had quite good experiences. We have one agent that we trust completely). But I still feel that the industry is ready for a game changer. My biggest complaint is that agents tend to make everything more complicated. More paperwork and so one ball or another gets dropped. My advice is Keep it simple.

The other problem I run into is that agents tend to pitch the buyer and the seller against each other. So you end up with one of those “specially held” , timely calulated meetings, where the big “Bombshell” that…. “guess what…. our clients love your house but I’m sorry…we found lead paint in your one hundred year old house, and so we will have to reflect that in the offer.” This is the kind of bullshit I can’t stand and drives me away from dealing with agents. Honestly…lead paint found in a one hundred year old house! We ended up selling the house to the people anyway but they will never know just how close we came to taking it off the market and the agents that try and operate that way don’t realize that you will never do business with them again.

More on the condo conundrum… This time from the Vancouver view instead of Toronto.

https://www.cbc.ca/news/canada/british-columbia/bc-condo-market-pandemic-1.5740269

If the spec tax does go away after the election and the price of SFD still remains extreme, I just might have to consider purchasing multiple condos if prices soften on condos in prime areas. However, with everything Covid-19, who knows…….

CMHC wanted feds to force stricter mortgage rules across the industry

https://financialpost.com/real-estate/mortgages/cmhc-worried-about-excessive-household-debt-wanted-tighter-mortgage-rules-for-competitors

@Ks112

I think you’re generally correct that the 750k-1.5 million market has seen the most increase, but there are also some examples of healthy, but less consistent, appreciation in the 2+ million market. But if the narrowing of the price gap between the average house vs luxury house escalates, it would mean there is more ‘value’ in buying the luxury house and potential long term return (say >20 years). That’s why I’m happy to have bought 1/2 acre in the core and will hold until the true value of my dirt is realized in >20 years. At that time, I will either sub-divide the crap out of it Or sell it as a rare find at a healthy gain.

Barrister, I think there have been quite a few posts of recent $2M sales that haven’t really moved from 2012 prices. Like Marko said, it’s the 500k 50 year old GH boxes that has enjoyed the boom the most.

I have been following the over 2 mil market and I am amazed at not only how many have sold but also what is selling for over 2 mil.

It’s one of the government’s most popular policies, so I guess you have to give him credit for sticking with his stand. But I think he’ll avoid saying it at the yacht club this time.

https://www.nsnews.com/news/liberal-leader-andrew-wilkinson-pans-speculation-tax-at-west-van-yacht-club-chat-1.23664125

Assets typically tank when the majority thinks everything is going great. The next 18 month will be interesting! It’s almost a self fulfilling prophecy.

Battles at the policy level..

From: https://financialpost.com/real-estate/mortgages/cmhc-worried-about-excessive-household-debt-wanted-tighter-mortgage-rules-for-competitors

It is still extremely odd that a government backed crown corporation competes with other insurers for high ratio mortgages and restricts what they back in their portfolio based on risk, but the government also guarantees the majority of the risk the private insurers take on that it’s own crown corporation will not accept on their books.

Thanks Marko. What is considered a reasonable fee these days? I’m seeing between $700 and $1,200.

Liberals’ Wilkinson would scrap speculation tax

https://vancouversun.com/news/politics/bc-election/wilkinson-to-scrap-speculation-tax-horgan-defends-housing-policies

Month to date new lists in Greater Victoria:

Single family: 373, up 14% from same period last year

Townhouse: 93, down 2%

Condo: 303, up 55%

Sales:

Single family: 299, up 89%

Townhouse: 66, up 83%

Condos: 181, up 32%

I can’t compare active listings because the stats module is broken. They’re working on fixing it.

Seems a few more SFD have started creeping on to the market the last couple of days…

If you want someone that is reasonable on fees -> https://realestatelawyervictoria.com/

Thanks Leo and Sarah.

You can use a markup language called markdown on the forum. So for quotes you put a > symbol before hand.

here’s a link to a small markdown cheatsheet:

https://duckduckgo.com/?t=ffab&q=markdown+cheat+sheet&ia=answer&iax=1

We used Mullin DeMeo Wirk too. They were great.

How do I make the fancy quotes? I’m the most computer-illiterate millennial, I swear.

Happy Friday Folks!

Halloween and Covid-19

I like Mullin DeMeo https://www.realestatelawvictoria.com/

Can anyone recommend a good real estate lawyer?

Cheers.

Thinking of switching VPN providers because the one I’m using bills in USD.

Any recommendations?

I’ve had thoughts along these lines myself. But instead of not paying taxes, I was thinking government should fully institute $10-a-day daycare tomorrow instead of over the next 10 years. There would literally be no better time to implement affordable childcare than right now.

Yeah, I just can’t imagine a big enough evaporation in demand to move the detached market from an strong sellers market to a buyers market bad enough to drop prices much. Certainly not by 2021. Condo market maybe.

But CERB is getting a 1 year extension for all intents and purposes. Who knows maybe they’ll come up with a plan to extend deferrals for a year too. Makes you think, since money doesn’t matter anymore, can we skip paying taxes this year? Just print another few hundred billion. Go big or go home I say.

“ Year to date average for single family is $957,000. A 7% decline if it happened would be to $890,000. 2019 value was $878,000”

Seen a lot of these reports lately, but with MOI sitting at 3 (lower for SFH), it would take a monumental shift in sales and/or listings per Leo’s wonderful graphic – above – to prove these reports true.

Market manipulation? Ignorance? Rubbish.

As someone who recently bought a home, maybe that’s wishful thinking… but it’s my 2 cents

Victoria RE is the Little Engine That Could.

My sympathies to anyone who, over the years, has been permanently priced-out due to simple lack of money. No sympathy for anyone who could have bought at any point in the past but didn’t because they thought the market would tank and now are priced-out.

Year to date average for single family is $957,000. A 7% decline if it happened would be to $890,000. 2019 value was $878,000

Good first meeting of the saanich housing task force. Lots of very sensible voices on there.

Darren was good. They had some other good agents that are no longer with the company.

I used 1% both when buying and selling. The realtors name was Darren Chamish, I believe he moved to Toronto. I actually found the company to be very good in both cases and I would recommend them as I had absolutely no problems at all. I have heard one of their realtors had some problems and lost his licence but I can’t say for sure if the rumours are true.

“In case you’ve seen the Gambler (warning: profanity and lots of it): https://www.youtube.com/watch?v=xdfeXqHFmPI

And JL Collins’ remake with slightly different advice: https://www.youtube.com/watch?v=eikbQPldhPY”

”

”

”

I did exactly that over 5 years ago, same discussion with my old boss and had a great laugh. After 3 years away I got a little bored with the prospect of 40 to 50 years ahead of me and went back to a lower stress but still fairly high paying job and couldn’t be happier, still in the FU position and loving life

Has anyone used One Percent Realty in Victoria? Any downsides? Would buyers’ agents avoid listings using this commission structure?

Also lowest price/income of major cities. Adds up to most sustainable prices.

Certainly not one where properties with more elbow room are more affordable.

Leo, start filing these institutional predictions away and then revisit them in 1-2 years, and give us a write-up on how accurate they ended up being. That would be amazing.

So the Moody’s forecast for declining prices.. https://www.rpsrealsolutions.com/documents//en/house-price-forecasts/RPS-MA%20Canada%20Housing%20Outlook%200920.pdf

Project 7% decline, bottom around mid or late 2021

The expect condos and single family to both decline ~6.5% in 2021. I’d be surprised if condos weren’t substantially weaker than detached (whatever the change in prices is).

Worst decline in Calgary/Edmonton at -10%. Vancouver forecast at -7%. Ottawa the outlier at -3%.

“The pandemic has boosted demand for properties offering more space for working from home and fewer shared areas with neighbors. Smaller markets where such properties are more affordable will particularly benefit from this trend.”

Not sure if we are a smaller market, and it’s not clear what factors lead to their conclusion that Ottawa will have a much smaller decline.

More gov’t employment perhaps.

In case you’ve seen the Gambler (warning: profanity and lots of it): https://www.youtube.com/watch?v=xdfeXqHFmPI

And JL Collins’ remake with slightly different advice: https://www.youtube.com/watch?v=eikbQPldhPY

Unfortunately not. No bathroom so it’s not a dwelling, and wouldn’t meet code even if it had one. But there is some wording about considering modular housing forms in the garden suite regs. Not sure how that will work, but would still have to be fully code compliant.

Would one of those meet Saanich’s legal garden suite requirements? I bet you could get $1500/month rent.

So are you gonna be taxed much when you withdraw (in retirement) the millions you’ve got stashed in your PRECs and Holdcos?

A low-fee realtor is probably the way I’ll eventually go. Also, who knows what disruptions and changes might happen in the RE buying/selling space over the next 20 years.

Very interesting.

I have 5 years left tops 🙂

Great, Marko, I’ll call you in 20-25 years when I want to sell. But I suspect by then you will be long retired and lounging on your 100-foot yacht on the Adriatic.

Most buyers are represented. It will be their realtors you are dealing with and it will just be answering questions by email for the most part and offers are sent by email too. I’ve found buyers realtors to be pretty easy to deal with for the most part.

An unrepresented buyer will be more work in that you will have to be present for any showing, but you will potentially save or split the buyer’s commission as well.

As for introversion, if you are so introverted that 15-30k in savings can’t conquer it I would use a low fee realtor or have a more extroverted friend or family member do the showing while directing the buyer to ask questions they can’t answer by email. Most of these answers should already be available in a write up you do on the property and the PDF you fill in.

We’ve saved well over 100k in commissions over the years doing this. It has gotten a lot easier to sell without a realtor with the flat fee listing services.

I wasn’t familiar with investing but I ran BNN in the background for a few months about 15 years ago and that is all I needed. Set up my own TD Waterhouse Account and have outperformed the market (I’ll admit, by luck) however I’ve saved close to 6 figures in MER fees. That isn’t luck or high level intelligence, just a bit of simple common sense.

Goodness gracious, no. Can’t say that I’ll live in Victoria forever, but I can say that if I move back to Alberta something has gone horribly wrong in my life. I’m in love with B.C.

With my full service business I reject listings all the time (too far of a drive, difficult to sell, etc.) and I’ll take a discount if it I think it is worth it (i.e. box in Gordon Head or nice house in Oaklands area of course I am willing to offer a discount).

This also depends on my workload. If I have a bunch of listings coming up and a crop of ready to go buyers I am less likely to negotiate down on the commission versus if I have absolutely nothing going on.

What has absolutely made no sense to me is how is it possible that the ABSOLUTE commission on a 1970s box in Colwood is so much less than a commission on a 1970s box in Gordon Head which is way easier to sell (no septic tank to deal with etc.).

I could be wrong but I feel like most realtors would take someone up on a reasonable lower-commission service (so that’s maybe one or two negotiations a seller has to do to find a realtor), whereas FSBO means you’re basically talking to, and negotiating with, possibly dozens of prospective buyers — which makes introverts like me recoil just a tad.

Yup, but in my case I’d be looking for more service than the “mere posting + I do the rest” plan.

Good to know that it has been done successfully.

This sounds like a great idea.

Although FSBO = maximum savings for the seller, it means you’re still doing a fair amount of very unfamiliar work, which doesn’t sit well with me.

Therefore, something like what Former Landlord described above is what I would call the sweet spot: the realtor is still handling everything, but you feel good because you saved $10K and 99% of people don’t.

This is cool: https://beehomenow.com/products/survive

Alberta calls!

In the end, everything, including commission is negotiable. But one wonders, if you don’t want to deal with the FSBO process whether you will want to negotiate about this. Could just use one that offers it up front

I like Marko’s strategy below.

Yup, I had mere posting sellers do this. It’s so simple but people in society generally don’t like to think or do research.

i/ mere post your home with professional photos and a floorplan assuming your floorplan is half decent. If the floorplan sucks you can probably skip it.

ii/ offer a decent cooperating commission

iii/ list on Thursday or Friday takes offers Sunday or Monday night.

iv/ whichever offer you accept add a “subject to seller’s lawyer review clause….” for three business days. Have your lawyer take a look if you are worried you missed something.

Easy way to save 15k tax fee +/-.

That being said demand for mere posting has dropped in the last 10 yrs to the point I am not even bothering to offer them anymore.

My observation is people are just too dumb to understand an extremely basic concept which is the market sets the price so they pay higher commission rates because somehow they think that paying a higher commission will lead to a higher sale price.

It’s why people pay 2% MERs…..once again too dumb to understand that on average the market cannot be outperformed.

I pay $150/month and $250/transaction to the brokerage. In reality not that much goes to the brokerage.

As totoro pointed out, legal issues regarding conditions really don’t have anything to do with whether you have a realtor or not . Conditions are between the would-be buyer and the seller. Realtors cannot give legal advice – lawyers do.

Frank: I never had a problem suing people.

I think it is a bit unfair to expect a full service realtor working for a brokerage to whom they have to pay part of their commission to work for vastly less. Plus they need to offer a commission split to buyer’s agents and this is part of their brokerage contract.

There are many realtors that advertise lower than standard commissions, just go with one of those.

If you feel like you can handle things yourself just use a flat fee to get on realtor.ca and you’ll have access to the forms too.

On our home sale we negotiated a fixed price with selling agent. A certain amount up front and a fee per month for each month it was listed and the a certain amount on close of the sale. This way the agent was guaranteed money for the work he put in even if we decided to delist the property or switch to a different agent. We still offered the buyers’ agent full commission to prevent them from steering their clients away from our property.

We saved almost 10k on commission this way.

Nope, just thinking ahead!

I feel like the sweet spot would be to get a competent realtor to do all the work, but pay him/her vastly less than is typical for the same transaction.

Not sure if that’s realistic. Mind you, Leo and Marko have no incentive to tell us that it is, if it is.

Introvert you skipping town?

What if you have a drop-dead easy-to-sell house in Gordon Head, right now, in this market, and the asking price you’re willing to go with is completely reasonable. Do you think you could persuade a good, not-very-desperate realtor to take you on with full service at half the regular amount realtors typically charge (so $15K instead of $30K, or whatever)?

Sure. Just underlist it on MLS and set a fixed date to review offers. In some ways the private seller can have an advantage because the board and many brokerages cracked down on the procedure for multiple offer situations after the chaos of 2016 with strict rules about notifying agents about specific things in the offer process to make it more fair. A private seller wouldn’t be bound by those and could negotiate as they saw fit.

I don’t tend to see it in FSBOs, but can’t say I’ve specifically looked. Maybe too stressful for most people (does raise the risk of screwing up and/or buyer getting cold feet if not unconditional), but if you want the thing gone fast it’s not a bad strategy. Not sure if there is systematic evidence of it actually raising price, but I’ve seen some crazy sales in ultra-hot markets like 2016 that seemed well over market value.

In the Victoria context, do you think a FSBO could manufacture a multiple-offer/bidding war situation, the way realtors can, when market conditions are right?

Do bidding wars ever happen with FSBO?

My theory about that is that when prices have risen then people don’t mind the realtor commission. Who cares about $30k when your house went up $400k. It’s just not the same as actually working a few months for that money.

In eastern markets where prices haven’t appreciated as much there is a huge market share in for sale by owner.

All this talk of lawyers, subject-to clauses, timing, law suits, etc., is why most people just say, Fuck it, I’m going to give the realtor $30K just get it all done and not screw it up, so that I don’t have to deal with any hassles or risk.

At the same time, everyone feels like $30K is about $27K too much to give to a realtor for the amount of work actually being performed.

It sucks.

The new CMHC housing assessments were amusing. No evidence of overvaluation in Toronto even though the CMHC insists that the 9-18% drop is coming.

Which is it? I don’t envy the CMHC analysts trying to mash their models into saying something that doesn’t contradict what they said before.

Why not just be honest and say this is a totally unprecedented situation that the models aren’t built for, instead of continuing to insist there is certainty where there is none?

Cool. I’m also still waiting for CMHC’s predicted 9-18% drop.

Leo, how are the drops looking so far? 🙂

Fresh off the press.

https://financialpost.com/real-estate/mortgages/home-prices-to-drop-new-report-predicts-and-even-toronto-and-vancouver-wont-be-immune/wcm/584e706a-4bbc-4b34-9b3e-635f887c3deb/amp/

Number of subject to clauses isn’t really as important as the lenght of the clauses. Personally I would way rather take 10 subject to clauses for three days than a financing clause for 10 days.

Financing clause is a great one for bailing on deals in event of cold feet or similar. Reason being it is written in such a manner that you as the buyer have to be happy with the rate, terms, etc. If you make your offer only subject to inspection than you could potentially have a problem on your hands if you bail, but you did not actually perform an inspection.

The ability to walk based on cold feet with a lot of subject to clauses such as financing is why sellers take a lot less money on average for unconditional offers.

Plus the more subject to clauses you have in this market the less likely you are to get to an accepted offer. Have the lawyer review before you make the offer.

Leo is talking about breaching a contract after you go unconditional. If you have a subject to lawyer’s review and you remove that condition and then fail to complete that subject won’t help you as it has been removed.

To avoid the bad move, always add one subject to lawyers’ review to your offer( attn. sellers when you get those offers).

to buyers, if you are not using a realtor, you better talk to your lawyer before presenting your offers to them( cost about 300-500 dollars)

Very low barrier to suing someone. $200 for $35,000 in small claims.

As for deposit, it’s not 100% that it is forfeited automatically if the deal doesn’t go through. Could still be challenged on both sides. Consult a lawyer, but breaking a contract is almost always a bad move.

I’ve bought 3 properties privately, prior to them going on the market, never had to prove financing in place. Most people would keep the deposit and move on. Suing someone is so much fun.

I am familiar with the market in Parksville/Qualicum. Prices have skyrocketed and there are competing out of town offers on many properties. Realtors are setting up properties for bidding wars, as they are here now, with offers accepted until a certain date instead of first accepted offer.

Hot take: the “fantasy” economy will continue however long it takes to restore a “real” economy; there will be minimal-to-no consequences for all this spending, despite the worries of conservatives; and Victoria real estate gonna keep doing what it do.

Interesting story out of the Big Suck today.

https://financialpost.com/real-estate/mortgages/toronto-condo-dwellers-flock-to-exurbs-creating-domino-effect-across-southern-ontario-real-estate

I know I keep seeing many condos popping up for sale here in Victoria on a more frequent basis. It will be interesting see if similar patterns occur out here. I know there have been discussions about affordability eroding north of the Malahat.

Thanks for that example, totoro. That was fantastic — my favourite part was the $133 for hot tub chemicals the guy added to his $300,000 claim. The judge was like, Sure.

CEWS wage subsidies for employers to be extended to next summer.

The fantasy economy will continue longer than expected. No one has a way to predict the outcome of all this.

They are all the same re. law, just details different. Here is an example where the buyer was ordered to pay 360k to the seller when they backed out: https://www.bccourts.ca/jdb-txt/sc/17/13/2017BCSC1361.htm

Interesting. How does one look these up?

And they will almost certainly win. Plenty of cases of breach of contract when buyers back out or can’t complete you can look up. Usually goes very badly for the buyer.

Nothing really shocking about it. And I doubt anyone took you at your word because you likely had a binding written contract with terms of payment and responsibility for financing clearly spelled out. This document would have been used to make the offer. The conveyance a few days before sale is just to deal with the transfer and registration of interests on title.

When you sign that contract and don’t make it contingent on financing or remove that condition you are responsible to pay. The realtors have no liability for this.

That means if you can’t qualify for financing the buyer can sue you for the difference between what your accepted non-contingent offer was and what they eventually sell for, plus any other damages they have like scheduled moving costs, mortgage fees, or bridge financing or other costs if the seller has already made an accepted offer on another property.

“The main advantage to using a real estate agent is that it is both agents responsibility to qualify that the buyer’s financing is in place before the sold sign goes on. When selling a property privately, you receive a deposit, but no assurance that the buyer has the funds to close the deal.,”

We bought our first house a few months ago and were shocked that everyone just took us at our word that we could secure a mortgage. We didn’t have to prove anything until we signed documents with the lawyer, two days before moving in!

It is the same whether you sell privately or use a realtor if the sale is subject to buyer financing. The buyer confirms subject removal in either case.

In markets such as the stock market, the salepersons (i.e. brokerages) are not in control of the information that buyers need to evaluate their purchases. That’s the difference.

The main advantage to using a real estate agent is that it is both agents responsibility to qualify that the buyer’s financing is in place before the sold sign goes on. When selling a property privately, you receive a deposit, but no assurance that the buyer has the funds to close the deal.,

Do you know of a market where a salesperson would present information to hurt his chances of selling for the highest possible price?

Guess Michael was right when he said 2018/19 slowdown was just mid cycle weakness

Solar pricing has dropped a lot lately. Installed annualized return now around 3%, roughly double from when I did the calculations 3 years ago: https://househuntvictoria.ca/2017/10/28/solar-power-does-it-make-sense-in-victoria/

I always wondered where info went.

Now we know… CMHC.

CMHC still sees weakness for real estate market ahead

my agent trust me wont go to other agent when I buy. that’s another issue that no agent would want to get played by wasting their efforts sending out those docs without that sense of trust.

Wow!

I would prolly do this, tbh.

This happens to me too! Bad website.

Just a spirited discussion on differing perspectives. No need to cast aspersions, it really doesn’t add to the points you are attempting to make. When monopolies are created intentionally or not, their functioning tends to support the practice of the continuation of that monopoly to the benefit of those vested in that monopoly. Not matter how ethical or altruistic those participating and benefiting may be, the actions and practices of that monopoly tend to the detriment of those not vested or participating. As much as one might attempt private direct sales via used Victoria or Craigslist, those really aren’t viable markets for real estate transactions, in part because of how the real estate cartel functions. Mostly, it is just reminiscent of the music industry fighting online, and taxi’s fighting Uber… Instead of adapting and leading consumer demand, it seems to be a fight to keep the same mechanisms of control. In the end, that fight for control by the existing industry structures cause more by the distraction of trying maintain the current structure instead of figuring out what the next business model will look like.

The sites would have to license the RETS data feed directly from each board. I had the license for the VREB for a couple years and could query it (SQL-like) for any info back to ~1990. Built a custom dashboard tool based on that but I let the license lapse this year because I wasn’t doing much with the product. I don’t think the board could realistically refuse to provide the data to a licensed agent or business in town with VREB member clients given the competition board ruling.

Where do they get that info Leo? Doesn’t seem like it’s provided from info that you get from CREA’s api.

Decision by the local board on what inf to provide.

I am in Rossland at the moment I just realised the sales history is on all the listings here. This should be automatic, why do some areas include it and others don’t?

ISP is Teksavvy perhaps?

It’s already available on Zealty and other sites in Canada. Just no one has bothered to add our backwoods market

I am pro sales history being available to the public.

For the last time Home Depot I don’t want my store to be set to Vancouver Cambie!!

I’m fine with navigating the system as a buyer but it would be helpful to have the same info publicly available online.

In the US, it’s been a decade already since data on individual real estate transactions was made widely available to the public. Buyers can access a lot of information about a home online. In the US you can access sold history, price per square foot, property taxes, Homeowner’s Association fees (if applicable), among other information on free websites such as Zillow and Redfin which are not controlled by the real estate board. Would mean that realtors would have to field fewer requests for information as well.

I don’t think the PDS should be publicly available, that is private information.

IP geolocation is often wrong. I just looked up my own and got Victoria, Duncan and Chatham Ontario from different services. Other sites often think I’m in Vancouver.

And away we go….

https://www.theglobeandmail.com/canada/article-horgan-calls-snap-bc-provincial-election-for-oct-24/

Would be nice to have this all online and transparent I agree. Open bidding for houses a la eBay. But in the end this is private property being sold by private owners. You could make it a requirement to use some online platform for agents, but any seller can simply chose not to use it, and hide details of offers, etc. Just like if you’re selling something on usedvic there’s no requirement to deal fairly and transparently with the buyers. If regulations are enacted to force agents to do things not in the interest of the seller then sellers will go their own route.

I suppose you could look for a go getter agent with enough time that will automatically send you all the docs whenever you favourite something in the portal. The buyer’s agent is the one working for you. I don’t think the system is deliberately designed to disadvantage buyers.

sigh…..the content on this blog is beyond delusional at times. Yes, the system is somehow set up to completely quash the concept of supply and demand.

This year my business has been 50% buyers/50% sellers. Does it suck sending 10 showings requests and 8 have an accepted offer? Yes. Does not mean I am compromising my seller client because I am annoyed at how things work when I represent my buyer clients. Fundamental reason it is this way is so many offers collapse and from my 10+ years in the business the number one reason for collapse is cold feet on part of the buyer.

And if you are annoyed with MLS just put an ad on usedvictoria that you are looking to buy privately. Find a seller that is willing to sell to you at fair market value and split the 40k commission with him or her. Simple enough and you don’t have to deal with a faulty mechanism. Good luck.

Ahh, that’s the problem, it’s a market that is engineered and manipulated to the sole benefit of the seller by the presentation of the information. As well, by the realtor to for the development of leads for the next possible sale (Not really in the buyers interest either). My point is, as a buyer, I do not want to reach out on a property that already has offers (a waste of my time) and I have no interest on competing up the cost on someone else (look at all the interest, let’s cancel and relist at a higher price).

Courts are public institutions, the information is public via the court records as well, title splits , receiverships, contractor liens and etc really assist in developing what a value offer will be for a buyer or if it is best to wait and let the courts sort it out and make the schedule offer at the court hearing instead of paying the higher price on market. But it’s understandable for a the people that benefit from the higher possible price wanting extra steps to gain access to this information.

Can you clarify the send to the municipality? Is this looking to get neighbour in trouble? I am just not sure on the context. For me, as I buyer it allows me to rule out a certain price point on a property if I know in advance if there’s going to 20k needed on a septic, 10k on a roof or whatever might be needed for an asbestos remediation or buried oil tank removal. Things that I may consider a much lower price, but maybe not a list price.

Or are we getting ready to admit that the realtor mechanism for the sale of a property just doesn’t support the interests of the buyer at all……

Yes, pay $15 to pull a title each time.

There are properties I list that have over 2,000 auto search emails registered when there may be only 5-10 serious buyers for that home. Why give access to 1990-1995 random people. They can pull the title if they are too lazy to email their realtor.

80% of my job is a complete waste so sending a title here and there is really insignificant in the grand scheme of things.

Same with PDS…..do you know how many people have no lives and would just collect the PDSs if they were available in the autosearch and send them into the municipality all day long?

It already is. https://www.ltsa.ca/

I personally think posting that a property has an accepted offer in the M2M notes is a dumb practice if you are truly working for the seller and the best interests of the seller. My preference is not to post that there is an accepted offer and that way I have a spreadsheet of everyone who expresses interest if the accepted offer collapses (which is common). If I post, there is an accepted offer impossible to know who and how many people are interested as they simply won’t reach out in the first place.

Yes, annoying for the buyers and the buyer’s agent but sellers are paying 20-30-40k to have their places sold. Might as well put in some work for their best interest if you are the listing agent.

As far as title, etc., I personally don’t think that should be public information. There is all sorts of stuff on titles like family court judgements, etc.

This is kind of what makes the portal view for clients irritating vs. the realtor view of the portal in addition to not being able to view the transaction history, title docs, and additional docs that get hung up there on the the realtor view portal. The delay of seeing pending offers on the client view is irritating. Do realtors actually like answering questions for clients they could just easily view on a webpage? I have had it happen several times where I ask the realtor about the property on the portal just to have them say it has an an accepted offer… But it still takes another week or so to show up on the client view of the portal. It just seems like a waste of time that does not have to be happening. This may not get updated in the price\sale field in a speedy manner, but I imagine it would be in the M2M notes…..

StatsCan says there are about 12,000 households in Victoria CMA with an income >= $150K. They also say there are about 90,000 people with a bachelor’s degree or better.

In fact the territory of the REBGV extends south only to the Fraser River, except for RIchmond and South Delta, and north of the Fraser it extends east to Maple Ridge. It does go north to Whistler and the Sunshine Coast, but that’s a small piece of the market. I would think that the MLS HPI for Vancouver used in the graph above is from REBGV.

https://twitter.com/xelan_gta/status/1307882176982257664

I’ve never had so many potential buyers reach out to me about moving to Victoria in October/November from other parts of Canada. Trying to encourage everyone to rent first versus getting into these insane bidding wars.

The 17 offer home yesterday ended up with 20 in total.

I think we are in for a record breaking October as well.

I’m seeing the supply side of the argument pick up again. So many people with a horse in this race making predictions: CMHC, Realtors, Brokers, Provincial Govs, Cities.

As a new home buyer it’s a pretty easy decision. If you have a job and a family income (dual) of $150k or more (which is fairly attainable if you went to Uni) you can borrow about $1mm. Although there’s been lots of arguments for “building up” the housing type is brutal and unliveable. The condos have gotten smaller and more expensive. What does a 2 bedroom condo cost now… $800k min? For that price it’s a no brainer to buy your own dirt and get more space at the same time.

I’m really disappointed in NA health organizations and the WHO. They failed to follow the precautionary principle despite lots of preliminary evidence on covid transmission pointing to it being airborne – plus China officially announced this was the case on Feb 20. Anyone who read the studies done in Asia early on would have know this was likely, and that is their job – not to wait for proof through studies in the midst of a pandemic. Now the CDC has changed its message to state that Covid spreads primarily via airborne droplets which are inhaled, not through touching infected surfaces, although that can happen too. This means that masks and indoor air exchange are important this fall.

https://ca.yahoo.com/news/cdc-says-coronavirus-spreads-mainly-034950288.html

a relative moved from w 16th area to yyj in 2016, got herself 4 houses ( 2 of them have waterfront in Gordon Head area here in YYJ, all rented out)….she still works in academia and come to this island more often than ever recently…. however, she recently told me that regrettably sold her place at the first place and it’s just not Vancouver and there is no way for her to get back to PointGrey any more. I told her should be grateful for thing she’s got 😉

This does make good sense. One point I would like to make though is when comparing Greater Vancouver prices to Victoria. There is a huge difference to what you are comparing. “Greater Vancouver” includes Bowen island and pretty well all the way out to Chilliwack. If you compare the inner core of the two cities then there is a “massive” difference to the prices. (This is something that I have found fascinating being from Vancouver.)

Anyone with a modest home in Kitsilano on Vancouver’s west side for example, can buy three modest houses on small lots in Fernwood. That’s a huge difference and it’s why I predicted a few years ago that Victoria prices had a long way to rise…. back when you could buy a house in Fernwood for $400 thousand or less. (It’s why, in 2012, our family bought three new houses in Sooke, each with a legal suite, when they were under $375,000.00. (Eight years later, they are now around $650,000.00

At the time I was told that you can’t compare Vancouver to Victoria. I agreed with that, but my point was that Vancouver would clearly have a “huge” influence on the prices in Victoria.