Sales hit yearly high and continue to break records

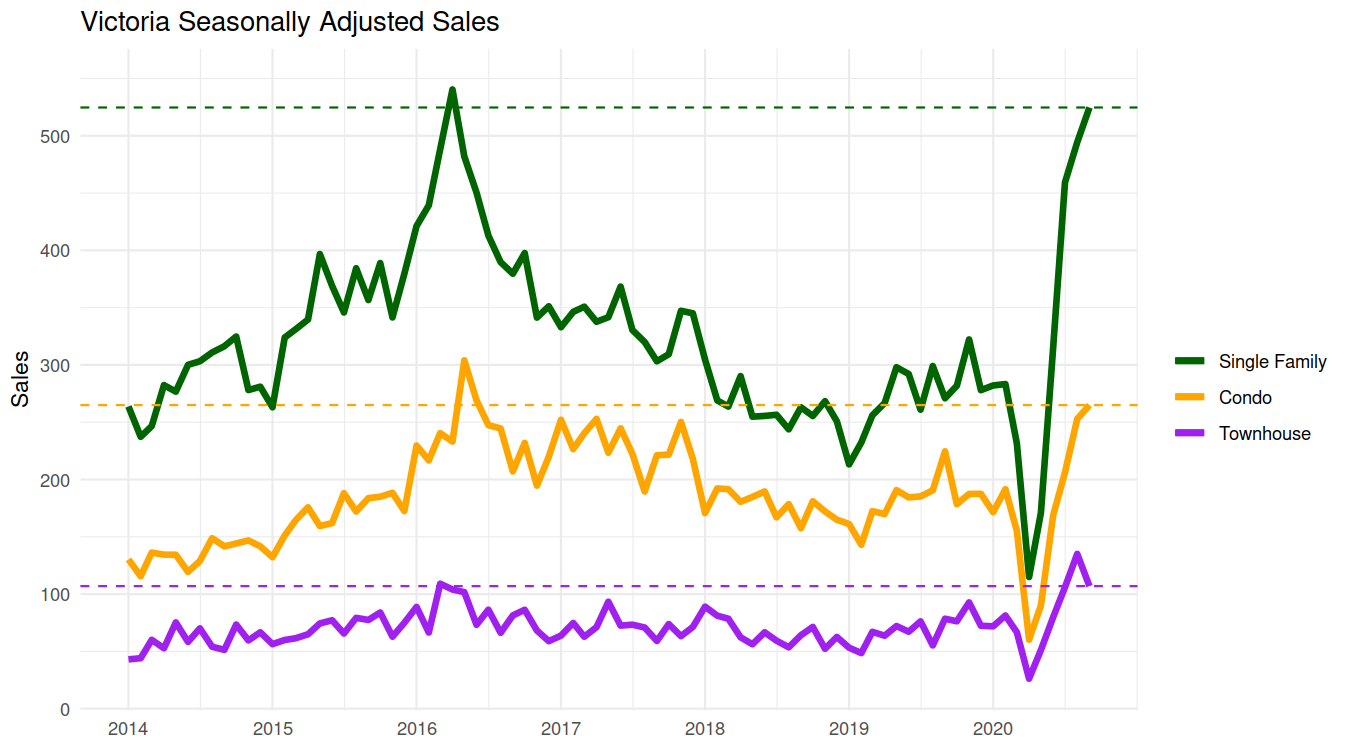

Another extremely active month in the Victoria real estate market is behind us. Sales were up even from August to end the month at 989, which is an astonishing 67% above the long term average for September. Daily sales are down slightly from peak, and should start declining more sharply from here on out as pent up demand becomes exhausted but it’s a long way to fall. Breaking it down by property type, only townhouse sales took a dip in September, with seasonally adjusted sales up for both condos and detached properties. All are close to their 2016 peaks and breaking records for September.

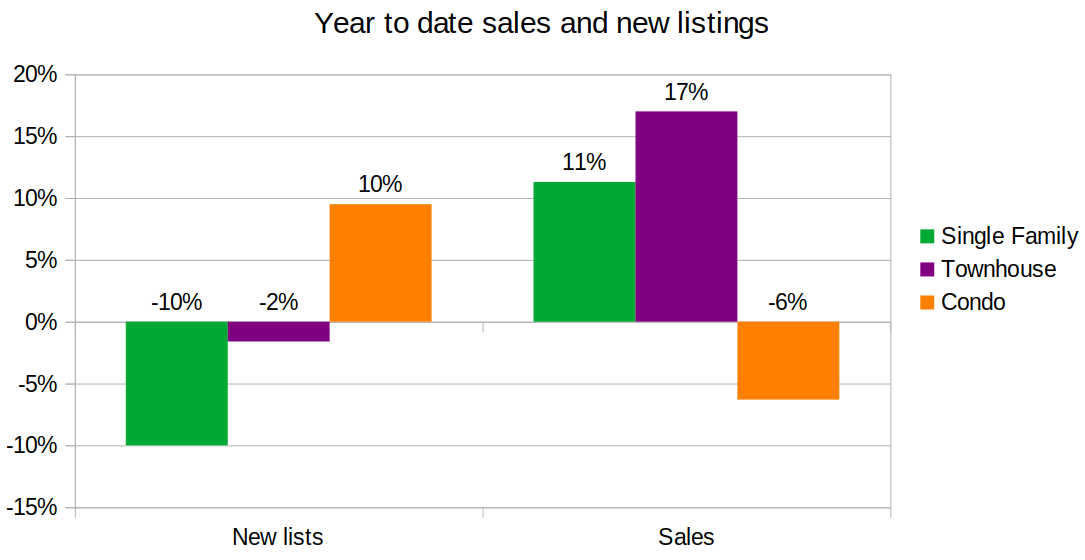

Condos did decently well in September, with sales up about 20% from a year ago, but looking at the year to date statistics, we can still see that they are going in the opposite direction as townhouses and detached homes. New lists for the latter two are down while sales are up, but condos have seen an increase of new listings matched with a decrease in sales.

Different market segments cannot go in opposite directions forever. As prices for detached homes spiral upwards, it will push some buyers out of that segment and force them to look at condos, which will slow down the detached market and boost condos. However there may be some more room to run here. Currently the detached median is just over twice that for condos, and we’ve seen that ratio go higher in the past. That ratio is also expected to continue to increase over the long run, as it has been for three decades. The jump from a condo to a house is getting larger, both because prices are increasing and because single family houses are appreciating at a faster rate than condos.

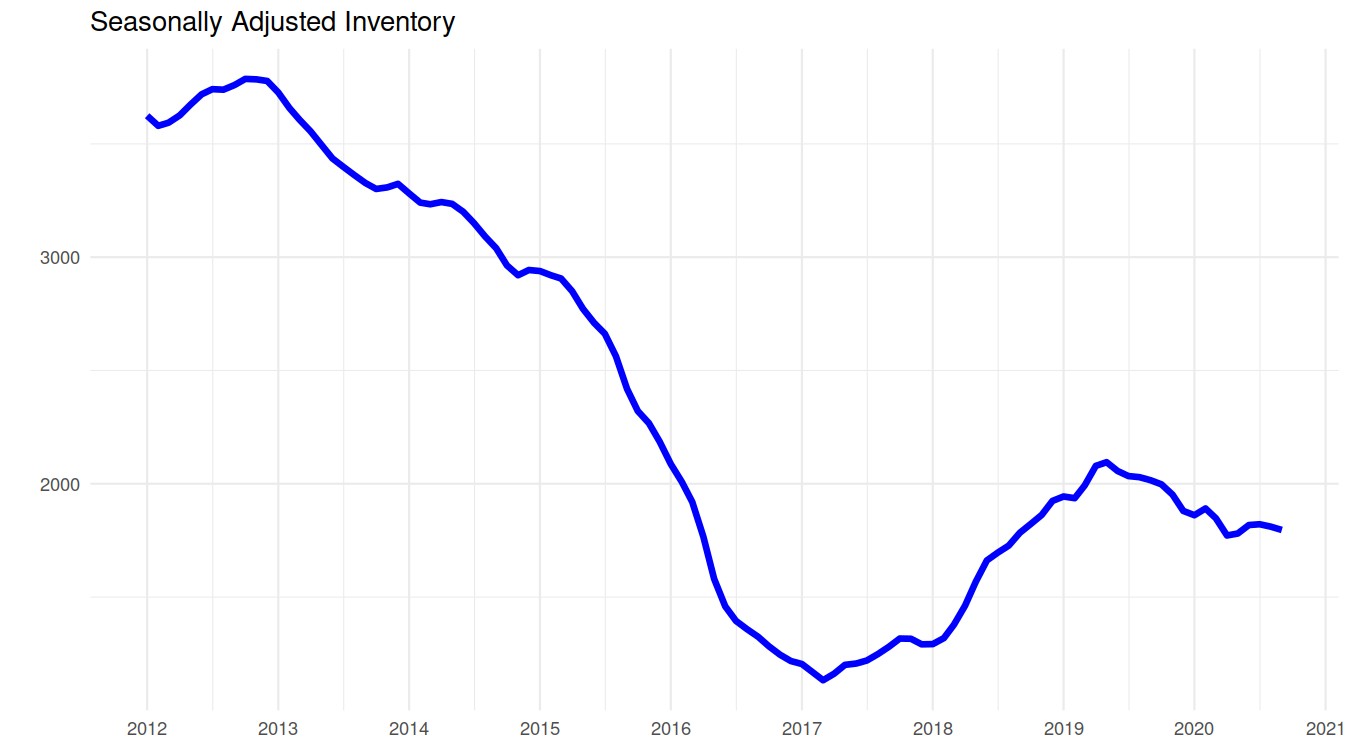

Inventory continued its long slow slide downwards in September. Overall new listings were disappointing in September, with the usual fall new listings rush missing in action this year. A 33% increase in new listings for condos was not enough to make up for the strong detached sales and lack of listings in other segments.

What does the future hold for prices?

We know that detached prices are on a strong upswing while condo prices have stayed pretty stable, but what of the future? Well if there’s one thing we learned from COVID it’s that we may as well throw any forecasts out the window since they’re even less reliable than in normal times. Whether bulls, bears, or regulators, not a single pundit predicted that the largest economic shock in our lifetime would cause house prices to spike in Victoria and across North America. I argued back in April that the market was well positioned to absorb this shock, and I didn’t see a big downside risk, but I certainly never expected the boom that we’ve seen, with luxury sales off the hook and the detached market back to nearly the crazyness we saw in 2016.

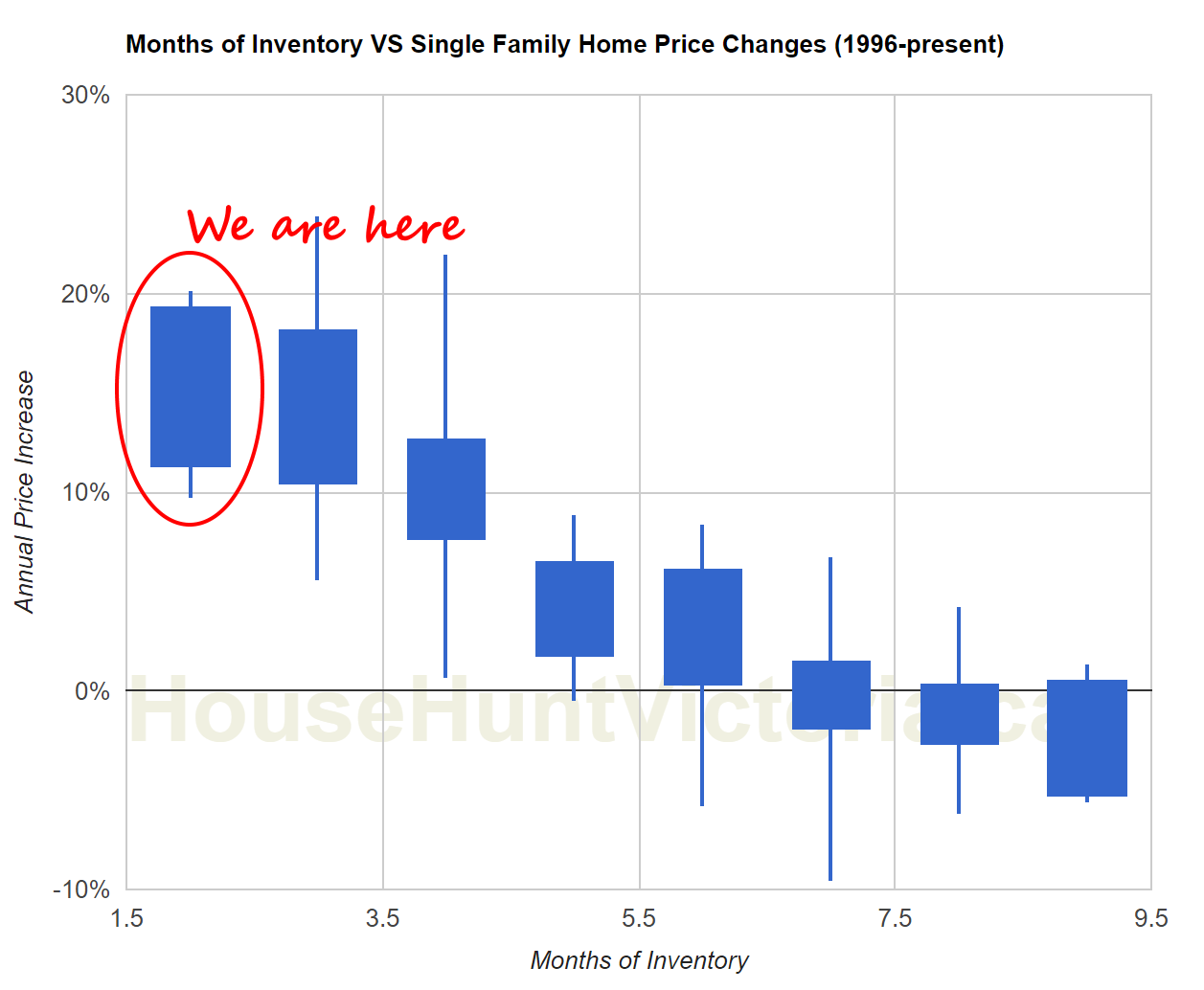

So I won’t make predictions about where prices are going. However I’ll leave this chart of Victoria single family house prices VS months of inventory here. In the past, market balance like what we have now (MOI about 2) has been usually followed by single family house price gains of 10-20%. Will it happen this time or is it different? Draw your own conclusions. I’m almost sure the market will not stay this hot for long, but right now this is where we are. It is perhaps interesting to note that after the financial crisis we had a price boom as well. That lasted for about a year before it burned itself out and consumer sentiment changed toward the negative.

Construction

A quick check on construction to close out. Since the pandemic, units under construction has held fairly steady and starts in the first 8 months of the year are actually up slightly over 2019.

The reason is likely that a lot of construction now is rental housing with money secured by the government, rather than the primarily condo-driven construction boom in 2008 where financing immediately dried up and starts went to zero for several months. Speaking of rentals, there are currently 2329 rental units under construction in the region, with 1827 of them in the westshore. With an average construction time of 17 months, we will see the majority of those complete over the next year. The increased supply hits at a time of weakened demand, which should strongly increase the rental vacancy rate and stop rent escalation in the region or even reduce rents.

Hi Ollie, there’s a new post here: https://househuntvictoria.ca/2020/10/09/jobs-friday-and-the-state-of-the-deferral-cliff

Basically very active start to October, sales are unchanged from September, but new listings are decreasing. Has only gotten tighter.

How’s the start of October going in terms of activity?

New post: https://househuntvictoria.ca/2020/10/04/cheap-no-longer-an-up-island-update

Welp

Enjoying watching Long Way Up. Charley Boorman and Ewan McGreggor riding electric Harleys from Argentina to LA, supported by electric Rivian trucks. Electrification of all transport will happen quite rapidly. BC is at around 10-15% of new vehicle sales as electric. It took 6 years for Norway to get from there to 80%. That was with high subsidies, but also in a time when electric vehicles cost a lot more and the only good option was Tesla. BC will be north of 50% of new vehicle sales as electric by 2025 is my bet.

522 single family sales. Active listings is broken in the board stats, so I don’t know, but as of this moment there are 858 active single family listings

Can anyone tell me what the figures were for September for SFH? Sales and active listings – thanks in advance

I can hardly wait for them to introduce electric motorcycles and get those annoying noise makers off the road. I hate how loud those things are and don’t know why that was allowed in the first place.

Well so much for the “NDP will take us back to the 1990’s” argument.

Let’s put things a bit more plainly. But you made the purchase offer conditional on selling your current property, right? Uh, right?

https://twitter.com/yfreemark/status/1312795624652369922

Was expecting sales to follow Manhattan’s lead, but I guess it depends on each regions management of the pandemic. https://www.dailymail.co.uk/news/article-8801205/Manhattan-apartment-sales-tumble-46-leaving-10-000-homes-market.html

Should have Q3 data on buyer origin relatively soon. Gotta think there was a pretty strong uptick. Doesn’t make sense that locals suddenly bid up all those luxury homes. We might nearly triple last year’s high end sales at this pace.

Introvert- It would be interesting to know the net worth of the people moving to B.C. versus the net worth of the people leaving for Alberta. I would assume the net worth of the Province also gained.

Cross your fingers that at least a few Alberta doctors will jump ship to Victoria, like this one did.

‘Only had so much fight in me left’: Two family doctors explain why they’re leaving Alberta

https://www.theglobeandmail.com/canada/alberta/article-only-had-so-much-fight-in-me-left-two-family-doctors-explain-why/

A little “whoops” from Toronto.

“I am closing on the house at the end of the month and I have not been able to sell my condo. I will need the money from the condo in order to have enough money for the closing transaction. I have had it listed for 2 months now and there is no interest. Total price drop already 75 thousand… I cannot afford to lower the price anymore, as at that point it will be at almost the same price I purchased in 2017 and I will lose lots of money after realtor commission.”

https://www.reddit.com/r/TorontoRealEstate/comments/j3d1mp/unable_to_sell_condo_need_funds_from_sale_to/

More today…. From UBS

https://www.cbc.ca/news/business/ubs-toronto-housing-bubble-1.5746432

Leo, thanks for this well-rounded and objective approach to presenting a picture of the market. Lots of different players in the forecasting business, makes it difficult to track their biases and to glean unbiased information and insights.

This is interesting:

Real estate site that backstops home buyers raises $100 million to expand across Canada

https://financialpost.com/real-estate/real-estate-site-that-backstops-home-buyers-raises-100-million-to-expand-across-canada

In the second quarter:

• 5,716 moved from B.C. to Alberta

• 9,302 moved from Alberta to B.C.

• net gain of 3,586 for B.C.

https://calgaryherald.com/news/local-news/more-than-2700-albertans-leave-province-amid-pandemic-harsh-economic-conditions

1st of the month seems to be quite the article day for real estate..

https://financialpost.com/news/economy/the-great-rethink-why-the-idea-that-everyone-deserves-to-own-a-home-is-fundamentally-flawed

From VREB – if you ignore median and average right now due to increase of ‘higher end properties'(words from VREB) and take the MLS benchmark its not THAT bleak out there:

“The Multiple Listing Service® Home Price Index benchmark value for a single family home in the Victoria Core in September 2019 was $849,100. The benchmark value for the same home in September 2020 increased by 3.5 per cent to $879,200, 1.1 per cent less than August’s value of $889,200. The MLS® HPI benchmark value for a condominium in the Victoria Core in September 2019 was $512,500, while the benchmark value for the same condominium in September 2020 decreased by 0.4 per cent to $510,600, 0.6 per cent less than the August value of $513.900.”

Up 3.5% on housing over the year but down 1.1% from last month and condo prices are slightly down over the year and last month. No doubt sales are up but not showing in crazy prices… yet.

Leo what are you seeing for over asks? still around 1 in 4? Cheers.

I think bigger effect is people not being able to travel. Just gave keys to out of town clients on their new home last night and they followed it up with “I have a sister in Winnipeg, not going down to their place in Florida, will be calling you in next month or so about buying in Victoria.”

Thanks so much Leo for all your research and hard work in getting us these numbers and giving us an educated opinion on where things are going. I look forward to it each mont.

An international look that included Canada from Reuters

https://www.reuters.com/article/global-property-poll-int-idUSKBN26M448

BC CDC’s COVID-19 Dashboard says that we have 3 active cases on Vancouver Island at the moment.

https://experience.arcgis.com/experience/a6f23959a8b14bfa989e3cda29297ded

Can’t help but wonder what effects our perpetually low case numbers are having on RE in terms of possibly drawing outsiders to move to the Island (and not just retirees).

At any rate, for everyone’s health, I hope we can keep our infections low throughout the fall and winter.